Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

REPORT

ON FORM 10-K

(Mark

one)

[X}

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934 for the fiscal year ended December 31, 2009

or

[ ]

Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934 for the transition period from __________ to __________.

Commission

File No. 1-15555

TENGASCO,

INC.

(name of

registrant as specified in its charter)

|

Tennessee

|

87-0267438

|

|

|

(state

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

Incorporation

or organization)

|

Identification

No.)

|

|

|

11121

Kingston Pike Suite, E

|

Knoxville,

TN 37934

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (865) 675-1554

Securities

registered pursuant to Section 12(b) of the Act: None.

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value per

share.

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined by Rule 405 of the

Securities Act. Yes [ ] [X] No

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act. Yes [ ] [X] No

Indicated by check mark whether the

registrant (1) filed all reports required to be filed by Section 13 or 15(d) of

the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes [X] [ ] No

Indicate by checkmark whether the

registrant has submitted electronically and posted on its corporate website, if

any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit

and post such files [ ] Yes [ ] No

Indicate by check mark if disclosure of

delinquent filers in response to Item 405 of Regulation SK is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer or smaller reporting company. See definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. Large Accelerated Filer [ ] Accelerated Filer

[ ] Non-accelerated Filer [ ] Smaller

Reporting Company [ ]

(Do not check if a Smaller Reporting

Company)

Indicate by checkmark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the

voting and non-voting common equity held by non-affiliates computed by reference

to the price at which the common equity was last sold, or the average bid and

asked price of such common equity, as of the last business day of the

registrant’s most recently completed second fiscal quarter was approximately $21

million (June 30, 2009 closing price $0.56)

The number of shares outstanding of the

registrant’s $.001 par value common stock as of the close of business on (March

12, 2010) was 59,760,661

Documents

Incorporated By Reference

The information required by Part III of

the Form 10-K, to the extent not set forth herein, is incorporated herein by

reference from the registrant’s definitive proxy statement for the Annual

Meeting of Shareholders to be held on June 21, 2010, to be filed with the

Securities and Exchange Commission pursuant to Regulation 14A not later than 120

days after the close of the registrant’s fiscal year.

Table

of Contents

|

PART

I

|

Page

|

||

|

Item

1.

|

Business……………………………………………………………..

|

5

|

|

|

Item

1A.

|

Risk

Factors…………………………………………………………

|

21

|

|

|

Item

1B.

|

Unresolved

Staff Comments….…………..…………………….......

|

31

|

|

|

Item

2.

|

Properties……………………………………………………………

|

31

|

|

|

Item

3.

|

Legal

Proceedings……………………………………..……....…....

|

39

|

|

|

Item

4.

|

(Removed

and Reserved)…………………………………………...

|

39

|

|

|

PART

II

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder

Matters

and Issuer Purchases of Equity Securities………………...

|

39

|

|

|

Item

6.

|

Selected

Financial Data…………………………………………….

|

41

|

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition

and

Results of Operation……………………………………….….

|

42

|

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk…….

|

49

|

|

|

Item

8.

|

Financial

Statements and Supplementary Data…….……………...

|

51

|

|

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting

and

Financial Disclosure………………………………………….

|

51

|

|

|

Item

9A(T).

|

Controls

and Procedures………………………………………….

|

51

|

|

|

Item

9B.

|

Other

Information………..………………………………………..

|

52

|

|

|

PART

III

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance………..

|

53

|

|

|

Item

11.

|

Executive

Compensation………………………………………….

|

53

|

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholders Matters….……………………………..

|

53

|

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence………..…………………………………………….

|

54

|

|

|

Item

14.

|

Principal

Accounting Fees and Service…………………………...

|

54

|

|

|

PART

IV

|

Item

15.

|

Exhibits,

Financial Statement and Schedules……………………..

|

55

|

|

SIGNATURES

……………………………………..……………

|

58

|

FORWARD LOOKING

STATEMENTS

The information contained in this

Report, in certain instances, includes forward-looking statements within the

meaning of applicable securities laws. Forward-looking statements

include statements regarding the Company’s “expectations,” “anticipations,”

“intentions,” “beliefs,” or “strategies” or any similar word or phrase regarding

the future. Forward-looking statements also include statements

regarding revenue margins, expenses, and earnings analysis for 2009 and

thereafter; oil and gas prices; exploration activities; development

expenditures; costs of regulatory compliance; environmental matters;

technological developments; future products or product development; the

Company’s products and distribution development strategies; potential

acquisitions or strategic alliances; liquidity and anticipated cash needs and

availability; prospects for success of capital raising activities; prospects or

the market for or price of the Company’s common stock; and control of the

Company. All forward-looking statements are based on information

available to the Company as of the date hereof, and the Company assumes no

obligation to update any such forward-looking statement. The

Company’s actual results could differ materially from the forward-looking

statements. Among the factors that could cause results to differ materially are

the factors discussed in “Risk Factors” below in Item 1A of this

Report.

Projecting the effects of commodity

prices, which in the past year have been extremely volatile, on production and

timing of development expenditures includes many factors beyond the Company’s

control. The future estimates of net cash flows from the Company’s

proved reserves and their present value are based upon various assumptions about

future production levels, prices, and costs that may prove to be incorrect over

time. Any significant variance from assumptions could result in the

actual future net cash flows being materially different from the

estimates.

GLOSSARY

OF OIL AND GAS TERMS

The

following are abbreviations and definitions of certain terms commonly used in

the oil and gas industry and this document:

Bbl. One

stock tank barrel, or 42 U.S. gallons liquid volume, used in reference to oil or

other liquid hydrocarbons.

Bcf. One

billion cubic feet of gas.

BOE. One

stock tank barrel equivalent of oil, calculated by converting gas volumes to

equivalent oil barrels at a ratio of 6 thousand cubic feet of gas to 1 barrel of

oil.

BOPD.

Barrels of oil per day.

Btu.

British thermal unit. One British thermal unit is the amount of heat required to

raise the temperature of one pound of water by one degree

Fahrenheit.

Developed oil and

gas reserves. Developed oil and gas reserves are reserves of any category

that can be expected to be recovered: (i) through existing wells with existing

equipment and operating methods or in which the cost of the required equipment

is relatively minor compared to the cost of a new well; and (ii)

1

through

installed extraction equipment and infrastructure operational at the time of the

reserves estimate if the extraction is by means not involving a

well.

Development

project. A development project is the means by which petroleum resources

are brought to the status of economically producible. As examples, the

development of a single reservoir or field, an incremental development in a

producing field or the integrated development of a group of several fields and

associated facilities with a common ownership may constitute a development

project.

Development

well. A well drilled within the proved area of an oil or gas reservoir to

the depth of a stratigraphic horizon known to be productive.

Differential.

An adjustment to the price of oil or gas from an established spot market price

to reflect differences in the quality and/or location of oil or

gas.

Economically

producible. The term economically producible, as it relates to a

resource, means a resource which generates revenue that exceeds, or is

reasonably expected to exceed, the costs of the operation. The value of the

products that generate revenue shall be determined at the terminal point of oil

and gas producing activities.

Estimated

ultimate recovery (EUR). Estimated ultimate recovery is the sum of

reserves remaining as of a given date and cumulative production as of that

date,

Exploratory

well. A well drilled to find a new field or to find a new reservoir in a

field previously found to be productive of oil or gas in another reservoir.

Generally, an exploratory well is any well that is not a development well, an

extension well, a service well or a stratigraphic test well.

Farmout.

An assignment of an interest in a drilling location and related acreage

conditional upon the drilling of a well on that location.

Gas.

Natural gas.

MBbl. One

thousand barrels of oil or other liquid hydrocarbons.

MBOE. One

thousand BOE.

Mcf. One

thousand cubic feet of gas.

Mcfd. One

thousand cubic feet of gas per day

MMcfe. One

million cubic feet of gas equivalent.

MMBOE. One

million BOE.

MMBtu. One

million British thermal units.

MMcf. One

million cubic feet of gas.

NYMEX. New

York Mercantile Exchange.

Oil. Crude

oil, condensate and natural gas liquids.

2

Operator.

The individual or company responsible for the exploration and/or production of

an oil or gas well or lease.

Play. A

geographic area with hydrocarbon potential.

Proved oil and

gas reserves. Proved oil and gas reserves are those quantities of oil and

gas, which, by analysis of geoscience and engineering data, can be estimated

with reasonable certainty to be economically producible from a given date

forward, from known reservoirs, and under existing economic conditions,

operating methods, and government regulations prior to the time at which

contracts providing the right to operate expire, unless evidence indicates that

renewal is reasonably certain, regardless of whether deterministic or

probabilistic methods are used for estimation. The project to extract the

hydrocarbons must have commenced, or the operator must be reasonably certain

that it will commence the project, within a reasonable time.

The area

of the reservoir considered as proved includes all of the following: (i)

the area identified by drilling and limited by fluid contacts, if any; and (ii)

adjacent undrilled portions of the reservoir that can, with reasonable

certainty, be judged to be continuous with it and to contain economically

producible oil and gas on the basis of available geoscience and engineering

data.

In the

absence of data on fluid contacts, proved quantities in a reservoir are limited

by the lowest known hydrocarbons as seen in a well penetration unless

geoscience, engineering or performance data and reliable technology establish a

lower contact with reasonable certainty.

Where

direct observation from well penetrations has defined a highest known oil

elevation and the potential exists for an associated gas cap, proved oil

reserves may be assigned in the structurally higher portions of the reservoir

only if geoscience, engineering or performance data and reliable technology

establish the higher contact with reasonable certainty.

Reserves

which can be produced economically through application of improved recovery

techniques (including, but not limited to, fluid injection) are included in the

proved classification when: (i) successful testing by a pilot project in an area

of the reservoir with properties no more favorable than in the reservoir as a

whole, the operation of an installed program in the reservoir or an analogous

reservoir or other evidence using reliable technology establishes the reasonable

certainty of the engineering analysis on which the project or program was based;

and (ii) the project has been approved for development by all necessary parties

and entities, including governmental entities.

Existing

economic conditions include prices and costs at which economic producibility

from a reservoir is to be determined. The price shall be the average price

during the twelve-month period prior to the ending date of the period covered by

the report, determined as an unweighted arithmetic average of the

first-day-of-the-month price for each month within such period, unless prices

are defined by contractual arrangements, excluding escalations based upon future

conditions.

Proved reserve

additions. The sum of additions to proved reserves from extensions,

discoveries, improved recovery, acquisitions and revisions of previous

estimates.

Reserves.

Reserves are estimated remaining quantities of oil and gas and related

substances anticipated to be economically producible, as of a given date, by

application of development projects to known

3

accumulations.

In addition, there must exist, or there must be a reasonable expectation that

there will exist, the legal right to produce or a revenue interest in the

production, installed means of delivering oil and gas or related substances to

market and all permits and financing required to implement the project. Reserves

should not be assigned to adjacent reservoirs isolated by major, potentially

sealing, faults until those reservoirs are penetrated and evaluated as

economically producible. Reserves should not be assigned to areas that are

clearly separated from a known accumulation by a non-productive reservoir (i.e.,

absence of reservoir, structurally low reservoir or negative test results). Such

areas may contain prospective resources (i.e., potentially recoverable resources

from undiscovered accumulations).

Reserve

additions. Changes in proved reserves due to revisions of previous

estimates, extensions, discoveries, improved recovery and other additions and

purchases of reserves in-place.

Reserve

life. A measure of the productive life of an oil and gas property or a

group of properties, expressed in years.

Royalty

interest. An interest in an oil and gas lease that gives the owner of the

interest the right to receive a portion of the production from the leased

acreage (or of the proceeds of the sale thereof), but generally does not require

the owner to pay any portion of the costs of drilling or operating the wells on

the leased acreage. Royalties may be either landowner's royalties, which are

reserved by the owner of the leased acreage at the time the lease is granted, or

overriding royalties, which are usually reserved by an owner of the leasehold in

connection with a transfer to a subsequent owner.

Standardized

measure. The present value, discounted at 10% per year, of estimated

future net revenues from the production of proved reserves, computed by applying

sales prices used in estimating proved oil and gas reserves to the year-end

quantities of those reserves in effect as of the dates of such estimates and

held constant throughout the productive life of the reserves and deducting the

estimated future costs to be incurred in developing, producing and abandoning

the proved reserves (computed based on year-end costs and assuming continuation

of existing economic conditions). Future income taxes are calculated by applying

the appropriate year-end statutory federal and state income tax rate with

consideration of future tax rates already legislated, to pre-tax future net cash

flows, net of the tax basis of the properties involved and utilization of

available tax carryforwards related to proved oil and gas reserves.

SWD. Salt

water disposal well

Undeveloped oil

and gas reserves. Undeveloped oil and gas reserves are reserves of any

category that are expected to be recovered from new wells on undrilled acreage,

or from existing wells where a relatively major expenditure is required for

recompletion. Reserves on undrilled acreage shall be limited to those directly

offsetting development spacing areas that are reasonably certain of production

when drilled, unless evidence using reliable technology exists that establishes

reasonable certainty of economic producibility at greater distances. Undrilled

locations can be classified as having undeveloped reserves only if a development

plan has been adopted indicating that they are scheduled to be drilled within

five years, unless the specific circumstances justify a longer time. Under no

circumstances shall estimates for undeveloped reserves be attributable to any

acreage for which an application of fluid injection or other improved recovery

technique is contemplated, unless such techniques have been proved effective by

actual projects in the same reservoir or an analogous reservoir, or by other

evidence using reliable technology establishing reasonable

certainty.

4

Working

interest. An interest in an oil and gas lease that gives the owner of the

interest the right to drill for and produce oil and gas on the leased acreage

and requires the owner to pay a share of the costs of drilling and production

operations.

References

herein to the “Company”, “we”, “us” and “our” mean Tengasco, Inc.

PART

I

ITEM

1. BUSINESS.

History

of the Company

The Company was initially organized in

Utah in 1916 under a name later changed to Onasco Companies, Inc. In

1995, the Company changed its name from Onasco Companies, Inc. by merging into

Tengasco, Inc., a Tennessee corporation, formed by the Company solely for this

purpose.

OVERVIEW

The

Company is in the business of exploration for and production of oil and natural

gas. The Company’s primary area of oil exploration and production is

in Kansas. The Company’s primary area of gas exploration and

production is the Swan Creek field in Tennessee.

The

Company’s wholly-owned subsidiary, Tengasco Pipeline Corporation (“TPC”) owns

and operates a 65-mile intrastate pipeline which it constructed to transport

natural gas from the Company’s Swan Creek Field to customers in Kingsport,

Tennessee.

The

Company’s wholly-owned subsidiary, Manufactured Methane Corporation (“MMC”) owns

and operates treatment and delivery facilities using the latest developments in

available treatment technologies for the extraction of methane gas from

nonconventional sources for delivery through the nation’s existing natural gas

pipeline system, including the Company’s TPC pipeline system in Tennessee for

eventual sale to natural gas customers.

The Company also has a management

agreement with Hoactzin Partners, L.P. (“Hoactzin”) to manage Hoactzin’s oil and

gas properties in the Gulf of Mexico offshore Texas and Louisiana. (See 4.

Management Agreement with Hoactzin on page 12) As consideration for that

agreement the Company obtained reimbursement from Hoactzin of a portion of

salary and expenses for the Company’s Vice President Patrick McInturff, as well

as an option to participate in production and exploration activities in

Hoactzin’s properties in those areas. Peter E. Salas, the Chairman of the Board

of Directors of the Company, is the controlling person of Hoactzin. He is also

the sole shareholder and controlling person of Dolphin Management, Inc., the

general partner of Dolphin Offshore Partners, L.P., which is the Company’s

largest shareholder.

5

General

1.

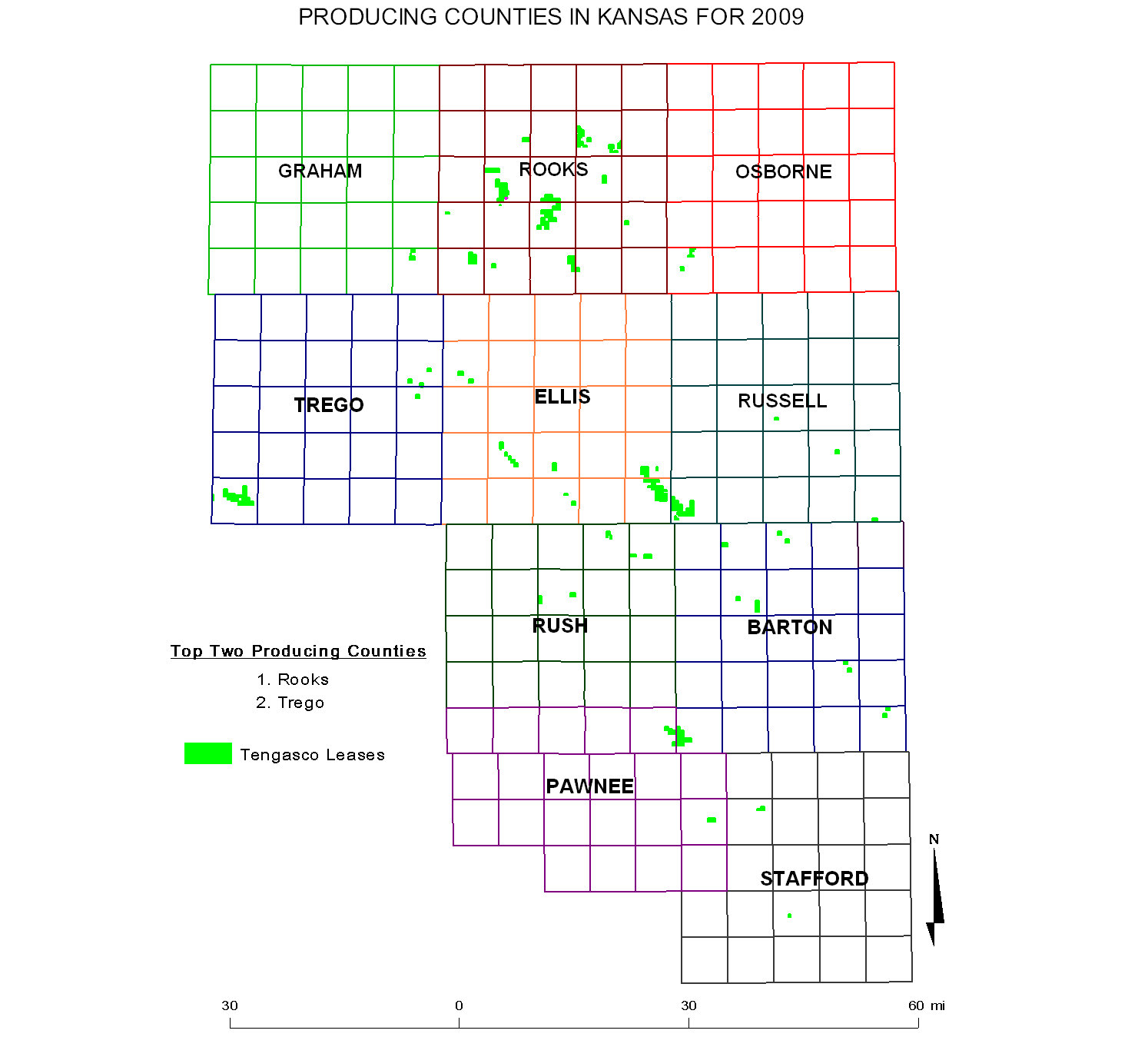

The Kansas Properties

The Kansas Properties presently include

184 producing oil wells in central Kansas. Our management and staff

have a great deal of Kansas exploration and production experience. We

have onsite production management and field personnel working in

Kansas.

On July 2, 2008, the Company acquired

19 leases encompassing approximately 1,577 acres and 41 oil wells producing

approximately 80 barrels of oil per day in Rooks County, Kansas together with

salt water disposal wells and related equipment from Black Diamond Oil, Inc. for

$5.35 million. The leases acquired are in the Company’s core area in

central Kansas and are a part of the larger Riffe Field. Polymer treatments on

several existing wells resulted in an increase in production of the

acquired wells to 147 BOPD by the end of 2008. Total production during the

initial six month ownership period was 22 MBbls, an average of 122

BOPD. In 2009, despite very little freshly deployed capital, these wells

averaged 111 BOPD.

In 2009, the decrease in oil prices,

particularly in the first 6 months of the year, prevented the Company from

having sufficient cash flow to remain as active in drilling new wells and

performing polymer treatments as we had been in prior years. We had

no capital spending until late 2009 and only drilled one salt water disposal

well for the 2008 Albers discovery wells which produced 21 MBbls in

2009. We also performed 2 polymer jobs late in 2009 which added 2.9

MBbls to our production total.

In 2009, the Company continued to try

to acquire key acreage and analyze seismic data to aid its exploration

and development program. While the Company intends in 2010 to

return to a more active drilling and workover program, the level of activity

will be driven by cash flow. Those expectations can be tempered with

a change in oil prices like we endured in late 2008 and early

2009. At the time of this writing, prices and our derivative position

will allow a more active plan for 2010.

A. Kansas Ten Well Drilling

Program

On September 17, 2007, the Company

entered into a ten well drilling program with Hoactzin, consisting of three

wildcat wells and seven developmental wells to be drilled on the Company’s

Kansas Properties (the “Program”). Under the terms of the Program, Hoactzin paid

the Company $400,000 for each producing well and $250,000 for each per dry

hole. The terms of the Program also provided that Hoactzin would

receive all the working interest in the producing wells, and would pay an

initial fee to the Company of 25% of its working interest revenues net of

operating expenses, referred to as a management fee. The fee paid to

the Company by Hoactzin will increase to 85% working interest when net revenues

received by Hoactzin reach an agreed payout point of approximately 1.35 times

Hoactzin’s purchase price (the “Payout Point”).

Nine of the ten wells in the program

were completed as oil producers and are currently producing approximately 61

barrels per day in total. Hoactzin paid a total of $3.85 million (the

“Purchase Price”) for its interest in the Program resulting in the Payout Point

being determined as $5.2 million. The Purchase Price paid by Hoactzin

for its interest in the Program wells exceeded the Company’s actual drilling

cost of approximately $2.6 million for the ten wells by more than $1

million.

6

In 2009, the wells from the Program

produced 22 MBbls of which 14 MBbls were net to Hoactzin. As of

December 31, 2009, net revenues received by Hoactzin from the Program total $2.5

million which leaves a balance of $2.7 million until the Payout Point is

reached.

Although production level of the

Program wells will decline over time in accordance with expected decline curves,

based on the drilling results of the Program wells to date and the current price

of oil, the Program wells are expected to reach the Payout Point in

approximately four years from first production. However, under the

terms of the agreement reaching the Payout Point could be accelerated by

applying 75% of the net proceeds Hoactzin receives from the methane extraction

project developed by MMC at the Carter Valley, Tennessee landfill (the “Methane

Project”), toward reaching the Payout Point. (The Methane

Project is discussed in greater detail below.) The Methane Project

net proceeds when applied would result in the Payout Point being achieved sooner

than the estimated four year period based solely upon revenues from the Program

wells.

On September 17, 2007, the Company

entered into another agreement with Hoactzin providing that if the Program and

the Methane Project in combination failed to return net revenues to Hoactzin

equal to 25% of the Purchase Price by December 31, 2009, then Hoactzin had an

option to exchange up to 20% of its net profits interest in the Methane Project

for convertible preferred stock to be issued by the Company with a liquidation

value equal to 20% of the Purchase Price less the net proceeds received at the

time of any exchange. The conversion option would be set at issuance

of the preferred stock at the then twenty business day trailing average closing

price of Company stock on the NYSE Amex. This option could not have

occurred at year-end 2009 because approximately 50% of the Purchase Price was

returned to Hoactzin from revenues from the wells in the Program by the end of

2008. Hoactzin has a similar option each year after 2010 in which

Hoactzin’s then-unrecovered Purchase Price at the beginning of the year is not

reduced 20% further by the end of that year, using the same conversion option

calculation. The Company, however, may in any year make cash payment

from any source in the amount required to prevent such an exchange option for

preferred stock from arising. In addition, the conversion right is

limited to a conversion of no more than 19% in the aggregate of the outstanding

common shares of the Company. In the event Hoactzin’s 75% net profits

interest in the Methane Project were fully exchanged for preferred stock

Hoactzin would retain no net profits interest in the Methane Project after the

full exchange.

Under this exchange agreement, if no

proceeds at all were received by Hoactzin through 2009 or in a later year (i.e.

a worst-case scenario already impossible in view of the success of the Program),

then Hoactzin would have an option to exchange 20% of its interest in the

Methane Project beginning in 2011 and each year thereafter for preferred stock

convertible at the trailing average price before each year’s issuance of the

preferred. The number of common shares into which the preferred stock

could be converted cannot be currently calculated, because the conversion price

is based on a future stock price.

However, as stated, net revenues

received by Hoactzin from the wells in the Program through December 31, 2009

totaled $2.5 million leaving a balance of $1.3 million to reach the point at

which no preferred stock can be issued to Hoactzin thus making it highly

unlikely that any preferred stock will ever be issued to

Hoactzin. The Company notes that with the demonstrated successful

results of production from the wells in the Program that the payout of 25% of

the Purchase Price was reached by year-end 2008, a full year before the December

31, 2009 required date, therefore no requirement to issue preferred

7

stock

will arise in 2010. The Company further anticipates that at current

prices of about $70.00 per barrel of oil and $6.00 per Mcf of gas, and at

currently expected sales levels of methane gas from the Methane Project that the

balance of the unrecovered Purchase Price by Hoactzin may be fully recovered by

Hoactzin by year-end 2011. If this occurs the possibility of being required to

issue any preferred ceases to exist. If it does not occur, the Company believes

it is highly unlikely that any obligation to issue preferred stock will arise

under the terms of this agreement at any time in the future, because the

production results in any future year should readily satisfy the small

production levels required to prevent an optional preferred stock issuance from

arising in any year.

B. Kansas

Production

The Company’s gross oil production in

Kansas decreased in 2009 from 2008 levels. In 2009, the Company produced 217

MBbls in Kansas compared to 232 MBbls in 2008. The two wells that were polymered

in 2009 produced 2.9 MBbl and the one new well drilled in 2009 was a salt water

disposal well (SWD) for the Albers lease.

Capital projects for the Company are

funded by cash flow and in 2009 the Company had reduced cash flow, especially in

the first 9 months of the year. We plan to be more active in 2010 as

current oil prices have increased. However, decreases in future oil

prices may cause the Company to reduce capital spending. In July 2009

the Company hedged a specified number of barrels of oil that currently

constitutes about two-thirds of the Company’s daily production to minimize this

effect.

2. The

Tennessee Properties

In the early 1980’s Amoco Production

Company owned numerous acres of oil and gas leases in the Eastern Overthrust in

the Appalachian Basin, including the area now referred to as the Swan Creek

Field. Amoco successfully drilled two natural gas discovery wells in

the Swan Creek Field to the Knox Formation. In the mid-1980’s,

however, development of this field was cost prohibitive due to a substantial

decline in worldwide oil and gas prices which was further exacerbated by the

high cost of constructing a necessary 23-mile pipeline to deliver gas from the

Swan Creek Field to the closest market. In July 1995, the Company acquired the

Swan Creek leases and began development of the field.

A. Swan Creek Pipeline

Facilities

The Company’s completed pipeline system

is owned and operated by Tengasco Pipeline Corporation (“TPC”), the Company’s

wholly-owned subsidiary and extends 65 miles from the Swan Creek Field to a

meter station at Eastman Chemical Company’s (“Eastman”) plant in Kingsport,

Tennessee. The pipeline system was built for a total cost of $16.4

million.

B. Swan Creek Production and

Development

The Company has concluded based on the

results of previously drilled wells and seismic data that drilling new gas wells

in the Swan Creek Field would not achieve any significant increase in daily gas

production totals from the Field. Current wells in production in the Swan Creek

Field would be capable of and would likely produce all the remaining reserves in

that Field. As a result, the Company has not drilled any new gas

wells in the Swan Creek Field since 2004.

8

Because no drilling for natural gas in

the Knox formation in Swan Creek is anticipated in the future, the current

production levels less decline are the sole value of natural gas reserves and

production. The existing production and the current 16 wells

producing natural gas are showing typical Appalachian production declines, which

exhibit a long-lived nature but more modest volumes. The experienced

decline in actual production levels from existing wells in the Swan Creek Field

from 2008 to 2009 was expected and predictable. Although there can be

no assurance, the Company expects these natural rates of decline in the future

will be comparable to the decline experienced over the 2008-2009

period.

During 2009, the Company had 17

producing gas wells and 4 producing oil wells in the Swan Creek

Field. Gas sales from the Swan Creek Field during 2009 averaged 124

Mcfd compared to 215 Mcfd in 2008.

In January 2008, the Company signed a

farmout agreement with Jacobs Energy, L.L.C. (“Jacobs Energy”) of Glasgow,

Kentucky related to development of the Company’s 1,405 leased acres in Hancock

County, Tennessee and an additional area of approximately 20,000 surrounding

acres constituting an area of mutual interest (“AMI”) for the purpose of

exploring the rim of the Swan Creek anticline for Devonian shale gas

production. The agreement was in the form of a “drill to earn”

relationship whereby Jacobs Energy was to establish commercial production at its

sole cost from the first two test wells in order to earn a 50% interest in the

two test wells and right to participate on a fifty-fifty basis in all remaining

wells that may be drilled in the AMI. The Company had no obligation

for any of the costs of the two test wells. The Company would bear

50% of the costs of any new wells drilled in the future within the

AMI. In the event commercial production was not established, Jacobs

Energy would not earn any interest in the test wells nor in the AMI and the

farmout agreement would terminate.

By the end of 2008, Jacobs Energy had

re-completed the Ted Hall No. 1 well, which constituted the completion of the

first of the two test wells under the farmout agreement. On July 8,

2009, the Company terminated the farmout agreement with Jacobs Energy under its

terms. The Company determined that the first of the two test wells contemplated

by the agreement was not properly completed and evaluated for nitrogen content.

It was never determined how much of the nitrogen was occurring naturally, and

how much was a result of the completion management. Second, the Company

determined that Jacobs Energy had failed to perform in a commercially timely

manner by not having yet drilled the second test well. Jacobs

Energy had stated to the Company in early July 2009 that for the foreseeable

future it would not be economically feasible for Jacobs Energy to drill the

second test well based on Jacobs’s assessment of the current state of the

financial markets. Based on that statement, together with the removal

of Jacobs’ equipment from the first well, the Company determined that Jacobs had

abandoned its obligations under the agreement, constituting a separate basis for

the Company’s termination of the agreement. Because the agreement was

terminated, no assignments of any interest in any properties were made, and no

such assignments are due to be conveyed to Jacobs Energy,

The

Company continues to seek development of these properties with other industry

partners as it remains possible that when more than one well is drilled, it may

be economically feasible to treat (if necessary) the produced gas as required,

and to construct gathering facilities necessary to connect to the Company’s

pipeline to bring the gas to market. To date no industry partners

have been found by the Company to further explore these properties and no

assurances can be made that such a partner can be found or that an agreement may

be reached with such partner on terms acceptable to the Company.

9

3. Methane

Project

On

October 24, 2006, the Company signed a twenty-year Landfill Gas Sale and

Purchase Agreement (the “Agreement”) with BFI Waste Systems of Tennessee, LLC

(“BFI”), an affiliate of Allied Waste Industries (“Allied”). In 2008, Allied

merged into Republic Services, Inc. (“Republic”). The Company assigned its

interest in the Agreement to MMC and provides that MMC will purchase the entire

naturally produced gas stream being collected at the Carter Valley municipal

solid waste landfill owned and operated by Republic in Church Hill, Tennessee

serving the metropolitan area of Kingsport, Tennessee. Republic’s

facility is located about two miles from the Company’s pipeline. The

Company installed a proprietary combination of advanced gas treatment technology

to extract the methane component of the purchased gas stream. Methane is

the principal component of natural gas and makes up about half of the purchased

raw gas stream by volume. The Company has constructed a pipeline to

deliver the extracted methane gas to the Company’s existing pipeline (the

“Methane Project”).

The total

cost for the Methane Project, including pipeline construction, was approximately

$4.5 million. The costs of the Methane Project were funded primarily by (a) the

money received by the Company from Hoactzin to purchase its interest in the Ten

Well Program which exceeded the Company’s actual costs of drilling the wells in

that Program by more than $1 million; (b) cash flow from the Company’s

operations; and (c) $0.8 million of the funds the Company borrowed under its

credit facility with Sovereign Bank of Dallas, Texas (“Sovereign Bank”). Methane

gas produced by the project facilities was initially mixed in the Company’s

pipeline and delivered and sold to Eastman under the terms of the Company’s

natural gas purchase and sale agreement with Eastman. At current gas production

rates in the landfill itself and expected extraction efficiencies, the Company

estimates it will be able to produce and deliver about 400 Mcfd of methane sales

gas. The gas supply from this landfill is projected to grow over the

years as the underlying operating landfill continues to expand and generate

additional naturally produced gas, and for several years following the closing

of the landfill, estimated by Republic to occur between the years 2022 and

2029. Gas production will continue in commercial quantities up to 15

years after closure of the landfill.

As part

of the Methane Project agreement, the Company agreed to install a new force-main

water drainage line for Republic, the landfill owner, in the same two-mile

pipeline trench as the gas pipeline needed for the Project, reducing overall

costs and avoiding environmental effects to private landowners resulting from

multiple installations of pipeline. Republic paid the additional

material costs for including the water line of approximately $0.7

million. As a certificated utility, the Company’s pipeline

subsidiary, TPC, required no additional permits for the gas pipeline

construction.

Initial

test volumes of methane were produced in late December 2008. During

the first two months of 2009, Eastman was reviewing its current air quality

permits with regard to MMC’s methane production and deliveries did not occur

during that review.

MMC

declared startup of commercial operations on April 1,

2009. During the month of April, the facility produced and sold

14 MMcf of methane gas to Eastman and was online about 91% of the calendar

month. System maintenance and landfill supply adjustments accounted for the

remainder of the time. On May 1, 2009, Eastman advised MMC that it

was suspending deliveries of the methane gas stream pending approval by the

federal Environmental Protection Agency (“EPA”) of Eastman’s petition for

inclusion of treated methane gas as natural gas within the meaning of the EPA’s

continuous emission

10

monitoring

rules applicable to Eastman’s large boilers during the annual “smog season”

beginning May 1 of each year. Although Eastman had begun seeking this

approval in February, 2009, with the assistance of the Air Quality Department of

the Tennessee Department of Environment and Conservation, the EPA had not acted

by May 1. Eastman furnished to the EPA information provided by MMC

that establishes that the methane gas stream is better fuel under the rule

standards than even “natural” gas, which is technically defined in the smog

season rules to include gas being “found in geologic formations beneath the

earth’s surface”. Methane sales to Eastman were intended to resume

upon EPA’s formal approval of Eastman’s petition or expansion of the regulatory

definition, or both. However, as of December 31, 2009 neither of

these actions has been taken by EPA, despite the existence of EPA’s own

established agency initiative, the Landfill Methane Outreach Program, which is

intended to encourage beneficial use of the methane component of raw landfill

gas. Because approval was not received, MMC was forced to seek

alternative markets for the methane gas stream.

The

Company concluded an agreement for sale of the methane gas to Hawkins County Gas

Utility, a local utility commencing August 1, 2009 on a month to month basis

until either sales to Eastman may resume or other customers were located by the

Company.

Effective

September 1, 2009 the Company began sales of its Swan Creek gas production to

Hawkins County Gas Utility District, because the physical mixing of Swan Creek

natural gas with MMC’s methane gas caused Eastman to suspend deliveries of both

categories of gas as mixed.

On August

27, 2009, the Company entered into a five-year fixed price gas sales contract

with Atmos Energy Marketing, LLC, (“AEM”) in Houston, Texas, a nonregulated unit

of Atmos Energy Corporation (NYSE: ATO) for the sale of the methane component of

landfill gas produced by MMC at the Carter Valley Landfill. The

agreement provides for the sale of up to 600 MMBtu per day. The

contract is effective beginning with September 2009 gas production and ends July

31, 2014. The agreed contract price of over $6 per MMBtu was a

premium to the then current five-year strip price for natural gas on the NYMEX

futures market.

MMC’s

plant is capable of producing a daily average of about 400 Mcfd of methane from

the Carter Valley landfill at current raw gas volumes. However, daily

production during September and October 2009 at MMC’s facility was intermittent

due to a combination of temporary factors. Average daily production

for September and October 2009 was 248 Mcfd on the twenty days the plant was in

production. In November 2009, MMC’s average daily gas production on

producing days was 288 Mcfd of sales methane and in December 2009, this amount

was 293 Mcfd of sales methane.

On September 17, 2007, Hoactzin,

simultaneously with subscribing to participate in the Ten Well Program (the

“Program”), pursuant to a separate agreement with the Company was conveyed a 75%

net profits interest in the Methane Project. The revenues from the Methane

Project received by Hoactzin are to be applied towards the determination of the

Payout Point (as defined above) for the Ten Well Program. When the

Payout Point is reached from either the revenues from the wells drilled in the

Program or the Methane Project or a combination thereof, Hoactzin’s net profits

interest in the Methane Project will decrease to a 7.5% net profits

interest. The Company believes that the application of revenues

from the Methane Project to reach the Payout Point could accelerate reaching the

Payout Point. As stated above, the Purchase Price paid by Hoactzin

for its interest in the Program exceeded the Company’s anticipated

11

and

actual costs of drilling the ten wells in the Program. Those excess funds

provided by Hoactzin were used to pay for approximately $1 million of equipment

required for the Methane Project, or about 22% of the Project’s capital

costs. The availability of the funds provided by Hoactzin eliminated

the need for the Company to borrow those funds, to have to pay interest to any

lending institution making such loans or to dedicate Company revenues or

revenues from the Methane Project to pay such debt

service. Accordingly, the grant of a 7.5% interest in the Methane

Project to Hoactzin was negotiated by the Company as a favorable element to the

Company of the overall transaction.

4. Management

Agreement with Hoactzin

The Company entered into a Management

Agreement with Hoactzin on December 17, 2007. On that same date, the

Company entered into an agreement with Charles Patrick McInturff employing him

as a Vice-President of the Company. Pursuant to the Management

Agreement with Hoactzin, Mr. McInturff’s duties while he is employed as

Vice-President of the Company will include the management on behalf of Hoactzin

of its working interest in certain oil and gas properties owned by Hoactzin and

located in the onshore Texas Gulf Coast, and offshore Texas and offshore

Louisiana. As consideration for the Company entering into the

Management Agreement, Hoactzin agreed that it will reimburse the Company for

one-half of Mr. McInturff’s salary, as well as certain other benefits he

receives during his employment by the Company. In further

consideration for the Company’s agreement to enter into the Management

Agreement, Hoactzin granted to the Company an option to participate in up to a

15% working interest for a corresponding price of up to 15% of the actual

project costs, in any new drilling or work-over activities undertaken on

Hoactzin’s managed properties during the term of the Management

Agreement. During 2009, the Company participated in an unsuccessful

workover on West Delta 62 and spent $0.2 million or 15% of the total workover

cost. The Company was able to recoup approximately one third of the

cost prior to the well ceasing production. The Company did not participate in

any additional projects and will not consider participation in any future

projects unless and until gas prices increase. The term of the

Management Agreement is the earlier of the period ending with the date Hoactzin

conveys its interest in its managed properties or 5 years from the date of the

agreement.

5. Other

Areas of Development

The Company is continuing to review and

analyze potential acquisitions of additional existing oil and gas production in

areas of Kansas, Oklahoma, and Texas. Whether the Company will

proceed with any such acquisition it deems appropriate will be dependent on a

number of factors, including available financing, oil prices,

etc. Current economic conditions, including any sharp decline in oil

prices, will certainly have an adverse impact on the Company’s ability to

acquire additional properties. Accordingly, there is no assurance that a

suitable property will become available or even if such property becomes

available that terms will be established leading to a completion of such a

purchase.

The Company has evaluated other

geological structures in the East Tennessee area that are similar to the Swan

Creek Field. While these areas are of interest, and may be further

evaluated at some future time, based on its review to date the Company does not

currently intend to actively explore these areas with its own

funds. The Company may consider entering into partnerships where

further exploration and drilling costs can be largely borne by third

parties. There can be no assurances that any third party

would

12

participate

in a drilling program in these structures, that any of these prospects will be

drilled, and if they were drilled that they would result in commercial

production.

The Company also intends to establish

and explore all business opportunities for connection of the pipeline system

owned by the Company’s subsidiary TPC to other sources of natural gas or gas

produced from non-conventional sources so that revenues from third parties for

transportation of gas across the pipeline system may be

generated. Although no assurances can be made, such connections may

also enable the Company to purchase natural gas from other sources and to then

market natural gas to new customers in the Kingsport, Tennessee area at retail

rates under a franchise agreement already granted to the Company by the City of

Kingsport, subject to approval by the Tennessee Regulatory

Authority.

The Company also intends to continue to

explore other opportunities such as its Methane Project in Church Hill,

Tennessee to obtain natural gas or substitutes for natural gas from

non-conventional sources if such gas can be economically treated and tendered in

commercial volumes for transportation not only through the Company’s existing

pipeline system but by other delivery mechanisms and through other interstate or

intrastate pipelines or local distribution companies for the purposes of

supplementing the Company’s revenues from the sale of the methane gas produced

by these projects.

Governmental

Regulations

The Company is subject to numerous

state and federal regulations, environmental and otherwise, that may have a

substantial negative effect on its ability to operate at a

profit. For a discussion of the risks involved as a result of such

regulations, see, “Effect of Existing or Probable Governmental Regulations on

Business and Costs and Effects of Compliance with Environmental Laws”

hereinafter in this section.

Principal

Products or Services and Markets

The principal markets for the Company’s

crude oil are local refining companies. The principal markets for the

Company’s natural gas and methane production are local utilities, private

industry end-users, and gas marketing companies.

Gas production from the Swan Creek

Field can presently be delivered through the Company’s completed pipeline to the

Powell Valley Utility District in Hancock County, Hawkins County Gas Utility,

Eastman and BAE in Sullivan County, as well as other industrial customers in the

Kingsport area. The Company has acquired all necessary regulatory

approvals and necessary property rights for the pipeline system. The

Company’s pipeline can provide transportation service not only for gas produced

from the Company’s wells, but also for small independent producers in the local

area as well or other pipelines that may be connected to the Company’s pipeline

in the future.

At present, crude oil produced by the

Company in Kansas is sold at or near the wells to Coffeyville Resources Refining

and Marketing; LLC (“Coffeyville Refining”) in Kansas City, Kansas. Coffeyville

Refining is solely responsible for transportation to its refinery of the oil it

purchases. The Company may sell some or all of its production to one

or more additional refineries in order to maximize revenues as purchases prices

offered by the refineries fluctuate from time to time. Crude oil

produced by the Company in Tennessee is sold to the Ashland Refinery in Kentucky

and is transported to the refinery by contracted truck delivery at the Company’s

expense.

13

Drilling

Equipment

The Company does not currently own a

drilling rig or any related drilling equipment. The Company obtains

drilling services as required from time to time from various companies as

available in the Swan Creek Field area and various drilling contractors in

Kansas.

Distribution

Methods of Products or Services

Crude oil is normally delivered to

refineries in Tennessee and Kansas by tank truck and natural gas is distributed

and transported by pipeline.

Competitive

Business Conditions, Competitive Position in the Industry and Methods of

Competition

The Company’s contemplated oil and gas

exploration activities in the States of Tennessee and Kansas will be undertaken

in a highly competitive and speculative business atmosphere. In

seeking any other suitable oil and gas properties for acquisition, the Company

will be competing with a number of other companies, including large oil and gas

companies and other independent operators with greater financial

resources. Management does not believe that the Company’s competitive

position in the oil and gas industry will be significant as the Company

currently exists.

The Company has numerous competitors in

the State of Tennessee that are in the business of exploring for and producing

oil and natural gas in Kentucky and East Tennessee areas. Some of

these companies are larger than the Company and have greater financial

resources. These companies are in competition with the Company for

lease positions in the known producing areas in which the Company currently

operates, as well as other potential areas of interest.

There are numerous producers in the

area of the Kansas Properties. Some are larger with greater financial

resources.

Although management does not foresee

any difficulties in procuring contracted drilling rigs, several factors,

including increased competition in the area, may limit the availability of

drilling rigs, rig operators and related personnel and/or equipment in the

future. Such limitations would have a natural adverse impact on the

profitability of the Company’s operations.

The Company anticipates no difficulty

in procuring well drilling permits in any state. They are usually

issued within one week of application. The Company generally does not

apply for a permit until it is actually ready to commence drilling

operations.

The prices of the Company’s products

are controlled by the world oil market and the United States natural gas

market. Thus, competitive pricing behaviors are considered unlikely;

however, competition in the oil and gas exploration industry exists in the form

of competition to acquire the most promising acreage blocks and obtaining the

most favorable process for transporting the product.

14

Sources

and Availability of Raw Materials

Excluding the development of oil and

gas reserves and the production of oil and gas, the Company’s operations are not

dependent on the acquisition of any raw materials.

Dependence

on One or a Few Major Customers

The Company is presently dependent upon

a small number of customers for the sale of gas from the Swan Creek Field and

the Methane Project principally gas marketing companies, utility districts, and

industrial customers in the Kingsport area with which the Company may enter into

gas sales contracts.

At present, crude oil from the Kansas

Properties is being purchased at the well and trucked by Coffeyville Refining,

which is responsible for transportation of the crude oil

purchased. The Company may sell some or all of its production to one

or more additional refineries in order to maximize revenues as purchase prices

offered by the refineries fluctuate from time to time.

Patents,

Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor

Contracts, Including Duration

None.

Need

For Governmental Approval of Principal Products or Services

None of the principal products offered

by the Company require governmental approval, although permits are required for

drilling oil or gas wells. In addition the transportation service

offered by TPC is subject to regulation by the Tennessee Regulatory Authority to

the extent of certain construction, safety, tariff rates and charges, and

nondiscrimination requirements under state law. These requirements

are typical of those imposed on regulated common carriers or utilities in the

State of Tennessee or in other states. TPC presently has all required

tariffs and approvals necessary to transport natural gas to all customers of the

Company.

The City of Kingsport, Tennessee has

enacted an ordinance granting to TPC a franchise for twenty years to construct,

maintain and operate a gas system to import, transport, and sell natural gas to

the City of Kingsport and its inhabitants, institutions and businesses for

domestic, commercial, industrial and institutional uses. This

ordinance and the franchise agreement it authorizes also require approval of the

Tennessee Regulatory Authority under state law. The Company will not

initiate the required approval process for the ordinance and franchise agreement

until such time that it can supply gas to the City of

Kingsport. Although the Company anticipates that regulatory approval

would be granted, there can be no assurances that it would be granted, or that

such approval would be granted in a timely manner, or that such approval would

not be limited in some manner by the Tennessee Regulatory

Authority.

Effect

of Existing or Probable Governmental Regulations on Business

Exploration and production activities

relating to oil and gas leases are subject to numerous environmental laws, rules

and regulations. The Federal Clean Water Act requires the Company to

construct a fresh water containment barrier between the surface of each drilling

site and the underlying water table. This involves the insertion of

steel casing into each well, with cement on the outside of the

15

casing. The

Company has fully complied with this environmental regulation, the cost of which

is approximately $10,000 per well.

The State of Tennessee also requires

the posting of a bond to ensure that the Company’s wells are properly plugged

when abandoned. A separate $2,000 bond is required for each well

drilled. The Company currently has the requisite amount of bonds in

effect.

As part of the Company’s purchase of

the Kansas Properties we acquired a statewide permit to drill in

Kansas. Applications under such permit are applied for and issued

within one to two weeks prior to drilling. At the present time, the

State of Kansas does not require the posting of a bond either for permitting or

to insure that the Company’s wells are properly plugged when

abandoned. All of the wells in the Kansas Properties have all permits

required and the Company believes that it is in compliance with the laws of the

State of Kansas.

The Company’s exploration, production

and marketing operations are regulated extensively at the federal, state and

local levels. The Company has made and will continue to make

expenditures in its efforts to comply with the requirements of environmental and

other regulations. Further, the oil and gas regulatory environment

could change in ways that might substantially increase these

costs. Hydrocarbon-producing states regulate conservation practices

and the protection of correlative rights. These regulations affect

the Company’s operations and limit the quantity of hydrocarbons it may produce

and sell. In addition, at the federal level, the Federal Energy

Regulatory Commission regulates interstate transportation of natural gas under

the Natural Gas Act. Other regulated matters include marketing,

pricing, transportation and valuation of royalty payments.

The Company’s operations are also

subject to numerous and frequently changing laws and regulations governing the

discharge of materials into the environment or otherwise relating to

environmental protection. The Company owns or leases, and has in the

past owned or leased, properties that have been used for the exploration and

production of oil and gas and these properties and the wastes disposed on these

properties may be subject to the Comprehensive Environmental Response,

Compensation and Liability Act, the Oil Pollution Act of 1990, the Resource

Conservation and Recovery Act, the Federal Water Pollution Control Act and

analogous state laws. Under such laws, the Company could be required

to remove or remediate preciously released wastes or property

contamination.

16

Laws and

regulations protecting the environment have generally become more stringent and,

may in some cases, impose “strict liability” for environmental

damage. Strict liability means that the Company may be held liable

for damage without regard to whether it was negligent or otherwise at

fault. Environmental laws and regulations may expose the Company to

liability for the conduct of or conditions caused by others or for acts that

were in compliance with all applicable laws at the time they were

performed. Failure to comply with these laws and regulations may

result in the imposition of administrative, civil and criminal

penalties.

While management believes that the

Company’s operations are in substantial compliance with existing requirements of

governmental bodies, the Company’s ability to conduct continued operations is

subject to satisfying applicable regulatory and permitting

controls. The Company’s current permits and authorizations and

ability to get future permits and authorizations may be susceptible, on a going

forward basis, to increased scrutiny, greater complexity resulting in increased

costs or delays in receiving appropriate authorizations.

The Company’s Board of Directors has

adopted resolutions to form an Environmental Response Policy and Emergency

Action Response Policy Program. A plan was adopted which provides for

the erection of signs at each well and at strategic locations along the pipeline

containing telephone numbers of the Company’s office. A list is

maintained at the Company’s office and at the home of key personnel listing

phone numbers for fire, police, emergency services and Company employees who

will be needed to deal with emergencies.

The foregoing is only a brief summary

of some of the existing environmental laws, rules and regulations to which the

Company’s business operations are subject, and there are many others, the

effects of which could have an adverse impact on the Company. Future

legislation in this area will no doubt be enacted and revisions will be made in

current laws. No assurance can be given as to that affect these

present and future laws, rules and regulations will have on the Company’s

current and future operations.

Research

and Development

None.

Number

of Total Employees and Number of Full-Time Employees

The Company presently has 29 full time

employees and no part-time employees.

17

Executive

Officers of the Registrant

Identification of Executive

Officers

The

following table sets forth the names of all current executive officers of the

Company. These persons will serve until their successors are elected

or appointed and qualified, or their prior resignations or

terminations.

|

Name

|

Positions

Held

|

Date

of Initial

Election

of Designation

|

|

Jeffrey

R. Bailey

|

Chief

Executive Officer1

|

6/17/2002

|

|

Charles

Patrick McInturff

|

Vice-President

|

12/18/2007

|

|

Cary

V. Sorensen

|

Vice-President;

General Counsel; Secretary

|

7/09/1999

|

|

Michael

J. Rugen

|

Chief

Financial Officer

|

9/28/2009

|

Business

Experience2

Charles Patrick McInturff is 57 years

old. Mr. McInturff received a Bachelor of Science Degree in Civil Engineering

from Texas A&M University in 1975. He is a Registered

Professional Engineering from Texas and a member of the Society of Petroleum

Engineers. Before joining the Company he was Vice President of

Operations of Capco Offshore, Inc. and related companies in Houston from

October 2006 until December 2007 responsible for managing and

supervising offshore operations and workovers and identification and evaluation

of drilling and workover candidates. From 1991 to 2006, he was

employed by Ryder Scott Company in Houston performing reservoir studies

including determination of oil, gas, condensate and plant product reserves,

enhanced recovery and oil and gas property appraisal. For most

of the period 1978 to 1991, he worked in various petroleum engineering positions

at Union Texas Petroleum Corp. in Midland and Houston, Texas, and Karachi,

Pakistan and was responsible for surveillance and engineering on primary and

secondary recovery projects as well as design and field supervision of

workovers, pressure-transient tests and completions both onshore and

offshore.

2 The

background and business experience of Jeffrey R. Bailey is incorporated by

reference from the section entitled “Proposal No. 1. Election of Directors” in

the Company’s Proxy Statement for the Company’s 2010 Annual Meeting of

Stockholders.

18

During

that time period he also worked for Global Natural Resources from 1983 to 1986

as senior operations engineer responsible for all engineering

activities. From 1981 to 1983 he was employed by Belco Petroleum

performing reservoir engineering duties including field studies, economic

evaluation, reserves estimation, and initiating major field studies on

waterflood projects in southwestern Wyoming and west Texas. Mr.

McInturff was employed by Exxon Co. USA from 1975 to 1978 primarily with the

reservoir engineering group in Midland, Texas performing drilling engineering

duties including cost estimation, AFE preparation, drilling programs and field

supervision. He was responsible for the surveillance of fifteen

Permian Basin oil and gas fields in west Texas using both primary and secondary

recovery techniques. On December 18, 2007, he was appointed to serve

as Vice-President of the Company.

Cary V. Sorensen is 61 years old. He is

a 1976 graduate of the University of Texas School of Law and has undergraduate

and graduate degrees from North Texas State University and Catholic University

in Washington, D.C. Prior to joining the Company in July 1999, he had been

continuously engaged in the practice of law in Houston, Texas relating to the

energy industry since 1977, both in private law firms and a corporate law

department, serving for seven years as senior counsel with the oil and gas

litigation department of a Fortune 100 energy corporation in Houston before

entering private practice in June, 1996. He has represented virtually

all of the major oil companies headquartered in Houston as well as local

distribution companies and electric utilities in a variety of litigated and

administrative cases before state and federal courts and agencies in nine

states. These matters involved gas contracts, gas marketing,

exploration and production disputes involving royalties or operating interests,

land titles, oil pipelines and gas pipeline tariff matters at the state and

federal levels, and general operation and regulation of interstate and

intrastate gas pipelines. He has served as General Counsel of the

Company since July 9, 1999.

Michael J. Rugen is 49 years old and

was named Tengasco Chief Financial Officer in September 2009. He is a

certified public accountant (Texas) with over 27 years of experience in

exploration and production and oilfield service. Prior to joining

Tengasco, Mr. Rugen spent 2 years as Vice President of Accounting and Finance

for Nighthawk Oilfield Services. From 2001 to June 2007, he was a

Manager/Sr. Manager with UHY Advisors, primarily responsible for managing

internal audit and Sarbanes-Oxley 404 engagements for various oil and gas

clients. In 1999 and 2000, Mr. Rugen provided finance and accounting consulting

services with Jefferson Wells International. From 1982 to 1998, Mr.

Rugen held various accounting and management positions at BHP Petroleum, with

accounting responsibilities for onshore and offshore US operations as well as

operations in Trinidad and Boliva. Mr. Rugen earned a Bachelor of

Science in Accounting in 1982 from Indiana University.

19

Code

of Ethics

The Company’s Board of Directors has

adopted a Code of Ethics that applies to the Company’s financial officers and

executives officers, including its Chief Executive Officer and Chief Financial

Officer. The Company’s Board of Directors has also adopted a Code of

Conduct and Ethics for Directors, Officers and Employees. A copy of

these codes can be found at the Company’s internet website at

www.tengasco.com. The Company intends to disclose any amendments to

its Codes of Ethics, and any waiver from a provision of the Code of Ethics

granted to the Company’s President, Chief Financial Officer or persons

performing similar functions, on the Company’s internet website within five

business days following such amendment or waiver. A copy of the Code

of Ethics can be obtained free of charge by writing to Cary V. Sorensen,

Secretary, Tengasco, Inc., 11121 Kingston Pike, Suite E, Knoxville, TN

37934.

Available

Information

The Company is a reporting company, as

that term is defined under the Securities Acts, and therefore files reports,

including Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K such as

this Report, proxy information statements and other materials with the

Securities and Exchange Commission (“SEC”). You may read and copy any

materials the Company files with the SEC at the SEC’s Public Reference Room at

450 Fifty Street, N.W., Washington D.C. 20549 upon payment of the prescribed

fees. You may obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800 SEC-0330.

In addition, the Company is an

electronic filer and files its Reports and information with the SEC through the

SEC’s Electronic Data Gathering, Analysis and Retrieval system

(“EDGAR”). The SEC maintains a website that contains reports, proxy

and information statements and other information regarding issuers that file

electronically through EDGAR with the SEC, including all of the Company’s

filings with the SEC. The address of that site is

http://www.sec.gov.

The Company’s website is located at

http://www.tengasco.com. On the home page of the website, you may

access, free of charge, the Company’s Annual Report on Form 10-K. Under the

Investor Information /SEC filings tab you will find the Quarterly Reports on

Form 10-Q, Current Reports on Form 8-K, Section 16 filings (Form 3, 4 and 5) and

any amendments to those reports as reasonably practicable after the Company

electronically files such reports with the SEC. The information

contained on the Company’s website is not part of the Report or any other report

filed with the SEC.

20

ITEM

1A. RISK FACTORS

In addition to the other information

included in this Form 10-K, the following risk factors should be considered in

evaluating the Company’s business and future prospects. The risk

factors described below are not exhaustive and you are encouraged to perform

your own investigation with respect to the Company and its

business. You should also read the other information included in this

Form 10-K, including the financial statements and related notes.

The

Company’s indebtedness, the current global recession, and disruption in the

domestic and global financial markets could have an adverse effect on the

Company’s operating results and financial condition.

As of December 31, 2009, the

outstanding principal amount of the Company’s indebtedness to Sovereign Bank was

approximately $9.9 million. The level of indebtedness, coupled with

the widely reported domestic and global recession, the associated low levels of

energy prices, and the unprecedented levels of disruption and continuing

relative illiquidity in the credit markets may, if continued for an extended

period, have several important and adverse consequences on the Company’s

business and operations. For example, any one or more of these

factors could (i) make it difficult for the Company to service or refinance its

existing indebtedness; (ii) increase the Company’s vulnerability to additional

adverse changes in economic and industry conditions; (iii) require the Company

to dedicate a substantial portion or all of its cash flow from operations and

proceeds of any debt or equity issuances or asset sales to pay or provide for

its indebtedness; (iv) limit the Company’s ability to respond to changes in our

businesses and the markets in which we operate; (v) place the Company at a