Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Viacom Inc. | form8-k11162018.htm |

Exhibit 99 FQ4’18 EARNINGS PRESS RELEASE | NOVEMBER 16, 2018 VIACOM REPORTS STRONG FOURTH QUARTER AND FULL YEAR RESULTS Company Delivered Turnaround of Core Business and Grew Full Year Consolidated Operating Income for First Time Since Fiscal 2014 Consolidated Revenues Increased 5% in the Quarter, Driven by Double Digit Gains at Paramount Media Networks Grew Total Affiliate Revenues 4% in the Quarter, with Domestic Affiliate Revenues Up 3% – Sequential Improvement of 1,100 Basis Points in Growth Rate in the Year Viacom International Media Networks Delivered Record Year of Revenues and Profitability Full Year Net Cash Provided by Operating Activities Grew 9% to $1.82 Billion; Operating Free Cash Flow Up 9% to $1.64 Billion; and Total Debt Reduced by Over $1 Billion STATEMENT FROM BOB BAKISH, PRESIDENT & CEO Our strong performance in the fourth quarter capped off a pivotal year for Viacom. We “ successfully turned around our core business, with dramatic improvements across our networks, at Paramount and in distribution. We also took important steps to evolve Viacom for the future – investing in our portfolio of advanced marketing solutions, digital and experiential offerings and global studio production business. As we head into 2019, we are excited about the company’s evolution and expect to return to topline growth.” FISCAL YEAR 2018 RESULTS $ millions, except per share amounts FQ4 FY GAAP 2018 2017 B/(W) 2018 2017 B/(W) Revenues $ 3,485 $3,319 5 % $12,943 $ 13,263 (2)% Operating income 645 705 (9) 2,570 2,489 3 Net earnings from continuing operations attributable to Viacom 386 674 (43) 1,688 1,871 (10) Diluted EPS from continuing operations 0.96 1.67 (43) 4.19 4.67 (10) Non-GAAP* Adjusted operating income $ 670 $ 578 16 % $ 2,795 $ 2,743 2% Adjusted net earnings from continuing operations attributable to Viacom 400 310 29 1,659 1,511 10 Adjusted diluted EPS from continuing operations 0.99 0.77 29 4.12 3.77 9 * Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release.

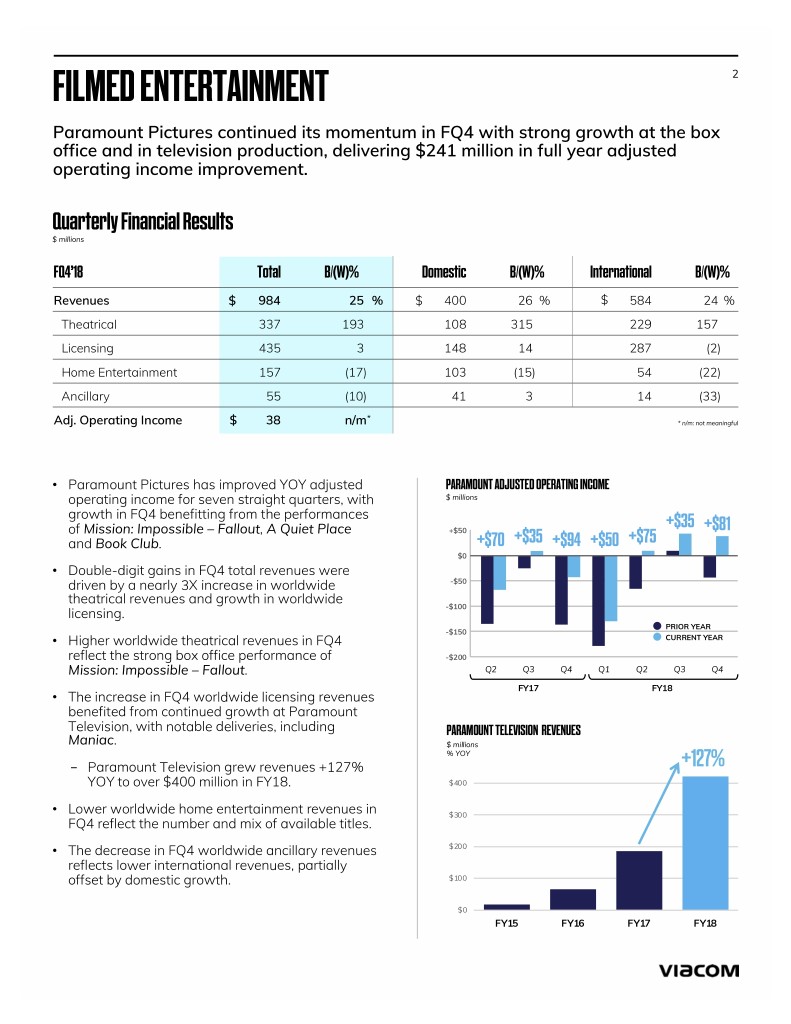

FILMED ENTERTAINMENT 2 Paramount Pictures continued its momentum in FQ4 with strong growth at the box office and in television production, delivering $241 million in full year adjusted operating income improvement. Quarterly Financial Results $ millions FQ4’18 Total B/(W)% Domestic B/(W)% International B/(W)% Revenues $ 984 25. % $ 400 26. % $ 584 24. % Theatrical 337 193. 108 315. 229 157. Licensing 435 3. 148 14. 287 (2) Home Entertainment 157 (17) 103 (15) 54 (22) Ancillary 55 (10) 41 3. 14 (33) * Adj. Operating Income $ 38 n/m * n/m: not meaningful Paramount Pictures has improved YOY adjusted PARAMOUNT ADJUSTED OPERATING INCOME operating income for seven straight quarters, with $ millions growth in FQ4 benefitting from the performances +$35 of Mission: Impossible – Fallout, A Quiet Place +$50 +$81 and Book Club. +$70 +$35 +$94 +$50 +$75 $0 Double-digit gains in FQ4 total revenues were driven by a nearly 3X increase in worldwide -$50 theatrical revenues and growth in worldwide -$100 licensing. PRIOR YEAR -$150 Higher worldwide theatrical revenues in FQ4 CURRENT YEAR reflect the strong box office performance of -$200 Mission: Impossible – Fallout. Q2 Q3 Q4 Q1 Q2 Q3 Q4 FY17 FY18 The increase in FQ4 worldwide licensing revenues benefited from continued growth at Paramount Television, with notable deliveries, including PARAMOUNT TELEVISION REVENUES Maniac. $ millions % YOY +127% - Paramount Television grew revenues +127% YOY to over $400 million in FY18. $400 Lower worldwide home entertainment revenues in $300 FQ4 reflect the number and mix of available titles. The decrease in FQ4 worldwide ancillary revenues $200 reflects lower international revenues, partially offset by domestic growth. $100 $0 FY15 FY16 FY17 FY18

FILMED ENTERTAINMENT 3 Operational Highlights Mission: Impossible – Fallout was #1 at the global TOP 5 WORLDWIDE THEATRICAL RELEASES – FQ4’18 box office in FQ4. It is the most successful film of the franchise, grossing nearly $800 million to date. #1 Mission: Impossible – Fallout 2 Incredibles 2 Disney With a production cost of approximately $20 million, 3 Ant-Man & The Wasp Disney A Quiet Place grossed more than $340 million at the 4 The Meg Warner Bros. worldwide box office. Released in April, it is the 5 Hotel Transylvania 3 Sony second highest grossing horror film in the U.S. over the past decade. Source: Rentrak Comedy hit Book Club grossed nearly $75 million worldwide – more than seven times its acquisition cost of $10 million. Paramount Pictures has built a diverse theatrical film slate of 13 titles for FY19 – up from nine in FY18 – that feature big-budget tentpoles, targeted-audience productions and Viacom-branded films. Mission: Impossible – Fallout - Upcoming releases include the latest installment of the Transformers franchise, Bumblebee; the BET co-branded film What Men Want; animated feature Wonder Park; a reboot of Stephen King’s horror classic Pet Sematary; and the Elton John biopic Rocketman. A Quiet Place Book Club Paramount Television delivered nine series to air in FY18, with FQ4 premieres including Tom Clancy’s Jack Ryan on Amazon and Maniac on Netflix. Maniac Tom Clancy’s Jack Ryan Anticipated to grow revenues +50% in FY19, with 16 series ordered for production: - Nine new shows, including The Haunting of Hill House for Netflix, Catch-22 for Hulu and First Wives Club for Paramount Network. 13 Reasons Why The Haunting of Hill House - Seven returning series, including third seasons of 13 Reasons Why for Netflix and Berlin Station for EPIX, and second seasons of Tom Clancy’s Jack Ryan for Amazon and The Alienist for TNT. Berlin Station The Alienist

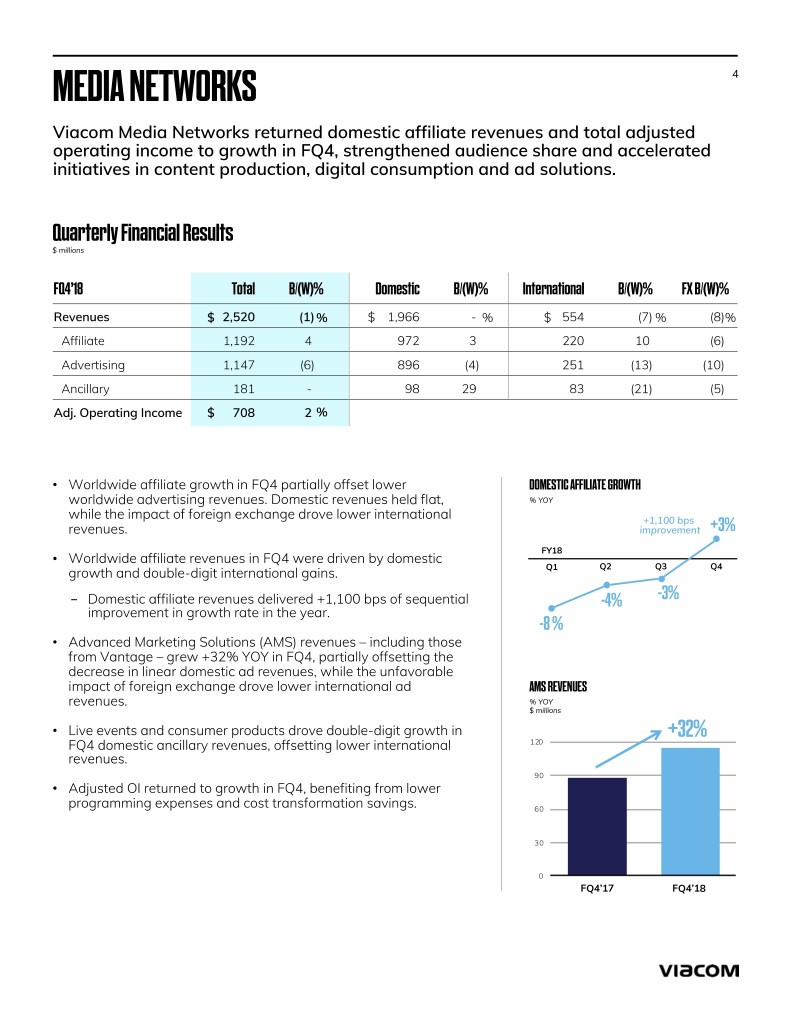

MEDIA NETWORKS 4 Viacom Media Networks returned domestic affiliate revenues and total adjusted operating income to growth in FQ4, strengthened audience share and accelerated initiatives in content production, digital consumption and ad solutions. Quarterly Financial Results $ millions FQ4’18 Total B/(W)% Domestic B/(W)% International B/(W)% FX B/(W)% Revenues$ 2,520 (1)% $ 1,966 -. % $ 554 (7)% (8)% Affiliate 1,192 4. 972 3. 220 10. (6) Advertising 1,147 (6) 896 (4) 251 (13) (10) Ancillary 181 -. 98 29. 83 (21) (5) Adj. Operating Income$ 708 2.% Worldwide affiliate growth in FQ4 partially offset lower DOMESTIC AFFILIATE GROWTH worldwide advertising revenues. Domestic revenues held flat, % YOY while the impact of foreign exchange drove lower international +1,100 bps +3% revenues. improvement FY18 Worldwide affiliate revenues in FQ4 were driven by domestic Q2 Q3 Q4 growth and double-digit international gains. Q1 -3% - Domestic affiliate revenues delivered +1,100 bps of sequential -4% improvement in growth rate in the year. -8 % Advanced Marketing Solutions (AMS) revenues – including those from Vantage – grew +32% YOY in FQ4, partially offsetting the decrease in linear domestic ad revenues, while the unfavorable impact of foreign exchange drove lower international ad AMS REVENUES revenues. % YOY $ millions Live events and consumer products drove double-digit growth in +32% FQ4 domestic ancillary revenues, offsetting lower international 120 revenues. 90 Adjusted OI returned to growth in FQ4, benefiting from lower programming expenses and cost transformation savings. 60 30 0 FQ4'17FQ4’17 FQ4’18 FQ4'18

MEDIA NETWORKS 5 Operational Highlights Viacom held the #1 share of U.S. basic cable viewing across TOP 10 ORIGINAL CABLE SERIES – FQ4’18 key audiences in FQ4, including viewers 2-49, 2-11, 12-17, 18-34 and 18-49, with particular strength at MTV, BET and FX 1 American Horror Story Comedy Central. 2 Jersey Shore: Family Vacation S2 3 Love & Hip Hop Hollywood S5 4 Love & Hip Hop Atlanta S7 - Viacom brands in FQ4 had six of 5 Teen Mom II S8 the 10 highest-rated original 6 Black Ink Crew S7 cable series among Adults 18-34, FX 7 Mayans M.C. including season two of MTV’s USA 8 WWE Entertainment Jersey Shore: Family Vacation – E! 9 Keeping Up With the Kardashians the most-watched unscripted 10 Basketball Wives S7 show on cable in the demo. Source: Nielsen; Total Day. Data represents C3 for P18-34. Internationally, Channel 5 returned to audience share growth in FQ4, while Telefe achieved 10 months of ratings leadership as of October. Viacom more than doubled YOY global social video views in FQ4, jumping from #24 to #10 in Tubular media industry rankings. Viacom doubled its YouTube subscribers in FY18 with launches of dedicated channels for hit franchises including MTV’s Wild ‘N Out. AMS continued to scale, generating more than $300 million in full-year revenues, and doubling its contribution from 5% of total domestic advertising revenues in FY16 to 10% in FY18. Vantage had its best quarter ever in FQ4, with revenues up 75% YOY. Viacom continued to build its studio production business to create content for third parties globally. Recent wins include: - The August release of Awesomeness’ To All the Boys I’ve Loved Before – one of Netflix’s most- watched original films ever. - Nickelodeon’s partnership with Netflix on a live- action series of Avatar: The Last Airbender, with production starting in 2019. - The launch of MTV Studios, which announced a three-season deal with Facebook Watch in October to reimagine MTV’s The Real World for global audiences. - The growth of Viacom International Studios (VIS), driven by production partnerships with Amazon, Cablevisión, Fox Network Group Latin America, Netflix and Telemundo. Through VIS, Viacom is now a leading global producer of original Spanish-language content, with more than 700 hours delivered in FY18.

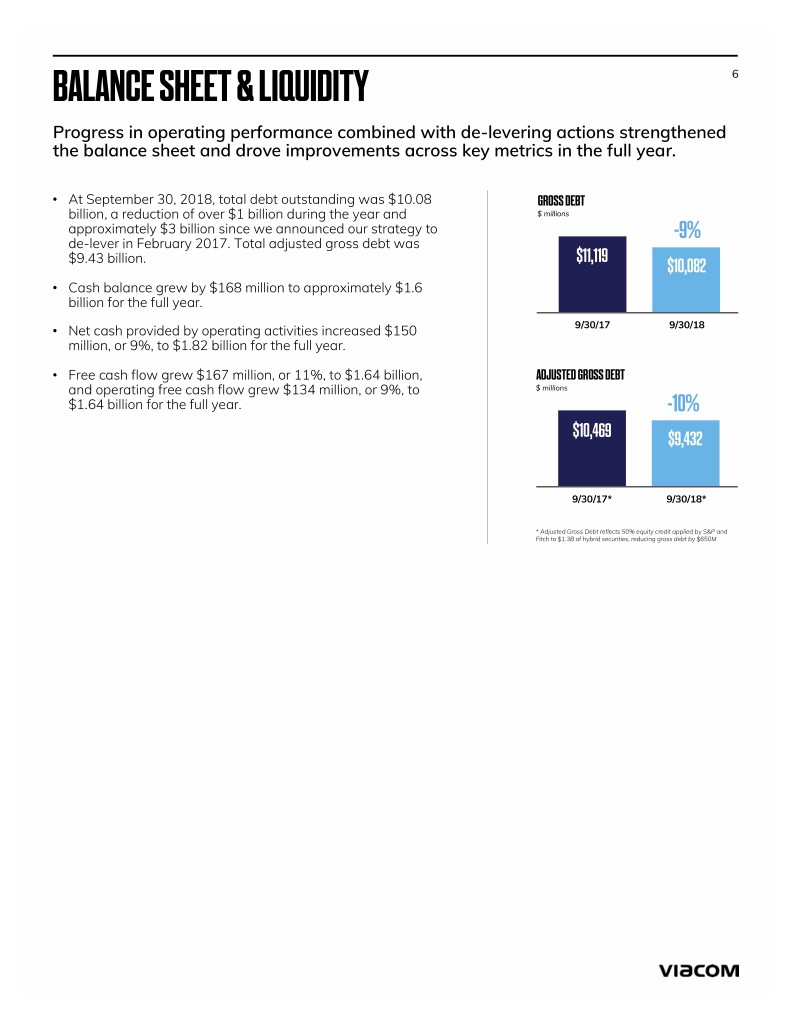

BALANCE SHEET & LIQUIDITY 6 Progress in operating performance combined with de-levering actions strengthened the balance sheet and drove improvements across key metrics in the full year. At September 30, 2018, total debt outstanding was $10.08 GROSS DEBT billion, a reduction of over $1 billion during the year and $ millions approximately $3 billion since we announced our strategy to -9% de-lever in February 2017. Total adjusted gross debt was $11,119 $9.43 billion. $10,082 Cash balance grew by $168 million to approximately $1.6 billion for the full year. Net cash provided by operating activities increased $150 9/30/17 9/30/18 million, or 9%, to $1.82 billion for the full year. Free cash flow grew $167 million, or 11%, to $1.64 billion, ADJUSTED GROSS DEBT and operating free cash flow grew $134 million, or 9%, to $ millions $1.64 billion for the full year. -10% $10,469 $9,432 9/30/17* 9/30/18* * Adjusted Gross Debt reflects 50% equity credit applied by S&P and Fitch to $1.3B of hybrid securities, reducing gross debt by $650M

ABOUT VIACOM 7 Viacom creates entertainment experiences that drive conversation and culture around the world. Through television, film, digital media, live events, merchandise and solutions, our brands connect with diverse, young and young at heart audiences in more than 180 countries. For more information on Viacom and its businesses, visit www.viacom.com. Viacom may also use social media channels to communicate with its investors and the public about the company, its brands and other matters, and those communications could be deemed to be material information. Investors and others are encouraged to review posts on Viacom’s Twitter feed (twitter.com/viacom), Facebook page (facebook.com/viacom) and LinkedIn profile (linkedin.com/company/viacom). CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS This news release contains both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements reflect our current expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: technological developments, alternative content offerings and their effects in our markets and on consumer behavior; competition for content, audiences, advertising and distribution in a swiftly consolidating industry; the public acceptance of our brands, programs, films and other entertainment content on the various platforms on which they are distributed; the impact on our advertising revenues of declines in linear television viewing, deficiencies in audience measurement and advertising market conditions; the potential for loss of carriage or other reduction in the distribution of our content; evolving cybersecurity and similar risks; the failure, destruction or breach of our critical satellites or facilities; content theft; increased costs for programming, films and other rights; the loss of key talent; domestic and global political, economic and/or regulatory factors affecting our businesses generally; volatility in capital markets or a decrease in our debt ratings; a potential inability to realize the anticipated goals underlying our ongoing investments in new businesses, products, services and technologies; fluctuations in our results due to the timing, mix, number and availability of our films and other programming; potential conflicts of interest arising from our ownership structure with a controlling stockholder; and other factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our 2018 Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. The forward-looking statements included in this document are made only as of the date of this document, and we do not have any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. If applicable, reconciliations for any non-GAAP financial information contained in this news release are included in this news release or available on our website at www.viacom.com. CONTACTS PRESS INVESTORS Justin Dini James Bombassei Senior Vice President, Corporate Communications Senior Vice President, Investor Relations and Treasurer (212) 846-2724 (212) 258-6377 justin.dini@viacom.com james.bombassei@viacom.com Alex Rindler Kareem Chin Senior Manager, Corporate Communications Vice President, Investor Relations (212) 846-4337 (212) 846-6305 alex.rindler@viacom.com kareem.chin@viacom.com

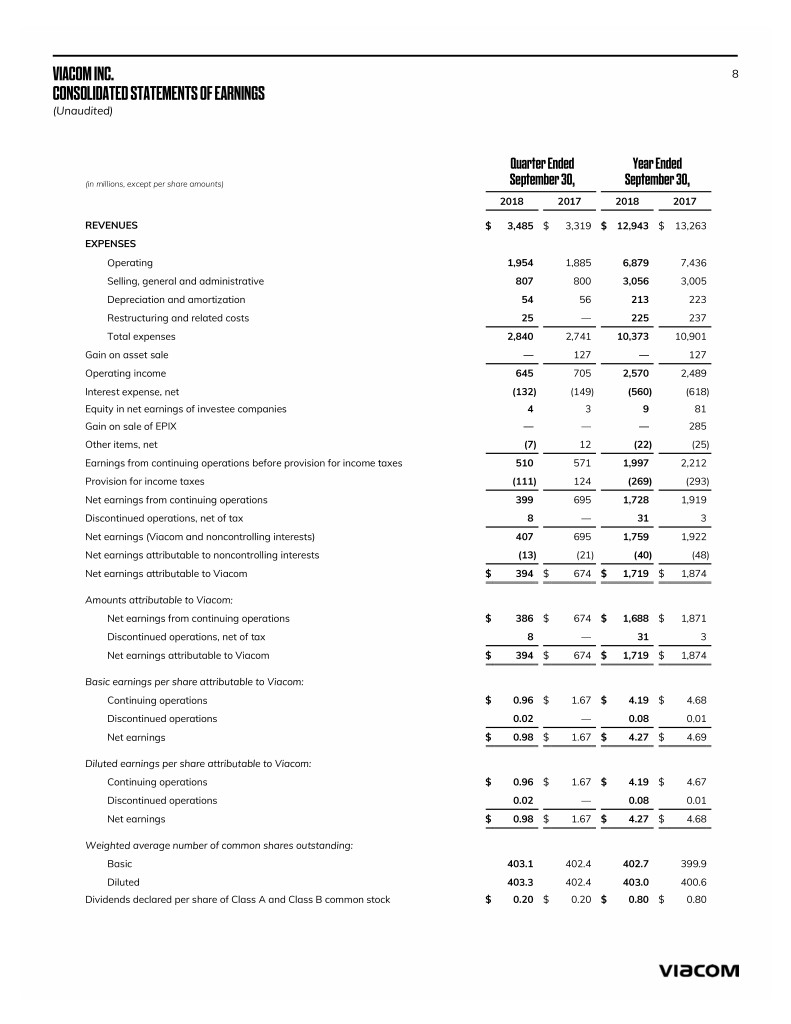

VIACOM INC. 8 CONSOLIDATED STATEMENTS OF EARNINGS (Unaudited) Quarter Ended Year Ended Quarter Ended Year Ended (in millions, except per share amounts) September 30, September 30, 2018 2017 2018 2017 REVENUES $ 3,485 $ 3,319 $ 12,943 $ 13,263 EXPENSES Operating 1,954 1,885 6,879 7,436 Selling, general and administrative 807 800 3,056 3,005 Depreciation and amortization 54 56 213 223 Restructuring and related costs 25 — 225 237 Total expenses 2,840 2,741 10,373 10,901 Gain on asset sale — 127 — 127 Operating income 645 705 2,570 2,489 Interest expense, net (132) (149) (560 ) (618) Equity in net earnings of investee companies 4 3 9 81 Gain on sale of EPIX — — — 285 Other items, net (7 ) 12 (22 ) (25 ) Earnings from continuing operations before provision for income taxes 510 571 1,997 2,212 Provision for income taxes (111 ) 124 (269) (293) Net earnings from continuing operations 399 695 1,728 1,919 Discontinued operations, net of tax 8 — 31 3 Net earnings (Viacom and noncontrolling interests) 407 695 1,759 1,922 Net earnings attributable to noncontrolling interests (13 ) (21 ) (40 ) (48 ) Net earnings attributable to Viacom $ 394 $ 674 $ 1,719 $ 1,874 Amounts attributable to Viacom: Net earnings from continuing operations $ 386 $ 674 $ 1,688 $ 1,871 Discontinued operations, net of tax 8 — 31 3 Net earnings attributable to Viacom $ 394 $ 674 $ 1,719 $ 1,874 Basic earnings per share attributable to Viacom: Continuing operations $ 0.96 $ 1.67 $ 4.19 $ 4.68 Discontinued operations 0.02 — 0.08 0.01 Net earnings $ 0.98 $ 1.67 $ 4.27 $ 4.69 Diluted earnings per share attributable to Viacom: Continuing operations $ 0.96 $ 1.67 $ 4.19 $ 4.67 Discontinued operations 0.02 — 0.08 0.01 Net earnings $ 0.98 $ 1.67 $ 4.27 $ 4.68 Weighted average number of common shares outstanding: Basic 403.1 402.4 402.7 399.9 Diluted 403.3 402.4 403.0 400.6 Dividends declared per share of Class A and Class B common stock $ 0.20 $ 0.20 $ 0.80 $ 0.80

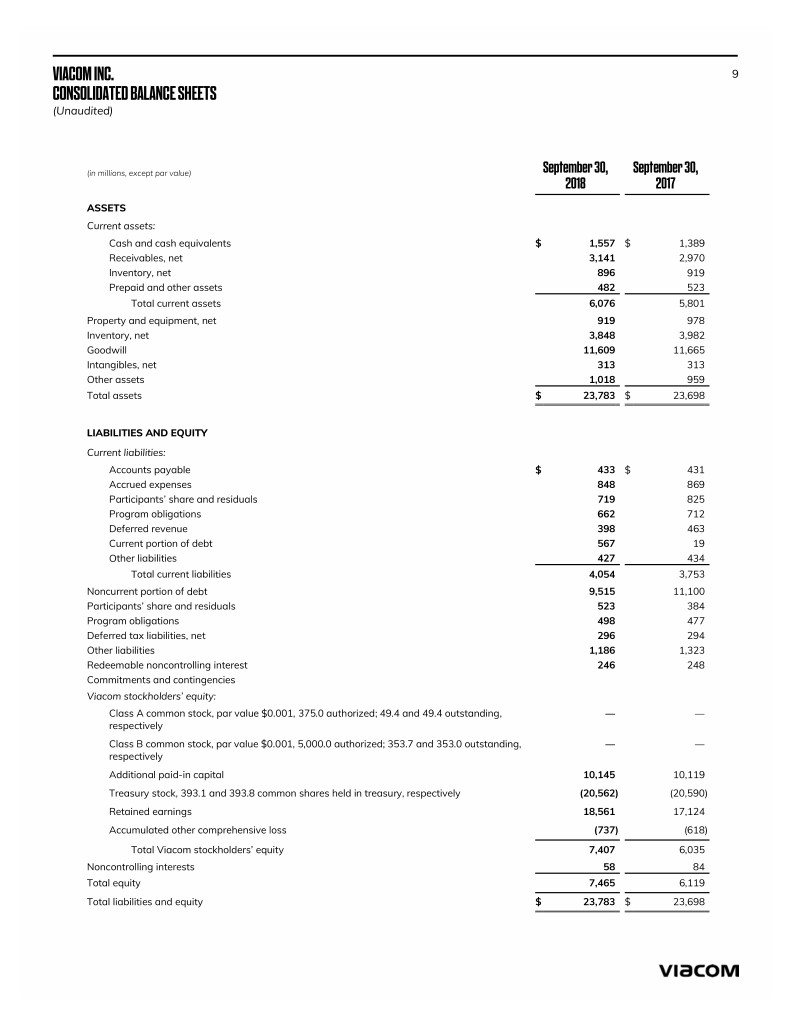

VIACOM INC. 9 CONSOLIDATED BALANCE SHEETS (Unaudited) (in millions, except par value) SeptemberSeptember 30, 30, SeptemberSeptember 30, 30, 2018 2017 2018 2017 ASSETS Current assets: Cash and cash equivalents $ 1,557 $ 1,389 Receivables, net 3,141 2,970 Inventory, net 896 919 Prepaid and other assets 482 523 Total current assets 6,076 5,801 Property and equipment, net 919 978 Inventory, net 3,848 3,982 Goodwill 11,609 11,665 Intangibles, net 313 313 Other assets 1,018 959 Total assets $ 23,783 $ 23,698 LIABILITIES AND EQUITY Current liabilities: Accounts payable $ 433 $ 431 Accrued expenses 848 869 Participants’ share and residuals 719 825 Program obligations 662 712 Deferred revenue 398 463 Current portion of debt 567 19 Other liabilities 427 434 Total current liabilities 4,054 3,753 Noncurrent portion of debt 9,515 11,100 Participants’ share and residuals 523 384 Program obligations 498 477 Deferred tax liabilities, net 296 294 Other liabilities 1,186 1,323 Redeemable noncontrolling interest 246 248 Commitments and contingencies Viacom stockholders’ equity: Class A common stock, par value $0.001, 375.0 authorized; 49.4 and 49.4 outstanding, — — respectively Class B common stock, par value $0.001, 5,000.0 authorized; 353.7 and 353.0 outstanding, — — respectively Additional paid-in capital 10,145 10,119 Treasury stock, 393.1 and 393.8 common shares held in treasury, respectively (20,562 ) (20,590) Retained earnings 18,561 17,124 Accumulated other comprehensive loss (737 ) (618 ) Total Viacom stockholders’ equity 7,407 6,035 Noncontrolling interests 58 84 Total equity 7,465 6,119 Total liabilities and equity $ 23,783 $ 23,698

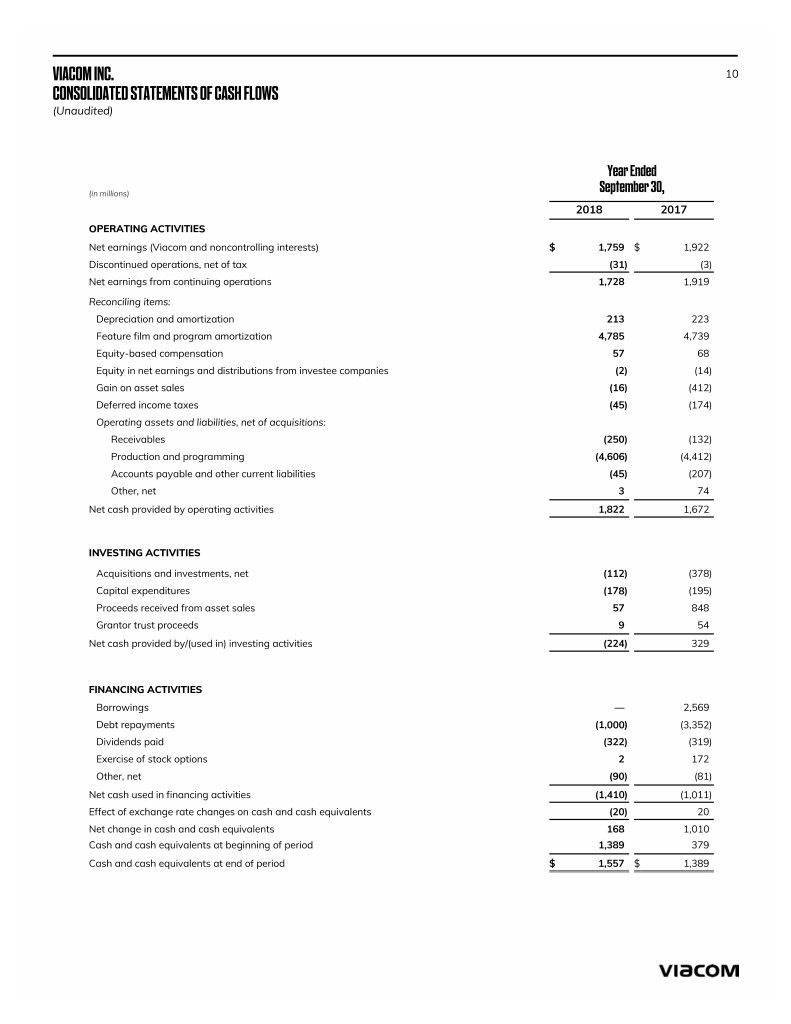

VIACOM INC. 10 CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) Year Ended September 30, (in millions) September 30, 2018 2017 OPERATING ACTIVITIES Net earnings (Viacom and noncontrolling interests) $ 1,759 $ 1,922 Discontinued operations, net of tax (31) (3) Net earnings from continuing operations 1,728 1,919 Reconciling items: Depreciation and amortization 213 223 Feature film and program amortization 4,785 4,739 Equity-based compensation 57 68 Equity in net earnings and distributions from investee companies (2) (14) Gain on asset sales (16) (412) Deferred income taxes (45) (174) Operating assets and liabilities, net of acquisitions: Receivables (250) (132) Production and programming (4,606) (4,412) Accounts payable and other current liabilities (45) (207) Other, net 3 74 Net cash provided by operating activities 1,822 1,672 INVESTING ACTIVITIES Acquisitions and investments, net (112) (378) Capital expenditures (178) (195) Proceeds received from asset sales 57 848 Grantor trust proceeds 9 54 Net cash provided by/(used in) investing activities (224) 329 FINANCING ACTIVITIES Borrowings — 2,569 Debt repayments (1,000) (3,352) Dividends paid (322) (319) Exercise of stock options 2 172 Other, net (90) (81) Net cash used in financing activities (1,410) (1,011) Effect of exchange rate changes on cash and cash equivalents (20) 20 Net change in cash and cash equivalents 168 1,010 Cash and cash equivalents at beginning of period 1,389 379 Cash and cash equivalents at end of period $ 1,557 $ 1,389

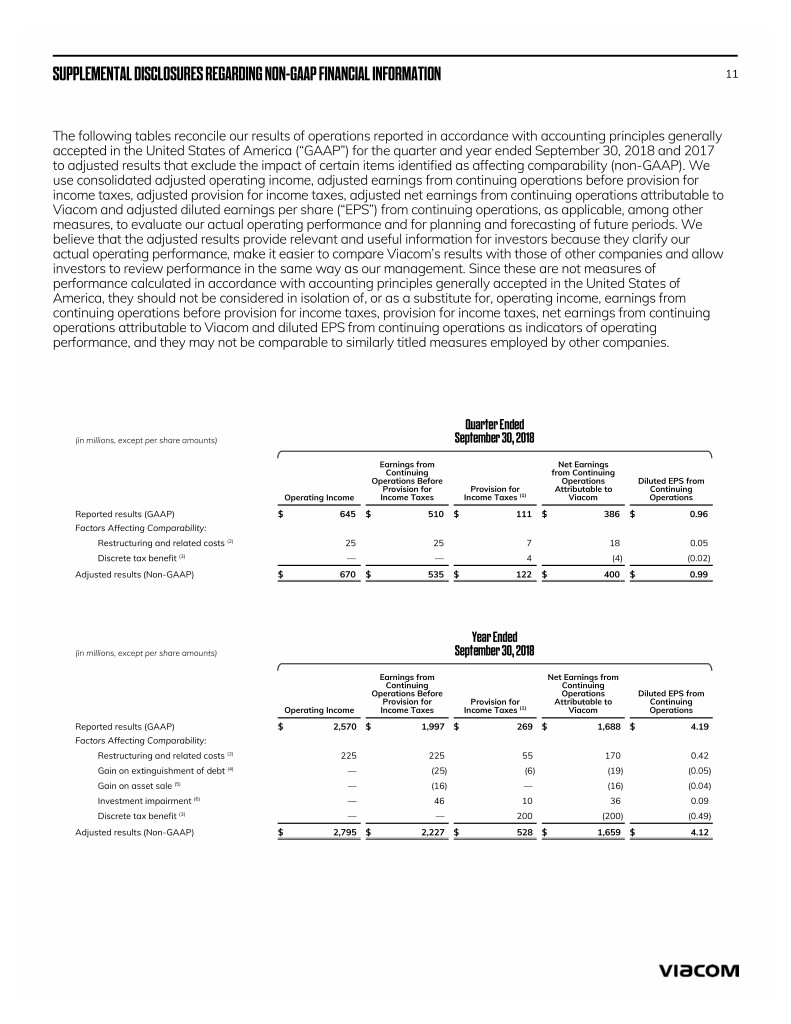

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION 11 The following tables reconcile our results of operations reported in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for the quarter and year ended September 30, 2018 and 2017 to adjusted results that exclude the impact of certain items identified as affecting comparability (non-GAAP). We use consolidated adjusted operating income, adjusted earnings from continuing operations before provision for income taxes, adjusted provision for income taxes, adjusted net earnings from continuing operations attributable to Viacom and adjusted diluted earnings per share (“EPS”) from continuing operations, as applicable, among other measures, to evaluate our actual operating performance and for planning and forecasting of future periods. We believe that the adjusted results provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare Viacom’s results with those of other companies and allow investors to review performance in the same way as our management. Since these are not measures of performance calculated in accordance with accounting principles generally accepted in the United States of America, they should not be considered in isolation of, or as a substitute for, operating income, earnings from continuing operations before provision for income taxes, provision for income taxes, net earnings from continuing operations attributable to Viacom and diluted EPS from continuing operations as indicators of operating performance, and they may not be comparable to similarly titled measures employed by other companies. QuarterQuarter Ended (in millions, except per share amounts) SeptemberSeptember 30, 20182018 Earnings from Net Earnings Continuing from Continuing Operations Before Operations Diluted EPS from Provision for Provision for Attributable to Continuing Operating Income Income Taxes Income Taxes (1) Viacom Operations Reported results (GAAP) $ 645 $ 510 $ 111 $ 386 $ 0.96 Factors Affecting Comparability: Restructuring and related costs (2) 25 25 7 18 0.05 Discrete tax benefit (3) — — 4 (4 ) (0.02 ) Adjusted results (Non-GAAP) $ 670 $ 535 $ 122 $ 400 $ 0.99 Year Ended (in millions, except per share amounts) SeptemberSeptember 30, 20182018 Earnings from Net Earnings from Continuing Continuing Operations Before Operations Diluted EPS from Provision for Provision for Attributable to Continuing Operating Income Income Taxes Income Taxes (1) Viacom Operations Reported results (GAAP) $ 2,570 $ 1,997 $ 269 $ 1,688 $ 4.19 Factors Affecting Comparability: Restructuring and related costs (2) 225 225 55 170 0.42 Gain on extinguishment of debt (4) — (25) (6 ) (19 ) (0.05 ) Gain on asset sale (5) — (16) — (16 ) (0.04 ) Investment impairment (6) — 46 10 36 0.09 Discrete tax benefit (3) — — 200 (200) (0.49 ) Adjusted results (Non-GAAP) $ 2,795 $ 2,227 $ 528 $ 1,659 $ 4.12

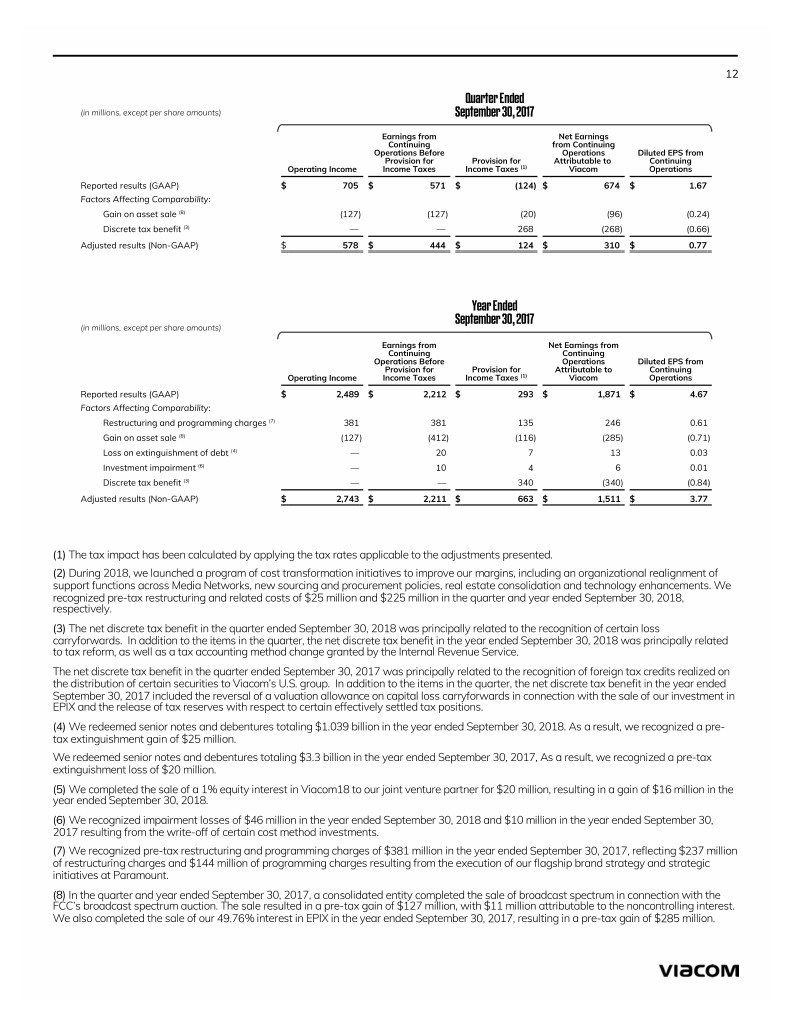

12 QuarterQuarter Ended (in millions, except per share amounts) SeptemberSeptember 30, 2017 Earnings from Net Earnings Continuing from Continuing Operations Before Operations Diluted EPS from Provision for Provision for Attributable to Continuing Operating Income Income Taxes Income Taxes (1) Viacom Operations Reported results (GAAP) $ 705 $ 571 $ (124 ) $ 674 $ 1.67 Factors Affecting Comparability: Gain on asset sale (8) (127) (127) (20 ) (96 ) (0.24 ) Discrete tax benefit (3) — — 268 (268) (0.66 ) Adjusted results (Non-GAAP) $ 578 $ 444 $ 124 $ 310 $ 0.77 Year Ended SeptemberYear Ended 30, 2017 (in millions, except per share amounts) September 30, 2017 Earnings from Net Earnings from Continuing Continuing Operations Before Operations Diluted EPS from Provision for Provision for Attributable to Continuing Operating Income Income Taxes Income Taxes (1) Viacom Operations Reported results (GAAP) $ 2,489 $ 2,212 $ 293 $ 1,871 $ 4.67 Factors Affecting Comparability: Restructuring and programming charges (7) 381 381 135 246 0.61 Gain on asset sale (8) (127 ) (412) (116 ) (285 ) (0.71) Loss on extinguishment of debt (4) — 20 7 13 0.03 Investment impairment (6) — 10 4 6 0.01 Discrete tax benefit (3) — — 340 (340) (0.84 ) Adjusted results (Non-GAAP) $ 2,743 $ 2,211 $ 663 $ 1,511 $ 3.77 (1) The tax impact has been calculated by applying the tax rates applicable to the adjustments presented. (2) During 2018, we launched a program of cost transformation initiatives to improve our margins, including an organizational realignment of support functions across Media Networks, new sourcing and procurement policies, real estate consolidation and technology enhancements. We recognized pre-tax restructuring and related costs of $25 million and $225 million in the quarter and year ended September 30, 2018, respectively. (3) The net discrete tax benefit in the quarter ended September 30, 2018 was principally related to the recognition of certain loss carryforwards. In addition to the items in the quarter, the net discrete tax benefit in the year ended September 30, 2018 was principally related to tax reform, as well as a tax accounting method change granted by the Internal Revenue Service. The net discrete tax benefit in the quarter ended September 30, 2017 was principally related to the recognition of foreign tax credits realized on the distribution of certain securities to Viacom’s U.S. group. In addition to the items in the quarter, the net discrete tax benefit in the year ended September 30, 2017 included the reversal of a valuation allowance on capital loss carryforwards in connection with the sale of our investment in EPIX and the release of tax reserves with respect to certain effectively settled tax positions. (4) We redeemed senior notes and debentures totaling $1.039 billion in the year ended September 30, 2018. As a result, we recognizeda pre- tax extinguishment gain of $25 million. We redeemed senior notes and debentures totaling $3.3 billion in the year ended September 30, 2017, As a result, we recognized a pre-tax extinguishment loss of $20 million. (5) We completed the sale of a 1% equity interest in Viacom18 to our joint venture partner for $20 million, resulting in a gain of $16 million in the year ended September 30, 2018. (6) We recognized impairment losses of $46 million in the year ended September 30, 2018 and $10 million in the year ended September 30, 2017 resulting from the write-off of certain cost method investments. (7) We recognized pre-tax restructuring and programming charges of $381 million in the year ended September 30, 2017, reflecting $237 million of restructuring charges and $144 million of programming charges resulting from the execution of our flagship brand strategy and strategic initiatives at Paramount. (8) In the quarter and year ended September 30, 2017, a consolidated entity completed the sale of broadcast spectrum in connection with the FCC’s broadcast spectrum auction. The sale resulted in a pre-tax gain of $127 million, with $11 million attributable to the noncontrolling interest. We also completed the sale of our 49.76% interest in EPIX in the year ended September 30, 2017, resulting in a pre-tax gain of $285 million.

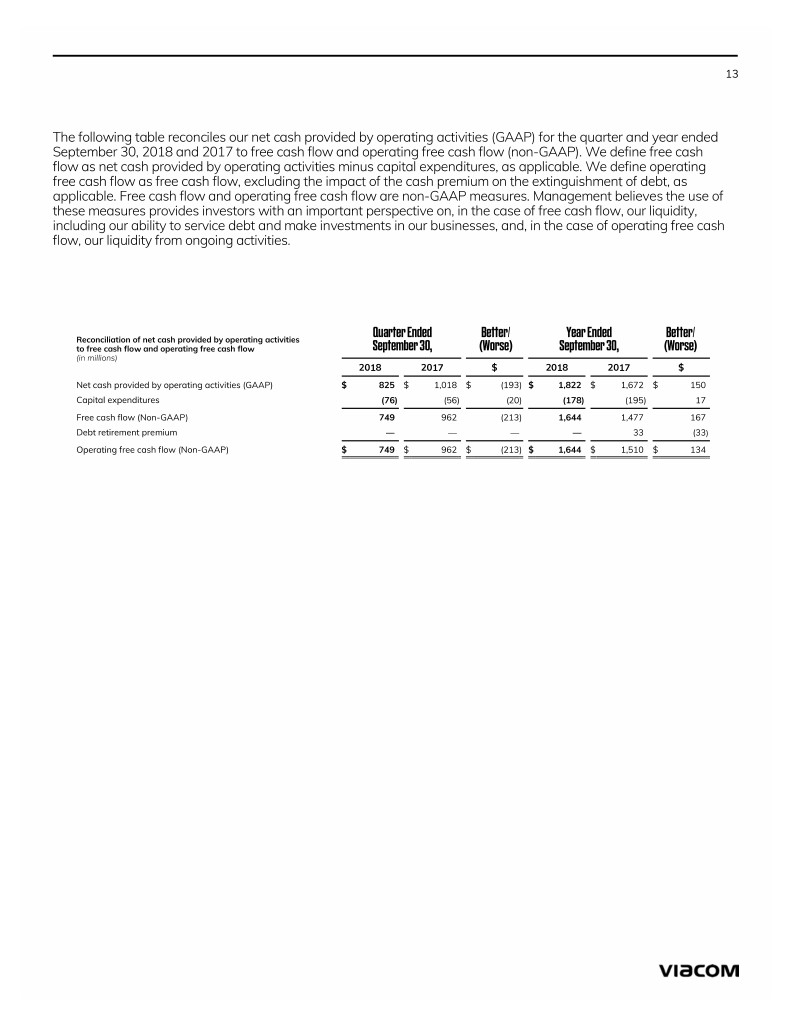

13 The following table reconciles our net cash provided by operating activities (GAAP) for the quarter and year ended September 30, 2018 and 2017 to free cash flow and operating free cash flow (non-GAAP). We define free cash flow as net cash provided by operating activities minus capital expenditures, as applicable. We define operating free cash flow as free cash flow, excluding the impact of the cash premium on the extinguishment of debt, as applicable. Free cash flow and operating free cash flow are non-GAAP measures. Management believes the use of these measures provides investors with an important perspective on, in the case of free cash flow, our liquidity, including our ability to service debt and make investments in our businesses, and, in the case of operating free cash flow, our liquidity from ongoing activities. Quarter Ended Better/ Year Ended Better/ Reconciliation of net cash provided by operating activities Quarter Ended Better/ Year Ended Better/ to free cash flow and operating free cash flow SeptemberSeptember 30,30, (Worse)(Worse) SeptemberSeptember 30,30, (Worse)(Worse) (in millions) 2018 2017 $ 2018 2017 $ Net cash provided by operating activities (GAAP) $ 825 $ 1,018 $ (193) $ 1,822 $ 1,672 $ 150 Capital expenditures (76) (56) (20 ) (178) (195 ) 17 Free cash flow (Non-GAAP) 749 962 (213) 1,644 1,477 167 Debt retirement premium — — — — 33 (33) Operating free cash flow (Non-GAAP) $ 749 $ 962 $ (213 ) $ 1,644 $ 1,510 $ 134