UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 24, 2018 (September 21, 2018)

Roan Resources, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 000-51719 | 83-1984112 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 14701 Hertz Quail Springs Pkwy Oklahoma City, OK |

73134 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

(405) 896-8050

(Registrants’ telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

Roan Resources History. Our predecessor, Roan Resources LLC (“Roan LLC”), was initially formed by Citizen Energy II, LLC (“Citizen”) in May 2017. In June 2017, subsidiaries of Linn Energy, Inc. (“Old Linn”), together with Citizen and Roan LLC entered into a contribution agreement (the “Contribution Agreement”), pursuant to which, among other things, Old Linn and Citizen agreed to contribute certain oil and natural gas assets to Roan LLC (the “LINN Contributed Business” and the “Citizen Contributed Business,” respectively, and collectively the “Roan Contribution”), each in exchange for a 50% equity interest in Roan LLC. On August 31, 2017 (the “Contribution Date”), Old Linn and Citizen consummated the transactions contemplated by the Contribution Agreement. Following these transactions, Citizen’s equity interest in Roan LLC was held through its wholly owned subsidiary, Roan Holdings, LLC (“Roan Holdings”).

In the second quarter of 2018, Old Linn and certain of its subsidiaries undertook an internal reorganization, pursuant to which:

| (i) | on July 25, 2018, Old Linn merged with and into Linn Merger Sub #1, LLC (“Riviera Merger Sub”), a wholly owned subsidiary of New LINN Inc. (subsequently renamed Linn Energy, Inc. and referred to herein as “New Linn”), with Riviera Merger Sub surviving such merger, and all outstanding shares of Class A common stock of Old Linn were automatically converted into shares of Class A common stock of New Linn on a one-for-one basis; |

| (ii) | on July 25, 2018, New Linn caused certain of its subsidiaries to effect a distribution of its indirect 50% equity interest in Roan LLC to be held directly by New Linn; |

| (iii) | on August 7, 2018, New Linn contributed to its wholly owned subsidiary, Riviera Resources, Inc. (“Riviera”), all of the membership interests in Riviera Merger Sub; and |

| (iv) | on August 7, 2018, New Linn completed the spin-off of Riviera by distributing to the stockholders of New Linn (the “Legacy Linn Stockholders”) all of the issued and outstanding common stock of Riviera on a pro rata basis. |

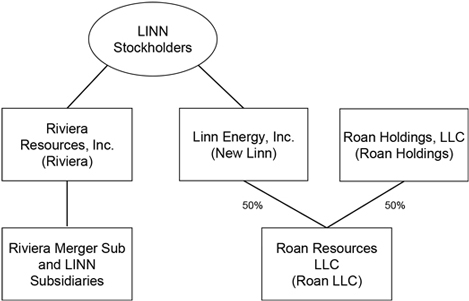

The above transactions are collectively referred to as the “Riviera Separation.” As a result of the Riviera Separation, Riviera held, directly or through its subsidiaries, substantially all of the assets of New Linn, other than New Linn’s 50% equity interest in Roan LLC. On August 8, 2018, Riviera began trading on the OTCQX tier of the OTC Markets Group, Inc. under the ticker symbol “RVRA.” Following the Riviera Separation, New Linn continued trading on the OTCQB tier of the OTC Markets Group, Inc. under the ticker symbol “LNGG.”

The ownership structure of Roan LLC immediately following the Riviera Separation is illustrated below:

2

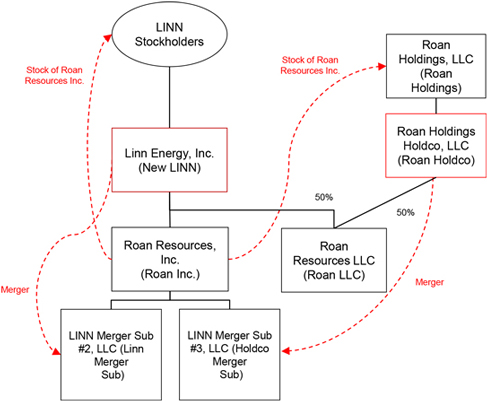

Current Reorganization. Following the Riviera Separation, New Linn and Roan Holdings reorganized their ownership of Roan LLC through the creation of certain new entities and the consummation of additional restructuring transactions illustrated below:

To effect this further reorganization, on September 24, 2018 (the “Effective Date”), Roan Resources, Inc. (the “Company” or “Roan Inc.”) consummated the previously announced reorganization transaction pursuant to that certain Master Reorganization Agreement, dated as of September 17, 2018 (the “Master Reorganization Agreement”) by and among New Linn, Roan Holdings and Roan LLC. In connection with the Master Reorganization Agreement, the Company entered into the following agreements on the Effective Date:

| • | a merger agreement (the “Linn Merger Agreement”) with New Linn and LINN Merger Sub #2, LLC (“Linn Merger Sub”), pursuant to which Linn Merger Sub merged with and into New Linn, with New Linn surviving the merger as the Company’s wholly owned direct subsidiary, and the Legacy Linn Stockholders receiving an aggregate of 76,269,766 shares of the Company’s Class A common stock, par value $0.001 per share (the “Common Stock”), as merger consideration (the “Linn Merger”); and |

| • | a merger agreement (the “Roan Holdco Merger Agreement” and, together with the Linn Merger Agreement, the “Merger Agreements”) with Roan Holdings, Roan Holdings Holdco, LLC (“Roan Holdco”) and LINN Merger Sub #3, LLC (“Holdco Merger Sub”), pursuant to which, immediately after the Linn Merger, Holdco Merger Sub merged with and into Roan Holdco, with Roan Holdco surviving the merger as the Company’s wholly owned direct subsidiary, and Roan Holdings, the sole member of Roan Holdco, receiving an aggregate of 76,269,766 shares of Common Stock as merger consideration (the “Holdco Merger”). |

The Linn Merger was effected pursuant to Section 251(g) of the Delaware General Corporation Law, which provides for the formation of a holding company without a vote of the stockholders of the constituent corporations.

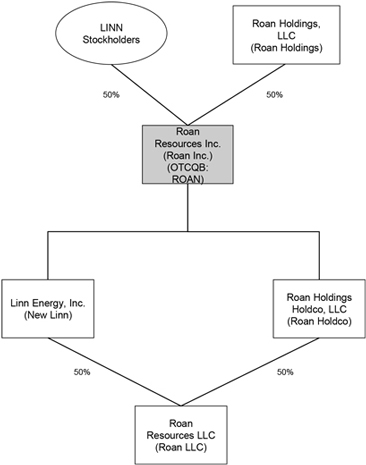

We refer to the Linn Merger, the Holdco Merger and the other transactions contemplated by the Merger Agreements and Master Reorganization Agreement as the “Reorganization.” The ownership structure of the Company immediately following the Reorganization is illustrated below.

3

On September 25, 2018, the Company will begin trading on the OTCQB under the symbol “ROAN.” As of the Effective Date and following the completion of the Reorganization, Roan Holdings owned an aggregate of 76,269,766 shares of Common Stock and the Legacy Linn Stockholders collectively owned an aggregate of 76,269,766 shares of Common Stock, each representing 50% of the Company’s outstanding Common Stock as of the closing.

Following the Reorganization, the Company became the owner, indirectly through its wholly-owned subsidiaries, of 100% of the equity in, and is the sole manager of, Roan LLC. The Company is responsible for all operational, management and administrative decisions relating to Roan LLC’s business.

For purposes of Rule 15d-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is the successor registrant to New Linn. The Company is thereby deemed subject to the periodic reporting requirements of the Exchange Act, and the rules and regulations promulgated thereunder, and in accordance therewith will file reports and other information with the Securities and Exchange Commission (the “SEC”). The first periodic report required to be filed by the Company with the SEC will be its Quarterly Report on Form 10-Q for the quarter ended September 30, 2018.

Certain Defined Terms. Unless the context otherwise requires, (i) “New Linn” refers to the registrant prior to the Effective Date, and (ii) references herein to “Roan,” “we,” “our,” “us,” the “Company” and “our company” refer (A) prior to the consummation of our Reorganization, to Roan Resources LLC, a Delaware limited liability company and wholly owned subsidiary of the Company following the Reorganization and (B) after the consummation of our Reorganization, to Roan Resources, Inc. and its wholly owned subsidiaries.

Unless otherwise indicated, the historical financial, reserve and operating information presented in this Current Report on Form 8-K (the “Current Report”) is that of Roan LLC, our predecessor for financial reporting purposes. Further, the historical financial and operating information of Roan LLC presented in this Current Report, (i) prior to August 31, 2017, the date of the completion of the Roan Contribution is that of Citizen, the predecessor of Roan LLC for financial reporting purposes and (ii) on and after August 31, 2017, is that of Roan LLC.

4

On September 24, 2018, the Company filed a Current Report on Form 8-K (the “Original Form 8-K”) to report the closing of the Reorganization and related matters in Items 1.01, 1.02, 2.01, 2.03, 3.02, 3.03, 4.01, 5.01 and 9.01 of Form 8-K. Due to the large number of events to be reported under the specified items of Form 8-K, this Form 8-K/A is being filed to amend the Original Form 8-K to include additional matters related to the closing of the Business Combination under Items 5.02, 5.03, 5.07 and 8.01.

Capitalized terms used herein but not defined herein shall have the meanings ascribed to such terms in the Original Form 8-K.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

To the extent required, the information set forth under Item 2.01 of this Current Report under “Directors and Executive Officers,” “Director and Executive Officer Compensation” and “Certain Relationships and Related Party Transactions” is incorporated herein by reference.

Management Incentive Plan

In connection with the Reorganization, our Board adopted the Amended and Restated Plan to reflect the Reorganization and attract, retain and motivate qualified persons as employees, directors and consultants, thereby enhancing the profitable growth of us and our affiliates. The Amended and Restated Plan provides for the grant, from time to time, at the discretion of our Board or a committee thereof, of stock options, stock appreciation rights, restricted stock, restricted stock units, stock awards, dividend equivalents, other stock-based awards, cash awards and substitute awards. The Amended and Restated Plan will be administered by our Board or a committee thereof.

Subject to adjustment in the event of certain transactions or changes of capitalization in accordance with the Amended and Restated Plan, 15,253,954 shares of our Common Stock have been reserved for issuance pursuant to awards under the Amended and Restated Plan, including with respect to the outstanding performance share unit awards. Common Stock subject to an award that expires or is canceled, forfeited, exchanged, settled in cash or otherwise terminated without delivery of shares and shares withheld to pay the exercise price of, or to satisfy the withholding obligations with respect to, an award will again be available for delivery pursuant to other awards under the Amended and Restated Plan.

The foregoing description is qualified in its entirety by reference to the full text of the Amended and Restated Plan, which is attached as Exhibit 10.4 to this Current Report and is incorporated in this Item 5.02 by reference.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

The information set forth under Item 2.01 of this Current Report under “Description of the Company’s Securities” is incorporated in this Item 5.03 by reference.

| Item 5.07 | Submissions of Matters to a Vote of Security Holders. |

On the Effective Date, immediately following the consummation of the Linn Merger, and prior to the consummation of the Holdco Merger, the holders of approximately 51.1% of the then-issued and outstanding Common Stock of Roan Inc. executed and delivered a written consent adopting and approving (a) our amended and restated certificate of incorporation and amended and restated bylaws and (b) the Holdco Merger.

The information set forth under “Introductory Note” and Item 2.01 of this Current Report under “Description of the Company’s Securities” is incorporated in this Item 5.07 by reference.

| Item 8.01 | Other Events. |

On the Effective Date, the Company issued a press release announcing the consummation of the Reorganization, which is included in this Current Report as Exhibit 99.6.

| Item 9.01. | Financial Statements and Exhibits. |

(a) Financial Statements of Businesses Acquired

The historical financial statements of Roan Resources LLC as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015 and as of June 30, 2018 and for the six months ended June 30, 2018 and 2017 are attached hereto as Exhibits 99.1 and 99.2.

5

The statements of revenues and direct operating expenses, which comprise the revenues and direct operating expenses of certain oil and gas properties of Old Linn for the period from January 1, 2015 to August 31, 2017 are attached hereto as Exhibit 99.3.

(b) Pro Forma Financial Information

The unaudited pro forma condensed combined financial information for the Company giving effect to the Reorganization and the LINN Contributed Business as of June 30, 2018 and for the six months ended June 30, 2018 and for the year ended December 31, 2017 is attached hereto as Exhibit 99.4.

(d) Exhibits

6

| † | Compensatory plan or arrangement |

| * | Previously filed with the Company’s Current Report on Form 8-K filed on September 24, 2018. |

7

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ROAN RESOURCES, INC. | ||||||

| Date: September 24, 2018 | ||||||

| By: | /s/ Tony C. Maranto | |||||

| Name: | Tony C. Maranto | |||||

| Title: | President and Chief Executive Officer | |||||

8