Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ENTEGRIS INC | entg2018q2ex991.htm |

| 8-K - 8-K - ENTEGRIS INC | entg2018q2.htm |

EXHIBIT 99.2 JULY 26, 2018 Earnings Summary Second Quarter 2018

SAFE HARBOR This presentation contains, and management may make, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include statements related to future period guidance; projected sales, net income, net income per diluted share, non-GAAP EPS, non-GAAP net income, expenses and other financial metrics; our performance relative to our markets; market and technology trends, including the duration and drivers of any growth trends; the development of new products and the success of their introductions; the focus of our engineering, research and development projects; our business strategies; our capital allocation strategy, which may be modified at any time for any reason, including share repurchases, dividends, debt repayments and potential acquisitions; the effect of the Tax Cuts and Jobs Act on our capital allocation strategy; the Company’s expected tax rate; the impact of the acquisitions we have made and commercial partnerships we have established; and other matters. These statements involve risks and uncertainties, and actual results may differ. These risks and uncertainties include, but are not limited to, weakening of global and/or regional economic conditions, generally or specifically in the semiconductor industry, which could decrease the demand for our products and solutions; our ability to meet rapid demand shifts; our ability to continue technological innovation and introduce new products to meet our customers' rapidly changing requirements; our ability to execute on our strategies; our concentrated customer base; our ability to identify, effect and integrate acquisitions, joint ventures or other transactions; our ability to protect and enforce intellectual property rights; operational, political and legal risks of our international operations; our dependence on sole source and limited source suppliers; the increasing complexity of certain manufacturing processes; raw material shortages and price increases; changes in government regulations of the countries in which we operate; fluctuation of currency exchange rates; fluctuations in the market price of Entegris’ stock; the level of, and obligations associated with, our indebtedness; and other risk factors and additional information described in our filings with the Securities and Exchange Commission, including under the heading “Risks Factors" in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed on February 15, 2018, and in our other periodic filings. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates. This presentation contains references to “Adjusted EBITDA,” “Adjusted EBITDA Margin,” “Adjusted Operating Income,” “Adjusted Operating Income Margin,” “Adjusted Gross Profit” and “Non-GAAP Earnings per Share” that are not presented in accordance GAAP. The non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures but should instead be read in conjunction with the GAAP financial measures. Further information with respect to and reconciliations of such measures to the most directly comparable GAAP financial measure can be found attached to this presentation. 2

2Q18 HIGHLIGHTS ◦ 2Q18 sales of $383 million grew 16% from same quarter a year ago and 4% from 1Q18, outpacing Entegris’ markets ◦ Growth was across all divisions: ◦ Specialty Chemicals and Engineered Materials sales grew 11% from prior year and 3% sequentially ◦ Microcontamination Control sales grew 19% from prior year and 5% sequentially ◦ Advanced Materials Handling sales were 20% from prior year and 5% sequentially ◦ Demand trends reflected strength from memory fab customers, OEMs, chemical makers, and wafer growers ◦ Completed the acquisition of SAES Pure Gas (SPG) on June 25, 2018 ◦ 2Q18 GAAP Earnings Per Share of $0.38 increased 36% from prior year; non-GAAP EPS of $0.49 grew 44% from the prior year ◦ Generated $109 million of adjusted EBITDA, or 29% of sales 3

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (GAAP) 2Q18 over 2Q18 over $ in millions, except per share data 2Q18 2Q18 Guidance 1Q18 2Q17 2Q17 1Q18 Net Revenue $383.1 $370 to $385 $367.2 $329.0 16.4% 4.3% Gross Margin 47.6% 47.9% 45.7% Operating Expenses $107.4 $101 to $104 $97.5 $91.2 17.8% 10.2% Operating Income $74.9 $78.5 $59.1 26.7% (4.6%) Operating Margin 19.6% 21.4% 18.0% Tax Rate 15.3% 19.0% 21.6% Net Income $54.3 $52 to $59 $57.6 $40.0 35.8% (5.7%) Earnings per diluted share $0.38 $0.36 to $0.41 $0.40 $0.28 35.7% (5.0%) 4

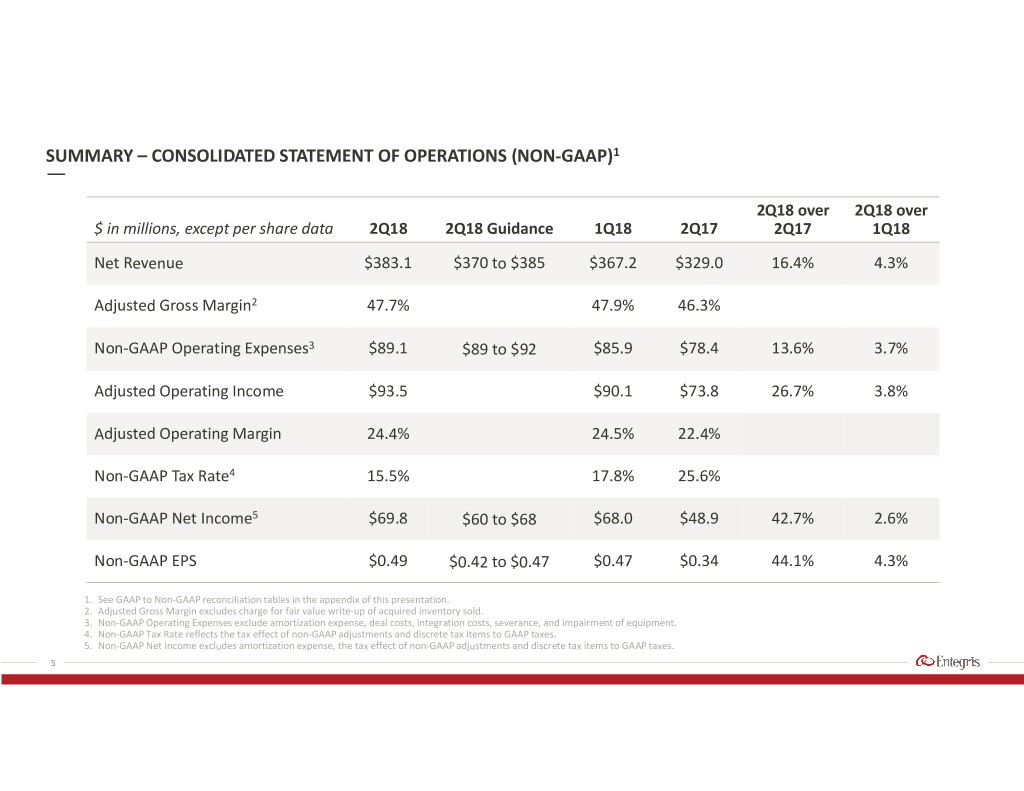

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (NON-GAAP)1 2Q18 over 2Q18 over $ in millions, except per share data 2Q18 2Q18 Guidance 1Q18 2Q17 2Q17 1Q18 Net Revenue $383.1 $370 to $385 $367.2 $329.0 16.4% 4.3% Adjusted Gross Margin2 47.7% 47.9% 46.3% Non-GAAP Operating Expenses3 $89.1 $89 to $92 $85.9 $78.4 13.6% 3.7% Adjusted Operating Income $93.5 $90.1 $73.8 26.7% 3.8% Adjusted Operating Margin 24.4% 24.5% 22.4% Non-GAAP Tax Rate4 15.5% 17.8% 25.6% Non-GAAP Net Income5 $69.8 $60 to $68 $68.0 $48.9 42.7% 2.6% Non-GAAP EPS $0.49 $0.42 to $0.47 $0.47 $0.34 44.1% 4.3% 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. 2. Adjusted Gross Margin excludes charge for fair value write-up of acquired inventory sold. 3. Non-GAAP Operating Expenses exclude amortization expense, deal costs, integration costs, severance, and impairment of equipment. 4. Non-GAAP Tax Rate reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5. Non-GAAP Net Income excludes amortization expense, the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (GAAP) – YEAR TO DATE 1H18 over $ in millions, except per share data 1H18 1H17 1H17 Net Revenue $750.3 $646.4 16.1% Gross Margin 47.8% 44.8% Operating Expenses $205.0 $179.9 14.0% Operating Income $153.4 $110.0 39.5% Operating Margin 20.4% 17.0% Tax Rate 17.2% 21.7% Net Income $111.9 $72.5 54.3% EPS $0.78 $0.51 52.9% 6

SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (NON-GAAP) – YEAR TO DATE1 1H18 over $ in millions, except per share data 1H18 1H17 1H17 Net Revenue $750.3 $646.4 16.1% Adjusted Gross Margin2 47.8% 45.2% Non-GAAP Operating Expenses3 $175.0 $156.2 12.0% Adjusted Operating Income $183.6 $135.7 35.3% Adjusted Operating Margin 24.5% 21.0% Non-GAAP Tax Rate4 16.7% 24.2% Non-GAAP Net Income5 $137.9 $89.7 53.6% Non-GAAP EPS $0.96 $0.63 52.4% 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. 2. Adjusted Gross Margin excludes charge for fair value write-up of acquired inventory sold. 3. Non-GAAP Operating Expenses exclude amortization expense, deal costs, integration costs, severance, and impairment of equipment. 4. Non-GAAP Tax Rate reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5. Non-GAAP Net Income excludes amortization expense, the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 7

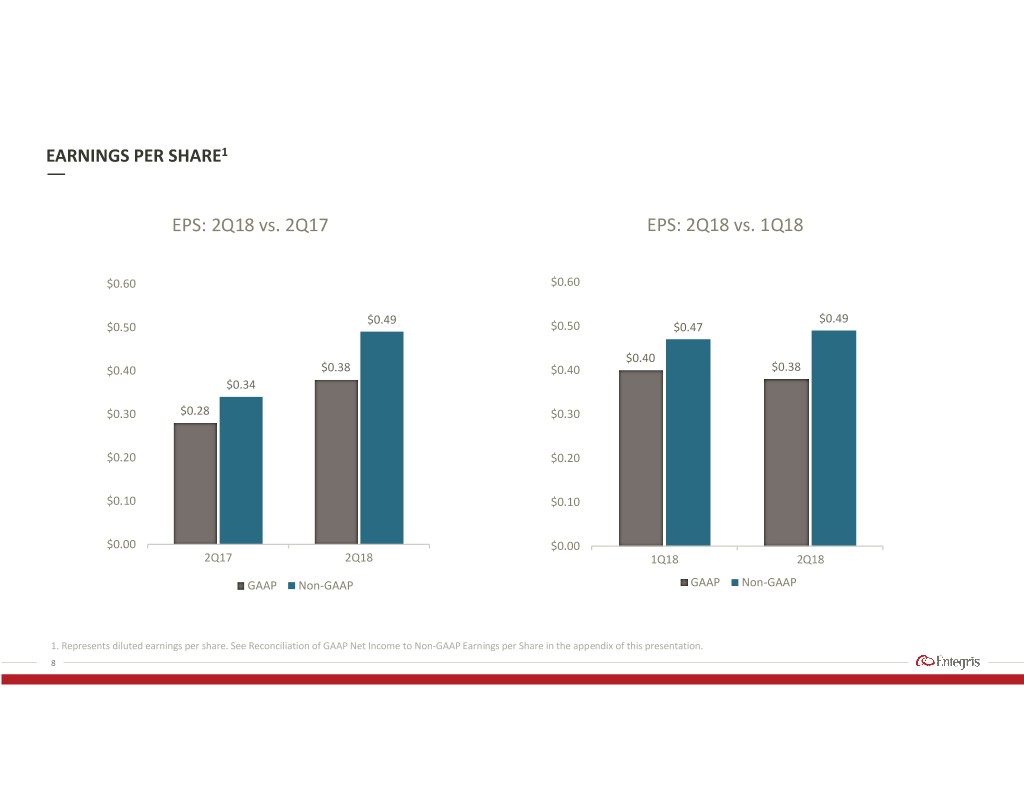

EARNINGS PER SHARE1 EPS: 2Q18 vs. 2Q17 EPS: 2Q18 vs. 1Q18 $0.60 $0.60 $0.49 $0.49 $0.50 $0.50 $0.47 $0.40 $0.40 $0.38 $0.40 $0.38 $0.34 $0.30 $0.28 $0.30 $0.20 $0.20 $0.10 $0.10 $0.00 $0.00 2Q17 2Q18 1Q18 2Q18 GAAP Non-GAAP GAAP Non-GAAP 1. Represents diluted earnings per share. See Reconciliation of GAAP Net Income to Non-GAAP Earnings per Share in the appendix of this presentation. 8

RESULTS BY SEGMENT1 Specialty Chemicals and Microcontamination Advanced Materials Engineered Materials Control Segment3 Handling Segment4 2 $ in millions Segment $140 40% $140 40% $140 40% $120 $120 $120 30% 30% $100 30% $100 $100 $80 $80 $80 20% 20% 20% $60 $60 $60 $40 $40 $40 10% 10% 10% $20 $20 $20 $0 0% $0 0% 2Q17 3Q17 4Q17 1Q18 2Q18 $0 0% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Sales Adj. Op. margin Sales Adj. Op. margin Sales Adj. Op. margin 1. Adjusted segment operating margin excludes amortization of intangibles and unallocated expenses. Corporate cost related to HR, Finance, and IT are charged back to the Segments starting 1Q18. Prior quarter results are adjusted retrospectively using consistent allocation method. 2. Segment profit for SCEM for 3Q17 includes a charge for severance of $14K. 3. Segment profit for MC for Q317 includes a charge for severance of $196K. Segment profit for MC for 2Q17 includes charges for impairment of equipment and severance of $884K and $559K, respectively. Segment profit for MC for Q218 includes a charge for fair value mark-up of acquired inventory sold of $208K. 4. Segment profit for AMH for 2Q17 includes charges for impairment of equipment of $2,286K. Segment profit for AMH for 3Q17 includes charges for impairment of equipment and severance totaling $5,221K. 9

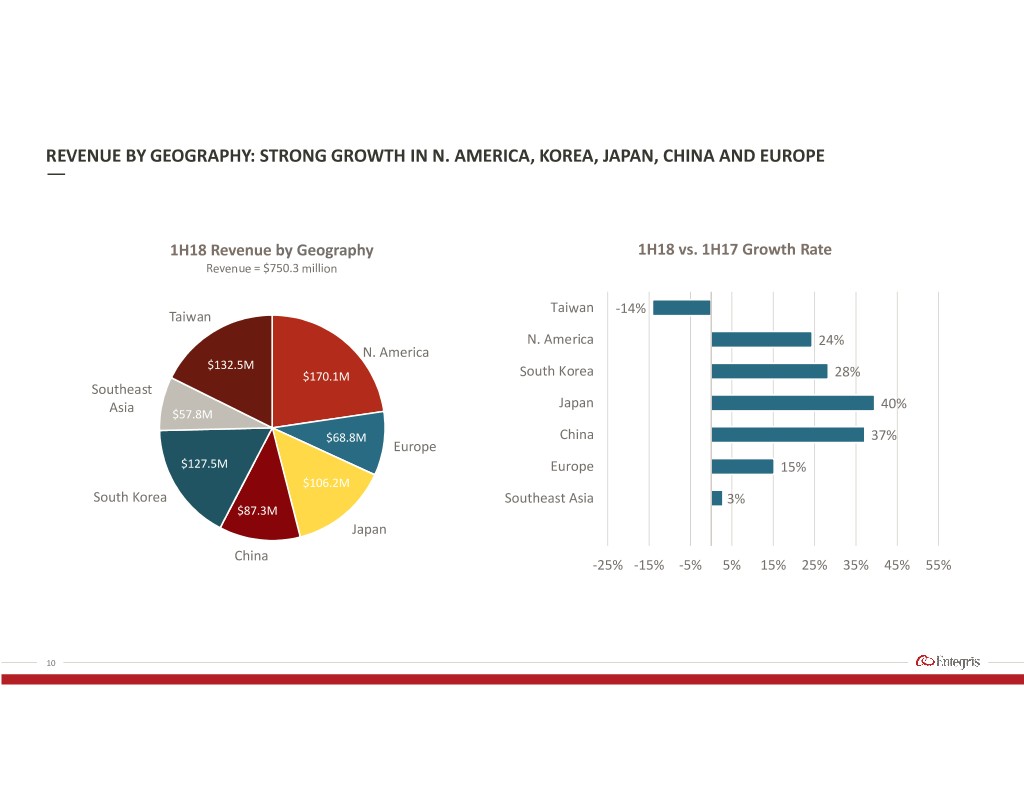

REVENUE BY GEOGRAPHY: STRONG GROWTH IN N. AMERICA, KOREA, JAPAN, CHINA AND EUROPE 1H18 Revenue by Geography 1H18 vs. 1H17 Growth Rate Revenue = $750.3 million Taiwan -14% Taiwan N. America 24% N. America $132.5M $170.1M South Korea 28% Southeast Japan 40% Asia $57.8M $68.8M China 37% Europe $127.5M Europe 15% $106.2M South Korea Southeast Asia 3% $87.3M Japan China -25% -15% -5% 5% 15% 25% 35% 45% 55% 10

SUMMARY – BALANCE SHEET ITEMS $ in millions 2Q18 1Q18 2Q17 $ Amount % Total $ Amount % Total $ Amount % Total Cash & Cash Equivalents $257.1 12.7% $550.2 28.1% $405.6 23.5% Accounts Receivable, net $200.4 9.9% $195.3 10.0% $171.1 9.9% Inventories $265.4 13.1% $214.1 10.9% $194.2 11.2% Net PP&E $380.3 18.8% $364.3 18.6% $341.1 19.7% Total Assets $2,066.1 $1,961.3 $1,727.4 Current Liabilities1 $204.3 10.1% $266.5 13.6% $251.0 14.5% Long-term debt, excluding $650.2 32.1% $549.8 28.0% $435.9 25.2% current maturities Total Liabilities $1,013.2 48.0% $936.9 47.8% $745.1 43.1% Total Shareholders’ Equity $1,052.9 52.0% $1,024.4 52.2% $982.3 56.9% AR – DSOs 47.7 48.5 47.5 Inventory Turns 3.3 3.7 3.7 1. Current Liabilities in 1Q18 and 2Q17 includes $100 million of current maturities of long term debt, respectively. 11

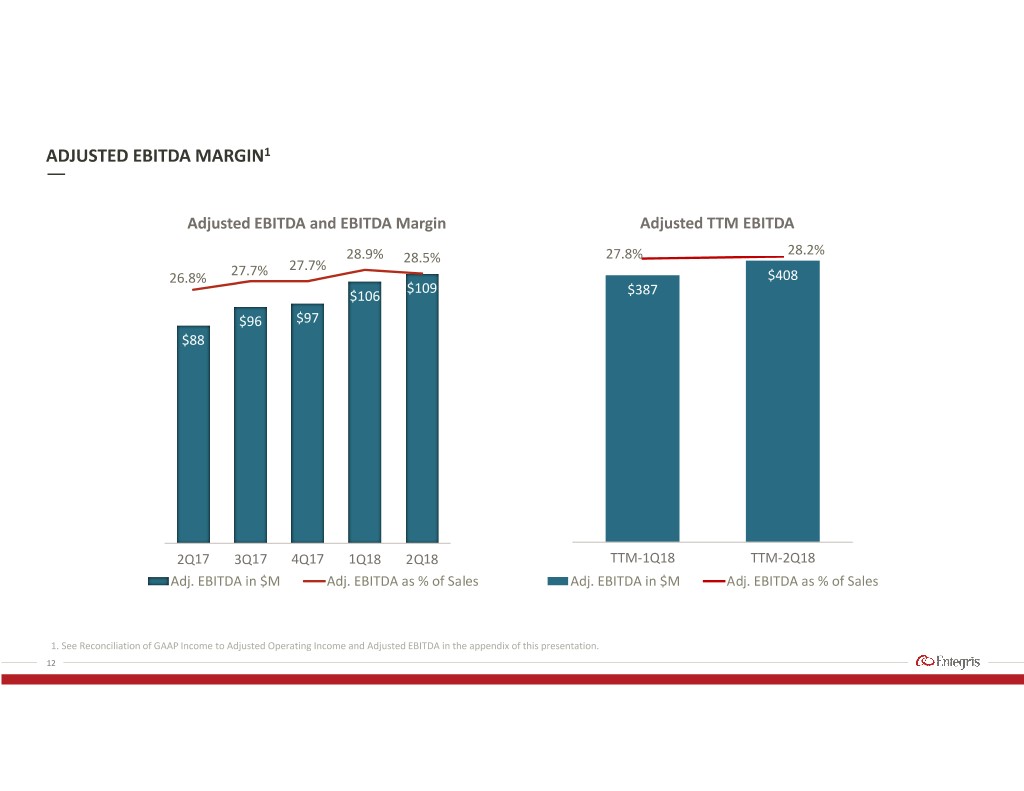

ADJUSTED EBITDA MARGIN1 Adjusted EBITDA and EBITDA Margin Adjusted TTM EBITDA 28.2% 28.9% 28.5% 27.8% 27.7% 27.7% 400 26.8% $408 $109 $387 $106 350 $96 $97 300 80 $88 250 200 40 150 100 50 0 0 2Q17 3Q17 4Q17 1Q18 2Q18 TTM-1Q18 TTM-2Q18 Adj. EBITDA in $M Adj. EBITDA as % of Sales Adj. EBITDA in $M Adj. EBITDA as % of Sales 1. See Reconciliation of GAAP Income to Adjusted Operating Income and Adjusted EBITDA in the appendix of this presentation. 12

CASH FLOWS $ in millions 2Q18 1Q18 2Q17 Beginning Cash Balance $550.2 $625.4 $391.2 Cash from operating activities $98.3 $38.8 $85.2 Capital expenditures ($26.4) ($21.0) ($20.3) Acquisition of business ($342.6) ($37.7) ($20.0) Payments on long-term debt ($2.0) ($25.0) ($25.0) Repurchase and retirement of common stock ($10.0) ($10.0) - Dividend payments ($9.9) ($9.9) - Other investing activities $1.8 $0.1 - Other financing activities $4.0 ($13.9) ($3.8) Effect of exchange rates ($6.3) $3.3 ($1.6) Ending Cash Balance $257.1 $550.2 $405.6 Free Cash Flow1 $71.9 $17.8 $64.9 Adjusted EBITDA $109.3 $106.0 $88.2 1. Free cash flow equals cash from operations less capital expenditures. 13

OUTLOOK GAAP $ in millions, except per share data 3Q18 Guidance 2Q18 Actual 3Q17 Actual Net Revenue $395 to $410 $383.1 $345.6 Operating Expenses1 $108 to $110 $107.4 $94.8 Net Income $52 to $59 $54.3 $40.9 Earnings Per Diluted Share $0.36 to $0.41 $0.38 $0.28 Non-GAAP $ in millions, except per share data 3Q18 Guidance 2Q18 Actual 3Q17 Actual Net Revenue $395 to $410 $383.1 $345.6 Non-GAAP Operating Expenses2 $90 to $92 $89.1 $78.4 Non-GAAP Net Income $66 to $73 $69.8 $57.0 Non-GAAP EPS $0.46 to $0.51 $0.49 $0.40 1. GAAP operating expenses in 3Q18 exclude integration costs. 2. Non-GAAP operating expenses exclude amortization. In 3Q18, amortization is estimated to be approximately $18 million, or $0.10 per share. 14

Entegris®, the Entegris Rings Design™ and Pure Advantage™ are trademarks of Entegris, Inc. ©2016 Entegris, Inc. All rights reserved. 15

NON-GAAP RECONCILIATION TABLE RECONCILIATION OF GAAP GROSS PROFIT TO ADJUSTED GROSS PROFIT $ in thousands Three months ended Six months ended June 30, 2018 July 1, 2017 March 31, 2018 June 30, 2018 July 1, 2017 Net Sales $383,059 $329,002 $367,199 $750,258 $646,379 Gross profit-GAAP $182,378 $150,303 $175,997 $358,375 $289,899 Adjustments to gross profit: Charge for fair value mark-up of acquired inventory sold 208 - - 208 - Impairment of equipment - 1,966 - - 1,966 Adjusted gross profit $182,586 $152,269 $175,997 $358,583 $291,865 Gross margin - as a % of net sales 47.6% 45.7% 47.9% 47.8% 44.8% Adjusted gross margin - as a % of net sales 47.7% 46.3% 47.9% 47.8% 45.2% 16

NON-GAAP RECONCILIATION TABLE RECONCILIATION OF GAAP SEGMENT PROFIT TO ADJUSTED OPERATING INCOME $ in thousands Three months ended Six months ended Segment profit-GAAP June 30, 2018 July 1, 2017 March 30, 2018 June 30, 2018 July 1, 2017 Specialty Chemicals and Engineered Materials $37,316 $29,060 $31,562 $68,878 $52,188 Microcontamination Control 39,054 31,796 41,991 81,045 62,783 Advanced Materials Handling 23,114 15,169 23,142 46,256 29,129 Total segment profit 99,484 76,025 96,695 196,179 144,100 Amortization of intangible assets 12,014 11,007 11,669 23,683 21,952 Unallocated expenses 12,537 5,928 6,553 19,090 12,138 Total operating income $74,933 $59,090 $78,473 $153,406 $110,010 Three months ended Six months ended Adjusted segment profit June 30, 2018 July 1, 2017 March 30, 2018 June 30, 2018 July 1, 2017 Specialty Chemicals and Engineered Materials $37,316 $29,060 $31,562 $68,878 $52,188 Microcontamination Control1 39,262 33,239 41,991 81,253 64,226 Advanced Materials Handling2 23,114 17,455 23,142 46,256 31,415 Total segment profit 99,692 79,754 96,695 196,387 147,829 Amortization of intangible assets3 - - - - - Unallocated expenses4 6,219 5,928 6,553 12,772 12,138 Total operating income $93,473 $73,826 $90,142 $183,615 $135,691 1 Adjusted segment profit for Microcontamination Control for the three and six months ended July 1, 2017 excludes charges for impairment of equipment and severance of $884K and $559K, respectively. Adjusted segment profit for Microcontamination Control for the three and six months ended June 30, 2018 excludes charges for fair value mark-up of acquired inventory sold of $208K, respectively. 2 Adjusted segment profit for Advanced Material Handling for the three and six months ended July 1, 2017 excludes charges for impairment of equipment of $2,286K. 3 Adjusted amortization of intangible assets excludes amortization expense of $12,014K, $11,007K, and $11,669K for the three months ended June 30, 2018, July 1, 2017, and March 31, 2018, respectively and $23,683K and $21,952K for the six months ended June 30, 2018 and July 1, 2017, respectively. 4 Adjusted unallocated expenses for the three and six months ended June 30, 2018 exclude deal costs and integration expenses of $5,121K and $1,197K, respectively. 17

NON-GAAP RECONCILIATION TABLE RECONCILIATION OF GAAP TO ADJUSTED OPERATING INCOME AND ADJUSTED EBITDA $ in thousands Three months ended Six months ended June 30, 2018 July 1, 2017 March 31, 2018 June 30, 2018 July 1, 2017 Net sales $383,059 $329,002 $367,199 $750,258 $646,379 Net income $54,349 $39,991 $57,562 $111,911 $72,505 Adjustments to net income: Income tax expense 9,782 11,042 13,546 23,328 20,153 Interest expense, net 6,925 8,103 7,226 14,151 16,496 Other expense (income), net 3,877 (46) 139 4,016 856 GAAP - Operating income 74,933 59,090 78,473 153,406 110,010 Charge for fair value write-up of acquired inventory sold 208 - - 208 - Deal Costs 5,121 - - 5,121 - Integration Costs 1,197 - - 1,197 - Severance - 559 - - 559 Impairment of equipment - 3,170 - - 3,170 Amortization of intangible assets 12,014 11,007 11,669 23,683 21,952 Adjusted operating income 93,473 73,826 90,142 183,615 135,691 Depreciation 15,802 14,411 15,897 31,699 28,388 Adjusted EBITDA $109,275 $88,237 $106,039 $215,314 $164,079 Adjusted operating margin 24.4% 22.4% 24.5% 24.5% 21.0% Adjusted EBITDA - as a % of net sales 28.5% 26.8% 28.9% 28.7% 25.4% 18

NON-GAAP RECONCILIATION TABLE RECONCILIATION OF GAAP TO NON-GAAP EARNINGS PER SHARE $ in thousands, except per share data Three months ended Six months ended June 30, 2018 July 1, 2017 March 31, 2018 June 30, 2018 July 1, 2017 GAAP net income $54,349 $39,991 $57,562 $111,911 $72,505 Adjustments to net income: Charge for fair value write-up of acquired inventory sold 208 - - 208 - Deal Costs 5,121 - - 5,121 - Integration Costs 1,197 - - 1,197 - Severance - 559 - - 559 Impairment of equipment - 3,170 - - 3,170 Amortization of intangible assets 12,014 - 11,669 23,683 - Tax effect of adjustments to net income and discrete items (3,702) 11,007 (2,710) (6,412) 21,952 Tax effect of Tax Cuts and Jobs Act 648 (5,821) 1,494 2,142 (8,526) Non-GAAP net income $69,835 $48,906 $68,015 $137,850 $89,660 Diluted earnings per common share $0.38 $0.28 $0.40 $0.78 $0.51 Effect of adjustments to net income $0.11 $0.06 $0.07 $0.18 $0.12 Diluted non-GAAP earnings per common share $0.49 $0.34 $0.47 $0.96 $0.63 19

GAAP SEGMENT TREND DATA $ in thousands Q116 Q216 Q316 Q416 Q117 Q217 Q317 Q417 Q118 Q218 Sales SCEM $ 101,107 $ 111,782 $ 104,494 $ 110,945 $ 114,435 $ 121,174 $ 124,522 $ 125,339 $ 130,743 $ 134,336 MC 77,619 91,584 94,738 98,717 100,055 104,407 116,113 115,650 118,637 124,681 AMH 88,298 99,686 97,460 98,840 102,887 103,421 104,956 109,573 117,819 124,042 Total Sales $ 267,024 $ 303,052 $ 296,692 $ 308,502 $ 317,377 $ 329,002 $ 345,591 $ 350,562 $ 367,199 $ 383,059 Segment Profit1 SCEM $ 17,818 $ 24,205 $ 14,244 $ 21,061 $ 23,128 $ 29,060 $ 29,539 $ 30,075 $ 31,562 $ 37,316 MC 14,181 24,511 27,684 27,535 30,987 31,796 39,302 39,328 41,991 39,054 AMH 14,697 18,203 11,192 12,190 13,960 15,169 12,483 18,226 23,142 23,114 Total Segment Profit $ 46,696 $ 66,919 $ 53,120 $ 60,786 $ 68,075 $ 76,025 $ 81,324 $ 87,629 $ 96,695 $ 99,484 Segment Profit Margin SCEM 17.6% 21.7% 13.6% 19.0% 20.2% 24.0% 23.7% 24.0% 24.1% 27.8% MC 18.3% 26.8% 29.2% 27.9% 31.0% 30.5% 33.8% 34.0% 35.4% 31.3% AMH 16.6% 18.3% 11.5% 12.3% 13.6% 14.7% 11.9% 16.6% 19.6% 18.6% 1. Segment profit excludes amortization of intangibles and unallocated expenses. Corporate cost related to HR, Finance, and IT are charged back to the Segments starting 1Q18. Prior quarter results are adjusted retrospectively using consistent allocation method. 20

NON-GAAP SEGMENT TREND DATA $ in thousands Q116 Q216 Q316 Q416 Q117 Q217 Q317 Q417 Q118 Q218 Sales SCEM $ 101,107 $ 111,782 $ 104,494 $ 110,945 $ 114,435 $ 121,174 $ 124,522 $ 125,339 $ 130,743 $ 134,336 MC 77,619 91,584 94,738 98,717 100,055 104,407 116,113 115,650 118,637 124,681 AMH 88,298 99,686 97,460 98,840 102,887 103,421 104,956 109,573 117,819 124,042 Total Sales $ 267,024 $ 303,052 $ 296,692 $ 308,502 $ 317,377 $ 329,002 $ 345,591 $ 350,562 $ 367,199 $ 383,059 Adjusted Segment Profit1 2 SCEM $ 17,818 $ 24,205 $ 14,943 $ 21,061 $ 23,128 $ 29,060 $ 29,553 $ 30,075 $ 31,562 $ 37,316 3 MC 14,181 24,511 28,421 27,535 30,987 33,239 39,498 39,328 41,991 39,262 4 AMH 14,697 18,203 17,987 12,190 13,960 17,455 17,704 18,226 23,142 23,114 Total Adj. Segment Profit $ 46,696 $ 66,919 $ 61,351 $ 60,786 $ 68,075 $ 79,754 $ 86,755 $ 87,629 $ 96,695 $ 99,692 Adjusted Segment Profit Margin SCEM 17.6% 21.7% 14.3% 19.0% 20.2% 24.0% 23.7% 24.0% 24.1% 27.8% MC 18.3% 26.8% 30.0% 27.9% 31.0% 31.8% 34.0% 34.0% 35.4% 31.5% AMH 16.6% 18.3% 18.5% 12.3% 13.6% 16.9% 16.9% 16.6% 19.6% 18.6% 1. Segment profit excludes amortization of intangibles and unallocated expenses. Corporate cost related to HR, Finance, and IT are charged back to the Segments starting 1Q18. Prior quarter results are adjusted retrospectively using consistent allocation method. 2. Adjusted segment profit for SCEM for Q316 excludes charges for severance of $699K. Adjusted segment profit for SCEM for Q317 excludes charges for severance of $14K. 3 Adjusted segment profit for MC for Q316 excludes charges for severance of $737K. Adjusted segment profit for MC for 2Q17 excludes charges for impairment of equipment and severance of $884K and $559K, respectively. Adjusted segment profit for MC for Q317 excludes charges for severance of $196K. Adjusted segment profit for MC for Q218 excludes charges for fair value mark-up of acquired inventory sold of $208K. 4. Adjusted segment profit for AMH for Q316 excludes charges for impairment of equipment and severance related to organizational realignment of $5,826K and $969K, respectively. Adjusted segment profit for AMH for 2Q17 excludes charges for impairment of equipment of $2,286K. Adjusted segment profit for AMH for Q317 excludes charges for impairment of equipment and severance related to organizational realignment of $3,364K and $1,857K, respectively. 21