Attached files

| file | filename |

|---|---|

| EX-99.1 - EX 99.1 FOR Q2 2018 EARNINGS RELEASE - LATTICE SEMICONDUCTOR CORP | lscc2018q2ex-991earningsre.htm |

| 8-K - FORM 8-K FOR Q2 2018 EARNINGS RELEASE - LATTICE SEMICONDUCTOR CORP | lscc2018q2form8-k.htm |

Exhibit 99.2 LATTICE SEMICONDUCTOR Q2 2018 Earnings Call July 2018

Safe Harbor This presentation contains forward-looking statements that involve estimates, assumptions, risks and uncertainties, including statements relating to our expectation that we will continue to successfully execute on the return-to-growth strategy we outlined at last fall’s investor day; and the statements under the heading “Business Outlook – Third Quarter of 2018.” Factors that may cause actual results to differ materially from the forward-looking statements in this presentation include global economic uncertainty, overall semiconductor market conditions, market acceptance and demand for our new and existing products, the Company's dependencies on its silicon wafer suppliers, the impact of competitive products and pricing, technological and product development risks. In addition, actual results are subject to other risks and uncertainties that relate more broadly to our overall business, including those risks more fully described in Lattice’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 30, 2017 and quarterly filings. Certain information in this presentation is identified as having been prepared on a non-GAAP basis. Management uses non-GAAP measures to better assess operating performance and to establish operational goals. Non-GAAP information should not be viewed by investors as a substitute for data prepared in accordance with GAAP. You should not unduly rely on forward-looking statements because actual results could differ materially from those expressed in any forward-looking statements. In addition, any forward-looking statement applies only as of the date on which it is made. The Company does not intend to update or revise any forward-looking statements, whether as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. [2]

Q2 2018 Exceeded Overall Expectations ☐ Continuing Execution on Business Strategy ☐ Achieving Operating Efficiency Improvements ☐ Delivering Higher non-GAAP Profitability ☐ Actively Paying Down Corporate Debt ☐ Further Enhancing Shareholder Value [3]

Q2 2018 Summary GAAP NON-GAAP Q2 2018 Q1 2018 Change Q2 2018 Q1 2018 Change Revenue $102.7M $98.6M $4.1M $102.7M $98.6M $4.1M Gross Margin % 48.9% 57.3% (8.4)% 57.2% 57.6% (0.04)% OpEx $63.8M $57.3M $6.5M $39.9M $45.4M ($5.5)M Net (Loss) Income $(20.2)M $(6.0)M ($14.2)M $12.4M $6.1M $6.3M EPS (diluted) $(0.16) $(0.05) ($0.11) $0.10 $0.05 $0.05 . Lattice continuing to execute; delivers improved results exceeding overall expectations for the second quarter of 2018 . Discontinuation of non-core millimeter wave business resulted in $24M of primarily non-cash restructuring charges which impacted GAAP operating expenses and gross margin . Operating expenses on a non-GAAP basis reduced to $39.9M, which does not reflect the expected $13M annual operating expense reduction from the discontinuation of Company’s millimeter wave business . Continues to maintain a healthy balance sheet; made $10M discretionary payment against corporate debt [4]

Revenue ($M) Q2 2018 Financial Highlights $120 $90 Q2 2018 Revenue was $102.7 million $60 . Q2 revenue was above our expectations $30 . Demand led by increases in Industrial and Computing $0 Discontinuation of non-core, unprofitable millimeter wave business 2Q17 3Q17 4Q17 1Q18 2Q18 . Company continues to execute improvements to cost structure Non-GAAP Gross Margin (%) . Action expected to result in $13M annual operating expense reduction starting in Q3 60% . Resulted in approximately $24M of primarily non-cash restructuring and impairment charges which impacted Q2 2018 GAAP operating expenses and gross margin 50% Q2 2018 Gross margin was 48.9% on a GAAP basis and 57.2% on a non- GAAP basis. 40% 2Q17 3Q17 4Q17 1Q18 2Q18 . Non-GAAP gross margin exceeds expectations on strategic shift to de- Non-GAAP EPS emphasize volatility of consumer handsets while focusing on Industrial, Computing and Automotive markets 0.12 Q2 2018 Operating expenses were $63.8 million on a GAAP basis and $39.9 0.08 million on a Non-GAAP basis. 0.04 . Non-GAAP operating expenses better than expectations 0.00 Q2 2018 net loss of $(0.16) per basic and diluted share on a GAAP basis, 2Q17 3Q17 4Q17 1Q18 2Q18 and net income of $0.10 per basic and diluted share on a non-GAAP basis [5]

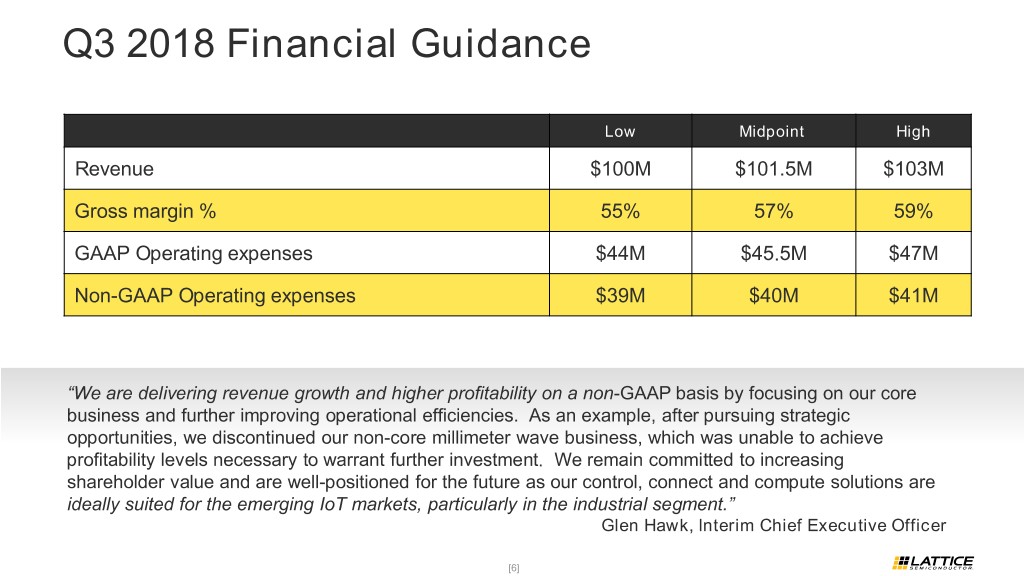

Q3 2018 Financial Guidance Low Midpoint High Revenue $100M $101.5M $103M Gross margin % 55% 57% 59% GAAP Operating expenses $44M $45.5M $47M Non-GAAP Operating expenses $39M $40M $41M “We are delivering revenue growth and higher profitability on a non-GAAP basis by focusing on our core business and further improving operational efficiencies. As an example, after pursuing strategic opportunities, we discontinued our non-core millimeter wave business, which was unable to achieve profitability levels necessary to warrant further investment. We remain committed to increasing shareholder value and are well-positioned for the future as our control, connect and compute solutions are ideally suited for the emerging IoT markets, particularly in the industrial segment.” Glen Hawk, Interim Chief Executive Officer [6]

Lattice’s Focus at The Intelligent Edge COMPUTE Making the “Things” of IoT smart & autonomous, decentralizing decisions with Artificial Intelligence Future Growth Driver for Lattice CONNECT New Market Needs Emerging Lattice Leveraging Existing Linking components and systems together Products CONTROL Proven Growth Driver for Lattice Expands Lattice Incumbency at the Edge Directing how things work together, and keeping them secure Provides Financial Stability for Lattice Lattice is the Market Leader [7]

Lattice Solves “Edge Computing” Challenges Devices at the edge of the network must quickly and autonomously make decisions, as well as fit into compact spaces and minimize power use ENERGY EFFICIENCY World’s lowest power mobile FPGA Integrated DSP and block RAM accelerate computing ARTIFICIAL INTELLIGENCE Lattice’s highest functional density Enhanced DSP and parallel processing 30% lower power consumption Full-featured AI stack includes modular hardware, neural network IP, software, reference designs, and custom design services from partners [8]

Lattice Value Proposition Compelling & Differentiated Solutions Smallest Production SIZE PRICED Lowest Fastest to POWER MARKET [9]

Q2 2018 Exceeded Overall Expectations ☐ Continuing Execution on Business Strategy ☐ Achieving Operating Efficiency Improvements ☐ Delivering Higher non-GAAP Profitability ☐ Actively Paying Down Corporate Debt ☐ Further Enhancing Shareholder Value [10]