Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TELEFLEX INC | a5-3x20188xkreq12018earnin.htm |

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | exhibit991to5-3x20188xkreq.htm |

1

Teleflex Incorporated

First Quarter 2018

Earnings Conference Call

2

Conference Call Logistics

The release, accompanying slides, and replay webcast are available online at

www.teleflex.com (click on “Investors”)

Telephone replay available by dialing 855-859-2056 or for international calls, 404-

537-3406, pass code number 2698233

3

Introductions

Liam Kelly

President and CEO

Thomas Powell

Executive Vice President and CFO

Jake Elguicze

Treasurer and Vice President of Investor Relations

4

Note on Forward-Looking Statements

This presentation and our discussion contain forward-looking information and statements including, but not limited to,

the expected timing for the submission of a biologics license application related to RePlas®; statements related to the

restructuring plan we initiated on May 1, 2018 (the “Plan”), including, without limitation, our expectations that actions

related to the Plan will be substantially completed by the end of 2024, estimated pre-tax charges we expect to incur

in connection with the Plan, the amount of cash outlays expected to result from those charges, capital expenditures

we expect to make in connection with the Plan, the amount of annualized savings we expect to realize once the Plan

is fully implemented and the estimated timing for when we expect to begin realizing Plan-related savings; forecasted

2018 GAAP and constant currency revenue growth, GAAP and adjusted gross and operating margins and GAAP and

adjusted earnings per share and the items that are expected to impact each of those forecasted results; our

assumptions with respect to the euro to U.S. dollar exchange rate for 2018 and our adjusted weighted average

shares for 2018; estimated pre-tax charges we expect to incur in connection with our ongoing restructuring programs;

estimated annualized pre-tax savings we expect to realize in connection with our ongoing restructuring programs and

a similar initiative within our OEM segment (the “OEM initiative”); our expectations with respect to when we will begin

to realize savings from our ongoing restructuring programs and the OEM initiative and when those programs will be

substantially completed; and other matters which inherently involve risks and uncertainties which could cause actual

results to differ from those projected or implied in the forward–looking statements. These risks and uncertainties are

addressed in our SEC filings, including our most recent Form 10-K.

Note on Non-GAAP Financial Measures

This presentation refers to certain non-GAAP financial measures, including, but not limited to, constant currency

revenue growth, organic constant currency revenue growth, adjusted diluted earnings per share, adjusted gross and

operating margins and adjusted tax rate. These non-GAAP financial measures should not be considered

replacements for, and should be read together with, the most comparable GAAP financial measures. Tables

reconciling these non-GAAP financial measures to the most comparable GAAP financial measures are contained

within this presentation and the appendices to this presentation.

Additional Notes

Unless otherwise noted, the following slides reflect continuing operations.

5

1Q18 Highlights

Note: See appendices for reconciliations of non-GAAP information

NeoTract business continues strong momentum, delivering $42.3 million in 1Q18 revenue, up ~87% versus 1Q17

Data from retrospective study of UroLift® System confirms clinical results consistent with 5-year LIFT data

Vascular Solutions 1Q18 global revenue reaches $47.7 million, and contributes ~1% to Teleflex’s 1Q18 organic, constant

currency revenue growth rate (VSI classified as organic revenue for only second half of 1Q18)

Two Scale Acquisitions Continue to Transform Our Portfolio

As-reported revenue increased 20.4% versus 1Q17

Constant currency revenue increased 14.6% versus 1Q17

Rebound in distributor buying patterns occurred in 1Q18

Acceleration in organic constant currency revenue growth during 1Q18 as compared to 4Q17 levels

Excluding impact of one less shipping day, organic constant currency revenue growth strong in Interventional North

America, Vascular North America, Asia, and Anesthesia North America

Softness in Surgical North America primarily driven by exit of lower margin product in 3Q17

Reaffirming previously provided 2018 constant currency revenue growth guidance

Revenue Growth Accelerates in 1Q18

Delivered 190 bps of adjusted gross margin expansion versus 1Q17

Delivered 60 bps of adjusted operating margin expansion versus 1Q17

Adjusted EPS of $2.15, up 19.4% versus 1Q17 and significantly ahead of mid-to-high single digit growth expectations

Announced new restructuring program to continue to drive non-revenue dependent margin expansion through 2024

Solid Margin Expansion and Adjusted EPS Performance

6

1Q Constant Currency Revenue Growth

Note: See appendices for reconciliations of non-GAAP information

Q1 2018

Constant Currency

Revenue Growth

Volume (excluding surgical product line exit and shipping day impact) 1.6%

New product introductions 1.5%

Price 0.6%

Shipping day impact (1.3%)

Surgical product line exit (0.6%)

M&A

NeoTract 8.3%

Vascular Solutions (for period from January 2018 through mid-February 2018) 4.2%

Other 0.3%

Constant Currency Revenue Growth 14.6%

7

Dollars

in Millions

Q1’18

Revenue

Q1’17

Revenue

Total

Sales

Growth

Currency

Impact

Constant

Currency

Growth

Vascular NA $83.0 $79.0 5.1% 0.2% 4.9%

Interventional NA $60.2 $39.9 50.7% 0.1% 50.6%

Anesthesia NA $50.6 $48.2 4.9% 0.2% 4.7%

Surgical NA $40.7 $46.0 (11.5%) 0.2% (11.7%)

EMEA $159.9 $133.6 19.7% 15.1% 4.6%

Asia $58.2 $50.2 16.1% 7.0% 9.1%

OEM $45.8 $43.3 5.8% 2.9% 2.9%

All Other $88.8 $47.7 86.2% 1.2% 85.0%

Segment Revenue Review

Note: Increases and decreases in revenue referred to above are as compared to results for the first quarter of 2017. See

appendices for reconciliations of non-GAAP information and for a reconciliation of segment reporting changes.

8

GPO and IDN Review

Group Purchasing Organization Update

• 2 renewed agreements

• 1 new agreements

• 0 existing agreements lost

IDN Update

• 4 renewed agreements

• 8 new agreements

• 2 existing agreements lost

9

Clinical Data Announcements

UroLift® Real World Retrospective Study

Data from >800 patients in “real world”

setting consistent with randomized, five-

year L.I.F.T. study across all major

measurements

Retention Cohort: 96% of catheterized

patients who entered study in retention

no longer required a catheter following

UroLift after 1 month

Enrollment will continue up to

>2,000 patients

KEY TAKEAWAYS

References:

1 No instances of de novo (or new), sustained erectile or ejaculatory dysfunction. Roehrborn, J Urology 2013 LIFT Study; Roehrborn, 2015 Can J Urol, 3 yr results of PUL LIFT study

2 Roehrborn et al. Can J Urol 2017 MAC00681-01 Rev A

10

Clinical Data Announcements

LMA® Gastro Airway Study

Study of 292 patients concluded that

endoscope and LMA® Gastro™ Airway

insertion success was 99%, indicating

LMA® Gastro™ Airway efficacy

Respiratory depression from sedative

drugs and airway obstruction requiring

intervention are known risks associated

with these procedures, with studies

demonstrating hypoxemia can occur in

11% to 50% of cases

KEY TAKEAWAYS

References:

1.Terblanche, NCS, Middleton C. Efficacy of a new dual channel laryngeal mask airway, the LMA® Gastro™ Airway, for upper gastrointestinal endoscopy: a prospective observational

study. British Journal of Anesthesia. 2018; 120(2):353-360.

2.Peery AF, Dellon ES, Lund J, et al. Burden of gastrointestinal disease in the United States: 2012 update. Gastroenterology. 2012;143(5):1179-1187 e1171-1173.

3.Qadeer MA, Rocio Lopez A, Dumot JA, Vargo JJ. Risk factors for hypoxemia during ambulatory gastrointestinal endoscopy in ASA I-II patients. Dig Dis Sci. 2009;54(5):1035-1040.

4.Cote GA, Hovis RM, Ansstas MA, et al. Incidence of sedation-related complications with Propofol use during advanced endoscopic procedures. Clin Gastroenterol Hepatol.

2010;8(2):137-142.

5.de Paulo GA, Martins FP, Macedo EP, Goncalves ME, Mourao CA, Ferrari AP. Sedation in gastrointestinal endoscopy: a prospective study comparing nonanesthesiologist-

administered Propofol and monitored anesthesia care. Endosc Int Open. 2015;3(1): E7-E13.

11

FDA and DoD launch joint program to

expedite medical products intended to save

lives of US Military; including freeze-dried

plasma

Dec 2017 Jan 2018

FDA confirms accelerated BLA

approval pathway; confirmatory

efficacy study must be ongoing at

time of licensure

2019

BLA submission

expected early 2019

RePlas® Freeze-Dried Plasma Regulatory Update

RePlas®

FDP Unit

(equivalent

to one FFP

unit)

Sterile Water

for Injection

(SWFI) 250ml

Fluid

Transfer

Set

Blood

Set for

Transfusion

RePlas®

Field Kit

12

On May 1, 2018, we initiated a restructuring plan involving the relocation of certain

manufacturing operations to an existing lower-cost location, the outsourcing of certain

distribution operations and related workforce reductions.

These actions are expected to commence in the second quarter 2018 and are expected to be

substantially completed by the end of 2024.

We estimate that we will incur aggregate pre-tax restructuring and restructuring related

charges in connection with the 2018 Footprint realignment plan of $102 million to $133

million, of which, we expect $55 million to $72 million to be incurred in 2018 and most of

the balance is expected to be incurred prior to the end of 2024.

We estimate that $99 million to $127 million of these charges will result in future cash

outlays, of which, $9 million to $10 million is expected to be made in 2018 and most of the

balance is expected to be made by the end of 2024.

Additionally, we expect to incur $19 million to $23 million in aggregate capital expenditures

under the plan, of which, up to $1 million is expected to be incurred during 2018 and most

of the balance is expected to be incurred by the end of 2021.

We expect to begin realizing plan-related savings in 2018 and expect to achieve annual

pre-tax savings of $25 million to $30 million once the plan is fully implemented.

2018 Restructuring Plan

13

First Quarter Financial Review

Revenue of $587.2 million

• Up 20.4% vs. prior year period on an as-reported basis

• Up 14.6% vs. prior year period on a constant currency basis

Gross Margin

• GAAP gross margin of 56.4%, up 400 bps vs. prior year period

• Adjusted gross margin of 56.6%, up 190 bps vs. prior year period

Operating Margin

• GAAP operating margin of 14.8%, up 230 bps vs. prior year period

• Adjusted operating margin of 24.0%, up 60 bps vs. prior year period

Tax Rate

• GAAP tax rate of 10.2%, up 1,730 bps vs. prior year period

• Adjusted tax rate of 12.8%, down 330 bps vs. prior year period

Earnings Per Share

• GAAP EPS of $1.18, up 35.6% vs. prior year period

• Adjusted EPS of $2.15, up 19.4% vs. prior year period

Note: See appendices for reconciliations of non-GAAP information

14

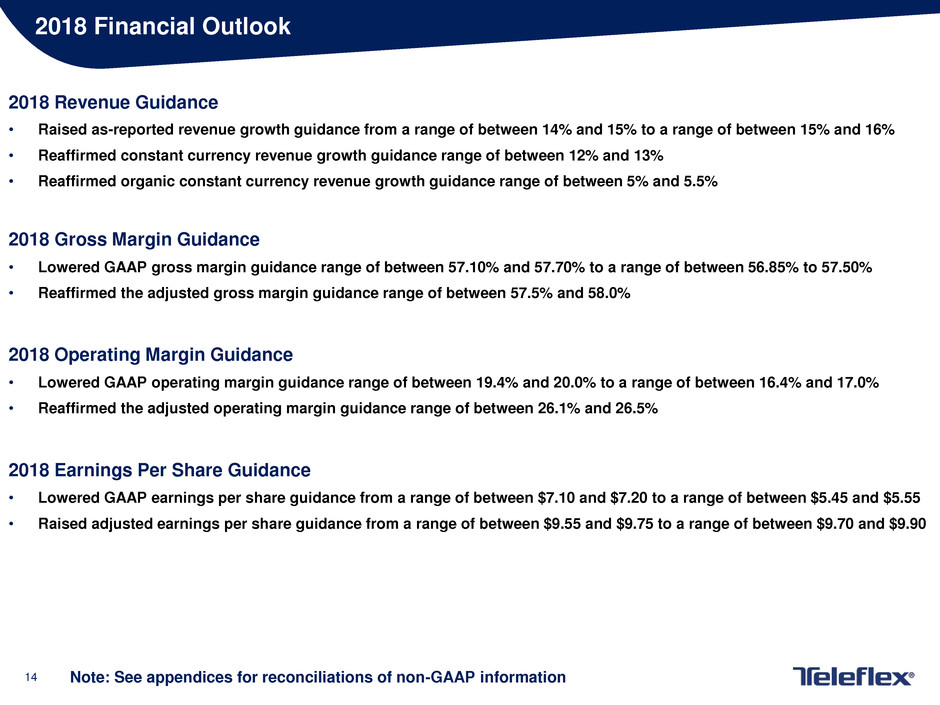

2018 Financial Outlook

2018 Revenue Guidance

• Raised as-reported revenue growth guidance from a range of between 14% and 15% to a range of between 15% and 16%

• Reaffirmed constant currency revenue growth guidance range of between 12% and 13%

• Reaffirmed organic constant currency revenue growth guidance range of between 5% and 5.5%

2018 Gross Margin Guidance

• Lowered GAAP gross margin guidance range of between 57.10% and 57.70% to a range of between 56.85% to 57.50%

• Reaffirmed the adjusted gross margin guidance range of between 57.5% and 58.0%

2018 Operating Margin Guidance

• Lowered GAAP operating margin guidance range of between 19.4% and 20.0% to a range of between 16.4% and 17.0%

• Reaffirmed the adjusted operating margin guidance range of between 26.1% and 26.5%

2018 Earnings Per Share Guidance

• Lowered GAAP earnings per share guidance from a range of between $7.10 and $7.20 to a range of between $5.45 and $5.55

• Raised adjusted earnings per share guidance from a range of between $9.55 and $9.75 to a range of between $9.70 and $9.90

Note: See appendices for reconciliations of non-GAAP information

15

Any Questions?

16

Thank You

17

Appendices

18

Non-GAAP Financial Measures

The presentation to which these appendices are attached and the following appendices include, among other things,

tables reconciling the following non-GAAP financial measures to the most comparable GAAP financial measure:

• Constant currency revenue growth. This measure excludes the impact of translating the results of international

subsidiaries at different currency exchange rates from period to period.

• Organic constant currency revenue growth. This measure excludes (i) the impact of translating the results of

international subsidiaries at different currency exchange rates from period to period; and (ii) the results of acquired

businesses (other than acquired distributors) for the first 12 months following the acquisition date.

• Adjusted diluted earnings per share. This measure excludes, depending on the period presented the impact of (i)

restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items;

(iii) other items identified in note (C) to the reconciliation tables appearing in Appendices E and F; (iv) amortization

of the debt discount on the Company’s previously outstanding convertible notes; (v) intangible amortization

expense; (vi) loss on extinguishment of debt; and (vii) tax adjustments identified in note (G) to the reconciliation

tables appearing in Appendices E and F. In addition, the calculation of diluted shares within adjusted earnings per

share gives effect to the anti-dilutive impact of the Company’s previously outstanding convertible note hedge

agreements, which reduced the potential economic dilution that otherwise would have occurred upon conversion of

the Company’s senior subordinated convertible notes (under GAAP, the anti-dilutive impact of the convertible note

hedge agreements is not reflected in diluted shares).

• Adjusted gross profit and margin. These measures exclude, depending on the period presented, the impact of (i)

restructuring, restructuring related and impairment items, (ii) acquisition, integration and divestiture related items

and (iii) other items identified in note (c) to the reconciliation tables appearing in Appendices C and J.

• Adjusted operating profit and margin. These measures exclude, depending on the period presented, (i) the impact

of restructuring, restructuring related and impairment items; (ii) acquisitions, integration and divestiture related

items; (iii) other items identified in note (C) to the reconciliation tables appearing in Appendices D and K; and (iv)

intangible amortization expense.

• Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing

operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from

continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated

with (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related

items; (iii) other items identified in note (A) to the reconciliation tables appearing in Appendix G; (iv) amortization of

the debt discount on the Company’s previously outstanding convertible notes; (v) intangible amortization expense;

and (v) tax adjustments identified in note (B) to the reconciliation tables appearing in Appendix G.

19

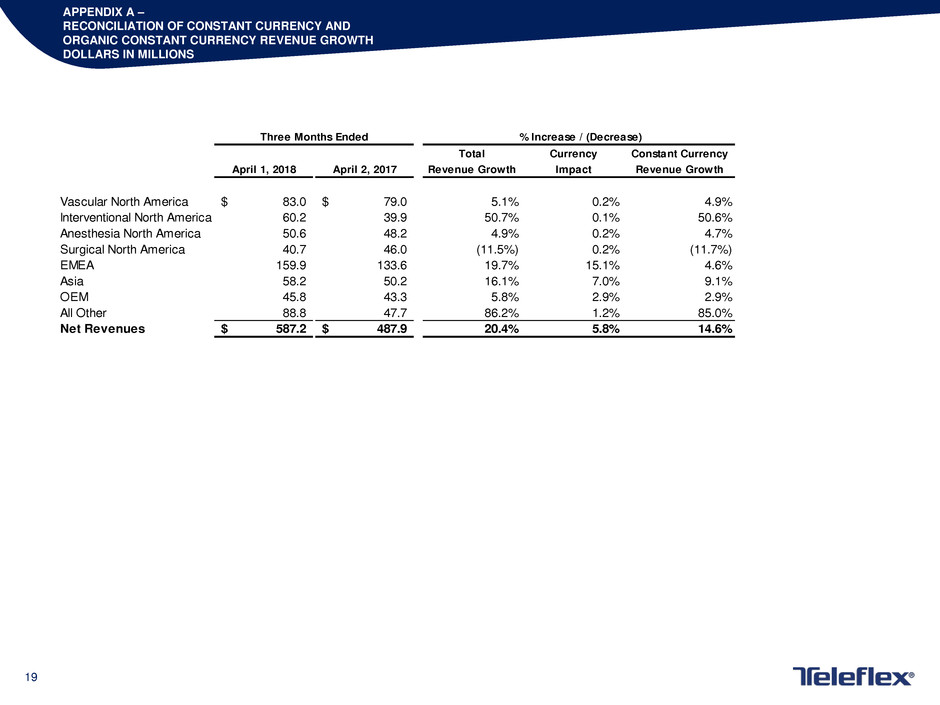

APPENDIX A –

RECONCILIATION OF CONSTANT CURRENCY AND

ORGANIC CONSTANT CURRENCY REVENUE GROWTH

DOLLARS IN MILLIONS

Total Currency Constant Currency

April 1, 2018 April 2, 2017 Revenue Growth Impact Revenue Growth

Vascular North America 83.0$ 79.0$ 5.1% 0.2% 4.9%

Interventional North America 60.2 39.9 50.7% 0.1% 50.6%

nesthesia North America 50.6 48.2 4.9% 0.2% 4.7%

Surgical North America 40.7 46.0 (11.5%) 0.2% (11.7%)

EMEA 159.9 133.6 19.7% 15.1% 4.6%

Asia 58.2 50.2 16.1% 7.0% 9.1%

OEM 45.8 43.3 5.8% 2.9% 2.9%

All Other 88.8 47.7 86.2% 1.2% 85.0%

Net Revenues 587.2$ 487.9$ 20.4% 5.8% 14.6%

Three Months Ended % Increase / (Decrease)

20

APPENDIX B –

RECONCILIATION OF REVENUE GROWTH

DOLLARS IN MILLIONS

% Basis Points

Three Months Ended April 2, 2017 Revenue As-Reported 487.9$

Foreign currency 24.5$ 5.8% 580

Volume (excluding Surgical product line exit and the impact of shipping days) 8.3$ 1.6% 160

Shipping day impact (6.7)$ -1.3% -130

Surgical product line exit (3.3)$ -0.6% -60

New product sales 7.7$ 1.5% 150

Pricing 3.2$ 0.6% 60

Acquisitions1 65.6$ 12.8% 1,280

Three Months Ended April 1, 2018 Revenue As-Reported 587.2$ 20.4%

1 = Includes:

NeoTract 42.3$ 8.3%

Vascular Solutions 21.8$ 4.2%

Other Acquisitions 1.5$ 0.3%

Year-Over-Year Growth

21

APPENDIX C –

RECONCILIATION OF ADJUSTED GROSS PROFIT AND MARGIN

DOLLARS IN THOUSANDS

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource

distribution operations, improve operating efficiencies and integrate acquired businesses. Restructuring related charges are directly related to our restructuring programs and

consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and

retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program.

(B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or

asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; inventory step-up amortization (amortization, through

cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date). For the three months ended April 1, 2018, the

majority of these charges were related to our acquisitions of Vascular Solutions and NeoTract. For the three months ended April 2, 2017, the majority of these charges were

related to our acquisition of Vascular Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture

transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may

recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented.

(C) These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended April 1, 2018, these items included the reversal

of previously recognized income due to distributor acquisitions related to Vascular Solutions.

April 1,2018 April 2, 2017

Gross profit as-reported 331,270$ 255,560$

Gross margin as-reported 56.4% 52.4%

Restructuring, restructuring related and impairment items (A) 1,959 3,663

Acquisition, integration and divestiture related items (B) 352 7,878

Other items (C) (983) -

Adjusted gross profit 332,598$ 267,101$

Adjusted gross margin 56.6% 54.7%

Revenue as-reported 587,230$ 487,881$

Three Months Ended

22

APPENDIX D –

RECONCILIATION OF ADJUSTED OPERATING PROFIT AND MARGIN

DOLLARS IN THOUSANDS

April 1, 2018 April 2, 2017

Income from continuing operations before interest, loss on extinguishment of debt and

taxes 86,843$ 60,819$

Income from continuing operations before interest, loss on extinguishment of debt and

taxes margin 14.8% 12.5%

Restructuring, restructuring related and impairment items (A) 5,142 16,963

Acquisition, integration and divestiture related items (B) 12,033 17,176

Other items (C) (838) 183

Intangible amortization expense (D) 37,816 18,785

Adjusted income from continuing operations before interest, loss on extinguishment of

debt and taxes 140,996$ 113,926$

Adjusted income from continuing operations before interest, loss on extinguishment of

debt and taxes margin 24.0% 23.4%

Revenue as-reported 587,230$ 487,881$

Three Months Ended

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource

distribution operations, improve operating efficiencies and integrate acquired businesses. Our restructuring charges consist of termination benefits, contract termination costs,

facility closure costs and other exit costs associated with a specific restructuring program. Restructuring related charges are directly related to our restructuring programs and

consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and

retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program.

(B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or

asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring

expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the

acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop financing fees in connection with facilities that ultimately were not

utilized. For the three months ended April 1, 2018, the majority of these charges were related to contingent consideration liabilities and our acquisitions of Vascular Solutions

and NeoTract. For the three months ended April 2, 2017, the majority of these charges were related to our acquisition of Vascular Solutions. Divestiture related activities involve

specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial

statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There

were no divestiture related activities for the periods presented.

(C) These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended April 1, 2018, these items included the reversal

of previously recognized income due to distributor acquisitions related to Vascular Solutions and relabeling costs. For the three months ended April 2, 2017, these items

included relabeling costs.

(D) Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at

historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things,

business or asset acquisitions or dispositions.

23

APPENDIX E –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – APRIL 1, 2018

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and

impairment

charges

Interest

expense, net

Loss on

extinguishment

of debt, net

Income

taxes

Income (loss) from

continuing operations

Diluted earnings

per share

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $256.0 $215.3 $26.0 $3.1 $25.7 — $6.2 $54.9 $1.18 46,695

Adjustments

Restructuring,

restructuring related and

impairment items (A)

2.0 0.1 0.1 3.1 — — 0.7 4.5 $0.10 —

Acquisition, integration

and divestiture related

items (B)

0.4 11.5 0.2 — — — 0.5 11.5 $0.25 —

Other items (C) (1.0) 0.1 — — — — (0.1) (0.7) ($0.02) —

Amortization of debt

discount on convertible

notes (D)

— — — — — — — — — —

Intangible amortization

expense (E)

— 37.7 0.1 — — — 7.6 30.3 $0.65 —

Loss on extinguishment

of debt (F)

— — — — — — — — — —

Tax adjustments (G) — — — — — — (0.2) 0.2 $0.00 —

Shares due to Teleflex

under note hedge (H)

— — — — — — — — — —

Adjusted basis $254.6 $165.9 $25.7 — $25.7 — $14.7 $100.6 $2.15 46,695

24

APPENDIX F –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – APRIL 2, 2017

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and

impairment

charges

Interest

expense, net

Loss on

extinguishment

of debt, net

Income

taxes

Income (loss) from

continuing operations

Diluted earnings

per share

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $232.3 $164.0 $17.8 $12.9 $17.6 $5.6 ($2.7) $40.3 $0.87 46,615

Adjustments

Restructuring,

restructuring related and

impairment items (A)

3.7 0.1 0.2 12.9 — — 4.4 12.5 $0.26 —

Acquisition, integration

and divestiture related

items (B)

7.9 9.3 — — 2.1 — 6.3 13.0 $0.28 —

Other items (C) — 0.2 — — — — 0.1 0.1 $0.00 —

Amortization of debt

discount on convertible

notes (D)

— — — — 0.4 — 0.1 0.2 $0.01 —

Intangible amortization

expense (E)

— 18.7 0.1 — — — 5.1 13.7 $0.29 —

Loss on extinguishment

of debt (F)

— — — — — 5.6 2.0 3.5 $0.08 —

Tax adjustments (G) — — — — — — 0.5 (0.5) ($0.01) —

Shares due to Teleflex

under note hedge (H)

— — — — — — — — $0.02 (477)

Adjusted basis $220.8 $135.7 $17.5 — $15.1 — $15.9 $82.9 $1.80 46,138

25

APPENDICES E AND F –

TICKMARKS

(A) Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate

manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Our restructuring charges consist

of termination benefits, contract termination costs, facility closure costs and other exit costs associated with a specific restructuring program. Restructuring related charges are directly

related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing

operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. For

the three months ended April 1, 2018 and April 2, 2017, pre-tax restructuring related charges were $2.1 million and $4.0 million, respectively. There were no impairment items during the

three months ended April 1, 2018 and April 2, 2017.

(B) Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that

are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration

costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value

calculation as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop financing fees in connection with facilities that ultimately

were not utilized. For the three months ended April 1, 2018, the majority of these charges were related to contingent consideration liabilities and our acquisitions of Vascular Solutions

and NeoTract. For the three months ended April 2, 2017, the majority of these charges were related to our acquisition of Vascular Solutions. Divestiture related activities involve specific

business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other

costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related

activities for the periods presented.

(C) Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended April 1, 2018, these items included the

reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions and relabeling costs. For the three months ended April 2, 2017, these items

included relabeling costs.

(D) Amortization of debt discount on convertible notes - When we sold $400 million principal amount of our 3.875% convertible notes (the “convertible notes”) in 2010, we allocated the

proceeds between the liability and equity components of the debt, in accordance with GAAP. As a result, the $83.7 million difference between the proceeds of the sale of the convertible

notes and the liability component of the debt constituted a debt discount that was to be amortized to interest expense over the approximately seven-year term of the convertible notes,

which significantly increased the amount we recorded as interest expense attributable to the convertible notes. The amount of the amortization of the debt discount was reduced as a

result of our repurchases of convertible notes in 2016 and 2017 and redemptions of the convertible notes by holders of the notes, although we continued to amortize the remaining

portion of the debt discount to interest expense until August 2017, when all remaining convertible notes were either converted or matured.

(E) Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements,

initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of,

among other things, business or asset acquisitions or dispositions.

(F) Loss on extinguishment of debt - In connection with debt refinancings, debt repayments, repurchases of convertible notes and redemptions of convertible notes, outstanding

indebtedness is extinguished. These events, which have occurred from time to time on an irregular basis, have resulted in losses reflecting, among other things, unamortized debt

issuance costs, as well as debt prepayment fees and premiums (including conversion premiums resulting from conversion of convertible securities).

(G) Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended

returns with respect to prior tax years and/or tax law changes affecting our deferred tax liability.

(H) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduced the potential economic

dilution that otherwise would have occurred upon conversion of the Company's convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not

reflected in the weighted average number of diluted shares.

26

APPENDIX G –

RECONCILIATION OF ADJUSTED TAX RATE

DOLLARS IN THOUSANDS

(A) Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended April 1, 2018, these items included the

reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions and relabeling costs. For the three months ended April 2, 2017, these items

included relabeling costs.

(B) Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended

returns with respect to prior tax years and/or tax law changes affecting our deferred tax liability.

Three Months Ended April 1, 2018

Income from

continuing

operations

before taxes

Taxes on

income from

continuing

operations Tax rate

GAAP basis $61,173 $6,242 10.2%

Restructuring, restructuring related and impairment charges 5,142 690

Acquisition, integration and divestiture related items 12,033 522

Other items (A) (838) (115)

Amortization of debt discount on convertible notes 0 0

Intangible amortization expense 37,816 7,559

Loss on extinguishment of debt 0 0

Tax adjustment (B) 0 (158)

Adjusted basis $115,326 $14,740 12.8%

Three Months Ended April 2, 2017

GAAP basis $37,680 ($2,669) -7.1%

Restructuring, restructuring related and impairment charges 16,963 4,419

Acquisition, integration and divestiture related items 19,247 6,257

Other items (A) 183 70

Amortization of debt discount on convertible notes 378 138

Intangible amortization expense 18,785 5,123

Loss on extinguishment of Debt 5,582 2,041

Tax adjustment (B) 0 494

Adjusted basis $98,818 $15,873 16.1%

27

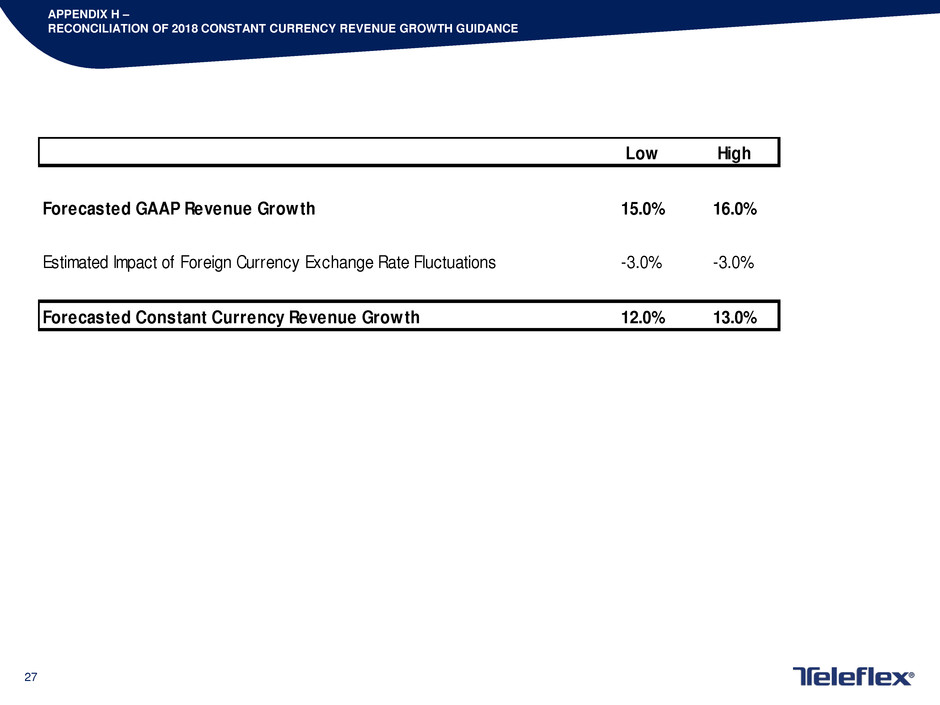

APPENDIX H –

RECONCILIATION OF 2018 CONSTANT CURRENCY REVENUE GROWTH GUIDANCE

Low High

Forecasted GAAP Revenue Growth 15.0% 16.0%

Estimated Impact of Foreign Currency Exchange Rate Fluctuations -3.0% -3.0%

Forecasted Constant Currency Revenue Growth 12.0% 13.0%

28 1 = includes approximately 1.5% of contribution from Vascular Solutions and NeoTract volume and new products.

2018 Guidance

Low High

GAAP Revenue Growth 15.0% 16.0%

Impact of Foreign Currency Exchange Rate Fluctuations 3.0% 3.0%

Constant Currency Revenue Growth 12.0% 13.0%

M&A 7.0% 7.5%

Organic Constant Currency Revenue Growth1 5.0% 5.5%

APPENDIX I –

RECONCILIATION OF 2018 CONSTANT CURRENCY AND ORGANIC CONSTANT CURRENCY REVENUE GROWTH GUIDANCE

29

APPENDIX J –

RECONCILIATION OF 2018 ADJUSTED GROSS MARGIN GUIDANCE

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other

facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Restructuring related charges are directly

related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures,

costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain

with our company after completion of the restructuring program.

(B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to

specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; inventory

step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the

acquisition date). Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction,

the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction,

we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented.

(C) These are discrete items that occur sporadically and can affect period to period comparisons. For the three months ended Apri l 1, 2018, these items

included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions.

Low High

Forecasted GAAP Gross Margin 56.85% 57.50%

Restructuring, restructuring related and impairment items (A) 0.60% 0.55%

Acquisition, integration and divestiture related items (B) 0.05% 0.00%

Other items (C) 0.00% -0.05%

Forecasted Adjusted Gross Margin 57.50% 58.00%

30

APPENDIX K –

RECONCILIATION OF 2018 ADJUSTED OPERATING MARGIN GUIDANCE

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities,

outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Our restructuring charges consist of termination benefits,

contract termination costs, facility closure costs and other exit costs associated with a specific restructuring program. Restructuring related charges are

directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures,

costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our

company after completion of the restructuring program.

(B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific

business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration

costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory

resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop

financing fees in connection with facilities that ultimately were not utilized. Divestiture related activities involve specific business or asset sales. Depending

primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur

as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture

related activities for the periods presented.

(C) These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended April 1, 2018, these items included

the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions and relabeling costs.

(D) Certain intangible assets, including customer lists, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded

at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of,

among other things, business or asset acquisitions or dispositions.

Low High

Forecasted GAAP Operating Margin 16.40% 17.00%

Estimated restructuring, restructuring related and impairment items (A) 3.15% 3.10%

Estimated acquisition, integration and divestiture related items (B) 0.60% 0.55%

Estimated other items (C) 0.05% 0.00%

Estimated intangible amortization expense (D) 5.90% 5.85%

Forecasted Adjusted Operating Margin 26.10% 26.50%

31

APPENDIX L –

RECONCILIATION OF 2018 ADJUSTED EARNINGS PER SHARE GUIDANCE

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities,

outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Our restructuring charges consist of termination benefits,

contract termination costs, facility closure costs and other exit costs associated with a specific restructuring program. Restructuring related charges are

directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures,

costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our

company after completion of the restructuring program.

(B) Acquisition and integration expenses are incremental costs, other than restructuring or restructuring related expenses, that are directly related to specific

business or asset acquisition transactions. These costs may include, among other things, professional, consulting and other fees; systems integration costs;

legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting

from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop financing fees

in connection with facilities that ultimately were not utilized. Divestiture related activities involve specific business or asset sales. Depending primarily on the

terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result

of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities

for the periods presented.

(C) These are discrete items that occur sporadically and can affect period-to-period comparisons.

(D) Certain intangible assets, including customer lists, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded

at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of,

among other things, business or asset acquisitions or dispositions.

Low High

Forecasted GAAP diluted earnings per share $5.45 $5.55

Restructuring, restructuring related and impairment items, net of tax (A) $1.51 $1.55

cquisition, integration and divestiture items, net of tax (B) $0.26 $0.28

Other items, net of tax (C) $0.01 $0.02

Intangible amortization expense, net of tax (D) $2.47 $2.50

Forecasted adjusted diluted earnings per share $9.70 $9.90

32

Euro to U.S. Dollar exchange rate assumed to be approximately 1.22 for full

year 2018

Adjusted weighted average shares expected to be approximately 46.9 million

for full year 2018

2018 Calendar of shipping days:

• Q1’18 vs. Q1’17: 1 less day

• Q2’18 vs. Q2’17: 1 additional day

• Q3’18 vs. Q3’17: no difference

• Q4’18 vs. Q4’17: 1 additional day

• FY’18 vs. FY’17: 1 additional day

APPENDIX M –

2018 FINANCIAL OUTLOOK ASSUMPTIONS

33

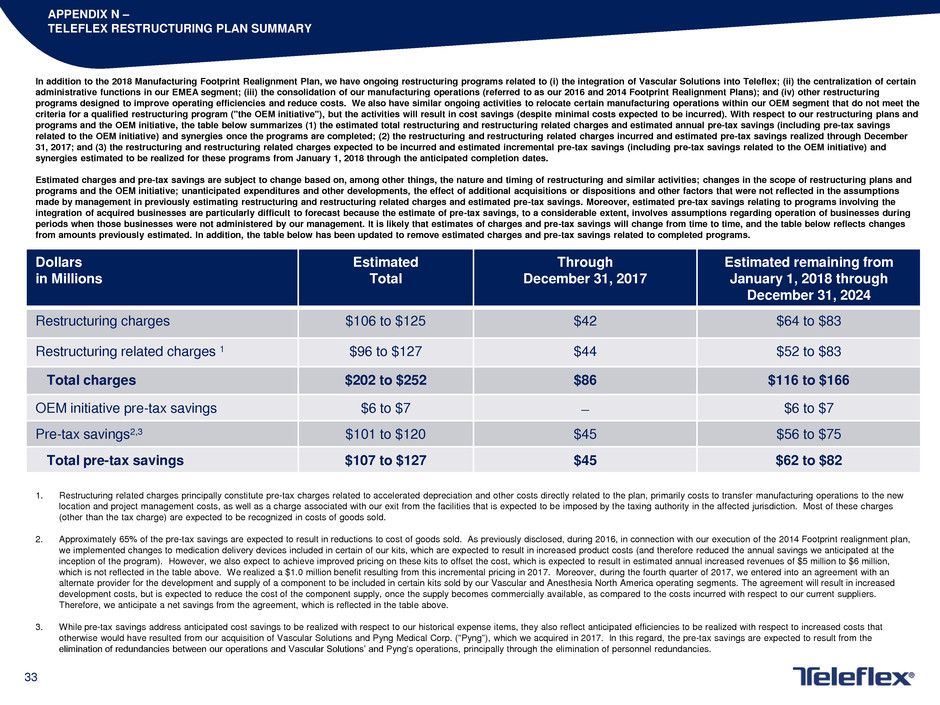

APPENDIX N –

TELEFLEX RESTRUCTURING PLAN SUMMARY

In addition to the 2018 Manufacturing Footprint Realignment Plan, we have ongoing restructuring programs related to (i) the integration of Vascular Solutions into Teleflex; (ii) the centralization of certain

administrative functions in our EMEA segment; (iii) the consolidation of our manufacturing operations (referred to as our 2016 and 2014 Footprint Realignment Plans); and (iv) other restructuring

programs designed to improve operating efficiencies and reduce costs. We also have similar ongoing activities to relocate certain manufacturing operations within our OEM segment that do not meet the

criteria for a qualified restructuring program ("the OEM initiative"), but the activities will result in cost savings (despite minimal costs expected to be incurred). With respect to our restructuring plans and

programs and the OEM initiative, the table below summarizes (1) the estimated total restructuring and restructuring related charges and estimated annual pre-tax savings (including pre-tax savings

related to the OEM initiative) and synergies once the programs are completed; (2) the restructuring and restructuring related charges incurred and estimated pre-tax savings realized through December

31, 2017; and (3) the restructuring and restructuring related charges expected to be incurred and estimated incremental pre-tax savings (including pre-tax savings related to the OEM initiative) and

synergies estimated to be realized for these programs from January 1, 2018 through the anticipated completion dates.

Estimated charges and pre-tax savings are subject to change based on, among other things, the nature and timing of restructuring and similar activities; changes in the scope of restructuring plans and

programs and the OEM initiative; unanticipated expenditures and other developments, the effect of additional acquisitions or dispositions and other factors that were not reflected in the assumptions

made by management in previously estimating restructuring and restructuring related charges and estimated pre-tax savings. Moreover, estimated pre-tax savings relating to programs involving the

integration of acquired businesses are particularly difficult to forecast because the estimate of pre-tax savings, to a considerable extent, involves assumptions regarding operation of businesses during

periods when those businesses were not administered by our management. It is likely that estimates of charges and pre-tax savings will change from time to time, and the table below reflects changes

from amounts previously estimated. In addition, the table below has been updated to remove estimated charges and pre-tax savings related to completed programs.

Dollars

in Millions

Estimated

Total

Through

December 31, 2017

Estimated remaining from

January 1, 2018 through

December 31, 2024

Restructuring charges $106 to $125 $42 $64 to $83

Restructuring related charges 1 $96 to $127 $44 $52 to $83

Total charges $202 to $252 $86 $116 to $166

OEM initiative pre-tax savings $6 to $7 ̶ $6 to $7

Pre-tax savings2,3 $101 to $120 $45 $56 to $75

Total pre-tax savings $107 to $127 $45 $62 to $82

1. Restructuring related charges principally constitute pre-tax charges related to accelerated depreciation and other costs directly related to the plan, primarily costs to transfer manufacturing operations to the new

location and project management costs, as well as a charge associated with our exit from the facilities that is expected to be imposed by the taxing authority in the affected jurisdiction. Most of these charges

(other than the tax charge) are expected to be recognized in costs of goods sold.

2. Approximately 65% of the pre-tax savings are expected to result in reductions to cost of goods sold. As previously disclosed, during 2016, in connection with our execution of the 2014 Footprint realignment plan,

we implemented changes to medication delivery devices included in certain of our kits, which are expected to result in increased product costs (and therefore reduced the annual savings we anticipated at the

inception of the program). However, we also expect to achieve improved pricing on these kits to offset the cost, which is expected to result in estimated annual increased revenues of $5 million to $6 million,

which is not reflected in the table above. We realized a $1.0 million benefit resulting from this incremental pricing in 2017. Moreover, during the fourth quarter of 2017, we entered into an agreement with an

alternate provider for the development and supply of a component to be included in certain kits sold by our Vascular and Anesthesia North America operating segments. The agreement will result in increased

development costs, but is expected to reduce the cost of the component supply, once the supply becomes commercially available, as compared to the costs incurred with respect to our current suppliers.

Therefore, we anticipate a net savings from the agreement, which is reflected in the table above.

3. While pre-tax savings address anticipated cost savings to be realized with respect to our historical expense items, they also reflect anticipated efficiencies to be realized with respect to increased costs that

otherwise would have resulted from our acquisition of Vascular Solutions and Pyng Medical Corp. ("Pyng"), which we acquired in 2017. In this regard, the pre-tax savings are expected to result from the

elimination of redundancies between our operations and Vascular Solutions’ and Pyng's operations, principally through the elimination of personnel redundancies.