Attached files

| file | filename |

|---|---|

| EX-32.2 - Adhera Therapeutics, Inc. | ex32-2.htm |

| EX-32.1 - Adhera Therapeutics, Inc. | ex32-1.htm |

| EX-31.2 - Adhera Therapeutics, Inc. | ex31-2.htm |

| EX-31.1 - Adhera Therapeutics, Inc. | ex31-1.htm |

| EX-21.1 - Adhera Therapeutics, Inc. | ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission File Number 000-13789

MARINA BIOTECH, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 11-2658569 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 17870 Castleton Street, Suite 250 | ||

| City of Industry, California | 91748 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(626) 964-5788

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.006 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| (Do not check if a smaller reporting company) | Emerging Growth Company | [ ] | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X].

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $19.5 million as of June 30, 2017 based upon the closing price of $3.80 per share on the OTCQB tier of the OTC Markets on June 30, 2017.

As of April 16, 2018, there were 10,521,278 shares of the registrant’s $0.006 par value common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the registrant’s fiscal year ended December 31, 2017, to be filed by the registrant with the Securities and Exchange Commission not later than 120 days from the end of the registrant’s fiscal year ended December 31, 2017, in conjunction with the registrant’s annual meeting of stockholders, are incorporated by reference in Part III of this Annual Report on Form 10-K.

MARINA BIOTECH, INC.

Table of Contents

| 2 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and regulations promulgated thereunder. These forward-looking statements reflect our current views with respect to future events or our financial performance, and involve certain known and unknown risks, uncertainties and other factors, including those identified below, those discussed in Item 1A of this report under the heading “Risk Factors,” and those discussed in our other filings with the Securities and Exchange Commission, which may cause our or our industry’s actual or future results, levels of activity, performance or achievements to differ materially from those expressed or implied by any forward-looking statements or from historical results. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act. Forward-looking statements include information concerning our possible or assumed future results of operations and statements preceded by, followed by, or that include the words “may,” “will,” “could,” “would,” “should,” “believe,” “expect,” “plan,” “anticipate,” “intend,” “estimate,” “predict,” “potential” or similar expressions.

Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, we can give no assurance that such expectations will be achieved. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report on Form 10-K or to conform them to actual results, new information, future events or otherwise, except as otherwise required by securities and other applicable laws.

The following factors, among others, could cause our or our industry’s future results to differ materially from historical results or those anticipated:

| ● | our ability to obtain additional and substantial funding for our company on an immediate basis, whether pursuant to a capital raising transaction arising from the sale of our securities, a strategic transaction or otherwise; | |

| ● | our ability to attract and/or maintain research, development, commercialization and manufacturing partners; | |

| ● | the ability of our company and/or a partner to successfully complete product research and development, including pre-clinical and clinical studies and commercialization; | |

| ● | the ability of our company and/or a partner to obtain required governmental approvals, including product and patent approvals; | |

| ● | the ability of our company and/or a partner to develop and commercialize products that can compete favorably with those of our competitors; | |

| ● | the timing of costs and expenses related to the research and development programs of our company and/or our partners; | |

| ● | the timing and recognition of revenue from milestone payments and other sources not related to product sales; | |

| ● | our ability to obtain suitable facilities in which to conduct our planned business operations on acceptable terms and on a timely basis; | |

| ● | our ability to satisfy our disclosure obligations under the Securities Exchange Act of 1934, as amended, and to maintain the registration of our common stock thereunder; | |

| ● | our ability to attract and retain qualified officers, employees and consultants as necessary; and | |

| ● | costs associated with any product liability claims, patent prosecution, patent infringement lawsuits and other lawsuits. |

| 3 |

These factors are the important factors of which we are currently aware that could cause actual results, performance or achievements to differ materially from those expressed in any of our forward-looking statements. We operate in a continually changing business environment, and new risk factors emerge from time to time. Other unknown or unpredictable factors also could have material adverse effects on our future results, performance or achievements. We cannot assure you that projected results or events will be achieved or will occur.

Overview

We are a fully integrated, commercial stage biopharmaceutical company delivering proprietary drug therapeutics for significant unmet medical needs in the U.S., Europe and certain additional international markets. Our portfolio of products currently focuses on fixed dose combinations (“FDC”) in hypertension, arthritis, pain and oncology allowing for innovative solutions to such unmet medical needs. Our mission is to provide effective and patient centric treatment for hypertension – including resistant hypertension – through our patented total care platform. In this connection, we acquired from Symplmed Pharmaceuticals LLC and its wholly-owned subsidiary, Symplmed Technologies, LLC, certain of the intellectual property assets related to the patented technology platform known as DyrctAxess, also called Total Care, that offers enhanced efficiency, control and information to empower patients, physicians and manufacturers to help achieve optimal care.

In doing so, we have created a universal platform for the effective treatment of hypertension as well as for the distribution of FDC hypertensive drugs such as our FDA-approved product Prestalia, and the other products in our pipeline, devices for Therapeutic Drug Monitoring (TDM), Blood Pressure (BP), and other cardiac monitors, as well as services such as counseling and prescription reminders.

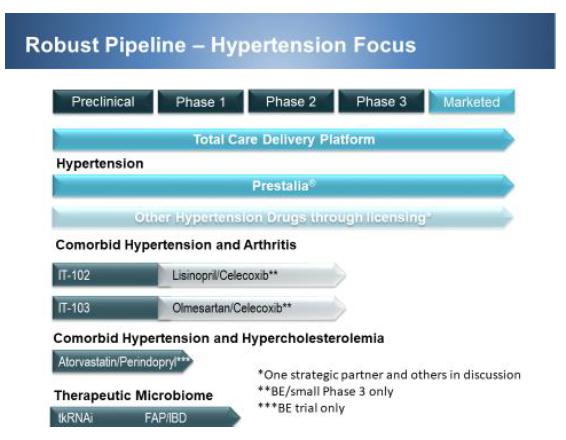

We currently have one commercial and three clinical development programs underway: (i) Prestalia®, a single-pill FDC of perindopril argentine (“perindopril”), an angiotensin-converting-enzyme (“ACE”) inhibitor and amlodipine besylate (“amlodipine”), a calcium channel blocker (“CCB”), which has been approved by the U.S. Food and Drug Administration (“FDA”) and is actively marketed in the U.S.; (ii) our next generation celecoxib program drug candidates for the treatment of acute and chronic pain, IT-102 and IT-103, each of which is an FDC of celecoxib, a COX-2 selective nonsteroidal anti-inflammatory drug (“NSAID”) and either lisinopril (IT-102) or olmesartan (IT-103) – both lisinopril and olmesartan are antihypertension drugs; (iii) CEQ508, an oral delivery of small interfering RNA (“siRNA”) against beta-catenin, combined with IT-102 to suppress polyps in the precancerous syndrome and orphan indication Familial Adenomatous Polyposis (“FAP”); and (iv) CEQ508 combined with IT-103 to treat Colorectal Cancer.

On April 16, 2018, we raised in excess of $10 million, net of fees and expenses from a private placement of our newly created Series E Convertible Preferred Stock (See Recent Developments: Series E Convertible Preferred Share Private Placement Offering below). The use of funds from the raise will primarily be on the commercialization of Prestalia, funding working capital and capex needs and other general corporate requirements. For the development of IT-102 and IT-103, we will seek partners or raise additional funds to advance the development programs. We believe that by combining a COX-2 inhibitor with an antihypertensive in a single FDC oral tablet, IT-102 and IT-103 will each offer improved safety profiles as compared to currently available and previously marketed COX-2 inhibitors as well as address patients with chronic pain who are commonly taking antihypertension drugs concurrently. We further believe that the current opioid addiction epidemic in the U.S. has been driven in part by the withdrawal from the market of certain COX-2 inhibitors due to their associated risk of cardiovascular-related adverse events. We plan to license or divest our other assets since they no longer align with our focus on the treatment of hypertension.

We intend to create value through the continued commercialization of our FDA-approved product, Prestalia, while moving our FDC development programs forward to further strengthen our commercial presence. We intend to retain ownership and control of all of our product candidates, but in the interest of accelerated growth and market penetration, we will also consider partnerships with pharmaceutical or biotechnology companies in order to reduce time to market and to balance development risks, both clinically and financially.

| 4 |

As our strategy is to be a fully integrated biopharmaceutical company, we will drive a primary corporate focus on revenue generation through our commercial assets, with a secondary focus on advancing our FDC pipeline to further enhance our commercial presence.

Background

As further described below under “Merger with IThenaPharma”, on November 15, 2016, Marina entered into an Agreement and Plan of Merger with IThenaPharma, Inc., a Delaware corporation (“IThena” or “IThenaPharma”), IThena Acquisition Corporation, a Delaware corporation and a wholly owned subsidiary of IThena (“Merger Sub”), and Vuong Trieu, Ph.D. as the IThena Representative (the “Merger Agreement”), pursuant to which, among other things, Merger Sub merged with and into IThena, with IThena surviving as a wholly owned subsidiary of Marina (such transaction, the “Merger”). As a result of the Merger, the former holders of IThena common stock immediately prior to the completion of the Merger owned approximately 65% of the issued and outstanding shares of Marina common stock immediately following the completion of the Merger.

Marina was incorporated under the laws of the State of Delaware under the name Nastech Pharmaceutical Company on September 23, 1983, and IThena was incorporated under the laws of the State of Delaware on September 3, 2014. IThena is deemed to be the accounting acquirer in the Merger, and thus the historical financial statements of IThena will be treated as the historical financial statements of our company and will be reflected in our quarterly and annual reports for periods ending after the effective time of the Merger. Accordingly, beginning with our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, we started to report the results of IThena and Marina and their respective subsidiaries on a consolidated basis. The December 31, 2017 statement of operations include the full year for Marina, Ithena and their subsidiaries whereas the December 31, 2016 statement of operations include the results of Ithena alone from January 1, 2016 to November 15, 2016 and combined with Marina and its subsidiaries from November 16, 2016 through December 31, 2016. As such, the statements of operations may not be comparable for the two years ended December 31, 2017.

Prior to the Merger, Marina’s pipeline consisted of oligonucleotide-based therapeutics. That pipeline included CEQ508, a product in clinical development for the treatment of FAP, for which Marina received both Orphan Drug Designation (“ODD”) and Fast Track Designation (“FTD”) from the FDA, as well as preclinical programs for the treatment of type 1 myotonic dystrophy (“DM1”) and DMD. The IThena pipeline of celecoxib FDCs is now incorporated into the combined company. We plan to develop IT-102/IT-103 – next generation celecoxib – together with CEQ508, as a therapeutic enhancer for therapies against FAP and CRC. We are also developing IT-102/IT-103 for the treatment of combined arthritis / hypertension and the treatment of pain requiring a high dose of celecoxib.

Following the Merger, we have reorganized the acquired Marina platform into a strong pipeline of preclinical and clinical drug candidates, which we believe will unlock their value. We plan to divest this asset as soon as reasonably practicable. At the same time, we have divested the SMARTICLES asset as it is no longer a strategic fit, as described under “Recent Developments – Sale of Smarticles Assets” below.

On March 16, 2018, Marina entered into an Licensing Agreement with Agenovir Corporation, whereby Marina granted Agenovir exclusive rights to the company’s DiLA2 delivery system in exchange for an upfront payment of $200,000 and further potential future consideration dependent upon event and sales-based milestones. Under the terms of the agreement, Marina has agreed to assign ownership of the intellectual property associated with the DiLA2 delivery system to Agenovir Corporation.

Subsequent to the Merger, we executed on our strategy to become a commercial stage company by acquiring Prestalia from Symplmed. Specifically, and as described under “Acquisition of Assets from Symplmed” below, on June 6, 2017 we entered into an Asset Purchase Agreement with Symplmed for the purchase of Prestalia. Prestalia is an FDA-approved and marketed anti-hypertensive drug. Prestalia is an FDC of perindopril arginine, which is an ACE inhibitor, and amlodipine besylate, which is a CCB, and is indicated as a first line therapy for hypertension control.

The acquisition of Prestalia transitions our company from a clinical stage company to a commercial organization. Prestalia was approved by the FDA in January 2015 and has been marketed in select U.S. states since then by Symplmed. Prestalia sales saw solid growth through September of 2016, via new patient acquisition and strong patient retention. Due to funding circumstances, further sales promotion of Prestalia was ceased by the end of calendar year 2016. In the near term our focus will be dedicated to re-acquiring prior Prestalia patients, with subsequent efforts dedicated to building a strong sales team to fully promote the product.

| 5 |

We believe that the Prestalia acquisition will make us a revenue-stage company. We also believe that the marketing, distribution and sales network that we will build will pave a strong foundation for the promotion and commercialization of our two other hypertension pipeline products – namely IT-102 and IT-103.

Recent Developments

Series E Convertible Preferred Share Private Placement Offering

On April 16, 2018, we entered into Subscription Agreements (the “Purchase Agreements”) with certain accredited investors and conducted a closing pursuant to which we sold 2,334 shares of our Series E convertible preferred stock, par value of $0.01 per share (the “Preferred Stock”), at a purchase price of $5,000 per share of Preferred Stock. Each share of Preferred Stock is initially convertible into shares of our common stock, par value $0.006 per share (the “Common Stock”), at a conversion price of $0.50 per share of Common Stock. In addition, each investor received a 5-year warrant (the “Warrants”, and collectively with the Preferred Stock, the “Securities”) to purchase 0.75 shares of Common Stock for each share of Common Stock issuable upon the conversion of the Preferred Stock purchased by such investor at an exercise price equal to $0.55 per share of Common Stock, subject to adjustment thereunder. The closing is the initial closing (the “Initial Closing”) of our private placement (the “Private Placement”) of up to $10,000,000 of Securities, which amount may be increased to $15,000,000 at the discretion of our company and its placement agent in the Private Placement (the “Maximum Offering Amount”). The Preferred Stock has voting rights, dividend rights, liquidation preferences, conversion rights and anti-dilution rights as described in the Certificate of Designation of Preferences, Rights and Limitations of the Preferred Stock. The Warrants have full-ratchet anti-dilution protection, are exercisable for a period of five years following the final closing of the Private Placement and contain customary exercise limitations.

We received total gross proceeds of approximately $11.7 million from the Initial Closing, prior to deducting placement agent fees and estimated expenses payable by us associated with the Initial Closing of $1.25 million. We intend to use the proceeds of the Private Placement for funding our commercial operations to the sale and promotion of our Prestalia product, working capital needs, capital expenditures, the repayment of certain liabilities and other general corporate purposes.

The outstanding balance related to the notes that we issued in June 2016 in the amount of $357,300 (plus certain additional “consideration securities” in the amount of $375,000 that we committed to issue to the holders of such notes pursuant to amendments that we entered into with such noteholders), the outstanding balance related to the notes that we issued in June 2017 in the amount of $417,173, the outstanding balance related to the lines of credit from our Executive Chairman and from Autotelic Inc. in the amounts of $573,174 and $94,981, respectively, the outstanding balance related to the note that we issued to a trust affiliated with Isaac Blech in November 2017 in the amount of $510,740, in each case inclusive of accrued but unpaid interest, as well as payables due to Autotelic Inc. in the amount of $812,967 pursuant to our Master Services Agreement with Autotelic Inc., have all been converted into our Series E Preferred Stock and Warrants, at the same terms mentioned above with respect to investors in the Private Placement, in full and complete satisfaction of the outstanding debt and as such the notes, lines of credit or payables are no longer outstanding. In addition, $291,250 of accrued and unpaid Board of Director fees due to four current and one former Board member for services rendered during the period prior to January 1, 2018 have also been converted into our Series E Preferred Stock and Warrants, at the same terms mentioned above with respect to investors in the Private Placement, in full and complete satisfaction of the outstanding fees owed to such directors, and as such the accrual is no longer outstanding.

Binding Term Sheet Agreement with Autotelic BIO

On January 11, 2018, we entered into a binding term sheet agreement with Autotelic BIO (“ATB”), as described below, pursuant to which, among other things, and subject to the satisfaction of certain conditions on or prior to January 15, 2019 (the “Termination Date”), we shall grant to ATB a perpetual exclusive right of development and marketing of our IT-103 product candidate, which is a fixed dose combination of celecoxib and olmesartan medoxomil (the “Product”), at the currently approved dose/approved indications only for celecoxib (100 mg, 200mg and 400mg) for combined hypertension and arthritis only, with such right extending throughout the entire world (excluding the United States and Canada and their territories) (the “Territory”). The grant of the license would be memorialized in a definitive license agreement to be entered into between the parties following the satisfaction of the applicable conditions.

The conditions to the grant of the license include, without limitation, that prior to the Termination Date, ATB shall satisfy one of the following conditions: (i) ATB shall obtain funding in a certain specified amount to perform thirteen (13) weeks of repeated toxicity testing with rats and to obtain Investigational New Drug Application approval in the Republic of Korea (the “Fundraising”); (ii) ATB shall obtain a co-development and licensing deal with other third-party pharmaceutical companies with respect to the Product; and (iii) ATB shall obtain a government-sponsored research and development project in the Republic of Korea with respect to the Product. There can be no assurance that all or any of the foregoing conditions to the grant of the license will be satisfied on or prior to the Termination Date, or at all. Such failure will cause the term sheet agreement to expire, and will result in a definitive agreement with respect to the grant of the license not being entered into, in which event we will retain full rights to the Product and full responsibility for its development and commercialization.

The term sheet agreement provides that, following the date on which the license is granted: (A) if ATB should sub-license the Product, we and ATB would share all proceeds of such sub-license equally; and (B) if ATB markets the Product on its own, ATB would provide us with a royalty equal to a percentage of net profits in the mid-single digits. The term sheet agreement also provides that ATB will make a payment to us in the amount of $100,000 upon the successful completion of the Fundraising, and a payment to us in the amount of $300,000 following the date on which we have transferred certain specified technology and provided certain assistance regarding the manufacturing and production of the Product. ATB will have the right to provide us with the Product at the price of Cost of Goods +30% in the event ATB can meet current good manufacturing practices, including obligations to obtain marketing approval in the United States, so long as ATB is able to meet our timeline as to production. Once we have initiated tech transfer for commercial production, if ATB is not providing us with Product, the term sheet provision under which if ATB markets the Product on its own, ATB would provide us with a royalty equal to a percentage of net profits in the mid-single digits, is null and void. We will be entitled to the clinical trial data and any enhancements and inventions developed by ATB during this process. ATB will have intellectual property rights and bear the cost of the Product worldwide, excluding the United States and Canada and their territories. We will have intellectual property rights and bear the cost of the Product in the United States and Canada and their territories. ATB is to conduct clinical trials in full gene therapy medicinal product / good clinical practice compliance with full consultation and approval of our company to be submissible to the U.S. FDA.

Autotelic LLC, an entity that owns approximately 22 % of our issued and outstanding shares of common stock and of which Dr. Trieu, our Executive Chairman, serves as Chief Executive Officer, owns approximately 19% of the issued and outstanding shares of the common stock of ATB.

| 6 |

Isaac Blech Investment / Board Appointment / Option Grant

On November 22, 2017, we entered into a Note Purchase Agreement (the “Purchase Agreement”) with a trust affiliated with Mr. Isaac Blech (the “Purchaser”) pursuant to which we issued to the Purchaser a secured convertible promissory note in the aggregate principal amount of $500,000 ( “Note”). The Note became due and payable on March 31, 2018. The unpaid principal balance of the Note, together with accrued and unpaid interest thereon, automatically converted into 103.7 shares of Preferred Stock and Warrants to purchase up to 777,750 shares of Common Stock upon the Initial Closing of the Private Placement described above. As a result of the conversion of the Note, all obligations of the Company to the Purchaser under the Note have been satisfied and the Note is no longer outstanding.

Reverse Stock Split

On August 1, 2017, we filed a Certificate of Amendment of our Amended and Restated Certificate of Incorporation to effect a one-for-ten reverse split of our issued and outstanding shares of common stock. Our common stock commenced trading on the OTCQB tier of the OTC Markets on a split-adjusted basis on Thursday, August 3, 2017. There were no changes to the authorized shares of our common stock as a result of the reverse split. No fractional shares were issued in connection with the reverse split; any fraction of a share of common stock that would otherwise have resulted from the reverse split was rounded up to the nearest whole share of common stock. Unless indicated otherwise, all share and per share information included in this report give effect to the reverse split.

Acquisition of Prestalia and DyrctAxess from Symplmed

On June 5, 2017, we entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Symplmed pursuant to which we purchased from Symplmed, for aggregate consideration of approximately $620,000 (consisting of $300,000 in cash plus the assumption of certain liabilities of Symplmed in the amount of approximately $320,000), Symplmed’s assets relating to a single-pill FDC of perindopril arginine and amlodipine besylate known as Prestalia, that has been approved by the FDA for the treatment of hypertension. In addition, as part of the transactions contemplated by the Purchase Agreement: (i) Symplmed agreed to transfer to us, not later than 150 days following the closing date, the New Drug Applications for the approval of Prestalia as a new drug by the FDA; and (ii) Symplmed assigned to us all of its rights and obligations under that certain Amended and Restated License and Commercialization Agreement by and between Symplmed and Les Laboratoires Servier (“Servier”) dated January 11, 2012, pursuant to which Symplmed has an exclusive license from Servier to manufacture, have manufactured, develop, promote, market, distribute and sell Prestalia in the U.S. (and its territories and possessions) in consideration of regulatory and sales-based milestone payments and royalty payments based on net sales.

Further, we entered into an offer letter with Erik Emerson, the President and Chief Executive Officer of Symplmed, pursuant to which we hired Mr. Emerson to serve as our Chief Commercial Officer, which appointment became effective on June 22, 2017. We also agreed in such offer letter to issue to Mr. Emerson 60,000 restricted shares of our common stock under our 2014 Long-Term Incentive Plan, which shares vested in December 2017.

| 7 |

In furtherance of the acquisition and commercialization of Prestalia, on July 21, 2017, we acquired from Symplmed and its wholly-owned subsidiary, Symplmed Technologies, LLC, certain of the intellectual property assets related to the patented technology platform known as DyrctAxess that offers enhanced efficiency, control and information to empower patients, physicians and manufacturers to help achieve optimal care. This acquisition is the basis for our opportunity to build out the total care platform through patient support, management and counseling.

Amendment of Notes and Warrants

On July 3, 2017, we entered into an amendment agreement (the “Amendment Agreement”) with respect to those certain promissory notes in the aggregate principal amount of $300,000 (each a “Note” and collectively the “Notes”) that we issued to two accredited investors (the “Purchasers”) pursuant to that certain Note Purchase Agreement dated June 20, 2016 by and among us and the Purchasers (the “Purchase Agreement”), and those certain warrants to purchase up to an aggregate of 951,263 shares of our common stock that were originally issued pursuant to that certain Note and Warrant Purchase Agreement dated as of February 10, 2012 by and among Marina, certain of its wholly-owned subsidiaries and the purchasers identified on the signature pages thereto (as amended from time to time), that are currently held by the Purchasers, and that were amended concurrently with the Purchase Agreement to, among other things, extend the price protection with respect to dilutive offerings afforded thereunder to June 19, 2017 (such warrants, as so amended, the “Amended Prior Warrants”).

Pursuant to the Amendment Agreement, among other things:

| (i) | the maturity date of the Notes was extended from June 20, 2017 to December 31, 2017; | |

| (ii) | the Purchasers agreed, upon the closing of any financing transaction yielding aggregate gross proceeds to us of not less than $3 million that occurs while the Notes are outstanding (any such financing transaction, the “Qualifying Financing Transaction”), to convert the outstanding principal balance and any accrued interest thereon into the securities of our company to be issued and sold at the closing of the Qualifying Financing Transaction at the most favorable price and terms at which our securities are sold to investors in the Qualifying Financing Transaction; | |

| (iii) | the parties agreed to extend the price protection with respect to the Amended Prior Warrants resulting from dilutive issuances until the expiration of the term of the Amended Prior Warrants (currently February 10, 2020); provided, that such protection shall not apply to the Qualifying Financing Transaction; | |

| (iv) | we agreed to issue to the Purchasers, on a pro rata basis, such number of our securities as are being issued to investors in the Qualifying Financing Transaction as have an aggregate purchase price equal to $375,000 (such securities, the “Consideration Securities”); | |

| (v) | the Purchasers agreed to waive any claim that the exercise price of the Amended Prior Warrants should be reduced to an amount less than $2.80 as a result of any issuance of securities that occurred while the Amended Prior Warrants were outstanding and prior to the date of the Amendment Agreement; | |

| (vi) | the Purchasers agreed that they shall not, for a period of 90 days after the closing of the Qualifying Financing Transaction, sell any Consideration Securities (or any securities issuable upon exercise or conversion of the Consideration Securities) without the prior written consent of the placement agent with respect to such financing transaction; | |

| (vii) | the Purchasers agreed that they shall not, beginning ninety (90) days following the closing of the Qualifying Financing Transaction, sell, in the aggregate, on any given trading day: (x) for so long as the closing price of our common stock is less than or equal to 200% of the per share purchase price of the Consideration Securities in the Qualifying Financing Transaction on the immediately preceding trading day, such number of Consideration Securities (or shares of common stock issuable upon exercise or conversion of the Consideration Securities) as is equal to more than 5% of the total number of shares of common stock traded on such trading day; and (y) for so long as the closing price of our common stock is greater than 200% of the per share purchase price of the Consideration Securities in the Qualifying Financing Transaction on the immediately preceding trading day, such number of Consideration Securities (or shares of common stock issuable upon exercise or conversion of the Consideration Securities) as is equal to more than 10% of the total number of shares of common stock traded on such trading day; and | |

| (viii) | each Purchaser agreed that, prior to one year before the termination date of the Prior Amended Warrants, such Purchaser shall not exercise any of the Prior Amended Warrants at such time as such Purchaser holds any Consideration Securities (or any securities issued upon the exercise or conversion of any Consideration Securities). |

The unpaid principal balance of the Notes, together with accrued and unpaid interest thereon, automatically converted into 71.46 shares of Preferred Stock and Warrants to purchase up to 535,950 shares of common stock upon the Initial Closing of the Private Placement described above. As a result of the conversion of the Notes, all obligations of the Company to the Purchasers under the Notes have been satisfied and the Notes are no longer outstanding. Also, upon the issuance by us to the Purchasers of 75 shares of Preferred Stock and Warrants to purchase up to 562,500 shares of our common stock upon the Initial Closing of the Private Placement described above, our obligations to issue the Consideration Securities to the Purchasers has been satisfied in full.

| 8 |

Merger with IThenaPharma

On November 15, 2016, Marina entered into the Merger Agreement with IThenaPharma, Merger Sub and Vuong Trieu, as the IThena representative, pursuant to which, among other things, Merger Sub merged with and into IThenaPharma, with IThenaPharma surviving as a wholly owned subsidiary of Marina.

Pursuant to the Merger Agreement, at the effective time of the Merger, without any action on the part of any shareholder, each issued and outstanding share of IThenaPharma’s common stock, other than shares to be cancelled pursuant to the Merger Agreement, was converted into the right to receive shares of Marina common stock at the exchange ratio set forth therein (the “Exchange Ratio”). In addition, each outstanding IThenaPharma warrant was assumed by Marina and converted into a warrant representing the right to purchase shares of Marina common stock, with the number of shares underlying such warrant and the exercise price thereof being adjusted by the Exchange Ratio, with any fractional shares rounded down to the next lowest number of whole shares.

As a result of the Merger, the former holders of IThenaPharma common stock immediately prior to the completion of the Merger owned approximately 65% of the issued and outstanding shares of Marina common stock immediately following the completion of the Merger.

Sale of DiLA2 Assets

On March 16, 2018, Marina entered into an Licensing Agreement with Agenovir Corporation, an unrelated entity, whereby Marina granted Agenovir exclusive rights to the company’s DiLA2 delivery system in exchange for an upfront payment of $200,000 and further potential future consideration dependent upon event and sales-based milestones. Under the terms of the agreement, Marina has agreed to assign ownership of the intellectual property associated with the DiLA2 delivery system to Agenovir Corporation.

Liquidity

We have sustained recurring losses and negative cash flows from operations. At December 31, 2017, we had an accumulated deficit of approximately $8.0 million, negative working capital of approximately $5.6 million, and $106,378 in cash. We have been funded primarily through a combination of licensing payments and debt and equity offerings.

On April 16, 2018, we raised in excess of $10 million from a private placement of our recently created Series E, Convertible Preferred Shares. The funds from this raise will be used primarily to commercialize our FDA approved product Prestalia, fund operations, working capital and capex needs and fund general corporate needs. For the development of our pipeline products, we will seek partners or raise additional funds to advance the development programs.

The volatility in our stock price, as well as market conditions in general, could make it difficult for us to raise capital on favorable terms, or at all. If we fail to obtain additional capital when required, we may have to modify, delay or abandon some or all of our planned activities, or terminate our operations. There can be no assurance that we will be successful in any such endeavors. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| 9 |

Our Strategy

Our mission is to provide effective and patient centric treatment for hypertension – including resistant hypertension. In doing so we plan to create a universal platform for the effective treatment of hypertension as well as for the distribution of FDC hypertensive drugs, such as our approved product Prestalia and the other products in our pipeline, devices for TDM, BP, and other cardiac monitors, as well as services such as counseling and prescription reminders.

Total Care Platform for Hypertension

Despite the availability of highly effective, safe and cheap generics, hypertension and especially resistant hypertension is still an unmet medical need. These are some of the fact about hypertension in the US (https://www.cdc.gov/bloodpressure/facts.htm). About 75 million American adults (29%) have high blood pressure. Only about half (54%) of people with high blood pressure have their condition under control. High blood pressure costs the nation $46 billion each year. This total includes the cost of health care services, medications to treat high blood pressure, and missed days of work. Worldwide, more than 1 billion hypertensive patients remain with uncontrolled BP. Even among hypertensive patients who receive treatment, in most countries at least half of them fail to reach currently recommended BP targets [Wolf-Maier K et al., Hypertension Treatment and control in five European countries, Canada, and the United States. Hypertension. 2004;43:10 –17].

As defined by the American Heart Association Scientific Statement on Resistant Hypertension in 2008, resistant hypertension refers to patients having uncontrolled BP (>140/90mmHg) despite use of three or more antihypertensive medications, including a diuretic. The prevalence of resistant hypertension from various cohorts is estimated to be around 10–20% of patients being treated for hypertension [Mohammed Siddiqui and David A. Calhoun. Refractory versus resistant hypertension. Curr Opin Nephrol Hypertens 2017, 26:14–19]. As would be expected with a history of poorly controlled, often severe hypertension, patients with resistant hypertension have a worse cardiovascular disease prognosis, including coronary heart disease, stroke, congestive heart failure, and peripheral artery disease, compared with patients with more easily controlled hypertension. Similarly, patients with resistant hypertension are more likely to develop chronic kidney disease. Not surprisingly, given this increased cardiovascular risk, having resistant hypertension is associated with an overall higher mortality compared with nonresistant hypertension [Mohammed Siddiqui and David A. Calhoun. Refractory versus resistant hypertension. Curr Opin Nephrol Hypertens 2017, 26:14–19].

Hypertension (HTN) affects approximately 1 billion people worldwide and the number of patients is projected to increase to 1.56 billion people by 2025 [http://www.world-heart-federation.org/cardiovascular-health/cardiovascular-disease-risk-factors/hypertension/]. While HTN can be controlled with drugs and lifestyle changes in the majority of patients, uncontrolled or resistant HTN is a significant unmet clinical need in 22% of the HTN population [Persell, S. D. (2011). Prevalence of Resistant Hypertension in the United States, 2003-2008. Hypertension, 57: 1076-108]. Resistant HTN is defined as the failure to reach controlled BP with at least a three drug regimen at optimal dosage, including at least one diuretic [The Seventh Report of the Joint National Committee on Prevention, Detection, Evaluation, and Treatment of High Blood Pressure: The JNC 7 report. JAMA. 2003;289:2560–72.]. Approximately 22% of the 1 billion HTN patients worldwide are affected by resistant HTN. Assuming a 4% penetration rate and an estimated price of $100 per 30 pills, there is over a $1 billion resistant HTN market. The recent clinical failure of renal denervation means limited competition “Despite meeting primary safety endpoints, SYMPLICITY HTN-3 – the pivotal U.S. trial examining renal denervation for treatment-resistant hypertension – has fallen short of its secondary efficacy goals, and failed to reach its primary efficacy endpoint as announced earlier this year by the study’s sponsor.” [SYMPLICITY HTN-3: Renal Artery Denervation Fails for Resistant HTN. March 29, 2014]. Without renal denervation, there are limited treatment options for resistant HTN except for potentially adding chlorthalidone and spironolactone if there is an underlying fluid retention problem.

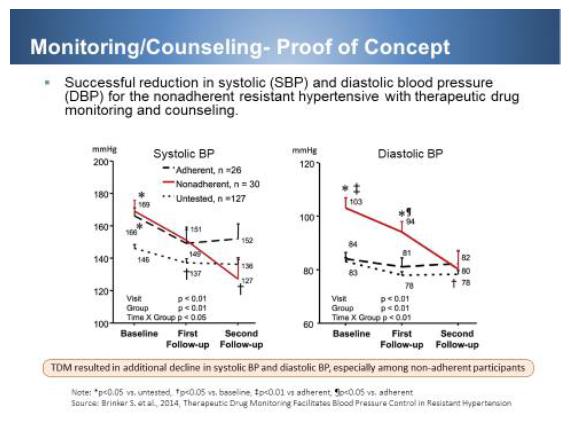

Adherence to medications is a major challenge clinicians often face in treating hypertension. An increasing number of studies show TDM is reliable for detecting medication nonadherence in patients who seem to have resistant hypertension (RH) [Jung O, Gechter JL, Wunder C, et al. Resistant hypertension? Assessment of adherence by toxicological urine analysis. J Hypertens. 2013; 31:766–774; Ceral J, Habrdova V, Vorisek V, Bima M, Pelouch R, Solar M. Difficult-to-control arterial hypertension or uncooperative patients? The assessment of serum antihypertensive drug levels to differentiate non-responsiveness from non-adherence to recommended therapy. Hypertens Res. 2011; 34:87–90.]. Strauch et al. [Strauch B, Petrak O, Zelinka T, et al. Precise assessment of noncompliance with the antihypertensive therapy in patients with resistant hypertension using toxicological serum analysis. J Hypertens 2013; 31:2455–2461] found medication nonadherence among a cohort of patients with resistant hypertension to be 47%, also having directly measured drug or appropriate metabolite levels by liquid chromatography–mass spectrometry. In fact Brinker et al [Stephanie Brinker et al., Therapeutic Drug Monitoring Facilitates Blood Pressure Control in Resistant Hypertension. J Am Coll Cardiol. 2014 March 4; 63(8): 834–835] found that over one-half (54%) of patients who underwent TDM were found to be nonadherent to treatment and when patients were informed of their undetectable serum drug levels and provided additional counseling, BP control was markedly improved without increasing treatment intensity.

| 10 |

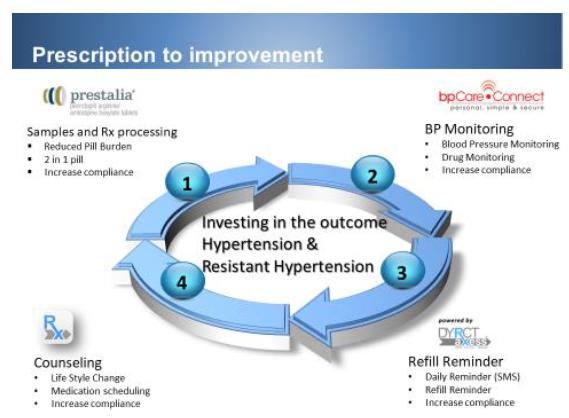

To this effect, we have developed a total care program consisting of four pillars to achieve improved compliance and therefore targeted BP: 1) FDCs. Hypertension is most effectively treated with combination therapy. Furthermore, hypertensive patients frequently suffer from other diseases such as hypercholesterolemia, arthritis, diabetes, dementia, Alzheimer, etc. Their pill burden can be upward of 10-15 pills per day. Any reduction in pill burden would increase compliance. 2) Monitoring- TDM as well as BP monitoring has been shown to improve compliance. With our current bpCareConnect, patients are provided with a BP monitoring system which allows both patients and health care provider to track treatment progress. We plan to upgrade the system to include a point of care TDM device developed by Autotelic Inc. and other cardiac monitoring devices as we further refine and enhance our platform. 3) Our current DyrctAxess platform reminds patients to take their medication through various mechanisms, including texting. More importantly, our call office center will call the patients and remind them to refill their prescriptions. This results in a refill rate of 80%, which is higher than the industry standard of 50%. This low turnover of patients allows us to build prescription rapidly during our launch of Prestalia. 4) As shown by Brinker et al, counseling coupled with monitoring effectively treats resistant hypertension. This arm of the total care program will be implemented using our current call center staff in conjunction with our medical and scientific team. Together this total care platform will transform care not only for hypertension but possibly for other chronic diseases such as diabetes and hypercholesterolemia. Below is the summary of our total care program, which focus on patient compliance to achieve target BP control.

| 11 |

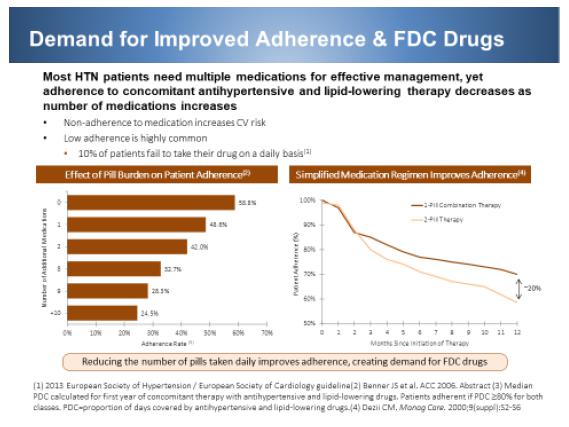

The demand for improved adherence will continue to drive the development of FDCs, which is one of the pillars for our total care program. The need for FDCs in total care program for hypertensive patients is shown below. Combination therapy administered as an FDC has superior efficacy and better tolerance, which is supplemented by higher adherence. Therefore, healthcare providers should not be reluctant and prioritize the use of FDCs over uptitration and switching strategies for addressing efficacy-related issues, particularly if a patient has a history of poor adherence. Compared with free-drug combinations, the use of FDCs of hypertensive agents is associated with a significant improvement in compliance and persistence with therapy and with possible beneficial trends on BP levels and reported adverse effects [Gupta AK et al., Compliance, Safety, and Effectiveness of Fixed-Dose Combinations of antihypertensive agents. A meta-analysis. Hypertension 2010; 55:399-407]. A recent meta-analysis showed that BP reduction by using two drugs in combination is approximately five times greater than doubling the dose of one drug [Krousel-Wood M et al., Medication adherence: a key factor in achieving blood pressure control and good clinical outcomes in hypertensive patients. Curr Opin Cardiol. 2004;19:357–362]. In this context, Prestalia is ideally suited to the total care program: 1) it is approved for 1st line therapy; 2) clinical data has shown that it can achieve rapid and sustained BP reduction; and 3) it is approved only in three strengths – therefore simplifying dose titration versus complicated dose titration scheme of single agent and then double agent.

| 12 |

To further expand our pipeline of FDCs, we will continue to acquire, inlicense, or internally develop FDCs that lend themselves to the total care program. A list of therapeutic agents in our pipeline is shown below.

| a. | Perindopril- ACEON (Perindopril) NDA- Ready to relaunch | |

| i. | Hypertension- monotherapy | |

| ii. | Reduction of cognitive decline in dementia | |

| iii. | Reduction in motor decline in DMD | |

| b. | Prestalia- Ready to relaunch. | |

| i. | Hypertension- combination therapy | |

| ii. | Perindopril/Amlodipine | |

| iii. | 1st line hypertension | |

| c. | Atorvastatin/Perindopril | |

| i. | Hypertension & hypercholesterolemia | |

| ii. | Actively developed by our partner Servier | |

| d. | Pipeline drug | |

| i. | Hypertension & Pain | |

| ii. | FDC developed by our strategic partner – NDA approved/ approval 2018 | |

| iii. | Celecoxib/Lisinopril- planned approval 2019 | |

| iv. | Celecoxib/Olmesartan- planned approval 2020 | |

We intend to initially advance sales of Prestalia in the U.S. through the total care platform. Of secondary priority, we plan push forward with the approval and launch of IT-102 and IT-103.

In our effort to focus and revitalize our company as well as increase shareholder value we intend to explore appropriate opportunities to divest our oligotherapeutics assets through either a spin off to our shareholders or the sale of, or the grant of licenses to, our assets related to these technologies. This will allow us to focus exclusively on Prestalia, as well as IT-102 and IT-103. We also intend to be opportunistic in acquiring assets/asset classes that further complement our product offering.

| 13 |

Prestalia

Acquired in June 2017, Prestalia is a commercially available product. Following the Initial Closing, we plan to integrate the distribution, marketing and sales platform of the acquired assets into our company. This will be concurrent with efforts to mobilize a sales force and build on the existing patient/prescription base of Prestalia and build a strong revenue base. The non-U.S. market for FDCs of ACE inhibitor and CCB is over $300 million and we believe that this market is underplayed in the U.S.

Prestalia was developed in conjunction with Les Laboratories, Servier. It was launched in October of 2015, driven to 1615 prescriptions per month with only 10 sales representatives. It is available in three doses: 3.5/2.5, 7/5 and 14/10 and is promoted worldwide ex-US as Coveram and/or Viacoram by Servier with >$1billion turnover in 2016 from perindopril franchise, WW, for Servier.

Prestalia is a unique FDC drug that simplified dose titration to only three dose strengths. Prestalia is approved for fist line hypertension and titration can be done with just Prestalia with only three dose levels to adjust unlike performing titration of each drug alone where there are at least three strengths for each drug requiring titrating through at least six different strengths and strength combinations. Lisinopril alone has six dose strengths. Per package insert information: Initiate treatment at 3.5/2.5 mg, once daily. Adjust dose according to blood pressure goals waiting 1 to 2 weeks between titration steps. DOSAGE FORMS AND STRENGTHS: Tablets (perindopril arginine/amlodipine): 3.5/2.5 mg, 7/5 mg and14/10 mg.

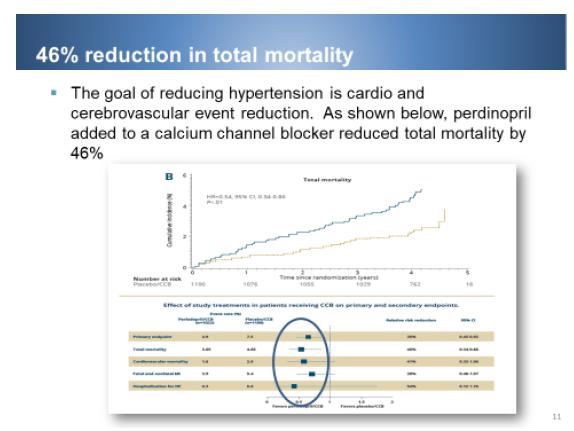

Prestalia is the only product with an active component to demonstrate event reduction across the CV continuum. In aggregate there was reduction in cardiovascular morbidity-mortality in randomised clinical trials with more than 54,000 patients. Various clinical trials have shown that despite lowering blood pressure not all drugs effectively reduce heart attack, stroke and death. In the CAMELOT trial, which compared amlodipine vs. enalapril – another ACEI – for 24 months, there was 31% vs 15% fewer events with amlodipine. In the EUROPA trial, using perindopril, compared to placebo in12,000 ACS (64% had previous MI) reduced CV events by 20%. Post-hoc analysis of EUROPA showed subjects on any CCB for 4.2 yrs. and either on perindopril or placebo, the event rate was 46% less for patients on perindopril and CCB than for patients on a CCB and placebo.

Key Prestalia messages: 1) Rapid and sustained blood pressure control - patients achieve better blood pressure reduction at day 21 on combination than at day 42 on monotherapy. 2) One pill, one time per day. 3) No out of pocket expense for patients with commercial insurance. Six out of 10 patients have unrestricted access to Prestalia with 100% coverage by Express Scripts PBM, 55% coverage by CVS Caremark RX, and 90% coverage by Anthem Inc. And finally as shown below, Prestalia combination reduced total mortality by 46%.

| 14 |

Hypertension Market

Approximately one in three adults, or roughly 75 million people, in the U.S. have high blood pressure, and only about half (54%) have their blood pressure under control. The population of hypertensive patients will continue to increase through 2050 as the current population ages and advances in treatment allow patients already diagnosed to live longer. Although many products within the market will become generic, the focus on combination therapies will prevent a significant decline in the market. Moreover, the launch of new disease-modifying therapies is expected to bolster the growth prospects of the market during the forecast period. The rise in the prevalence of hypertension, from a population of 181 million to 190 million, combined with the anticipated launches of FDCs will continue to create a valuable market opportunity.

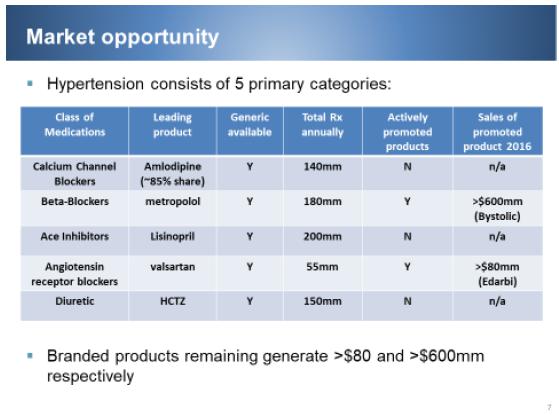

In the U.S., 37 of the 50 states have a hypertension rate of greater than 30% of their residents. According to JNC VII (Joint national committee on hypertension), only 1/3 of patients will be controlled by a single product, meaning that 2/3 of all patients will require more than one class of medication to control their high blood pressure (reference https://www.ncbi.nlm.nih.gov/books/NBK9626/). First line therapy, initial treatment, for all hypertension patients should include either a CCB, angiotensin converting enzyme inhibitor (“ACEi”), Angiotensin receptor blocker or diuretic. According to a market share study on hypertension therapies from 2009 to 2019, it was estimated that market share of combination therapies of Renin Angiotensin Aldosterone System inhibitors (RAASi) (of which ACEi is a type) and CCBs would increase from 6% in 2009 to 27% in 2019 (Decision Resources).

In a national prescription audit conducted by IMS health in 2011, it was reported that ACEi were the most prescribed anti-hypertensive category at 163 million prescriptions and CCBs were the third most prescribed antihypertensive category with 98.1 million prescriptions. Ultimately, the market of hypertension patients will continue to expand, but with the proliferation of generics, the pharmaceutical participation in sales and promotion has declined. For our company, the opportunity exists to promote a branded combination, comprised of the two highest prescribed categories in hypertension. Only one product of a similar type, an ACEi and Amlodipine (the CCB that controls over 90% of the CCB market) has ever been promoted and sold in the U.S. That product, Lotrel®, had peak sales of $1.3 billion in the U.S. alone. This level of sales was experienced by Novartis in 2008, and achieved when there were over 15 large pharmaceutical companies, including Wyeth, Novartis, AstraZeneca, King, Forrest, Takeda, Merck, Sanofi and multiple others fighting for share of voice and positioning with patients and physicians. Currently, only two companies other than us compete in the hypertension market - Actavis, selling a beta blocker, Bystolic, with over $500 million in sales in 2015, and Arbor, selling an Angiotensin Receptor Blocker, Edarbi and EdarbiChlor – an FDC of Edarbi and chlortahlidone. The edarbi franchise is selling in excess of $100 million annually.

| 15 |

The benchmark for our hypertension product, Prestalia, is Lotrel. Lotrel is the only FDC of an ACEi and amlodipine, and is currently responsible as a brand and generic combined for a total prescription volume in excess of 11 million annually. The product is not promoted, and through analysis of the Prestalia clinical data in market research, Prestalia has been termed by physicians as ‘better than Lotrel’. The success of the Lotrel brand was driven by the combination of two classes of medication that had not only shown the ability to reduce blood pressure but, via the Camelot study for amlodipine and the HOPE and Europa study for ramipril and perindopril, the ability to lower cardiovascular events beyond the effect of lowering blood pressure. The potential success of Prestalia in the U.S. is further supported by the data outside the U.S., which has shown that our worldwide partner, Servier, has produced in excess of €400 million in annual sales of perindopriil and amlodipine as an FDC.

In summary, as one looks at the opportunity for our Prestalia product, there are four key concepts:

| 1) | The market of patient opportunity continues to grow and the top two dispensed categories are ACEi and Amlodipine; |

| 2) | The competitive landscape regarding promotion to physicians leaves us as the only active promoter; |

| 3) | As a branded, patent-protected product, there is no generic alternative to Prestalia; and |

| 4) | The category of ACEi/CCB combination has been proven through the success of Lotrel with $1.3 billion in peak sales, and further validated for Prestalia with sales by Servier in excess of €400 million outside the U.S. |

Commercialization Plan

The two main challenges to the uptake of a drug are getting physicians to prescribe it and getting insurance to reimburse for its use. Prestalia has an existing patient base of 1,500 patients and 400 prescribers that was achieved over a year. It has established unrestricted access to 60% of all commercial plans in the U.S. It has Medicaid coverage nationwide (with the exception of Oregon) and is preferred without step edits and prior authorizations in a few states. With the demonstrated history of physician acceptance and growing acceptance by insurers, combined with the fact that combination of ACEi and CCB are well characterized and understood, we believe that our ability to penetrate the market is dictated by the number of people we are able to engage to assist in our commercialization efforts.

| 16 |

In terms of execution, we plan to take a targeted approach looking to capitalize on geographies with a strong reimbursement position for Prestalia, along with a high degree of hypertension within the territory. Our targeting efforts from the physician perspective will be focused on identifying high prescribers of FDC therapy that includes ACEi and CCB use, along with those physicians writing ACE/Diuretic combinations. An additional key to our targeting will be high prescribers of each of these as concomitant monotherapy, or individual use. This approach will allow us to focus our message on physicians that are already committed to the components, and do not require a clinical communication to convert them from use of other classes of medications.

These targeting approaches will be supplemented by a distribution program, “Prestalia Direct”, which will be operated through the patented DyrctAxess platform that we acquired from Symplmed. The concepts here revolve around fulfillment via mail through our partner pharmacies, and support through a patient engagement call center that drives an emphasis on compliance, persistence and high conversion of initial prescriptions. This marketing platform is what was previously used in the execution of Prestalia fulfillment and led to patient retention greater than 80% after one year. As we execute our commercialization plan in this manner, and drive new prescription volume in a supported and focused fashion, we believe that our ability to maintain our existing patients will create a strong growth of patient accounts as each new patient will be incremental to our growing total. Furthermore as we continue to demonstrate value through the total care program for the effective treatment of hypertension we expect to gain traction and market share within the hypertension space.

Finally, to ensure that we convert the highest percentage of prescriptions generated to new patients, along with keeping our existing patients on medication, we plan to run an expansive patient co-pay support program through our pharmacy partners. This program will be specifically dedicated to ensuring all patients receive medication, covered or not, so that we can ensure patients and physicians are satisfied, as well as put us in a position to continue expanding insurance coverage through continued demand growth.

The final piece to our promotional strategy will be the implementation of our sales team. We plan to have approximately 20 sales people promoting Prestalia in key geographies by the end of the second quarter of 2018 and increasing to 35 by end of the second quarter of 2019. It is intended that these representatives will be trained and implemented by management, and that many of them will be young business-to-business professionals that are looking to get a start in the pharmaceutical industry.

Summary of Follow on Products

To build on commercialization capabilities of Prestalia, we plan to further increase the menu of product offerings through acquisition or internal development. We will be opportunistic in acquiring products/ product lines that complement Prestalia and align with our goal to become a strong player in the hypertension space. We believe we have assembled a strong team with in-depth domain knowledge in drug development and commercialization to have a substantial internal product development program. However, our internal program would be secondary to the primary goal of total care platform and marketing of Prestalia through that platform. With respect to the programs in our internal pipeline described below, items 2 through 5 are part of the therapeutic microbiome program which we are actively discussing to either outlicensing or spin off:

| 1) | IT-102 and IT013 as our next generation celecoxib for management of arthritis pain. IT-102 targets a population requiring angiotensin converting enzyme (“ACE”) inhibitors such as lisinopril and IT-103 targets a population requiring olmesartan. The initial approval based on pivotal bioequivalence (“BE”) trial and a small phase III trial will be for combined arthritis pain and hypertension for patients already taking both drugs. Exploiting the suppression of celecoxib induced edema, we anticipate that these FDCs can eventually replace all of celecoxib prescriptions with or without hypertension once our phase III trial is completed with positive demonstration of edema suppression. This trial will be conducted post approval for label change and will target the highest edema risk patients- the elderly patients whose pill burden is greater than five per day. The inherent lower risk of gastrointestinal (“GI”) bleeding with celecoxib makes it likely that IT-102 and IT-103 can also capture market shares of other pain medications such as ibuprofen and indomethacin. |

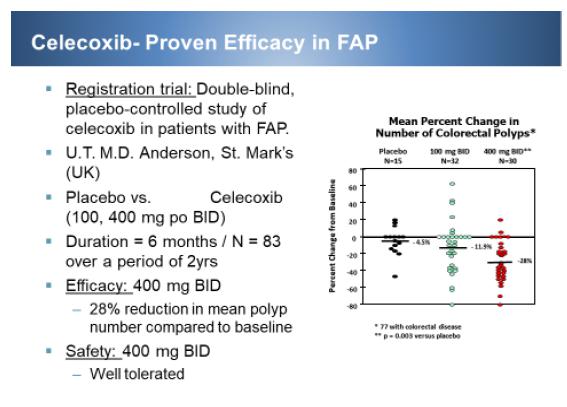

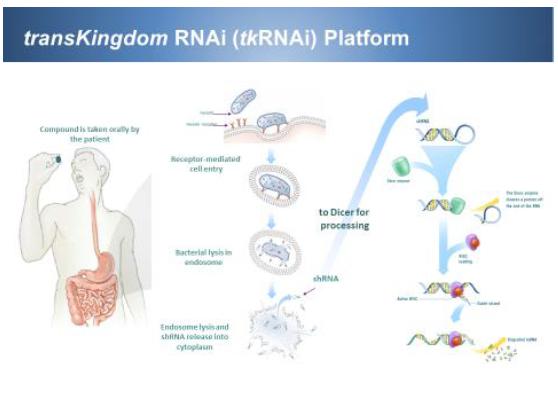

| 2) | M101 as beta-catenin short-hairpin RNA (“shRNA”) combination against FAP. This is a combination of IT-102 and CEQ508 (tkRNAi beta-catenin shRNA). Celecoxib was originally approved for FAP, however, it was removed from the market due to fear of cardiovascular risks during the VIOXX withdrawal. But with the PRECISION trial showing that celecoxib is as safe as ibuprofen and naproxen, we anticipate more acceptance of celecoxib. Furthermore, having lisinopril on board to control edema and hypertension, we anticipate that high doses of celecoxib would be safe and effective against FAP. Additionally, the systemic suppression of COX-2 directly and beta-catenin indirectly with celecoxib will be augmented by targeted and local suppression of beta-catenin by beta-catenin shRNA (CEQ508). Together we anticipate a synergistic, safe and effective suppression of polyps in FAP. Since we have completed the phase I proof of concept study for CEQ508, we will move forward to registration phase III trial once we have FDA acceptance of Special Protocol Assessment (“SPA”). |

| 17 |

| 3) | M102 as beta-catenin shRNA combination against CRC. This is a combination of IT-103 and CEQ508 (tkRNAi beta-catenin shRNA). Olmesartan has been shown to improve overall survival (“OS”) among various cancer types, the combination of systemic suppression of ARB/COX-2/Catenin by IT-103 augmented by targeted and local suppression of beta-catenin by CEQ508 is expected to significantly improve the outcome for CRC patients. Additionally, the potential of using CEQ508 to manipulate the microbiome such that it is therapeutic will be investigated. We have termed this “therapeutic microbiome”. |

| 4) | M300 series as IL-6Ra/ Claudin-2/ MIP3a as specific tkRNA/shRNAs against IBD. We evaluated live attenuated bacterial delivery of shRNAs against selected IBD gene targets to achieve specificity, efficacy, and safety. The in vitro efficacy was assessed by an invasion assay using the CMT-93 mouse colon epithelial cells (or RAW264.7 macrophages for TNF-a) and qRT-PCR measurement of mRNA reduction vs. b-actin control. Three gene targets (IL-6Ra, Claudin-2, and MIP3a) and two tkRNAi delivery strains were tested in vivo using an oxazolone or dextran sulfate sodium (DSS) acute murine colitis model. Oral delivery of IL-6Ra tkRNAi strains (CEQ608 and CEQ609) led to a significant reduction in colon length and abolished IL-6Rα message in proximal ileum in DSS exposed groups. Claudin-2 strains (CEQ621 and CEQ626) caused a significant reduction in Claudin-2 mRNA expression and protein levels in the colon as well as attenuation of the disease phenotype and enhanced survival. Treatment with MIP3a therapeutic strains CEQ631 and CEQ632 also resulted in a significant reduction in sum pathology scores and reduction in MIP3a mRNA expression. These findings suggest that tkRNAi-mediated gene silencing of pro-inflammatory targets represents a potential therapeutic development avenue for IBD therapy. |

| 5) | M400 series as surviving/PLK1 as specific DiLA2 (Di-Alkylated Amino Acid)/siRNA against bladder cancer . This program was originally licensed to Debiopharm. A range of RNA interference (“RNAi”) triggers against the cancer-related genes polo-like kinase 1 (PLK1) and survivin were able to knockdown efficacies with IC50 values in the 10 to 30 pM range in cell based assays. This triggered widespread apoptosis and, in the case of PLK1, a strong reduction in cell viability. The selected siRNAs were formulated into positively charged multilamellar liposomes of around 100nm. Due to the negatively charged proteoglycan-rich urothelium, a formulation with a lipid containing a guanidinium group was deemed particularly promising in being able to penetrate the 6-7 cell-layered urothelium. Accordingly, these formulations, when instilled into the bladder, were able to very efficiently suppress the growth of nonmuscle invasive bladder cancers in mouse models of the disease. Highly efficient in vivo knockdowns were found, 90-95% with 1mg/kg dose level. |

Product Candidates

We currently have two late stage arthritis pain/hypertension drug candidates, IT-102 and IT-103. These programs will be conducted secondary to the launch of Prestalia and are dependent on partnering with other entities or fund raising for their development.

Clinical Program for M101: Combination of celecoxib and CEQ508

We believe that the effectiveness of CEQ508 and celecoxib justify the combination as M101. We plan to meet with the FDA to discuss an SPA with a clearly defined clinical design and endpoints for regulatory approval. Depending on being able to partner with other entities or raise additional funding, we plan to meet the FDA sometime in 2018 and the trial may start in 2019. If successful, we could anticipate a potential launch of the product in 2024.

The oncology programs targeting beta-catenin against FAP and CRC will progress along their developmental timeline following a meeting with the FDA to obtain concurrence on trial design and endpoints. Additionally we have programs for IBD and bladder cancer with completed animal proof of concept.

These programs will be developed as resources allow. In subsequent sections we will discuss in detail our three leading clinical programs (IT-102, IT-103, and M101). The M101 program no longer aligns with our focus and we are actively engaged in efforts to outlicense or spin off the therapeutic microbiome asset.

| 18 |

The potential market size of IT-102 and IT-103 was projected to be $170 million and $250 million, respectively. With the FAP potential market size of $400 million, we are projecting the total addressable market for these product candidates to be approximately $820 million annually.

IT-102/IT-103

IT-102 is a FDC formulation of celecoxib, a cyclooxygenase (COX) - 2 selective inhibitor, and lisinopril, an ACE inhibitor, indicated in patients for whom treatment with both celecoxib and lisinopril is appropriate. IT-103 is the same as IT-102, except lisinopril was replaced by olmesartan- an Angiotensin II receptor blockers (“ARB”). IT-103 is for patients for whom treatment with both celecoxib and olmesartan is appropriate. These FDCs will allow rapid access to market through a short clinical program. The initial approval based on pivotal BE trial and a small phase III trial will be for combined arthritis pain and hypertension for patients already taking both drugs. Exploiting the suppression of celecoxib induced edema, we anticipate that they can eventually replace all of celecoxib prescriptions with or without hypertension once our phase III trial is completed with positive demonstration of edema suppression. This trial will be conducted post approval for label change and will target the highest edema risk patients- the elderly patients whose pill burden is greater than five per day. The inherent lower risk of GI bleeding with celecoxib can push IT-102 and IT-103 to also capture market shares of other pain medications such as ibuprofen and indomethacin.

The rationale for IT-102/IT-103 drug development is based on the coexistence of arthritis pain and hypertension in populations, as well as association of hypertension and edema with celecoxib treatment. Additionally, the preference for and improved compliance with a single tablet makes the proposed FDC formulation a very useful drug for treatment of two common conditions of increasing frequency in the aging population.

Arthritis/Hypertension

Arthritis and hypertension often coexist due to common risk factors. Firstly, both conditions are age related. The risk of developing osteoarthritis (“OA”) increases from the age of 40 onwards, with 25% of the population over the age of 45 presenting with clinical symptoms (Hunter et al, 2006). It has been reported that approximately 50% of patients with OA suffer from hypertension. Data from the 2009 Behavioral Risk Factor Surveillance System indicated that the top 2 most prevalent conditions in those over 70 years of age were hypertension (60.7%) and arthritis (55%) (Hunter et al, 2011). The prevalence of hypertension in rheumatoid arthritis (“RA”) in most large studies lies between 52% and 73%, with the age ranging from 51 to 66 years (Fernandes et al, 2015).

| 19 |

Hypertension is one of the most important modifiable risk factors for the development of cardiovascular disease in the general population (Yusuf et al, 2004). It affects about 1 billion individuals worldwide (Kearney et al, 2005) and about 30% of the adult population in the United States (Nwankwo et al, 2013). Despite its high prevalence and the impact of its complications, control of hypertension is far from adequate both in the general population (Chobanian et al, 2003; Oliveria et al, 2002; Primatesta et al, 2006; Luepker et al, 2006) and in arthritis patients (Panoulas et al, 2007). The poor control rates in the general population, where only a third of the people with hypertension have their blood pressure under control (Wang et al, 2005), is attributed to poor access to health care and medications, as well as a lack of adherence to long-term therapy for a usually asymptomatic condition. In the general population, anti-hypertensive therapy has been associated with a reduction of 40% in strokes, 20% in myocardial infarction and >50% in heart failure (Neal et al, 2000), which emphasizes the importance of optimal blood pressure control in any population, including arthritis patients.

Effective simultaneous control of arthritis and hypertension is greatly facilitated by FDC, as most hypertension patients require multiple medications for effective management. However, adherence to concomitant hypertension therapy decreases as the number of medications increases. As the pill burden increases from 1 to ≥10, patient adherence rapidly decreases from 58.8% to 24.5%, respectively (Resnic et al., 2006). A single FDC tablet results in 20% higher patient adherence than observed with a 2-tablet combination therapy (Dezii et al, 2009). In addition, coupling the treatment for asymptomatic hypertension with painful arthritis will not only improve compliance to the long-term therapy of hypertension, but also reduce the renal adverse events associated with NSAIDs/celecoxib treatment. So far, there is no such FDC available in the U.S. Therefore, there is an urgent need for a celecoxib/anti-hypertensive FDC such as IT-102.

Celecoxib side effects

Hypertension and other cardiovascular risks are associated with celecoxib treatment. Clinical trials and observational studies have shown that nonselective and COX-2 selective NSAIDs are associated with increased cardiovascular risks and events (Cheng et al, 2002; Boers et al, 2001; Mukherjee et al, 2001; Solomon et al, 2005). That is why cardiovascular thrombotic events, hypertension, congestive heart failure and edema are listed in the warnings and precautions of the CELEBREXÒ package insert (CELEBREX® Package Insert, 2016). Two randomized, placebo-controlled trials, Adenoma Prevention with Celecoxib (APC) trial and Prevention of Spontaneous Adenomatous Polyps (PreSAP) trial, showed a nearly 2-fold-increased cardiovascular risk in celecoxib treatment groups compared with the control group. Both dose groups in APC trial, celecoxib at 200 or 400mg twice daily, showed significant systolic blood pressure (SBP) elevations at 1 and 3 years from 2 to 5.2 mmHg; however, no significant elevation of SBP was observed in the 400 mg once daily group in the PreSAP trial (Solomon et al, 2006). This trend for a dose-related increase in cardiovascular events and blood pressure raises the possibility that lower doses or other dose intervals may be associated with less cardiovascular risk.

Celecoxib has been intensively evaluated on its blood pressure effects. A post hoc analysis on the renal safety of celecoxib with data from more than 50 clinical studies involving more than 13,000 subjects showed that celecoxib had no clinically detectable effect on blood pressure (Whelton 2000). In the Celecoxib Long-term Arthritis Safety Study (CLASS) with more than 8000 OA and RA patients, there were 2.7% of patients in the celecoxib group (400 mg, b.i.d, N=3987) that showed either new-onset or aggravated hypertension (Whelton 2006). A meta-analysis on the adverse events of celecoxib in OA and RA patients, which included data from 39,605 randomized patients in 31 trials, showed that the proportion of any patient having hypertension or aggregated hypertension was only 1-2% with celecoxib and there was no significant difference between celecoxib and placebo group (Moore 2005).

The large meta-analysis of 31 randomized controlled trials in patients with OA or RA found that celecoxib was associated with a significantly higher incidence of edema (at any site) than placebo (2.6% vs 1.4%: RR 1.9, 95% CI 1.4, 2.7) (Moore et al, 2005). Similarly, a pooled analysis of renal adverse event data from seven 12-week North American trials involving 9,666 patients with OA or RA found that the overall incidence of renal adverse events with celecoxib (4.3%) was greater than that with placebo (2.5%; p<0.05) and was not significantly different from that with NSAIDs (4.1%) (Whelton et al, 2000). The most common renal adverse events with celecoxib were peripheral edema (2.1%), hypertension (0.8%) and aggravated hypertension (0.6%) (Whelton et al, 2000).

| 20 |

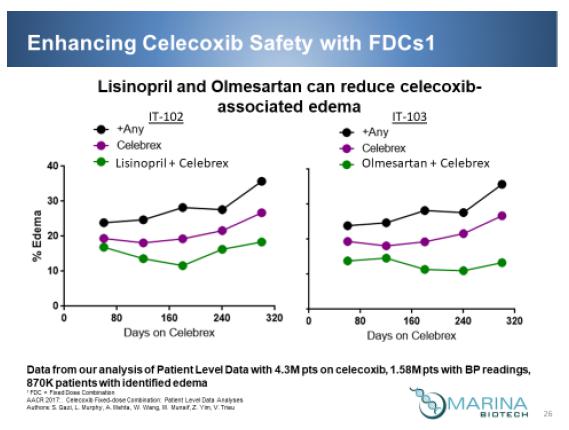

Proprietary Patient Level Data Analyses

We have also compared the edema in patient populations receiving celecoxib alone and celecoxib in combination with a variety of antihypertensives. To support this study a proprietary database was created which contains: 1) Claims data from Symphony pertaining to anti-hypertensives, Statins, COX-2 inhibitors, and NSAIDs. The data span the most recent 36 months and 2) registry data from the ACC reporting blood pressure (systolic/diastolic), peripheral edema flags (yes, no, missing), heart rate, LDL, glucose level, ejection fraction, glomerular filtration rate, height, weight, body mass index, and the like.

Symphony dataset is True Patient Level data - All Data Sources be it RX or MX claims is tied back to individual patients which is tracked and then encrypted based on first name, last name, gender, date of birth and zip code to give an accurate picture of patient level informatics year over year regardless of insurance changes. The source of Managed Markets prescription claims data comes from various providers, including Intelligent network services (Switch Data) as well as direct data feeds from pharmacies that do not use Switches so it does not create payer biases.