Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DELTA AIR LINES, INC. | delta_8k.htm |

Exhibit 99.1

Delta: Built to Last Deutsche Bank Global Industrials and Materials Summit June 6, 2018

Safe Harbor Statements in this presentation that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections o r strategies for the future, may be "forward - looking statements" as defined in the Private Securities Litigation Reform Act of 199 5. All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectat ion s, beliefs, intentions, projections and strategies reflected in or suggested by the forward - looking statements. These risks and uncertainties include, but are not limi ted to, the cost of aircraft fuel; the impact of fuel hedging activity including rebalancing our hedge portfolio, recording mark - to - market adjustments or posting colla teral in connection with our fuel hedge contracts; the availability of aircraft fuel; the performance of our significant investments in airlines in other parts of the world; the possible effects of accidents involving our aircraft; breaches or security lapses in our information technology systems; disruptions in our infor mat ion technology infrastructure; our dependence on technology in our operations; the restrictions that financial covenants in our financing agreements could have on our financial and business operations; labor issues; the effects of weather, natural disasters and seasonality on our business; the effects of an extend ed disruption in services provided by third party regional carriers; failure or inability of insurance to cover a significant liability at Monroe’s Trainer refiner y; the impact of environmental regulation on the Trainer refinery, including costs related to renewable fuel standard regulations; our ability to retain senior management and ke y employees; damage to our reputation and brand if we are exposed to significant adverse publicity through social media; the effects of terrorist attack s o r geopolitical conflict; competitive conditions in the airline industry; interruptions or disruptions in service at major airports at which we operate; the effect s o f extensive government regulation on our business; the sensitivity of the airline industry to prolonged periods of stagnant or weak economic conditions; uncertainty i n e conomic conditions and regulatory environment in the United Kingdom related to the likely exit of the United Kingdom from the European Union; and the effects o f t he rapid spread of contagious illnesses. Additional information concerning risks and uncertainties that could cause differences between actual results and forward - lookin g statements is contained in our Securities and Exchange Commission filings, including our Annual Report on Form 10 - K for the fiscal year ended December 31, 2017 and our Quarterly Report on Form 10 - Q for the period ended March 31, 2018. Caution should be taken not to place undue reliance on our forward - looking statements, which represent our views only as of June 6, 2018, and which we have no current intention to update. 1

Delta Delivers Again in 2017 2 Running a reliable, customer - focused airline is producing strong profits and cash flows that are sustainable through the business cycle Balanced capital allocation allows for investment in the future and stronger financial foundation Solid demand producing revenue - driven earnings growth, but sharp rise in fuel pressures near - term benefit Delta: Built to Last A durable business model focused on customer service and reliability with sustainable financial results Driving Long - Term Value For Owners Solid June Quarter Producing Consistent Results

Delta Delivers Again in 2017 3 Consistently Producing Solid Results Running a reliable, customer - focused airline is producing strong profits and cash flows, allowing for improved balance sheet strength and increased return of capital to shareholders Expect 2018 will be 4 th year with over $5B in p retax profits $4.5B $5.9B $5.9B $5.3B 2014 2015 2016 2017 Target returning at least 70% of FCF to Shareholders $1.4B $2.6B $3.1B $2.4B 2014 2015 2016 2017 Pre - Tax Profit Returns to Shareholders Note: Adjusted for special items, 2016 and 2017 recast for new accounting standards; non - GAAP financial measures reconciled in A ppendix $5.8B $7.4B $7.0B $6.8B 2014 2015 2016 2017 Operating Cash Flow Cash flow generation allows for investment in the business

Delta T o Deliver A Solid June Quarter 4 June Quarter 2018 Forecast Earnings per Share $1.65 – $1.75 Pre - tax margin 13 – 14% Total unit revenue change year over year Up 4 – 5% Fuel price $2.20 – $2.25 CASM - Ex , change year over year Up ~3% Non - operating expense ~$100 million System Capacity, change year over year Up 3 – 4% • Expecting to deliver earnings per share of $1.65 – $1.75 for the June quarter • Revenue and demand remains strong across all entities in both leisure and business segments • Market fuel prices up ~50% year over year and ~12% since beginning of quarter ‒ Recapture through higher revenues typically lags fuel price increase by 6 - 12 months • Non - fuel unit costs at high end of guidance, remain on track to deliver non - fuel unit cost growth of below 2% for the year Solid demand environment producing revenue - driven earnings growth, but sharp rise in fuel price pressuring near - term results

Revenue Environment Remains Strong, Fuel Price Increase Pressuring Short - term Results • Delta initiatives expected to drive continued revenue benefits – Branded fares and American Express partnership each expected to drive an incremental $300 million of revenue in 2018 – Leveraging alliance partnerships expected to drive incremental $100 million revenue this year – Continue to invest in products and services customers value which has resulted in a 10% revenue premium vs. the industry • Decisions on Fall 2018 capacity plans expected to be made over the next month through the lens of strong demand and volatile fuel – Revenue and demand remains strong across all entities in both leisure and business segments – Market fuel prices up ~50% year over year and ~ 12% since beginning of quarter – Remain focused on recapturing fuel through revenue – fuel prices are highly correlated over long - term with 6 - 12 month lag 5 Delta PRASM Versus Fuel Price Change -54% -49% -44% -39% -34% -29% -24% -19% -14% -9% -4% 1% 6% 11% 16% 21% 26% 31% 36% -8% -6% -4% -2% 0% 2% 4% 6% YoY PRASM Change YoY Fuel Price Change

Investments in Customer Experience and Operational Reliability Driving Revenue Premium • Delta’s strong customer focus combined with investments in our fleet, network, product, and partners have driven a significant revenue premium to the industry – Top global operation – named World’s Most On - Time Airline in 2017 by FlightGlobal – Strong customer satisfaction with record NPS scores YTD in 2018 • Initiatives in place to sustain and improve upon performance , including producing a premium to the industry in each international entity 6 Delta Domestic Net Promoter Score Delta Domestic Passenger Unit Revenue vs. Industry 15.3% 27.2% 33.5% 40.1% 44.3% 2010 2012 2014 2016 1Q18 106% 112% 115% 116% 118% 2010 2012 2014 2016 1Q18

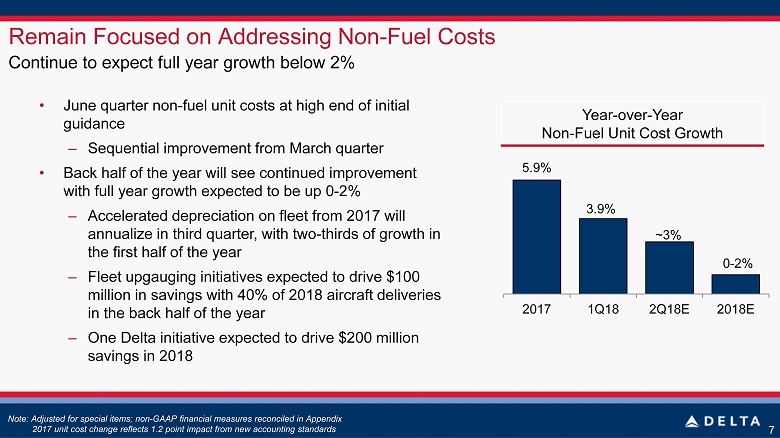

Remain Focused on Addressing Non - Fuel Costs • June quarter non - fuel unit costs at high end of initial guidance – Sequential improvement from March quarter • Back half of the year will see continued improvement with full year growth expected to be up 0 - 2% – Accelerated depreciation on fleet from 2017 will annualize in third quarter, with two - thirds of growth in the first half of the year – Fleet upgauging initiatives expected to drive $100 million in savings with 40% of 2018 aircraft deliveries in the back half of the year – One Delta initiative expected to drive $200 million savings in 2018 Continue to expect full year growth below 2% Note: Adjusted for special items; non - GAAP financial measures reconciled in Appendix 2017 unit cost change reflects 1.2 point impact from new accounting standards 7 Year - over - Year Non - Fuel Unit Cost Growth 5.9% 3.9% ~3% 0 - 2% 2017 1Q18 2Q18E 2018E

Continuing Balanced Capital Allocation in 2018 8 Balancing cash flows between investment in business, balance sheet and shareholders Reinvest In The Business • Capital spending targets ~50% of operating cash flow • Allows for replacement of ~30% of Delta’s mainline fleet from 2017 - 2020 • Provides for continued investment in technology Strengthen The Balance Sheet • Balance sheet progress will allow Delta to shift cash from debt and pension funding to pay cash taxes • Investment grade rating from all three ratings agencies Return Cash To Shareholders • Expect to return 70% of free cash flow to shareholders • Long - term target to return 20 - 25% of free cash flow through dividends

Harnessing the Power of an Investment Grade Balance Sheet • Provided path to $2 billion earnings - accretive accelerated pension funding ‒ Issued unsecured debt in Mar - 17 at 3.3% blended rate ‒ Completed all minimum required funding through 2024, increasing cash flow flexibility • Pension liability $5.7 billion at current market rates – over $7.5 billion improvement since the end of 2012 • Raised $1.6 billion of unsecured debt in Apr - 18 at a blended rate of 3.8% ‒ Proceeds used to refinance existing secured term loans , lowered interest expense by $20 million annually ‒ Increased revolver capacity by $600 million to $3.1 billion ‒ Freed over $8 billion in previously encumbered assets Stronger balance sheet provides access to lower cost financing, more business flexibility Non - Operating Expense 9 $1,257M $873M $413M 2009 2013 2017 2018E Reduced by $1B+ since 2009 $150 - 200M

Committed to Consistent Shareholder Returns • Delta has increased the dividend by 50% annually since initiated in 2013 – T arget returning 20 - 25 % of free cash flow through dividends over the long - term – Dividend yield ~2.2% at current stock price • Delta is a consistent purchaser of its stock – Current shares repurchase authorization has ~$4 billion remaining – expect to complete by mid - 2020 – Since 2013, Delta has reduced share count by 18% while also improving the balance sheet and earning back an investment grade rating Target returning ~70 % of free cash flow to owners 10 $200M $300M $ 425M $ 600M $875M Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Annual Dividend Dividend per Share $0.24 $0.36 $0.54 $0.81 $1.22

Delta: Built to Last 11 America’s Best Run Airline Consistent Financial Performance Investment Grade Balance Sheet Investing for Delta’s Future Setting the standard for financial, operational and service excellence in the airline industry

Non - GAAP Reconciliations 12 Delta sometimes uses information ("non - GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non - GAAP financial measures may be considered in additio n to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The tables below show reconciliations of non - GAAP financial measures used in this pr esentation to the most directly comparable GAAP financial measures. Forward Looking Projections . We do not reconcile forward looking non - GAAP financial measures because mark - to - market ("MTM") adjustments and settlements wil l not be known until the end of the period and could be significant. Non - GAAP Financial Measures Pre - Tax Profit, Adjusted We adjust for the following items to determine pre - tax profit, adjusted for the reasons described below: Mark - to - Market ("MTM") adjustments and settlements . MTM adjustments are defined as fair value changes recorded in periods other than the settlement period. Such fair value cha nge s are not necessarily indicative of the actual settlement value of the underlying hedge in the contract settlement period. Settleme nts represent cash received or paid on hedge contracts settled during the period. These items adjust fuel expense to show the economic impact of hedging, including cash received or paid on he dge contracts during the period. Adjusting for these items allows investors to understand and analyze our core financial performance in the periods shown." Investment MTM adjustments . We record our proportionate share of earnings from our equity investment in Virgin Atlantic and Aeroméxico in non - operating expense. We adjust for these MTM adjustments to allow investors to understand and analyze the company’s core financial performance in the periods shown. Restructuring and other and loss on extinguishment of debt . Because of the variability from period to period, the adjustments for these items are helpful to investors to analyze the c omp any’s recurring core performance in the periods shown. Year Ended Year Ended Year Ended Year Ended (in billions) December 31, 2017 December 31, 2016 December 31, 2015 December 31, 2014 GAAP 5.5$ 6.4$ 7.2$ 1.1$ Adjusted for: MTM adjustments and settlements (0.3) (0.4) (1.3) 2.3 Investment MTM adjustments 0.1 (0.1) - 0.1 Restructuring and other - - - 0.7 Loss on extinguishment of debt - - - 0.3 Total adjustments (0.2) (0.5) (1.3) 3.4 Non-GAAP 5.3$ 5.9$ 5.9$ 4.5$

Non - GAAP Reconciliations 13 Operating Cash Flow, adjusted We adjusted operating cash flow because management believes this metric is helpful to investors to evaluate the company's abilit y t o generate cash that is available for use for capital expenditures, debt service or general corporate initiatives. Adjustments include : Hedge deferrals, including early settlements . During the March 2015 quarter, we effectively deferred settlement of a portion of our fuel hedge portfolio by entering into tr ansactions that, excluding market movements from the date of inception, would provide approximately $300 million in cash receipts during the s eco nd half of 2015 and require approximately $300 million in cash payments in 2016. During the March 2016 quarter, we further deferred settlement of a portion of our hedge portfolio unti l 2 017 by entering into transactions that, excluding market movements from the date of inception, would provide approximately $300 million in cash receipts during the second half of 201 6 a nd require approximately $300 million in cash payments in 2017. Additionally, during the June 2016 quarter, we early terminated certain of our outstanding deferral transactions and ma de cash payments of $170 million, including normal settlements. Operating cash flow is adjusted to include the impact of these deferral transactions in order to allow investors to understa nd the net impact of hedging activities in the periods shown Hedge margin and other . Operating cash flow is adjusted for hedge margin and other as we believe this adjustment removes the impact of current mark et volatility on our unsettled hedges and allows investors to understand and analyze the company’s core operational performance in the periods shown . Reimbursements related to build - to - suit facilities and other . Management believes investors should be informed that these reimbursements for build - to - suit leased facilities effectively red uce net cash provided by operating activities and related capital expenditures . Pension plan contribution . In 2017, we contributed $2 billion to our pension plans using net proceeds from our debt issuance. We adjusted operating ca sh flow to exclude this contribution to allow investors to understand the cash flows related to our core operations in the periods shown. Year Ended Year Ended Year Ended Year Ended December 31, 2017 December 31, 2016 December 31, 2015 December 31, 2014 5.1$ 7.2$ 7.9$ 4.9$ (0.2) (0.1) 0.4 - - (0.1) (0.8) 0.9 (0.1) - (0.1) - 2.0 - - - 6.8$ 7.0$ 7.4$ 5.8$ (in billions) Net cash provided by operating activities, adjusted Net cash provided by operating activities (GAAP) Adjustments: Hedge deferrals, including early settlements Hedge margin and other Reimbursements related to build-to-suit facilities and other Pension plan contribution

Non - GAAP Reconciliations 14 Non - Fuel Unit Cost or Cost per Available Seat Mile (“CASM - Ex”) We adjust CASM for the following items to determine CASM - Ex for the reasons described below : Aircraft fuel and related taxes . The volatility in fuel prices impacts the comparability of year - over - year financial performance. The adjustment for aircraft f uel and related taxes allows investors to understand and analyze our non - fuel costs and year - over - year financial performance. Ancillary businesses and refinery . These expenses include aircraft maintenance and staffing services we provide to third parties, our vacation wholesale opera tio ns and refinery cost of sales to third parties. Because these businesses are not related to the generation of a seat mile, we adjust for the costs related to these sales to provide a more meaningful comparison of the costs of our airline operations to the rest of the airline industry. Profit sharing . We adjust for profit sharing because this adjustment allows investors to better understand and analyze our recurring cost p erf ormance and provides a more meaningful comparison of our core operating costs to the airline industry. March 31, 2018 March 31, 2017 Change 15.35 14.00 (3.12) (2.56) (0.83) (0.51) Profit sharing (0.30) (0.26) 11.10 10.67 3.9% December 31, 2017 December 31, 2016 Change CASM (cents) 13.83 12.89 (2.66) (2.38) (0.58) (0.47) (0.42) (0.44) CASM-Ex 10.17 9.60 5.9% Three Months Ended Year Ended Adjusted for: Aircraft fuel and related taxes CASM (cents) Adjusted for: Ancillary businesses and refinery Profit sharing Aircraft fuel and related taxes Ancillary businesses and refinery CASM-Ex