Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - CHARTER FINANCIAL CORP | chfn-12312016ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - CHARTER FINANCIAL CORP | chfn-12312016ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - CHARTER FINANCIAL CORP | chfn-12312016ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 10-Q

_____________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2016

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-35870

_____________________________________

CHARTER FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

_____________________________________

Maryland | 90-0947148 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1233 O.G. Skinner Drive, West Point, Georgia | 31833 |

(Address of Principal Executive Offices) | (Zip Code) |

(706) 645-1391

(Registrant’s telephone number)

N/A

(Former name or former address, if changed since last report)

_____________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such requirements for the past 90 days. YES x NO o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer | o | Accelerated filer | x |

Non-accelerated filer | o (Do not check if smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

The number of shares of the registrant’s common stock outstanding as of February 1, 2017 was 15,038,204.

CHARTER FINANCIAL CORPORATION

TABLE OF CONTENTS

Page No. | ||

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

December 31, 2016 | September 30, 2016 (1) | ||||||

Assets | |||||||

Cash and amounts due from depository institutions | $ | 15,234,277 | $ | 14,472,867 | |||

Interest-earning deposits in other financial institutions | 116,614,291 | 77,376,632 | |||||

Cash and cash equivalents | 131,848,568 | 91,849,499 | |||||

Loans held for sale, fair value of $3,290,098 and $2,991,756 | 3,235,852 | 2,941,982 | |||||

Certificates of deposit held at other financial institutions | 12,256,580 | 14,496,410 | |||||

Investment securities available for sale | 196,278,652 | 206,336,287 | |||||

Federal Home Loan Bank stock | 3,361,800 | 3,361,800 | |||||

Restricted securities, at cost | 279,000 | 279,000 | |||||

Loans receivable | 1,002,346,206 | 1,005,702,737 | |||||

Unamortized loan origination fees, net | (1,211,828 | ) | (1,278,830 | ) | |||

Allowance for loan losses | (10,499,228 | ) | (10,371,416 | ) | |||

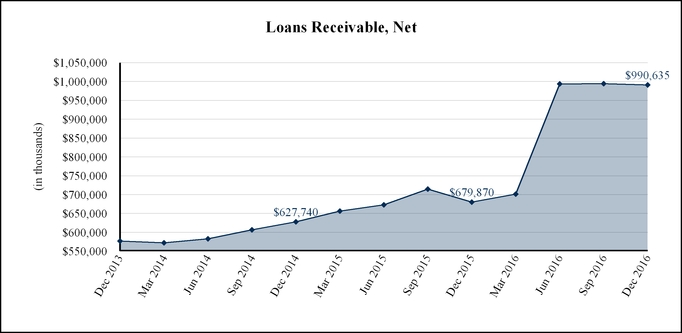

Loans receivable, net | 990,635,150 | 994,052,491 | |||||

Other real estate owned | 2,160,694 | 2,706,461 | |||||

Accrued interest and dividends receivable | 3,579,205 | 3,442,051 | |||||

Premises and equipment, net | 28,291,503 | 28,078,591 | |||||

Goodwill | 29,793,756 | 29,793,756 | |||||

Other intangible assets, net of amortization | 2,485,947 | 2,639,608 | |||||

Cash surrender value of life insurance | 49,601,324 | 49,268,973 | |||||

Deferred income taxes | 5,849,030 | 4,366,522 | |||||

Other assets | 2,009,914 | 4,775,805 | |||||

Total assets | $ | 1,461,666,975 | $ | 1,438,389,236 | |||

Liabilities and Stockholders’ Equity | |||||||

Liabilities: | |||||||

Deposits | $ | 1,186,346,952 | $ | 1,161,843,586 | |||

Long-term borrowings | 50,000,000 | 50,000,000 | |||||

Floating rate junior subordinated debt | 6,621,823 | 6,587,549 | |||||

Advance payments by borrowers for taxes and insurance | 1,211,165 | 2,298,513 | |||||

Other liabilities | 11,986,812 | 14,510,052 | |||||

Total liabilities | 1,256,166,752 | 1,235,239,700 | |||||

Stockholders’ equity: | |||||||

Common stock, $0.01 par value; 15,030,926 shares issued and outstanding at December 31, 2016 and 15,031,076 shares issued and outstanding at September 30, 2016 | 150,309 | 150,311 | |||||

Preferred stock, $0.01 par value; 50,000,000 shares authorized at December 31, 2016 and September 30, 2016 | — | — | |||||

Additional paid-in capital | 84,182,259 | 83,651,623 | |||||

Unearned compensation – ESOP | (4,673,761 | ) | (5,106,169 | ) | |||

Retained earnings | 127,615,344 | 123,349,890 | |||||

Accumulated other comprehensive (loss) income | (1,773,928 | ) | 1,103,881 | ||||

Total stockholders’ equity | 205,500,223 | 203,149,536 | |||||

Total liabilities and stockholders’ equity | $ | 1,461,666,975 | $ | 1,438,389,236 | |||

__________________________________

(1) | Financial information at September 30, 2016 has been derived from audited financial statements. |

See accompanying notes to unaudited condensed consolidated financial statements.

1

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

Three Months Ended December 31, | |||||||

2016 | 2015 | ||||||

Interest income: | |||||||

Loans receivable | $ | 12,569,903 | $ | 9,441,525 | |||

Taxable investment securities | 1,095,900 | 946,510 | |||||

Nontaxable investment securities | 4,571 | — | |||||

Federal Home Loan Bank stock | 39,210 | 38,928 | |||||

Interest-earning deposits in other financial institutions | 110,817 | 12,391 | |||||

Certificates of deposit held at other financial institutions | 42,629 | — | |||||

Restricted securities | 2,573 | — | |||||

Total interest income | 13,865,603 | 10,439,354 | |||||

Interest expense: | |||||||

Deposits | 1,158,316 | 665,433 | |||||

Borrowings | 386,975 | 552,882 | |||||

Floating rate junior subordinated debt | 120,792 | — | |||||

Total interest expense | 1,666,083 | 1,218,315 | |||||

Net interest income | 12,199,520 | 9,221,039 | |||||

Provision for loan losses | (750,000 | ) | — | ||||

Net interest income after provision for loan losses | 12,949,520 | 9,221,039 | |||||

Noninterest income: | |||||||

Service charges on deposit accounts | 1,887,810 | 1,752,558 | |||||

Bankcard fees | 1,282,358 | 1,145,826 | |||||

Gain on investment securities available for sale | — | 35,965 | |||||

Bank owned life insurance | 332,352 | 320,663 | |||||

Gain on sale of loans | 731,262 | 347,856 | |||||

Brokerage commissions | 165,996 | 141,715 | |||||

Recoveries on acquired loans previously covered under FDIC loss share agreements | 250,000 | 2,875,000 | |||||

Other | 333,067 | 210,957 | |||||

Total noninterest income | 4,982,845 | 6,830,540 | |||||

Noninterest expenses: | |||||||

Salaries and employee benefits | 6,133,673 | 5,262,989 | |||||

Occupancy | 1,323,323 | 1,057,274 | |||||

Data processing | 908,955 | 824,517 | |||||

Legal and professional | 284,156 | 379,838 | |||||

Marketing | 356,524 | 289,575 | |||||

Federal insurance premiums and other regulatory fees | 165,495 | 223,843 | |||||

Net benefit of operations of real estate owned | (359,270 | ) | (21,243 | ) | |||

Furniture and equipment | 174,055 | 168,415 | |||||

Postage, office supplies and printing | 270,385 | 184,712 | |||||

Core deposit intangible amortization expense | 153,662 | 48,985 | |||||

Other | 878,549 | 659,125 | |||||

Total noninterest expenses | 10,289,507 | 9,078,030 | |||||

Income before income taxes | 7,642,858 | 6,973,549 | |||||

Income tax expense | 2,597,191 | 2,359,271 | |||||

Net income | $ | 5,045,667 | $ | 4,614,278 | |||

Basic net income per share | $ | 0.36 | $ | 0.31 | |||

Diluted net income per share | $ | 0.33 | $ | 0.30 | |||

Weighted average number of common shares outstanding | 14,207,468 | 14,885,529 | |||||

Weighted average number of common and potential common shares outstanding | 15,064,879 | 15,545,216 | |||||

See accompanying notes to unaudited condensed consolidated financial statements.

2

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

Three Months Ended December 31, | ||||||||

2016 | 2015 | |||||||

Net income | $ | 5,045,667 | $ | 4,614,278 | ||||

Reclassification adjustment for net gains realized in net income, net of taxes of $0 and $13,882, respectively | — | (22,083 | ) | |||||

Net unrealized holding losses on investment and mortgage securities available for sale arising during the period, net of taxes of $(1,809,176) and $(650,925), respectively | (2,877,809 | ) | (1,035,409 | ) | ||||

Comprehensive income | $ | 2,167,858 | $ | 3,556,786 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

3

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (UNAUDITED)

Common stock | Additional paid-in capital | Unearned compensation ESOP | Retained earnings | Accumulated other comprehensive income (loss) | Total stockholders' equity | |||||||||||||||||||||

Number of shares | Amount | |||||||||||||||||||||||||

Balance at September 30, 2015 (1) | 16,027,654 | $ | 160,277 | $ | 95,355,054 | $ | (5,551,193 | ) | $ | 114,362,386 | $ | 604,086 | $ | 204,930,610 | ||||||||||||

Net income | — | — | — | — | 11,863,320 | — | 11,863,320 | |||||||||||||||||||

Dividends paid, $0.20 per share | — | — | — | — | (2,875,816 | ) | — | (2,875,816 | ) | |||||||||||||||||

Change in other comprehensive income | — | — | — | — | — | 499,795 | 499,795 | |||||||||||||||||||

Allocation of ESOP common stock | — | — | 216,340 | 445,024 | — | — | 661,364 | |||||||||||||||||||

Effect of restricted stock awards | — | — | 784,280 | — | — | — | 784,280 | |||||||||||||||||||

Stock option expense | — | — | 330,783 | — | — | — | 330,783 | |||||||||||||||||||

Issuance of common stock, restricted stock | 19,846 | 198 | 126,259 | — | — | — | 126,457 | |||||||||||||||||||

Repurchase of shares | (1,016,424 | ) | (10,164 | ) | (13,161,093 | ) | — | — | — | (13,171,257 | ) | |||||||||||||||

Balance at September 30, 2016 (1) | 15,031,076 | $ | 150,311 | $ | 83,651,623 | $ | (5,106,169 | ) | $ | 123,349,890 | $ | 1,103,881 | $ | 203,149,536 | ||||||||||||

Net income | — | — | — | — | 5,045,667 | — | 5,045,667 | |||||||||||||||||||

Dividends paid, $0.055 per share | — | — | — | — | (780,213 | ) | — | (780,213 | ) | |||||||||||||||||

Change in other comprehensive income | — | — | — | — | — | (2,877,809 | ) | (2,877,809 | ) | |||||||||||||||||

Allocation of ESOP common stock | — | — | 251,610 | 432,408 | — | — | 684,018 | |||||||||||||||||||

Effect of restricted stock awards | — | — | 196,070 | — | — | — | 196,070 | |||||||||||||||||||

Stock option expense | — | — | 84,835 | — | — | — | 84,835 | |||||||||||||||||||

Repurchase of shares | (150 | ) | (2 | ) | (1,879 | ) | — | — | — | (1,881 | ) | |||||||||||||||

Balance at December 31, 2016 | 15,030,926 | $ | 150,309 | $ | 84,182,259 | $ | (4,673,761 | ) | $ | 127,615,344 | $ | (1,773,928 | ) | $ | 205,500,223 | |||||||||||

__________________________________

(1) | Financial information at September 30, 2016 and 2015 has been derived from audited financial statements. |

See accompanying notes to unaudited condensed consolidated financial statements.

4

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Three Months Ended December 31, | |||||||

2016 | 2015 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 5,045,667 | $ | 4,614,278 | |||

Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |||||||

Provision for loan losses | (750,000 | ) | — | ||||

Depreciation and amortization | 443,635 | 288,221 | |||||

Accretion and amortization of premiums and discounts, net | 269,906 | 291,481 | |||||

Accretion of fair value discounts related to acquired loans | (724,109 | ) | (1,168,982 | ) | |||

Gain on sale of loans | (731,262 | ) | (347,856 | ) | |||

Proceeds from sale of loans | 29,996,590 | 12,766,789 | |||||

Originations and purchases of loans held for sale | (29,725,305 | ) | (13,297,878 | ) | |||

Gain on sale of mortgage-backed securities, collateralized mortgage obligations and other investments | — | (35,965 | ) | ||||

Gain on sale of real estate owned | (444,045 | ) | (184,719 | ) | |||

Loss on sale of fixed assets | 38,528 | 6,581 | |||||

Restricted stock award expense | 196,070 | 196,070 | |||||

Stock option expense | 84,835 | 80,578 | |||||

Increase in cash surrender value of bank owned life insurance | (332,352 | ) | (320,663 | ) | |||

Changes in assets and liabilities: | |||||||

(Increase) decrease in accrued interest and dividends receivable | (137,154 | ) | 173,289 | ||||

Decrease in other assets | 2,682,188 | 636,075 | |||||

Decrease in other liabilities | (1,839,222 | ) | (7,398,694 | ) | |||

Net cash provided by (used in) operating activities | 4,073,970 | (3,701,395 | ) | ||||

Cash flows from investing activities: | |||||||

Proceeds from sales of investment securities available for sale | — | 1,231,330 | |||||

Principal collections on investment securities available for sale | 5,198,331 | 5,403,881 | |||||

Purchase of investment securities available for sale | (7,644,193 | ) | — | ||||

Proceeds from maturities or calls of investment securities available for sale | 7,900,000 | — | |||||

Proceeds from redemption of Federal Home Loan Bank stock | — | 510,000 | |||||

Net decrease in certificates of deposit held at other financial institutions | 2,237,000 | — | |||||

Net decrease in loans receivable | 4,365,488 | 35,857,671 | |||||

Proceeds from sale of real estate owned | 1,427,624 | 555,531 | |||||

Proceeds from sale of premises and equipment | 211,283 | 351,399 | |||||

Purchases of premises and equipment | (502,885 | ) | (36,240 | ) | |||

Net cash provided by investing activities | 13,192,648 | 43,873,572 | |||||

Cash flows from financing activities: | |||||||

Repurchase of shares | (1,881 | ) | (10,309,070 | ) | |||

Dividends paid | (780,213 | ) | (748,603 | ) | |||

Net increase in deposits | 24,601,893 | 5,378,891 | |||||

Principal payments on Federal Home Loan Bank advances | — | (12,000,000 | ) | ||||

Net decrease in advance payments by borrowers for taxes and insurance | (1,087,348 | ) | (955,318 | ) | |||

Net cash provided by (used in) financing activities | 22,732,451 | (18,634,100 | ) | ||||

Net increase in cash and cash equivalents | 39,999,069 | 21,538,077 | |||||

See accompanying notes to unaudited condensed consolidated financial statements.

5

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) continued | |||||||

Three Months Ended December 31, | |||||||

2016 | 2015 | ||||||

Cash and cash equivalents at beginning of period | 91,849,499 | 30,343,225 | |||||

Cash and cash equivalents at end of period | $ | 131,848,568 | $ | 51,881,302 | |||

Supplemental disclosures of cash flow information: | |||||||

Interest paid | $ | 2,140,157 | $ | 1,213,148 | |||

Income taxes paid | 1,233,170 | — | |||||

Supplemental disclosure of noncash activities: | |||||||

Real estate acquired through foreclosure of collateral on loans receivable | $ | 437,812 | $ | 124,979 | |||

Issuance of common stock under stock benefit plan | 684,018 | 661,364 | |||||

Unrealized loss on investment securities available for sale, net | (2,877,809 | ) | (1,057,492 | ) | |||

See accompanying notes to unaudited condensed consolidated financial statements.

6

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Note 1: Nature of Operations

Charter Financial Corporation (“Charter Financial” or the “Company”) is a savings and loan holding company that was incorporated under the laws of the State of Maryland in April 2013 to serve as the holding company for CharterBank ("CharterBank" or "the Bank”). The Bank is a federally-chartered savings bank that was originally founded in 1954 as a federally-chartered mutual savings and loan association.

On April 8, 2013, the Company completed its conversion and reorganization pursuant to which it converted from the mutual holding company form of organization to the stock holding company form of organization. The Company sold 14.3 million shares of common stock for gross offering proceeds of $142.9 million in the offering. Following the conversion and reorganization, the Bank became 100% owned by Charter Financial and Charter Financial became 100% owned by public shareholders.

The Company operates 20 branch offices in Metro Atlanta, the I-85 corridor south to Auburn, Alabama, and the Florida Gulf Coast, including one cashless branch office in Norcross, Georgia.

Note 2: Basis of Presentation

The accompanying unaudited interim consolidated financial statements of Charter Financial and the Bank include the accounts of the Company and the Bank as of December 31, 2016 and September 30, 2016 (derived from audited financial statements), and for the three-month periods ended December 31, 2016 and 2015. All intercompany accounts and transactions have been eliminated in consolidation. The unaudited interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the unaudited interim condensed consolidated financial statements include all necessary adjustments, consisting of normal recurring accruals, necessary for a fair presentation for the periods presented. The results of operations for the three-month period ended December 31, 2016, are not necessarily indicative of the results that may be expected for the entire year or any other interim period.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change in the near term relate to the determination of the allowance for loan losses, the valuation of real estate acquired in connection with foreclosures or in satisfaction of loans, the estimates used for fair value acquisition accounting, the estimate of expected cash flows on purchased impaired and other acquired loans, and the assessment for other-than-temporary impairment of investment securities, mortgage-backed securities, collateralized mortgage-backed securities and collateralized mortgage obligations. Certain reclassifications of prior fiscal year balances have been made to conform to classifications used in the current fiscal year. These reclassifications did not change net income or stockholders' equity.

Note 3: Recent Accounting Pronouncements

In January 2017, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment ("ASU 2017-04"), which eliminates the second step of the previous FASB guidance for testing goodwill for impairment and is intended to reduce cost and complexity of goodwill impairment testing. The amendments in this ASU modify the concept of impairment from the condition that exists when the carrying amount of goodwill exceeds its implied fair value to the condition that exists when the carrying amount of a reporting unit exceeds its fair value. After determining if the carrying amount of a reporting unit exceeds its fair value, the entity should take an impairment charge of the same amount to the goodwill for that reporting unit, not to exceed the total goodwill amount for that reporting unit. This eliminates the second step of calculating the implied fair value of goodwill by assigning the fair value of a reporting unit to all of its assets and liabilities as if that reporting unit had been acquired in a business combination. ASU 2017-04 is effective for annual periods beginning after December 15, 2019, including interim periods within those annual periods. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The Company is currently evaluating the impact of adopting the new guidance on its consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business, which is intended to provide guidance in evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses in order to provide stakeholders with more detailed reporting and less cost to analyze transactions. This

7

ASU provides a screen to determine when a set of assets is not a business. It requires that when substantially all fair value of gross assets acquired (or disposed of) is concentrated in a single identifiable asset or group of similar identifiable assets, the set of assets is not a business. If the screen is not met, the amendments in this update provide a framework to assist entities in evaluating whether both an input and a substantive process are present for the set to be a business. ASU 2017-01 is effective for annual periods beginning after December 15, 2017, including interim periods within those annual periods. No disclosures are required at transition and early adoption is permitted. The Company is currently evaluating the impact of adopting the new guidance on its consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which sets forth a "current expected credit loss" ("CECL") model requiring the Company to measure all expected credit losses for financial instruments held at the reporting date based on historical experience, current conditions and reasonable supportable forecasts. This replaces the existing incurred loss model and is applicable to the measurement of credit losses on financial assets measured at amortized cost and applies to some off-balance sheet credit exposures. For public business entities that are U.S. Securities and Exchange Commission filers, the amendments in this update are effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. The Company is currently in the process of assembling a transition team to assess the adoption of this ASU, which will develop a project plan regarding implementation.

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, which is intended to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. ASU 2016-09 is effective for annual periods beginning after December 15, 2016, and interim periods within those annual periods. Early application is permitted. During the first quarter of the current fiscal year, the Company early adopted this ASU, with an immaterial impact of a $127,000 reduction in income tax expense for the three months ended December 31, 2016.

In May 2014, the FASB issued ASU 2014-09, Revenue From Contracts With Customers. This standard outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry specific guidance. The core principle of the revenue model is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard was to be effective for annual reporting periods beginning after December 15, 2016. In August 2015, the FASB issued ASU 2015-14, deferring the effective date for the standard to reporting periods beginning after December 15, 2017. The Company is currently in the process of implementing the new standard, and initial assessments indicate there will not be a material impact to the Company's current accounting policies for revenue recognition.

Note 4: Business Combinations

On April 15, 2016, the Company completed its acquisition of CBS Financial Corporation ("CBS") and its wholly-owned subsidiary, Community Bank of the South, for cash consideration of $55.9 million. In addition to the cash paid by Charter Financial, CBS paid approximately $2.9 million in Stock Appreciation Rights and Stock Options payouts to its holders for a total transaction value of $58.8 million. Upon completion of the acquisition, CBS merged into Charter Financial, and Community Bank of the South merged into CharterBank. The acquisition expanded the bank's presence in the Atlanta market with four branches in Cobb County.

The following table provides a summary of the assets acquired and liabilities assumed of CBS as recorded by the Company. As provided for under GAAP, management has up to one year following the date of acquisition to finalize the fair values of the acquired assets and assumed liabilities. Once management has finalized the fair value of acquired assets and assumed liabilities within this one-year period, management considers such values to be the Day 1 Fair Values. The fair values shown in the following table have been determined by management to be the Day 1 Fair Values.

8

Purchase Price: | |||||||

Cash paid to CBS shareholders | $ | 55,906,124 | |||||

Fair value of assets acquired: | |||||||

Cash and cash equivalents | $ | 13,385,564 | |||||

Certificates of deposit held at other financial institutions | 25,202,320 | ||||||

Investment securities available for sale | 22,198,577 | ||||||

Loans held for sale | 924,000 | ||||||

Loans receivable, net | 300,775,423 | ||||||

Federal Home Loan Bank stock | 545,300 | ||||||

Restricted securities, at cost | 279,000 | ||||||

Premises and equipment | 7,945,313 | ||||||

Accrued interest and dividends receivable | 838,865 | ||||||

Other real estate owned | 454,900 | ||||||

Core deposit intangible | 2,898,000 | ||||||

Other assets | 938,774 | ||||||

Total assets acquired | 376,386,036 | ||||||

Fair value of liabilities assumed: | |||||||

Deposits | 333,719,277 | ||||||

Federal Home Loan Bank advances | 5,000,000 | ||||||

Floating rate junior subordinated debt | 6,519,000 | ||||||

Advance payments by borrowers for taxes and insurance | 134,031 | ||||||

Other liabilities | 576,077 | ||||||

Total liabilities assumed | $ | 345,948,385 | |||||

Fair value of net assets acquired | 30,437,651 | ||||||

Goodwill recognized for CBS | $ | 25,468,473 | |||||

Goodwill of $25.5 million, which is the excess of the merger consideration over the estimated fair value of net assets acquired, was recorded in the CBS acquisition and is the result of expected operational synergies and other factors. A portion of this goodwill is expected to be deductible for tax purposes.

No loans were recognized as credit impaired in the acquisition.

The Company recorded $4.2 million of merger-related expenses during the year ended September 30, 2016. Integration of the acquisition was completed during the fourth quarter of fiscal 2016, and no further merger-related costs have been incurred nor are expected.

9

Note 5: Investment Securities

Investment securities available for sale are summarized as follows:

December 31, 2016 | |||||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

Other investment securities: | |||||||||||||||

State and municipal securities | $ | 2,472,442 | $ | 16,525 | $ | (18,227 | ) | $ | 2,470,740 | ||||||

Collateralized loan obligations | 39,561,864 | 99,956 | (81,748 | ) | 39,580,072 | ||||||||||

Mortgage-backed securities: | |||||||||||||||

FHLMC certificates | 25,749,475 | 200,089 | (270,913 | ) | 25,678,651 | ||||||||||

FNMA certificates | 122,825,855 | 265,138 | (2,902,159 | ) | 120,188,834 | ||||||||||

GNMA certificates | 1,497,499 | 3,549 | — | 1,501,048 | |||||||||||

Private-label mortgage securities: (1) | |||||||||||||||

Investment grade | 789,949 | 769 | (35,388 | ) | 755,330 | ||||||||||

Split rating (2) | 538,360 | — | (7,072 | ) | 531,288 | ||||||||||

Non-investment grade | 5,530,978 | 232,227 | (190,516 | ) | 5,572,689 | ||||||||||

Total | $ | 198,966,422 | $ | 818,253 | $ | (3,506,023 | ) | $ | 196,278,652 | ||||||

________________________________

(1) | Credit ratings are current as of December 31, 2016. |

(2) | Bonds with split ratings represent securities with both investment and non-investment grades. |

September 30, 2016 | |||||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

Other investment securities: | |||||||||||||||

State and municipal securities | $ | 2,483,779 | $ | 42,041 | $ | (1,653 | ) | $ | 2,524,167 | ||||||

Collateralized loan obligations | 39,748,828 | 79,464 | (121,564 | ) | 39,706,728 | ||||||||||

Mortgage-backed securities: | |||||||||||||||

FHLMC certificates | 27,432,208 | 592,777 | — | 28,024,985 | |||||||||||

FNMA certificates | 126,292,589 | 1,213,349 | (102,546 | ) | 127,403,392 | ||||||||||

GNMA certificates | 1,509,079 | 3,878 | — | 1,512,957 | |||||||||||

Private-label mortgage securities: | |||||||||||||||

Investment grade | 847,064 | 1,100 | (36,696 | ) | 811,468 | ||||||||||

Split rating (1) | 553,376 | — | (5,390 | ) | 547,986 | ||||||||||

Non-investment grade | 5,796,816 | 212,151 | (204,363 | ) | 5,804,604 | ||||||||||

Total | $ | 204,663,739 | $ | 2,144,760 | $ | (472,212 | ) | $ | 206,336,287 | ||||||

______________________________

(1) | Bonds with split ratings represent securities with both investment and non-investment grades. |

The amortized cost and estimated fair value of investment securities available for sale as of December 31, 2016, by contractual maturity, are shown below. Expected maturities may differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

Amortized Cost | Estimated Fair Value | ||||||

Due within one year | $ | 507,032 | $ | 505,774 | |||

Due from one year to five years | 1,515,946 | 1,508,479 | |||||

Due after five years | 40,011,328 | 40,036,559 | |||||

Mortgage-backed securities | 156,932,116 | 154,227,840 | |||||

Total | $ | 198,966,422 | $ | 196,278,652 | |||

10

During the three months ended December 31, 2016, $7.9 million in investment securities available for sale were called or matured. No investment securities were called or matured during the three months ended December 31, 2015. No investment securities available for sale were sold during the three months ended December 31, 2016. Proceeds from sales of investment securities available for sale during the three months ended December 31, 2015, were $1.2 million. Gross realized gains on the sale of these securities were $36,224 and gross realized losses were $259 for the three months ended December 31, 2015.

Investment securities available for sale with an aggregate carrying value of $95.9 million and $103.5 million at December 31, 2016 and September 30, 2016, respectively, were available to be pledged to secure Federal Home Loan Bank (“FHLB”) advances. However, no securities were pledged at either period end to secure FHLB advances.

Investment securities available for sale that had been in a continuous unrealized loss position for less than 12 months at December 31, 2016 and September 30, 2016 are as follows:

December 31, 2016 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Other investment securities: | |||||||||||

State and municipal securities | $ | 1,867,669 | $ | (18,227 | ) | $ | 1,849,442 | ||||

Mortgage-backed securities: | |||||||||||

FHLMC certificates | 12,550,014 | (270,913 | ) | 12,279,101 | |||||||

FNMA certificates | 95,343,561 | (2,816,838 | ) | 92,526,723 | |||||||

Total | $ | 109,761,244 | $ | (3,105,978 | ) | $ | 106,655,266 | ||||

September 30, 2016 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Other investment securities: | |||||||||||

State and municipal securities | $ | 1,025,997 | $ | (1,653 | ) | $ | 1,024,344 | ||||

Mortgage-backed securities: | |||||||||||

FNMA certificates | 15,742,485 | (71,197 | ) | 15,671,288 | |||||||

Private-label mortgage securities | 2,487,651 | (125,727 | ) | 2,361,924 | |||||||

Total | $ | 19,256,133 | $ | (198,577 | ) | $ | 19,057,556 | ||||

Investment securities available for sale that had been in a continuous unrealized loss position for greater than 12 months at December 31, 2016 and September 30, 2016 are as follows:

December 31, 2016 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Other investment securities: | |||||||||||

Collateralized loan obligations | $ | 15,461,723 | $ | (81,748 | ) | $ | 15,379,975 | ||||

Mortgage-backed securities: | |||||||||||

FNMA certificates | 3,790,201 | (85,321 | ) | 3,704,880 | |||||||

Private-label mortgage securities | 4,656,060 | (232,976 | ) | 4,423,084 | |||||||

Total | $ | 23,907,984 | $ | (400,045 | ) | $ | 23,507,939 | ||||

11

September 30, 2016 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Other investment securities: | |||||||||||

Collateralized loan obligations | $ | 15,469,859 | $ | (121,564 | ) | $ | 15,348,295 | ||||

Mortgage-backed securities: | |||||||||||

FNMA certificates | 3,923,709 | (31,349 | ) | 3,892,360 | |||||||

Private-label mortgage securities | 2,463,439 | (120,722 | ) | 2,342,717 | |||||||

Total | $ | 21,857,007 | $ | (273,635 | ) | $ | 21,583,372 | ||||

At December 31, 2016 the Company had approximately $233,000 of gross unrealized losses on private-label mortgage securities with aggregate amortized cost of approximately $4.7 million. Previously, in fiscal 2011, the Company recognized $380,000 in credit losses on its investment portfolio. During the three months ended December 31, 2016 and 2015, the Company recorded no other-than-temporary unrealized loss impairment charges. Other than what is discussed in the paragraphs below, the Company is projecting that it will receive essentially all contractual cash flows, so there is no break in yield or additional other than temporary impairment.

Regularly, the Company performs an assessment to determine whether there have been any events or economic circumstances to indicate that a security on which there is an unrealized loss is impaired other-than-temporarily. The assessment considers many factors including the severity and duration of the impairment, the Company’s intent and ability to hold the security for a period of time sufficient for recovery in value, recent events specific to the industry, and current characteristics of each security such as delinquency and foreclosure levels, credit enhancements, and projected losses and loss coverage ratios. It is possible that the underlying collateral of these securities will perform worse than current expectations, which may lead to adverse changes in cash flows on these securities and potential future other-than-temporary impairment losses. Events that may trigger material declines in fair values for these securities in the future include but are not limited to, deterioration of credit metrics, significantly higher levels of default and severity of loss on the underlying collateral, deteriorating credit enhancement and loss coverage ratios, or further illiquidity. All of these securities were evaluated for other-than-temporary impairment based on an analysis of the factors and characteristics of each security as previously enumerated. The Company considers these unrealized losses to be temporary impairment losses primarily because of continued sufficient levels of credit enhancements and credit coverage levels of less senior tranches to tranches held by the Company.

The following table shows issuer-specific information, including current par value, book value, fair value, credit rating and unrealized gain (loss) for the Company's portfolio of non-agency collateralized mortgage obligations as of December 31, 2016:

Cusip | Description | Credit Rating (1) | Cumulative Net Impairment Losses Recognized in Earnings | Current Par Value | Amortized Cost | Market Value | Unrealized Gain (Loss) | |||||||||||||||||||||

Moody | S&P | Fitch | (dollars in thousands) | |||||||||||||||||||||||||

Investment Grade | ||||||||||||||||||||||||||||

36228FQF6 | GSR 2003-4F 1A2 | n/a | AA+ | BBB | $ | — | $ | 120 | $ | 120 | $ | 120 | $ | — | ||||||||||||||

55265KL80 | MASTR 2003-8 4A1 | n/a | AA+ | AA | — | 66 | 65 | 66 | 1 | |||||||||||||||||||

86359BVF5 | SARM 2004-6 3A3 | n/a | A+ | n/a | — | 604 | 605 | 569 | (36 | ) | ||||||||||||||||||

Total | — | 790 | 790 | 755 | (35 | ) | ||||||||||||||||||||||

Split Rating | ||||||||||||||||||||||||||||

17307GDL9 | CMLTI 2004-HYB1 A31 | Ba2 | n/a | BBB | — | 538 | 538 | 531 | (7 | ) | ||||||||||||||||||

Total | — | 538 | 538 | 531 | (7 | ) | ||||||||||||||||||||||

Non-Investment Grade | ||||||||||||||||||||||||||||

576433UQ7 | MARM 2004-13 B1 | NR | CCC | n/a | 380 | 2,399 | 2,018 | 2,251 | 233 | |||||||||||||||||||

576433VN3 | MARM 2004-15 4A1 | Caa2 | n/a | BB | — | 1,173 | 1,173 | 1,104 | (69 | ) | ||||||||||||||||||

576433QD1 | MARM 2004-7 5A1 | B2 | BB | n/a | — | 2,339 | 2,340 | 2,218 | (122 | ) | ||||||||||||||||||

Total | 380 | 5,911 | 5,531 | 5,573 | 42 | |||||||||||||||||||||||

Grand Total | $ | 380 | $ | 7,239 | $ | 6,859 | $ | 6,859 | $ | — | ||||||||||||||||||

______________________________

(1) | Credit ratings are current as of December 31, 2016. |

12

Changes in accumulated other comprehensive income (loss) by component for the three months ended December 31, 2016 and 2015 are shown in the table below. All amounts are net of tax. The line item affected in the consolidated statements of income by the reclassified amounts is gain (loss) on investment securities available for sale.

Unrealized Gain/Loss on Available-for-Sale Securities | |||||||

Three Months Ended December 31, | |||||||

2016 | 2015 | ||||||

Beginning balance | $ | 1,103,881 | $ | 604,086 | |||

Other comprehensive loss before reclassifications | (2,877,809 | ) | (1,035,409 | ) | |||

Amounts reclassified from accumulated other comprehensive gain/loss to gain on investment securities available for sale | — | (22,083 | ) | ||||

Net current-period other comprehensive loss | (2,877,809 | ) | (1,057,492 | ) | |||

Ending balance | $ | (1,773,928 | ) | $ | (453,406 | ) | |

Note 6: Loans Receivable

Loans outstanding, by portfolio segment, are summarized in the following table:

December 31, 2016 | September 30, 2016 | ||||||

1-4 family residential real estate | $ | 223,608,882 | $ | 236,939,555 | |||

Commercial real estate | 595,207,275 | 595,157,268 | |||||

Commercial | 73,181,769 | 71,865,081 | |||||

Real estate construction | 79,136,008 | 80,500,321 | |||||

Consumer and other | 31,212,272 | 21,240,512 | |||||

Total loans, net of acquisition fair value adjustments | 1,002,346,206 | 1,005,702,737 | |||||

Unamortized loan origination fees, net | (1,211,828 | ) | (1,278,830 | ) | |||

Allowance for loan losses | (10,499,228 | ) | (10,371,416 | ) | |||

Total loans, net | $ | 990,635,150 | $ | 994,052,491 | |||

Loan Origination and Risk Management. The Company has certain lending policies and procedures in place that are designed to maximize loan income within an acceptable level of risk. Management reviews and approves these policies and procedures on a regular basis. A reporting system supplements the review process by providing management with frequent reports related to loan production, loan quality, concentrations of credit, loan delinquencies and nonperforming and potential problem loans. Diversification in the loan portfolio is a means of managing risk associated with fluctuations in economic conditions.

Commercial real estate loans are generally made by the Company to entities in Georgia, Alabama, Florida and adjoining states and are secured by properties in these states. Commercial real estate lending involves additional risks compared to one- to four-family residential lending. Repayment of commercial real estate loans often depends on the successful operations and income stream of the borrowers, and commercial real estate loans typically involve larger loan balances to single borrowers or groups of related borrowers compared to residential real estate loans. The Company’s underwriting criteria for commercial real estate loans include maximum loan-to-value ratios, debt coverage ratios, secondary sources of repayment, guarantor requirements, net worth requirements and quality of cash flow. As part of the loan approval and underwriting of commercial real estate loans, management undertakes a cash flow analysis, and generally requires a debt-service coverage ratio of at least 1.15 times. In addition, management tracks the level of owner-occupied commercial real estate loans versus non-owner occupied loans. At December 31, 2016, approximately 29.9% of the outstanding principal balance of the Company’s commercial real estate loans was secured by owner-occupied properties.

The Company makes construction and land development loans primarily for the construction of one- to four-family residences but also for multi-family and nonresidential real estate projects on a select basis. The Company offers construction loans to builders including both speculative (unsold) and pre-sold loans to pre-approved local builders. The number of speculative loans that management will extend to a builder at one time depends upon the financial strength and credit history of the builder. The Company’s construction loan program is expected to remain a modest portion of the loan volume and management generally limits the number of outstanding loans on unsold homes under construction within a specific area.

13

The Company also originates first and second mortgage loans and home equity lines of credit secured by one- to four-family residential properties within Georgia, Alabama and the Florida panhandle. Management currently originates mortgages at all branch locations, but utilizes a centralized processing location to reduce the underwriting risk. The Company originates both fixed rate and adjustable rate one- to four-family residential mortgage loans. Fixed rate 30 year conforming loans are generally originated for resale into the secondary market and loans that are non-conforming due to property exceptions and that have adjustable rates are generally retained in the Company’s portfolio. The non-conforming loans originated are not considered to be subprime loans and the amount of subprime and low documentation loans held by the Company is not material. The Company also offers home equity lines of credit as a complement to one- to four-family residential mortgage lending. The underwriting standards applicable to home equity credit lines are similar to those for one- to four-family residential mortgage loans, except for slightly more stringent credit-to-income and credit score requirements. Home equity loans are generally limited to 80% of the value of the underlying property unless the loan is covered by private mortgage insurance. At December 31, 2016, the Company had $37.8 million of home equity lines of credit and second mortgage loans.

The Company originates consumer loans that consist of loans on deposits, auto loans, purchased mobile home loans, and various other installment loans. The Company primarily offers consumer loans as an accommodation to customers. Consumer loans tend to have a higher credit risk than residential mortgage loans because they may be secured by rapidly depreciable assets, or may be unsecured. The Company’s consumer lending generally follows accepted industry standards for non-subprime lending, including credit scores and debt to income ratios.

The Company’s commercial business loans are generally limited to terms of five years or less. While management typically collateralizes these loans with a lien on commercial real estate or, much less frequently, with a lien on business assets and equipment, the primary underwriting consideration is the business cash flow. Management also generally requires the personal guarantee of the business owner. Interest rates on commercial business loans are generally higher than interest rates on residential or commercial real estate loans due to the risk inherent in this type of loan. Commercial business loans are generally considered to have more risk than residential mortgage loans or commercial real estate loans because the collateral may be in the form of intangible assets and/or readily depreciable inventory. Commercial business loans may also involve relatively large loan balances to single borrowers or groups of related borrowers, with the repayment of such loans typically dependent on the successful operation and income stream of the borrower. Such risks can be significantly affected by economic conditions. In addition, commercial business lending generally requires substantially greater supervision efforts by management compared to residential mortgage or commercial real estate lending.

The Company maintains an internal loan review function that reviews and validates the credit risk program on a periodic basis. Results of these reviews are presented to management. The loan review process complements and reinforces the risk identification and assessment decisions made by lenders and credit personnel, as well as the Company’s policies and procedures.

14

Nonaccrual and Past Due Loans. An aging analysis of past due loans, segregated by portfolio segment, at December 31, 2016 and September 30, 2016 was as follows:

December 31, 2016 | September 30, 2016 | ||||||

Current | $ | 994,969,921 | $ | 998,370,863 | |||

Accruing past due loans: | |||||||

30-89 days past due | |||||||

1-4 family residential real estate | 1,576,320 | 1,101,667 | |||||

Commercial real estate | 2,983,613 | 604,724 | |||||

Commercial | 750,627 | 50,712 | |||||

Real estate construction | — | — | |||||

Consumer and other | 300,590 | 335,062 | |||||

Total 30-89 days past due | 5,611,150 | 2,092,165 | |||||

90 days or greater past due (1) | |||||||

1-4 family residential real estate | 223,173 | 449,901 | |||||

Commercial real estate | — | 929,944 | |||||

Commercial | — | 124,553 | |||||

Real estate construction | — | — | |||||

Consumer and other | 14,682 | — | |||||

Total 90 days or greater past due | 237,855 | 1,504,398 | |||||

Total accruing past due loans | 5,849,005 | 3,596,563 | |||||

Nonaccruing loans: (2) | |||||||

1-4 family residential real estate | 904,962 | 930,121 | |||||

Commercial real estate | 501,449 | 2,705,439 | |||||

Commercial | 82,469 | 99,751 | |||||

Real estate construction | — | — | |||||

Consumer and other | 38,400 | — | |||||

Nonaccruing loans | 1,527,280 | 3,735,311 | |||||

Total loans | $ | 1,002,346,206 | $ | 1,005,702,737 | |||

(1) | Acquired loans in the amount of $0 and $1.5 million at December 31, 2016 and September 30, 2016, respectively, are regarded as accruing loans and included in this section. These loans which are accounted for under ASC 310-30 are reported as accruing loans because of the ongoing recognition of accretion income established at the time of acquisition. |

(2) | Acquired loans in the amount of $1.9 million and $2.5 million at December 31, 2016 and September 30, 2016, respectively, are regarded as accruing loans and excluded from the nonaccrual section due to the ongoing recognition of accretion income established at the time of acquisition. |

Impaired Loans. The Company evaluates “impaired” loans, which include nonperforming loans and accruing troubled debt restructured loans having risk characteristics that are unique to an individual borrower, on a loan-by-loan basis with balances above a specified level. For smaller loans, the allowance is calculated based on the credit grade utilizing historical loss experience and other qualitative factors.

15

Impaired loans for the periods ended December 31, 2016 and September 30, 2016, segregated by portfolio segment, are presented below. There were $12,057 and $47,955 of recorded allowances for loan losses on impaired loans at December 31, 2016 and September 30, 2016, respectively.

Three Months Ended December 31, 2016 | |||||||||||||||||||

Recorded Investment | Unpaid Principal Balance | Related Allowance (1) | Average Investment in Impaired Loans | Interest Income Recognized | |||||||||||||||

1-4 family residential real estate | $ | 1,510,990 | $ | 2,125,432 | $ | — | $ | 1,524,127 | $ | 6,421 | |||||||||

Commercial real estate | 5,229,472 | 6,092,083 | 12,057 | 5,275,707 | 73,738 | ||||||||||||||

Commercial | 82,469 | 256,198 | — | 91,110 | — | ||||||||||||||

Real estate construction | — | — | — | — | — | ||||||||||||||

Total impaired loans | $ | 6,822,931 | $ | 8,473,713 | $ | 12,057 | $ | 6,890,944 | $ | 80,159 | |||||||||

________________________________

(1) | Commercial real estate loans with related allowances totaling $12,057 had a recorded investment and unpaid principal balance of $349,823 at December 31, 2016. During the three months ended December 31, 2016, the Company had an average investment in such loans of $352,257 and recorded $7,320 of interest income on the loans. |

The recorded investment in accruing troubled debt restructured loans (“TDRs”) at December 31, 2016 totaled $4.8 million and is included in the impaired loan table above.

Year Ended September 30, 2016 | |||||||||||||||||||

Recorded Investment | Unpaid Principal Balance | Related Allowance (1) | Average Investment in Impaired Loans | Interest Income Recognized | |||||||||||||||

1-4 family residential real estate | $ | 1,042,504 | $ | 1,644,044 | $ | — | $ | 1,108,660 | $ | 10,113 | |||||||||

Commercial real estate | 7,177,709 | 8,814,954 | 47,955 | 7,489,531 | 325,540 | ||||||||||||||

Commercial | 99,751 | 269,707 | — | 131,506 | — | ||||||||||||||

Real estate construction | — | — | — | — | — | ||||||||||||||

Total impaired loans | $ | 8,319,964 | $ | 10,728,705 | $ | 47,955 | $ | 8,729,697 | $ | 335,653 | |||||||||

________________________________

(1) | Commercial real estate loans with related allowances totaling $47,955 had a recorded investment and unpaid principal balance of $120,174 at September 30, 2016. During the year ended September 30, 2016, the Company had an average investment in such loans of $97,131 and recorded $3,931 of interest income on the loans. |

The recorded investment in accruing TDRs at September 30, 2016 totaled $6.0 million and is included in the impaired loan table above.

Loans are classified as restructured by the Company when certain modifications are made to the loan terms and concessions are granted to the borrowers due to financial difficulty experienced by those borrowers. The Company only restructures loans for borrowers in financial difficulty that have presented a viable business plan to fully pay off all obligations, including outstanding debt, interest, and fees, either by generating additional income from the business or through liquidation of assets. Generally, these loans are restructured to provide the borrower additional time to execute upon their plans. The concessions granted on TDRs generally include terms to reduce the interest rate or extend the term of the debt obligation.

Loans on nonaccrual status at the date of modification are initially classified as nonaccrual TDRs. Loans on accruing status at the date of concession are initially classified as accruing TDRs if the loan is reasonably assured of repayment and performance is expected in accordance with its modified terms. Such loans may be designated as nonaccrual loans subsequent to the concession date if reasonable doubt exists as to the collection of interest or principal under the restructuring agreement. TDRs are returned to accruing status when there is economic substance to the restructuring, there is documented credit evaluation of the borrower’s financial condition, the remaining balance is reasonably assured of repayment in accordance with its modified terms, and the borrower has demonstrated sustained repayment performance in accordance with the modified terms for a reasonable period of time (generally a minimum of six months).

16

For the three month period ended December 31, 2016, the following table presents a breakdown of the types of concessions determined to be TDRs during the period by loan class. There were no new TDRs in the three month period ended December 31, 2015.

Accruing Loans | Nonaccrual Loans | ||||||||||||||||||

Three Months Ended December 31, 2016 | Three Months Ended December 31, 2016 | ||||||||||||||||||

Number of Loans | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Number of Loans | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | ||||||||||||||

Payment structure modification: | |||||||||||||||||||

1-4 family residential real estate | 3 | $ | 250,146 | $ | 250,146 | — | $ | — | $ | — | |||||||||

Consumer and other | — | — | — | 1 | 32,138 | 32,138 | |||||||||||||

Total | 3 | $ | 250,146 | $ | 250,146 | 1 | $ | 32,138 | $ | 32,138 | |||||||||

At December 31, 2016, restructured loans with a modified balance of $4.8 million were accruing and $191,983 were nonaccruing, while restructured loans with a modified balance of $7.3 million were accruing and $317,280 were nonaccruing at December 31, 2015. As of December 31, 2016, there was one loan in the amount of $271,107 that was restructured within the past twelve months and subsequently defaulted. There was one loan in the amount of $108,861 that defaulted within twelve months of its restructure at December 31, 2015.

Acquired Impaired Loans. The following table documents changes in the accretable discount on acquired credit impaired loans during the three months ended December 31, 2016 and the year ended September 30, 2016:

Three Months Ended December 31, 2016 | Year Ended September 30, 2016 | ||||||

Balance, beginning of period | $ | 462,071 | $ | 3,391,288 | |||

Loan accretion | (192,260 | ) | (2,929,217 | ) | |||

Balance, end of period | $ | 269,811 | $ | 462,071 | |||

The following table presents the outstanding balances and related carrying amounts for all purchase credit impaired loans at the periods ended December 31, 2016 and September 30, 2016:

December 31, 2016 | September 30, 2016 | ||||||

Unpaid principal balance | $ | 21,446,493 | $ | 22,666,947 | |||

Carrying amount | 19,905,484 | 21,118,977 | |||||

Acquired Performing Loans. Included within total loans are acquired performing loans shown net of fair value discounts in the amount of $252.0 million and $286.1 million at December 31, 2016 and September 30, 2016, respectively. These fair value discounts are being amortized over the remaining lives of the respective loans and totaled $2.1 million and $2.6 million at December 31, 2016 and September 30, 2016, respectively.

Credit Quality Indicators. As part of the ongoing monitoring of the credit quality of the Company’s loan portfolio, management tracks certain credit quality indicators including the level of classified loans, net charge-offs, nonperforming loans (see details above) and the general economic conditions in its market areas.

The Company utilizes a risk rating system to assign a risk grade to each of its loans. Loans are graded on a scale of 1 to 8. The risk grade for each individual loan is determined by the loan officer and other approving officers at the time of loan origination and is adjusted from time to time to reflect an ongoing assessment of loan risk. Risk grades are reviewed quarterly for all substandard, nonaccrual and TDR loans, and annually as part of the Company's internal loan review process. In addition, individual loan risk grades are reviewed in connection with all renewals, extensions and modifications.

17

The following table presents the risk grades of the loan portfolio, segregated by class of loans:

December 31, 2016

1-4 family residential real estate | Commercial real estate | Commercial | Real estate construction | Consumer and other | Total | ||||||||||||||||||

Pass (1-4) | $ | 218,400,914 | $ | 558,011,779 | $ | 72,571,814 | $ | 77,945,089 | $ | 31,117,607 | $ | 958,047,203 | |||||||||||

Special Mention (5) | 1,339,720 | 13,267,632 | 71,330 | 76,668 | — | 14,755,350 | |||||||||||||||||

Substandard (6) | 3,868,248 | 23,927,864 | 538,625 | 1,114,251 | 94,665 | 29,543,653 | |||||||||||||||||

Doubtful (7) | — | — | — | — | — | — | |||||||||||||||||

Loss (8) | — | — | — | — | — | — | |||||||||||||||||

Total loans | $ | 223,608,882 | $ | 595,207,275 | $ | 73,181,769 | $ | 79,136,008 | $ | 31,212,272 | $ | 1,002,346,206 | |||||||||||

September 30, 2016

1-4 family residential real estate | Commercial real estate | Commercial | Real estate construction | Consumer and other | Total | ||||||||||||||||||

Pass (1-4) | $ | 231,606,989 | $ | 552,056,562 | $ | 71,053,118 | $ | 79,347,882 | $ | 21,171,121 | $ | 955,235,672 | |||||||||||

Special Mention (5) | 1,314,543 | 11,699,353 | 73,878 | 38,159 | — | 13,125,933 | |||||||||||||||||

Substandard (6) | 4,018,023 | 31,401,353 | 738,085 | 1,114,280 | 69,391 | 37,341,132 | |||||||||||||||||

Doubtful (7) | — | — | — | — | — | — | |||||||||||||||||

Loss (8) | — | — | — | — | — | — | |||||||||||||||||

Total loans | $ | 236,939,555 | $ | 595,157,268 | $ | 71,865,081 | $ | 80,500,321 | $ | 21,240,512 | $ | 1,005,702,737 | |||||||||||

Allowance for Loan Losses. The allowance for loan losses is established through a provision for loan losses charged to expense and is an amount that management believes will be adequate to absorb losses on existing loans that become uncollectible, based on evaluations of the collectability of loans. The evaluations take into consideration such factors as changes in the nature and volume of the loan portfolio, historical loss rates, overall portfolio quality, review of specific problem loans, and current economic conditions and trends that may affect a borrower’s ability to repay. Loans are charged against the allowance for loan losses when management believes that the collectability of the principal is unlikely. Subsequent recoveries are added to the allowance.

Management’s allowance for loan losses methodology is a loan classification-based system. Management bases the required reserve on a percentage of the loan balance for each type of loan and classification level. Loans may be classified manually and are automatically classified if they are not previously classified when they reach certain levels of delinquency. Unclassified loans are reserved at different percentages based on the loan loss history of the last seven years. Reserve percentages are also adjusted based upon our estimate of the effect that the current economic environment will have on each type of loan.

Management segments its allowance for loan losses into the following four major categories: (1) specific reserves; (2) general allowances for Classified/Watch loans; (3) general allowances for loans with satisfactory ratings; and (4) an unallocated amount. Risk ratings are initially assigned in accordance with CharterBank’s loan and collection policy. An organizationally independent department reviews risk grade assignments on an ongoing basis. Management reviews current information and events regarding a borrowers’ financial condition and strengths, cash flows available for debt repayment, the related collateral supporting the loan and the effects of known and expected economic conditions. When the evaluation reflects a greater than normal risk associated with the individual loan, management classifies the loan accordingly. If the loan is determined to be impaired, management allocates a portion of the allowance for loan losses for that loan based on the fair value of the collateral, if the loan is considered collateral-dependent, as the measure for the amount of the impairment. Impaired and Classified/Watch loans are aggressively monitored.

The allowances for loans by credit grade are further subdivided by loan type. Charter Financial has developed specific quantitative allowance factors to apply to each loan which considers loan charge-off experience over the most recent seven years by loan type. In addition, loss estimates are applied for certain qualitative allowance factors that are subjective in nature and require considerable judgment on the part of management. Such qualitative factors include economic and business conditions, the volume of past due loans, changes in the value of collateral of collateral-dependent loans, and other economic uncertainties. An unallocated component of the allowance is also established for potential losses that exist in the remainder of the portfolio, but have yet to be identified.

The Company incorporates certain refinements and improvements to its allowance for loan losses methodology from time to time. During the current quarter and the prior fiscal year, the Company made minor refinements to the qualitative risk factors but no

18

significant changes to its allowance methodology. The adjustments in the Company's methodology were not material to the overall allowance or provision for the three months ended December 31, 2016 or for the fiscal year ended September 30, 2016.

An unallocated allowance is generally maintained in a range of 4% to 12% of the total allowance in recognition of the imprecision of the estimates and other factors. In times of greater economic downturn and uncertainty, the higher end of this range is provided.

The Company recorded net recoveries of $878,000 during the three months ended December 31, 2016. With asset quality remaining strong, and the continued trend of net recoveries, the Company recorded a negative provision of $750,000 in order to limit the reserve build to $128,000 during the three months ended December 31, 2016. A negative provision of $250,000 was recorded during the fiscal year ended September 30, 2016, while no negative provision was recorded during the three months ended December 31, 2015.

The following tables are a summary of transactions in the allowance for loan losses by portfolio segment for the three months ended December 31, 2016 and the fiscal year ended September 30, 2016:

Three Months Ended December 31, 2016 | |||||||||||||||||||||||||||

1-4 family real estate | Commercial real estate | Commercial | Real estate construction | Consumer and other | Unallocated | Total | |||||||||||||||||||||

Allowance for loan losses: | |||||||||||||||||||||||||||

Beginning balance | $ | 779,288 | $ | 7,346,130 | $ | 600,258 | $ | 516,556 | $ | 79,140 | $ | 1,050,044 | $ | 10,371,416 | |||||||||||||

Charge-offs | — | (49,097 | ) | — | — | (946 | ) | — | (50,043 | ) | |||||||||||||||||

Recoveries | 111,914 | 669,083 | 130,795 | — | 16,063 | — | 927,855 | ||||||||||||||||||||

Provision | (118,142 | ) | (866,210 | ) | 38,612 | 153,948 | 64,220 | (22,428 | ) | (750,000 | ) | ||||||||||||||||

Ending balance | $ | 773,060 | $ | 7,099,906 | $ | 769,665 | $ | 670,504 | $ | 158,477 | $ | 1,027,616 | $ | 10,499,228 | |||||||||||||

Amounts allocated to: | |||||||||||||||||||||||||||

Individually evaluated for impairment | $ | — | $ | 12,057 | $ | — | $ | — | $ | 27,000 | $ | — | $ | 39,057 | |||||||||||||

Other loans not individually evaluated | 773,060 | 7,087,849 | 769,665 | 670,504 | 131,477 | 1,027,616 | 10,460,171 | ||||||||||||||||||||

Ending balance | $ | 773,060 | $ | 7,099,906 | $ | 769,665 | $ | 670,504 | $ | 158,477 | $ | 1,027,616 | $ | 10,499,228 | |||||||||||||

Loans: | |||||||||||||||||||||||||||

Amounts collectively evaluated for impairment | $ | 219,565,872 | $ | 576,437,169 | $ | 69,266,470 | $ | 79,136,008 | $ | 31,180,839 | $ | 975,586,358 | |||||||||||||||

Amounts individually evaluated for impairment | 1,510,990 | 5,229,472 | 82,469 | — | 31,433 | 6,854,364 | |||||||||||||||||||||

Amounts related to loans acquired with deteriorated credit quality | 2,532,020 | 13,540,634 | 3,832,830 | — | — | 19,905,484 | |||||||||||||||||||||

Ending balance | $ | 223,608,882 | $ | 595,207,275 | $ | 73,181,769 | $ | 79,136,008 | $ | 31,212,272 | $ | 1,002,346,206 | |||||||||||||||

19

Year Ended September 30, 2016 | |||||||||||||||||||||||||||

1-4 family real estate | Commercial real estate | Commercial | Real estate construction | Consumer and other | Unallocated | Total | |||||||||||||||||||||

Allowance for loan losses: | |||||||||||||||||||||||||||

Beginning balance | $ | 708,671 | $ | 7,787,165 | $ | 473,342 | $ | 503,112 | $ | 16,222 | $ | — | $ | 9,488,512 | |||||||||||||

Charge-offs | (53,620 | ) | (135,983 | ) | (25,993 | ) | — | (11,529 | ) | — | (227,125 | ) | |||||||||||||||

Recoveries | 98,541 | 441,118 | 793,191 | 5,000 | 22,179 | — | 1,360,029 | ||||||||||||||||||||

Provision (1) | 25,696 | (746,170 | ) | (640,282 | ) | 8,444 | 52,268 | 1,050,044 | (250,000 | ) | |||||||||||||||||

Ending balance | $ | 779,288 | $ | 7,346,130 | $ | 600,258 | $ | 516,556 | $ | 79,140 | $ | 1,050,044 | $ | 10,371,416 | |||||||||||||

Amounts allocated to: | |||||||||||||||||||||||||||

Individually evaluated for impairment | $ | — | $ | 47,955 | $ | — | $ | — | $ | — | $ | — | $ | 47,955 | |||||||||||||

Other loans not individually evaluated | 779,288 | 7,298,175 | 600,258 | 516,556 | 79,140 | 1,050,044 | 10,323,461 | ||||||||||||||||||||

Ending balance | $ | 779,288 | $ | 7,346,130 | $ | 600,258 | $ | 516,556 | $ | 79,140 | $ | 1,050,044 | $ | 10,371,416 | |||||||||||||

Loans: | |||||||||||||||||||||||||||

Amounts collectively evaluated for impairment | $ | 232,761,343 | $ | 573,936,063 | $ | 67,825,557 | $ | 80,500,321 | $ | 21,240,512 | $ | 976,263,796 | |||||||||||||||

Amounts individually evaluated for impairment | 1,042,504 | 7,177,709 | 99,751 | — | — | 8,319,964 | |||||||||||||||||||||

Amounts related to loans acquired with deteriorated credit quality | 3,135,708 | 14,043,496 | 3,939,773 | — | — | 21,118,977 | |||||||||||||||||||||

Ending balance | $ | 236,939,555 | $ | 595,157,268 | $ | 71,865,081 | $ | 80,500,321 | $ | 21,240,512 | $ | 1,005,702,737 | |||||||||||||||

Included within the above loan amounts are acquired loans, both performing and purchased credit impaired, which are shown net of fair value discounts. The total acquired net loan amounts reflected in the above tables were $271.6 million and $306.8 million at December 31, 2016 and September 30, 2016, respectively. The total remaining fair value discounts related to the acquired loans totaled $2.4 million and $3.1 million at December 31, 2016 and September 30, 2016, respectively.

Note 7: Income Per Share

Basic net income per share for the three months ended December 31, 2016 and 2015 was computed by dividing net income to common shareholders by the weighted average number of shares of common stock outstanding, which consists of issued shares less unallocated employee stock ownership plan (“ESOP”) shares and unvested restricted shares.

Diluted net income per share for the three months ended December 31, 2016 and 2015 was computed by dividing net income by weighted average shares outstanding plus potential common shares resulting from dilutive stock options and unvested restricted shares, determined using the treasury stock method.

Three Months Ended December 31, | |||||||

2016 | 2015 | ||||||

Numerator: | |||||||

Net income | $ | 5,045,667 | $ | 4,614,278 | |||

Denominator: | |||||||

Weighted average common shares outstanding | 14,207,468 | 14,885,529 | |||||

Common stock equivalents | 857,411 | 659,687 | |||||

Diluted shares | 15,064,879 | 15,545,216 | |||||

Net income per share: | |||||||

Basic | $ | 0.36 | $ | 0.31 | |||

Diluted | $ | 0.33 | $ | 0.30 | |||

20

For the three months ended December 31, 2016 and 2015 there were 663,418 and 405,679, respectively, of dilutive stock options. Additionally, for the three months ended December 31, 2016 and 2015, there were 193,993 and 254,008 shares, respectively, of dilutive unvested restricted stock. There were no shares which were subject to options issued with exercise prices in excess of the average market value per share during the periods ended December 31, 2016 and 2015.

Note 8: Real Estate Owned

The following is a summary of transactions in real estate owned:

Three Months Ended December 31, 2016 | Year Ended September 30, 2016 | ||||||

Balance, beginning of period | $ | 2,706,461 | $ | 3,410,538 | |||

Real estate acquired through foreclosure of loans receivable | 437,812 | 1,757,886 | |||||

Real estate purchased in acquisition | — | 454,900 | |||||

Donation of other real estate owned | — | (21,500 | ) | ||||

Proceeds from real estate sold | (1,427,624 | ) | (3,631,676 | ) | |||

Provision for losses on real estate owned recognized in noninterest expense | — | (163,741 | ) | ||||

Gain on sale of real estate owned recognized in noninterest expense | 444,045 | 900,054 | |||||

Balance, end of period | $ | 2,160,694 | $ | 2,706,461 | |||

Included in the tables above is approximately $501,000 and $618,000 of foreclosed residential real estate property at December 31, 2016 and September 30, 2016, respectively. The Company had no consumer mortgage loans collateralized by residential real estate in the process of foreclosure at December 31, 2016, while $536,000 in consumer mortgage loans collateralized by residential real estate were in the process of foreclosure at September 30, 2016.

Note 9: Employee Benefits

The Company has a 2002 stock option plan which allows for stock option awards of the Company’s common stock to eligible directors and key employees of the Company. The option price is determined by a committee of the board of directors at the time of the grant and may not be less than 100% of the market value of the common stock on the date of the grant. For options granted under the 2002 stock option plan, when granted, the options vest over periods of up to four or five years from grant date or upon death, disability, or qualified retirement. All options must be exercised within a 10-year period from grant date. The Company may grant either incentive stock options, which qualify for special federal income tax treatment, or non-qualified stock options, which do not receive such tax treatment. The Company’s stockholders have authorized 882,876 shares for the plan, of which 111,184 have been issued or retired upon the exercise of the option granted under the plan, 613,288 are granted and outstanding and no shares are available to be granted at December 31, 2016 within this plan. All share and share amounts related to employee benefits have been updated to reflect the completion of the second-step conversion on April 8, 2013 at a conversion ratio of 1.2471. As of December 31, 2016, 587,605 shares have vested under this plan. During the three months ended December 31, 2016, 11,224 options from this plan vested.

In addition to the plan above, on December 19, 2013, the Company's stockholders approved the 2013 Equity Incentive Plan, which allows for stock option awards of the Company’s common stock to eligible directors and key employees of the Company. The option price is determined by a committee of the board of directors at the time of the grant and may not be less than 100% of the market value of the common stock on the date of the grant. When granted, the options vest from one year to five years from grant date or upon death or disability. All options must be exercised within a 10-year period from the grant date. The Company may grant either incentive stock options, which qualify for special federal income tax treatment, or non-qualified stock options, which do not receive such tax treatment. The Company’s stockholders have authorized 1,428,943 shares for the plan, of which 1,080,680 were granted and outstanding as of December 31, 2016, with the remaining 348,263 shares available to be granted at December 31, 2016. During the three months ended December 31, 2016, 194,335 options from this plan vested. As of December 31, 2016, 583,005 shares have vested under this plan.

21

The following table summarizes activity for shares under option and weighted average exercise price per share:

Shares | Weighted average exercise price/share | Weighted average remaining life (years) | ||||||

Options outstanding – September 30, 2016 | 1,693,968 | $ | 10.14 | 6 | ||||

Options exercised | — | — | 0 | |||||

Options forfeited | — | — | 0 | |||||

Options granted | — | — | 0 | |||||

Options outstanding – December 31, 2016 | 1,693,968 | $ | 10.14 | 6 | ||||

Options exercisable – December 31, 2016 | 1,140,667 | $ | 9.70 | 5 | ||||

The stock price at December 31, 2016 was greater than the exercise prices on 1,693,968 options outstanding and therefore had an intrinsic value of $11,059,177. The total intrinsic value of all 1,140,667 shares exercisable at December 31, 2016 was $7,954,097.

Stock option expense was $84,835 and $80,578 for the three months ended December 31, 2016 and 2015, respectively. The following table summarizes information about the options outstanding at December 31, 2016:

Number of options outstanding at December 31, 2016 | Remaining contractual life in years | Exercise price per share | |||||||||||||

354,515 | 2 | $ | 8.82 | ||||||||||||

174,594 | 4 | $ | 8.18 | ||||||||||||

66,720 | 4 | $ | 7.22 | ||||||||||||

12,471 | 5 | $ | 7.34 | ||||||||||||

4,988 | 5 | $ | 7.79 | ||||||||||||

971,680 | 7 | $ | 10.89 | ||||||||||||

30,000 | 9 | $ | 12.66 | ||||||||||||

3,000 | 9 | $ | 13.16 | ||||||||||||

73,000 | 9 | $ | 13.31 | ||||||||||||

3,000 | 10 | $ | 13.30 | ||||||||||||

1,693,968 | |||||||||||||||

In addition to the above, the Company implemented the Charter Financial Corporation 2013 Equity Incentive Plan as described above, which has 571,577 shares authorized, and during the year ended September 30, 2014, the Company granted 360,092 shares of restricted stock to key employees and directors. During the three months ended December 31, 2016, 72,015 shares vested. The remaining 211,485 shares are available to be granted at December 31, 2016.

Shares | Weighted average grant date fair value per award | |||||

Unvested restricted stock awards - September 30, 2016 | 216,062 | $ | 10.89 | |||

Granted | — | — | ||||

Vested | 72,015 | 10.89 | ||||

Canceled or expired | — | — | ||||

Unvested restricted stock awards – December 31, 2016 | 144,047 | $ | 10.89 | |||

Grants subsequent to December 1, 2013 will be expensed to the scheduled vesting.

Note 10: Commitments and Contingent Liabilities