Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - Dolby Laboratories, Inc. | a10-qxq318singlesource.htm |

| EX-32.1 - EXHIBIT 32.1 - Dolby Laboratories, Inc. | exhibit321-section906certi.htm |

| EX-31.2 - EXHIBIT 31.2 - Dolby Laboratories, Inc. | exhibit312-section302certi.htm |

| EX-31.1 - EXHIBIT 31.1 - Dolby Laboratories, Inc. | exhibit311-section302certi.htm |

Exhibit 10.1 June 26th, 2018 Todd Pendleton 4711 Balboa Ave Encino, CA 91316 Dear Todd, It is my distinct pleasure to confirm to you our offer to join Dolby Laboratories, Inc. (“Dolby”) as Chief Marketing Officer, reporting to Kevin Yeaman, President & Chief Executive Officer. We will assume your date of hire to be Monday, July 9th, 2018. Your starting base salary will be $485,000 per year, payable bi-weekly (in accordance with our 9/80 work schedule) and subject to applicable tax withholdings. You are eligible to participate in the Executive Dolby Annual Incentive Plan (“Executive Plan”) for the fiscal year ending September 28, 2018. You are eligible to receive an Executive Plan target award of 65% of your annual base salary, prorated to your date of hire. Your actual bonus, which may be more or less than your target (for fiscal year ending September 28, 2018 it will not be less than 75% of your target), and will be based on the achievement of company goals, your individual performance and the terms of the Executive Plan. Subject to your continued employment with Dolby, your first incentive payout of the Executive Plan is anticipated to be in December 2018 for the fiscal year ending September 28, 2018. You will receive one-time new hire stock option and restricted stock unit (“RSU”) awards under the Dolby Laboratories, Inc. 2005 Stock Plan (the “Plan”) as follows: (i) a stock option to purchase 125,000 shares of Dolby’s Class A common stock, and (ii) 17,500 RSUs. The awards will have an effective date of the 15th day (or the next business day if the 15th day is not on a business day) of the calendar month on or following your date of hire. The stock options will have an exercise price equal to the fair market value of the Class A common stock as of the close of the market on the date of grant. The stock options and RSUs are also subject to the standard terms and conditions of the Plan and the execution of the applicable award agreements. This offer also includes a sign-on bonus of $300,000 (less all federal, state, and local tax withholdings) that will be paid to you in your first paycheck from Dolby. If you resign your employment within 24 months of receiving this payment (other than for Good Reason, as defined below), it will be repayable to Dolby immediately. If Dolby terminates your employment for reasons other than Cause, as defined below, the sign on bonus will not be repayable to Dolby. For purposes of this offer letter, “Good Reason” means the occurrence of any of the following events or conditions unless consented to by you: (i) a material reduction in your base salary to a level below that in effect immediately preceding such reduction (other than pursuant to a reduction that also is applied generally to employees of Dolby at your then level); or (ii) requiring you to be based at any place outside a 50-mile radius from your then job location or residence, except for reasonably required travel on business. For purposes of this offer letter, “Cause” means: (i) refusal or failure to act in accordance with any specific, lawful direction or order of Dolby; (ii) unfitness or Dolby Laboratories, Inc. 1275 Market Street, San Francisco, CA 94103 USA T +1 415 558 0200 DOLBY.COM

unavailability for service or unsatisfactory performance (other than as a result of disability); (iii) performance of any act or failure to perform any act in bad faith and to the detriment of Dolby; (iv) dishonesty, intentional misconduct or material breach of any agreement with Dolby; or (v) commission of a crime involving dishonesty, breach of trust, or physical or emotional harm to any person. Please be advised that your sign-on bonus will be subject to federal and state taxation. For specific tax information, please refer to the IRS website or contact your tax advisor. Dolby will also provide you with relocation benefits as outlined in the attached relocation addendum. Please be advised that where relocation-related expenses are deemed taxable per IRS & state regulations, Dolby will pay for the related federal & state taxes at current supplemental tax rates on your behalf. The taxes paid by Dolby and any taxable relocation expenses will be reported on your W-2. For specific tax information, please refer to the IRS website or contact your tax advisor. As a full-time employee of Dolby, you will be eligible to participate in our comprehensive benefits program. As part of your benefits package, you will initially accrue Personal Time Off (PTO) at a rate of 4.62 hours per full pay period (120 hours per year). Additionally, you will receive 40 hours per year, up to a maximum of 120 hours, in a Reserve Illness Account (RIA) on January 1st (a prorated number of hours will be added for calendar year 2018 upon hire). You will also be eligible for Dolby’s designated paid holidays. You will be eligible to enroll in Dolby’s health plan(s) on the first day of your employment. You will also be eligible to participate in our 401(k) Plan (the “Dolby Laboratories, Inc. Retirement Plan”) as soon as administratively feasible following your date of hire. The employment relationship between you and Dolby is one of employment “at-will” with either party having the right to terminate the relationship at any time, with or without cause. Our employment at-will relationship can only be modified by a written agreement signed by Dolby’s President. By signing this offer of employment as set forth below, you acknowledge that this offer of employment is contingent upon completion of the four factors noted below prior to or on your first day of employment. The documents noted in factors 1) & 2) will be sent to you electronically. 1. That you execute a Confidential Information and Invention Assignment Agreement upon acceptance of our offer of employment. 2. That you sign the Acknowledgement of Receipt Form to acknowledge that you have received and read the following: (a) Dolby Laboratories, Inc. Code of Business Conduct and Ethics (the “Code”); (b) Dolby Laboratories, Inc. Insider Trading Compliance Program (the “Insider Trading Policy”); (c) Dolby Laboratories, Inc. Anticorruption Policy (the “Anticorruption Policy”); and (d) Dolby Laboratories, Inc. Policy Regarding Reporting of Financial and Accounting Concerns (the “Policy Regarding Reporting of Financial and Accounting Concerns”). -2-

3. That on your first day of employment, you produce documentation that verifies your eligibility to be legally employed in the United States. This documentation generally consists of any combination of documents listed on the enclosed Employment Eligibility Verification (I-9) Form. This documentation must be presented to us on your first working day. As needed, Dolby will sponsor non-immigrant visas for you and your dependents to the extent of your eligibility. 4. That a pre-employment background and reference check is completed to our satisfaction. Please accept this offer by signing below and returning it to my attention no later than Tuesday, June 26th, 2018. We very much hope that you will accept our offer, but if we do not receive your acceptance by that date, this offer will expire. We feel that you can make a significant contribution to the growth and future of Dolby and we look forward to welcoming you to our team! Sincerely, /s/ Linda Rogers Linda Rogers Senior Vice President, Human Resources ************************************************************************ I have read, understand, and accept the offer of employment as stated above: /s/ Todd Pendleton 27 June 2018 Todd Pendleton Date -3-

Todd Pendleton Your new role requires you to relocate from Los Angeles, CA to San Francisco, CA, USA with your immediate family (other than adult children) no later than 7/30/2018, with the understanding that the sale of your current home may not occur until the end of 2019. Below is a summary of the relocation benefits Dolby will provide to assist you with your move to the San Francisco bay area. Relocation Allowance - A one-time relocation allowance of $15,000 (gross) will be provided to cover all miscellaneous relocation expenses, and will be paid with your first paycheck from Dolby, Laboratories, Inc. Additional Flights - Dolby will reimburse you and your spouse for one round trip (3 days/2 nights) back to your former place of residence to attend to any remaining tasks associated with your move. Transportation - One-way, coach/economy class flight will be provided for you and your accompanying dependents from Los Angeles to San Francisco in accordance with Dolby’s Travel and Expense Policy. This will include reimbursing you for the cost of shipping excess baggage on the flight, up to a maximum of 50lbs (23kg) per traveler, not to exceed $500. This allowance is in addition to the airline’s standard baggage entitlement. Shipment of Household Goods - Dolby will assist you in contracting a relocation company to move your household belongings and two automobiles from Los Angeles to San Francisco. Our relocation vendor will conduct a personalized assessment of your relocation needs within a few days of signing this offer Temporary Housing - Dolby will provide temporary housing for you and your family for a period of 90 up to 270 days Home Search - You will be provided with two house hunting trips for you and your spouse (4 days/3 nights each trip) to the San Francisco bay area including accommodations and flights. Rental Car- You will be reimbursed for up to 14 days for a car rental in San Francisco Home Sale Assistance/New Home Closing Cost - Dolby will reimburse customary home selling closings costs, up to 8% of the sale price of your home. In addition, should you choose to purchase a home in the San Francisco bay area upon your relocation, Dolby will reimburse customary new home closing costs up to a maximum of 2%, not to exceed $50,000 of your loan amount. This assistance is subject to the terms contained in the attached document, “Relocation Assistance, Clarification of Policy”. Duplicate Mortgage - You will be reimbursed duplicate mortgage payments for a maximum of 30 days All the relocation monies will be repayable to Dolby should you voluntarily end your employment within twenty four (24) months from your hire date. Also, please be advised that some or all of the monies, including your sign-on bonus, will be subject to federal and state taxation. Gross-ups will be applied for relocation-related items provided by Dolby that are taxable to you. For specific tax information, please refer to the IRS website or contact your tax advisor. In order to comply with various tax laws, including section 409A of the Internal Revenue Code, Dolby and you agree to structure these relocation benefits in a manner intended to avoid subjecting

you to tax under section 409A. In furtherance of this goal, a maximum of $250,000 will be paid or reimbursed for expenses incurred in 2018. A maximum of $200,000 will be paid or reimbursed for expenses incurred in 2019, exclusive of your home selling expenses (which also will be reimbursed in 2019). All relocation expenses must be reasonable and will be subject to the Company’s relocation policy applicable to senior executives as in effect from time to time. You must submit reasonable documentation of the expenses promptly after they are incurred but in no event later than January 31, 2019 for expenses incurred in 2018 and December 31st , 2019 for expenses incurred in 2019. Reimbursement of eligible expenses generally will be made within forty-five (45) days after Executive’s submission of the required documentation but in all cases no later than March 15, 2019 (for expenses incurred in 2018) or March 15, 2020 (for expenses incurred in 2019 and home selling expenses). /s/ Todd Pendleton 27 June 2018 Todd Pendleton Date -2-

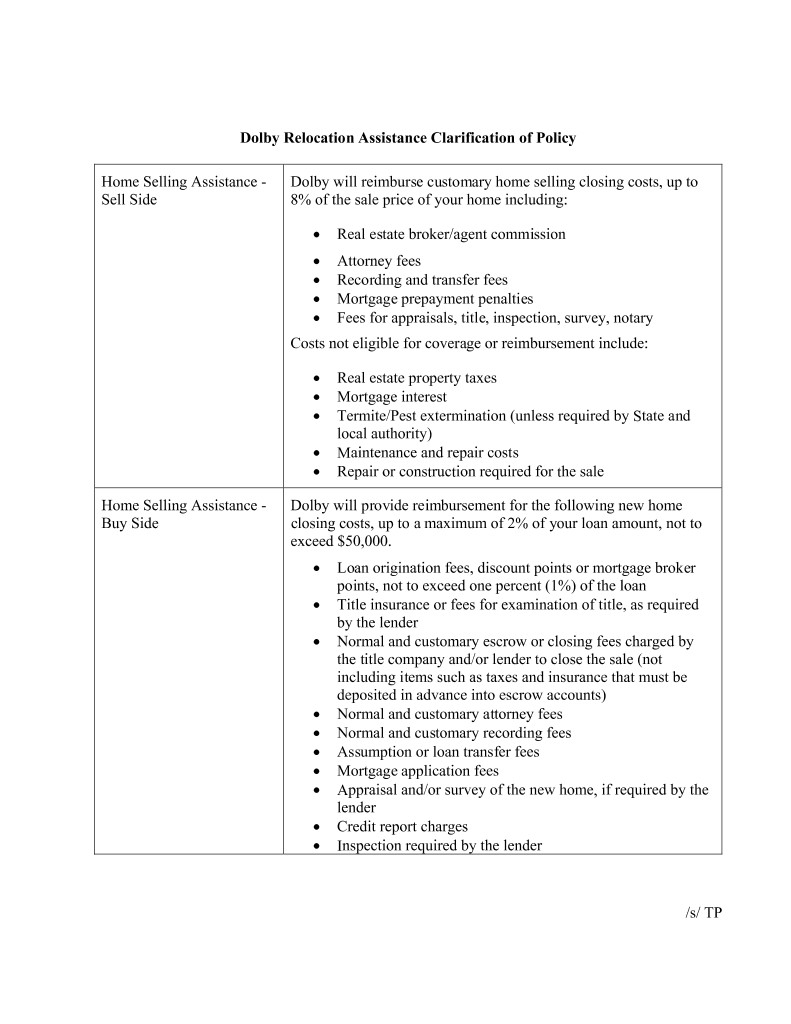

Dolby Relocation Assistance Clarification of Policy Home Selling Assistance - Dolby will reimburse customary home selling closing costs, up to Sell Side 8% of the sale price of your home including: Real estate broker/agent commission Attorney fees Recording and transfer fees Mortgage prepayment penalties Fees for appraisals, title, inspection, survey, notary Costs not eligible for coverage or reimbursement include: Real estate property taxes Mortgage interest Termite/Pest extermination (unless required by State and local authority) Maintenance and repair costs Repair or construction required for the sale Home Selling Assistance - Dolby will provide reimbursement for the following new home Buy Side closing costs, up to a maximum of 2% of your loan amount, not to exceed $50,000. Loan origination fees, discount points or mortgage broker points, not to exceed one percent (1%) of the loan Title insurance or fees for examination of title, as required by the lender Normal and customary escrow or closing fees charged by the title company and/or lender to close the sale (not including items such as taxes and insurance that must be deposited in advance into escrow accounts) Normal and customary attorney fees Normal and customary recording fees Assumption or loan transfer fees Mortgage application fees Appraisal and/or survey of the new home, if required by the lender Credit report charges Inspection required by the lender /s/ TP