Attached files

| file | filename |

|---|---|

| EX-4.2 - CERTIFICATE OF DESIGNATION OF SERIES B PREFERRED STOCK - Home Bistro, Inc. /NV/ | f8k032318ex4-2_gratitude.htm |

| EX-10.2 - SPIN-OFF AGREEMENT - Home Bistro, Inc. /NV/ | f8k032318ex10-2_gratitude.htm |

| EX-10.1 - SHARE EXCHANGE AGREEMENT - Home Bistro, Inc. /NV/ | f8k032318ex10-1_gratitude.htm |

| EX-4.1 - CERTIFICATE OF DESIGNATION OF SERIES A PREFERRED STOCK - Home Bistro, Inc. /NV/ | f8k032318ex4-1_gratitude.htm |

| EX-3.1 - AMENDMENT TO THE ARTICLES OF INCORPORATION OF ISSUER - Home Bistro, Inc. /NV/ | f8k032318ex3-1_gratitude.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 23, 2018

GRATITUDE HEALTH, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada | 333-185083 | 27-1517938 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification Number) |

11231 US Highway One

Suite 200

North Palm Beach, Fl. 33408

(Address of Principal Executive Offices, Zip Code)

Registrant’s telephone number, including area code: (561) 227-2727

3511 Ryder Street, Santa Clara, California 95051

(Former Name or Former Address, if Changed Since Last Report)

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

As used herein, the terms, “we,” “us,” “our,” and the “Company” refers to Vapir Enterprises, Inc., a Nevada corporation and its subsidiaries, unless otherwise stated.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by Gratitude Health, Inc. (“Gratitude” or the “Company”) from time to time with the Securities and Exchange Commission (collectively, the “Filings”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by the Company’s management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to the Company or Company’s management identify forward looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to the Company’s industry, the Company’s operations and results of operations and any businesses that may be acquired by the Company. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Company’s management believes that the expectations reflected in the forward looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Company’s pro forma financial statements and the related notes filed with this Form 8-K.

| 1 |

Item 1.01 Entry into a Material Definitive Agreement.

Share Exchange Agreement

On March 26, 2018, Gratitude Health, Inc. f/ka Vapir Enterprises, Inc., a corporation organized under the laws of Nevada (the “Acquiror” or “Company”), Hamid Emarlou, the principal shareholder of the Acquiror (the “Acquiror Principal Shareholder”), Gratitude Health, Inc. (FL), a corporation organized under the laws of Florida (the “Acquiree”), and each of the Persons who are shareholders of the Acquiree (collectively, the “Acquiree Shareholders,” and individually an “Acquiree Shareholder”) entered into a Share Exchange Agreement (the “Agreement”) pursuant to which the Acquiree Shareholders (who are the holders of all of the issued and outstanding shares of common stock of the Acquiree (the “Acquiree Interests”)) have agreed to transfer to the Acquiror, and the Acquiror has agreed to acquire from the Acquiree Shareholders, all of the Acquiree Interests, in exchange for the issuance of 520,000 shares of Series A Preferred Stock and 500,000 shares of Series B Preferred Stock, to the Acquiree Shareholders the “Acquiror Shares”), which Acquiror Shares shall, upon conversion into 102,000,000 shares of common stock of the Acquiror, constitute approximately 85.84% on a fully diluted basis of the issued and outstanding shares of Acquiror Common Stock immediately after the closing of the transactions contemplated herein, in each case, on the terms and conditions as set forth in the Agreement.

For accounting purposes, the Share Exchange was treated as an acquisition of Acquiror and a recapitalization of Acquiree. Acquiree is the accounting acquirer, and the result is of its operations carryover.

In issuing the Acquiror Shares to the Acquiree Shareholders, the Company relied upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, as, among other things, the transaction did not involve a public offering and the securities were acquired for investment purposes only and not with a view to or for sale in connection with any distribution thereof.

Disposition of the Business of Vapir, Inc.

On the Closing Date, Acquiror Principal Shareholder entered into a Spin Off Agreement with Acquiror for the sale of the existing wholly owned Vapir, Inc. subsidiary of the Acquiror in exchange for Acquiror Principal Shareholder’s shares of Common Stock of Acquiror. The Spin Off Agreement shall not close less than five (5) days from the closing of the Agreement.

Item 2.01 Completion of Acquisition or Disposition of Assets.

As described in Item 1.01 above, effective March 26, 2018, we acquired all the issued and outstanding shares of Acquiree pursuant to the Exchange Agreement and Acquiree became our wholly-owned subsidiary. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Acquiree is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of Acquiree have been brought forward at their book value and no goodwill has been recognized.

At the time of the acquisition, the Company was engaged in the business of engaged in inventing, developing and producing aromatherapy devices and vaporizers. As a result of the acquisition of all the issued and outstanding shares of common stock of Acquiree, we have now assumed Acquiree’s business operations as our own. The acquisition of Acquiree is treated as a reverse acquisition, and the business of Acquiree became the business of the Company.

| 2 |

Business Plan

The Company manufactures, sells and markets functional RTD (Ready to Drink) beverages sold under the Gratitude trademark. The Company’s first five drinks are Chinese Dragon Well Green Teas. Second and third functional-drink lines are now in development. The Gratitude mission is to disrupt this beverage market through our manufacturing and marketing of functional beverages that specifically promote healthy aging and to never produce a product that in any way will adversely affect the health of our customer. The Gratitude vision is to work with research partners to develop functional drinks that can easily be incorporated into one’s daily lifestyle and fit their nutritional goals.

THE PRODUCTS AND PACKAGING:

Gratitude Health, Inc. is building the “Gratitude” brand with the launch of unique, naturally flavored and unsweetened RTD (Ready To Drink) teas.

Today, RTD tea is the second largest drink category in America and is an obvious driver and mainstay in delivery systems across food and beverage categories. Americans and, especially, Millennial Americans are increasingly becoming more and more aware of the generous levels of cancer-fighting antioxidants found in tea.

While Green, White and Black teas are the most common types consumed in America, research shows that their growth is solid year-over-year but barely above flat. We believe this is due to two factors:

| ● | The category is staid and boring and, | |

| ● | RTD teas are not delivering on their health promises. |

We will address these issues with unique varieties of tea that not only have interesting and curious names but also health research that supports their benefits. Naturally, we will be calorie and carb free and always strive for maximum antioxidant delivery. Our teas are sourced from Dragon Well in China. Our initial five flavors are:

| ● | Wildberry | |

| ● | Blood Orange | |

| ● | Mint | |

| ● | Original | |

| ● | Peach |

Supporting these unique flavors and key to our brand-building presentation will our package-- a first-to- RTD-market “mason jar” like 16-oz bottle featuring artistic, graphic designs actually etched onto the glass-container.

| 3 |

We will promote this unique presentation as more than eco-friendly (“eco” being of great importance to millennials) because they will be collectibles and advertised as such thus making their collectability and reuse arguably the eco-friendliest mass-market beverage bottle in the world. To even further support this unique presentation, artistic and colorful labels (logo, art, nutritional and redemption information) will cover the etchings driving the desires for those that keep them to buy their “missing” collectible.

Interestingly, the 2017 Natural Beverage Guide (Bevnet, Inc) displays hundreds of Natural-Drink companies and not one has a “Mason” jar configuration. We believe this packaging will be widely preferred to the predominantly plastic bottles in the market today, we further expect modern consumers to understand and appreciate the flavor profile and obvious nutritional benefits of the teas.

Having identified the opportunity and clearly focused upon the healthy features and benefits available in Gratitude’s tea offerings, Gratitude will shortly introduce its first five flavors of tea. This will kick off sales efforts in earnest for the larger chained retail accounts across the Country. These accounts generally review new products for “planogram” resets during calendar Q-1 with a view to begin new product offering and new sets in April each year.

This gives Gratitude three months to sell and arrange for new product authorizations in regional and national accounts while managing our initial placements in New York City and smaller accounts with whom we have relationships in the Northeastern United States.

| 4 |

MARKET INFORMATION AND THE VALUE CHAIN AND ROUTES TO MARKET

According to Beverage Marketing Corporation’s 2017 “DrinkTell” database, RTD tea sales totaled $10.31 billion in 2017 up four percent. Importantly, Gratitude’s market analyses and product development perfectly targets the main attributes fueling this growth. According to this database, “Ready-to-drink tea is leading the growth in its category with new forms and formulations that offer both function and flavor. Consumers are willing to trade up to products that offer them better quality or benefits.” Further according to BMC, “Retailers say refrigerated RTD teas are the leading segment in this category, and new varieties are emerging. In the RTD tea category, reduced-sugar formulations and local and artisanal brands are poised for continued growth.”

We are the first company to introduce Chinese Dragon Well Tea to the mass RTD American market. Dragon Well is subtle in taste with a hint of chestnut and is the most popular tea in China being granted “Imperial” status. Because it is “Green”, our tea will be well known to the US consumer. Because it is “DragonWell”, it will be a welcome new experience to the US RTD market. All our teas are either low calorie--45 per 16z—or totally unsweetened. Our “small batch * hand made” brand positioning features totally unique and first-to-market packaging that meets artisanal characteristics influencing today’s consumer purchase.

According to the Tea Association of the USA, in its 2017-2018 Tea Market Review and Forecast, Ready-to-drink (RTD) tea accounted for some 45.7% of the tea market share in 2017 and will exceed 1.7 billion gallons in 2017. The Review states “Specialty Tea is still driving interest and consumption in the category with consumers grazing for new and different options and flavors and origins. Sustainability of these high quality, higher priced teas confirms that the analogy to wine is stronger than ever.” Furthermore, according to the Tea Association: “Naturalness continues to drive consumers who demand foods that are closer to their unrefined or pure state, seeking “less processed” drinks, incentivizing companies to remove artificial ingredients. This trend will also encourage consumers to reach for foods in their most natural, original form, such as true teas, for health benefits, instead of supplements and nutraceuticals. Tea is a natural, simple and whole food.”

By marrying a famous and revered green tea in China with such organic flavors as Peach, Mint, Wildberry and Blood Orange and putting those complementary flavors in a totally unique glass package, Gratitude is well positioned for our targeted consumer audience.

Gratitude’s retail shelf price is between $2.99 to $3.49 per bottle. We have established cost for finished product per bottle and per 12-count case. We will approach and engage the same retail systems and value chain structure relative to all RTD beverage brands in the industry.

| 5 |

There will be three routes to market:

| 1. | Direct-to-Retail sales (grocery, big box, and drug chains). | |

| 2. | Direct Store Delivery (DSD) with shelf management for C-stores, specialty accounts, and such institutions as colleges and universities. | |

| 3. | Direct-to-Consumer sales via the internet. We will partner with Amazon for fulfillment. |

| 1. | Value chain for channel one includes delivered pricing from Gratitude direct to the retailer. We will target a suggested retail price in these accounts. Knowing that these accounts demand net delivery to their warehouses and a SET gross margin, Gratitude will price cases at wholesale to this channel of trade at a set price per bottle per cost of goods sold as calculated so that the Company has already calculated its margin less cost of freight for delivery. |

| 2. | Sales to DSD delivery systems require a more competitive wholesale price and higher retail price, which enables a structure where a distributor can earn a meaningful margin in an extremely competitive environment. The DSD retail customer is often a C-Store or Specialty store that requires regular deliveries and in-store management of inventory in “reaches”, meaning that often the DSD merchandises the shelf for his customer. This service cost is passed to the wholesaler. Therefore, to accommodate this pricing model, Gratitude must be more competitively priced to the DSD. The retailer also needs room to mark up the brand to accommodate their gross margin goals. So, Gratitude will reduce its gross margin in this channel and the DSD distributor will expect a set gross margin. The C-Store retailer usually expects a minimum set gross margin at his level. |

| 3. | The third sales model is direct consumer sales through the internet. These sales are always made by the case with an added delivery fee to the individual. We will partner with Amazon to handle orders and fulfillment and simply deliver to their regional warehouses. These sales provide great opportunity for gross margin having eliminated the distributor and retailer margin, but require significant digital marketing programs and advertising. We will use this channel immediately to service consumers that have heard of the brand but can’t find it at their local store yet. We know this channel will not be a large business initially but, as the brand grows, we plan to build this segment aggressively. |

| 6 |

COMPETITION

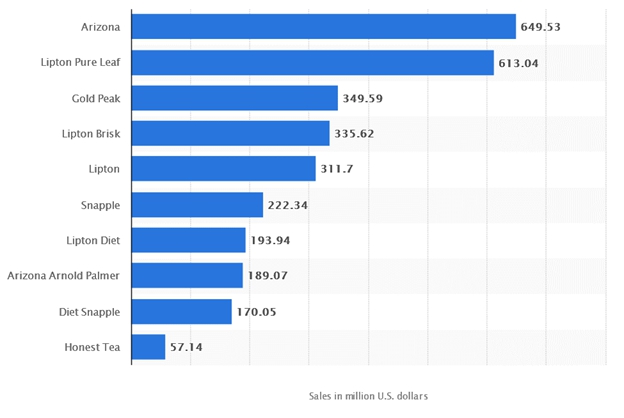

Source: Statista 2018

RESEARCH, DEVELOPMENT AND PHILANTHROPY

Gratitude’s RD&P (Research, Development and Philanthropy) is working with a number of institutions to develop, license and/or acquire valid and proven intellectual property that fights cancer and promotes healthy aging. To that end, Gratitude has solely licensed patented technology from a prominent U.S. university research foundation for their patent (U.S. Patent #: 6,713,605) for the use of tea polyphenol esters for cancer prevention and treatment. The patented invention relates to novel polyphenol esters derived from green teas, which are potent inhibitors of the growth of cancerous cells, and their use in the prevention and treatment of conditions characterized by abnormal cellular proliferation. Gratitude will fund our charities from our sales and, in addition to giving away product to those who cannot afford them, we will contribute to university and institutional research studies that focus on chemo-protection, healthy aging, phytochemical superfoods and clean nutrition.

Item 3.02 Unregistered Sales of Equity Securities.

Reference is made to the disclosure made under Item 1.01 and 2.01 which are incorporated herein by reference to this Item 3.02.

| 7 |

Item 5.01 Changes in Control of Registrant

The information set forth in Item 1.01 and Item 2.01 of this Current Report on Form 8-K is incorporated by reference to this Item 5.01.

Item 5.02 Departure of Directors and Principal Officers, Election of Directors, Appointment of Principal Officers

In connection with the Agreement, on March 26, 2018, the current officers and directors of the Company resigned, and concurrently, the Company appointed new officers and a new board of directors as follows:

| Name | Age | Position | Commencement of Service As Officer/Director | |||

| Roy G. Warren | 63 | Chairman and CEO and Director | 2018 | |||

| Andy Schamisso | 55 | President and COO | 2018 | |||

| Jack Shea | 68 | Director | 2018 | |||

| Mike Edwards | 58 | Director | 2018 | |||

| Bruce Zanca | 57 | Director | 2018 |

Set forth below are brief accounts of the business experience during the past five years of each director and executive officer of the Company.

Roy G. Warren, Chairman and CEO

Roy Warren was founder and CEO of a public company called Bravo Brands from 1997 to 2007. There, he developed America’s first vitamin-fortified, branded consumer friendly flavored milk line. Having introduced shelf stable bottled flavored milk in 2003, Roy led the company to a market capitalization that increased from approximately $20mm to over $300mm. Roy left Bravo after 10 years and immediately, in late 2007, founded Attitude Drinks to develop functional protein delivery drinks made with ultra-filtered milk with which he was involved until 2015, when he temporarily stepped back from business pursuits for personal reasons. After this temporary hiatus, in 2017, Roy began his quest to develop drinks specifically intended to promote healthy aging and, thus, Gratitude Health, Inc. was born.

Andy Schamisso, President and CEO

Andy Schamisso was the President and Founder of Inko’s Tea from 2002 to 2015, creating that brand for the health-conscious consumer and focusing on low carb/calorie and totally unsweetened teas. He was the first to introduce RTD white tea to the beverage market and his drive to provide great-tasting, organic and healthy alternative drinks is evident in every offering Gratitude provides. Andy successfully commercialized the line of all natural RTD white teas and sold the company and drink brand to a private brand developer in 2015. He created the brand for the discerning consumer and the entire offerings (17 skus in all) were low carb/calorie and/or totally unsweetened. Andy was the first to introduce RTD white tea to the beverage market and white tea is now offered by all “Big Three” companies.

| 8 |

Jack Shea, Independent Director

Jack Shea has been involved in the sales and marketing of food and beverages for over 35 years. Mr. Shea has directed the sales and marketing efforts of soft drink bottlers, RTD tea brewers, beer, wine and spirits importers and shelf stable milk companies. He has also led the US divisions of companies from China, Israel and the United Kingdom. Since 2009, Mr. Shea has been Director of Parish Ministries of Religious education at Saints John and Paul Parish and School in Mamaroneck, NY. Mr. Shea was ordained a Deacon in the Catholic Church in 2010 and now devotes his talents and abilities to taking care of the poor and the sick and also teaching in a Catholic School. Deacon Shea is well suited to be our director as a result of his long experience in the food and beverage industry.

Mike Edwards, Independent Director

Mike Edwards, who is the current owner of Car Pro Auto Spa in Stuart, Florida, a position he has held since 2008, is a self-motivated, results-oriented entrepreneur and has extensive executive and marketing professional experience with over 26 years in business development, promotion, strategic planning, and finance. He previously worked as the Executive Vice President of International Sales and Marketing at the Bravo! Brands International Corporation, an international functional drink marketing firm operational in the Americas, Australia, Europe, and Asia. He also has more than two decades of experience in private financial banking.

Mr. Edwards also worked as an Executive for Peregrine Enterprises, a market research company that provided custom study design and implementation for a wide range of Fortune 500 clients. He holds a Bachelor of Science degree from Florida State University, and has completed training in market research, banking, sales management, commercial lending, and credit analysis. He also served in the United States Navy Reserve as a Lieutenant for five years. Mr. Edwards is suited to sit on the Company’s board due to his experience in private financial banking and his industry experience with Bravo! Brands.

| 9 |

Bruce Zanca, Independent Director

Over the course of a career spanning more than 30 years, Bruce Zanca has developed a core competency in building award-winning “earned media campaigns” for companies to gain positive exposure in broadcast, print, and social media. He worked as a “C-Suite” communications executive at four publicly traded businesses; assisting three companies to complete initial public offerings and helping to bring one public company private. He served as a White House spokesperson and communications advisor for three presidential administrations. He’s lead teams of PR experts to win numerous awards including four American Business Awards "Stevies" and a Telly award for video production. Bankrate, Inc (NASDAQ:RATE) in July 2004 Bruce Zanca joined Bankrate as Senior Vice President/Chief Marketing Communications Office. Among Zanca’s other responsibilities is managing the company’s communications and investor relations efforts. In July 2011 Bankrate once again became a public company by making an initial public offering New York Stock Exchange. (NYSE: RATE) Zanca continued to manage the company’s investor relations programs until he retired from the company as of December 31, 2014. Since he has retired, he has headed Zanca PR & Corporate Communications, a public relations and corporate communications firm, which has the ability to lead the public opinion for all aspects of external communications: Investor Relations, television including the major television networks and news shows (CNN, MSNBC, CSPAN, Fox News, etc.), internet, social media, and print. In 2011 Bruce J Zanca was recruited and elected as a board member/director to the charity Scenarios USA, (501(c)(3)). He was elected chairman of the board in 2013 and served in that position until his term ended at the end of 2015. Founded in 1999, scenarios usa is a national non-profit organization that uses writing and film to foster youth leadership, advocacy and self-expression in students across the country with a focus on marginalized populations and underserved communities. The Company believes that Mr. Zanca has the qualifications to act as a director for the Company due to his public relations and public company experience.

Reference is made to the disclosure made under Item 1.01 and Item 2.01 which is incorporated herein by reference to this Item 5.02.

Item 5.03 Amendments to the Articles of Incorporation of the Company

Effective March 23, 2018, upon receipt of approval from FINRA, the Company changed its name to Gratitude Health, Inc. and began trading on the OTCQB under the symbol GRTD. Effective March 26, 2018, the Company further amended its Articles of Incorporation to include two series of preferred stock authorized, Series A and Series B Preferred Stock.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired.

The Company intends to file the financial statements of Acquiree Co., Ltd. required by Item 9.01(a) as part of an amendment to this Current Report on Form 8-K not later than 71 calendar days after the date of this Current Report on Form 8-K is required to be filed.

(b) Pro forma Financial Information.

The Company intends to file the pro forma financial information required by Item 9.01(B) as part of an amendment to this Current Report on Form 8-K not later than 71 calendar days after the date of this Current Report on Form 8-K is required to be filed.

(d) Exhibits

| Exhibit Number |

Description | |

3.1 |

||

| 4.1 | Certificate of Designation of Series A Preferred Stock | |

| 4.2 | Certificate of Designation of Series B Preferred Stock | |

| 10.1 | Share Exchange Agreement | |

| 10.2 | Spin Off Agreement |

| 10 |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| GRATITUDE HEALTH, INC. | ||

| Date: March 28, 2018 | By: | /s/ Roy G. Warren |

| Roy G. Warren, Chairman and CEO | ||

11