Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FULTON FINANCIAL CORP | a8-k5x21x18.htm |

ANNUAL SHAREHOLDERS’ MEETING May 21, 2018 1

REMINDER: If you have not yet voted your shares, please do so now by visiting the Judge of Election table at the side of the room. 2

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, they are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2017 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which have been filed with the Securities and Exchange Commission (the “SEC”) and are available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the SEC’s website (www.sec.gov) and in the Corporation’s subsequent filings with the SEC. The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 3

RULES OF CONDUCT FOR TODAY’S MEETING • Large bags, cameras, cell phones, recording devices and other electronic devices are not permitted at, or to be used during, the meeting. • The display of placards and/or signs is prohibited. • Questions from shareholders should be directed to the Chairman of the meeting during the Question and Answer (Q&A) period. • During the Q&A period, shareholders will be asked to state their name prior to asking a question. • During the Q&A period, please limit yourself to one question to give other shareholders the opportunity to speak. • Fulton’s Chairman of the Board and CEO shall preside as Chairman of the meeting and retain sole authority to make determinations with respect to the rules of conduct of the meeting. • Individuals who fail to comply with these rules of conduct, disrupt or otherwise impede the orderly conduct of the meeting may be asked to immediately leave the meeting. 4

Phil Wenger, Chairman and CEO WELCOME AND OPENING REMARKS 5

TODAY’S AGENDA • Business Meeting • Proposals: • Election of Directors • Say on Pay • Ratification of appointment of independent auditor • Introductions • Results of Voting • Conclusion of Business Meeting • Management Presentation • Questions and Answers 6

BOARD OF DIRECTORS 7

BOARD OF DIRECTORS Lisa Crutchfield 8

BOARD OF DIRECTORS Denise Devine 9

BOARD OF DIRECTORS Pat Freer 10

BOARD OF DIRECTORS George Hodges 11

BOARD OF DIRECTORS Al Morrison 12

BOARD OF DIRECTORS Rob Moxley 13

BOARD OF DIRECTORS Scott Smith 14

BOARD OF DIRECTORS Scott Snyder 15

BOARD OF DIRECTORS Ron Spair 16

BOARD OF DIRECTORS Mark Strauss 17

BOARD OF DIRECTORS Ernie Waters 18

SENIOR MANAGEMENT 19

Retirements Phil Rohrbaugh Craig Roda 20

SENIOR MANAGEMENT Mark McCollom 21

SENIOR MANAGEMENT Curt Myers 22

SENIOR MANAGEMENT Meg Mueller 23

SENIOR MANAGEMENT Betsy Chivinski 24

SENIOR MANAGEMENT Angie Sargent 25

SENIOR MANAGEMENT Dave Campbell 26

SENIOR MANAGEMENT Angela Snyder 27

SENIOR MANAGEMENT Dan Stolzer 28

SENIOR MANAGEMENT Bernadette Taylor 29

REPORT OF THE JUDGE OF ELECTION 30

ANNUAL SHAREHOLDERS’ MEETING May 21, 2018 31

Phil Wenger, Chairman and CEO A LOOK BACK AND A LOOK AHEAD 32

Pennsylvania New Jersey Delaware Maryland Virginia 33

BASIC FACTS (AT 3/31/18) Banking offices: 243 Asset size: $19.9 billion Team members: Nearly 3,700 Shares outstanding: 175.4 million Market capitalization: $3.1 billion Book value per share: $12.74 Tangible book value per share*: $9.71 *Non-GAAP based financial measure. For a reconciliation to the most comparable GAAP measure, please refer to the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 34

FINANCIAL PERFORMANCE 35

2017 HIGHLIGHTS(1) Increased diluted earnings per share Record year of revenues and net income, excluding tax charge(2) Growth in loans and deposits Stable asset quality Pre-provision net revenue(3) increased Surpassed $20 billion in total assets (1) Comparisons are to 2016. (2) In the fourth quarter of 2017, a $15.6 million charge to income taxes was recorded related to the re-measurement of net deferred tax assets resulting from the new federal tax legislation enacted in December 2017. (3) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. 36

RETURN ON AVERAGE ASSETS, TANGIBLE EQUITY & AVERAGE EQUITY Return on Average Assets Return on Tangible Equity Return on Average Equity 1.00% 14.0% 10.0% 1.00% 9.34% 0.98% 12.30% 0.90% 12.0% 7.83% 0.88% 11.57% 8.0% 0.80% 10.0% 10.33% 7.81% 0.70% 8.0% 6.0% 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 FULT Peer^ Top 50* FULT Peer^ Top 50* FULT Peer^ Top 50* Note: Return an average assets determined by dividing net income for the period indicated by average assets. Return on average equity determined by dividing net income for the period indicated by average shareholders’ equity. Return an tangible equity is a non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. None of these ratios have been adjusted for the $15.6 million tax charge taken during the fourth quarter of 2017 due to the re-measurement of net deferred tax assets. ˄ See “Appendix” for listing of 2017 Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31, 2017. Excludes credit card companies. Source: SNL Financial LC 37

AVERAGE LOAN AND AVERAGE DEPOSIT GROWTH Average Loan Growth Average Deposit Growth 13.0% 13.0% 11.0% 9.4% 11.0% 9.4% 9.0% 9.0% 7.8% 6.1% 7.0% 7.0% 5.0% 6.0% 5.0% 6.0% 3.0% 3.0% 1.0% 1.0% -1.0% -1.0% 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 FULT Peer^ Top 50* FULT Peer^ Top 50* Note: 2013 through 2017 represents December year-over-year change in average loans and average deposits ˄ See “Appendix” for listing of 2017 Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31,2017. Excludes credit card companies. Source: SNL Financial LC 38

DEPOSIT PORTFOLIO COMPOSITION Average demand and savings were up 8.1% compared to 2016; while total average deposits were up 6.1%. Year Ended Year Ended December 31, 2016 December 31, 2017 10% 19% 9% 18% 18% 20% 29% 28% 24% 25% Note: Deposit composition is based on average balances for the periods indicated. Average brokered deposits were $49.1 million and $0 as of the years ended December 31, 2017 and 2016, respectively; the percentage balance in both comparative periods was 0%. 39

NON-PERFORMING LOANS (NPLS) & NPLS TO LOANS ($ IN MILLIONS) $175.0 3.00% $154.3 $150.0 $144.8 $138.5 $131.6 $134.8 2.50% $125.0 2.00% $100.0 1.50% $75.0 1.00% $50.0 1.21% 1.05% 1.06% 0.90% 0.85% $25.0 0.50% $- 0.00% 2013 2014 2015 2016 2017 NPLs NPLs/Loans Note: NPLs consist of nonaccrual loans and accruing loans 90 days or more past due. 40

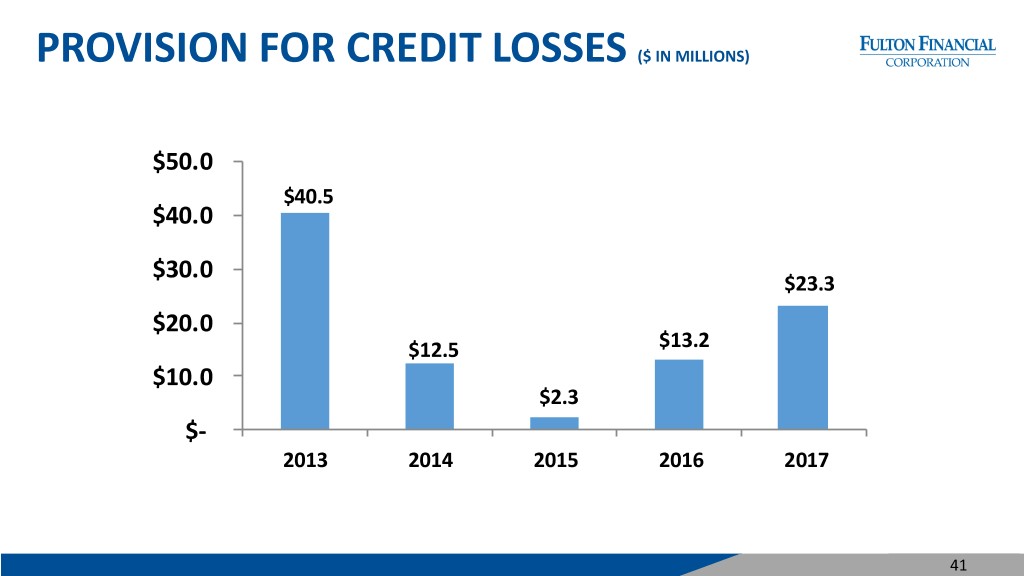

PROVISION FOR CREDIT LOSSES ($ IN MILLIONS) $50.0 $40.5 $40.0 $30.0 $23.3 $20.0 $12.5 $13.2 $10.0 $2.3 $- 2013 2014 2015 2016 2017 41

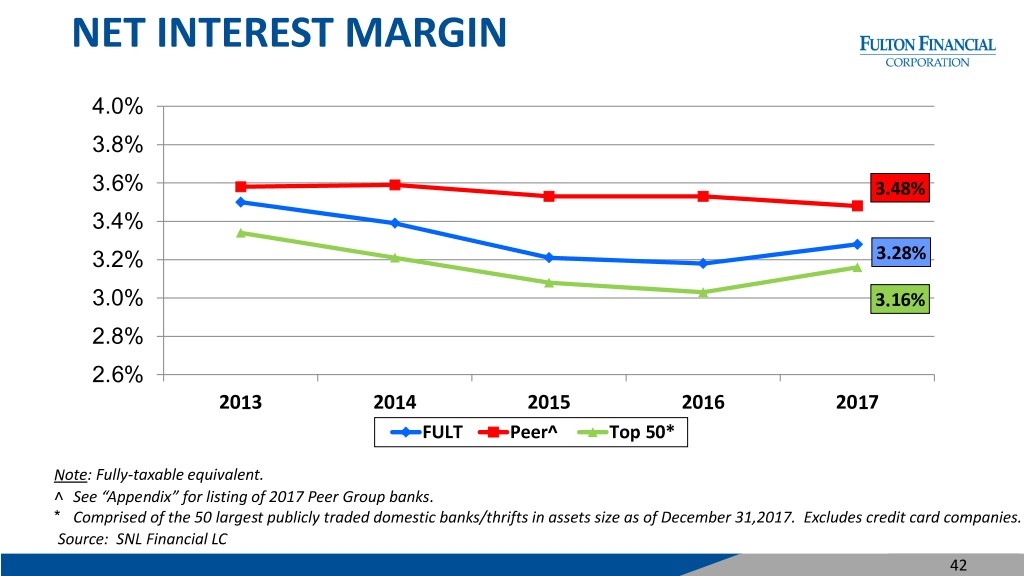

NET INTEREST MARGIN 4.0% 3.8% 3.6% 3.48% 3.4% 3.2% 3.28% 3.0% 3.16% 2.8% 2.6% 2013 2014 2015 2016 2017 FULT Peer^ Top 50* Note: Fully-taxable equivalent. ˄ See “Appendix” for listing of 2017 Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31,2017. Excludes credit card companies. Source: SNL Financial LC 42

EFFICIENCY RATIO 70.0% 68.0% 66.0% 64.0% 64.5% 62.0% 62.6% 60.0% 58.0% 59.3% 56.0% 54.0% 2013 2014 2015 2016 2017 FULT Peer^ Top 50* Note: The efficiency ratio is a non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. ˄ See “Appendix” for listing of 2017 Peer Group banks. * Comprised of the 50 largest publicly traded domestic banks/thrifts in assets size as of December 31, 2017. Excludes credit card companies. Source: SNL Financial LC 43

CAPITAL STRENGTH Regulatory Capital Ratios & TCE Ratio 16.0% 15.0% 14.7% 13.1% 13.2% 13.2% 13.0% 12.3% 12.0% 10.4% 10.2% 10.4% 9.3% 8.8% 8.7% 8.6% 8.7% 8.0% 4.0% 0.0% 2013 2014 2015 2016 2017 Total Risk-Based Capital Ratio Tier 1 Risk-Based Capital Ratio TCE Ratio (1) (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. 44

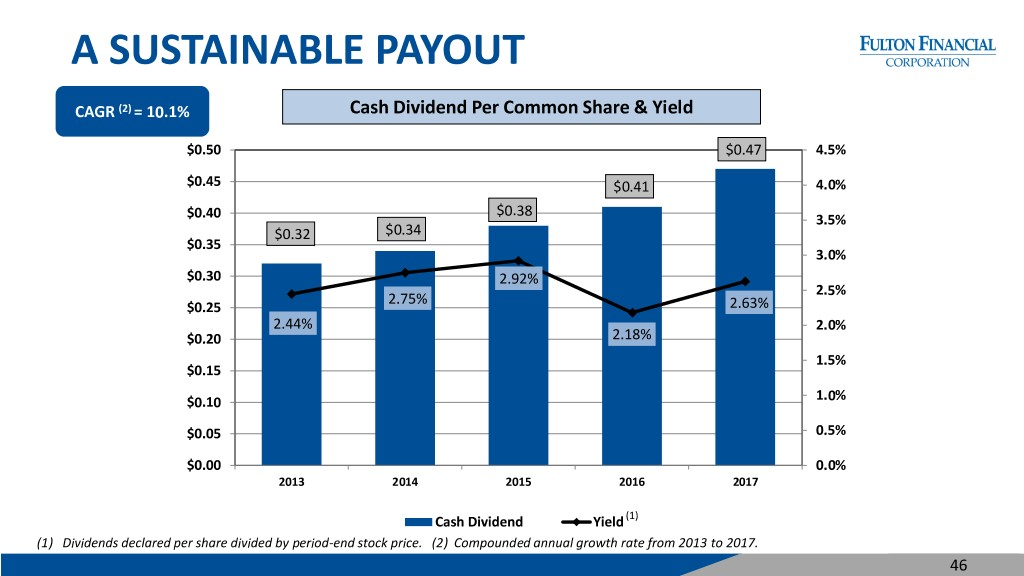

CAPITAL DEPLOYMENT 2017: • Increased quarterly cash dividend by $0.01 to $0.11 • Paid a $0.03 special dividend in 4th quarter March 2018: • Increased quarterly cash dividend by $0.01 to $0.12 45

A SUSTAINABLE PAYOUT CAGR (2) = 10.1% Cash Dividend Per Common Share & Yield $0.50 $0.47 4.5% $0.45 $0.41 4.0% $0.38 $0.40 3.5% $0.32 $0.34 $0.35 3.0% $0.30 2.92% 2.5% 2.75% $0.25 2.63% 2.44% 2.0% $0.20 2.18% 1.5% $0.15 $0.10 1.0% $0.05 0.5% $0.00 0.0% 2013 2014 2015 2016 2017 Cash Dividend Yield (1) (1) Dividends declared per share divided by period-end stock price. (2) Compounded annual growth rate from 2013 to 2017. 46

SHARE REPURCHASE PROGRAMS • Repurchased 31.9 million shares (June 2012 – December 2017) • $31.4 million remaining in current board-authorized share repurchase program 47

1ST QUARTER 2018 PERFORMANCE • Diluted earnings per share: $0.28 • 47.4% increase linked quarter • 12.0% increase year over year • Return on assets: 1.01% • Return on equity: 9.02% • Return on tangible equity(1): 11.85% • Average loans increased 5.4% year over year • Average demand and savings deposits increased 4.5% year over year • Net interest margin improved linked quarter and year over year • Most credit metrics were stable to improving (1) Non-GAAP-based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation. 48

FULTON FINANCIAL STOCK PERFORMANCE AND ANALYSTS’ RECOMMENDATIONS 49

STOCK PERFORMANCE Stock Price Change FULT Peer (1) Large Banks (2) December 31, 2014 – 44.82% 35.38% 42.30% December 31, 2017 December 31, 2016 – -4.79% -0.81% 20.10% December 31, 2017 (1) See “Appendix” for listing of 2017 Peer Group banks (2) Price change of Large Banks, which consist of: Bank of America Corporation, BB&T Corporation, Citigroup, Inc., Fifth Third Bancorp, JPMorgan Chase & Co., KeyCorp, M&T Bank Corporation, PNC Financial Services Group, Inc., SunTrust Banks Inc., U.S. Bancorp, and Wells Fargo & Company. Source: S&P Global Market Intelligence 50

ANALYSTS’ RECOMMENDATIONS (AS OF 4/18/18) • Barclays Capital, Inc. Underweight • Boenning & Scattergood, Inc. Neutral • D.A. Davidson & Co. Neutral • Hovde Group, LLC Market Perform • Jefferies LLC Hold • Keefe, Bruyette & Woods, Inc. Market Perform • Merion Capital Group Neutral • Piper Jaffray & Co. Neutral • Raymond James & Associates, Inc. Market Perform • Sandler O’Neill & Partners, L.P. Hold • Stephens, Inc. Equal-Weight Hold =Neutral =Market Perform=Equal-Weight Underperform =Underweight =Sell 51

THE STORY BEHIND THE NUMBERS 52

KEY GOALS AND OBJECTIVES: • Sustaining our BSA/AML program • Consolidating subsidiary banks • Controlling expenses • Enhancing shareholder value • Optimizing customer delivery channels • Investing in talent • Advancing digital and other technologies • Promoting home ownership to low- and moderate-income individuals 53

BANK SECRECY ACT/ ANTI-MONEY LAUNDERING 54

PROGRESS IS BEING MADE • Enforcement actions terminated at: 55

CONSOLIDATING OUR BANKING CHARTERS 56

Pennsylvania (Post-Charter Consolidation) New Jersey Delaware Maryland Virginia 57

OPTIMIZING CUSTOMER DELIVERY CHANNELS 58

THREE MAIN BUSINESS AREAS . Focused on the needs of specific customer segments Consumer Shared Commercial Services 59

CONSUMER: BRANCH OPTIMIZATION • Transforming the environment • More reflective of customer needs/ market opportunities • Developed team in new ways • Transformed physical space • Increasing transaction automation 60

COMMERCIAL: SPECIALIZED BANKING • Focus on specific industries and business segments • Expanding in commercial real estate, municipalities and health care • Enhanced training and support for staff 61

CREATING AN OUTSTANDING CUSTOMER EXPERIENCE 62

DEEPER AND BROADER USE OF DATA AND TECHNOLOGY 63

NEW FULTON BANK WEBSITE • Mobile-friendly • Improved user experience • Ability to tailor content to each user’s interests www.fultonbank.com 64

SERVING LOW- AND MODERATE- INCOME AND MINORITY INDIVIDUALS AND COMMUNITIES 65

PARTNERS IN SERVING OUR COMMUNITY • Credit and money management counseling • Homebuyer financial assistance • Offices open in: • Reading, PA • Baltimore, MD • Opening soon in: • Philadelphia, PA 66

SERVING LOW- AND MODERATE- INCOME AND MINORITY INDIVIDUALS AND COMMUNITIES 67

THANK YOU TO OUR SHAREHOLDERS! 68

QUESTIONS & ANSWERS May 21, 2018 69

ANNUAL SHAREHOLDERS’ MEETING May 21, 2018 70

APPENDIX 71

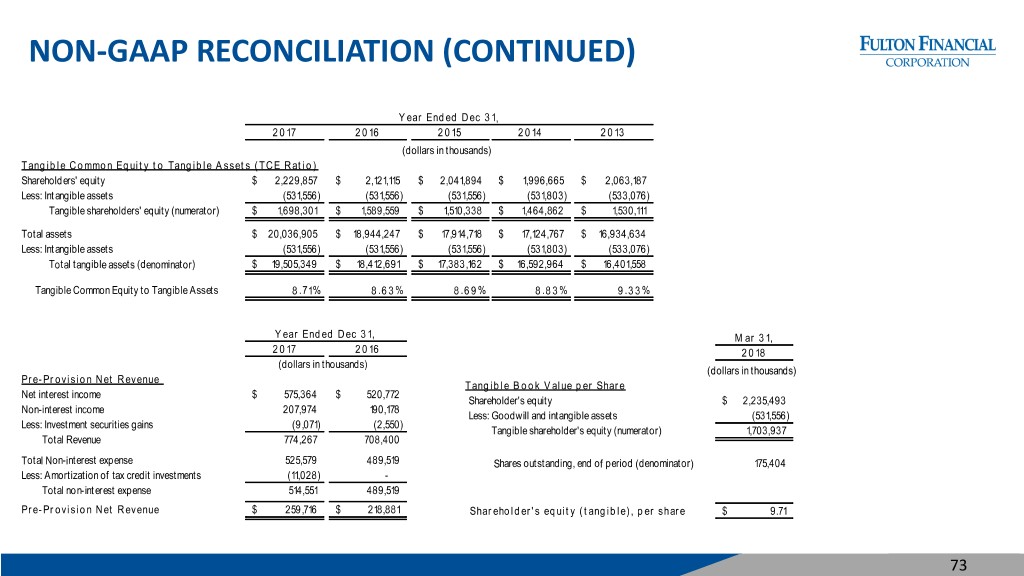

NON-GAAP RECONCILIATION Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Year Ended D ecember 31, 2017 2016 2015 2014 2013 Efficiency ratio (dollars in thousands) Non-interest expense $ 525,579 $ 489,519 $ 480,160 $ 459,246 $ 461,433 Less: Intangible amortization - - (247) (1,259) (2,438) Less: Loss on redemption of trust preferred securities - - (5,626) - - Less: Amortization of tax credit investments (11,028) - - - - Numerator $ 514,551 $ 489,519 $ 474,287 $ 457,987 $ 458,995 Net interest income (fully taxable equivalent) $ 598,565 $ 541,271 $ 518,464 $ 532,322 $ 544,474 Plus: Total Non-interest income 207,974 190,178 181,839 167,379 187,664 Less: Investment securities (gains) losses (9,071) (2,550) (9,066) (2,041) (8,004) Denominator $ 797,468 $ 728,899 $ 691,237 $ 697,660 $ 724,134 Efficiency ratio 64.5% 67.2% 68.6% 65.6% 63.4% T hree M o nths Ended M arch 31, Year Ended D ec 31, 2018 2017 2016 2015 2014 2013 (dollars in thousands) R eturn o n T angible Equity Net income $ 49,480 $ 171,753 $ 161,625 $ 149,502 $ 157,894 $ 161,840 Plus: Intangible amortization, net of tax - - - 161 818 1,585 Numerator $ 49,480 $ 171,753 $ 161,625 $ 149,663 $ 158,712 $ 163,425 Average shareholders' equity $ 2,224,615 $ 2,193,863 $ 2,100,634 $ 2,026,883 $ 2,071,640 $ 2,053,821 Less: Average goodwill and intangible assets (531,556) (531,556) (531,556) (531,618) (532,425) (534,431) Average tangible shareholders' equity (denominator) $ 1,693,059 $ 1,662,307 $ 1,569,078 $ 1,495,265 $ 1,539,215 $ 1,519,390 Return on average common shareholders' equity (tangible), annualized 11.85% 10.33% 10.30% 10.01% 10.31% 10.76% 72

NON-GAAP RECONCILIATION (CONTINUED) Y ear End ed D ec 3 1, 2 0 17 2 0 16 2 0 15 2 0 14 2 0 13 (dollars in thousands) T ang ib le C o mmo n Eq uit y t o T ang ib le A sset s ( T C E R at io ) Shareholders' equity $ 2,229,857 $ 2,121,115 $ 2,041,894 $ 1,996,665 $ 2,063,187 Less: Intangible assets (531,556) (531,556) (531,556) (531,803) (533,076) Tangible shareholders' equity (numerator) $ 1,698,301 $ 1,589,559 $ 1,510,338 $ 1,464,862 $ 1,530,111 Total assets $ 20,036,905 $ 18,944,247 $ 17,914,718 $ 17,124,767 $ 16,934,634 Less: Intangible assets (531,556) (531,556) (531,556) (531,803) (533,076) Total tangible assets (denominator) $ 19,505,349 $ 18,412,691 $ 17,383,162 $ 16,592,964 $ 16,401,558 Tangible Common Equity to Tangible Assets 8 .71% 8 .6 3 % 8 .6 9 % 8 .8 3 % 9 .3 3 % Y ear End ed D ec 3 1, M ar 3 1, 2 0 17 2 0 16 2 0 18 (dollars in thousands) (dollars in thousands) Pre- Pro visio n N et R evenue T ang ib le B o o k V alue p er Share Net interest income $ 575,364 $ 520,772 Shareholder's equity $ 2,235,493 Non-interest income 207,974 190,178 Less: Goodwill and intangible assets (531,556) Less: Investment securities gains (9,071) (2,550) Tangible shareholder's equity (numerator) 1,703,937 Total Revenue 774,267 708,400 Total Non-interest expense 525,579 489,519 Shares outstanding, end of period (denominator) 175,404 Less: Amortization of tax credit investments (11,028) - Total non-interest expense 514,551 489,519 Pre- Pro visio n N et R evenue $ 259,716 $ 218,881 Shareho ld er' s eq uit y ( t ang ib le) , p er share $ 9.71 73

2017 PEER GROUP(1) BancorpSouth Bank Trustmark Corporation Commerce Bancshares, Inc. UMB Financial Corporation F.N.B. Corporation Umpqua Holdings Corporation Hancock Holding Company United Bankshares, Inc. IBERIABANK Corporation Valley National Bancorp MB Financial, Inc. Webster Financial Corporation Northwest Bancshares, Inc. Old National Bancorp Western Alliance Bancorporation Prosperity Bancshares, Inc. Wintrust Financial Corporation TCF Financial Corporation (1) Fulton’s Peer group as of December 31, 2017. Peer comparisons for all historical periods included within this presentation have been updated based on the above peer group for all periods presented. For Fulton’s 2018 Peer Group comparisons, refer to slide 75. 74

2018 PEER GROUP(1) BancorpSouth Bank Provident Financial Services, Inc. Commerce Bancshares, Inc. TCF Financial Corporation First Midwest Bancorp, Inc. Trustmark Corporation F.N.B. Corporation UMB Financial Corporation Hancock Holding Company Umpqua Holdings Corporation IBERIABANK Corporation Union Bankshares Corporation Investors Bancorp, Inc. United Bankshares, Inc. MB Financial, Inc. United Community Banks, Inc. Northwest Bancshares, Inc. Valley National Bancorp Old National Bancorp Webster Financial Corporation Prosperity Bancshares, Inc. Wintrust Financial Corporation (1) Fulton’s Peer group for 2018. Additions from 2017 Peer group are bolded. Western Alliance Bancorporation was removed from the Peer group for 2018. 75