Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - TRUPAL MEDIA, INC. | ex312.htm |

| EX-32.1 - CERTIFICATION - TRUPAL MEDIA, INC. | ex321.htm |

| EX-31.1 - CERTIFICATION - TRUPAL MEDIA, INC. | ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended March 31, 2018

or

Commission file number 333-208862

|

TRUPAL MEDIA, INC.

|

|||

|

(Exact name of registrant as specified in its charter)

|

|||

|

Florida

|

46-5200354

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

||

|

1205 Lincoln Avenue, Suite 220

Miami Beach, FL

|

33139

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

||

|

Registrant's telephone number, including area code:

|

(954) 882-7951

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

|||

|

Title of each class

|

Name of each exchange on which registered

|

||

|

Common Stock

|

|||

|

Securities registered pursuant to section 12(g) of the Act

|

|||

|

None.

|

|||

|

(Title of class)

|

|||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

|

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files

|

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

|

|

|

|

[ ]

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer[ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer[ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

|

|

Emerging growth company [X]

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

Yes [ ] No [X ]

|

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant as of September 29, 2017 (the last business day of the Registrant's most recently completed second fiscal quarter) was approximately $0.

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

|

|

As of June 20, 2018 the Registrant had 26,485,129 shares of common stock issued and outstanding.

|

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

ii

|

|

|

Page

|

|

|

PART I

|

|

|

|

|

|

|

Item 1

|

Business

|

1 |

|

Item 1A

|

Risk Factors

|

10 |

|

Item 1B

|

Unresolved Staff Comments

|

10 |

|

Item 2

|

Properties

|

10 |

|

Item 3

|

Legal Proceedings

|

10 |

|

Item 4

|

Mine Safety Disclosures

|

10 |

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

Item 5

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

11 |

|

Item 6

|

Selected Financial Data

|

12 |

|

Item 7

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

12 |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

14 |

|

Item 8

|

Financial Statements and Supplementary Data

|

14 |

|

|

|

|

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

15 |

|

Item 9A

|

Controls and Procedures

|

15 |

|

Item 9B

|

Other Information

|

16 |

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

17 |

|

Item 11

|

Executive Compensation

|

19 |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

20 |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

21 |

|

Item 14

|

Principal Accounting Fees and Services

|

22 |

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

Item 15

|

Exhibits, Financial Statement Schedules

|

23 |

|

|

|

|

|

|

SIGNATURES

|

24 |

iii

PART I

ITEM 1. BUSINESS

Forward Looking Statements

This Annual Report on Form 10-K ("Annual Report") contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology.

Forward looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," "Company," "our", "Trupal" and "Trupal Media " mean Trupal Media, Inc., unless otherwise indicated.

Corporate Information

Trupal Media, Inc. is a social-casino-game publisher, incorporated in the State of Florida on March 14, 2014. We operate in the gaming content delivery business. The Company launched its flagship social gaming app "Cleo's Casino" on April 1, 2014. Cleo's Casino which is available on Facebook, is an ancient Egyptian themed app that offers 5 slot games per room, with each room being themed around the life story of Cleopatra. Users download the app and purchase virtual coins from the Company to play the various games in the app. Each user plays the first slot game of each room trying to achieve objectives in order to unlock the next slot game in a progressive fashion. A "User" or "Player" is a person who has downloaded the application, signed in and made use of the games. Playing the slots using purchased virtual coins allows users to earn additional virtual coins to extend play. Slot tournaments have been added to the app for players to compete against each other and win additional virtual coins. Trupal generates revenue as the users purchase virtual coins in order to commence and continue game play. Since inception, Trupal has integrated more than 40 slot games and slot tournaments. Over 10,000 users have made at least 1 or more in app purchases to date.

On April 1, 2014, the Company entered into an agreement with Game Media Works, Ltd., a company 100% controlled by our sole officer and director, Panayis Palexas, whereby Game Media Works, Ltd. grants to the Company a non-exclusive non-transferable and individual license making the Casino Games, Jackpot Games and Branded Games ("The System") available to End Users to play via the internet using the Cleo's Casino proprietary platform. The fee for the license of the System is an ongoing usage fee equal to 10% of the monthly gross income generated by the games.

On April 14, 2014, the Company entered into an agreement with Panash S.A.C., a company owned by our President Panayis Palexas. Under the Agreement, the Provider develops creative ads, manages social media networks, maintains and engages existing users via social media networks, creates positing and manages the Company's Facebook Fan page. In addition, the Provider ensures brand positioning and increased awareness as we grow and retain users. The Provider is paid by the Company for its services with a minimum of $10,000 monthly or 10% of monthly revenue earned by the application the Provider is servicing. This amount will not exceed $100,000 per month.

To date we have relied heavily on capital provided from Mr. Panayis Palexas, our sole officer and director, to meet operational shortfalls as we expand our business and seek outside financing sources to complete the implementation of our growth plan. In addition, Mr. Palexas, controls over 99% of the voting power for our Common Stock by virtue of his ownership of 1,000,000 shares of Series A Preferred Stock. As a result, Mr. Palexas will continue to have significant influence over the management and affairs of the company and control over matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of our company or our assets, for the foreseeable future.

Based on our financial history since inception, our auditor has expressed substantial doubt as to our ability to continue as a going concern. While we have generated revenues, we are not yet able to meet our operational overhead on an annual basis. We have not yet received adequate financing to fully implement our plans for growth and increased revenue generation.

1

Although the Company has obtained a trading symbol "TRMM" we presently have no market for our common stock. We are presently aggressively pursing additional financing to allow us to move forward with our planned expansion.

The Company's fiscal year end is March 31.

Company Overview

Trupal is a social-casino-game publisher operating in the gaming content delivery business, and presently focused on its flagship app "Cleo's Casino". The Company's ability to become profitable is dependent on our ability to market to a wider audience and thereby generate continuous in app purchases from a broad user base accelerating the purchase of virtual currency for use in our games.

Cleo's Casino has had good response from players as demonstrated through our consistent user retention rate. Trupal is focused on delivering high quality gaming apps, maintaining low costs and driving a rigorous marketing campaign that will ensure steady growth and value for the Company and its shareholders. In order to maintain user/player interest, ensure repeat visits and increase our user base we are looking to raise funds to invest in additional marketing and increase unique user downloads. Through additional capital for expanded marketing activities we can also encourage revisits and expanded play from our existing user/player base. Most importantly we intend targeted marketing efforts to increase our in app purchasing/ user/player database and thereby the expansion of new user downloads and purchases of virtual currency. We have not yet been able to raise sufficient capital to fully implement our marketing plan in order to jumpstart further user growth.

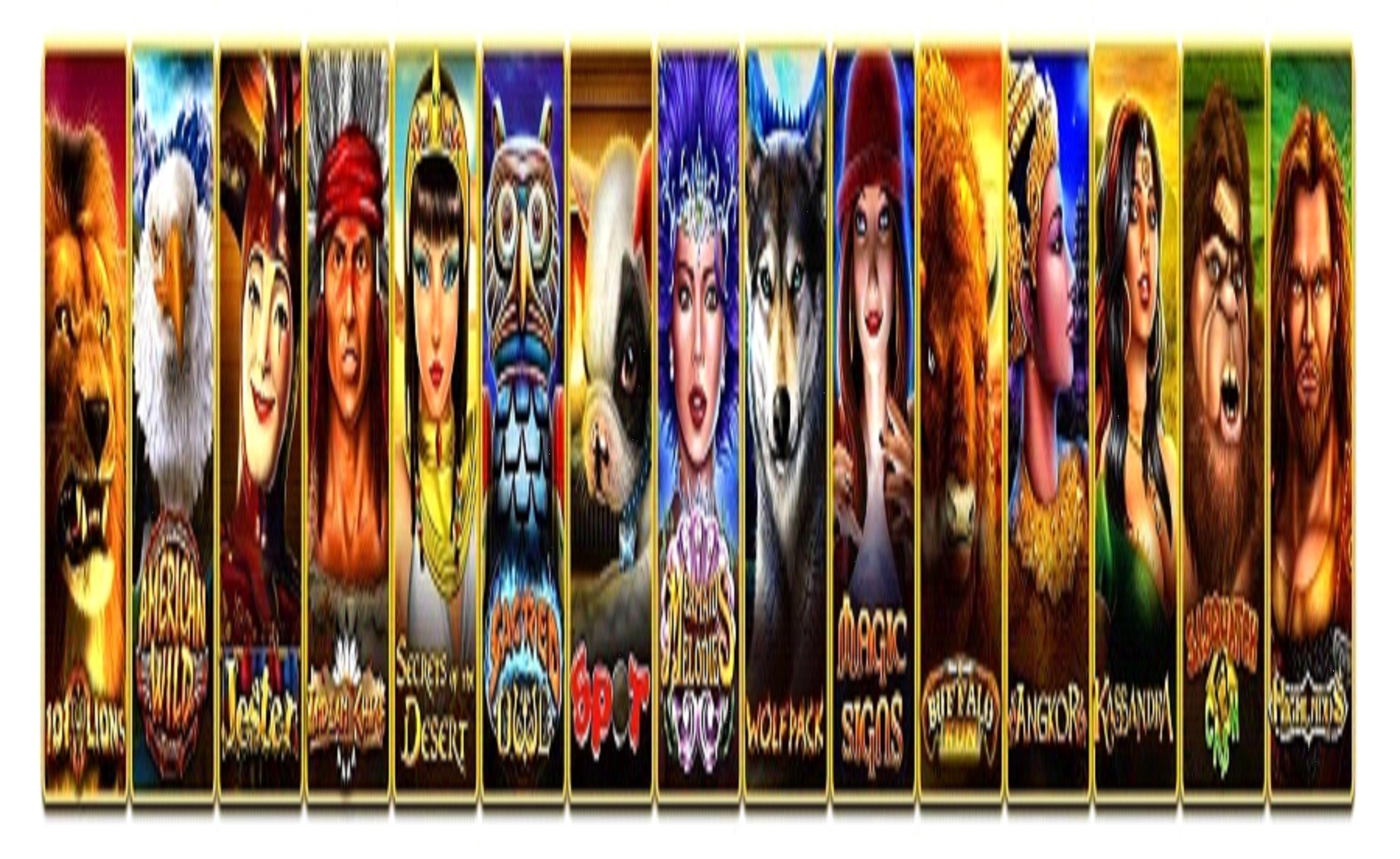

Images of some of our gaming content are below:

2

Cleo's Casino is an Egyptian themed casino app with a storyboard based on the life of Cleopatra. The app has been developed offering ten themed game rooms.

|

·

|

Each room contains five games and the first game of each room is unlocked and available for play.

|

|

·

|

Players need to earn at least one trophy during the free games feature in order to unlock the next game.

|

|

·

|

The player is able to achieve up to three trophies per game.

|

|

·

|

If the player earns fifteen trophies in a room then they will qualify to enter a special pyramid treasure bonus.

|

|

·

|

Once this has been achieved the in-play challenge cycle starts again.

|

|

·

|

Other special features include allowing players to accumulate high scores.

|

|

·

|

Players are able to compete and compare their score and trophies with their friends.

|

|

·

|

Each room's achievements are graded separately.

|

3

The app offers an exciting new way to play and enjoy slots socially. The challenges are set around the key features by which a player naturally measures a slot game session. The themed storyboard creates a pleasant environment and the multi-layered in-game challenges will keep players interested for longer.

The rules of purchase encourage trial and revisits through free play offers. The game app must provide sufficient in-game challenges, entertainment with reward, which encourages revisits to the app. The coin packages are competitively priced and more importantly players are given optimum playtime with the coins purchased.

4

Industry Overview

The social casino game industry continues to show positive growth year on year. Due to relatively low barriers to market entry, many new social casino app companies are trying out their products in this lucrative industry. What remains true is that the market leaders maintain their position for a number of key reasons; first to market, large marketing budgets, large game/app development budgets, in most cases (IGT/DoubleDown, High5, Jackpot Party) brand recognition and proven game content. New entrants need to ensure that they have at least three key components to compete successfully:

|

1.

|

Noticeably better performing and higher quality casino games combined with a well-rounded game app that offers enticing challenges, look and feel appeal.

|

|

2.

|

Healthy marketing budgets coupled with a skilled marketing team of media buyers and community media managers.

|

|

3.

|

A consistent and ongoing role out of quality content whose development costs do not suffocate revenues, especially during the growth phase.

|

The world is changing and so are our habits; games like Candy Crush and others have managed to convert the most resistant people into avid social gamers. The trend is clear, social gaming has now become a way of life, not just for the young, but all age groups. Social Media economies are growing and expanding their offerings, more and more smartphones are being sold and online buying habits are increasing across the globe. The future growth prospects are very positive for this industry.

Current Operations

The Company launched its flagship app on Facebook called "Cleo's Casino" on April 1, 2014. Despite being unable to raise sufficient capital to date to fully implement our marketing plan, performance has been promising. While fiscal 2018 results reflect a substantial decrease in overall operations as the Company was not able to raise the funds to continue to fully support its marketing program and maintain/ increase growth year over year, our gross profit increased from 37% to 40% in the current fiscal year, albeit gross sales decreased by 40% year over year. Operating expenses were reduced in the current fiscal year and were approximately 80% of the total operating costs of the prior fiscal year. This is directly attributable to a decline in advertising costs as a result of lack of funding to fully implement our advertising plan. The app continues to reflect good retention of monetized users. Marketing capital will be needed to speed up the acquisition of purchasing users and achieve a return to higher gross sales and ultimately, profitability.

Marketing Strategy

Positioning

The Company's app is completely unique in the way players unlock games, meet in-game challenges and competitiveness between friends. The slot games are tried and tested casino slots with a history of performance in casinos across Latin America and the US. The artwork, look and feel brings it all together; the app is noticeably different from the competition. The recognized game theme of Cleopatra and ancient Egyptian theme bring together an enjoyable background setting to the slots and challenges.

Sales strategy and tactics

The Company understands that developing a strong user base takes dedication, consistency and time. High quality images, educating the user base on the game features and in-game challenges, creating a sense of competitiveness amongst the players are all part of encouraging players to purchase more and more coins.

It takes a concerted effort to build trust and loyalty from the user base, but once this is established, players become less and less resistant with spending money on your app for ongoing entertainment.

With the ongoing introduction of new games and brands, the Company can expect a higher retention rate and increase in coin sales from its users.

5

Advertising and Promotion Plans

A combined marketing and sales effort will be ongoing as this is important in order to achieve revisits and in-app purchases. A number of efforts will be employed:

|

1.

|

Facebook ads spend to encourage new users to commit to product trial.

|

|

2.

|

App engagement ads keep existing users informed and returning.

|

|

3.

|

Fan page community builds: fan engagement and participation grows loyalty and increases app revisits.

|

|

4.

|

Interactive competitions and free coin sale offers via fan page.

|

|

5.

|

Follow up emails to encourage new conversions and revisits.

|

|

6.

|

Mini game applications and competitions.

|

|

7.

|

Notifications via applications on coin sales.

|

|

8.

|

Affiliate offers.

|

|

9.

|

Frequent and periodic content launches.

|

|

10.

|

In-app promotions and competitions.

|

|

11.

|

Ongoing viral efforts in-app, fan page, offers, mailers, etc.

|

The Company's experience indicates that a spend of $30 is required to secure a new user and as such allocates its advertising spend as to 80% to attract new users and 20% to retain existing users with promotions, competitions and other efforts. Results to date indicate that between 5% and 10% of all acquired users currently have an average repeat spend of $0.85 per day, or approximately $26 per month, with newly acquired users making at least one $26-$30 spend at time of acquisition. The larger the user database, the more monthly purchasing users and the lower the spend per user to continue to retain site visits and purchases of virtual currency. With additional marketing efforts and targeted advertising campaigns the Company intends to ultimately achieve a user base of between 200,000 and 500,000 users with a retention rate of up to 15% per month or between 30,000 and 75,000 purchasing users each month. Presently we have over 10,000 users with an average of between 90 and 110 purchasing users each month.

Pricing Strategy

Pricing is important and needs to be very well calculated to ensure optimum profitability and growth.

Coins pricing, RTP (Return to Player) Percentage and bet denominations need to be carefully set and calculated in order to:

|

1.

|

Allow for user app trial.

|

|

2.

|

Allow for satisfactory user playtime.

|

|

3.

|

Optimize monetization.

|

|

4.

|

Allow for free coin promos that encourage revisits, without hurting bottom-line revenue.

|

|

5.

|

Enough leeway that still allows for purchases through value sales offers.

|

All these points are taken under careful consideration to ensure optimum retention and monetization.

Channels of distribution

Cleo's Casino has begun marketing on Facebook, in order to develop a strong user base and following before launching on mobile/tablets. Ideally a minimum of 500,000 active monthly users are required before launching the offering on Apple Store, Google Play and Kindle.

6

Growth Strategy

The Company's future goal is to continue with expanded game development and to ensure new feature roll out is on time and consistent. This will require that there are enough funds to keep the user acquisition machine running, as well as acquiring as many new purchasing users as possible whilst retaining and servicing existing users.

The Company is looking to raise the funding needed to pay for user downloads and grow its user base across Facebook and mobile platforms to over 100,000 paying users within the next three years, depending on successful raising of additional capital. These funds will also be used to promote ongoing user engagement, fund the media marketing team that will be responsible for retention and the ongoing marketing campaign. Our marketing campaign will revolve around optimizing monetization strategies using creative communicative campaigns and effective socially interactive community management programs. These efforts would need to drive and maximize viability. The Company understands that a successful app requires a strong momentum building strategy that will ensure brand positioning as the best social casino gaming alternative.

The Company plans to hire a Chief Financial Officer, Vice President and at least three digital media experts once it is feasible to do so.

Long-term plans for the company are based on keeping to the same principals upon which it was founded; no frills, low cost structures, transparency, excellent products, employing talented people and continually adding value to ensure long-term success and profitability for it's shareholders.

The key factors to the Company's success continue to be:

|

1.

|

Consistent and periodic updated game releases – this is critical in maintaining players interest.

|

|

2.

|

Core game appeal – The Company's game offering uses real and proven casino slots, this is the foundation of a successful casino game app. Proven casino games lower the churn ratio (players who leave the app each month).

|

|

3.

|

Overall app appeal and playability – The Company's app deploys a monetization strategy that is unique to other publishers in the industry. Multi-layered in-game challenges are based on actual game feature results, which sets the Cleo's Casino app apart.

|

|

4.

|

A talented marketing team that is able to optimize media buying to ensure the lowest possible user acquisition cost and viral programs.

|

|

5.

|

Funds for marketing efforts – the best game app would still need a healthy budget for user acquisitions, app engagements and promotions. A large user base is key to ensure consistent revenue flow, and player loyalty development.

|

|

6.

|

Employing talented experts in the social media field to guide the process.

|

Competition

The Company's direct competitors for a share of the social casino game market are game developers including Caesars Interactive, Zynga, IGT/DoubleDown, Big Fish Games, Jackpot Party, DoubleU and others. Being first to market with an established user base places those top ten market players in an advantageous position over new arrivals. Although there are many casino apps and many new app entries, the top ten still manage to hold onto 65% of the market. For a new entry to make any significant inroads, a substantial investment in brand awareness over time will need to be made in the social media space. Brand awareness backed by an excellent product, and a clever ongoing marketing campaign that is consistently implemented will ensure that a new market entry can gain the brand recognition and positioning needed to compete successfully.

As the social casino game industry grows and the barriers to entry are lowered for new market entrants, more and more new entrants will be investing time and money to get their piece of this market. What has been shown to be true is that although entry is relatively easy, the market still dictates survival of the fittest. A strong skill in the art of great game development coupled with deep pockets for marketing determines who gets to keep the lion's share of this business. This will remain true in the future.

The Company owns a competitive and unique social casino app. No other social casino app to date offers the same or similar game unlocking features or overall challenge mechanics. By utilizing Game Media Works, Ltd's game library, we are able to reduce our outlay cost and increase our chances of developing successful and proven slot games.

7

Dependence on one or a few major Customers

Although the Company is not dependent upon a few major customers, it is duly noted that access to the Company's software for end users is through Facebook applications as our sole customer access. We are confident in our ability to adjust to changing protocols, rules and regulations put forth by Facebook. However, these efforts could be detrimental to our focus on continued growth.

Patents, Trademarks, Licenses, Agreements or Contracts

Our business is significantly based on the creation, acquisition, use and protection of intellectual property. Some of this intellectual property is in the form of software code and trade secrets that we use to develop our games and to enable them to run properly on multiple platforms. Other intellectual property we create includes audio-visual elements, including graphics, music, story lines and interface design. We presently have no patents on this intellectual property.

While most of the intellectual property we use is created by us, we have acquired rights to proprietary intellectual property from Game Media Works, Ltd., a company 100% controlled by our sole officer and director, Panayis Palexas, whereby Game Media Works, Ltd. grants to the Company a non-exclusive non-transferable and individual license making the Casino Games, Jackpot Games and Branded Games ("The System") available to End Users to play via the internet using the Cleo's Casino proprietary platform for a term of 8 years from April 1, 2014.

We protect our intellectual property rights by relying on federal, state and common law rights, as well as contractual restrictions. We will control access to our proprietary technology by entering into confidentiality and invention assignment agreements with our employees (upon hire) and all contractors, as well as confidentiality agreements with third parties. We also actively engage in monitoring and enforcement activities with respect to infringing uses of our intellectual property by third parties.

We may also seek patent protection when appropriate and when funding permits, covering inventions originating from the company and acquire patents we believe may be useful or relevant to our business.

In addition to these contractual arrangements, we also rely on a combination of trade secret, copyright, trademark, trade dress, domain name and patents to protect our games and other intellectual property. We typically own the copyright to the software code to our content, as well as the brand or title name trademark under which our games are marketed. We pursue the registration of our domain names, trademarks, and service marks in the United States and in locations outside the United States.

8

Circumstances outside our control could pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in the United States or other countries in which our games are distributed. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time-consuming. Any unauthorized disclosure or use of our intellectual property could make it more expensive to do business, thereby harming our operating results.

Companies in the Internet, games, social media, technology and other industries may own large numbers of patents, copyrights and trademarks and may frequently request license agreements, threaten litigation or file suit against us based on allegations of infringement or other violations of intellectual property rights. From time to time, we have faced, and we expect to face in the future, allegations by third parties, including our competitors and non-practicing entities, that we have infringed their trademarks, copyrights, patents and other intellectual property rights. As we face increasing competition and as our business grows, we will likely face more claims of infringement.

Government Regulation

We are subject to a number of foreign and domestic laws and regulations that affect companies conducting business on the Internet, many of which are still evolving and could be interpreted in ways that could harm our business. In the United States and internationally, laws relating to the liability of providers of online services for activities of their users and other third parties are currently being tested by a number of claims, including actions based on invasion of privacy and other torts, unfair competition, copyright and trademark infringement, and other theories based on the nature and content of the materials searched, the ads posted, or the content provided by users. Any court ruling or other governmental action that imposes liability on providers of online services for the activities of their users and other third parties could harm our business. We are potentially subject to a number of foreign and domestic laws and regulations that affect the offering of certain types of content, such as that which depicts violence, many of which are ill defined, still evolving and could be interpreted in ways that could harm our business or expose us to liability.

In addition, rising concern about the use of social networking technologies for illegal conduct, such as the unauthorized dissemination of national security information, money laundering or supporting terrorist activities may in the future produce legislation or other governmental action that could require changes to our games or restrict or impose additional costs upon the conduct of our business.

Some of our games are based upon traditional casino games, such as poker. We have structured and operate our slot-machine game, Cleo's Casino, with the gambling laws in mind and believe that playing Cleo's Casino does not constitute gambling. We also sometimes offer our players various types of sweepstakes, giveaways and promotion opportunities. We are subject to laws in a number of jurisdictions concerning the operation and offering of such activities and games, many of which are still evolving and could be interpreted in ways that could harm our business. Any court ruling or other governmental action that imposes liability on providers of online services could result in criminal or civil liability and could harm our business.

In the area of information security and data protection, many states have passed laws requiring notification to users when there is a security breach for personal data, such as the 2002 amendment to California's Information Practices Act, or requiring the adoption of minimum information security standards that are often vaguely defined and difficult to implement. The costs of compliance with these laws may increase in the future as a result of changes in interpretation. Furthermore, any failure on our part to comply with these laws may subject us to significant liabilities.

We are also subject to federal, state and foreign laws regarding privacy and protection of player data. We post our Privacy Policy and Terms of Service online, in which we describe our practices concerning the use, transmission and disclosure of player data. Any failure by us to comply with our posted privacy policy or privacy related laws and regulations could result in proceedings against us by governmental authorities or others, which could harm our business. In addition, the interpretation of data protection laws, and their application to the Internet is unclear and in a state of flux. There is a risk that these laws may be interpreted and applied in conflicting ways from state to state, country to country, or region to region, and in a manner that is not consistent with our current data protection practices. Complying with these varying international requirements could cause us to incur additional costs and change our business practices. Further, any failure by us to adequately protect our players' privacy and data could result in a loss of player confidence in our services and ultimately in a loss of players, which could adversely affect our business.

In addition, because our services are accessible worldwide, certain foreign jurisdictions have claimed and others may claim that we are required to comply with their laws, including in jurisdictions where we have no local entity, employees, or infrastructure.

Employees and Consultants

The Company does not have any employees and relies predominantly on the services of its sole officer and director, Panayis Palexas, as well as third party service providers controlled by Mr. Palexas for its operations.

The Company entered into a software license and services agreement with Game Media Works, Ltd. ("GMW"), a company 100% controlled by our President, Panayis Palexas. Under the software license and services agreement, GMW grants to the Company a non-exclusive non-transferable and individual license making the Casino Games, Jackpot Games and Branded Games ("The System") available to End Users to play via the internet using the Cleo's Casino proprietary platform.

9

Panash S.A.C., a company owned by our President Panayis Palexas entered into a Service Software Provider Agreement (the "Agreement") with the Company on April 14, 2014. Under the terms of the Agreement, the Provider develops creative ads, manages social media networks, maintains and engages existing users via social media networks, creates postings and manages the Company's Facebook Fan page. In addition, the Provider ensures brand positioning and increases awareness to help us grow and retain users.

All of the aforementioned related party service providers continue to provide services for accrued fees until such time as the Company has raised sufficient funds to fully implement its full marketing plan.

Research and Development Activities and Costs

We believe continued investment in enhancing existing games and developing new games, and in software development tools and code modification, is important to attaining our strategic objectives. However, we have no substantive plans to implement research and development for our products over the next 12 months. Any expenditure for research and development will be nominal to the Company.

ITEM 1A. RISK FACTORS

The Company is a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and is not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Office Space

The Company's principal business and corporate address is 1205 Lincoln Road, Suite 220, Miami Beach, Florida, 33139; the telephone number is (954) 882-7951. The space is being provided by management on a rent-free basis. We have no intention of finding, in the near future, another office space to rent during the Company's ongoing efforts to raise capital to become profitable.

We currently do not own any real property.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFTEY DISCLOSURES

Not applicable to our operations.

10

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

No public market currently exists for shares of our common stock. On March 6, 2017 we received our Trading Symbol, TRMM, and we have been listed on the OTC Market Site (Pink). Presently there is no bid or ask for our stock.

Because the Company is quoted on the OTC Markets Pink Sheets, its securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading, (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws, (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price, (d) contains a toll-free telephone number for inquiries on disciplinary actions, (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks, and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock, (b) the compensation of the broker-dealer and its salesperson in the transaction, (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock, and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock once we obtain a listing on a regulated market. Therefore, stockholders may have difficulty selling their shares of our common stock.

Record Holders

The Company's common shares are issued in registered form. V Stock Transfer, LLC, 18 Lafayette Place, Woodmere, NY 11598, Phone: 212.828.8436 is the registrar and transfer agent for the Company's common shares.

As of June 20, 2018, the V Stock Transfer shareholders' list of the Company's common shares showed 38 registered shareholders and 26,485,129 shares outstanding, all of which have been recorded by the Company.

Common and Preferred stock

Our authorized capital stock consists of 1,000,000,000 shares of Common Stock, $0.001 par value per share, and 5,000,000 preferred shares, $0.001 par value. Each one share of Series A Preferred stock has a voting right equivalent to 500 votes of Common Stock, and each one share of Series A Preferred stock is convertible into 500 common shares.

As at March 31, 2018 and March 31, 2017 there were a total of 26,485,129 shares of common stock issued and outstanding, and 1,000,000 preferred shares issued and outstanding. We have not issued any shares subsequent to our fiscal year end and up to the date of this report.

Re-Purchase of Equity Securities

Not applicable.

11

Dividends

The Company has not declared any dividends on its common stock since the Company's inception. There is no restriction in the Company's Articles of Incorporation and Bylaws that will limit its ability to pay dividends on its common stock. However, the Company does not anticipate declaring and paying dividends to its shareholders in the near future.

Recent Sales of Unregistered Securities

None.

Securities Authorized for Issuance Under Equity Compensation Plans

As of June 20, 2018, we did not have any authorized Equity Compensation Plans.

Share Purchase Warrants

We have not issued and do not have any warrants to purchase shares of our stock outstanding.

Options

We have not issued and do not have any options to purchase shares of our stock outstanding.

ITEM 6. SELECTED FINANCIAL DATA

|

|

March 31, 2018

|

March 31, 2017

|

||||||

|

Revenue

|

$

|

49,481

|

$

|

83,058

|

||||

|

Total cost of revenue

|

(29,265

|

)

|

(52,596

|

)

|

||||

|

Gross Profit

|

20,216

|

30,462

|

||||||

|

|

||||||||

|

Operating expenses

|

(220,612

|

)

|

(278,925

|

)

|

||||

|

Net (loss)

|

$

|

(200,396

|

)

|

$

|

(248,463

|

)

|

||

|

|

||||||||

|

Total Assets

|

1,035

|

3,462

|

||||||

|

Total Liabilities

|

(947,374

|

)

|

(749,405

|

)

|

||||

|

Stockholders' Deficit

|

$

|

(946,339

|

)

|

$

|

(745,943

|

)

|

||

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements and the notes thereto included in this Report beginning on page F-1. The results shown herein are not necessarily indicative of the results to be expected in any future periods. This discussion contains forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. We use words such as "anticipate," "estimate," "plan," "project," "continuing," "ongoing," "expect," "believe," "intend," "may," "will," "should," "could," and similar expressions to identify forward-looking statements.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to our financial statements, ref: Note 2. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

12

Emerging Growth Company

We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

|

·

|

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

|

|

·

|

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

·

|

submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and

|

|

·

|

disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO's compensation to median employee compensation.

|

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Results of Operations

During the fiscal years ended March 31, 2018 and 2017, the Company generated gross revenues of $49,481 and $83,058 respectively, providing a gross profit after costs totaling $ 20,216 (2018) and $30,462 (2017). The Company incurred operating expenses in fiscal 2018 of $220,612 compared to operating expenses of $278,925 in fiscal 2017, and we had no other expenses in fiscal 2018 or 2017. The Company recorded a net loss in fiscal 2018 of $200,396 compared to $248,463 in fiscal 2017. During fiscal 2018 the Company expended $66,072 on advertising fees (2017 - $127,475), professional fees of $25,482 (2017 - $22,228), social media application management fees of $120,000 (2017 - $120,000) and general and administrative fees of $9,058 (2017 - $9,222). The decrease in advertising fees expended is directly related to the inability to raise sufficient capital in fiscal 2018 to maintain and increase the Company's marketing program.

Liquidity and Capital Resources

Our sole officer and related entities have funded our shortfall in operational capital to date and have agreed to advance funds as needed to allow the business to operate until such time as sufficient outside financing is secured or profitable operations are achieved. While Mr. Palexas has agreed to advance these funds, the agreement is verbal and is unenforceable as a matter of law.

We do not presently have sufficient funds on hand to meet all of our operational expenses as well as planned expansion costs. At a minimum Mr. Palexas has verbally agreed to spend between $150 and $250 per day on advertising and marketing efforts as we seek a larger financing, and to accrue associated costs from the third party service providers controlled by him until such time as there is sufficient cash flow to pay these amounts as they come due. These advertising expenditures are not sufficient to grow and maintain our user base, therefore we are aggressively seeking sufficient funding to fully implement our marketing plans.

We have no formal agreements in place with Mr. Palexas evidencing these commitments. We will seek to raise up to $5,000,000 in order to fully implement our business plan, including our planned future operations, which includes substantive funding for marketing and development of new product for our online apps. Currently we do not have sufficient capital to fully implement our business development. If we fail to raise additional funds in the future, we will not be able to achieve profitable operations.

Working Capital

Total current assets as of March 31, 2018 were $1,035 as compared to $3,462 at March 31, 2017, a decrease of $2,427 year over year. The decrease in current assets is primarily attributable to general operating expenses settled in the period using cash on hand and a reduction to our accounts receivable.

Total current liabilities as of March 31, 2018 were $947,374 as compared to $749,405 in fiscal 2017, an increase of $197,969. The substantive increase in current liabilities is entirely due to the increase in accounts payable, related parties as a result of the Company's inability to meet operating expenses when they come due, resulting in accrued fees and advances from our officer and director and entities controlled by him.

Cash Flow

Cash Used in Operating Activities

Cash used in operating activities of $870 increased during the fiscal year ended March 31, 2018 compared to only $27 of cash used in operating activities during the prior fiscal year.

13

Cash Used in Investing Activities

There was no cash used in investing activities during the fiscal years ended March 31, 2018 and 2017, respectively.

Cash Provided by Financing Activities

Cash provided by financing activities totaled $Nil in each of fiscal 2018 and 2017.

Cash Requirements

We anticipate that our operating and other expenses will increase significantly as we continue to implement our marketing plan and pursue our operational goals. We estimate that our cash requirements for our fiscal year ending March 31, 2019 will be between $250,000 and $5,000,000 based on the success we have in raising additional capital and the marketing efforts we undertake. We do not presently have sufficient funds on hand to pay for the expenses to meet all of our operational expenses as well as planned expansion costs. At a minimum Mr. Palexas has verbally agreed to spend between $150 and $250 per day on advertising and marketing efforts as we seek a larger financing, and to accrue associated costs from the third party service providers controlled by him until such time as there is sufficient cash flow to pay these amounts as they come due. The majority of the anticipated shortfalls are expected to represent amounts payable to service providers controlled by Mr. Palexas under licensing and marketing contracts, which amounts will be accrued until such time as the Company reaches profitable operations or is successful in raising additional capital.

We have developed use of proceeds for our gaming expansion plans for various investment amounts ranging from the minimum of $250,000 up to $5,000,000 in available capital. The speed with which we grow and achieve profitability is directly related to our initial and ongoing marketing expenditures. Dependent on our success in raising additional capital above the minimum capital requirements, we will implement a marketing program which fits our available funds. Should we be successful in raising total proceeds of $5,000,000, we will implement an aggressive marketing and advertising program which should provide for profitable operations before the close of fiscal 2020, and the allocation of $4,500,000 on targeted advertising and marketing programs. Our estimates of the amount of cash necessary to operate our business may prove to be wrong and we could spend our available financial resources much faster than we currently expect. Further, our estimates regarding our use of cash could change if we encounter unanticipated difficulties or other issues arise, in which case our current funds may not be sufficient to operate our business for the period we expect, or we are unable to continue to generate revenues.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Recent accounting pronouncements

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Going Concern

The Company has incurred net losses since inception and had a working capital deficit of $946,339 at March 31, 2018 ($745,943 at March 31, 2017). These conditions raise substantial doubt as to the Company's ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern. If we fail to generate positive cash flow or obtain additional financing, when required, we may have to modify, delay, or abandon some or all of our business and expansion plans.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company does not hold any assets or liabilities requiring disclosure under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements appear beginning on page F-1.

14

TRUPAL MEDIA, INC.

Index to Audited Financial Statements for the

Fiscal years ended March 31, 2018 and 2017

TABLE OF CONTENTS

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

F-2

|

|

Balance Sheets as of March 31, 2018 and 2017

|

F-3

|

|

Statements of Operations for the fiscal year ended March 31, 2018 and 2017

|

F-4

|

|

Statements of Stockholders' Equity

|

F-6

|

|

Statements of Cash Flows for the fiscal year ended March 31, 2018 and 2017

|

F-6

|

|

Notes to Financial Statements

|

F-7 to F-13

|

F-1

Report of Independent Registered Public Accounting Firm

To The Board of Directors and Stockholders of

Trupal Media Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Trupal Media Inc. (the "Company") as of March 31, 2018 and 2017, and the related statements of operations, stockholders' equity (deficit), and cash flows for each of the years in the two-year period ended March 31, 2018 and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31, 2018 and 2017, and the results of its operations and its cash flows for each of the years in the two-year period ended March 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has negative working capital and recurring losses. These factors, among others, raise substantial doubt about the Company's ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/Pinnacle Accountancy Group of Utah

We have served as the Company's auditor since 2017

Farmington, Utah

June 29, 2018

F-2

|

|

March 31, 2018

|

March 31,

2017

|

||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$

|

138

|

$

|

1,008

|

||||

|

Accounts receivable

|

897

|

2,454

|

||||||

|

Total current assets

|

1,035

|

3,462

|

||||||

|

|

||||||||

|

Total assets

|

$

|

1,035

|

$

|

3,462

|

||||

|

|

||||||||

|

LIABILTIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable

|

$

|

36,342

|

$

|

45,446

|

||||

|

Accounts payable – related parties

|

911,032

|

703,959

|

||||||

|

Total current liabilities

|

||||||||

|

|

||||||||

|

Commitments and Contingencies

|

||||||||

|

|

||||||||

|

Total Liabilities

|

947,374

|

749,405

|

||||||

|

|

||||||||

|

Stockholders' equity deficit)

|

||||||||

|

Preferred stock, $0.001 par value, 5,000,000 shares authorized, 1,000,000 shares issued and outstanding

|

1,000

|

1,000

|

||||||

|

Common stock, $0.001 par value, 1,000,000,000 shares authorized, 26,485,129 shares issued and outstanding

|

26,485

|

26,485

|

||||||

|

Additional paid-in capital

|

4,369,512

|

4,369,512

|

||||||

|

Accumulated deficit

|

(5,343,336

|

)

|

(5,142,940

|

)

|

||||

|

Total stockholders' equity (deficit)

|

(946,339

|

)

|

(745,943

|

)

|

||||

|

Total Liabilities and Stockholders' equity (deficit)

|

$

|

1,035

|

$

|

3,462

|

||||

F-3

TRUPAL MEDIA, INC.

STATEMENTS OF OPERATIONS

|

|

Fiscal Year ended

March 31,

|

|||||||

|

|

2018

|

2017

|

||||||

|

$

|

49,481

|

$

|

83,058

|

|||||

|

Cost of revenue

|

||||||||

|

Commission fees

|

14,844

|

24,917

|

||||||

|

Hosting fees

|

9,473

|

18,729

|

||||||

|

Content licensing fees

|

4,948

|

8,950

|

||||||

|

Total cost of revenue

|

29,265

|

52,596

|

||||||

|

|

||||||||

|

Gross Profit

|

20,216

|

30,462

|

||||||

|

|

||||||||

|

Operating expenses

|

||||||||

|

Advertising

|

66,072

|

127,475

|

||||||

|

Professional fees

|

25,482

|

22,228

|

||||||

|

120,000

|

120,000

|

|||||||

|

General and administration

|

9,058

|

9,222

|

||||||

|

Total operating expenses

|

220,612

|

278,925

|

||||||

|

|

||||||||

|

Loss from operations

|

(200,396

|

)

|

(248,463

|

)

|

||||

|

|

||||||||

|

-

|

-

|

|||||||

|

|

||||||||

|

Net income (loss)

|

$

|

(200,396

|

)

|

$

|

(248,463

|

)

|

||

|

|

||||||||

|

Weighted average shares outstanding – basic and diluted

|

26,485,129

|

26,485,129

|

||||||

|

|

||||||||

|

Net income (loss) per share – basic and diluted

|

$

|

(0.01

|

)

|

$

|

(0.01

|

)

|

||

See accompanying notes to audited financial statements.

F-4

TRUPAL MEDIA, INC.

STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

|

|

Preferred Series A

|

Common Stock

|

Additional

Paid-in

|

Accumulated

|

||||||||||||||||||||||||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Deficit

|

Total

|

|||||||||||||||||||||

|

Balance March 31, 2016

|

1,000,000

|

$

|

1,000

|

26,485,129

|

$

|

26,485

|

$

|

4,369,512

|

$

|

(4,894,477

|

)

|

$

|

(497,480

|

)

|

||||||||||||||

|

|

||||||||||||||||||||||||||||

|

(248,463

|

)

|

(248,463

|

)

|

|||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

1,000,000

|

1,000

|

26,485,129

|

26,485

|

4,369,512

|

(5,142,940

|

)

|

(745,943

|

)

|

||||||||||||||||||||

|

Net (loss) for the period

|

(200,396

|

)

|

(200,396

|

)

|

||||||||||||||||||||||||

|

Balance March 31, 2018

|

1,000,000

|

$

|

1,000

|

26,485,129

|

$

|

26,485

|

$

|

4,369,512

|

$

|

(5,343,336

|

)

|

$

|

(946,339

|

)

|

||||||||||||||

F-5

TRUPAL MEDIA, INC.

STATEMENTS OF CASH FLOWS

|

|

March 31, 2018

|

March 31, 2017

|

||||||

|

Cash flows from operating activities:

|

||||||||

|

$

|

(200,396

|

)

|

$

|

(248,463

|

)

|

|||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Decrease in accounts receivable

|

1,557

|

6,996

|

||||||

|

Increase (decrease) in accounts payable and accrued liabilities

|

(9,104

|

)

|

(44,801

|

)

|

||||

|

Increase (decrease) in accounts payable and accrued liabilities – related parties

|

207,073

|

286,241

|

||||||

|

Net cash used in operating activities

|

(870

|

)

|

(27

|

)

|

||||

|

|

||||||||

|

Cash flows from investing activities:

|

||||||||

|

Net cash provided (used) by investing activities

|

-

|

-

|

||||||

|

|

||||||||

|

Cash flows from financing activities:

|

||||||||

|

Net cash provided by financing activities

|

-

|

-

|

||||||

|

|

||||||||

|

Net increase (decrease) in cash

|

(870

|

)

|

(27

|

)

|

||||

|

Cash, beginning of period

|

1,008

|

1,035

|

||||||

|

Cash, end of period

|

$

|

138

|

$

|

1,008

|

||||

|

|

||||||||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Cash paid for:

|

||||||||

|

Interest

|

$

|

-

|

$

|

-

|

||||

|

Income taxes

|

$

|

-

|

$

|

-

|

||||

See accompanying notes to audited financial statements

.

F-6

Note 1 – Description of business and basis of presentation

Organization and nature of business

Trupal Media, Inc. (hereinafter referred to as "we", "us", "our", or "the Company") has developed a platform for casino-game play in a social media environment. We were incorporated in the State of Florida on March 14, 2014. We are headquartered in Miami Beach, Florida and our contracted software development, marketing and implementation providers are based in Peru. The Company launched its flagship social gaming application, "Cleo's Casino" on April 1, 2014. We license over 50 casino based games presently on our social media platform. Trupal Media, Inc. is focused on delivering high quality gaming platforms, maintaining low costs and driving a rigorous marketing campaign that will ensure steady growth and value for the Company and its shareholders.

On May 6, 2015 the Company's Board of Directors approved an amendment to the articles of incorporation to increase the authorized share capital from 10,000,000 to 1,000,000,000 common shares. The effect of this action has been retroactively impacted in these financial statements.

On July 13, 2016, the Company's Form S-1 Registration Statement received a notice of effect from the Securities and Exchange Commission. The Company has received a trading symbol, "TRMM", and expects to commence trading on OTC Pink in the near future.

Note 2 - Summary of Significant Accounting Policies

Fiscal year end: The Company has selected March 31 as its fiscal year end.

Functional currency: The Company's functional currency is the United States Dollar.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reported periods. Actual results could materially differ from those estimates.

Cash and Cash Equivalents

For purposes of reporting within the statements of cash flows, the Company considers all cash on hand, cash accounts not subject to withdrawal restrictions or penalties, and all highly liquid debt instruments purchased with a maturity of three months or less to be cash and cash equivalents.

Revenue Recognition

We derive revenue from the sale of virtual goods associated with our online games, as well as from services provided for customer events. All sales are recorded in accordance with ASC 605, Revenue Recognition. Revenue is recognized when all the criteria have been met:

• When persuasive evidence of an arrangement exists.

• The services have been provided to the customer.

• The fee is fixed or determinable.

• Collectability is reasonably assured.

F-7

TRUPAL MEDIA, INC.

NOTES TO AUDITED FINANCIAL STATEMENTS

MARCH 31, 2018 AND 2017

Note 2 - Summary of Significant Accounting Policies (continued)

Online Game

We operate our flagship social gaming application "Cleo's Casino". Cleo's Casino is available on Facebook. Cleo's Casino generates revenue through the sale of virtual currency to players that they may exchange to play at any of our licensed online slot machines, video poker machines, Hold'em style poker tables, or for other features and experiences available within Cleo Casino. Players can pay for our virtual currency using Facebook credits or Facebook local currency payments when playing our games through Facebook and can use other payment methods such as credit cards or PayPal on other platforms.

Players may have the opportunity to "earn", "buy" or "purchase" (a) virtual in-game items; or (b) virtual in-game points, including but not limited to virtual coins, cash or points, all for use in the game(s) (together with virtual in-game items, "Virtual Items"). Players do not in fact "own" the Virtual Items and the amounts of any Virtual Item does not refer to any credit balance of real points or its equivalent. Rather, by "earning", "buying", or "purchasing" Virtual Items (whether through the use of Facebook Credits or virtual points), Players are granted a limited license to use the software programs that manifest themselves as the Virtual Items. The purchase and sale, with Facebook Credits, of such limited licenses to use Virtual Items, is a completed transaction upon redemption of the applicable Facebook Credits and under no circumstances is refundable, transferable or exchangeable including, without limitation, upon termination of the Player's account, or the discontinuation of the services provided. As a result, the Company recognizes revenue following the sale of the game credits to the customer, and settlement of such amounts from the payment processor, which occurs within a period of 30 days from the date of the original sale to the customer. Any refunds or refuted purchasers are fully settled and cleared by the payment processor within the 30-day time frame allotted and prior to settlement of funds to the Company's account. Therefore, proceeds deposited to the Company's account are not subject to any future reductions by the customer or payment processor and is considered revenue on deposit.

Cost of Revenue

Our cost of revenue consists primarily of the direct expenses incurred in order to generate revenue. Such costs are recorded as incurred. Our cost of revenue consists primarily of virtual good transaction fees paid to platform operators such as Facebook, Google, Amazon and Apple and content licensing fees, all of which are expensed as commissions and recorded as costs of revenue. We also incur hosting fees and server rental fees. We also record costs related to the fulfillment of specific customer advertising campaigns.

Fair Value of Financial Instruments

The Company's financial instruments consist of cash, receivables, payables, and due to related party. The carrying amount of cash, receivables and payables approximates fair value because of the short-term nature of these items.

Research and Development and Capitalized Software Development Costs