Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Celcuity Inc. | tv487729_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Celcuity Inc. | tv487729_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Celcuity Inc. | tv487729_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Celcuity Inc. | tv487729_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Celcuity Inc. | tv487729_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number: 001-38207

Celcuity Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 82-2863566 |

|

(State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 16305 36th Avenue North, Suite 450 Minneapolis, MN |

55446 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (763) 392-0767

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Each Class | Name of Each Exchange on which Registered | |

| Common Stock, $0.001 par value per share | The Nasdaq Capital Market | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definition of “large accelerated filer,” “accelerated filer,”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller reporting company x |

| Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant as of September 19, 2017 was approximately $54,831,578, based on a price per share of $9.50. The Registrant was privately held on June 30, 2017 (the last business day of the Registrant’s most recently completed second fiscal quarter), and as such, the Registrant has elected to use September 19, 2017 as the calculation date, which was the effective date of the registration statement for the Registrant’s initial public offering. The price per share listed above is equal to the initial public offering price of the Registrant’s common stock and the value of the Registrant’s voting and non-voting common equity listed above assumes conversion of the Company’s outstanding convertible promissory notes immediately following the Registrant’s initial public offering, which closed on September 22, 2017.

As of February 28, 2018, there were 10,106,464 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2018 Annual Meeting of Stockholders is incorporated by reference into Part III of this Annual Report on Form 10-K.

2017 Annual Report on Form 10-K

Table of Contents

| 2 |

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements regarding us, our business prospects and our results of operations that are subject to certain risks and uncertainties posed by many factors and events that could cause our actual business, prospects and results of operations to differ materially from those that may be anticipated by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those described in Part I, Item 1A. “Risk Factors” and elsewhere in this report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We expressly disclaim any intent or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the Securities and Exchange Commission that advise interested parties of the risks and factors that may affect our business.

All statements, other than statements of historical facts, contained in this Annual Report on Form 10-K, including statements regarding our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial performance and condition, are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “target,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Annual Report on Form 10-K. Forward-looking statements may include, among other things, statements relating to:

| · | our plans to develop and commercialize our CELx platform and CELx tests for patients with cancer and our expectations regarding the various cancer sub-types our CELx tests will identify; |

| · | any perceived advantage of our CELx platform and CELx tests as compared to traditional molecular or other diagnostic tests, including without limitation, the ability of our platform and tests to help physicians treat their patients’ cancers or to identify new patient populations not diagnosable with currently available diagnostic tests; |

| · | our expected first-mover advantage in providing products to culture living tumor cells on a commercial scale, or the sustainability of our competitive advantages; |

| · | the size and growth potential of the markets for our CELx platform, and our ability to serve those markets; |

| · | the rate and degree of market acceptance, both in the United States and internationally, and clinical utility of our diagnostic platform and tests; |

| · | our ability to partner with and generate revenue from pharmaceutical partners and physicians, and the market opportunity for HER2 therapies and other CELx programs for our pharmaceutical partners as a result of our CELx platform; |

| · | the success of competing tests that are or may become available; |

| · | the ability of our CELx platform and tests to impact clinical trials by our pharmaceutical partners, such as streamlining approval from the U.S. Food and Drug Administration, or FDA of targeted therapeutics; |

| · | the success, cost and timing of our CELx platform development activities and planned clinical trials, as well as our reliance on collaboration with third parties to conduct our clinical trials; |

| · | our commercialization, marketing and manufacturing capabilities and strategy; |

| · | expectations regarding federal, state, and foreign regulatory requirements and developments, such as potential FDA regulation of our CELx platform and CELx tests, our operations, as well as our laboratory; |

| · | our plans with respect to pricing in the United States and internationally, and our ability to obtain reimbursement for CELx tests, including expectations as to our ability or the amount of time it will take to achieve successful reimbursement from third-party payors, such as commercial insurance companies and health maintenance organizations, and government insurance programs, such as Medicare and Medicaid; |

| · | our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our CELx platform and CELx tests; |

| 3 |

| · | our expectations with respect to our facility needs; |

| · | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| · | future agreements with third parties about the commercialization of our CELx diagnostic platform and tests; |

| · | our expectations regarding our ability to obtain and maintain intellectual property protection for CELx platform and approach; |

| · | our ability to attract and retain key scientific or management personnel; |

| · | our expectations regarding the period during which we qualify as an emerging growth company defined under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act; |

| · | the requirements of being a public company; |

| · | our expectations regarding having our stock listed on The Nasdaq Capital Market; and |

| · | our anticipated use of the net proceeds from our initial public offering. |

You should read the matters described in Part I, Item 1A. “Risk Factors” and the other cautionary statements made in this Annual Report on Form 10-K. We cannot assure you that the forward-looking statements in this report will prove to be accurate and therefore you are encouraged not to place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. You are urged to carefully review and consider the various disclosures made by us in this report and in other filings with the SEC that advise of the risks and factors that may affect our business. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make.

| 4 |

Overview

Unless otherwise provided in this Annual Report on Form 10-K, references to the “Company,” “we,” “us,” and “our” and similar references refer to Celcuity Inc., a Delaware corporation.

We are a cellular analysis company that is discovering new cancer sub-types and commercializing diagnostic tests designed to significantly improve the clinical outcomes of cancer patients treated with targeted therapies. Our proprietary CELx diagnostic platform is the only commercially ready technology we are aware of that uses a patient’s living tumor cells to identify the specific abnormal cellular process driving a patient’s cancer and the targeted therapy that best treats it. We believe our CELx platform provides two important improvements over traditional molecular diagnostics. First, molecular diagnostics can only provide a snapshot of the genetic mutations present in a patient’s tumor because they analyze dead cells. Using dead cells prevents molecular diagnostics from analyzing in real-time the dynamic cellular activities, known as cell signaling, that regulate cell proliferation or survival. Cancer can develop when certain cell signaling activity becomes abnormal. Since genetic mutations are often only weakly correlated to the cell signaling activity driving a patient’s cancer, a molecular diagnostic is prone to providing an incomplete diagnosis. CELx tests overcome this limitation by measuring real-time cell signaling activity in a patient’s living tumor cells. When a CELx test detects abnormal signaling activity, a more accurate diagnosis of the patient’s cancer driver is obtained. Second, molecular diagnostics can only estimate the probability of a patient’s potential drug response based on a statistical analysis of the drug’s clinical trial results. Instead of this indirect estimate of drug response, CELx tests directly measure the effectiveness of a targeted therapy in a patient’s living tumor cells. This enables physicians to confirm that the therapeutic matching the patient’s cancer driver is functional in the patient’s tumor cells before prescribing it, which significantly increases the likelihood of a positive clinical outcome. We have one U.S. patent, five pending U.S. patent applications, one pending PCT patent application, as well as numerous corresponding non-U.S. patent applications covering our diagnostic approach using cell signaling analysis in living patient cells to guide treatment of patients with targeted therapies.

Our first analytically validated and commercially ready test using our CELx platform, is our CELx HER2 Signaling Function Test, or CELx HSF Test. Our CELx HSF Test diagnoses two new sub-types of HER2-negative breast cancer that traditional molecular diagnostics cannot detect. Our internal studies show that approximately 20% of HER2-negative breast cancer patients have abnormal HER2 signaling activity similar to levels found in HER2+ breast cancer cells. As a result, these HER2-negative patients have undiagnosed HER2-driven breast cancer and would be likely to respond to the same anti-HER2 targeted therapies only HER2+ patients receive today. Our CELx HSF Test is targeting HER2-negative breast cancer patients receiving drug treatment. As a companion diagnostic, or CDx, our CELx HSF Test could potentially drive additional clinical usage of HER2 therapies to treat the patients our test identifies with abnormal HER2 signaling. We believe this creates financial motivation for pharmaceutical companies to partner with us. We also believe that having an analytically validated and commercially ready diagnostic platform is attractive to potential pharmaceutical company partners as it will enable them to use our diagnostic tests immediately after receiving the regulatory approvals required to sell their drug therapies to the newly identified patient populations identified by our CDx.

Once our CELx HSF Test was analytically validated and became commercially ready, we sought opportunities to collaborate with pharmaceutical companies that owned HER2 drugs. Our efforts resulted in a collaboration with Genentech, Inc., or Genentech and the National Surgical Adjuvant Breast and Bowel Project Foundation, or NSABP, to field a prospective clinical trial to evaluate the efficacy of Genentech’s HER2 targeted therapies in patients with these newly identified cancer sub-types. We expect interim results from this trial in late 2018 and final results six to nine months later. We believe a successful outcome of this collaboration will demonstrate the suitability of our CELx HSF Test as a CDx for HER2 therapies and support our activities to attract other pharmaceutical company partnerships.

| 5 |

In addition to the two new breast cancer sub-types our CELx HSF Test diagnoses, we discovered 14 new potential cancer sub-types in breast, lung, colon, ovarian, kidney, bladder and hematological cancers. Approved or investigational drugs are currently available to treat each of these new potential cancer sub-types. CELx tests for these additional cancer sub-types are in various stages of development, and we expect them to become commercially ready on a staggered basis over the next few years. The development process for these additional CELx tests will mirror the process used to develop our CELx HSF test. This process includes completion of internal animal, verification, training set, and validation studies. As new CELx tests become commercially ready, we expect to initiate collaborations with pharmaceutical companies to help them obtain new drug indications for the new cancer sub-types our tests identify. In addition, we will continue our research to identify additional new cancer sub-types and to develop the corresponding CELx tests to diagnose them.

The need for more complete cancer diagnoses is significant. The complexity and dynamic nature of cancer makes it difficult to determine the underlying cellular activity driving the disease. Molecular tests are used to identify genetic mutations and select targeted therapies, but the overall impact of those tests on patient outcomes has fallen far short of expectations, primarily due to two factors. First, molecular tests provide a static and limited genetic profile of a patient’s tumor, and, therefore, cannot measure dynamic disease activity. These tests rely on statistical correlations to diagnose patients, and when a genetic mutation is only weakly correlated to oncogenic-related cellular dysfunction, a high number of false positive diagnoses will result. With patient response rates to therapies targeting a genetic mutation typically less than 50%, and in some cases, only 10% to 20%, there is significant need for an alternative approach. Second, many cancers lack a genetic biomarker to guide treatment. For those patients, the cellular dysfunction responsible for their cancer goes undiagnosed, which means they are less likely to receive a potentially beneficial targeted therapy. Thus, current molecular tests have demonstrated only a limited ability to diagnose the specific cellular dysfunction that is driving most patients’ cancer.

Our CELx platform addresses the need for better cancer diagnostic tests using two complementary technologies that represent a significant departure from molecular-based analyses. Unlike molecular tests that use fixed or lysed (dead) cells and can only measure the static composition of a cell, our CELx platform measures real-time signaling activity in a patient’s live tumor cells. This enables us to: (1) identify the cellular signaling dysfunction driving a patient’s cancer; and (2) confirm whether the matching targeted therapy is functional in the patient’s cells. Our CELx tests are performed in our laboratory in Minneapolis, Minnesota that is certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and accredited by the College of American Pathologies, or CAP.

Our platform, comprised of our internally developed cell microenvironment and cell signaling quantification technologies, allows for more accurate diagnoses and the discovery of new cancer sub-types:

| · | Cell microenvironment. Culturing living tumor cells poses three primary challenges. First, there is typically only a small amount of patient tumor tissue available. Second, the tumor cells often die once they are removed from the tumor tissue. Third, tumor cells that do survive are difficult to maintain. Moreover, when conventional cell culture approaches are used it can often take more than two months to prepare a test sample and the success rate is typically less than 50%. Due to these challenges, the pharmaceutical industry principally relies on widely available immortalized or genetically modified cancer cell lines, which are easily maintained and proliferate indefinitely at predictable rates. While these properties are useful for drug discovery purposes, that usefulness has minimized incentives to transfer patient tumor cell culturing technologies to the clinical setting. Our proprietary cell microenvironment technologies were designed to overcome these challenges and provide a testable cell sample from a patient tumor specimen as small as 20 milligrams in 10 to 14 days for more than 90% of the patient tumor specimens we receive. |

| · | Dynamic cell signaling quantification. We analyze the signaling pathway activity of live patient tumor cells using a biosensor that converts the dynamic cellular response to pathway activators or pathway inhibitors to a measurable electrical signal in real-time. To determine the activity of a specific signaling pathway, an activating agent specific to a pathway receptor is used to turn on the pathway and a corresponding inhibitory agent specific to the pathway receptor is used to turn signaling off. Thus, our tests allow us to identify both the signaling pathway abnormalities driving a patient’s cancer and to confirm whether a matching targeted therapy may prove beneficial. |

We believe our CELx platform will fundamentally change the standard-of-care many cancer patients receive. Patients with the newly identified cancer sub-types we have discovered have oncogenic pathways that are signaling abnormally, and, we believe, may respond positively to a matching targeted therapy. By identifying patients with a new cancer sub-type, each CELx test will create, in effect, a proprietary patient population that molecular diagnostics cannot identify.

| 6 |

Our initial commercial strategy is to partner with pharmaceutical companies to provide companion diagnostics for the pharmaceutical partners’ existing or investigational targeted therapies. We expect such partnerships to involve collaboration on clinical trials, regulatory submissions, and commercialization activities. We will initiate activities to pursue partnerships as our CELx tests become commercially ready and can be matched with a potential partner’s targeted therapies. Our commercial-related efforts to date have focused on seeking partnerships for our CELx HSF test, which became commercially ready as a laboratory developed test after it was analytically validated in 2016. We expect to seek pharmaceutical partnerships for a variety of different targeted therapies in other solid tumor types as we are conducting our initial clinical trial with Genentech and the NSABP.

We believe our CELx CDx tests will expand the matching drug’s market size because they can facilitate approval of new drug indications that a pharmaceutical company would not otherwise be able to obtain.

We expect that successful pharmaceutical company partnerships will generate significant revenue from the sale of tests to identify patients eligible for clinical trials, from milestone payments, and, potentially, from royalties on the incremental drug revenues our tests enable. A key requirement for success of these partnerships will be clinical trial results that demonstrate the advantages of using a CELx test as a companion diagnostic. Once a new drug indication is received that requires use of our CDx to identify eligible patients, we will offer our tests directly to treating physicians and coordinate go-to-market strategies with our partner. This coordination of commercialization strategies will allow us to significantly leverage the sales, marketing and reimbursement resources of our pharmaceutical partner, unlike traditional molecular diagnostic companies.

Our Value Proposition

We believe we offer a clear and compelling value proposition to the key healthcare stakeholders:

| · | Patients & Providers—Improved patient outcomes. Our CELx tests provide a more accurate diagnosis of a patient’s cancer driver and an assessment of a matching targeted therapy’s effectiveness in blocking the cellular dysfunction. This will enable physicians to match more precisely the targeted therapy they use to treat their patients. We believe this will increase the percentage of patients responding to the drug, improving overall patient outcomes significantly. |

| · | Pharma—Increased revenue & optimized clinical trials. CELx tests can significantly increase the revenue potential for many existing targeted therapies by identifying entirely new pools of patients potentially responsive to their therapy. For some targeted therapies, we estimate a CELx test could double the number of patients approved to receive treatment, thus driving billions of dollars in incremental sales. Also, by providing more precise selection of patients, our CELx tests can increase the odds a clinical trial meets its trial endpoint, greatly enhancing the likelihood the drug will obtain FDA approval for a new indication. In addition, according to an ARK Invest publication dated August 2016, companion diagnostics that increase the response rates of a drug can reduce Phase 3 clinical trial size as much as ten-fold and costs as much as 60%. |

| · | Payors—Lower costs per responsive patient. By providing more precise cancer diagnoses and driving higher drug response rates, we will significantly reduce the money spent on drugs that do not benefit patients. Many targeted therapies cost more than $50,000 per treatment and only benefit a small fraction of patients receiving them. Calculating drug costs on a cost-per-responsive patient, and not just cost-per-treated patient, highlights the true cost of targeted therapies and the expense associated with low drug response rates. For instance, a $50,000 targeted therapy with a 30% response rate costs $167,000 per responsive patient; however, that same drug would only cost $83,000 per responsive patient if the response rate was 60%. |

Our Competitive Strengths

We have a number of key strengths that enhance our ability to achieve our mission and build a successful company:

| · | First mover. We are the first company that we are aware of to launch diagnostic tests that measure the signaling pathway activity in a patient’s live tumor cells, which we believe gives us a significant first mover advantage. |

| · | High barriers to entry. Our issued and pending patents, as well as our proprietary information and trade secrets, give us a strong intellectual property position that we believe creates a significant barrier to entry for potential competitors. |

| 7 |

| · | Broad range of applications for our platform. We can develop tests for a wide range of signaling pathways and a wide range of cancer types. This allows us to build a deep new product pipeline that creates multiple paths to build a large and profitable business. |

| · | Diverse revenue streams including pharma partnerships. We anticipate generating significant revenue from CDx pharmaceutical partners, including revenue from the sale of tests to identify patients eligible for clinical trials, milestone payments, and potentially, from royalties on the incremental drug revenues our tests enable. Our most significant revenue opportunity comes from ongoing sales of CELx tests to physicians during the commercialization stage of the CDx. |

| · | Strong senior leadership team. Our founders and senior leaders have a proven track record of success building, operating and selling several successful companies. We have deep and highly relevant and complementary diagnostic, scientific, product development, and commercialization experience that has enabled us to establish market leadership positions for the companies we previously led. |

Our Platform Advantages

Our unique and proprietary CELx functional cellular analysis technology represents a major shift from the diagnostic industry’s reliance on molecular profiling to characterize a patient’s cancer sub-type. Our goal is to leverage our technology to build a durable competitive advantage that enables us to improve outcomes for a significant percentage of cancer patients.

Our CELx platform advantages include:

| · | Powerful cancer sub-type discovery tool. We have already discovered 16 new potential cancer sub-types that are not currently diagnosed and treated with a matching targeted therapy. These sub-types are characterized by the dysfunctional signaling pathway activity our CELx tests identify. By identifying new cancer sub-types, we are creating new patient populations to which pharmaceutical companies can offer new and existing drug therapies. |

| · | Direct patient-specific assessment of disease status. Even though the response rates for many targeted therapeutics are low, for those patients who do respond, their outcomes can be improved significantly. The problem is matching the patient to the right drug. Our platform overcomes this problem by directly identifying whether an oncogenic signaling pathway is abnormally active in a patient’s cells. This provides the most complete assessment available today of the intracellular activity driving a patient’s cancer. Existing genomic tests typically can only provide a determination whether cancer is present and an assessment of molecular mutations that may or may not be associated with the patient’s cancer driver. |

| · | Direct measurement of matching drug effectiveness. An important advantage of the CELx platform is its ability to quantify the amount of signaling dysfunction that a matching targeted therapy can inhibit in an individual patient’s cancer cells. This allows us to evaluate whether there are inherent drug resistance mechanisms that would prevent the therapy from functioning in the patient’s tumor cells. Molecular tests cannot provide this evaluation. |

| · | Improved response rates. We believe a patient population will have a higher response rate to a matching targeted therapy when it is diagnosed with a CELx test than with a molecular biomarker. By first identifying whether dysfunctional signaling is present and then confirming that a matching targeted therapy can inhibit the dysfunction, a CELx test eliminates the two primary variables that confound patient response to targeted therapy signaling: the presence or absence of the disease and the drug not functioning as intended. A molecular test provides insight on neither of these variables in most cases. |

| · | Identify drug responsive proprietary patient cohorts. There are large numbers of cancer patients who lack a genetic biomarker to guide treatment. For these patients, the cellular dysfunction driving the cancer goes undiagnosed, thus excluding such patients from receiving a potentially beneficial targeted therapy. We believe our CELx tests will enable us to identify new proprietary patient populations not currently diagnosable with molecular tests and increase the number of patients likely to respond to a matching targeted therapy. Moreover, we will be the only partner a pharmaceutical company can work with to develop a CDx for a new indication of a targeted therapy addressing these new patient populations. By contrast, most molecular diagnostic tests are undifferentiated and have little proprietary value, which gives pharmaceutical companies a wide range of companies to select from when choosing a molecular-based CDx partner. |

| 8 |

| · | Streamlined FDA approval of targeted therapeutics. CELx tests will enable our pharmaceutical partners to enroll patients in their clinical trial with the same cellular dysfunction their targeted therapy is designed to inhibit. We believe this will improve patient response rates, increasing the likelihood the trial meets its endpoint target and thus the likelihood the drug receives FDA approval. Improved patient response rates would also help reduce the size, cost, and length of our partner’s clinical trials. |

Our Industry

According to the Centers for Disease Control and Prevention, or CDC, cancer was the second-leading cause of death in the United States in 2015, responsible for nearly one of every four deaths. There are many types of cancer treatment options, including surgery, radiation therapy, chemotherapy, immunotherapy, hormone therapy, stem cell transplant, and targeted therapy. Targeted therapies are drugs or other substances that block the growth and spread of cancer by interfering with specific molecular targets involved in the progression of cancer. Targeted therapies differ from standard chemotherapy drugs in that they are often cytostatic (block tumor cell proliferation) rather than cytotoxic (kill tumor cells). According to the National Cancer Institute, there are currently more than 80 approved targeted oncology therapies, some of which cost more than $100,000 per treatment course.

Diagnostic tests to detect single biomarkers are now widely used by pathologists to determine the molecular sub-type of a cancer. When a molecular biomarker test is used to support the choice of therapy to prescribe, it is often referred to as a “companion diagnostic.” Increasing numbers of targeted therapeutics are prescribed based on the results from a companion diagnostic test to detect the presence of a molecular biomarker. Only patients testing positive for the biomarker are eligible to receive the associated therapy.

Companion diagnostics are becoming increasingly important to the pharmaceutical industry. The use of companion diagnostics to better match patients to effective treatments positively impacts clinical outcomes and lowers expenditures on drugs that do not benefit patients. Stratifying the eligible patient population to include only likely responders is particularly important when the percentage of likely responders is only a fraction of the total cancer population. In these circumstances, narrowing the eligible patient population is often necessary to meet the clinical endpoint targets required to receive FDA drug approval.

Our Market Opportunities

CDx Development Opportunities

We believe there at least 50 different potential opportunities for our company to collaborate on CDx programs with pharmaceutical companies. Our ability to develop partnering relationships with these pharmaceutical companies will be predicated on a number of factors, including the size of the patient population our CELx test identifies, the remaining patent life of the matching targeted therapy, as well as the success or failure of clinical trials we have conducted with other pharmaceutical companies. Completing clinical trials requires, among other things, successful enrollment of patients, meeting trial endpoint goals, and completing the trial in a timely manner. The time to complete a clinical trial can vary widely depending on a number of factors, many of which will be specific to any particular clinical trial.

We believe the revenue opportunity per CDx program will be consistent with other development programs pharmaceutical companies support. In addition, the revenue for an individual CDx program would represent only a small fraction of the potential value the new drug indication our CDx could create for our pharmaceutical company partner. For some drugs, our tests could double the number of patients eligible for a targeted therapy. Our CELx HSF Test identified 20% of HER2-negative patients with abnormal HER2 signaling who may benefit from treatment with HER2 drugs. Fully deployed, this test could double the annual number of eligible patients to receive HER2 targeted therapies in the U.S. alone.

| 9 |

CELx Testing Opportunities

We expect to generate recurring CDx testing revenues once a CELx CDx-linked drug therapy is approved for patient use. On average, we believe that the lifetime value of providing the CDx test will significantly exceed the revenue generated from the CDx development program. We expect to offer each CELx test to patients at prices ranging from $4,000–$7,000, depending on the number of pathways evaluated. No tests directly comparable to the CELx tests are available today to offer reference points for pricing purposes. Pricing for several proprietary complex genomic tests, however, fall within this range and we believe this provides guidance on the amount insurance companies are willing to pay for highly informative tests that guide patient care.

CELx Technology Background

The Role of Cellular Signaling Pathways in Cancer

Cancer is a class of exceedingly complex and diverse diseases characterized by the development of abnormal cells that divide uncontrollably and can infiltrate and destroy normal body tissue and disrupt normal organ function. In normal cells, a series of biochemical activities, known as signal transduction, transmit biochemical signals through an interconnected network of signaling pathways to control cell proliferation and survival. Cancer arises when alterations occur in one or more of these signaling pathways and normal cell processes are disrupted, resulting in uncontrolled cell proliferation. These alterations are driven by a variety of cellular aberrations, including genetic mutations and dysfunctional signaling pathway mechanisms. Identifying the alteration driving an individual’s cancer is complicated by the immense complexity of these signal transduction processes and the practically unquantifiable number of pathway variables.

As recently as 20 years ago, most cancers were classified and subsequently treated solely on the basis of the anatomical location of the tumor in the body. Chemotherapies that kill rapidly dividing cells were widely used, but they had only limited efficacy for many patients and caused a wide range of dangerous side effects due to lack of discrimination for tumor tissue. As tools to identify molecular mutations became available, scientists began to uncover correlations between certain molecular mutations, cancer tissue type, and a patient’s prognosis. This fostered the development of molecularly targeted therapeutics that were designed to disrupt the specific cellular function of the drug target, typically abnormal signaling pathway activity, associated the molecular mutation. These targeted therapies greatly improved outcomes for some cancer patients and are a testament to the efficacy of targeted therapies when effectively prescribed. According to information published by the Journal of Clinical Oncology in July 2015, targeted therapies are oftentimes 10 to 20 times more expensive than chemotherapies.

In conjunction with the advent of targeted therapies, new molecular diagnostics were developed to help physicians refine the classification of a patient’s cancer into sub-types based on the presence of a specific molecular anomalies, such as genetic mutations or over-expressed proteins. Such mutations or over-expressed proteins are commonly referred to as “biomarkers” when they are used to diagnose a disease and evaluate treatment options. For instance, breast cancer diagnostic tests are performed to determine whether two protein biomarkers, human epidermal growth factor receptor 2 (HER2) or estrogen receptors (ER), are overexpressed in the cancer cells. The results of these tests are used to classify the patient’s cancer molecular sub-type and to guide selection of a corresponding targeted drug therapy.

The launch and on-going development of many new targeted therapies and the increasing use of companion molecular diagnostics to guide selection of the most appropriate therapy for each patient ushered in the era of so-called “precision medicine” in oncology. Advances in genomic and proteomic techniques and drug discovery enabled researchers to identify new drug targets, new molecular diagnostics, and drugs that would specifically bind to the target.

While the increased usage of targeted therapies has improved patient outcomes, there is increasing recognition that the promise of molecularly guided diagnoses and targeted treatment has fallen far short of expectations. This is generally due to the heterogeneous nature of these diseases from patient to patient and the challenge of identifying the specific cellular dysfunction driving a cancer patient’s tumor growth. No matter how sophisticated or detailed, a point-in-time molecular profile can only provide a snapshot of a tumor. As a result, the genetic mutations many current tests identify are often only weakly correlated to the abnormal signaling driving a patient’s cancer. This is because protein and gene profiling provide an incomplete assessment of the biochemical activity promoting cancer tumor growth. In fact, when dysfunctional, the activity of signaling pathway networks are, we believe, not possible to assess using current genetic analyses, despite the impressive investments in mapping the human genome and advancements in techniques to identify molecular mutations.

| 10 |

The combination of the heterogeneous nature of cancer and the weak correlation of abnormal signaling to many genetic mutations helps explain why the response rates for patients treated with many targeted therapies are often less than 50%, and in some cases as low as 10% to 20%. For a patient to respond to a targeted therapy designed to disrupt disease-related signaling activity, two factors must be present: (1) the patient’s diseased cells must have the same signaling pathway dysfunction the drug is designed to inhibit, and (2) the drug affects its targeted pathway as intended. Current state-of-the-art genomic tests use fixed (dead) cells, which limits them to evaluating the presence or concentration of a genetic mutation or protein. These tests cannot evaluate either dynamic signaling activity or whether a drug can affect that activity. When a patient’s genomic biomarker status does not represent underlying signaling pathway dysfunction, this can lead to selection of the wrong targeted therapy to treat the patient. Of particular interest to us are those patients with dysfunctional signaling who lack a corresponding biomarker; they are not currently eligible to receive any targeted therapy that treats their dysfunctional signaling.

To measure dynamic cellular activity, living patient tumor cells are required. Until our advancements, efforts to use living patient tumor cells have been limited by the lack of reliable methods to extract and culture cancer cells from patient tumors. These previously limited efforts reflect the emphasis amongst cancer researchers on creating stable cell lines for use to model cell function or to studies screen millions of test compounds in drug discovery programs. Pharmaceutical companies driving the commercial development of cell technologies work primarily with immortalized cells or cell lines genetically modified to express a target or mutation of interest. These cell lines consist of established cell cultures that proliferate indefinitely and very uniformly. They are used primarily because they provide a highly uniform response when tested with millions of small molecules in the search for potential new drugs, and because techniques to culture these cells are well known, their properties well understood, and other experimental results using them are available for comparison purposes. Conversely, live patient tumor cells are difficult to obtain, are only available in small quantities, and according to a 2014 article published by Science, the percentage of tumors that yield proliferative cells with conventional culturing methods has until now been well below 50%, which required months of culturing to obtain sufficient testable quantities of cells. For these reasons, researchers prefer paraffin-fixed tissue or cell lines over living tumor cells when studying disease processes or screening drug candidates. This lack of compelling rationale for pharmaceutical companies and academic institutions to work with live tumor cells for research purposes left the field of live tumor cell research in a relatively immature state.

Our CELx Platform

We have made significant investments in research and development to build the first commercially-ready cancer diagnostic platform that we are aware of that measures the signaling pathway activity in a patient’s living tumor cells. To measure dynamic cellular activity, we internally developed two distinct but complementary technologies, which now comprise our CELx platform:

| · | our proprietary cell microenvironment; and |

| · | our method to quantify dynamic patient cell signaling dysfunction. |

We utilize our CELx platform to create CELx tests that measure specific signaling pathway activity in various tumor types.

Cell microenvironment. Previous research has shown that cancer cells extracted from a patient’s tumor share the molecular features of the primary cancers from which they were derived and could provide an ex vivo (outside the patient) model of a patient’s tumor. The technology around tumor cell extraction from individual patients and culturing techniques, however, has largely remained undeveloped. For instance, no competing diagnostic tests use live patient tumor cells to measure dynamic cell signaling activity and studies on the topic have historically highlighted the challenges of deriving a viable patient tumor cell sample from an individual patient tumor specimen.

We have developed a cell microenvironment to extract and expand viable tumor cells from fresh human tumor tissue, which meets the three critical clinical parameters a patient-derived tumor cell sample would need to satisfy in order to meet the regulatory and clinical requirements for a diagnostic test measuring signaling activity:

| · | The patient cell sample tested must reflect the starting tumor’s composition. If samples do not reflect the original tumor’s composition, test results derived from that sample may not be representative of the patient’s tumor. Competing techniques largely rely upon use of irradiated non-tumor cells to foster cell proliferation, transformative “engineering” techniques or other un-natural manipulations of the cells to keep them alive. Because these competing approaches significantly increase the risk that the resulting patient cell test sample may not mirror the patient’s original tumor, we developed processes that only utilize tumor cells derived directly from the patient’s tumor specimen. |

| 11 |

| · | The sample must be available for testing in less than 21 days. Clinicians generally require test results in cases of complex diseases such as cancer within two to three weeks so they can begin treatment of their patient as soon as the initial symptoms are evaluated or a preliminary diagnosis is made. Competing techniques require two to six months to culture sufficient tumor cells for a test sample, making them unsuitable for use with a clinical diagnostic. To meet this time requirement, we developed processes that allow tumor cell proliferation outside the patient. |

| · | At least 90% of the tumor specimens obtained from a patient must yield testable samples. Clinicians will only order tests that require a patient specimen when they are highly likely to receive a test result. The challenges of increasing the cell sample yield from tumor tissue are well known and competing techniques are only able to obtain testable quantities of cells from less than 50% of patient tumor specimens. To meet this requirement, we developed processes that enhance cell survival when tumor cells are removed from live tissue. |

We believe our pioneering efforts have substantially advanced the technology of primary tumor cell culture technology. We have one issued U.S. patent, five pending U.S. patent applications, nine pending non-U.S. patent applications and one pending international PCT patent application, as well as significant proprietary know-how and trade secrets for the various cell sample preparation methods we have developed.

Dynamic patient cell signaling quantification. The second component of our CELx platform involves methods to quantify specific dynamic signal transduction events in patient derived tumor cells. The complexity of signal transduction processes is immense and the permutations of the pathway variables are practically unquantifiable. Current analytical methods to assess these variables use dead (fixed or lysed) cells. Point-in-time measurements are limited to assessment of the compositional status (e.g. mutation), concentration level (e.g. protein amount), or activation status (e.g. phosphorylation) of a finite number of signaling pathway components. A key insight underlying our technology was our observation that, no matter how sophisticated or detailed, a point-in-time molecular profile would only provide a snapshot. These methods could not provide a complete, dynamic assessment of the signaling activity driving a patient’s cancer. These point-in-time molecular analyses would, in many cases, only provide a weak correlation to the presence of the signaling pathway dysfunction driving a patient’s cancer. Instead, we concluded that a complete diagnosis of cancer and an assessment of a patient’s response to treating their disease requires measurement of the underlying activity of signaling pathways in live patient tumor cells.

To measure live real-time dynamic cell signaling activity, we utilize an impedance biosensor instrument. An impedance biosensor is an analytical platform that converts changes in cellular activity to a measurable electrical signal. We use the instrument to monitor dynamic changes in cell adhesion and morphology initiated by signal pathway activation or inhibition in live patient tumor cells. The instrument is comprised of a 96-well microplate with thin gold electrodes covering the bottom of each well. Wells employed with a selective extracellular matrix attach viable cells in a specific manner to the electrodes. The presence of viable cells on top of the electrodes affects the local ionic environment at the electrode/cell interface, leading to an increase in electrode impedance. To obtain a measurement, a small alternating current is applied across the electrode. When cells are added to the microplate wells and attach to the electrodes, they act as insulators increasing the impedance in each well.

As cells cover the electrodes, the current is impeded in a manner related to the number of cells and their adhesion properties. In addition, since cell signaling changes modulate a cell’s adhesion properties, the impedance biosensor detects and quantifies these changes. When cells are stimulated and change their function, the accompanying changes in cell adhesion thus alter the impedance that is measured.

To determine the activity of a specific signaling pathway, an activating agent specific to a pathway receptor is used to turn on the pathway and a corresponding inhibitory agent specific to the pathway receptor is used to turn signaling off. When signaling pathways are stimulated in this manner, adhesion molecules are effected and cause a change in the impedance measured in a well. By relying on the principle of detecting signaling pathway activity, we believe we can develop tests for a range of disease types and targeted therapies that affect various cellular pathways.

| 12 |

Data is recorded in real-time when a patient’s tumor cells are responding to activating or inhibitory agents and analyzed with the impedance biosensor. The output value is reported as the change in the electrical impedance measured. The change in impedance values is quantified over time and used to determine a Signaling Function Score.

New Product Development

We are leveraging our CELx technology to discover new cancer sub-types that a genomic test cannot detect. These new sub-types are characterized by the hyperactive signaling pathway our test identifies. These sub-types cannot be detected by genomic tests because they lack a corresponding molecular biomarker to identify it. We will translate our discoveries into diagnostic tests that incorporate the following primary steps:

| (1) | Extraction of proliferative tumor cells from patient biopsy. This step provides the patient tumor cells that we use to perform the test. |

| (2) | Activation of signaling pathway activity. This step determines whether the signaling pathway we are assessing is dysfunctional or not. |

| (3) | Inhibition of signaling pathway activity. This step determines whether the matching targeted therapy is functional in the patient’s tumor cells. If the drug can block a significant amount of the signaling dysfunction, this demonstrates lack of an inherent resistance mechanism in the patient’s tumor cells that would prevent the drug from functioning when prescribed to the patient. |

We confirmed that we can discover new cancer sub-types in 2015 with the discovery of two new breast cancer sub-types—HER2-/ER+ and HER2-/ER- breast cancer with abnormal HER2 signaling. We are now leveraging the expertise we gained while validating the resulting CELx HSF Test for breast cancer to guide our discovery of additional cancer sub-types.

We are currently conducting research to identify additional cancer sub-types in five solid tumor types. Our research studies to date have identified 14 potentially new breast, lung, ovarian, kidney, and bladder cancer sub-types that involve dysfunctional oncogenic signaling pathways. Multiple dysfunctional pathways were active in each of these tumor types. These studies confirm that the CELx platform can be a cancer sub-type discovery engine and that we can create a multi-pathway test to identify the specific driver in a patient’s tumor. We expect to eventually expand the tumor types we evaluate to include colon, head and neck, leukemia, esophageal, and gastric cancers.

We will seek to identify individual signaling pathways that may be driving at least 5% to 10% of the total cancers in each tissue area. Once we have characterized the prevalence of the different sub-types of signaling dysfunction in each tumor type and validated the tests for the different pathways, our plan will be to launch a corresponding CELx test. Eventually, each CELx test will analyze multiple pathways in a patient’s tumor to identify the specific pathway dysfunction driving a patient’s cancer. Testing multiple pathways will thus provide a systems view of the patient’s cancer using dynamic functional analysis. We believe this will result in more accurate diagnosis of a patient compared to molecular diagnostics that are using next generation sequencing to assess the status of multiple static biomarkers.

Clinical Trial Approach

A major component of our development and commercial activities is providing clinical data from interventional clinical trials using our CELx tests. Our clinical trial strategy is predicated on proving the correlation between our CELx Signaling Function Score and a patient’s clinical results. Once our first trial demonstrates that our CELx HER2 Test identifies patients responsive to HER2 targeted therapies, we expect pharmaceutical companies to partner with us to fund trials to evaluate new potential indications for their drugs with patients identified by one of our CELx tests. The trials will be designed to confirm that patients with abnormal pathway signaling obtain a superior clinical response to a therapy targeting that pathway than to the standard-of-care therapy they currently receive.

Each clinical trial would be structured as a prospective interventional study. The objective would be to confirm the relationship between the CELx Signaling Function Score generated by the CELx test and the study endpoint. Different primary endpoints will be used depending on the stage and type of cancer. For late-stage solid tumor trials, Time-to-Progression, or TTP, or Progression-Free Survival, or PFS, would likely be used, mirroring the endpoints used in the tested drug’s pivotal trial. For early stage solid tumor trials, pathological complete response, or pCR, would likely be used. The trials will either be single-arm or randomized two-arm.

| 13 |

We also expect to evaluate multiple CELx tests in the same trial when we have identified two or more cancer sub-types in the same tumor type (e.g., breast, ovarian, lung). Screened subjects would be assigned to a therapy arm that corresponds to the pathway found to be abnormal.

To obtain statistically significant results, a randomized two-arm trial is projected to require enrollment of approximately 120 to 150 patients for each drug evaluated, or between 60 to 75 patients in each arm. A single-arm trial would require 25 to 50 patients. We estimate each trial will require 18 to 27 months from the initiation of enrollment to completion of the follow-up period and that interim analysis will be performed in most trials with interim data available after 10 to 15 months.

For trials involving patients not currently eligible for a cancer drug that targets a certain pathway, we would first obtain a tissue specimen from each subject and perform the CELx test to identify subjects who have abnormal signaling. These patients would then be randomly assigned to either an arm that receives the current standard-of-care therapy or one that includes the current standard-of-care therapy plus the targeted therapy. All patients would be monitored until their disease progresses.

First Test—CELx HER2 Signaling Function Test

HER2+ breast cancer. Roughly 15% to 20% of breast cancer patients are diagnosed with HER2+ breast cancer when their tumor cells are found to have overexpressed or amplified levels of HER2. These patients are treated with anti-HER2 targeted therapies in combination with chemotherapies. Results from a number of clinical trial results for HER2 drugs reveal that only about 40% of HER2-positive patients respond to them. In addition, findings from several clinical trials have shown that a sub-set of HER2-negative patients benefit from therapies that target HER2. These results highlight the relatively weak correlation between HER2 receptor or gene amplification status and drug response.

Signaling activity status vs. HER2 receptor status. Based on this analysis, we concluded that measurement of HER2 signaling activity, rather than absolute HER2 levels, may more accurately diagnose HER2-driven breast cancer. This led to our successful studies in 2014 when we discovered abnormal HER2 signaling in HER2-negative breast cancer patient tissue. We concluded that this patient population provided an excellent opportunity to validate our hypothesis that signaling activity is more correlative to disease activity than receptor status. Measuring HER2-status not sufficient to diagnose all HER2 cancers. Despite the widely recognized role that a dysfunctional HER2-related signaling network plays in promoting breast cancer, only tests measuring a single reactant, HER2 protein, are performed in the clinic to diagnose it; we believe no diagnostic tests are available today that measure HER2 signaling activity within a patient’s breast tumor epithelial cells. This focus on measuring HER2 expression-levels reflects the widely-held view that measuring a patient’s HER2 status is sufficient to diagnose HER2-driven breast cancers. When only HER2 expression is measured, though, patients classified as HER2-negative but whose tumor cells have abnormal HER2 signaling are diagnosed as not having HER2-driven breast cancer, when, in fact, they do.

Diagnosing HER2 disease in HER2-negative patients with CELx HER2 Signaling Function Test. Since current genomic methods cannot identify the HER2-negative breast cancer patients who have the HER2-driven cancer, a new method was required. Such a method would need to analyze the HER2-signaling pathways (MAPK and PI3K) associated with HER2 cancers in a patient’s tumor cells. This is what our CELx HER2 Test is designed to do. Our test identifies patients whose HER2 status as determined by conventional techniques does not represent the correct diagnosis of their breast cancer at a functional level.

Improving outcomes, HER2 drug response rates, and lower cost per responding patient. Identifying these HER2-negative/HER2-signaling abnormal patients, and treating them with HER2 therapies, offers the potential to improve their clinical outcomes significantly. It is also likely that patients with abnormal HER2 signaling will respond at higher rates than HER2-positive patients. We believe that patients with abnormal HER signaling (e.g., those the CELx HSF Test diagnoses) are very likely to respond because they have the specific disease mechanism the HER2 therapies are designed to treat. This would result in a reduction in the cost of HER2 drugs per responsive patient for those the CELx HSF Test identifies compared to those identified with HER2 protein or gene status tests.

| 14 |

Clinical Studies

Prevalence Studies: 20% of HER2-Negative Patients Have Abnormal HER2-Signaling

To derive an initial estimate of the prevalence of abnormal HER2 signaling within the HER2-negative breast cancer population, we conducted a cell line survey, a training set study and a validation study using primary tumor cells. Live cell response to specific HER2 agonists (NRG1b and EGF) and antagonist (pertuzumab) was measured.

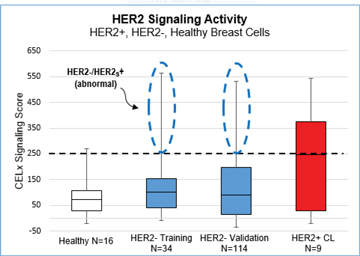

Key findings include:

| · | Cell Line Survey Study (N=19) |

| · | 4 of 9 HER2+ cell lines had HER2 signaling activity above 250 signaling units—these results helped establish an initial cut-off value; |

| · | Confirmed that normal HER2 signaling can occur in cells with overexpressed amounts of HER2; and |

| · | Confirmed that abnormal HER2 signaling can occur in cells with normal HER2 receptor levels. |

| · | Training Set Study (N=50). |

| · | 7 of 34 HER2-negative breast cancer patients (20.5%; 95% CI = 10%–37%) had tumor cells with HER2 signaling activity that was characterized as abnormally high and consistent with the HER2 signaling found in the upper 50% of the HER2+ cell lines; and |

| · | The 16 healthy breast specimens had a significantly lower average and standard deviation HER2 Signaling Scores than the HER2- and HER2+ breast cancer specimens. |

| · | Validation Study (N=114) |

| · | 27 of 114 patients (23.7%; 95% CI = 17%–32%) had tumor cells with HER2 signaling activity that was characterized as abnormally high and consistent with the HER2 signaling found in the upper 50% of the HER2+ cell lines. |

| · | The graph below presents the data from the Cell Line, Training Set and Validation Prevalence Studies in a Box-Whiskers plot format. |

| o | The dotted line at 250 represents the cut-off value for the CELx HSF Test. The cut-off value of 250 is equivalent to the median CELx Signaling Score recorded from the sample of HER2+ cell lines. |

| o | HER2-negative breast cancer patients with CELx Signaling Scores at or above 250 have abnormal HER2 signaling. |

| o | The circled portions of the plots for the HER2- Training Set and HER2 Validation Set results represent the specimens with Abnormal HER2-driven signaling. |

| 15 |

Xenograft Study: Abnormal HER2 Signaling Correlates to Drug Response Better than HER2 Status

We conducted a study in collaboration with the University of Minnesota using xenograft mouse models of human breast tumors to evaluate the relationship of HER2-driven signaling and response to lapatinib, a reversible dual-HER2 kinase inhibitor. Key findings:

| · | The HER2 signal inhibitor shrank a HER2-negative tumor with abnormal HER2 signaling; |

| · | The HER2 signal inhibitor did not affect the HER2+ tumor with normal HER2 signaling; and |

| · | Findings contradict HER2 receptor-based conclusions: |

| · | Lapatinib inhibition more correlative to HER2 signaling than HER2 receptor expression; and |

| · | HER2 signaling status independent of HER2 receptor expression. |

These findings support the hypothesis that HER2-negative breast cancer patients with abnormal HER2-driven signaling may benefit from treatment with anti-HER2 drugs.

A summary of results:

Xenograft Study Results

| Cell Line | ||||

| Parameter | HCC1954 | BT483 | ||

| HER2 Receptor Expression (IHC) | HER2+ (3+) | HER2- (0) | ||

| HER2 Signaling Status (CELx) | Normal | Abnormal | ||

| Lapatinib Inhibition (Xenograft) | 13% (p = 0.34) | 49% (p = 0.01) | ||

Study of Two HER2 Antibody Therapies, Trastuzumab and Pertuzumab, in HER2- and HER2+ Cells

We conducted this study to compare the effectiveness of two anti-HER2 antibodies in blocking HER2-driven signaling in HER2+ and HER2- cells. Tumor cells from 5 HER2- primary tumors and 4 HER2+ cell lines were obtained. Real-time live cell response to NRG1, a specific HER2/HER3 agonist, with or without pertuzumab, trastuzumab, or the combination of the two, was measured and quantified. All cell samples tested had comparable, and abnormal, levels of NRG1 activated HER2-driven signaling. Key findings:

| 16 |

| · | In each sample, the two mAb’s inhibited a higher percentage of signaling in combination than either mAb alone; no interference effects between the two mAb’s were detected; |

| · | Pertuzumab and trastuzumab alone were each more effective in the HER2- cell samples than in the HER2+ ones; and |

| · | Two HER2 mAb’s used to treat HER2+ breast cancer patients are as effective in blocking abnormal HER2-driven function ex vivo in HER2- primary cells as they are in HER2+ cell lines. |

Average % NRG1 Inhibition

| HER2 mAb | HER2+ Cell Lines |

HER2-(HER2S+) Primaries | ||

| Pertuzumab | 62% | 73% | ||

| Trastuzumab | 19% | 44% | ||

| T+P | 87% | 81% | ||

Study of Four HER2 Signal Inhibitors in HER2- and HER2+ Cells with Abnormal HER2 Signaling

Tumor cells from seven HER2-negative tumor specimens with abnormal HER2-driven signaling (HER2 S +) and the nine HER2-positive cell lines were obtained. Real time live cell response to NRG1, a specific HER2/HER3 agonist, with or without a HER2 targeted drug (pertuzumab, lapatinib, neratinib, afatinib) was measured and quantified. From these responses, the percentage inhibition of the HER2-driven signaling initiated by NRG1 by the HER2 drugs was determined. Key findings:

| · | Each of the HER2 drugs inhibited an average of at least 69% of the HER2-driven signaling activated by NRG1 stimulation in the HER2-negative primary cell samples; |

| · | The highest level of inhibition was found with the two irreversible covalent dual RTKi’s, afatinib and neratinib; and |

| · | All of the HER2 drugs inhibited a greater percentage of HER2-driven signaling in the HER2-negative primary tumor cells than in the HER2-positive cell lines. |

Average % NRG1 Inhibition

| HER2 Drugs | Mechanism of Action | Cell Lines (HER2+) |

Primaries (HER2-/HER2S+) | |||

| Pertuzumab | HER2 dimerization inhibitor | 46% | 78% | |||

| Lapatinib | Reversible Dual RTKi | 15% | 69% | |||

| Afatinib | Irreversible Covalent Dual RTKi | 47% | 93% | |||

| Neratinib | Irreversible Covalent Dual RTKi | 95% | 100% |

Analytical Validation Study

We conducted analytical validation studies in accordance with applicable FDA guidance and Clinical and Laboratory Standards Institute, or CLSI, standards to characterize the performance of the CELx HSF Test. CLSI standards define the test protocols that the FDA and CLIA require laboratories to use to characterize the performance of their diagnostic tests. The study results confirm that the CELx HSF Test has high analytical sensitivity and specificity. A summary of the results is provided below:

| 17 |

CELx HSF Test Analytical Study Results

| Performance Characteristics | Results | |

| Analytical Precision (Qualitative) | ||

| Analytical Sensitivity (95% CI) | 95.8%–100% (88/88) | |

| Analytical Specificity (95% CI) | 95.8%–100% (88/88) | |

| Detection Limits | ||

| Limit of Blank | 0.0020 cell attachment units | |

| Limit of Detection | 0.0099 cell attachment units | |

| Cut-Off Characterization | 250 signaling units | |

| Carry Over | 0% |

Clinical Trial (in process): CELx test FDA Approved for Use in Clinical Trials

On May 8, 2017, we entered into a non-exclusive Clinical Trial Agreement with NSABP to conduct a 54-patient single-arm interventional trial. Pursuant to the agreement, NSABP serves as the Sponsor and Principal Investigator of the trial and is responsible for, among other things, setting up clinical sites, enrolling patients, and managing clinical data. NSABP has contracted separately with Genentech to provide drugs for the study at no cost. We are performing the CELx HSF Test to select patients for the trial and are providing the funding for the trial’s patient-related costs. Completing this trial will require, among other things, successful enrollment of patients, meeting trial endpoint goals, and completing the trial in a timely manner. Based on our estimates of patient enrollment rates, we expect to obtain interim results in late 2018 and final results six to nine months later.

NSABP is one of the country’s premier clinical research cooperatives. Its members include many of the country’s leading medical centers and their investigators are amongst the most-respected in the breast cancer field. Genentech is one of the largest biopharmaceutical companies in the world and was the first company to launch a HER2 targeted therapy; their anti-HER2 targeted therapies have roughly 95% market share.

We submitted an Investigational Device Exemption, or IDE, application to the FDA to obtain approval to use our CELx HSF Test in a clinical trial setting. The IDE submission included validation test protocols and study reports, manufacturing process summaries, and relevant publications. The FDA approved our IDE in early 2017.

The goal is to demonstrate that patients who have an abnormal signaling pathway, as identified by our CELx test, respond to treatment with a matching targeted therapy. A synopsis of the trial protocol is provided below.

| 18 |

Clinical Trial Synopsis

| Objective | To evaluate the efficacy of neoadjuvant HER2 drug treatment in early stage HER2-/HER2S+ breast cancer patients |

Sites/Sponsor Endpoint Investigational (Single) Arm |

Multi-center in collaboration with NSABP and Genentech 54 HER2- early stage breast cancer (26 ER+/28ER-) Pathological complete response (ypT0/Tis ypN0) N=54 (HER2S+) |

Pursuant to our agreement with NSABP, the cost of the study is $2.65 million, subject to adjustment based on reimbursement for travel and similar expenses. Of this amount, we paid $300,000 upon entry into the agreement and $50,000 or one quarterly payment in 2017 and we will pay: (i) an aggregate of approximately $1.8 million as certain patient milestones are met, (ii) five quarterly payments of $50,000 in 2018 and ending in 2019, and (iii) a final payment of $250,000 upon completion of the study.

Our agreement with NSABP may be terminated by one or either party upon certain events, such as: (i) the FDA withdrawing its authorization and approval to perform the study, (ii) NSABP determining that the human and/or toxicology test results support termination of the study, (iii) either us or NSABP determining that an adverse reaction or side-effect of drugs administered in the study or a modification of the study’s protocol raises safety issues to support termination of the study, (iv) either party remaining in material breach of the agreement for a period of 30 days following notice of such breach, (v) us not performing the CELx HSF Tests or providing study kits, (vi) us failing to pay amounts owed to NSABP, and/or (vii) Genentech terminating its agreement with NSABP to supply drugs for the study or the drugs for the study no longer being manufactured or being available.

Commercialization Strategy

Our commercial activities will target three complementary groups at various phases of the development of our CELx tests.

| · | Pharmaceutical companies. For each CELx test we develop to diagnose a new cancer sub-type, we will identify the matching targeted therapies, either currently approved or in the investigational phase, and the manufacturer of those therapies. We will initiate discussions and seek to reach development agreements with each of these pharmaceutical companies when we have verified the prevalence of the cancer sub-type and completed successful animal studies. |

| · | Medical and surgical oncologists. We will initially target key opinion leaders, or KOLs, in each cancer type once we have completed the analytical validation of a CELx test. This will allow us to build awareness and credibility for the CELx test as we are generating clinical validation data. When a new drug indication is received that requires use of a CELx CDx to identify eligible patients, we will coordinate the pharmaceutical company’s go-to-market activities with our own. This coordination will allow us to significantly leverage the pharmaceutical company’s sales, marketing, and reimbursement, unlike traditional molecular diagnostic companies. |

| · | Payors. We will initiate pilot activities with payors for late stage patients during the clinical validation phase of a CELx test’s development. We will expand our payor efforts to include health economics analysis once we have clinical trial data available. When a new drug indication is received that requires use of a CELx CDx to identify eligible patients, we expect to coordinate the pharmaceutical company’s reimbursement activities with our own. |

| 19 |

Our CELx tests are laboratory developed tests and subject to regulation under CLIA. We completed the analytical validation of our first CELx test and received CLIA certification in 2016, at which time our CELx HSF Test was ready to sell commercially on a stand-alone basis to treating physicians. We expect to generate revenues from CELx tests performed in conjunction with the clinical trials a pharmaceutical company will field during the clinical phase of our partners’ drug approval process. We also expect that the agreements we enter into with the pharmaceutical companies partnering with us on these trials will include milestone payments at initiation and completion of trials and perhaps at various other negotiated points during the trials. We expect to generate revenue from the sale of CELx tests ordered by physicians either as stand-alone diagnostics or, upon the approval of our pharmaceutical company’s matching drug, as a CDx. A key requirement for success of these partnerships will be clinical trial results that demonstrate the advantages of using a CELx test as a companion diagnostic.

We intend to position our unique and highly differentiated tests as practice changing advancements in patient care. To inform key stakeholders of the value of our solution in order to drive adoption and reimbursement, we expect to employ the following diverse commercialization strategies over time:

| · | leverage our pharmaceutical partnership and their go-to-market initiatives for the drug our CDx is partnered with; |

| · | collaborate with oncology thought and KOLs and leading institutions on clinical research, publications, and product development; |

| · | build an experienced, oncology-focused sales force in the United States and international distribution channels that are supported by dedicated company personnel; |

| · | integrate into the everyday practice of clinicians through our medical affairs and client services efforts; |

| · | publish important medical and scientific data in peer-reviewed journals and present at major industry conferences, conduct clinical trials; and |

| · | work with patient advocacy groups, leading cancer philanthropic organizations, and medical societies to drive awareness of CELx tests and the importance of incorporating functional cellular analysis into cancer treatment. |

Through these efforts, we will seek to promote our CELx test’s unique capabilities throughout the oncology community—from patients, to the physicians treating them, to the third-party payors for these treatments and to biopharmaceutical companies developing new treatments—all with the goal of facilitating better-informed treatment decisions for the greatest number of patients.

Once results from our current clinical trial are available, we expect to launch our first test, the CELx HSF Test in two phases. During the first phase, we intend to target KOLs in the oncology field to build awareness of our CELx platform. These KOLs are primarily comprised of oncologists and surgeons practicing at major academic health systems who participate in clinical research and cancer research scientists. They often are early adopters of new technologies, particularly those involving new insights into disease mechanisms. We expect to gradually ramp up our efforts to the remainder of the medical oncologists once we have established our reputation within the KOL community.

Once a CELx test is launched to the broader market, we expect physicians, typically a medical or surgical oncologist, will order our tests either as stand-alone diagnostics or, upon the approval of a pharmaceutical company’s matching drug, as a CDx. The physician will prescribe a CELx test and coordinate provision of a patient specimen from a biopsy or surgical procedure. The fresh tissue would then be shipped overnight directly to our laboratory where we would use our proprietary methods to extract diseased cell samples from the patient’s tissue and perform the CELx tests ordered. Test results would typically be available in 10 to 14 days after receipt of the patient specimen. For each patient sample analyzed, a Signaling Function Score would be calculated quantitatively and converted into a final qualitative result: abnormal or normal. For patients found to have an abnormal signaling function, clinicians would use the results of the CELx test as a guide to select a targeted drug that inhibits the abnormal signaling activity identified.

United States