Attached files

| file | filename |

|---|---|

| EX-10.16 - EX-10.16 THIRD AMENDMENT TO CREDIT AGREEMENT - ICHOR HOLDINGS, LTD. | ichr-ex1016_297.htm |

| EX-32.2 - EX-32.2 SECTION 906 CFO CERTIFICATION - ICHOR HOLDINGS, LTD. | ichr-ex322_6.htm |

| EX-32.1 - EX-32.1 SECTION 906 CEO CERTIFICATION - ICHOR HOLDINGS, LTD. | ichr-ex321_7.htm |

| EX-31.2 - EX-31.2 SECTION 302 CFO CERTIFICATION - ICHOR HOLDINGS, LTD. | ichr-ex312_8.htm |

| EX-31.1 - EX-31.1 SECTION 302 CEO CERTIFICATION - ICHOR HOLDINGS, LTD. | ichr-ex311_9.htm |

| EX-23.1 - EX-23.1 CONSENT OF KPMG LLP - ICHOR HOLDINGS, LTD. | ichr-ex231_74.htm |

| EX-21.1 - EX-21.1 LIST OF SUBSIDIARIES - ICHOR HOLDINGS, LTD. | ichr-ex211_73.htm |

| EX-10.15 - EX-10.15 OFFER LETTER DATED NOVEMBER 9, 2017 - ICHOR HOLDINGS, LTD. | ichr-ex1015_100.htm |

| EX-10.14 - EX-10.14 OFFER LETTER DATED JULY 20, 2017 - ICHOR HOLDINGS, LTD. | ichr-ex1014_99.htm |

| EX-2.2 - EX-2.2 STOCK PURCHASE AGREEMENT, DATED AS OF DECEMBER 11, 201 - ICHOR HOLDINGS, LTD. | ichr-ex22_448.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10‑K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 29, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001‑37961

ICHOR HOLDINGS, LTD.

(Exact name of registrant as specified in its charter)

|

Cayman Islands |

|

001-37961 |

|

Not Applicable |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

3185 Laurelview Ct.

Fremont, California 94538

(Address of principal executive offices, including Zip Code)

(510) 897-5200

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

|

Title of each class |

|

Name of exchange on which registered |

|

Ordinary Shares, $0.0001 par value |

|

The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

(Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

|

Emerging Growth Company |

☒ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes ☐ No ☒

There were 26,254,862 ordinary shares, $0.0001 par value, outstanding as of March 6, 2018. The aggregate market value of ordinary shares held by non-affiliates was $260,085,228 as of March 6, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of Form 10‑K is incorporated herein by reference to the registrant’s definitive Proxy Statement relating to its 2018 General Meeting, which will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year.

|

|

Page |

|

|

PART I |

|

|

|

ITEM 1. |

1 |

|

|

ITEM 1A. |

9 |

|

|

ITEM 1B. |

25 |

|

|

ITEM 2. |

25 |

|

|

ITEM 3. |

25 |

|

|

ITEM 4. |

25 |

|

|

|

|

|

|

PART II |

|

|

|

ITEM 5. |

26 |

|

|

ITEM 6. |

28 |

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

29 |

|

ITEM 7A. |

46 |

|

|

ITEM 8. |

47 |

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

47 |

|

ITEM 9A. |

47 |

|

|

ITEM 9B. |

48 |

|

|

|

|

|

|

PART III |

|

|

|

ITEM 10. |

48 |

|

|

ITEM 11. |

48 |

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

48 |

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

49 |

|

ITEM 14. |

49 |

|

|

|

|

|

|

PART IV |

|

|

|

ITEM 15. |

49 |

|

|

ITEM 16. |

49 |

|

|

EXHIBIT INDEX |

|

|

SIGNATURES |

|

|

|

|

CAUTIONARY STATEMENT CONCERNING FORWARD‑LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact included in this report are forward-looking statements. These statements relate to analyses and other information, which are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to our future prospects, developments and business strategies. These forward-looking statements are identified by the use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” and similar terms and phrases, including references to assumptions. However, these words are not the exclusive means of identifying such statements. These statements are contained in many sections of this report, including those entitled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that we will achieve those plans, intentions or expectations. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected.

Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements contained in this report under the heading “Risk Factors,” as well as other cautionary statements that are made from time to time in our other filings with the Securities and Exchange Commission and public communications. You should evaluate all forward-looking statements made in this report in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Unless expressly indicated or the context requires otherwise, the terms “Ichor,” “Company,” “we,” “us,” “our,” and similar terms in this report refer to Ichor Holdings, Ltd. and its consolidated subsidiaries.

We use a 52 or 53 week fiscal year ending on the last Friday in December. The years ended December 29, 2017, December 30, 2016, and December 25, 2015 were 52 weeks, 53 weeks, and 52 weeks, respectively. All references to 2017, 2016, and 2015 are references to fiscal years unless explicitly stated otherwise.

Company Overview

We are a leader in the design, engineering and manufacturing of critical fluid delivery subsystems and components for semiconductor capital equipment. Our product offerings include gas and chemical delivery subsystems, collectively known as fluid delivery subsystems, which are key elements of the process tools used in the manufacturing of semiconductor devices. Our gas delivery subsystems deliver, monitor and control precise quantities of the specialized gases used in semiconductor manufacturing processes such as etch and deposition. Our chemical delivery subsystems precisely blend and dispense the reactive liquid chemistries used in semiconductor manufacturing processes such as chemical-mechanical planarization, electroplating, and cleaning. We also manufacture precision machined components, weldments, and proprietary products for use in fluid delivery systems for direct sales to our customers. This vertically integrated portion of our business is primarily focused on metal and plastic parts that are used in gas and chemical systems, respectively.

Fluid delivery subsystems ensure accurate measurement and uniform delivery of specialty gases and chemicals at critical steps in the semiconductor manufacturing processes. Any malfunction or material degradation in fluid delivery reduces yields and increases the likelihood of manufacturing defects in these processes. Historically, semiconductor original equipment manufacturers, or OEMs, internally designed and manufactured the fluid delivery subsystems used in their process tools. Currently, most OEMs outsource all or a portion of the design, engineering and manufacturing of their gas delivery subsystems to a few specialized suppliers, including us. Additionally, many OEMs are also increasingly outsourcing the design, engineering and manufacturing of their chemical delivery subsystems due to the increased fluid expertise required to manufacture these subsystems. Outsourcing these subsystems has allowed OEMs to leverage the suppliers’ highly specialized engineering, design and production skills while focusing their internal resources on their own value-added processes. We believe that this outsourcing trend has enabled OEMs to reduce their fixed costs and development time, as well as provided significant growth opportunities for specialized subsystems suppliers like us.

Our goal is to be a leading supplier of outsourced fluid delivery subsystems and components to OEMs engaged in manufacturing capital equipment to produce semiconductors and to leverage our technology to expand our addressable markets. To achieve this goal, we engage with our customers early in their design and development processes and utilize our deep engineering resources and operating expertise to jointly create innovative and advanced solutions that meet the current and future needs of our customers. These collaborations frequently involve our engineers working at our customers’ sites and serving as an extension of our customers’ product design teams. We employ this approach with two of the largest manufacturers of semiconductor capital equipment in the world. We believe this approach enables us to design subsystems that meet the precise specifications our customers demand, allows us to often be the sole supplier of these subsystems during the initial production ramp and positions us to be the preferred supplier for the full five to ten-year lifespan of the process tool.

The broad technical expertise of our engineering team, coupled with our early customer engagement approach, enables us to offer innovative and reliable solutions to complex fluid delivery challenges. With two decades of experience developing complex fluid delivery subsystems and meeting the constantly changing production requirements of leading semiconductor OEMs, we have developed expertise in fluid delivery that we offer to our OEM customers. In addition, our capital efficient model and the integration of our business systems with those of our customers provides us the flexibility to fulfill increased demand and meet changing customer requirements with relatively low levels of capital expenditures. With an aim to superior customer service, we have a global footprint with many facilities strategically located in close proximity to our customers. We have long standing relationships with top tier OEM customers, including Lam Research and Applied Materials, which were our two largest customers by sales in 2017.

1

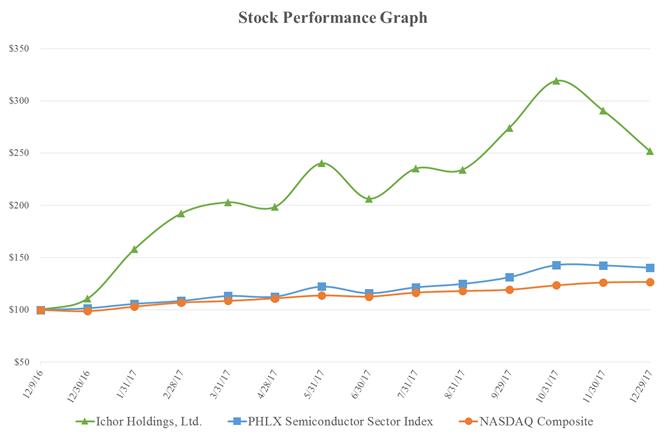

We grew our revenue from continuing operations by 62% to $655.9 million in 2017 from $405.7 million in 2016 (hereinafter, all references to “sales” or “revenue” relates to sales from continuing operations, unless explicitly stated otherwise). We generated net income from continuing operations of $56.9 million in 2017 and $20.8 million in 2016. We generated adjusted net income from continuing operations of $65.1 million in 2017 and $31.6 million in 2016. See Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations, Non-GAAP Results for a discussion of adjusted net income from continuing operations, an accompanying presentation of the most directly comparable financial measure calculated in accordance with generally accepted accounting principles in the United States, net income from continuing operations, and a reconciliation of the differences between adjusted net income from continuing operations and net income from continuing operations.

Our Competitive Strengths

As a leader in the fluid delivery industry, we believe that our key competitive strengths include the following:

Deep Fluids Engineering Expertise

We believe that our engineering team, comprised of chemical engineers, mechanical engineers and software and systems engineers, has positioned us to expand the scope of our solutions, provide innovative subsystems and strengthen our incumbent position at our OEM customers. Many of our engineers are industry veterans and have spent a significant portion of their careers at our customers, bringing first-hand expertise and a heightened understanding of our customers’ needs. Our engineering team acts as an extension of our customers’ product development teams, providing our customers with technical expertise that is outside of their core competencies.

Early Engagement with Customers on Product Development

We seek to engage with our customers and potential customers very early in their process for new product development. We believe this approach enables us to collaborate on product design, qualification, manufacturing and testing in order to provide a comprehensive, customized solution. Through early engagement during the complex design stages, our engineering team gains early insight into our customers’ technology roadmaps which enables us to pioneer innovative and advanced solutions. In many cases our early engagement with our customers enables us to be the sole source supplier when the product is initially introduced.

Long History and Strong Relationships with Top Tier Customers

We have established deep relationships with top tier OEMs such as Lam Research and Applied Materials, which were our two largest customers by sales in 2017. Our customers are global leaders by sales in the increasingly concentrated semiconductor capital equipment industry. Our existing relationships with our customers have enabled us to effectively compete for new fluid delivery subsystems for our customers’ next generation products in development. We leverage our deep rooted existing customer relationships with these market leaders to penetrate new business opportunities created through industry consolidation. Our close collaboration with them has contributed to our established market position and several key supplier awards.

Operational Excellence with Scale to Support the Largest Customers

Over our 18 year history of designing and building gas delivery systems, we have developed deep capabilities in operations. We have strategically located our manufacturing facilities near our customers’ locations in order to provide fast and efficient responses to new product introductions, and accommodate configuration or design changes late in the manufacturing process. We also added significant capacity in our Singapore facility to support high volume products and will continue to add capacity as needed to support future growth. In addition to providing high quality and reliable fluid delivery subsystems, one of our principal strategies is delivering the lead-times that provide our customers the required flexibility needed in their production processes. We have accomplished this by investing in manufacturing systems and processes and an efficient supply chain. Our focus on operational efficiency and flexibility allows us to reduce manufacturing cycle times in order to respond quickly to customer requests and lead-times that are often less than four weeks.

2

Capital Efficient and Scalable Business Model

In general, our business is not capital intensive and we are able to grow sales with a low investment in property, plant and equipment. In 2017, 2016, and 2015, our total capital expenditures were $8.2 million, $4.3 million, and $1.4 million, respectively. The semiconductor capital equipment market has historically been cyclical. We have structured our business to minimize fixed manufacturing overhead and operating expenses to enable us to grow net income at a higher rate than sales during periods of growth. Conversely, our low fixed cost approach allows us to minimize the impact of cyclical downturns on our net income, but results in a lower level of gross margin leverage or improvement as a percentage of sales in times of increased demand. For example, from 2014 to 2017, sales grew at a compound annual growth rate, or CAGR, of 38% while adjusted net income from continuing operations grew at a CAGR of 77%. Conversely, our low fixed cost approach allows us to minimize the impact of cyclical downturns on our net income, but results in a smaller increase in gross margin as a percentage of sales in times of increased demand.

Our Growth Strategy

Our objective is to enhance our position as a leader in providing fluid delivery solutions, including subsystems, components, and tool refurbishment, to our customers by leveraging our core strengths. The key elements of our growth strategy are:

Grow Our Market Share within Existing Customer Base

We intend to grow our position with existing customers by continuing to leverage our specialized engineering talent and early collaboration approach with OEMs to foster long-term relationships. Each of our customers produces many different process tools for various process steps. At each customer, we are an outsourced supplier of fluid delivery subsystems for a subset of their entire process tool offerings. We are constantly looking to expand our market share at our existing customers. We believe that our early collaborative approach with customers positions us to deliver innovative and dynamic solutions, offer timely deployment and meet competitive cost targets, further enhancing our brand reputation. Through our recent acquisitions of a weldment company and a precision machining company completed in July and December 2017, respectively, as well as our 2016 acquisition of a plastic machining & fabrication company, we expanded our served market and entered the market for chemical delivery subsystems for wet process tools where we had only limited engagement in the past. Using this and our existing engineering capability, we developed a liquid delivery module and were qualified on a wet process equipment system at one of our two largest customers who is a market leader in this space.

Grow Our Total Available Market at Existing Customers with Expanded Product Offerings

We continue to work with our existing core customers on additional opportunities, including chemical delivery, one of our important potential growth areas. We believe that wet processes, clean and electro chemical deposition, or ECD, that require precise chemical delivery are currently an underpenetrated market opportunity for us. By leveraging our existing customer relationships and strong reputation in fluid mechanics, we intend to increase our chemical delivery module market share and introduce additional related products. Through our recent acquisitions of a weldment company and a precision machining company completed in July and December 2017, respectively, as well as our 2016 acquisition of a plastic machining & fabrication company, we expanded our served market and entered the market for chemical delivery subsystems. The acquisitions allow us to manufacture and assemble the complex plastic and metal products and precision machined components for the semiconductor equipment, aerospace, and general-industrial industries.

Expand Our Total Customer Base within Fluid Delivery Market

We have expanded our customer base and are currently a supplier for of gas delivery systems for a leading lithography system manufacturer in addition to a leading ALD system manufacturer. We continue to actively engage with new customers that are considering outsourcing their gas and chemical delivery needs.

Continue to Improve Our Manufacturing Process Efficiency

We continually strive to improve our processes to reduce our manufacturing process cycle time, improve our ability to respond to short lead-time and last minute configuration changes, reduce our manufacturing costs, and improve our inventory efficiency requirements in order to improve profitability and make our product offerings more attractive to new and existing customers.

3

We are a leader in the design, engineering and manufacturing of critical fluid delivery subsystems. Our product and service offerings are classified in the following categories:

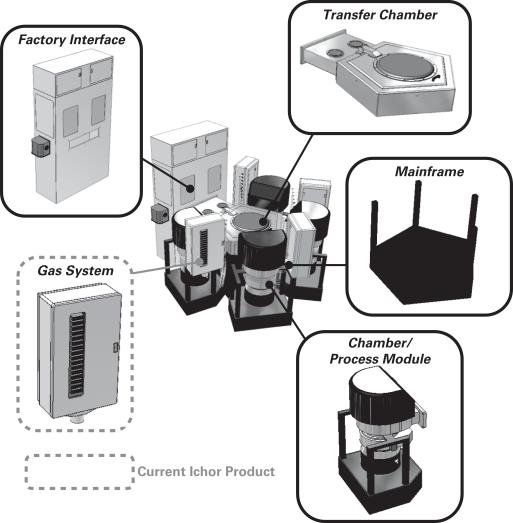

Gas Delivery Subsystems

Gas delivery is among the most technologically complex functions in semiconductor capital equipment and is used to deliver, monitor and control precise quantities of the vapors and gases critical to the manufacturing process. Our gas delivery systems consist of a number of gas lines, each controlled by a series of mass flow controllers, regulators, pressure transducers and valves, and an integrated electronic control system. Our gas delivery subsystems are primarily used in equipment for “dry” manufacturing processes, such as etch, chemical vapor deposition, physical vapor deposition, epitaxy and strip.

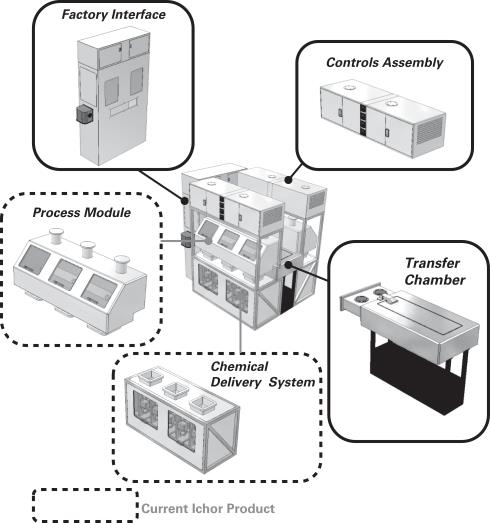

Chemical Delivery Subsystems

Our chemical delivery subsystems are used to precisely blend and dispense reactive chemistries and colloidal slurries critical to the specific “wet” front-end process, such as wet clean, electro chemical deposition (“ECD”), and chemical-mechanical planarization (“CMP”). In addition to the chemical delivery subsystem, we also develop the process modules that apply the various chemicals directly to the wafer in a process and application-unique manner to create the desired chemical reaction.

4

The image below shows a typical wet-process front end semiconductor tool, with a chemical delivery subsystem and corresponding application process module highlighted:

Weldments

Our complete offering of weldments support the delivery of fluids through the process tool. We have developed both automated and manual welding process to support world class workmanship on all types of metals needed to support fluid delivery within the semiconductor market. The welded assemblies are used in both wet and dry processes.

Precision Machining

Precision machining provides the ability to supply our customers with components used in our gas delivery systems and weldments, while also providing custom machined solutions throughout customers’ equipment. Many of these items are used downstream of the gas system and in process critical applications. Our precision machined products can be used in both wet and dry applications.

5

We were originally incorporated as Celerity, Inc. (“Celerity”) in 1999. Our business of designing and manufacturing critical systems for semiconductor capital equipment manufacturers operated as a stand-alone business until 2009 when Celerity sold the business to a private equity fund. Francisco Partners acquired the business in December 2011 and formed Ichor Holdings, Ltd., an exempt company incorporated in the Cayman Islands, in March 2012 to serve as the parent company as part of a restructuring to accommodate the expansion of our business in Singapore and Malaysia. In April 2012, we acquired Semi Scenic UK Limited to provide refurbishment services for legacy tools. In April 2016, we purchased Ajax for $17.6 million to add chemical delivery subsystem capabilities with existing customers. We completed the initial public offering of our ordinary shares in December 2016. In July 2017 we acquired Cal‑Weld, Inc. (“Cal‑Weld”) for $56.9 million to add to our gas delivery subsystem and weldment capabilities. In December 2017 we acquired Talon Innovations Corporation (“Talon”) for $137.0 million to add to our gas delivery subsystem, precision machining, and component manufacturing capabilities. We intend to continue to evaluate opportunistic acquisitions to supplement our organic growth.

Customers, Sales and Marketing

We market and sell our products directly to equipment OEMs in the semiconductor equipment market. We are dependent upon a small number of customers, as the semiconductor equipment manufacturer market is highly concentrated with four companies accounting for over 80% of all process tool revenues. For 2017, our two largest customers were Lam Research and Applied Materials, which accounted for 53% and 40% of sales, respectively. We do not have long-term contracts that require customers to place orders with us in fixed or minimum volumes, and we generally operate on a purchase order basis with customers.

Our sales and marketing efforts focus on fostering close business relationships with our customers. As a result, we locate many of our account managers near the customer they support. Our sales process involves close collaboration between our account managers and engineering and operations teams. Account managers and engineers work together with customers and in many cases provide on-site support, including attending customers’ internal meetings related to production and engineering design. Each customer project is supported by our account managers and customer support team, who ensure we are aligned with all of the customer’s quality, cost and delivery expectations.

Operations, Manufacturing and Supply Chain Management

We have developed a highly flexible manufacturing model with cost-effective locations situated nearby the manufacturing facilities of our largest customers. We have facilities in the United States, Singapore, Malaysia, and the United Kingdom.

Operations

Our product cycle engagements begin by working closely with our customers to outline the solution specifications before design and prototyping even begin. Our design and manufacturing process is highly flexible, enabling our customers to make alterations to their final requirements throughout the design, engineering and manufacturing process. This flexibility results in significantly decreased order-to-delivery cycle times for our customers. For instance, it can take as little as 20 to 30 days for us to manufacture a gas delivery system with fully evaluated performance metrics after receiving an order.

Manufacturing

We are ISO 9001 qualified at each of our manufacturing locations, and our manufactured subsystems and modules adhere to strict design tolerances and specifications. We operate Class 100 and Class 10,000 clean room facilities for customer-specified testing, assembly and integration of high-purity gas and chemical delivery systems at our locations in Singapore; Tualatin, Oregon; and Austin, Texas. We operate a facility in Malaysia; Tualatin, Oregon; and Fremont, California for weldments and related components used in our gas delivery subsystems and a facility in Union City, California for critical components used in our chemical delivery subsystems. We operate a facility in Sauk Rapids, Minnesota for precision machining of components for sale to our customers and internal use. Our facilities are located in close proximity to our largest customers to allow us to collaborate with them on a regular basis and to enable us to deliver our products on a just-in-time basis, regardless of order size or the degree of changes in the applicable configuration or specifications.

6

We qualify and test key components that are integrated into our subsystems, and test our fluid delivery subsystems during the design process and again prior to shipping. Our quality management system allows us to access real-time corrective action reports, non-conformance reports, customer complaints and controlled documentation. In addition, our senior management conducts quarterly reviews of our quality control system to evaluate effectiveness. Our customers also complete quarterly surveys which allow us to measure satisfaction.

Supply Chain Management

We use a wide range of components and materials in the production of our gas and chemical delivery systems, including filters, mass flow controllers, regulators, pressure transducers and valves. We obtain components and materials from a large number or sources, including single source and sole source suppliers. We use consignment material and just-in-time stocking programs to better manage our component inventories and better respond to changing customer requirements. These approaches enable us to significantly reduce our inventory levels and maintain flexibility in responding to changes in product demand.

In addition, a key part of our strategy is to identify multiple suppliers with a strong global reach that are located within close proximity to our manufacturing locations.

Technology Development and Engineering

We have a long history of engineering innovation and development. Over time, we have transitioned from being simply an integration engineering and components company into a gas and chemical delivery subsystem leader with complete system engineering and integration expertise. Our industry continues to experience rapid technological change, requiring us to continuously invest in technology and product development and to regularly introduce new products and features that meet our customers’ evolving requirements.

We have built a team of gas delivery experts, many of whom have previously worked for certain of our customers. As of December 29, 2017, our engineering team consisted of approximately 65 engineers and designers with mechanical, electrical, chemical, systems and software expertise. Our engineers are closely connected with our customers and typically work at our customers’ sites and operate as an extension of our customers’ design team. We engineer within our customers’ processes, design vaults, drawing standards and part numbering systems. These development efforts are designed to meet specific customer requirements in the areas of subsystem design, materials, component selection and functionality. The majority of our sales are generated from projects during which our engineers cooperated with our customer early in the design cycle. Through this early collaborative process, we become an integral part of our customers’ design and development processes, and we are able to quickly anticipate and respond to our customers’ changing requirements.

Our engineering team also works directly with our suppliers to help them identify new component technologies and make necessary changes in, and enhancements to, the components that we integrate into our products. Our analytical and testing capabilities enable us to evaluate multiple supplier component technologies and provide customers with a wide range of appropriate component and design choices for their gas and chemical delivery systems and other critical subsystems. Our analytical and testing capabilities also help us anticipate technological changes and the requirements in component features for next-generation gas delivery systems and other critical subsystems.

Competition

The markets for our products are very competitive. When we compete for new business, we face competition from other suppliers of gas or chemical delivery subsystems, as well as the internal manufacturing groups of OEMs. While many OEMs have outsourced the design and manufacture of their gas and chemical delivery systems, we would face additional competition if in the future these OEMs elected to develop these systems internally.

The gas delivery subsystem market is highly concentrated and we face competition primarily from Ultra Clean Technology, with limited competition from regional or specialized suppliers. The chemical delivery subsystem industry is fragmented and we face competition from numerous suppliers. In addition, the market for tool refurbishment is fragmented and we compete with many regional competitors. The primary competitive factors we emphasize include:

|

|

• |

early engagement with customers; |

|

|

• |

size and experience of engineering staff; |

7

|

|

• |

flexible manufacturing capabilities; and |

|

|

• |

customer relationships. |

We expect our competitors to continue to improve the performance of their current products and to introduce new products or new technologies that could adversely affect sales of our current and future products. In addition, the limited number of potential customers in our industry further intensifies competition. We anticipate that increased competitive pressures will cause intensified price-based competition and we may have to reduce the prices of our products. In addition, we expect to face new competitors as we enter new markets.

Intellectual Property

Our success depends, in part, upon our ability to maintain and protect our technology and products and to conduct our business without infringing the proprietary rights of others. We continue to invest in securing intellectual property protection for our technology and products and protect our technology by, among other things, filing patent applications. We also rely on a combination of trade secrets and confidentiality provisions, and to a much lesser extent, copyrights and trademarks, to protect our proprietary rights. We have historically focused our patent protection efforts in the United States. As of December 29, 2017, we held 33 patents, 16 of which were U.S. patents. While we consider our patents to be valuable assets, we do not believe the success of our business or our overall operations are dependent upon any single patent or group of related patents. In addition, we do not believe that the loss or expiration of any single patent or group of related patents would materially affect our business.

Intellectual property that we develop on behalf of our customers is generally owned exclusively by those customers. In addition, we have agreed to indemnify certain of our customers against claims of infringement of the intellectual property rights of others with respect to our products. Historically, we have not paid any claims under these indemnification obligations, and we do not have any pending indemnification claims against us.

Employees and Labor Relations

As of December 29, 2017, we had approximately 1,420 full‑time employees, 320 contract or temporary workers , and 20 part‑time employees, which allow flexibility as business conditions and geographic demand change. Of our total employees, approximately 65 are engineers, 60 are engaged in sales and marketing, 1,530 are engaged in manufacturing, and 100 perform executive and administrative functions. None of our employees are unionized, but in various countries, local law requires our participation in works councils. We have not experienced any material work stoppages at any of our facilities. We consider our relationship with our employees to be good.

Environmental, Health, and Safety Regulations

Our operations and facilities are subject to federal, state and local regulatory requirements and foreign laws and regulations, relating to environmental, waste management and health and safety matters, including those relating to the release, use, storage, treatment, transportation, discharge, disposal and remediation of contaminants, hazardous substances and wastes, as well as practices and procedures applicable to the construction and operation of our facilities. We believe that our business is operated in substantial compliance with applicable regulations. However, in the future we could incur substantial costs, including cleanup costs, fines or civil or criminal sanctions, or third-party property damage or personal injury claims, in the event of violations or liabilities under these laws and regulations, or non-compliance with the environmental permits required at our facilities. Potentially significant expenditures could be required in order to comply with environmental laws that may be adopted or imposed in the future. We are not aware of any threatened or pending environmental investigations, lawsuits or claims involving us, our operations or our current or former facilities.

Available Information

Our internet address is www.ichorsystems.com. We make a variety of information available, free of charge, at our Investor Relations website, ir.ichorsystems.com. This information includes our Annual Reports on Form 10‑K, our Quarterly Reports on Form 10‑Q, our Current Reports on Form 8‑K, and any amendments to those reports as soon as reasonably practicable after we electronically file those reports with or furnish them to the Securities and Exchange Commission (“SEC”), as well as our Code of Business Ethics and Conduct and other governance documents.

8

The public may read and copy materials filed by us with the Securities and Exchange Commission, or the SEC, at the SEC’s Public Reference Room at 100 F Street, NE Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1‑800‑SEC‑0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file documents electronically with the SEC at www.sec.gov.

The contents of these websites, or the information connected to those websites, are not incorporated into this report. References to websites in this report are provided as a convenience and do not constitute, and should not be viewed as, incorporation by reference of the information contained on, or available through, the website.

There are many factors that affect our business and the results of operations, some of which are beyond our control. The following is a description of some important factors that may cause the actual results of operations in future periods to differ materially from those currently expected or desired.

Risks Related to Our Business

Our business depends significantly on expenditures by manufacturers in the semiconductor capital equipment industry, which, in turn, is dependent upon the semiconductor device industry. When that industry experiences cyclical downturns, demand for our products and services is likely to decrease, which would likely result in decreased sales. We may also be forced to reduce our prices during cyclical downturns without being able to proportionally reduce costs.

Our business, financial condition and results of operations depend significantly on expenditures by manufacturers in the semiconductor capital equipment industry. In turn, the semiconductor capital equipment industry depends upon the current and anticipated market demand for semiconductor devices. The semiconductor device industry is subject to cyclical and volatile fluctuations in supply and demand and in the past has periodically experienced significant downturns, which often occur in connection with declines in general economic conditions, and which have resulted in significant volatility in the semiconductor capital equipment industry. The semiconductor device industry has also experienced recurring periods of over-supply of products that have had a severe negative effect on the demand for capital equipment used to manufacture such products. We have experienced, and anticipate that we will continue to experience, significant fluctuations in customer orders for our products and services as a result of such fluctuations and cycles. Any downturns in the semiconductor device industry could have a material adverse effect on our business, financial condition and results of operations.

In addition, we must be able to appropriately align our cost structure with prevailing market conditions, effectively manage our supply chain and motivate and retain employees, particularly during periods of decreasing demand for our products. We may be forced to reduce our prices during periods of decreasing demand. While we operate under a low fixed cost model, we may not be able to proportionally reduce all of our costs if we are required to reduce our prices. If we are not able to timely and appropriately adapt to the changes in our business environment, our business, financial condition and results of operations will be materially adversely affected. The cyclical and volatile nature of the semiconductor device industry and the absence of long-term fixed or minimum volume contracts make any effort to project a material reduction in future sales volume difficult.

We rely on a very small number of OEM customers for a significant portion of our sales. Any adverse change in our relationships with these customers could materially adversely affect our business, financial condition and results of operations.

The semiconductor capital equipment industry is highly concentrated and has experienced significant consolidation in recent years. As a result, a relatively small number of OEM customers have historically accounted for a significant portion of our sales, and we expect this trend to continue for the foreseeable future. For 2017, our top two customers accounted for approximately 53% and 40%, respectively, of sales, and we expect that our sales will continue to be concentrated among a very small number of customers. We do not have any long-term contracts that require customers to place orders with us in fixed or minimum volumes. Accordingly, the success of our business depends on the success of our customers and those customers and other OEMs continuing to outsource the manufacturing of critical subsystems and process solutions to us. Because of the small number of OEMs in the markets we serve, a number of which are already our customers, it would be difficult to replace lost sales resulting from the loss of, or the reduction, cancellation or delay in purchase orders by, any one of these customers, whether due to a reduction in the amount of outsourcing they do, their giving orders to our competitors, their acquisition by an OEM who is not a customer or with whom we do less business, or otherwise. We have in the past lost business from customers for a number of these reasons. If we are unable to replace sales from customers who reduce the volume of products and services they purchase from us or terminate their relationship with us entirely, such events could have a material adverse impact on our business, financial condition and results of operations.

9

Additionally, if one or more of the largest OEMs were to decide to single- or sole-source all or a significant portion of manufacturing and assembly work to a single equipment manufacturer, such a development would heighten the risks discussed above.

Our customers exert a significant amount of negotiating leverage over us, which may require us to accept lower prices and gross margins or increased liability risk in order to retain or expand our market share with them.

By virtue of our largest customers’ size and the significant portion of our sales that is derived from them, as well as the competitive landscape, our customers are able to exert significant influence and pricing pressure in the negotiation of our commercial arrangements and the conduct of our business with them. Our customers often require reduced prices or other pricing, quality or delivery commitments as a condition to their purchasing from us in any given period or increasing their purchase volume, which can, among other things, result in reduced gross margins in order to maintain or expand our market share. Our customers’ negotiating leverage also can result in customer arrangements that may contain significant liability risk to us. For example, some of our customers require that we provide them indemnification against certain liabilities in our arrangements with them, including claims of losses by their customers caused by our products. Any increase in our customers’ negotiating leverage may expose us to increased liability risk in our arrangements with them, which, if realized, may have a material adverse effect on our business, financial condition and results of operations. In addition, new products often carry lower gross margins than existing products for several quarters following their introduction. If we are unable to retain and expand our business with our customers on favorable terms, or if we are unable to achieve gross margins on new products that are similar to or more favorable than the gross margins we have historically achieved, our business, financial condition and results of operations may be materially adversely affected.

The industries in which we participate are highly competitive and rapidly evolving, and if we are unable to compete effectively, our business, financial condition and results of operations could be materially adversely affected.

We face intense competition from other suppliers of gas or chemical delivery subsystems, as well as the internal manufacturing groups of OEMs. Increased competition has in the past resulted, and could in the future result, in price reductions, reduced gross margins or loss of market share, any of which would materially adversely affect our business, financial condition and results of operations. We are subject to significant pricing pressure as we attempt to maintain and increase market share with our existing customers. Our competitors may offer reduced prices or introduce new products or services for the markets currently served by our products and services. These products may have better performance, lower prices and achieve broader market acceptance than our products. OEMs also typically own the design rights to their products. Further, if our competitors obtain proprietary rights to these designs such that we are unable to obtain the designs necessary to manufacture products for our OEM customers, our business, financial condition and results of operations could be materially adversely affected.

Certain of our competitors may have or may develop greater financial, technical, manufacturing and marketing resources than we do. As a result, they may be able to respond more quickly to new or emerging technologies and changes in customer requirements, devote greater resources to the development, promotion, sale and support of their products and services, and reduce prices to increase market share. In addition to organic growth by our competitors, there may be merger and acquisition activity among our competitors and potential competitors that may provide our competitors and potential competitors with an advantage over us by enabling them to expand their product offerings and service capabilities to meet a broader range of customer needs. The introduction of new technologies and new market entrants may also increase competitive pressures.

10

We are exposed to risks associated with weakness in the global economy and geopolitical instability.

Our business is dependent upon manufacturers of semiconductor capital equipment, whose businesses in turn ultimately depend largely on consumer spending on semiconductor devices. Continuing uncertainty regarding the global economy continues to pose challenges to our business. Economic uncertainty and related factors, including current unemployment levels, uncertainty in European debt markets, geopolitical instability in various parts of the world, fiscal uncertainty in the U.S. economy, market volatility and the slow rate of recovery of many countries from recent recessions, exacerbate negative trends in business and consumer spending and may cause certain of our customers to push out, cancel or refrain from placing orders for products or services, which may reduce sales and materially adversely affect our business, financial condition and results of operations. Difficulties in obtaining capital, uncertain market conditions or reduced profitability may also cause some customers to scale back operations, exit businesses, merge with other manufacturers, or file for bankruptcy protection and potentially cease operations, leading to customers’ reduced research and development funding and/or capital expenditures and, in turn, lower orders from our customers and/or additional slow moving or obsolete inventory or bad debt expense for us. These conditions may also similarly affect our key suppliers, which could impair their ability to deliver parts and result in delays for our products or require us to either procure products from higher-cost suppliers, or if no additional suppliers exist, to reconfigure the design and manufacture of our products, and we may be unable to fulfill some customer orders. Any of these conditions or events could have a material adverse effect on our business, financial condition and results of operations.

If we do not keep pace with developments in the industries we serve and with technological innovation generally, our products and services may not be competitive.

Rapid technological innovation in the markets we serve requires us to anticipate and respond quickly to evolving customer requirements and could render our current product offerings, services and technologies obsolete. In particular, the design and manufacturing of semiconductors is constantly evolving and becoming more complex in order to achieve greater power, performance and efficiency with smaller devices. Capital equipment manufacturers need to keep pace with these changes by refining their existing products and developing new products.

We believe that our future success will depend upon our ability to design, engineer and manufacture products that meet the changing needs of our customers. This requires that we successfully anticipate and respond to technological changes in design, engineering and manufacturing processes in a cost-effective and timely manner. If we are unable to integrate new technical specifications into competitive product designs, develop the technical capabilities necessary to manufacture new products or make necessary modifications or enhancements to existing products, our business, financial condition and results of operations could be materially adversely affected.

The timely development of new or enhanced products is a complex and uncertain process which requires that we:

|

|

• |

design innovative and performance-enhancing features that differentiate our products from those of our competitors; |

|

|

• |

identify emerging technological trends in the industries we serve, including new standards for our products; |

|

|

• |

accurately identify and design new products to meet market needs; |

|

|

• |

collaborate with OEMs to design and develop products on a timely and cost-effective basis; |

|

|

• |

ramp-up production of new products, especially new subsystems, in a timely manner and with acceptable yields; |

|

|

• |

manage our costs of product development and the costs of producing the products that we sell; |

|

|

• |

successfully manage development production cycles; and |

|

|

• |

respond quickly and effectively to technological changes or product announcements by others. |

If we are unsuccessful in keeping pace with technological developments for the reasons above or other reasons, our business, financial condition and results of operations could be materially adversely affected.

11

We must design, develop and introduce new products that are accepted by OEMs in order to retain our existing customers and obtain new customers.

The introduction of new products is inherently risky because it is difficult to foresee the adoption of new standards, coordinate our technical personnel and strategic relationships and win acceptance of new products by OEMs. We attempt to mitigate this risk by collaborating with our customers during their design and development processes. We cannot, however, assure you that we will be able to successfully introduce, market and cost-effectively manufacture new products, or that we will be able to develop new or enhanced products and processes that satisfy customer needs. In addition, new capital equipment typically has a lifespan of five to ten years, and OEMs frequently specify which systems, subsystems, components and instruments are to be used in their equipment. Once a specific system, subsystem, component or instrument is incorporated into a piece of capital equipment, it will often continue to be purchased for that piece of equipment on an exclusive basis for 18 to 24 months before the OEM generates enough sales volume to consider adding alternative suppliers. Accordingly, it is important that our products are designed into the new systems introduced by the OEMs. If any of the new products we develop are not launched or successful in the market, our business, financial condition and results of operations could be materially adversely affected.

The manufacturing of our products is highly complex, and if we are not able to manage our manufacturing and procurement process effectively, our business, financial condition and results of operations may be materially adversely affected.

The manufacturing of our products is a highly complex process that involves the integration of multiple components and requires effective management of our supply chain while meeting our customers’ design-to-delivery cycle time requirements. Through the course of the manufacturing process, our customers may modify design and system configurations in response to changes in their own customers’ requirements. In order to rapidly respond to these modifications and deliver our products to our customers in a timely manner, we must effectively manage our manufacturing and procurement process. If we fail to manage this process effectively, we risk losing customers and damaging our reputation. We may also be subject to liability under our agreements with our customers if we or our suppliers fail to re- configure manufacturing processes or components in response to these modifications. In addition, if we acquire inventory in excess of demand or that does not meet customer specifications, we could incur excess or obsolete inventory charges. We have from time to time experienced bottlenecks and production difficulties that have caused delivery delays and quality control problems. These risks are even greater as we seek to expand our business into new subsystems. In addition, certain of our suppliers have been, and may in the future be, forced out of business as a result of the economic environment. In such cases, we may be required to procure products from higher-cost suppliers or, if no additional suppliers exist, reconfigure the design and manufacture of our products. This could materially limit our growth, adversely impact our ability to win future business and have a material adverse effect on our business, financial condition and results of operations.

Defects in our products could damage our reputation, decrease market acceptance of our products and result in potentially costly litigation.

A number of factors, including design flaws, material and component failures, contamination in the manufacturing environment, impurities in the materials used and unknown sensitivities to process conditions, such as temperature and humidity, as well as equipment failures, may cause our products to contain undetected errors or defects. Errors, defects or other problems with our products may:

|

|

• |

cause delays in product introductions and shipments; |

|

|

• |

result in increased costs and diversion of development resources; |

|

|

• |

cause us to incur increased charges due to unusable inventory; |

|

|

• |

require design modifications; |

|

|

• |

result in liability for the unintended release of hazardous materials; |

|

|

• |

create claims for rework, replacement and/or damages under our contracts with customers, as well as indemnification claims from customers; |

|

|

• |

decrease market acceptance of, or customer satisfaction with, our products, which could result in decreased sales and increased product returns; or |

|

|

• |

result in lower yields for semiconductor manufacturers. |

12

If any of our products contain defects or have reliability, quality or compatibility problems, our reputation may be damaged and customers may be reluctant to buy our products. We may also face a higher rate of product defects as we increase our production levels in periods of significant growth. Product defects could result in warranty and indemnification liability or the loss of existing customers or impair our ability to attract new customers. In addition, we may not find defects or failures in our products until after they are installed in a manufacturer’s fabrication facility. We may have to invest significant capital and other resources to correct these problems. Our current or potential customers also might seek to recover from us any losses resulting from defects or failures in our products. In addition, hazardous materials flow through and are controlled by certain of our products and an unintended release of these materials could result in serious injury or death. Liability claims could require us to spend significant time and money in litigation or pay significant damages.

We may incur unexpected warranty and performance guarantee claims that could materially adversely affect our business, financial condition and results of operations.

In connection with our products and services, we provide various product warranties, performance guarantees and indemnification rights. Warranty or other performance guarantee or indemnification claims against us could cause us to incur significant expense to repair or replace defective products or indemnify the affected customer for losses. In addition, quality issues can have various other ramifications, including delays in the recognition of sales, loss of sales, loss of future sales opportunities, increased costs associated with repairing or replacing products, and a negative impact on our reputation, all of which could materially adversely affect our business, financial condition and results of operations.

Our dependence on a limited number of suppliers may harm our production output and increase our costs, and may prevent us from delivering acceptable products on a timely basis.

Our ability to meet our customers’ demand for our products depends upon obtaining adequate supplies of quality components and other raw materials on a timely basis. In addition, our customers often specify components from particular suppliers that we must incorporate into our products. We also use consignment and just-in-time stocking programs, which means we carry very little inventory of components or other raw materials, and we rely on our suppliers to deliver necessary components and raw materials in a timely manner. However, our suppliers are under no obligation to provide us with components or other raw materials. As a result, the loss of or failure to perform by any of our key suppliers could materially adversely affect our ability to deliver products on a timely basis. In addition, if a supplier was unable to provide the volume of components we require on a timely basis and at acceptable prices and quality, we would have to identify and qualify replacements from alternative sources of supply. However, the process of qualifying new suppliers for complex components is also lengthy and could delay our production. We may also experience difficulty in obtaining sufficient supplies of components and raw materials in times of significant growth in our business. If we are unable to procure sufficient quantities of components or raw materials from suppliers, our customers may elect to delay or cancel existing orders or not place future orders, which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to order and shipment uncertainties, and any significant reductions, cancellations or delays in customer orders could have a material adverse effect on our business, financial condition and results of operations.

Our sales are difficult to forecast because we generally do not have a material backlog of unfilled orders and because of the short time frame within which we are often required to manufacture and deliver products to our customers. Most of our sales for a particular quarter depend on customer orders placed during that quarter or shortly before it commences. Our contracts generally do not require our customers to commit to minimum purchase volumes. While most of our customers provide periodic rolling forecasts for product orders, those forecasts do not become binding until a formal purchase order is submitted, which generally occurs only a short time prior to shipment. As a result of the foregoing and the cyclicality and volatility of the industries we serve, it is difficult to predict future orders with precision. Occasionally, we order component inventory and build products in advance of the receipt of actual customer orders. Customers may cancel order forecasts, change production quantities from forecasted volumes or delay production for reasons beyond our control. Furthermore, reductions, cancellations or delays in customer order forecasts usually occur without penalty to, or compensation from, the customer. Reductions, cancellations or delays in forecasted orders could cause us to hold inventory longer than anticipated, which could reduce our gross profit, restrict our ability to fund our operations and result in unanticipated reductions or delays in sales. If we do not obtain orders as we anticipate, we could have excess components for a specific product and/or finished goods inventory that we would not be able to sell to another customer, likely resulting in inventory write-offs, which could have a material adverse effect on our business, financial condition and results of operations.

13

Because our customers generally require that they qualify our engineering, documentation, manufacturing and quality control procedures, our ability to add new customers quickly is limited.

We are generally required to qualify and maintain our status as a supplier for each of our customers. This is a time-consuming process that involves the inspection and approval by a customer of our engineering, documentation, manufacturing and quality control procedures before that customer will place orders with us. Our ability to lessen the adverse effect of any loss of, or reduction in sales to, an existing customer through the rapid addition of one or more new customers is limited in part because of these qualification requirements. Consequently, the risk that our business, financial condition and results of operations would be materially adversely affected by the loss of, or any reduction in orders by, any of our significant customers is increased. Moreover, if we lost our existing status as a qualified supplier to any of our customers, such customer could cancel its orders from us or otherwise terminate its relationship with us, which could have a material adverse effect on our business, financial condition and results of operations.

We may be subject to interruptions or failures in our information technology systems.

We rely on our information technology systems to process transactions, summarize our operating results and manage our business. Our information technology systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyber-attack or other security breaches, catastrophic events, such as fires, floods, earthquakes, tornadoes, hurricanes, acts of war or terrorism, and usage errors by our employees. If our information technology systems are damaged or cease to function properly, we may have to make a significant investment to fix or replace them, and we may suffer loss of critical data and interruptions or delays in our operations.

We may be the target of attempted cyber attacks, computer viruses, malicious code, phishing attacks, denial of service attacks and other information security threats. To date, cyber attacks have not had a material impact on our financial condition, results or business; however, we could suffer material financial or other losses in the future and we are not able to predict the severity of these attacks. Our risk and exposure to these matters remains heightened because of, among other things, the evolving nature of these threats, the current global economic and political environment, our prominent size and scale and our role in the financial services industry, the outsourcing of some of our business operations, the ongoing shortage of qualified cyber security professionals, and the interconnectivity and interdependence of third parties to our systems. The occurrence of a cyber attack, breach, unauthorized access, misuse, computer virus or other malicious code or other cyber security event could jeopardize or result in the unauthorized disclosure, gathering, monitoring, misuse, corruption, loss or destruction of confidential and other information that belongs to us, our customers, our counterparties, third-party service providers or borrowers that is processed and stored in, and transmitted through, our computer systems and networks. The occurrence of such an event could also result in damage to our software, computers or systems, or otherwise cause interruptions or malfunctions in our, our customers’, our counterparties’ or third parties’ operations. This could result in significant losses, loss of customers and business opportunities, reputational damage, litigation, regulatory fines, penalties or intervention, reimbursement or other compensatory costs, or otherwise adversely affect our business, financial condition or results of operations.

The reliability and capacity of our information technology systems is critical to our operations and the implementation of our growth initiatives. Any material disruption in our information technology systems, or delays or difficulties in implementing or integrating new systems or enhancing current systems, could have an adverse effect on our business, and results of operations.

Restrictive covenants under our Credit Facilities may limit our current and future operations. If we fail to comply with those covenants, the lenders could cause outstanding amounts, which are currently substantial, to become immediately due and payable, and we might not have sufficient funds and assets to pay such loans.

As of December 29, 2017, we had $179.5 million of indebtedness outstanding under our term loan facility, or our Term Loan Facility, and $10.0 million of indebtedness outstanding under our revolving credit facility, or our Revolving Credit Facility, and together with our Term Loan Facility, our Credit Facilities. The outstanding amount of our Credit Facilities reflected in our consolidated financial statements included elsewhere in this report on Form 10-K is net of $2.8 million of debt issuance costs. On February 14, 2018, we amended and restated the credit agreement governing our Credit Facilities resulting in a $175.0 million Term Loan Facility and a Revolving Credit Facility enabling borrowing up to $125.0 million. We may incur additional indebtedness in the future. Our Credit Facilities contain certain restrictive covenants and conditions, including limitations on our ability to, among other things:

|

|

• |

incur additional indebtedness or contingent obligations; |

|

|

• |

create or incur liens, negative pledges or guarantees; |

|

|

• |

make investments; |

|

|

• |

make loans; |

14

|

|

• |

merge, consolidate or sell substantially all of our assets; |

|

|

• |

make certain payments on indebtedness; |

|

|

• |

pay dividends on or make distributions in respect of capital stock or make certain other restricted payments or investments; |

|

|

• |

enter into certain agreements that restrict distributions from restricted subsidiaries; |

|

|

• |

enter into transactions with affiliates; |

|

|

• |

change the nature of our business; and |

|

|

• |

amend the terms of our organizational documents. |

As a result of these covenants, we may be restricted in our ability to pursue new business opportunities or strategies or to respond quickly to changes in the industries that we serve. A violation of any of these covenants would be deemed an event of default under our Credit Facilities. In such event, upon the election of the lenders, the loan commitments under our Credit Facilities would terminate and the principal amount of the loans and accrued interest then outstanding would be due and payable immediately. A default may also result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In the event our lenders accelerate the repayment of our borrowings, we cannot assure you that we and our subsidiaries would have sufficient funds to repay such indebtedness or be able to obtain replacement financing on a timely basis or at all. These events could force us into bankruptcy or liquidation, which could have a material adverse effect on our business, financial condition and results of operations.

We also may need to negotiate changes to the covenants in the agreements governing our Credit Facilities in the future if there are material changes in our business, financial condition or results of operations, but we cannot assure you that we will be able to do so on terms favorable to us or at all.

Certain of our customers require that we consult with them in connection with specified fundamental changes in our business, and address any concerns or requests such customer may have in connection with a fundamental change. While those customers do not have contractual approval or veto rights with respect to fundamental changes, our failure to consult with such customers or to satisfactorily respond to their requests in connection with any such fundamental change could constitute a breach of contract or otherwise be detrimental to our relationships with such customers.

Certain of our key customers require that we consult with them in connection with specified fundamental changes in our business, including, among other things:

|

|

• |

entering into any new line of business; |

|

|

• |

amending or modifying our organizational documents; |

|

|

• |

selling all or substantially all of our assets, or merging or amalgamating with a third party; |

|

|

• |

incur borrowings in excess of a specific amount; |

|

|

• |

making senior management changes; |

|

|

• |

entering into any joint venture arrangement; and |

|

|

• |

effecting an initial public offering. |

These customers do not have contractual approval or veto rights with respect to any fundamental changes in our business. However, our failure to consult with such customers or to satisfactorily respond to their requests in connection with any such fundamental change could constitute a breach of contract or otherwise be detrimental to our relationships with such customers, which could have a material adverse effect on our business, financial condition and results of operations.

15

We may not be able to generate sufficient cash to service all of our indebtedness, including under our Credit Facilities, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or to refinance our indebtedness, including under our Credit Facilities, depends on our financial condition and results of operations, which are subject to prevailing economic and competitive conditions and other factors beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to fund our day-to-day operations or to pay the principal, premium, if any, and interest on our indebtedness. If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to sell assets or operations, seek additional capital or restructure or refinance our indebtedness. If we cannot make scheduled payments on our debt, we will be in default and, as a result, the lenders under our Credit Facilities could terminate their commitments to loan money, or foreclose against the assets securing such borrowings, and we could be forced into bankruptcy or liquidation, in each case, which would have a material adverse effect on our business, financial condition and results of operations.

Our business is largely dependent on the know-how of our employees, and we generally do not have an intellectual property position that is protected by patents.

We believe that the success of our business depends in part on our proprietary technology, information, processes and know-how and on our ability to operate without infringing on the proprietary rights of third parties. We rely on a combination of trade secrets and contractual confidentiality provisions and, to a much lesser extent, patents, copyrights and trademarks to protect our proprietary rights. Accordingly, our intellectual property position is more vulnerable than it would be if it were protected primarily by patents. We cannot assure you that we have adequately protected or will be able to adequately protect our technology, that our competitors will not be able to utilize our existing technology or develop similar technology independently, that the claims allowed with respect to any patents held by us will be broad enough to protect our technology or that foreign intellectual property laws will adequately protect our intellectual property rights. If we fail to protect our proprietary rights successfully, our competitive position could suffer. Any future litigation to enforce patents issued to us, to protect trade secrets or know-how possessed by us or to defend ourselves or to indemnify others against claimed infringement of the rights of others could have a material adverse effect on our business, financial condition and results of operations.

Third parties have claimed and may in the future claim we are infringing their intellectual property, which could subject us to litigation or licensing expenses, and we may be prevented from selling our products if any such claims prove successful.