Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - TD Holdings, Inc. | f10k2017ex32-2_chinacomm.htm |

| EX-32.1 - CERTIFICATION - TD Holdings, Inc. | f10k2017ex32-1_chinacomm.htm |

| EX-31.2 - CERTIFICATION - TD Holdings, Inc. | f10k2017ex31-2_chinacomm.htm |

| EX-31.1 - CERTIFICATION - TD Holdings, Inc. | f10k2017ex31-1_chinacomm.htm |

| EX-23.1 - CONSENT OF MARCUM BERNSTEIN & PINCHUK LLP - TD Holdings, Inc. | f10k2017ex23-1_chinacomm.htm |

| EX-21.1 - SUBSIDIARIES OF REGISTRANT - TD Holdings, Inc. | f10k2017ex21-1_chinacomm.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number: 001-36055

China Commercial Credit, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 45-4077653 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

No.1 Zhongying Commercial Plaza, Zhong Ying Road, Wujiang, Suzhou, Jiangsu Province, China |

215200 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: +86 512 63960022

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |

| Common stock, par value $.001 | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $57.68 million based on the closing price of $3.2031 for the registrant’s common stock as reported on the NASDAQ Capital Market.

As of April 11, 2018, there were 20,250,915 shares of the Company’s common stock issued and outstanding.

China Commercial Credit, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2017

TABLE OF CONTENTS

| i |

All references to “we,” “us,” “our,” “CCC,” “Company,” “Registrant” or similar terms used in this report refer to China Commercial Credit, Inc., a Delaware corporation (“CCC”), including its consolidated subsidiaries and variable interest entities (“VIE”), unless the context otherwise indicates. We conduct our business through three operating entities, Wujiang Luxiang Rural Microcredit Co., Ltd., a PRC company with limited liability by stock (“Wujiang Luxiang”), which is a VIE controlled by Wujiang Luxiang Information Technology Consulting Co., Ltd (“WFOE”), a wholly-owned subsidiary of ours, through a series of contractual arrangements, and Pride Financial Leasing (Suzhou) Co. Ltd (“PFL”), our wholly-owned indirect subsidiary.

“PRC” or “China” refers to the People’s Republic of China, excluding, for the purpose of this report, Taiwan, Hong Kong and Macau. “RMB” or “Renminbi” refers to the legal currency of China and “$”, “US$” or “U.S. Dollars” refers to the legal currency of the United States.

Note Regarding Forward-Looking Statements

The information contained in this Annual Report on Form 10-K includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our company and our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained herein are based on current expectations and beliefs concerning future developments and the potential effects on us. Future developments actually affecting us may not be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Examples are statements regarding future developments with respect to the following:

| ● | Our ability to improve internal controls and procedures; |

| ● | Our ability to develop and market our microcredit lending and guarantee business in the future; |

| ● |

Our ability to collect from default borrowers;

|

| ● |

Our ability to make timely adjustment to ensure adequate loan loss and financial guarantee provisions;

|

| ● | Inflation and fluctuations in foreign currency exchange rates; |

| ● | Our on-going ability to obtain all mandatory and voluntary government and other industry certifications, approvals, and/or licenses to conduct our business; |

| ● | Development of a liquid trading market for our securities; and |

| ● | Our plan to regain compliance with NASDAQ continue listing requirement |

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to changes in our expectations.

We qualify all of our forward-looking statements by these cautionary statements. The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

| ii |

| Item 1. | Description of Business. |

General

China Commercial Credit, Inc., is a financial services firm operating in China. Our mission is to fill the significant void in the market place by offering lending, financial guarantee and financial leasing products and services to a target market which has been significantly under-served by the traditional Chinese financial community. Our current operations consist of providing direct loans, loan guarantees and financial leasing services to small-to-medium sized businesses (“SMEs”), farmers and individuals in the city of Wujiang, Jiangsu Province.

Our loan and loan guarantee business is conducted through Wujiang Luxiang, a fully licensed microcredit company which we control through our subsidiaries and certain contractual arrangements. Our financial leasing business is conducted through PFL, our wholly owned subsidiary. Historically, many SMEs and farmers have been borrowing at high interest rates from unregulated and often illegal lenders, referred to as “underground” lenders, to finance their operations and growth, contrary to the preferences of Chinese banking authorities. Such high interest rate borrowing makes it difficult for businesses to grow, and also exacerbates China’s concerns about inflation. By operating through licensed and regulated businesses, we seek to bridge the gap between Chinese state-owned and commercial banks that have not traditionally served the capital needs of SMEs and higher interest rate “underground” lenders.

Jiangsu, which is an eastern coastal province, has among the highest population density in China and is home to many of the world’s leading exporters of electronic equipment, chemicals and textiles. As a result, the city of Wujiang ranks as one of the most economically successful cities in China. The SMEs, both in Jiangsu and other provinces in China, have historically been an under-served segment of the Chinese banking market.

Since Wujiang Luxiang’s inception in October 2008, it has developed a large number of borrowers in Wujiang City. All of our loans are made from our sole office, located in Wujiang City. As of December 31, 2017, we have built a $40.7 million portfolio of direct loans to 71 borrowers and a total of $11.6 million in loan guarantees for 14 borrowers.

During 2016 and 2017, the microcredit companies in Wujiang area went through the most difficult time since their inceptions in 2008. Twelve of fourteen microcredit companies in the Wujiang area went bankrupt while the remainder are struggling with high default rates due to the poor economic condition, especially the slow-down in the textile industry. The operations of Wujiang Luxiang were also affected. For the year ended December 31, 2017, we had a loss of $5,486,667 and a net loss of $10,699,740 compared to a revenue of $2,246,807 and net loss of $2,580,136 in 2016, a change of 344% and an increase of 315%, respectively. As a result of the deteriorating economic condition, we experienced a substantial increase in the amount of default loans in both our direct lending and guarantee business. The amount of underlying loans we guaranteed has been increased by 6.7% to $11.6 million as of December 31, 2017 compared to $10.9 million as of December 31, 2016. As the rate of fees and commissions generated from the guarantee business has been decreasing, the Company decided that the revenue does not justify the default risks involved in the guarantee business, and therefore expects to further reduce the traditional guarantee business and hold off on pursuing the guarantee business to be provided via the Kaixindai Financing Services Jiangsu Co. Ltd (“Kaixindai”) platform as previously planned. Management may actively resume the guarantee business in the future if economic conditions improve.

Our financial leasing services were previously expected to be provided to a diverse base of customers, including textile and other manufacturing companies, railroads, port facilities, local bus, and rail companies and municipal governments. Customers will include existing clients of Wujiang Luxiang in addition to new clients. PFL, our wholly owned subsidiary, planned to provide leases on both new and used manufacturing equipment, medical devices, transportation vehicles and industrial equipment, purchased both domestically and from foreign suppliers, to meet its customer’s needs. In 2015, PFL entered into two financial leasing agreements for an aggregate of $5.61 million in lease receivables. We do not currently have further funds to deploy in the financial leasing business and plan to hold off expansion of the leasing business until otherwise determined by the management based on the economic environment and other considerations.

On August 9, 2017, CCC entered into a share exchange agreement (the “Exchange Agreement”) with Sorghum Investment Holdings Ltd. (“Sorghum”). Pursuant to the terms of the Exchange Agreement, CCC would have acquired 100% of Sorghum through issuance of 152,587,000 of its common share. On December 29, 2017, CCC received a notice from Sorghum that the Exchange Agreement was terminated based on Sorghum’s allegation that the Company’s filing of the Current Report on Form 8-K on December 27, 2017 constituted a breach of the Exchange Agreement. CCC filed an arbitration demand with the American Arbitration Association against Sorghum in connection with Sorghum’s own breaches of the Exchange Agreement. The Company and Sorghum’s counsels are currently having initial conferences with the arbitrator. For more information refer to Item 3—Legal Proceedings.

| 1 |

Recent Development

On February 28, 2018, the Company received a letter (the “Notification Letter”) from The NASDAQ Stock Market LLC (“Nasdaq”) notifying the Company that it is not in compliance with the minimum Market Value of Listed Securities (MVLS) requirement set forth in Nasdaq Listing Rule 5550(b)(2) for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5550(b)(2) requires listed securities to maintain a minimum MVLS of $35 million. Nasdaq Listing Rule 5810(c)(3)(C) provides that a failure to meet a minimum MVLS exists if the deficiency continues for a period of 30 consecutive business days. Based upon Nasdaq’s review of the Company’s MVLS for the last 30 consecutive business days, the Company no longer meets the minimum MVLS requirement. The Nasdaq staff noted the Company also does not meet the requirements under Listing Rules 5550(b)(1) and 5550(b)(3). The Notification Letter does not impact the Company’s listing on the Nasdaq Capital Market at this time. In accordance with Nasdaq Listing Rule 5810(c)(3)(C), the Company has been provided 180 calendar days, or until August 27, 2018, to regain compliance with Nasdaq Listing Rule 5550(b)(2). The Company has been evaluating options available to regain compliance.

On April 11, 2018, the Company closed a private placement to two non-affiliated individual investors in China for a gross proceeds of approximately US$500,000 at a per share price of US$0.77. The Company issued 649,350 shares of common stock. The net proceeds of the sale of the shares shall be used by the Company for working capital and general corporate purpose.

On November 22, 2016, the Company entered into a Stipulation and Agreement of Settlement (the “Stipulation”) to settle the Securities Class Action. The Stipulation resolves the claims asserted against the Company and certain of its current and former officers and directors in the Securities Class Action without any admission or concession of wrongdoing or liability by the Company or the other defendants. The Stipulation resolved the claims asserted against the Company and certain of its current and former officers and directors in the Securities Class Action without any admission or concession of wrongdoing or liability by the Company or the other defendants. The Stipulation also provides, among other things, a settlement payment by the Company of $245,000 in cash and the issuance of 950,000 shares of its common stock (the “Settlement Shares”) to the plaintiff’s counsel and class members. The terms of the Stipulation were subject to approval by the Court following notice to all class members. The issuance of the Settlement Shares are exempt from registration pursuant to Section 3(a)(10) of the Securities Act of 1933, as amended. A fairness hearing was held on May 30, 2017, and the Court approved the settlement.

On June 1, 2017, following a final fairness hearing on May 30, 2017 regarding the proposed settlement, the Court entered a final judgment and order that: (i) dismisses with prejudice the claims asserted in the Securities Class Action against all named defendants in connection with the Securities Class Action, including the Company, and releases any claims that were or could have been asserted that arise from or relate to the facts alleged in the Securities Class Action, such that every member of the settlement class will be barred from asserting such claims in the future; and (ii) approves the payment of $245,000 in cash and the issuance of 950,000 shares of its common stock to members of the settlement class.

On July 28, 2017, the Court amended the order that 1) Attorney’s Fees, Litigation Expenses, and Incentive Awards be paid out of the Settlement Fund; and 2) Levi & Korsinsky be awarded attorney’s fees in the amount of $55,000 in cash and 237,500 shares (Plaintiff Attorney Fee Shares). Thus, cash to be paid to the class shall be $190,000 (“Class Settlement Cash”) and shares to be issued to the class shall be 712,500 (“Class Settlement Shares”).

On December 22, 2017, the Court entered a distribution order approving the distribution of the Settlement Stock to the class plaintiffs. The $245,000 cash portion of the settlement has been paid in full. The 712,500 Class Settlement Shares were issued on or about January 19, 2018. The settlement has been finalized, and that thereafter there are no remaining claims outstanding as against the Company with respect to this litigation. On April 10, 2018, the 237,500 of plaintiff attorney fee shares were issued to plaintiff’s attorney’s broker account.

As of December 31, 2017 and 2016, the Company had no information regarding the shareholder list and share allocation to these shareholders.

On December 1, 2017, the Company has entered into a securities purchase agreement with Mr. Yang Jie, a significant shareholder and Vice President of Finance of the Company and Mr. Long Yi, the Chief Financial Officer of the Company to sell 150,000 and 50,000 common shares, respectively, at a per share price of US$3.5, in the total amount of US$525,000 and US$175,000, respectively. As of the date of this report, the Company issued 50,000 shares of common stocks and related warrants to Mr. Long Yi with 150,000 shares of common stocks and related warrants unissued to Mr. Yang Jie.

Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The realization of assets and the satisfaction of liabilities in the normal course of business are dependent on, among other things, the Company’s ability to operate profitably, to generate cash flows from operations, and to pursue financing arrangements to support its working capital requirements.

The following includes conditions give rise to substantial doubt about the Company’s ability to continue as a going concern within one year from the financial statement issuance date and management’s plans to mitigate these adverse conditions:

| 1) | Limited funds necessary to maintain operations |

The Company had an accumulated deficit of US$81,534,396 as of December 31, 2017. In addition, the Company had a negative net asset of US$5,272,461 as of December 31, 2017. As of December 31, 2017, the Company had cash of US$2,498,194 and total liabilities other than accrual for financial guarantee services of $ 3,166,863. Caused by the limited funds, the management assessed that the Company was not able to keep the size of lending business within one year from the financial statement issuance date.

The Company is actively seeking other strategic partners with experience in lending business.

| 2 |

| 2) | Recurring operating loss |

During the year ended December 31, 2017, the Company incurred operating loss of US$10,699,740. Affected by the reduction of lending business and guarantee business and increased loss loans, the management was in the opinion that recurring operating losses would be made continue within one year from the financial statement issuance date.

The Company continues to use its best effort to improve collection of loan receivable and interest receivable. Management engaged two PRC law firms to represent the Company in the legal proceedings against the borrowers and their counter guarantors.

| 3) | Negative operating cash flow |

During the year ended December 31, 2017, the Company incurred negative operating cash flow of US$1,184,630. Affected by significant balance of charged-off interest receivable, the management assessed the Company would continue to have negative operating cash flow within one year from the financial statement issuance date.

The Company continues to reduce the redundant headcount and entered into a new office lease with lower rent commitment since January 1, 2017 to improve operating cash flow.

| 4) | Downward industry |

Most loan customers are from textile industry which has been facing downward pressure. Additionally adversely affected by emergence of internet finance entities, the Company was facing fierce competition. Considering the high risks from both customers and competitors, management assessed the Company would further reduced the loan business.

The Company is actively seeking other strategic partners with experience in lending business.

| ● | Financial Support |

The Company has been actively seeking strategic investors with experience in lending business as well as financial investors. Management also invested in the Company during 2017.

On May 11, 2017 and June 21, 2017, the Company closed two private placements to third-party individual investors who purchased 60,000 and 625,000 shares of common stock, respectively, at a per share price of US$1.0 and US$0.8, for a total gross proceeds of US$60,000 and US$500,000, respectively. The net proceeds of the sale of the shares were used by the Company for working capital and general corporate purpose.

On September 29, 2017, the Company closed two private placements to two individual investors who purchased 552,486 shares of common stock at a per share price of US$1.81 with total gross proceeds of amount of US$1,000,000. One of the investors was the then Vice President of Finance of the Company. The net proceeds of the sale of the shares were used by the Company for working capital and general corporate purpose, payment of the transactional expenses related to the acquisition of all the outstanding issued shares of Sorghum Investment Holding Limited (“Sorghum”) from certain shareholders of Sorghum, and payments related to the securities class action and derivative action.

In December 2017, the Company sold an aggregate 200,000 registered shares of common stock at a purchase price of $3.50 per share to Long Yi, the Chief Financial Officer of the Company and Yang Jie, the then VP of Finance of the Company pursuant to certain securities purchase agreement dated December 1, 2017. In connection with the purchase, Mr. Yi and Mr. Jie also receive warrants to purchase up to the number of shares of the Company’s common stock equal to 80,000 shares of common stock pursuant to the securities purchase agreement. The warrants have an exercise price of $4.20 per share. The warrants became exercisable on the date of issuance and shall expire five years from the date of issuance. The gross proceeds to the Company of approximately $700,000 and should be used for working capital and general corporate purpose.

| 3 |

The Company plans to continue to seek financial as well as strategic investors for additional financing to regain compliance of the NASDAQ continued listing requirement.

On April 11, 2018, the Company closed a private placement to two individual investor in China for a gross proceeds of US$500,000 at a per share price of US$0.77. The net proceeds of the sale of the shares shall be used by the Company for working capital and general corporate purpose.

| ● | Plan to acquire new business or assets |

Although we have continued to use our best effort to improve our collection of loan receivable and interest receivable by engaging local law firms in China, it has been very difficult for us to collect from the borrowers. As such, the Company has been actively seeking strategic acquisition of business or assets to improve our liquidity. Since the termination of the Exchange Agreement with Sorghum in last December, we have evaluated a few potential acquisition targets. As of now, the Company plans to acquire certain second-hand luxury cars dealership business assets or other appropriate business deemed to be appropriate by the board of directors. As of the date of this Annual Report, the Company has not entered into any letter of intent or definitive agreement for such acquisition and there can be no assurance that we will be able to locate any target or negotiate definitive agreements.

Though management had plans to mitigate the conditions or events that raise substantial doubt, there is substantial doubt about the Company’s ability to continue as a going concern within one year from the financial statements issuance date, as there is no assurance that the liquidity plan will be successfully implemented. Failure to successfully implement the plan will have a material adverse effect on the Company’s business, results of operations and financial position, and will materially adversely affect its ability to continue as a going concern.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, (the “JOBS Act”) and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies, that are not emerging growth companies, including, but not limited to, (1) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in our initial public offering, (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, stockholders may have less information then they might otherwise have.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We elected to opt out of such extended transition period and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

We could remain an emerging growth company for up to five years, or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Corporate Structure

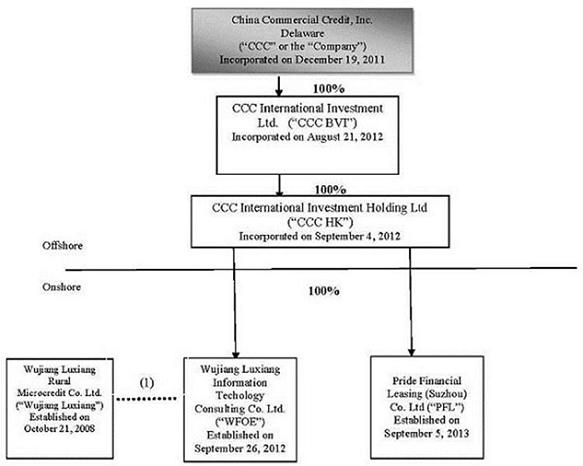

China Commercial Credit, Inc. is a holding company that was incorporated under the laws of the State of Delaware on December 19, 2011. The Company, through its indirect wholly-owned subsidiary, Wujiang Luxiang Information Technology Consulting Co. Ltd. (“WFOE”), a limited liability company formed under the laws of the PRC on September 26, 2012, controls Wujiang Luxiang, a company established under the laws of the PRC on October 21, 2008, through a series of contractual arrangements. CCC International Investment Ltd. (“CCC BVI”), a company incorporated under the laws of the British Virgin Islands (“BVI”) on August 21, 2012, is wholly owned by the Company. CCC BVI wholly owns CCC International Investment Holding Ltd. (“CCC HK”), a company incorporated under the laws of the Hong Kong S.A.R. of the PRC on September 4, 2012. WFOE is wholly owned by CCC HK. On September 5, 2013, CCC HK incorporated PFL a wholly owned subsidiary, to start our financial leasing business.

| 4 |

On April 11, 2015, WFOE delivered a notice of termination to Pride Information Technology Co. Ltd. (“Pride Online”), a domestic entity established on February 19, 2014 and 100% owned by Huichun Qin, a former officer and director of the Company, to terminate the VIE agreements by and among the parties. The Company entered into the VIE agreements with Pride Online in order to provide WFOE absolute control over the economic interest in Pride Online. As a result of the termination notice, the contractual arrangements by and among the Company, Mr. Qin and Pride Online terminated as of May 11, 2015 and WFOE no longer controls Pride Online.

The following diagram illustrates our corporate structure as of the date of this Annual Report:

(1) Pursuant to a series of contractual arrangements, WFOE effectively controls and manages the business activities of Wujiang Luxiang.

Contractual Arrangements between WFOE and Wujiang Luxiang

There are no PRC state, provincial or local laws, rules and regulations prohibiting or restricting direct foreign equity ownership in companies engaged in rural microcredit business. However, the provincial authorities regulate microcredit companies through strict licensing requirements and approval procedures. Direct controlling foreign ownership in a for-profit microcredit company has never been approved by competent Jiangsu government authorities. Based on the current position taken by the competent Jiangsu government authorities, direct foreign controlling ownership of a for-profit rural microcredit company will not be approved in the foreseeable future.

| 5 |

As such, neither we nor our subsidiaries own any equity interest in Wujiang Luxiang. Instead, we control and receive the economic benefits of Wujiang Luxiang’s business operation through a series of contractual arrangements. WFOE, Wujiang Luxiang and its shareholders entered into a series of contractual arrangements, also known as VIE Agreements, on September 26, 2012. The VIE Agreements are designed to provide WFOE with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of Wujiang Luxiang, including absolute control rights and the rights to the assets, property and revenue of Wujiang Luxiang. Based on a legal opinion issued by Dacheng Law Offices to WFOE, the VIE Agreements constitute valid and binding obligations of the parties to such agreements, and are enforceable and valid in accordance with the laws of the PRC.

Each of the VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Wujiang Luxiang and WFOE, WFOE provides Wujiang Luxiang with technical support, consulting services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, Wujiang Luxiang granted an irrevocable and exclusive option to WFOE to purchase from Wujiang Luxiang, any or all of Wujiang Luxiang’s assets at the lowest purchase price permitted under the PRC laws. WFOE may exercise, at its sole discretion, the option to purchase equity interests of Wujiang Luxiang from all the 12 equity holders of Wujiang Luxiang (the “Wujiang Shareholders”) permitted by PRC laws. Should WFOE exercise such option, the parties shall enter into a separate asset transfer or similar agreement. For services rendered to Wujiang Luxiang by WFOE under this agreement, WFOE is entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, the plus amount of the services fees or ratio decided by the board of directors of WFOE based on the value of services rendered by WFOE and the actual income of Wujiang Luxiang from time to time, which is approximately equal to the net income of Wujiang Luxiang.

The Exclusive Business Cooperation Agreement shall remain in effect for ten years unless it is terminated by WFOE with 30-day prior notice. Wujiang Luxiang does not have the right to terminate the agreement unilaterally. WFOE may unilaterally extend the term of this agreement with prior written notice.

The sole director and president of WFOE, Mr. Ling, is currently managing Wujiang Luxiang pursuant to the terms of the Exclusive Business Cooperation Agreement. WFOE has absolute authority relating to the management of Wujiang Luxiang, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. The Exclusive Business Cooperation Agreement does not prohibit related party transactions. The audit committee of CCC is required to review and approve in advance any related party transactions, including transactions involving WFOE or Wujiang Luxiang.

Share Pledge Agreement

Under the Share Pledge Agreement between the Wujiang Shareholders and WFOE, the Wujiang Shareholders pledged all of their equity interests in Wujiang Luxiang to WFOE to guarantee the performance of Wujiang Luxiang’s obligations under the Exclusive Business Cooperation Agreement. Under the terms of the agreement, in the event that Wujiang Luxiang or its shareholders breach their respective contractual obligations under the Exclusive Business Cooperation Agreement, WFOE, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests. The Wujiang Shareholders also agreed that upon occurrence of any event of default, as set forth in the Share Pledge Agreement, WFOE is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. The Wujiang Shareholders further agree not to dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest.

The Share Pledge Agreement shall be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Wujiang Luxiang. WFOE shall cancel or terminate the Share Pledge Agreement upon Wujiang Luxiang’s full payment of fees payable under the Exclusive Business Cooperation Agreement.

| 6 |

Exclusive Option Agreement

Under the Exclusive Option Agreement, the Wujiang Shareholders irrevocably granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in Wujiang Luxiang. The option price is equal to the capital paid in by the Wujiang Shareholders subject to any appraisal or restrictions required by applicable PRC laws and regulations. As of the date of this report, if WFOE exercised such option, the total option price that would be paid to all of the Wujiang Shareholders would be $51.2 million, which is the aggregate registered capital of Wujiang Luxiang. The option purchase price shall increase in the event that the Wujiang Shareholders make additional capital contributions to Wujiang Luxiang, including when the registered capital is increased upon Wujiang Luxiang receiving the proceeds from our initial public offering.

The agreement remains effective for a term of ten years and may be renewed at WFOE’s election.

Power of Attorney

Under the Power of Attorney, the Wujiang Shareholders authorize WFOE to act on their behalf as their exclusive agent and attorney with respect to all rights as shareholders, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association of Wujiang Luxiang, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of Wujiang Luxiang.

Although it is not explicitly stipulated in the Power of Attorney, the term of the Power of Attorney shall be the same as the term of that of the Exclusive Option Agreement.

This Power of Attorney is coupled with an interest and shall be irrevocable and continuously valid from the date of execution of this Power of Attorney, so long as the Wujiang Shareholder is a shareholder of Company.

Timely Reporting Agreement

To ensure Wujiang Luxiang promptly provides all of the information that WFOE and the Company need to file various reports with the SEC, a Timely Reporting Agreement was entered between Wujiang Luxiang and the Company.

Under the Timely Reporting Agreement, Wujiang Luxiang agrees that it is obligated to make its officers and directors available to the Company and promptly provide all information required by the Company so that the Company can file all necessary SEC and other regulatory reports as required.

Although it is not explicitly stipulated in the Timely Reporting Agreement, the parties agreed its term shall be the same as that of the Exclusive Business Cooperation Agreement.

Our Business

General

We have three business lines, lending, guarantee and financial leasing.

For our lending and guarantee services, we generally provide direct loans and guarantee services, to borrowers located within City of Wujiang, Jiangsu Province of China. In our direct loan business, we provide short-term loans to the borrowers and generate interest income. In our guarantee business, we act as a guarantor to borrowers applying for short-term direct loans with other lenders and generate fee income. Our clients in both the direct loan and guarantee businesses are primarily SMEs, farmers and individuals who generally use the proceeds of the loans for business related purposes. We are not dependent on any one borrower in either our direct loan or guarantee business.

We fund our lending and guarantee operations by using our registered capital and using cash generated from our operations. As of December 31, 2017, we had repaid all outstanding bank loans and had US$nil balance of short-term loans. Currently there is $4.5 million (RMB 29 million) available under the line of credit. This line of credit was granted to Wujiang Luxiang since its inception in 2008 as a provincial government’s measure to support rural microcredit company’s operations. The total line of credit decreased from RMB 150 million to RMB 100 million during 2014 due to PBOC’s tightened monetary policy. Interest rates under this line of credit vary, but have been no more than 110% of the PBOC benchmark interest rate (the “PBOC Rate”).

| 7 |

On September 5, 2013, we formed PFL to start our financial leasing business. PFL is licensed by SAIC to provide leasing services in all of the Chinese provinces. PFL offers financial leases on machinery and equipment, public transportation vehicles, and medical devices to municipal government agencies, public transportation agencies, hospitals and SMEs in Jiangsu Province and other provinces. As of December 31, 2017, PFL incurred two finance lease transactions with total lease receivables of $5.61 million according to lease agreements.

Our Services

Direct Loans

We provide direct loans to borrowers with terms not exceeding one year. During 2017 and 2016 the average principal loan amount we provided was approximately $577,825 and $527,234, respectively. The interest rate we charge on a specific direct loan depends on a number of factors, including the type of borrower and whether the loan is secured or unsecured. We also take into account the quality of the collateral or guarantee given and the term of the loan.

Interest on our loans is usually payable monthly and averaged 10% and 12.68% for our direct loan portfolio for the twelve months ended December 31, 2017 and 2016, respectively. Under certain Jiangsu banking regulations, since August 2012, we are allowed to charge an interest rate within the range of 0.9 time and 3 times PBOC Rate. As of December 31, 2017, the PBOC Rate was set at 4.75% per annum for one-year term loans and 4.35% for six-month term loans. During the fiscal year ended 2017 and 2016, the average interest rate we charged to SMEs was three times the PBOC Rate or 13.39% for one-year term loans and 11.61% for six-month term loans.

We offer both secured and unsecured direct loans. As of December 31, 2017, there were 71 direct loans outstanding, with a total aggregate outstanding balance of approximately $40.7 million and interest rates ranging from 9.6% to 19.44% and original terms of the loans ranging from 1 month to 12 months, none of which were unsecured loans. The following table sets forth a summary of our direct loan portfolio as of December 31, 2016 and 2017:

| Total Outstanding Balance as of 12/31/2016 | Percentage of the Total Loan Portfolio as of 12/31/2016 | Total Outstanding Balance as of 12/31/2017 | Percentage of the Total Loan Portfolio as of 12/31/2017 | |||||||||||||

| Guarantee-backed loans | 55,461,801 | 94.8 | % | 39,826,845 | 97.9 | % | ||||||||||

| Collateral-backed loans | 3,061,180 | 5.2 | % | 851,469 | 2.1 | % | ||||||||||

| Total: | 58,522,981 | 100 | % | 40,678,314 | 100 | % | ||||||||||

All our loans are secured. We offer three types of secured loans:

| ● | loans guaranteed by a third party, referred to in China as “guarantee-backed loans;” |

| ● | loans secured by real property, referred to in China as “collateral-backed loans;” and |

| Guarantee-backed loans |

In the case of guarantee-backed loans, the third party guarantor and the borrower are jointly and severally liable for the repayment of the loan. The third party guarantor, whether being an individual or legal entity, must be creditworthy. We do not require any asset from the borrower as collateral for such guarantee-backed loans.

Collateral-backed loans

In the case of collateral-backed loans, the borrowers provide land use rights or building ownership as collateral for the loan.

For loans secured by land use rights, the principal amount we grant is no more than 50-70% of the value of the land use rights. The percentage varies depending on the liquidity of the land use rights. For loans secured by building ownership, the principal amount we grant can be up to 100% of the value of the building. We engage independent appraisal firms to determine the value of the land use rights or the building.

| 8 |

Prior to funding a direct loan secured by land use rights or building ownership, we register our security interest in the collateral with the appropriate government authority. In the event the borrower defaults, we take legal actions including legal proceedings against the default borrower and enforcement action resulting in the court’s sale of the asset through an auction.

Guarantee Services

For a fee, we also provide guarantees to third party lenders on behalf of borrowers applying for loans with such other lenders. Our guarantee is a commitment by us to repay the loan to the lender if the borrower defaults. We, as the third party guarantor, are jointly and severally liable with the borrower for the repayment of the full amount of the loan.

In order for us to agree to act as a guarantor, a borrower must provide a counter-guarantor to us or acceptable collateral to the third party lender such as land use rights, building ownership, or a negotiable instrument. In addition, the borrower must deposit cash with us in an amount equal to the amount we are required to deposit with the third party lender which is usually 10% to 20% of the principal amount of the loan. If the borrower defaults and we pay the lender on the borrower’s behalf, we will first recover from the cash deposit the borrower provided us and then demand the counter-guarantor make payment to us or recover the payment from the sale proceeds of the collateral asset.

In exchange for our guarantee, the borrowers pay us guarantee fees. We charge a per annum guarantee fee ranging from 1.56% to 1.80% of the principal amount of the underlying loan. The guarantee fees are payable in full when the guarantee is made. The criteria in determining the guarantee fee paid by the borrower are summarized in the following table:

| Types of Security Interest | New Client | Previous or Existing Client | ||

| Land Use Rights or Building Ownership |

1.68% of the principal amount of the underlying loan multiplied by the number of years of the guarantee |

1.56% of the principal amount of the underlying loan multiplied by the number of years of the guarantee | ||

| Counter-Guarantor |

1.80 % of the principal amount of the underlying loan multiplied by the number of years of the guarantee |

1.62 % of the principal amount of the underlying loan multiplied by the number of years of the guarantee |

In addition to the fee income, we earn interest on the refundable cash deposits provided to us by the borrowers. Such cash deposits are required to be made to our bank account when we approve the guarantee application. After the expiration of the guarantee term, such cash deposits, without interest, will be refunded to the borrower once we receive a notice from the third party lender confirming termination of our guarantee obligation.

As of December 31, 2017, we have provided guarantees for a total of $11.6 million underlying loans to approximately 14 borrowers.

Due to impact of foreign exchange rates converting Renminbi yuan to US Dollar, the amount of underlying loans we guaranteed has been induced by 6.7% as of December 31, 2017 compared to as of December 31, 2016. As the rate of fees and commissions generated from the guarantee business has been decreasing, the Company has decided that the revenue does not justify the default risks involved, and therefore expects to further reduce the traditional guarantee business and hold off on pursuing the guarantee business to be provided via the Kaixindai platform as previously planned. Management may actively resume the guarantee business in the future if economic conditions improve.

Financial Leasing Services

On September 5, 2013, we formed PFL, a wholly owned subsidiary, to start our financial leasing business. PFL is licensed by SAIC to provide leasing services in all of the Chinese provinces. PFL plans to offer financial leases on machinery and equipment, public transportation vehicles, and medical devices to municipal government agencies, public transportation agencies, hospitals and SMEs in Jiangsu Province and other provinces. As of the date of this annual report, PFL entered into two financial leasing agreements for an aggregate of $5.61 million in loan receivables. We do not currently have further funds to deploy in the financial leasing business.

| 9 |

We had used substantially all of the net proceeds from the follow-on public offering closed in May 2014 to increase the registered capital of PFL and corresponding financing leasing capacity. Currently, PFL is approved to have a registered capital of $50 million. We were required to contribute 15% of the $50 million by December 4, 2013. In 2014, we orally obtained an extension from the relevant government authority to delay the initial contribution without any monetary penalty. In October 2014, approximately $5.7 million (RMB 30.7 million) of the net proceeds raised in our follow-on public offering closed in May 2014 was transferred to PFL to increase its registered capital.

Due to the short history of China’s financial leasing industry, there are certain gaps in relevant PRC law. There is no nation-wide uniform equipment title registration process and system in China and each municipality adopts different procedures. As such, our ownership interest on the leased property may be threatened. In addition, there is no guidance on the reserve requirement for financial leasing companies. Based on the past experience and expected customer default status of financial leasing services, the Company estimates the probable loss for financial leasing services to be approximately 100% of outstanding balance as of December 31, 2017. We believe such reserve should be sufficient to cover potential financial leasing loss of PFL’s operations. We may adjust these rates as we roll out our operations.

Loan/Guarantee Application, Review and Approval Process

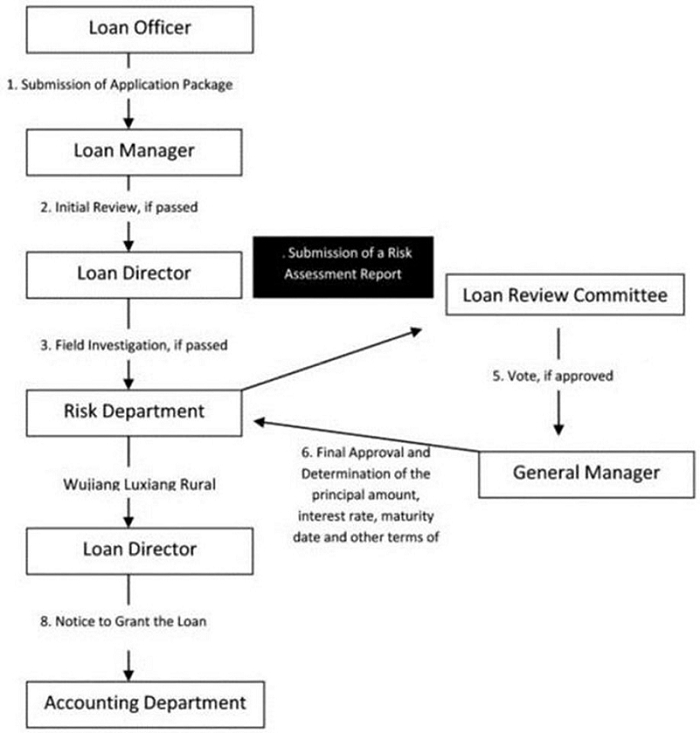

We have a standard process with regard to how a loan or guarantee application is reviewed, processed and approved. The same process applies to both applications for direct loans and for guarantees.

The application process starts with an inquiry from potential borrowers to our Loan Officer. The Loan Officer has the discretion whether to accept the inquirer as an applicant. If accepted, the Loan Officer assists in the preparation of an application package and implements a field visit of the applicant.

The application package usually includes the following items in order for it to be considered:

| ● |

Summary of the desired loan/guaranty: general description of the borrower, use of proceeds, amount, term of the loan, guarantee, collateral or counter-guarantee to be provided.

|

| ● |

Identity information: if the borrower is a legal entity, we require articles of incorporation, business license, state and local tax registration certificates, copies of the personal identification cards of all the shareholders and the legal representative; if the borrower is an individual, we require copies of personal identification cards of all the borrowers.

|

| ● |

Banking relationship documents: including loan application with banks or other lenders, permission to open bank accounts, and credit record.

|

| ● |

Financial reports such as prior three years’ financial statements, interim financial reports, and recent tax returns.

|

| ● |

Business operation documents including samples of sales contracts or customer contracts, and utility bills over the past few months.

|

| ● | Consents: if the borrower is an entity, board or shareholder consent for the loan. |

| 10 |

The flow chart below summarizes the loan/guarantee application, review and approval process.

The reviews during steps 1, 2, 3 and 4 are deemed Level One review. The Loan Review Committee’s review is deemed Level Two review. The General Manager’s final review is the Level Three review. Typically it takes one to two weeks to complete our review.

Loan Extension and Renewal

In our direct loan business, if a borrower has difficulty repaying the principal amount and/or accrued interest in full at the maturity date due to a temporary situation, the borrower may choose to either apply for an extension of the term or a renewal of the loan. The extension or renewal applications are reviewed in accordance with the same loan application, review and approval process outlined above. In our guarantee business, we generally do not extend the guarantee period.

| 11 |

Loan Extension

We will generally approve loan extensions for borrowers who have made timely interest payments, are capable of paying the balance and have loans secured by sufficient collateral or guaranteed by an acceptable guarantor. The term of the loan extensions we grant is generally no longer than the term of the original loan and we only agree to extend a loan one time. If the loan extension application is not approved prior to the original maturity date of the loan, it will be transferred to the collection department and labeled as a default loan. As of December 31, 2017 and 2016, extended loans constituted 0.00% and 0.00% of our total outstanding direct loan balance, respectively. During 2017, the Company did not approve any extensions to default customers after considering the payment ability and payment intentions.

Loan Renewal

Many of our borrowers repay their loans and re-borrow at a later date, being referred to as a “loan renewal”. We consider a renewed loan a new loan, not a loan extension, despite our previous relationship with the borrower. Prior to the maturity date of the loan, the borrower may choose to apply to renew the loan. In order for the loan renewal application to be approved, the borrower must agree to repay the existing loan’s principal amount and accrued interest in full before the renewal application is approved. Although we do not have a specific clean-up period policy, we do require that the period of time between repayment of the existing loan and the funding of the new loan to be 2-10 days. As of December 31, 2017 and 2016, renewed loans constituted 2.5% and 0.00% of our total outstanding direct loan balance, respectively. During 2016, we did not approve any loan renewal.

Collection Procedure

We have standard collection procedures in our direct loan business. We call every borrower approximately 15 days prior to the maturity date to remind them that if we do not receive the repayment in full on the maturity date, we will send a written collection notice within 7 days after the maturity date. The Loan Officer will frequently call and make on-site visits to a borrower upon a loan going into default. Within 90 days after the default, our legal counsel will send warning letters to the default borrower. If the outstanding amount cannot be collected within 180 days after the maturity date and the parties could not reach an agreement on a specific repayment plan, we will initiate legal proceedings in the court.

We apply the same collection procedure in our guarantee business. The only difference is that we will collect from both the borrowers (including recovery from the cash deposit the borrowers deposit with us) and the counter-guarantor or pursue recovery from the collateral.

We will apply the same collection procedure in our financial leasing business.

Description of Our Financial Leasing Business

Target Customers

PFL plans to serve a diverse base of customers, including textile and other manufacturing companies, railroads, port facilities, local bus and rail companies and municipal governments. Customers will include existing clients of the Company in addition to new clients.

(1) Municipal Governments - Municipal governments throughout China have begun to realize the benefits of leasing equipment utilized to manage and run China’s large newly developed infrastructure. PFL believes this is an opportunity for substantial growth of its leasing business, especially as a result of the Company’s strong and long-term relationship with Wujiang and other Jiangsu municipal government agencies.

(2) Public Transportation Agencies - PFL plans to lease transportation vehicles to public transportation agencies which would replace existing municipally and regionally owned buses, subway cars, and trains. For example, PFL has been engaged in discussions with a local transportation authority to provide leases for the replacement of existing buses on several city bus routes.

| 12 |

(3) Hospitals - The Company has existing relationships with several local hospitals that are potential customers to lease medical devices, such as x-ray equipment. Since healthcare and medical technologies are constantly improving, frequently making existing medical technology and equipment obsolete, hospitals and other healthcare facilities are increasingly interested in leasing versus purchasing more modern equipment. The switch from one-time cash purchases to leasing will allow hospitals to preserve more of their working capital for other purposes, such as building upgrades, education and training programs and/or the leasing of additional equipment and devices.

(4) SMEs - PFL plans to lease a variety of industrial equipment and machinery to local SMEs in Jiangsu Province and beyond. Potential customers include local manufacturing businesses, mining companies, farmers and individuals. PFL initially targeted the Company’s existing SME lending clients since it has a relationship with these customers and understands their operational and credit history and financing needs.

As PFL’s business develops further, we expect to provide leases to customers in other sectors as opportunities arise. PFL, although not required by government mandate, will only lease to businesses that are within the sectors encouraged by the Chinese national industry development and planning policy and environmentally friendly businesses.

The two customers whom PFL provided financial leasing to during 2015 are local SMEs in the manufacturing industry. They are existing borrowers in our lending business. They paid off the outstanding principal and interest of their loans before the Company provided the financial leasing to them.

Leased Equipment

PFL plans to provide leases on both new and used manufacturing equipment, medical devices, transportation vehicles and industrial equipment, purchased both domestically and from foreign suppliers to meet its customer’s needs. PFL may attempt to import technologically advanced transportation vehicles, engines, other vehicular components, industrial equipment and machinery identified by its lessees. PFL anticipates its potential customers will have strong demand for imported technologically advanced equipment and machinery and expects to lease these to its customers at a significant premium due to the real and perceived technical and superior performance and durability characteristics of these imported products.

PFL leased manufacturing equipment to the two current customers.

Lease Underwriting

PFL underwrites the leases via a 3-step process:

(1) A potential customer applies to PFL for a lease on certain equipment that the customer has already identified from a seller;

(2) PFL performs a detailed legal and credit analysis to determine the potential customer’s creditworthiness and ability to make the lease payments; and

(3) If the application is approved, PFL will purchase the asset from the seller, take ownership of such asset, and then lease it to the customer/lessee. Sometimes PFL will require a third party guarantor, who must be pre-approved by PFL, who will guaranty the monthly payment obligations of the lessee.

The underwriting process takes approximately 2 weeks.

Lease Terms

The terms and conditions of the lease will generally include following:

(1) A lease term ranging between 3 and 10 years.

(2) The lessee will be required to pay 30% of the purchase price to the seller and PFL will pay 70% of the purchase price (which will be the lease value) to the seller.

(3) The lessee will pay a deposit equal to 10% of the lease value to PFL and PFL will finance the remaining 90%.

(4) The lessee will pay a one-time servicing fee equal to 1% of the total lease value multiplied by the number of years of the lease (for example, a four-year lease requires a 4% service fee.

(5) The lessee will make amortized lease payments consisting of principal and interest (generally at the interest rate of 12%), which will be due monthly or quarterly.

| 13 |

(6) Lessees must (i) operate the leased equipment and perform minimum maintenance in accordance with the manufacturer’s instructions during the entire term of the lease; (ii) insure the equipment against property and casualty loss; and (iii) make all scheduled lease and interest payment regardless of the performance of the equipment.

(7) At the end of the lease term, the lessee will have the option to purchase the leased asset for its residual value. We expect to enter into our boiler plate lease contracts with lessees. Pursuant to the terms of these lease agreements, lessee shall either pay RMB 1,000 (approximately $160) to acquire or automatically acquire the title of the leased assets at the end of the lease term. The buy-back purchase price of RMB 1,000 shall be paid along with the last installment of the rent.

Collateral and Default Assumptions

Some of PFL’s initial target customers are our direct loan customers. We are very familiar with these businesses and individuals and their growth prospects, credit worthiness, management teams, and profitability. We will take advantage of this knowledge and lease to creditworthy customers only, thereby potentially reducing defaults and bad debt expense. When evaluating potential customers with which we do not have a pre-existing relationship, we will utilize our prior experience in the risk assessment of lending clients to timely evaluate a new customer’s creditworthiness.

PFL may require a third party guarantor to reduce financial exposure in the event of a default. PFL may choose to work with a third party to assist with the repossession, storage and sale of the leased equipment in the event of lease defaults.

Risk Management

Credit Risk

As a microcredit lender, credit risk is the most significant risk for our business. In our direct loan business, we suffer financial loss when a borrower defaults and full collection cannot be achieved. In our guarantee business, in the event the borrower defaults in its payment obligation and we pay the lender on behalf of the borrower, we suffer financial loss when we cannot recover the full amount of the payment we paid to the lender (after collection from the cash deposit provided by the borrower) from the counter guarantor or the sale proceeds of the collateral. In our financial leasing business, we suffer financial loss when a lessee defaults while we are unable to lease the equipment at the same or better leasing terms in a timely manner.

Risk Assessment

We apply the same risk assessment approach and procedures for direct lending, guarantee as well as financial leasing activities. We have a dedicated Risk Department which assesses and evaluates the credit risks through in-house research and analysis. We follow the methodology and procedure outlined in our risk assessment guidelines. According to our risk assessment guidelines, the basic principle is that the bench mark ratio multiplied by the financial risk quotient and non-financial risk quotient and the result is the comprehensive risk ratio. The financial risk quotient takes into consideration 16 factors in three categories, i.e. leverage, profitability and growth. The non-financial risk quotient takes into consideration 12 factors in four categories, i.e. industry risk, enterprise risk, management risk and other risks. In summary, our Risk Department assesses the credit risks based on the payment ability of the underlying obligors, transaction structure as well as the industry of borrower and the general economic condition of the market in which we operate.

Risk Control

In our direct lending business, we assess, monitor and control the credit risks both before and after the loan is extended.

As discussed above, we assess the risks through the loan application, review and approval process. Our Risk Department quantifies the risks related to a loan application in a risk assessment report by classifying the loan into one of three categories. A loan with a score of less than 0.35 points is deemed to be a low-risk loan. A loan with a score of between 0.35 and 0.5 points is considered a medium-risk loan. A loan with a score higher than 0.5 points will be classified as a high-risk loan. We have higher requirements for the collateral and require the guarantor to be of higher payment capacity for loans labeled as higher risk.

| 14 |

After the loan or guarantee application is approved, we continue to monitor the credit risk. Our Loan Officers collect the borrower’s financial statements at the end of each quarter and conduct periodic field trips to the borrower’s facilities to observe its operation, sales, ability to make timely repayments, etc. Based on the Loan Officer’s report, the comprehensive risk ratio of each loan is reviewed on a quarterly basis and adjustments are made to the ratio as necessary, according to the borrower’s operational and financial position and other factors outlined above. We label each outstanding loan as “Good”, “Maintenance” or “Contraction”. For “Good” loans, we may extend further credit. For “Maintenance” loans, we will maintain the current credit level. For “Contraction” loans, we may reduce credit to the borrower.

We will apply the same risk control procedure for the financial leasing business.

Liquidity Risk

Liquidity risk is the risk to a bank’s earnings and capital arising from its inability to timely meet obligations when they come due without incurring unacceptable losses. As a microcredit company, we are prohibited by PRC banking regulations to accept deposits from the public. Our funding sources include our registered capital, draw-down ability from any lines of credit we have with state-owned or commercial banks as well as cash generated from our operations. Liquidity risk in our operation is therefore limited. We monitor the repayment of loans drawn from the line of credit with Agricultural Bank of China, the only line of credit we currently have.

Allowance for Loan Loss

Reserve for Direct Loan

In our direct loan business, we apply two loan loss reserve measurements:

| ● | Measurement 1 - The General Reserve: |

General reserves are is based on total loan receivable balance and to be used to cover unidentified probable loan loss. The management assessed the General Reserve is required to be no less than 1% of total loan receivable balance..

| ● | Measurement 2 - Special Reserve |

Special reserves are funds set aside covering losses due to risks related to a particular country, region, industry, company or type of loans. The reserve rate could be decided based on management estimate of loan collectability. The Loan portfolio did not include any loans outside of the PRC.

The allowance for loan losses is maintained at a level considered adequate to provide for losses that can be reasonably anticipated. Management performs a quarterly evaluation of the adequacy of the allowance. The allowance is based on the Company’s past loan loss history, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, the estimated value of any underlying collateral, composition of the loan portfolio, current economic conditions and other relevant factors. This evaluation is inherently subjective as it requires material estimates that may be susceptible to significant revision as more information becomes available.

The allowance is calculated at portfolio-level since our loans portfolio is typically of smaller balance homogenous loans and is collectively evaluated for impairment. Additionally, the management also reviewed the portfolio on a loan by loan basis and individually evaluated for impairment if any.

For the purpose of calculating portfolio-level reserves, we have grouped our loans into two portfolio segments: Corporate and Personal. The allowance consists of the combination of a quantitative assessment component based on statistical models, a retrospective evaluation of actual loss information to loss forecasts, value of collaterals and could include a qualitative component based on management judgment.

In estimating the probable loss of the loan portfolio, the Company also considers qualitative factors such as current economic conditions and/or events in specific industries and geographical areas, including unemployment levels, trends in real estate values, peer comparisons, and other pertinent factors such as regulatory guidance. Finally, as appropriate, the Company also considers individual borrower circumstances and the condition and fair value of the loan collateral, if any.

In December 2017, the Company revisited the classification of its loan portfolios within its rating system to test the adequacy of the allowances calculated thereby. As a result of such testing, the Company decided to reclassify certain loans into different categories. The Company reviewed the profile, financial condition and other relevant information and documents of each customer in the lending businesses. For customers with several loans with different due dates, if one loan was past due, the Company decided to reclassify all of this customer’s loans as past due (even the other loans that were not mature yet). For extended loans, the Company re-evaluated the customer’s repayment ability in a more cautions manner and reclassified the loans of customers without very strong financial condition into the past due category. These reclassifications affected numerous customer accounts.

| 15 |

As of December 31, 2017 and 2016, the total outstanding balance of loan receivable was and $40,678,314 and $58,522,981 and the allowance for loan losses was $36,613,393 and $51,708,062, respectively.

Reserve for the Guarantee Services.

A provision for possible loss to be absorbed by the Company for the financial guarantee it provides is recorded as an accrued liability when the guarantees are made and recorded as “Accrual for financial guarantee services” on the consolidated balance sheets. This liability represents probable losses and is increased or decreased by accruing a “(Provision)/ Reversal of provision for financial guarantee services” against the income of commissions and fees on guarantee services.

This is done throughout the life of the guarantee, as necessary when additional relevant information becomes available. The methodology used to estimate the liability for possible guarantee loss considers the guarantee contract amount and a variety of factors, which include, depending on the counterparty, latest financial position and performance of the borrowers, actual defaults, estimated future defaults, historical loss experience, estimated value of collaterals or guarantees the customers or third parties offered, and other economic conditions such as the economy trend of the area and the country. The estimates are based upon currently available information.

In December 2017, the Company revisited the classification of its guarantee portfolios within its rating system to test the adequacy of the allowances calculated thereby. As a result of such testing, the Company decided to reclassify certain guarantees into different categories. The Company reviewed the profile, financial condition and other relevant information and documents of each customer in the guarantee businesses. For customers with several guarantees with different due dates, if one guaranteed loan was past due, the Company decided to reclassify all of this customer’s guaranteed loans as past due (even the other loans that were not mature yet). These reclassifications affected numerous customer accounts. We engaged He-Partners Law Firm, one of the largest law firms in Suzhou City, to represent us in the legal proceedings against the borrowers and their counter guarantors, and expect to collect part of the outstanding balance in a period ranging from six months to one year upon adjudication by the court in favor of the Company. The timing of collection and ultimate amount of funds we can recover depend on a few factors, including the repayment ability of the borrower and their counter-guarantors, the execution time of the court, other obligations the borrowers have and priority over the claim for the Company.

As of December 31, 2017 and 2016, the total outstanding balance we guaranteed was and $11,627,013 and $10,893,089 and the accrual for financial guarantee services was $9,270,882 and $6,005,608, respectively.

Reserve for the Financial Leasing Services

A provision for possible loss to be absorbed by the Company for the financial leasing services it provides is recorded as an allowance against investment in direct financing lease. This liability represents probable losses and is increased or decreased by accruing a “Reversal of provision for direct financing lease losses” against the interests and fees on loans and direct financing lease.

This is done throughout the life of the financial lease service, as necessary when additional relevant information becomes available. The methodology used to estimate the liability for possible financial lease loss considers the lease contract amount and a variety of factors, which include, depending on the counterparty, latest financial position and performance of the borrowers, actual defaults, estimated future defaults, historical loss experience, estimated value of leased asset, and other economic conditions such as the economy trend of the area and the country. The estimates are based upon currently available information.

As of December 31, 2017 and 2016, the total outstanding balance we guaranteed was and $2,537,008 and $2,441,663 and the allowance for direct financing lease losses was $2,537,008 and $2,441,663, respectively.

Business Strategy

As we anticipate the economic condition will remain challenging in the next 12 months, the Company plans to continue to aggressively collect the default loans and guarantees with all available legal remedies.

| 16 |

Although we have continued to use our best effort to improve our collection of loan receivable and interest receivable by engaging local law firms in China, it has been very difficult for us to collect from the borrowers. As such, the Company has been actively seeking strategic acquisition of business or assets to improve our liquidity. Since the termination of the Exchange Agreement with Sorghum in last December, we have evaluated a few potential acquisition targets. As of now, the Company plans to acquire certain second-hand luxury cars dealer dealership business assets or other appropriate business deemed appropriate by the board of directors. As of the date of this Annual Report, the Company has not entered into any letter of intent or definitive agreement for such acquisition and there can be no assurance that we will be able to locate any target or negotiate definitive agreements with them.

Competition for Our Lending and Guarantee Business

The number of microcredit companies in China has been decreasing recently. According to data compiled by PBOC and released on its website released on its website, as of December 2017, there were approximately 8,551 microcredit companies in China compared to 8,910 in 2016. In Jiangsu province, there are about 636 microcredit companies with total paid-in capital of $13.90 billion (RMB 89.6 billion) as of December 31, 2017 according to PBOC.

Due to the poor economic condition in the Wujiang area, especially the slow-down in the local textile industry, many microcredit companies including most of our competitors went bankrupt since 2015. We believe currently we have only one competitor in the Wujiang region.

Competitive Strengths for Our Lending and Guarantee Business

We believe there are several key factors that will continue to differentiate us from other microcredit companies in the city of Wujiang.

| ● | Experienced Management Team. We have a senior management team that has time-tested, hands-on experience with a high degree of market knowledge and a thorough understanding of the lending industry in China. We believe that our management’s significant experience in the lending industry and our efficient underwriting process allow us to more carefully determine to whom to lend to and how to structure the loans. |

| ● | Early Entrance and Good Reputation. We are one of the first microcredit companies approved in the city of Wujiang region. We have strong brand recognition among the small borrowers in the city of Wujiang, which we believe should create a steady flow of business from borrowers. |

Competitive Weakness for Our Lending and Guarantee Business

We believe we are at a disadvantage to compete with peer-to-peer platforms and other online lending businesses. We are struggling with keeping with our borrower base in light of the sprouting online lending platforms which offer more diverse loan products with competitive prices. Such online platforms also have more efficient business models. Despite of the recent crackdown of these online platforms and tightened regulatory supervisions, we believe such online lending platforms pose serious threat to us.

Applicable Government Regulations