Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - MALIBU BOATS, INC. | exhibit994proformafinancia.htm |

| EX-99.3 - EXHIBIT 99.3 - MALIBU BOATS, INC. | exhibit993pursuitboats42.htm |

| EX-99.1 - EXHIBIT 99.1 - MALIBU BOATS, INC. | exhibit991pursuitclosingpr.htm |

| EX-23.1 - EXHIBIT 23.1 - MALIBU BOATS, INC. | exhibit231consentofexterna.htm |

| 8-K - 8-K - MALIBU BOATS, INC. | mbuufy19-octoberx8xkannoun.htm |

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Carve-Out Financial Statements Year Ended July 29, 2017 The report accompanying these financial statements was issued by BDO USA, LLP, a Delaware limited liability partnership and the U.S. member of BDO International Limited, a UK company limited by guarantee.

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Carve-Out Financial Statements Year Ended July 29, 2017

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Contents Independent Auditor’s Report 3-4 Carve-Out Financial Statements Balance Sheet as of July 29, 2017 6 Statement of Income for the Year Ended July 29, 2017 7 Statement of Changes in Investment of Parent as of July 29, 2017 8 Statement of Cash Flows for the Year Ended July 29, 2017 9 Notes to Financial Statements 10-19 2

Exhibit 99.2 Tel: 616-774-7000 200 Ottawa Avenue NW, Suite 300 Fax: 616-776-3680 Grand Rapids, MI 49503 www.bdo.com Independent Auditor’s Report Board of Directors Pursuit Boats (a division of S2 Yachts, Inc.) Holland, Michigan We have audited the accompanying carve-out financial statements of Pursuit Boats (a division of S2 Yachts, Inc.), which comprise the carve-out balance sheet as of July 29, 2017, and the related carve-out statements of income, changes in investment of parent, and cash flows for the year then ended, and the related notes to the carve-out financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these carve-out financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of carve-out financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these carve-out financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the carve-out financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the carve-out financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the carve- out financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the preparation and fair presentation of the carve- out financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the carve-out financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms.

Exhibit 99.2 Opinion In our opinion, the carve-out financial statements referred to above present fairly, in all material respects, the financial position of Pursuit Boats (a division of S2 Yachts, Inc.) as of July 29, 2017, and the results of its operations and cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Emphasis of Matter As described in Note 1, the financial statements of the Pursuit Boats (a division of S2 Yachts, Inc.) business are not those of a stand-alone entity. The financial statements of Pursuit Boats (a division of S2 Yachts, Inc.) reflect the assets, liabilities, revenues and expenses directly attributable to Pursuit Boats (a division of S2 Yachts, Inc.), as well as allocations deemed reasonable by management, to present the financial position, results of operations, changes in investment of parent and cash flows of Pursuit Boats (a division of S2 Yachts, Inc.) on a stand-alone basis and do not necessarily reflect the financial position, results of operations, changes in investment of parent and cash flows of Pursuit Boats (a division of S2 Yachts, Inc.) in the future or what they would have been had Pursuit Boats (a division of S2 Yachts, Inc.) been a separate, standalone entity during the periods presented. /s/ BDO USA, LLP October 15, 2018

Exhibit 99.2 Carve-Out Financial Statements

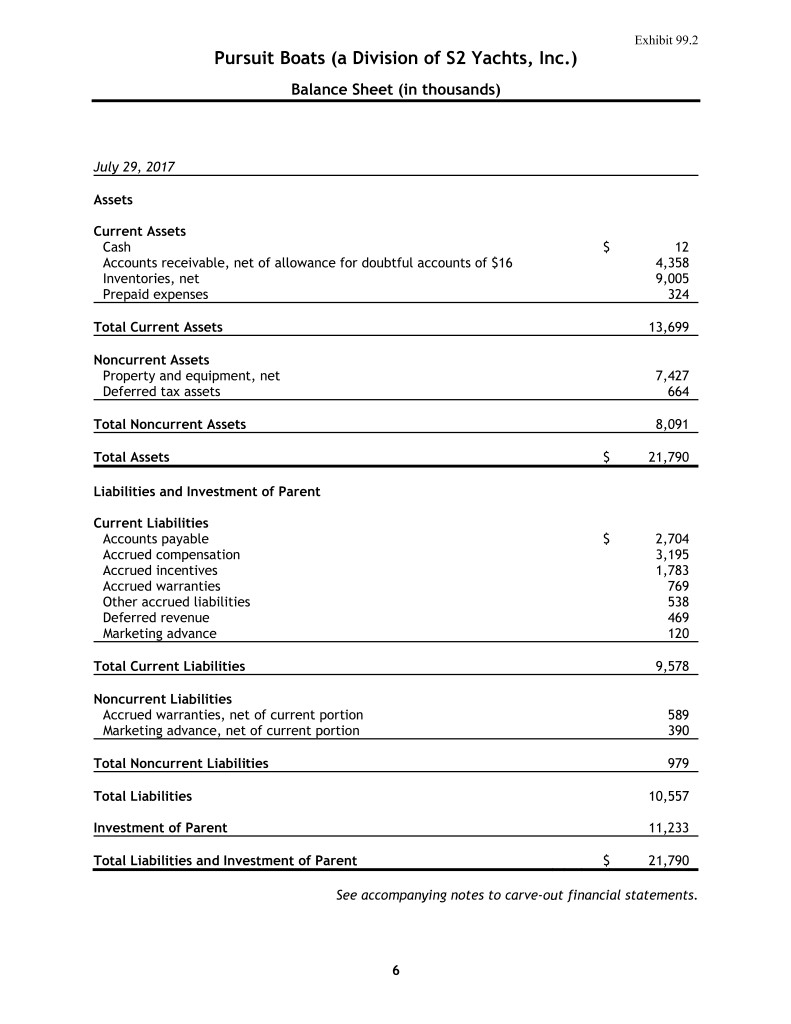

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Balance Sheet (in thousands) July 29, 2017 Assets Current Assets Cash $ 12 Accounts receivable, net of allowance for doubtful accounts of $16 4,358 Inventories, net 9,005 Prepaid expenses 324 Total Current Assets 13,699 Noncurrent Assets Property and equipment, net 7,427 Deferred tax assets 664 Total Noncurrent Assets 8,091 Total Assets $ 21,790 Liabilities and Investment of Parent Current Liabilities Accounts payable $ 2,704 Accrued compensation 3,195 Accrued incentives 1,783 Accrued warranties 769 Other accrued liabilities 538 Deferred revenue 469 Marketing advance 120 Total Current Liabilities 9,578 Noncurrent Liabilities Accrued warranties, net of current portion 589 Marketing advance, net of current portion 390 Total Noncurrent Liabilities 979 Total Liabilities 10,557 Investment of Parent 11,233 Total Liabilities and Investment of Parent $ 21,790 See accompanying notes to carve-out financial statements. 6

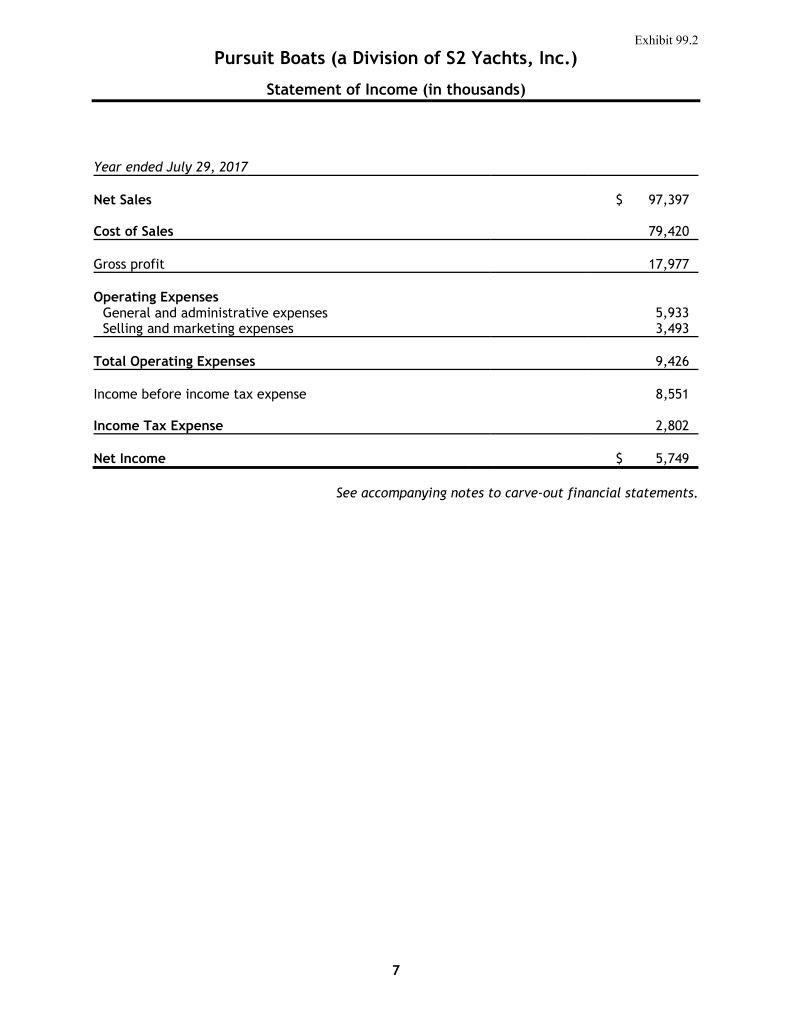

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Statement of Income (in thousands) Year ended July 29, 2017 Net Sales $ 97,397 Cost of Sales 79,420 Gross profit 17,977 Operating Expenses General and administrative expenses 5,933 Selling and marketing expenses 3,493 Total Operating Expenses 9,426 Income before income tax expense 8,551 Income Tax Expense 2,802 Net Income $ 5,749 See accompanying notes to carve-out financial statements. 7

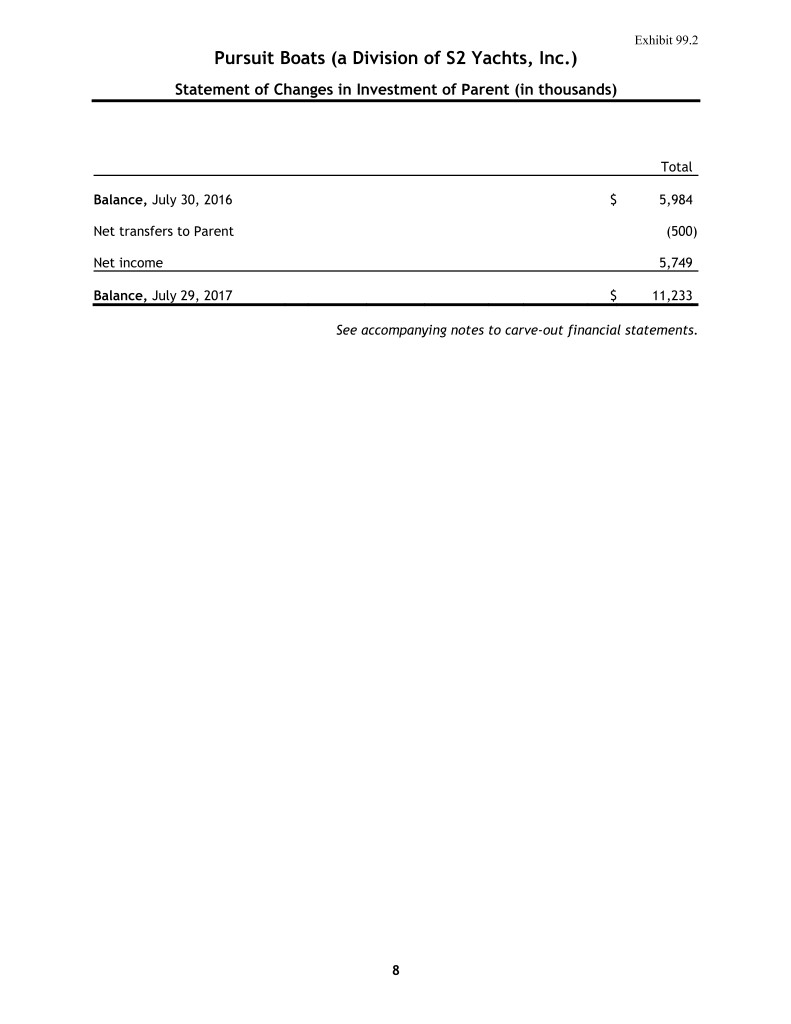

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Statement of Changes in Investment of Parent (in thousands) Total Balance, July 30, 2016 $ 5,984 Net transfers to Parent (500) Net income 5,749 Balance, July 29, 2017 $ 11,233 See accompanying notes to carve-out financial statements. 8

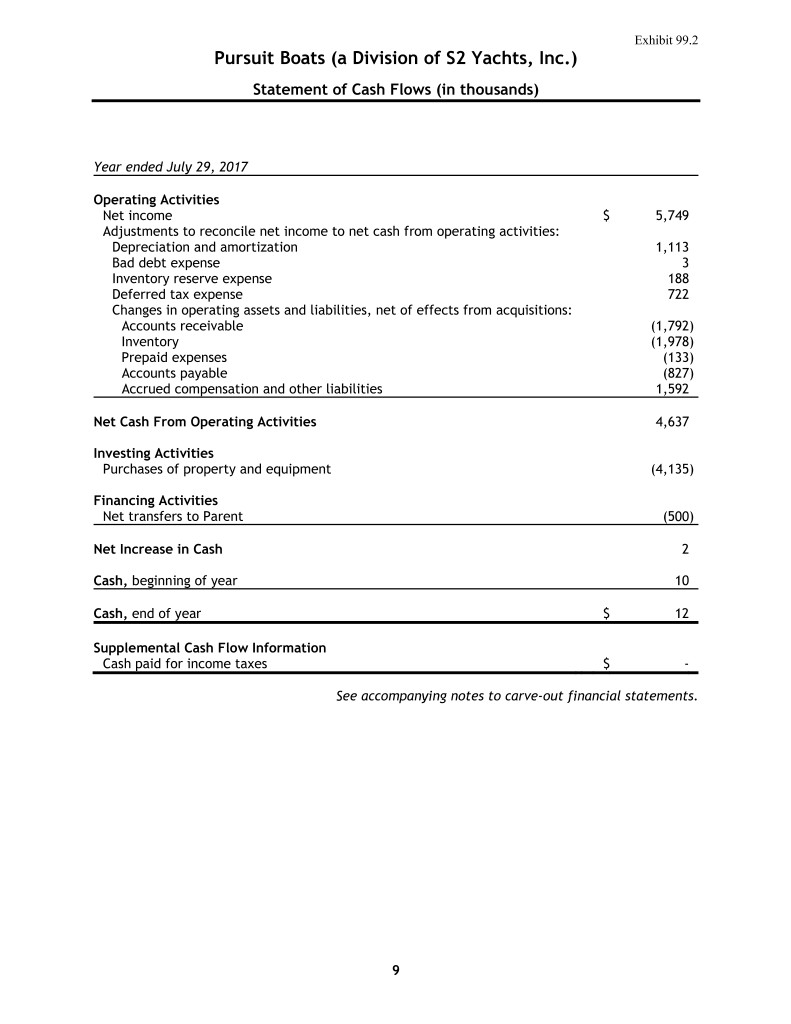

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Statement of Cash Flows (in thousands) Year ended July 29, 2017 Operating Activities Net income $ 5,749 Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization 1,113 Bad debt expense 3 Inventory reserve expense 188 Deferred tax expense 722 Changes in operating assets and liabilities, net of effects from acquisitions: Accounts receivable (1,792) Inventory (1,978) Prepaid expenses (133) Accounts payable (827) Accrued compensation and other liabilities 1,592 Net Cash From Operating Activities 4,637 Investing Activities Purchases of property and equipment (4,135) Financing Activities Net transfers to Parent (500) Net Increase in Cash 2 Cash, beginning of year 10 Cash, end of year $ 12 Supplemental Cash Flow Information Cash paid for income taxes $ - See accompanying notes to carve-out financial statements. 9

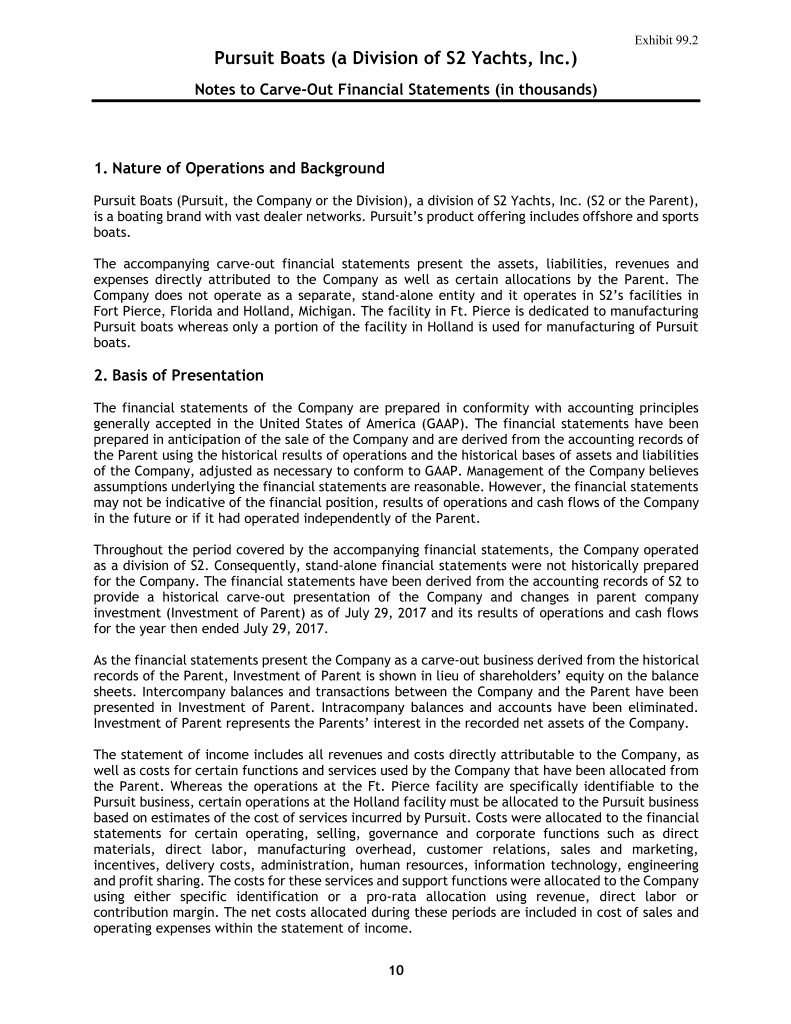

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) 1. Nature of Operations and Background Pursuit Boats (Pursuit, the Company or the Division), a division of S2 Yachts, Inc. (S2 or the Parent), is a boating brand with vast dealer networks. Pursuit’s product offering includes offshore and sports boats. The accompanying carve-out financial statements present the assets, liabilities, revenues and expenses directly attributed to the Company as well as certain allocations by the Parent. The Company does not operate as a separate, stand-alone entity and it operates in S2’s facilities in Fort Pierce, Florida and Holland, Michigan. The facility in Ft. Pierce is dedicated to manufacturing Pursuit boats whereas only a portion of the facility in Holland is used for manufacturing of Pursuit boats. 2. Basis of Presentation The financial statements of the Company are prepared in conformity with accounting principles generally accepted in the United States of America (GAAP). The financial statements have been prepared in anticipation of the sale of the Company and are derived from the accounting records of the Parent using the historical results of operations and the historical bases of assets and liabilities of the Company, adjusted as necessary to conform to GAAP. Management of the Company believes assumptions underlying the financial statements are reasonable. However, the financial statements may not be indicative of the financial position, results of operations and cash flows of the Company in the future or if it had operated independently of the Parent. Throughout the period covered by the accompanying financial statements, the Company operated as a division of S2. Consequently, stand-alone financial statements were not historically prepared for the Company. The financial statements have been derived from the accounting records of S2 to provide a historical carve-out presentation of the Company and changes in parent company investment (Investment of Parent) as of July 29, 2017 and its results of operations and cash flows for the year then ended July 29, 2017. As the financial statements present the Company as a carve-out business derived from the historical records of the Parent, Investment of Parent is shown in lieu of shareholders’ equity on the balance sheets. Intercompany balances and transactions between the Company and the Parent have been presented in Investment of Parent. Intracompany balances and accounts have been eliminated. Investment of Parent represents the Parents’ interest in the recorded net assets of the Company. The statement of income includes all revenues and costs directly attributable to the Company, as well as costs for certain functions and services used by the Company that have been allocated from the Parent. Whereas the operations at the Ft. Pierce facility are specifically identifiable to the Pursuit business, certain operations at the Holland facility must be allocated to the Pursuit business based on estimates of the cost of services incurred by Pursuit. Costs were allocated to the financial statements for certain operating, selling, governance and corporate functions such as direct materials, direct labor, manufacturing overhead, customer relations, sales and marketing, incentives, delivery costs, administration, human resources, information technology, engineering and profit sharing. The costs for these services and support functions were allocated to the Company using either specific identification or a pro-rata allocation using revenue, direct labor or contribution margin. The net costs allocated during these periods are included in cost of sales and operating expenses within the statement of income. 10

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) The financial statements include the attribution of certain assets and liabilities that have historically been held at the Holland facility or corporate level by the Parent, but which are specifically identifiable or allocable to the Company. This also includes all of the assets and liabilities at the Ft. Pierce facility. The Parent’s cash management and financing activities are centralized. Accordingly, no cash, debt or related interest expense have been allocated to the financial statements, except for certain cash accounts that are retained by the business. For purposes of the financial statements, the income tax provision of the Company was prepared under the separate return method, as if the Company filed income tax returns on a stand-alone basis, separate from the Parent. Management believes the carve-out methodology for expense and cost allocations to be a reasonable reflection of common expenses incurred by the Company or by the Parent on the Company’s behalf, relative to the total costs incurred by the Parent. These expenses were related to the operating, selling, governance and corporate functions to the Company. The financial statements of the Company do not present the Company’s historical debt or related interest expense. See Note 8 for future discussion of cost allocations included in the financial statements. Transactions between the Parent and the Company are considered to be effectively settled for cash at the time the transaction is recorded. The net effect of the settlement of these intercompany transactions is reflected in the statement of cash flows as a financing activity and in the balance sheet as Investment of Parent. The Company operates on a 52/53-week fiscal year ending on the Saturday nearest to July 31. The fiscal year ended July 29, 2017 consisted of 52 weeks. 3. Summary of Significant Accounting Policies Use of Estimates The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities; disclosure of contingent assets; liabilities at the date of the reported financial statements; and reported amounts of revenue and expenses during the reporting period. These estimates include the carve-out allocations, reserves of inventory and accounts receivable, discounts and rebates, accrued incentives, and warranties. Actual results could differ from those estimates. Revenue Recognition The Company recognizes revenue from boat sales at the time of shipment and when title and risk of ownership transfer to the customer. Payments received prior to shipment are recorded as deferred revenue in the accompanying balance sheet. Cost of Sales Cost of sales consists of costs related to the production of the Company’s products. These costs primarily relate to raw materials, components, supplies, direct labor and factory overhead. 11

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) Discounts and Rebates The cost of discounts and rebates is recognized at the later of the date at which the related sale is recognized or the date at which the incentive is offered. The cost of these incentives is estimated using a number of factors including historical utilization and redemption rates. Certain boat sales may qualify for incentives as specified in dealer programs and are accrued accordingly. Substantially all cash incentives of this type are included in the determination of net sales, totaling $4,802 for the period. Advertising Costs Advertising expenses are charged to income during the year in which they are incurred. Advertising expenses for the year ended July 29, 2017 were $877. Cash The Company considers all investments with an original maturity of three months or less when purchased to be cash. Historically the company has participated in and relied upon the centralized cash management system. Accounts Receivable Accounts receivable are stated at net invoice amounts. An allowance for doubtful accounts is established based on a specific assessment of all invoices that remain unpaid following normal customer payment periods. All amounts deemed to be uncollectible are charged against the allowance for doubtful accounts in the period that determination is made. The allowance for doubtful accounts on accounts receivable balances was approximately $16 as of July 29, 2017. Property and Equipment Property and equipment are recorded at cost. Both straight-line and accelerated methods are used for computing depreciation and amortization. Assets are depreciated over their estimated useful lives, except for costs of replacement or renewals that improve or extend the lives of existing assets. Costs of maintenance and repairs are charged to expense when incurred. The cost and related accumulated depreciation of sold or retired assets are removed from the accounts and any gain or loss is included in operating expenses. Inventories Inventory is stated at the lower of cost or net realizable value, with cost determined on an average cost method, net of the allowance for obsolete and slow-moving inventory. The balance of this allowance was $526 as of July 29, 2017. Income Taxes Income taxes as presented herein attribute current and deferred income taxes of the Parent to the Pursuit stand-alone financial statements in a manner that is systematic, rational, and consistent with the asset and liability method prescribed by Accounting Standards Codification (ASC) 740, Income Taxes. Accordingly, the Pursuit income tax provision was prepared following the Separate Return Method. The Separate Return Method applies ASC 740 to the standalone financial statements 12

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) of each member of the consolidated group as if the group member were a separate taxpayer and a standalone enterprise. As a result, actual tax transactions included in the consolidated financial statements of the Parent may not be included in the financial statements of the Company. Similarly, the tax treatment of certain items reflected in the financial statements of the Company may not be reflected in the consolidated financial statements and tax returns of the Parent; therefore, such items as net operating losses, credit carry forwards and valuation allowances may exist in the stand- alone financial statements that may or may not exist in the Parent’s consolidated financial statements. The provision for income taxes is determined using the asset and liability approach of accounting for income taxes. Under this approach, deferred taxes represent the future tax consequences expected to occur when the reported amounts of assets and liabilities are recovered or paid. This method also requires the recognition of future tax benefits relating to net operating loss carry forwards and tax credits, to the extent that realization of such benefits is more likely than not after consideration of all available evidence. Deferred taxes result from differences between the financial and tax basis of the Company’s assets and liabilities and are adjusted for changes in tax rates and tax laws when changes are enacted. A valuation allowance is established to offset any deferred tax assets if, based upon the available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The determination of the amount of a valuation allowance to be provided on recorded deferred tax assets involves estimates regarding (1) the timing and amount of the reversal of taxable temporary differences, (2) expected future taxable income, and (3) the impact of tax planning strategies. In assessing the need for a valuation allowance, we consider all available positive and negative evidence, including past operating results, projections of future taxable income and the feasibility of ongoing tax planning strategies. Investment of Parent In the balance sheet, the Investment of Parent represents the Parent’s historical investment in the Company, accumulated net earnings after taxes and the net effect of transactions with the Parent. Recently Issued Accounting Standards In May 2014, the Financial Accounting Standards Board (FASB) and International Accounting Standards Board jointly issued a final standard on revenue recognition, Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606), which outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. This standard will supersede most current revenue recognition guidance. Under the new standard, entities are required to identify the contract with a customer; identify the separate performance obligations in the contract; determine the transaction price; allocate the transaction price to the separate performance obligations in the contract; and recognize the appropriate amount of revenue when (or as) the entity satisfies each performance obligation. The standard is effective for public company fiscal years beginning after December 15, 2017. For all other entities, the new standard is effective for fiscal years beginning after December 15, 2018. Entities have the option of using either the retrospective or cumulative effect transition method. The impact is currently being assessed. In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). This guidance establishes a right-of-use (ROU) model that requires a lessee to record a ROU asset and a lease liability on the 13

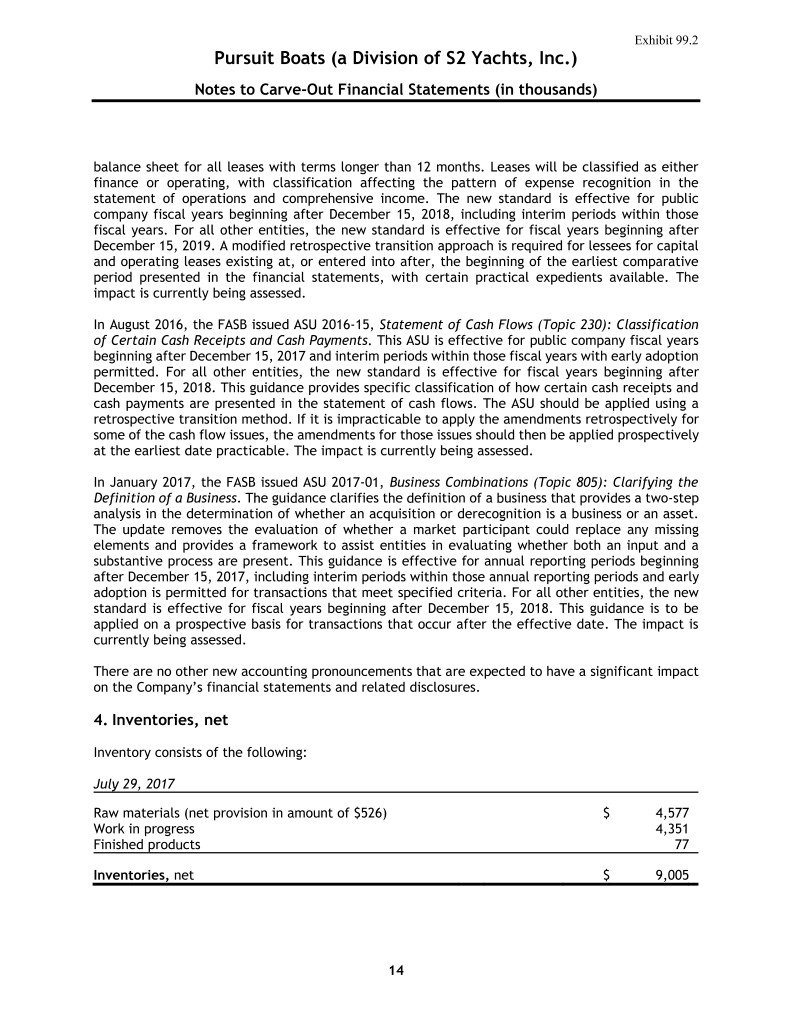

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the statement of operations and comprehensive income. The new standard is effective for public company fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. For all other entities, the new standard is effective for fiscal years beginning after December 15, 2019. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The impact is currently being assessed. In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. This ASU is effective for public company fiscal years beginning after December 15, 2017 and interim periods within those fiscal years with early adoption permitted. For all other entities, the new standard is effective for fiscal years beginning after December 15, 2018. This guidance provides specific classification of how certain cash receipts and cash payments are presented in the statement of cash flows. The ASU should be applied using a retrospective transition method. If it is impracticable to apply the amendments retrospectively for some of the cash flow issues, the amendments for those issues should then be applied prospectively at the earliest date practicable. The impact is currently being assessed. In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. The guidance clarifies the definition of a business that provides a two-step analysis in the determination of whether an acquisition or derecognition is a business or an asset. The update removes the evaluation of whether a market participant could replace any missing elements and provides a framework to assist entities in evaluating whether both an input and a substantive process are present. This guidance is effective for annual reporting periods beginning after December 15, 2017, including interim periods within those annual reporting periods and early adoption is permitted for transactions that meet specified criteria. For all other entities, the new standard is effective for fiscal years beginning after December 15, 2018. This guidance is to be applied on a prospective basis for transactions that occur after the effective date. The impact is currently being assessed. There are no other new accounting pronouncements that are expected to have a significant impact on the Company’s financial statements and related disclosures. 4. Inventories, net Inventory consists of the following: July 29, 2017 Raw materials (net provision in amount of $526) $ 4,577 Work in progress 4,351 Finished products 77 Inventories, net $ 9,005 14

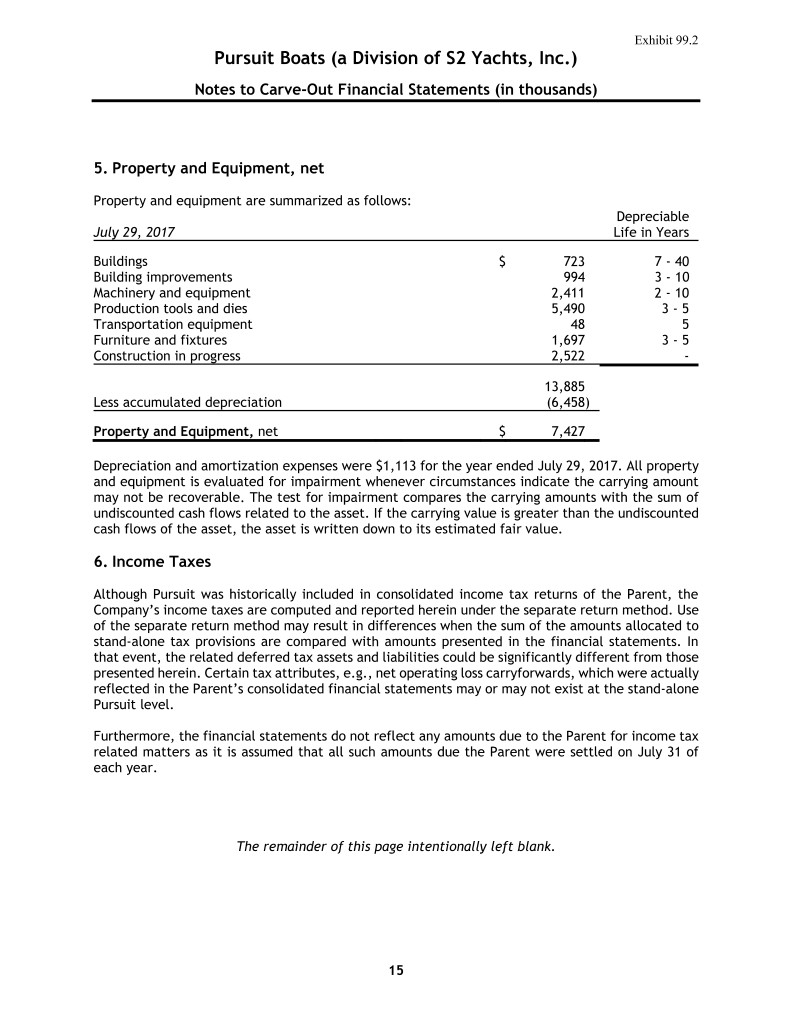

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) 5. Property and Equipment, net Property and equipment are summarized as follows: Depreciable July 29, 2017 Life in Years Buildings $ 723 7 - 40 Building improvements 994 3 - 10 Machinery and equipment 2,411 2 - 10 Production tools and dies 5,490 3 - 5 Transportation equipment 48 5 Furniture and fixtures 1,697 3 - 5 Construction in progress 2,522 - 13,885 Less accumulated depreciation (6,458) Property and Equipment, net $ 7,427 Depreciation and amortization expenses were $1,113 for the year ended July 29, 2017. All property and equipment is evaluated for impairment whenever circumstances indicate the carrying amount may not be recoverable. The test for impairment compares the carrying amounts with the sum of undiscounted cash flows related to the asset. If the carrying value is greater than the undiscounted cash flows of the asset, the asset is written down to its estimated fair value. 6. Income Taxes Although Pursuit was historically included in consolidated income tax returns of the Parent, the Company’s income taxes are computed and reported herein under the separate return method. Use of the separate return method may result in differences when the sum of the amounts allocated to stand-alone tax provisions are compared with amounts presented in the financial statements. In that event, the related deferred tax assets and liabilities could be significantly different from those presented herein. Certain tax attributes, e.g., net operating loss carryforwards, which were actually reflected in the Parent’s consolidated financial statements may or may not exist at the stand-alone Pursuit level. Furthermore, the financial statements do not reflect any amounts due to the Parent for income tax related matters as it is assumed that all such amounts due the Parent were settled on July 31 of each year. The remainder of this page intentionally left blank. 15

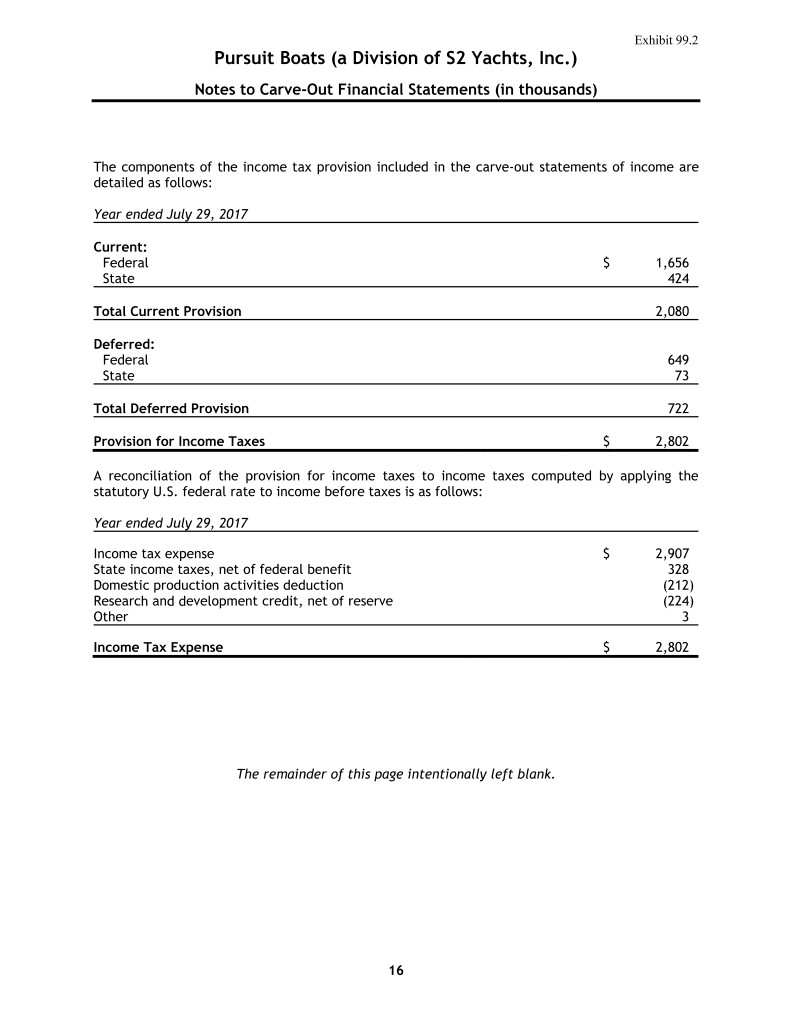

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) The components of the income tax provision included in the carve-out statements of income are detailed as follows: Year ended July 29, 2017 Current: Federal $ 1,656 State 424 Total Current Provision 2,080 Deferred: Federal 649 State 73 Total Deferred Provision 722 Provision for Income Taxes $ 2,802 A reconciliation of the provision for income taxes to income taxes computed by applying the statutory U.S. federal rate to income before taxes is as follows: Year ended July 29, 2017 Income tax expense $ 2,907 State income taxes, net of federal benefit 328 Domestic production activities deduction (212) Research and development credit, net of reserve (224) Other 3 Income Tax Expense $ 2,802 The remainder of this page intentionally left blank. 16

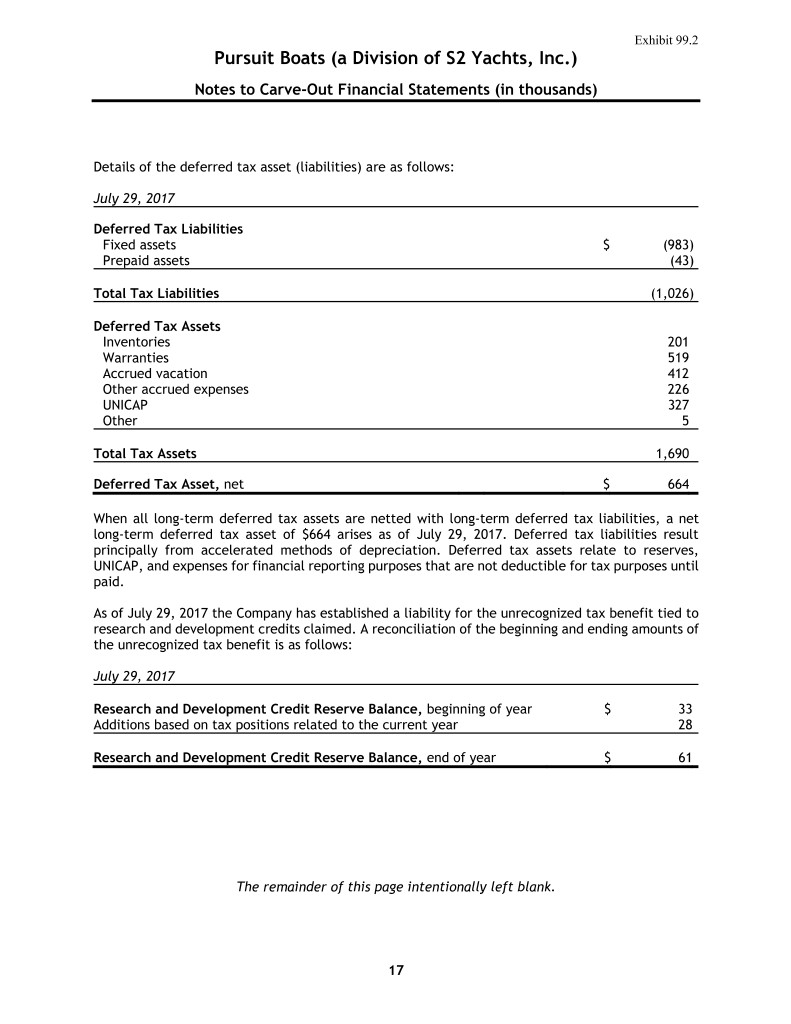

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) Details of the deferred tax asset (liabilities) are as follows: July 29, 2017 Deferred Tax Liabilities Fixed assets $ (983) Prepaid assets (43) Total Tax Liabilities (1,026) Deferred Tax Assets Inventories 201 Warranties 519 Accrued vacation 412 Other accrued expenses 226 UNICAP 327 Other 5 Total Tax Assets 1,690 Deferred Tax Asset, net $ 664 When all long-term deferred tax assets are netted with long-term deferred tax liabilities, a net long-term deferred tax asset of $664 arises as of July 29, 2017. Deferred tax liabilities result principally from accelerated methods of depreciation. Deferred tax assets relate to reserves, UNICAP, and expenses for financial reporting purposes that are not deductible for tax purposes until paid. As of July 29, 2017 the Company has established a liability for the unrecognized tax benefit tied to research and development credits claimed. A reconciliation of the beginning and ending amounts of the unrecognized tax benefit is as follows: July 29, 2017 Research and Development Credit Reserve Balance, beginning of year $ 33 Additions based on tax positions related to the current year 28 Research and Development Credit Reserve Balance, end of year $ 61 The remainder of this page intentionally left blank. 17

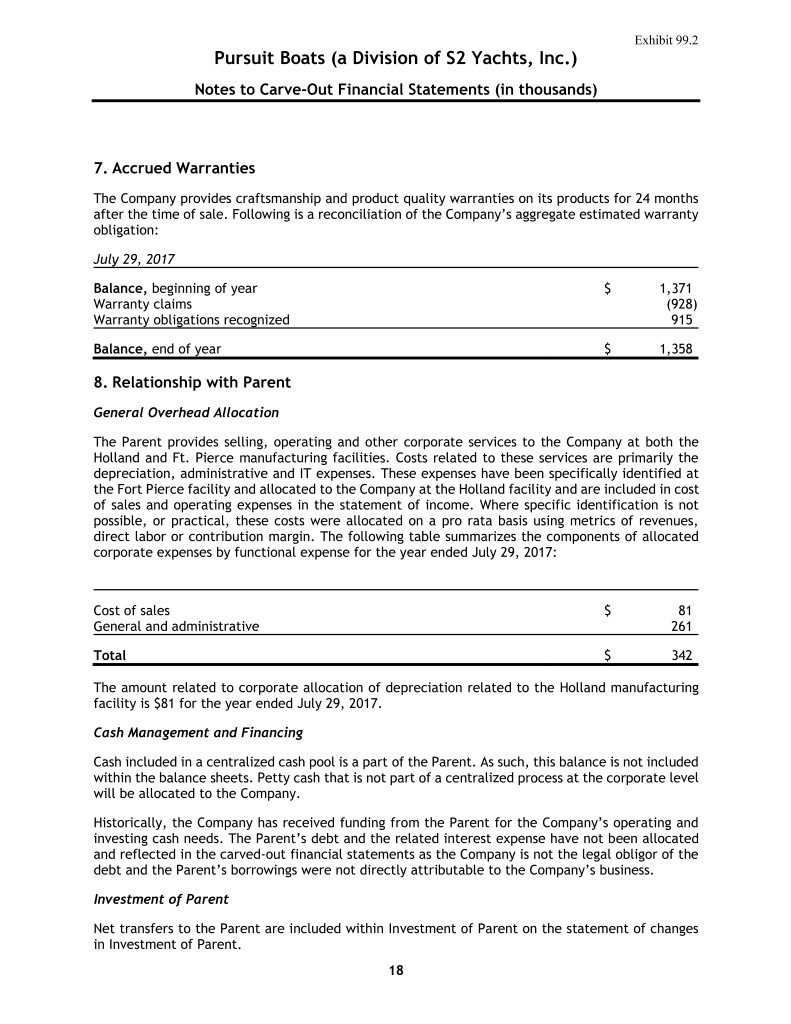

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) 7. Accrued Warranties The Company provides craftsmanship and product quality warranties on its products for 24 months after the time of sale. Following is a reconciliation of the Company’s aggregate estimated warranty obligation: July 29, 2017 Balance, beginning of year $ 1,371 Warranty claims (928) Warranty obligations recognized 915 Balance, end of year $ 1,358 8. Relationship with Parent General Overhead Allocation The Parent provides selling, operating and other corporate services to the Company at both the Holland and Ft. Pierce manufacturing facilities. Costs related to these services are primarily the depreciation, administrative and IT expenses. These expenses have been specifically identified at the Fort Pierce facility and allocated to the Company at the Holland facility and are included in cost of sales and operating expenses in the statement of income. Where specific identification is not possible, or practical, these costs were allocated on a pro rata basis using metrics of revenues, direct labor or contribution margin. The following table summarizes the components of allocated corporate expenses by functional expense for the year ended July 29, 2017: Cost of sales $ 81 General and administrative 261 Total $ 342 The amount related to corporate allocation of depreciation related to the Holland manufacturing facility is $81 for the year ended July 29, 2017. Cash Management and Financing Cash included in a centralized cash pool is a part of the Parent. As such, this balance is not included within the balance sheets. Petty cash that is not part of a centralized process at the corporate level will be allocated to the Company. Historically, the Company has received funding from the Parent for the Company’s operating and investing cash needs. The Parent’s debt and the related interest expense have not been allocated and reflected in the carved-out financial statements as the Company is not the legal obligor of the debt and the Parent’s borrowings were not directly attributable to the Company’s business. Investment of Parent Net transfers to the Parent are included within Investment of Parent on the statement of changes in Investment of Parent. 18

Exhibit 99.2 Pursuit Boats (a Division of S2 Yachts, Inc.) Notes to Carve-Out Financial Statements (in thousands) 9. Marketing Advance During 2012, the Parent received $950 from a third party to develop and manufacture three new models of Pursuit sport boats complemented exclusively by products manufactured by the third party. During 2013, an additional $200 was received under the same agreement. The Parent is obligated to refund the amount to the third party based on the rate at which the new boats are sold. The agreement calls for a minimum of 240 boats to be sold, and the total amount paid to the third party will be $1,200. A minimum of $10 per month is required to be repaid starting in January 2013, and this minimum amount is reflected as a current liability, with the remainder recorded as a long-term liability on the balance sheet. The agreement expires at the earlier of August 2018, or when the Parent has sold 240 boats as specified under the agreement. The remaining obligation is $510 as of July 29, 2017. In specifically identifying this obligation of the Parent to Pursuit’s business, the entirety of this deposit has been allocated to the Company. 10. Commitments and Contingencies The Company sells boats and yachts to various dealers under third-party floor plan financing arrangements with Wells Fargo Commercial Distribution Finance, LLC (Wells Fargo) and Northpoint Commercial Finance, LLC (Northpoint). Both companies provide personalized lines of credit facilities to dealers based on financial strength and credit worthiness. The Parent indemnifies Wells Fargo and Northpoint against losses up to specified amounts for units sold under the financing arrangements. Indemnification is made through the repurchase of boats and yachts that are repossessed by each company. The aggregate repurchase obligation by the Parent to Wells Fargo is the greater of $5,000 or 15% of the average net receivable financed during the prior calendar year. The aggregate repurchase obligation by the Parent to Northpoint is the greater of $3,000 or 15% of the average net receivable financed during the prior calendar year. No boats or yachts sold to dealers under these financing arrangements are in foreclosure or repossession at July 29, 2017 and therefore, there is no reserve for this purpose. 11. Subsequent Events Management has evaluated subsequent events through October 15, 2018, the date these financial statements were available to be issued, and recognized or disclosed unrecognized transactions in the financial statements as appropriate. On September 8, 2017, the Parent increased its aggregate repurchase obligation to Wells Fargo to the greater of $25,000 or 25% of the average net receivable financed during the prior calendar year. Legislation H.R. 1, also referred to as the Tax Cuts and Jobs Act of 2017 (the Tax Act), was enacted into law on December 22, 2017 and is generally effective starting in 2018. The Tax Act changes the taxation of businesses and individuals by lowering tax rates and broadening the tax base through the acceleration of taxable income and the deferral or elimination of certain deductions, as well as changing the system of taxation of earnings of foreign subsidiaries. The most significant change for the Company is the reduction of the corporate tax rate from 35% to 21%. On August 22, 2018, Malibu Boats, Inc., a leading manufacturer of fiberglass recreational boats, entered into a definitive agreement with S2 to purchase the assets of Pursuit for total consideration of $100,000. The transaction is expected to close during the fourth calendar quarter of 2018, subject to certain closing conditions. 19