Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MANITOWOC CO INC | mtw-8k_20180320.htm |

The Manitowoc Company, Inc. SEAPORT GLOBAL TRANSPORTS & INDUSTRIALS CONFERENCE CORAL GABLES, FL MARCH 21, 2018

Forward- Looking Statements Safe Harbor Statement Any statements contained in this presentation that are not historical facts are “forward-looking statements.” These statements are based on the current expectations of the management of the company, only speak as of the date on which they are made, and are subject to uncertainty and changes in circumstances. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. Forward-looking statements include, without limitation, statements typically containing words such as “intends,” “expects,” “anticipates,” “targets,” “estimates,” and words of similar import. By their nature, forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. For a list of factors that could cause actual results to differ materially from those discussed or implied, please see the company’s periodic filings with the SEC, particularly those disclosed in “Risk Factors” in the company’s Form 10-K for the fiscal year ended December 31, 2017. Any “forward-looking statements” in this presentation are intended to qualify for the safe harbor from liability under the Private Securities Litigation Reform Act of 1995. Non-GAAP Measures The company uses certain non-GAAP measures in discussing the company’s performance. The company believes that these non-GAAP financial measures provide important supplemental information to both management and investors regarding financial and business trends used in assessing its results of operations; however, these measures are not substitutes for GAAP financial measures. The reconciliation of those measures to the most comparable GAAP measures is detailed in Manitowoc’s press release for the fourth-quarter of 2017, which is available at www.manitowoc.com, together with this presentation.

Global leader in lifting equipment Global customer financing and aftermarket solutions Serving wide range of end markets Stable customer base across diverse range of geographies Strategically located manufacturing footprint allows us to serve attractive markets globally Leader in innovation (17 new products in 2017) Industry-Leading Crane Company Continued transformation to a high quality, higher margin crane company compared to peers

Strong Aftermarket Solutions Aftermarket Parts and Service Skills Training Financing Rebuild/Refurbish Special Applications Fleet Management/ Diagnostics (Tower)

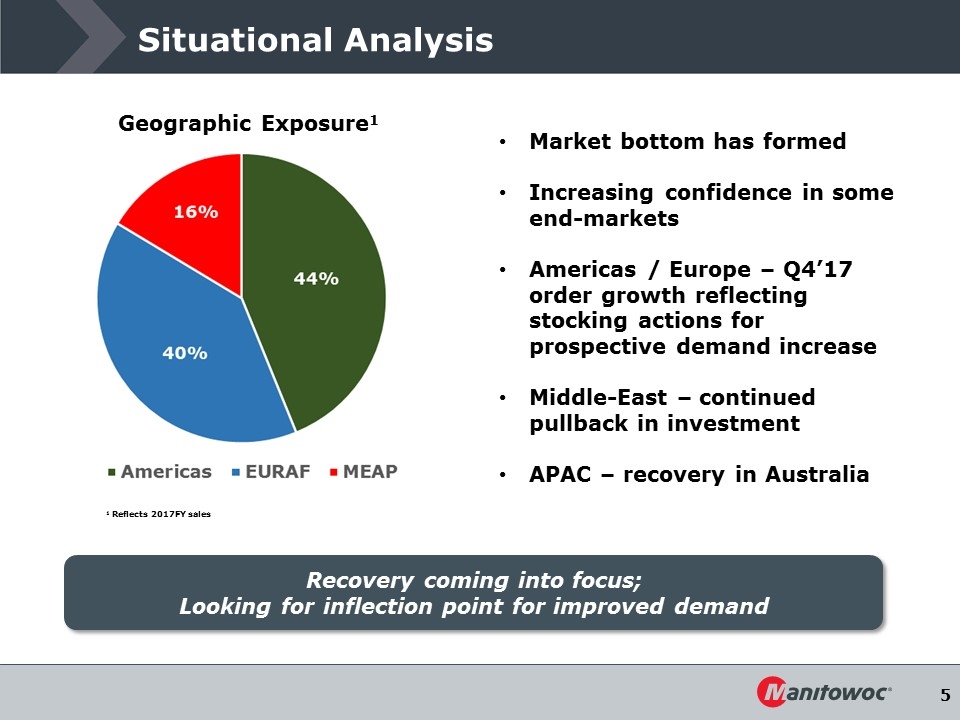

Situational Analysis Recovery coming into focus; Looking for inflection point for improved demand Geographic Exposure1 1 Reflects 2017FY sales Market bottom has formed Increasing confidence in some end-markets Americas / Europe – Q4’17 order growth reflecting stocking actions for prospective demand increase Middle-East – continued pullback in investment APAC – recovery in Australia

State of the Business Signs of Market Recovery from Cyclical Downturn Year-over-Year order growth Increasing manufacturing flexibility to manage through the cycle Renewed Focus on Quality and Reliability Embed quality prior to new product delivery Winning back customers Well Accepted New Products New crane shipments starting Continue NPD pipeline Balance Sheet Focus Sufficient liquidity Cash flow focus

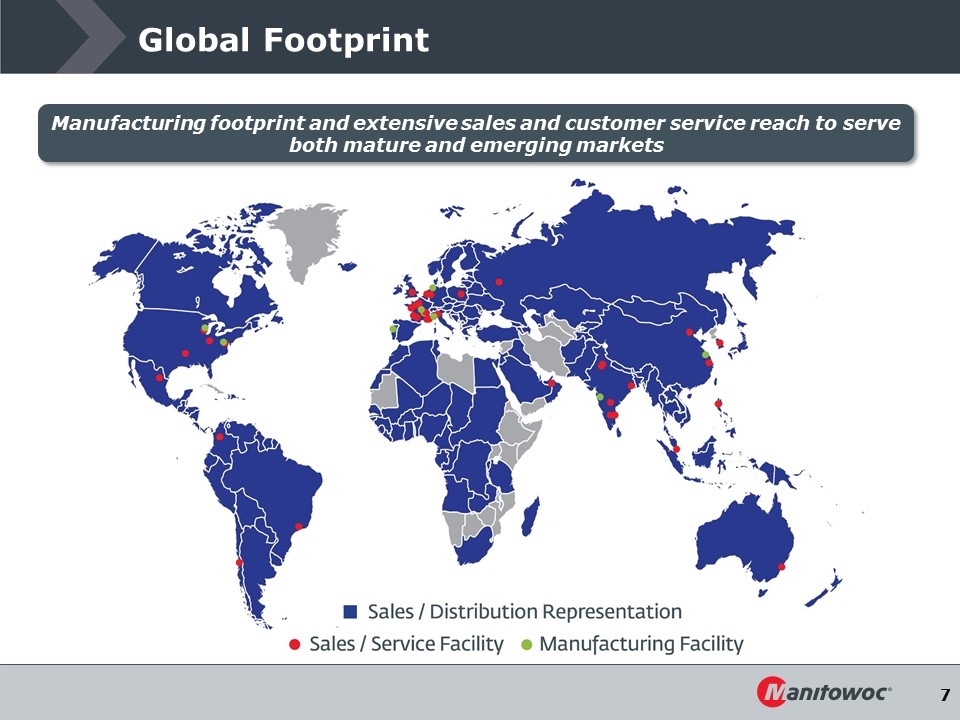

Global Footprint Manufacturing footprint and extensive sales and customer service reach to serve both mature and emerging markets

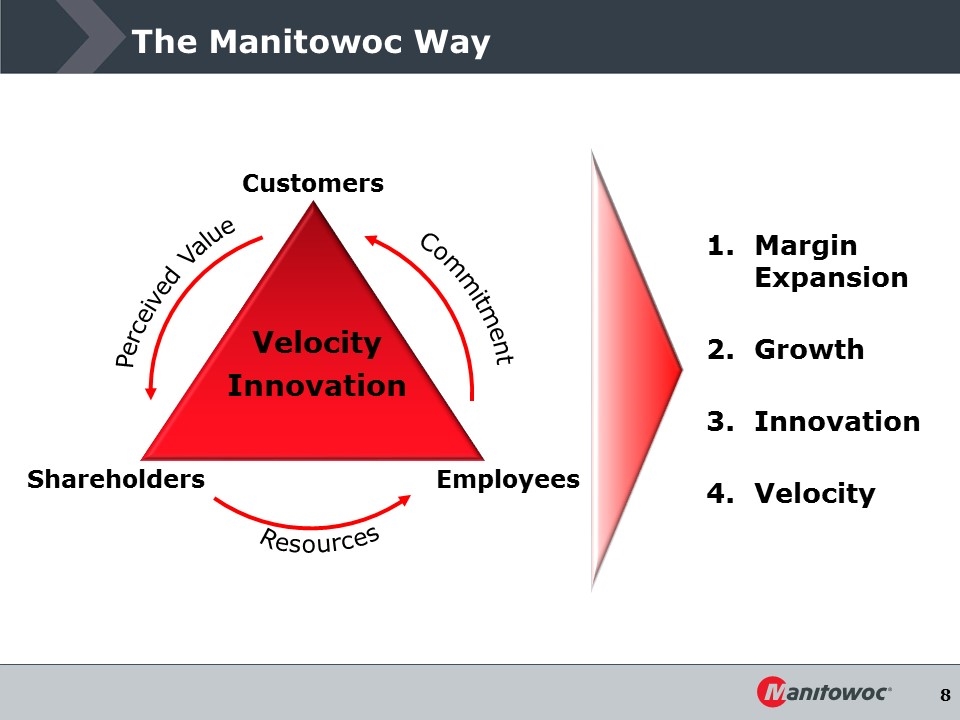

The Manitowoc Way Customers Shareholders Employees Commitment Resources Velocity Innovation Perceived Value Margin Expansion Growth Innovation Velocity

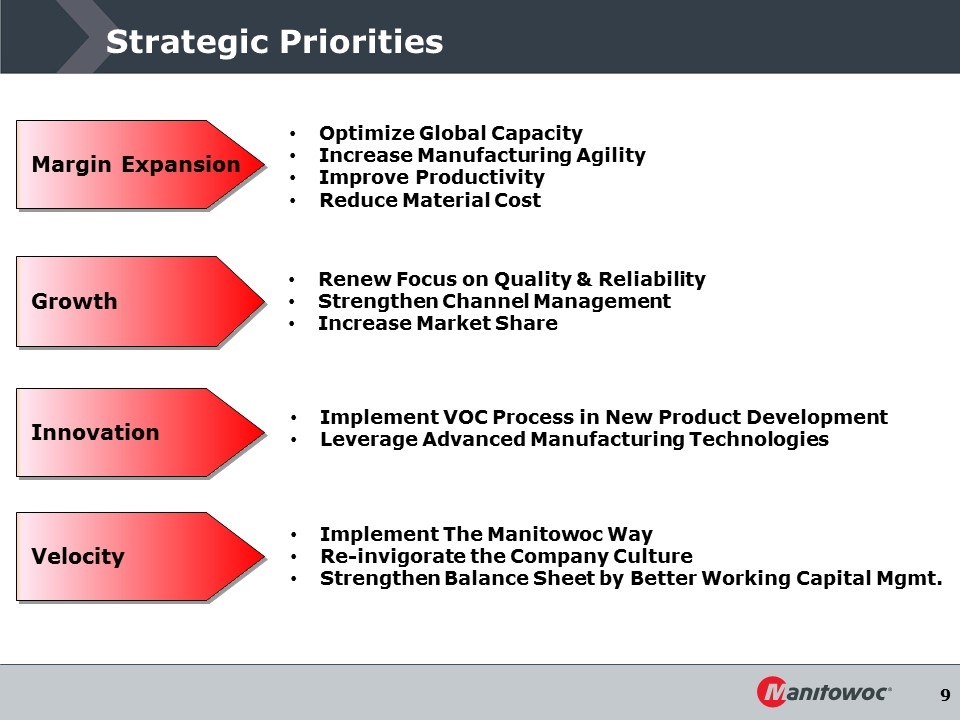

Strategic Priorities Renew Focus on Quality & Reliability Strengthen Channel Management Increase Market Share Optimize Global Capacity Increase Manufacturing Agility Improve Productivity Reduce Material Cost Implement VOC Process in New Product Development Leverage Advanced Manufacturing Technologies Margin Expansion Growth Innovation Velocity Implement The Manitowoc Way Re-invigorate the Company Culture Strengthen Balance Sheet by Better Working Capital Mgmt.

Progress on Strategic Priorities Continued investment in product innovation 40% total Q4 sales from new products Crane Days in June 2018 Positioned to fully leverage capacity in Shady Grove Realigning manufacturing capacity in Europe to increase velocity Margin Expansion Innovation Growth Velocity Adopt new approaches to grow above market; aided by third party growth-oriented firm Continue implementing The Manitowoc Way processes Kaizen actions in India and China

4th Quarter 2017 Update

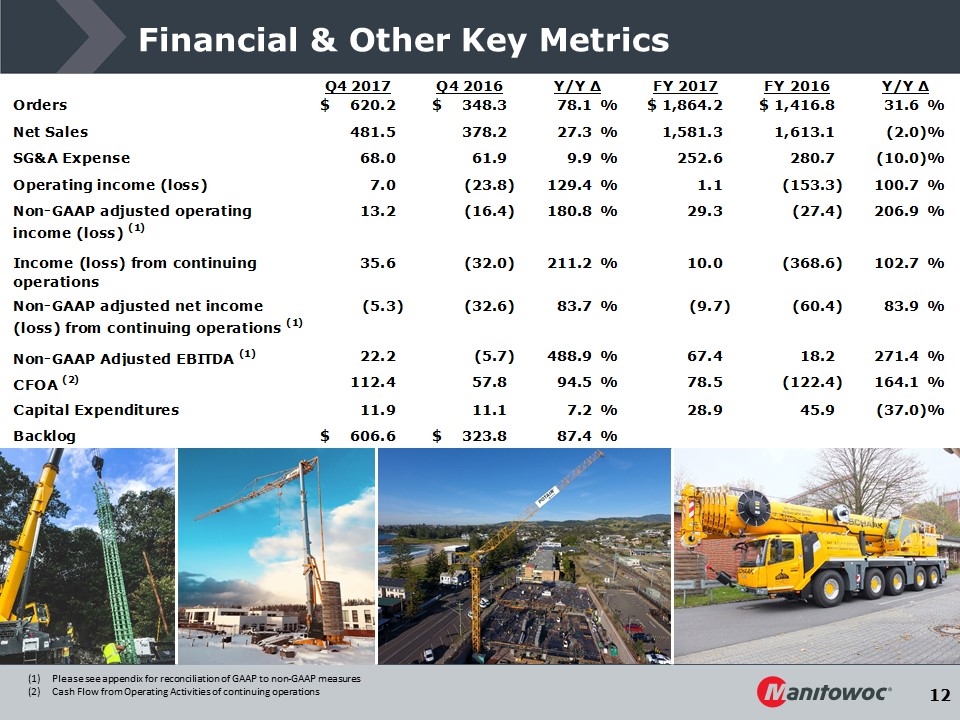

Financial & Other Key Metrics Please see appendix for reconciliation of GAAP to non-GAAP measures Cash Flow from Operating Activities of continuing operations

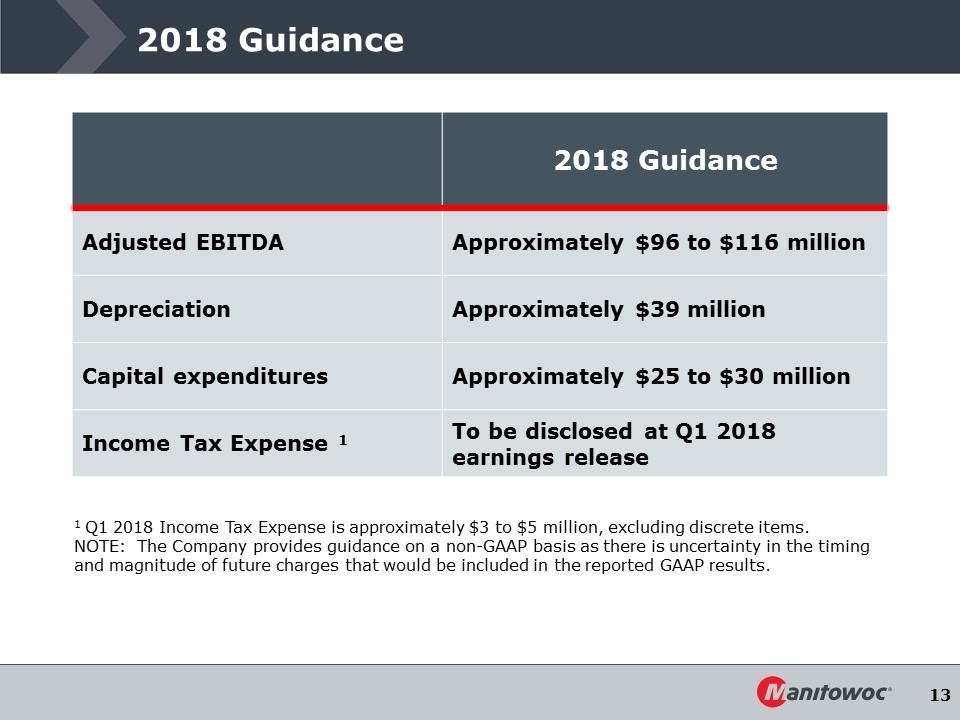

2018 Guidance 2018 Guidance Adjusted EBITDA Approximately $96 to $116 million Depreciation Approximately $39 million Capital expenditures Approximately $25 to $30 million Income Tax Expense 1 To be disclosed at Q1 2018 earnings release 1 Q1 2018 Income Tax Expense is approximately $3 to $5 million, excluding discrete items. NOTE: The Company provides guidance on a non-GAAP basis as there is uncertainty in the timing and magnitude of future charges that would be included in the reported GAAP results.

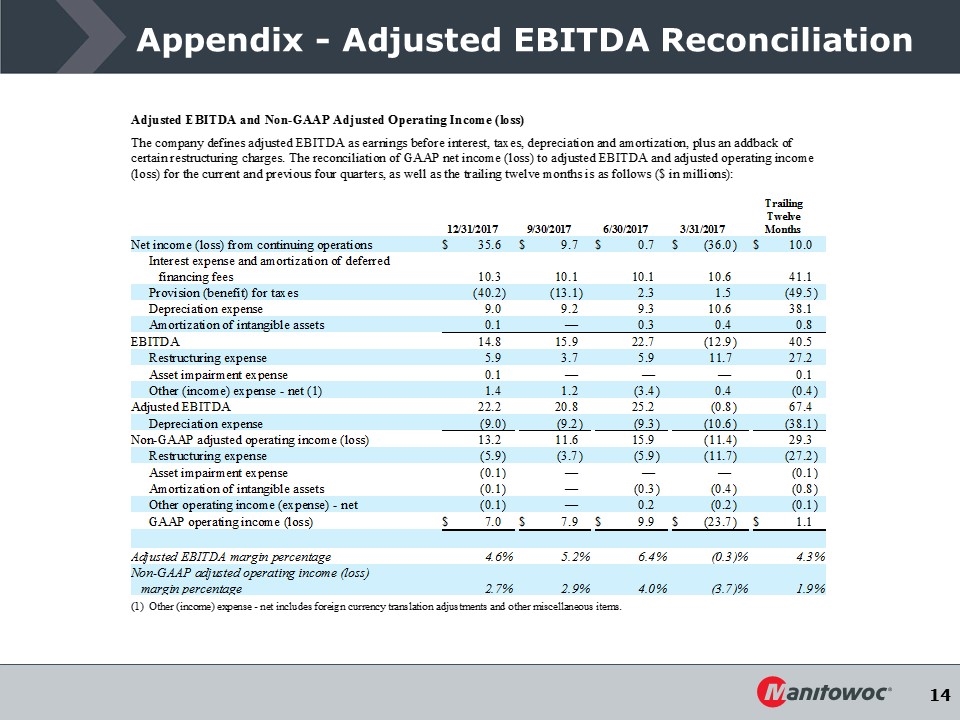

Appendix - Adjusted EBITDA Reconciliation