Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-k3618raymondjamespre.htm |

RAYMOND JAMES

INSTITUTIONAL INVESTORS CONFERENCE

MARCH 6, 2018 | ORLANDO, FL

1

FORWARD LOOKING STATEMENT AND USE OF ADJUSTED MEASURES

This presentation contains forward-looking statements including but not limited to statements with respect to estimated 2018

guidance and the related assumptions, the impact of various factors on operating and financial results, expected savings and

synergies (including from the LaunchPad initiative and as a result of acquisitions), and the opportunities for future growth.

This presentation contains forward-looking statements which are subject to change based on various important factors,

including without limitation, competitive actions and other unforeseen changes and general uncertainties in the marketplace,

changes in government regulations, including health care reform, customer purchasing decisions, including changes in payer

regulations or policies, other adverse actions of governmental and third-party payers, changes in testing guidelines or

recommendations, adverse results in material litigation matters, the impact of changes in tax laws and regulations, failure to

maintain or develop customer relationships, our ability to develop or acquire new products and adapt to technological

changes, failures in information technology systems or data security, challenges in implementing business process changes,

employee relations, and the effect of exchange rate fluctuations on international operations.

Actual results could differ materially from those suggested by these forward-looking statements. The Company has no

obligation to provide any updates to these forward-looking statements even if its expectations change. Further information on

potential factors, risks and uncertainties that could affect the operating and financial results of Laboratory Corporation of

America Holdings (the “Company”) is included in the Company’s Form 10-K for the year ended December 31, 2017, and Forms

10-Q, including in each case under the heading risk factors, and in the Company’s other filings with the SEC.

This presentation contains “adjusted” financial information that has not been prepared in accordance with GAAP, including

Adjusted EPS, and Free Cash Flow, and certain segment information. The Company believes these adjusted measures are

useful to investors as a supplement to, but not as a substitute for, GAAP measures, in evaluating the Company’s operational

performance. The Company further believes that the use of these non-GAAP financial measures provides an additional tool for

investors in evaluating operating results and trends, and growth and shareholder returns, as well as in comparing the

Company’s financial results with the financial results of other companies. However, the Company notes that these adjusted

measures may be different from and not directly comparable to the measures presented by other companies. Reconciliations

of these non-GAAP measures to the most comparable GAAP measures are included in this presentation.

2

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

3

WHO WE ARE

Our Mission

is to

improve health

and improve lives

LabCorp is

a leading global

life sciences company

that is deeply integrated

in guiding patient care

Our Strategic Objectives are to:

Deliver World-Class Diagnostics

Bring Innovative Medicines to Patients Faster

Use Technology to Improve the Delivery of Care

4

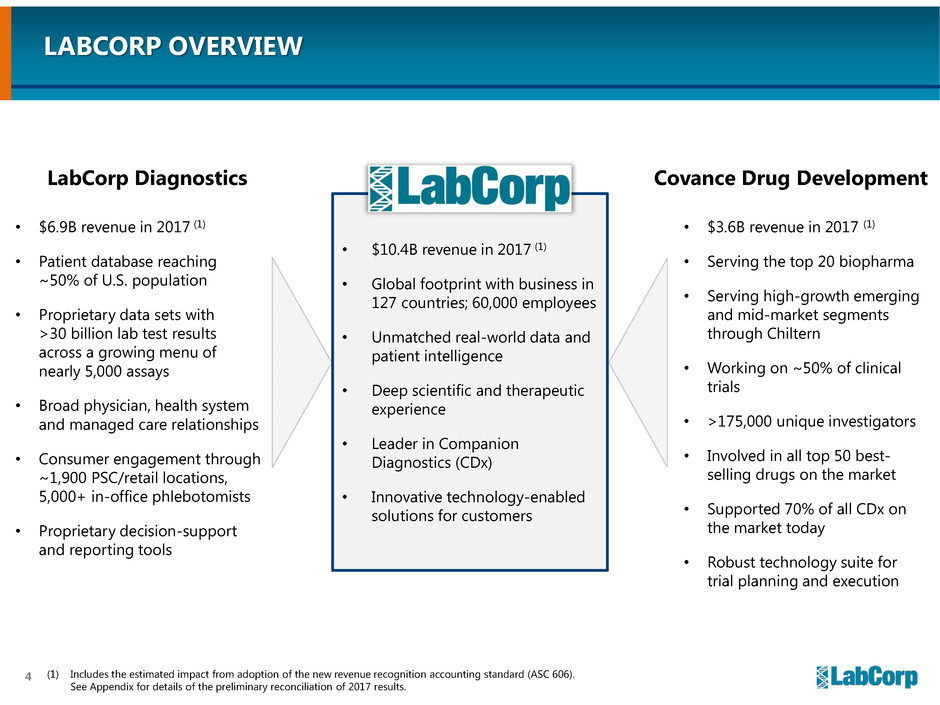

LABCORP OVERVIEW

• $6.9B revenue in 2017 (1)

• Patient database reaching

~50% of U.S. population

• Proprietary data sets with

>30 billion lab test results

across a growing menu of

nearly 5,000 assays

• Broad physician, health system

and managed care relationships

• Consumer engagement through

~1,900 PSC/retail locations,

5,000+ in-office phlebotomists

• Proprietary decision-support

and reporting tools

• $3.6B revenue in 2017 (1)

• Serving the top 20 biopharma

• Serving high-growth emerging

and mid-market segments

through Chiltern

• Working on ~50% of clinical

trials

• >175,000 unique investigators

• Involved in all top 50 best-

selling drugs on the market

• Supported 70% of all CDx on

the market today

• Robust technology suite for

trial planning and execution

• $10.4B revenue in 2017 (1)

• Global footprint with business in

127 countries; 60,000 employees

• Unmatched real-world data and

patient intelligence

• Deep scientific and therapeutic

experience

• Leader in Companion

Diagnostics (CDx)

• Innovative technology-enabled

solutions for customers

LabCorp Diagnostics Covance Drug Development

(1) Includes the estimated impact from adoption of the new revenue recognition accounting standard (ASC 606).

See Appendix for details of the preliminary reconciliation of 2017 results.

5

30%

23%

11%

31%

3% 3%

29%

23% 11%

32%

3%3%

Pharma & Biotech

Other Payers

Medicare & Medicaid

Managed Care (Fee for Service)

Patient

Managed Care (Capitated)

(2)

Attractive Customer Mix and Geographic Presence(1)

EXPANDED REVENUE BASE

1. Based on full year 2017 results, which include results from Chiltern as of September 1, 2017. Does not tie due to rounding.

2. Includes physicians and hospitals, occupational testing services, non-U.S. clinical diagnostic laboratory operations, nutritional

chemistry and food safety operations, and Beacon LBS.

29%

23% 11%

32%

3%3%

Pharma & Biotech

Other Payers

Medicare & Medicaid

Managed Care (Fee for Service)

Patient

Managed Care (Capit ted)

(2)

USA Rest of World

81%

19%

Managed Care (Fee for Service)

Patient

Managed Care (Capitated)

Pharma & Biotech

Other Payers (2)

edicare & Medicaid

6

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

7

OUR 2018 PRIORITIES

Drive Profitable

Growth

Optimize

Enterprise

Margins

Integrate Key

Acquisitions

8

DRIVING PROFITABLE GROWTH

Diagnostics: Capitalize on Growth Opportunities

• Health systems, large physician

groups and managed care

partnerships

• Expand 23andMe collaboration

• Mitigate pricing impact of PAMA

Drug Development: Build on Existing

Momentum to Exceed Historical Growth Rates

• Convert backlog into profitable revenue growth

• Maintain broad-based strength in net orders

• Capitalize on strategic investments in leadership,

sales force and technology

• Women’s health, genetics and

medical drug monitoring

portfolio and capabilities

• Pursue accretive acquisitions

• Continue focus on quality,

service and innovation

3.2%

1.2%

2.2%

2015 2016 2017

Year Over Year

Organic Volume Growth

$4.9

$7.1

Dec. 31, 2016 Dec. 31, 2017

Backlog ($B)

1.11x

1.15x

1.23x

1.33x

1.36x

Q4 '16 Q1 '17 Q2 '17 Q3 '17 Q4 '17

Trailing Twelve Month

Net Book to Bill

(1)

(1) Beginning with the fourth quarter of 2016, the Company began reporting net orders, net book-to-bill and backlog based upon fully-executed

contracted awards. The Company believes this methodology is a more conservative and objective practice, providing greater visibility into its

revenue conversion from the backlog. Results shown include the impact from cancellations and foreign currency translation.

(2) Includes backlog from the acquisition of Chiltern.

(3) Includes results from Chiltern following the closing of the acquisition on September 1, 2017.

(1)

(3) (3) (2)

9

• Generates approximately

$500 million in profitable

revenue growth in 2018 from

Chiltern, PAML, and Mount

Sinai transactions

• Successful “Best of the Best”

approach to selecting and

retaining talent

• Dedicated and experienced

integration teams, focused on

customer retention and

synergies

Maximize Value Through Flawless Integration

INTEGRATING KEY ACQUISITIONS

Mount Sinai

Clinical Outreach

Lab Assets

10

OPTIMIZING ENTERPRISE MARGINS

Continue Value Creation Through the

LaunchPad Business Process Improvement Initiative

Covance LaunchPad

• Applying LaunchPad principles to

Drug Development

• Rightsizing implemented in mid-2017

generating $20 million in savings

• Expect $130 million in additional net savings

over the three-year period ending in 2020

• Aided by Chiltern capabilities and expertise

Diagnostics LaunchPad

• Ongoing benefit from reengineering projects

• Additional opportunities, including

streamlining delivery of services

Opportunities for Productivity Gains

Automation Global Service

Delivery Model

Procurement

New Tools

and Technology

11

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

12

HEALTHCARE IS UNDERGOING

A PERIOD OF UNPRECEDENTED CHANGE

Transition to

Value-Based Care

Enhance

Drug Development

Process

Role of the

Consumer

• Improve efficiency in care

delivery

• Reduce the overall cost of

patient care

• Utilize advanced tools and

analytics to deliver better

outcomes via personalized

medicine and population

health

• Address increased trial

complexity, and competition

for patients and investigators

• Greater need for scalable tools

and processes to initiate and

manage trials

• Increased sponsor demand for

data-driven study design and

execution, as well as access to

relevant analytes, biomarkers

and tests

• Increased interest in and

influence over healthcare

decision-making

• Technology advances driving

expectation of convenience

• Consumer satisfaction

increasingly important to

other healthcare stakeholders

13

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

• National access

• Comprehensive test menu

• Sales and service organization

• Scientific innovation

• Power of scale

Clinical Decision Support

• Programs on key disease states

• Lab reports support care guidelines

• Developed by physicians

• Data monitoring drives

cost-effective care management

Leading Laboratory Services

Payer and Provider Collaboration

• Help stakeholders achieve total cost of

care metrics in value-based care contracts

• Actionable lab results

• Global patient results data

• MACRA, HEDIS, and ACO quality metrics

• Care Intelligence® population health

Drug Development Solutions

Value-Based Care Solutions

• Companion diagnostics leadership

• Potential provider revenue stream from

increased participation in clinical trials

• Cost savings to patients and payers

• “Real World” data

14

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

Reduces the time,

cost and risk of

specimen based

research.

Increases value of

existing assets

with advanced

analytics,

visualizations, and

first-to-market

patient consent

mapping.

Most modern,

end-to-end clinical

trial solution.

Decreases risk,

increases patient

safety and data

quality.

Includes advanced

clinical data

management, risk-

based monitoring,

and dashboards.

Best-in-class

interactive

response systems.

Continuous

innovation and

investment

including new

high-value

physical sample

management

solutions.

Providing insights

into site selection,

patient recruitment

and resource

allocation.

Using custom

analytics to

leverage the power

of Covance’s

unparalleled

patient and

investigator

databases.

Leverages

proprietary and

public data

providing insights

and guiding

decisions;

optimizes trial

planning.

Includes metrics

benchmarking,

trial forecasting,

and protocol

optimization.

Voice of patient

insights from

industry leading

patient panel.

Understand patient

view of trial

participation,

enhance protocol

design and

recruiting tactics.

Creates patient-

centric development

approach.

Maximizing Drug Development Tools and Technologies

for Innovative Solutions Focused on Client Needs

Contributed to $1B+ of Revenue

Across Clinical Development in 2017

15

Real World Data

• Not biased and represents

people as they live with

their disease

• Patient data is granular and

identifiable

Vast Test Menu

• 30+ billion test results across

thousands of diagnostic assays

• >2.5 million samples collected

(>30% by LabCorp

phlebotomists) and processed

weekly across many diseases

and therapeutic areas

Population Level

Disease Analysis

• Surveillance of disease spread

to enable just in time

recruitment

• Unlike other types of real

world data, lab data can be

easily accessed near real time

Power of the LabCorp Data for Trial Design, Site Selection,

and Patient Recruitment

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

16

Covance supports

~50%

of all clinical trials

Number of Patients

Date of First Patient In

Quality

Lab Cancellations and Queries

Standardized Site Rank

> 175,000 unique investigators

> 15,000 unique protocols

Investigator Performance

Database

Power of the Xcellerate Investigator Database

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

17

On pace to

significantly exceed $100 million

in cumulative new CDx-related revenue from

the acquisition of Covance through 2018

• Dedicated CDx organization with capabilities

across development, validation, testing,

regulatory support, commercialization and

market access

• Opened purpose built, state of the art CDx

laboratory, with focus on genomics and

molecular pathology

• Supported ~70% of CDx on the market(1)

• Customizable offering -- in vitro diagnostic

(IVD) partnerships and single site pathway

• Collaborated with over 40 clients on more

than 165 CDx projects in 2017

• ~$135M in CDx-related enterprise revenue in

2017; 3-year CAGR of ~20%

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

Increasing Our Leadership in

Companion and Complementary Diagnostics (CDx)

1. As of January 1, 2018.

$114

$153

$300

2015 2016 2017

CDx-Related Backlog ($M)

18

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

Developing a Broad Consumer Platform to Create Deep Relationships

• Organizing around the

empowered consumer

• Creating a convenient,

seamless experience

• Providing easy access to lab

test results and personalized

content

• Offering price transparency to

highlight access to highest

quality, low-cost diagnostics

19

• Patient Service Centers opened inside Walgreens stores

• Strong patient volume, net promoter scores, and patient feedback

• Start to roll out to new markets in 2018

• Launch new at-home, self-collection offering built on LabCorp’s

10 years of experience with dried blood spot testing

• Invest in expanded capacity and enhanced automation to support

23andMe strategic collaboration

• Collaborate on new delivery models, such as telehealth and

on-demand phlebotomy

Bringing our High-Quality Offering to Consumers

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

20

2016

>$200 million

2017

~$500 million

OUR DIFFERENTIATED SOLUTIONS ARE

RESONATING WITH CUSTOMERS

Value-Based Care

Solutions

Streamlining

Clinical Studies

Consumer Platform

Completed

3 marquee transactions

in 2017

Cumulative new orders won

through the combination of

LabCorp patient data and

Covance capabilities:

On track to deliver

$150 million

in cumulative new revenue

from the acquisition of Covance

through 2018

LabCorp PSCs in

Walgreens stores are

attracting new patients

28%

18%

0%

10%

20%

30%

LabCorp at

Walgreens

PSCs

%

o

f

p

a

ti

e

n

ts

s

e

e

n

n

ew

to

L

a

b

C

or

p

Comparable

LabCorp

PSCs

21

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

22

$4.5

$4.7

$5.0

$5.5 $5.7

$5.8

$6.0

$6.2

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

$8.5

$9.4

$11.5

$6.6

$6.9

$2.3

$2.8

$7.1

$10.4 $4.3

$3.6

$3.6

REVENUE(1) GROWTH (DOLLARS IN BILLIONS)

(1) 2008-2014 revenues excludes Covance results. 2008 revenue includes a $7.5 million adjustment relating to certain historic overpayments made

by Medicare for claims submitted by a subsidiary of the Company.

(2) Guidance issued on February 6, 2018.

(3) Includes the estimated impact from adoption of the new revenue recognition accounting standard (ASC 606). See Appendix for details of the preliminary

reconciliation of 2017 results.

2018 Guidance(2)

Midpoint 10.5%

Drug

Development

Diagnostics

10-Year CAGR: 10%

(3) (3)

23

ADJUSTED EPS(1)(2) GROWTH

(1) EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special charges).

See Appendix for non-GAAP reconciliation.

(2) 2008-2014 figures exclude Covance results.

(3) Guidance issued on February 6, 2018.

2018 Guidance(3)

Midpoint 19.8%

$4.91

$5.24

$5.98

$6.37

$6.82 $6.95 $6.80

$7.91

$8.83

$9.60

$11.50

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

10-Year CAGR: 9%

24

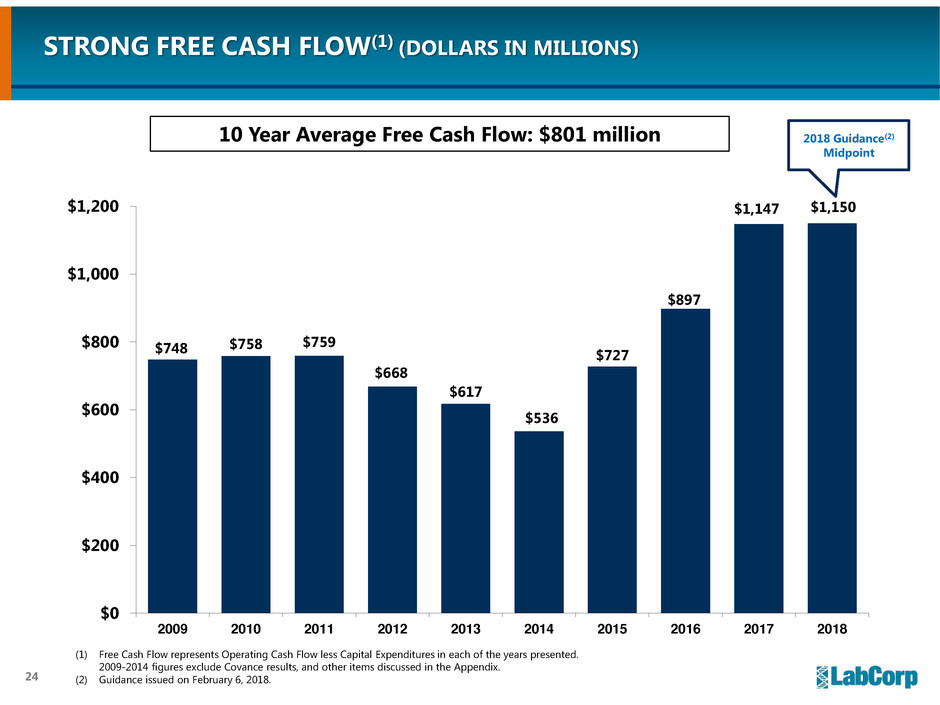

STRONG FREE CASH FLOW(1) (DOLLARS IN MILLIONS)

(1) Free Cash Flow represents Operating Cash Flow less Capital Expenditures in each of the years presented.

2009-2014 figures exclude Covance results, and other items discussed in the Appendix.

(2) Guidance issued on February 6, 2018.

10 Year Average Free Cash Flow: $801 million 2018 Guidance(2)

Midpoint

$748 $758 $759

$668

$617

$536

$727

$897

$1,147 $1,150

$0

$200

$400

$600

$800

$1,000

$1,200

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

25

TRACK RECORD OF EFFECTIVE AND BALANCED

CAPITAL DEPLOYMENT TO BUILD SHAREHOLDER VALUE

Approximately $2.5 Billion in

Capital Deployment in 2017

2018 Free Cash Flow

M&A Priorities

• Diagnostics “tuck-in” transactions

Return of Capital to Shareholders

• Continue share repurchases

Debt Reduction

• Pay down debt to reduce leverage

Chiltern Acquisition

$1.2 Billion (47%)

Other

Acquisitions

$0.7 Billion (27%)

26

OUR MARKET OPPORTUNITY AND DIFFERENTIATED CAPABILITIES

POSITION US TO DELIVER UNPARALLELED VALUE

Beyond CRO Beyond Lab

• Engage consumers through clinical study

participation and care management tools

• Provide health systems, physicians, and

ACOs with greater access to cutting-edge

care through clinical trials

• Expand our leadership in companion

diagnostics development and

commercialization

• Engage consumers directly with

>115 million patient encounters per year

in LabCorp Diagnostics

• Apply insights from rich patient database

of granular, timely, real world evidence

to clinical study planning and execution

• Utilize patient service center footprint

for virtual real world evidence studies

Value of the Enterprise

Actionable data for everyone

Leading proprietary IT solutions and analytics

Positioned to outperform in the healthcare system of the future

RAYMOND JAMES

INSTITUTIONAL INVESTORS CONFERENCE

MARCH 6, 2018 | ORLANDO, FL

28

Appendix

29

29

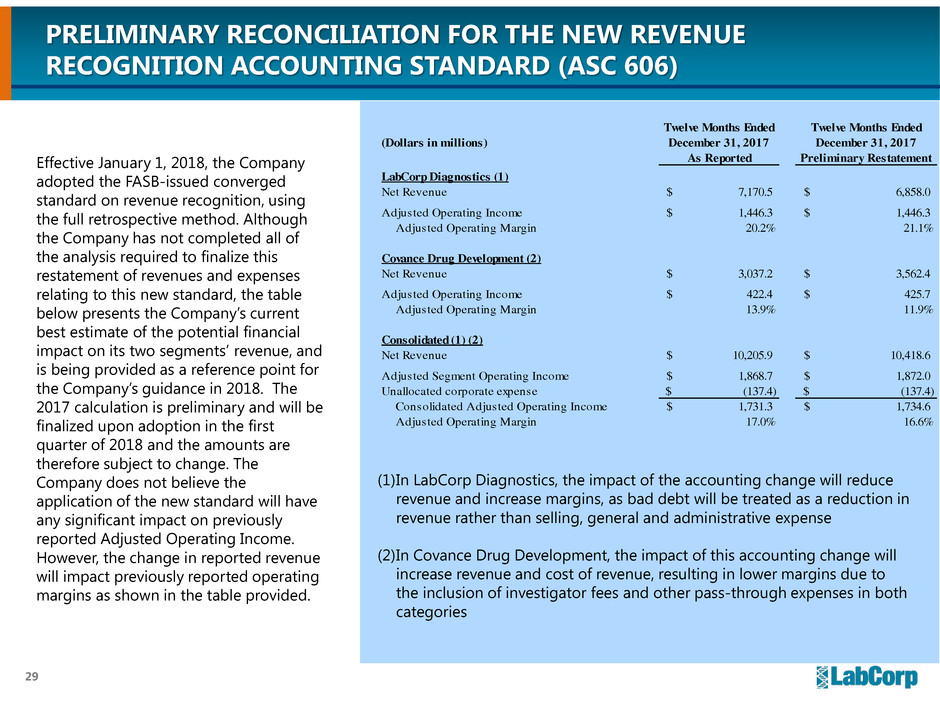

PRELIMINARY RECONCILIATION FOR THE NEW REVENUE

RECOGNITION ACCOUNTING STANDARD (ASC 606)

Effective January 1, 2018, the Company

adopted the FASB-issued converged

standard on revenue recognition, using

the full retrospective method. Although

the Company has not completed all of

the analysis required to finalize this

restatement of revenues and expenses

relating to this new standard, the table

below presents the Company’s current

best estimate of the potential financial

impact on its two segments’ revenue, and

is being provided as a reference point for

the Company’s guidance in 2018. The

2017 calculation is preliminary and will be

finalized upon adoption in the first

quarter of 2018 and the amounts are

therefore subject to change. The

Company does not believe the

application of the new standard will have

any significant impact on previously

reported Adjusted Operating Income.

However, the change in reported revenue

will impact previously reported operating

margins as shown in the table provided.

(1)In LabCorp Diagnostics, the impact of the accounting change will reduce

revenue and increase margins, as bad debt will be treated as a reduction in

revenue rather than selling, general and administrative expense

(2)In Covance Drug Development, the impact of this accounting change will

increase revenue and cost of revenue, resulting in lower margins due to

the inclusion of investigator fees and other pass-through expenses in both

categories

(Dollars in millions)

As Reported Preliminary Restatement

LabCorp Diagnostics (1)

Net Revenue 7,170.5$ 6,858.0$

Adjusted Operating Income 1,446.3$ 1,446.3$

Adjusted Operating Margin 20.2% 21.1%

Covance Drug Development (2)

Net Revenue 3,037.2$ 3,562.4$

Adjusted Operating Income 422.4$ 425.7$

Adjusted Operating Margin 13.9% 11.9%

Consolidated (1) (2)

Net Revenue 10,205.9$ 10,418.6$

Adjusted Segment Operating Income 1,868.7$ 1,872.0$

Unallocated corporate expense (137.4)$ (137.4)$

Consolidated Adjusted Operating Income 1,731.3$ 1,734.6$

Adjusted Operating Margin 17.0% 16.6%

Twelve Months Ended

December 31, 2017

Twelve Months Ended

December 31, 2017

30

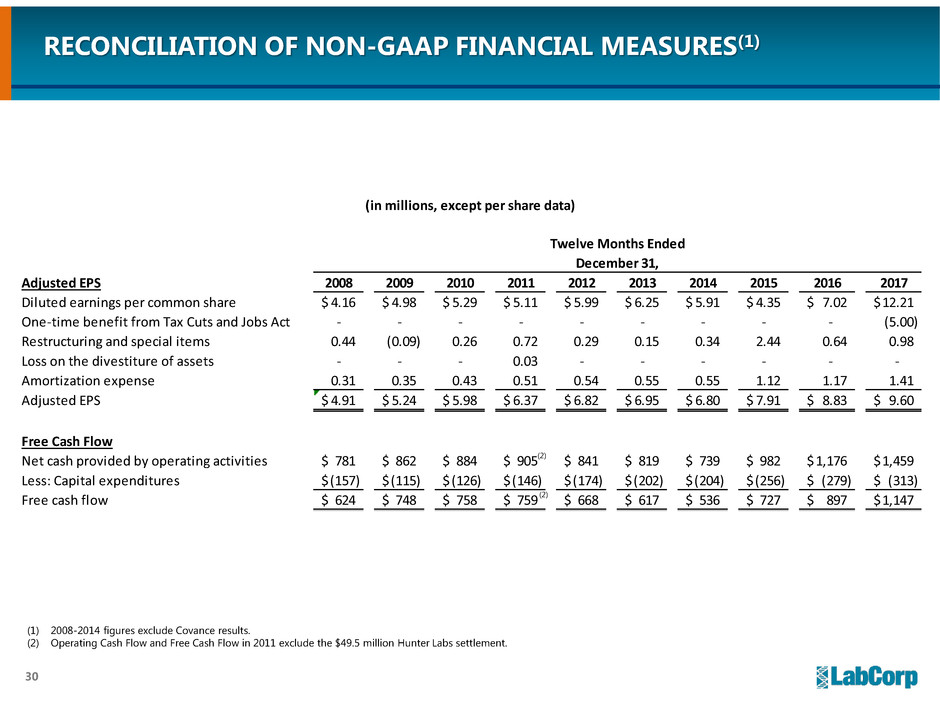

(in millions, except per share data)

Twelve Months Ended

December 31,

Adjusted EPS 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Diluted earnings per common share 4.16$ 4.98$ 5.29$ 5.11$ 5.99$ 6.25$ 5.91$ 4.35$ 7.02$ 12.21$

One-time benefit from Tax Cuts and Jobs Act - - - - - - - - - (5.00)

Restructuring and special items 0.44 (0.09) 0.26 0.72 0.29 0.15 0.34 2.44 0.64 0.98

Loss on the divestiture of assets - - - 0.03 - - - - - -

Amortization expense 0.31 0.35 0.43 0.51 0.54 0.55 0.55 1.12 1.17 1.41

Adjusted EPS 4.91$ 5.24$ 5.98$ 6.37$ 6.82$ 6.95$ 6.80$ 7.91$ 8.83$ 9.60$

Free Cash Flow

Net cash provided by operating activities 781$ 862$ 884$ 905$ 841$ 819$ 739$ 982$ 1,176$ 1,459$

Less: Capital expenditures (157)$ (115)$ (126)$ (146)$ (174)$ (202)$ (204)$ (256)$ (279)$ (313)$

Free cash flow 624$ 748$ 758$ 759$ 668$ 617$ 536$ 727$ 897$ 1,147$

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES(1)

(1) 2008-2014 figures exclude Covance results.

(2) Operating Cash Flow and Free Cash Flow in 2011 exclude the $49.5 million Hunter Labs settlement.

(2)

(2)