Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ZILLOW GROUP, INC. | d557189dex991.htm |

| 8-K - 8-K - ZILLOW GROUP, INC. | d557189d8k.htm |

April 12, 2018 Investor Update Call Exhibit 99.2

Select preliminary financial information and forward-looking statements This presentation contains select preliminary Q1 2018 financial information. This information is subject to change pending completion of our financial closing and review procedures, and the preliminary financial information presented here and actual financial results as reported in our Quarterly Report on Form 10-Q may differ materially. This presentation also contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties, including, without limitation, statements regarding our financial outlook, market opportunities, and operational plans for 2018. Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “will,” “projections,” “continue,” “business outlook,” “forecast,” “estimate,” “outlook,” “guidance,” or similar expressions constitute forward-looking statements. Differences in Zillow Group’s actual results from those described in these forward-looking statements may result from actions taken by Zillow Group, as well as from risks and uncertainties beyond Zillow Group’s control. Factors that may contribute to such differences include, but are not limited to, Zillow Group’s investment of resources to pursue strategies that may not prove effective; the impact of the real estate industry on Zillow Group’s business; Zillow Group’s ability to innovate and provide products and services that are attractive to its users and advertisers; Zillow Group’s ability to compete successfully against existing or future competitors; and the impact of pending litigation and other legal and regulatory matters. The foregoing list of risks and uncertainties is illustrative, but is not exhaustive. For more information about potential factors that could affect Zillow Group’s business and financial results, please review the “Risk Factors” described in Zillow Group’s Annual Report on Form 10-K for the year ended December 31, 2017 filed with the Securities and Exchange Commission, or SEC, and in Zillow Group’s other filings with the SEC. Except as may be required by law, Zillow Group does not intend, and undertakes no duty, to update this information to reflect future events or circumstances.

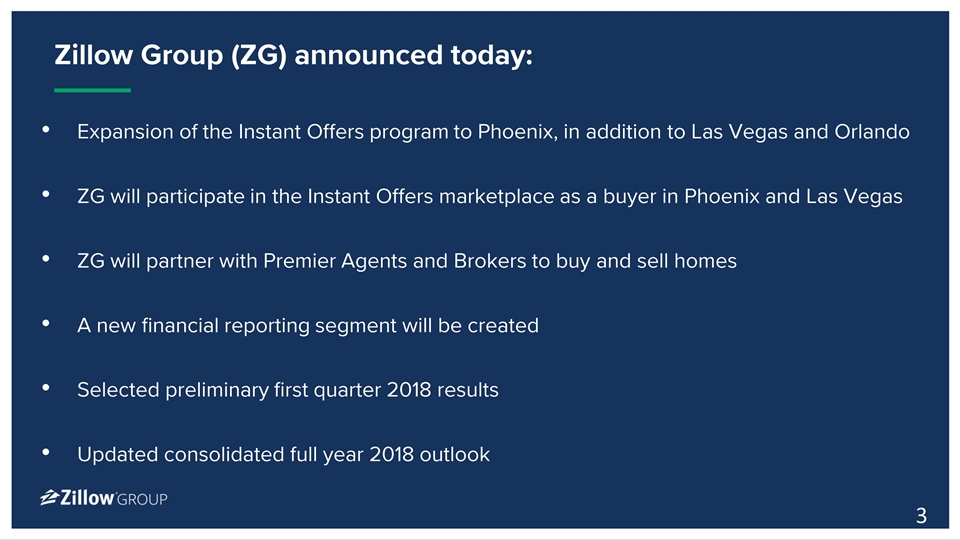

Zillow Group (ZG) announced today: Expansion of the Instant Offers program to Phoenix, in addition to Las Vegas and Orlando ZG will participate in the Instant Offers marketplace as a buyer in Phoenix and Las Vegas ZG will partner with Premier Agents and Brokers to buy and sell homes A new financial reporting segment will be created Selected preliminary first quarter 2018 results Updated consolidated full year 2018 outlook

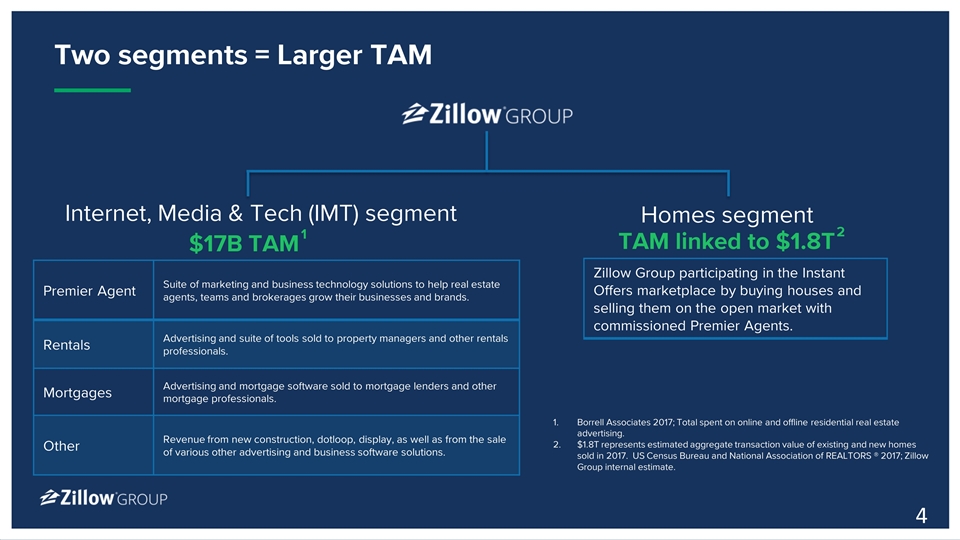

Two segments = Larger TAM Internet, Media & Tech (IMT) segment Homes segment Premier Agent Suite of marketing and business technology solutions to help real estate agents, teams and brokerages grow their businesses and brands. Rentals Advertising and suite of tools sold to property managers and other rentals professionals. Mortgages Advertising and mortgage software sold to mortgage lenders and other mortgage professionals. Other Revenue from new construction, dotloop, display, as well as from the sale of various other advertising and business software solutions. Zillow Group participating in the Instant Offers marketplace by buying houses and selling them on the open market with commissioned Premier Agents. TAM linked to $1.8T $17B TAM 1 2 Borrell Associates 2017; Total spent on online and offline residential real estate advertising. $1.8T represents estimated aggregate transaction value of existing and new homes sold in 2017. US Census Bureau and National Association of REALTORS ® 2017; Zillow Group internal estimate.

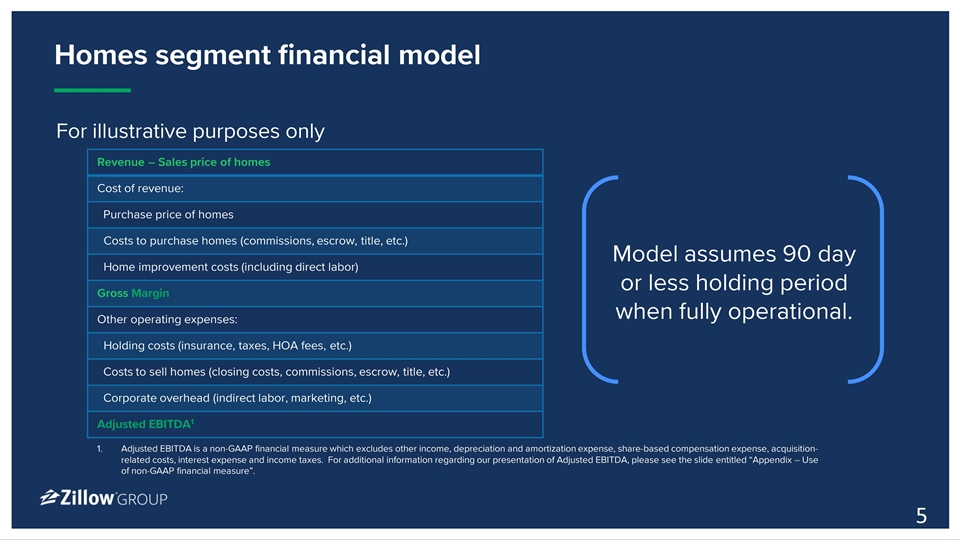

Homes segment financial model Revenue – Sales price of homes Cost of revenue: Purchase price of homes Costs to purchase homes (commissions, escrow, title, etc.) Home improvement costs (including direct labor) Gross Margin Other operating expenses: Holding costs (insurance, taxes, HOA fees, etc.) Costs to sell homes (closing costs, commissions, escrow, title, etc.) Corporate overhead (indirect labor, marketing, etc.) Adjusted EBITDA1 For illustrative purposes only Model assumes 90 day or less holding period when fully operational. Adjusted EBITDA is a non-GAAP financial measure which excludes other income, depreciation and amortization expense, share-based compensation expense, acquisition-related costs, interest expense and income taxes. For additional information regarding our presentation of Adjusted EBITDA, please see the slide entitled “Appendix – Use of non-GAAP financial measure”.

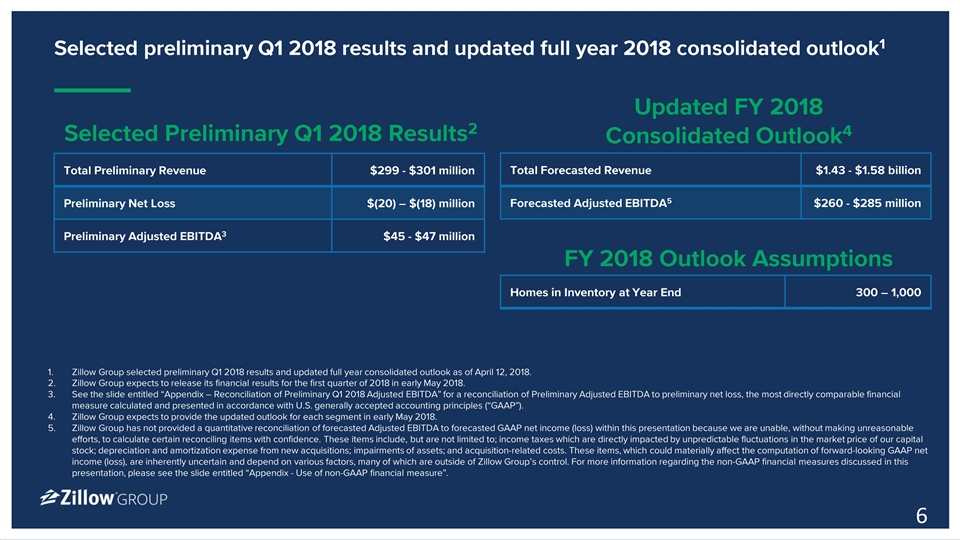

Selected preliminary Q1 2018 results and updated full year 2018 consolidated outlook1 Total Preliminary Revenue $299 - $301 million Preliminary Net Loss $(20) – $(18) million Preliminary Adjusted EBITDA3 $45 - $47 million Selected Preliminary Q1 2018 Results2 Total Forecasted Revenue $1.43 - $1.58 billion Forecasted Adjusted EBITDA5 $260 - $285 million Updated FY 2018 Consolidated Outlook4 Homes in Inventory at Year End 300 – 1,000 FY 2018 Outlook Assumptions Zillow Group selected preliminary Q1 2018 results and updated full year consolidated outlook as of April 12, 2018. Zillow Group expects to release its financial results for the first quarter of 2018 in early May 2018. See the slide entitled “Appendix – Reconciliation of Preliminary Q1 2018 Adjusted EBITDA” for a reconciliation of Preliminary Adjusted EBITDA to preliminary net loss, the most directly comparable financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Zillow Group expects to provide the updated outlook for each segment in early May 2018. Zillow Group has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this presentation because we are unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to; income taxes which are directly impacted by unpredictable fluctuations in the market price of our capital stock; depreciation and amortization expense from new acquisitions; impairments of assets; and acquisition-related costs. These items, which could materially affect the computation of forward-looking GAAP net income (loss), are inherently uncertain and depend on various factors, many of which are outside of Zillow Group’s control. For more information regarding the non-GAAP financial measures discussed in this presentation, please see the slide entitled “Appendix - Use of non-GAAP financial measure”.

Questions Questions may be submitted via Slido. We encourage you to visit www.slido.com where you can submit questions by entering the event code #ZHomes. Participants may vote on which submitted questions are prioritized to be answered on the call.

Appendix – Use of non-GAAP financial measure To provide investors with additional information regarding our financial results, this presentation includes references to Adjusted EBITDA (including forecasted Adjusted EBITDA), which is a non-GAAP financial measure. We have provided a reconciliation of preliminary Q1 2018 Adjusted EBITDA to preliminary Q1 2018 net loss, the most directly comparable GAAP financial measure, on the slide entitled “Appendix – Reconciliation of Preliminary Q1 2018 Adjusted EBITDA”. Adjusted EBITDA is a key metric used by our management and board of directors to measure operating performance and trends, and to prepare and approve our annual budget. The exclusion of certain expenses in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis. Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: -Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; -Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; -Adjusted EBITDA does not consider the potentially dilutive impact of share-based compensation; -Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; -Adjusted EBITDA does not reflect acquisition-related costs; -Adjusted EBITDA does not reflect interest expense or other income; -Adjusted EBITDA does not reflect income taxes; and -Other companies, including companies in our own industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net loss and our other GAAP results.

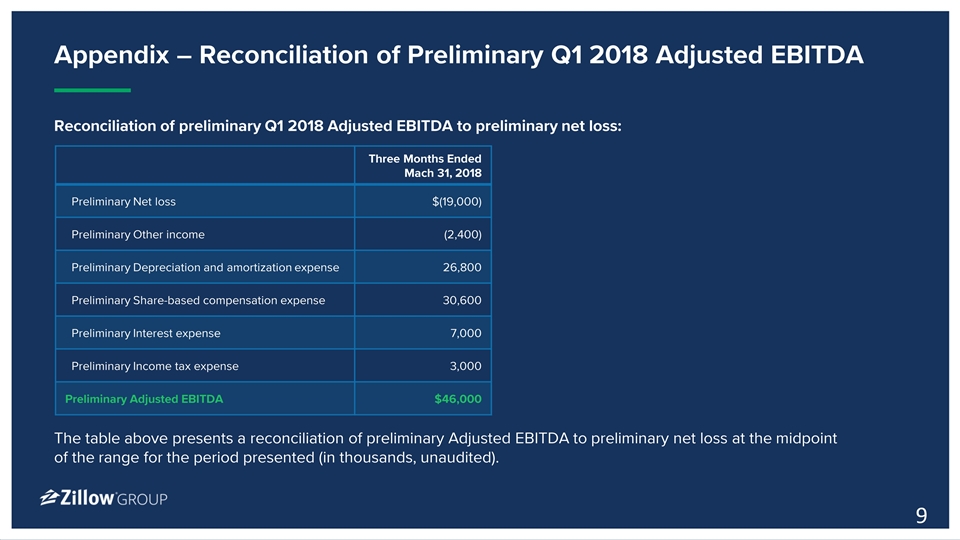

Appendix – Reconciliation of Preliminary Q1 2018 Adjusted EBITDA Three Months Ended Mach 31, 2018 Preliminary Net loss $(19,000) Preliminary Other income (2,400) Preliminary Depreciation and amortization expense 26,800 Preliminary Share-based compensation expense 30,600 Preliminary Interest expense 7,000 Preliminary Income tax expense 3,000 Preliminary Adjusted EBITDA $46,000 Reconciliation of preliminary Q1 2018 Adjusted EBITDA to preliminary net loss: The table above presents a reconciliation of preliminary Adjusted EBITDA to preliminary net loss at the midpoint of the range for the period presented (in thousands, unaudited).