Attached files

| file | filename |

|---|---|

| EX-99.1 - FINANCIAL RESULTS PRESS RELEASE. - FEDERAL SIGNAL CORP /DE/ | fss-20171231x10kexhx991.htm |

| EX-32.2 - CFO CERTIFICATION OF PERIODIC REPORT UNDER SECTION 906 OF SARBANES-OXLEY ACT. - FEDERAL SIGNAL CORP /DE/ | fss-20171231x10kexhx322.htm |

| EX-32.1 - CEO CERTIFICATION OF PERIODIC REPORT UNDER SECTION 906 OF SARBANES-OXLEY ACT. - FEDERAL SIGNAL CORP /DE/ | fss-20171231x10kexhx321.htm |

| EX-31.2 - CFO CERTIFICATION UNDER SECTION 302 OF SARBANES-OXLEY ACT. - FEDERAL SIGNAL CORP /DE/ | fss-20171231x10kexhx312.htm |

| EX-31.1 - CEO CERTIFICATION UNDER SECTION 302 OF SARBANES -OXLEY ACT. - FEDERAL SIGNAL CORP /DE/ | fss-20171231x10kexhx311.htm |

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - FEDERAL SIGNAL CORP /DE/ | fss-20171231x10kexhx23.htm |

| EX-21 - SUBSIDIARIES OF THE REGISTRANT. - FEDERAL SIGNAL CORP /DE/ | fss-20171231x10kexhx21.htm |

| 10-K - FORM 10-K. - FEDERAL SIGNAL CORP /DE/ | fss10k20171231.htm |

Federal Signal Q4 2017 Earnings Call

February 28, 2018

Jennifer Sherman, President & Chief Executive Officer

Ian Hudson, SVP, Chief Financial Officer

Safe Harbor

This presentation contains unaudited financial information and various forward-looking

statements as of the date hereof and we undertake no obligation to update these forward-

looking statements regardless of new developments or otherwise. Statements in this

presentation that are not historical are forward-looking statements. Such statements are subject

to various risks and uncertainties that could cause actual results to vary materially from those

stated. Such risks and uncertainties include but are not limited to: economic conditions in various

regions, product and price competition, supplier and raw material prices, risks associated with

acquisitions such as integration of operations and achieving anticipated revenue and cost

benefits, foreign currency exchange rate changes, interest rate changes, increased legal expenses

and litigation results, legal and regulatory developments and other risks and uncertainties

described in filings with the Securities and Exchange Commission.

This presentation also contains references to certain non-GAAP financial information. Such items

are reconciled herein and in our earnings news release provided as of the date of this

presentation.

2

Full-Year Financial Highlights *

3* Comparisons versus full year 2016, unless otherwise noted

• Net sales of $898.5 M, up $191 M, or 27%

• Organic sales growth of $26.5 M, or 4%

• Operating income of $67.1 M, up $9.4 M, or 16%

• Includes $6.1 M non-cash pension settlement charge

• Adjusted EBITDA of $113.1 M, up $29.6 M, or 35%

• ESG up $30.8 M, or 42%

• Adjusted EBITDA margin of 12.6%, compared to 11.8%

• GAAP EPS of $1.00, up $0.36, or 56%

• Includes benefit of ~$20 M associated with tax reform and impact of

pension settlement charge

• Adjusted EPS of $0.85, up $0.16, or 23%

• Orders of $1,018 M, up $344 M, or 51%

• Backlog of $258 M, up $121 M, or 88%

Q4 Highlights *

4* Comparisons versus Q4 of 2016, unless otherwise noted

• Net sales of $247.6 M, up $72 M, or 41%

• Organic sales growth of $27 M, or 16%

• Operating income of $14.9 M, up $1.1 M, or 8%

• Includes $6.1 M non-cash pension settlement charge

• Adjusted EBITDA of $32.0 M, up $11.0 M, or 52%

• ESG up $11.9 M, or 74%

• Adjusted EBITDA margin of 12.9%, compared to 11.9%

• GAAP EPS of $0.48, up $0.28, or 140%

• Includes benefit of ~$20 M associated with tax reform and impact of

pension settlement charge

• Adjusted EPS of $0.24, up $0.08, or 50%

• Orders of $303 M, up $137 M, or 83%

• Organic order growth of ~$84 M, or 51%

• Backlog of $258 M, up $54 M, or 26% vs. Q3 FY17

5

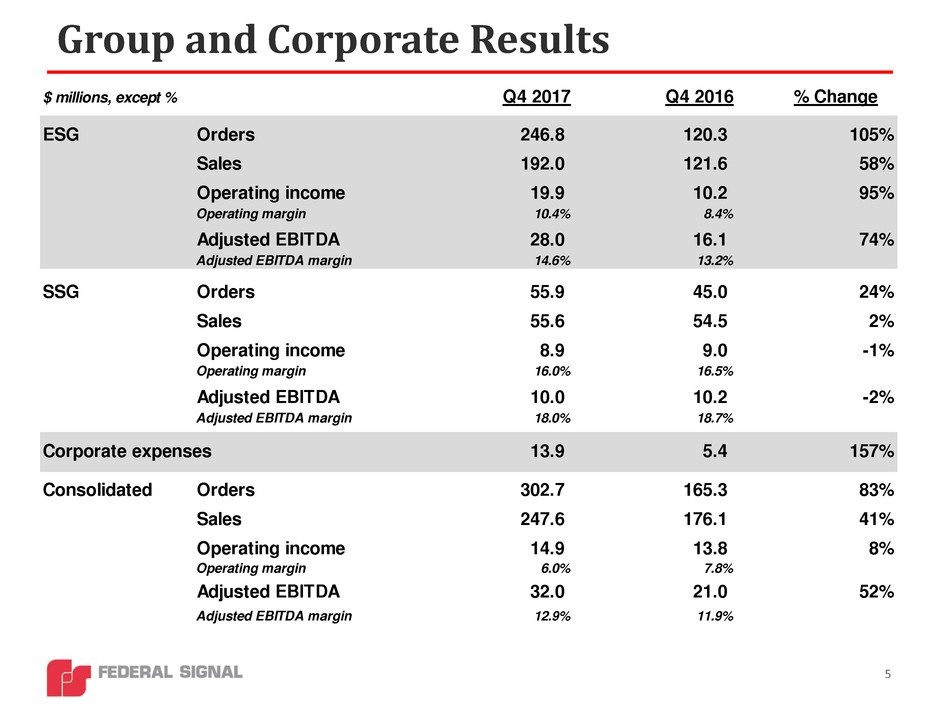

Group and Corporate Results

$ millions, except % Q4 2017 Q4 2016 % Change

ESG Orders 246.8 120.3 105%

Sales 192.0 121.6 58%

Operating income 19.9 10.2 95%

Operating margin 10.4% 8.4%

Adjusted EBITDA 28.0 16.1 74%

Adjusted EBITDA margin 14.6% 13.2%

SSG Orders 55.9 45.0 24%

Sales 55.6 54.5 2%

Operating income 8.9 9.0 -1%

Operating margin 16.0% 16.5%

Adjusted EBITDA 10.0 10.2 -2%

Adjusted EBITDA margin 18.0% 18.7%

Corporate expenses 13.9 5.4 157%

Consolidated Orders 302.7 165.3 83%

Sales 247.6 176.1 41%

Operating income 14.9 13.8 8%

Operating margin 6.0% 7.8%

Adjusted EBITDA 32.0 21.0 52%

Adjusted EBITDA margin 12.9% 11.9%

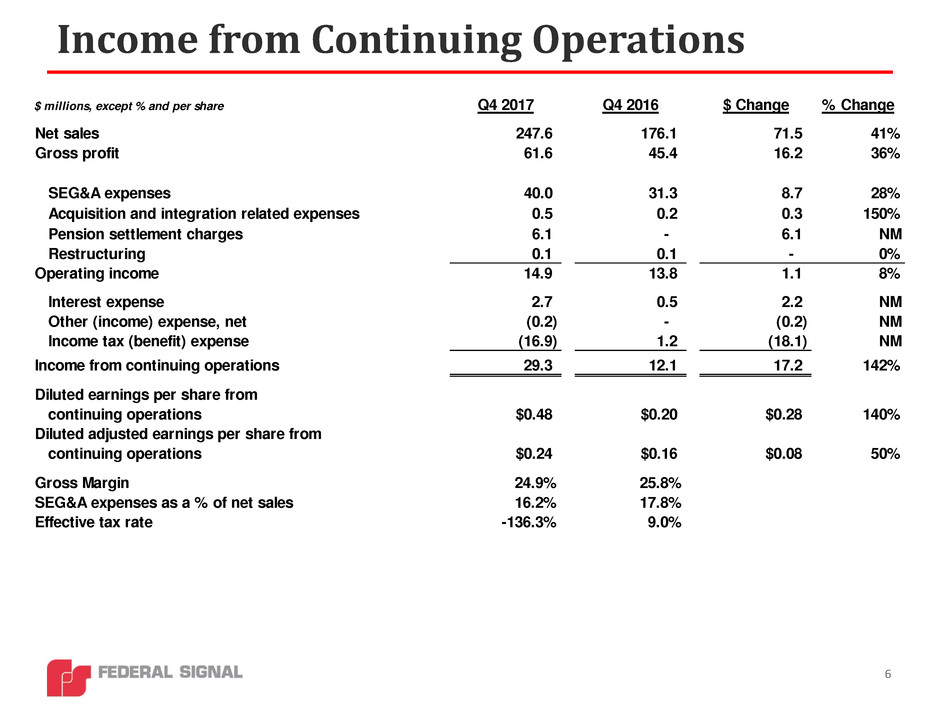

Income from Continuing Operations

6

$ millions, except % and per share Q4 2017 Q4 2016 $ Change % Change

Net sales 247.6 176.1 71.5 41%

Gross profit 61.6 45.4 16.2 36%

SEG&A expenses 40.0 31.3 8.7 28%

Acquisition and integration related expenses 0.5 0.2 0.3 150%

Pension settlement charges 6.1 - 6.1 NM

Restructuring 0.1 0.1 - 0%

Operating income 14.9 13.8 1.1 8%

Interest expense 2.7 0.5 2.2 NM

Other (income) expense, net (0.2) - (0.2) NM

Income tax (benefit) expense (16.9) 1.2 (18.1) NM

Income from continuing operations 29.3 12.1 17.2 142%

Diluted earnings per share from

continuing operations $0.48 $0.20 $0.28 140%

Diluted adjusted earnings per share from

continuing operations $0.24 $0.16 $0.08 50%

Gross Margin 24.9% 25.8%

SEG&A expenses as a % of net sales 16.2% 17.8%

Effective tax rate -136.3% 9.0%

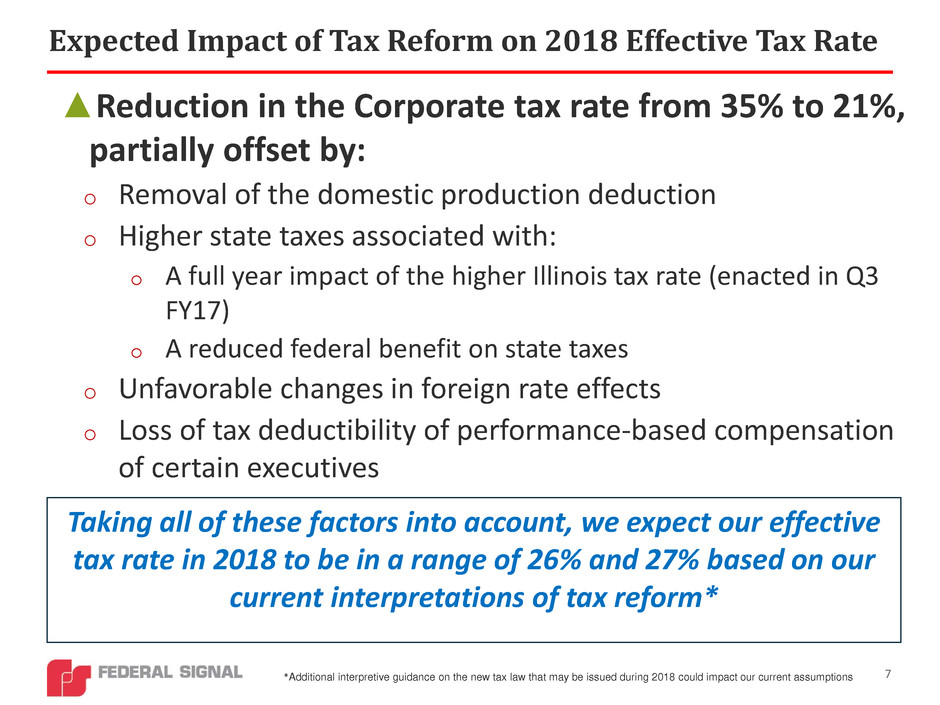

Expected Impact of Tax Reform on 2018 Effective Tax Rate

7

▲Reduction in the Corporate tax rate from 35% to 21%,

partially offset by:

o Removal of the domestic production deduction

o Higher state taxes associated with:

o A full year impact of the higher Illinois tax rate (enacted in Q3

FY17)

o A reduced federal benefit on state taxes

o Unfavorable changes in foreign rate effects

o Loss of tax deductibility of performance-based compensation

of certain executives

Taking all of these factors into account, we expect our effective

tax rate in 2018 to be in a range of 26% and 27% based on our

current interpretations of tax reform*

*Additional interpretive guidance on the new tax law that may be issued during 2018 could impact our current assumptions

8

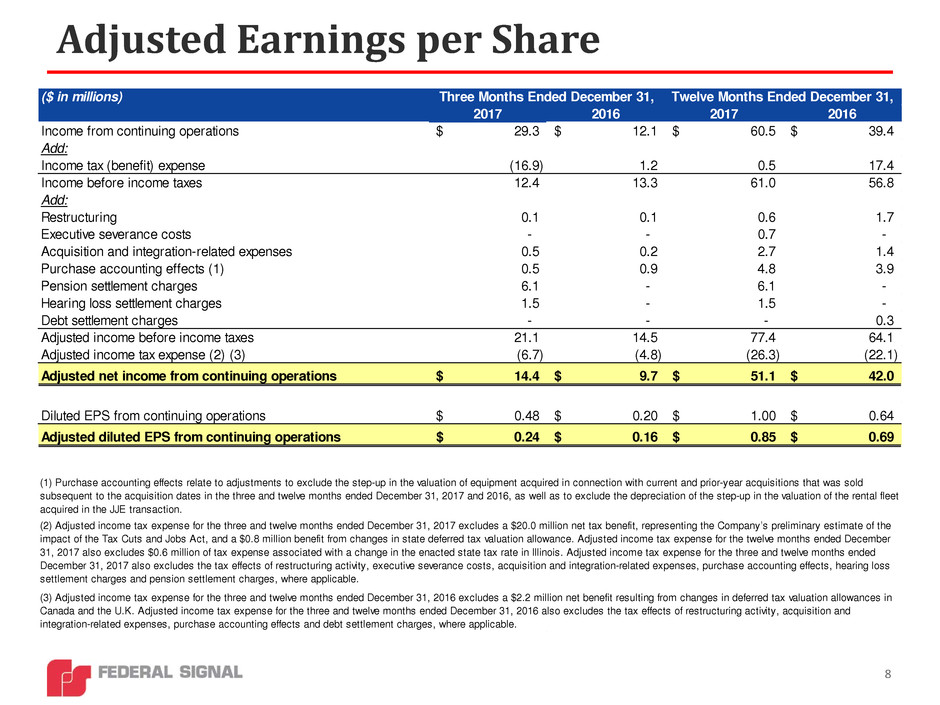

Adjusted Earnings per Share

($ in millions)

2017 2016 2017 2016

Income from continuing operations 29.3$ 12.1$ 60.5$ 39.4$

Add:

Income tax (benefit) expense (16.9) 1.2 0.5 17.4

Income before income taxes 12.4 13.3 61.0 56.8

Add:

Restructuring 0.1 0.1 0.6 1.7

Executive severance costs - - 0.7 -

Acquisition and integration-related expenses 0.5 0.2 2.7 1.4

Purchase accounting effects (1) 0.5 0.9 4.8 3.9

Pension settlement charges 6.1 - 6.1 -

Hearing loss settlement charges 1.5 - 1.5 -

Debt settlement charges - - - 0.3

Adjusted income before income taxes 21.1 14.5 77.4 64.1

Adjusted income tax expense (2) (3) (6.7) (4.8) (26.3) (22.1)

Adjusted net income from continuing operations 14.4$ 9.7$ 51.1$ 42.0$

Diluted EPS from continuing operations 0.48$ 0.20$ 1.00$ 0.64$

Adjusted diluted EPS from continuing operations 0.24$ 0.16$ 0.85$ 0.69$

Three Months Ended December 31, Twelve Months Ended December 31,

(3) Adjusted income tax expense for the three and twelve months ended December 31, 2016 excludes a $2.2 million net benefit resulting from changes in deferred tax valuation allowances in

Canada and the U.K. Adjusted income tax expense for the three and twelve months ended December 31, 2016 also excludes the tax effects of restructuring activity, acquisition and

integration-related expenses, purchase accounting effects and debt settlement charges, where applicable.

(1) Purchase accounting effects relate to adjustments to exclude the step-up in the valuation of equipment acquired in connection with current and prior-year acquisitions that was sold

subsequent to the acquisition dates in the three and twelve months ended December 31, 2017 and 2016, as well as to exclude the depreciation of the step-up in the valuation of the rental fleet

acquired in the JJE transaction.

(2) Adjusted income tax expense for the three and twelve months ended December 31, 2017 excludes a $20.0 million net tax benefit, representing the Company’s preliminary estimate of the

impact of the Tax Cuts and Jobs Act, and a $0.8 million benefit from changes in state deferred tax valuation allowance. Adjusted income tax expense for the twelve months ended December

31, 2017 also excludes $0.6 million of tax expense associated with a change in the enacted state tax rate in Illinois. Adjusted income tax expense for the three and twelve months ended

December 31, 2017 also excludes the tax effects of restructuring activity, executive severance costs, acquisition and integration-related expenses, purchase accounting effects, hearing loss

settlement charges and pension settlement charges, where applicable.

9

Financial Strength and Flexibility *

* Dollar amounts as of, or for the quarter ending 12/31/2017

** Net debt is a non-GAAP measure and is computed as total debt of $277.7 M, less total cash and cash equivalents of $37.5 M

• Generated $21.4 M of cash from operations in Q4, compared to

$9.6 M in prior year

Full-year cash from operations of $74 M, up $47 M, or 175%, from $27

M last year

• Paid down $5 M of debt in Q4

• $278 M of debt outstanding; $38 M of cash

Net debt of $240 M **

• ~$106 M of availability under credit facility

• Paid $4.2 M for dividends; recently declared $0.07 per share

dividend for Q1 2018

Dividends paid in 2017 totaled $16.8 M

• $31 M remaining on share repurchase authorization (~ 3% of

market capitalization)

2017 in Review

10

• 2017 highlights include the following year-over-

year improvements:

35% increase in Adjusted EBITDA, with improved

EBITDA margin of 12.6%

23% improvement in Adjusted EPS

$47 M operating cash flow increase facilitates $34 M

debt paydown subsequent to TBEI acquisition

• Debt leverage ratio at 2.2 times at end of year, down from 2.7

times at TBEI closing

• New COO focused on Federal Signal’s operational

model: Eighty-Twenty Improvement (“ETI”)

program

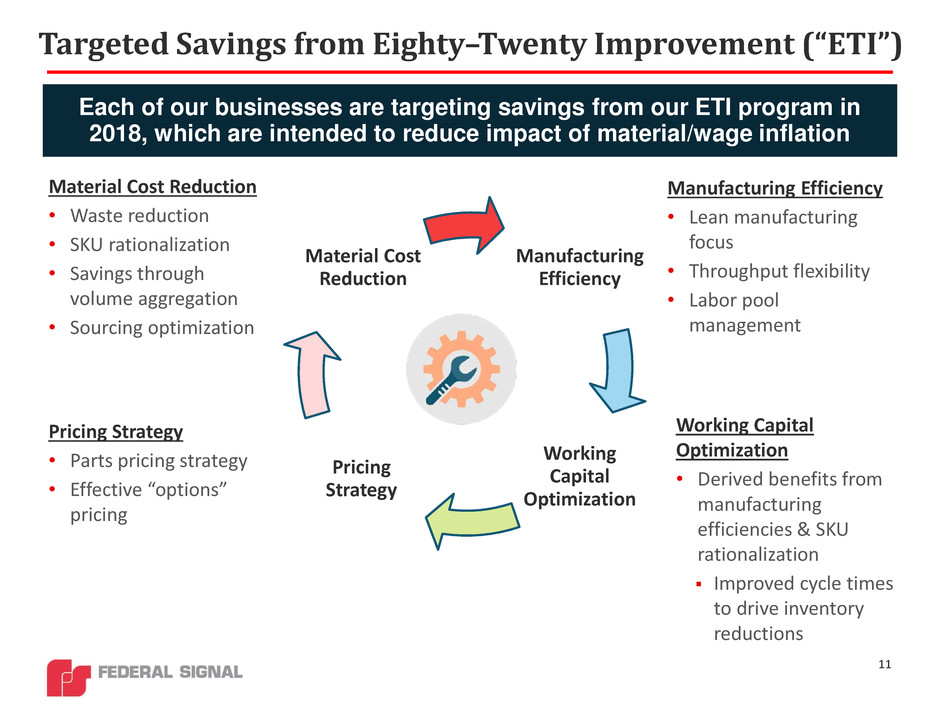

Targeted Savings from Eighty–Twenty Improvement (“ETI”)

Each of our businesses are targeting savings from our ETI program in

2018, which are intended to reduce impact of material/wage inflation

11

Manufacturing

Efficiency

Working

Capital

Optimization

Pricing

Strategy

Material Cost

Reduction

Manufacturing Efficiency

• Lean manufacturing

focus

• Throughput flexibility

• Labor pool

management

Working Capital

Optimization

• Derived benefits from

manufacturing

efficiencies & SKU

rationalization

Improved cycle times

to drive inventory

reductions

Material Cost Reduction

• Waste reduction

• SKU rationalization

• Savings through

volume aggregation

• Sourcing optimization

Pricing Strategy

• Parts pricing strategy

• Effective “options”

pricing

CEO Remarks

12

• Execution against strategic initiatives continues to

contribute to growth

• New product development successes

• Intend to make investments in support of long-term

growth opportunities with expected savings from

tax reform

• Recent acquisitions on track to deliver on financial

and strategic objectives

• Hearing loss litigation update

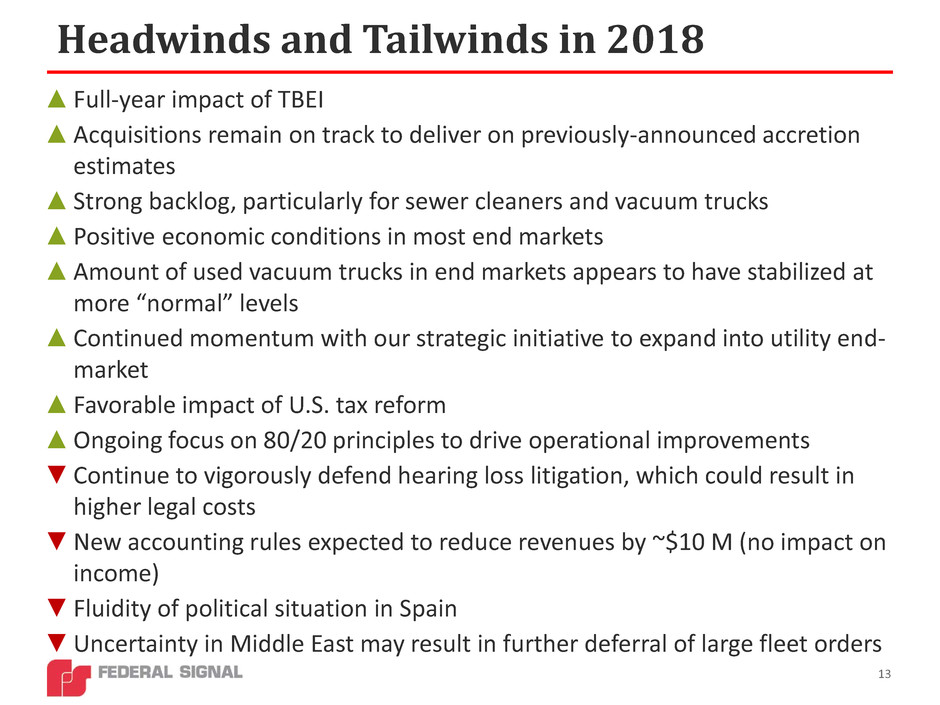

Headwinds and Tailwinds in 2018

13

▲Full-year impact of TBEI

▲Acquisitions remain on track to deliver on previously-announced accretion

estimates

▲Strong backlog, particularly for sewer cleaners and vacuum trucks

▲Positive economic conditions in most end markets

▲Amount of used vacuum trucks in end markets appears to have stabilized at

more “normal” levels

▲Continued momentum with our strategic initiative to expand into utility end-

market

▲Favorable impact of U.S. tax reform

▲Ongoing focus on 80/20 principles to drive operational improvements

▼Continue to vigorously defend hearing loss litigation, which could result in

higher legal costs

▼New accounting rules expected to reduce revenues by ~$10 M (no impact on

income)

▼Fluidity of political situation in Spain

▼Uncertainty in Middle East may result in further deferral of large fleet orders

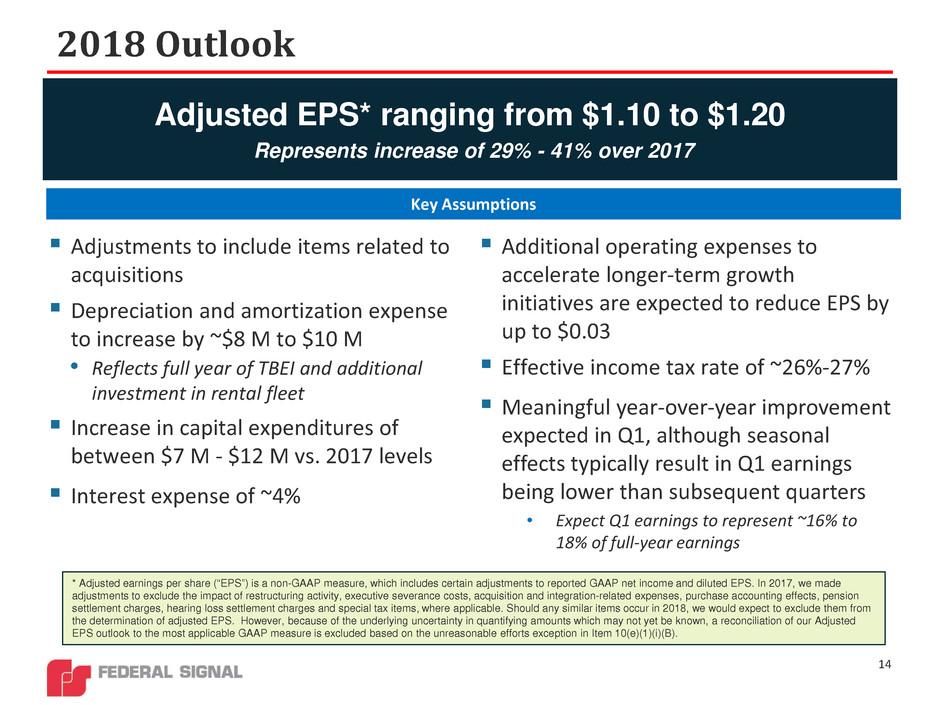

2018 Outlook

Adjusted EPS* ranging from $1.10 to $1.20

Represents increase of 29% - 41% over 2017

14

Adjustments to include items related to

acquisitions

Depreciation and amortization expense

to increase by ~$8 M to $10 M

• Reflects full year of TBEI and additional

investment in rental fleet

Increase in capital expenditures of

between $7 M - $12 M vs. 2017 levels

Interest expense of ~4%

Key Assumptions

Additional operating expenses to

accelerate longer-term growth

initiatives are expected to reduce EPS by

up to $0.03

Effective income tax rate of ~26%-27%

Meaningful year-over-year improvement

expected in Q1, although seasonal

effects typically result in Q1 earnings

being lower than subsequent quarters

• Expect Q1 earnings to represent ~16% to

18% of full-year earnings

* Adjusted earnings per share (“EPS”) is a non-GAAP measure, which includes certain adjustments to reported GAAP net income and diluted EPS. In 2017, we made

adjustments to exclude the impact of restructuring activity, executive severance costs, acquisition and integration-related expenses, purchase accounting effects, pension

settlement charges, hearing loss settlement charges and special tax items, where applicable. Should any similar items occur in 2018, we would expect to exclude them from

the determination of adjusted EPS. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted

EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B).

Federal Signal Q4 2017 Earnings Call

15

Q&A

February 28, 2018

Jennifer Sherman, President & Chief Executive Officer

Ian Hudson, SVP, Chief Financial Officer

Investor Information

Stock Ticker - NYSE:FSS

Company website: federalsignal.com/investors

HEADQUARTERS

1415 West 22nd Street, Suite 1100

Oak Brook, IL 60523

INVESTOR RELATIONS CONTACTS

630-954-2000

Ian Hudson

SVP, Chief Financial Officer

IHudson@federalsignal.com

Svetlana Vinokur

VP, Treasurer and Corporate Development

SVinokur@federalsignal.com

16

Federal Signal Q4 2017 Earnings Call

17

Appendix

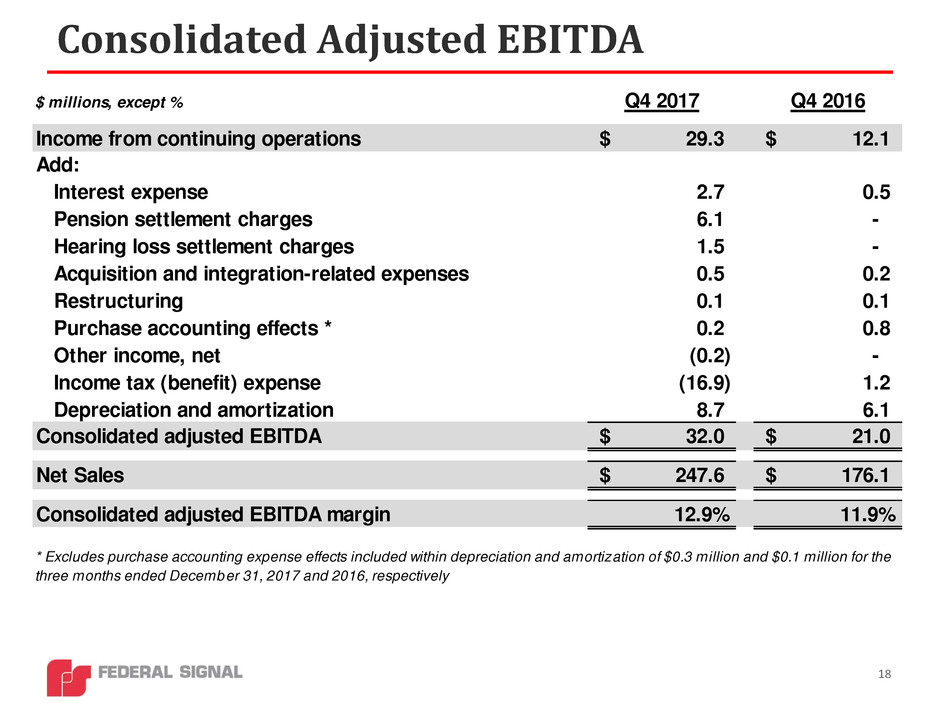

Consolidated Adjusted EBITDA

18

$ millions, except % Q4 2017 Q4 2016

Income from continuing operations 29.3$ 12.1$

Add:

Interest expense 2.7 0.5

Pension settlement charges 6.1 -

Hearing loss settlement charges 1.5 -

Acquisition and integration-related expenses 0.5 0.2

Restructuring 0.1 0.1

Purchase accounting effects * 0.2 0.8

Other income, net (0.2) -

Income tax (benefit) expense (16.9) 1.2

Depreciation and amortization 8.7 6.1

Consolidated adjusted EBITDA 32.0$ 21.0$

Net Sales 247.6$ 176.1$

Consolidated adjusted EBITDA margin 12.9% 11.9%

* Excludes purchase accounting expense effects included within depreciation and amortization of $0.3 million and $0.1 million for the

three months ended December 31, 2017 and 2016, respectively

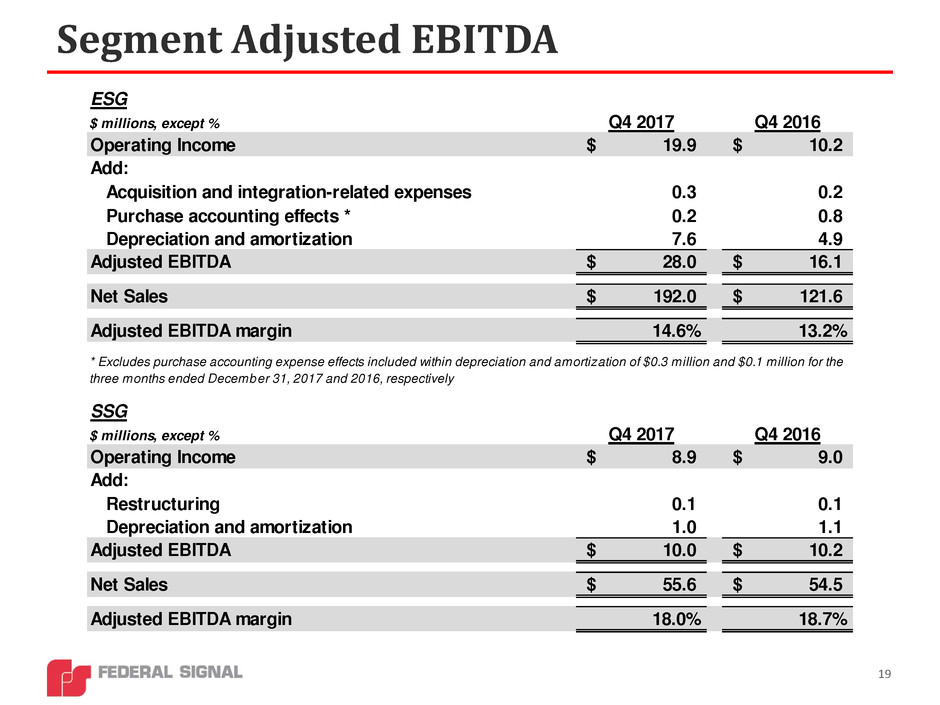

Segment Adjusted EBITDA

19

ESG

$ millions, except % Q4 2017 Q4 2016

Operating Income 19.9$ 10.2$

Add:

Acquisition and integration-related expenses 0.3 0.2

Purchase accounting effects * 0.2 0.8

Depreciation and amortization 7.6 4.9

Adjusted EBITDA 28.0$ 16.1$

Net Sales 192.0$ 121.6$

Adjusted EBITDA margin 14.6% 13.2%

SSG

$ millions, except % Q4 2017 Q4 2016

Operating Income 8.9$ 9.0$

Add:

Restructuring 0.1 0.1

Depreciation and amortization 1.0 1.1

Adjusted EBITDA 10.0$ 10.2$

Net Sales 55.6$ 54.5$

Adjusted EBITDA margin 18.0% 18.7%

* Excludes purchase accounting expense effects included within depreciation and amortization of $0.3 million and $0.1 million for the

three months ended December 31, 2017 and 2016, respectively

Non-GAAP Measures

• Adjusted net income and earnings per share (“EPS”) - The Company believes that modifying its 2017 and 2016 net income

and diluted EPS provides additional measures which are representative of the Company’s underlying performance and

improve the comparability of results between reporting periods. During the three and twelve months ended December 31,

2017 and 2016, adjustments were made to reported GAAP net income and diluted EPS to exclude the impact of

restructuring activity, executive severance costs, acquisition and integration-related expenses, purchase accounting effects,

pension settlement charges, hearing loss settlement charges and debt settlement charges, where applicable. In addition,

during the three and twelve months ended December 31, 2017 and 2016, adjustments were made to reported GAAP

income tax expense to exclude certain special tax items, which include the Company’s preliminary estimate of the impact of

the 2017 Tax Act, which was enacted in the fourth quarter of 2017.

• Adjusted EBITDA and adjusted EBITDA margin - The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net

sales ("adjusted EBITDA margin"), at both the consolidated and segment level, as additional measures which are

representative of its underlying performance and to improve the comparability of results across reporting periods. We

believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that

adjusted EBITDA and adjusted EBITDA margin, at both the consolidated and segment level, are meaningful metrics to

investors in evaluating the Company’s underlying financial performance.

• Consolidated adjusted EBITDA is a non-GAAP measure that represents the total of income from continuing operations,

interest expense, pension settlement charges, hearing loss settlement charges, debt settlement charges, acquisition and

integration-related expenses, restructuring activity, executive severance costs, purchase accounting effects, other

income/expense, income tax benefit/expense, and depreciation and amortization expense. Consolidated adjusted EBITDA

margin is a non-GAAP measure that represents the total of income from continuing operations, interest expense, pension

settlement charges, hearing loss settlement charges, debt settlement charges, acquisition and integration-related expenses,

restructuring activity, executive severance costs, purchase accounting effects, other income/expense, income tax

benefit/expense, and depreciation and amortization expense divided by net sales for the applicable period(s).

• Segment adjusted EBITDA is a non-GAAP measure that represents the total of segment operating income, acquisition and

integration-related expenses, restructuring activity, purchase accounting effects and depreciation and amortization expense,

as applicable. Segment adjusted EBITDA margin is a non-GAAP measure that represents the total of segment operating

income, acquisition and integration-related expenses, restructuring activity, purchase accounting effects and depreciation

and amortization expense, as applicable, divided by net sales for the applicable period(s). Segment operating income

includes all revenues, costs and expenses directly related to the segment involved. In determining segment income, neither

corporate nor interest expenses are included. Segment depreciation and amortization expense relates to those assets, both

tangible and intangible, that are utilized by the respective segment. Other companies may use different methods to calculate

adjusted EBITDA and adjusted EBITDA margin.

20