Attached files

| file | filename |

|---|---|

| 8-K - TRINITY CAPITAL CORP | form8k_073118.htm |

1

Forward Looking Statements This presentation contains forward looking statements of Trinity Capital Corporation (“Trinity” or “the Company”) within the meaning of the Private Securities Litigation Reform Act of 1995, with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Words such as “expects,” “believes,” “estimates,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans, “seeks,” and variations of such words and similar expressions are intended to identify such forward-looking statements which are not statements of historical fact. These statements are based on current expectations, estimates, forecasts and projections and management assumptions about the future performance of the Company, as well as the businesses and markets in which it does and is expected to operate. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Actual results could differ materially from the results indicated in this presentation because of risks and uncertainties, known or unknown (many of which are beyond the Company’s control), including, but not limited to: (i) local and national economic conditions, (ii) interest rate changes, (iii) competition among financial institutions, (iv) credit quality, (v) loan production, (vi) the ability to attract low-cost deposits, (vii) ability of borrowers to repay their loans, (viii) ability to maintain capital requirements and adequate sources of liquidity, (ix) effects of or changes in accounting policies, (x) regulatory requirements and changes in regulatory legislation, and (xi) those other risks and uncertainties described in Item 1A “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017. You should not place undue reliance on any such forward looking statements. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update or revise any statement in light of new information or future events, except as required by law.All subsequent written and oral forward-looking statements made during this presentation attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

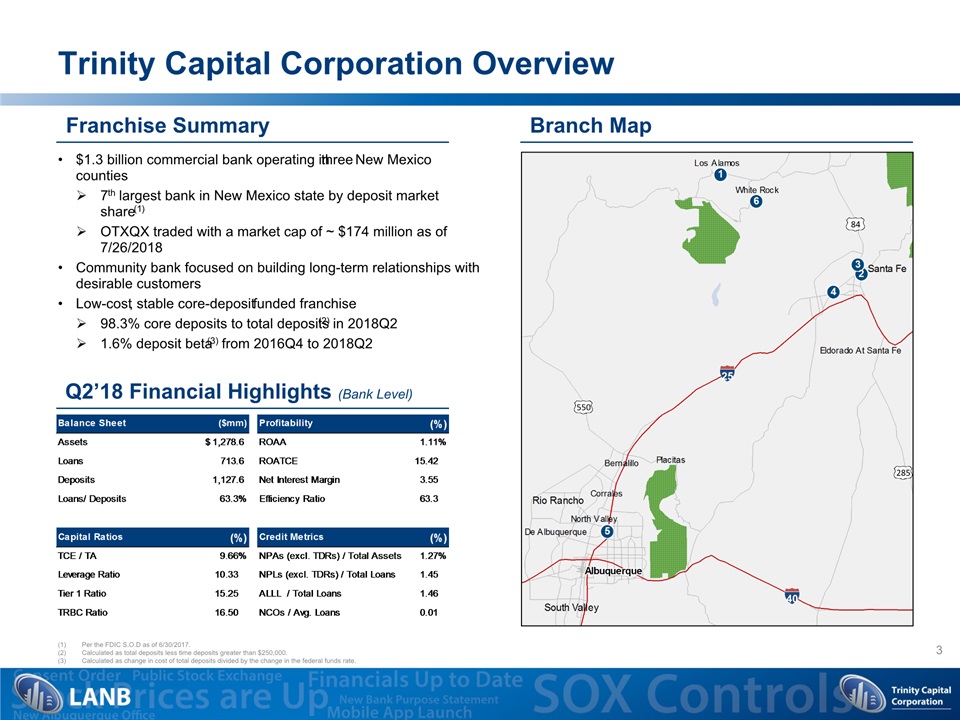

3 Trinity Capital Corporation Overview $1.3 billion commercial bank operating in three New Mexico counties7th largest bank in New Mexico state by deposit market share(1)OTXQX traded with a market cap of ~ $174 million as of 7/26/2018Community bank focused on building long-term relationships with desirable customersLow-cost, stable core-deposit funded franchise98.3% core deposits to total deposits(2) in 2018Q21.6% deposit beta(3) from 2016Q4 to 2018Q2 Franchise Summary Q2’18 Financial Highlights (Bank Level) Branch Map 25 40 550 285 84 Per the FDIC S.O.D as of 6/30/2017.Calculated as total deposits less time deposits greater than $250,000.Calculated as change in cost of total deposits divided by the change in the federal funds rate.

4 Executive Management Team Name Title Years of Experience Year Joining Trinity Recent Professional Experience and Education John S. Gulas President Chief Executive Officer 35 2014 Former President and Chief Executive Officer for Farmers National Bank in OhioJ.D. from the University of Toledo College of Law; B.A. in Political Science and History from the Youngstown State University Tom Dolan Executive Vice PresidentChief Financial Officer 36 2017 Former Chief Operating Officer of Anchor Bank in Madison, WisconsinMBA from the University of Chicago with a Concentration in Finance; B.S. in Economics from the Loyola University Eddie Ho Executive Vice PresidentChief Information Officer Chief Operation Officer 40 2014 Former Executive Vice President and Chief Information Officer at OmniAmerican Bank in Fort Worth, TexasMS in Computer Science from the North Dakota State University; Holds CIPP, CISA, CISM, CGEIT, and CISSP certifications; B.S. in Mathematics from the University of Wisconsin Joe Martony Executive Vice PresidentChief Risk Officer 31 2016 Former Executive Vice President and Chief Risk Officer for SKBHC Holdings LLC, Starbuck Bancshares, Inc. and American West Bank in WashingtonB.S. in Business Finance from the Indiana University Stan Sluder Executive Vice PresidentChief Lending Officer Director of Sales 29 2015 Former Market President and Chief Lending Officer for Peoples Bank in New MexicoB.S. in Communication Studies from the New Mexico State University Tom Lilly Executive Vice PresidentChief Credit Officer 26 2013 Former Senior Vice President and Chief Credit Officer for The National Bank in IowaGraduated from the School of Banking at the University of Wisconsin and completed certifications from the Commercial Lending School in Norman, Oklahoma, and the Consumer Lending School from the University of Wisconsin Liddie Martinez Senior Vice PresidentMarket President of Los Alamos 28 2016 Former Executive Director of Regional Development Corporation for Northern New MexicoCurrently serves on the board of the LANL Subcontractor Consortium, Think New Mexico, New Mexico Economic Development Rural Council, Northern New Mexico College Foundation, and the Los Alamos Commerce and Development Dion Silva Senior Vice PresidentMarket President of Santa Fe 17 2001 Former Vice President of Lending for TRIN through 2016; Currently the Market President of Santa Fe MBA in Finance and B.S. in Environmental engineering from the New Mexico State University

Our Turnaround Story 5 2010 2015 2018 2005 March 2009Trinity receives $35.5 million in TARP September 2012Bank enters into formal agreement with OCC January 2013Company receives subpoena from SEC opening a investigation into restatementSeptember 2013Trinity enters Written Agreement with Federal ReserveDecember 2013The Bank enters Consent Order with OCC (supersedes the formal agreement) May 2014John Gulas hired as CEO and PresidentDecember 2014Restated 2011YE and 2012Q1 and 2012Q2 financials September 2015Settled SEC investigation paying $1.5 million in fines January 2017Redeemed all TARP preferredMarch 2017Repaid all deferred interest on sub debtJune 2017Relocated Albuquerque BranchSeptember 2017Listed on OTCQXNovember 2017OCC Consent Order liftedCompleted $10.0 million rights offeringDecember 2017Remediated material weakness in financial reportingRemediated ESOP issuesSold MSRsAddressed tax reform July 2016Conversion of core systemsDecember 2016Raised $52.0 million of new capital February 2018Federal Reserve Written Agreement liftedMarch 2018Paid off $10.3 million of TruPs Other AchievementsReduced NIE/Avg. Assets ratio from 3.87% at 3/31/2017 to 2.98% at 3/31/2018Hired experienced, quality commercial lendersBeginning to see strong loan growth in Q1 & Q2 2018

6 New Mexico Deposit Market Share Los Alamos County Bernalillo County Santa Fe County Source: FDIC S.O.D as of 6/30/2017.

7 Balance Sheet Composition – Consolidated Asset Composition ($mm) Liability Composition ($mm) Total Assets: $1.3 billionYield on Interest Earning Assets: 3.62% Total Liabilities: $1.2 billionCost of Funds: 0.50% Note: As of March 31, 2018.

Loan Portfolio Summary – Bank Level Historic Trends Loan to Deposits (%) Loan Portfolio Composition 12/31/2013 6/30/2018 Note: Annual data as of or for the year ended December 31 of each respective year. Quarterly data as of or for the three months ended March 31, 2018 and June 30, 2018 respectively. 8

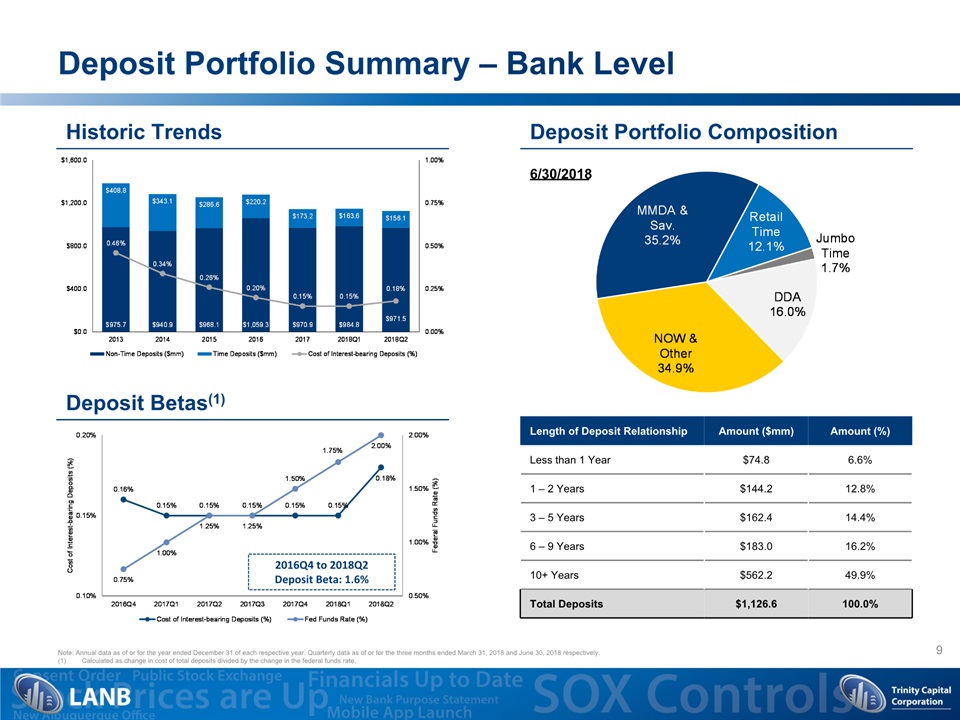

Deposit Portfolio Summary – Bank Level Historic Trends Deposit Betas(1) Deposit Portfolio Composition 6/30/2018 Length of Deposit Relationship Amount ($mm) Amount (%) Less than 1 Year $74.8 6.6% 1 – 2 Years $144.2 12.8% 3 – 5 Years $162.4 14.4% 6 – 9 Years $183.0 16.2% 10+ Years $562.2 49.9% Total Deposits $1,126.6 100.0% 2016Q4 to 2018Q2Deposit Beta: 1.6% Note: Annual data as of or for the year ended December 31 of each respective year. Quarterly data as of or for the three months ended March 31, 2018 and June 30, 2018 respectively.Calculated as change in cost of total deposits divided by the change in the federal funds rate. 9

10 Historic Profitability Metrics – Consolidated Return on Average Assets Net Interest Margin Return on Average Equity Efficiency Ratio Note: Annual data as of or for the year ended December 31 of each respective year. Quarterly data as of or for the three months ended March 31, 2018.

11 Historic Profitability Metrics – Bank Level Return on Average Assets Net Interest Margin Return on Average Equity Efficiency Ratio Note: Annual data as of or for the year ended December 31 of each respective year. Quarterly data as of or for the three months ended March 31, 2018 and June 30, 2018 respectively.

12 Credit Quality Metrics – Bank Level NPAs (excl. TDRs) to Total Assets ALLL to Total Loans NPLs (excl. TDRs) to Total Loans NCOs to Average Loans Note: Annual data as of or for the year ended December 31 of each respective year. Quarterly data as of or for the three months ended March 31, 2018 and June 30, 2018 respectively.

13 Capital Adequacy – Consolidated TCE / TA Tier 1 Capital Ratio Leverage Ratio Total Risk-Based Capital Ratio Note: Annual data as of December 31 of each respective year. Quarterly data as of March 31, 2018 and June 30, 2018 respectively.

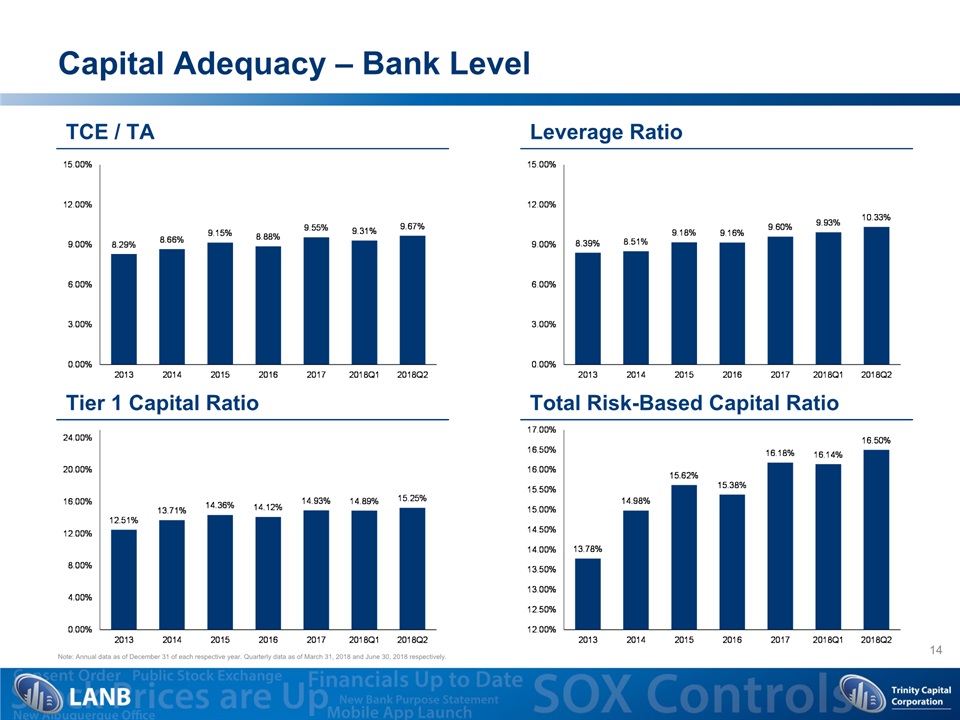

14 Capital Adequacy – Bank Level TCE / TA Tier 1 Capital Ratio Leverage Ratio Total Risk-Based Capital Ratio Note: Annual data as of December 31 of each respective year. Quarterly data as of March 31, 2018 and June 30, 2018 respectively.

15 Executing Our 2018 Business Plan

Appendix

17 Board of Directors Name Title Year Joining Trinity Board of Director Biographies James E. Goodwin Jr. Chairman 2013 Mr. James E. Goodwin is the Chairman of the Board of Trinity and Los Alamos National Bank (“Bank”) and has served as a member of the Board of Directors of Trinity since 2013. He was a Partner in the firm of PricewaterhouseCoopers LLP (“PwC”) and served as a member of the firm’s U.S. Board of Partners and Principals. He was a CPA in various states from 1973 until his retirement from PwC in 2009. John S. Gulas President Chief Executive OfficerDirector 2014 See “Executive Management Team” for details. Charles A. Slocomb Vice Chairman 1999 Mr. Charles A. Slocomb has been Vice-Chairman at Los Alamos National Bank since 2013. He has been Vice-Chairman at Trinity Capital Corp since 2013. He served as Program Manager at Los Alamos National Laboratory since March 2002. He retired from the Los Alamos National Laboratory in August 2004. Gregory A. Antonsen Director 2015 Mr. Gregory A. Antonsen, serves as Senior Vice President of Western/Central Region, Brokerage Manager of Western/Central Region and Qualifying Broker at Sotheby's International Realty, Inc. Mr. Antonsen has over 30 years of real estate experience, including eight years as the Founder of a boutique real estate firm in Hawaii, Antonsen Garrett & Associates, Ltd., specializing in the management and sale of distinctive properties. James F. Deutsch Director 2017 Mr. James F. Deutsch has been a Managing Director at Patriot Financial Manager, L.P. since April 2011 and serves as its Partner. Prior to joining Patriot, Mr. Deutsch served as the President and Chief Executive Officer at Team Capital Bank from November 2004 to April 12, 2011. He was Founder of Team Capital Bank. Mr. Deutsch was also one of the founding members of Team Capital. Jeffrey F. Howell Director 2002 Ms. Jeffrey F. Howell served as the Chief Executive Officer and President of Howell Fuel and Lumber Company, Inc., Headquartered in Wallkill, New York from 1998 to 2009. Ms. Howell serves as Treasurer of Los Alamos National Laboratory Foundation. She was the Founder and Managing Director of Howell Meyers Associates from 1997 to 2001. Samuel T. Hubbard Jr. Director 2001 Mr. Samuel T. Hubbard, Jr., also known as Tom, serves as the Chief Operating Officer of Homewise, Inc. Mr. Hubbard is Director of Trinity Capital Corporation and Los Alamos National Bank since November, 2017. Mr. Hubbard served as the Chairman of the Board of High Falls Brewing Company, LLC from 2001 to 2007 and again until 2009, and as President and Chief Executive Officer from January 2001 to 2007. Arthur B. Montoya Jr. Director 2001 Dr. Arthur B. Montoya, Jr., also known as art, DDS has been Secretary at Trinity Capital Corp. since 2015. Dr. Montoya has been Secretary of Los Alamos National Bank since 2012. Dr. Montoya has been a Director of Trinity Capital Corp. and its subsidiary Los Alamos National Bank since 2001. Dr. Montoya runs a successful dental practice in Los Alamos, New Mexico. Leslie Nathanson Juris Director 2015 Dr. Leslie Nathanson Juris, Ph.D. is the Founder and Managing Director of Nathanson/Juris Consulting which advises corporate executives on issues of strategy, leadership, culture and organizational and personal performance. Dr. Juris was founding Partner of RNW Consulting, Inc. From 1994 to January 1, 1999, Dr. Juris served as the Managing Director of Roberts, Nathanson & Wolfson Consulting, Inc. Anthony R. Scavuzzo Director 2015 Mr. Anthony R. Scavuzzo also known as Tony, C.F.A., has been a Director of Guaranty Federal Bancshares, Inc. since March 2018. He serves as a Principal of Castle Creek Capital LLC and Castle Creek Capital Partners IV, L.P. (“Castle Creek”). He joined the Castle Creek Capital LLC in 2009. Robert P. Worcester Director 1995 Mr. Worcester was a Director of Los Alamos National Bank since 1995 until May 30, 2018 and served as the Chairman of the Board of Directors from 2008 to 2012. Mr. Worcester served as the Vice Chairman of the Board from 2004 to 2008. Mr. Worcester retired in October 2014 after practicing law for 40 years. Mr. Worcester most recently practiced at the firm of Sommer Udall Sutin Law. He was previously the President and a 50% stockholder of Worcester & McKay, LLC which merged with Sommer Udall Sutin Law in 2013.

18 Financial Summary – Consolidated

19 Financial Summary – Bank Level