Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HCI Group, Inc. | d477505d8k.htm |

| EX-99.5 - EX-99.5 - HCI Group, Inc. | d477505dex995.htm |

| EX-99.3 - EX-99.3 - HCI Group, Inc. | d477505dex993.htm |

| EX-99.2 - EX-99.2 - HCI Group, Inc. | d477505dex992.htm |

| EX-99.1 - EX-99.1 - HCI Group, Inc. | d477505dex991.htm |

Exhibit 99.4

STRICTLY CONFIDENTIAL –

Summary Presentation for

Federated National’s Board of Directors

April 18, 2018

01

Important Cautions Regarding Forward- STRICTLY CONFIDENTIAL Looking Statements TM NYSE:HCI STRICTLY CONFIDENTIAL This presentation includes certain forward-looking statements and information, including statements regarding plans, strategies and expectations of HCI Group, Inc. (“HCI” or the “Company”). When used in this presentation, words such as “believes,” “anticipates,” “expects” and “estimates,” or words of similar meaning, are generally intended to identify forward-looking statements. All statements other than statements of historical fact included in this presentation are forward-looking statements. These forward-looking statements are subject to risks, uncertainties, assumptions and other factors, many of which are beyond the control of the Company. Important factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements are described in the Company’s filings that it makes from time to time with the Securities and Exchange Commission, including within the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 filed on March 7, 2018. © 2018 HCI Group, Inc. All Rights Reserved 02

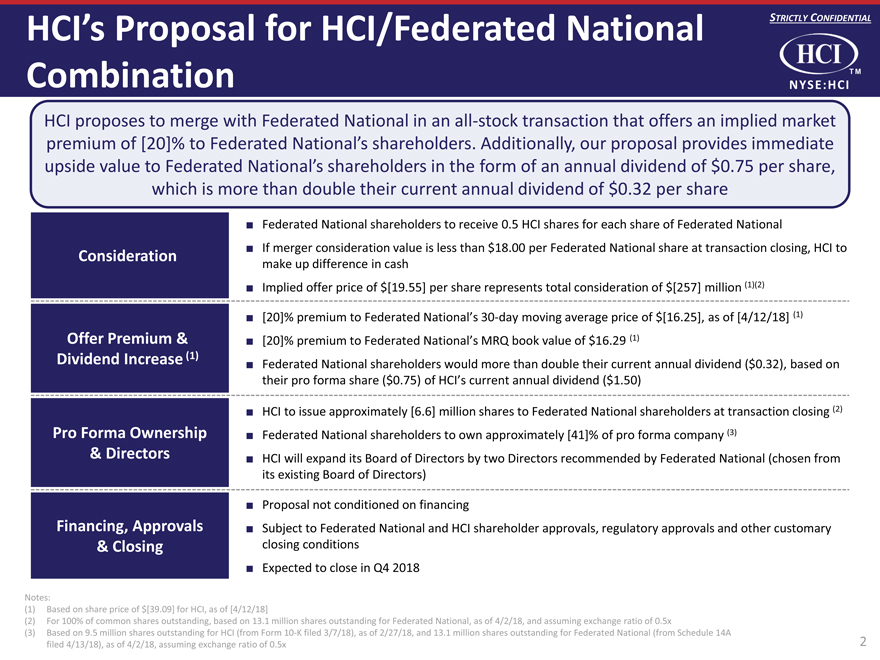

HCI’s Proposal for HCI/Federated National STRICTLY CONFIDENTIAL Combination TM NYSE:HCI STRICTLY CONFIDENTIAL HCI proposes to merge with Federated National in an all-stock transaction that offers an implied market premium of [20]% to Federated National’s shareholders. Additionally, our proposal provides immediate upside value to Federated National’s shareholders in the form of an annual dividend of $0.75 per share, which is more than double their current annual dividend of $0.32 per share Federated National shareholders to receive 0.5 HCI shares for each share of Federated National If merger consideration value is less than $18.00 per Federated National share at transaction closing, HCI to make up difference in cash Implied offer price of $[19.55] per share represents total consideration of $[257] million (1)(2) [20]% premium to Federated National’s 30-day moving average price of $[16.25], as of [4/12/18] (1) [20]% premium to Federated National’s MRQ book value of $16.29 (1) Federated National shareholders would more than double their current annual dividend ($0.32), based on their pro forma share ($0.75) of HCI’s current annual dividend ($1.50) HCI to issue approximately [6.6] million shares to Federated National shareholders at transaction closing (2) Federated National shareholders to own approximately [41]% of pro forma company (3) HCI will expand its Board of Directors by two Directors recommended by Federated National (chosen from its existing Board of Directors) Proposal not conditioned on financing Subject to Federated National and HCI shareholder approvals, regulatory approvals and other customary closing conditions Expected to close in Q4 2018 Consideration Offer Premium & Dividend Increase (1) Pro Forma Ownership & Directors Financing, Approvals & Closing Notes: (1) Based on share price of $[39.09] for HCI, as of [4/12/18] (2) For 100% of common shares outstanding, based on 13.1 million shares outstanding for Federated National, as of 4/2/18, and assuming exchange ratio of 0.5x (3) Based on 9.5 million shares outstanding for HCI (from Form 10-K filed 3/7/18), as of 2/27/18, and 13.1 million shares outstanding for Federated National (from Schedule 14A filed 4/13/18), as of 4/2/18, assuming exchange ratio of 0.5x 2 03

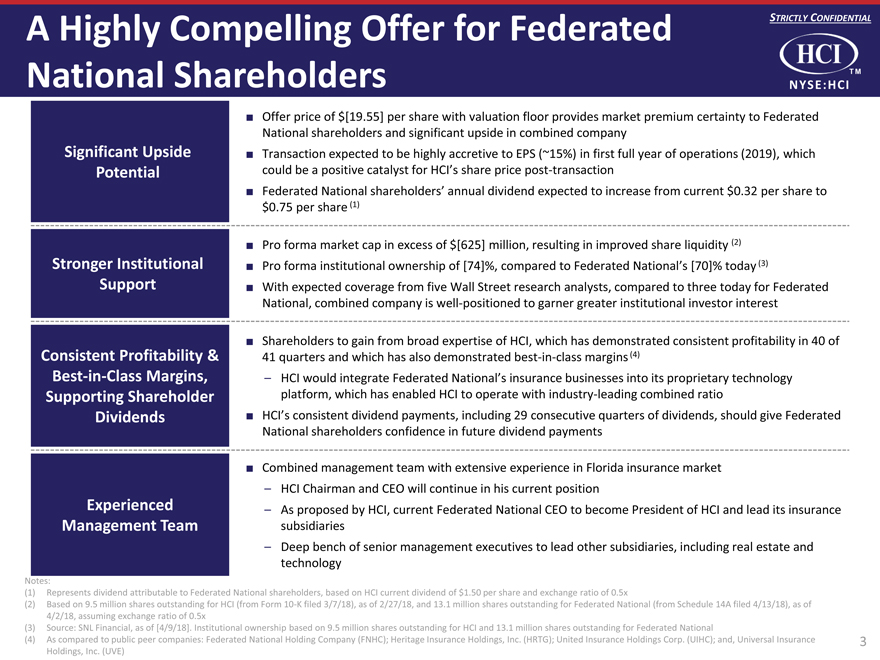

A Highly Compelling Offer for Federated STRICTLY CONFIDENTIAL National Shareholders TM

NYSE:HCI

STRICTLY CONFIDENTIAL

Offer price of $[19.55] per share with valuation floor provides market premium certainty to Federated National shareholders and significant upside in combined company Transaction

expected to be highly accretive to EPS (~15%) in first full year of operations (2019), which could be a positive catalyst for HCI’s share price post-transaction

Federated National shareholders’ annual dividend expected to increase from current $0.32 per share to $0.75 per share (1)

Pro forma market cap in excess of $[625] million, resulting in improved share liquidity (2) Pro forma institutional ownership of [74]%, compared to Federated National’s

[70]% today (3) With expected coverage from five Wall Street research analysts, compared to three today for Federated National, combined company is well-positioned to garner greater institutional investor interest

Shareholders to gain from broad expertise of HCI, which has demonstrated consistent profitability in 40 of 41 quarters and which has also demonstrated best-in-class margins (4) – HCI would integrate Federated National’s insurance businesses into its proprietary technology platform, which has enabled HCI to operate

with industry-leading combined ratio HCI’s consistent dividend payments, including 29 consecutive quarters of dividends, should give Federated National shareholders confidence in future dividend payments

Combined management team with extensive experience in Florida insurance market – HCI Chairman and CEO will continue in his current position – As proposed by HCI, current

Federated National CEO to become President of HCI and lead its insurance

subsidiaries – Deep bench of senior management executives to lead other subsidiaries,

including real estate and technology

Notes: (1) Represents dividend attributable to Federated National shareholders, based on HCI current dividend of $1.50 per

share and exchange ratio of 0.5x (2) Based on 9.5 million shares outstanding for HCI (from Form 10-K filed 3/7/18), as of 2/27/18, and 13.1 million shares outstanding for Federated National (from

Schedule 14A filed 4/13/18), as of 4/2/18, assuming exchange ratio of 0.5x (3) Source: SNL Financial, as of [4/9/18]. Institutional ownership based on 9.5 million shares outstanding for HCI and 13.1 million shares outstanding for

Federated National (4) As compared to public peer companies: Federated National Holding Company (FNHC); Heritage Insurance Holdings, Inc. (HRTG); United Insurance Holdings Corp. (UIHC); and, Universal Insurance Holdings, Inc. (UVE) 04

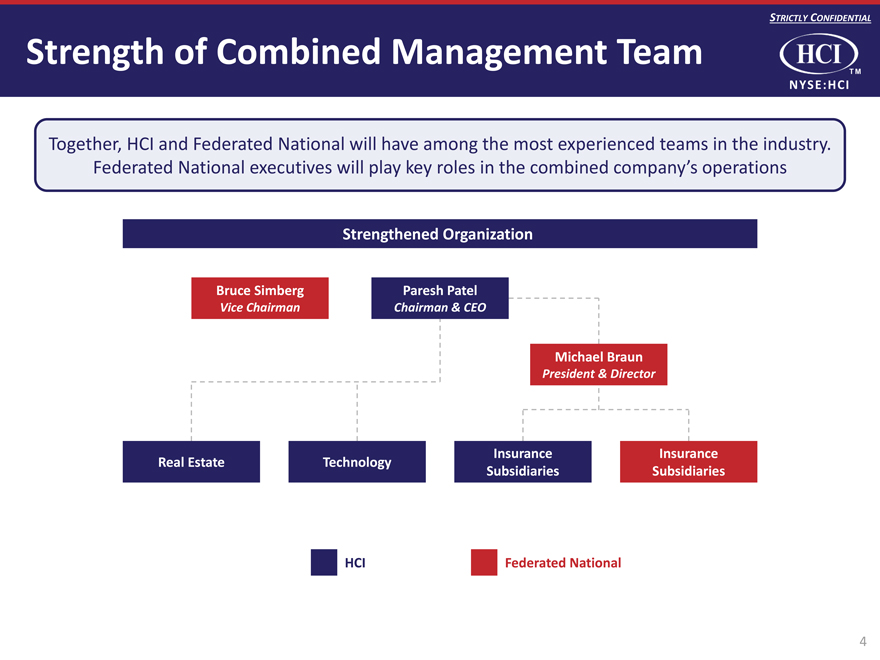

Strength of Combined Management Team

TM NYSE:HCI STRICTLY CONFIDENTIAL

Together, HCI and Federated National will have among the

most experienced teams in the industry. Federated National executives will play key roles in the combined company’s operations Strengthened Organization Bruce Simberg Paresh Patel Vice

Chairman Chairman & CEO Michael Braun President & Director Insurance Insurance Real Estate Technology Subsidiaries Subsidiaries HCI Federated National 05

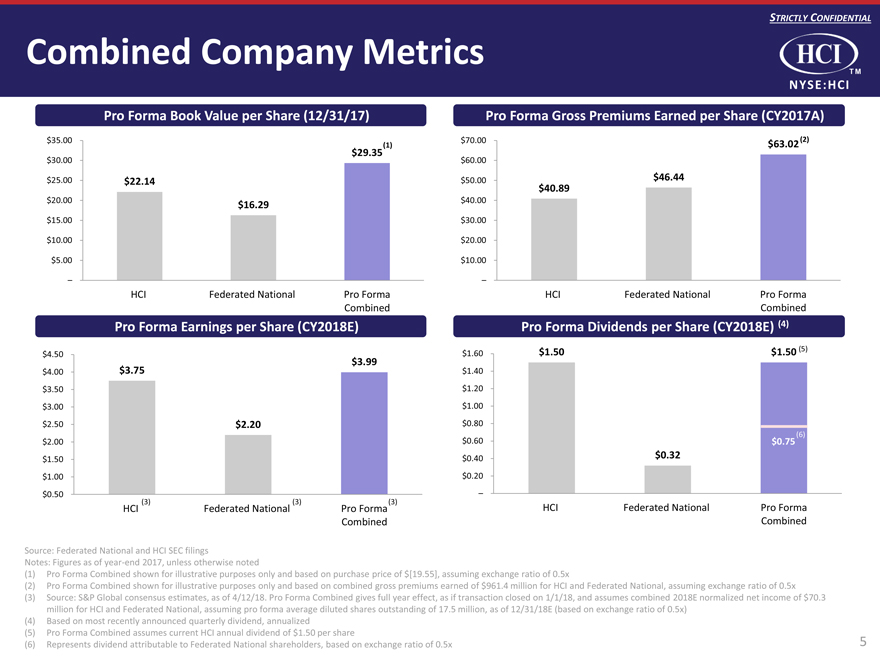

Combined Company Metrics STRICTLY CONFIDENTIAL TM NYSE:HCI

Pro Forma Book Value per Share (12/31/17) $35.00 (1) $29.35 $30.00 $25.00 $22.14

$20.00 $16.29 $15.00 $10.00 $5.00 – HCI Federated National Pro Forma Combined Pro Forma Gross

Premiums Earned per Share (CY2017A)

$ 70.00 $63.02 (2) $ 60.00 $ 50.00 $46.44

$ 40.89 $ 40.00 $ 30.00 $ 20.00 $ 10.00

– HCI Federated NationalPro Forma Combined Pro Forma Earnings per Share (CY2018E) $ 4.50 $3.99

$ 4.00 $3.75 $ 3.50 $ 3.00 $ 2.50 $2.20 $ 2.00 $ 1.50 $ 1.00

$ 0.50 HCI (3) Federated National (3)Pro Forma(3) Combined Pro Forma Dividends per Share (CY2018E) (4) $ 1.60 $1.50$1.50 (5) $ 1.40 $ 1.20

$ 1.00 $ 0.80 $ 0.60 $0.75 (6) $ 0.40 $0.32 $ 0.20 –

HCI Federated NationalPro Forma Combined Source: Federated National and HCI SEC filings Notes: Figures as of year-end 2017, unless otherwise

noted

(1) Pro Forma

Combined shown for illustrative

purposes only and based on purchase price of $[19.55], assuming exchange ratio of 0.5x (2) Pro Forma Combined shown for illustrative purposes only and based on combined gross premiums earned of $961.4 million for HCI and

Federated National, assuming exchange ratio of 0.5x (3) Source: S&P Global consensus estimates, as of 4/12/18. Pro Forma Combined gives full year effect, as if transaction closed on 1/1/18, and assumes combined 2018E

normalized net income of $70.3 million for HCI and Federated National, assuming pro forma average diluted shares outstanding of 17.5 million, as of 12/31/18E (based on exchange ratio of 0.5x) (4) Based on most recently

announced quarterly dividend, annualized (5) Pro Forma Combined assumes current HCI annual dividend of $1.50 per share (6) Represents dividend attributable to Federated National shareholders, based on

exchange ratio of 0.5x 06

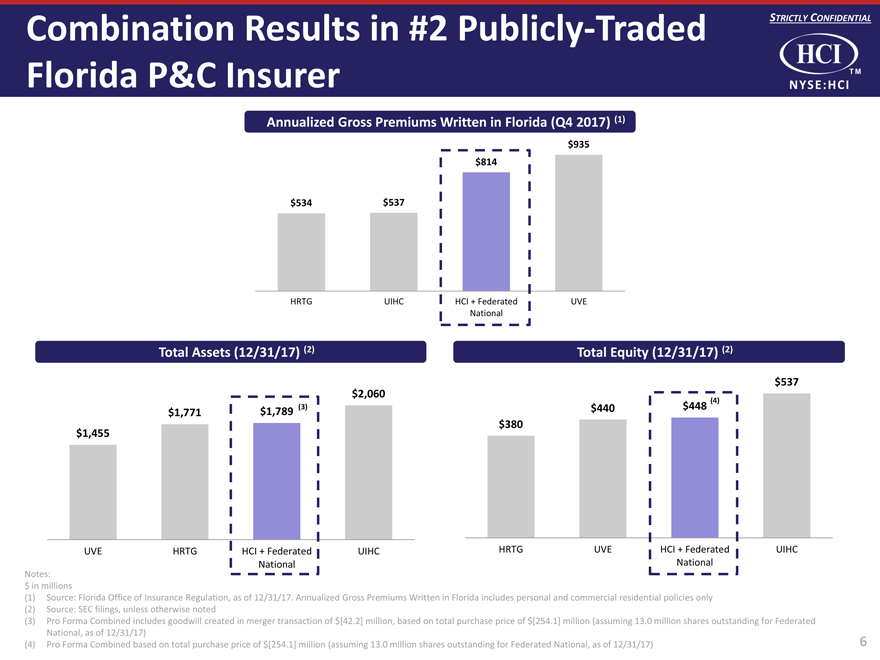

Combination Results in #2 Publicly-Traded Florida P&C Insurer STRICTLY CONFIDENTIAL TM

NYSE:HCI Annualized Gross Premiums Written in Florida (Q4 2017) (1) $935 $814 $534 $537

HRTG UIHC HCI + FederatedUVE National Total Assets (12/31/17) (2) $2,060 $1,771 $1,789 (3)

$1,455 UVE HRTG HCI + FederatedUIHC National Total Equity (12/31/17) (2) $537 $440 $448 (4) $380 HRTG UVE

HCI + FederatedUIHC National Notes: $ in millions (1) Source: Florida Office of Insurance Regulation, as of 12/31/17. Annualized Gross Premiums Written in Florida includes personal and commercial residential policies only (2) Source: SEC

filings, unless otherwise noted (3) Pro Forma Combined includes goodwill created in merger transaction of $[42.2] million, based on total purchase price of $[254.1] million (assuming 13.0 million shares outstanding for Federated National, as of

12/31/17) (4) Pro Forma Combined based on total purchase price of $[254.1] million (assuming 13.0 million shares outstanding for Federated National, as of 12/31/17) 07

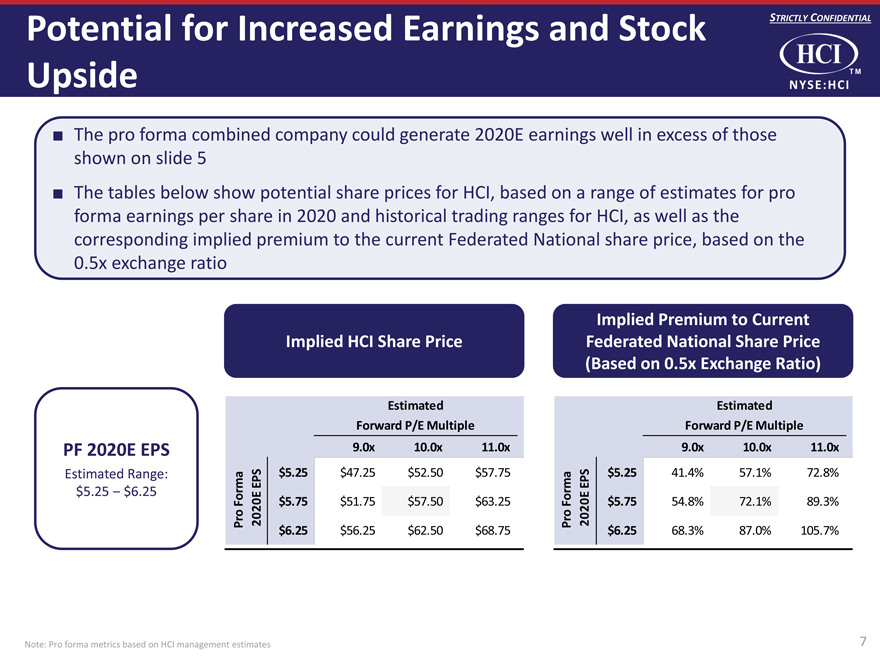

Potential for Increased Earnings and Stock Upside STRICTLY CONFIDENTIAL TM NYSE:HCI The pro forma combined company could generate 2020E earnings well in excess of those shown on slide 5 The tables below show potential share prices for HCI, based on a range of estimates for pro forma earnings per share in 2020 and historical trading ranges for HCI, as well as the corresponding implied premium to the current Federated National share price, based on the 0.5x exchange ratio PF 2020E EPS Estimated Range: $5.25 - $6.25 Implied HCI Share Price Estimated Forward P/E Multiple 9.0x10.0x11.0x $5.25 $47.25$52.50$57.75 Forma 2020E EPS $5.75$51.75$57.50$63.25 Pro $6.25$56.25$62.50$68.75 Implied Premium to Current Federated National Share Price (Based on 0.5x Exchange Ratio) Estimated Forward P/E Multiple 9.0x 10.0x11.0x $5.25 41.4% 57.1%72.8% Forma 2020E EPS $5.75 54.8%72.1%89.3% Pro $6.25 68.3%87.0%105.7% Note: Pro forma metrics based on HCI management estimates 08

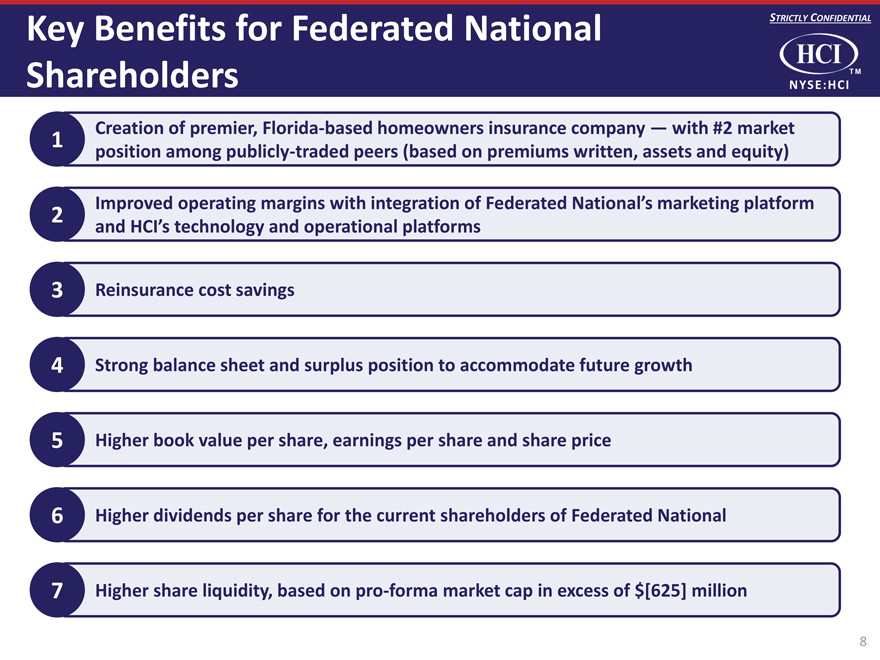

Key Benefits for Federated National Shareholders STRICTLY CONFIDENTIAL TM NYSE:HCI Creation of premier, Florida-based homeowners insurance company — with #2 market 1 position among publicly-traded peers (based on premiums written, assets and equity) Improved operating margins with integration of Federated National’s marketing platform 2 and HCI’s technology and operational platforms 3 Reinsurance cost savings 4 Strong balance sheet and surplus position to accommodate future growth 5 Higher book value per share, earnings per share and share price 6 Higher dividends per share for the current shareholders of Federated National 7 Higher share liquidity, based on pro-forma market cap in excess of $[625] million 09

HCI TM