Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Presbia PLC | lens-ex321_7.htm |

| EX-31.2 - EX-31.2 - Presbia PLC | lens-ex312_6.htm |

| EX-31.1 - EX-31.1 - Presbia PLC | lens-ex311_8.htm |

| EX-23.1 - EX-23.1 - Presbia PLC | lens-ex231_10.htm |

| EX-21.1 - EX-21.1 - Presbia PLC | lens-ex211_9.htm |

| EX-10.28 - EX-10.28 - Presbia PLC | lens-ex1028_756.htm |

| EX-10.27 - EX-10.27 - Presbia PLC | lens-ex1027_755.htm |

| EX-10.26 - EX-10.26 - Presbia PLC | lens-ex1026_798.htm |

Ch

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-36824

PRESBIA PLC

(Exact name of registrant as specified in its charter)

|

Ireland |

98-1162329 |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

Suite 7, Sandyford Office Centre, 17 Corrig Road, Sandyford

Dublin 18 Ireland

(Address of principal executive offices, including zip code)

Registrant’s Telephone Number, Including Area Code:

+353 (1) 551 1487

Securities registered pursuant to Section 12(b) of the Act:

|

Ordinary Shares, $0.001 Par Value |

The NASDAQ Capital Market |

|

(Title of each class) |

(Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

|

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s ordinary shares (the only common equity of the Registrant) held by non-affiliates for the last business day of the Registrant’s most recently completed second fiscal quarter: $10,932,997.

As of March 30, 2018, there were 17,121,857 ordinary shares outstanding.

PRESBIA PLC

2017 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

Item 1. |

2 |

|

|

Item 1A. |

26 |

|

|

Item 1B. |

53 |

|

|

Item 2. |

54 |

|

|

Item 3. |

54 |

|

|

Item 4. |

54 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

55 |

|

|

Item 6. |

55 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

56 |

|

Item 7A. |

64 |

|

|

Item 8. |

65 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

86 |

|

Item 9A. |

86 |

|

|

Item 9B. |

87 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

88 |

|

|

Item 11. |

92 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

99 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

101 |

|

Item 14. |

103 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

104 |

|

|

Item 16. |

104 |

|

|

105 |

||

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections of this Annual Report on Form 10-K titled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere in this Annual Report on Form 10-K. In some cases, you can identify forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” or “would,” and or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report on Form 10-K, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain.

The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements about:

|

|

• |

the timing, progress and results of our U.S. staged pivotal clinical trial and our regulatory submissions; |

|

|

• |

our ability to advance our microlens and successfully complete our U.S. staged pivotal clinical trial; |

|

|

• |

our ability to obtain pre-market approvals; |

|

|

• |

the commercialization of our microlens outside the U.S.; |

|

|

• |

our ability to continue as a going concern; |

|

|

• |

our anticipated cash needs and our needs for additional financing; |

|

|

• |

the implementation of our business model, strategic plans for our business, products and technology; |

|

|

• |

the scope of protection we are able to establish and maintain for intellectual property rights covering our products |

|

|

• |

estimates of our expenses, future revenues, capital requirements and our needs for additional financing; |

|

|

• |

the timing or likelihood of regulatory filings and approvals; |

|

|

• |

our financial performance; and |

|

|

• |

developments relating to our competitors and our industry. |

You should refer to “Part I, Item 1A. Risk Factors” of this Annual Report on Form 10-K for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Industry and Market Data

We obtained the industry and market data in this Annual Report on Form 10-K from our own research as well as from industry and general publications and surveys and studies conducted by third parties. Industry and general publications, studies and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. These third parties may, in the future, alter the manner in which they conduct surveys and studies regarding the markets in which we operate our business. As a result, you should carefully consider the inherent risks and uncertainties associated with the industry and market data contained in this Annual Report on Form 10-K, including those discussed in “Part I, Item 1A. Risk Factors.”

1

This Annual Report on Form 10-K includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this Annual Report on Form 10-K are the property of their respective owners. Our principal trademark or trade name that we use is PresbiaTM.

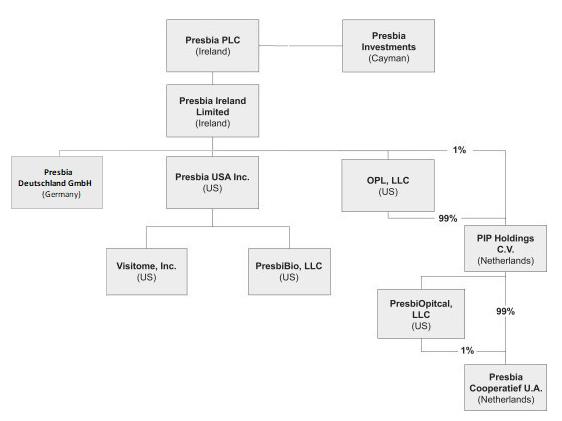

In January 2015, we completed a series of corporate reorganization transactions described in “Item 1. Business—Corporate History and Information,” which we refer to herein as the Reorganization Transactions. Unless we state otherwise, the terms “we,” “us,” “our,” “Presbia” and the “Company” refer to Presbia PLC and its consolidated subsidiaries after giving effect to the Reorganization Transactions. Prior to the completion of the Reorganization Transactions, the foregoing terms refer to the entities that became the consolidated subsidiaries of Presbia PLC upon consummation of the Reorganization Transactions.

Overview

We are an ophthalmic device company which has developed and is in the process of obtaining FDA approval for a proprietary optical lens implant for treating presbyopia, the age-related loss of the ability to focus on near objects. Our lens, which we refer to as our microlens, is a miniature lens designed to be surgically implanted in a patient’s eye to improve that patient’s ability to see objects at close distances. Our current strategy is to continue to commercialize our microlens in certain strategic countries where we currently have marketing approval and to obtain FDA approval for our microlens in the United States. Our goal is to become a leading provider of corneal inlay presbyopia-correcting treatment worldwide.

According to Market Scope, an ophthalmic market research organization, presbyopia is a common vision disorder that affects approximately 1.9 billion people worldwide. Presbyopia is associated with the inability of the eye’s natural lens to change shape, or accommodate, in order to see clearly objects in the near and middle distance ranges. According to Market Scope, the worldwide presbyopic population is expected to grow to approximately 2.1 billion by 2021. We believe that the optimum market for our microlens is the global emmetropic presbyopic market, which as an example, in the U.S., is estimated at 38% of the total U.S. presbyopic market, estimated at 119 million presbyopes. According to Market Scope, spending on devices, equipment and procedure fees for presbyopia-correcting surgery is expected to increase from approximately $476 million in 2015 to approximately $906 million in 2020 at the manufacturer level. We do not currently have marketing approval in many jurisdictions included in the foregoing global data, which jurisdictions collectively represent a majority of the worldwide presbyopic population, including the United States.

We believe that our solution offers each of the following benefits:

|

|

• |

our solution is intended primarily for emmetropic-presbyopes, or those individuals who suffer from presbyopia but do not have any other visual disorder, and it has also been used effectively after laser procedures. |

|

|

• |

our solution is also intended for plano-presbyopes, those who have had prior lens replacement procedures, and currently seek treatment for presbyopia. |

|

|

• |

our solution is minimally invasive; our microlens can be implanted and removed in simple, surgical procedures. |

|

|

• |

our solution offers significant near vision improvement with little or no loss of binocular distance visual acuity (the ability to see distant objects with both eyes without prescription enhancement) and minimal risk of adverse side effects. |

|

|

• |

our solution offers a wide range of corrective power, from +1.5 diopters to +3.5 diopters, in 0.25 diopter increments (a diopter is a unit of measurement of the optical power of a lens). |

|

|

• |

once implanted, our microlens is invisible to the naked eye. |

In addition, our microlens and the procedure to implant our microlens are not currently reimbursed through private or governmental third-party payors in any country, nor do we anticipate that they will be reimbursable in the foreseeable future. The commercialization of our microlens depends on a prospective patient’s ability to cover the costs of our microlens and the implantation procedure. We believe that a substantial portion of presbyopes worldwide do not have the financial means to cover the costs of our microlens, but we believe that a direct patient pay model enables medical providers to avoid pricing pressure from private or governmental third-party payors.

Our microlens procedure is performed using a 150 kilohertz or greater frequency femtosecond laser, which is a laser that is currently used in certain LASIK surgeries, cataract surgeries and cornea replacement surgeries. In commercializing our solution, we intend to target those markets with a well-established presence of ophthalmic clinics equipped with femtosecond lasers. We believe that the existing infrastructure in most such ophthalmic clinics is sufficient to make our solution an attractive opportunity for such ophthalmic

2

clinics and our commercialization strategy includes working closely with such ophthalmic clinics to train and qualify ophthalmic surgeons on the use of our solution.

Through our European Union CE Mark, we are generally authorized to market our microlens throughout the European Economic Area (all European Union member states plus Iceland, Liechtenstein and Norway), or “EEA”, and, through mutual recognition agreements, in Switzerland. We currently market our microlens in certain strategic EEA countries as well as certain strategic countries outside of the EEA in which we possess marketing approval, such as South Korea. Through February 2018, we have shipped approximately 2,200 of our microlenses to commercial partners outside of the United States, of which ophthalmic surgeons have implanted approximately 1,300. For geographic information regarding our revenues and long-lived assets, please see Note 11 to our audited financial statements included elsewhere in this Annual Report on Form 10-K.

We are presently seeking marketing approval in the United States. In order to commercialize our microlens in the United States, we must first obtain a premarket approval, or “PMA”, from the U.S. Food and Drug Administration, or the “FDA”. In December 2013, we received approval to commence a staged pivotal clinical trial as part of the FDA approval process. Beginning in May 2014, we enrolled a total of seventy-five (75) subjects at six (6) investigational sites in the U.S. and each subject underwent insertion of our microlens in the non-dominant eye. Based on nine-month data on fifty-two (52) subjects, in January 2015, we submitted an interim safety report as a supplement to our investigational device exemption, or IDE, to the FDA. In February 2015, we received approval from the FDA to commence second stage enrollment in this trial. In September 2015, we completed enrollment of the second stage study of 346 subjects at up to five (5) additional investigational sites. This trial is necessary in order to obtain clinical data to provide the primary support for a safety and effectiveness evaluation to support a PMA for commercial distribution in the U.S.. Data on a minimum of 300 subjects with 24-month data will be submitted as part of the PMA, and all subjects will be followed for three (3) years following implantation. We are pursuing a modular PMA submission strategy whereby we submitted to the FDA information regarding biocompatibility in the second quarter of 2016. We submitted to the FDA the second and third PMA modules in the first quarter of 2017, which contains information regarding preclinical testing, engineering and manufacturing. We are targeting submission to the FDA of our final PMA module, containing 24-month data on 300 subjects, in the second quarter of 2018. We are targeting PMA approval of our microlens in the fourth quarter of 2018. We are also targeting submission to the FDA of a final report with 36-month data on these 300 subjects in the fourth quarter of 2018.

The Eye and Vision Problems

The human eye is a specialized sensory organ capable of receiving visual images and transmitting them to the visual center in the brain. Among the main parts of the eye are the cornea, the iris, the lens and the retina. The cornea is the clear window in the front of the eye through which light first passes. The interior surface of the cornea is lined with a single layer of flat, tile-like endothelial cells, whose function is to maintain the transparency of the cornea. The iris is a pigmented muscular curtain located behind the cornea that opens and closes to regulate the amount of light entering the eye through the pupil, an opening at the center of the iris. The lens, known in medical terminology as the “crystalline lens,” is a clear structure located behind the iris that changes shape, or accommodates, to focus light on the back of the eye. The retina is a layer of nerve tissue in the back of the eye that senses the light image and transmits it to the brain via the optic nerve. The figure below illustrates certain elements of the basic anatomy of the human eye.

3

The eye may be affected by common visual disorders, disease or trauma. A normal, well-functioning eye receives images of objects at varying distances and focuses the images on the retina. Refractive errors (including myopia, hyperopia, presbyopia and astigmatism, each described below) occur when the eye cannot properly focus an image on the retina. In addition to presbyopia, common vision problems include:

|

|

• |

myopia, or nearsightedness, which occurs when the eye’s lens focuses images in front of the retina; |

|

|

• |

hyperopia, or farsightedness, which occurs when the eye’s lens focuses images behind the plane of the retina; |

|

|

• |

astigmatism, an optical defect in which vision is blurred due to an oval-shaped cornea or, in some cases, an oval-shaped natural lens, producing a distorted image on the retina. Astigmatism may accompany myopia or hyperopia; and |

|

|

• |

cataracts, a clouding of the lens, which worsens with time and gradually occludes incoming light images. |

Cataracts are mostly age-related, while myopia, hyperopia and astigmatism are not. The most common surgical treatment for myopia, hyperopia and astigmatism is LASIK surgery, in which the surface of the cornea is carefully mapped and then a computerized optical laser uses this mapping to reshape the surface of the cornea by ablation to permit proper focusing. Cataracts are most often treated by surgically removing the affected lens and replacing it with a monofocal or multi-focal IOL.

Presbyopia is an age-related refractive disorder that generally begins to develop when a person reaches the age of 40. The disorder may go unnoticed for several years after its initial onset and can worsen with age. The first symptoms of presbyopia are typically experienced when a person begins to have difficulty reading fine print. Presbyopia is associated with a loss of lens “elasticity,” the ability of the lens to change shape in order to focus incoming light on the retina from objects in near and middle distance ranges. Elasticity is slowly lost as people age, resulting in a slow decrease in the ability of the eye to focus on nearby objects. Presbyopia is a natural part of aging and affects substantially all people at some point in their adult lives.

Presbyopia Market

According to Market Scope, presbyopia currently affects approximately 1.9 billion people worldwide, or approximately 25% of the global population. According to Market Scope, the worldwide presbyopic population is expected to grow to approximately 2.1 billion people by the end of 2021. The global market opportunity for surgical treatment of presbyopia is large and growing due to the aging of the population. Globally, the median age is projected to increase from 29 years in 2011 to 38 years by 2050. Consistent with the expected growth in the worldwide presbyopic population, according to Market Scope, the annual number of presbyopia-correcting surgeries performed globally is expected to increase from approximately 712,000 procedures in 2015 to approximately 1.2 million procedures by 2020. According to Market Scope, corneal inlays are projected to be the fastest growing segment of this market and are expected to grow from approximately 18,000 procedures in 2014 to approximately 204,000 procedures in 2019. In addition, according to Market Scope, spending on devices, equipment and procedure fees for presbyopia-correcting surgery is expected to increase from approximately $476 million in 2015 to approximately $906 million in 2020 at the manufacturer level. We believe that the optimum market for our microlens is the emmetropic presbyopic market, which, as an example, in the U.S., is estimated at 38% of the total U.S. presbyopic population. We do not have marketing approval in many jurisdictions included in the foregoing global data, which jurisdictions collectively represent a majority of the worldwide presbyopic population. We have marketing approval in a number of strategic countries that we are targeting for commercialization and we are actively seeking marketing approval in the United States.

Approaches for Treating Presbyopia

Although reading glasses and contact lenses have historically been, and remain, the most common solution for presbyopia, there are significant drawbacks associated with these non-surgical approaches. Eyeglasses can easily be lost, misplaced, broken or scratched and require frequent cleaning. Also, many people wish to avoid the inconvenience of keeping reading glasses close at hand. Contact lenses require daily insertion, removal and maintenance, which can be problematic for an increasingly mobile population and for people living and working in dusty environments or in unsanitary conditions.

There are presently four surgical correction categories for treating presbyopia:

Monovision. Monovision treatments correct one eye, typically the dominant eye, for distance vision and correct the other, non-dominant eye for near vision. While monovision may be accomplished through the use of glasses with two different lenses with varying thickness, that approach can cause bothersome symptoms when a person looks through the edges of the glasses. A more typical approach to monovision is the use of two different contact lenses. A more permanent monovision approach is to undergo laser or IOL-based refractive surgeries adapted for presbyopia correction. A significant drawback of monovision surgical treatments is the complexity of achieving additional correction, if vision further deteriorates. Additional drawbacks include occasional patient adaptation issues, whereby patients have difficulty adjusting to the monovision arrangement and suffer from blurring of vision, difficulty driving at night and loss of stereopsis, or the ability to focus upon an object with both eyes and create a single stereoscopic image.

4

Multifocal. Multifocal approaches are designed to provide both distance and near focus at the same time in each eye. Generally, both depth perception, or the ability to judge the distance of an object, and contrast sensitivity, or the ability to detect detail having subtle color gradations, are generally improved when two eyes can focus on an object. In addition, these approaches are intended to be improvements over constantly taking glasses off and putting them back on (possibly by wearing glasses around the neck) or by using bifocal or varifocal glasses or contact lenses, in which the eye is trained to look through the top part for distance vision and the bottom part for near vision. Multifocal effects can be achieved by lens replacement, including multifocal IOLs (IOLs with different zones of varying power), or through the creation of a multifocal cornea using laser refractive surgery (to create two or more refractive zones on the central cornea) or intrastromal ablation (laser used to make small changes in the thickness of the cornea). As with monovision, a significant drawback of these multifocal approaches is the complexity of achieving additional correction, if vision further deteriorates. In addition, some patients may experience halos, or rings around lights, at night, and it may also take time for multifocal patients to adapt to the different focal areas.

Restoring Accommodation. Accommodating approaches generally attempt to replace the natural lens with an accommodating IOL, which is an artificial lens that is designed to mimic the movement of the natural crystalline lens of the eye. All IOL-based surgeries are susceptible to opacification, or clouding, of the lens capsule, which is the part of the natural lens covering that remains after surgery, decreasing vision and requiring a laser procedure to cut a hole in the clouded back lining of the lens capsule to allow light to pass through the membrane to the retina. Accommodating IOLs are also subject to certain other complications pertaining to the shrinkage, closure or clouding of the capsule that can reduce the mode of action of the accommodating IOLs, rendering them less effective. Other less common accommodating techniques include lens softening and scleral relaxation techniques, which are designed to improve near vision by restoring the function of the eye’s own accommodative system. Lens-softening techniques use pharmaceuticals or lasers to soften or change the structure of the natural crystalline lens, allowing it to flex better to increase accommodation. Scleral relaxation techniques use implants in the sclera of the eye to increase the eye’s ability to focus at near distances. To date, these procedures have had little documented success.

Corneal Inlays. Corneal inlays include miniature surgically implanted lenses (such as our microlens), optical devices inserted into the cornea to reshape the front surface of the eye, and small implants to reduce the size of the opening into the eye to reset the angle of the light rays entering the eye and reduce both the number of rays and the light scatter, each of which is designed to improve near vision.

Our Solution

We have designed our microlens to address certain limitations of other surgical approaches to treat presbyopia. The critical aspects of our solution include:

|

|

• |

Effective Treatment Option for Emmetropic Presbyopes. The largest sub-group of the presbyopic population is emmetropic presbyopes, or those individuals without significant refractive error who suffer from presbyopia. Emmetropic presbyopes account for approximately 38% of the total presbyopic population. We believe that ophthalmologists are generally reluctant to recommend a LASIK or IOL procedure as a solution for an emmetropic presbyope given the inherent risks and visual compromises of such procedures. Because our procedure does not involve the removal of the natural lens, the reshaping of the cornea or the removal of corneal tissue, we believe that ophthalmologists will be more likely to recommend our microlens as a solution for emmetropic presbyopes than a LASIK or IOL procedure. |

|

|

• |

Complementary Solution. While our solution is intended primarily for emmetropic-presbyopes, or those individuals who suffer from presbyopia but do not have any other visual disorder, it has also been used effectively on plano-presbyopes after laser procedures or lens replacement procedures for treatment of presbyopia. |

|

|

• |

Minimally Invasive. Our microlens is implanted in a pocket in the cornea created with a femtosecond laser. The pocket seals itself within a few days, holding the lens in place. The procedure does not require the reshaping of the cornea and no corneal tissue is removed. Moreover, the nature of our solution permits normal nutrient flow to the cornea, enabling corneal metabolism. As a result, there is less potential for dry-eye symptoms and less damage to the collagen fibers that support corneal shape and structure. |

|

|

• |

Correction Options. The range of optical power corrections available in our microlens allows the ophthalmic surgeon to choose the correction most appropriate for the patient’s specific near vision requirements, as opposed to a unilateral “one size fits all” approach. |

|

|

• |

Invisible. The clear nature of our microlens renders it invisible to the naked eye which we believe will make it appealing to patients. |

|

|

• |

Does Not Hinder Certain Other Procedures. Our microlens does not hinder examination of the retina and other structures in the eye necessary to diagnose other ocular health disorders. |

5

|

|

generally begin immediately after the surgery, with the immediate common side effects of such a procedure generally being mild eye dryness and irritation, transient elevated intraocular pressure due to standard post-surgery medication regimen, corneal haze (the activation of inflammatory cells in connection with surgery), transient light sensitivity (an abnormal occurrence of photosensitivity associated with the femtosecond laser) and certain visual symptoms, such as halos or glare. |

We believe that surgical treatment for presbyopia represents a large new market opportunity for ophthalmic surgeons. The market for traditional surgical ophthalmic treatments, such as LASIK for myopia, hyperopia and astigmatism, and traditional monofocal IOLs for cataracts, is highly mature. Our procedure utilizes the femtosecond laser currently used for certain LASIK surgeries, cataract surgeries and cornea replacement surgeries. We believe that many ophthalmic clinics equipped with such lasers are not operating at full capacity, and we hope to utilize such untapped capacity. Our procedure would allow these ophthalmic clinics and ophthalmic surgeons to introduce a new treatment modality using their existing laser equipment, adding incremental revenue without the need for significant new capital commitments.

We believe demand is likely to be fueled further by the ever-evolving, near-vision needs resulting from the increasing reliance on smart phones, tablets and other technological advances requiring good near vision.

Our Technology

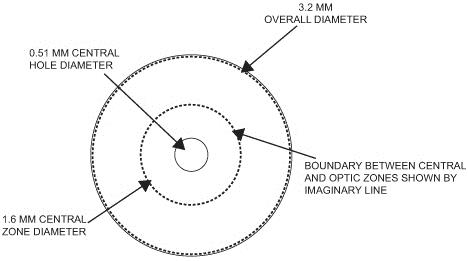

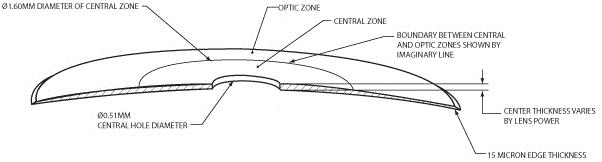

Our microlens is a disc shaped lens that has a refractive zone in the periphery designed to improve near vision problems associated with presbyopia. The two figures below illustrate the design of our microlens.

Our microlens is 3.2 millimeters (mm) in diameter, has an edge thickness of 0.015 mm and has a center thickness that ranges from approximately 0.03 mm to 0.05 mm (depending on the lens power). Once implanted, it is invisible to the naked eye. Our microlens is made of a hydrophilic acrylic material, similar to the kind that has been used to make IOLs for over 20 years. Our microlens is designed to be removable. In addition, our microlens is designed to reduce the risk of permanent corneal tissue loss and is designed to be biocompatible with the cornea, allowing for corneal metabolism, which is essential to the health and normal functioning of the cornea.

6

Ocular dominance is the tendency to prefer visual input from one eye to the other. Our microlens is implanted in a patient’s non-dominant eye to minimize impact to binocular uncorrected distance vision. Through implantation in the patient’s non-dominant eye, our solution seeks to exploit the brain’s ability to perceptually suppress central vision in one eye when the two eyes are receiving disparate stimuli and focus on the clearer images while ignoring the blurrier images. Prior to implantation, we require patients to wear a contact lens for near vision correction in their non-dominant eye for a minimum of five to seven days before insertion of our microlens in order to assess whether or not the patient is able to adapt to the change in the visual system. Not all prospective patients are able to adapt to the change in the visual system. Based on feedback that we have received from surgeons to date, we believe that approximately 40% of prospective patients who underwent monofocal contact lens correction in their non-dominant eye were unable to adapt to the change in the visual system and approximately 25% of prospective patients who underwent multifocal contact lens correction in their non-dominant eye were unable to adapt to the change in the visual system.

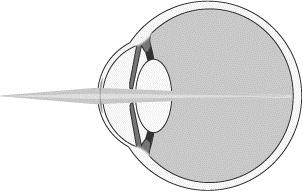

To improve near vision, as shown below, the refractive peripheral portion of our microlens is designed to help focus light from near objects (darker shaded light) onto the retina.

Near Vision with Microlens

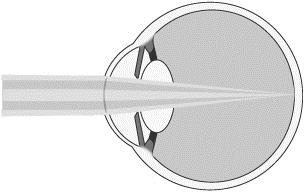

To improve maximum distance vision, the central refractive portion of our microlens is designed to permit light from distant objects to pass through the cornea and lens and focus on the retina (lighter shaded light shown below). The refractive peripheral portion of the lens causes some distant light rays to focus in front of the retina, instead of on it (darker shaded light shown below). However, when the brain receives dual visual stimulus from the corrected non-dominant eye, as well as the uncorrected dominant eye, it is able to correctly combine the information into an image for the patient.

Distance Vision with Microlens

Insertion of our Microlens

Our microlens is surgically implanted in an outpatient setting. The procedure, requiring only topical anesthesia, typically takes a trained ophthalmic surgeon approximately 10 minutes. The procedure and equipment needed to create a corneal pocket to insert the microlens are similar to those currently used in LASIK procedures. In addition to our microlens inserter, we believe that the existing infrastructure in most ophthalmic clinics equipped with femtosecond lasers and existing surgical tools in ophthalmic surgery clinics is sufficient for our procedure.

7

The ophthalmic surgeon starts the procedure by making a mark on the cornea at the center of the visual axes in order to determine the most appropriate location of the corneal pocket as well as the microlens placement and alignment once in place. Then, using a 150 kilohertz or greater frequency femtosecond laser, the ophthalmic surgeon creates a pocket, approximately four to 5.5 mm in diameter, in the cornea of the patient’s non-dominant eye. Using a microlens inserter, the ophthalmic surgeon then inserts our microlens into the corneal pocket. Finally, the ophthalmic surgeon centers and checks the position of the implanted microlens before completing the surgery. The corneal pocket automatically seals itself within a few days, holding the microlens in place at the center of the eye’s visual axis.

We have designed our microlens and procedure to be removable in a minimally invasive manner in the event that a patient wishes to have a stronger prescription microlens implanted. This may occur if a patient’s presbyopia significantly progresses over time or in the event that a patient wishes to have the microlens removed for any other reason, including if the patient is uncomfortable with the results, if neural adaptation is not achieved, or if technological advances produce alternative solutions in the future. In the United States, our IDE does not permit replacement of a microlens in the event that a patient’s microlens is removed after implantation. Also, in the United States, our IDE requires any removal of the microlens to be reported as an adverse event.

The procedure to remove our microlens may take place in an outpatient setting, using only topical anesthesia. The removal procedure consists of opening the corneal pocket entry point and, using a fluid to lubricate the pocket of the lens, sliding the lens from the corneal pocket. This procedure typically takes a trained ophthalmic surgeon approximately 10 minutes. A new microlens can be immediately inserted into a patient’s existing corneal pocket.

Through February 2018, we have shipped approximately 2,200 of our microlenses to commercial partners outside of the United States, of which ophthalmic surgeons have implanted approximately 1,300.

Clinical Studies

We have completed a multicenter clinical study outside the United States. In addition, several third parties have conducted limited studies of our microlens. These studies are summarized below.

Evaluation Conducted Outside of the United States

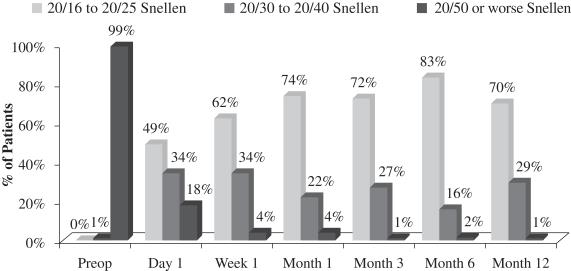

In early 2012, we completed a 12-month multicenter, post-market evaluation in Italy and Greece of our microlens in presbyopic patients between the ages of 45 and 60 to evaluate the safety and effectiveness of our microlens. We designed, and oversaw the implementation of, the protocol for this evaluation, which was conducted at our request by a surgeon at the Vardinoyannion Eye Institute at the University of Crete in Crete, Greece and by a surgeon at Prato Hospital in Prato, Italy. The 12-month data for the 70 patients who completed the study demonstrated successful patient outcomes and a low rate of post-operative adverse events. The average UCVA-near in the operated eye pre-surgery for those 70 patients was 20/110 and 99% of those patients started the study with UCVA-near in the operated eye of 20/50 or worse. Key effectiveness findings from this evaluation included the following:

|

|

• |

the average UCVA-near in the operated eye for such patients post-surgery was 20/27, 99% of such patients completed the study with 20/40 or better UCVA-near in the operated eye and 70% of such patients completed the study with 20/25 or better UCVA-near in the operated eye (see Figure 1 below); |

|

|

• |

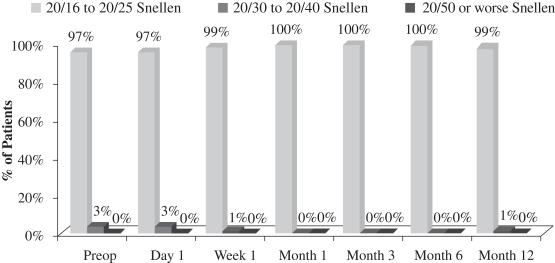

although there was a slight loss in uncorrected distance visual acuity (the ability to see distant objects without prescription enhancement), or UCVA-distance, in the operated eye (see Figure 4 below), there was no significant change in binocular UCVA-distance (UCVA-distance when using both eyes) from before treatment to after treatment in this study (see Figure 2 below); and |

|

|

• |

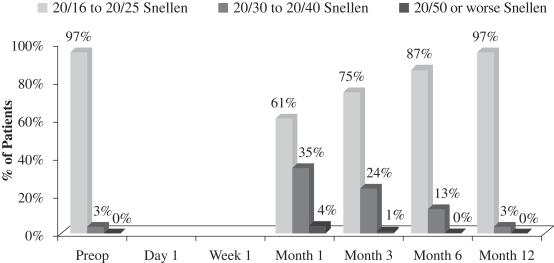

there was no significant change in best corrected distance visual acuity (distance vision using prescription enhancement), or BCVA-distance, in the operated eye after 12 months (see Figure 3 below). |

A Snellen chart is an eye chart used by eye care professionals and others to measure visual acuity. It usually consists of letters printed in lines of decreasing size which a person is asked to read at a fixed distance. 20/20 is a term used to define normal visual acuity, which relates to the Snellen chart. The first number denotes a certain distance, and the second number denotes the distance at which a person with normal visual acuity could read clearly those letters that the subject of the assessment can read clearly at the distance denoted in the first number. The standard distance for testing distance visual acuity is 20 feet. Thus, with respect to distance vision, if an individual has 20/100 vision, it means that a person with normal distance vision can read at 100 feet what the patient can only read at 20 feet (poor distance vision). 20/10 vision, on the other hand, would mean the individual has better than normal distance vision, being able to read at 20 feet what a person with normal distance vision could only read at 10 feet. With respect to near vision, the 20/20 nomenclature is used with the distances in the first number and the second number scaled to the distance used in the study. Thus, an individual with 20/20 near vision means the patient can read clearly those letters at the distance tested (usually 40 centimeters (cm) in the United States and 33 cm outside of the United States) that a person with normal near visual acuity could read clearly at that

8

distance. In our post-market evaluation, we tested visual acuity using an Early Treatment Diabetic Retinopathy Chart, or ETDRS, Snellen chart; the distance used to test distance visual acuity was 20 feet and the distance used to test near visual acuity was 33 cm.

An important measurement is the number of patients who reach better visual acuity levels, or visual correction, after treatment. Before surgery, the 70 patients who completed the study had an average UCVA-near in the eye to be operated on of 20/110 and 99% of such patients started the study with UCVA-near measurements of 20/50 or worse in that eye. After treatment with our microlens, such patients had an average UCVA-near in the operated eye of 20/27 and 99% of such patients achieved UCVA-near measurements of 20/40 or better in the operated eye and 70% of such patients achieved UCVA-near measurements of 20/25 or better in the operated eye. The following chart summarizes the positive UCVA-near results in this post-market evaluation:

Figure 1

Uncorrected Near Visual Acuity Operated Eye (33 cm chart)

(N=70 at Month 12)

Another important measurement is the number of patients who maintain binocular UCVA-distance levels post-treatment. There was no significant change in binocular UCVA-distance from before treatment to after treatment in this study. This stability in binocular vision is important because it indicates that patients in the study did not experience a significant compromise in binocular UCVA-distance as a result of the insertion of our microlens, meaning that their normal binocular far vision was not compromised. The following chart summarizes the binocular UCVA-distance findings in this post-market evaluation:

9

Uncorrected Binocular Distance Visual Acuity

(N=70 at Month 12)

In addition, patients in this study experienced no significant change in BCVA-distance in the operated eye at 12 months post-implantation, which indicates that there was no compromise in the operated eye’s optical system at 12 months. The following chart summarizes BCVA-distance findings with respect to the patient’s operated eye in this post-market evaluation:

Figure 3

Best Corrected Distance Vision Acuity Operated Eye

(N=70 at Month 12)

10

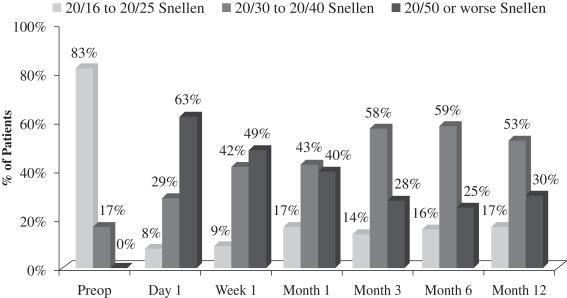

There was a slight loss of UCVA-distance in the operated eye in the study population. Before surgery, 83% of patients achieved UCVA-distance in the operated eye of 20/16 to 20/25 and 17% achieved UCVA-distance in the operated eye of 20/30 to 20/40. After treatment with our microlens, 17% of patients achieved UCVA-distance in the operated eye of 20/16 to 20/25, 53% achieved UCVA-distance in the operated eye of 20/30 to 20/40, and 30% achieved UCVA-distance in the operated eye of 20/50 or worse. Although, as mentioned above, there was no significant change in binocular UCVA-distance from before treatment to after treatment in this study, far distance vision in the operated eye is also important, particularly as it relates to overall patient satisfaction. In the study population, 78% of patients who responded reported that they perceived their UCVA-distance in the operated eye as “excellent” to “good.” This generally correlates to the data at month 12, where 70% of patients achieved 20/40 vision or better in the operated eye. The remaining 30% of patients achieved UCVA-distance in the operated eye of 20/50 or worse, and consistent with such results, 20% of patients who responded reported that they perceived their UCVA-distance in the operated eye as “fair.” One patient who responded considered his outcome with respect to UCVA-distance in the operated eye as “poor.” The following chart summarizes UCVA-distance findings with respect to the patient’s operated eye in this post-market evaluation:

Figure 4

Uncorrected Distance Visual Acuity Operated Eye

(N=70 at Month 12)

There are several possible explanations for the loss of distance visual acuity in the operated eye, including, but not limited to the following:

|

|

• |

the time required for neural adaptation, or the time it takes the brain to adapt to the change in the visual system; |

|

|

• |

improper patient selection, or the selection of patients who are intolerant of monovision, impatient or not willing to wait for the neural adaptation time period; and |

|

|

• |

improper lens power selection, meaning the patient is difficult to refract. |

11

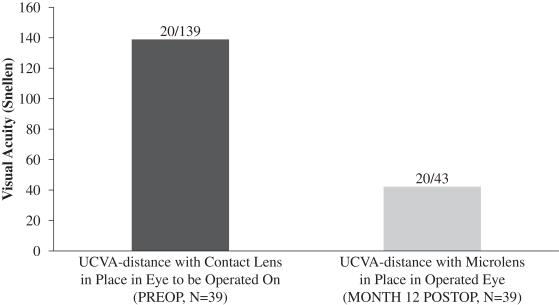

A subset of 39 patients enrolled in this evaluation underwent a monovision simulation, whereby pre-surgery UCVA-distance in the eye to be operated on with near vision contact lens correction in place was compared to UCVA-distance in the operated eye following implantation of our microlens. The purpose of this simulation was to evaluate whether UCVA-distance in the operated eye following implantation of our microlens is better than pre-surgery UCVA-distance in such eye with the use of a near vision correction contact lens. These patients were found to have an average UCVA-distance in the operated eye of 20/43 12 months post-surgery, while the same patients pre-surgery had an average UCVA-distance in the eye with near vision contact lens correction of 20/139. We believe that this result is due to the nature of the design of our microlens which is intended to maintain distance vision in the operated eye to the greatest extent possible. The central portion of our microlens is designed to allow for light from distant objects to enter the eye and focus on the retina, and the retina ultimately transmits that image to the brain. Figure 5 below illustrates the findings in this evaluation with respect to post-surgery UCVA-distance in the operated eye compared to pre-surgery UCVA-distance in the eye to be operated upon with near vision contact lens correction in place:

Figure 5

Overall, patient satisfaction with the procedure was generally high. 97% of patients who responded reported “excellent” or “good” perception of UCVA-near, and 97% of patients who responded reported “excellent” or “good” perception of binocular UCVA-distance. 75% of patients who responded reported no use of glasses for near tasks while the remaining 25% reported use of glasses less than 50% of the time. 78% of patients who responded indicated that they used glasses for near tasks more than 50% of the time prior to implantation.

Key safety findings from the evaluation over a 12-month period included the following:

|

|

• |

low rate of post-operative adverse events; |

|

|

• |

one patient complained one week after implantation of significant halos and glare when driving at night and requested removal of the microlens (the lens was removed one month post-surgery); |

|

|

• |

one case of transient light sensitivity syndrome was reported: this represents an abnormal occurrence of photosensitivity associated with the femtosecond laser, which resolved after application of a topical steroid regimen; |

|

|

• |

one case of epithelial ingrowth was reported: this represents an abnormal growth of corneal epithelium in an area where it does not belong, associated with the femtosecond laser, which resolved after the ingrowth was surgically cleared; and |

|

|

• |

four cases of transient stromal haze were reported: these cases involved the activation of inflammatory cells in connection with surgery, which resolved after application of a topical steroid regimen. |

There was no significant change in:

|

|

• |

intraocular pressure, or the fluid pressure in the eye; |

|

|

• |

endothelial cell density, or the tissue layer undersurface of the cornea and which regulates corneal water content; |

12

|

|

• |

binocular contrast sensitivity. |

We continue to evaluate our microlens through clinical studies and marketing and post-marketing evaluations in connection with regulatory requirements and our commercialization efforts. In addition, through February 2018, we have shipped approximately 2,200 of our microlenses to commercial partners outside of the United States, of which ophthalmic surgeons have implanted approximately 1,300.

Third Party Studies

Our microlens has been the subject of certain third party studies that have been conducted to assess the effectiveness and safety of our microlens. We did not commission these studies or design, review or oversee the implementation of their protocols (although we paid the annual fees of the institutional review board, or “IRB”, reviewing one such study in Japan), and we have limited information with respect to these studies. These studies have reported certain adverse effects relating to the safety and effectiveness of our microlens. In connection with the findings in certain of such studies and observations of other surgeons regarding our procedure, we have undertaken certain investigative actions as part of our ongoing risk mitigation efforts. See “Risk Factors—Risks Related to Our Business—If concerns regarding side effects from presbyopia-correcting surgery generally, or our products specifically, develop, including as a result of third-party studies and publications, our business, results of operations and financial condition will be materially and adversely affected.”

U.S. Staged Pivotal Clinical Trial

In May 2014, we began a staged pivotal clinical trial to seek marketing approval for our microlens in the United States. See “Clinical Development and Commercialization Targets” below for a description of this study. For a description of adverse events to date in this study, see “Risk Factors—Risks Related to Our Business—If concerns regarding side effects from presbyopia-correcting surgery generally, or our products specifically, develop, including as a result of third-party studies and publications, our business, results of operations and financial condition will be materially and adversely affected.”

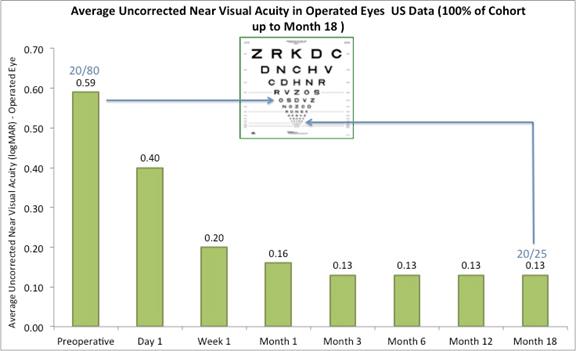

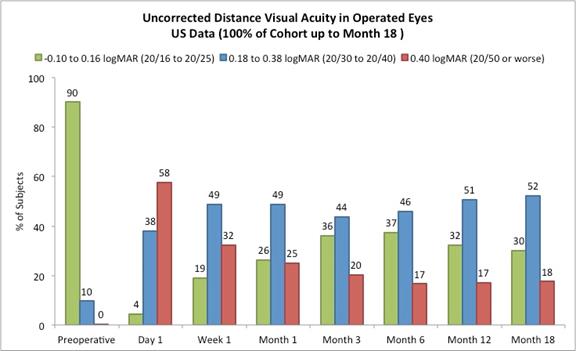

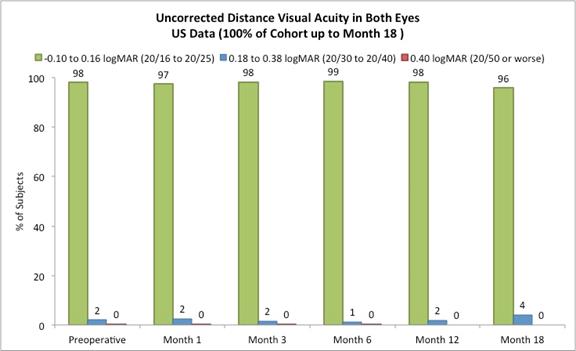

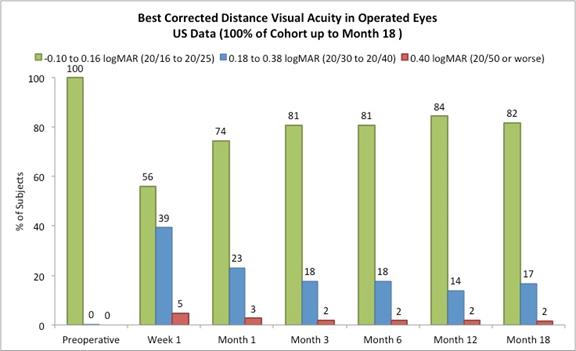

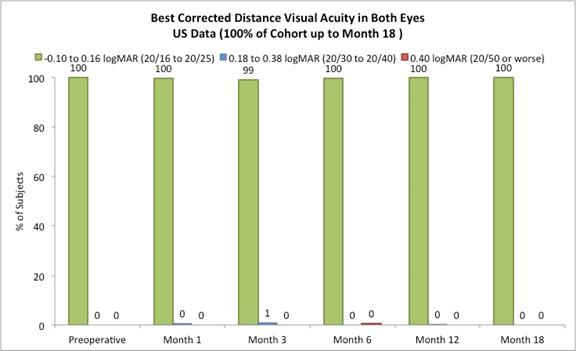

On May 23, 2017, we reported the following data from our U.S. staged pivotal clinical trial. Through May 19, 2017, 421 subjects had undergone insertion of the Company’s microlens during the staged pivotal clinic trial that the Company is performing to obtain the clinical data required to enable the Company to obtain pre-market approval from the FDA. Data (representing 100% of the study cohort at month 18 and excluding subjects who had the Microlens explanted or those that did not return for scheduled trial visits and considered lost to follow-up) made available to the Company in May 2017 indicates that:

|

|

• |

Subjects gained an average of 5 lines of uncorrected near visual acuity (the ability to see close objects without prescription enhancement) in treated eyes (Figure A). |

|

|

• |

Approximately 82% of subjects achieved 20/40 or better uncorrected distance vision in treated eyes (Figure B) and there was little to no change in binocular uncorrected distance vision from preoperative values (Figure C), and |

|

|

• |

Approximately 98% of subjects achieved 20/40 or better best corrected distance vision in the treated eyes (Figure D) and there was little to no change in binocular best corrected distance vision from preoperative values (Figure E). (Presbia Flexivue MicrolensTM is designed to take advantage of binocular vision. Most patients have the ability to fuse images in the brain from each eye to ensure the best image. This process is known as “neuroadaptation.”). |

13

The following chart summarizes the uncorrected near visual acuity in the treated eyes:

Figure A

The following chart summarizes the uncorrected distance vision in the operated eyes:

Figure B

14

The following chart summarizes the binocular uncorrected distance visual acuity:

Figure C

The following chart summarizes the best corrected distance vision in the operated eyes:

Figure D

15

The following chart summarizes the binocular best corrected distance vision:

Figure E

Notwithstanding these results, we cannot assure you when or whether the Company will obtain pre-market approval, or what expenditures the Company will incur whether or not we obtain such approval, given the many significant risks associated with seeking such an approval from the FDA. Furthermore, certain adverse events have been reported as part of the on-going staged pivotal clinical trial. For a discussion of previously reported adverse events, please see the risk factors, including the risk factor titled “If concerns regarding side effects from presbyopia correction surgery generally, or our products specifically, develop, including as a result of third-party studies and publications, our business, results of operations and financial condition will be materially and adversely affected.”, in the Company’s annual report on Form 10-K for the year ended December 31, 2017.

The Company requires PMA approval in order to market its products in the United States.

To date, 100% of the subjects have passed through the 24-month post-operative visit. We are in the process of analyzing this data and preparing to submit to the FDA. We are targeting submission to the FDA of our final PMA module, containing 24-month data, in the second quarter of 2018. We do not expect to disclose any additional clinical data until we have received FDA approval or feedback on our fourth module PMA submission.

Clinical Development and Commercialization Targets

In December 2013, we received approval from the FDA to commence a staged pivotal clinical trial of our microlens in the United States. This clinical trial is a prospective, non-randomized, unmasked, multicenter clinical investigation. Beginning in May 2014, we enrolled a total of 75 subjects at six investigational sites in the United States. Beginning in June 2014, each of these subjects underwent insertion of our microlens in the subject’s non-dominant eye. Based on six-month data on 52 of these subjects, in January 2015, we submitted to the FDA an interim safety report as a supplement to our IDE. In February 2015, we received approval from the FDA to commence second stage enrollment in this trial. Through February 15, 2018, 346 subjects have undergone insertion of our microlens in the second stage of this study. All subjects will be followed for three years following implantation. Subjects from outside the United States are not enrolled in this study. The primary endpoint is UCVA-near at 24 months post- implantation, together with safety objectives such as a low rate of ocular adverse events, endothelial cell loss over time in the operated eye, and an assessment of BCVA-distance and contrast sensitivity in the operated eye (the visual ability, with distance vision correction in place, to see objects that may not be outlined clearly or that do not stand out from their background). Although our microlens is designed to be removable, our IDE requires any removal to be reported as an adverse event. We are pursuing a modular PMA submission strategy whereby we submitted to the FDA information regarding biocompatibility in the second quarter of 2016. We submitted to the FDA the second and third PMA modules in the first quarter of 2017, which contains information regarding preclinical testing, engineering and manufacturing. We are targeting submission to the FDA of our final PMA module, containing 24-month data, in the second quarter of 2018. We are targeting PMA approval of our microlens in the fourth quarter of 2018. We are also targeting submission to the FDA of

16

a final report with 36-month data on all available subjects in the fourth quarter of 2018. These milestones could be delayed by further interactions with the FDA or by a variety of other factors, including the final design of the study that is approved by the FDA, and are subject to risks and uncertainties. There can be no assurance that the FDA will grant our PMA approval or, if granted, that it will be granted in accordance with our anticipated time schedule. In addition, the FDA may require us to conduct post-approval studies as a condition of approval.

Outside of the United States, we plan to focus our commercialization and ongoing clinical trials in Germany and South Korea.

Strategy

Our goal is to become the leading provider of corneal lens implants for patients with presbyopia, which includes obtaining regulatory approval of the Flexivue Microlens from the FDA and, through our European CE Mark, selective commercialization and ongoing clinical trials in Germany and South Korea.

U.S. Staged Pivotal Clinical Trial

Gaining approval to market our products in the United States is a critical element in our strategy. In order to obtain such approval, we must obtain a PMA from the FDA. We cannot assure you when or whether we will obtain such an approval, or what expenditures we will incur whether or not we obtain such approval, given the many significant risks associated with seeking such an approval from the FDA.

International Commercialization

By affixing the Conformité Européene mark, or European Union CE Mark, to the products, we are authorized to market the Flexivue microlens throughout the EEA and, through mutual recognition agreements, in Switzerland (certain EEA countries also require additional in-country registration).

On December 10, 2017, our board of directors approved the re-ordering of the Company’s operational priorities, focusing its resources on FDA approval of its microlens and ongoing clinical trials and commercialization efforts in Germany and South Korea. These actions reduce the pre-FDA approval marketing, manufacturing and engineering expenses associated with the post-FDA approval U.S. commercial launch of our microlens.

Sales & Marketing

We intend to utilize a direct selling structure unless a country requires us to sell through a distributor, agent or we determine that a distributor/agent will offer us a more effective path to commercialization. We have a focused team consisting of our European commercial vice president, our clinical services director, clinical application specialists and surgical trainers. Our microlens and the procedure to implant our microlens are not currently reimbursed through private or governmental third-party payors in any country, nor do we anticipate that our microlens and the procedure to implant our microlens will be reimbursable through private or governmental third-party payors in the foreseeable future. Although the commercialization of our microlens depends on a prospective patient’s ability to cover the costs of our microlens and the implantation procedure and we believe that a substantial portion of presbyopes worldwide do not have the financial means to cover the costs of our microlens, we believe that a direct patient-pay model enables medical providers to avoid pricing pressure from private or governmental third-party payors. We do not have control over the prices that medical providers charge patients for our microlens and the implantation procedure.

Research and Development

We remain focused on advancing our technology and continuing to improve our microlens. We maintain an active internal research and development process, which also includes clinical activities and regulatory affairs. We expended $7.1 million and $5.5 million for research and development during the years ended December 31, 2017 and December 31, 2016, respectively.

Intellectual Property

Our commercial success depends, in part, on our ability to obtain and maintain proprietary protection for our products, technologies and other know-how, to operate without infringing the proprietary rights of others and to prevent others from infringing on our proprietary rights. We strive to protect our investment in the research, development, manufacturing and marketing of our products through the use of patents, trademarks, copyrights and trade secrets, as well as customary confidentiality and other contractual protections. We own intellectual property related to refractive powered inlays to treat presbyopia. We believe that our intellectual property portfolio, specifically the patents therein, also gives us the ability to expand into broader vision correction solutions if we so

17

decide. However, the extent to which our intellectual property will provide us with protection and enable us to commercialize our proprietary technology without interference from others is subject to numerous risks. See “Risk Factors—Risk Relating to Our Intellectual Property.”

Patents

We currently own six issued U.S. patents, and four pending U.S. patent applications, all of which we consider material to our business. Three of our existing patents relate to our microlens inserter and corresponding methods of use; these patents expire in 2030 or 2031. Two additional patents relate to the method and apparatus to package and transport our microlens, making it readily accessible; these patents expire in 2030. The other patent relates to a method that can be used by a laser to cut a pocket in the cornea and insert the microlens; this patent expires in 2028. Our four pending applications relate to a method and apparatus to package and transport our microlens, to an extension of the method for laser cutting a corneal pocket to insert our microlens, to the apparatus and method to use a preloaded inserter to insert our microlens, and a system for inserting our intracorneal lens.

Additionally, we have a total of 33 foreign patent applications, 27 of which are still pending in Australia, Brazil, Canada, China, Europe, Israel, Hong Kong, India, Japan, Korea and Russia. The foreign applications correspond to the content of the six issued U.S. patents. We currently own a patent in Canada, which corresponds to the U.S. patent which covers the method and apparatus to insert our microlens, and we have granted applications in Israel and China which correspond to the same U.S. patent. We also own patents in Japan and Australia, which correspond to the U.S. patent which covers the microlens inserter.

Our patents and patent applications may allow us to exclude others from practicing our proprietary inventions and may provide us with an opportunity to obtain royalties or cross-licenses of intellectual property from other manufacturers. Because we have limited knowledge of the research and development efforts and strategic plans of our competitors, we can only estimate the value of our patents and patent applications. Competitors may be able to design products and/or processes that avoid infringing our patent portfolio as it may exist from time to time. We may choose to abandon any of our issued or pending U.S. and/or foreign patents and/or patent applications that no longer match our commercialization and IP strategy.

Trademarks

Worldwide, we have several registered trademarks and pending trademark applications that we consider to be important to our business. The scope and duration of trademark protection varies widely throughout the world. In some countries, trademark protection continues only as long as the mark is used. Other countries require registration of trademarks and the payment of registration fees. Trademark registrations are generally for fixed but renewable terms.

Confidentiality Agreements

We protect our proprietary technology, in part, through confidentiality and nondisclosure agreements with employees, consultants and other parties. Our confidentiality agreements with employees and consultants generally contain standard provisions requiring those individuals to assign to Presbia, without additional consideration, inventions conceived or reduced to practice by them while employed or retained by Presbia, subject to customary exceptions.

Competition

The medical device industry in general, and the ophthalmic medical device market in particular, are highly competitive, subject to rapid technological change and significantly affected by new product introductions and market activities of other participants. Our currently marketed products are, and any future products we commercialize will be, subject to intense competition.

We expect to compete against companies that are developing corneal inlay surgical solutions for presbyopia, such as the KAMRA lens owned by Sightlife Surgical Inc., which acquired the product from AcuFocus, Inc. in March 2018. The KAMRA corneal inlay attempts to use small aperture optics to reduce distortion by eliminating peripheral light rays and limiting the width of diverging light rays. The KAMRA completed pivotal clinical trials in the U.S. and received FDA approval in April 2015. LensGen, Inc. is a newer company with little publicly available information regarding its intraocular lens which is being designed to harness fluidics and displacement to manipulate curvature to better capture light. ReVision Optics, Inc., which developed a corneal inlay solution and received FDA approval in June 2016, discontinued commercial activity in February 2018. Refocus Group, Inc. has developed the VisAbility Micro-Insert System, a procedure performed on both eyes and consisting of micro implants inserted just below the surface of the eye. Refocus Group, Inc. submitted its final module to the FDA for pre-market approval of the VisAbility Micro-Insert System in December 2017. The KAMRA corneal inlay, like the Presbia microlens, has marketing approval in certain jurisdictions outside the United States, including the EEA, and can be expected to compete with Presbia in such jurisdictions. However, we believe our microlens is less cosmetically conspicuous than the KAMRA and offers a wider range of optical power corrections.

We expect to compete against companies that offer alternative surgical treatment methodologies, including monovision, multifocal and accommodating approaches, and companies that promote reading glasses and/or contact lenses as approaches for responding to

18

presbyopia. At any time, our known competitors and other potential market entrants may develop new devices or treatment alternatives that may compete directly with our products. In addition, they may gain a market advantage by developing and patenting competitive products or processes earlier than we can or by obtaining regulatory approvals/clearances or market registrations more rapidly than we can.

Certain of our current and potential competitors may have significantly greater financial, technical, marketing and other resources than we do and may be able to devote greater resources to the development, regulatory approval, promotion, sale and support of their products. Our competitors may also have more extensive customer bases and broader customer relationships than we do, including relationships with our potential customers. In addition, many of these companies have longer operating histories and greater brand recognition than we do. Because of the size of the presbyopia market and the high growth profile of that market, we anticipate that companies will dedicate significant resources to developing competing products. We believe that the principal competitive factors in our market include:

|

|

• |

improved outcomes for patients and other product quality issues; |

|

|

• |

product innovation; |

|

|

• |

acceptance by ophthalmic surgeons; |

|

|

• |

ease of use and reliability; |

|

|

• |

regulatory status and speed to market; |

|

|

• |

product price and procedure price; and |

|

|

• |

reputation for technical leadership. |

We cannot assure you that we will be able to compete effectively against our competitors in regard to any one or all of these factors.

Manufacturing

Our microlens is manufactured using hydrophilic acrylic material that has been utilized in the lens manufacturing market for the last 20 years. This material is well known and has an established safety profile. High precision lathing machines are used to generate sub-micro level accuracy of convex/concave radii. Like other traditional IOL manufacturing processes, the manufacturing of the microlens is divided into a dry and a wet process.

We currently have certified ISO Class 8 cleanroom manufacturing capacity in Irvine, California. Items manufactured in this facility to date have been used solely for the current IDE. We believe the facility is scalable to meet future U.S. and out of the U.S., or “OUS”, demand with the Irvine facility having received all applicable regulatory registrations, approvals and certifications in December 2016, allowing us to manufacture CE marked products at this site. Our U.S. facility received regulatory approval from the State of California to manufacture our microlens for our U.S. staged pivotal trial, and during 2014 and 2015, this facility provided all of the required lenses that were used in the treatment phase for our ongoing IDE. Additionally, our U.S. facility has demonstrated conformity with the Essential Requirements under Annex I of Directive 93/42/EEC, referred herein as the EU Medical Device Directive, with respect to the manufacture of our microlens for sale in the EEA and FDA Quality System Regulation 21 CFR Part 820, current good manufacturing practices (“CGMPs”).

We believe that our current manufacturing arrangements are sufficient to support our foreseeable manufacturing needs. Product manufactured at the Irvine, California site includes lens manufacturing, final assembly, and packaging. Sterilization for the Irvine manufactured product is conducted at an FDA registered and ISO 13485 certified full service medical device contract manufacturer. Inventory of our microlens is housed at our facilities in Ireland as well as in Irvine, CA.

Sources and Availability of Raw Materials

We use a wide range of raw materials in the production of our products, with most of the raw materials and components being purchased from external suppliers. The hydrophilic acrylic material used to manufacture our microlens is supplied to us by a single supplier located in the United Kingdom. We would be required to obtain approval from the FDA in the event that we wished to use different material or similar material from a different supplier with respect to any products to be offered and sold in the United States. Although we do not have a guaranteed supply commitment from our sole supplier of such hydrophilic acrylic material, we believe that such supplier will be able to sufficiently meet our currently anticipated supply needs. Additionally, we do not currently have any long-term agreements in place for the supply of any other raw materials used in manufacturing of the microlens, however, all other materials are currently readily available from a number of suppliers, both in the United States and abroad.

19

Our medical device products are subject to extensive regulation by the FDA and various other U.S. federal, state and non-U.S. governmental authorities, such as the competent authorities of the countries of the EEA. Government regulation of medical devices is meant to assure their safety and effectiveness, and includes regulation of, among other things:

|

|

• |

design, development and manufacturing; |

|

|

• |

testing, labeling, content and language of instructions for use and storage; |

|

|

• |

clinical trials; |

|

|

• |

product safety; |

|

|

• |

marketing, sales and distribution; |

|

|

• |

regulatory clearances and approvals, including premarket clearance and approval; |

|

|

• |

conformity assessment procedures; |

|

|

• |

product traceability and record keeping procedures; |

|

|

• |

advertising and promotion; |

|

|

• |

product complaints, complaint reporting, recalls and field safety corrective actions; |

|

|

• |

post-market surveillance, including reporting of deaths or serious injuries and malfunctions that, if they were to recur, could lead to death or serious injury; |

|

|

• |

post-market studies; and |

|

|

• |

product import and export. |

To market and sell our products in any country, we must first seek and obtain regulatory approvals, certifications or registrations and comply with the laws and regulations of that country. These laws and regulations, including the requirements for approvals, certifications or registrations and the time required for regulatory review, vary from country to country. Obtaining and maintaining regulatory approvals, certifications and/or registrations are expensive, and we cannot be certain that we will receive regulatory approvals, certifications and/or registrations in any country for which we have yet to receive such approvals, certifications and/or registrations or that we will be able to maintain any regulatory approvals, certifications or registrations that we currently possess in any country. If we fail to obtain or maintain regulatory approvals, certifications or registrations in any country in which we currently market or plan to market our products or if we fail to comply with all applicable regulatory laws, rules and regulations, our ability to sell our products could be jeopardized and we could be subject to enforcement actions. See “Part I, Item 1a. Risk Factors—Risks Related to Regulatory Requirements” for a discussion of the risks and uncertainties that apply to Presbia in connection with government regulation of its products.

Regulatory Requirements in the United States

Under the U.S. Food, Drug and Cosmetic Act, or the FD&C Act, manufacturers of medical devices must comply with extensive regulation relating to the issues described above, including regulations governing the design, testing, manufacturing, packaging, quality, servicing and marketing of medical products. Our immediate focus is upon the steps that we must take before our products can be marketed and sold in the United States.

FDA’s Premarket Clearance and Approval Requirements

Unless an exemption applies, each medical device that is distributed commercially in the United States requires either prior 510(k) clearance or prior approval of a PMA application from the FDA. The FDA classifies medical devices into one of three classes. Devices deemed to pose low to moderate risk are placed in either Class I or II, which, absent an exemption, requires the manufacturer to submit to the FDA a premarket notification requesting permission for commercial distribution. This process is known as 510(k) clearance. Some low risk devices are exempt from this requirement. Devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously cleared 510(k) device, are placed in Class III, requiring approval of a PMA application. Our Class III products/devices require prior approval of a PMA application from the FDA. Both premarket clearance and PMA applications are subject to the payment of user fees, paid at the time of submission for FDA review. The FDA can also impose restrictions on the sale, distribution or use of devices at the time of their clearance or approval, or subsequent to marketing.

20