Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MERIT MEDICAL SYSTEMS INC | pressrelease10012018.htm |

| 8-K - 8-K - MERIT MEDICAL SYSTEMS INC | a100120188-k.htm |

Exhibit 99.2 Transaction Summary October 1, 2018

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS This presentation and any accompanying management commentary include “forward-looking statements,” as defined within applicable securities laws and regulations. All statements in this presentation, other than statements of historical fact, are “forward-looking statements”, including statements regarding the proposed transaction with Cianna Medical, Inc. (“Cianna”), projections of earnings, revenues or other financial items, statements regarding our plans and objectives for future operations (including the proposed merger and integration of Cianna’s operations), statements concerning proposed products or services (including the products offered by Cianna), statements regarding the integration, development or commercialization of our business or any business, assets or operations we have acquired or may acquire (including Cianna), statements regarding future economic conditions or performance, statements regarding governmental inquiries, investigations or proceedings and statements of assumptions underlying any of the foregoing. All forward-looking statements, including financial projections, included in this presentation are made as of the date of this presentation, and are based on information available to us as of such date. We assume no obligation to update or disclose revisions to any forward-looking statement, except as required by law or regulation. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “likely,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “projects,” ”forecast,” “potential,” “plan,” or other comparable terminology. Forward- looking statements are based on our current beliefs, expectations and assumptions regarding our business, domestic and global economies, regulatory and competitive environments and other conditions. There can be no assurance that such beliefs, expectations or assumptions or any of the forward-looking statements will prove to be correct. Actual results will likely differ, and may differ materially, from those projected or assumed in the forward-looking statements. Our future financial and operating results and condition, as well as any forward-looking statements, are subject to inherent risks and uncertainties such as those described in our Annual Report on Form 10-K for the year ended December 31, 2017 and other filings with the U.S. Securities and Exchange Commission. Such risks and uncertainties include the following: the possibility that conditions to the closing of the proposed merger, including regulatory conditions, will not be satisfied; Merit's potential inability to successfully manage the proposed merger and integration of the two companies and achieve anticipated financial results, product development and other anticipated benefits; uncertainties as to whether Merit will achieve sales, gross margin, cost of goods sold, cash flow and other results from the proposed merger which are comparable to the experience of Cianna Medical; unknown costs and risks associated with the business and operations of Cianna Medical, Merit’s internal models or the projections in this presentation; governmental scrutiny and regulation of the medical device industry, including governmental inquiries, investigations and proceedings involving Merit or the business and operations proposed to be acquired; how the occurrence of any unanticipated event or cost in connection with the proposed transaction or subsequent integration of Cianna may affect Merit’s projected ability to comply with debt covenants; infringement of acquired technology or the assertion that acquired technology infringes the rights of other parties; the potential of fines, penalties or other adverse consequences if Merit's or Cianna Medical’s employees or agents violate the U.S. Foreign Corrupt Practices Act or other laws or regulations; laws and regulations targeting fraud and abuse in the healthcare industry; potential for significant adverse changes in governing regulations; changes in tax laws and regulations in the United States or other countries; increases in the prices of commodity components; negative changes in economic and industry conditions in the United States or other countries; termination or interruption of relationships with Merit's or Cianna Medical’s suppliers, or failure of such suppliers to perform; the effects of fluctuations in exchange rates on projected financial results; development of new products and technology that could render Merit's or Cianna Medical’s products obsolete; changes in healthcare policies or markets related to healthcare reform initiatives; failure to comply with applicable environmental laws; changes in key personnel; work stoppage or transportation risks; price and product competition; availability of labor and materials; fluctuations in and obsolescence of inventory; and other factors referred to in Merit's Annual Report on Form 10-K for the year ended December 31, 2017 and other materials filed with the Securities and Exchange Commission. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The financial projections set forth in this presentation are based on a number of assumptions, estimates and forecasts. The inaccuracy of any one of those assumptions, estimates or forecasts could materially impact our financial results. Inevitably, some of those assumptions, estimates or forecasts will not occur and unanticipated events and circumstances will occur subsequent to the date of this presentation. In addition to changes in the underlying assumptions, our future performance is subject to a number of risks and uncertainties with respect to our existing and proposed business and other factors that may cause our actual results or performance to be materially different from any predicted or implied. Although we have attempted to identify important assumptions in the financial projections, there may be other factors that could materially affect our actual financial performance, and no assurance can be given that all material factors have been considered in the preparation of the financial projections. Accordingly, you should not place undue reliance on such projections. Future operating results are, in fact, impossible to predict, and we assume no obligation to update or disclose revisions to any forward-looking statement.

NON-GAAP FINANCIAL MEASURES Although Merit’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), Merit’s management believes that certain non-GAAP financial measures provide investors with useful information regarding the underlying business trends and performance of Merit’s ongoing operations and can be useful for period- over-period comparisons of such operations. Certain financial measures included in this presentation, or which may be referenced in management’s discussion of the proposed Cianna transaction and Merit’s historical and future operations and financial results, have not been calculated in accordance with GAAP, and, therefore, are referenced as non-GAAP financial measures. Readers should consider non-GAAP measures used in this presentation in addition to, not as a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures generally exclude some, but not all, items that may affect Merit's net income. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which items are excluded. Additionally, non-GAAP financial measures used in this presentation may not be comparable with similarly titled measures of other companies. Merit urges investors and potential investors to review the reconciliations of its non- GAAP financial measures to the comparable GAAP financial measures, and not to rely on any single financial measure to evaluate Merit’s business or results of operations. Please refer to “Notes to Non-GAAP Financial Measures” at the end of these materials for more information.

OVERVIEW Cianna Medical is a women’s health company dedicated to the innovative treatment of early- stage breast cancer. When diagnosed early, most women have the option to save their healthy breast tissue with breast conserving surgery. Cianna, a leader in wire-free breast localization, has developed advanced approaches to tumor localization, surgical guidance and targeted radiation therapy. Cianna offers better choices for better outcomes, reducing the burden of breast cancer.

SAVI SCOUT® Wire-free radar tumor localization system Adopted by over 320 Hospitals Used in over 42,000 procedures Modernizes breast surgery Better patient experience, scheduling flexibility, and real-time surgical guidance for better outcomes.

SAVI SCOUT® REFLECTOR Transmits 50 million pulses per second Documented detection range of 60mm +/- 1mm accuracy Compatible with all imaging

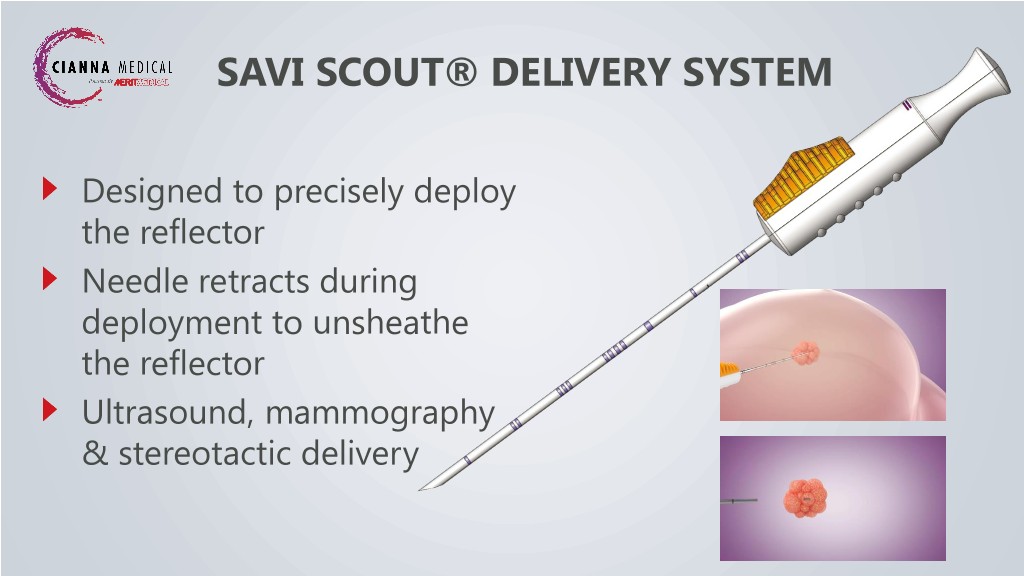

SAVI SCOUT® DELIVERY SYSTEM Designed to precisely deploy the reflector Needle retracts during deployment to unsheathe the reflector Ultrasound, mammography & stereotactic delivery

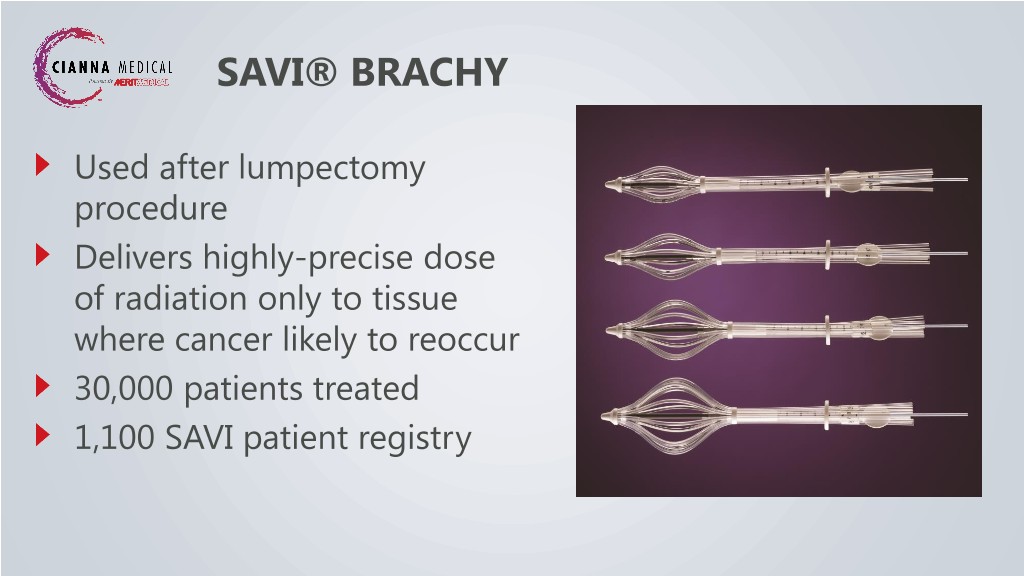

SAVI® BRACHY Used after lumpectomy procedure Delivers highly-precise dose of radiation only to tissue where cancer likely to reoccur 30,000 patients treated 1,100 SAVI patient registry

STRATEGIC RATIONALE Strong strategic fit with high-margin, high growth pathway utilizing award-winning technology Cianna transaction structured to expand Merit’s current Women’s Health and Interventional Oncology Suite of products and therapies: – Embolotherapy Portfolio – STAR™ Tumor Ablation System – Delivery Systems Highly synergistic to Merit’s “follow the patient” commercial strategy US-based revenue, but opportunity to utilize Merit’s global infrastructure

FINANCIALS Anticipated annual revenues of $50-$56 million Anticipated non-GAAP gross margins of 70- 75% on acquired business; GAAP gross margins of 55-65% on acquired business Anticipated combined GAAP and combined non-GAAP gross margin accretion of 55-130 basis points Anticipated 2019 non-GAAP EPS of $0.08-$0.13 and GAAP EPS of $(0.06)-$(0.10) Purchase Price: $135 million with earn-out of an additional $15 million for supply chain and scalability metrics as well as sales-based contingent payments capped at $50 million over the next 4 years Financed out of existing credit facilities

USE OF NON-GAAP MEASURES NON-GAAP FINANCIAL MEASURES Although Merit’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), Merit’s management believes that certain non-GAAP financial measures referred to in this presentation provide investors with useful information regarding the underlying business trends and performance of Merit’s ongoing operations and can be useful for period-over-period comparisons of such operations. Non-GAAP financial measures used in this presentation include: non-GAAP gross margin; non-GAAP earnings per share. Merit’s management team uses these non-GAAP financial measures to evaluate Merit’s profitability and efficiency, to compare operating results to prior periods, to evaluate changes in the operating results of its operating segments, and to measure and allocate financial resources internally. However, Merit’s management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in accordance with GAAP. Readers should consider non-GAAP measures used in this presentation in addition to, not as a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures generally exclude some, but not all, items that may affect Merit's net income. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which items are excluded. Merit believes it is useful to exclude such items in the calculation of non-GAAP earnings per share, and non-GAAP gross margin because such amounts in any specific period may not directly correlate to the underlying performance of Merit’s business operations and can vary significantly between periods as a result of factors such as new acquisitions, non-cash expenses related to amortization of previously acquired tangible and intangible assets, unusual compensation expenses or expenses resulting from litigation, governmental proceedings or changes in tax regulations. Merit may incur similar types of expenses in the future, and the non-GAAP financial information included in this presentation should not be viewed as a statement or indication that these types of expenses will not recur. Additionally, the non-GAAP financial measures used in this presentation may not be comparable with similarly titled measures of other companies. Merit urges investors and potential investors to review the reconciliations of its non-GAAP financial measures to the comparable GAAP financial measures, and not to rely on any single financial measure to evaluate Merit’s business or results of operations.

USE OF NON-GAAP MEASURES Non-GAAP Gross Margin Non-GAAP gross margin is calculated by reducing GAAP cost of sales by amounts recorded for amortization of intangible assets and inventory mark-up related to acquisitions. Non-GAAP Net Income Non-GAAP net income is calculated by adjusting GAAP net income for certain items which are deemed by Merit’s management to be outside of core operations and vary in amount and frequency among periods, such as expenses related to new acquisitions, non-cash expenses related to amortization of acquired tangible and intangible assets, unusual compensation expenses or expenses resulting from litigation, governmental proceedings or changes in tax regulations, as well as other items. Non-GAAP EPS Non-GAAP EPS is defined as non-GAAP net income divided by the diluted shares outstanding for the corresponding period.