Attached files

| file | filename |

|---|---|

| EX-10.4.2 - EXHIBIT 10.4.2 - MALIBU BOATS, INC. | fy2016-exhibit1042.htm |

| EX-32 - EXHIBIT 32 - MALIBU BOATS, INC. | fy2016-exhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - MALIBU BOATS, INC. | fy2016-exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - MALIBU BOATS, INC. | fy2016-exhibit311.htm |

| EX-23.2 - EXHIBIT 23.2 - MALIBU BOATS, INC. | fy2016-exhibit232.htm |

| EX-23.1 - EXHIBIT 23.1 - MALIBU BOATS, INC. | fy2016-exhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - MALIBU BOATS, INC. | fy2016-exhibit211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2016

Commission file number: 001-36290

MALIBU BOATS, INC.

(Exact Name of Registrant as specified in its charter)

Delaware | 5075 Kimberly Way Loudon, Tennessee 37774 | 46-4024640 | ||

(State or other jurisdiction of incorporation or organization) | (Address of principal executive offices, including zip code) | (I.R.S. Employer Identification No.) | ||

(865) 458-5478 | ||||

(Registrant’s telephone number, including area code) | ||||

Securities Registered Pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Class A Common Stock ($0.01 par value per share) | NASDAQ Global Select Market | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

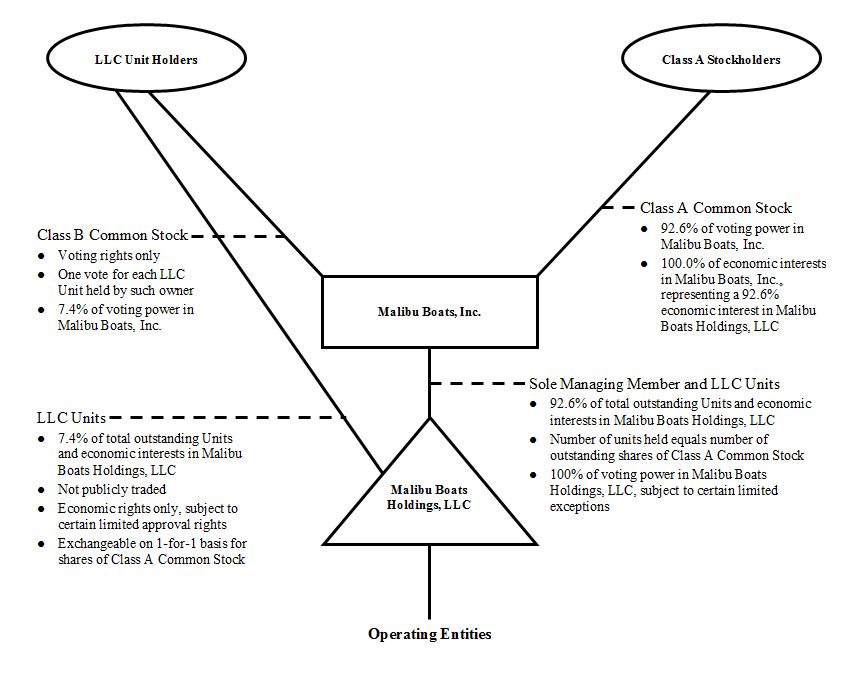

As of December 31, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate value of the registrant’s common stock held by non-affiliates was approximately $261.0 million, based on the number of shares of Class A common stock held by non-affiliates as of December 31, 2015 and the closing price of the registrant’s Class A common stock on the NASDAQ Global Select Market on December 31, 2015. Shares held by each executive officer, director and by each person who owns 10% or more of the outstanding Class A common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of outstanding shares of the registrant’s Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01, as of September 8, 2016 was 17,696,693 and 23, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended June 30, 2016.

1

TABLE OF CONTENTS

Page | ||

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical facts contained in this Form 10-K are forward-looking statements, including statements regarding our future financial position, sources of revenue, demand for our products, our strengths, business strategy and plans, prospective products or products under development, costs, timing and likelihood of success, gross margins, non-GAAP financial measures and management’s objectives for future operations. In particular, many of the statements under the headings “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1. Business” constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” the negative of these terms, or by other similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions, involving known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Such factors include general economic conditions; significant fluctuations in our annual and quarterly financial results; unfavorable weather conditions; our reliance on our network of independent dealers and increasing competition for dealers; the financial health of our dealers and their continued access to financing; our obligation to repurchase inventory of certain dealers; our failure to manage our manufacturing levels while addressing the seasonal retail pattern for our products; our large fixed cost base; intense competition within our industry; increased consumer preference for used boats or the supply of new boats by competitors in excess of demand; the successful introduction of new products; competition with other activities for consumers’ scarce leisure time; the continued strength of our brands; our ability to execute our manufacturing strategy successfully; our ability to meet our manufacturing workforce needs; our reliance on third-party suppliers and ability to obtain adequate raw materials and components; our exposure to claims for product liability and warranty claims; our dependence on key personnel; our ability to grow our business through acquisitions or strategic alliances and new partnerships; our growth strategy which may require us to secure significant additional capital; our ability to protect our intellectual property; disruptions to our network and information systems; exposure to workers' compensation claims and other workplace liabilities; risks inherent in operating in foreign jurisdictions; changes in currency exchange rates; an increase in energy and fuel costs; any failure to comply with laws and regulations including environmental and other regulatory requirements; a natural disaster or other disruption at our manufacturing facilities; increases in income tax rates or changes in income tax laws; covenants in our credit facilities which may limit our operating flexibility; our variable rate indebtedness which subjects us to interest rate risk; our status as an “emerging growth company”; and any failure to maintain effective internal control over financial reporting or disclosure controls or procedures.

We discuss many of these factors, risks and uncertainties in greater detail under the heading “Item 1A. Risk Factors” and elsewhere in this Form 10-K. These factors expressly qualify as forward-looking statements attributable to us or persons acting on our behalf.

You should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from those suggested by the forward-looking statements for various reasons, including those discussed under “Item 1A. Risk Factors” in this Form 10-K. Except as required by law, we assume no obligation to update forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations.

2

PART I.

Item 1. Business

Unless otherwise expressly indicated or the context otherwise requires, in this Annual Report on Form 10-K:

• | we use the terms “Malibu Boats,” the “Company,” “we,” “us,” “our” or similar references to refer (1) prior to the consummation of our initial public offering on February 5, 2014, or IPO, to Malibu Boats Holdings, LLC, or the LLC, and its consolidated subsidiaries and (2) after the IPO, to Malibu Boats, Inc. and its consolidated subsidiaries; |

• | we refer to the owners of membership interests in the LLC immediately prior to the consummation of the IPO, collectively, as our “pre-IPO owners”; |

• | we refer to owners of membership interests in the LLC (the "LLC Units"), collectively, as our “LLC members”; |

• | references to “fiscal year” refer to the fiscal year of Malibu Boats, which ends on June 30. Fiscal years 2012 and 2013 for the LLC ended on June 30, 2012 and 2013, respectively. Fiscal years 2014, 2015 and 2016 ended on June 30, 2014, 2015, and 2016, respectively; |

• | we use the term “performance sport boat category” to refer to our industry category, primarily consisting of fiberglass boats equipped with inboard propulsion and ranging from 19 feet to 26 feet in length, which we believe most closely corresponds to (1) the inboard ski/wakeboard category, as defined and tracked by the National Marine Manufacturers Association, or NMMA, and (2) the inboard skiboat category, as defined and tracked by Statistical Surveys, Inc., or SSI; and |

• | references to certain market and industry data presented in this Form 10-K are determined as follows: (1) U.S. boat sales and unit volume for the overall powerboat industry and any powerboat category during any calendar year are based on retail boat market data from the NMMA; (2) U.S. market share and unit volume for the overall powerboat industry and any powerboat category during any fiscal year ended June 30 or any calendar year ended December 31 are based on comparable same-state retail boat registration data from SSI, as reported by the 50 states for which data was available as of the date of this Form 10-K; and (3) market share among U.S. manufacturers of exports to international markets of boats in any powerboat category for any period is based on data from the Port Import Export Reporting Service, available through March 31, 2016, and excludes such data for Australia and New Zealand. |

This Annual Report on Form 10-K includes our trademarks, such as “Surf Gate” and “Wakesetter,” which are protected under applicable intellectual property laws and are the property of Malibu Boats. This Form 10-K also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this Form 10-K may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

Our Company

We are a leading designer, manufacturer and marketer of performance sport boats, having the #1 market share position in the United States since 2010. Our boats are used for water sports, including water skiing, wakeboarding and wake surfing, as well as general recreational boating. Since inception in 1982, we believe we have been a consistent innovator in the powerboat industry, designing products that appeal to an expanding range of recreational boaters and water sports enthusiasts whose passion for boating and water sports is a key aspect of their lifestyle. We believe many of our innovations, such as our proprietary Surf Gate technology launched in 2012, expand the market for our products by introducing consumers to new and exciting recreational activities. We believe that our boats are increasingly versatile, allowing consumers to use them for a wide range of activities that enhance the experience of a day on the water with family and friends. While there is no guarantee that we will achieve market share growth in the future, we believe that the performance, quality, value and multi-purpose features of our boats position us to achieve our goal of increasing our market share in the expanding recreational boating market.

We sell our high performance boats under two brands-Malibu and Axis Wake Research, or Axis. Our flagship Malibu brand boats offer our latest innovations in performance, comfort and convenience, and are designed for consumers seeking a premium boating experience. Retail prices of our Malibu boats typically range from $40,000 to $175,000. We launched our Axis brand of boats in 2009 to appeal to consumers who desire a more affordable product but still demand high performance, functional simplicity and the option to upgrade key features. Retail prices of our Axis boats typically range from $45,000 to $95,000.

3

Our boats are constructed of fiberglass, equipped with inboard propulsion systems and available in a range of sizes and hull designs. We employ experienced product development and engineering teams that enable us to offer a range of models across each of our brands while consistently introducing innovative features in our product offerings. Our engineering team closely collaborates with our manufacturing personnel in order to improve product quality and process efficiencies. The results of this collaboration are reflected in our receipt of numerous industry awards, including the Watersports Industry Association’s Innovation of the Year in 2010 and 2013.

We sell our boats through a dealer network that we believe is the strongest in the performance sport boat category. As of July 1, 2016, our distribution channel consisted of 110 independent dealers in North America operating in 147 locations in North America and we had 58 independent dealer locations across 38 countries outside of North America, including Australia. Our boats are the exclusive performance sport boats offered by the majority of our dealers. Additionally, we believe that our Australia segment is the largest performance sport boat manufacturer in that country. Our dealer base is an important part of our consumers’ experience, our marketing efforts and our brands. We devote significant time and resources to find, develop and improve the performance of our dealers and believe our dealer network gives us a distinct competitive advantage.

Financial Information About Segments

We report our results of operations under two reportable segments called U.S. and Australia segments based on their respective manufacturing footprints. Each segment participates in the manufacturing, distribution, marketing and sale of performance sport boats. The U.S. operating segment primarily serves markets in North America, South America, Europe, and Asia while the Australia operating segment principally serves the Australian and New Zealand markets.

The segment and geographic information required herein is contained in Note 18 - Segment Reporting, in the notes to our consolidated financial statements.

Our Market Opportunity

During calendar year 2015, retail sales of new powerboats in the United States totaled $7.8 billion. Of the powerboat categories defined and tracked by the NMMA, our core market corresponds most directly to the inboard ski/wakeboard category, which we refer to as the performance sport boat category. We believe our addressable market also includes similar and adjacent powerboat categories identified by the NMMA, which totaled over $5.6 billion of sales in 2015. The following table illustrates the size of our addressable market in units and retail sales for calendar year 2015:

Powerboat Category | Unit Sales | Retail Sales | |||||

(Dollars in millions) | |||||||

Outboard | 155,800 | $ | 3,828 | ||||

Sterndrive | 12,900 | 924 | |||||

Performance sport boat | 7,800 | 686 | |||||

Jet boat | 4,400 | 208 | |||||

Total addressable market | 180,900 | $ | 5,646 | ||||

We believe we are well-positioned to benefit from trends in our addressable market, including:

Improving Macroeconomic Environment Driving Increased Consumer Demand for Boats. Following the economic downturn, the recreational boating industry has grown and is projected to continue to recover. While domestic sales of new performance sport boats in 2015 grew to approximately 7,800 units, they remained 40% below the category’s 2006 sales volume of 13,100. We believe there remains significant opportunity for growth from increased consumer demand in the recreational boating industry as the economy improves, but there are numerous variables that have potential to impact the growth to be achieved in the future,

Increasing Ages of Used Boats Driving New Boat Sales. In 2015, according to NMMA retail sales data, new powerboats accounted for approximately one out of five powerboat sales in the United States compared to an average of approximately one out of four between 2002 and 2008. We believe the shift toward purchasing more used boats during the economic downturn helped cause the average age of powerboats in use to increase from 15 years in 1997 to over 21 years today. As the powerboat industry continues its ongoing recovery and older boats reach the end of their usable lives, we expect consumer purchases of new boats to shift back toward historic levels benefiting new boat manufacturers.

Our Strengths

4

#1 Market Share Position in Performance Sport Boat Category. According to SSI, we have held the number one market share position, based on unit volume, in the United States among manufacturers of performance sport boats for calendar years since 2010 including 2015. We have grown our U.S. market share from 23.3% in 2008, the year prior to the arrival of our current Chief Executive Officer and Chief Financial Officer, to 32.0% in 2015. The following table reflects our U.S. market share in the performance sport boat category compared to the market share of our competitors for the periods shown:

U.S. Market Share in Performance Sport Boat Category | ||||||||||||||||||||||||

Manufacturer/Brand(s) | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

Malibu Boats/Malibu and Axis | 23.3 | % | 23.5 | % | 24.4 | % | 29.0 | % | 30.8 | % | 33.0 | % | 32.0 | % | 32.0 | % | ||||||||

MasterCraft Boat Company, LLC/MasterCraft | 24.1 | 25.1 | 23.3 | 23.9 | 21.8 | 20.0 | 20.5 | 21.7 | ||||||||||||||||

Correct Craft, Inc./Nautique1 | 24.0 | 24.7 | 23.1 | 19.9 | 19.6 | 20.6 | 23.0 | 21.6 | ||||||||||||||||

Skier's Choice, Inc./Supra and Moomba | 16.7 | 15.6 | 16.7 | 15.6 | 14.7 | 12.6 | 12.0 | 12.8 | ||||||||||||||||

All others | 11.9 | 11.1 | 12.5 | 11.6 | 13.1 | 13.8 | 12.5 | 11.9 | ||||||||||||||||

Total | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||

(1) | In June 2015, Correct Craft acquired majority interest in both Centurion Boats and Supreme Boats. Accordingly, market share for Ski Supreme, Centurion, and Nautique are reflected combined here for all periods for better comparison. | |

In addition, our 53% market share of performance sport boat exports to international markets for the 12 months ended March 31, 2016 was the highest among U.S. manufacturers and was more than our top two competitors combined.

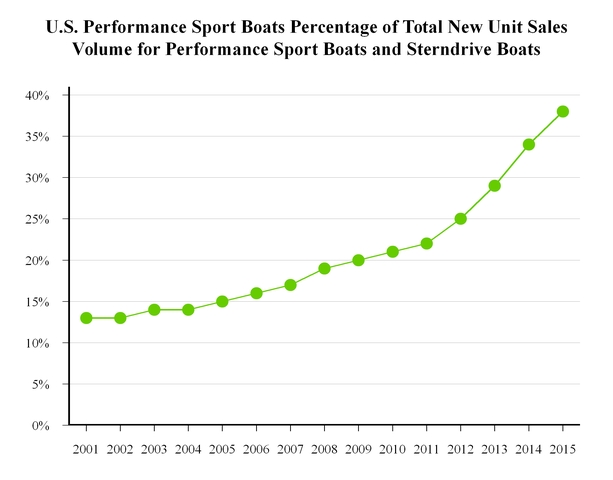

Performance Sport Boat Category Taking Share. As the recovery in the general economy and overall powerboat industry has continued, the performance sport boat category in which we participate has experienced one of the highest growth rates. New unit sales of performance sport boats in the United States increased by 16% from 2013 to 2014, while new unit sales of all other powerboats in the United States increased 6% over the same period. This trend continued in 2015, as new unit sales of performance sport boats and all other powerboats in the United States increased by 10% and 7%, respectively, for the year ended December 31, 2015. We believe this is largely attributable to increased innovation in the features, designs and layouts of performance sport boats, which has improved the performance, functionality and versatility of these boats versus other recreational powerboats, particularly the larger category of sterndrive boats. We believe that we have been at the forefront of product innovation and will continue to appeal to a broader consumer base that values our boats not only for water sports, but also for general recreational boating and leisure activities. We believe that our market-leading position within our expanding category will create continued growth opportunities for us.

Poised to Take Advantage of the Performance Sport Boat Market Recovery. With our leading and growing market share in our category, we believe that we are well-positioned to take advantage of the ongoing recovery in the powerboat market. While the performance sport boat category grew 10% in calendar year 2015, new unit sales still remain significantly below historical peaks. As illustrated in the chart below, the 7,800 new units sold in calendar year 2015 were 33% below the average annual new unit sales volume of 11,714 observed between 2001 and 2007 and 40% below the 13,100 new units sold in 2006. While there is no guarantee that the market will continue to grow or return to historical sales levels, we believe the continuing recovery in the performance sport boat market presents significant opportunity for growth.

5

Even if the performance sport boat market does not reach previous peak levels, we believe that our #1 market share position in a category that is growing faster than the overall powerboat industry, our investments in our business during and subsequent to the economic downturn, including the acquisition of our Australian licensee, vertical integration efforts related to manufacturing our own towers, trailers, and other products, and our innovative product offering should drive superior performance.

Industry-leading Product Design and Innovation. We believe that our innovation in the design of new boat models and new features has been a key to our success, helping us increase our market share within our category and generally broaden the appeal of our products among recreational boaters. As a result of the features we have introduced, we believe that our boats are used for an increasingly wide range of activities and are increasingly easier to use, while maintaining the high performance characteristics that consumers expect. Additionally, by introducing new boat models in a range of price points, sizes, bow and hull designs, and optional performance features, we have enhanced consumers’ ability to select a boat suited to their individual preferences. Our commitment to, and consistency in, developing new boat models and introducing new features are reflected in several notable achievements, including:

• | release of our patented Surf Gate technology in 2012, which allows users to surf on either side of the boat’s wake, generates a better quality surf wave and was the Watersports Industry Association’s Innovation of the Year in 2013; |

• | launch of the Axis brand of boats in 2009, designed from the ground up to be an entry-level product, which has already captured a 11.0% share of the U.S. market in our category as of December 31, 2015; |

• | introduction of the patented Power Wedge in 2006, which gives boaters the ability to customize the size and shape of the boat’s wake with the push of a button. This was followed in 2014 with the Power Wedge II, which provides an even larger displacement and more control of wakes and waves than the original Power Wedge. It was integrated into our Integrated Surf Package to further provide a competitive advantage for wake surfing; |

• | introduction of the first Malibu designed and manufactured tower in 2009; |

6

• | integration of the manufacturing of our own trailers beginning with model year 2016, including full trailer design and construction which provides greater customization and quality control; |

• | a strong new product lineup for model year 2016 that included the launch of the Malibu M235, Wakesetter 25 LSV, the Wakesetter 20 VTX and Axis A20. In addition, on our model year 2016 products, we offered an improved Surf Gate system with hydraulic actuators, our patented rider controlled Surf Band technology, new windshields, new vinyl and backup cameras; and |

• | successful new model introductions each year. For model year 2017, we will launch four new models: the Malibu Wakesetter 24 MXZ, the Malibu Wakesetter 22 MXZ, and the Malibu Wakesetter 21 VLX were all launched in the summer of 2016 and an additional Malibu model will be launched this fall. |

Intellectual Property. A key element of our growth and increased market share has been our intellectual property which we believe is the best in our industry. Among our most innovative and sought after features on our boats has been Surf Gate. Together with Power Wedge and Surf Band, these patented technologies continue to drive demand for our products and increased margins. We vigorously defend our patents and other intellectual property to ensure we maintain our competitive edge. Because of the appeal of these technologies, we have entered into agreements to license them to other manufacturers within the powerboat category. We believe licensing our products provides us with significant strategic advantage over our competitors by allowing us to expand into other markets and broadening the appeal of these technologies into segments that would not otherwise have them thereby eventually creating a path to Malibu.

Strong Dealer Network. We have worked diligently with our dealers to develop the strongest distribution network in the performance sport boat category. We believe that our distribution network of 147 North American dealer locations and 58 international dealer locations as of July 1, 2016 allows us to distribute our products more broadly and effectively than our competitors. For calendar year 2015, our dealers held or tied for the #1 market share position for the performance sport boat category in 71 of 118 U.S. markets. We have nominal dealer concentration, with no single dealer accounting for more than 5.3% of our unit volume for fiscal year 2016 and 4.7% for fiscal years 2015 and 2014, and our top ten dealers represented 31.9%, 33.7% and 34.1% of our unit volume for fiscal years 2016, 2015 and 2014, respectively. We continually review our geographic coverage to identify opportunities for expansion and improvement, and will, where necessary, add dealer locations to address previously underserved markets or replace under performing dealers.

Highly Recognized Brands. We believe our Malibu and Axis brands are widely recognized in the powerboat industry, which helps us reach a growing number of target consumers. For over 30 years, our Malibu brand has generated a loyal following of recreational boaters and water sports enthusiasts who value the brand’s premium performance and features. Our Axis brand has grown rapidly as consumers have been drawn to its more affordable price point and available optional features. We believe that the appeal of our high performance and innovative products with athletes and enthusiasts contributes to our brand awareness with dealers and with consumers. We are able to build on this brand recognition and support through a series of marketing initiatives coordinated with our dealers or executed directly by us. Many of our marketing efforts are conducted on a grass-roots level domestically and internationally. Key grass-roots initiatives include: production and distribution of water sports videos; online and social marketing; on-the-water events; athlete, tournament and water sport facility sponsorships; and participation and product placement at important industry events. Additionally, our boats, their innovative features, our sponsored athletes and our dealers all frequently win industry awards, which we believe further boosts our brand recognition and reputation for excellence. We believe our marketing strategies and accomplishments enhance our profile in the industry, strengthen our credibility with consumers and dealers and increase the appeal of our brands.

Compelling Margins and Cash Flow. Our net income margin and adjusted EBITDA margin was 8.0% and 19.1%, respectively, for fiscal year 2016. For the definition of adjusted EBITDA margin and a reconciliation to net income (loss), see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - GAAP Reconciliation of Non-GAAP Financial Measures.” We also produced $35.6 million net cash from operating activities for fiscal year 2016. We have an array of initiatives focused on reducing our cost base and improving the efficiency of our manufacturing process that have enabled us to maintain attractive margins and strong cash flows. We have re-engineered the manufacturing process in our Tennessee facility reducing labor hours per boat produced. We have also improved production throughput and product quality through close collaboration between our product development and manufacturing teams. Further, vertical integration of trailers, towers and tower accessories production gives us the ability to increase incremental margin per boat sold. In addition, our low capital expenditure requirements and a highly efficient working capital cycle have allowed us to generate significant excess cash flow from operations, excluding one-time litigation and settlement costs in fiscal years 2016, 2015 and 2014. We believe our strong cash flow increases our financial stability and provides us with more flexibility to invest in growth initiatives.

Highly Experienced Management Team. Our experienced management team has demonstrated its ability to navigate through various economic cycles, to identify, create and integrate new product innovations, improve financial performance,

7

optimize operations, enhance our distribution model and recruit top industry talent. Our Chief Executive Officer, Jack Springer, joined Malibu Boats in 2009 and has assembled an executive team with strong, complementary talents and experience. This team has led a workforce that we believe has produced superior results, including market share gains, sales growth and profitability improvement.

Our Strategy

We intend to capitalize on the ongoing recovery in the powerboat market through the following strategies:

Continue to Develop New and Innovative Products in Our Core Markets. We intend to continue developing and introducing new and innovative products—both new boat models to better address a broader range of consumers and new features to deliver better performance, functionality, convenience, comfort and safety to our consumers. We believe that new products and features are important to the growth of our market share, the continued expansion of our category and our ability to maintain attractive margins.

Our product development strategy consists of a two-pronged approach. First, we seek to introduce new boat models to target unaddressed or underserved segments of the performance sport boat category, while also updating and refreshing our existing boat models regularly. For example, we introduced Axis-branded boats starting in 2009 to address the entry-level segment of our category, we launched the Malibu Wakesetter MXZ product line in 2012 to enter the premium “picklefork” bow design segment of our market, and in 2016 we released the Malibu M235 designed to deliver luxury and performance in the ultra-premium market. Second, we seek to develop and integrate innovative new features into our boats, such as Surf Gate, Malibu Touch Command and Power Wedge. Over the past two years, we have continued these strategies by introducing eight new models, including three in the Axis line, and we have enhanced our optional feature offerings with the new Power Wedge II and the industry's first 12-inch touchscreen dash system. For the 2016 model year, which began July 1, 2015, we released the Wakesetter 25 LSV, the Wakesetter 20 VTX and the Axis A20 and in November 2015 we launched the Malibu M235. In addition, on our model year 2016 products, we offered an improved Surf Gate system with hydraulic actuators, our patented rider controlled Surf Band technology, new windshields, new vinyl and backup cameras. Furthermore, at the end of fiscal year 2015 we began production of trailers for the model year 2016 product, continuing our vertical integration strategy focused on delivering better quality and value to our consumers while enhancing margins. For the 2017 model year, we released the Wakesetter 22 MXZ, the Wakesetter 24 MXZ and the Wakesetter 21VLX. We intend to continue releasing new products and features multiple times during the year, which we believe enhances our reputation as a leading-edge boat manufacturer and provides us with a competitive advantage.

Capture Additional Share from Adjacent Boating Categories. Our culture of innovation has enabled us to expand the market for our products by attracting consumers from other categories, most notably from the sterndrive category. As illustrated by the chart below, the new unit sales volume of performance sport boats steadily increased from 2001 through 2015 as a percentage of the total new unit sales volume of performance sport boats and sterndrive boats. While there is no guarantee that this trend will continue in the future, we believe our market-leading position and broad offering of boat models and features will continue to attract consumers to our performance sport boats.

8

We intend to continue to enhance the performance, comfort and versatility of our products in order to further target crossover consumers seeking high-performance powerboats for general recreational activity. For example, we believe that one of our newest boat models, the Wakesetter 25 LSV, appeals to a broader range of recreational boaters by offering the performance benefits of our products, including superior drivability and water sports versatility, while also providing greater seating capacity, a roomy, plush interior and extensive storage space to allow an increased number of family and friends to spend time together on the water. In addition, in fiscal year 2016, we released a new line of boats in the ultra-premium segment anchored by the M235, which is designed to deliver luxury and performance in the ultra-premium market.

Further Strengthen Our Dealer Network. Our goal is to achieve and maintain leading market share in each of the markets in which we operate. We continually assess our distribution network and take the actions necessary to achieve our goal. We intend to strengthen our current footprint by selectively recruiting market-leading dealers who currently sell our competitors’ products. In addition, we plan to continue expanding our dealer network in certain geographic areas to increase consumer access and service in markets where it makes strategic sense. We believe our targeted initiatives to enhance and grow our dealer network will increase unit sales in the future.

Accelerate International Expansion. Based on our U.S. leadership position, brand recognition, diverse, innovative product offering and distribution strengths, we believe that we are well-positioned to increase our international sales. Our 53% market share of performance sport boat exports to international markets for the last twelve months ended March 31, 2016 was the highest among U.S. manufacturers and is supported by an extensive international distribution network of 58 international dealer locations. Including our Australia operations which we acquired in October 2014, unit volumes outside of North America accounted for approximately 8.0% of our total unit volume for fiscal years 2016 and 2015. We believe we will increase our international sales both by promoting our products in developed markets where we have a well-established dealer base, such as Western Europe, and by penetrating new and emerging markets where we expect rising consumer incomes to increase demand for recreational products, such as Asia and South America, although there is no guarantee that our efforts will be successful or that international sales will increase.

Over the last few years we have taken a number of steps to enhance our international presence and our ability to drive sales in developed and emerging markets. In fiscal year 2013, we restructured our agreements with those parties to provide for direct

9

sales coverage of key markets, including Central America, South America, Asia (excluding the Middle East) and most of Africa. In fiscal year 2015, we acquired our exclusive licensee in Australia. In fiscal year 2016, to better manage and optimize international sales in Europe, we have added dedicated company resources and increased our sales and marketing activity there, including international dealer meetings, dealer service schools, regional marketing campaigns and promotional visits by water sport athletes. We expect the growing demand for our product to continue, but the continued strength of the U.S. dollar has had an impact on international markets.

Our Products and Brands

We design, manufacture and sell performance sport boats that we believe deliver superior performance for water sports, including wakeboarding, water skiing and wake surfing, as well as general recreational boating. We market our boats under two brands:

• | Malibu, our flagship brand, dates to our inception in 1982, primarily targeting consumers seeking a premium boating experience and offering our latest innovations in performance, comfort and convenience; and |

• | Axis, which we launched as a new brand in 2009, targets a younger demographic and provides them with a more affordably priced, entry-level boat that provides high performance, functional simplicity and the option to upgrade key features. |

In addition, we offer various accessories and aftermarket parts.

Boat Models

We believe our boats are renowned for their performance, design, innovative technology, quality and ability to provide consumers a high-quality boating experience at varying price points. We currently offer a number of performance sport boat models across our two brands, which provide consumers with a variety of options across length, hull type, bow type, horsepower and seating capacity in addition to customizable designs and features available for upgrade across our models. The following table provides an overview of our most popular product offerings by brand:

Brand | Series | Number of Models | Lengths | Hull Types | Bow Types | Maximum Power | Maximum Capacity (persons) | Retail Price Range (In thousands) |

Malibu | M | 1 | 23.5’ | Wake Plus | Picklefork | 575 Lb-ft | 11-17 | $160-$175 |

Malibu | Wakesetter | 7 | 20’-25’ | Wake, Cut Diamond, Diamond | Traditional, Picklefork | 575 Lb-ft | 11-19 | $65-$150 |

Malibu | Response | 3 | 20’-21’ | Cut Diamond | Traditional | 450 Lb-ft | 5-7 | $40-$75 |

Axis | Axis | 5 | 20’-24’ | Wake | Traditional, Picklefork | 555 Lb-ft | 11-17 | $45-$95 |

• | Malibu M Series. The Malibu M235, created in 2015, is a new line of ultra-premium towboats, built from the ground up by a team of our designers, engineers, and athletes, and designed to provide consumers with a seamless blend of beauty, luxury, and power. The M235, at almost 24 feet, is deeper than any other boat in our category and loaded with every technologically innovative feature we offer including our Integrated Surf Platform, premium luxury interiors, and most advanced helm in the industry. Further, the M235 is driven by our most powerful engine delivering what we believe is the best performance of any performance sport boat on the market today. |

• | Malibu Wakesetter. Introduced in 1998, the Wakesetter series is our premium boat series and the top selling series within the performance sport boat category. The Wakesetter series is designed for consumers seeking the highest-performance water sport and boating experience. Wakesetter offers consumers a highly-customizable boat with our most innovative technologies, premium features, newest graphics, color options and interior finishes. Demonstrating Wakesetter’s industry-leading performance and market position, the Wakesetter 23 LSV model was the best-selling boat in the performance sport boat category for fiscal years 2009 through 2015. |

• | Malibu Response. The Response series, created in 1995, was designed for consumers who desire a high-performance water ski boat. Primarily because of its direct drive engine setup, the Response series produces the smallest wake of any of our boats and is designed to accommodate both professional and recreational skiers by allowing for a range of speeds and line lengths. Demonstrating Response’s reputation for high-performance and quality, the Response TXI model is the boat of choice for Regina Jaquess, a member of the Malibu Pro Ski Team since 2011 and the holder of the women’s slalom world record. |

10

• | Axis. After the continued success with our Wakesetter series, we identified a market opportunity in entry-level performance sport boats and, in 2009, launched our Axis brand. We designed Axis for consumers who desire a lower price point, but who still demand high performance, functional simplicity and the option to upgrade their boats to have key features such as Surf Gate. The Axis series currently has five available models and we plan to refine these models continually as well as add new ones as we build out the brand. We believe the Axis series successfully provides consumers with a high quality water sport and boating experience at an attractive price, as evidenced by its #4 market position in the performance sport boat category after only seven years on the market. |

Innovative Features

In addition to the standard features included on all of our boats, we offer consumers the ability to upgrade our base models by adding certain of our full line of innovative features designed to enhance performance, functionality and the overall boating experience. Our innovative features drive our high average selling prices. Some of these include:

• | Surf Gate. Introduced in July 2012 and initially patented in September 2013, Surf Gate is available as an optional feature on all Malibu Wakesetter models and Axis brand boats. Surf Gate has revolutionized the increasingly popular sport of wake surfing. Prior to Surf Gate, boaters needed to empty ballast tanks on one side of the boat and shift passengers around to lean the boat to create a larger, more pronounced surf-quality wake. By employing precisely engineered and electronically controlled panels, Surf Gate alleviates this time-consuming and cumbersome process, allowing boaters to easily surf behind an evenly weighted boat without the need to wait for ballast changes. Recent enhancements to Surf Gate have improved upon the system’s actuators, allowing for easier and faster transfer, as well as the installation of an indicator horn and optional light signaling, which alert riders to wave transfers. For the 2016 model year, we introduced our patented Surf Band technology that allows the rider to control the surf wave, shape, size and side. In 2013, the Watersports Industry Association named Surf Gate as Innovation of the Year. |

• | Manual Wedge/Power Wedge. Our patented Manual Wedge and Power Wedge allow riders to customize their wakes by simulating up to 1,200 pounds of ballast weight in the transom of their boats. Used in conjunction with Surf Gate, wake surfers are able to customize the size and shape of the wave. The Manual Wedge is available on all Malibu and Axis brand boats. Unlike our Manual Wedge, the Power Wedge, available exclusively on our Malibu line, is fully automated and integrated within the Malibu Touch Command system, increasing functionality and ease-of-use for the driver. Re-engineered for model year 2015, we released the Power Wedge II. It features a larger foil and a 21% surface-area increase, which equates to an additional 300 pounds of simulated ballast, for a total of 1,500 pounds of wake-creating water displacement. In addition, a new upward angle increases lift, allowing the driver to achieve a fully loaded boat planing much faster. |

• | G3/G4 Tower. Our G3 Towers, available on Malibu brand boats, are fully customizable with speakers, power lights and racks, enhancing the overall style, performance and functionality of our boats. Our G3 Tower can easily be folded down by one person with its weightless, gas spring-assisted design, making the G3 Tower safe and easy to store. We are the only manufacturer of performance sport boats that produces towers in-house, allowing us to control this critical design element of our boats. For model year 2015, we offered a new G4 Tower featuring aerospace aluminum and an internal honeycomb structure to provide the optimal strength-to-weight ratio, making the G4 three times more rigid than its predecessor. The new design contains automatic visible locks, a fully integrated wiring harness, Z5 Bimini compatibility, and zero pinch points. The new G4 has an aggressive design yet preserves ease of use by taking less than 30 pounds of force to lift, lower, and latch. |

• | Electronic Dashboard Controls. Every boat in our Wakesetter series is equipped with our MaliView and Malibu Touch Command ("MTC") systems, which function as an electronic command center that enhances the driver’s experience by providing simple and quick control of all systems on board, including the Power Wedge and Surf Gate systems, rider presets, music, lighting and navigation. For the model year 2015, we were first to market with a 12-inch touchscreen. It joined our seven-inch MTC to form the display for our new Command Center, giving the driver endless data in an easy-to-navigate interface. Every major feature is on the home screen, menu paths have been streamlined and each component meets IP60 water-intrusion standards. Built with more processing power, higher levels of integration, a feature-packed new operating system and powerful wireless connectivity, the new Command Center represents the most advanced screen technology available on performance sport boats. |

• | Surf Band. Malibu’s exclusive, patented Surf Band allows a rider to strap a buoyant, hi-viz wristband and tap a simple, intuitive remote interface to take command of all aspects of the rider's surfing experience. At the same time, the interface enables the driver to monitor the rider through alerts on the electronic command center, eliminating the need for hand-signals to the spotters or driver. If the rider is wakeboarding, the Surf Band lets the rider adjust the Power Wedge II and control speed. |

11

We also offer an array of less technological, but nonetheless value-added boat features such as gelcoat upgrades, upholstery upgrades, engine drivetrain enhancements (such as silent exhaust tips, propeller upgrades and closed cooling engine configuration), sound system upgrades, Bimini tops, boat covers and trailers which further increase the level of customization afforded to consumers.

Our Dealer Network

We rely on independent dealers to sell our products. We establish performance criteria that our dealers must meet as part of their dealer agreements to ensure our dealer network remains the strongest in the industry. As a member of our network, dealers in North America may qualify for floor plan financing programs, rebates, seasonal discounts, promotional co-op payments and other allowances. We believe our dealer network is the most extensive in the performance sport boat category. The majority of our dealers, including nine in our top ten markets, are exclusive to Malibu and Axis brand boats within the performance sport boat category, highlighting the commitment of our key dealers to our boats.

North America

In North America, we had a total of 147 dealer locations as of July 1, 2016. Of these locations, 19% sell our products exclusively, 63% are multi-line locations that only carry non-competitive brands and products and 18% sell our brands as well as other performance sport boat brands. Approximately 37% of our dealer locations have been with us for over ten years. For calendar year 2015, our dealers held or tied for the #1 market share position for the performance sport boat category in 71 of 118 U.S. markets.

We consistently review our distribution network to identify opportunities to expand our geographic footprint and improve our coverage of the market. We have the ability to opportunistically add new dealers and new dealer locations to previously underserved markets and use data and performance metrics to monitor dealer performance. We believe our outstanding dealer network allows us to distribute our products more efficiently than our competitors.

We do not have a significant concentration of sales among our dealers. For fiscal year 2016, our top ten dealers accounted for 31.9% of our units sold and none of our dealers accounted for more than 5.3% of our total sales volume.

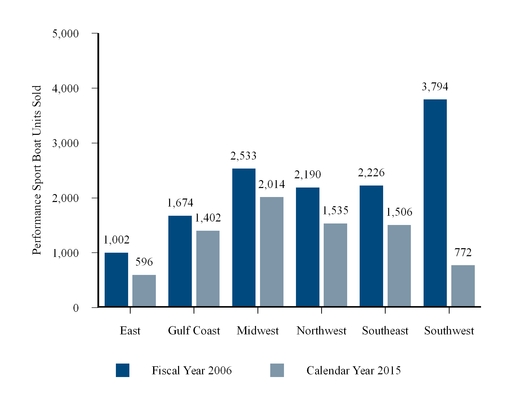

We believe that our strong market position in each region of the United States will help us capitalize on growth opportunities as our industry continues to recover from the economic downturn. In particular, we expect to generate continued growth in the southwestern United States (which includes California), a region that experienced the most pronounced decline in sales of new performance sport boats and where we have our highest regional market share. The following graph provides a comparison of the number of units sold by U.S. geographic region during fiscal year 2006, when the market was generally at its pre-recession peak, and calendar year 2015, as well as our U.S. market share in the performance sport boat category for calendar year 2015:

12

Market Size and Our Market Share by Region

2015 Market Share | 35% | 32% | 30% | 29% | 32% | 41% | |

International

As of July 1, 2016, our extensive international distribution network consisted of 58 international dealer locations in 33 countries, including Europe, Asia, Middle East, South America, South Africa, and Australia/New Zealand. We service our independent dealers in the Australian and New Zealand markets through our Australian operations acquired in October 2014. Including our Australia operations, international unit volumes accounted for approximately 8.0% of our total unit volume for fiscal years 2016 and 2015.

For our international sales, other than Australia, we have historically relied, in part, on our relationship with an independent representative who serviced international dealer arrangements in Europe, the Middle East and South Africa on our behalf and was responsible for managing dealer relationships, dealer sourcing and account management, which included order management and customer service support in those countries. Under the terms of the agreement with the independent representative, the independent representative purchased boats directly from us at a predetermined percentage discount. These sales were made under the same terms and conditions offered to all dealers, which include, among other things, no right of return except in limited circumstances under our warranty policy. Like sales to our dealers, there were no continuing performance obligations in connection with our sales to the independent representative. Revenue from these sales has been recognized in accordance with our customary shipping terms, free on board shipping point. A fixed percentage discount was earned by the independent representative at the time a boat was shipped as a reduction in the price of the boat and recorded in our consolidated statement of operations and comprehensive income (loss) as a reduction in sales.

To further our international expansion strategy, we ended our relationship with the independent representative during the fourth quarter of fiscal 2016 after several years of transitioning parts of the international market to a direct relationship with Malibu and its international dealers. Effective July, 1, 2016, we assumed direct management of Europe, the Middle East and South Africa from the former international representative. We believe this model will provide additional expansion opportunities which will lead to increased unit sales and more revenue over time.

Dealer Management

13

Our relationship with our dealers is governed through dealer agreements. Each dealer agreement has a finite term lasting between one and three years. Our dealer agreements also are typically terminable without cause by the dealer at any time and by us with 90 days’ prior notice. We may also generally terminate these agreements immediately for cause upon certain events. Pursuant to our dealer agreements, the dealers typically agree to, among other things:

• | represent our products at specified boat shows; |

• | market our products only to retail end users in a specific geographic territory; |

• | promote and demonstrate our products to consumers; |

• | place a specified minimum number of orders of our products during the term of the agreement in exchange for rebate eligibility that varies according to the level of volume they commit to purchase; |

• | provide us with regular updates regarding the number and type of our products in their inventory; |

• | maintain a service department to service our products, and perform all appropriate warranty service and repairs; and |

• | indemnify us for certain claims. |

Our dealer network, including all additions, renewals, non-renewals or terminations, is managed by our sales personnel. Our sales team operates using a semi-annual dealer review process involving our senior management team. Each individual dealer is reviewed semi-annually with a broad assessment across multiple key elements, including the dealer’s geographic region, market share and customer service ratings, to identify underperforming dealers for remediation and to manage the transition process when non-renewal or termination is a necessary step.

We have developed a system of financial incentives for our dealers based on customer satisfaction and achievement of best practices. Our dealer incentive program has been refined through nearly 30 years of experience and provides the following key elements:

• | Rebates. Our dealers agree to an annual commitment volume that places each dealer into a certain rebate tier and determines its prospective rebate percentage. If a dealer meets its annual commitment volume as well as other terms of the rebate program, the dealer is entitled to the specified rebate. Failure to meet the commitment volume may result in partial or complete forfeiture of the dealer’s rebate. |

• | Co-op. Dealers of the Malibu product line may earn certain co-op reimbursements upon reaching a specified level of qualifying expenditures. |

• | Free flooring. Our dealers that take delivery of current model year boats in the offseason, typically July through April, are entitled to have us pay the interest to floor the boat until the earlier of (1) the sale of the unit or (2) a date near the end of the current model year. This program is an additional incentive to encourage dealers to order in the offseason and helps us balance our seasonal production. |

Our dealer incentive programs are also structured to promote more evenly distributed ordering throughout the fiscal year, which allows us to achieve better level-loading of our production and thereby generate plant operating efficiencies. In addition, these programs offer further rewards for dealers who are exclusive to Malibu and Axis in our performance sport boat category.

Floor Plan Financing

Our North American dealers often purchase boats through floor plan financing programs with third-party floor plan financing providers. During fiscal year 2016, approximately 87% of our domestic shipments were made pursuant to floor plan financing programs through which our dealers participate. These programs allow dealers to establish lines of credit with third-party lenders to purchase inventory. Under these programs, a dealer draws on the floor plan facility upon the purchase of our boats and the lender pays the invoice price of the boats. As is typical in our industry, we have entered into repurchase agreements with certain floor plan financing providers to our dealers. Under the terms of these arrangements, in the event a lender repossesses a boat from a dealer that has defaulted on its floor financing arrangement and is able to deliver the repossessed boat to us, we are obligated to repurchase the boat from the lender. Our obligation to repurchase such repossessed products for the unpaid balance of our original invoice price for the boat is subject to reduction or limitation based on the age and condition of the boat at the time of repurchase, and in certain cases by an aggregate cap on repurchase obligations associated with a particular floor financing program.

Our exposure under repurchase agreements with third-party lenders is mitigated by our ability to reposition inventory with a new dealer in the event that a repurchase event occurs. The primary cost to us of a repurchase event is any loss on the resale

14

of a repurchased unit, which is often less than 10% of the repurchase amount. For fiscal year 2016, we agreed to repurchase three units from the lender of two of our former dealers. Other than these repurchase commitments, the Company has not repurchased any boats under our repurchase agreements since July 1, 2010.

Marketing and Sales

We believe that providing a high level of service to our dealers and end consumers is essential to maintaining our reputation. Our sales personnel receive training on the latest Malibu Boats products and technologies, as well as training on our competitors’ products and technologies, and attend trade shows to increase their market knowledge. This training is then passed along to our dealers to ensure a consistent marketing message and leverage our marketing expenditures. We enjoy strong brand awareness, as evidenced by our substantial market share.

Our marketing strategy focuses on strengthening and promoting the Malibu and Axis brands in the performance sport boat marketplace. One element of our marketing strategy involves specialized promotions at competitive water sports events, and individual and team sponsorships. Our leading position in the performance sport boat category is supported by our sponsorship of some of the most prestigious water sports competitions, including the Malibu Evolution Pro Series, Malibu Open and World Wakeboard Association Riders Experience, which we believe positively influences the purchasing habits of enthusiasts and other consumers seeking high-performance products. These events feature the most popular figures in water sports, drawing large audiences of enthusiasts to a variety of sites around the country. Further, these events are focused on fan and retail consumer engagement and offer interactive, experiential opportunities for consumers to experience watersports behind our product. To aid in driving brand awareness we also sponsor a team of elite male and female athletes from the professional water sports tours. Team Malibu includes legendary wakeboarders such Ralph Derome and Amber Wing, along with World Wakeskate Champion and two-time Masters Champion Brian Grubbs. Additionally leading members of the team are World Champion waterskiers Thomas Degasperi and World Record Holder Regina Jaquess. The Axis Wake Research Pro Team includes watersports legends like Brostock Champion, Video of the Year winner, Randall Harris and King of the Cable, Best Wake Park Rider, and Wake Park World Series Champion Tom Fooshee. We believe that the performance of our products has been demonstrated by, and our brands benefit from, the success of professional athletes who use our products.

In addition to our website and traditional marketing channels, such as print advertising and tradeshows, we maintain an active digital advertising and social media platform, including use of Facebook and Twitter to increase brand awareness, foster loyalty and build a community of users. In addition, we benefit from the various Malibu and Axis user-generated videos and photos that are uploaded to websites including YouTube, Vimeo and Instagram. As strategies and marketing plans are developed for our products, our internal marketing and communications group works to ensure brand cohesion and consistency. We believe that our marketing initiatives, as well as our strategic focus on product innovation, performance and quality attracts aspiring and enthusiast consumers to our brands and products.

Product Development and Engineering

We are strategically and financially committed to innovation, as reflected in our dedicated product development and engineering group and evidenced by our track record of new product introduction. Our product development and engineering group spans both our Tennessee headquarters and our California facility and comprises 18 professionals. These individuals bring to our product development efforts significant expertise across core disciplines, including boat design, trailer design, computer-aided design, electrical engineering and mechanical engineering. They are responsible for execution of all facets of our new product strategy, including designing new and refreshed boat models and new features, engineering these designs for manufacturing and integrating new features into our boats. In addition, our Chief Executive Officer and Chief Operating Officer are actively involved in the product development process and integration into manufacturing.

We take a disciplined approach to the management of our product development strategy. We use a formalized phase gate process, overseen by a dedicated project manager, to develop, evaluate and implement new product ideas for both boat models and innovative features. Application of the phase gate process requires management to establish an overall timeline that is sub-divided into milestones, or “gates,” for product development. Setting milestones at certain intervals in the product development process ensures that each phase of development occurs in an organized manner and enables management to become aware of and address any issues in timely fashion, which facilitates on-time, on-target release of new products with expected return on investment. Extensive testing and coordination with our manufacturing group are important elements of our product development process, which we believe enable us to minimize the risk associated with the release of new products. Our phase gate process also facilitates our introduction of new boat models and features throughout the year, which we believe provides us with a competitive advantage in the marketplace. Finally, in addition to our process for managing new product introductions in a given fiscal year, we also engage in longer-term product life cycle and product portfolio planning.

15

Manufacturing

Our manufacturing efforts are led by our Chief Operating Officer, who brings 30 years of experience in the manufacture of performance sport boats. We manufacture our boats at both our Tennessee and Australia facilities, and we manufacture towers, tower accessories and stainless steel and aluminum billet at our California facility. Beginning with model year 2016, we began manufacturing our own trailers at our Tennessee facility.

Our boats are built through a continuous flow manufacturing process that encompasses fabrication, assembly, quality management and testing. Each boat is produced over a seven-day cycle that includes the fabrication of the hull and deck through gelcoat application and fiberglass lamination, grinding and hole cutting, installation of components, rigging, finishing, detailing and on-the-water testing. Trailers are also produced in a continuous flow manufacturing process involving cutting and bending of the main frame from raw top grade carbon steel, painting using our state of the art system and installation of components. We manufacture certain components and subassemblies for our boats, such as upholstery, stainless steel and aluminum billet and towers. We procure other components, such as engines and electronic controls, from third-party vendors and install them on the boat.

We acquired our tower and tower accessory manufacturing capability in 2009 through the acquisition of certain assets of Titan Wake Accessories, which had been one of our suppliers. Tower-related manufacturing occurs in our Merced-based machine shop, where we use multiple computer-controlled machines to cut all of the aluminum parts required for tower assembly. We are the only performance sport boat company that manufacturers towers in-house. We believe that the vertical integration of these components is a distinct competitive advantage that allows us to control key design elements of our boats and generate higher margins.

We are committed to continuous improvement in our operations, and our efforts in this regard have resulted in higher gross margins. Specifically, we have increased labor efficiency, reduced cost of materials and reduced warranty claims. Our production engineers evaluate and seek to optimize the configuration of our production line given our production volumes and model mix. We use disciplined mold maintenance procedures to maintain the usable life of our molds and to reduce surface defects that would require rework. We have instituted scrap material reduction and recovery processes, both internally and with our supplier base, helping to manage our material costs. Finally, we have implemented a quality management system to ensure that proper procedures and control measures are in place to deliver consistent, high-quality product, especially as our production volumes have increased.

We focus on worker safety in our operations. From July 1, 2012 to June 30, 2016, we recorded 2,601,211 consecutive man-hours with only one lost-time accident in our Tennessee facility, an accomplishment that has reduced workers’ compensation claims and warranty costs, as our most experienced employees continue to remain on the job.

Suppliers

We purchase a wide variety of raw materials from our supplier base, including resins, fiberglass, hydrocarbon feedstocks and steel, as well as product parts and components, such as engines and electronic controls, through a sales order process.

We belong to Independent Boat Buildings, Inc., or IBBI, a 20-member marine purchasing cooperative and sit on its board of directors. Membership in IBBI is limited to top-tier manufacturers and is not only helpful for procuring materials, but also helps us stay abreast of technological developments and industry best practices. Although we purchase certain supplies, such as fiberglass and resins, through the IBBI cooperative agreement, we maintain informal arrangements with third-party suppliers outside of the IBBI agreement for other raw materials and components, which we believe ensures that our boats are constructed using the best available components and raw materials.

We have not experienced any material shortages in any of our raw materials, product parts or components. Temporary shortages, when they do occur, usually involve manufacturers of these products adjusting model mixes, introducing new product lines or limiting production in response to an industry-wide reduction in boat demand.

The most significant component used in manufacturing our boats, based on cost, are engines. We maintain a strong and long-standing relationship with our primary supplier of engines from whom we purchased approximately 60% of our engines for fiscal year 2016, and we have also developed a relationship with a second supplier from whom we sourced approximately 40% of our engines for fiscal year 2016. As is typical in our industry, our engine suppliers are marinizers of engines that they procure from larger engine block manufacturers, such as General Motors Corporation.

Insurance and Product Warranties

We carry various insurance policies, including policies to cover general products liability, workers’ compensation and other casualty and property risks, to protect against certain risks of loss consistent with the exposures associated with the nature and

16

scope of our operations. Our policies are generally based on our safety record as well as market trends in the insurance industry and are subject to certain deductibles, limits and policy terms and conditions.

Effective for model year 2016, we began providing a limited warranty for a period up to five years for both Malibu and Axis brand boats. For model years prior to 2016, we provided a limited warranty for a period of up to three years for our Malibu brand boats and two years for our Axis boats. During the warranty period, we reimburse dealers and Malibu Boats authorized service facilities for all or a portion of the cost of repair or replacement performed on the products (mainly composed of parts or accessories provided by us and labor costs incurred by dealers or Malibu Boats authorized service facilities). Some materials, components or parts of the boat that are not covered by our limited product warranties are separately warranted by their manufacturers or suppliers. These other warranties include warranties covering engines and other components.

Intellectual Property

We rely on a combination of patent, trademark and copyright protection, trade secret laws, confidentiality procedures and contractual provisions to protect our rights in our brand, products and proprietary technology. This is an important part of our business and we intend to continue protecting our intellectual property. We currently hold 18 U.S. patents, one Australian patent, one Canadian patent, seven pending U.S. patent applications and three pending Australian patent applications.

We own 32 registered trademarks in various countries around the world. Such trademarks may endure in perpetuity on a country-by-country basis, provided that we comply with all statutory maintenance requirements, including continued use of each trademark in each such country. We currently do not own any registered copyrights.

Competition

The powerboat industry, including the performance sport boat category, is highly competitive for consumers and dealers. Competition affects our ability to succeed in the markets we currently serve and new markets that we may enter in the future. We compete with several large manufacturers that may have greater financial, marketing and other resources than we do. We compete with large manufacturers who are represented by dealers in the markets in which we now operate and into which we plan to expand. We also compete with a wide variety of small, independent manufacturers. Competition in our industry is based primarily on brand name, price and product performance. For more information, see Item 1A. “Risk Factors—Risks Related to Our Business—Our industry is characterized by intense competition, which affects our sales and profits.”

Environmental, Safety and Regulatory Matters

Our operations and products are subject to extensive environmental, health and safety regulation under various federal, commonwealth, state, and local statutes, ordinances, rules and regulations in the United States and Australia where we manufacture our boats, and in other foreign jurisdictions where we sell our products. We believe we are in material compliance with those requirements. However, we cannot be certain that costs and expenses required for us to comply with such requirements in the future, including for any new or modified regulatory requirements, or to address newly discovered environmental conditions, will not have a material adverse effect on our business, financial condition, operating results, or cash flow. The regulatory programs to which we are subject include the following:

Hazardous Materials and Waste

Certain materials used in our manufacturing, including the resins used in production of our boats, are toxic, flammable, corrosive or reactive and are classified as hazardous materials by the national, state and local governments in those jurisdictions where we manufacture our products. The handling, storage, release, treatment and recycling or disposal of these substances and wastes from our operations are regulated in the United States by the United States Environmental Protection Agency (“USEPA”), and state and local environmental agencies. The handling, storage, release, treatment and recycling or disposal of these substances and wastes from our operations are regulated in Australia by the Australian Department of Environment and Energy, the New South Wales EPA and other state and local authorities. Failure by us to properly handle, store, release, treat, recycle or dispose of our hazardous materials and wastes could result in liability for us, including fines, penalties, or obligations to investigate and remediate any contamination originating from our operations or facilities. We are not aware of any contamination at our current or former facilities for which we could be liable under environmental laws or regulations, and we currently are not undertaking any remediation or investigation activities in connection with any contamination. Future spills or accidents or the discovery of currently unknown conditions or non-compliance could, however, could give rise to investigation and remediation obligations or related liabilities.

Air Quality

17

In the United States, the federal Clean Air Act (“CAA”) and corresponding state and local laws and rules regulate emissions of air pollutants. Because our manufacturing operations involve molding and coating of fiberglass materials, which involves the emission of certain volatile organic compounds, hazardous air pollutants, and particulate matter, we are required to maintain and comply with a CAA operating permit (Title V permit) for our Tennessee and local air permits for our California facilities. Our air permits require us to monitor our emissions and periodically certify that our emissions are within specified limits. To date, we have not had material difficulty complying with those limits.

The USEPA and the California Air Resources Board (“CARB”) have adopted regulations stipulating that many marine propulsion engines and watercraft meet certain air emission standards. Some of those standards requires fitting a catalytic converter to the engine. These regulations also require, among other things, that engine manufacturers provide a warranty that their engines meet USEPA and CARB emission standards. The engines used in our products are subject to these regulations. CARB also recently adopted an evaporative emissions regulation that applies to all MY 2018 spark-ignition marine watercraft with permanently installed fuel tanks sold in California. The new regulation requires subject boat manufacturers to use specific CARB-certified components for the fuel systems in their boats, or to certify the boat meets a related performance standard. The USEPA and CARB emissions regulations have increased the cost to manufacture our products.

OSHA

In the United States, the Occupational Safety and Health Administration (“OSHA”) standards limit the amount of emissions to which an employee may be exposed without the need for respiratory protection or upgraded plant ventilation. Our facilities are regularly inspected by OSHA and by state and local inspection agencies and departments. We believe that our facilities comply in all material aspects with these regulations. Although capital expenditures related to compliance with environmental laws are expected to increase, we do not currently anticipate any material expenditure will be required to continue to comply with existing OSHA environmental or safety regulations in connection with our existing manufacturing facilities.

At our New South Wales, Australia (“NSW”) facility, employee health and safety is regulated by SafeWork NSW, which also has requirements that limit the amount of certain emissions to which an employee may be exposed without the need for respiratory protection or upgraded plant ventilation. In addition, SafeWork NSW provides licensing and registration for potentially dangerous work, investigates workplace incidents, and enforces work health and safety laws in NSW. Our NSW facilities are regularly inspected by SafeWork NSW. We believe that our facilities comply in all material aspects with these requirements.

Boat Design and Manufacturing Standards