Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - OptiNose, Inc. | q318earningsrelease.htm |

| 8-K - 8-K - OptiNose, Inc. | a8-kq318earningsrelease.htm |

Exhibit 99.2 Building a Leading ENT / Allergy Specialty Company Corporate Presentation November 13, 2018

Forward-Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: potential benefits of XHANCE® and our EDS technology; potential drivers of future growth; potential benefits of our patient affordability programs; market access objectives; potential effects of INS market seasonality on XHANCE prescriptions; market opportunities; commercial strategies; initiation of DTC pilot; the initiation and timing of clinical trials for chronic sinusitis; projected 2018 operating expenses; expectations regarding average revenue per prescription in fourth quarter of 2018; and other statements regarding our future operations, financial performance, prospects, intentions, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: physician and patient acceptance of XHANCE; our ability to obtain, maintain and increase insurance coverage for XHANCE (market access); our ability to grow XHANCE prescriptions and become profitable; uncertainties and delays relating to the initiation, enrollment, completion and results of clinical trials; market opportunities for XHANCE may be smaller than we believe; unexpected costs and expenses; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise. This presentation and our accompanying remarks also contain estimates, projections, market research and other data generated by independent third parties and by us concerning our industry, XHANCE, brand awareness, market access, the estimated size of markets, the prevalence of certain medical conditions and the perceptions and preferences of patients and physicians. Information that is based on estimates, projections, market research or similar methodologies is inherently subject to uncertainties and actual events and circumstances may differ materially from events and circumstances reflected in this information. You are cautioned not to give undue weight to such information. 2

Optinose Key Priorities Accelerate XHANCE® prescription growth Advance our clinical program for XHANCE for a follow-on indication for the treatment of chronic sinusitis Support our commercial and development objectives through efficient use of capital ■ ~$220 Million of cash as of September 30, 2018 3

XHANCE Launch Update

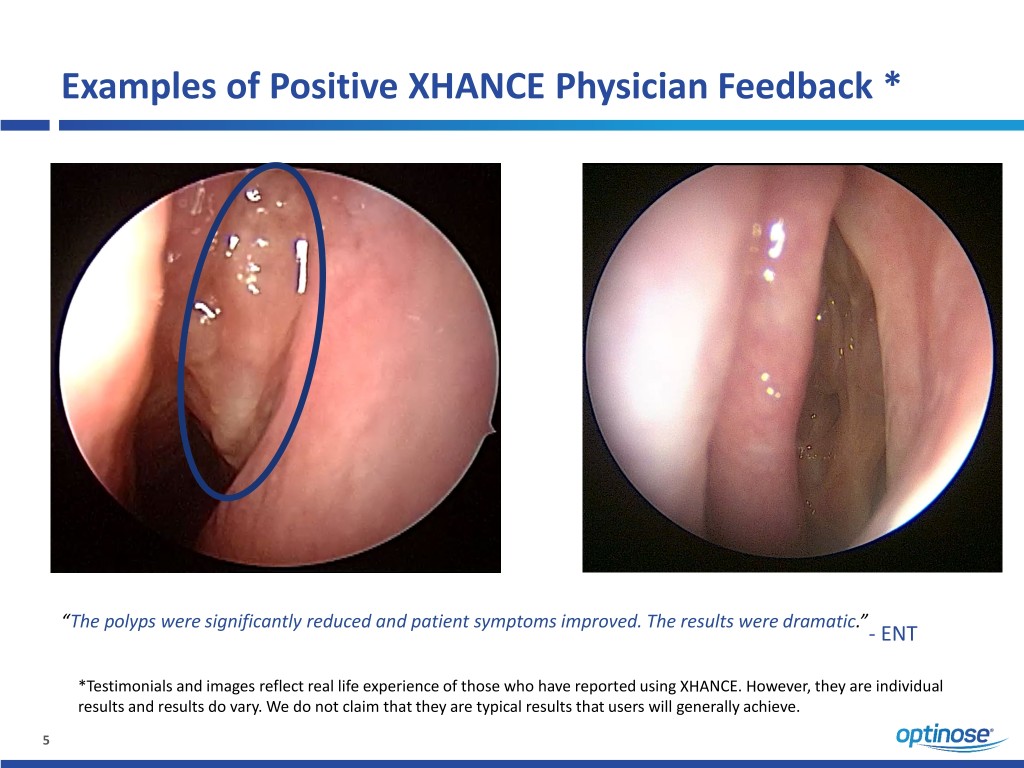

Examples of Positive XHANCE Physician Feedback * “The polyps were significantly reduced and patient symptoms improved. The results were dramatic.” - ENT *Testimonials and images reflect real life experience of those who have reported using XHANCE. However, they are individual results and results do vary. We do not claim that they are typical results that users will generally achieve. 5

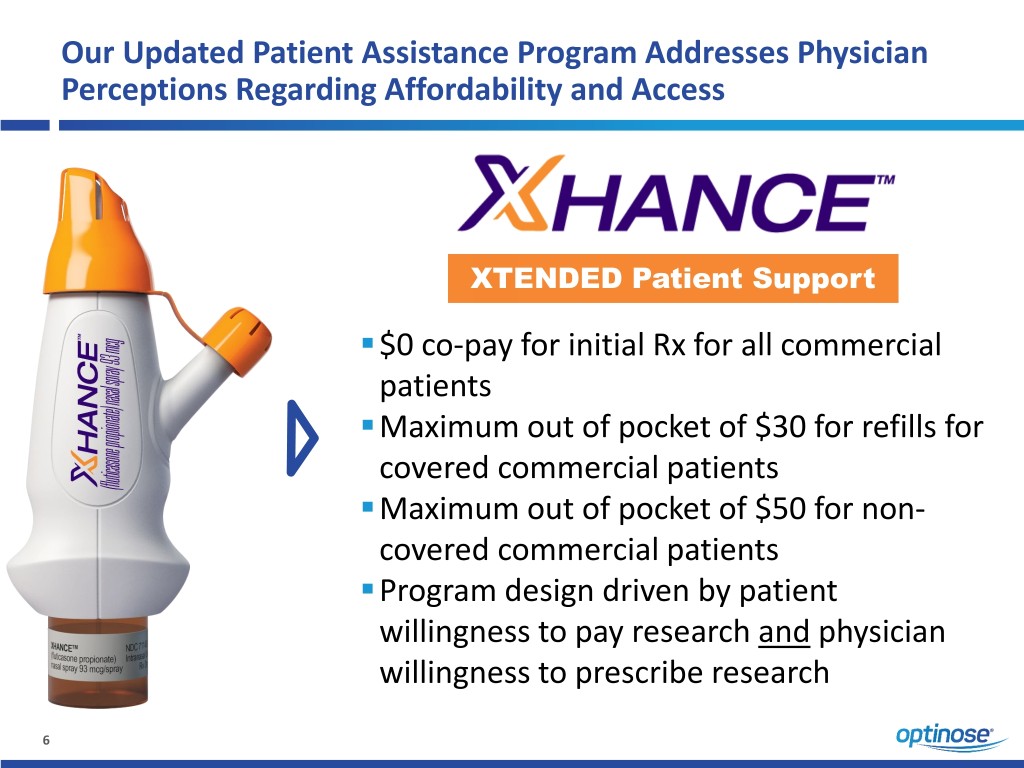

Our Updated Patient Assistance Program Addresses Physician Perceptions Regarding Affordability and Access XTENDED Patient Support .$0 co-pay for initial Rx for all commercial patients .Maximum out of pocket of $30 for refills for covered commercial patients .Maximum out of pocket of $50 for non- covered commercial patients .Program design driven by patient willingness to pay research and physician willingness to prescribe research 6

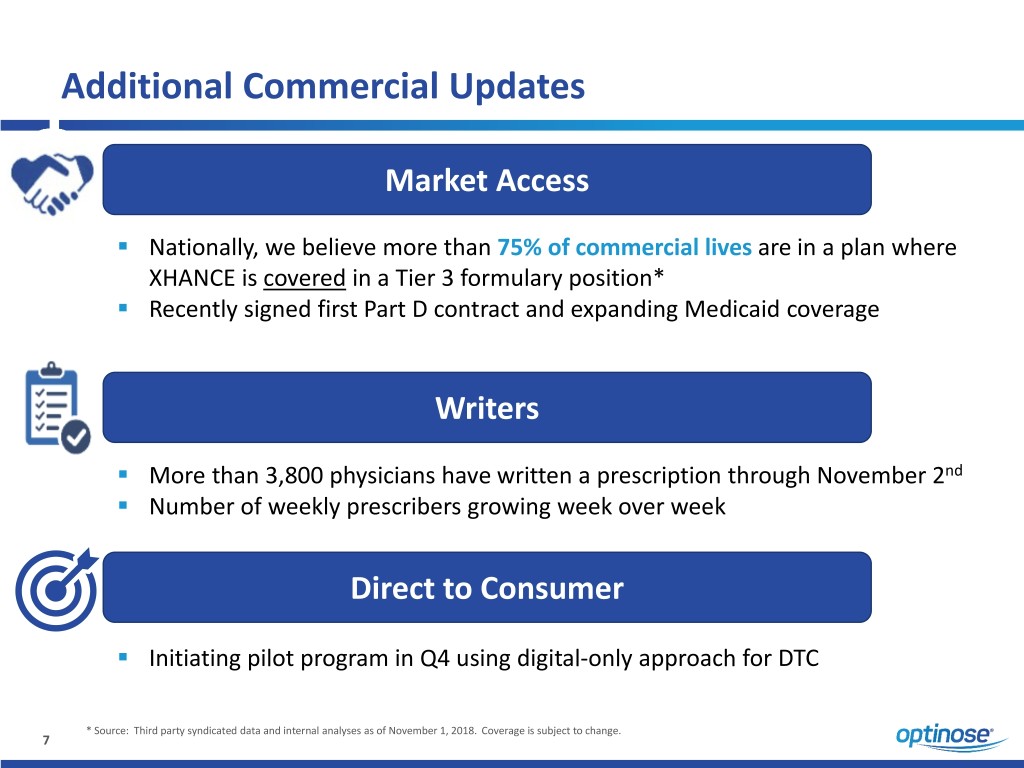

Additional Commercial Updates Market Access . Nationally, we believe more than 75% of commercial lives are in a plan where XHANCE is covered in a Tier 3 formulary position* . Recently signed first Part D contract and expanding Medicaid coverage Writers . More than 3,800 physicians have written a prescription through November 2nd . Number of weekly prescribers growing week over week Direct to Consumer . Initiating pilot program in Q4 using digital-only approach for DTC * Source: Third party syndicated data and internal analyses as of November 1, 2018. Coverage is subject to change. 7

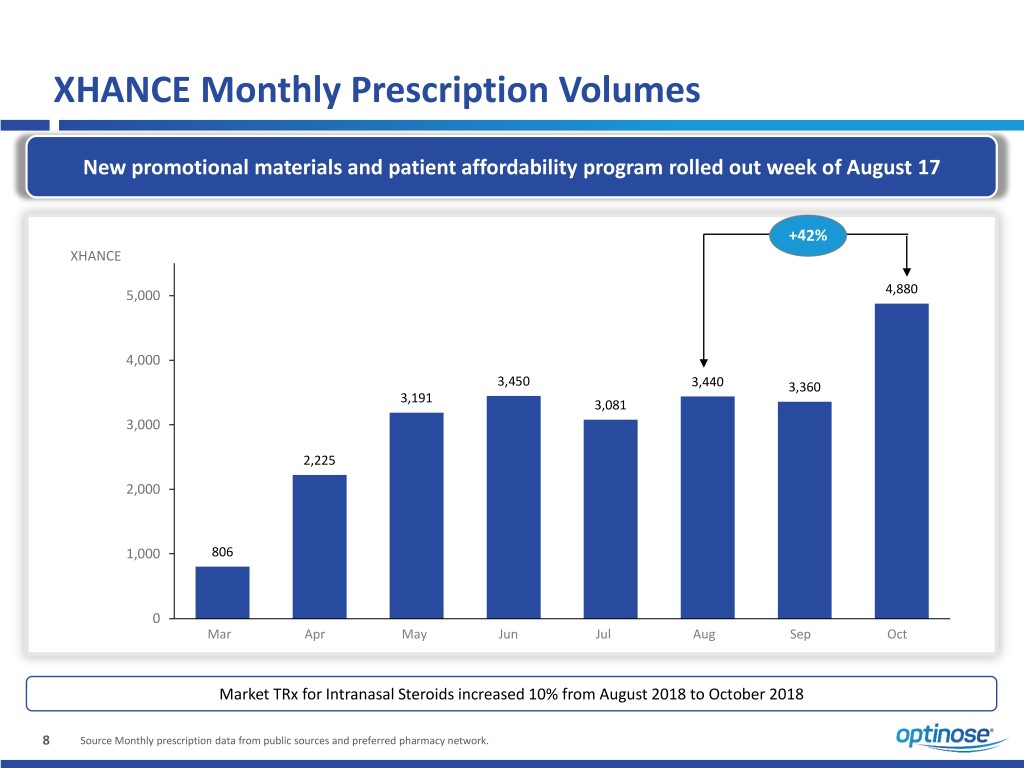

XHANCE Monthly Prescription Volumes New promotional materials and patient affordability program rolled out week of August 17 +42% XHANCE 5,000 4,880 4,000 3,450 3,440 3,360 3,191 3,081 3,000 2,225 2,000 1,000 806 0 Mar Apr May Jun Jul Aug Sep Oct Market TRx for Intranasal Steroids increased 10% from August 2018 to October 2018 8 Source Monthly prescription data from public sources and preferred pharmacy network.

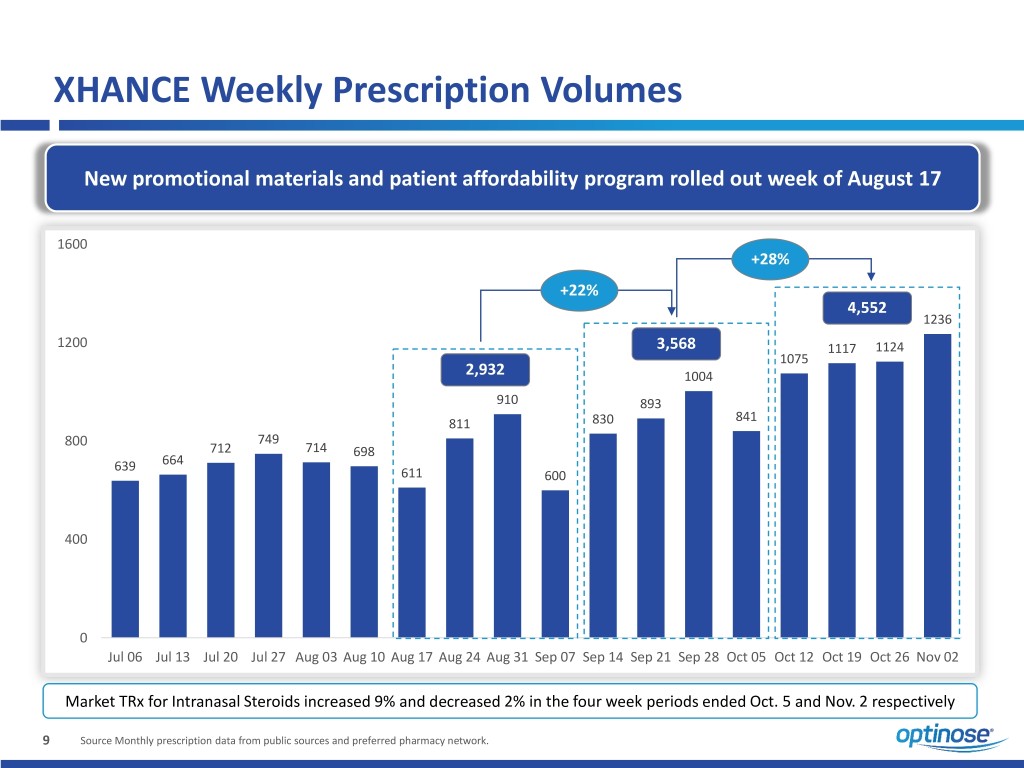

XHANCE Weekly Prescription Volumes New promotional materials and patient affordability program rolled out week of August 17 1600 +28% +22% 4,552 1236 1200 3,568 1117 1124 1075 2,932 1004 910 893 841 811 830 800 749 712 714 698 639 664 611 600 400 0 Jul 06 Jul 13 Jul 20 Jul 27 Aug 03 Aug 10 Aug 17 Aug 24 Aug 31 Sep 07 Sep 14 Sep 21 Sep 28 Oct 05 Oct 12 Oct 19 Oct 26 Nov 02 Market TRx for Intranasal Steroids increased 9% and decreased 2% in the four week periods ended Oct. 5 and Nov. 2 respectively 9 Source Monthly prescription data from public sources and preferred pharmacy network.

Q3 2018 Financial Update

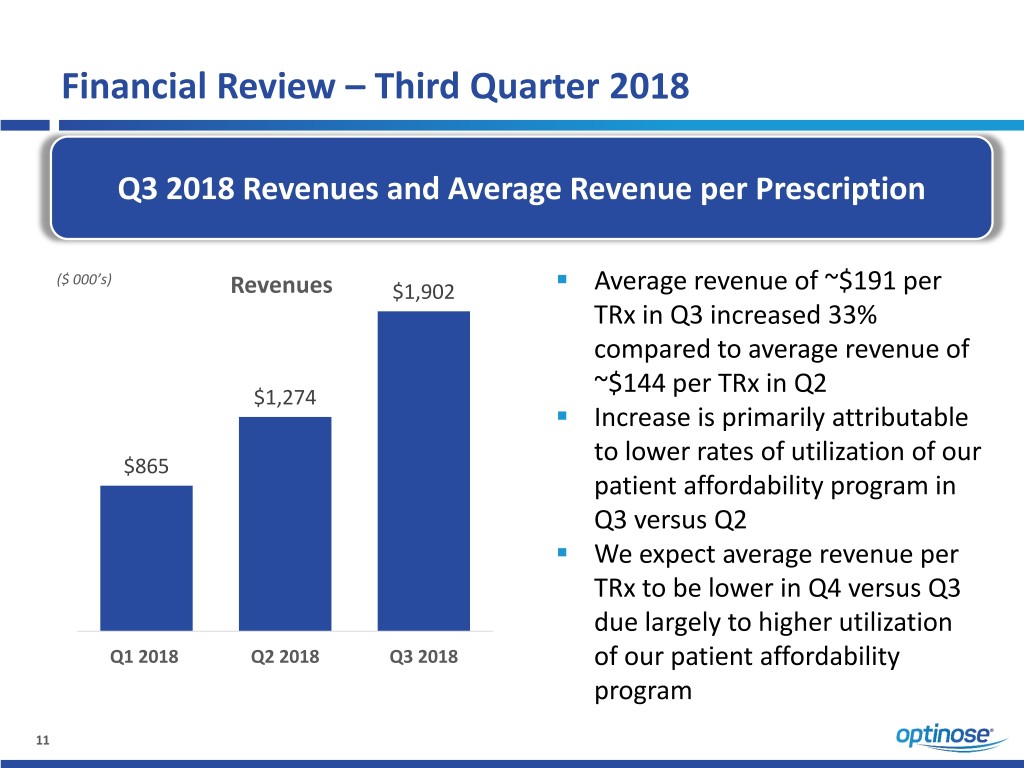

Financial Review – Third Quarter 2018 Q3 2018 Revenues and Average Revenue per Prescription ($ 000’s) Revenues $1,902 . Average revenue of ~$191 per TRx in Q3 increased 33% compared to average revenue of $1,274 ~$144 per TRx in Q2 . Increase is primarily attributable $865 to lower rates of utilization of our patient affordability program in Q3 versus Q2 . We expect average revenue per TRx to be lower in Q4 versus Q3 due largely to higher utilization Q1 2018 Q2 2018 Q3 2018 of our patient affordability program 11

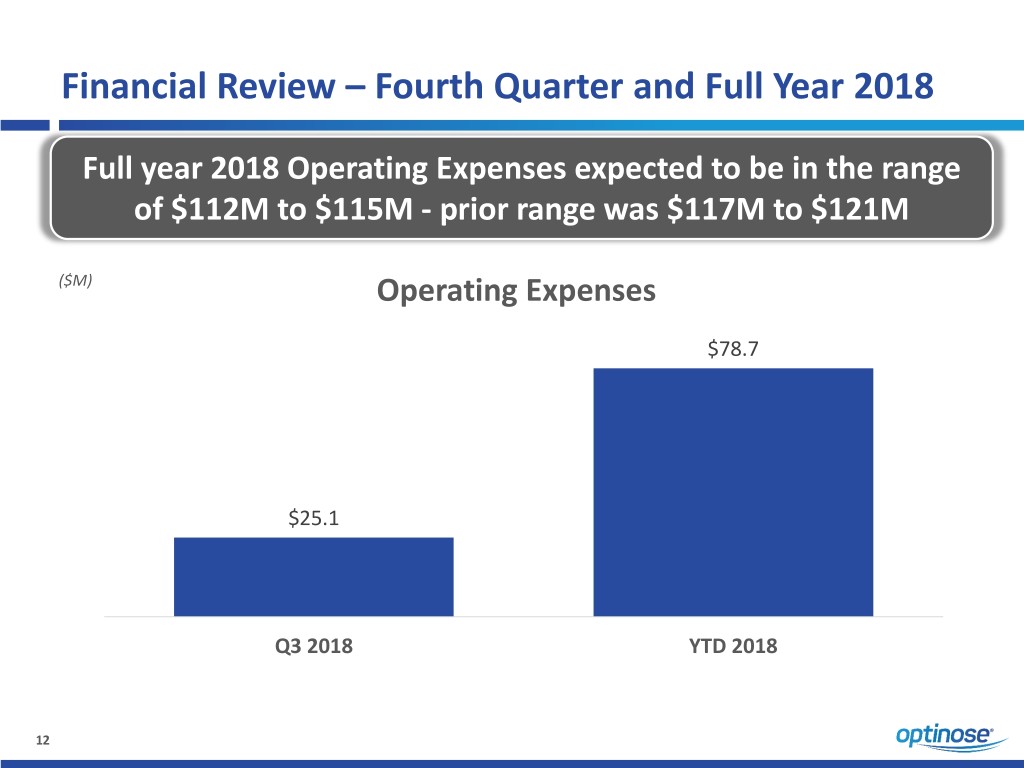

Financial Review – Fourth Quarter and Full Year 2018 Full year 2018 Operating Expenses expected to be in the range of $112M to $115M - prior range was $117M to $121M ($M) Operating Expenses $78.7 $25.1 Q3 2018 YTD 2018 12

Pipeline Update and Closing Remarks

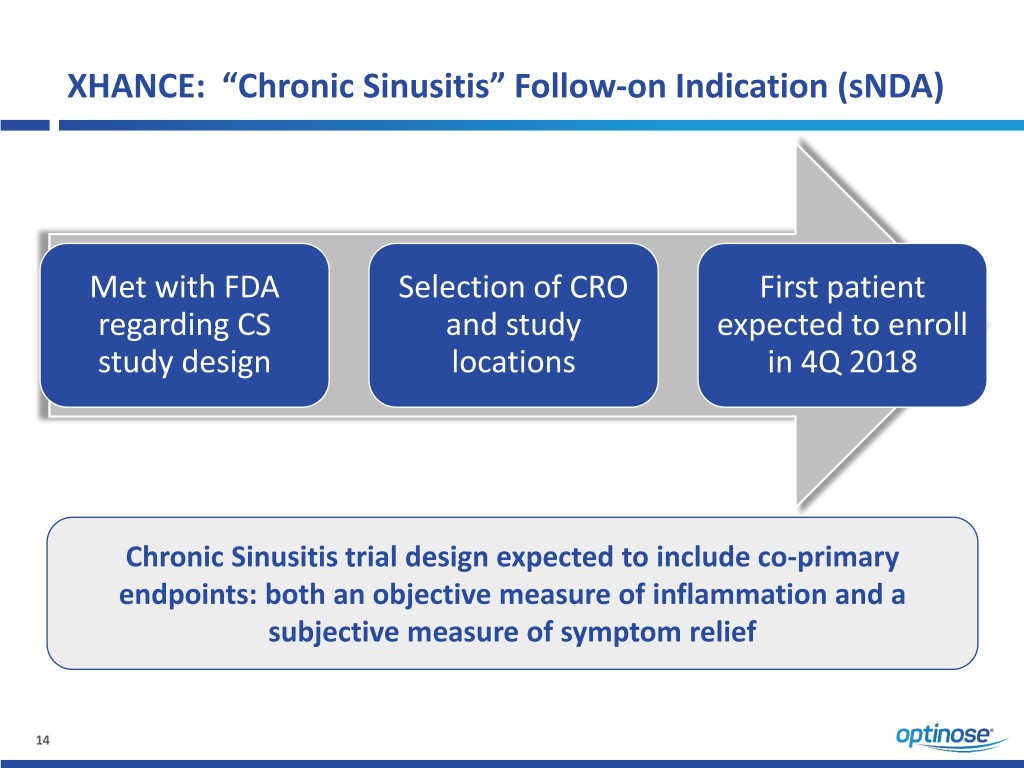

XHANCE: “Chronic Sinusitis” Follow-on Indication (sNDA) Met with FDA Selection of CRO First patient regarding CS and study expected to enroll study design locations in 4Q 2018 Chronic Sinusitis trial design expected to include co-primary endpoints: both an objective measure of inflammation and a subjective measure of symptom relief 14

Emerging Growth Company with Approved Products BUILDING A LEADING ENT / ALLERGY SPECIALTY COMPANY XHANCE® presents a significant opportunity in the ENT/Allergy market with the current indication XHANCE offers “pipeline within a product” opportunities Additional business development expected to focus on leveraging ENT/Allergy infrastructure and expertise Aim to add value from technology applications outside the ENT/Allergy market by early development and/or licensing ~$220 million of cash as of September 30, 2018 15

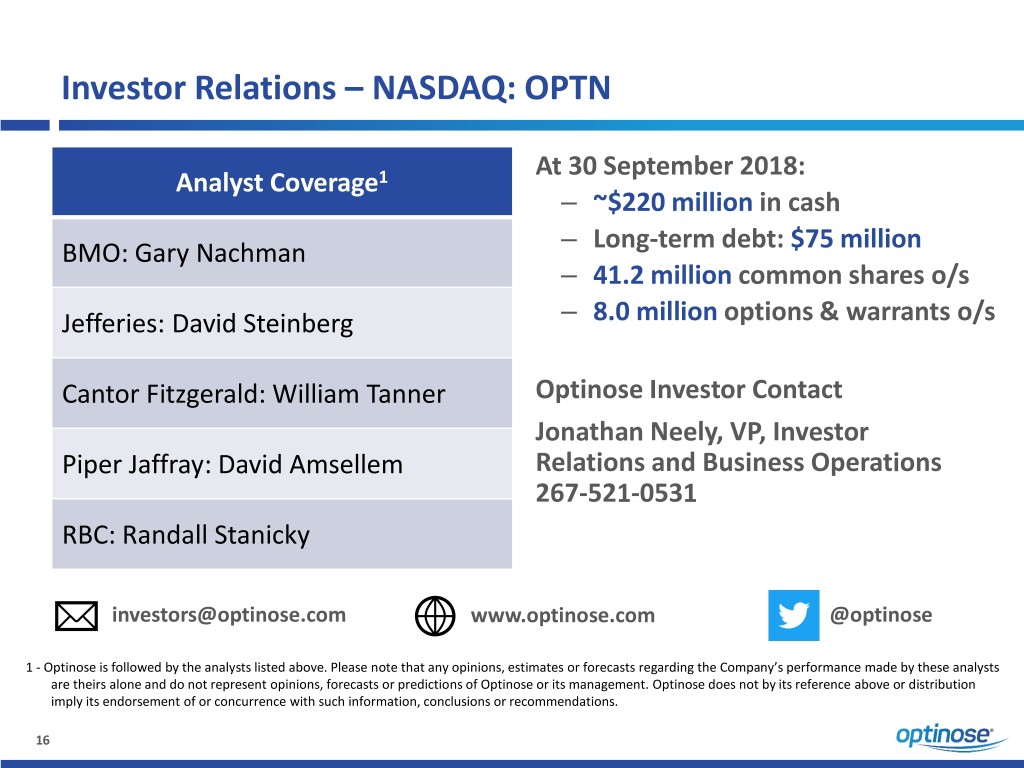

Investor Relations – NASDAQ: OPTN At 30 September 2018: Analyst Coverage1 – ~$220 million in cash BMO: Gary Nachman – Long-term debt: $75 million – 41.2 million common shares o/s Jefferies: David Steinberg – 8.0 million options & warrants o/s Cantor Fitzgerald: William Tanner Optinose Investor Contact Jonathan Neely, VP, Investor Piper Jaffray: David Amsellem Relations and Business Operations 267-521-0531 RBC: Randall Stanicky investors@optinose.com www.optinose.com @optinose 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. 16

Building a Leading ENT / Allergy Specialty Company Corporate Presentation November 13, 2018