Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASTEA INTERNATIONAL INC | astea8k.htm |

Exhibit 99.1

Service Smart. Enterprise Proven

Highlights

Astea International Inc. (Astea) is a global leader in field service and mobile workforce management. Its service management software addresses the unique needs of companies that manage capital equipment, mission critical assets and human capital.

Astea participates in a $2.5-billion industry that, based on projections by MarketsandMarkets, a leading market research firm, could grow at a five-year compound annual rate of 15%.

Founded in 1979, Astea has unmatched experience and expertise in the field service management (FSM) industry and is a leader in mobile solutions to support technicians in the field.

Astea is pursuing a three-pronged business growth and profitability plan, which includes an increased focus on leveraging its sales and marketing-driven culture to increase awareness in the market of the power of its FSM solutions; increasing recurring revenues by growing software-as-a-service (SaaS) revenues as well as maintenance revenues from perpetual license sales; and introducing a major advancement in its Alliance FSM software.

The initial success of these strategies has been reflected in recent positive financial results.

Astea's revenues have grown year-over-year in seven of the last eight quarters and for eight quarters in a row if adjusted for one-time revenues* booked in the fourth quarter of 2016.

The Company's SaaS revenues are growing rapidly, increasing 71% year-over-year in the second quarter of 2018 and 33% in the year's first half. Not only are SaaS revenues predictable, reliable and recurring, but their margins are among the highest of any of Astea's products and services.

Total recurring revenues now contribute more than half of total revenues. Total recurring revenues, which include both SaaS revenues and maintenance fees, increased 9% year-over-year to $7.0 million in the first half of 2018 and contributed 52% of total revenues.

Adjusted EBITDA*, which management considers a useful measure of Astea's financial performance, has improved significantly in recent periods, including a positive swing of $3.2 million year-over-year in 2017 to approximately $1 million and an improvement of $1.3 million to approximately $580,000 in the first half of 2018.

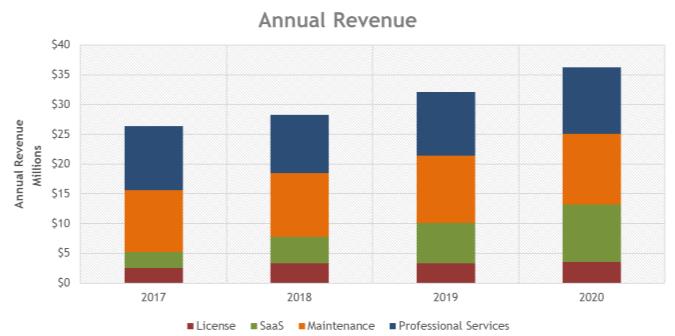

Management expects recent positive trends in total revenues, SaaS revenues and recurring revenues to continue long term and projects total revenues will grow from $26.3 million in 2017 to an estimated $36.3 million in 2020.

* This is a non-GAAP measure. See Supplementary Information at the end of the report for further explanation.

The Company

Horsham, Pennsylvania-based Astea International develops, markets and supports FSM and mobile workforce management solutions, which are licensed to companies that sell and service equipment or sell and deliver professional services. As a global leader in the industry, Astea is the only platform provider that offers all cornerstones of FSM within one application: customer management, service management, asset management, forward and reverse logistics management, and mobile workforce management and optimization.

FSM is generally defined as a technician performing repair, installation, or maintenance activities at a customer site. It involves the manual or automated creation and management of incoming service requests; scheduling and dispatching of service technicians; coordinating parts planning; delivery and usage; managing contracts; meeting service level agreements; the repair, refurbishment and retirement of assets; and remote and predictive maintenance.

Today's service-driven enterprises must plan and manage complex service delivery on a global scale in the face of heightened competition, growing customer demands, and cost and margin pressures. The benefits of implementing FSM solutions are applicable in virtually every service organization, regardless of type, size, or geography served. For those where equipment downtime or service interruption can significantly impair operations or even endanger human life and safety, it is essential and critical. For Astea's customers, the improvement in quality and reliability of customer service that comes from using its FSM platform can provide a competitive edge and drive sales and profit growth.

Astea markets and supports its products through a worldwide network of direct and indirect sales and services offices. The Company has corporate headquarters in the United States and regional headquarters in the United Kingdom, Australia and Japan. It also has product development centers in Israel and the United States.

Products

Astea's principal software product offering is its Astea Alliance platform, which integrates and automates sales and service business processes and is designed to assist users to increase competitive advantages, top-line revenues growth, and profitability through better management of information, people, assets and cash flows.

Astea Alliance, Astea's flagship FSM platform, supports the complete service lifecycle, from lead generation and project quotation to service and billing through asset retirement. By integrating and optimizing a wide range of critical service, sales and marketing processes, it provides service organizations with technology-enabled business solutions that improve profitability, stabilize cash flows, and reduce operational costs.

Astea, which is a Microsoft Gold Partner, uses widely accepted commercially available Microsoft application development tools. These software tools give customers the flexibility to deploy Astea's products across a variety of hardware platforms, operating systems and relational database management systems.

Astea Alliance is available either as an on-premise owned license or a SaaS subscription, cloud-based application, allowing each customer to choose the option that aligns best with its strategy and information technology (IT) ecosystem.

Since the debut of the Alliance platform in 2001, Astea has been committed to continuous product development and has regularly released upgraded, more comprehensive versions of this flagship product with greater functionality. This evolution has continued to date, with the introduction, in September 2018, of the newest version of Alliance, Alliance Enterprise.

Management believes that Alliance Enterprise is the Company's most transformative version of Alliance to date. It has an entirely new look and feel and incorporates innovative capabilities designed to maximize the efficiency of service operations, digitize and improve the customer experience, enhance the effectiveness of field workers, and help organizations compete in the face of a global talent war for skilled labor. A core design tenet of the Alliance Enterprise platform is unmatched in configurability and usability, making it easier than ever to use and putting powerful capabilities into the hands of even non-technical users. Further, it is aligned with today's market demand including customer self-service and customer centric experiences, increased connectivity with smart devices, knowledge management, increased reliance on contingent workforce, and proactive and predictive support.

Astea provides customers with an array of professional consulting, training and customer support services to implement its products and integrate them with other corporate systems such as back-office financial and ERP applications. Astea also maintains and supports its software over the software's installed life cycle.

Customers

Astea's software has been licensed to approximately 700 companies worldwide ranging from mid-size organizations to large, multinational corporations with geographically dispersed locations around the globe. It has licensed applications to companies in a wide range of sectors including information technology, medical devices and diagnostic systems, industrial controls and instrumentation, retail systems, office automation, imaging systems, facilities management and telecommunications. The Company's customers operate in industries where downtime is not an option, and resource utilization directly impacts financial performance -- companies that market, sell, service and support mission-critical assets. Just a few of the household-name users of Astea's software are Honeywell, Stanley Black and Decker, Mitsubishi Electric, Scientific Games, Tyco, and Cintas.

Sales and Marketing

Astea's sales and marketing efforts are primarily focused on new software licensing and support services for its latest generation of products. The Company markets its products through a worldwide network of direct and indirect sales and services offices. Sales partners include distributors (value-added resellers, system integrators and sales agents) and OEM partners. The Company is actively seeking to expand its reseller network and to establish an international indirect distribution channel targeted at the mid-market tier.

Astea's corporate marketing department is responsible for product marketing, lead generation and marketing communications.

Revenues

Astea generates revenues from four sources: software license fees for its software products, subscriptions for its SaaS cloud-based (or hosted) services, services and maintenance. Software license fees accounted for approximately 10% of the Company's total revenues in 2017, subscriptions accounted for 10%, professional services for 41% and maintenance fees for 39%.

Table 1

Astea International Inc.

Revenue Breakdown Statistics

(figures in thousands)

|

12 Months Ended December 31,

|

3 Mo. Ended June 30,

|

6 Mo. Ended June 30,

|

||||||||||||||||||||||||||||||||||||||

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2017

|

2018

|

2017

|

2018

|

|||||||||||||||||||||||||||||||

|

Revenues by Category

|

||||||||||||||||||||||||||||||||||||||||

|

Software license fees

|

$

|

4,796

|

$

|

2,809

|

$

|

3,357

|

$

|

5,000

|

$

|

2,699

|

$

|

2,533

|

$

|

402

|

$

|

892

|

$

|

645

|

$

|

1,311

|

||||||||||||||||||||

|

Subscriptions

|

$

|

-

|

$

|

153

|

$

|

790

|

$

|

1,082

|

$

|

3,991

|

$

|

2,736

|

$

|

504

|

$

|

864

|

$

|

1,271

|

$

|

1,692

|

||||||||||||||||||||

|

Service

|

$

|

10,976

|

$

|

7,057

|

$

|

6,413

|

$

|

6,896

|

$

|

9,074

|

$

|

10,753

|

$

|

2,434

|

$

|

2,233

|

$

|

4,917

|

$

|

5,032

|

||||||||||||||||||||

|

Maintenance

|

$

|

10,618

|

$

|

10,318

|

$

|

10,174

|

$

|

9,979

|

$

|

10,034

|

$

|

10,312

|

$

|

2,616

|

$

|

2,643

|

$

|

5,124

|

$

|

5,293

|

||||||||||||||||||||

|

Total revenues

|

$

|

26,390

|

$

|

20,337

|

$

|

20,734

|

$

|

22,957

|

$

|

25,798

|

$

|

26,334

|

$

|

5,956

|

$

|

6,632

|

$

|

11,957

|

$

|

13,328

|

||||||||||||||||||||

|

Revenues Breakdown

|

||||||||||||||||||||||||||||||||||||||||

|

Software license fees

|

18.2

|

%

|

13.8

|

%

|

16.2

|

%

|

21.8

|

%

|

10.5

|

%

|

9.6

|

%

|

6.7

|

%

|

13.4

|

%

|

5.4

|

%

|

9.8

|

%

|

||||||||||||||||||||

|

Subscriptions

|

0.0

|

%

|

0.8

|

%

|

3.8

|

%

|

4.7

|

%

|

15.5

|

%

|

10.4

|

%

|

8.5

|

%

|

13.0

|

%

|

10.6

|

%

|

12.7

|

%

|

||||||||||||||||||||

|

Service

|

41.6

|

%

|

34.7

|

%

|

30.9

|

%

|

30.0

|

%

|

35.2

|

%

|

40.8

|

%

|

40.9

|

%

|

33.7

|

%

|

41.1

|

%

|

37.8

|

%

|

||||||||||||||||||||

|

Maintenance

|

40.2

|

%

|

50.7

|

%

|

49.1

|

%

|

43.5

|

%

|

38.9

|

%

|

39.2

|

%

|

43.9

|

%

|

39.9

|

%

|

42.9

|

%

|

39.7

|

%

|

||||||||||||||||||||

|

Total revenues

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||||||||||||||||||||

|

Year-over-Year Change

|

||||||||||||||||||||||||||||||||||||||||

|

Software license fees

|

-41.4

|

%

|

19.5

|

%

|

48.9

|

%

|

-46.0

|

%

|

-6.2

|

%

|

121.9

|

%

|

103.3

|

%

|

||||||||||||||||||||||||||

|

Subscriptions

|

NM

|

NM

|

NM

|

NM

|

NM

|

NM

|

NM

|

|||||||||||||||||||||||||||||||||

|

Service

|

-35.7

|

%

|

-9.1

|

%

|

7.5

|

%

|

31.6

|

%

|

18.5

|

%

|

-8.3

|

%

|

2.3

|

%

|

||||||||||||||||||||||||||

|

Maintenance

|

-2.8

|

%

|

-1.4

|

%

|

-1.9

|

%

|

0.6

|

%

|

2.8

|

%

|

1.0

|

%

|

3.3

|

%

|

||||||||||||||||||||||||||

|

Total revenues

|

-22.9

|

%

|

2.0

|

%

|

10.7

|

%

|

12.4

|

%

|

2.1

|

%

|

11.3

|

%

|

11.5

|

%

|

||||||||||||||||||||||||||

Software license, or on-premise, fee revenues are recognized when a software license purchased by a customer has been delivered. Typically, these customers, who own the software license, pay an annual fee for support services and upgrades.

SaaS customers typically purchase three-year license subscriptions, but occasionally purchase annual license subscriptions. Astea does not recognize revenues or costs from SaaS sales until the customer goes live, which generally takes about 6 to 10 months. Subscription revenues are recognized on a straight-line basis over the service period but may increase if the number of users grows.

Services and maintenance revenues consist principally of fees from professional services associated with the implementation and deployment of the Company's software products and maintenance fees for ongoing customer support. The Company recognizes revenues from professional services as the services are performed unless the services are under a fixed-price arrangement or are pursuant to a subscription arrangement. Maintenance fees are typically paid under written agreements entered into at the time of the initial software license sale and are generally invoiced annually and recognized ratably over the term of the agreement.

International Sales

Astea's products are marketed and sold worldwide. International sales accounted for 47% of the Company's revenues in 2017 and 36% of the Company's revenues in 2016.

KEY CONSIDERATIONS

Astea Participates in Large and Fast-Growing Industry

Based on estimates from MarketsandMarkets, a leading market research firm, the current size of the global FSM market is more than $2.5 billion worldwide, and it projects that the market will grow at a compound annual rate of nearly 15% from 2018 through 2023.

Some estimates suggest that the potential market could be even larger than that. For example, in the press release issued by General Electric in November 2016 announcing its $915-million purchase of ServiceMax, a leading provider of FSM software, ServiceMax estimated its worldwide market at $25 billion.

Industry growth is being driven by businesses' need to increase revenues, cut costs and improve productivity in the face of increased competitive and margin pressures.

Differentiators Set Astea Apart

Astea believes that FSM software providers fall into three categories: those in the premier category that offer comprehensive products and serve a wide range of industries; those in the industry-focused category that specialize in very narrow market segments; and those in the integrator category that offer FSM software as an add-on to other software. Astea participates in the premier category, where it believes that a number of factors help to differentiate it from competitors, including:

Comprehensive Lifecycle Product. Astea's Alliance software platform is a comprehensive product that can satisfy customers' FSM needs for the complete service lifecycle of a project or piece of equipment, including asset management, customer management, mobile workforce management, service management, and forward/reverse logistics management.

Owned and Licensed Options. Astea is one of the few companies that offers customers both on-premise (purchase) and SaaS (hosting) options, which allows each customer to make the best financial decision for his or her company. While Astea is pursuing a strategy to shift more customers to its SaaS product, it is committed to continue offering a purchase option for those who prefer it.

Quantifiable Benefits. Astea's FSM software provides customers with quantifiable benefits by helping them to reduce service costs, streamline operations, improve productivity, and drive revenue growth. For example, even a modest improvement in productivity over a large workforce, such as freeing up 15 minutes per day per technician at a company with hundreds or thousands of technicians, can translate into significant efficiency gains and cost savings. These potential savings can easily be quantified using an interactive ROI calculator on Astea's website as well as in discussions with Astea's sales team.

Product Flexibility. Astea believes that its software solutions provide customers with unparalleled functionality and configurability. Astea's Alliance platform has a feature-rich foundation that can easily be adapted to suit each customer's needs, and it is modular, which allows customers to choose the applications most relevant to their businesses and to add modules with greater capabilities over time. Also, Astea uses Microsoft application development tools, which give customers the flexibility to deploy the Company's products across a broad range of hardware platforms, operating systems and relational database management systems.

Responsiveness to Changing Customer Needs. As discussed previously, product evolution and enhancement to respond to changing and expanding customer needs are ongoing processes at Astea.

Unmatched Industry Expertise. Astea has decades of FSM experience and unmatched industry expertise. As a result, the Company's customers have tended to be "sticky" with an average life of about 10 years.

Astea is Shifting to a Sales-Driven and Market-Driven Culture

During 2017, Astea initiated several important strategies as part of its business growth and profitability plan, including reinvigorating the Company's sales and marketing culture. As part of this strategy, in 2017, Astea made significant changes in both sales and marketing aimed at enhancing how the Company communicates the unique value of its products, services and industry expertise. It has already seen a positive response from the market to this reinvigorated sales effort as evidenced by a large number of notable customer acquisitions at the end of 2017.

On the marketing front, it has taken a number of steps, including launching a new corporate website that will serve as the launchpad for an overall brand evolution. The new website features educational videos, interactive ROI calculators, and a new blog; it is easier to use and navigate; and it highlights Astea's differentiators.

Astea's SaaS Revenues Are Growing Rapidly

Another important strategic priority for Astea is growing recurring revenues by increasing SaaS, or subscription, revenues with new and existing customers. Regarding the latter, most of the Astea's historical customer base owns on-premise perpetual licenses, and it is focusing on migrating many of them to its SaaS subscription product, which was introduced in 2013. Most often a customer will move to the SaaS subscription product when shifting to an upgraded version of Alliance. These efforts are already paying off, as indicated by the 71% year-over-year increase in SaaS revenues in the second quarter of 2018 and the 33% increase in SaaS revenues in the year's first half.

Table 2

Astea International Inc.

SaaS Revenue Growth Statistics

(figures in thousands)

Astea International Inc.

SaaS Revenue Growth Statistics

(figures in thousands)

|

Yr-over-Yr % Chg

|

||||||||||||||||||||||||

|

SaaS Revenues

|

SaaS Revenues

|

% of Total Revenues

|

||||||||||||||||||||||

|

Reported

|

Adjusted(1)(2)

|

Reported

|

Adjusted(1)(2)

|

Reported

|

Adjusted(1)(2)

|

|||||||||||||||||||

|

Years ended Dec. 31,

|

||||||||||||||||||||||||

|

2012

|

$

|

-

|

$

|

-

|

NM

|

NM

|

0

|

%

|

0

|

%

|

||||||||||||||

|

2013

|

$

|

153

|

$

|

153

|

NM

|

NM

|

1

|

%

|

1

|

%

|

||||||||||||||

|

2014

|

$

|

790

|

$

|

790

|

416

|

%

|

416

|

%

|

4

|

%

|

4

|

%

|

||||||||||||

|

2015

|

$

|

1,082

|

$

|

1,082

|

37

|

%

|

37

|

%

|

5

|

%

|

5

|

%

|

||||||||||||

|

2016

|

$

|

3,991

|

$

|

2,925

|

269

|

%

|

170

|

%

|

15

|

%

|

12

|

%

|

||||||||||||

|

2017

|

$

|

2,736

|

$

|

2,736

|

-31

|

%

|

-6

|

%

|

10

|

%

|

10

|

%

|

||||||||||||

|

1Q 2018(3)

|

$

|

828

|

$

|

828

|

8

|

%

|

8

|

%

|

12

|

%

|

12

|

%

|

||||||||||||

|

2Q 2018(4)

|

$

|

864

|

$

|

864

|

71

|

%

|

71

|

%

|

13

|

%

|

13

|

%

|

||||||||||||

|

1H 2018(4)

|

$

|

1,692

|

$

|

1,692

|

33

|

%

|

33

|

%

|

13

|

%

|

13

|

%

|

||||||||||||

|

(1) Adjusted to eliminate $1,066,000 of one-time revenues booked in the 4Q of 2016

|

||||||||||||||||||||||||

|

(2)This is a non-GAAP measure. See Supplementary Information at the end of the report

|

||||||||||||||||||||||||

|

for further explantion

|

||||||||||||||||||||||||

|

(3) Period ended March 31, 2018

|

||||||||||||||||||||||||

|

(4) Periods ended June 30, 2018

|

||||||||||||||||||||||||

From a financial standpoint, there are a number of significant benefits to growing SaaS revenues, including:

Higher margins. While the sale of a perpetual license has a very high up-front cash margin, since the associated cash costs are quite low, its ongoing margins are much lower. In contrast, SaaS margins are, on an ongoing basis, among the Company's highest. As a result, if SaaS revenues grow as a share of total revenues, this "richer" sales mix should result in higher margins.

Predictable, reliable, recurring revenues. The average SaaS subscription is three years, so as the share of revenues contributed by subscriptions increases, so should the predictability of Astea's revenues, and more predictable recurring revenues are typically perceived to be higher-quality revenues by investors.

Increased profitability. The combination of higher margins and more ongoing or recurring revenues could help to drive profit growth.

Total Recurring Revenues Are Growing and Now Contribute More Than Half of Revenues

While SaaS subscriptions are the fastest-growing source of recurring revenues for Astea, annual maintenance fees paid by its on-premise perpetual license population are the largest contributor of predictable, reliable, and recurring revenues. Including maintenance fees, the Company's recurring revenues increased 9% year-over-year to $7.0 million in the first half of 2018 and contributed 52% of total revenues.

Table 3

Astea International Inc.

Recurring Revenue Statistics

Quarterly and First Half 2018

(figures in millions)

Astea International Inc.

Recurring Revenue Statistics

Quarterly and First Half 2018

(figures in millions)

|

Year-over Year Percent Chg.

|

||||||||||||||||||||||||

|

6 Mo

|

6 Mo

|

|||||||||||||||||||||||

|

3 Mo. Ended

|

Ended

|

3 Mo. Ended

|

Ended

|

|||||||||||||||||||||

|

3/31/18

|

6/30/18

|

6/30/18

|

3/31/17

|

6/30/17

|

6/30/17

|

|||||||||||||||||||

|

Recurring Revenue

|

||||||||||||||||||||||||

|

Saas

|

$

|

828

|

$

|

864

|

$

|

1,692

|

8

|

%

|

71

|

%

|

33

|

%

|

||||||||||||

|

Maintenance

|

$

|

2,650

|

$

|

2,643

|

$

|

5,293

|

6

|

%

|

1

|

%

|

3

|

%

|

||||||||||||

|

Total Recurring Revenue

|

$

|

3,478

|

$

|

3,507

|

$

|

6,985

|

6

|

%

|

12

|

%

|

9

|

%

|

||||||||||||

|

Total Revenue

|

$

|

6,696

|

$

|

6,632

|

$

|

13,328

|

||||||||||||||||||

|

Saas revenue/total

|

12

|

%

|

13

|

%

|

13

|

%

|

||||||||||||||||||

|

Maintenance revenue/total

|

40

|

%

|

40

|

%

|

40

|

%

|

||||||||||||||||||

|

Recurring revenue/total

|

52

|

%

|

53

|

%

|

52

|

%

|

||||||||||||||||||

Initial Success of Growth Strategies Reflected in Recent Results

The initial success of Astea's current strategic priorities has been reflected in recent results, as indicated by:

Customer acquisitions. Astea had a strong close to 2017, when it signed several new large multinational companies, including a multinational IT services firm with thousands of employees providing world-class IT support to global companies on all seven continents; a global IT service company that operates in over 100 countries; one of the most all-inclusive commercial gaming suppliers in the world; and one of the U.S.'s leading providers of commercial HVAC services and integrated building technologies. As a result of these successes, Astea entered 2018 with a service back log of approximately $6 million.

Consistent revenue growth. Astea's revenues have grown year-over-year in seven of the last eight quarters and for eight quarters in a row if adjusted for one-time revenues* booked in the fourth quarter of 2016. In that period, a SaaS customer who was close to completing implementation and going live was acquired and was forced by the buyer to terminate its hosting contract with the Company. This resulted in the recognition of $1.1 million of deferred hosting revenues and $2.2 million of deferred professional services. If this $3.3 million of one-time revenues* is eliminated from fourth quarter 2016 results, total revenues increased 37% year-over-year in the fourth quarter 2017.

* This is a non-GAAP measure. See Supplementary Information at the end of the report for further explanation.

Table 4

Astea International Inc.

Quarterly Income Statement Highlights

(figures in thousands)

Astea International Inc.

Quarterly Income Statement Highlights

(figures in thousands)

|

Three Months Ended

|

||||||||||||||||||||||||||||||||||||||||

|

3/31/16

|

6/30/16

|

9/30/16

|

12/31/16

|

3/31/17

|

6/30/17

|

9/30/17

|

12/31/17

|

3/31/18

|

6/30/18

|

|||||||||||||||||||||||||||||||

|

Revenues

|

$

|

5,348

|

$

|

5,686

|

$

|

5,688

|

$

|

9,076

|

$

|

6,001

|

$

|

5,956

|

$

|

6,482

|

$

|

7,895

|

$

|

6,696

|

$

|

6,632

|

||||||||||||||||||||

|

Adjusted Revenues(1)(2)

|

$

|

5,348

|

$

|

5,686

|

$

|

5,688

|

$

|

5,776

|

$

|

6,001

|

$

|

5,956

|

$

|

6,482

|

$

|

7,895

|

$

|

6,696

|

$

|

6,632

|

||||||||||||||||||||

|

Gross profit

|

$

|

1,347

|

$

|

1,147

|

$

|

1,937

|

$

|

4,428

|

$

|

1,522

|

$

|

1,559

|

$

|

2,003

|

$

|

2,811

|

$

|

2,210

|

$

|

2,458

|

||||||||||||||||||||

|

Net income (loss)

|

$

|

(697

|

)

|

$

|

(1,048

|

)

|

$

|

148

|

$

|

2,007

|

$

|

(679

|

)

|

$

|

(227

|

)

|

$

|

186

|

$

|

819

|

$

|

6

|

$

|

304

|

||||||||||||||||

|

Net income (loss) allocable to common stockholders

|

$

|

(822

|

)

|

$

|

(1,173

|

)

|

$

|

23

|

$

|

1,882

|

$

|

(804

|

)

|

$

|

(352

|

)

|

$

|

61

|

$

|

694

|

$

|

(119

|

)

|

$

|

179

|

|||||||||||||||

|

Basic & diluted income (loss)/shr

|

$

|

(0.23

|

)

|

$

|

(0.33

|

)

|

$

|

0.01

|

$

|

0.52

|

$

|

0.22

|

$

|

(0.10

|

)

|

$

|

0.02

|

$

|

0.19

|

$

|

(0.03

|

)

|

$

|

0.05

|

||||||||||||||||

|

Gross margin

|

25.2

|

%

|

20.2

|

%

|

34.1

|

%

|

48.8

|

%

|

25.4

|

%

|

26.2

|

%

|

30.9

|

%

|

35.6

|

%

|

33.0

|

%

|

37.1

|

%

|

||||||||||||||||||||

|

Year-over-year % change:

|

||||||||||||||||||||||||||||||||||||||||

|

Revenues

|

-9

|

%

|

-13

|

%

|

9

|

%

|

70

|

%

|

12

|

%

|

5

|

%

|

14

|

%

|

-13

|

%

|

12

|

%

|

11

|

%

|

||||||||||||||||||||

|

Adjusted Revenues(1)(2)

|

-9

|

%

|

-13

|

%

|

9

|

%

|

8

|

%

|

12

|

%

|

5

|

%

|

14

|

%

|

37

|

%

|

12

|

%

|

11

|

%

|

||||||||||||||||||||

|

(1) 4Q 2016 adjusted to eliminate $3.3 million of one-time revenues

|

||||||||||||||||||||||||||||||||||||||||

|

(2) This is a non-GAAP measure. See Supplementary Information at the end of the report for further explanation.

|

||||||||||||||||||||||||||||||||||||||||

Rapid SaaS growth. SaaS revenues have been growing fast—up more than 71% in the second quarter of 2018 and up approximately 33% in first six months of 2018.

Growing adjusted EBITDA*. Adjusted EBITDA*, which management considers a useful measure of Astea's financial performance, was $312,000 in the second quarter of 2018 compared with negative $300,000 in the second quarter of 2017, and $580,000 in the first half of 2018, an improvement of $1.3 million from negative $700,000 in the first half of 2017. In 2017, adjusted EBITDA* was positive $1 million compared to negative $2.2 million in 2016, a positive swing of $3.2 million year-over-year.

Recent profitable results. Astea was profitable in six of the past eight quarters and in both the second quarter and first half of 2018.

* This is a non-GAAP measure. See Supplementary Information at the end of the report for further explanation.

Ongoing Growth Projected

Management expects recent growth in SaaS users and revenues and in total revenues to continue long term. In particular, it projects that:

The number of quarterly SaaS users will nearly double in 2018,

The number of quarterly SaaS users will continue to grow rapidly, increasing from approximately 7,000 in the fourth quarter of 2017 to an estimated 26,000 in the fourth quarter of 2020 (based on current customers and expected growth from new customers),

Quarterly SaaS revenues will increase from $873,000 in the fourth quarter of 2017 to an estimated $2.7 million in the fourth quarter of 2020, and

Quarterly recurring revenues, including SaaS revenues and maintenance fees, will increase from $3.5 million in the first quarter of 2018 to nearly $6 million in the fourth quarter of 2020.

Chart 3

Astea International Inc.

17 Quarterly Recurring Revenue is Substantial & Growing A = Actual E = Estimated

Total revenues will grow from $26.3 million in 2017 to an estimated $36.3 million in 2020.

R Astea ® Confidential ATEAOTCQB R * Annual Revenue Expected to Steadily Increase A = Actual E = Estimated A E E E

Chart 4

Astea International Inc.

Recent Financial Results

Astea's financial performance in 2017 was highlighted by double-digit revenue growth, when adjusted for one-time items booked in late 2016, significant year-over-year improvement in adjusted EBITDA*, and the addition of a number of large customers late in the year.

For the year ended December 31, 2017, Astea reported revenues of $26.3 million, up 2% from revenues of $25.8 million for the same period in 2016.

As discussed previously, in the fourth quarter of 2016, a SaaS customer who was close to completing implementation and going live was acquired and was forced by the buyer to terminate its hosting contract with the Company, which resulting in Astea recognizing $3.3 million of one-time deferred revenues. If this one-time revenue* contribution is eliminated from 2016 results, total revenues increased 17% year over year in 2017.

In the fourth quarter of 2017, Astea added several large multinational SaaS customers, as discussed previously.

Adjusted EBITDA* improved $3.2 million year-over-year in 2017 to $1 million from negative $2.2 million in 2016 as a result of signing many new hosted customers in 2017 who were still in the implementation process and, therefore, were not yet contributing revenues.

The net loss available to shareholders in 2017 was $0.4 million or $0.11 per share compared to a net loss to shareholders of $90,000 or $0.03 per share for the same period in 2016.

From a financial standpoint, Astea performed significantly better in the first half of 2018 than in the prior year, both in terms of revenue growth and improved profitability. Second quarter and first half 2018 highlights include:

For the quarter ended June 30, 2018, Astea reported revenues of $6.6 million, up 11% from revenues of $6.0 million for the same period in 2017.

Net income to shareholders for the quarter was $179,000 or $0.05 per share compared to a net loss to shareholders of $352,000 or $0.10 per share for the same period in 2017.

Second quarter 2018 recurring revenues, which consists of the combined total of SaaS and maintenance revenues, increased 12.4% year-over-year to $3.5 million and comprised 53% of total revenues.

For the first half of 2018, revenues totaled $13.3 million, up 11% from revenues of $12.0 million for the same period in 2017.

Total recurring revenues increased approximately 9% year-over-year in the first half to $7.0 million and contributed 52% of total revenues. SaaS revenues increased 33% and maintenance revenues increased 3%. Maintenance revenues grow at a slower pace because of their much larger share of total revenues than SaaS revenues.

Net income to shareholders was $60,000 or $0.02 per share for the first six months of 2018 compared to a loss of $1.2 million or $0.32 per share for the same period in 2017.

First half 2018 adjusted EBITDA* was $0.6 million compared to negative $0.7 million for the same period in 2017.

* This is a non-GAAP measure. See Supplementary Information at the end of the report for further explanation.

Table 5

Astea International Inc.

Second Quarter and First Half Income Statement Highlights

(figures in thousands)

Astea International Inc.

Second Quarter and First Half Income Statement Highlights

(figures in thousands)

|

3 Mo. Ended June 30

|

%

|

6 Mo. Ended June 30

|

%

|

|||||||||||||||||||||

|

2017

|

2018

|

Chg

|

2017

|

2018

|

Chg

|

|||||||||||||||||||

|

Revenues by Category

|

||||||||||||||||||||||||

|

Software license fees

|

$

|

402

|

$

|

892

|

122

|

%

|

$

|

645

|

$

|

1,311

|

103

|

%

|

||||||||||||

|

Subscriptions

|

$

|

504

|

$

|

864

|

71

|

%

|

$

|

1,271

|

$

|

1,692

|

33

|

%

|

||||||||||||

|

Service

|

$

|

2,434

|

$

|

2,233

|

-8

|

%

|

$

|

4,917

|

$

|

5,032

|

2

|

%

|

||||||||||||

|

Maintenance

|

$

|

2,616

|

$

|

2,643

|

1

|

%

|

$

|

5,124

|

$

|

5,293

|

3

|

%

|

||||||||||||

|

Total Revenues

|

$

|

5,956

|

$

|

6,632

|

11

|

%

|

$

|

11,957

|

$

|

13,328

|

11

|

%

|

||||||||||||

|

Cost of Revenues

|

$

|

4,397

|

$

|

4,174

|

-5

|

%

|

$

|

8,876

|

$

|

8,660

|

-2

|

%

|

||||||||||||

|

Gross Profit

|

$

|

1,559

|

$

|

2,458

|

58

|

%

|

$

|

3,081

|

$

|

4,668

|

52

|

%

|

||||||||||||

|

Total operating expenses

|

$

|

1,747

|

$

|

2,078

|

19

|

%

|

$

|

3,899

|

$

|

4,241

|

9

|

%

|

||||||||||||

|

Operating income (loss)

|

$

|

(188

|

)

|

$

|

380

|

NM

|

$

|

(818

|

)

|

$

|

427

|

NM

|

||||||||||||

|

Net interest expense

|

$

|

32

|

$

|

64

|

100

|

%

|

$

|

74

|

$

|

99

|

34

|

%

|

||||||||||||

|

Pretax income (loss)

|

$

|

(220

|

)

|

$

|

316

|

NM

|

$

|

(892

|

)

|

$

|

328

|

NM

|

||||||||||||

|

Income tax (benefit) expense

|

$

|

7

|

$

|

12

|

71

|

%

|

$

|

14

|

$

|

18

|

29

|

%

|

||||||||||||

|

Net income (loss)

|

$

|

(227

|

)

|

$

|

304

|

NM

|

$

|

(906

|

)

|

$

|

310

|

NM

|

||||||||||||

|

Preferred dividend

|

$

|

125

|

$

|

125

|

0

|

%

|

$

|

250

|

$

|

250

|

0

|

%

|

||||||||||||

|

Net inc (loss) allocable/available to common stockholders

|

$

|

(352

|

)

|

$

|

179

|

NM

|

$

|

(1,156

|

)

|

$

|

60

|

NM

|

||||||||||||

|

Basic & diluted income (loss)/shr

|

$

|

(0.10

|

)

|

$

|

0.05

|

NM

|

$

|

(0.32

|

)

|

$

|

0.02

|

NM

|

||||||||||||

|

Shrs used to calculate diluted EPS

|

3,594

|

3,773

|

5

|

%

|

3,594

|

3,773

|

5

|

%

|

||||||||||||||||

|

Gross Margin

|

26.2

|

%

|

37.1

|

%

|

25.8

|

%

|

35.0

|

%

|

||||||||||||||||

|

Operating expenses/revenues

|

29.3

|

%

|

31.3

|

%

|

32.6

|

%

|

31.8

|

%

|

||||||||||||||||

Accounting note: On January 1, 2018, Astea adopted the new revenue recognition standard called Revenue from Contracts with Customers. As a result, a required opening adjustment of $0.6 million was made on that date and was reflected on the balance sheet as a deferred cost with an offsetting adjustment to accumulated deficit. This amount represents costs incurred and reported as expense in prior periods related to hosting implementation projects that were not live as of December 31, 2017.

In the first six months of 2018, Astea deferred hosting implementation expenses, net of amortized costs, of $630,000 for work performed during the period. Once each customer goes live, the Company will begin to amortize the related deferred costs. Management believes that this new standard better matches the Company's revenues with its expenses.

Financial Highlights

As of June 30, 2018, Astea held cash and cash equivalents of $1.4 million and owed $2.4 million under a revolving line of credit with Bridge Bank, a division of Western Alliance Bank (WAB). The WAB loan agreement matures on November 15, 2020.

Key Management

Zack B. Bergreen, Chief Executive Officer and Chairman

Zack Bergreen founded Astea in 1979. Under his leadership, the Company has grown from a consulting firm specializing in field service applications to a dominant global provider of service-centric CRM solutions, integrating all customer-facing business processes for companies that manage mission critical assets. Prior to founding Astea, Zack held senior executive positions with such leading companies as Gould Electronics, Bechtel Corporation and General Signal. He holds a Bachelor of Science and a Masters of Science in Electrical Engineering from the University of Maryland.

Fredric (Rick) Etskovitz, Chief Financial Officer and Treasurer

Rick Etskovitz joined Astea International in June 2000, when he was elected Chief Financial Officer and Treasurer. He is responsible for the firm's financial planning, investor relations, and executive guidance to help drive corporate performance. He is a CPA and has 25 years of experience in financial management and reporting. Prior to joining Astea in 2000, Rick served Astea for seven years as the engagement partner from an independent accounting firm. Before beginning his career in private practice, Rick was part of the financial management team at DuPont where he held responsibilities for Mergers and Acquisitions, Financial Planning, Corporate Accounting and Benefits. Rick received his Bachelor of Science from the Pennsylvania State University and his Masters of Business Administration from the Wharton Graduate School at the University of Pennsylvania.

David F. Giannetto, Chief Operating Officer

David F. Giannetto joined Astea in August 2015 as Senior Vice President of Client Services. In February 2017, he was appointed Chief Operating Officer. In this role, he has taken on expanded Service and Operations management responsibilities, including management of marketing and assistance in sales execution. He is engaged in developing strategies to improve overall profitability and market position, and facilitate operational and technical efficiencies. Prior to joining Astea, he was Senior Vice President of Performance Management at Salient Corporation. He has extensive experience as a senior manager in technology and professional service companies, and is a nationally respected thought-leader in the areas of business intelligence, the application of enterprise-level technology, information management, and big data and analytics. David graduated from Monmouth University, received an MBA from Rutgers University where he was formerly a professor, and was a regular army officer in the 10th Mountain Division.

Share Ownership

As of April 27, 2018, Zack Bergreen, Astea's Chief Executive Officer and Chairman of the Board, was beneficial owner of approximately 55.1% of Astea's outstanding shares.

Mr. Bergreen owns Astea's two preferred stock issues: 826,000 shares of Series-A Convertible Preferred Stock issued on September 24, 2008 at a price of $3.63 per share for a total of $3.0 million and 797,000 shares of Series-B Convertible Preferred Stock issued on June 20, 2014 at a price of $2.51 per share in exchange for the cancellation of $2.0 million owed to Mr. Bergreen under a Revolving Promissory Note. The conversion rate to Common Stock of both the Series A and the Series B Preferred Stock is one-to-one and each has a dividend rate of 10%. The Company reports the Series A and Series B Preferred Stock on the Company's condensed consolidated balance sheet within stockholders' deficit. Additional information about the preferred shares' conversion terms is provided in the Supplementary Information section at the end of this report.

Supplementary Information

Non-GAAP Financial Measures

Table 6

Astea International Inc.

Adjusted EBITDA Reconciliation

(figures in thousands)

Astea International Inc.

Adjusted EBITDA Reconciliation

(figures in thousands)

|

3 Mo. Ended

|

6 Mo. Ended

|

|||||||||||

|

3/31/2018

|

6/30/2018

|

6/30/2018

|

||||||||||

|

EBITDA Calculation (in thousands)

|

||||||||||||

|

Net income (loss)

|

$

|

5.8

|

$

|

304.4

|

$

|

310.3

|

||||||

|

Add back:

|

||||||||||||

|

Interest

|

$

|

35.9

|

$

|

63.9

|

$

|

99.8

|

||||||

|

Taxes

|

$

|

5.9

|

$

|

12.7

|

$

|

18.6

|

||||||

|

Depreciation and Amortization

|

$

|

726.2

|

$

|

511.3

|

$

|

1,237.5

|

||||||

|

Total EBITDA

|

$

|

773.9

|

$

|

892.3

|

$

|

1,666.2

|

||||||

|

Adjustments:

|

||||||||||||

|

Capitalized software

|

$

|

(900.2

|

)

|

$

|

(885.1

|

)

|

$

|

(1,785.2

|

)

|

|||

|

Inc. (dec.) in deferred hosting

|

$

|

250.9

|

$

|

138.3

|

$

|

389.2

|

||||||

|

(Inc.) dec. in deferred hosting services

|

$

|

143.3

|

$

|

166.3

|

$

|

309.6

|

||||||

|

Total Adjusted EBITDA

|

$

|

267.9

|

$

|

311.8

|

$

|

579.8

|

||||||

To supplement the Company's unaudited financial data presented on a generally accepted accounting principles (GAAP) basis, management has used EBITDA and Adjusted EBITDA, non-GAAP measures. These non-GAAP measures are among the indicators management uses as a basis for evaluating the Company's financial performance as well as for forecasting future periods. Management establishes performance targets, annual budgets and makes operating decisions based in part upon these metrics. Accordingly, disclosure of these non-GAAP measures provides investors with the same information that management uses to understand the Company's economic performance year-over-year. The presentation of this additional information is not meant to be considered in isolation or as a substitute for net income or other measures prepared in accordance with GAAP.

EBITDA is defined as net income before interest, provision for income taxes, and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA adjusted for capitalized software expense, increase or (decrease) in deferred hosting fees, and increase (or decrease) in deferred hosting services fees. EBITDA and Adjusted EBITDA are not measures of the Company's liquidity or financial performance under GAAP and should not be considered as an alternative to net income or any other performance measure derived in accordance with GAAP, or as an alternative to cash flows from operating activities as a measure of its liquidity.

Management also supplements GAAP revenues discussed in this report with non-GAAP revenue adjusted for one-time revenues booked in the fourth quarter of 2016.

While management believes that the non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these measures. The measures are not prepared in accordance with GAAP and may not be directly comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation. Management compensates for these limitations by relying primarily on the Company's GAAP results and by using EBITDA and Adjusted EBITDA only supplementally and by reviewing the reconciliations of the non-GAAP financial measures to their most comparable GAAP financial measures.

Non-GAAP financial measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The Company's non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures, and should be read only in conjunction with the Company's consolidated financial statements prepared in accordance with GAAP.

Forward-Looking Statements

This report may contain, in addition to historical information, forward-looking statements, including financial projections. These forward-looking statements and projections are based on the Company's current assumptions, expectations and projections about future events. Words like "believe," "anticipate," "intend," "estimate," "expect," "project," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and similar expressions are used to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements are estimates reflecting the best judgment of the Company's management and actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors that could cause actual results to differ materially from those estimated by us include:

risks discussed in this report;

our ability to recruit and retain key technical and management personnel;

changes in existing laws;

our ability to expand our customer base;

infringement on the proprietary rights of our property and the rights of others;

competitive pricing pressures in the service management industry and our responses to those pressures;

our ability to develop new products on a timely basis that keep pace with new technological developments;

our increased dependence on technology from third parties; and

our ability to expand our products into international markets.

Many of these factors are beyond our ability to predict or control. In addition, as a result of these and other factors, our past financial performance should not be relied on as an indication of future performance. The cautionary statements referred to in this section also should be considered in connection with any subsequent written or oral forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this report might not occur. Furthermore, we cannot guarantee future results, events, levels of activity, performance, or achievements.

The Company is not under any obligation and does not intend to make publicly available any update or other revision to any forward-looking statements to reflect circumstances existing after the date of this report or to reflect the occurrence of future events even if experience or future events make it clear that any expected results expressed or implied by these forward-looking statements will not be realized.