Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - EVO Payments, Inc. | evop-20180630xex32.htm |

| EX-31.2 - EX-31.2 - EVO Payments, Inc. | evop-20180630ex312a2451e.htm |

| EX-31.1 - EX-31.1 - EVO Payments, Inc. | evop-20180630ex3110f9592.htm |

| EX-10.7 - EX-10.7 - EVO Payments, Inc. | evop-20180630ex1077df107.htm |

| EX-10.6 - EX-10.6 - EVO Payments, Inc. | evop-20180630ex1065e604b.htm |

| EX-10.5 - EX-10.5 - EVO Payments, Inc. | evop-20180630ex105018924.htm |

| EX-10.4 - EX-10.4 - EVO Payments, Inc. | evop-20180630ex104fd2827.htm |

| EX-10.3 - EX-10.3 - EVO Payments, Inc. | evop-20180630ex10315f590.htm |

| EX-10.2 - EX-10.2 - EVO Payments, Inc. | evop-20180630ex102ed5009.htm |

| EX-10.1 - EX-10.1 - EVO Payments, Inc. | evop-20180630ex10172ad95.htm |

| 10-Q - 10-Q - EVO Payments, Inc. | evop-20180630x10q.htm |

Exhibit 3.1

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

EVO PAYMENTS, INC.

EVO Payments, Inc., a Delaware corporation (the “Corporation”), hereby certifies as follows:

1. The original Certificate of Incorporation of the Corporation was filed with the Office of the Secretary of State of the State of Delaware on April 20, 2017 (the “Certificate of Incorporation”). The name of the Corporation is EVO Payments, Inc.

2. The Corporation is filing this Amended and Restated Certificate of Incorporation of the Corporation (the “Amended and Restated Certificate of Incorporation”), which amends and restates the Certificate of Incorporation in its entirety. The full text of the Amended and Restated Certificate of Incorporation is set forth on Exhibit A attached hereto.

3. The Amended and Restated Certificate of Incorporation was duly adopted by the Board of Directors of the Corporation on May 22, 2018 and duly approved by the sole stockholder of the Corporation in accordance with the provisions of Sections 242, 245 and 228 of the General Corporation Law of the State of Delaware on May 22, 2018.

4. The Amended and Restated Certificate of Incorporation shall become effective upon filing with the Secretary of State of the State of Delaware.

[Signature Page Follows]

IN WITNESS WHEREOF, the Corporation has caused the Amended and Restated Certificate of Incorporation to be executed as of May 24, 2018.

|

|

|

EVO Payments, Inc. |

||

|

|

|

|

||

|

|

|

|

||

|

|

|

By: |

/s/ Steven J. de Groot |

|

|

|

|

|

Name: |

Steven J. de Groot |

|

|

|

|

Title: |

Executive Vice President, |

A-2

Exhibit A

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

EVO PAYMENTS, INC.

ARTICLE I

The name of the corporation is EVO Payments, Inc. (the “Corporation”).

ARTICLE II

The address of the Corporation’s initial registered office in the State of Delaware is 1209 Orange Street, in the city of Wilmington, County of New Castle, 19801. The name of the Corporation’s initial registered agent at such address is The Corporation Trust Company.

ARTICLE III

The purpose for which the Corporation is organized is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended or any successor statute (the “DGCL”), and the Corporation shall have all powers necessary to engage in such acts or activities, including, but not limited to, the powers enumerated in the DGCL or any amendment thereto.

ARTICLE IV

Section 4.01. Authorized Stock. The capital stock that the Corporation has authority to issue consists of the following:

(a) 200,000,000 shares of Class A common stock, par value $0.0001 per share (“Class A Common Stock”);

(b) 40,000,000 shares of Class B common stock, par value $0.0001 per share (“Class B Common Stock”);

(c) 4,000,000 shares of Class C common stock, par value $0.0001 per share (“Class C Common Stock”);

(d) 32,000,000 shares of Class D common stock, par value $0.0001 per share (“Class D Common Stock” and, together with the Class A Common Stock, Class B Common Stock and Class C Common Stock, the “Common Stock”); and

(e) 10,000,000 shares of preferred stock, par value $0.0001 per share (“Preferred Stock”).

A-1

The number of authorized shares of Class A Common Stock and Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the Corporation’s capital stock entitled to vote thereon, irrespective of the provisions of Section 242(b)(2) of the DGCL. The number of authorized shares of Class B Common Stock, Class C Common Stock or Class D Common Stock may be decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the Corporation’s capital stock entitled to vote thereon, irrespective of the provisions of Section 242(b)(2) of the DGCL.

Section 4.02. Common Stock.

(a) Voting Rights.

(i) Each holder of Class A Common Stock, as such, shall be entitled to one vote for each share of Class A Common Stock held of record by such holder on all matters submitted to a vote of the holders of Class A Common Stock, whether voting separately as a class or otherwise.

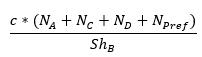

(ii) Except as set forth in Section 4.02(a)(iii), each holder of Class B Common Stock, as such, shall be entitled to a number of votes for each share of Class B Common Stock held of record by such holder on all matters submitted to a vote of the holders of Class B Common Stock when voting with other classes of the Corporation’s capital stock equal to the following:

where:

|

c |

= |

|

|

|

|

|

|

NA |

= |

the aggregate number of shares of Class A Common Stock entitled to vote on such matter, |

|

|

|

|

|

NC |

= |

the aggregate number of votes entitled to be cast on such matter by holders of Class C Common Stock, as calculated pursuant to Section 4.02(a)(iv), |

|

|

|

|

|

ND |

= |

the aggregate number of shares of Class D Common Stock entitled to vote on such matter, |

|

|

|

|

|

Npref |

= |

the aggregate number of votes entitled to be cast on such matter by holders of all classes or series of Preferred Stock, and |

|

|

|

|

|

ShB |

= |

the aggregate number of shares of Class B Common Stock entitled to vote on such matter. |

A-2

(iii) Each holder of Class B Common Stock, as such, shall be entitled to one vote for each share of Class B Common Stock held of record by such holder on all matters submitted to a vote of the holders of Class B Common Stock voting as a separate class distinct from all other classes or series of the Corporation’s capital stock.

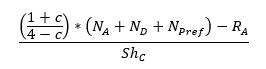

(iv) Except as set forth in Section 4.02(a)(v), each holder of Class C Common Stock, as such, shall be entitled to a number of votes for each share of Class C Common Stock held of record by such holder on all matters submitted to a vote of the holder of Class C Common Stock when voting with other classes of the Corporation’s capital stock equal to the lesser of (1) 3.5 and (2) the following:

where:

|

c |

= |

|

|

|

|

|

|

NA |

= |

the aggregate number of shares of Class A Common Stock entitled to vote on such matter, |

|

|

|

|

|

ND |

= |

the aggregate number of shares of Class D Common Stock entitled to vote on such matter, |

|

|

|

|

|

Npref |

= |

the aggregate number of votes entitled to be cast on such matter by holders of all classes or series of Preferred Stock, |

|

|

|

|

|

RA |

= |

the aggregate number of shares of Class A Common Stock that are subject to vesting or forfeiture and beneficially owned by any director or employee of the Corporation and entitled to vote on such matter, and |

|

|

|

|

|

Shc |

= |

the aggregate number of shares of Class C Common Stock entitled to vote on such matter. |

(v) Each holder of Class C Common Stock, as such, shall be entitled to one vote for each share of Class C Common Stock held of record by such holder on all matters submitted to a vote of the holders of Class C Common Stock voting as a separate class distinct from all other classes or series of the Corporation’s capital stock.

(vi) Each holder of Class D Common Stock, as such, shall be entitled to one vote for each share of Class D Common Stock held of record by such holder on all matters submitted to a vote of the holders of Class D Common Stock, whether voting separately as a class or otherwise.

(vii) Except as otherwise provided by this Amended and Restated Certificate of Incorporation (as the same may be further amended or restated from time to time, this “Amended and Restated Certificate of Incorporation”) or by applicable law, and subject to the rights of holders of any series of Preferred Stock then outstanding,

A-3

holders of Common Stock shall vote together as a single class (or, if any holders of shares of any other class or series of the Corporation’s capital stock are entitled to vote on such matter (including, without limitation, any class or series of Preferred Stock), as a single class with such holders of capital stock) on all matters submitted to a vote of the stockholders of the Corporation. No class of Common Stock shall be entitled to cumulative voting in the election of directors.

(b) Dividends. Subject to the DGCL and the rights of any then outstanding Preferred Stock, dividends may be declared and paid on the Class A Common Stock out of assets or funds lawfully available therefor as and when determined by the Board of Directors of the Corporation (the “Board of Directors”). Except as otherwise provided by the DGCL or this Amended and Restated Certificate of Incorporation, the holders of record of Class A Common Stock shall share ratably, on a per share basis, in all dividends, whether payable in cash, stock or otherwise. Dividends, whether payable in cash, stock or otherwise, shall not be declared or paid on the Class B Common Stock, Class C Common Stock or Class D Common Stock.

(c) Liquidation. Upon any liquidation, dissolution or winding up of the affairs of the Corporation, whether voluntary or involuntary, holders of Class A Common Stock will be entitled to receive all assets of the Corporation available for distribution to its stockholders ratably in proportion to the number of shares of Class A Common Stock held of record by them, subject to any preferential rights of any then outstanding Preferred Stock. Holders of shares of Class B Common Stock, Class C Common Stock or Class D Common Stock, as such, shall not be entitled to receive any assets of the Corporation in the event of any liquidation, dissolution or winding up of the affairs of the Corporation, whether voluntary or involuntary. A merger or consolidation of the Corporation with or into any other entity, or a sale or conveyance of all or any part of the assets of the Corporation, shall not be deemed to be a voluntary or involuntary liquidation or dissolution or winding up of the Corporation for purposes of this Section 4.02(c) unless such merger, consolidation, sale or conveyance in fact results in the liquidation, dissolution or winding up of the Corporation.

(d) Preemptive Rights. No stockholder of the Corporation shall have any preemptive right to purchase, subscribe for or otherwise acquire shares of any class or series of capital stock issued by the Corporation, or any options, rights or warrants to purchase any shares of any class or series of capital stock issued by the Corporation, or any other securities of the Corporation convertible into, exchangeable or exercisable for, or carrying an option to purchase shares of any class or series of capital stock issued by the Corporation. The Board of Directors may authorize the issuance of shares of stock of any class or series of capital stock issued by the Corporation, or options, rights or warrants to purchase shares of any class or series of capital stock issued by the Corporation, or any securities convertible into, exchangeable or exercisable for, or carrying an option to purchase shares of any class or series of capital stock issued by the Corporation, in each case without offering such securities, either in whole or in part, to any stockholder of the Corporation.

(e) Transfer Restrictions; Ownership of Common Stock.

(i) Shares of Class B Common Stock shall be issued only to, and registered only in the name of, Blueapple, Inc., a Delaware corporation (“Blueapple”),

A-4

and any transferee in a transfer permitted under the Amended and Restated Limited Liability Company Agreement, dated as of May 22, 2018, of EVO Investco, LLC, as the same may be further amended and restated from time to time (the “EVO Investco LLC Agreement” and such transferee, a “Permitted Transferee”).

(ii) Shares of Class C Common Stock shall be issued only to, and registered only in the name of those persons listed as a holder of “Class C Original Units” on Schedule I to the EVO Investco LLC Agreement and their Permitted Transferees.

(iii) Following its issuance by the Corporation, no holder of Class B Common Stock, Class C Common Stock or Class D Common Stock may transfer beneficial or record ownership of, or any right or other interest in, any share of such class of Common Stock by any means, other than to a Permitted Transferee in connection with the simultaneous transfer to such Permitted Transferee of an equal number of such holder’s Common Units (as defined below) in compliance with the EVO Investco LLC Agreement. Any purported transfer of any share of Class B Common Stock, Class C Common Stock or Class D Common Stock, or any interest or right therein, other than as permitted by this Section 4.02(e)(iii) shall be null and void ab initio and shall not be recognized by the Corporation or the transfer agent for the Class B Common Stock, Class C Common Stock or Class D Common Stock, as applicable, and the purported transferee or purported owner in any such purported transfer shall acquire no rights to any share of Class B Common Stock, Class C Common Stock or Class D Common Stock purportedly held in violation of these restrictions. For purposes of this Amended and Restated Certificate of Incorporation, “Common Unit” means a membership interest in EVO Investco, LLC authorized and issued under the EVO Investco LLC Agreement and constituting a “Common Unit” as defined in the EVO Investco LLC Agreement.

(iv) The Corporation shall, to the fullest extent permitted by law, undertake all necessary and appropriate action to ensure that the number of shares of Class B Common Stock, Class C Common Stock and Class D Common Stock held of record at any time by any holder thereof shall be equal to the aggregate number of Common Units held of record by such holder.

(v) As a condition to the registration of the transfer of beneficial or record ownership of, or any right or other interest in, any share of Class B Common Stock, Class C Common Stock and Class D Common Stock, the proposed transferee and the transferor of such shares shall provide an affidavit containing such information, to the extent reasonably available and legally permissible, as the Corporation may reasonably request from time to time in order to determine compliance with Section 4.02(e)(iii). The Board of Directors may, to the extent permitted by law, from time to time establish (and may thereafter amend or rescind) procedures not inconsistent with the provisions of this Section 4.02 for determining whether any transfer or acquisition of shares of Class B Common Stock, Class C Common Stock or Class D Common Stock would violate the restrictions contained in this Section 4.02 and for the orderly application, administration and implementation of the provisions of this Section 4.02. Any such procedures shall be kept on file with the Secretary of the Corporation and with the transfer agent for the Class B Common Stock, Class C Common Stock or Class D Common Stock, as applicable, and

A-5

shall be made available for inspection by any prospective transferee and, upon written request, shall be mailed to holders of shares of Class B Common Stock, Class C Common Stock or Class D Common Stock.

(vi) Upon a determination by the Board of Directors that anyone has attempted or may attempt to transfer or to acquire shares of Class B Common Stock, Class C Common Stock and Class D Common Stock in violation of this Section 4.02(e) (including, without limitation, any procedures established pursuant to Section 4.02(e)(v)), the Board of Directors may take such action as it deems advisable to refuse to give effect to such transfer or acquisition on the books and records of the Corporation, including without limitation, to cause the transfer agent for the Class B Common Stock, Class C Common Stock or Class D Common Stock, as applicable, to not record the purported transferee as the record holder of such shares of Class B Common Stock, Class C Common Stock or Class D Common Stock, as applicable, and to institute proceedings to enjoin or rescind any such transfer or acquisition.

(vii) All certificates or book entries representing shares of Class B Common Stock, Class C Common Stock or Class D Common Stock shall bear a legend substantially in the following form (or in such other form as the Board of Directors may determine):

“THE SECURITIES REPRESENTED BY THIS [CERTIFICATE][BOOK ENTRY] ARE SUBJECT TO THE RESTRICTIONS (INCLUDING RESTRICTIONS ON TRANSFER) SET FORTH IN THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF THE CORPORATION (A COPY OF WHICH IS ON FILE WITH THE SECRETARY OF THE CORPORATION AND SHALL BE PROVIDED FREE OF CHARGE TO ANY STOCKHOLDER MAKING A REQUEST THEREFOR).”

(f) Surrender, Cancellation and Extinguishment of Common Stock.

(i) Notwithstanding anything to the contrary in this Amended and Restated Certificate of Incorporation, any holder of Class B Common Stock, Class C Common Stock or Class D Common Stock may surrender such shares of Common Stock to the Corporation at any time without the payment of any consideration by the Corporation for such shares.

(ii) Each share of Class B Common Stock shall be automatically and immediately cancelled for no consideration and shall no longer be issued or outstanding, without any further action on the part of the Corporation or any holder of Class B Common Stock, upon the earliest to occur of the following:

(1) any point in time in which Blueapple and its Permitted Transferees hold of record an aggregate of less than 3% of all Common Units issued and outstanding as of such time; and

(2) May 25, 2021.

A-6

(iii) Following the surrender to the Corporation or cancellation of any shares of Class B Common Stock, Class C Common Stock or Class D Common Stock, as applicable, the Corporation shall take all actions necessary to retire and cancel such shares of Common Stock, and such shares of Common Stock shall not be re-issued by the Corporation following such retirement and cancellation.

(g) Automatic Conversion of the Class C Common Stock.

(i) Each share of Class C Common Stock shall automatically convert into one share of Class D Common Stock, without any further action on the part of the Corporation or any holder of Class C Common Stock and without any obligation on the part of the Corporation to notify such holder of Class C Common Stock, upon the earliest to occur of the following:

(1) the date on which the Original Class C Holder to whom such share of Class C Common Stock was initially issued by the Corporation is no longer employed by the Corporation or any of its subsidiaries; and

(2) May 25, 2021.

The Corporation shall not re-issue any shares of Class C Common Stock converted into Class D Common Stock pursuant to this Section 4.02(g)(i).

(ii) The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Class D Common Stock, solely for the purpose of effecting the conversion of the Class C Common Stock, a number of shares of Class D Common Stock as shall from time to time be sufficient to effect the conversion of Class C Common Stock in accordance with Section 4.02(g)(i). If at any time the number of authorized but unissued shares of Class D Common Stock is not sufficient to effect the conversion of all then outstanding shares of Class C Common Stock, the Corporation shall take such action as may be necessary to increase its authorized but unissued Class D Common Stock to such number as shall be sufficient for such purpose.

(iii) Other than as explicitly set forth in Section 4.02(g)(i), no share of Common Stock shall be convertible into, or exchangeable or exercisable for, any shares of any class or series of capital stock issued by the Corporation, whether now or hereafter authorized.

(h) No Fractional Shares. The Corporation shall not be authorized to issue fractional shares of any class or series of the Corporation’s capital stock.

Section 4.03. Preferred Stock. The Board of Directors is authorized, subject to any limitations prescribed by applicable law, to provide for the issuance of shares of Preferred Stock in one or more classes or series, and by filing a certificate pursuant to the DGCL (such certificate being hereinafter referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such class or series and to fix the powers, designations, preferences and relative, participating, optional or other special rights, and

A-7

qualifications, limitations or restrictions thereof, including, without limitation, dividend rights, dividend rates, conversion rights, exchange rights, voting rights, rights and terms of redemption (including sinking and purchase fund provisions), the redemption price or prices, restrictions on the issuance of shares of such class or series, the dissolution preferences and the rights in respect to any distribution of assets of any wholly unissued class or series of Preferred Stock, and the designation thereof, or any of them and to increase or decrease the number of shares of any class or series so created (except where otherwise provided in the Preferred Stock Designation), subsequent to the issue of that class or series but not below the number of shares of such class or series then outstanding. In case the number of shares of any class or series of Preferred Stock shall be so decreased, the shares constituting such decrease shall resume the undesignated status which they had prior to the adoption of the resolution originally fixing the number of shares of such class or series. There shall be no limitation or restriction on any variation between any of the different classes or series of Preferred Stock as to the designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof; and the several classes or series of Preferred Stock may vary in any and all respects as fixed and determined by the resolution or resolutions of the Board of Directors or by a committee of the Board of Directors providing for the issuance of the various classes or series of Preferred Stock.

ARTICLE V

Section 5.01. Election of Director by Written Ballot. Election of directors need not be by written ballot unless provided otherwise in the Corporation’s bylaws (as the same may be amended or restated from time to time, the “Bylaws”).

Section 5.02. Number of Directors. The number of directors constituting the Board of Directors shall be not fewer than seven and not more than fifteen, each of whom shall be a natural person. The initial number of directors shall be seven and, except as otherwise set forth in that certain Director Nomination Agreement, dated on or about May 22, 2018 (as amended or supplemented, the “Nomination Agreement”), by and among the Corporation and funds affiliated with Madison Dearborn Partners, LLC (“MDP”), to the extent in effect, and subject to the special rights of the holders of any class or series of Preferred Stock to elect directors, any change in the number of directors shall be made from time to time exclusively pursuant to a resolution adopted by the Board of Directors.

Section 5.03. Staggered Board

(a) Subject to the special rights of the holders of any class or series of Preferred Stock to elect directors, the Board of Directors shall be divided into three groups: Group I; Group II; and Group III. The allocation of directors among the three groups (including the allocation of each director already in office as of the effectiveness of this Amended and Restated Certificate of Incorporation and each director elected or appointed as the result of any increase or decrease in the number of directors on the Board of Directors) shall be determined by a resolution of the Board of Directors, and to the extent in effect, in accordance with the Nomination Agreement. The initial Group I Directors shall serve for a term expiring at the annual meeting of stockholders of the Corporation held in 2019; the initial Group II Directors shall serve for a term expiring at the annual meeting of stockholders of the Corporation held in

A-8

2020; and the initial Group III Directors shall serve for a term expiring at the annual meeting of stockholders of the Corporation held in 2021. Each director in each group shall hold office until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. At each annual meeting of stockholders of the Corporation beginning with the annual meeting of stockholders of the Corporation held in 2019, the directors (or successors thereof) of the group whose term expires at that meeting shall be elected to hold office for a term expiring at the annual meeting of stockholders of the Corporation to be held in the third year following the year of their election, with each director in each such group to hold office until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal.

(b) Any director elected by a separate voting class consisting solely of the holders of one or more classes or series of Preferred Stock shall be allocated among the three groups as determined by resolution of the Board of Directors.

Section 5.04. Vacancies and Newly Created Directorships. Except as otherwise set forth in the Nomination Agreement, to the extent in effect, any vacancy or newly-created directorship shall be filled exclusively by vote of a majority of the directors then in office. No decrease in the number of directors constituting the Board of Directors shall shorten the term of any incumbent director. A director selected to fill a vacancy shall continue to hold office for the unexpired term of his or her predecessor in office. A director selected to fill a position resulting from an increase in the number of directors shall hold office until the next annual meeting of stockholders of the Corporation held for the election of directors of the Corporation for the group for which such director shall have been selected, subject to the election and qualification of his or her successor and to his or her earlier death, resignation or removal.

Section 5.05. Removal. Directors may be removed only for cause and only by the affirmative vote of at least 66 ⅔% of votes entitled to be cast by holders of Common Stock, voting together as a single class.

ARTICLE VI

Section 6.01. No Action by Written Consent. No action required or permitted to be taken by the holders of any class or series of the Corporation’s capital stock may be taken by one or more written consents in lieu of a meeting.

Section 6.02. Annual Meeting of Stockholders. The annual meeting of stockholders of the Corporation for the election of directors and for the transaction of such other business as may properly come before the meeting shall be held at such date, time and place, if any, as shall be determined by resolution of the Board of Directors in its sole and absolute discretion.

Section 6.03. Special Meetings of Stockholders. Subject to any special rights of the holders of any class or series of Preferred Stock and to the requirements of applicable law, special meetings of stockholders of the Corporation may be called only (i) by or at the direction of the Board of Directors, acting pursuant to a resolution adopted by the affirmative vote of the majority of the total number of directors then in office, or (ii) by the chairperson of the Board of Directors. Any business transacted at any special meeting of stockholders of the Corporation shall be limited to matters relating to the purpose or purposes stated in the notice of meeting.

A-9

ARTICLE VII

No director shall have any personal liability to the Corporation or to its stockholders for monetary damages for breach of fiduciary duty as a director by reason of any act or omission occurring subsequent to the date when this provision becomes effective, except that this provision shall not eliminate or limit the liability of a director (a) for any breach of the director's duty of loyalty to the Corporation or its stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) for liabilities of a director imposed by Section 174 of the DGCL or (d) for any transaction from which the director derived an improper personal benefit. If the DGCL is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL as so amended. Any repeal or modification of this provision shall not adversely affect any right or protection of a director of the Corporation with respect to any act or omission occurring prior to the repeal or modification of this provision.

To the fullest extent permitted by applicable law, the Corporation is authorized to provide indemnification of (and advancement of expenses to) directors, officers and agents of the Corporation (and any other persons to which applicable law permits the Corporation to provide indemnification and advancement of expenses) through provisions of the Bylaws, agreements with such persons, vote of stockholders or disinterested directors, or otherwise. Any repeal or modification of this provision shall not adversely affect any right or protection hereunder of any person in respect of any act or omission occurring prior to the time of such repeal or modification.

ARTICLE VIII

Section 8.01. Opt Out of DGCL 203. The Corporation shall not be governed by Section 203 of the DGCL.

Section 8.02. Limitations on Business Combinations. Notwithstanding the foregoing, the Corporation shall not engage in any Business Combination, at any point in time at which the Class A Common Stock is registered under Section 12(b) or 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with any Interested Stockholder for a period of three years following the time that such stockholder became an Interested Stockholder, unless:

(a) prior to such time, the Board of Directors approved either the Business Combination or the transaction which resulted in the stockholder becoming an Interested Stockholder;

(b) upon consummation of the transaction that resulted in the stockholder becoming an Interested Stockholder, the Interested Stockholder Owned at least 85% of the Voting Stock outstanding at the time the transaction commenced, excluding for purposes of determining the Voting Stock outstanding (but not the outstanding Voting Stock Owned by the Interested Stockholder) those shares Owned by (i) Persons who are directors and also officers of the Corporation and (ii) employee stock plans in which employee participants do not have the

A-10

right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

(c) at or subsequent to that time, the Business Combination is approved (i) by the Board of Directors and (i) by the affirmative vote of at 66 ⅔% of the outstanding Voting Stock that is not Owned by the Interested Stockholder at an annual or special meeting of stockholders of the Corporation.

Section 8.03. Certain Definitions. Solely for purposes of this Article VIII, the following terms shall have the meanings assigned below:

(a) “Affiliate” means a Person that directly, or indirectly through one or more intermediaries, Controls, or is Controlled by, or is under common Control with, another Person.

(b) “Associate,” when used to indicate a relationship with any Person, means: (i) any corporation, partnership, unincorporated association or other entity of which such Person is a director, officer or partner or is, directly or indirectly, the Owner of 20% or more of any class of Voting Stock; (ii) any trust or other estate in which such Person has at least a 20% beneficial interest or as to which such Person serves as trustee or in a similar fiduciary capacity; and (iii) any relative or spouse of such Person, or any relative of such spouse, who has the same residence as such Person.

(c) “Business Combination” means:

(i) any merger or consolidation of the Corporation or any direct or indirect majority-owned subsidiary of the Corporation (1) with the Interested Stockholder, or (2) with any other corporation, partnership, unincorporated association or other entity if the merger or consolidation is caused by the Interested Stockholder and as a result of such merger or consolidation Section 8.02 is not applicable to the surviving entity;

(ii) any sale, lease, exchange, mortgage, pledge, transfer or other disposition (in one transaction or a series of transactions), except proportionately as a stockholder of the Corporation, to or with the Interested Stockholder, whether as part of a dissolution or otherwise, of assets of the Corporation or of any direct or indirect majority-owned subsidiary of the Corporation, which assets have an aggregate market value equal to 10% or more of either the aggregate market value of all the assets of the Corporation determined on a consolidated basis or the aggregate market value of all the outstanding Stock of the Corporation;

(iii) any transaction which results in the issuance or transfer by the Corporation or by any direct or indirect majority-owned subsidiary of the Corporation of any Stock of the Corporation or of such subsidiary to the Interested Stockholder, except: (1) pursuant to the exercise, exchange or conversion of securities exercisable for, exchangeable for or convertible into Stock of the Corporation or any such subsidiary which securities were outstanding prior to the time that the Interested Stockholder became such; (2) pursuant to a merger under Section 251(g) or Section 253 of the DGCL; (3) pursuant to a dividend or distribution paid or made, or the exercise, exchange or

A-11

conversion of securities exercisable for, exchangeable for or convertible into Stock of the Corporation or any such subsidiary which security is distributed, pro rata to all stockholders of a class or series of Stock of the Corporation subsequent to the time the Interested Stockholder became such; (4) pursuant to an exchange offer by the Corporation to purchase Stock made on the same terms to all stockholders of said stock; or (5) any issuance or transfer of stock by the Corporation; provided that in no case under clauses (3) through (5) above shall there be an increase in the Interested Stockholder’s proportionate share of the Stock of any class or series of the Corporation or of the Voting Stock of the Corporation (except as a result of immaterial changes due to fractional share adjustments);

(iv) any transaction involving the Corporation or any direct or indirect majority-owned subsidiary of the Corporation which has the effect, directly or indirectly, of increasing the proportionate share of the Stock of any class or series, or securities convertible into the Stock of any class or series, of the Corporation or of any such subsidiary which is Owned by the Interested Stockholder, except as a result of immaterial changes due to fractional share adjustments or as a result of any purchase or redemption of any shares of Stock not caused, directly or indirectly, by the Interested Stockholder; or

(v) any receipt by the Interested Stockholder of the benefit, directly or indirectly (except proportionately as a stockholder of the Corporation), of any loans, advances, guarantees, pledges, or other financial benefits (other than those expressly permitted in subsections (i) through (iv) above) provided by or through the Corporation or any direct or indirect majority-owned subsidiary.

(d) “Control,” including the terms “Controlling,” “Controlled by” and “under common Control with,” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of Voting Stock of such Person, by contract, or otherwise. A Person who is the Owner of 20% or more of the voting power of the outstanding Voting Stock of a corporation, partnership, unincorporated association or other entity shall be presumed to have Control of such entity, in the absence of proof by a preponderance of the evidence to the contrary. Notwithstanding the foregoing, a presumption of Control shall not apply where such Person holds Voting Stock, in good faith and not for the purpose of circumventing this Article VIII, as an agent, bank, broker, nominee, custodian or trustee for one or more owners who do not individually or as a group have Control of such entity.

(e) “Interested Stockholder” means any Person (other than the Corporation and its subsidiaries) that (i) is the Owner of 15% or more of the Voting Stock of the Corporation, or (ii) is an Affiliate or Associate of the Corporation and was the Owner of 15% or more of the Voting Stock of the Corporation at any time within the three-year period immediately prior to the date on which it is sought to be determined whether such Person is an Interested Stockholder; and the Affiliates and Associates of such Person; but “Interested Stockholder” shall not include any Person whose ownership of shares in excess of the 15% limitation set forth herein is the result of any action taken solely by the Corporation; provided that such Person shall be an Interested Stockholder if thereafter such Person acquires additional shares of Voting Stock of the Corporation, except as a result of further corporate action not caused, directly or indirectly, by

A-12

such Person. For the purpose of determining whether a Person is an Interested Stockholder, the Voting Stock of the Corporation deemed to be outstanding shall include Stock deemed to be Owned by the Person through application of the definition of “owner” below but shall not include any other unissued Stock of the Corporation which may be issuable pursuant to any agreement, arrangement or understanding, or upon exercise of conversion or exchange rights, warrants or options, or otherwise. Notwithstanding anything in this Section 8.03(e) to the contrary, none of Blueapple, MDP or any of their respective Permitted Transferees to whom Blueapple or MDP transfer 15% or more of the Voting Stock of the Corporation, or any of their respective Affiliates or Associates and any of their respective Permitted Transferees, shall be considered an Interested Stockholder for purposes of this Article VIII.

(f) “Owner,” including the terms “Own” and “Owned,” when used with respect to any Stock, means a Person that individually or with or through any of its Affiliates or Associates:

(i) beneficially owns such Stock, directly or indirectly; or

(ii) has (1) the right to acquire such Stock (whether such right is exercisable immediately or only after the passage of time) pursuant to any agreement, arrangement or understanding, or upon the exercise of conversion rights, exchange rights, warrants or options, or otherwise; provided, however, that a Person shall not be deemed the Owner of Stock tendered pursuant to a tender or exchange offer made by such Person or any of such Person’s Affiliates or Associates until such tendered Stock is accepted for purchase or exchange; or (2) the right to vote such Stock pursuant to any agreement, arrangement or understanding; provided, however, that a Person shall not be deemed the Owner of any Stock because of such Person’s right to vote such Stock if the agreement, arrangement or understanding to vote such Stock arises solely from a revocable proxy or consent given in response to a proxy or consent solicitation made to 10 or more Persons; or

(iii) has any agreement, arrangement or understanding for the purpose of acquiring, holding, voting (except voting pursuant to a revocable proxy or consent as described in Section 8.03(f)(ii)(2) above), or disposing of such Stock with any other Person that beneficially owns, or whose Affiliates or Associates beneficially own, directly or indirectly, such stock.

(g) “Person” means any individual, corporation, firm, partnership, joint venture, limited liability company, estate, trust, business association, organization, governmental entity or other entity.

(h) “Stock” means, with respect to any corporation, capital stock and, with respect to any other entity, any equity interest.

(i) “Voting Stock” means Stock of the Corporation of any class or series entitled to vote generally in the election of directors. Every reference to a percentage of Voting Stock shall refer to such percentage of the votes of such Voting Stock.

A-13

ARTICLE IX

Section 9.01. Certain Definitions. Solely for purposes of this Article IX, the following terms shall have the meanings assigned below:

(a) “Agent” has the meaning set forth in Section 9.05.

(b) “Business Day” shall mean any day other than a Saturday, a Sunday, or a day on which banking institutions in the State of New York are authorized or obligated by law or executive order to close.

(c) “Code” means the Internal Revenue Code of 1986, as it may be amended from time to time.

(d) “Corporation Securities” means (i) shares of Common Stock, (ii) shares of Preferred Stock (other than nonvoting preferred stock described in Section 1563(c)(1)(A) of the Code), and (iii) any option (within the meaning of Section 1563(e)(1) of the Code and Treasury Regulations §1.1563-3(b)(1)) to acquire any Corporation Securities described in clause (i) or (ii) above.

(e) “Excess Securities” has the meaning given such term in Section 9.04(a).

(f) “Expiration Date” means the date upon which the Board of Directors determines by resolution that this Article IX is no longer necessary for the preservation or realization of Tax Benefits.

(g) “Operating Company” means EVO Investco, LLC, a Delaware limited liability company.

(h) “Percentage Stock Ownership” means, with respect to any Person, the percentage stock ownership interest of such Person in the Corporation for purposes of Section 1563 of the Code and the Treasury Regulations promulgated thereunder, determined separately with respect to the voting power of the stock of the Corporation and the value of stock of the Corporation, in each case taking into account any applicable constructive ownership rules under Section 1563(e) of the Code and Treasury Regulations §1.1563-3.

(i) “Person” means any individual, corporation, firm, partnership, joint venture, limited liability company, estate, trust, business association, organization, governmental entity or other entity.

(j) “Prohibited Distributions” means any and all dividends or other distributions paid by the Corporation with respect to any Excess Securities received by a Purported Transferee.

(k) “Prohibited Transfer” means any Transfer or purported Transfer of Corporation Securities to the extent that such Transfer is prohibited or void under this Article IX.

(l) “Proposed Transaction” has the meaning set forth in Section 9.03(b).

A-14

(m) “Purported Transferee” has the meaning set forth in Section 9.04(a).

(n) “Request” has the meaning set forth in Section 9.03(b).

(o) “Requesting Person” has the meaning set forth in Section 9.03(b).

(p) “Stock Ownership Threshold Percentage” means 15.90%.

(q) “Tax Benefits” means tax benefits potentially available to the Corporation for U.S. federal, state and local income tax purposes as a result of any increase in the inside basis of the assets of the Operating Company (arising out of an election by the Operating Company under Section 754 of the Code).

(r) “Transfer” means, any direct or indirect sale, transfer, assignment, conveyance, pledge or other disposition or other action taken by a Person that alters the Percentage Stock Ownership of any Person.

(s) “Transferee” means, with respect to any Transfer, any Person to whom Corporation Securities are, or are proposed to be, Transferred.

(t) “Transferor” means, with respect to any Transfer, any Person by or from whom Corporation Securities are, or are proposed to be, Transferred.

(u) “Treasury Regulations” means the regulations, including temporary regulations or any successor regulations promulgated under the Code, as amended from time to time.

(v) “Sixteen Percent Transaction” has the meaning set forth in Section 9.02.

Section 9.02. Transfer and Ownership Restrictions. In order to preserve the ability of the Corporation to realize certain Tax Benefits, any attempted Transfer of Corporation Securities prior to the Expiration Date and any attempted Transfer of Corporation Securities pursuant to an agreement entered into prior to the Expiration Date shall be prohibited and void ab initio to the extent that, as a result of such Transfer (or any series of Transfers of which such Transfer is a part), the aggregate Percentage Stock Ownership of Blueapple, by vote or value, would exceed the Stock Ownership Threshold Percentage (any such Transfer, a “Sixteen Percent Transaction”).

Section 9.03. Exceptions; Waiver of Transfer and Ownership Restrictions.

(a) Any Transfer of Corporation Securities that would otherwise be prohibited pursuant to Section 9.02 shall nonetheless be permitted if prior to such Transfer being consummated (or, in the case of an involuntary Transfer, as soon as practicable after the transaction is consummated), the Board of Directors authorizes the Transfer in accordance with Section 9.03(b) or Section 9.03(c) (which authorization may relate to a Transfer or series of identified Transfers).

(b) The restrictions set forth in Section 9.02 shall not apply to a proposed Transfer that is a Sixteen Percent Transaction if the Transferor or the Transferee obtains the

A-15

authorization of the Board of Directors in the manner described below. In connection therewith, and to provide for effective implementation of this Section 9.03(b), any Person who desires to effect a Sixteen Percent Transaction (a “Requesting Person”) shall, prior to the date of such transaction for which the Requesting Person seeks authorization (the “Proposed Transaction”), request in writing (a “Request”) that the Board of Directors review the Proposed Transaction and authorize or not authorize the Proposed Transaction in accordance with this Section 9.03(b). A Request shall be mailed or delivered to the Secretary of the Corporation at the Corporation’s principal place of business. Such Request shall be deemed to have been received by the Corporation when actually received by the Corporation. A Request shall include: (i) the name, address and telephone number of the Requesting Person; (ii) the number and Percentage Stock Ownership of Corporation Securities then beneficially owned by the Requesting Person; (iii) a reasonably detailed description of the Proposed Transaction or Proposed Transactions for which the Requesting Person seeks authorization; and (iv) a request that the Board of Directors authorize the Proposed Transaction pursuant to this Section 9.03(b). The Board of Directors shall, in good faith, endeavor to respond to each Request within 20 Business Days of receiving such Request. The Board of Directors may authorize a Proposed Transaction if it determines that the Proposed Transaction would not jeopardize the Corporation’s ability to realize Tax Benefits. Any determination by the Board of Directors not to authorize a Proposed Transaction shall cause such Proposed Transaction to be deemed a Prohibited Transfer. The Board of Directors may impose any conditions and restrictions that it deems reasonable and appropriate in connection with authorizing any Proposed Transaction. In addition, the Board of Directors may require an affidavit or representations from such Requesting Person or opinions of counsel to be rendered by counsel selected by the Requesting Person (and reasonably acceptable to the Board of Directors), in each case, as to such matters as the Board of Directors may reasonably determine with respect to preserving the Corporation’s ability to realize Tax Benefits. Any Requesting Person who makes a Request to the Board of Directors shall reimburse the Corporation, within 30 days of demand therefor, for all reasonable out-of-pocket costs and expenses incurred by the Corporation with respect to any Proposed Transaction, including, without limitation, the Corporation’s reasonable costs and expenses incurred in determining whether to authorize the Proposed Transaction, which costs may include, but are not limited to, any expenses of counsel and/or tax advisors engaged by the Board of Directors to advise the Board of Directors or deliver an opinion thereto. Any authorization of the Board of Directors hereunder may be given prospectively or retroactively.

(c) Notwithstanding the foregoing, the Board of Directors may determine that the restrictions set forth in Section 9.02 shall not apply to any particular transaction or transactions, whether or not a request has been made to the Board of Directors, including a Request pursuant to Section 9.03(b), subject to any conditions that it deems reasonable and appropriate in connection therewith. Any determination of the Board of Directors hereunder may be made prospectively or retroactively.

(d) The Board of Directors, to the fullest extent permitted by law, may exercise the authority granted by this Article IX through duly authorized officers or agents of the Corporation. Nothing in this Section 9.03 shall be construed to limit or restrict the Board of Directors in the exercise of its fiduciary duties under applicable law.

A-16

Section 9.04. Excess Securities.

(a) No employee or agent of the Corporation shall record any Prohibited Transfer, and the purported Transferee of such a Prohibited Transfer (the “Purported Transferee”) shall not be recognized as a stockholder of the Corporation for any purpose whatsoever in respect of the Corporation Securities which are the subject of the Prohibited Transfer (the “Excess Securities”). Until the Excess Securities are acquired by another Person in a Transfer that is not a Prohibited Transfer, the Purported Transferee shall not be entitled to any rights of stockholders of the Corporation with respect to such Excess Securities, including, without limitation, the right to vote such Excess Securities and to receive dividends or distributions, whether liquidating or otherwise, in respect thereof, if any, and the Excess Securities shall be deemed to remain with the Transferor unless and until the Excess Securities are transferred to the Agent pursuant to Section 9.05 or until an authorization is obtained under Section 9.03. After the Excess Securities have been acquired in a Transfer that is not a Prohibited Transfer, the Corporation Securities shall cease to be Excess Securities. For this purpose, any Transfer of Excess Securities not in accordance with the provisions of this Section 9.04 or Section 9.05 shall also be a Prohibited Transfer.

(b) The Corporation may make such arrangements or issue such instructions to its stock transfer agent as may be determined by the Board of Directors to be necessary or advisable to implement this Article IX, including, without limitation, authorizing, in accordance with Section 9.09, such transfer agent to require an affidavit from a Purported Transferee regarding such Person’s actual and constructive ownership of stock and other evidence that a Transfer will not be prohibited by this Article IX as a condition to registering any Transfer.

Section 9.05. Transfer to Agent. If the Board of Directors determines that a Transfer of Corporation Securities constitutes a Prohibited Transfer then, upon written demand by the Corporation sent within 30 days of the date on which the Board of Directors determines that the attempted Transfer constitutes a Prohibited Transfer, the Purported Transferee shall transfer or cause to be transferred any certificate or other evidence of ownership of the Excess Securities within the Purported Transferee’s possession or Control, together with any Prohibited Distributions, to an agent designated by the Board of Directors (the “Agent”). The Agent shall thereupon sell to a buyer or buyers, which may include the Corporation, the Excess Securities transferred to it in one or more arm’s-length transactions (on the public securities market on which such Excess Securities are traded, if possible, or otherwise privately); provided, however, that any such sale must not constitute a Prohibited Transfer and provided, further, that the Agent shall effect such sale or sales in an orderly fashion and shall not be required to effect any such sale within any specific time frame if, in the Agent’s discretion, such sale or sales would disrupt the market for the Corporation Securities, would otherwise adversely affect the value of the Corporation Securities or would be in violation of applicable securities laws. If the Purported Transferee has resold the Excess Securities before receiving the Corporation’s demand to surrender Excess Securities to the Agent, the Purported Transferee shall be deemed to have sold the Excess Securities for the Agent, and shall be required to transfer to the Agent any Prohibited Distributions and proceeds of such sale, except to the extent that the Corporation grants written permission to the Purported Transferee to retain a portion of such sales proceeds not exceeding the amount that the Purported Transferee would have received from the Agent pursuant to Section 9.06 if the Agent rather than the Purported Transferee had resold the Excess Securities.

A-17

Section 9.06. Application of Proceeds and Prohibited Distributions. The Agent shall apply any proceeds of a sale by it of Excess Securities and, if the Purported Transferee has previously resold the Excess Securities, any amounts received by the Agent from a Purported Transferee, together, in either case, with any Prohibited Distributions, as follows: (a) first, such amounts shall be paid to the Agent to the extent necessary to cover its costs and expenses incurred in connection with its duties hereunder; (b) second, any remaining amounts shall be paid to the Purported Transferee, up to the amount paid by the Purported Transferee for the Excess Securities (or the fair market value at the time of the Transfer, in the event the purported Transfer of the Excess Securities was, in whole or in part, a gift, inheritance or similar Transfer, such fair market value to be calculated on the basis of the closing market price for the Corporation Securities on the principal U.S. stock exchange on which the Corporation Securities are listed or admitted for trading on the day before the Prohibited Transfer; provided, however, that (1) if the Corporation Securities are not listed or admitted for trading on any U.S. stock exchange but are traded in the over-the-counter market, such fair market value shall be calculated based upon the difference between the highest bid and lowest asked prices, as such prices are reported by Nasdaq or any successor system on the day before the Prohibited Transfer or, if not so reported, on the last preceding day for which such quotations exist, or (2) if the Corporation Securities are neither listed nor admitted to trading on any U.S. stock exchange and are not traded in the over-the-counter market, then such fair market value shall be determined in good faith by the Board of Directors); and (c) third, any remaining amounts shall be paid to the Transferor that was party to the subject Prohibited Transfer, or, if the Transferor that was party to the subject Prohibited Transfer cannot be readily identified, to one or more organizations qualifying under Section 501(c)(3) of the Code (or any comparable successor provision) selected by the Board of Directors. The Purported Transferee of Excess Securities shall have no claim, cause of action or any other recourse whatsoever against any Transferor of Excess Securities. The Purported Transferee’s sole right with respect to such shares shall be limited to the amount payable to the Purported Transferee pursuant to this Section 9.06. In no event shall the proceeds of any sale of Excess Securities pursuant to this Section 9.06 inure to the benefit of the Corporation or the Agent, except to the extent used to cover costs and expenses incurred by the Agent in performing its duties hereunder.

Section 9.07. Modification of Remedies for Certain Indirect Transfers. In the event of any Transfer of securities that does not involve a direct Transfer of Corporation Securities (for example, a transfer of an equity interest in an entity that owns Corporation Securities) but which would cause the aggregate Percentage Stock Ownership of Blueapple, by vote or value, to exceed the Stock Ownership Threshold Percentage, the application of Section 9.05 and Section 9.06 shall be modified as described in this Section 9.07. In such case, the transferee of such securities shall be considered a Purported Transferee and shall be deemed to have disposed of and shall be required to dispose of such securities to the extent necessary such that, following such disposition, the aggregate Percentage Stock Ownership of Blueapple, by vote and value, is less than the Stock Ownership Threshold Percentage. Such disposition shall be deemed to occur simultaneously with the Transfer giving rise to the application of this provision, and such number of securities that are deemed to be disposed of shall be considered Excess Securities and shall be disposed of through the Agent as provided in Sections 9.05 and 9.06, except that the maximum aggregate amount payable under Section 9.06 in respect of such Excess Securities, in connection with such disposition, shall be the fair market value of such Excess Securities at the time of the purported Transfer. All expenses incurred by the Agent in disposing of such Excess

A-18

Securities shall be paid out of the sales proceeds from such Excess Securities. The purpose of this Section 9.07 is to extend the restrictions in Sections 9.02 and 9.05 to indirect Transfers of Corporation Securities that would cause the aggregate Percentage Stock Ownership of Blueapple, by vote or value, to exceed the Stock Ownership Threshold Percentage, and this Section 9.07, along with the other provisions of this Article IX, shall be interpreted to produce the same results, with differences as the context requires, as a direct Transfer of Corporation Securities.

Section 9.08. Legal Proceedings; Prompt Enforcement. If the Purported Transferee fails to surrender the Excess Securities or the proceeds of a sale thereof, in either case, with any Prohibited Distributions, to the Agent within 30 days from the date on which the Corporation makes a written demand pursuant to Section 9.05 (whether or not made within the time specified in Section 9.05), then the Corporation may take any actions it deems necessary to enforce the provisions hereof, including the institution of legal proceedings to compel the surrender. Nothing in this Section 9.08 shall (a) be deemed inconsistent with any Transfer of the Excess Securities provided in this Article IX being void ab initio, (b) preclude the Corporation in its discretion from immediately bringing legal proceedings without a prior demand or (c) cause any failure of the Corporation to act within the time periods set forth in Section 9.05 to constitute a waiver or loss of any right of the Corporation under this Article IX. The Board of Directors may authorize such additional actions as it deems advisable to give effect to the provisions of this Article IX.

Section 9.09. Obligation to Provide Information. As a condition to the registration of the Transfer of any Corporation Securities, any Person who is a beneficial, legal or record holder of Corporation Securities, and any proposed Transferee and any Person Controlling, Controlled by or under common Control with (as such terms are defined in Section 8.03) the proposed Transferee, shall provide an affidavit containing such information, to the extent reasonably available and legally permissible, as the Corporation may reasonably request from time to time in order to determine compliance with this Article IX.

Section 9.10. Authority of Board of Directors.

(a) The Board of Directors shall have the power to determine all matters necessary for assessing compliance with this Article IX, including, without limitation, (i) whether a Transfer is a Sixteen Percent Transaction or a Prohibited Transfer, (ii) the Percentage Stock Ownership of any Person, (iii) whether an instrument constitutes a Corporation Security, (iv) the amount (or fair market value) due to a Purported Transferee pursuant to Section 9.06, and (v) any other matters which the Board of Directors determines to be relevant; and the good faith determination of the Board of Directors on such matters shall be conclusive and binding for all the purposes of this Article IX. In addition, the Board of Directors may, to the extent permitted by law, from time to time establish, modify, amend or rescind Bylaws and procedures of the Corporation not inconsistent with the provisions of this Article IX for purposes of determining whether any Transfer of Corporation Securities would jeopardize the Corporation’s ability to realize Tax Benefits and for the orderly application, administration and implementation of this Article IX.

(b) Nothing contained in this Article IX shall limit the authority of the Board of Directors to take such other action to the extent permitted by law as it deems necessary or

A-19

advisable to protect the Corporation and its stockholders in preserving the ability to realize Tax Benefits.

(c) In the case of an ambiguity in the application of any of the provisions of this Article IX, including any definition used herein, the Board of Directors shall have the power to determine the application of such provisions with respect to any situation based on its reasonable belief, understanding or knowledge of the circumstances. In the event this Article IX requires an action by the Board of Directors but fails to provide specific guidance with respect to such action, the Board of Directors shall have the power to determine the action to be taken so long as such action is not contrary to the provisions of this Article IX. All such actions, calculations, interpretations and determinations that are done or made by the Board of Directors in good faith shall be conclusive and binding on the Corporation, the Agent, and all other parties for all other purposes of this Article IX. The Board of Directors may delegate all or any portion of its duties and powers under this Article IX to a committee of the Board of Directors as it deems necessary or advisable and, to the fullest extent permitted by law, may exercise the authority granted by this Article IX through duly authorized officers or agents of the Corporation. Nothing in this Article IX shall be construed to limit or restrict the Board of Directors in the exercise of its fiduciary duties under applicable law.

Section 9.11. Reliance. To the fullest extent permitted by law, the Corporation and the members of the Board of Directors shall be fully protected in relying in good faith upon the opinions, reports or statements of the Corporation’s officer’s, employees, legal counsel, independent auditors, transfer agent, investment bankers and agents in making the determinations and findings contemplated by this Article IX, and the members of the Board of Directors shall not be responsible for any good faith errors made in connection therewith. For purposes of determining the existence and identity of, and the amount of any Corporation Securities owned by, any Person, the Corporation is entitled to rely on the existence and absence of filings of Schedule 13D or 13G under the Exchange Act (or similar filings), as of any date, subject to its actual knowledge of the ownership of Corporation Securities.

Section 9.12. Benefits of This Article IX. Nothing in this Article IX shall be construed to give to any Person other than the Corporation or the Agent any legal or equitable right, remedy or claim under this Article IX. This Article IX shall be for the sole and exclusive benefit of the Corporation and the Agent.

Section 9.13. Severability. If any provision of this Article IX or the application of any such provision to any Person or under any circumstance shall be held invalid, illegal or unenforceable in any respect by a court of competent jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provision of this Article IX.

Section 9.14. Waiver. With regard to any power, remedy or right provided herein or otherwise available to the Corporation or the Agent under this Article IX, (a) no waiver will be effective unless expressly contained in a writing signed by the waiving party, and (b) no alteration, modification or impairment will be implied by reason of any previous waiver, extension of time, delay or omission in exercise, or other indulgence.

A-20

ARTICLE X

Section 10.01. Corporate Opportunity.

(a) To the fullest extent permitted by the laws of the State of Delaware, (a) the Corporation hereby renounces all interest and expectancy that it otherwise would be entitled to have in, and all rights to be offered an opportunity to participate in, any business opportunity that from time to time may be presented to (i) any director, (ii) any stockholder, officer or agent of the Corporation, or (iii) any Affiliate (as defined in Section 8.03 herein) of any person or entity identified in the preceding clause (i) or (ii); (b) no stockholder and no director, in each case, that is not an employee of the Corporation or its subsidiaries, will have any duty to refrain from (i) engaging in a corporate opportunity in the same or similar lines of business in which the Corporation or its subsidiaries from time to time is engaged or proposes to engage or (ii) otherwise competing, directly or indirectly, with the Corporation or any of its subsidiaries; and (c) if any stockholder or any director, in each case, that is not an employee of the Corporation or its subsidiaries, acquires knowledge of a potential transaction or other business opportunity which may be a corporate opportunity both for such stockholder or such director or any of their respective Affiliates (as defined in Section 8.03 herein), on the one hand, and for the Corporation or its subsidiaries, on the other hand, such stockholder or director shall have no duty to communicate or offer such transaction or business opportunity to the Corporation or its subsidiaries and such stockholder or director may take any and all such transactions or opportunities for itself or offer such transactions or opportunities to any other person or entity. The preceding sentence of this Article X shall not apply to any potential transaction or business opportunity that is expressly offered to a director or employee of the Corporation or its subsidiaries, solely in his or her capacity as a director or employee of the Corporation or its subsidiaries.

(b) To the fullest extent permitted by the laws of the State of Delaware, no potential transaction or business opportunity may be deemed to be a corporate opportunity of the Corporation or its subsidiaries unless (a) the Corporation or its subsidiaries would be permitted to undertake such transaction or opportunity in accordance with this Amended and Restated Certificate of Incorporation, (b) the Corporation or its subsidiaries at such time have sufficient financial resources and are legally able to undertake such transaction or opportunity, (c) the Corporation or its subsidiaries have an interest or expectancy in such transaction or opportunity, and (d) such transaction or opportunity would be in the same or similar line of business in which the Corporation or its subsidiaries are then engaged or a line of business that is reasonably related to, or a reasonable extension of, such line of business.

Section 10.02. Liability. No stockholder and no director will be liable to the Corporation or its subsidiaries or stockholders for breach of any duty (contractual or otherwise) solely by reason of any activities or omissions of the types referred to in this Article X, except to the extent such actions or omissions are in breach of this Article X.

ARTICLE XI

Section 11.01. Exclusive Jurisdiction. Unless the Corporation, as authorized by the Board of Directors, consents in writing to the selection of one or more alternative forums, the

A-21

Court of Chancery of the State of Delaware shall, to the fullest extent permitted by applicable law, be the sole and exclusive forum for (a) any derivative action or proceeding brought on behalf of the Corporation, (b) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, (c) any action asserting a claim against the Corporation arising pursuant to any provision of the DGCL or this Amended and Restated Certificate of Incorporation or the Bylaws or (d) any action asserting a claim against the Corporation governed by the internal affairs doctrine, in each such case subject to said Court of Chancery determining that it has personal jurisdiction over the indispensable parties named as defendants therein, and if it has determined that it does not, subject to such indispensable party consenting to the personal jurisdiction of the Court of Chancery within ten days following such determination. Any person or entity purchasing or otherwise acquiring any interest in the shares of the Corporation’s capital stock shall be deemed to have notice of and consented to the provisions of this Article XI.

ARTICLE XII

Section 12.01. Amendments. The Corporation reserves the right to alter, amend, repeal or adopt any provision contained in this Amended and Restated Certificate of Incorporation, in the manner now or hereafter prescribed by the DGCL, and all rights conferred upon stockholders herein are granted subject to this reservation. Notwithstanding anything to the contrary contained in this Certificate of Incorporation, (a) regardless whether a lesser percentage may be permitted from time to time by applicable law, no provision of Section 5.02, Section 5.03, Section 5.04, Section 5.05, Section 6.01, Section 6.03, Article VII, Article VIII, Article IX, Article X, Article XI and this Article XII may be altered, amended or repealed in any respect, nor may any provision inconsistent therewith (including any provision in the Bylaws) be adopted, unless, in addition to any other vote required by this Amended and Restated Certificate of Incorporation or otherwise required by law, approved by the affirmative vote of the holders of at least 66 ⅔% of the Common Stock, voting together as a single class, (b) so long as any shares of Class B Common Stock remain outstanding, the Corporation may not amend, alter or repeal any provision of this Amended and Restated Certificate of Incorporation, or adopt one or more additional provisions whether by merger, consolidation or otherwise, in a manner which would materially and adversely affect any right, preference or privilege of the Class B Common Stock in a manner different than other holders of Common Stock without the affirmative vote of a majority of the votes entitled to be cast by holders of Class B Common Stock, voting as a separate class distinct from all other classes and series of the Corporation’s capital stock, (c) so long as any shares of Class C Common Stock remain outstanding, the Corporation may not amend, alter or repeal any provision of this Amended and Restated Certificate of Incorporation, or adopt one or more additional provisions whether by merger, consolidation or otherwise, in a manner which would materially and adversely affect any right, preference or privilege of the Class C Common Stock in a manner different than other holders of Common Stock without the affirmative vote of a majority of the votes entitled to be cast by holders of Class C Common Stock, voting as a separate class distinct from all other classes and series of the Corporation’s capital stock, and (d) so long as any shares of Class D Common Stock remain outstanding, the Corporation may not amend, alter or repeal any provision of this Amended and Restated Certificate of Incorporation, or adopt one or more additional provisions whether by merger, consolidation or otherwise, in a manner which would materially and adversely affect any right, preference or privilege of the Class D Common Stock in a manner different than other holders of

A-22

Common Stock without the affirmative vote of a majority of the votes entitled to be cast by holders of Class D Common Stock, voting as a separate class distinct from all other classes and series of the Corporation’s capital stock.

Section 12.02. Severability. If any provision or provisions of this Amended and Restated Certificate of Incorporation shall be held to be invalid, illegal or unenforceable as applied to any circumstance for any reason whatsoever: (a) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Amended and Restated Certificate of Incorporation (including, without limitation, each portion of any paragraph of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in any way be affected or impaired thereby and (b) the provisions of this Amended and Restated Certificate of Incorporation (including, without limitation, each such portion of any paragraph of this Amended and Restated Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable) shall be construed so as to permit the Corporation to protect its directors, officers, employees and agents from personal liability in respect of their good faith service to or for the benefit of the Corporation to the fullest extent permitted by law.

A-23