Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - JETBLUE AIRWAYS CORP | ex992-investorupdateq12018.htm |

| EX-99.1 - EXHIBIT 99.1 - JETBLUE AIRWAYS CORP | ex991-earningsreleaseq12018.htm |

| 8-K - 8-K - JETBLUE AIRWAYS CORP | form8-kxq12018earningsrele.htm |

1

1Q 2018 EARNINGS PRESENTATION

APRIL 24, 2018

2

SAFE HARBOR

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act,

which represent our management's beliefs and assumptions concerning future events. When used in this document and in documents incorporated

herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,”

“targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and

assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking

statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could

affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; our significant fixed obligations and substantial

indebtedness; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our

growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers;

our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated

systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some

international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from

information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation; changes in our industry due to other

airlines' financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated

decrease in demand for air travel; the spread of infectious diseases; adverse weather conditions or natural disasters; and external geopolitical events

and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it

should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the end of

each quarter or year. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings,

including but not limited to, the Company's 2017 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. In light of these risks and

uncertainties, the forward-looking events discussed in this presentation might not occur. We undertake no obligation to update any forward-looking

statements to reflect events or circumstances that may arise after the date of this presentation.

The following presentation also includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934.

We refer you to the reconciliations made available in our Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K (available on our website at

jetblue.com and at sec.gov) and in our first quarter earnings call (furnished on April 24th, 2018), which reconcile the non-GAAP financial measures

included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

3

1Q 2018 EARNINGS UPDATE

ROBIN HAYES

PRESIDENT & CEO

4

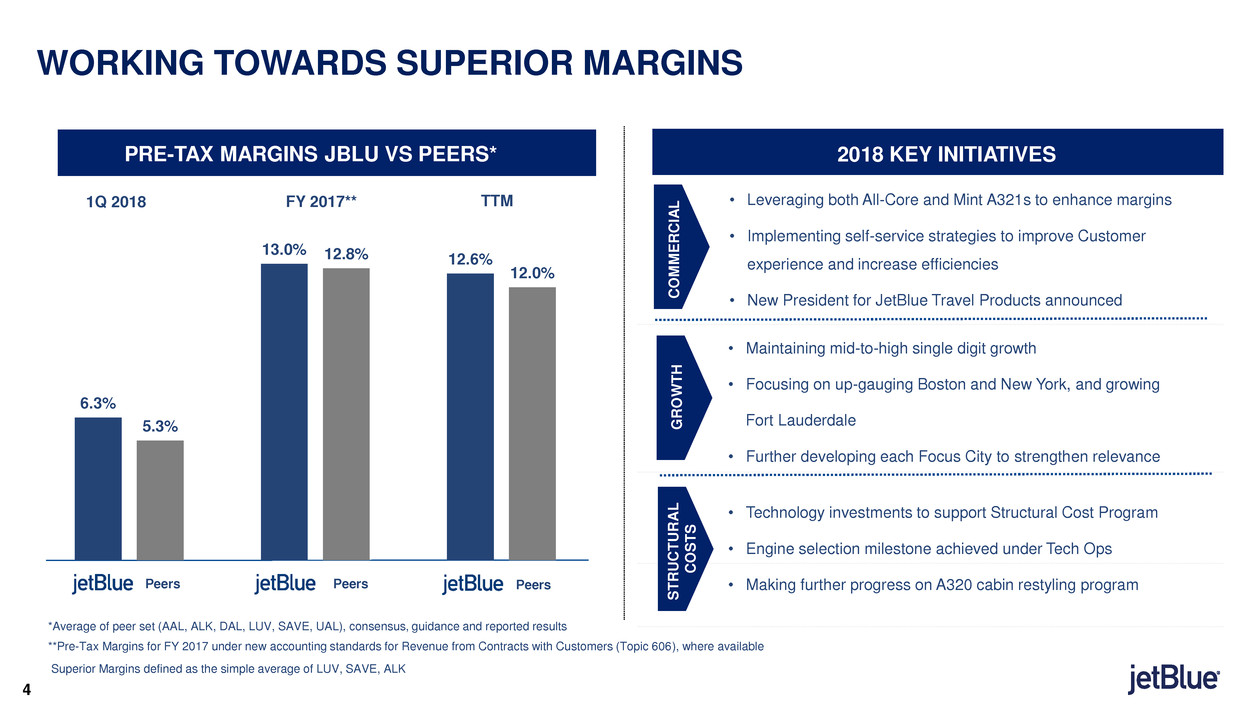

• Maintaining mid-to-high single digit growth

• Focusing on up-gauging Boston and New York, and growing

Fort Lauderdale

• Further developing each Focus City to strengthen relevance

PRE-TAX MARGINS JBLU VS PEERS*

*Average of peer set (AAL, ALK, DAL, LUV, SAVE, UAL), consensus, guidance and reported results

WORKING TOWARDS SUPERIOR MARGINS

4

TTM1Q 2018

2018 KEY INITIATIVES

C

O

M

M

E

R

C

IA

L

G

R

O

W

T

H

S

T

R

U

C

T

U

R

A

L

C

O

S

T

S

FY 2017**

Peers Peers Peers

• Leveraging both All-Core and Mint A321s to enhance margins

• Implementing self-service strategies to improve Customer

experience and increase efficiencies

• New President for JetBlue Travel Products announced

• Technology investments to support Structural Cost Program

• Engine selection milestone achieved under Tech Ops

• Making further progress on A320 cabin restyling program

Superior Margins defined as the simple average of LUV, SAVE, ALK

**Pre-Tax Margins for FY 2017 under new accounting standards for Revenue from Contracts with Customers (Topic 606), where available

6.3%

5.3%

13.0% 12.8% 12.6%

12.0%

COMMERCIAL UPDATE & OUTLOOK

MARTY ST. GEORGE

EVP COMMERCIAL AND PLANNING

6

FOCUSED GROWTH SUPPORTS MARGIN COMMITMENTS

*Flown capacity

6

ASM YOY GROWTH*

− RASM growth outperforming system for four consecutive quarters

− Network growth continues via added frequencies and destinations

− Low completion factor in the Northeast reduced growth below initial

capacity guidance range

− Continuing to up-gauge VFR and leisure markets

− Transcon franchise performing well, both Mint and non-Mint markets

− New Mint routes (San Diego, Las Vegas, Seattle) ramping as expected

− Strongest region in year over year RASM growth

− Puerto Rico recovery continues and developing as expected

3.3%

1Q 2018 2Q 2018E 2018E

6.5% - 8.5%

5.0% - 7.0%

N

Y

C

F

L

L

BO

S

M

IN

T

/

T

C

O

N

L

A

TI

N

− Strengthening business franchise (Minneapolis starting 2Q)

− Similar to NYC, leisure market up-gauging with A321 deliveries

3.5 - 5.5%

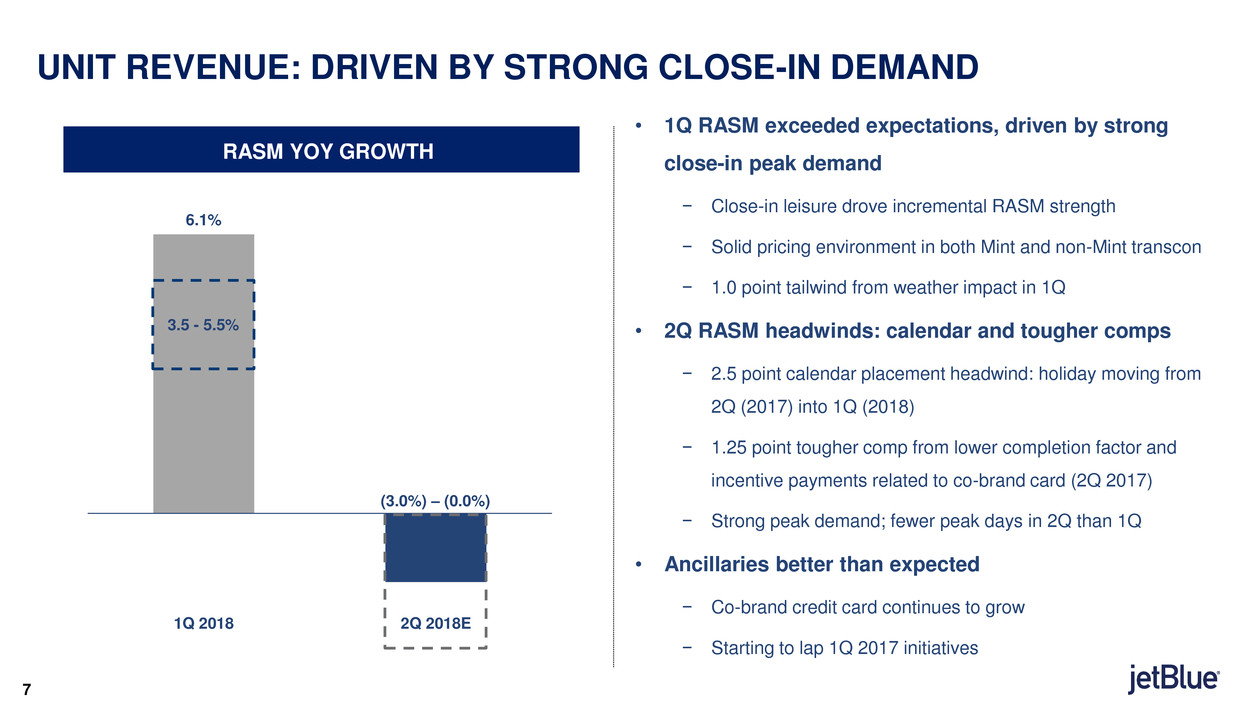

7

6.1%

1Q 2018 2Q 2018E

RASM YOY GROWTH

UNIT REVENUE: DRIVEN BY STRONG CLOSE-IN DEMAND

• 1Q RASM exceeded expectations, driven by strong

close-in peak demand

− Close-in leisure drove incremental RASM strength

− Solid pricing environment in both Mint and non-Mint transcon

− 1.0 point tailwind from weather impact in 1Q

• 2Q RASM headwinds: calendar and tougher comps

− 2.5 point calendar placement headwind: holiday moving from

2Q (2017) into 1Q (2018)

− 1.25 point tougher comp from lower completion factor and

incentive payments related to co-brand card (2Q 2017)

− Strong peak demand; fewer peak days in 2Q than 1Q

• Ancillaries better than expected

− Co-brand credit card continues to grow

− Starting to lap 1Q 2017 initiatives

7

(3.0%) – (0.0%)

3.5 - 5.5%

8

-7.8%

-3.7%

1.1%

2.8%

1H 2016 2H 2016 1H 2017 2H 2017 1H 2018E

RASM YOY GROWTH

SOLID UNIT REVENUE TRENDS DESPITE CALENDAR SHIFTS

• 1H 2018 RASM growth between 1.5% and 3.0%

− 1Q to 2Q calendar shift masks underlying positive unit

revenue trends year over year

− Margin-accretive revenue initiatives resulting in solid

trends as comparisons get steadily tougher

• 2H 2018 RASM considerations

− Expect summer demand peak to have a positive impact on

RASM; lapping 2017 initiatives naturally becoming tougher

underlying comparisons in 2H 2018

− 2H17 RASM negatively impacted by hurricanes, both in

Florida and Caribbean

8

1.5% - 3.0%

FINANCIAL UPDATE & OUTLOOK

STEVE PRIEST

EVP CHIEF FINANCIAL OFFICER

10

11.79

12.50

1Q 2017 1Q 2018 1Q 2017 1Q 2018

1Q 2018 RESULTS

CASM EX-FUEL* PRE TAX MARGIN EARNINGS PER SHARE

• Solid revenue growth driven by

close-in leisure demand

• Growing ancillary revenues

• Pressure from lower

completion factor (weather)

• Positive impact of shift

of maintenance expenses

• Higher fuel prices more

than offset strong RASM

performance

• Pressure from fuel was

offset by lower tax rate

and share repurchases

6.1%

8.30

8.55

1Q 2017 1Q 2018

3.1%

7.6%

6.3%

1Q 2017 1Q 2018

(US$ cents) (US$ cents) (US$ cents)

27

24

RASM

*Refer to Appendix D on Non-GAAP Financial Measures

11

CASM EX-FUEL YOY GROWTH*

UNIT COSTS: MANAGING HEADWINDS TO ACHIEVE GOALS

• 1Q CASM ex-fuel at the mid-point of initial guidance

− Lower completion factor from a more active winter than

normal in the Northeast, resulted in ~one point headwind to

CASM ex-fuel

− Strong focus on cost management; timing of maintenance

expenses shifting to later in the year

• 2Q and full year 2018 cost guidance

− 2Q 2018 range between 2.0% to 4.0%, driven by

maintenance timing from 1Q

− Continue to expect full year 2018 CASM ex-fuel growth

between (1.0%) and 1.0%, driven by ongoing cost controls

and progress in Structural Cost program

4.8%

3.1%

2017 1Q 2018 2Q 2018E 2018E

2.0% - 4.0% 2.0% - 4.0%

(1.0)% - 1.0%

*Refer to Appendix D on Non-GAAP Financial Measures

12

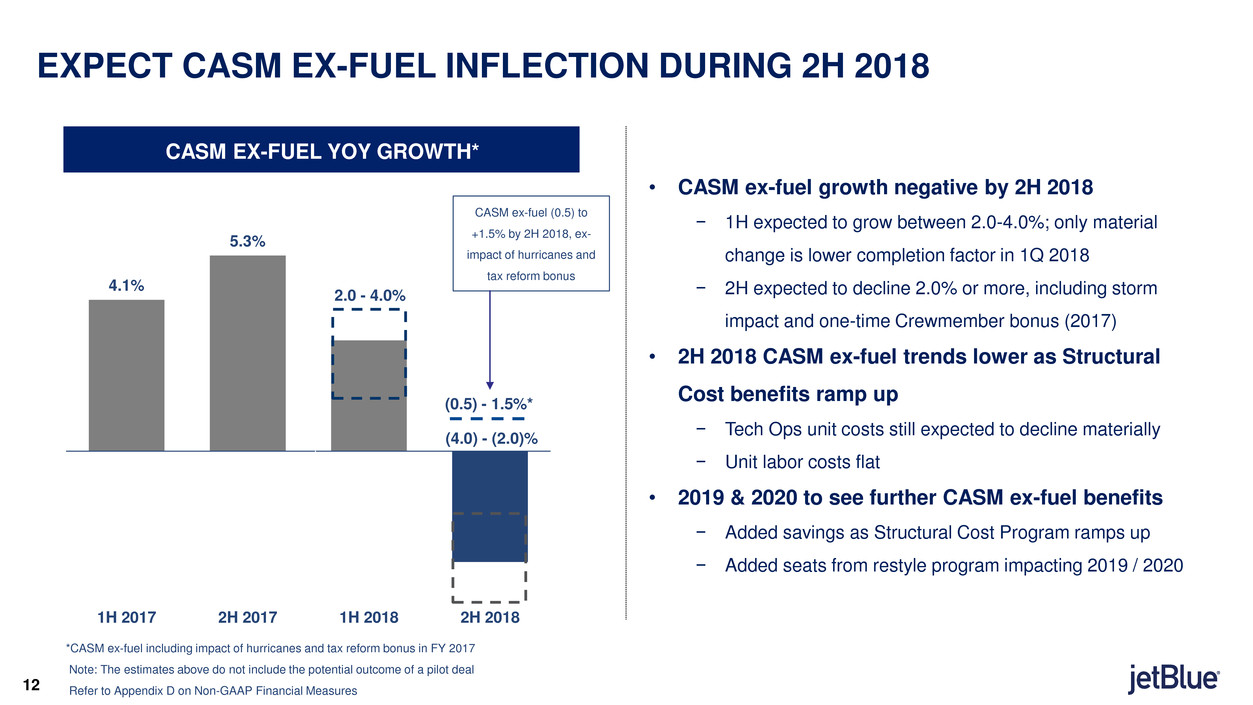

4.1%

5.3%

1H 2017 2H 2017 1H 2018 2H 2018

EXPECT CASM EX-FUEL INFLECTION DURING 2H 2018

• CASM ex-fuel growth negative by 2H 2018

− 1H expected to grow between 2.0-4.0%; only material

change is lower completion factor in 1Q 2018

− 2H expected to decline 2.0% or more, including storm

impact and one-time Crewmember bonus (2017)

• 2H 2018 CASM ex-fuel trends lower as Structural

Cost benefits ramp up

− Tech Ops unit costs still expected to decline materially

− Unit labor costs flat

• 2019 & 2020 to see further CASM ex-fuel benefits

− Added savings as Structural Cost Program ramps up

− Added seats from restyle program impacting 2019 / 2020

*CASM ex-fuel including impact of hurricanes and tax reform bonus in FY 2017

Note: The estimates above do not include the potential outcome of a pilot deal

Refer to Appendix D on Non-GAAP Financial Measures

CASM ex-fuel (0.5) to

+1.5% by 2H 2018, ex-

impact of hurricanes and

tax reform bonus

412

CASM EX-FUEL YOY GROWTHCASM L YOY GROWTH*

(0.5) - 1.5%*

2.0 - 4.0%

(4.0) - (2.0)%

13

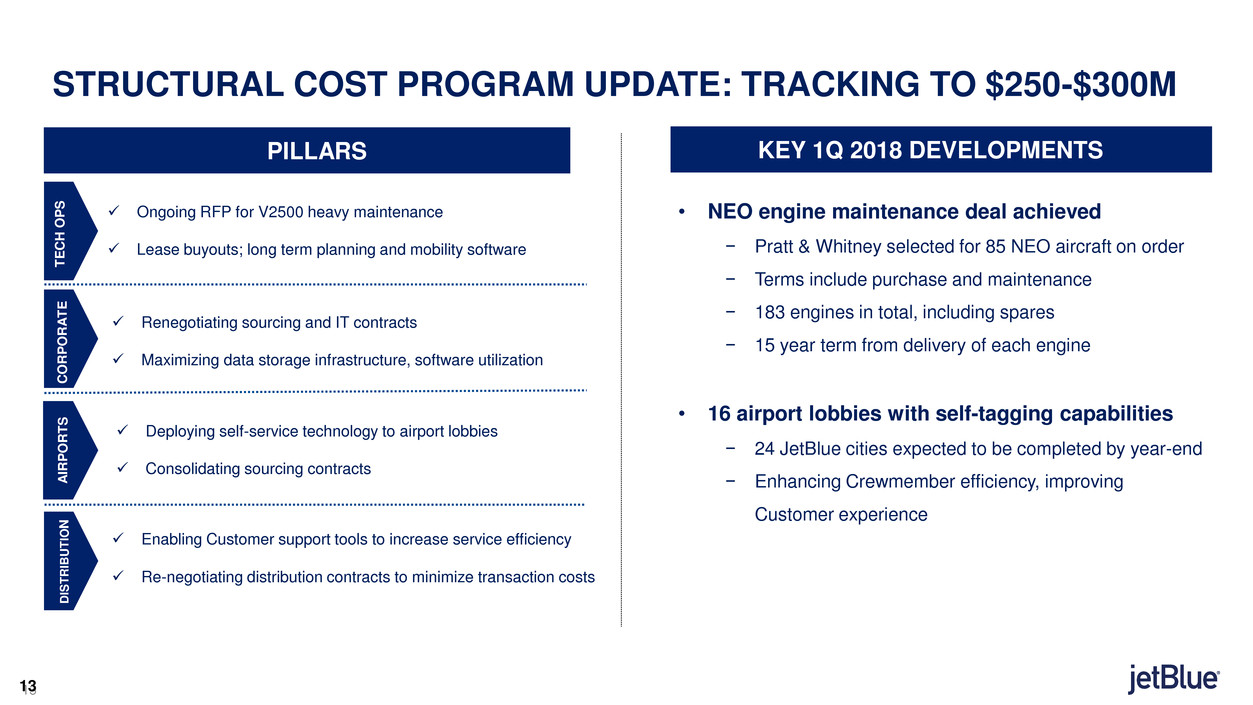

STRUCTURAL COST PROGRAM UPDATE: TRACKING TO $250-$300M

13

Renegotiating sourcing and IT contracts

Maximizing data storage infrastructure, software utilization

Enabling Customer support tools to increase service efficiency

Re-negotiating distribution contracts to minimize transaction costs

T

E

CH

O

P

S

C

O

R

P

O

R

A

T

E

A

IR

P

O

R

T

S

DISTRIBUTI

O

N

Ongoing RFP for V2500 heavy maintenance

Lease buyouts; long term planning and mobility software

KEY 1Q 2018 DEVELOPMENTSPILLARS

• NEO engine maintenance deal achieved

− Pratt & Whitney selected for 85 NEO aircraft on order

− Terms include purchase and maintenance

− 183 engines in total, including spares

− 15 year term from delivery of each engine

• 16 airport lobbies with self-tagging capabilities

− 24 JetBlue cities expected to be completed by year-end

− Enhancing Crewmember efficiency, improving

Customer experience

Deploying self-service technology to airport lobbies

Consolidating sourcing contracts

14

2Q 2018E 2018E 2017-2020E

CAPEX: ACCRETIVE FLEET GROWTH AND REINVESTMENT

Year A320neo A3 1ceo A321neo Total

2018 - - 10

2019 - - 13 13

2020 6 - 7 13

~$1.1b

60 60 60 60

130 130 130 130

21 21 23 28

32 34 34

35

2017 1Q 2018 2Q 2018E 2018E

E190 A320 A321 HD A321 Mint

243 245

253

247

FLEET CAPITAL EXPENDITURES

$35m - $50m

$190m - $225m

$150m - $200m

$750m - $900m

Guidance as of 04/24/18

Aircraft Non-Aircraft

15

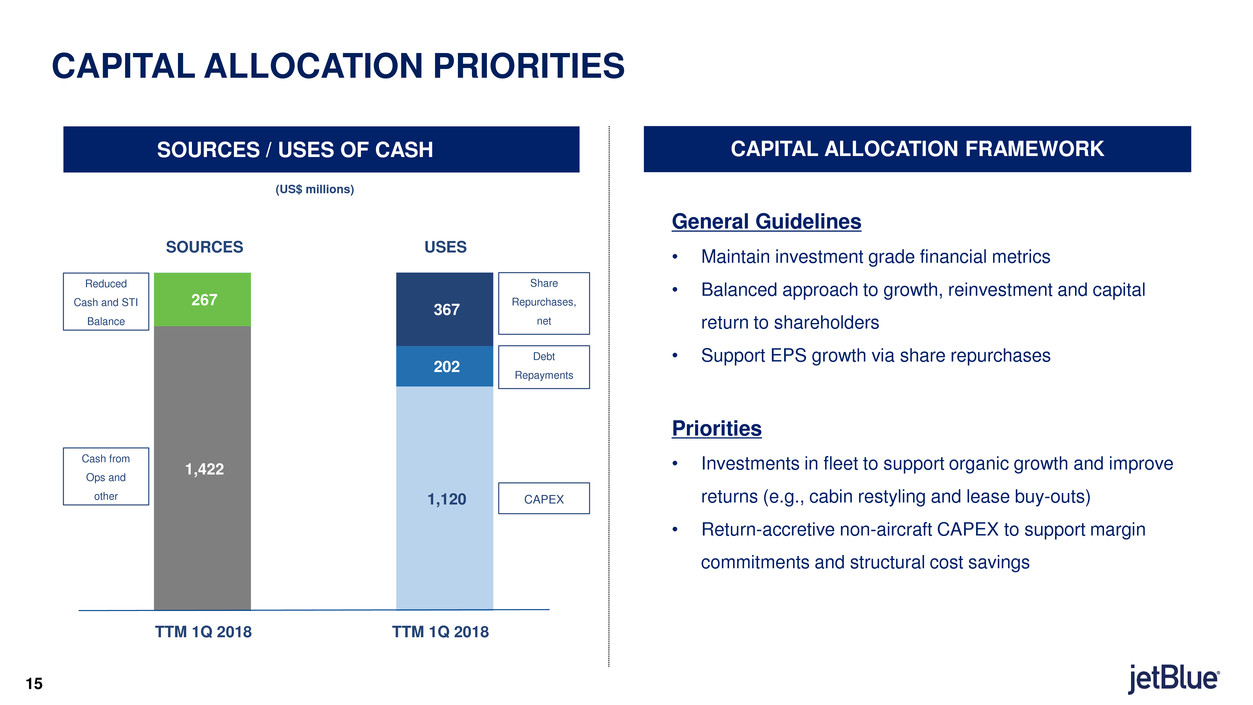

1,422

267

1,120

202

367

CAPITAL ALLOCATION PRIORITIES

15

General Guidelines

• Maintain investment grade financial metrics

• Balanced approach to growth, reinvestment and capital

return to shareholders

• Support EPS growth via share repurchases

Priorities

• Investments in fleet to support organic growth and improve

returns (e.g., cabin restyling and lease buy-outs)

• Return-accretive non-aircraft CAPEX to support margin

commitments and structural cost savings

SOURCES / USES OF CASH

SOURCES USES

(US$ millions)

CAPITAL ALLOCATION FRAMEWORK

TTM 1Q 2018 TTM 1Q 2018

Cash from

Ops and

other

Reduced

Cash and STI

Balance

Share

Repurchases,

net

Debt

Repayments

CAPEX

16

2018 GUIDE SUMMARY

CAPACITY

2Q 2018 FY 2018

5.0 – 7.0% 6.5 – 8.5%

RASM

2Q 2018 FY 2018

(3.0) – 0.0% N/A

CASM EX-FUEL

2Q 2018 FY 2018

2.0 – 4.0% (1.0) – 1.0%

ALL-IN FUEL PRICE

2Q 2018 FY 2018

$2.23 / gal N/A

CAPEX AIRCRAFT

2Q 2018 FY 2018

$190 - 225m $750 – 900m

CAPEX NON-AIRCRAFT

2Q 2018 FY 2018

$35 – 50m $150 – 200m

OTHER INCOME / (EXPENSE)

2Q 2018 FY 2018

($18) – (23)m ($80) – (90)m

JBTP / JTV (EXPENSES)

2Q 2018 FY 2018

($9) – (14)m ($35) – (45)m

18

APPENDIX A: 1Q 2018 FINANCIAL RESULTS

US$ millions 1Q 2018 1Q 2017 Var %

Total Operating Revenues 1,754 1,600 9.6

Aircraft fuel and related taxes 417 323 29.2

Salaries, wages and benefits 499 466 7.0

Landing fees and other rents 100 95 4.4

Depreciation and amortization 117 105 11.7

Aircraft rent 24 26 (5.2)

Sales and marketing 67 61 10.8

Maintenance, materials and repairs 142 152 (6.9)

Other operating expenses 260 230 12.8

OPERATING INCOME

128 142 (10.0)

Other Income (Expense)

(18) (21) (15.0)

Income before taxes

110 121 (9.2)

Income tax expense

22 39 (43.4)

NET INCOME 88 82 7.0

Pre-Tax Margin 6.3% 7.6% (1.3) pts

Earnings per Share (EPS) $0.27 $0.24

19

APPENDIX B: OTHER NON-AIRLINE OPERATING EXPENSES

(JBTP/JTV EXPENSES, $m)

$8

$9 $9 $9 $9

1Q 2017 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018E 2017 2018E

$36

$35 - $45

$9 – $14

20

APPENDIX C: RELEVANT JETBLUE MATERIALS

Investor Presentations http://blueir.investproductions.com/investor-relations/events-and-presentations/presentations

Earnings Releases http://blueir.investproductions.com/investor-relations/financial-information/quarterly-results

Annual Reports http://blueir.investproductions.com/investor-relations/financial-information/reports/annual-reports

SEC Filings http://blueir.investproductions.com/investor-relations/financial-information/sec-filings

Proxy Statements http://blueir.investproductions.com/investor-relations/financial-information/reports/proxy-statements

Investor Updates http://blueir.investproductions.com/investor-relations/financial-information/investor-updates

Traffic Reports http://blueir.investproductions.com/investor-relations/financial-information/traffic-releases

ESG Reports* http://blueir.investproductions.com/investor-relations/financial-information/reports/sustainable-accounting-standards-board-reports

www.investor.jetblue.com/investor-relations

DOCUMENT LOCATION

* Environmental, Social, and Governance Reports

21

APPENDIX D: NOTE ON NON-GAAP FINANCIAL MEASURES

Consolidated operating cost per available seat mile, excludes fuel and related taxes, and operating expenses

related to other non-airline businesses (CASM Ex-Fuel) is a non-GAAP financial measure that we use to

measure our core performance. Note A within our quarterly earnings release (provided in our Current Report

on Form 8-K furnished to the Securities and Exchange Commission on April 24, 2018) provides a

reconciliation of non-GAAP financial measures used in this presentation and provides the reasons

management uses those measures.