Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF RBSM, LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Icagen, Inc. | f10k2017ex23-1_icageninc.htm |

| EX-32.2 - CERTIFICATION - Icagen, Inc. | f10k2017ex32-2_icageninc.htm |

| EX-32.1 - CERTIFICATION - Icagen, Inc. | f10k2017ex32-1_icageninc.htm |

| EX-31.2 - CERTIFICATION - Icagen, Inc. | f10k2017ex31-2_icageninc.htm |

| EX-31.1 - CERTIFICATION - Icagen, Inc. | f10k2017ex31-1_icageninc.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Icagen, Inc. | f10k2017ex21-1_icageninc.htm |

| EX-4.19 - FORM OF AMENDED AND RESTATED WARRANT DATED MAY 15, 2017 ISSUED BY ICAGEN, INC. - Icagen, Inc. | f10k2017ex4-19_icageninc.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-54748

ICAGEN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-0982060 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

4222 Emperor Blvd., Suite 350

Durham, North Carolina 27703

(Address of principal executive offices) (Zip Code)

(919) 941- 5206

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: | Name of each exchange on which registered | |

| (Title of Class) | None |

Securities registered pursuant to Section 12 (g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the issuer: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of issuer’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated file, a non-accelerated file, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2017, was approximately $22,375,875 based on $3.50, the price at which the registrant’s common stock was last sold, which was January 7, 2015. The registrant has provided this information as of January 7, 2015 because its common stock was not publicly traded as of the last business day of its most recent completed second quarter.

As of April 13, 2018, the issuer had 6,393,107 shares of common stock outstanding.

Documents incorporated by reference: None

FORM 10-K

TABLE OF CONTENTS

Special Note Regarding Forward-Looking Statements

Many of the matters discussed within this Annual Report on Form 10-K (“Annual Report”) contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) on our current expectations and projections about future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “potential,” “continue,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” and similar expressions. These statements are based on our current beliefs, expectations, and assumptions and are subject to a number of risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed, projected or implied in or by the forward-looking statements. Such risks and uncertainties include the risks noted under Part 1. “Business,” Part 1A “Risk Factors” and Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere. We do not undertake any obligation to update any forward-looking statements. Unless the context requires otherwise, references to “we,” “us,” “our,” and “Icagen,” refer to Icagen, Inc. and its subsidiaries.

You should refer to Item 1A. “Risk Factors” section of this Annual Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We do not undertake any obligation to update any forward-looking statements.

Company Overview

We are engaged in the advancement of early drug discovery. Our business model is divided into three sources of revenue: our integrated drug discovery services that we have been providing to third parties since our inception; partnerships and collaborations with third parties that should allow us to receive revenue for services provided as well as future milestone and royalty payments and potential licensing fees and other related fees paid for the licensing of our technology.

For the past two years, a significant portion of our revenue has been derived from our operations as a partner research organization providing integrated drug discovery services with unique expertise in the field of ion channel, transporter, neuroscience, muscle biology and rare disease targets while also covering many other classes of drug discovery targets and therapeutic areas. Our customers are pharmaceutical and biotechnology companies to whom we offer our industry-leading scientific expertise and technologies to aid in their determination of which molecules to advance into late stage preclinical studies and ultimately clinical trials. The core of our offering is the discovery of pre-clinical drug candidates (PDC’s), which are lead molecules (Leads) that are selected to enter into in-vivo studies during the pre-clinical phase of drug discovery. We offer a full complement of pre-clinical drug discovery services which include; assay development technologies (including high throughput fluorescence, manual and automated electrophysiology and radiotracer flux assays), cell line generation, high-throughput and ultra-high-throughput screening, medicinal chemistry, computational chemistry and custom assay services to our customers. Our capabilities also include molecular biology and the use of complex functional assays, electrophysiology, bioanalytics and pharmacology. We believe that this integrated set of capabilities enhances our ability to help our customers identify drug candidates.

More recently, we have begun to focus on partnership and collaboration opportunities with third parties, and we are currently in active negotiations regarding our first such collaboration. This collaboration is expected to provide us with an opportunity to derive revenue not only from our standard fees for integrated early discovery services but also from future milestone and royalty revenue from product candidates that may be developed and commercialized with our aid. We have developed in house a portfolio of multiple assets targeting different indications that we believe would be ideal candidates for partnership opportunities.

Lastly, we are regularly pursuing opportunities for the licensing of our proprietary XRPro technology, our legacy technology, which has unique capabilities in the transporter target class. For any licensing transactions that we may engage in, we anticipate receiving an up-front license fee, as well as fees for the equipment we provide and our services in aiding the licensee with the use of the technology.

1

We utilize a target class approach to drug discovery where we leverage our deep expertise in specific areas to more rapidly move drug discovery projects forward. Whereas traditional drug discovery tends to take a more linear approach to compound advancement, our depth of both technical assets, including our XRPro technology, and area experts allows us to use more parallel approaches to aid in eliminating problematic molecules early and identifying high quality leads in the drug discovery process. This saves time, money and increases the probability of success in human clinical studies. We believe that our deep understanding of the ion channel genome, neuroscience, muscle biology, and rare disease targets, in particular, and our ability to apply this knowledge in a target class approach to drug discovery facilitates our identification of small molecule drug candidates with novel mechanisms of action and enhanced selectivity and specificity profiles. Moreover, because our drug discovery and development process screens for potential side effects at an earlier stage than some alternative approaches, we believe that this process enables us to identify small molecule drug candidates that may have a reduced risk of clinical failure and may shorten clinical development timelines.

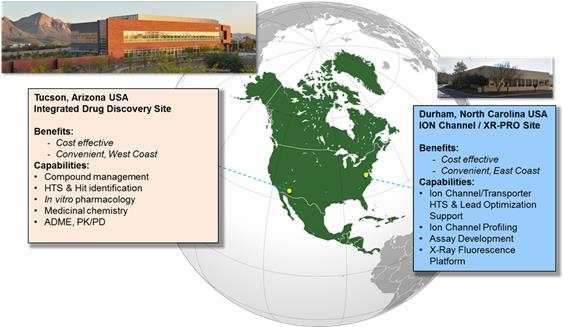

We currently operate out of two sites, one in Durham, North Carolina and the other in Tucson, Arizona (the “Tucson Facility”). The teams in North Carolina and Arizona have extensive experience over the last 20 plus years performing early drug discovery within Pfizer, Inc. (“Pfizer”) and Sanofi US Inc. (“Sanofi”), respectively, delivering Leads from the pre-clinical stage to the clinical stage of drug discovery. At the North Carolina site (“Icagen NC”), which we began to operate in July 2015, we have a leading biology expertise focused on ion channels which are important targets in Neuroscience. The North Carolina site also houses the XRpro® technology. The XRPro technology is an x-ray fluorescence technology that delivers ion channel screening, transporter screening, ion channel kinetics and custom screening services to our customers to detect and quantitatively analyze the x-ray signature of each element with an atomic number greater than 12. More specifically, our capabilities in North Carolina include a focus on ion channels and transporters, HTS and Lead optimization, ion channel profiling, assay development and x-ray fluorescence-based assays. At the Arizona site, which we acquired in July 2016, we have leading biology expertise and platform capabilities in rare diseases, muscle biology and integrated drug discovery. The Arizona site provides capacity in cell models, human biomarkers, muscle biology expertise and stem cells-based assays. In addition, the Arizona site provides compound management services, HTS and Hit identification, in vitro pharmacology, medicinal chemistry, computational chemistry and ADME. The Arizona facility also features high volume biology with a flexible robotic infrastructure capable of performing high throughput screening in ultra high 1536 format, enhancing our depth of expertise as a specialized pharmaceutical services company. This enables us to offer a broad range of integrated drug discovery services in a growing market. The extensive integrated drug discovery platform and technologies at the Arizona site enable us to utilize our biology expertise in both the North Carolina and Arizona sites to accelerate the drug discovery and identify quality leads faster.

2

Subsequent to our acquisition of certain assets of Pfizer and Sanofi, our customer base has expanded and a significant portion of our revenue has been derived from several commercial customers. For the year ended December 31, 2017, 56.2% of our revenue was derived from services sales, 42.4% was derived from deferred subsidy revenue and 1.4% was generated from Government revenue. For the year ended December 31, 2016, 59.5% (2015 - 84%) of our revenue was derived from services sales; 36.7% was derived from subsidies (2015 0%) and the remaining 3.8% was generated from Government revenues (2015 - 16%). Prior to our acquisition of certain assets from Pfizer and Sanofi, substantially all of our revenue was derived from government grants related to services provided by our XRpro technology.

To date, we have been granted twenty-one grants and contracts from United States governmental agencies; of which nine were granted from the Department of Defense and twelve were granted from the National Institutes of Health. Of such contracts, twenty have been completed and we received payment in full for all twenty completed contracts. There is one contract from the National Institutes of Health under which we performed services during the year ended December 31, 2017, this contract was for $600,000 and has been fully invoiced as of December 31, 2017. The NIH invited us to submit a Phase II SBIR application for the completed contract of which we are awaiting the outcome.

3

Strategy

Our goal is to become a leader in the discovery, development and commercialization of drugs in the early phase of drug discovery that address disease areas with significant unmet medical need and commercial potential. We intend to diversify our business and increase awareness about our company through the execution of our strategy, key elements of which are as follows:

| ● | Maximize and Strengthen and expand our core drug discovery technologies and development capabilities. All of our drug candidates and research programs have resulted from our core drug discovery technologies. We have steadily built these technologies, which span the key disciplines of biology, chemistry and pharmacology, over a number of years. We intend to continue to invest in these core technologies, as the key to our future research programs and drug candidates. We are focusing a significant portion of our business efforts on increasing our customers that utilize our scientific expertise and technologies to aid in their determination of which molecules to advance to into late stage preclinical and clinical trials. |

| ● | Establish strategic alliances with leading pharmaceutical and biotechnology companies. We plan to selectively enter into new strategic alliances with leading pharmaceutical and biotechnology companies to assist us in advancing our drug discovery and development programs. We expect that these alliances will provide us with access to the therapeutic area expertise and research, development and commercialization resources of our collaborators as well as augment our financial resources. We expect that in some of these alliances we will seek to maintain rights in the development of drug candidates and the commercialization of drugs as part of our effort to build our internal clinical development and sales and marketing capabilities. |

| ● | Build and advance our product candidate pipeline. Through our ion channel drug discovery and development programs, we have created a pipeline of drug candidates that address diseases with significant unmet medical need and commercial potential across a range of therapeutic areas. We plan to aggressively pursue the development and commercialization of these drug candidates. We believe that the breadth of our capabilities in ion channel drug discovery technology and rare diseases will enable us to continue to identify and develop additional drug candidates on an efficient and rapid basis. In addition to developing drug candidates internally, we continue to evaluate opportunities to in-license promising compounds and technologies. |

| ● | Enter into licensing relationships for our XRPro Technology. We are regularly pursuing opportunities for the licensing of our proprietary XRPro technology, our legacy technology, which has unique capabilities in the transporter target class. For any licensing transactions that we may engage in, we anticipate receiving an up-front license fee, as well as fees for the equipment we provide and our services in aiding the licensee with the use of the technology. |

Company History

The Company, formerly known as XRpro Sciences and Caldera, was founded in 2003 at the request of the then director of Los Alamos National Laboratory (“LANL”) for the purpose of commercializing the use of x-ray fluorescence to measure the chemical composition of pharmaceuticals. In March 2015, we effected a 1-for -2 reverse stock split of our common stock. In July 2015, we expanded our services and capabilities and entered into an asset purchase agreement with Icagen, Inc., an indirect subsidiary of Pfizer (“Icagen NC”), whereby certain assets were acquired from Icagen NC, including the name Icagen. We moved our headquarters to Research Triangle Park, Durham, North Carolina, where the Pfizer subsidiary’s operations were conducted and on August 28, 2015 changed our name to Icagen, Inc.

Icagen NC was founded in 1992 as a start-up biotech to discover, develop and commercialize small molecules targeting ion channels. Icagen NC sent its first molecule into the clinic for sickle cell anemia in 1999. Over the years Icagen NC also provided access to its innovative discovery platform. In 2007, Icagen NC entered into a collaborative agreement with Pfizer to identify novel compounds targeting voltage-gated sodium channels for the treatment of pain. Due to the success of the programs, Icagen NC was acquired in 2011 by Pfizer. Pfizer integrated Icagen NC into Neusentis which was a biotech-like unit within Pfizer combining research in pain, sensory disorders, and regenerative medicine for the next 4 years. In an effort to move to a more variable (outsourced) R&D model Pfizer in July 2015 divested Icagen NC to us and we re-launched the Icagen NC team and capabilities under the Icagen name.

Since the Icagen NC spinout from Pfizer, we have experienced accelerated growth and market acceptance as a leader in the area of ion channel and transporter targets with major large pharma clients and biotechs. We then began to look for ways to leverage that success and did so in July 2016 with the newly acquired Icagen Tucson business from Sanofi which added a complete integrated drug discovery capability beyond ion channels and transporters covering most classes of drug discovery targets.

4

The Tucson Research Center, a two-story laboratory and office building with approximately 113,950 square feet of space located in the Town of Oro Valley, Pima County, Arizona (the “Facility”), which we acquired from Sanofi in July 2016, enhances our depth of expertise as a specialized pharmaceutical services company, enabling us to offer a broad range of integrated drug discovery services in a growing market. The Facility provides capacity in cell models, human biomarkers, muscle biology expertise and stem cells-based assays. In addition, the site provides compound management services, HTS and Hit identification, in vitro pharmacology, medicinal chemistry, computational chemistry and ADME, as well as high volume biology with a flexible robotic infrastructure capable of performing high throughput screening in ultra high 1536 format.

Corporate Information

We were incorporated in the State of Delaware on November 12, 2003 under the name Caldera Pharmaceuticals, Inc. On December 4, 2014 we changed our name to XRpro Sciences, Inc. and on August 28, 2015, after our acquisition of certain assets of Icagen, Inc., we changed our name to Icagen, Inc. Our principal executive offices are located at 4222 Emperor Blvd., Suite 350 Durham, North Carolina 27703 our telephone number is (919) 941-5206.

Discussions with respect to our operations included herein include the operations of our operating subsidiary, Icagen Corp (formerly known as XRpro Corp), formed on July 10, 2010 and Icagen-T, Inc, formed on June 16, 2016, a subsidiary formed to acquire the assets of Sanofi’s ultra high-throughput biology, screening and chemistry capabilities and research facility in Oro Valley, Arizona. We have two other subsidiaries, XRpro Sciences Inc., formed on December 10, 2015 and Caldera Discovery Inc., formed on March 26, 2015, which have always been dormant.

Recent Developments

We have offered on a best efforts basis up to a maximum of forty (40) units and a minimum of ten (10) units, at a purchase price of $100,000 per unit (the “Offering’), each unit consisting of 28,571 shares of our Series C Convertible Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”) and a seven year warrant (the “Warrants”) to acquire 28,571 shares of our common stock, par value, $0.001 per share, at an exercise price of $3.50 per share. On April 4, 2018, we closed the first tranche of the Offering and entered into a securities purchase agreement (the “Purchase Agreements”) with one accredited investor that is a trust of which a member of our Board of Directors if the trustee, pursuant to which we offered and sold an aggregate of twenty (20) Units. The sale of the twenty (20) Units resulted in gross offering proceeds of $2,000,000. See “Item 7-Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information with respect to the Offering.

5

Source and Availability of Raw Materials

In general, most of the materials we use for our research operation are readily available from multiple suppliers including specialty chemicals for certain types of assays. We do, however, conduct high throughput electrophysiology experiments on specific pieces of equipment from multiple vendors. In these cases, the consumables (i.e. chips or plates) are manufactured and sold by the same vendor, Bruker Nano GmbH, who manufactures the equipment. Should these vendors fail to deliver the consumables in a timely manner this could adversely affect our assay services operation.

Research and Development

For the years ended December 31, 2017 and 2016, we spent approximately $3,328,843 and $1,200,223, on research and development salaries. For more information regarding our research and development expenses, please see “Critical Accounting Policies” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Intellectual Property

Patents and Trade Secrets

Our success depends in part on our ability to obtain and maintain proprietary protection for our product candidates, technology and know-how, to operate without infringing the proprietary rights of others and to prevent others from infringing our proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing United States and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development of our business. We also rely on trade secrets, know-how, continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position.

6

We are maintaining and building our patent portfolio by filing new patent applications and prosecuting existing applications. In total, we hold approximately 75 patents, both U.S. and foreign, and approximately 10 pending patent applications, both U.S. and foreign, all related to our X-ray fluorescence-based technologies. As shown below, these patents and patent applications are spread across roughly 9 technology families.

Our patent estate as of April 13, 2018 is summarized below:

| ● | Method for Detecting Binding Events Using Micro X-Ray Fluorescence Spectrometry, which includes an issued U.S. patent that is expected to expire in about 2021; |

| ● | Flow Method and Apparatus for Screening Chemicals Using Micro X-Ray Fluorescence, which includes issued patents in the U.S., Europe, Japan and Singapore, such patents are expected to expire in 2022; |

| ● | Method and Apparatus for Detecting Chemical Binding, which includes about 10 issued patents in the U.S., Europe, Japan and Singapore; such patents are expected to expire in 2023; |

| ● | Drug Development and Manufacturing, which includes an issued U.S. patent that is expected to expire in about 2021; |

| ● | Advanced Drug Development and Manufacturing, which includes about 20 issued foreign patents, in Europe, Japan, and Hong Kong, expected to expire in about 2026, and a pending application in the U.S. which, if issued, is expected to expire between 2021-2026; |

| ● | Well Plate/Apparatus for Preparing Samples for Measurement by X-Ray Fluorescence Spectrometry, which includes issued over 15 issued patents in the U.S. Europe, and Japan, which are expected to expire in about 2028, and a pending application in the U.S., which, if issued, is also expected to expire in 2028; |

| ● | Method and Apparatus for Measuring Protein Post Translational Modification, which includes a patent issued in Japan, which is expected to expire in about 2028 and pending applications in U.S. and Japan, which, if issued, are also expected to expire in about 2028; |

| ● | Method and Apparatus for Measuring Analyte Transport Across Barriers, which includes 3 issued U.S. patents and issued patents in China and Hong Kong, which are expected to expire in about 2030/2031, and pending applications in U.S., Europe, and China, which, if issued, are also expected to expire in about 2030; and |

| ● | Method for Analysis Using X-Ray Fluorescence, which includes 4 issued U.S. patents, which is expected to expire in 2031, and a pending U.S. patent application which, if issued, is expected to expire in 2031. |

The patent positions of companies like ours are generally uncertain and involve complex legal and factual questions. Our ability to maintain and solidify our proprietary position for our technology will depend on our success in obtaining effective claims and enforcing those claims once granted. We do not know whether any of our patent applications or those patent applications that we license will result in the issuance of any patents. Our issued patents and those that may issue in the future, may be challenged, invalidated or circumvented, which could limit our ability to stop competitors from marketing related products or the length of term of patent protection that we may have for our products. In addition, our competitors may independently develop similar technologies or duplicate any technology developed by us, and the rights granted under any issued patents may not provide us with any meaningful competitive advantages against these competitors.

We may rely, in some circumstances, on trade secrets to protect our technology. However, trade secrets are difficult to protect. We seek to protect our proprietary technology and processes, in part, by confidentiality agreements with our employees, consultants, scientific advisors and other contractors, as well as physical security of our premises and our information technology systems. These agreements may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. To the extent that our consultants or contractors use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. We face competition from many different sources and organizational sizes, including commercial pharmaceutical and biotechnology enterprises, academic institutions, government agencies and private and public research institutions. Many of the major multi-national contract research organizations offer some similar assay services to those we provide. These include companies with operations in the US, China, Europe and Asia. None of these companies, however, are exclusively focused and dedicated to ion channel services. There are also a small number of private companies of similar size to us that provide ion channel-related services. In addition, we also compete in the pre-clinical drug discovery space with in-house groups of pharmaceutical and biotechnology companies as well as universities.

7

Many of our competitors have significantly greater financial resources and expertise in research and development. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Our commercial opportunity will be reduced or eliminated if our competitors develop screening services that are more effective, faster or are less expensive than any products that we may develop. These third parties compete with us in recruiting and retaining qualified scientific and management personnel, as well as customers.

Government and Environmental Regulation and Laws

We currently operate two laboratories, one in our principal headquarters in Durham, North Carolina and the other in our facility located in Tucson, Arizona. Our laboratory services are subject to various regulatory requirements and our standard operating procedures are written in accordance with appropriate regulations and guidelines for operations.

There are certain licensing and regulations under federal, state and local laws relating to hazard communication and employee right-to- know regulations, our use and handling and disposal of bio-medical specimens and hazardous waste. In addition, there are regulations related to ensuring the health and safety of laboratory employees. Our laboratories are subject to applicable laws and regulations as appropriate from the Nuclear Regulatory Commission, Environmental Protection Agency, the Department of Transportation, and the National Fire Protection Agency and the Resource Conservation and Recovery Act. In addition, the Nuclear Regulatory Commission has rules and regulations regarding the use of x-ray devices and radioactive materials. To the best of our knowledge we are currently in compliance in all material respects with such laws and continual endeavors to maintain compliance. Lack of compliance with such laws could subject us to denial of the right to conduct business, fines, criminal penalties and other enforcement actions.

The Occupational Safety and Health Administration have also established extensive requirements relating to workplace safety for healthcare employers whose workers may be exposed to blood-borne pathogens. Our employees receive initial and periodic training focusing on lab safety including blood-borne pathogens.

The use of controlled substances in testing for drugs with a potential for abuse is regulated in the United States by the U.S. Drug Enforcement Administration. Our laboratories have all necessary licenses from the U.S. Drug Enforcement Administration for the use of controlled substances.

The United States has addressed the disclosure of confidential personal data with increased regulation. In the United States, various federal and state laws address the security and privacy of health and other personal information. We will continue to monitor our compliance with applicable regulations.

The regulations of the U.S. Department of Transportation, the U.S. Public Health Service and the U.S. Postal Service apply to the surface and air transportation of laboratory specimens. Our laboratory also must comply with the applicable International Air Transport Association regulations, which govern international shipments of laboratory specimens.

Employees

As of April 13, 2018, we employed seventy-two full time employees. A significant number of our management and professional employees have had prior experience with pharmaceutical, biotechnology or medical product companies. None of our employees are covered by collective bargaining agreements, and management considers relations with our employees to be good.

Available Information

Additional information about Icagen is contained at our website, www.icagen.com. Information on our website is not incorporated by reference into and does not form ant part of this Annual Report. We have included our website address as a factual reference and do not intend it to be an active link to our website. We make available on our website, www.icagen.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, all of which are available free of charge through the investor relations page of our internet website as soon as reasonably practicable after those reports are filed with the SEC. The following Corporate Governance documents are also posted on our website: Code of Business Conduct and Ethics and the Charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee of the Board of Directors. Our phone number is (919) 433-5206 and our facsimile number is (919) 941- 0813.

8

Investing in our securities involves a high degree of risk. In addition to the risks related to our business set forth in this Form 10-K and the other information included and incorporated by reference in this Form 10-K, you should carefully consider the risks described below before purchasing our securities. Additional risks, uncertainties and other factors not presently known to us or that we currently deem immaterial may also impair our business operations.

We have a history of losses and there can be no assurance that we will generate or sustain positive earnings.

For the year ended December 31, 2017, we had a net loss of $(6,110,434) and for the year ended December 31, 2016 we had a net loss of $(5,504,412). The only year that we had net income was the year ended December 31, 2014 when we received proceeds from the settlement of litigation with LANS. We cannot be certain that our business strategy will ever be successful. Future revenues and profits, if any, will depend upon various factors, including the success, if any, of our expansion plans and our services to biotechnical and pharmaceutical customers, marketability of our instruments and services, our ability to maintain favorable relations with manufacturers and customers, and general economic conditions. There is no assurance that we can operate profitably or that we will successfully implement our plans. There can be no assurance that we will ever generate positive earnings.

A significant portion of our net revenue has been generated from services provided to five customers.

The termination of our relationship with either Pfizer and Sanofi would adversely affect our business. For the year ended December 31, 2017 we derived 56.2% of our revenue from commercial contracts (of which 78.8% of our services revenue was for services provided to five large pharmaceutical customers and one biotech company); 42.4% of our revenue was from subsidy revenue and the remaining 1.4% was derived from government contracts. For the year ended December 31, 2016, we derived 59.5% of our revenues from commercial contracts of which 79.4% of our revenue was for services provided to three large pharmaceutical customers; 36.7% of our revenue was from subsidy revenue and the remaining 3.8% was derived from government contracts. Prior to the acquisition of certain of the assets of Icagen NC we derived substantially all of our revenue from services we performed for two governmental agencies. Our business model which now concentrates on commercial customers is relatively new and there can be no assurance that we will be able to increase the revenue derived from commercial customers to a significant amount. As of the date hereof we have completed all contracts with the National Institutes of Health (“NIH”). Our Sanofi MSA provided that Sanofi make payments to Icagen-T of $8.75 million over the next forty-two (42) months in consideration of Icagen-T providing services to Sanofi, so long as Icagen-T complies with the covenants set forth in the Sanofi MSA. Our MSA with Pfizer which terminated in July 2017 guaranteed $1,000,000 of revenue to us for the twelve-month period ended June 30, 2017. Our MSA with Sanofi guaranteed $32 million over a five-year period of which: (i) $23.25 million has been received; ii) a further $2.75 million is expected to be paid in 2018; (iii) $3 million is expected to be paid over twelve months from July 2018 to June 2019; (iv) $2 million is expected to be paid over twelve months from July 2019 to June 2020; and (v) $1 million is expected to be paid over twelve months from July 2020 to June 2021, all subject to us meeting certain terms and conditions. There can be no assurance that we will attract a sufficient number of other pharmaceutical companies to provide our services to or that Pfizer will continue to use our services or that Sanofi will increase the scope of the services required. We do not have enough information regarding our new business model to assess its success.

During the past two years, a significant portion of our net revenue has been generated from services to be provided to Sanofi.

The termination of our relationship with Sanofi would adversely affect our business. Our Sanofi MSA required Sanofi to make significant payments to us during the last two years in consideration of Icagen-T providing services to Sanofi, so long as Icagen-T complies with the covenants set forth in the Sanofi MSA. The Sanofi MSA requires that Sanofi make payments to us of an aggregate $8,750,000 over the next three and a half years. Inasmuch as prior to the acquisition of the Tucson Facility, the Tucson Facility was used solely to service Sanofi and had no third-party customers, Sanofi continues to be a significant customer of Icagen-T. We cannot guarantee when, or if ever, our dependence upon Sanofi as a major customer at the Tucson Facility will end. There can be no assurance that we will attract a sufficient number of other pharmaceutical companies to provide our services to or that Sanofi will increase the scope of the services required. We do not have enough information regarding our new business model to assess its success.

Our business is dependent upon our ability to attract new commercial customers.

Our future success is dependent upon us attracting new commercial customers and increasing the services that we provide to existing customers, including Sanofi and Pfizer. The $1,000,000 guaranteed payment that we were to receive from Pfizer under the Pfizer MSA terminated on June 30, 2017. The payments that we are to receive from Sanofi under the terms of the Sanofi MSA are subject to termination in the event that we do not comply with certain covenants contained in the Sanofi MSA that are unrelated to our performance of services under the Sanofi MSA. In addition, the guaranteed payments from Sanofi in this year and years three through five of the Sanofi MSA are significantly less than those to be paid in year one and will not be sufficient to cover the costs of the operations at the Tucson Facility. We do not have enough information regarding our new business model which concentrates on commercial customers to assess its success. Our future success is dependent upon us attracting new customers and increasing the services that we provide to existing customers, including Sanofi and Pfizer. There can be no assurance that we will be able to attract new commercial customers or increase the services that we provide to existing customers, including Pfizer and Sanofi.

9

Our consolidated financial statements have been prepared assuming that we will continue as a going concern.

Although we have generated revenue, our operating losses, negative cash flows from operations and limited alternative sources of revenue raise substantial doubt about our ability to continue as a going concern. During the year ended December 31, 2017 and the years ended December 31, 2016, we did not generate enough revenue from operations to sustain our operations. We will be required to increase our revenue from customers and/or obtain additional financing in order to pay existing contractual obligations (which include the guaranteed payments to employees and amounts required to maintain the facility in Tucson and the amounts owed under the convertible notes that we issued to GPB Debt Holdings II, LLC in May 2017, the “Convertible Notes”) and to continue to cover operating losses and working capital needs. We cannot assure you that our revenue generated from operations or any future funds we raise will be sufficient to support our continued operations.

The audit report of RBSM LLP for the fiscal year ended December 31, 2017 contained a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. If we cannot raise adequate capital on acceptable terms we will need to revise our business plans.

If we cannot establish profitable operations, we will need to raise additional capital to fully implement our business plan and to meet our current obligations, which may not be available on commercially reasonable terms, or at all, and which may dilute your investment.

We incurred a net loss of $(6,110,434) for the year ended December 31, 2017, a net loss of $(5,504,412) for the year ended December 31, 2016. Achieving and sustaining profitability will require us to increase our revenues and manage our product, operating and administrative expenses. We cannot guarantee that we will be successful in achieving profitability. Pursuant to the terms of the Pfizer APA, as amended July 15, 2016, we are required to pay Pfizer, commencing May 2017, minimum quarterly payments of $50,000 each for the period May 2017 to March 31, 2019, including interest on the difference between the unpaid deferred purchase consideration and the $50,000, a lump sum of unpaid deferred purchase consideration due for the period January 1, 2017 to December 31, 2018, the deferred portion of the quarterly payments from March 2017 until December 31, 2018 on March 31, 2019 and thereafter a minimum payment of $250,000 each quarter up to a maximum of $10,000,000. Pursuant to the terms of the Sanofi APA, Icagen-T agreed to retain 46 employees at an estimated remaining cost to Icagen-T of $4,459,000 and to maintain and pay the maintenance costs of the Sanofi chemical libraries that remain at the Tucson Facility. We are also required to make significant payments under the terms of the Convertible Notes. If we are unable to generate sufficient revenues to pay our expenses and our existing sources of cash and cash flows are otherwise insufficient to fund our activities, we will need to raise additional funds to continue our operations at their current level and in order to fully implement our business plan. We do not have any commitments in place for additional funds. If needed, additional funds may not be available on favorable terms, or at all. As of the date hereof, we expect that our current cash and revenues generated from services, our private placement financings will provide us with enough funds to continue our operations at our current level for the next four months. Unless we raise additional funds or increase revenues we will be forced to curtail our operations and limit our marketing expenditures. Furthermore, if we issue equity or debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities, such as senior secured notes, may have rights, preferences and privileges senior to those of our existing stockholders. If we are unsuccessful in achieving profitability and we cannot obtain additional funds on commercially reasonable terms or at all, we may be required to curtail significantly or cease our operations significantly, it could result in the loss of all of your investment in our stock.

We have claims against us that may result in material adverse outcomes.

On April 22, 2014, Dentons’ US LLP (Dentons) filed a complaint against us seeking to confess a judgment in the amount of $3,050,000.00 based upon a settlement agreement we entered into with Dentons, dated July 5, 2013. In May 2017, we entered into a settlement agreement with Dentons that requires that we pay Dentons an aggregate of $1,400,000 over a fourteen (14) month period of which $1,200,000 has been paid to date. In addition, to secure its obligations under the agreement, we executed and delivered to Dentons a Confession of Judgment Affidavit in Support of Confession of Judgment in the amount of $3,891,549.32, representing the amount of the Judgment had obtained plus the costs of suit and interest accrued through May 15, 2017. The Confession of Judgment is not to be filed unless we default on our obligations under the agreement and the Confession of Judgment will be returned to us upon payment in full under the agreement. If the Confession of Judgment were to be enforced against Icagen, Inc. by Dentons it could result in, among other things, our cash balances being depleted and/or extinguished, or the seizure of assets, which would have material adverse effect on us and our ability to continue to operate our business.

10

We depend significantly on our relationship with our two third party collaborators.

A termination or expiration of our current collaboration with Sanofi or any potential future collaborations would adversely affect us financially and could harm our business reputation. The Pfizer MSA provided that we will perform ion channel screening and other contract research for Pfizer Inc. Pfizer Inc. guaranteed revenue of $1,000,000 for each of the first two years of the agreement (which two-year period ended July 2017), which represented a substantial portion of our revenue for the year ended December 31, 2016. The Sanofi MSA provides that Icagen-T will perform services for Sanofi at our Tucson Facility for the next three years for payments from Sanofi to Icagen-T of $8.75 million, so long as Icagen-T complies with the covenants set forth in the Sanofi MSA. Our collaboration with Pfizer and/ or Sanofi or future collaborations we may enter into may not be scientifically or commercially successful.

Collaborations with pharmaceutical companies and other third parties often are terminated or allowed to expire by the other party. A termination or expiration of our current collaboration with Pfizer, Sanofi or any potential future collaborations would adversely affect us financially and could harm our business reputation.

If we do not comply with certain of the covenants under the Sanofi MSA, Sanofi has the right to terminate the Sanofi MSA and foreclose on its lien on the Tucson Facility.

The Sanofi MSA has several affirmative and negative covenants as well as certain maintenance covenants with which Icagen-T must comply. Under the Sanofi MSA, the failure to comply with the maintenance covenants and certain responsibilities with respect to maintenance of the chemical libraries results in the automatic termination of the Sanofi MSA which would result in termination of the subsidy payments to us as well as the right of Sanofi to exercise its rights under the Deed of Trust and foreclose on its $5,000,000 lien on the Tucson Facility.

Our business is difficult to evaluate because we have recently changed our business model to offering a full complement of screening services to the broader pharmaceutical sector. There can be no guarantee that we will be able to effectively integrate the Icagen and Sanofi business.

Since our acquisition of the Icagen NC assets, we have shifted our business model from offering only our XRpro screening services to governmental agencies as we did in the past to now offer a full complement of screening services to the broader pharmaceutical sector. With the addition of the assets acquired from Sanofi, we now offer ultra high-throughput biology, screening and chemical capabilities. There is a risk that we will be unable to successfully conduct our business or be able to successfully integrate the assets acquired with our management and structure. Our estimates of capital, personnel and equipment required for our expanded business model are based on the experience of management and businesses they are familiar with. We are subject to the risks such as our ability to implement our business plan, market acceptance of our services, under-capitalization, cash shortages, limitations with respect to personnel, financing and other resources, competition from better funded and experienced companies, and uncertainty of our ability to generate revenues. There is no assurance that our activities will be successful or will result in any revenues or profit, and the likelihood of our success must be considered in light of the stage of our development. Even if we generate revenue, there can be no assurance that we will be profitable. In addition, no assurance can be given that we will be able to consummate our business strategy and plans, as described herein, or that financial, technological, market, or other limitations may force us to modify, alter, significantly delay, or significantly impede the implementation of such plans. We have insufficient results for investors to use to identify historical trends or even to make quarter to quarter comparisons of our operating results. You should consider our prospects in light of the risk, expenses and difficulties we will encounter as an early stage company. Our revenue and income potential is unproven and our business model is continually evolving. We are subject to the risks inherent to the operation of a new business enterprise, and cannot assure you that we will be able to successfully address these risks.

To date we have not established any partnerships or collaborations or entered into any licenses for our technology.

Although we expect to generate future revenue from partnerships and collaborations as well as license revenue for the use of our technology, to date, we have not derived any revenue from such sources. To date, our sole source of revenue has been our provision of services. We are currently in active negotiations with a collaborator that if consummated will provide us with an opportunity to receive revenue for providing early drug discovery services as well as clinical milestone payments and royalty payments. However, there can be no assurance that a collaboration will be entered into or if entered into that the milestones will be met and that we will receive the milestone payments or royalty payments.

We may not be able to utilize our tax net operating loss carry-forwards to offset future taxable income.

At December 31, 2017 we had approximately $20,624,000 in tax net operating loss carry-forwards available to offset future taxable income, thereby potentially reducing our future tax expense/liabilities. However, these tax net operating loss carry-forwards may be limited in accordance with IRC Section 382 following a more than 50 percentage point change in ownership, in aggregate during any three year look-back period. This potential limitation on our ability to use our tax net operating loss carry-forwards to offset future taxable income could result in increased tax expense/liabilities and decreased net earnings. These loss carry-forwards expire through 2034 if unused.

11

We must expend a significant amount of time and resources to develop new products, and if these products do not achieve commercial acceptance, our operating results may suffer.

We expect to spend a significant amount of time and resources to develop new products and refine existing products and have spent significant time and money developing our XRpro® instruments. We commenced development of our XRpro® instruments in the year 2006 and since then have developed four enhanced versions of our original instrument; each enhancement was developed over an approximate two-year period of time. We enhance our XRpro® instruments on a regular basis, including recent improvements to the throughput capabilities of the instrument, increasing production efficiency. We may also be required to make modifications or enhancements at the request of our customers. Our expense for research and development salaries for the year ended December 31, 2017 was $3,328,843 and for the year ended December 31, 2016 was $1,200,223, most of which was used to develop assays for commercial applications. In light of the long product development cycles inherent in our industry, any developmental expenditure will typically be made well in advance of the prospect of deriving revenues from the sale of new products. Our ability to commercially introduce and successfully market new products will be subject to a wide variety of challenges during this development cycle that could delay introduction of these products. In addition, since our potential customers are not expected to be obligated by long-term contracts to purchase our products, our anticipated product orders may not materialize, or orders that do materialize may be canceled. As a result, if we do not achieve market acceptance of new products, our operating results will suffer. Our products may also be priced higher than competitive products, which may impair commercial acceptance. We cannot predict whether new products that we expect to introduce will achieve commercial acceptance.

Our Chairman of the Board beneficially owns a substantial portion of our outstanding common stock and as well as a significant percentage of our voting power, which may limit your ability and the ability of our other stockholders, whether acting alone or together, to propose or direct the management or overall direction of our company.

The concentration of ownership of our stock could discourage or prevent a potential takeover of our company that might otherwise result in an investor receiving a premium over the market price for his shares. Our Chairman of the Board owns 164,284 shares of our common stock, 571,428 shares of the Series C Preferred Stock, which shares have the right to 1,714,284 votes and exercisable options, representing beneficial ownership of 13.3% of our outstanding shares of common stock and 23.2% of our voting power. In addition, the holders of the Series C Preferred Stock have the right to elect one director to our Board of Directors and have certain consent rights. In addition, the directors as a group beneficially own 2,586,240 shares of our common stock, 571,428 shares of the Series C Preferred Stock, which shares have the right to 1,714,284 votes and exercisable warrants and options, representing beneficial ownership of 31.6% of our outstanding shares of common stock and 31% of our voting power. Accordingly, our Chairman of the Board and our Board members alone and together with our directors would have significant influence over the election of our directors and the approval of actions for which the approval of our stockholders is required. If you acquire shares of our securities, you may have no effective voice in the management of our company. Such significant influence over control of our company may adversely affect the price of our common stock. Our Chairman of the Board as well as our board of directors may be able to significantly influence matters requiring approval by our stockholders, including the election of directors, as well as mergers or other business combinations which require the vote of a majority of our outstanding shares. Such significant influence may also make it difficult for our stockholders to receive a premium for their shares of our common stock in the event we merge with a third party or enter into different transactions which require stockholder approval. These provisions could also limit the price that investors might be willing to pay in the future for shares of our common stock.

If we deliver products or services with defects, our credibility will be harmed and the sales and market acceptance of our products will decrease.

Our products and services are complex and may at times contain errors, defects and bugs when introduced. If in the future, we deliver products or services with errors, defects or bugs, our credibility and the market acceptance and sales of our products would be harmed. Further, if our products or services contain errors, defects or bugs, we may be required to expend significant capital and resources to alleviate such problems. Defects could also lead to product liability as a result of product liability lawsuits against us or against our customers. We may agree to indemnify our customers in some circumstances against liability arising from defects in our products or services. In the event of a successful product liability claim, we could be obligated to pay significant damages.

Most of our potential customers are from the pharmaceutical and biotechnology sector and are subject to risks faced by those industries.

We expect to derive a significant portion of our future revenues from sales to customers in the pharmaceutical and biotechnology sector, which includes governments and private companies. We expect a substantial part of our future revenue to be derived from pharmaceutical companies, including Pfizer, GSK and Sanofi. As a result, we will be subject to risks and uncertainties that affect the pharmaceutical and biotechnology industries, such as availability of capital and reduction and delays in research and development expenditures by companies in these industries, pricing pressures as third-party payers continue challenging the pricing of medical products and services, government regulation, and the uncertainty resulting from technological change.

12

In addition, our future revenues may be adversely affected by the ongoing consolidation in the pharmaceutical and biotechnology industries, as well as decisions of pharmaceutical companies to conduct the services we provide in house, which would reduce the number of our potential customers. Furthermore, we cannot assure you that the pharmaceutical and biotechnology companies that may be our customers will not develop their own competing products or capabilities, or choose our competitors’ technology instead of our technology.

Many of our current and potential competitors have significantly greater resources than we do, and increased competition could impair sales of our products and services.

We operate in a highly competitive industry and face competition from companies that design, manufacture and market instruments for use in the life sciences research industry, from genomic, pharmaceutical, biotechnology and diagnostic companies and from academic and research institutions and government or other publicly-funded agencies, both in the United States and elsewhere. We may not be able to compete effectively with all of these competitors. Many of these companies and institutions have greater financial, engineering, manufacturing, marketing and customer support resources than we do. As a result, our competitors may be able to respond more quickly to new or emerging technologies or market developments by devoting greater resources to the development, promotion and sale of products, which could impair sales of our products. Moreover, there has been significant merger and acquisition activity among our competitors and potential competitors. These transactions by our competitors and potential competitors may provide them with a competitive advantage over us by enabling them to rapidly expand their product offerings and service capabilities to meet a broader range of customer needs. Many of our potential customers are large companies that require global support and service, which may be easier for our larger competitors to provide. Many of the large pharmaceuticals companies have the financial resources to conduct the services we provide internally.

We believe that competition within the markets we serve is primarily driven by the need for innovative products that address the needs of customers. We attempt to counter competition by seeking to develop new products and provide quality, cost-effective products and services that meet customers’ needs. We cannot assure you, however, that we will be able to successfully develop new products or that our existing or new products and services will adequately meet our potential customers’ needs.

Rapidly changing technology, evolving industry standards, changes in customer needs, emerging competition and frequent new product and service introductions characterize the markets for our products. To remain competitive, we may be required to develop new products and periodically enhance our existing products in a timely manner. We may face increased competition as new companies enter the market with new technologies that compete with our products and future products, and our services and future services. We cannot assure you that one or more of our competitors will not succeed in developing or marketing technologies products or services that are more effective or commercially attractive than our products or future products, or our services or future services, or that would render our technologies and products obsolete or uneconomical. Our future success will depend in large part on our ability to maintain a competitive position with respect to our current and future technologies, which we may not be able to do. In addition, delays in the launch of our new products or the provision of our services may result in loss of market share due to our customers’ purchases of competitors’ products or services during any delay.

We are dependent upon one vendor for consumables.

The consumables (i.e., chips or plates) used in our equipment upon which we conduct high throughput electrophysiology experiments are manufactured and sold by the same vendor who manufactures the equipment. Should this vendor fail to deliver the consumables in a timely manner this could adversely affect our assay services operations.

We depend on our key personnel, the loss of whom would impair our ability to compete.

We are highly dependent on the employment services of key management, engineering and scientific staff. The loss of the service of any of these persons could seriously harm our product development and commercialization efforts. In addition, research, product development and commercialization will require additional skilled personnel in areas such as chemistry and biology, and software and electronic engineering and recruitment and retention of personnel, particularly for employees with technical expertise, is uncertain. If we are unable to hire, train and retain a sufficient number of qualified employees, our ability to conduct and expand our business could be seriously reduced. Since our facilities are located in two specific cities, it may be difficult for us to attract employees in the cities in which our facilities are located. The inability to retain and hire qualified personnel could also hinder the planned expansion of our business and may result in us relocating some or all of our operations.

We have initiated and may in the future need to initiate lawsuits to protect or enforce our patents and other proprietary rights, which would be expensive and, if we lose, may cause us to lose some of our intellectual property rights, which would reduce our ability to compete in the market.

Our success will depend in part upon protecting our technology from infringement, misappropriation, duplication and discovery, and avoiding infringement and misappropriation of third party rights. We intend to rely, in part, on a combination of patent and contract law to protect our technology in the United States and abroad.

13

The risks and uncertainties that we face with respect to our patents and other proprietary rights include the following:

| ● | the pending patent applications we have filed or to which we have exclusive rights may not result in issued patents or may take longer than we expect to result in issued patents; |

| ● | the claims of any patents which are issued may not provide meaningful protection; |

| ● | we may not be able to develop additional proprietary technologies that are patentable; |

| ● | the patents licensed or issued to us or our customers may not provide a competitive advantage; |

| ● | other companies may challenge patents licensed or issued to us or our customers; |

| ● | patents issued to other companies may harm our ability to do business; |

| ● | other companies may independently develop similar or alternative technologies or duplicate our technologies; and |

| ● | other companies may design around the technologies we have licensed or developed. |

There can be no assurance that any of our patent applications or licensed patent applications will issue or that any patents that may issue will be valid and enforceable. We may not be successful in securing or maintaining proprietary patent protection for our products and technologies that we develop or license. In addition, our competitors may develop products similar to ours using methods and technologies that are beyond the scope of our intellectual property protection, which could reduce our anticipated sales. While some of our products have proprietary patent protection, a challenge to these patents can subject us to expensive litigation. Litigation concerning patents, other forms of intellectual property, and proprietary technology is becoming more widespread and can be protracted and expensive and distract management and other personnel from performing their duties.

We also rely upon trade secrets, unpatented proprietary know-how, and continuing technological innovation to develop a competitive position. If these measures do not protect our rights, third parties could use our technology, and our ability to compete in the market would be reduced. In addition, employees, consultants and others who participate in the development of our products may breach their agreements with us regarding our intellectual property, and we may not have adequate remedies for the breach. We also may not be able to effectively protect our intellectual property rights in some foreign countries and our trade secrets may become known through other means not currently foreseen by us. We cannot assure you that others will not independently develop substantially equivalent proprietary technology and techniques or otherwise gain access to our trade secrets and technology, or that we can adequately protect our trade secrets and technology.

There can be no assurance that third parties will not assert infringement or other claims against us with respect to rights to any of our products. Litigation to protect and defend the rights to our licensed technology or to determine the validity of any third-party claims could result in significant expense to us and divert the efforts of our technical and management personnel, whether or not such litigation is determined in our favor. If we determine that additional rights are necessary for the development of our product(s) and further determine that a license to additional third-party rights is needed, there can be no assurance that we can obtain a license from the relevant party or parties on commercially reasonable terms, if at all. We could be sued for infringing patents or other intellectual property that purportedly cover products and/or methods of using such products held by persons other than us. Litigation arising from an alleged infringement could result in removal from the market, or a substantial delay in, or prevention of, the introduction of our products, any of which could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Additionally, in order to protect or enforce our patent rights, we may initiate patent litigation against third parties, such as infringement suits or interference proceedings. Litigation may be necessary to:

| ● | assert claims of infringement; |

| ● | enforce our patents; |

| ● | protect our trade secrets or know-how; or |

| ● | determine the enforceability, scope and validity of the proprietary rights of others. |

Lawsuits could be expensive, take significant time and divert management’s attention from other business concerns. They would put our licensed patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing. We may also provoke third parties to assert claims against us. Patent law relating to the scope of claims in the technology fields in which we operate is still evolving and, consequently, patent positions in our industry are generally uncertain. If initiated, we cannot assure you that we would prevail in any of these suits or that the damages or other remedies awarded, if any, would be commercially valuable. During the course of these suits, there could be public announcements of the results of hearings, motions and other interim proceedings or developments in the litigation. If securities analysts or investors were to perceive any of these results to be negative, our stock price could decline.

14

We may incur substantial liabilities and may be required to limit commercialization of our products in response to product liability lawsuits.

We could be the subject of complaints or litigation from customers alleging product quality or operational concerns. Litigation or adverse publicity resulting from these allegations could materially and adversely affect our business, regardless of whether the allegations are valid or whether we are liable. We currently do not have product liability insurance coverage, and even if there was such coverage, there would be no assurance that such coverage would be sufficient to properly protect us. Further, claims of this type, whether substantiated or not, may divert our financial and management resources from revenue generating activities and the business operation.

We are subject to the risks of doing business internationally.

We currently offer our services to companies located outside of the United States, and therefore our business is subject to risks associated with doing business internationally, including:

| ● | trade restrictions and changes in tariffs; |

| ● | the impact of business cycles and downturns in economies outside of the United States; |

| ● | unexpected changes in regulatory requirements that may limit our ability to export our products or sell into particular jurisdictions; |

| ● | import and export license requirements and restrictions; |

| ● | difficulties in maintaining effective communications with employees and customers due to distance, language and cultural barriers; |

| ● | disruptions in international transport or delivery; |

| ● | difficulties in protecting our intellectual property rights, particularly in countries where the laws and practices do not protect proprietary rights to as great an extent as do the laws and practices of the United States; |

| ● | difficulties in enforcing agreements through non-U.S. legal systems; |

| ● | longer payment cycles and difficulties in collecting receivables; and |

| ● | potentially adverse tax consequences. |

If any of these risks materialize, our international sales could decrease and our foreign operations could suffer.

We may acquire other businesses or make investments in other companies or technologies that could harm our operating results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense.

As part of our business strategy, we may pursue acquisitions of businesses and assets. To date we have made two acquisitions, the acquisition of certain of the assets of Icagen NC and the acquisition of the Tucson Facility from Sanofi. We also may pursue strategic alliances and joint ventures that leverage our technology and industry experience to expand our offerings or other capabilities. Though certain company personnel have business development and corporate transaction experience, including with licensing, and acquisitions, and strategic partnering, as a company we have limited experience with forming strategic alliances and joint ventures. We may not be able to find suitable partners or acquisition candidates, and we may not be able to complete such transactions on favorable terms, if at all. If we make any acquisitions, we may not be able to integrate these acquisitions successfully into our existing business, and we could assume known liabilities as well as unknown or contingent liabilities. Any future acquisitions also could result in significant write-offs or the incurrence of debt and contingent liabilities, any of which could have a material adverse effect on our financial condition, results of operations and cash flows. Integration of an acquired company also may disrupt ongoing operations and require management resources that would otherwise focus on developing our existing business. We may experience losses related to investments in other companies, which could have a material negative effect on our results of operations. We may not identify or complete these transactions in a timely manner, on a cost-effective basis, or at all, and we may not realize the anticipated benefits of any acquisition, technology license, strategic alliance or joint venture.

To finance any acquisitions or joint ventures, we may choose to issue shares of our Common Stock as consideration, which would dilute the ownership of our stockholders. If the price of our Common Stock is low or volatile, we may not be able to acquire other companies or fund a joint venture project using our stock as consideration. Alternatively, it may be necessary for us to raise additional funds for acquisitions through public or private financings. Additional funds may not be available on terms that are favorable to us, or at all.

15

The issuance of shares of common stock upon conversion of the Series C Preferred Stock would dilute the ownership of such holders and may adversely affect the market price of our common stock.

The conversion of the Series C Preferred Stock to common stock would dilute the ownership interest of existing holders of our common stock, and any sales in the public market of the common stock issuable upon conversion of the Series C Preferred Stock could adversely affect prevailing market prices of our common stock. Sales by such holders of a substantial number of shares of our common stock in the public market, or the perception that such sales might occur, could have a material adverse effect on the price of our common stock.

The holders of shares of the Series C Preferred Stock may exercise significant influence over us.

The holders of the Series C Preferred Stock will own approximately 15% of our shares of common stock on a fully diluted as-converted basis based on the number of shares of common stock outstanding as of the date hereof and have the right to votes or 31% of our outstanding voting securities.

In addition, under the terms of the Certificate of Designation that governs the Series C Preferred Stock, the Series C Preferred Stock generally ranks, with respect to liquidation, dividends and redemption, senior to other securities and, so long as any shares of Series C Preferred Stock remain outstanding, the approval of the holders of 75% of the Series C Preferred Stock outstanding at the time of approval is required in order for us to, among other things, (i) alter or change adversely the powers, preferences or rights given to the Series C Preferred Stock or alter or amend the Certificate of Designation; (ii) amend our Articles of Incorporation or bylaws in any manner that adversely affects any powers, preferences or rights of the Series C Preferred Stock; (iii) authorize or create any series or class of stock ranking as to redemption, distribution of assets upon a Liquidation Event (as defined in the Certificate of Designation) or dividends senior to, or otherwise pari passu with, the Series C Preferred Stock; (iv) declare or make any dividends other than dividend payments on the Series C Preferred Stock or other distributions payable solely in common stock; (v) authorize any increase in the number of shares of Series C Preferred Stock or issue any additional shares of Series C Preferred Stock; or (vi) enter into any agreement with respect to any of the foregoing.

16

The holders of Series C Preferred Stock will have rights, preferences and privileges that are not held by, and are preferential to, the rights of our common stockholders.