Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CNO Financial Group, Inc. | form8-k06302018managementd.htm |

Exhibit 99.1 2Q18 Financial and operating results for the period ended June 30, 2018 August 2, 2018 Unless otherwise specified, comparisons in this presentation are between 2Q17 and 2Q18. CNO Financial Group | 2017 Investor Day | June 5, 2017 1

Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press releases issued on August 1, 2018, our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 2

Non-GAAP Measures This presentation contains the following financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP): operating earnings measures; book value, excluding accumulated other comprehensive income (loss) per share; operating return measures; earnings before net realized investment gains (losses), fair value changes in embedded derivative liabilities, fair value changes and amendment related to the agent deferred compensation plan, other non- operating items, corporate interest expense and taxes; and debt to capital ratios, excluding accumulated other comprehensive income (loss). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 3

CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 4

Long-term Care Reinsurance Transaction CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 5

Executive Summary A transformative risk reduction transaction for CNO . Bankers Life has entered into an agreement with Wilton Re to cede ~$2.7 billion of long- term care reserves through 100% indemnity coinsurance – Represents 100% of Bankers Life legacy (prior to 2003) comprehensive and nursing home business – Comprising 51% of CNO’s statutory long-term care reserves – $825 million ceding commission paid to Wilton Re, financed from existing capital resources . Significant risk reduction, especially in severe stress scenarios . Culmination of a multi-year exploration of strategic alternatives . Wilton Re is a highly-rated and well-capitalized counterparty . Subject to regulatory approval and expected to close in 2018 . Step forward in achieving investment grade ratings CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 6

Key Transaction Details . $2.7 billion of statutory reserves to be ceded – Business ceded is the most volatile from an earnings and capital perspective . $825 million ceding commission funding: – ~$375 million of statutory reserves no longer required and immediate tax benefits – ~$175 million of released capital reflecting lower go-forward required capital – ~$275 million contribution from Holding Company . Reinsured block to be moved to the LTC in run-off segment starting with 3Q18 earnings . Expect to record a GAAP after-tax charge of approximately $650 million before year-end CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 7

Summary of Key Terms and Conditions . Bankers Life & Casualty Company (IL Domicile) to cede to Wilton Reassurance Company (MN domicile) . Domestic comfort trust established to hold assets backing 100% of the statutory liabilities plus an additional $500 million of over-collateralization – Collateral amount steps down by $62.5 million every 5 years – Over-collateralization as percentage of reserves is expected to increase over the life of the agreement – Strict investment guidelines with oversight and reporting requirements . CNO to continue administering the business for a 36-month transition period CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 8

Material Risk Reduction Under Stress Test Scenarios Bankers Life Long-term Care - Projected Inforce Cashflows Pre-Transaction Post-Transaction $50 $50 $0 $0 ($50) ($50) ($) Millions ($) Millions ($100) ($100) ($150) ($150) 2018 2023 2028 2033 2038 2043 2048 2018 2023 2028 2033 2038 2043 2048 Best Estimate 15% Morbidity Level Portfolio Compound Best Estimate 15% Morbidity Level Portfolio Compound CNO realizes material reduction in tail-risk Best Estimate – Current projection of inforce cashflows 15% Morbidity – Projected inforce cashflows with 15% higher claims experience in all years Level Portfolio – Projected inforce cashflows assuming investment portfolio rate drops to 5.25% permanently Compound – Projected inforce cashflows assuming 15% higher claims and permanent investment portfolio rate of 5.25% CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 9

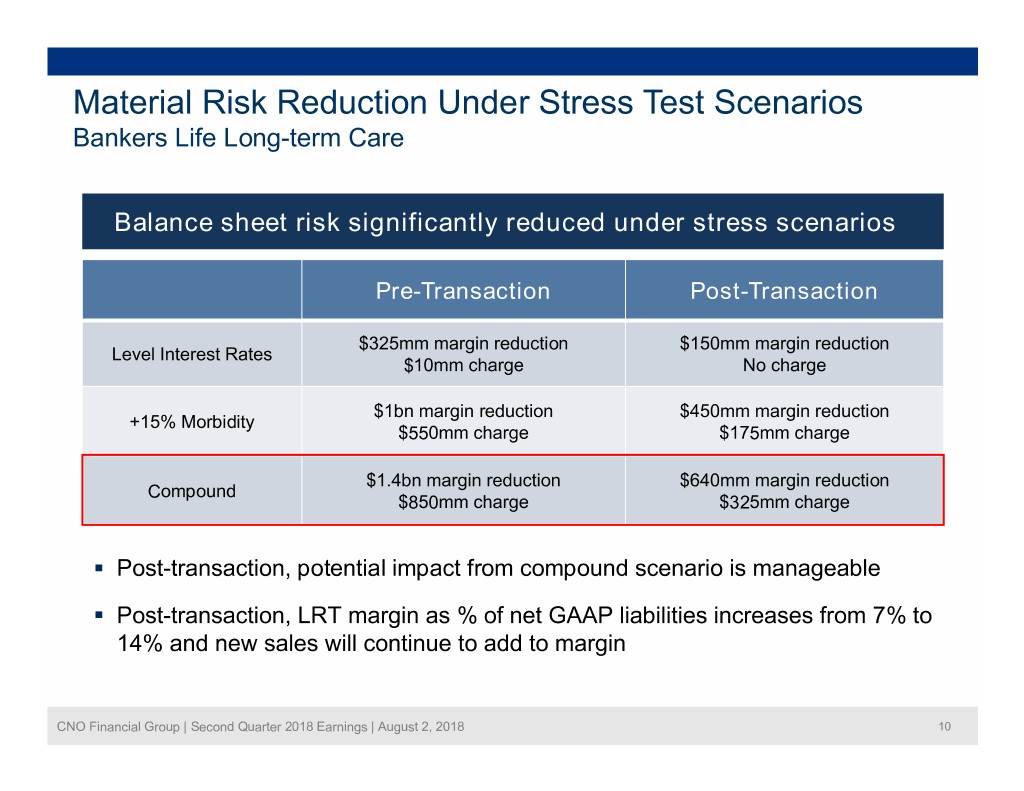

Material Risk Reduction Under Stress Test Scenarios Bankers Life Long-term Care Balance sheet risk significantly reduced under stress scenarios Pre-Transaction Post-Transaction $325mm margin reduction $150mm margin reduction Level Interest Rates $10mm charge No charge $1bn margin reduction $450mm margin reduction +15% Morbidity $550mm charge $175mm charge $1.4bn margin reduction $640mm margin reduction Compound $850mm charge $325mm charge . Post-transaction, potential impact from compound scenario is manageable . Post-transaction, LRT margin as % of net GAAP liabilities increases from 7% to 14% and new sales will continue to add to margin CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 10

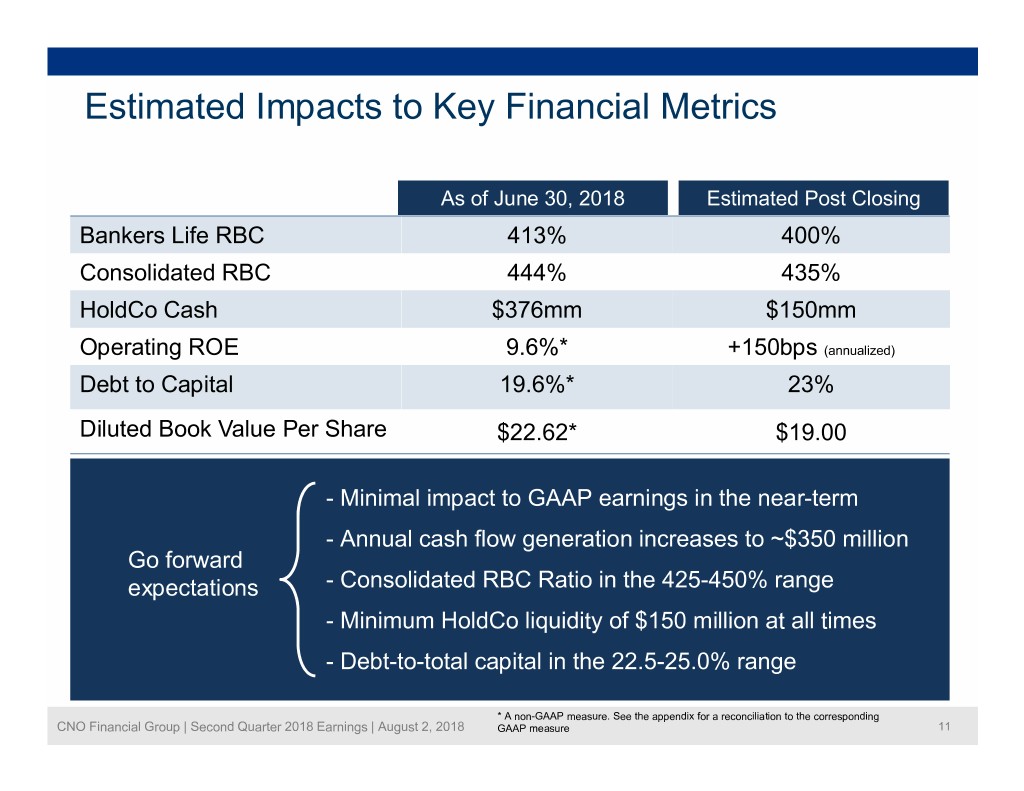

Estimated Impacts to Key Financial Metrics As of June 30, 2018 Estimated Post Closing Bankers Life RBC 413% 400% Consolidated RBC 444% 435% HoldCo Cash $376mm $150mm Operating ROE 9.6%* +150bps (annualized) Debt to Capital 19.6%* 23% Diluted Book Value Per Share $22.62* $19.00 - Minimal impact to GAAP earnings in the near-term - Annual cash flow generation increases to ~$350 million Go forward expectations - Consolidated RBC Ratio in the 425-450% range - Minimum HoldCo liquidity of $150 million at all times - Debt-to-total capital in the 22.5-25.0% range * A non-GAAP measure. See the appendix for a reconciliation to the corresponding CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 GAAP measure 11

Long-term Care at CNO Going Forward Inforce New Business Comfortable with retained business risk profile . Continue to focus new business on products with short benefit periods Percent of Policies by Benefit Period – Average benefit period for new sales is 60.0% 51.6% ~10 months 50.0% 42.9% Pre‐transaction Post‐transaction 40.0% 30.0% – CNO will cease selling LTC with 20.0% benefit periods longer than 3 years 7.7% 10.0% 4.8% 4.4% 2.8% 0.0% ≤ 1 year > 4 years excluding Lifetime Benefits . Future sales will continue to increase Lifetime Benefits earnings and reserve margins Reserve Composition* . Continue to reinsure 25% of new Pre Transaction Post Transaction business LTC LTC 25% 13% Life Fixed 14% Fixed Annuities Life Annuities 52% Health 12% 60% 13% Health 11% CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 * Reserves net of reinsurance 12

Closing Comments A transformative risk reduction transaction for CNO Reduces potential volatility on earnings and reserves • Represents 100% of Bankers Life legacy comprehensive and nursing home business Differentiated block of long-term care enabled CNO to execute at reasonable economic terms Wilton Re is a highly-rated and well-capitalized counterparty Significantly enhances the balance sheet strength of CNO Step forward in achieving investment grade ratings CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 13

Second Quarter 2018 Earnings Results CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 14

Quarter in Review . Continued strong earnings and capital results – Operating EPS up 9%, benefiting from tax reform – Book value per diluted share (excluding AOCI)1 of $22.62, up 3% sequentially . Diversified business model driving growth – 5 of 7 Growth Scorecard metrics up – Progress in agent force initiatives and expanded pilots . Returned $77 million to shareholders CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 1 A non-GAAP measure. See the Appendix for a reconciliation to the 15 corresponding GAAP measure.

Segment Update Results Key Initiatives – Total collected premiums up 2%, driven by – Reshape the agent force through annuities up 9% recruiting and retention – Annuity account values increased 5% – Improve success rate of new agents – Life and health NAP down 2% and 5%, respectively – Enhanced use of data for better underwriting results – Continued growth in BD/RIA key metrics – Fee revenue1 up 15% – Total average producing agents2 down 6% – Total collected premiums up 3%; – Worksite recruiting supplemental health up 3% – Geographic expansion – Life and health NAP up 2% – Product diversity – Total average producing agent2 count stable – Enhanced Web/digital sales – Total collected premiums up 2% capabilities – NAP up 5% – Improved sales efficiency 1 Fee revenue for prior periods revised to reflect the revenue recognition accounting policy that went into effect January 1, 2018 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 2 The average producing agent counts represent the average of the last 12 months producing agent counts. 16

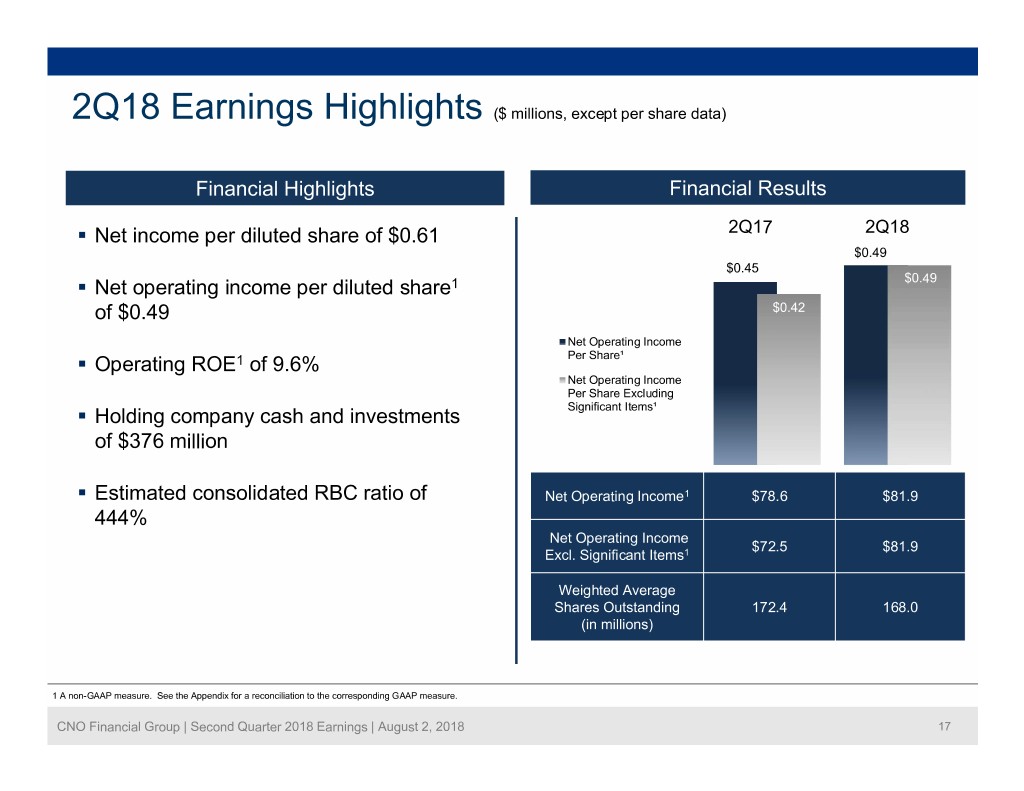

2Q18 Earnings Highlights ($ millions, except per share data) Financial Highlights Financial Results . Net income per diluted share of $0.61 2Q17 2Q18 $0.49 $0.45 . Net operating income per diluted share1 $0.49 of $0.49 $0.42 Net Operating Income . Operating ROE1 of 9.6% Per Share¹ Net Operating Income Per Share Excluding . Holding company cash and investments Significant Items¹ of $376 million . Estimated consolidated RBC ratio of Net Operating Income1 $78.6 $81.9 444% Net Operating Income $72.5 $81.9 Excl. Significant Items1 Weighted Average Shares Outstanding 172.4 168.0 (in millions) 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 17

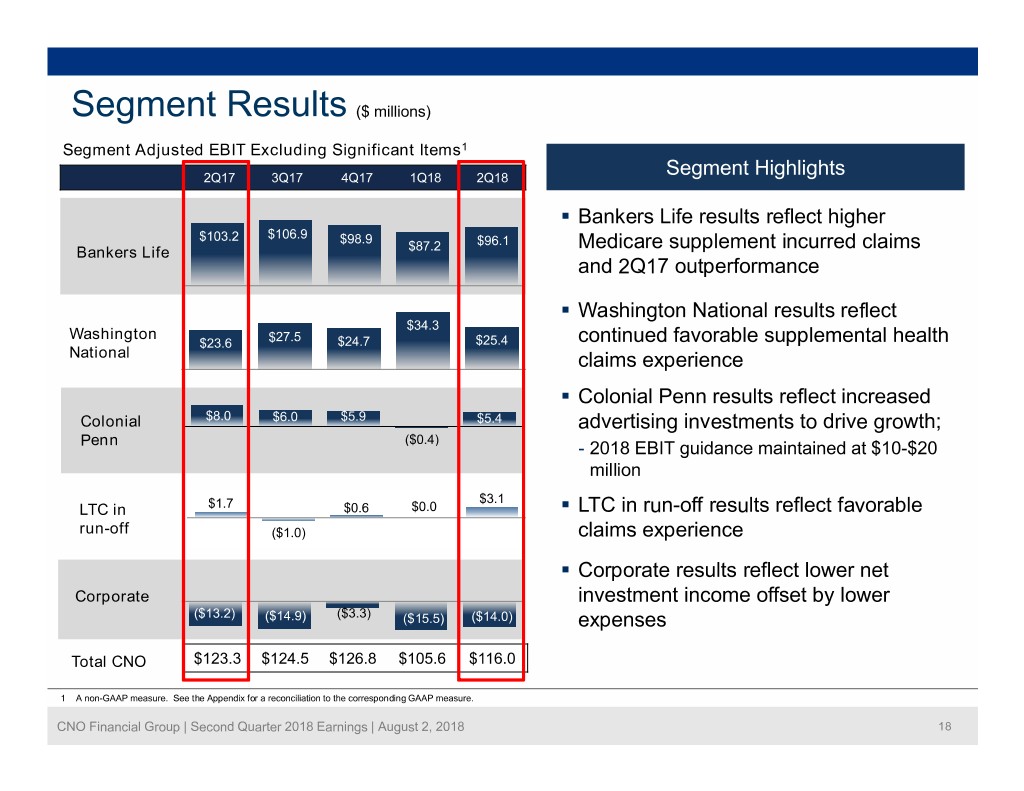

Segment Results ($ millions) Segment Adjusted EBIT Excluding Significant Items1 2Q17 3Q17 4Q17 1Q18 2Q18 Segment Highlights . Bankers Life results reflect higher $106.9 $103.2 $98.9 $96.1 Medicare supplement incurred claims Bankers Life $87.2 and 2Q17 outperformance . Washington National results reflect $34.3 Washington $27.5 $23.6 $24.7 $25.4 continued favorable supplemental health National claims experience . Colonial Penn results reflect increased Colonial $8.0 $6.0 $5.9 $5.4 advertising investments to drive growth; Penn ($0.4) - 2018 EBIT guidance maintained at $10-$20 million $3.1 LTC in $1.7 $0.6 $0.0 . LTC in run-off results reflect favorable run-off ($1.0) claims experience . Corporate results reflect lower net Corporate investment income offset by lower ($13.2) ($14.9) ($3.3) ($15.5) ($14.0) expenses Total CNO $123.3 $124.5 $126.8 $105.6 $116.0 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 18

Health Margins ($ millions) Bankers Life Medicare Bankers Life Long-term Care Washington National Supplement Benefit Ratio IABR1 Supplemental Health IABR1 $194 $195 $193 $193 $192 $146 $147 $149 $151 $152 $114 $113 $111 $110 $108 72.0% 73.3% 73.1% 70.4% 70.7% 76.5% 74.4% 60.4% 73.1% 72.6% 59.0% 72.9% 56.6% 56.6% 76.5% 54.4% 72.9% 73.1% 70.2% 66.2% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Earned Premium Earned Premium Earned Premium Reported Benefit Ratio Reported IABR Reported Benefit Ratio Adjusted Benefit Ratio² . Benefit ratio of 73.1%, in-line with . Adjusted IABR2 of 76.5%, due to . IABR1 of 56.6%, driven by favorable expectations higher incurred claims claims experience . Benefit ratio guidance maintained . Temporarily suspending IABR1 . IABR1 guidance lowered to at 71-74% for remainder of 2018 guidance due to announced 56-59% from 58-61% for reinsurance transaction remainder of 2018 1 Interest-adjusted benefit ratio (IABR); a non-GAAP measure. Refer to the Appendix for the corresponding GAAP measure. 2 Adjusted benefit ratio; long-term care IABR1 excluding impact of policyholder actions following rate increases and other one-time impacts CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 19

Wrap-up . Accelerate growth through execution and alignment – Investing in associates key to success . No change to go-forward capital deployment strategy . CNO is a unique investment opportunity CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 20

Questions and Answers CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 21

Appendix CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 22

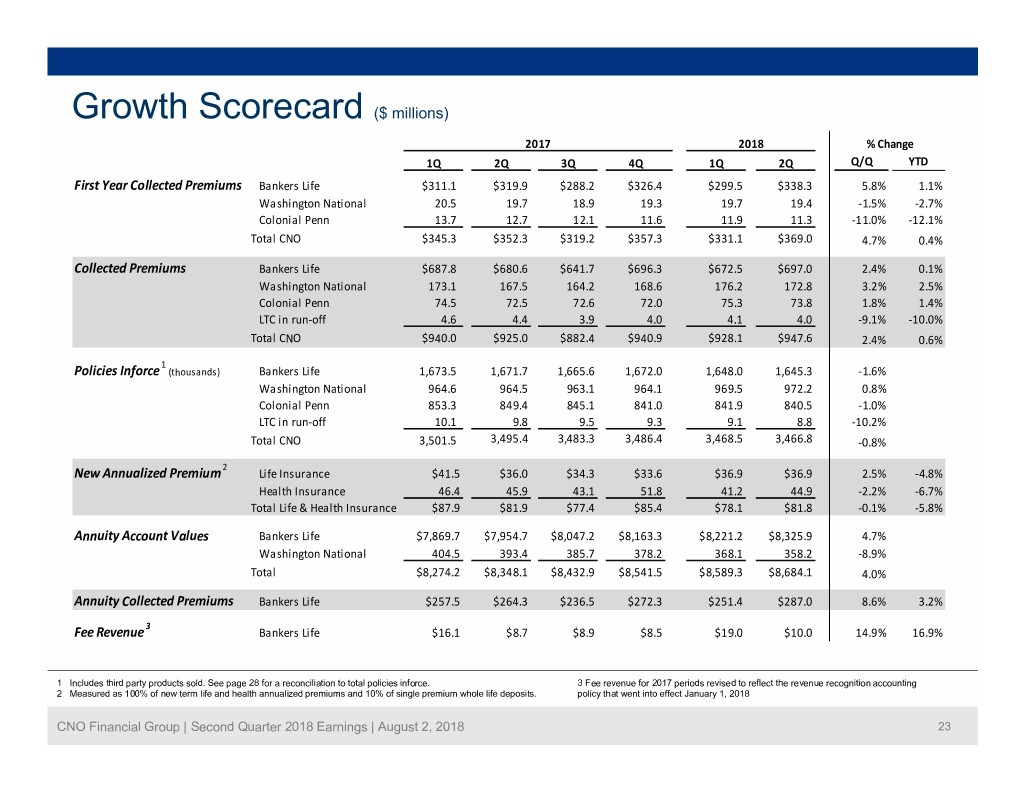

Growth Scorecard ($ millions) 1Q 2Q 3Q 4Q 1Q 2Q Q/Q YTD 2017 2018 % Change First Year Collected Premiums Bankers Life $311.1 $319.9 $288.2 $326.4 $299.5 $338.3 5.8% 1.1% Washington National 20.5 19.7 18.9 19.3 19.7 19.4 ‐1.5% ‐2.7% Colonial Penn 13.7 12.7 12.1 11.6 11.9 11.3 ‐11.0% ‐12.1% Total CNO $345.3 $352.3 $319.2 $357.3 $331.1 $369.0 4.7% 0.4% Collected Premiums Bankers Life $687.8 $680.6 $641.7 $696.3 $672.5 $697.0 2.4% 0.1% Washington National 173.1 167.5 164.2 168.6 176.2 172.8 3.2% 2.5% Colonial Penn 74.5 72.5 72.6 72.0 75.3 73.8 1.8% 1.4% LTC in run‐off 4.6 4.4 3.9 4.0 4.1 4.0 ‐9.1% ‐10.0% Total CNO $940.0 $925.0 $882.4 $940.9 $928.1 $947.6 2.4% 0.6% 1 Policies Inforce (thousands) Bankers Life 1,673.5 1,671.7 1,665.6 1,672.0 1,648.0 1,645.3 ‐1.6% Washington National 964.6 964.5 963.1 964.1 969.5 972.2 0.8% Colonial Penn 853.3 849.4 845.1 841.0 841.9 840.5 ‐1.0% LTC in run‐off 10.1 9.8 9.5 9.3 9.1 8.8 ‐10.2% Total CNO 3,501.5 3,495.4 3,483.3 3,486.4 3,468.5 3,466.8 ‐0.8% 2 New Annualized Premium Life Insurance $41.5 $36.0 $34.3 $33.6 $36.9 $36.9 2.5% ‐4.8% Health Insurance 46.4 45.9 43.1 51.8 41.2 44.9 ‐2.2% ‐6.7% Total Life & Health Insurance $87.9 $81.9 $77.4 $85.4 $78.1 $81.8 ‐0.1% ‐5.8% Annuity Account Values Bankers Life $7,869.7 $7,954.7 $8,047.2 $8,163.3 $8,221.2 $8,325.9 4.7% Washington National 404.5 393.4 385.7 378.2 368.1 358.2 ‐8.9% Total $8,274.2 $8,348.1 $8,432.9 $8,541.5 $8,589.3 $8,684.1 4.0% Annuity Collected Premiums Bankers Life $257.5 $264.3 $236.5 $272.3 $251.4 $287.0 8.6% 3.2% 3 Fee Revenue Bankers Life $16.1 $8.7 $8.9 $8.5 $19.0 $10.0 14.9% 16.9% 1 Includes third party products sold. See page 28 for a reconciliation to total policies inforce. 3 Fee revenue for 2017 periods revised to reflect the revenue recognition accounting 2 Measured as 100% of new term life and health annualized premiums and 10% of single premium whole life deposits. policy that went into effect January 1, 2018 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 23

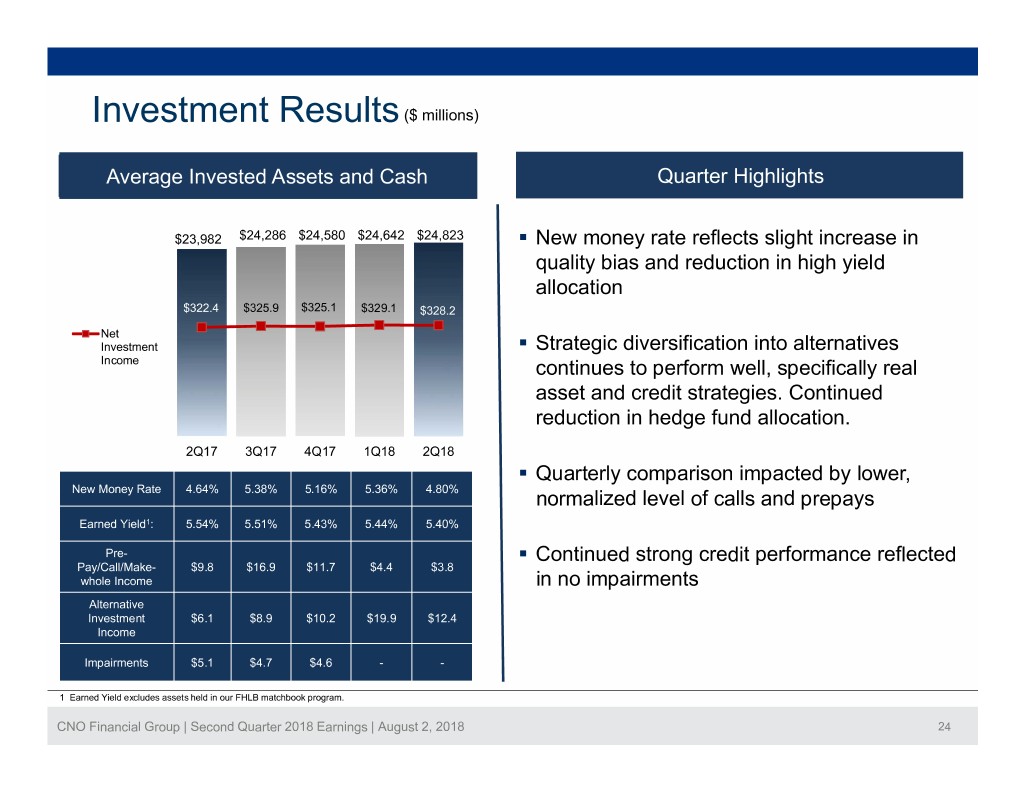

Investment Results ($ millions) Average Invested Assets and Cash Quarter Highlights $23,982 $24,286 $24,580 $24,642 $24,823 . New money rate reflects slight increase in quality bias and reduction in high yield allocation $322.4 $325.9 $325.1 $329.1 $328.2 Net Investment . Strategic diversification into alternatives Income continues to perform well, specifically real asset and credit strategies. Continued reduction in hedge fund allocation. 2Q17 3Q17 4Q17 1Q18 2Q18 . Quarterly comparison impacted by lower, New Money Rate 4.64% 5.38% 5.16% 5.36% 4.80% normalized level of calls and prepays Earned Yield1: 5.54% 5.51% 5.43% 5.44% 5.40% Pre- . Continued strong credit performance reflected Pay/Call/Make- $9.8 $16.9 $11.7 $4.4 $3.8 whole Income in no impairments Alternative Investment $6.1 $8.9 $10.2 $19.9 $12.4 Income Impairments $5.1 $4.7 $4.6 - - 1 Earned Yield excludes assets held in our FHLB matchbook program. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 24

Average Producing Agents1 Bankers Life Washington National 1st Yr 2nd Yr 3rd Yr + Total 1st Yr 2nd Yr 3rd Yr + Total 6/30/2018 1,805 436 1,835 4,076 274 87 321 682 3/31/2018 1,808 453 1,847 4,108 285 85 316 686 12/31/2017 1,845 463 1,863 4,171 288 85 314 687 9/30/2017 1,887 483 1,873 4,243 287 89 310 686 6/30/2017 1,941 503 1,880 4,324 285 91 308 684 3/31/2017 1,994 533 1,877 4,404 280 92 308 680 12/31/2016 2,037 567 1,875 4,479 279 90 308 677 9/30/2016 2,081 584 1,875 4,540 283 89 309 681 6/30/2016 2,123 598 1,882 4,603 284 88 307 679 1 Producing agent counts are determined at the end of each month and only include agents who submitted at least one policy in the month. The average producing agent counts represent the average of the last 12 months producing agent counts. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 25

2Q18 Holding Company Liquidity ($ millions) 2Q18 FY18 Cash and Investments Balance - Beginning $377.9 $396.6 Sources Dividends from Insurance Subsidiaries 51.5 71.5 Dividends from Non-insurance Subsidiaries 11.0 11.0 Management Fees 28.3 55.0 Surplus Debenture Interest 12.1 24.1 Earnings on Corporate Investments 4.4 7.9 Net Intercompany Settlements and Other 13.7 (5.0) Total Sources 121.0 164.5 Uses Share Repurchases 60.5 60.5 Interest Expense 21.4 22.3 Common Stock Dividends 16.5 31.9 Tax Payments 6.0 26.0 General Expenses & Other 18.5 40.5 Total Uses 122.9 181.2 Mark-to-market Changes in Investment Balances - (3.9) Cash and Investments Balance - June 30, 2018 $376.0 $376.0 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 26

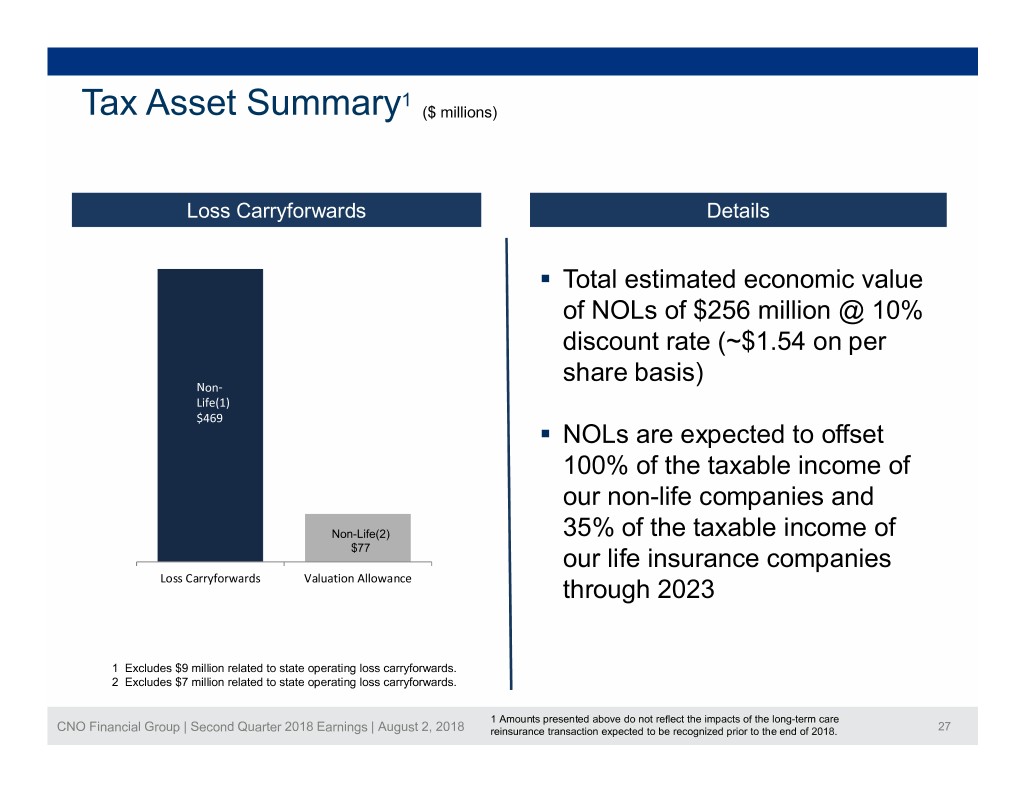

1 Tax Asset Summary ($ millions) Loss Carryforwards Details . Total estimated economic value of NOLs of $256 million @ 10% discount rate (~$1.54 on per share basis) Non‐ Life(1) $469 . NOLs are expected to offset 100% of the taxable income of our non-life companies and Non-Life(2) 35% of the taxable income of $77 our life insurance companies Loss Carryforwards Valuation Allowance through 2023 1 Excludes $9 million related to state operating loss carryforwards. 2 Excludes $7 million related to state operating loss carryforwards. 1 Amounts presented above do not reflect the impacts of the long-term care CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 reinsurance transaction expected to be recognized prior to the end of 2018. 27

Policies Inforce The following summarizes total policies inforce as of the end of the period indicated. 2Q17 3Q17 4Q17 1Q18 2Q18 Policies inforce: Bankers Life 1,515,445 1,510,160 1,500,573 1,485,235 1,482,002 Washington National 964,519 963,141 964,138 969,525 972,175 Colonial Penn 849,353 845,135 840,979 841,944 840,507 Long-term care in run-off 9,769 9,473 9,265 9,044 8,843 Total policies inforce 3,339,086 3,327,909 3,314,955 3,305,748 3,303,527 Third party policies inforce sold by Bankers Life agents 156,308 155,430 171,421 162,784 163,317 Total policies inforce and third party policies inforce sold by Bankers Life agents 3,495,394 3,483,339 3,486,376 3,468,532 3,466,844 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 28

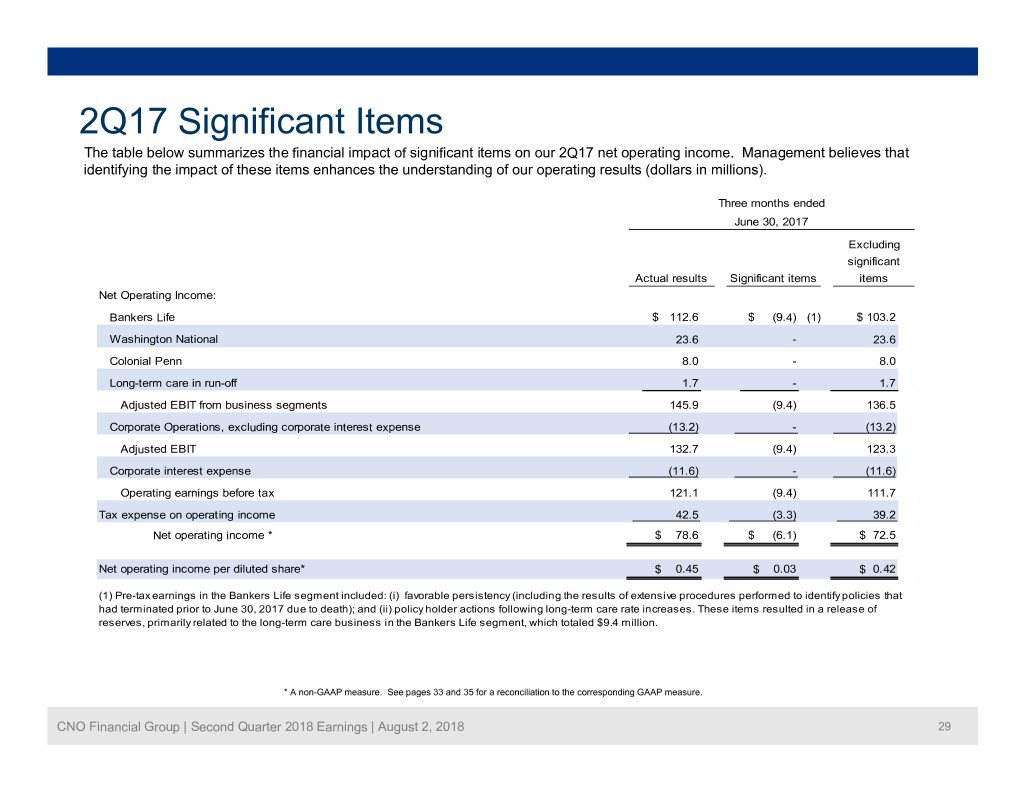

2Q17 Significant Items The table below summarizes the financial impact of significant items on our 2Q17 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended June 30, 2017 Excluding significant Actual results Significant items items Net Operating Income: Bankers Life $ 112.6 $ (9.4) (1) $ 103.2 23.6 - 23.6 Washington National 8.0 - 8.0 Colonial Penn 1.7 Long-term care in run-off 1.7 - 145.9 (9.4) 136.5 Adjusted EBIT from business segments (13.2) - (13.2) Corporate Operations, excluding corporate interest expense 132.7 (9.4) 123.3 Adjusted EBIT (11.6) - (11.6) Corporate interest expense 121.1 (9.4) 111.7 Operating earnings before tax 42.5 (3.3) 39.2 Tax expense on operating income Net operating income * $ 78.6 $ (6.1) $ 72.5 Net operating income per diluted share* $ 0.45 $ 0.03 $ 0.42 (1) Pre-tax earnings in the Bankers Life segment included: (i) favorable persistency (including the results of extensive procedures performed to identify policies that had terminated prior to June 30, 2017 due to death); and (ii) policy holder actions following long-term care rate increases. These items resulted in a release of reserves, primarily related to the long-term care business in the Bankers Life segment, which totaled $9.4 million. * A non-GAAP measure. See pages 33 and 35 for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 29

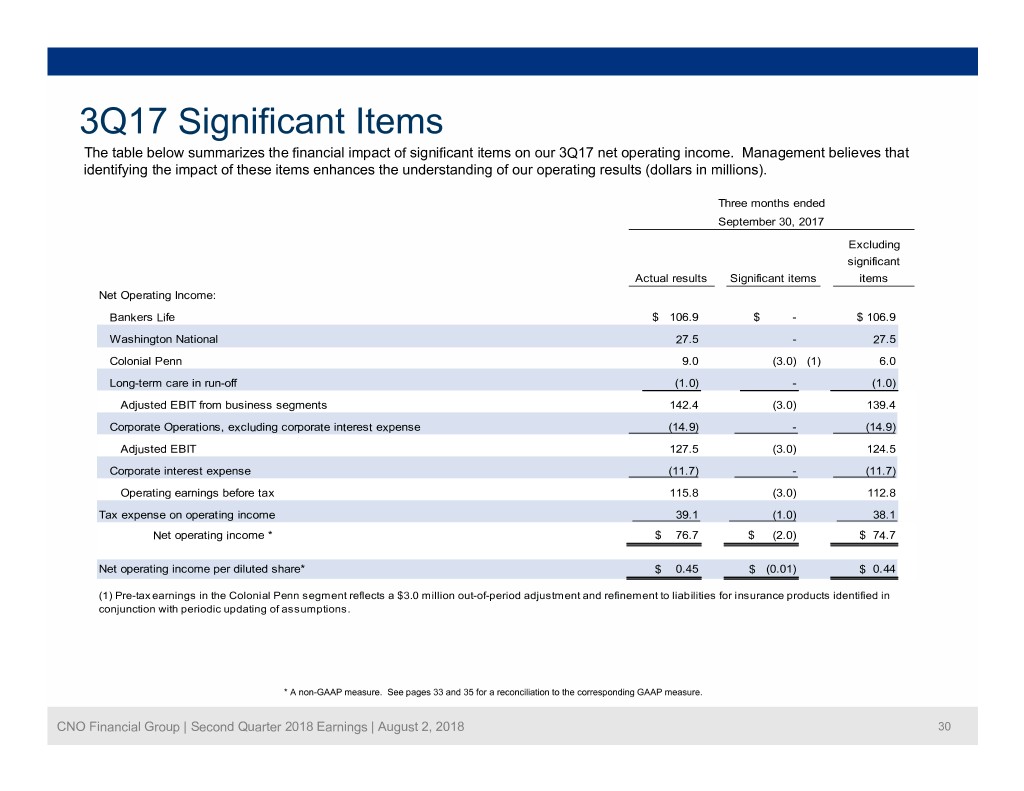

3Q17 Significant Items The table below summarizes the financial impact of significant items on our 3Q17 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended September 30, 2017 Excluding significant Actual results Significant items items Net Operating Income: Bankers Life $ 106.9 $ - $ 106.9 Washington National 27.5 - 27.5 Colonial Penn 9.0 (1)(3.0) 6.0 Long-term care in run-off (1.0) - (1.0) Adjusted EBIT from business segments 142.4 (3.0) 139.4 - (14.9) Corporate Operations, excluding corporate interest expense (14.9) 127.5 Adjusted EBIT (3.0) 124.5 (11.7) - (11.7) Corporate interest expense 115.8 (3.0) 112.8 Operating earnings before tax 39.1 (1.0) 38.1 Tax expense on operating income Net operating income * $ 76.7 $ (2.0) $ 74.7 Net operating income per diluted share* $ 0.45 $ (0.01) $ 0.44 (1) Pre-tax earnings in the Colonial Penn segment reflects a $3.0 million out-of-period adjustment and refinement to liabilities for insurance products identified in conjunction with periodic updating of assumptions. * A non-GAAP measure. See pages 33 and 35 for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 30

4Q17 Significant Items The table below summarizes the financial impact of significant items on our 4Q17 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended December 31, 2017 Excluding significant Actual results Significant items items Net Operating Income: Bankers Life $ 109.7 $ (10.8) (1) $ 98.9 Washington National 23.7 (1) 1.0 24.7 Colonial Penn 5.9 - 5.9 Long-term care in run-off 0.6 - 0.6 Adjusted EBIT from business segments 139.9 (9.8) 130.1 - (3.3) Corporate Operations, excluding corporate interest expense (3.3) 136.6 Adjusted EBIT (9.8) 126.8 (11.7) - (11.7) Corporate interest expense 124.9 (9.8) 115.1 Operating earnings before tax 39.1 (3.4) 35.7 Tax expense on operating income Net operating income * $ 85.8 $ (6.4) $ 79.4 Net operating income per diluted share* $ 0.51 $ (0.04) $ 0.47 (1) Pre-tax earnings in the Bankers Life and Washington National segments reflect $10.8 million of favorable impacts and $1.0 million of unfavorable impacts, respectively, from our comprehensive annual actuarial review of assumptions. * A non-GAAP measure. See pages 33 and 35 for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 31

1Q18 Significant Items The table below summarizes the financial impact of significant items on our 1Q18 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended March 31, 2018 Excluding significant Actual results Significant itemsitems Net Operating Income: Bankers Life $ 89.5 $ (2.3) (1) $ 87.2 Washington National 34.3 - 34.3 Colonial Penn (1.5) (2) 1.1 (0.4) - Long-term care in run-off - - 122.3 121.1 Adjusted EBIT from business segments (1.2) (15.5) - (15.5) Corporate Operations, excluding corporate interest expense 106.8 (1.2) 105.6 Adjusted EBIT (11.9) - Corporate interest expense (11.9) 94.9 (1.2) 93.7 Operating earnings before tax 21.0 20.7 Tax expense on operating income (0.3) Net operating income * $ 73.9 $ (0.9) $ 73.0 Net operating income per diluted share* $ 0.44 $ (0.01) $ 0.43 (1) Pre-tax earnings in the Bankers Life segment included the $2.3 million release of long-term care reserves (net of the reduction in insurance intangibles) due to the impact of policyholder actions following rate increases. (2) Pre-tax earnings in the Colonial Penn segment included a $1.1 million out-of-period adjustment which increased reserves on closed block payout annuities. * A non-GAAP measure. See pages 33 and 35 for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 32

Quarterly Earnings ($ millions) 2Q17 3Q17 4Q17 1Q18 2Q18 Bankers Life $ 112.6 $ 106.9 $ 109.7 $ 89.5 $ 96.1 Washington National 23.6 27.5 23.7 34.3 25.4 Colonial Penn 8.0 9.0 5.9 (1.5) 5.4 Long-term care in run-off 1.7 (1.0) 0.6 - 3.1 Adjusted EBIT from business segments 145.9 142.4 139.9 122.3 130.0 Corporate operations, excluding interest expense (13.2) (14.9) (3.3) (15.5) (14.0) Adjusted EBIT* 132.7 127.5 136.6 106.8 116.0 Corporate interest expense (11.6) (11.7) (11.7) (11.9) (11.9) Operating earnings before taxes 121.1 115.8 124.9 94.9 104.1 Tax expense on period income 42.5 39.1 39.1 21.0 22.2 Net operating income 78.6 76.7 85.8 73.9 81.9 Net realized investment gains (losses), net of related amortization 14.9 28.5 (2.0) (15.2) 10.6 Fair value changes in embedded derivative liabilities, net of related amortization (5.9) 2.3 5.5 25.1 8.3 Fair value changes related to the agent deferred compensation plan - (13.4) 1.2 - 11.0 Other (1.6) (3.3) (4.2) 3.3 (4.2) Non-operating income before taxes 7.4 14.1 0.5 13.2 25.7 Income tax expense (benefit): On non-operating income 2.6 5.0 0.1 2.8 5.4 Valuation allowance for deferred tax assets and other tax items - (15.0) 157.1 - - Net non-operating income (loss) 4.8 24.1 (156.7) 10.4 20.3 Net income (loss) $ 83.4 $ 100.8 $ (70.9) $ 84.3 $ 102.2 *Management believes that an analysis of earnings before net realized investment gains (losses), fair value changes in embedded derivative liabilities, fair value changes related to the agent deferred compensation plan, other non-operating items, corporate interest expense and taxes (“Adjusted EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) net realized investment gains (losses); (2) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals; (3) fair value changes related to the agent deferred compensation plan; (4) charges in the valuation allowance for deferred tax assets and other tax items; and (5) other non-operating items consisting primarily of earnings attributable to variable interest entities. The table above provides a reconciliation of Adjusted EBIT to net income. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 33

Information Related to Certain Non-GAAP Financial Measures The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, changes in the valuation allowance for deferred tax assets and other tax items and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 34

Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income(loss) applicable to common stock to net operating income (and related per-share amounts) is as follows (dollars in millions, except per-share amounts): 2Q17 3Q17 4Q17 1Q18 2Q18 Net income(loss) applicable to common stock $ 83.4 $ 100.8 $ (70.9) $ 84.3 $ 102.2 Non-operating items: Net realized investment (gains) losses, net of related amortization (14.9) (28.5) 2.0 15.2 (10.6) Fair value changes in embedded derivative liabilities, net of related amortization 5.9 (2.3) (5.5) (25.1) (8.3) Fair value changes related to the agent deferred compensation plan - 13.4 (1.2) - (11.0) Other 1.6 3.3 4.2 (3.3) 4.2 Non-operating income before taxes (7.4) (14.1) (0.5) (13.2) (25.7) Income tax (expense) benefit: On non-operating (income) loss (2.6) (5.0) (0.1) (2.8) (5.4) Valuation allowance for deferred tax assets and other tax items - 15.0 (157.1) - - Net non-operating (income) loss (4.8) (24.1) 156.7 (10.4) (20.3) Net operating income (a non-GAAP financial measure) $ 78.6 $ 76.7 $ 85.8 $ 73.9 $ 81.9 Per diluted share: Ne t incom e (loss) $ 0.48 $ 0.59 $ (0.42) $ 0.50 $ 0.61 Net realized investment (gains) losses (net of related amortization and taxes) (0.06) (0.11) 0.01 0.07 (0.05) Fair value changes in embedded derivative liabilities (net of related amortization and taxes) 0.02 (0.01) (0.02) (0.12) (0.04) Fair value changes related to the agent deferred compensation plan (net of taxes) - 0.05 (0.01) - (0.05) Valuation allowance for deferred tax assets and other tax items - 0.01 (0.09) 0.02 0.94 0.01 - (0.01) - 0.02 OtherNet operating income (a non-GAAP financial measure) $ 0.45 $ 0.45 $ 0.51 $ 0.44 $ 0.49 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 35

Information Related to Certain Non-GAAP Financial Measures A reconciliation of operating income and shares used to calculate basic and diluted operating earnings per share is as follows (dollars in millions, except per-share amounts, and shares in thousands): 2Q17 3Q17 4Q17 (a) 1Q18 2Q18 Operating income$ 78.6 $ 76.7 $ 85.8 $ 73.9 $ 81.9 Weighted average shares outstanding for basic earnings per share 170,556 168,684 167,428 167,060 166,098 Effect of dilutive securities on weighted average shares: Stock options, restricted stock and performance units 1,796 2,298 - 2,617 1,880 Weighted average shares outstanding for diluted earnings per share 172,352 170,982 167,428 169,677 167,978 Net operating income per diluted share$ 0.45 $ 0.45 $ 0.51 $ 0.44 $ 0.49 (a) Equivalent common shares of 2,750 were not included in the diluted weighted average shares outstanding due to the net loss recognized in 4Q17. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 36

Information Related to Certain Non-GAAP Financial Measures Book value per diluted share Book value per diluted share reflects the potential dilution that could occur if outstanding stock options were exercised, restricted stock and performance units were vested and convertible securities were converted. The dilution from options, restricted shares and performance units is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the closing market price on the last day of the period. In addition, the calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments. Management believes this adjustment to the December 31, 2017 non- GAAP measure is useful because it removes the tax effects stranded in accumulated other comprehensive income as a result of accounting rules which require the effects of the Tax Reform Act on deferred tax balances to be recorded in earnings, even if the balance was originally recorded in accumulated other comprehensive income. A reconciliation from book value per share to book value per diluted share, excluding accumulated other comprehensive income (loss) is as follows (dollars in millions, except per share amounts): 2Q17 3Q17 4Q17 1Q18 2Q18 Total shareholders' equity$ 4,779.3 $ 4,881.7 $ 4,847.5 $ 4,617.2 $ 4,454.9 Shares outstanding for the period 169,018,890 167,762,323 166,857,931 167,354,255 164,433,085 Book value per share$ 28.28 $ 29.10 $ 29.05 $ 27.59 $ 27.09 Total shareholders' equity$ 4,779.3 $ 4,881.7 $ 4,847.5 $ 4,617.2 $ 4,454.9 Less accumulated other comprehensive income (894.5) (933.6) (1,212.1) (894.3) (700.2) Adjusted shareholders' equity excluding AOCI$ 3,884.8 $ 3,948.1 $ 3,635.4 $ 3,722.9 $ 3,754.7 Shares outstanding for the period 169,018,890 167,762,323 166,857,931 167,354,255 164,433,085 Dilutive common stock equivalents related to: Stock options, restricted stock and performance units 1,840,391 2,474,837 2,796,385 2,351,172 1,537,947 Diluted shares outstanding 170,859,281 170,237,160 169,654,316 169,705,427 165,971,032 Book value per diluted share (a non-GAAP financial measure)$ 22.74 $ 23.19 $ 21.43 $ 21.94 $ 22.62 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 37

Information Related to Certain Non-GAAP Financial Measures Interest-adjusted benefit ratios The interest-adjusted benefit ratio (a non-GAAP measure) is calculated by dividing the product's insurance policy benefits less imputed interest income on the accumulated assets backing the insurance liabilities by insurance policy income. Interest incomeis an important factor in measuring the performance of longer duration health products. The net cash flows generally cause an accumulation of amounts in the early years of a policy (accounted for as reserve increases), which will be paid out as benefits in later policy years (accounted for as reserve decreases). Accordingly, as the policies age, the benefit ratio will typically increase, but the increase in the change in reserve will be partially offset by the imputed interest income earned on the accumulated assets. The interest-adjusted benefit ratio reflects the effects of such interest income offset. Since interest income is an important factor in measuring the performance of these products, management believes a benefit ratio, which includes the effect of interest income, is useful in analyzing product performance. The interest-adjusted benefit ratio excluding the impact of rate increases and other one- time impacts eliminates the release of reserves due to the impact of policyholder actions following rate increases and other one-time impacts. (Dollars in millions) 2Q17 3Q17 4Q17 1Q18 2Q18 Bankers Life Long-term care benefit ratios Earned premium $ 113.7 $ 112.7 $ 111.1 $ 109.5 $ 108.2 Benefit ratio before imputed interest income on reserves 126.9% 134.2% 135.3% 133.4% 140.6% Interest-adjusted benefit ratio 66.2% 72.9% 73.1% 70.2% 76.5% Interest-adjusted benefit ratio, excluding the impact of reserve releases due to rate increases and other one-time impacts 74.4% 72.9% 73.1% 72.6% 76.5% Underwriting margin (earned premium plus imputed interest income on reserves less policy benefits)$ 38.4 $ 30.5 $ 29.9 $ 32.6 $ 25.4 Adjusted underwriting margin (excluding the impact of reserve releases due to rate increases and other one-time impacts) 29.0 30.5 29.9 30.0 25.4 Washington National Supplemental health benefit ratios Earned premium $ 146.3 $ 147.2 $ 149.4 $ 151.3 $ 151.8 Benefit ratio before imputed interest income on reserves 84.5% 83.2% 80.7% 78.3% 80.7% Interest-adjusted benefit ratio 60.4% 59.0% 56.6% 54.4% 56.6% Underwriting margin (earned premium plus imputed interest income on reserves less policy benefits)$ 57.9 $ 60.4 $ 64.8 $ 69.0 $ 65.8 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 38

Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes and amendment related to the agent deferred compensation plan, loss on reinsurance transaction, changes in the valuation allowance for deferred tax assets and other tax items, loss on extinguishment of debt and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non- GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals. Management also believes that an operating return, excluding significant items, is important as the impact of these items enhances the understanding of our operating results. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation. CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 39

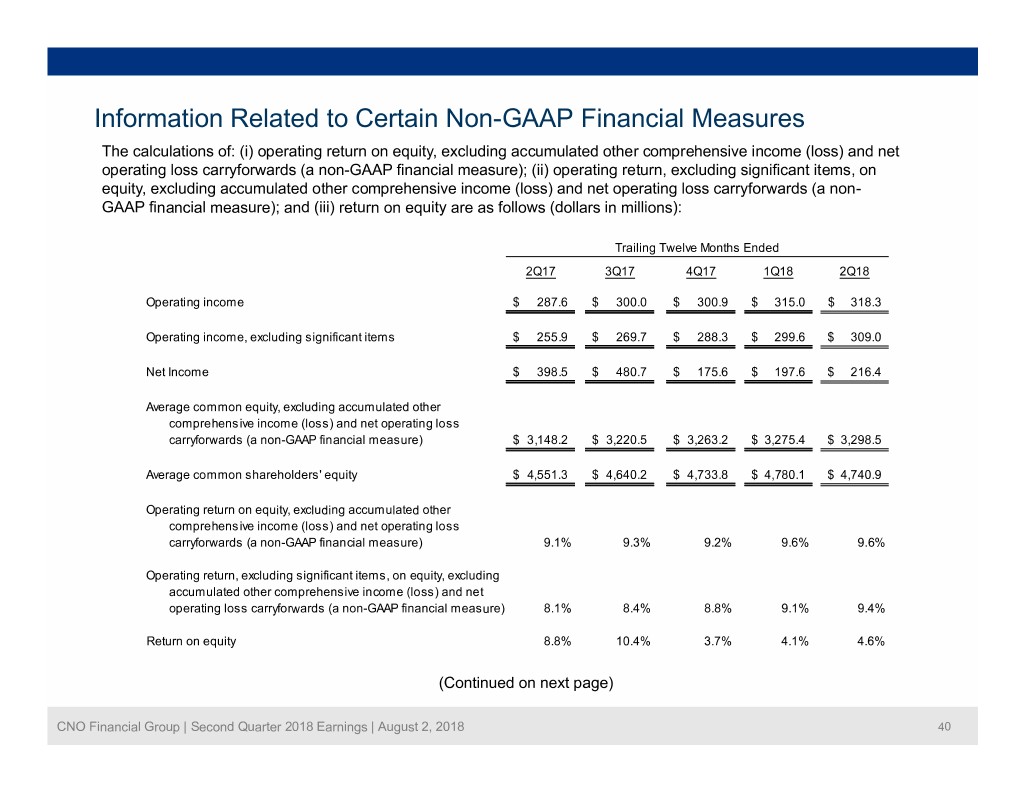

Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non- GAAP financial measure); and (iii) return on equity are as follows (dollars in millions): Trailing Twelve Months Ended 2Q17 3Q17 4Q17 1Q18 2Q18 Operating income$ 287.6 $ 300.0 $ 300.9 $ 315.0 $ 318.3 Operating income, excluding significant items$ 255.9 $ 269.7 $ 288.3 $ 299.6 $ 309.0 Net Income$ 398.5 $ 480.7 $ 175.6 $ 197.6 $ 216.4 Average common equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,148.2 $ 3,220.5 $ 3,263.2 $ 3,275.4 $ 3,298.5 Average common shareholders' equity$ 4,551.3 $ 4,640.2 $ 4,733.8 $ 4,780.1 $ 4,740.9 Operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 9.1% 9.3% 9.2% 9.6% 9.6% Operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 8.1% 8.4% 8.8% 9.1% 9.4% Return on equity 8.8% 10.4% 3.7% 4.1% 4.6% (Continued on next page) CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 40

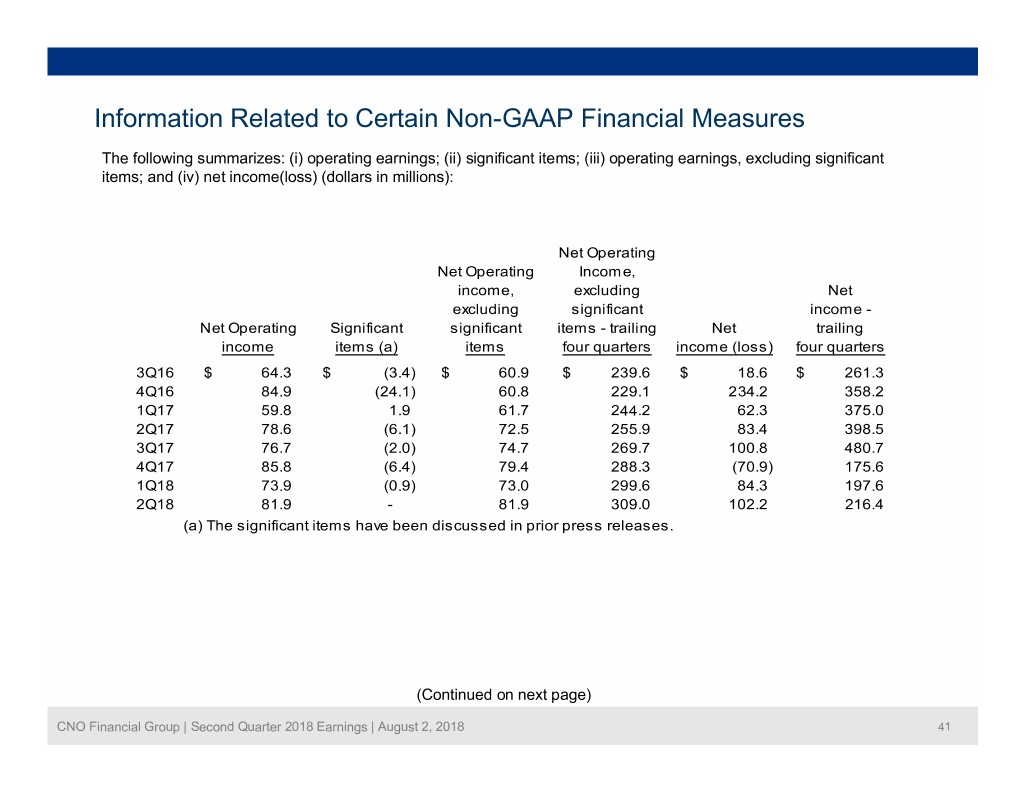

Information Related to Certain Non-GAAP Financial Measures The following summarizes: (i) operating earnings; (ii) significant items; (iii) operating earnings, excluding significant items; and (iv) net income(loss) (dollars in millions): Net Operating Net Operating Income, income, excluding Net excluding significant income - Net Operating Significant significant items - trailing Net trailing items (a) items four quarters income (loss) four quarters income 3Q16$ 64.3 $ (3.4) $ 60.9 $ 239.6 $ 18.6 $ 261.3 4Q16 84.9 (24.1) 60.8 229.1 234.2 358.2 1Q17 59.8 1.9 61.7 244.2 62.3 375.0 2Q17 78.6 (6.1) 72.5 255.9 83.4 398.5 3Q17 76.7 (2.0) 74.7 269.7 100.8 480.7 4Q17 85.8 (6.4) 79.4 288.3 (70.9) 175.6 1Q18 73.9 (0.9) 73.0 299.6 84.3 197.6 2Q18 81.9 - 81.9 309.0 102.2 216.4 (a) The significant items have been discussed in prior press releases. (Continued on next page) CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 41

Information Related to Certain Non-GAAP Financial Measures A reconciliation of pretax operating earnings (a non-GAAP financial measure) to net income is as follows (dollars in millions): Twelve Months Ended 2Q17 3Q17 4Q17 1Q18 2Q18 Pretax operating earnings (a non-GAAP financial measure)$ 447.3 $ 464.8 $ 454.7 $ 456.7 $ 439.7 Income tax expense (159.7) (164.8) (153.8) (141.7) (121.4) Operating return 287.6 300.0 300.9 315.0 318.3 Non-operating items: Net realized investment gains (losses), net of related amortization 19.4 36.5 49.3 26.2 21.9 Fair value changes in embedded derivative liabilities, net of related amortization 45.3 38.2 (2.5) 27.0 41.2 Fair value changes and amendment related to the agent deferred compensation plan 21.4 1.7 (12.2) (12.2) (1.2) Loss on reinsurance transaction (75.4) - - - - Other (2.8) (5.4) (8.8) (5.8) (8.4) Non-operating income before taxes 7.9 71.0 25.8 35.2 53.5 Income tax expense (benefit): On non-operating income 2.8 24.9 9.0 10.5 13.3 Valuation allowance for deferred tax assets and other tax items (105.8) (134.6) 142.1 142.1 142.1 Net non-operating income (loss) 110.9 180.7 (125.3) (117.4) (101.9) Net income $ 398.5 $ 480.7 $ 175.6 $ 197.6 $ 216.4 (Continued on next page) CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 42

Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 1Q16 2Q16 3Q16 4Q16 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 2,975.3 $ 3,010.1 $ 3,010.1 $ 3,209.5 Net operating loss carryforwards 710.8 668.3 628.2 655.0 Accumulated other comprehensive income 540.5 777.8 855.5 622.4 Common shareholders' equity$ 4,226.6 $ 4,456.2 $ 4,493.8 $ 4,486.9 1Q17 2Q17 3Q17 4Q17 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,236.6 $ 3,263.2 $ 3,335.0 $ 3,225.6 Net operating loss carryforwards 640.6 621.6 613.1 409.8 Accumulated other comprehensive income 729.6 894.5 933.6 1,212.1 Common shareholders' equity$ 4,606.8 $ 4,779.3 $ 4,881.7 $ 4,847.5 1Q18 2Q18 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,318.7 $ 3,366.0 Net operating loss carryforwards 404.2 388.7 Accumulated other comprehensive income 894.3 700.2 Common shareholders' equity$ 4,617.2 $ 4,454.9 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 43

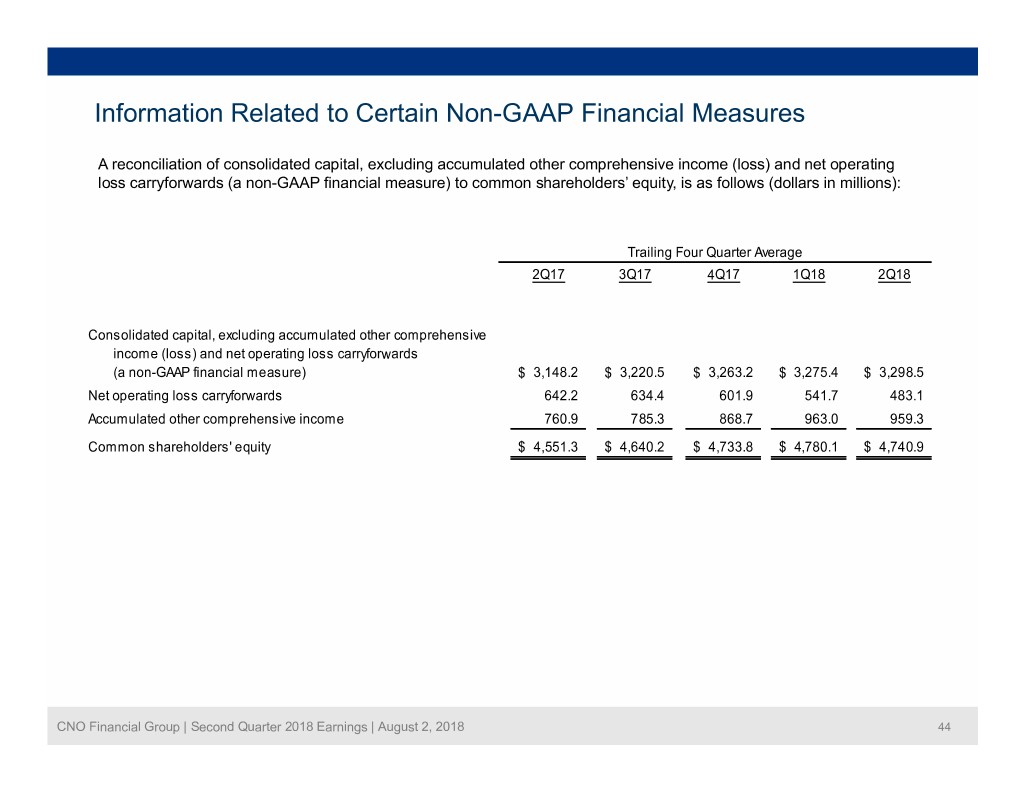

Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): Trailing Four Quarter Average 2Q17 3Q17 4Q17 1Q18 2Q18 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,148.2 $ 3,220.5 $ 3,263.2 $ 3,275.4 $ 3,298.5 Net operating loss carryforwards 642.2 634.4 601.9 541.7 483.1 Accumulated other comprehensive income 760.9 785.3 868.7 963.0 959.3 Common shareholders' equity$ 4,551.3 $ 4,640.2 $ 4,733.8 $ 4,780.1 $ 4,740.9 CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 44

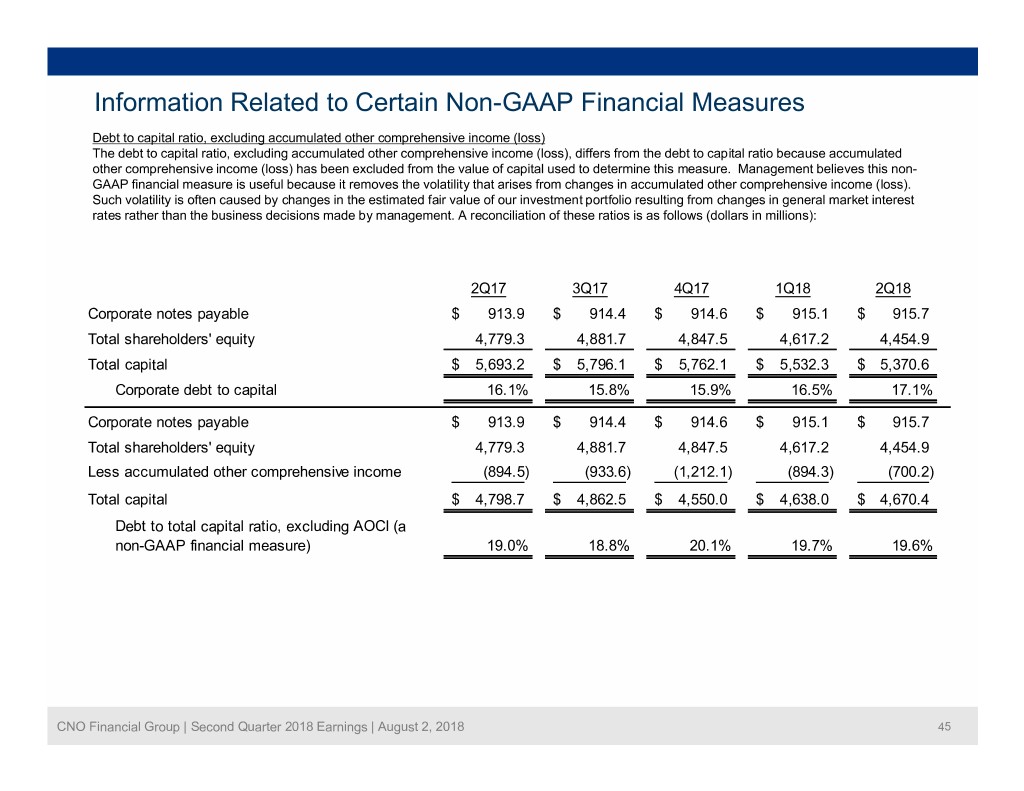

Information Related to Certain Non-GAAP Financial Measures Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non- GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows (dollars in millions): 2Q17 3Q17 4Q17 1Q18 2Q18 Corporate notes payable$ 913.9 $ 914.4 $ 914.6 $ 915.1 $ 915.7 Total shareholders' equity 4,779.3 4,881.7 4,847.5 4,617.2 4,454.9 Total capital$ 5,693.2 $ 5,796.1 $ 5,762.1 $ 5,532.3 $ 5,370.6 Corporate debt to capital 16.1% 15.8% 15.9% 16.5% 17.1% Corporate notes payable$ 913.9 $ 914.4 $ 914.6 $ 915.1 $ 915.7 Total shareholders' equity 4,779.3 4,881.7 4,847.5 4,617.2 4,454.9 Less accumulated other comprehensive income (894.5) (933.6) (1,212.1) (894.3) (700.2) Total capital$ 4,798.7 $ 4,862.5 $ 4,550.0 $ 4,638.0 $ 4,670.4 Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 19.0% 18.8% 20.1% 19.7% 19.6% CNO Financial Group | Second Quarter 2018 Earnings | August 2, 2018 45