Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 4TH QUARTER FISCAL 2018 EARNINGS PRESS RELEASE - MATTHEWS INTERNATIONAL CORP | form8k-2018q4earnings.htm |

| EX-99.1 - EXHIBIT 99.1 4TH QUARTER FISCAL 2018 EARNINGS PRESS RELEASE - MATTHEWS INTERNATIONAL CORP | ex991_4q2018earningspr.htm |

Fourth Quarter Fiscal 2018 Earnings Teleconference November 16, 2018 Joseph C. Bartolacci President and Chief Executive Officer Steven F. Nicola Chief Financial Officer ©2018 Matthews International Corporation. All Rights Reserved.

Disclaimer ➢ Any forward-looking statements with respect to Matthews International Corporation (the “Company”) in connection with this presentation are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could cause the Company’s results to differ from those presented herein are set forth in the Company’s Annual Report on Form 10-K and other periodic filings with the Securities and Exchange Commission (“SEC”). ➢ The Company periodically provides information derived from financial data which is not presented in the consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Certain of this information are considered “non-GAAP financial measures” under the SEC rules. The Company believes that this information provides management and investors with a useful measure of the Company’s financial performance on a comparable basis. These non-GAAP financial measures are supplemental to the Company’s GAAP disclosures and should not be considered an alternative to the GAAP financial information. ➢ The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition-related items, system-integration costs, adjustments related to intangible assets, litigation items, and strategic initiative and other charges, which includes non-recurring charges related to operational initiatives and exit activities. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. ➢ Similarly, the Company believes that EBITDA, adjusted EBITDA, and adjusted EBITDA margin provide relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure performance as well as strategic planning and forecasting. ➢ The Company has also presented adjusted earnings per share and believes it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the per share effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of our operations. This measure provides management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, this measure may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. ➢ Lastly, the Company has presented adjusted net income and believes it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing financial performance. Adjusted net income provides the Company with an understanding of the results from the primary operations of its business by excluding the effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating the underlying performance of the business. ©2018 Matthews International Corporation. All Rights Reserved. 2

Financial Overview ©2018 Matthews International Corporation. All Rights Reserved. 3

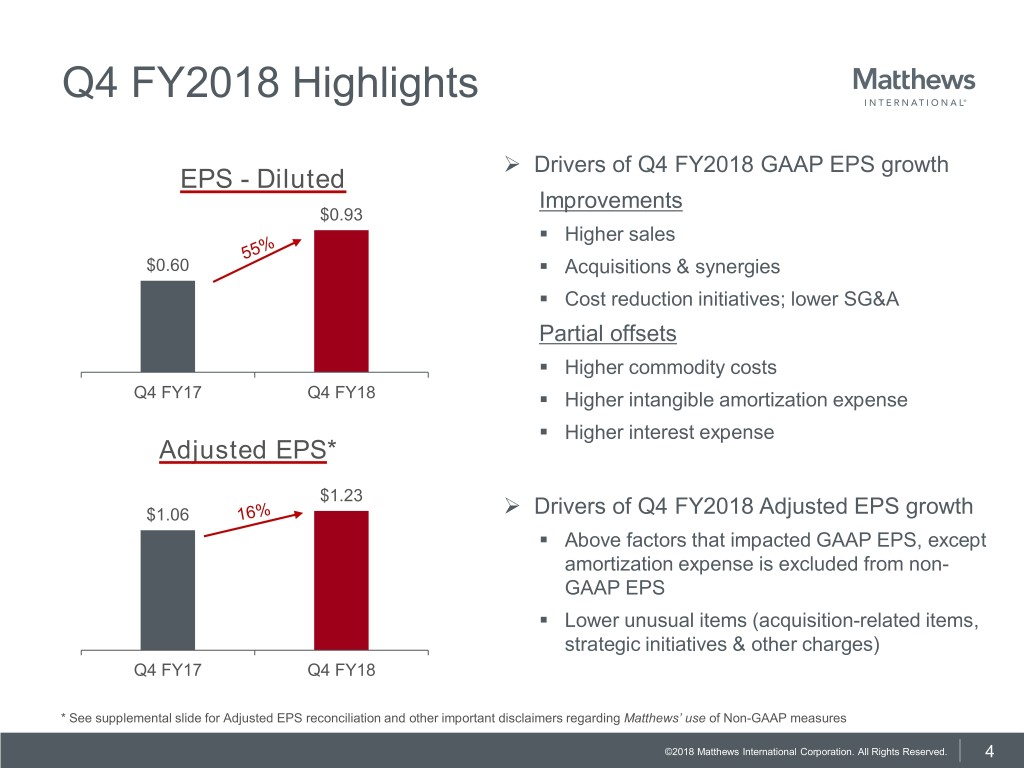

Q4 FY2018 Highlights ➢ Drivers of Q4 FY2018 GAAP EPS growth EPS - Diluted Improvements $0.93 ▪ Higher sales $0.60 ▪ Acquisitions & synergies ▪ Cost reduction initiatives; lower SG&A Partial offsets ▪ Higher commodity costs Q4 FY17 Q4 FY18 ▪ Higher intangible amortization expense ▪ Higher interest expense Adjusted EPS* $1.23 ➢ $1.06 Drivers of Q4 FY2018 Adjusted EPS growth ▪ Above factors that impacted GAAP EPS, except amortization expense is excluded from non- GAAP EPS ▪ Lower unusual items (acquisition-related items, strategic initiatives & other charges) Q4 FY17 Q4 FY18 * See supplemental slide for Adjusted EPS reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 4

Full Year Highlights ➢ Drivers of FY2018 GAAP EPS growth EPS - Diluted Improvements ▪ $3.37 Higher sales ▪ Acquisitions & synergies $2.28 ▪ Cost reduction initiatives; lower SG&A ▪ Tax regulation implementation Partial offsets ▪ FY 2017 FY 2018 Higher commodity costs ▪ Higher intangible amortization expense Adjusted EPS* ▪ Higher interest expense ▪ FY2017 included nonrecurring loss recoveries $3.96 $3.60 ➢ Drivers of FY2018 Adjusted EPS growth ▪ Above factors that impacted GAAP EPS, except amortization expense and tax regulation implementation are excluded from non-GAAP EPS FY 2017 FY 2018 ▪ Lower unusual items (acquisition-related items, strategic initiatives & other charges) * See supplemental slide for Adjusted EPS reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 5

Q4 FY2018 Consolidated Results ($ in millions) Sales GAAP Operating Profit and Margin $396.1 $407.4 $47.2 $29.9 7.6% 11.6% Q4 FY2017 Q4 FY2018 Q4 FY2017 Q4 FY2018 GAAP Gross Profit Adjusted EBITDA* and Margin and Margin $153.6 $148.8 $77.0 $64.1 38.8 % 36.5% 16.2% 18.9% Q4 FY2017 Q4 FY2018 Q4 FY2017 Q4 FY2018 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 6

Full Year Consolidated Results ($ in millions) Sales GAAP Operating Profit and Margin $1,515.6 $1,602.6 $132.8 $112.6 7.4% 8.3% FY2017 FY2018 FY2017 FY2018 GAAP Gross Profit Adjusted EBITDA* and Margin and Margin $238.7 $255.1 $563.4 $581.4 37.2% 36.3% 15.7% 15.9% FY2017 FY2018 FY2017 FY2018 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 7

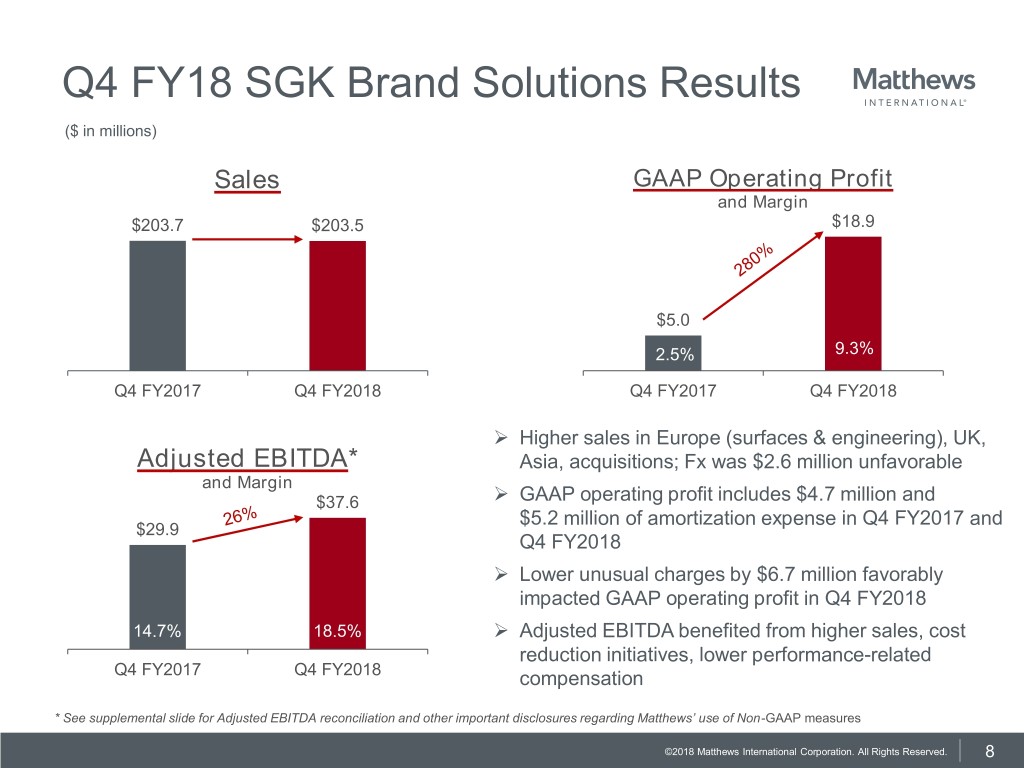

Q4 FY18 SGK Brand Solutions Results ($ in millions) Sales GAAP Operating Profit and Margin $203.7 $203.5 $18.9 $5.0 2.5% 9.3% Q4 FY2017 Q4 FY2018 Q4 FY2017 Q4 FY2018 ➢ Higher sales in Europe (surfaces & engineering), UK, Adjusted EBITDA* Asia, acquisitions; Fx was $2.6 million unfavorable and Margin ➢ $37.6 GAAP operating profit includes $4.7 million and $5.2 million of amortization expense in Q4 FY2017 and $29.9 Q4 FY2018 ➢ Lower unusual charges by $6.7 million favorably impacted GAAP operating profit in Q4 FY2018 14.7% 18.5% ➢ Adjusted EBITDA benefited from higher sales, cost reduction initiatives, lower performance-related Q4 FY2017 Q4 FY2018 compensation * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 8

Full Year SGK Brand Solutions Results ($ in millions) Sales GAAP Operating Profit and Margin $770.2 $805.3 $35.4 $24.9 3.2% 4.4% FY2017 FY2018 FY2017 FY2018 ➢ Higher sales in Europe (surfaces & engineering), UK, Adjusted EBITDA* Asia, acquisitions; Fx was $22.8 million favorable; LY and Margin included $18 million nonrecurring merchandising project $113.2 $107.2 ➢ GAAP operating profit includes $17.3 million and $20.6 million of amortization expense in FY2017 and FY2018 ➢ Lower unusual charges by $8.8 million favorably 13.9% 14.1% impacted GAAP operating profit in FY2018 ➢ Adjusted EBITDA benefited from higher sales, cost FY2017 FY2018 reduction initiatives, lower performance-related compensation * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 9

Q4 FY18 Memorialization Results ($ in millions) Sales GAAP Operating Profit and Margin $23.1 $152.3 $155.8 $19.9 13.1% 14.8% Q4 FY2017 Q4 FY2018 Q4 FY2017 Q4 FY2018 Adjusted EBITDA* ➢ Higher sales from acquisitions and bronze market share and Margin gains partially offset by lower casket sales, memorials $31.7 and pre-need; Fx was $0.3 million unfavorable $27.8 ➢ GAAP operating profit includes $1.3 million and $2.1 million of amortization expense in Q4 FY2017 and Q4 FY2018 ➢ 18.3% 20.3% Adjusted EBITDA benefited from acquisition synergies and higher sales; partially offset by higher steel costs Q4 FY2017 Q4 FY2018 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 10

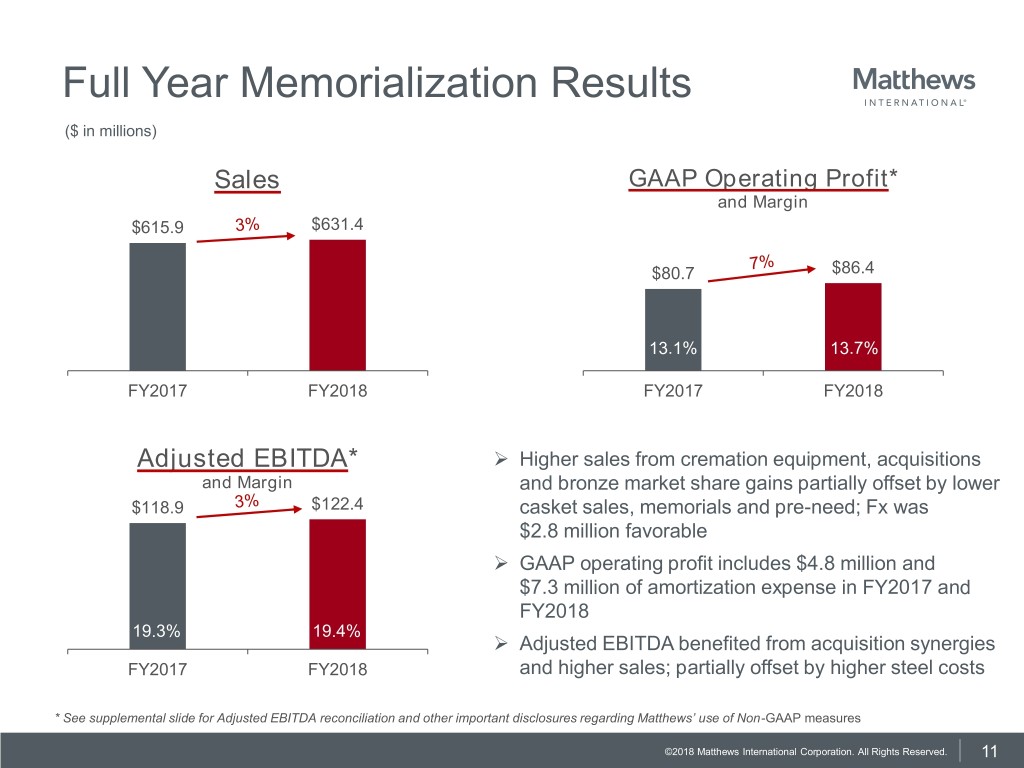

Full Year Memorialization Results ($ in millions) Sales GAAP Operating Profit* and Margin $615.9 $631.4 $80.7 $86.4 13.1% 13.7% FY2017 FY2018 FY2017 FY2018 Adjusted EBITDA* ➢ Higher sales from cremation equipment, acquisitions and Margin and bronze market share gains partially offset by lower $118.9 $122.4 casket sales, memorials and pre-need; Fx was $2.8 million favorable ➢ GAAP operating profit includes $4.8 million and $7.3 million of amortization expense in FY2017 and FY2018 19.3% 19.4% ➢ Adjusted EBITDA benefited from acquisition synergies FY2017 FY2018 and higher sales; partially offset by higher steel costs * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 11

Q4 FY18 Industrial Technologies Results ($ in millions) Sales GAAP Operating Profit and Margin $48.1 6 $5.1 $5.3 $40.1 5 4 3 2 1 12.7% 11.0% 0 Q4 FY2017 Q4 FY2018 Q4 FY2017 Q4 FY2018 Adjusted EBITDA* ➢ Higher sales from fulfillment systems, marking products, and Margin OEM solutions, Compass Engineering acquisition; Fx was $0.5 million unfavorable $7.6 ➢ $6.5 GAAP operating profit includes $0.4 million and $1.0 million of amortization expense in Q4 FY2017 and Q4 FY2018 ➢ Adjusted EBITDA benefited from higher sales; each 16.2% 15.8% period includes $1.8 million of new product development Q4 FY2017 Q4 FY2018 project costs * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 12

Full Year Industrial Technologies Results ($ in millions) Sales GAAP Operating Profit and Margin $165.9 $11.0 $129.5 $7.0 5.4% 6.6% FY2017 FY2018 FY2017 FY2018 ➢ Adjusted EBITDA* Higher sales from fulfillment systems, marking products, OEM solutions, acquisitions; Fx was $1.2 million and Margin favorable $19.6 ➢ GAAP operating profit includes $1.3 million and $3.6 million of amortization expense in FY2017 and $12.6 FY2018 ➢ Adjusted EBITDA benefited from higher sales; partially 9.7% 11.8% offset by higher new product development project costs ($6.9 million in FY2017 vs. $8.0 million in FY2018) FY2017 FY2018 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures ©2018 Matthews International Corporation. All Rights Reserved. 13

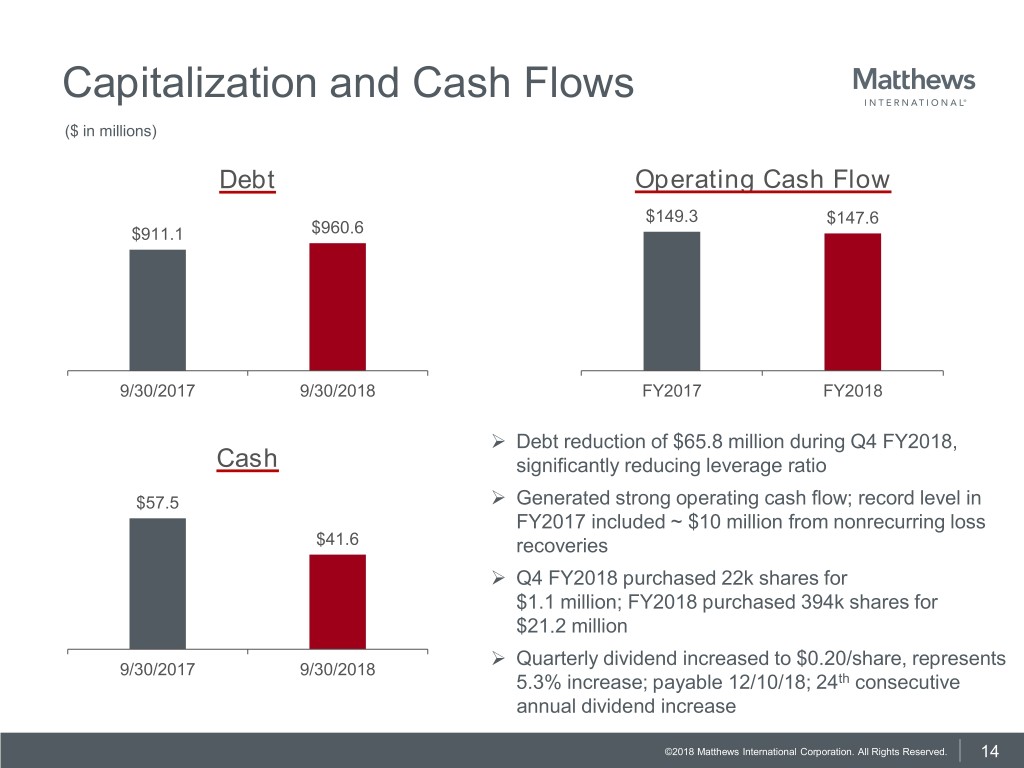

Capitalization and Cash Flows ($ in millions) Debt Operating Cash Flow $149.3 $147.6 $911.1 $960.6 9/30/2017 9/30/2018 FY2017 FY2018 ➢ Debt reduction of $65.8 million during Q4 FY2018, Cash significantly reducing leverage ratio ➢ $57.5 Generated strong operating cash flow; record level in FY2017 included ~ $10 million from nonrecurring loss $41.6 recoveries ➢ Q4 FY2018 purchased 22k shares for $1.1 million; FY2018 purchased 394k shares for $21.2 million ➢ Quarterly dividend increased to $0.20/share, represents 9/30/2017 9/30/2018 5.3% increase; payable 12/10/18; 24th consecutive annual dividend increase ©2018 Matthews International Corporation. All Rights Reserved. 14

Business Overview ©2018 Matthews International Corporation. All Rights Reserved. 15

Business Highlights & Market Climate ➢ Equator showing signs of recent ➢ Several global clients pressuring wins; private label and retail focused segment performance SGK Brand ➢ ➢ Solutions Europe seeing positive momentum Currency climate ➢ Several new account wins; but ➢ Realizing benefits from cost savings volume ramp has been slow initiatives ➢ Acquisitions mitigated impact of ➢ Aurora synergies continue to increase declines in US casketed deaths ➢ Realizing planned synergies from Star ➢ Memorialization Gaining market share in bronze Granite & Bronze acquisition cemetery products ➢ Commodity cost pressures continue ➢ Price realization ➢ Strong cost controls ➢ Fulfillment products group increasing ➢ New product in beta test phase; market penetration launch still expected early 2019 Industrial ➢ Released new products by product ➢ Expanding opportunities with new Technologies identification group, gaining traction customer for turnkey warehouse ➢ Compass Engineering acquisition solutions contributing to segment performance ➢ Large, global logistics client releasing new projects ©2018 Matthews International Corporation. All Rights Reserved. 16

Acquisitions Integration Update SGK Brand Solutions ➢ Frost Converting Systems (November 2018) ➢ Equator (March 2017) ➢ Ungricht (January 2017) ➢ VCG (January 2017) Memorialization ➢ Star Granite & Bronze (February 2018) ➢ Aurora (August 2015) Industrial Technologies ➢ Compass Engineering (November 2017) ➢ RAF Technology (February 2017) ©2018 Matthews International Corporation. All Rights Reserved. 17

Outlook for Fiscal 2019* Observations ➢ Order rates for fulfillment systems (Industrial Technologies) and engineered solutions (SGK Brand Solutions) remain solid ➢ Recent new brand account wins and Frost acquisition will contribute favorably ➢ Commodity cost increases (primarily steel) present ongoing headwinds ➢ Effective income tax rate will increase since tax benefits discrete to FY2018 will not repeat next year Guidance ➢ Adjusted EBITDA will grow mid-to-high single digit rate over FY2018 ➢ Non-GAAP EPS will grow mid-single digit rate over FY2018; pre-tax to contribute high-single digit EPS growth, partially offset by higher tax rate ➢ Excess cash will be applied to reduce debt * As of November 15, 2018 ©2018 Matthews International Corporation. All Rights Reserved. 18

Supplemental Information ©2018 Matthews International Corporation. All Rights Reserved. 19

Reconciliations of Non-GAAP Financial Measures The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition-related items, adjustments related to intangible assets, litigation items, and strategic initiative and other charges, which includes non-recurring charges related to operational initiatives and exit activities. Management believes that presenting non-GAAP financial measures (such as EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income and Adjusted EPS) is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. These non- GAAP financial measures are supplemental to the Company’s GAAP disclosures and should not be considered an alternative to the GAAP financial information. ©2018 Matthews International Corporation. All Rights Reserved. 20

Adjusted Earnings Per Share Non-GAAP Reconciliation Three Months Ended Fiscal Year Ended September 30, September 30, ($ in thousands, except per share data) 2018 2017 2018 2017 Net income attributable to Matthews $ 29,595 $ 19,641 $ 107,371 $ 74,368 Acquisition-related items (1) 3,104 4,925 16,168 20,615 Pension and postretirement expense (2) 1,071 1,567 4,235 6,141 Intangible amortization expense 6,141 4,546 23,356 16,319 Strategic initiatives and other charges (1,012) 4,440 1,106 6,722 Loss recoveries, net of costs - (974) - (7,478) Tax-related (3) 771 200 (25,967) 485 Adjusted net income $ 39,670 $ 34,345 $ 126,269 $ 117,172 Adjusted EPS $ 1.23 $ 1.06 $ 3.96 $ 3.60 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 26.0% and 20.1%, for the three months ended September 30, 2018 and 2017, respectively, and 26.0% and 30.0% for the fiscal year ended September 30, 2018 and 2017, respectively. (1) Acquisition-related items included acquisition costs and ERP integration costs, net of tax, for each period presented, as follows: Three M onths Ended Fiscal Year Ended September 30, September 30, 2018 2017 2018 2017 Acquisition costs 1,191 3,093 8,128 13,828 ERP integration costs 1,913 1,832 8,040 6,787 Total Acquisition-related items 3,104 4,925 16,168 20,615 (2) The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related components of these costs. Non- service related components include interest cost, expected return on plan assets and amortization of actuarial gains and losses. The service cost and prior service cost components of pension and postretirement expense are considered to be a better reflection of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and postretirement expense are primarily influenced by general market conditions impacting investment returns and interest (discount) rates. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (3) The tax-related adjustments in fiscal 2018 consisted of income tax regulation changes which included an estimated favorable tax benefit of approximately $37,800 for the reduction in the Company’s net deferred tax liability principally reflecting the lower U.S. Federal tax rate, offset partially by an estimated repatriation transition tax charge and other charges of approximately $11,800, for the fiscal year ended September 30, 2018. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. ©2018 Matthews International Corporation. All Rights Reserved. 21

EBITDA and Adjusted EBITDA Non-GAAP Reconciliation Three Months Ended Fiscal Year Ended September 30, September 30, ($ in thousands, except percentage amounts) 2018 2017 2018 2017 Net income attributable to Matthews $ 29,595 $ 19,641 $ 107,371 $ 74,368 Interest expense 10,645 6,621 37,427 26,371 Income taxes (1) 9,585 5,036 (9,118) 22,354 Depreciation and amortization 19,922 17,171 76,974 67,981 EBITDA $ 69,747 $ 48,469 $ 212,654 $ 191,074 Acquisition-related items (2) 4,195 6,135 21,782 25,748 Strategic initiatives and other charges (1,367) 5,925 1,495 9,209 Loss recoveries, net of costs - (1,325) - (10,683) Stock-based compensation 2,929 2,708 13,460 14,562 Pension and postretirement expense (3) 1,447 2,191 5,723 8,773 Adjusted EBITDA $ 76,951 $ 64,103 $ 255,114 $ 238,683 Adjusted EBITDA margin 18.9% 16.2% 15.9% 15.7% (1) The income tax regulation changes identified in the adjusted net income/earnings per share reconciliation are included in this line and therefore not separately identified in the calculation of adjusted EBITDA. (2) Acquisition-related items included acquisition costs and ERP integration costs for each period presented, as follows: Three M onths Ended Fiscal Year Ended September 30, September 30, 2018 2017 2018 2017 Acquisition costs 1,609 3,577 10,918 17,722 ERP integration costs 2,586 2,558 10,864 8,026 Total Acquisition-related items 4,195 6,135 21,782 25,748 (3) The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related components of these costs. Non- service related components include interest cost, expected return on plan assets and amortization of actuarial gains and losses. The service cost and prior service cost components of pension and postretirement expense are considered to be a better reflection of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and postretirement expense are primarily influenced by general market conditions impacting investment returns and interest (discount) rates. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to EBITDA, adjusted EBITDA, and adjusted EBITDA margin. ©2018 Matthews International Corporation. All Rights Reserved. 22

Adjusted EBITDA by Segment Non-GAAP Reconciliation Three Months Ended Year Ended ($ in thousands) September 30, September 30, 2018 2017 2018 2017 SGK Brand Solutions Operating profit $ 18,893 $ 4,978 $ 35,443 $ 24,919 Depreciation and amortization (1) 12,484 11,513 48,970 43,508 Other (2) 1,209 637 1,323 4,877 EBITDA 32,586 17,128 85,736 73,304 Acquisition-related items (1) 4,071 5,407 18,879 19,541 Strategic initiatives and other charges (3) (984) 5,749 17 8,620 Loss recoveries, net of costs — (617) — (4,968) Stock-based compensation 1,274 1,194 5,892 6,639 Pension and postretirement expense (4) 674 1,020 2,662 4,080 Adjusted EBITDA $ 37,621 $ 29,881 $ 113,186 $ 107,216 Memorialization Operating profit $ 23,076 $ 19,893 $ 86,370 $ 80,652 Depreciation and amortization (1) 5,733 4,781 21,961 21,408 Other (2) 1,236 652 1,352 4,983 EBITDA 30,045 25,326 109,683 107,043 Acquisition-related items (1) 44 712 2,630 5,851 Strategic initiatives and other charges (3) (505) — 769 — Loss recoveries, net of costs — (629) — (5,074) Stock-based compensation 1,426 1,305 6,553 6,893 Pension and postretirement expense (4) 687 1,041 2,718 4,167 Note: See Disclaimer (Page 2) for Management’s assessment of Adjusted EBITDA $ 31,697 $ 27,755 $ 122,353 $ 118,880 supplemental information related to EBITDA and adjusted EBITDA. Industrial Technologies Operating profit $ 5,255 $ 5,055 $ 11,021 $ 7,032 (1) One-time depreciation and amortization charges related to (1) Depreciation and amortization 1,705 877 6,043 3,065 recent acquisitions are included in Depreciation and amortization. Other (2) 156 83 171 630 EBITDA 7,116 6,015 17,235 10,727 (2) Other represents Investment (loss) income, Other income Acquisition-related items (1) 80 16 273 356 (deductions), net, and Net loss (income) attributable to Strategic initiatives and other charges (3) 122 176 709 589 noncontrolling interests Loss recoveries, net of costs — (79) — (641) (3) One-time non-operating related charges are included in the Stock-based compensation 229 209 1,015 1,030 calculation of Adjusted EBITDA. Pension and postretirement expense (4) 86 130 343 526 Adjusted EBITDA $ 7,633 $ 6,467 $ 19,575 $ 12,587 (4) The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related Consolidated components of these costs. Non-service related components Operating profit $ 47,224 $ 29,926 $ 132,834 $ 112,603 include interest cost, expected return on plan assets and Depreciation and amortization (1) 19,922 17,171 76,974 67,981 amortization of actuarial gains and losses. The service cost and (2) prior service cost components of pension and postretirement Other 2,601 1,372 2,846 10,490 EBITDA 69,747 48,469 212,654 191,074 expense are considered to be a better reflection of the ongoing service-related costs of providing these benefits. The other Acquisition-related items (1) 4,195 6,135 21,782 25,748 components of GAAP pension and postretirement expense are (3) Strategic initiatives and other charges (1367) 5,925 1,495 9,209 primarily influenced by general market conditions impacting Loss recoveries, net of costs — (1,325) — (10,683) investment returns and interest (discount) rates. Please note that Stock-based compensation 2,929 2,708 13,460 14,562 GAAP pension and postretirement expense or the adjustment Pension and postretirement expense (4) 1,447 2,191 5,723 8,773 above are not necessarily indicative of the current or future cash Adjusted EBITDA $ 76,951 $ 64,103 $ 255,114 $ 238,683 flow requirements related to these employee benefit plans. ©2018 Matthews International Corporation. All Rights Reserved. 23

Fourth Quarter Fiscal 2018 Earnings Teleconference November 16, 2018 ©2018 Matthews International Corporation. All Rights Reserved.