Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INDEPENDENCE REALTY TRUST, INC. | irt-8k_20180301.htm |

2.60 1.80 2.15 3.30 3.75 5.10 0.15 5.10 4.50 - logo 0.15 Investor Presentation March 2018 0 34 84 18 86 154 108 134 195 82 89 95 191 191 191 241 229 24 33 75 35 255 175 25 Exhibit 99.1

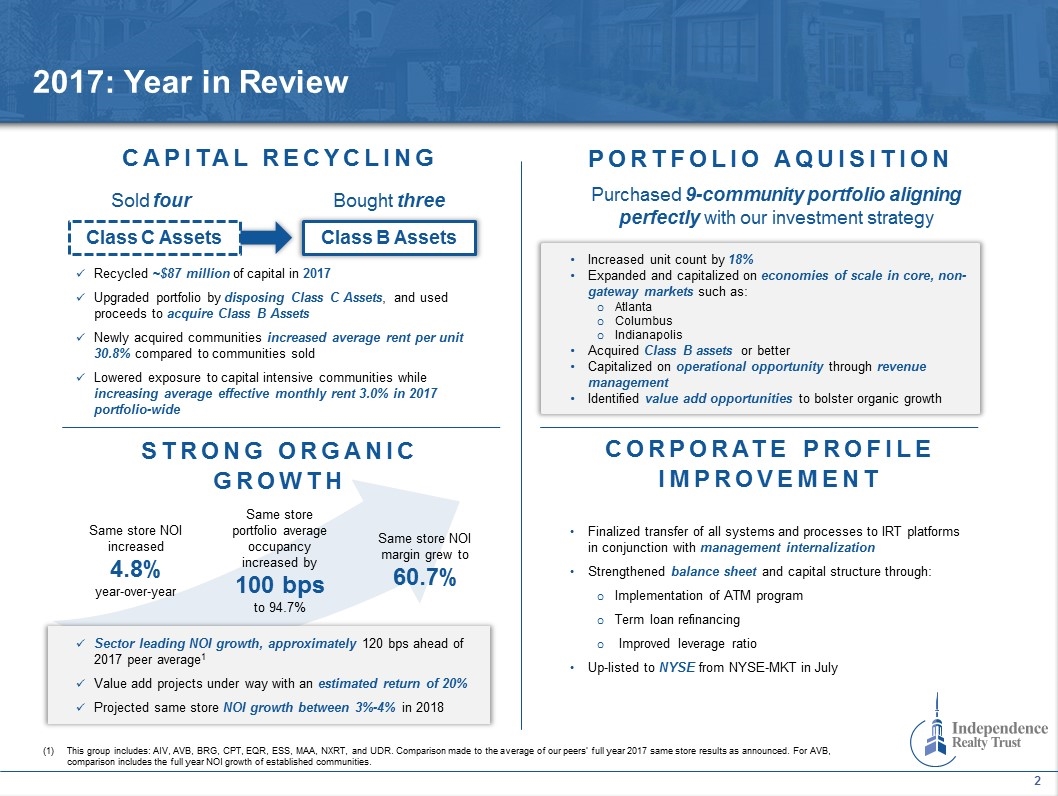

2017: Year in Review CAPITAL RECYCLING PORTFOLIO AQUISITION CORPORATE PROFILE IMPROVEMENT STRONG ORGANIC GROWTH Class C Assets Class B Assets Sold four Bought three Recycled ~$87 million of capital in 2017 Upgraded portfolio by disposing Class C Assets, and used proceeds to acquire Class B Assets Newly acquired communities increased average rent per unit 30.8% compared to communities sold Lowered exposure to capital intensive communities while increasing average effective monthly rent 3.0% in 2017 portfolio-wide Purchased 9-community portfolio aligning perfectly with our investment strategy Increased unit count by 18% Expanded and capitalized on economies of scale in core, non-gateway markets such as: Atlanta Columbus Indianapolis Acquired Class B assets or better Capitalized on operational opportunity through revenue management Identified value add opportunities to bolster organic growth Same store NOI increased 4.8% year-over-year Same store portfolio average occupancy increased by 100 bps to 94.7% Same store NOI margin grew to 60.7% Finalized transfer of all systems and processes to IRT platforms in conjunction with management internalization Strengthened balance sheet and capital structure through: Implementation of ATM program Term loan refinancing Improved leverage ratio Up-listed to NYSE from NYSE-MKT in July Sector leading NOI growth, approximately 120 bps ahead of 2017 peer average1 Value add projects under way with an estimated return of 20% Projected same store NOI growth between 3%-4% in 2018 This group includes: AIV, AVB, BRG, CPT, EQR, ESS, MAA, NXRT, and UDR. Comparison made to the average of our peers’ full year 2017 same store results as announced. For AVB, comparison includes the full year NOI growth of established communities.

Positioned to Unlock Long-term Value Clear investment strategy focused on middle-market communities across non-gateway MSAs Accretive, tenant-first approach to owning and operating high-quality multifamily communities $ Value-add community redevelopment and capital recycling initiatives Simple, conservative capital structure, focused on increasing returns

Clear Investment and Ownership Strategy Assets Our Focus: Well-located middle-market communities, likely to benefit from IRT’s: Robust management platform Operational expertise Economies of scale Markets Our Focus: Targeted Submarkets within Non-Gateway Markets exhibiting: Strong apartment demand Limited new construction Strong economic indicators We Look For: Strong employment drivers Population growth & positive net migration trends Limited multi-family housing starts Well-rated schools Attractive rent vs. buy dynamics Mature, infill locations with high barriers to entry We look for: Mid-rise/garden style (150–500 units) with attractive amenities Acquire properties at less than replacement cost A 5-15 year operating track record Opportunities for repositioning or updating through capex Ability to apply tailored marketing and management strategies to attract and retain residents and increase rents Creating value by identifying the right assets in the right markets Leading To Increased Property Level NOI – Stable Occupancy Rates, Above Average Rent Growth and Reduced Expenses

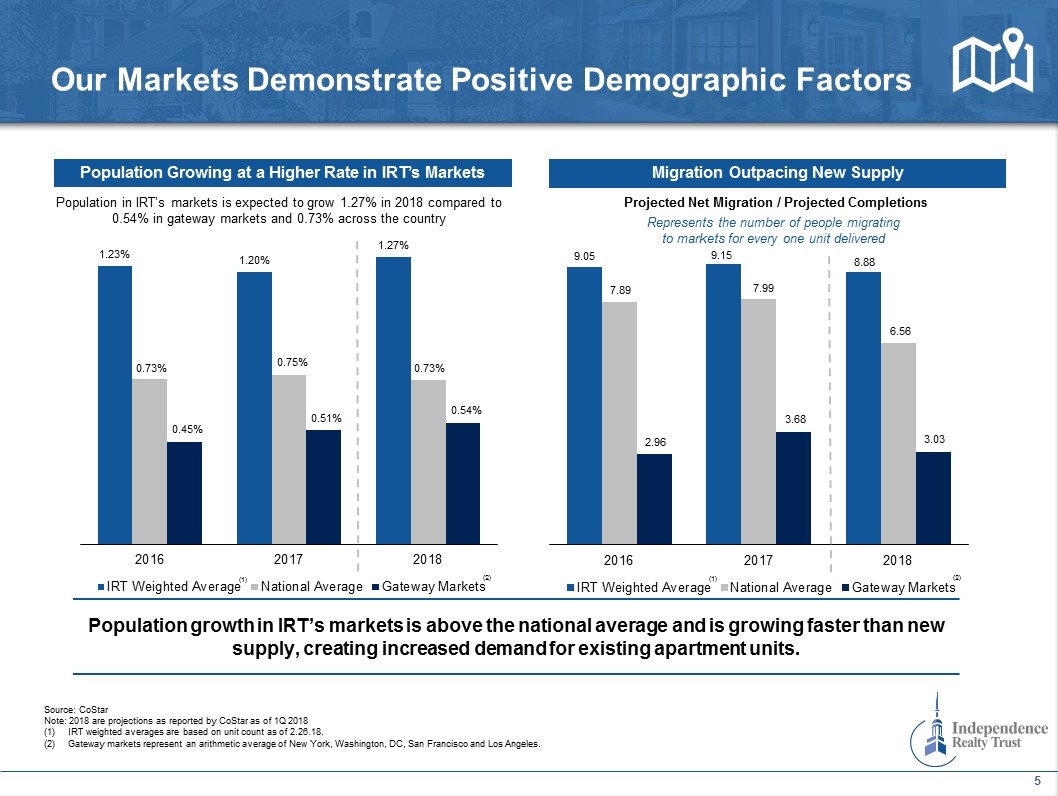

Population growth in IRT’s markets is above the national average and is growing faster than new supply, creating increased demand for existing apartment units. Migration Outpacing New Supply Projected Net Migration / Projected Completions Population Growing at a Higher Rate in IRT’s Markets Represents the number of people migrating to markets for every one unit delivered Population in IRT’s markets is expected to grow 1.27% in 2018 compared to 0.54% in gateway markets and 0.73% across the country (1) (2) (1) (2) Our Markets Demonstrate Positive Demographic Factors 0 34 84 18 86 154 108 134 195 82 89 95 191 191 191 241 229 24 33 75 35 255 175 25 Source: CoStar Note: 2018 are projections as reported by CoStar as of 1Q 2018 IRT weighted averages are based on unit count as of 2.26.18. Gateway markets represent an arithmetic average of New York, Washington, DC, San Francisco and Los Angeles.

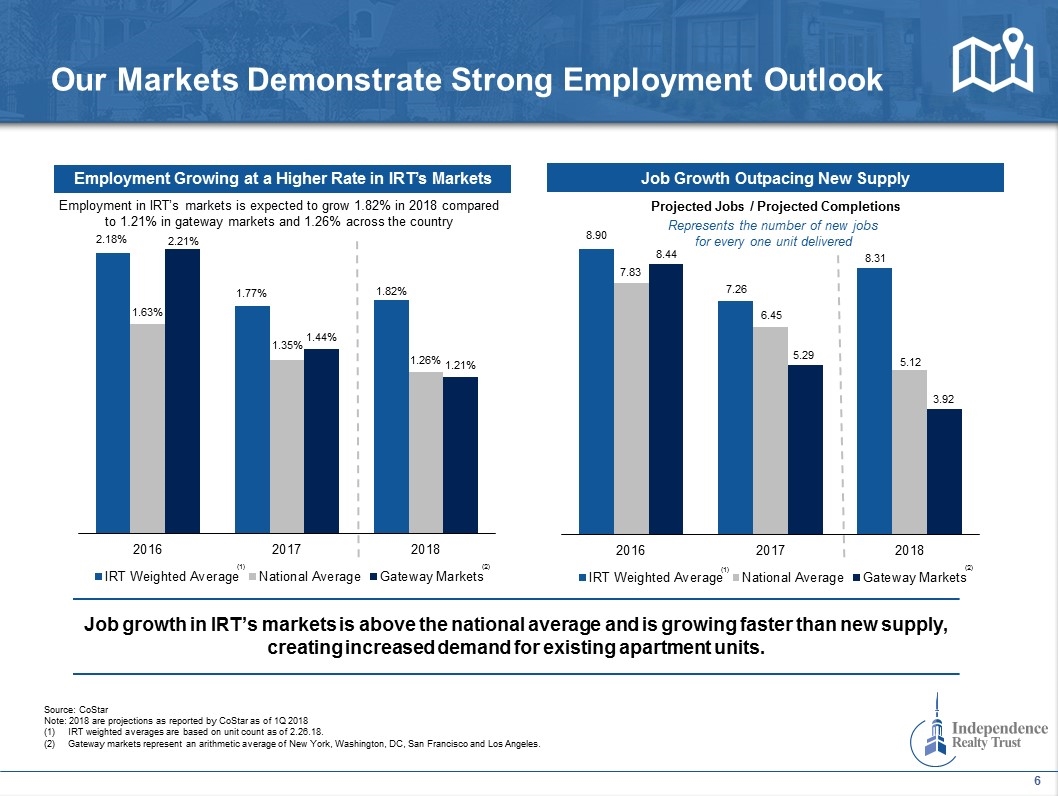

Job growth in IRT’s markets is above the national average and is growing faster than new supply, creating increased demand for existing apartment units. Job Growth Outpacing New Supply Employment Growing at a Higher Rate in IRT’s Markets Projected Jobs / Projected Completions Represents the number of new jobs for every one unit delivered Employment in IRT’s markets is expected to grow 1.82% in 2018 compared to 1.21% in gateway markets and 1.26% across the country (1) (1) (2) (2) Our Markets Demonstrate Strong Employment Outlook 0 34 84 18 86 154 108 134 195 82 89 95 191 191 191 241 229 24 33 75 35 255 175 25 Source: CoStar Note: 2018 are projections as reported by CoStar as of 1Q 2018 IRT weighted averages are based on unit count as of 2.26.18. Gateway markets represent an arithmetic average of New York, Washington, DC, San Francisco and Los Angeles.

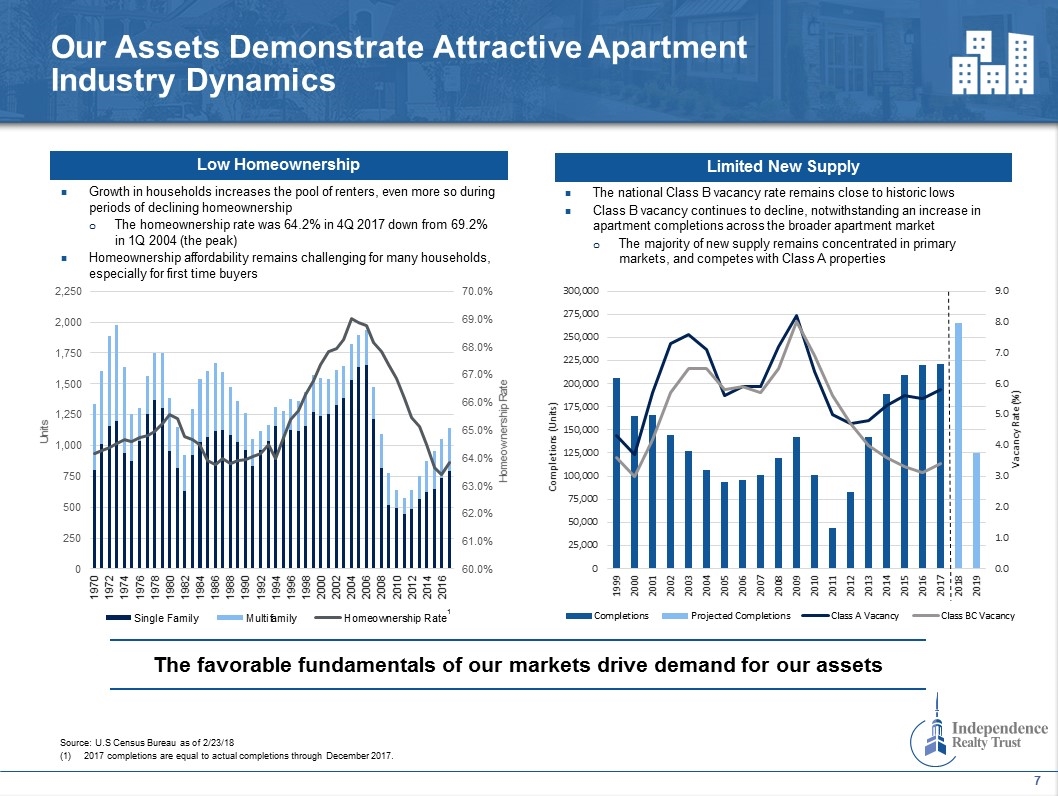

Low Homeownership Limited New Supply The national Class B vacancy rate remains close to historic lows Class B vacancy continues to decline, notwithstanding an increase in apartment completions across the broader apartment market The majority of new supply remains concentrated in primary markets, and competes with Class A properties Source: U.S Census Bureau as of 2/23/18 2017 completions are equal to actual completions through December 2017. Our Assets Demonstrate Attractive Apartment Industry Dynamics The favorable fundamentals of our markets drive demand for our assets Growth in households increases the pool of renters, even more so during periods of declining homeownership The homeownership rate was 64.2% in 4Q 2017 down from 69.2% in 1Q 2004 (the peak) Homeownership affordability remains challenging for many households, especially for first time buyers 1

Property Name Market State Built / Renovated Units Period End Occupancy1 Avg. Effective Rent/Unit1 Close Date Kensington Commons Columbus OH 2004 264 97.7% $882 9/26/2017 Schirm Farms Columbus OH 2002 264 95.8% $846 9/26/2017 Riverchase Apts Indianapolis IN 2000 216 89.8% $814 9/26/2017 Cherry Grove Commons Myrtle Beach SC 2001 172 98.3% $946 9/26/2017 Live Oak Trace Baton Rouge LA 2002/2017 264 60.6%2 $916 10/25/2017 Tides at Calabash Wilmington NC 2011 168 91.7% $846 11/14/2017 Brunswick Point Wilmington NC 2005 288 93.1% $795 12/12/2017 Hartshire Lakes Indianapolis IN 2008 272 91.9%3 $9174 1/3/2018 Creekside Corners Apts Atlanta GA 2001 444 93.7%3 $9314 1/3/2018 Total 2,352 90.3% $877 Recent Opportunistic Portfolio Acquisition Hartshire Lakes Indianapolis, IN Schirm Farms Columbus, OH Cherry Grove Commons Myrtle Beach, SC Riverchase Apartments Indianapolis, IN Creekside Corners Atlanta, GA Brunswick Point Wilmington, NC Kensington Commons Columbus, OH Live Oak Trace Baton Rouge, LA Tides at Calabash Wilmington, NC Portfolio Overview Physical occupancy and average effective rent as of 12/31/17, unless otherwise noted. Property was recently renovated and impacted units are in the process of being leased up. Physical occupancy for each property is calculated as (i) total units rented as of 7/31/17 divided by (ii) total units available as of 7/31/17, expressed as a percentage. Average monthly effective rent, per unit, represents the average monthly rent for all occupied units for the three-month period ended 12/31/17. Transaction Rationale In September 2017, IRT announced the acquisition of a nine-community portfolio, totaling 2,352 units for $228.1 million Increases scale with 18% expansion in total unit count Operational upside Accelerates IRT’s penetration into a number of core existing non-gateway markets High-quality middle-market communities Value-add opportunities +

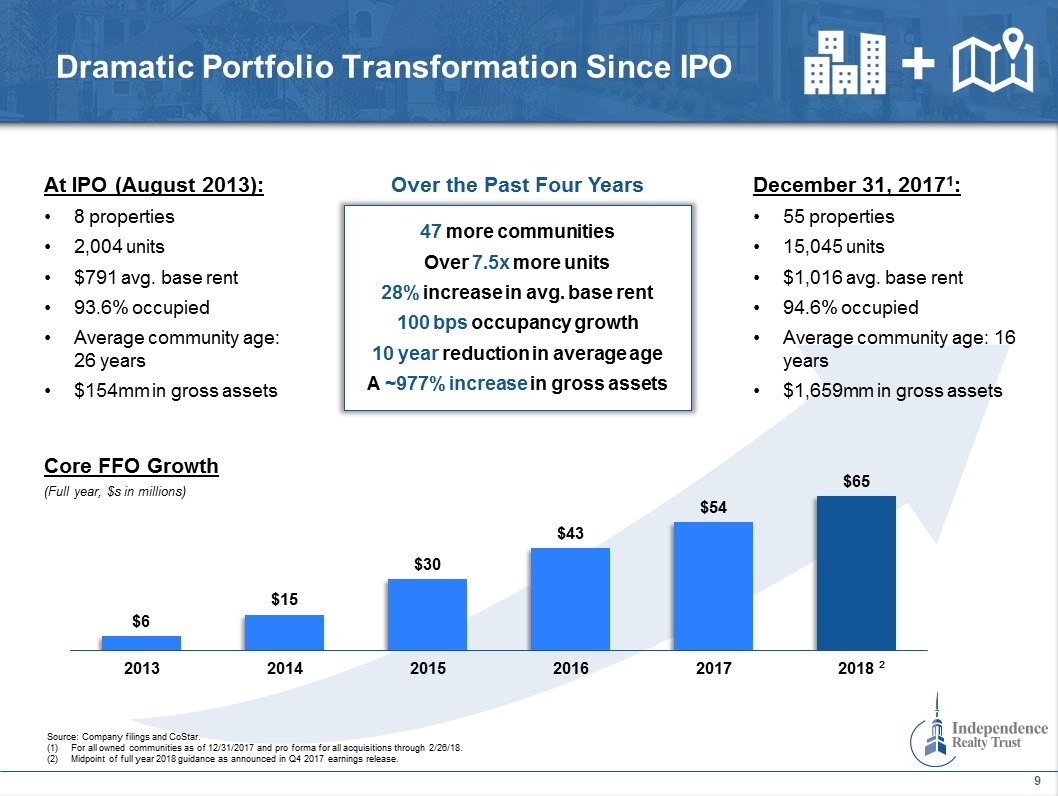

Dramatic Portfolio Transformation Since IPO Source: Company filings and CoStar. For all owned communities as of 12/31/2017 and pro forma for all acquisitions through 2/26/18. Midpoint of full year 2018 guidance as announced in Q4 2017 earnings release. 2 At IPO (August 2013): 8 properties 2,004 units $791 avg. base rent 93.6% occupied Average community age: 26 years $154mm in gross assets December 31, 20171: 55 properties 15,045 units $1,016 avg. base rent 94.6% occupied Average community age: 16 years $1,659mm in gross assets Core FFO Growth (Full year, $s in millions) 47 more communities Over 7.5x more units 28% increase in avg. base rent 100 bps occupancy growth 10 year reduction in average age A ~977% increase in gross assets Over the Past Four Years +

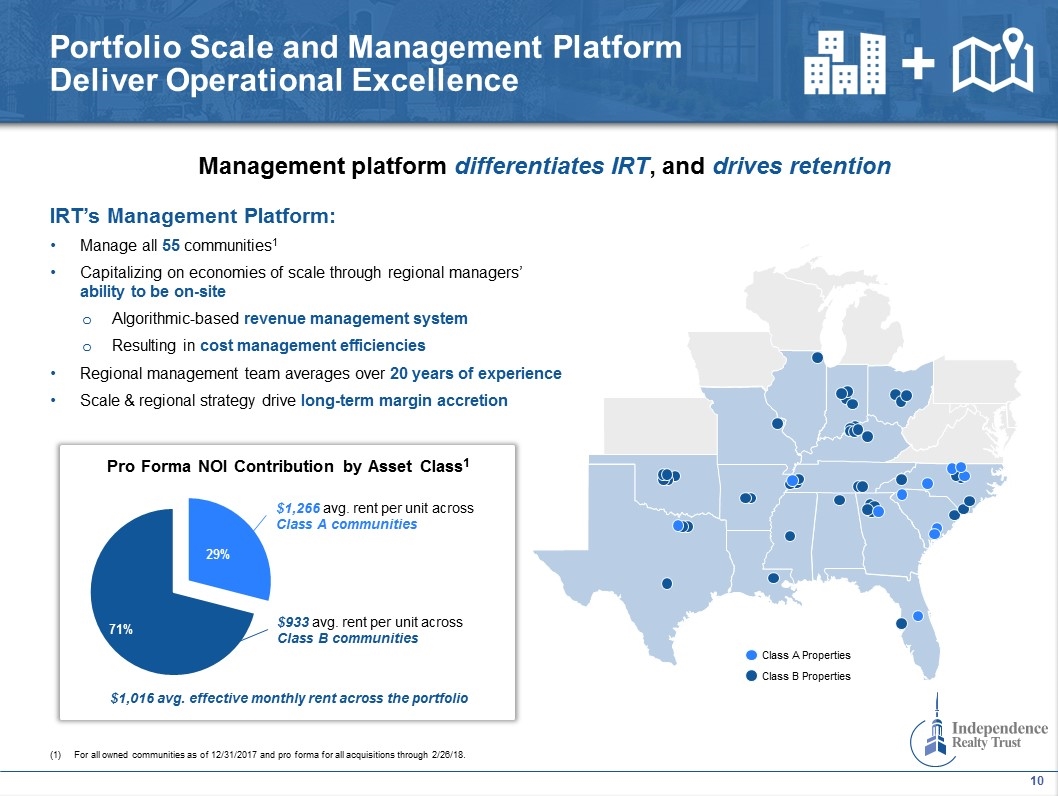

Portfolio Scale and Management Platform Deliver Operational Excellence For all owned communities as of 12/31/2017 and pro forma for all acquisitions through 2/26/18. IRT’s Management Platform: Manage all 55 communities1 Capitalizing on economies of scale through regional managers’ ability to be on-site Algorithmic-based revenue management system Resulting in cost management efficiencies Regional management team averages over 20 years of experience Scale & regional strategy drive long-term margin accretion Management platform differentiates IRT, and drives retention $1,016 avg. effective monthly rent across the portfolio + Class A Properties Class B Properties $1,266 avg. rent per unit across Class A communities $933 avg. rent per unit across Class B communities Pro Forma NOI Contribution by Asset Class1

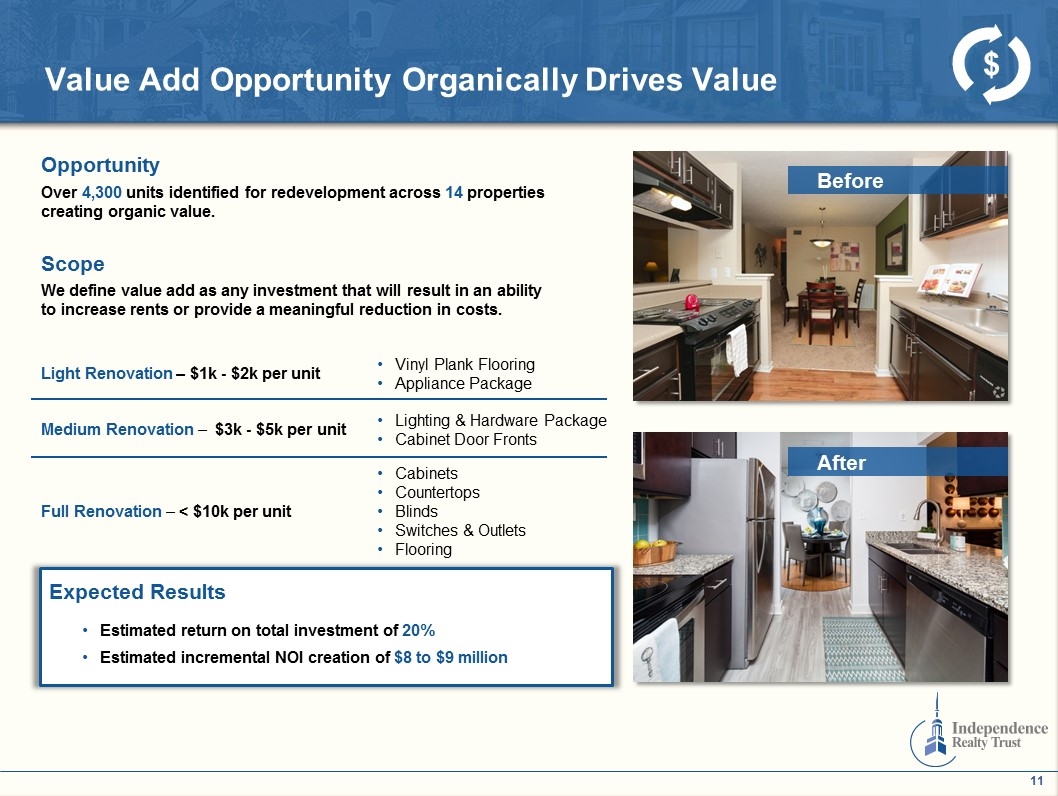

We define value add as any investment that will result in an ability to increase rents or provide a meaningful reduction in costs. Value Add Opportunity Organically Drives Value $ Before After Over 4,300 units identified for redevelopment across 14 properties creating organic value. Cabinets Countertops Blinds Switches & Outlets Flooring Lighting & Hardware Package Cabinet Door Fronts Vinyl Plank Flooring Appliance Package Full Renovation – < $10k per unit Medium Renovation – $3k - $5k per unit Light Renovation – $1k - $2k per unit Opportunity Scope Estimated return on total investment of 20% Estimated incremental NOI creation of $8 to $9 million Expected Results

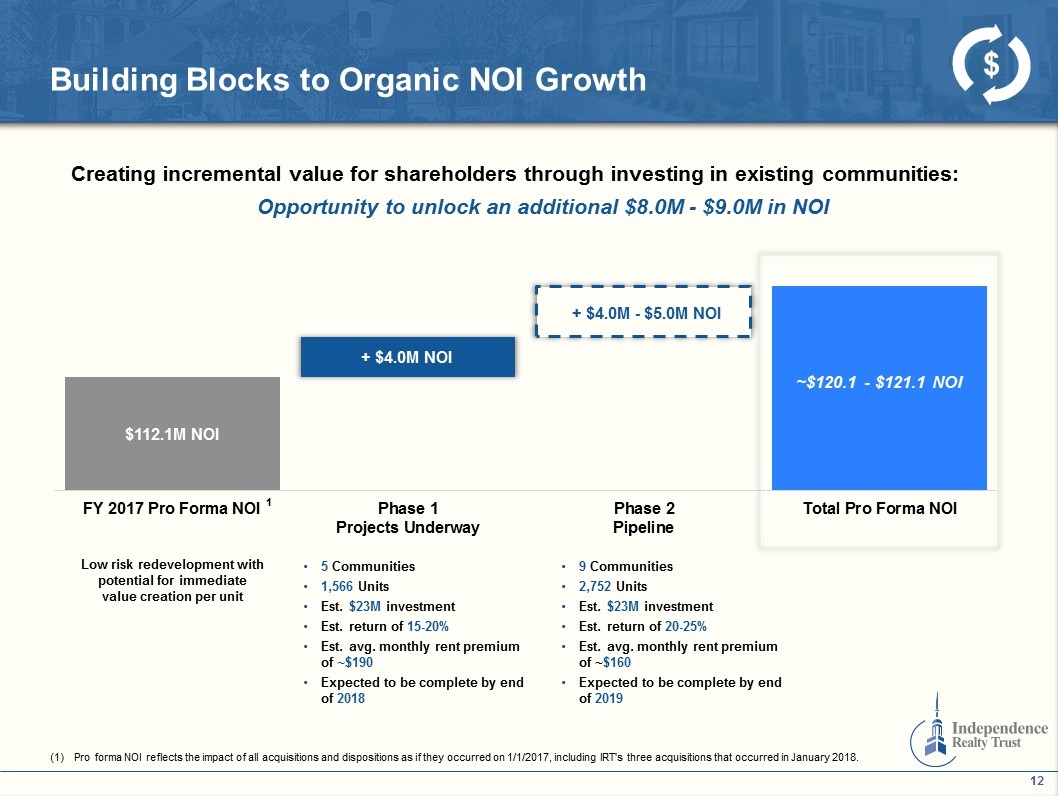

Low risk redevelopment with potential for immediate value creation per unit 5 Communities 1,566 Units Est. $23M investment Est. return of 15-20% Est. avg. monthly rent premium of ~$190 Expected to be complete by end of 2018 9 Communities 2,752 Units Est. $23M investment Est. return of 20-25% Est. avg. monthly rent premium of ~$160 Expected to be complete by end of 2019 Building Blocks to Organic NOI Growth Creating incremental value for shareholders through investing in existing communities: Opportunity to unlock an additional $8.0M - $9.0M in NOI $ 1 Pro forma NOI reflects the impact of all acquisitions and dispositions as if they occurred on 1/1/2017, including IRT's three acquisitions that occurred in January 2018.

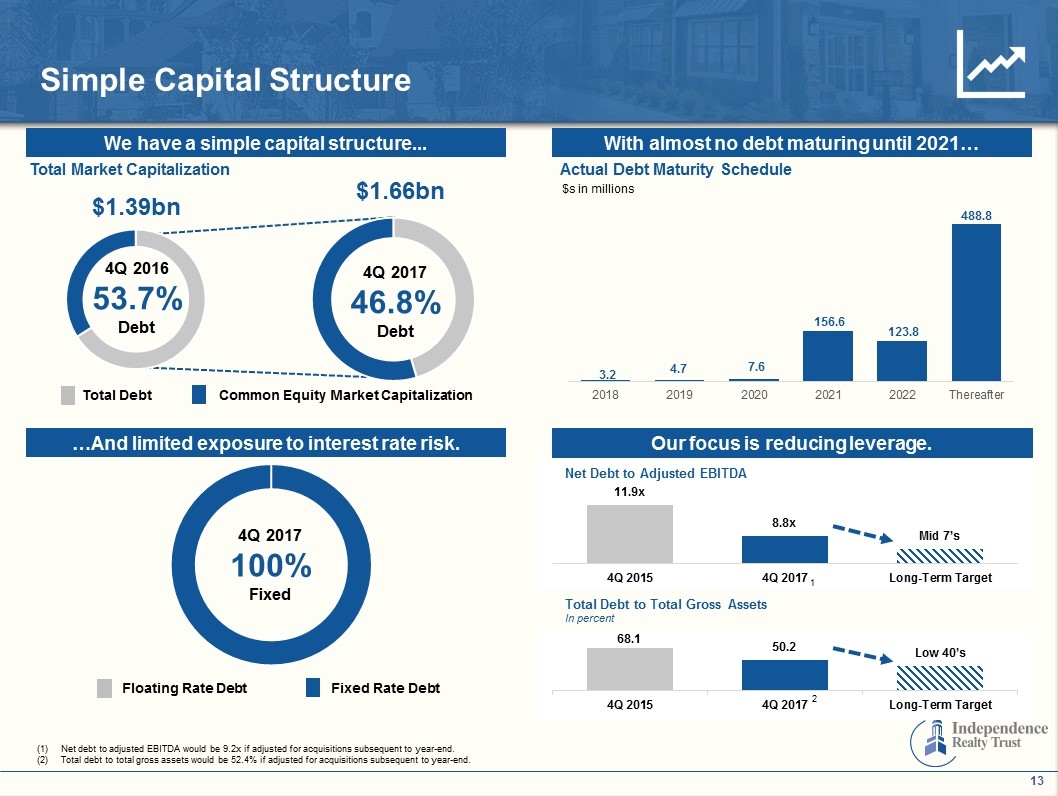

Net debt to adjusted EBITDA would be 9.2x if adjusted for acquisitions subsequent to year-end. Total debt to total gross assets would be 52.4% if adjusted for acquisitions subsequent to year-end. 4Q 2016 53.7% Debt Simple Capital Structure We have a simple capital structure... With almost no debt maturing until 2021… …And limited exposure to interest rate risk. Our focus is reducing leverage. 4Q 2017 46.8% Debt Total Debt Common Equity Market Capitalization Net Debt to Adjusted EBITDA Total Market Capitalization Floating Rate Debt Fixed Rate Debt 4Q 2017 100% Fixed 1 $s in millions $1.39bn $1.66bn Actual Debt Maturity Schedule Total Debt to Total Gross Assets In percent 2

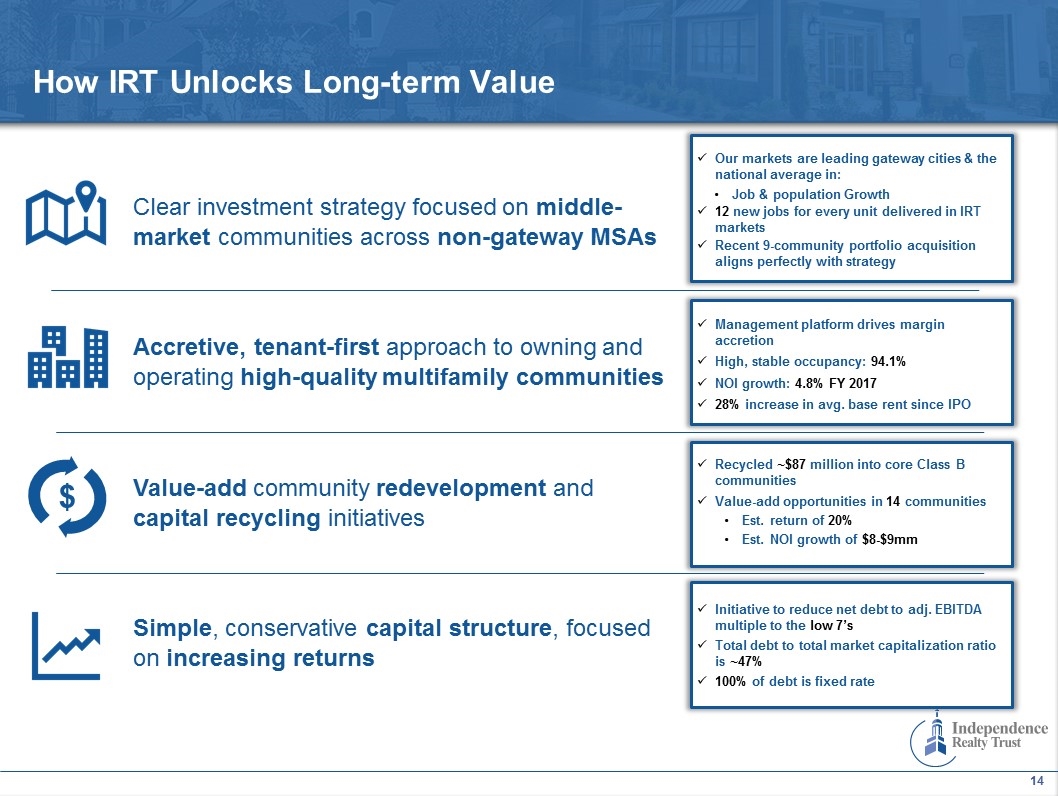

How IRT Unlocks Long-term Value Clear investment strategy focused on middle-market communities across non-gateway MSAs Accretive, tenant-first approach to owning and operating high-quality multifamily communities Value-add community redevelopment and capital recycling initiatives Simple, conservative capital structure, focused on increasing returns $ Our markets are leading gateway cities & the national average in: Job & population Growth 12 new jobs for every unit delivered in IRT markets Recent 9-community portfolio acquisition aligns perfectly with strategy Management platform drives margin accretion High, stable occupancy: 94.1% NOI growth: 4.8% FY 2017 28% increase in avg. base rent since IPO Recycled ~$87 million into core Class B communities Value-add opportunities in 14 communities Est. return of 20% Est. NOI growth of $8-$9mm Initiative to reduce net debt to adj. EBITDA multiple to the low 7’s Total debt to total market capitalization ratio is ~47% 100% of debt is fixed rate

2.60 1.80 2.15 3.30 3.75 5.10 0.15 5.10 4.50 - logo 0.15 Definitions 15

Definitions Average Effective Monthly Rent per Unit Average effective rent per unit represents the average of gross rent amounts, divided by the average occupancy (in units) for the period presented. We believe average effective rent is a helpful measurement in evaluating average pricing. This metric, when presented, reflects the average effective rent per month. Average Occupancy Average occupancy represents the average of the daily physical occupancy for the period presented. Adjusted EBITDA EBITDA is defined as net income before interest expense including amortization of deferred financing costs, income tax expense, and depreciation and amortization expenses. Adjusted EBITDA is EBITDA before acquisition and integration expenses and certain other non-operating gains or losses related to items such as asset sales, debt extinguishments, acquisition related debt extinguishment expenses, gains on the TSRE merger, and management internalization expenses. EBITDA and Adjusted EBITDA are each non-GAAP measures. We consider each of EBITDA and Adjusted EBITDA to be an appropriate supplemental measure of our performance because it eliminates interest, income taxes, depreciation and amortization, acquisition and integration expenses and other non-operating gains and losses, which permits investors to view income from operations without these non-cash or non-operating items. IRT’s calculation of Adjusted EBITDA differs from the methodology used for calculating Adjusted EBITDA by certain other REITs and, accordingly, IRT’s Adjusted EBITDA may not be comparable to Adjusted EBITDA reported by other REITs. Funds From Operations (“FFO”) and Core Funds From Operations (“CFFO”) IRT believes that FFO and CFFO, each of which is a non-GAAP measure, are additional appropriate measures of the operating performance of a REIT and IRT in particular. IRT computes FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT, as net income or loss (computed in accordance with GAAP), excluding real estate-related depreciation and amortization expense, gains or losses on sales of real estate and the cumulative effect of changes in accounting principles. CFFO is a computation made by analysts and investors to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations, including stock compensation expense, depreciation and amortization of other items not included in FFO, amortization of deferred financing costs, acquisition and integration expenses, and other non-operating gains or losses related to items such as defeasance costs we incur when we sell a property subject to secured debt, asset sales, debt extinguishments, acquisition related debt extinguishment expenses, gains on the TSRE merger, and management internalization expenses, from the determination of FFO. IRT incurs acquisition expenses in connection with acquisitions of real estate properties and expenses those costs when incurred in accordance with GAAP. As these expenses are one-time and reflective of investing activities rather than operating performance, IRT adds back these costs to FFO in determining CFFO. IRT’s calculation of CFFO differs from the methodology used for calculating CFFO by certain other REITs and, accordingly, IRT’s CFFO may not be comparable to CFFO reported by other REITs. IRT’s management utilizes FFO and CFFO as measures of IRT’s operating performance, and believes they are also useful to investors, because they facilitate an understanding of IRT’s operating performance after adjustment for certain non-cash or non-operating items that are required by GAAP to be expensed but may not necessarily be indicative of current operating performance and that may not accurately compare IRT’s operating performance between periods. Furthermore, although FFO, CFFO and other supplemental performance measures are defined in various ways throughout the REIT industry, IRT believes that FFO and CFFO may provide IRT and our investors with an additional useful measure to compare IRT’s financial performance to certain other REITs. Neither FFO nor CFFO is equivalent to net income or cash generated from operating activities determined in accordance with GAAP. Furthermore, FFO and CFFO do not represent amounts available for management’s discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments or uncertainties. Neither FFO nor CFFO should be considered as an alternative to net income as an indicator of IRT’s operating performance or as an alternative to cash flow from operating activities as a measure of IRT’s liquidity.

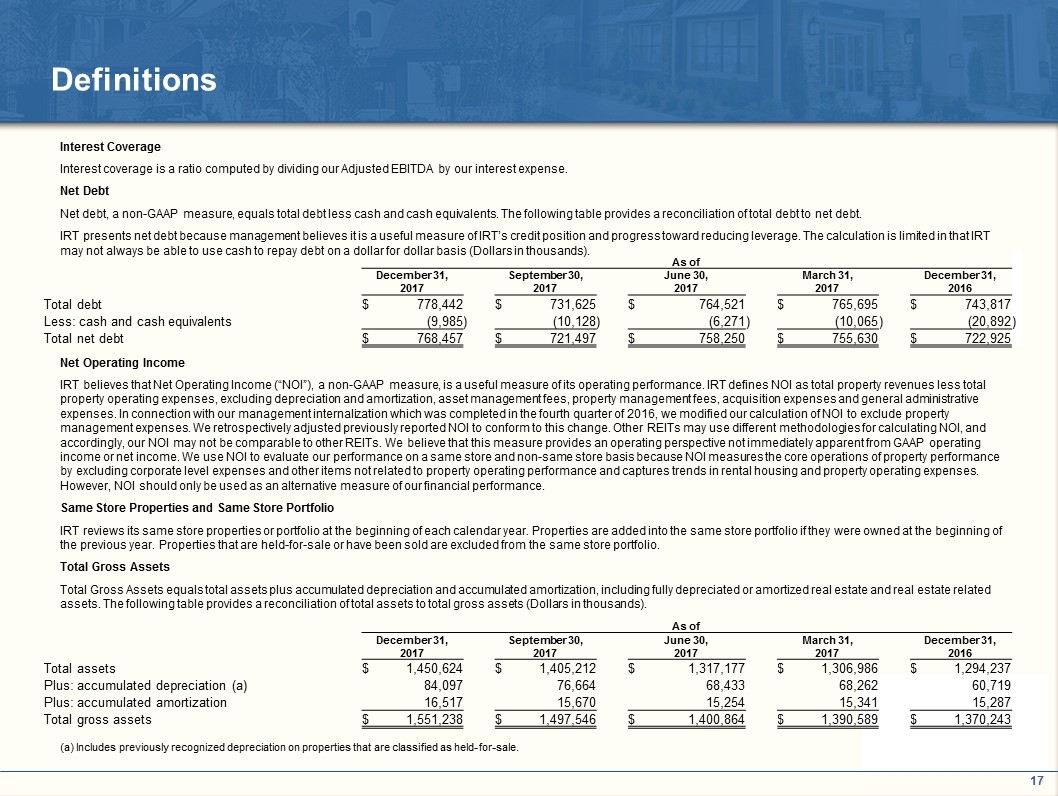

Definitions Interest Coverage Interest coverage is a ratio computed by dividing our Adjusted EBITDA by our interest expense. Net Debt Net debt, a non-GAAP measure, equals total debt less cash and cash equivalents. The following table provides a reconciliation of total debt to net debt. IRT presents net debt because management believes it is a useful measure of IRT’s credit position and progress toward reducing leverage. The calculation is limited in that IRT may not always be able to use cash to repay debt on a dollar for dollar basis (Dollars in thousands). Net Operating Income IRT believes that Net Operating Income (“NOI”), a non-GAAP measure, is a useful measure of its operating performance. IRT defines NOI as total property revenues less total property operating expenses, excluding depreciation and amortization, asset management fees, property management fees, acquisition expenses and general administrative expenses. In connection with our management internalization which was completed in the fourth quarter of 2016, we modified our calculation of NOI to exclude property management expenses. We retrospectively adjusted previously reported NOI to conform to this change. Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REITs. We believe that this measure provides an operating perspective not immediately apparent from GAAP operating income or net income. We use NOI to evaluate our performance on a same store and non-same store basis because NOI measures the core operations of property performance by excluding corporate level expenses and other items not related to property operating performance and captures trends in rental housing and property operating expenses. However, NOI should only be used as an alternative measure of our financial performance. Same Store Properties and Same Store Portfolio IRT reviews its same store properties or portfolio at the beginning of each calendar year. Properties are added into the same store portfolio if they were owned at the beginning of the previous year. Properties that are held-for-sale or have been sold are excluded from the same store portfolio. Total Gross Assets Total Gross Assets equals total assets plus accumulated depreciation and accumulated amortization, including fully depreciated or amortized real estate and real estate related assets. The following table provides a reconciliation of total assets to total gross assets (Dollars in thousands). As of December 31, 2017 September 30, 2017 June 30, 2017 March 31, 2017 December 31, 2016 Total debt $ 778,442 $ 731,625 $ 764,521 $ 765,695 $ 743,817 Less: cash and cash equivalents (9,985 ) (10,128 ) (6,271 ) (10,065 ) (20,892 ) Total net debt $ 768,457 $ 721,497 $ 758,250 $ 755,630 $ 722,925 As of December 31, 2017 September 30, 2017 June 30, 2017 March 31, 2017 December 31, 2016 Total assets $ 1,450,624 $ 1,405,212 $ 1,317,177 $ 1,306,986 $ 1,294,237 Plus: accumulated depreciation (a) 84,097 76,664 68,433 68,262 60,719 Plus: accumulated amortization 16,517 15,670 15,254 15,341 15,287 Total gross assets $ 1,551,238 $ 1,497,546 $ 1,400,864 $ 1,390,589 $ 1,370,243 (a) Includes previously recognized depreciation on properties that are classified as held-for-sale.

Disclosure Notices This presentation may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which Independence Realty Trust, Inc. (“IRT”) operates and beliefs of and assumptions made by IRT management, and involve uncertainties that could significantly affect the financial results of IRT. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “focused,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about IRT’s plans, objectives, expectations and intentions and statements that address operating performance, events or developments that IRT expects or anticipates will occur in the future. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although IRT believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, IRT can give no assurance that IRT’s expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, regional and local economic climates, (ii) changes in financial markets and interest rates, or to the business or financial condition of IRT, (iii) changes in market demand for rental apartment homes and competitive pricing, (iv) IRT’s maintenance of its real estate investment trust (“REIT”) status, (v) availability of financing and capital, (vi) risks associated with pursuing strategic acquisitions, including risks associated with the need to raise additional capital to fund the acquisitions, and (vii) those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (“SEC”) by IRT from time to time, including those discussed under the heading “Risk Factors” in IRT’s most recently filed reports on Forms 10-K and 10-Q. IRT does not undertake any duty to update any forward-looking statements appearing in this presentation, except as may be required by applicable law. This document and the related presentation may contain non-U.S. generally accepted accounting principals (“GAAP”) financial measures. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is included in this document and/or IRT’s reports filed or furnished with the SEC available at IRT’s website www.IRTLIVING.com under Investor Relations. IRT’s other SEC filings are also available through this link.