Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHARTER FINANCIAL CORP | chfn021420188-k.htm |

This presentation may contain certain forward-looking statements

regarding our prospective performance and strategies within the

meaning of Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended. We

intend such forward-looking statements to be covered by the Safe

Harbor Provision for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995, and are including

this statement for purposes of said safe harbor provision. Forward-

looking statements can be identified by the use of words such as

“estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,”

“seek,” “expect” and words of similar meaning. These forward-

looking statements include, but are not limited to:

• statements of our goals, intentions and expectations;

• statements regarding our business plans, prospects, growth and

operating strategies;

• statements regarding the asset quality of our loan and investment

portfolios; and

• estimates of our risks and future costs and benefits.

These forward-looking statements are based on current beliefs and

expectations of our management and are inherently subject to significant

business, economic and competitive uncertainties and contingencies, many

of which are beyond our control. In addition, these forward-looking

statements are subject to assumptions with respect to future business

strategies and decisions that are subject to change.

The following factors, among others, could cause actual results to differ

materially from the anticipated results or other expectations expressed in

the forward-looking statements:

• general economic conditions, either nationally or in our market

areas, that are worse than expected;

• competition among depository and other financial institutions

Forward Looking Statements

• changes in the interest rate environment that reduce our margins

or reduce the fair value of financial instruments;

• adverse changes in the securities markets;

• changes in laws or government regulations or policies affecting

financial institutions, including changes in regulatory fees and

capital requirements;

• our ability to enter new markets successfully and capitalize on

growth opportunities;

• our ability to successfully identify, acquire, and integrate future

acquisitions;

• our incurring higher than expected loan charge-offs with respect

to assets acquired in FDIC-assisted acquisitions;

• changes in consumer spending, borrowing and savings habits;

• changes in accounting policies and practices, as may be adopted

by the bank regulatory agencies and the Financial Accounting

Standards Board; and

• changes in our organization, compensation and benefit plans.

Because of these and other uncertainties, our actual future results may

be materially different from the results indicated by these forward-looking

statements. Readers are cautioned not to place undue reliance on the

forward-looking statements contained herein, which speak only as of

the date of this presentation. Except as required by applicable law or

regulation, we do not undertake, and specifically disclaim any obligation to

update any forward-looking statements that may be made from time to

time by or on behalf of the Company. Please see “Risk Factors” beginning

on page 15 of the Company’s 10-K dated December 9, 2016.

2

CHFN Profile

3

Dollars in thousands

Data as of or for the three months ended 12/31/17; Tangible Equity and Tangible Assets are month end balances

Core deposits defined as total deposits less wholesale deposits and jumbo time deposits greater than $250,000

Financial Highlights - December 2017

Company Overview

Branch Map

• Founded in 1954 in West Point, GA

• Successful acquirer, completed two whole

bank and three FDIC acquisitions since 2009

• 349 FTEs servicing 62,236 checking accounts

• 22 Branches located throughout strong

growth markets

CHFN (16)

Resurgens (2)

CBS Financial (4)

Balance Sheet ($mm)

Total Assets $1,644

Gross Loans 1,163

Deposits 1,344

Core Deposits 1,255

Loans / Deposits 87 %

Profitability

ROAA 1.08 %

Efficiency Ratio 60.3

Asset Quality

NPA / Loans + OREO 0.27 %

Reserves / NPLs 575.1

LLR / Loans 0.96

Capital Ratios

Tang. Com. Equity / Tang. Assets Ratio 10.96 %

Leverage Ratio 11.55

CET1 Capital Ratio 14.44

Tier 1 Capital Ratio 14.99

Total Risk Based Capital Ratio 15.90

GEORGIA

ALABAMA

FLORIDA

Roswell

Atlanta

LaGrange

West Point

Auburn

Savannah

Montgomery

Augusta

Mobile

Pensacola

Jacksonville

Dothan

Birmingham

Columbus

Huntsville

Tallahassee

Athens

Macon

Tuscaloosa

Albany

Gainesville

Panama City

75

75

16

65

20

20

95

10

65

Atlanta

Sandy Springs

Roswell

Marietta

Alpharetta

Duluth

Douglasville

Strategic Direction

4

December 2017

CHFN Branch (22)

December 2007

CHFN Branch (10)

2000 2001 2008 2009 2013 2015 2016 2017 1954

(1954 – 2000)

Small Town Mutual Thrift

(2009 – 2012)

Financial Crisis

• Three FDIC assisted acquisitions

(2 in the Atlanta MSA)

• Supplemental capital raises to

40% public

2012 2014

4/8/2013

Completed full

conversion

raising

$143 Million

(2013 – 2015)

Bought back 35.6% of

outstanding stock through

buybacks

12/3/2015

Announced CBS

Financial

Corporation

Acquisition

(closed 4/15/16)

February 2017

Opened

Buckhead

Branch

6/1/2017

Announced

Resurgens Bancorp

Acquisition

(closed 9/1/2017)

(2001 – 2008)

MHC 20%

• Raised $39 Million in

Capital

• Buyback and dividends

totaling $85 Million

24.78%

10.96%

3.06%

10.10%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

2013 2014 2015 2016 2017 Q1 2018

Annualized

Tangible Common Equity/Tangible Assets

Return on Average Tangible Common Equity

$10.08

$18.50

$8

$10

$12

$14

$16

$18

$20

$22

4/8/2013 2013 2014 2015 2016 2/12/2018

Market Highlights

Closing Price (02/12/18): 18.50

Shares Outstanding: 15,132,320

Market Capitalization ($mm): $279.9

Price / Tangible Book Value: 160 %

Price / LTM EPS: 19.3 x

Dividend Yield: 1.73 %

Source: SNL Financial, Bloomberg, Company documents

Pricing data as of 02/12/18; financial data as of or for the three months ended 12/31/17

Data as of or for the twelve months ended 9/30 each respective year; Tangible Common Equity/Tangible Assets are month end balances

Performance Profile

5

Effective Capital Deployment

CHFN Stock Price

Price Performance Since Full Conversion (4/8/13) Basic Earnings Per Share

$0.29

$0.35

$0.83

$1.01

$0.31

$0.93

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

2014 2015 2016 2017 Q1 2018

Annualized

$1.24

27.90% 25.48%

16.74% 15.79% 15.90%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

2014 2015 2016 2017 Q1 2018

17.67%

19.11%

12.68% 12.05% 11.55%

5

10.00%

15.00%

20.00%

25.00%

2014 2015 2016 2017 Q1 2018

21.90%

19.56%

12.14%

10.72% 10.96%

.

10.00%

15.00%

20.00%

25.00%

2014 2015 2016 2017 Q1 2018

Capital Leveraging Strategy

Effectively deploy capital through:

• Organic growth

• Adding loan producers

• M&A

• Cash dividends

• Share Buybacks

6

Source: SNL Financial

Data as of 9/30 each respective year; Tangible Equity and Tangible Assets are month end balances

TCE / TA

Leverage Ratio

Total Risk-Based Capital Ratio

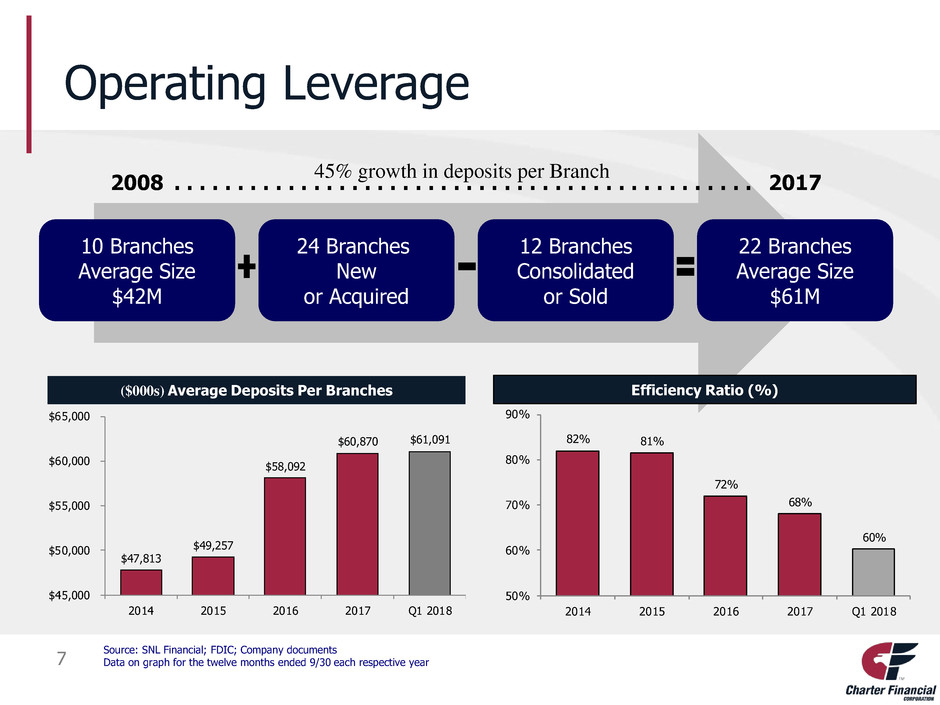

7

Operating Leverage

($000s) Average Deposits Per Branches

Source: SNL Financial; FDIC; Company documents

Data on graph for the twelve months ended 9/30 each respective year

$47,813

$49,257

$58,092

$60,870 $61,091

$45,000

$50,000

$55,000

$60,000

$65,000

2014 2015 2016 2017 Q1 2018

10 Branches

Average Size

$42M

24 Branches

New

or Acquired

12 Branches

Consolidated

or Sold

22 Branches

Average Size

$61M

2008 2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

45% growth in deposits per Branch

Efficiency Ratio (%)

82% 81%

72%

68%

60%

50%

60%

70%

80%

90%

2014 2015 2016 2017 Q1 2018

Overview of Management Team

8

• Served as the Chief Executive Officer of CHFN since 2001 and as the CEO of

CharterBank since 1996

• Graduate of School of Community Bank Management

• Began working with CharterBank in 1984

• Served as Vice President and Treasurer of CharterBank since 1991 and became CFO

of Charter Financial in 2001

• Graduate of School of Community Bank Management

• Certified Public Accountant and Certified Management Accountant

• Served as President of CharterBank since 2007

• Graduate School of Banking at LSU

• 34 years of banking experience; 18 years with CharterBank

Lee W. Washam

President

Curtis R. Kollar

Senior Vice President

& CFO

Robert L. Johnson

Chairman & CEO

• Earnings growth in strong markets

• Highly productive retail deposit franchise

• Substantial progress leveraging excess capital

• Conservative credit underwriting

• M&A execution experience

• History of rewarding shareholders

Investment Highlights

9

Overview of Our Markets

• Atlanta

- Fourth fastest growing city in the US

- Projected to be the sixth largest US city in the next

30 years

- Wage growth outpaced the US average for the

last two years

- Home to fifteen FORTUNE 500 companies

• Auburn

- Home to a top Public Research University

- 6th best performing city for economic growth in

the U.S.

• Pensacola

- 50 acre port with over 200,000 tonnage of annual

shipments

- Home to the Naval Air Station

• West Point / LaGrange

- Charter’s home market, 23.3% market share

- Epicenter of the I-85 automotive industry

- KIA auto plant produced over half-a-million cars last year

10

Market Highlights http://www.ajc.com/news/local-govt--politics/census-

metro-atlanta-population-approaches-

million/1pxSPBRYI6L26zn4jgVBrN/

https://www.auburnalabama.org/economic-

development/auburn-community-

profile/National%20Recognition.pdf

http://www.fdot.gov/seaport/pdfs/2015%20Florida%20Seaport%20Profiles%20Final.pdf

’18 – ’23 Projected Population Growth

Unemployment Rate

1.7%

4.6%

5.2%

6.1%

6.7% 6.7%

US: 3.8%

0.0%

2.0%

4.0%

6.0%

8.0%

Alabama Southeast Georgia Pensacola, FL Atlanta, GA Auburn, AL

3.9% 4.0%

4.2%

4.6% 4.7%

US: 4.4%

2.0%

3.0%

4.0%

5

6.

Auburn, AL Pensacola, FL Alabama Atlanta, GA Georgia

Source: SNL Financial; LaGrange Chamber of Commerce; Auburn Economic Development, FDOT; KIA; Atlanta Journal Constitution

http://www.automobilemag.com/news/the-15-top-producing-american-car-plants-151801/

www.lagrangechamber.c

om/work/economic-

development

https://www.bls.gov/regions/southeast/summary/blss

ummary_atlanta.pdf

https://www.kmmgusa.com/about-kmmg/our-history/

Population Growth By County

11

Source: SNL Financial

(6%) to 0% (84)

.01% to 3% (90)

3.1% to 6% (68)

6.1% to 10.7% (51)

Total Pop. Growth

CHFN (22)

Source: SNL Financial

Deposit data as of 6/30/17

Demographic data deposit weighted by county

Acquired branches include all transactions announced since 12/31/07

12

Acquisitive Growth in Attractive Markets

‘18 – ‘23 Projected Population Growth (%) ‘18 – ‘23 Projected Median HHI Growth (%)

2023 Projected Median HHI ($)

4.1%

6.3%

5.5%

4.6%

0.0%

2.0%

4.0%

6.0%

8.0%

Legacy Branches Acquired Branches Combined Southeast

9.8% 9.9% 9.8%

6.5%

0.0%

3.0%

6.0%

9.0%

12.0%

Legacy Branches Acquired Branches Combined Southeast

$48,507

$73,669

$64,135

$54,678

$30,000

$45,000

$60, 00

$75,000

$90,000

Legacy Branches Acquired Branches Combined Southeast

5.5%

Median: 3.4%

(4.0%)

0.0%

4.0%

8.0%

12.0%

Top Quartile Southeast Banks by

Population Growth

13

Source: SNL Financial

Includes all major exchange traded banks headquartered in AL, AR, FL, GA, KY, LA, MS, NC, SC, TN, VA, WV with total assets between $1.0 bn and

$10.0 bn; excludes merger targets

Population Growth vs. Southeast Banks with Assets $1.0 bn - $10.0 bn

0.47% Median: 0.49%

0.00%

0.50%

1.00%

1.50%

2.00%

Low Cost of Deposits

Southeast Banks by Cost of Deposits

14

Source: SNL Financial as of September 30, 2017

Includes all major exchange traded banks headquartered in AL, AR, FL, GA, KY, LA, MS, NC, SC, TN, VA, WV with total assets between $1.0 bn and

$10.0 bn; excludes merger targets

Cost of Deposits vs. Southeast Banks with Assets $1.0 bn - $10.0 bn

Deposits Market % Deposits in

Rank Institution ($mm) Share Branches Atlanta

1 Fidelity Southern Corp. $3,062 1.84 % 46 78.4 %

2 Brand Group Holdings Inc. 1,840 1.10 7 97.2

3 Atlantic Capital Bancshares Inc. 1,573 0.94 1 73.9

4 Hamilton State Bancshares Inc. 1,335 0.80 24 86.3

5 State Bank Financial Corp. 1,271 0.76 7 30.1

6 United Bank Corp. 981 0.59 14 83.7

7 MetroCity Bankshares Inc. 740 0.44 6 77.5

8 Charter Financial Corp. 712 0.43 11 52.7

9 Piedmont Bancorp Inc. 502 0.30 4 74.6

10 Landmark Bancshares Inc. 443 0.27 3 100.0

11 CCF Holding Co. 380 0.23 6 100.0

12 Georgia Banking Co. 361 0.22 2 100.0

13 Quantum Capital Corp. 361 0.22 3 100.0

14 National Commerce Corp. 311 0.19 2 12.2

15 First IC Corp. 296 0.18 6 99.8

Strong Positioning in the Atlanta Metro

Market

15

• Rank 8th in deposit market share among community banks in Atlanta MSA with less than

$10.0 billion in assets

• 56% or $651 million of CHFN’s loans are in the Atlanta MSA

• Atlanta MSA proportion of CHFN’s deposits is 52% or $696 million

Source: SNL Financial, Company Documents

Peer Comparison data as of 6/30/17

CHFN bullet %’s of loans/deposits in MSA data as of 12/31/17

Atlanta Market Share – Banks Under $10 bn in Assets

West Point,

LaGrange,

GA & Valley,

AL

74%

Auburn, AL

MSA

26%

Atlanta, GA

MSA

53%

West Point,

LaGrange,

GA & Valley,

AL

24%

Auburn, AL

MSA

11%

Pensacola,

FL MSA

12%

Source: SNL Financial

Deposit data as of 6/30 each respective year 16

Expanded Presence in the Atlanta MSA

2007 Deposits by Market 2017 Deposits by Market

Checking Highlights

17

• 62,236 checking accounts

• 52,778 active debit cards

• 2.5% (1) gross fee yield on

checking account balances

• Bank card revenue 41% of

deposit fees

• 66% checking accounts accept

electronic statements

(1) Annualized fees divided by average checking account balances

(2) Data for the twelve months ended 12/31 each respective year

December 31, 2017

47,918

49,402

56,546

62,236

45,000

49,500

54,000

58,500

63,000

2014 2015 2016 2017

Total Checking Accounts (#) (2)

Demand

Deposits

7%

Transaction

Accounts

15%

Money

Market &

Savings

36%

Retail Time

Deposits

35%

Jumbo Time

Deposits

7%

Demand

Deposits

17%

Transaction

Accounts

26%

Money

Market &

Savings

27%

Retail Time

Deposits

26%

Jumbo Time

Deposits

4%

Deposit Highlights

18

2012 Q1 2018

Deposit Composition

Core Deposit Growth

Source: SNL Financial

Data as of or for the twelve months ended 9/30 each respective year

Core deposits defined as total deposits less wholesale deposits and jumbo time deposits greater than $250,000

$755 $718

$695

$684

$1,088

$1,245 $1,255

0.86%

0.61%

0.50% 0.44% 0.43%

0.47% 0.53%

0.20%

0.40%

0.60%

0.80%

1.00%

$400

$650

$900

$1,150

$1,400

2012 2013 2014 2015 2016 2017 Q1 2018

Core Deposits ($mm) Cost of Deposits (%)

Retail Checking Strategy

19

• Checking Strategy – Shared benefits influence card spend and swipe

selection, higher balances, e-statement adoption and account ‘stickiness’.

• Interchange Strategy – Rewarded customer behavior drives card

acceptance, top-of-wallet usage and credit (signature) spend.

Negotiated scale benefits with vendors.

• Overdraft Strategy – Early adopter 2010 FDIC Overdraft Guidance;

Availability based on deposit history; Low per item fee.

• Retention Strategy – Effective onboarding with ‘sticky’ services and

‘New Start Repayment’ Initiative.

Interchange Strategy

20

Drive Card Acceptance, Activation, Spend, Credit Swipe Mix – Low Durbin Impact

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2014 2015 2016 2017

Ca

rd

s

Active Checking Accounts Active Cards

Source: Company documents

Data for the twelve months ended 12/31 each respective year

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

2014 5 2016 2017

Check Card Spend ($000)

Int

erc

ha

ng

e

($

00

0)

SIGN PIN Check Card Spend

• Favorable Signature/PIN ratio limits estimated Durbin impact to $250,000

Noninterest Income on Deposits

21

Source: Company documents

Data for the twelve months ended 12/31 each respective year

$9,646

$10,850

$12,269

$13,555

$0

$3,000

$6,000

$9,000

$12,000

$15,000

2014 2015 2016 2017

NII on Deposits ($000s)

22

Financial Information

$0.29

$0.35

$0.83

$1.01

$0.31

$0.93

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

2014 2015 2016 2017 Q1 2018 Annualized

$1.24

Basic Earnings Per Share

23

Source: SNL Financial; Company documents

Data for the twelve months ended 9/30 each respective year

CAGR is based on 2014-2017

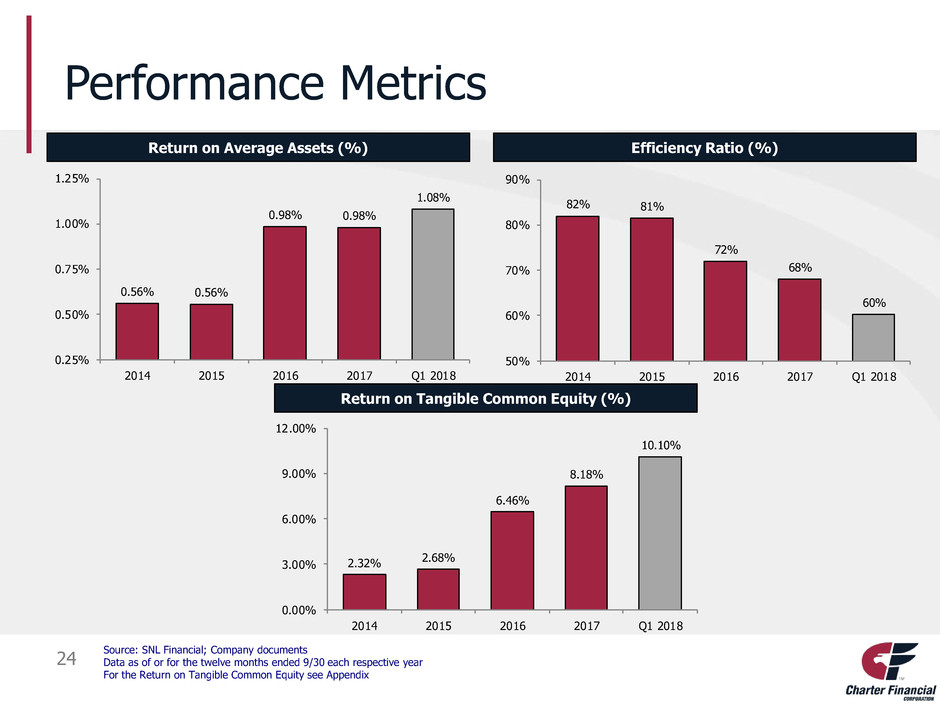

Performance Metrics

24

Return on Average Assets (%) Efficiency Ratio (%)

Return on Tangible Common Equity (%)

Source: SNL Financial; Company documents

Data as of or for the twelve months ended 9/30 each respective year

For the Return on Tangible Common Equity see Appendix

0.56% 0.56%

0.98% 0.98%

1.08%

0.25%

0.50%

0.75%

1.00%

1.25%

2014 2015 2016 2017 Q1 2018

82% 81%

72%

68%

60%

50%

60%

70%

80%

90%

2014 2015 2016 2017 Q1 2018

2.32% 2.68%

6.46%

8.18%

10.10%

0.00%

3.00%

6.00%

9.00%

12.00%

2014 2015 2016 2017 Q1 2018

$617

$726

$1,006

$1,162 $1,163

$500

$750

$1,000

$1,250

$1,500

2014 2015 2016 2017 Q1 2018

$717 $740

$1,162

$1,339 $1,344

$500

$750

$1,000

$1,250

$1,500

2014 2015 2016 2017 Q1 2018

Assets ($mm)

$1,010 $1,027

$1,438

$1,640 $1,644

$800

$1,050

$1,300

$1,550

$1,800

2 14 2015 2016 2017 Q1 2018

Balance Sheet Growth

25

Deposits ($mm) Gross Loans ($mm)

Source: SNL Financial

Data as of 9/30 each respective year

CAGR is based on 2014-2017

Credit Quality

26

Return on Average Assets (%) Efficiency Ratio (%)

Allowance for Loan Losses / Total Loans

NPAs / Total As ets Reserves / NPLs

Net Charge Offs / Total Average Loans

Source: SNL Financial; Company documents

Data as of or for the twelve months ended 9/30 each respective year

1.14%

0.73%

0.45%

0.19% 0.19%

0.00%

0.40%

0.80%

1.20%

1.60%

2014 2015 2016 2017 Q1 2018

223.1% 229.9%

277.7%

649.1%

575.1%

75.0%

225.0%

375.0%

525.0%

675.0%

2014 2015 2016 2017 Q1 2018

1.53%

1.30%

1.03%

0.96% 0.96%

0.00%

0.50%

1.00%

1.50%

2.00%

2014 2015 2016 2017 Q1 2018

0.06%

(0.00%)

(0.13%)

(0.16%)

(0.01%)

(0.20%)

(0.10%)

0.00%

0.10%

0.20%

2014 2015 2016 2017 Q1 2018

4.17%

3.82%

3.22%

3.67%

3.89%

3.67%

3.87%

1.06% 1.00%

0.35% 0.41% 0.42%

0.14% 0.10%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

2012 2013 2014 2015 2016 2017 Q1 2018

Impact of Purchase Accounting on Net Interest Margin

Net Interest Margin

Data for twelve months ended 9/30 each respective year

27

Net Interest Margin

28

Non-Interest Income

Dollars in millions

Noninterest Income adjusted for FDIC purchase accounting accretion

*Other includes BOLI, Brokerage Commissions, Gain/Loss on Sale of Securities, Recovery on Purchase Accounting Loans

Data for the twelve months ended 9/30 each respective year

11.5%

22.2%

$0.0

$6.0

$12.0

$18.0

$24.0

2012 2013 2014 2015 2016 2017 Q1 2018

Deposit Fees 1-4 Loan Gain on Sale Other*

$11.5

21.8%

66.7%61.2%

30.4%

64.9%

27.5%

$14.5

57.2%

32.7%

$14.8

71.0%

18.1%

$21.0

$11.6 10.1%

10.9%

7.6%

11.5%

8.4% 68.3%

12.6%

19.1%

$19.2

66.3%

$5.4

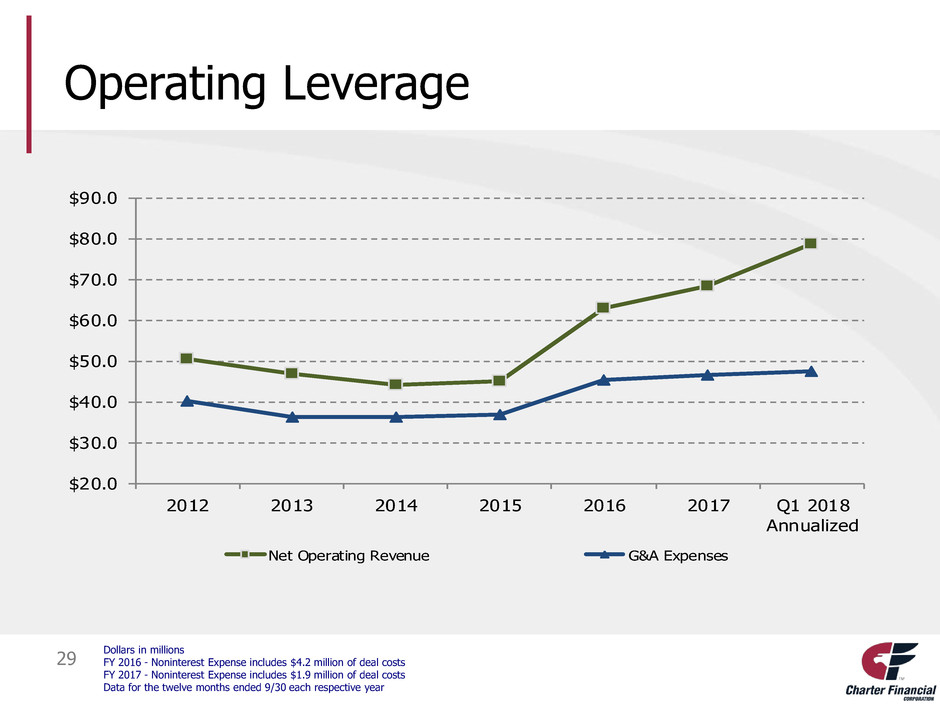

29

Operating Leverage

Dollars in millions

FY 2016 - Noninterest Expense includes $4.2 million of deal costs

FY 2017 - Noninterest Expense includes $1.9 million of deal costs

Data for the twelve months ended 9/30 each respective year

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

$90.0

2012 2013 2014 2015 2016 2017 Q1 2018

Annualized

Net Operating Revenue G&A Expenses

$0.0

$12.0

$24.0

$36.0

$48.0

2012 2013 2014 2015 2016 2017 Q1 2018

Salaries and Benefits Other Occupancy & Furn. and Equip. Professional Services Marketing

22.4%

17.9%

50.8%48.0%

21.7%

21.6%

54.6%

14.1%

22.7%

$36.2

56.5%

11.9%

23.3%

$36.8

23.2%

56.2%

13.3%

$45.4

$40.3

$36.3

55.1%

7.6%

29.8%

$46.5

4.0%

3.5%

4.6%5.3%

4.0%

4.7%

3.6% 4.0% 3.5%

3.2%

3.8%

5.1%

59.0%

21.5%

14.5%

$11.9

30

Non-Interest Expense

Dollars in millions

FY 2016 - Noninterest Expense includes $4.2 million of deal costs

FY 2017 - Noninterest Expense includes $1.9 million of deal costs

Data for the twelve months ended 9/30 each respective year

31

Why Charter?

Investment Merits

32

• Accelerating EPS growth

• Positioned in high growth markets including Atlanta MSA

• Capacity for additional operating and capital leverage

• Focused on organic growth

• Strategic M&A potential

• Track record of returns to shareholders

• Annualized total return since 2013 stock conversion of 14.6%

Investor Contacts

1233 O. G. Skinner Drive

West Point, Georgia 31833

1-800-763-4444

www.charterbk.com

33

Robert L. Johnson

Chairman and Chief Executive Officer

bjohnson@charterbank.net

(706) 645-3249

Lee W. Washam

President

lwasham@charterbank.net

(706) 645-3630

Curtis R. Kollar

Senior Vice President and

Chief Financial Officer

ckollar@charterbank.net

(706) 645-3237

34

Appendix

Non

Interest

Bearing

17%

Interest

Bearing &

Other Trans

25%

MMDA &

Sav

27%

Time

Deposits <

$250k

24%

Time

Deposits >

250k

7%

Loan Portfolio Amount % of Total

C&D 165,440 14 %

1-4 Family 242,588 21

Home Equity 42,702 4

Owner-Occupied CRE 200,194 17

Other CRE 333,890 29

Multifamily 30,073 3

C&I 96,651 8

Consr & Other 51,910 4

Gross Loans & Leases $1,163,448 100.0 %

Deposit Type Amount % of Total

Non Interest Bearing $232,156 17 %

Interest Bearing & Other Trans 342,527 25

MMDA & Sav 360,195 27

Time Deposits < $250k 320,095 24

Time Deposits > 250k 89,024 7

Total Deposits $1,343,997 100.0 %

C&D

14%

1-4 Family

21%

Home Equity

4%

Owner-

Occupied

CRE

17%

Other CRE

29%

Multifamily

3%

C&I

8%

Consr &

Other

4%

Loan and Deposit Detail

35 Data as of 12/31/17

Source: SNL Financial

Loans Deposits

Reconciliation of Non-GAAP Measures

36

Source: SNL Financial

Data as of or for the twelve months ended 9/30 each respective year

2014 2015 2016 2017 Q1 2018

Tangible Book Value Per Share

Book value per share $12.32 $12.79 $13.52 $14.17 $14.42

Effect to adjust for goodwill and other intangible assets ($0.26) ($0.31) ($2.16) ($2.84) ($2.83)

Tangible book value per share (Non-GAAP) $12.06 $12.48 $11.36 $11.33 $11.59

Tangible Common Equity Ratio

Total eq ity to total assets 22.26% 19.95% 14.12% 13.06% 13.27%

Effect to adjust for goodwill and other intangible assets -0.36% -0.39% -1.98% -2.34% -2.31%

Tangible common equity ratio (Non-GAAP) 21.90% 19.56% 12.14% 10.72% 10.96%

Return on Average Tangible Equity

Return on average equity 2.28% 2.62% 5.90% 6.89% 8.10%

Effect to adjust for goodwill and other intangible assets 0.04% 0.06% 0.56% 1.29% 2.00%

Return on average tangible equity (Non-GAAP) 2.32% 2.68% 6.46% 8.18% 10.10%

Interest Rate Risk Bank Net Portfolio

37

(1) Assumes an instantaneous uniform change in interest rates at all maturities.

(2) NPV is the difference between the present value of an institution's assets and liabilities.

(3) Present value of assets represents the discounted present value of incoming cash flows on interest-earning assets.

(4) NPV ratio represents NPV divided by the present value of assets.

At December 31, 2017

Change in Interest

Ra s (bp) (1) Estimated NPV (2)

Estimated

Increase

(Decrease)

in NPV

Percentage

Change in

NPV

NPV Ratio as a

Percent of

Present Value of

Assets (3)(4)

Increase (Decrease)

in NPV Ratio as a

Percent of Present

Value of Assets (3)(4)

(dollars in thousands)

300 $299,295 $21,298 7.7% 18.3% 1.3%

200 $293,106 $15,109 5.4% 18.0% 1.0%

100 $286,084 $8,087 2.9% 17.5% 0.5%

— $277,997 — — 17.0% —

(100) $259,452 ($18,545) (6.7%) 15.9% (1.1%)