Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Core-Mark Holding Company, LLC | a2017-exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - Core-Mark Holding Company, LLC | a2017exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - Core-Mark Holding Company, LLC | a2017-exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - Core-Mark Holding Company, LLC | a2017-exhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - Core-Mark Holding Company, LLC | a2017-exhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - Core-Mark Holding Company, LLC | a2017-exhibit211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

x | Annual Report Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2017

o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number: 000-51515

Core-Mark Holding Company, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 20-1489747 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

395 Oyster Point Boulevard, Suite 415 South San Francisco, California 94080 | (650) 589-9445 |

(Address of Principal Executive Offices, including Zip Code) | (Registrant's Telephone Number, including Area Code) |

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company o |

Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2017, the last business day of the registrant's most recently completed second fiscal quarter: $1,496,890,911

As of February 23, 2018, the registrant had 46,147,688 shares of its common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information called for by Part III of this Form 10-K will be included in an amendment to this Form 10-K or incorporated by reference to the registrant’s 2018 definitive proxy statement to be filed pursuant to Regulation 14A.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

Page | ||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this Annual Report on Form 10-K that are not statements of historical fact are forward-looking statements made pursuant to the safe-harbor provisions of the Exchange Act of 1934 and the Securities Act of 1933.

Forward-looking statements in some cases can be identified by the use of words such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “would,” “project,” “predict,” “continue,” “plan,” “propose” or other similar words or expressions. Forward-looking statements are made only as of the date of this Form 10-K and are based on our current intent, beliefs, plans and expectations. They involve risks and uncertainties that could cause actual results to differ materially from historical results or those described in or implied by such forward-looking statements.

A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in Part I, Item 1A, “Risk Factors” of this Form 10-K. Management of Core-Mark Holding Company, Inc. ("Core-Mark") undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SEC Regulation - Non-GAAP Information

The financial statements in this Annual Report on Form 10-K are prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Core-Mark uses certain non-GAAP financial measures including Adjusted EBITDA, net sales less excise taxes, remaining gross profit, remaining gross profit margin, remaining gross profit margin less excise taxes and cigarette remaining gross profit per carton. We believe these non-GAAP financial measures provide meaningful supplemental information for investors regarding the performance of our business and facilitate a meaningful period to period evaluation. Management uses these non-GAAP financial measures in order to have comparable financial results to analyze changes in Core-Mark’s underlying business. These non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. More information about such measures are included in Item 7 - Adjusted EBITDA and Item 7 - Non-GAAP Financial Information.

ii

PART I

ITEM 1. BUSINESS

Unless the context indicates otherwise, all references in this Annual Report on Form 10-K to “Core-Mark,” “the Company,” “we,” “us,” or “our” refer to Core-Mark Holding Company, Inc. and its subsidiaries.

Company Overview

Core-Mark is one of the largest wholesale distributors to the convenience retail industry in North America, providing sales, marketing, distribution and logistics services to approximately 45,000 customer locations across the United States ("U.S.") and Canada through 32 distribution centers (excluding two distribution facilities we operate as a third-party logistics provider). Our origins date back to 1888, when Glaser Bros., a family-owned-and-operated candy and tobacco distribution business, was founded in San Francisco, California.

Our mission is to be the most valued marketer of fresh and broad-line supply solutions to the convenience retail industry. While the past century has brought incredible changes to our business and the world in which we operate, our goal is the same today as it was 130 years ago - to provide customers with the best possible service and to help them grow their sales and profits. We have grown our business organically and through acquisitions which have expanded our distribution network, product selection and customer base.

We operate in an industry where, in 2016, total in-store sales at convenience retail locations across both the U.S. and Canada were approximately $264.0 billion. In the U.S., total in-store sales at convenience locations in 2016 were approximately $233.0 billion, an increase of 3.2% over the prior year, based on the National Association of Convenience Stores ("NACS") State of the Industry ("SOI") report. Over the ten years from 2007 through the end of 2016, U.S. convenience in-store sales have increased by a compounded annual growth rate of approximately 3.3%. The most recent NACS Convenience Industry Store Count noted that the U.S. had approximately 155,000 convenience store locations as of December 31, 2017. Approximately 103,000, or 66%, of the convenience stores in the U.S. are considered independents with ten or fewer stores. In Canada, we estimate that total in-store sales at convenience locations in 2016 were approximately CAD $41.1 billion generated through approximately 27,000 stores, based on the Canadian Convenience Store Association 2016 Industry report.

Core-Mark is one of two national distributors to the convenience store industry in the U.S. and is the largest in Canada. Our established national market presence rests primarily with our ability to service customers in every geographic region within the U.S. through 27 primary distribution centers and servicing customers in Canada with our five Canadian distribution centers. We offer our national and large regional convenience store customers scale and buying power, and we offer our independent store customers store support and marketing programs to assist them in growing their businesses. Our Vendor Consolidation Initiative (“VCI”), Focused Marketing Initiative (“FMI”) and Fresh programs have a proven track record of helping our customers grow their sales and profits at an accelerated rate. We believe this gives us a strong competitive advantage in the North American convenience store industry.

Company Highlights

Our net sales grew from $8.9 billion in 2012 to $15.7 billion in 2017, yielding an annual compounded growth rate of approximately 12%. Our growth has been driven primarily by our business strategies described more fully below. We believe these strategies have positioned us to continue to grow our approximate 7% market share of total in-store sales within the convenience store channel in North America and to take advantage of growth opportunities with other retail store formats. Below are recent key highlights:

• | In July 2017, we acquired substantially all of the assets of Farner-Bocken Company ("Farner-Bocken"), located in Carroll Iowa, for approximately $174.0 million. The acquisition of Farner-Bocken further expands our market share in the Midwest. |

• | In May 2017, we began service of our three-year supply agreement with approximately 530 Walmart Inc. ("Walmart") stores in five western states (Arizona, California, New Mexico, Nevada and Utah). Core-Mark is the primary distributor to these stores for candy, tobacco and certain snack foods. Candy sales, the largest product category serviced under the agreement, contributed to approximately 24% to the total sales for this category. |

• | In October 2016, we began service of our five-year supply agreement with 7-Eleven Inc. ("7-Eleven") as the primary wholesale distributor to approximately 900 stores serviced from three of our divisions in the western U.S.- Las Vegas, NV, Salt Lake City, UT and Sacramento, CA. |

1

• | In June 2016, we acquired substantially all of the assets of Pine State Convenience ("Pine State"), a division of Pine State Trading Company, located in Gardiner, Maine, for approximately $88 million. |

Business Strategy

Our objective is to increase overall return to stockholders by growing our revenues and leveraging operating costs to increase profitability. As one of the largest marketers of fresh and broad-line supply solutions to the convenience retail industry in North America with a track record of effectively selling into other retail channels, we believe we are well-positioned to meet this objective moving forward. Our business strategy includes the following initiatives, designed to further enhance the value we provide to our retail customers:

Fresh Products. There is an increasing trend among consumers to purchase fresh food from convenience and other retail store formats. To meet this demand, we have modified and upgraded our refrigerated capacity, including investing in chill docks, and tri-temperature ("tri-temp") trailers, which provide the infrastructure to deliver a significant range of chilled items including milk, produce and other fresh foods to retail outlets. We have established partnerships with strategically-located dairies, fresh kitchens and bakeries to further enable us to deliver premium consumer items such as sandwiches, wraps, cut-fruit, parfaits, pastries, doughnuts, bread and home meal replacement solutions. We continue to promote our fresh products through the development of unique and comprehensive marketing and equipment programs that assist retailers in showcasing their fresh product offerings. We believe our investments in infrastructure, combined with our strategically located suppliers and in-house expertise, position us as the leader in providing fresh products and programs to the convenience retail industry. Proper execution of Vendor Consolidation Initiative ("VCI"), the cornerstone being dairy distribution, provides Core-Mark the critical mass necessary to offer retailers a multiple weekly delivery platform, which facilitates the proper handling and dating of fresh products. We believe that fresh items are increasingly driving consumer decisions and will continue to be an important category.

Vendor Consolidation Initiative. We expect our VCI program will allow us to continue to grow our sales by capitalizing on the highly fragmented supply chain that services the convenience retail industry. A convenience retailer generally receives store merchandise through a large number of direct-store deliveries. This represents a highly inefficient and costly process for retailers. Our VCI program targets inefficiencies in the convenience store supply chain by offering the retailer the ability to receive multiple weekly deliveries for the bulk of their products, including dairy and other merchandise they previously purchased from multiple direct-store delivery companies. This simplifies the customer supply chain and provides retailers with an opportunity to improve inventory turns and working capital, reduce operational and transaction costs, and greatly diminish their out-of-stocks.

Focused Marketing Initiative. Designed to enhance our relationship with our independent customer base and to further differentiate us in the market place, our FMI program is centered on increasing the sales and profitability of the independent store through improved category insights, optimized retail price strategy and demographic decision-making, along with providing Core-Mark’s marketing solutions to create a comprehensive retail marketing strategy. We believe our innovative approach, which focuses on building a trusted partnership with our customers, has established us as the market leader in providing valuable marketing and supply chain solutions to the convenience retail industry.

Acquisitions and Expansion. We believe there is significant opportunity to increase our market presence and revenue growth through strategic and opportunistic acquisitions and the continued expansion of our facility infrastructure. We completed seven acquisitions and added three primary distribution centers between 2008 and 2017, which expanded our distribution network, product selection and customer base. We will continue to be opportunistic in pursuing acquisitions that allow further leveraging of our geographic footprint and bring Fresh and VCI to a broader customer base.

Competitive Strengths

We believe we have the following fundamental competitive strengths, which form the foundation for our business strategy:

Innovation and Flexibility. Wholesale distributors typically provide convenience retailers access to a broad product line, the ability to place small quantity orders, inventory management and access to trade credit. Our capability to increase sales and profitability with existing and new customers is based on our ability to deliver consistently high levels of service, innovative marketing programs, technology solutions and logistics support. We believe we are one of the first to recognize emerging trends and to offer retailers our unique strategic solutions such as Fresh, VCI, and FMI.

Distribution Capabilities. The wholesale distribution industry is highly fragmented and historically has consisted of a large number of small, privately-owned businesses and a small number of large, full-service wholesale distributors serving multiple geographic regions. Relative to smaller competitors, large national distributors such as Core-Mark benefit from several competitive advantages including: increased purchasing power, the ability to service large national chain accounts, economies of scale in sales and operations, and the resources to invest in information technology and other productivity-enhancing technologies. Our wholesale distributing capabilities provide valuable services to both manufacturers of consumer products and convenience retailers.

2

Manufacturers benefit from our broad retail coverage, inventory management, efficiency in processing small orders and frequency of deliveries. Convenience retailers benefit from our distribution capabilities by gaining access to a broad product line, optimizing inventory management and accessing trade credit.

Customers

We service approximately 45,000 customer locations in all 50 states in the U.S. and five Canadian provinces. Our primary customer base consists of traditional convenience stores, as well as alternative outlets selling consumer packaged goods. Our traditional convenience store customers include many of the major national and super-regional convenience store operators, as well as independently owned convenience stores. Our alternative outlet customers comprise a variety of store formats, including grocery stores, drug stores, big box or supercenter stores, liquor stores, cigarette and tobacco shops, hotel gift shops, military exchanges, college and corporate campuses, casinos, hardware stores, airport concessions and other specialty and small format stores that carry convenience products.

Our top ten customers accounted for 38.7% of our net sales in 2017 including Murphy U.S.A., our largest customer, which accounted for 12.2% of our total net sales.

Products

We purchase a variety of brand name and private label products, in excess of 55,000 stock keeping units ("SKUs"), from suppliers and manufacturers. Cigarette products represent less than 5% of our total SKUs purchased. We offer customers a variety of food/non-food products, including fast food, candy, snacks, groceries, fresh products, dairy, bread, beverages, other tobacco products, general merchandise, and health and beauty care products.

Below is a comparison of our net sales mix by primary product category for the last three years (in millions):

Year Ended December 31, | ||||||||||||||||||||

2017 | 2016 | 2015 | ||||||||||||||||||

Product Category | Net Sales | % of Net Sales | Net Sales | % of Net Sales | Net Sales | % of Net Sales | ||||||||||||||

Cigarettes | $ | 10,887.4 | 69.4 | % | $ | 10,335.7 | 71.1 | % | $ | 7,528.5 | 68.0 | % | ||||||||

Food | 1,561.1 | 10.0 | 1,422.5 | 9.8 | 1,251.1 | 11.3 | ||||||||||||||

Fresh | 436.3 | 2.8 | 389.8 | 2.7 | 335.0 | 3.0 | ||||||||||||||

Candy | 833.4 | 5.3 | 620.0 | 4.3 | 557.0 | 5.0 | ||||||||||||||

Other tobacco products ("OTP") | 1,272.3 | 8.1 | 1,133.8 | 7.8 | 870.3 | 8.0 | ||||||||||||||

Health, beauty & general | 513.3 | 3.3 | 446.7 | 3.1 | 368.8 | 3.3 | ||||||||||||||

Beverages | 183.4 | 1.1 | 176.5 | 1.2 | 156.6 | 1.4 | ||||||||||||||

Equipment/other | 0.4 | — | 4.4 | — | 2.1 | — | ||||||||||||||

Total food/non-food products | 4,800.2 | 30.6 | % | 4,193.7 | 28.9 | % | 3,540.9 | 32.0 | % | |||||||||||

Total net sales | $ | 15,687.6 | 100.0 | % | $ | 14,529.4 | 100.0 | % | $ | 11,069.4 | 100.0 | % | ||||||||

Cigarette Products. We purchase cigarette products from major U.S. and Canadian manufacturers. We have no long-term cigarette purchase agreements and buy substantially all of our products on an as-needed basis. Cigarette manufacturers historically offer structured incentive programs to wholesalers based on maintaining market share and executing promotional programs. Net sales of the cigarettes category grew 5.3% in 2017 to $10,887.4 million, accounting for approximately 69.4% of our total net sales and 27.0% of our total gross profit in 2017. We control major purchases of cigarettes centrally to optimize inventory levels and purchasing opportunities. Daily replenishment of inventory and brand selection is controlled by our distribution centers.

In 2017, our cigarette carton sales in the U.S. and Canada decreased 2.5% and 2.3%, respectively, caused by the expiration of distribution agreements with Kroger Convenience and with Circle K Corp. in the Southeastern Region of the U.S., increases in excise taxes in certain jurisdictions, and a general decline in carton sales to existing customers. These impacts were partially offset by the addition of Walmart in May 2017 and 7-Eleven in October 2016, and the acquisitions of Farner-Bocken in July 2017 and Pine State in June 2016. In the industry overall, U.S. and Canadian cigarette consumption steadily declined over the last decade. Based on data compiled from the U.S. Department of Agriculture - Economic Research Service and provided by the Tobacco Merchants Association ("TMA"), total cigarette consumption in the U.S. declined from 374 billion cigarettes in 2007 to 262 billion cigarettes in 2016, or a compounded annual decline of approximately 3.9%. Total cigarette consumption declined in Canada from 30 billion cigarettes in 2007 to 26 billion cigarettes in 2016, or a compounded annual decline of approximately 1.6% based on statistics provided by the TMA. Although we anticipate overall cigarette consumption will continue to decline, we expect to offset

3

these declines through market share expansion, growth in our non-cigarette categories and incremental gross profit from cigarette manufacturer price increases.

We expect cigarette manufacturers will continue to raise prices as carton sales decline in order to maintain or enhance their overall profitability.

Excise taxes are levied on cigarettes and other tobacco products by the U.S. and Canadian federal governments and are also imposed by various states, localities and provinces. We collect state, local, and provincial excise taxes from our customers and remit these amounts to the appropriate authorities based on the credit terms, if applicable, extended by each jurisdiction. Net sales and cost of sales included amounts related to state, local and provincial excise taxes were approximately $3.5 billion, $3.0 billion and $2.2 billion in 2017, 2016 and 2015, respectively.

Food/Non-food Products. Our food products include fast food, candy, snacks, groceries, beverages and fresh products such as sandwiches, juices, salads, produce, dairy and bread. Our non-food products include cigars, tobacco, health and beauty care products, general merchandise and equipment. Net sales of the combined food/non-food product categories grew 14.5% in 2017 to $4,800.2 million, which was 30.6% of our total net sales, driven primarily by incremental sales to existing customers and market share gains including Walmart and the acquisition of Farner-Bocken. The increase in candy was driven primarily by sales to Walmart, which we began servicing in May 2017. Sales generated from Fresh, VCI and FMI were the primary drivers of increased sales to existing customers. Our OTP and Health, beauty & general categories continued to benefit from higher sales of smokeless tobacco and e-cigarettes products, respectively, which we believe will be a continuing trend. Gross profit for food/non-food categories grew $61.0 million, or 11.8%, to $577.8 million in 2017, which was 73.0% of our total gross profit. Our strategy is to continue to grow sales of food/non-food products through our Fresh, VCI and FMI strategies. In order to take advantage of the significantly higher margins earned by food/non-food products, two of our key business strategies, Fresh and VCI, focus primarily on the highest margin categories in the food/non-food group. We believe there is an increasing trend toward purchases of fresh food from convenience and other retail store formats. Combined sales of our Food and Fresh categories grew $185.1 million, or 10.2%, to $1,997.4 million in 2017. Sales of OTP increased $138.5 million, or 12.2%, while the Health, beauty and general category increased $66.6 million or 14.9%, driven primarily by this trend, as well as market share gains.

Suppliers

We purchase products for resale from approximately 5,300 trade suppliers and manufacturers located across the U.S. and Canada. In 2017, we purchased approximately 81% of our products from our top 20 suppliers, with our top two suppliers, Philip Morris USA, Inc. and R.J. Reynolds Tobacco Company, accounting for approximately 35% and 23% of our purchases, respectively. We coordinate our purchasing from suppliers by negotiating, on a Company-wide basis, special arrangements to obtain volume discounts and additional incentives, while also taking advantage of promotional and marketing incentives offered to us as a wholesale distributor. In addition, buyers in each of our distribution facilities purchase products directly from manufacturers, improving product mix and availability for individual markets.

4

Operations

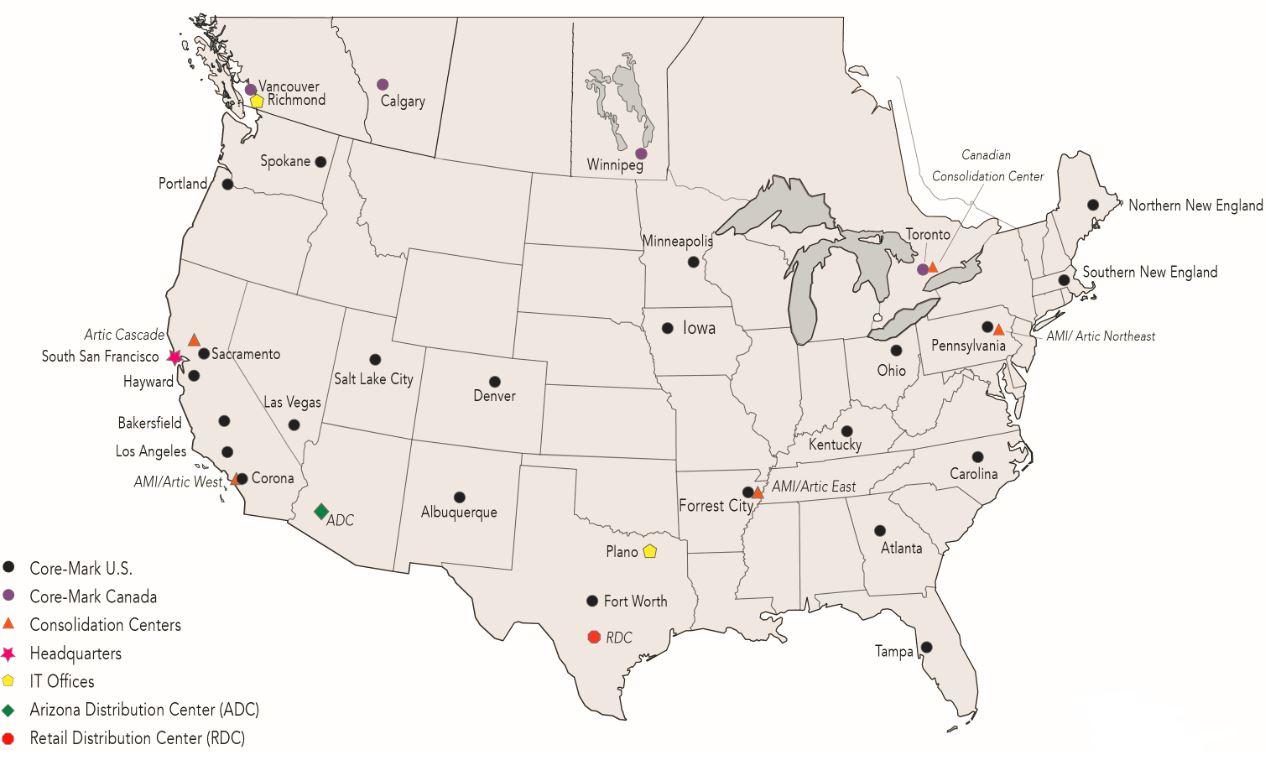

As of December 31, 2017, we operated a network of 32 primary distribution centers in the U.S. and Canada (excluding two distribution facilities we operate as a third-party logistics provider). Twenty-seven of our distribution centers are located in the U.S. and five are located in Canada.

The map below depicts the scope of our operations and the names of our distribution centers.

We operate five consolidation centers which buy products from our suppliers in bulk quantities and then redistribute the products to many of our other distribution centers. The products purchased by our consolidation centers may include frozen and chilled items, candy, snacks, beverages, health and beauty care and general merchandise products. We operate two additional facilities as a third-party logistics provider dedicated solely to supporting the logistics and management requirements of one of our major customers, Alimentation Couche-Tard, Inc. ("Couche-Tard"). One distribution facility located in Phoenix, Arizona, is referred to as the Arizona Distribution Center. The other distribution facility located in San Antonio, Texas, is referred to as the Retail Distribution Center.

Our proprietary Distribution Center Management System platform provides our distribution centers with the flexibility to adapt rapidly to changing business needs and allows them to provide our customers with necessary information technology requirements and integration capabilities.

Distribution

As of December 31, 2017, we employed approximately 2,100 transportation department personnel, including delivery drivers, shuttle drivers, routers, training supervisors and managers, all of whom focus on achieving safe, on-time deliveries. Our daily orders are picked and loaded nightly in reverse order of scheduled delivery. At December 31, 2017, our distribution fleet primarily consisted of approximately 1,500 leased tractors and trailers with over 1,300 additional owned tractors and trailers. We have made a significant investment in recent years to upgrade our trailer fleet to tri-temp, which gives us the capability to deliver frozen, chilled and non-refrigerated goods in one delivery. Excluding the fleet of trucks and trailers acquired from the acquisition of Farner-Bocken, 100% of our trailers were tri-temp as of December 31, 2017 This provides us the multiple temperature zone capability needed to support our focus on delivering fresh products to our customers.

As of December 31, 2017, approximately 16% of our trucks ran on Compressed Natural Gas ("CNG"), which allows us to reduce our carbon footprint and lower our transportation costs. To date, we have opened seven CNG stations, two of which we

5

own, located in Wilkes-Barre, Pennsylvania and Corona, California, and the other five are operated in partnership with U.S. Oil and are located in Aurora, Colorado, Forrest City, Arkansas, Sanford, North Carolina, Atlanta, Georgia and Tampa, Florida under the name GAIN Clean Fuel ("GAIN"). In addition to providing fuel to our fleet, the GAIN stations are also open to other public fleets for fueling.

Competition

Competition within the industry is based primarily on the range and quality of the services provided, price, product selection and the reliability of wholesalers’ logistics as well as proximity to the customer's stores. We operate from a perspective that focuses heavily on flexibility and providing outstanding customer service through our distribution centers, order fulfillment rates, on-time delivery, innovative marketing solutions and merchandising support as well as competitive pricing.

Core-Mark is one of the two largest wholesale convenience distributors (measured by annual sales) serving North America. We service both convenience store chain customers and independent operators with ten or fewer stores which comprise approximately 66% of the convenience retail store market. The McLane Company, Inc., a subsidiary of Berkshire Hathaway Inc., our largest competitor focuses on servicing large regional or national convenience store chains as well as our chain customers in other trade channels. There are two other large companies that cover the eastern half of the U.S: The H.T. Hackney Company and the Eby-Brown Company. In addition, there are hundreds of local distributors serving small regional chains and independent convenience retailers. In Canada, in addition to Core-Mark, several companies make-up the competitive landscape. Wallace & Carey, Inc., has national distribution capabilities. Pratts Wholesale Limited, regionally serves the Manitoba, Saskatchewan, and Alberta markets. Sobeys Inc. is a large national convenience store and grocery wholesaler.

Beyond the traditional wholesale supply channels, we face potential competition from at least three other supply avenues. First, certain consumer product manufacturers such as Anheuser-Busch Companies, Inc., MillerCoors LLC, The Coca-Cola Company, Frito-Lay, Inc., a division of PepsiCo, Inc. ("PepsiCo") and PepsiCo deliver their products directly to convenience retailers. Secondly, club wholesalers such as Costco Wholesale Corporation and Sam’s West, Inc. ("Sam's Club") provide a limited selection of products at generally competitive prices; however, they often have limited delivery options and limited services. Finally, some large convenience retail chains self-distribute products due to the geographic density of their stores and their belief that they can economically service such locations.

We face competition from the diversion into the U.S. and Canadian markets of cigarettes intended for sale outside of these markets, including the sale of cigarettes in non-taxable jurisdictions, inter-state/provincial and international smuggling of cigarettes, the sale of counterfeit cigarettes by third parties, increased imports of foreign low priced brands, the sale of cigarettes by third parties over the internet and by other means designed to avoid collection of applicable taxes. The competitive environment has been characterized by a continued influx of cheap products and tobacco alternatives, including electronic cigarettes that challenge sales of higher priced and fully taxed cigarettes.

Working Capital Practices

We sell products on credit terms to our customers that averaged, as measured by days sales outstanding, about nine days for each of 2017, 2016 and 2015. Credit terms may impact pricing and are competitive within our industry. Many of our customers remit payment electronically, which facilitates efficient and timely monitoring of payment risk. Canadian days sales outstanding in receivables tend to be lower as Canadian industry practice is for shorter credit terms than in the U.S.

We maintain our inventory of products based on the level of sales of the particular product and manufacturer replenishment cycles. The number of days a particular item of inventory remains in our distribution centers varies by product and is principally driven by the turnover of that product and economic order quantities. We typically order and carry in inventory additional amounts of certain critical products to assure high order fulfillment levels for these items. Periodically, we may carry higher levels of inventory to take advantage of anticipated manufacturer price increases. The number of days of cost of sales in inventory averaged about 16 days, 15 days, and 16 days, in 2017, 2016 and 2015, respectively. The cigarette category averaged eleven days, nine days, and ten days, in 2017, 2016 and 2015, respectively. The food/non-food categories averaged 29 days, 27 days and 29 days in 2017, 2016 and 2015, respectively.

We obtain terms from our vendors and certain taxing jurisdictions based on industry practices, consistent with our credit standing. We take advantage of the full complement of term offerings, which may include enhanced cash discounts for earlier payment or prepayment. Terms for our accounts payable and cigarette and tobacco taxes payable range anywhere from two days prepaid to 60 days credit. Days payable outstanding for both categories, excluding the impact of prepayments, during each of 2017, 2016 and 2015 averaged 11 days.

6

Employees

The following chart provides a breakdown of our employees by function and geographic region (including employees at our third-party logistics facilities) as of December 31, 2017:

TOTAL EMPLOYEES BY BUSINESS FUNCTION

U.S. | Canada | Total | ||||||

Sales and Marketing | 1,542 | 106 | 1,648 | |||||

Warehousing and Distribution | 5,284 | 390 | 5,674 | |||||

Management, Administration, Finance and Purchasing | 941 | 150 | 1,091 | |||||

Total for all categories | 7,767 | 646 | 8,413 | |||||

Four of our distribution centers, Hayward, Las Vegas, Los Angeles and Calgary, have employees who are covered by collective bargaining agreements with local affiliates of The International Brotherhood of Teamsters (Hayward, Las Vegas and Los Angeles) and the United Food and Commercial Workers International Union (Calgary). Approximately 400 employees, or 5% of our workforce, are unionized. There have been no disruptions in customer service, strikes, work stoppages or slowdowns as a result of union activities, and we believe we have satisfactory relations with our employees.

Regulation

As a distributor of food products in the U.S., we are subject to the Federal Food, Drug and Cosmetic Act and regulations promulgated by the U.S. Food and Drug Administration ("FDA"). In Canada, similar standards related to food and over-the-counter medications are governed by Health Canada. The products we distribute are also subject to federal, state, provincial and local regulation through such measures as: the licensing of our facilities; enforcement by state, provincial and local health agencies of relevant standards for the products we distribute; and regulation of our trade practices in connection with the sale of our products. Our facilities are inspected periodically by federal, state, provincial and local authorities, including the Occupational Safety and Health Administration ("OSHA") under the U.S. Department of Labor, which require us to comply with certain health and safety standards to protect our employees.

We are also subject to regulation by the U.S. and Canadian Departments of Transportation, which regulate transportation of perishable goods, and similar state, provincial and local agencies. Our distribution centers in the U.S. and Canada are subject to a broad spectrum of federal, state, provincial and local environmental protection statutes including those that govern emissions to air, soil and water, and the disposal of hazardous substances.

Our policy is to comply with all regulatory and legal requirements, and management is not aware of any related issues that may have a material effect upon our business, financial condition or results of operations.

Registered Trademarks

We have registered trademarks including the following: Arcadia Bay®, Arcadia Bay Coffee Company®, Cable Car®, Core-Mark®, Core Solutions Group®, EMERALD®, Java Street®, SmartStock®, Pine State Convenience®, Taco Depot® and Farner-Bocken®.

Segment and Geographic Information

We have two operating segments which aggregate into one reportable segment. We also present certain financial information by operating segment region -- the U.S. and Canada. See Note 16 - Segment and Geographic Information to our consolidated financial statements.

Seasonality

We typically generate higher net sales and gross profits during the warm weather months (April through September) than other times of the year. We believe this occurs because the convenience store industry tends to be busier due to timing of vacations and an increase in travel during this period.

Corporate and Contact Information

Our corporate headquarters is located at 395 Oyster Point Boulevard, Suite 415, South San Francisco, California, 94080 and our telephone number is (650) 589-9445.

7

Our website address is www.core-mark.com. We provide free access to various reports that we file with or furnish to the U.S. Securities and Exchange Commission ("SEC") through our website, as soon as they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports. Our SEC reports can be accessed through the “Investors” section of our website under “Financials & Filings,” or through www.sec.gov.

Also available on our website are printable versions of Core-Mark’s Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter, Code of Business Conduct and Ethics, Corporate Governance Guidelines and Principles and other corporate information. Copies of these documents may also be requested from:

Core-Mark Holding Company, Inc.

395 Oyster Point Blvd, Suite 415

South San Francisco, CA 94080

Attention: Investor Relations

Code of Business Conduct and Ethics and Whistle Blower Policy

Our Code of Business Conduct and Ethics is designed to promote honest, ethical and lawful conduct by all employees, officers and directors and is available on the “Investors” section of our website at www.core-mark.com under “Corporate Governance.”

Additionally, the Audit Committee of the Board of Directors of Core-Mark has established procedures to receive, retain, investigate and act on complaints and concerns of employees, stockholders and others regarding accounting, internal accounting controls and auditing matters, including complaints regarding attempted or actual circumvention of internal accounting controls or complaints regarding violations of our accounting policies. The procedures are also described on our website at www.core-mark.com under “Corporate Governance” in the “Investors” section.

8

ITEM 1A. RISK FACTORS

Our business is subject to a variety of risks. Set forth below are certain of the important risks that we face, the occurrence of which may have a material effect on our business, financial condition or results of operations.

Risks Related to Our Business and Industry

We are dependent on the convenience retail industry, and our results of operations could suffer if it experiences an overall decline or consolidation.

The majority of our sales are generated from convenience retail stores which inherently involve industry-specific risks. These risks include: declining sales in the convenience retail industry due to general economic conditions, including rising energy and fuel costs, which may impact “in-store” retail sales; competition from internet retailers such as Amazon, club stores, grocery stores, dollar stores and other retail outlets; termination of customer relationships and consolidation of our customer base. Such events could cause us to experience decreases in revenues, put pressure on our margins and increase our credit risk and potential bad debt exposure.

We depend on attracting and retaining qualified labor including our senior management and other key personnel.

We depend on the continued services and performance of our senior executive officers as named in our Proxy Statement and other key employees. We do not maintain key person life insurance policies on these individuals, and we do not have employment agreements with any of them. The loss of the services of one or more of our senior executive officers or other key personnel could harm our business.

We compete with other businesses in each of our markets to attract and retain qualified employees. A shortage of qualified employees, especially drivers, in any given market could require us to enhance our wage and benefit packages in order to compete effectively in the hiring and retention of qualified employees or to hire more expensive temporary employees in the affected market. Any such shortage of qualified employees could decrease our ability to effectively serve our customers and might lead to lower profits due to higher labor costs.

Our ability to meet our labor needs is generally subject to numerous other external factors, including prevailing wage rates, changing demographics, health and other insurance costs, and adoption of new or revised employment and labor laws and regulations. These external factors could prevent us from locating, attracting or retaining qualified personnel, which could adversely impact the quality of the services we provide to our customers, as well as our financial performance.

Our sales volume is largely dependent upon the distribution of cigarettes, sales of which are declining generally.

The distribution of cigarettes is currently a significant portion of our business. In 2017, approximately 69.4% of our net sales (including excise taxes) and 27.0% of our gross profit were generated from the distribution of cigarettes. Due to increases in the prices of cigarettes, restrictions on cigarette manufacturers’ marketing and promotions, increases in cigarette regulation and excise taxes, health concerns, increased pressure from anti-tobacco groups, the rise in popularity of tobacco alternatives, including electronic cigarettes, and other factors, cigarette consumption in the U.S. and Canada has been declining gradually over the past few decades. In most instances, tobacco alternatives, such as electronic cigarettes, are not subject to federal, state, provincial and local excise taxes like the sale of conventional cigarettes or other tobacco products. We expect consumption trends of legal cigarette products will continue to be negatively impacted by the factors described above. In addition, we expect rising prices may lead to a higher percentage of consumers purchasing cigarettes through illicit markets, over the internet and by other means designed to avoid payment of cigarette taxes. If we are unable to sell other products to make up for these declines in cigarette unit sales, our operating results may suffer.

Many of the markets in which we compete are highly competitive and we may lose market share and suffer a decline in sales and profitability in these markets if we are unable to outperform our competition.

Our distribution centers operate in highly competitive markets. A substantial amount of our sales are made under purchase orders and short-term contracts with convenience retail stores which inherently involve significant risks. We face competition from local, regional and national tobacco and consumable products distributors on the basis of service, price, reliability, delivery schedules, and variety of products offered. We also face competition from club stores, dollar stores and alternate sources that sell consumable products to convenience retailers. Some of our competitors, including The McLane Company, Inc. (a subsidiary of Berkshire Hathaway Inc.), have substantial financial resources and long-standing customer relationships. In addition, heightened competition among our existing competitors, or by new entrants into the distribution market, could create additional competitive pressures that may result in the loss of major customers, reduced margins, or other adverse effects on our business. If we fail to successfully respond to these competitive pressures or to implement our strategies effectively, we may lose market share, and our results of operations could suffer.

9

Our ability to operate effectively could be impaired by the risks and costs associated with expansion activities.

Our business has expanded rapidly and market share growth is one of our key company initiatives. To accomplish this growth, we have focused on strategic acquisitions and securing large regional and national customers as key elements of success. Any significant expansion activity comes with inherent risks. Acquisitions may entail various risks, such as identifying suitable candidates, realizing acceptable rates of return on investment, identifying potential liabilities, obtaining adequate financing, negotiating acceptable terms and conditions, and successfully integrating operations and converting systems post acquisition. Integrating a large new customer has similar risks related to realizing acceptable returns on invested working capital and negotiating acceptable pricing and service levels, while managing resources and business interruptions as we integrate the new business into our current infrastructure. We may realize higher costs, lower margins or fewer benefits than originally anticipated and may experience disruption to our base business in connection with such acquisitions and other new customer integration activities.

Our failure to maintain relationships with large customers could potentially harm our business.

We have relationships with many large regional and national convenience and other store chains. While we expect to maintain these relationships for the foreseeable future, any termination, non-renewal or reduction in services that we provide to such customers could cause our revenues and operating results to suffer.

We may lose business if manufacturers or large retail customers convert to direct distribution of their products.

In the past, certain large manufacturers and customers have elected to engage in direct distribution or third-party distribution of their products and ceased relying on wholesale distributors such as Core-Mark. Similarly, manufacturers or other providers may choose to move their product distribution to Amazon or other e-commerce providers. If other manufacturers or retail customers make similar elections in the future, our revenues and profits would be adversely affected and there can be no assurance that we will be able to mitigate such losses.

Our business is sensitive to fuel prices and related transportation costs, which could adversely affect our business.

Our operating results may be adversely affected by unexpected increases in fuel or other transportation-related costs, including costs from the use of third-party carriers, temporary staff and overtime. Historically, we have been able to pass on a substantial portion of increases in our own fuel or other transportation costs to our customers in the form of fuel or delivery surcharges, but our ability to continue to pass through these increases is not assured. If we are unable to continue to pass on fuel and transportation-related cost increases to our customers, do not realize the benefits we expect from converting a large percentage of our trucks to operate on natural gas or incur higher expenses due to decreases in diesel fuel prices that are not matched by similar decreases in natural gas prices, our operating results could be negatively affected.

Our information technology systems may be subject to failure, disruptions, security breaches (such as malware, viruses, hacking or other cyber-attacks) which could compromise our ability to conduct business, seriously harm our business and adversely affect our financial results.

Our business is highly dependent on our enterprise information technology systems. We rely on our information technology systems and our information technology staff to maintain the information required to operate our distribution centers and to provide our customers with fast, efficient and reliable deliveries. We continue to take steps to increase redundancy in our information technology systems and have disaster recovery plans in place to mitigate events that could disrupt our systems’ service. However, if our systems fail or are not reliable, we may suffer disruptions in service to our customers and our results of operations could suffer.

In addition, we retain sensitive data, including intellectual property, proprietary business information and personally identifiable information, in our secure data centers and on our networks. As the number of global cyber-attacks continue to escalate, we may face increased threats of unauthorized access, security breaches and other system disruptions to our data centers and networks. To help mitigate the risk, we utilize the expertise of our internal and external security resources to monitor our environment and work to install/upgrade tools that protect our systems and data. However, despite these measures, our infrastructure may be vulnerable to attacks by experienced hackers or other disruptive events.

Computer malware, viruses, hacking and other cyber-attacks have become more prevalent and may occur on our systems in the future. Intruders may also take the form of parties that attempt to fraudulently induce employees or other users of our systems to disclose sensitive or confidential information or otherwise disrupt operations. Any such security breach may compromise information stored on our networks and may result in significant data losses or theft of intellectual property, proprietary business information or personally identifiable information belonging to us or our customers, business partners or employees. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain performance, reliability and security affects the availability of our technical infrastructure and technology-based services. Any such failure may harm our reputation and our ability to retain existing customers and attract new customers and could impact our

10

results of operation. We attempt to address these risks, in part, by continuously providing communications to our employees regarding the characteristics of phishing attempts and are increasing the level of awareness training across the Company.

Cigarette and consumable goods distribution is a low-margin business sensitive to inflation and deflation.

We derive most of our revenues from the distribution of cigarettes, other tobacco products, candy, snacks, fast food, groceries, fresh products, dairy, beverages, general merchandise and health and beauty care products. Our industry is characterized by a high volume of sales with low profit margins. Our food/non-food sales are generally priced based on the manufacturer’s cost of the product plus a percentage markup. As a result, our profit levels may be negatively impacted during periods of cost deflation or stagnation for these products, even though our gross profit as a percentage of the price of goods sold may remain relatively constant. In addition, periods of product cost inflation may have a negative impact on our gross profit margins with respect to sales of cigarettes because gross profits on cigarette sales are generally fixed on a cents per carton basis. Therefore, as cigarette prices increase, gross profit generally decreases as a percentage of sales. In addition, if the cost of the cigarettes that we purchase increases due to manufacturer price increases, reduced or eliminated manufacturer discounts and incentive programs, or increases in applicable excise tax rates, our inventory carrying costs and accounts receivable could rise, placing pressure on our working capital requirements.

We rely on manufacturer discount and incentive programs and cigarette excise stamping allowances, and any material changes in these programs could adversely affect our results of operations.

We receive payments from manufacturers on the products we distribute for allowances, discounts, volume rebates and other merchandising and incentive programs. These payments are a substantial contributor to our gross profit. The amount and timing of these payments are affected by changes in the programs by manufacturers, our ability to sell specified volumes of a particular product, attaining specified levels of purchases by our customers and the duration of carrying a specified product. In addition, we receive discounts from certain taxing jurisdictions in connection with the collection of excise taxes. If manufacturers or taxing jurisdictions change or discontinue these programs or change the timing of payments, or if we are unable to maintain the volume of our sales required by such programs, our results of operations could be negatively affected.

We depend on relatively few suppliers for a large portion of our products, and any interruptions in the supply of the products that we distribute could adversely affect our results of operations.

We obtain the products we distribute from third-party suppliers. At December 31, 2017, we had approximately 5,300 vendors and during 2017 we purchased approximately 81% of our products from our top 20 suppliers, with purchases from our top two suppliers, Philip Morris USA, Inc. and R.J. Reynolds Tobacco Company, representing approximately 35% and 23% of our purchases, respectively. We do not have any long-term contracts with our suppliers committing them to provide products to us. Our suppliers may not provide the products we distribute in the quantities we request on favorable terms, or at all. We are also subject to delays caused by interruptions in production due to conditions outside our control, such as slow-downs or strikes by employees of suppliers, inclement weather, transportation interruptions, regulatory requirements and natural disasters. Our inability to obtain adequate supplies of the products we distribute could cause us to fail to meet our contractual and other obligations to our customers and reduce the volume of our sales and profitability.

We may be subject to product liability claims and counterfeit product claims which could materially adversely affect our business.

As a distributor of food and consumer products, we face the risk of exposure to product liability claims in the event that the use of a product sold by us causes injury or illness. In addition, certain products that we distribute may be subject to counterfeiting. Our business could be adversely affected if consumers lose confidence in the safety and quality of the food and other products we distribute. Further, our operations could be subject to disruptions as a result of manufacturer recalls. This risk may increase as we continue to expand our distribution of fresh products. If we do not have adequate insurance, if contractual indemnification from the supplier or manufacturer of the defective, contaminated or counterfeit product is not available, or if a supplier or manufacturer cannot fulfill its indemnification obligations to us, the liability relating to such product claims or disruption as a result of recall efforts could adversely impact our results of operations.

We may not be able to achieve the expected benefits from the implementation of marketing initiatives.

We are continuously improving our competitive performance through a series of strategic marketing initiatives, such as Focused Marketing Initiative, SmartStock and Vendor Consolidation Initiative. The goal of this effort is to develop and implement a comprehensive and competitive business strategy, addressing the special needs of the convenience industry environment, increasing our market position within the industry and ultimately creating increased stockholder value. Customer acceptance of our new marketing initiatives may not be as anticipated or competitive pressures may cause us to curtail or abandon these initiatives, resulting in lower revenue growth and unachieved cost savings.

11

Maintaining our brand and reputation is necessary for the success of our business.

Our established brand and reputation within the market largely contributes to our success. Our current and future business could be negatively impacted if we were poorly represented or garnered negative publicity through various media channels, which include but are not limited to print, broadcast, web-based, and social media. Brand value is based in large part on perceptions of subjective qualities, and even isolated incidents can erode trust and confidence, particularly if they result in adverse publicity, governmental investigations or litigation. Even if the aforementioned situations were unfounded or not material to our business, these events could still decrease demand for our products and services and erode customer confidence. If any of these events were to occur, they could have a negative impact on our results of operations and financial condition.

We may be subject to various claims and lawsuits that could result in significant expenditures.

The nature of our business exposes us to the potential for various claims and litigation related to labor and employment, personal injury, property damage, business practices, environmental liability and other matters. Any material litigation or a catastrophic accident or series of accidents could have a material adverse effect on our business, financial position, results of operations and cash flows.

Unions may attempt to organize our employees.

As of December 31, 2017, approximately 400 or 5%, of our employees were covered by collective bargaining agreements with labor organizations, under agreements that expire at various times. We cannot assure that we will be able to renew our respective collective bargaining agreements on favorable terms, that employees at other facilities will not unionize or that our labor costs will not increase. In addition, the United States National Labor Relations Board is becoming more active with the passage of administrative rules that could impact our ability to manage our labor force and wage successful campaigns preventing further unionization of our employees. To the extent we suffer business interruptions as a result of strikes or other work stoppages or slow-downs, or our labor costs increase and we are not able to recover such increases through increased prices charged to customers or offsets by productivity gains, our results of operations could be materially adversely affected.

Employee health benefit costs represent a significant expense to us and may negatively affect our profitability.

With over 6,000 employees and their families participating in our health plans, our expenses relating to employee health benefits are substantial. In past years, we have experienced significant increases in certain of these costs, largely as a result of economic factors beyond our control, including, in particular, ongoing increases in health care costs well in excess of the rate of inflation. Increased participation in our health plans, continued increasing health care costs, as well as changes in laws, regulations and assumptions used to calculate health and benefit expenses, may adversely affect our business, financial position and results of operations. In addition, the Patient Protection and Affordable Care Act ("ACA") may continue to increase our employee healthcare-related costs. We have migrated a significant number of employees to our high deductible plan, resulting in a reduction in our claims exposure and offsetting other costs related to ACA. While we have taken steps to minimize the impact of ACA, there is no guarantee our efforts will be successful.

Changes to minimum wage laws and other governmental legislation or regulations could increase our costs substantially.

As of December 31, 2017, we had no employees who were paid under the minimum wage in their respective locations. Several bills have been introduced in the U.S. legislature over the past few years to increase the federal minimum wage. In addition, certain states have adopted or are considering adopting minimum wage statutes that exceed the federal minimum wage rate. Any increases in federal or state minimum wages could require us to increase the wages paid to our minimum wage employees and create pressure to raise wages for other employees who already earn above-minimum wages. Further, changes to wage and hour laws and/or new legislation increasing mandatory paid leave can add costs to our business. If we are unable to pass these additional labor costs on to our customers in the form of increased prices or surcharges, our business and results of operations would be adversely affected.

If we are unable to comply with governmental regulations that affect our business or if there are substantial changes in these regulations, our business could be adversely affected.

As a distributor of food and other consumable products, we are subject to regulation by the FDA, Health Canada and similar regulatory authorities at the federal, state, provincial and local levels. In addition, our employees operate tractor trailers, trucks, forklifts and various other powered material handling equipment, and we are therefore subject to regulation by the U.S. and Canadian Departments of Transportation. Our operations are also subject to regulation by OSHA, the U.S. Drug Enforcement Administration and a myriad of other federal, state, provincial and local agencies. Each of these regulatory authorities has broad administrative powers with respect to our operations. Regulations, and the costs of complying with those regulations, have been increasing in recent years. If we fail to adequately comply with government regulations, we could experience increased inspections or audits, regulatory authorities could take remedial action including imposing fines or shutting down our operations, or we could be subject to increased compliance costs. If any of these events were to occur, our results of operations would be adversely affected.

12

Natural disaster damage could have a material adverse effect on our business.

Our headquarters and several of our warehouses in California, and one warehouse located near Vancouver, British Columbia, Canada, are in or near high hazard earthquake zones. We also have operations in areas that have been affected by natural disasters such as hurricanes, tornados, floods, and ice and snow storms. While we maintain insurance to cover us for certain potential losses, our insurance may not be sufficient in the event of a significant natural disaster, or payments under our policies may not be received timely enough to prevent adverse impacts on our business. Our customers could also be affected by similar events, which could adversely affect our sales and results of operations.

Insurance and claims expenses could have a material adverse effect on us.

We have a combination of both self-insurance and high-deductible insurance programs for the risks arising out of the services we provide and the nature of our operations throughout North America, including claims exposure resulting from personal injury, property damage, business interruption and workers’ compensation. Workers’ compensation, automobile and general liabilities are determined using actuarial estimates of the aggregate liability for claims incurred and an estimate of incurred but not reported claims. Our accruals for insurance reserves reflect certain actuarial assumptions and management judgments, which are subject to a high degree of variability. If the number or severity of claims for which we are retaining risk increases, our financial condition and results of operations could be adversely affected. If we lose our ability to self-insure these risks, our insurance costs could materially increase and we may find it difficult to obtain adequate levels of insurance coverage.

Risks Related to the Distribution of Cigarettes and Other Tobacco Products

Legislation, regulation and other matters are negatively affecting the cigarette and tobacco industry.

The tobacco industry is subject to a wide range of laws and regulations regarding the marketing, distribution, sale, taxation and use of tobacco products imposed by governmental entities. Various jurisdictions have adopted or are considering legislation and regulations restricting displays and marketing of tobacco products, establishing fire safety standards for cigarettes, raising the minimum age to possess or purchase tobacco products, requiring the disclosure of ingredients used in the manufacture of tobacco products, imposing restrictions on public smoking, restricting the sale of tobacco products directly to consumers or other recipients over the internet and other tobacco product regulation. In addition, the FDA has been empowered to regulate changes to nicotine yields and the chemicals and flavors used in tobacco products (including cigars, pipe and e-cigarette products), require ingredient listings be displayed on tobacco products, prohibit the use of certain terms which may attract youth or mislead users as to the risks involved with using tobacco products, as well as limit or otherwise impact the marketing of tobacco products by requiring additional labels or warnings as well as pre-approval by the FDA. Such legislation and related regulation is likely to continue adversely impacting the market for tobacco products and, accordingly, our sales of such products.

In Canada, many provinces have enacted legislation authorizing and facilitating the recovery by provincial governments of tobacco-related health care costs from the tobacco industry by way of lawsuit. Some Canadian provincial governments have either already initiated lawsuits or indicated an intention that such lawsuits will be filed. It is unclear at this time how such restrictions and lawsuits may affect Core-Mark and its Canadian operations.

If excise taxes are increased or credit terms are reduced, our sales of cigarettes and other tobacco products could decline and our liquidity could be negatively impacted.

Cigarettes and tobacco products are subject to substantial excise taxes in the U.S. and Canada. Significant increases in cigarette-related taxes and/or fees have been proposed or enacted and are likely to continue to be proposed or enacted by various taxing jurisdictions within the U.S. and Canada as a means of increasing government revenues. These tax increases negatively impact consumption. Additionally, they may cause a shift in sales from premium brands to discount brands, illicit channels or tobacco alternatives, such as electronic cigarettes, as smokers seek lower priced options.

Taxing jurisdictions have the ability to change or rescind credit terms currently extended for the remittance of taxes that we collect on their behalf. If these excise taxes are substantially increased, or credit terms are substantially reduced, it could have a negative impact on our liquidity. Accordingly, we may be required to obtain additional debt financing, which we may not be able to obtain on satisfactory terms or at all.

Our distribution of cigarettes and other tobacco products exposes us to potential liabilities.

In June 1994, the Mississippi attorney general brought an action against various tobacco industry members on behalf of the state to recover state funds paid for health care costs related to tobacco use. Most other states sued the major U.S. cigarette manufacturers based on similar theories. In November 1998, the major U.S. tobacco product manufacturers entered into a Master Settlement Agreement ("MSA") with 46 states, the District of Columbia and certain U.S. territories. The other four states--Mississippi, Florida, Texas and Minnesota ("non-MSA states")--settled their litigations with the major cigarette manufacturers by separate agreements. The MSA and the other state settlement agreements settled health care cost recovery actions and monetary

13

claims relating to future conduct arising out of the use of, or exposure to, tobacco products, imposed a stream of future payment obligations on major U.S. cigarette manufacturers and placed significant restrictions on the ability to market and sell cigarettes. The payments required under the MSA result in higher pricing of products sold by the participating manufacturers than those sold by non-MSA state manufacturers. In addition, the growth in market share of discount brands since the MSA was signed has had an adverse impact on the total volume of the cigarettes that we sell.

In connection with the MSA, we were indemnified by most of the tobacco product manufacturers from which we purchased cigarettes and other tobacco products, for liabilities arising from our sale of the tobacco products that they supplied to us. Should the MSA ever be invalidated, we could be subject to substantial litigation due to our distribution of cigarettes and other tobacco products, and we may not be indemnified for such costs by the tobacco product manufacturers in the future. In addition, even if we are indemnified by cigarette manufacturers that are parties to the MSA, future litigation awards against such cigarette manufacturers could be so large as to prevent the manufacturers from satisfying their indemnification obligations.

Risks Related to Financial Matters, Financing and Foreign Exchange

Changes to federal, state or provincial income tax legislation could have a material adverse effect on our business and results of operations.

From time to time, new tax legislation is adopted by the federal government and various states or other regulatory bodies. Significant changes in tax legislation could adversely affect our business or results of operations in a material way. On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “TCJA”). The changes included in the TCJA are broad and complex. The final transition impacts of the TCJA may differ from the estimates provided elsewhere in this report, possibly materially, due to, among other things, changes in interpretations of the TCJA, any legislative action to address questions that arise because of the TCJA, any changes in accounting standards for income taxes or related interpretations in response to the TCJA, or any updates or changes to estimates the company has utilized to calculate the transition impacts, including impacts from changes to current year earnings estimates and foreign exchange rates of foreign subsidiaries. As these and other tax laws and related regulations change, our financial results could be materially impacted. For example, in the U.S. the federal government has in the past proposed legislation which effectively could limit, or even eliminate, use of the last-in, first-out ("LIFO") inventory method for financial and income tax purposes. Although the final outcome of any such proposals cannot be ascertained, the ultimate financial impact to us of the transition from LIFO to another inventory method could be material to our operating results. Given the unpredictability of possible changes and their potential interdependency, it is very difficult to assess whether the overall effect of such potential tax changes would be cumulatively positive or negative for our earnings and cash flow, but such changes could adversely impact our financial results.

There can be no assurance that we will continue to declare cash dividends in the future or in any particular amounts and if there is a reduction in dividend payments, our stock price may be harmed.

Since the fourth quarter of 2011, we have paid a quarterly cash dividend to our stockholders. We intend to continue to pay quarterly dividends subject to capital availability and periodic determinations by our Board of Directors that cash dividends are in the best interest of our stockholders and are in compliance with all applicable laws and agreements to which we are a party. Future dividends may be affected by a variety of factors such as available cash, anticipated working capital requirements, overall financial condition, credit agreement restrictions, future prospects for earnings and cash flows, capital requirements for acquisitions, stock repurchase programs, reserves for legal risks and changes in federal and state income tax or corporate laws. Our Board of Directors may, at its discretion, decrease or entirely discontinue the payment of dividends at any time. Any such action could have a material, negative effect on our stock price.

Currency exchange rate fluctuations could have an adverse effect on our revenues and financial results.

We generate a significant portion of our revenues in Canadian dollars, approximately 9% in 2017 and 10% in 2016. We also incur a significant portion of our expenses in Canadian dollars. To the extent that we are unable to match revenues received in Canadian dollars with costs paid in the same currency, exchange rate fluctuations in Canadian dollars could have an adverse effect on our financial results. During times of a strengthening U.S. dollar, our reported sales and earnings from Canadian operations will be reduced because the Canadian currency will be translated into fewer U.S. dollars. Conversely, during times of a weakening U.S. dollar, our reported sales and earnings from our Canadian operations will be increased because the Canadian currency will be translated into more U.S. dollars. U.S. GAAP requires that foreign currency transaction gains or losses on short-term intercompany transactions be recorded currently as gains or losses within the statement of operations. To the extent we incur losses on such transactions, our net income will be reduced. We currently do not hedge our Canadian foreign currency cash flows.

14

We may not be able to borrow additional capital to provide us with sufficient liquidity and capital resources necessary to meet our future financial obligations.

We expect that our principal sources of funds will be cash generated from our operations and, if necessary, borrowings under a $750 million revolving credit facility ("Credit Facility") as of December 31, 2017. On March 28, 2017, we entered into a tenth amendment to the Credit Facility which increased our Credit Facility from $600 million to $750 million. The Credit Facility, initially dated as of October 12, 2005, as amended or otherwise modified from time to time, is between us, as Borrowers, the Lenders named therein, and JPMorgan Chase Bank, N.A., as administrative agent. The Credit Facility expires in March 2022. While we believe our sources of liquidity are adequate, we cannot guarantee that these sources will be available or continue to provide us with sufficient liquidity and capital resources required to meet our future financial obligations, or to provide funds for our working capital, capital expenditures and other needs. As such, additional equity or debt financing sources may be necessary and we may not be able to expand our existing Credit Facility or obtain new financing on terms satisfactory to us.

Our operating flexibility is limited in significant respects by the restrictive covenants in our Credit Facility.

Our Credit Facility imposes restrictions on us that could increase our vulnerability to general adverse economic and industry conditions by limiting our flexibility in planning for and reacting to changes in our business and industry. Specifically, these restrictions place limits on our ability to, among other things, incur additional indebtedness, pay dividends, issue stock of subsidiaries, make investments, repurchase stock, create liens, enter into transactions with affiliates, merge or consolidate, or transfer and sell our assets. In addition, under our Credit Facility, under certain circumstances we are required to meet a fixed charge coverage ratio. Our ability to comply with this covenant may be affected by factors beyond our control and a breach of the covenant could result in an event of default under our Credit Facility, which would permit the lenders to declare all amounts incurred thereunder to be immediately due and payable and to terminate their commitments to make further extensions of credit.

Our actual business and financial results could differ as a result of the accounting methods, estimates and assumptions that we use in preparing our financial statements, which may negatively impact our results of operations and financial condition.