Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GENERAL DYNAMICS CORP | d522115d8k.htm |

General Dynamics To Acquire CSRA February 12, 2018 Exhibit 99.1

Caution Regarding Forward-Looking Statements Certain statements made in this presentation, including any statements as to future results of operations and financial projections, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company’s filings with the Securities and Exchange Commission, including, without limitation, our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to any forward-looking statements to reflect events, circumstances or changes in expectations after the date of this presentation. Notice to Investors The tender offer described in this presentation has not yet commenced. This presentation is not a recommendation, an offer to purchase or a solicitation of an offer to sell shares of CSRA stock. At the time the tender offer is commenced, Red Hawk Enterprises Corp., a wholly owned subsidiary of the company (“Merger Sub”), will file a tender offer statement and related exhibits with the SEC and CSRA will file a solicitation/recommendation statement with respect to the tender offer. Investors and stockholders of CSRA are strongly advised to read the tender offer statement (including the related exhibits) and the solicitation/recommendation statement, as they may be amended from time to time, when they become available, because they will contain important information that stockholders should consider before making any decision regarding tendering their shares. The tender offer statement (including the related exhibits) and the solicitation/recommendation statement will be available at no charge on the SEC's website at www.sec.gov. In addition, the tender offer statement and other documents that Merger Sub files with the SEC will be made available to all stockholders of CSRA free of charge at www.gd.com. The solicitation/recommendation statement and the other documents filed by CSRA with the SEC will be made available to all stockholders of CSRA free of charge at www.csra.com. Additional Information about the Merger and Where to Find It In connection with the potential one-step merger of Merger Sub with and into CSRA without the prior consummation of the Offer (the “One Step Merger”), CSRA will file a proxy statement with the SEC. Additionally, CSRA will file other relevant materials with the SEC in connection with the proposed acquisition of CSRA by General Dynamics and Merger Sub pursuant to the terms of the Merger Agreement. Investors and stockholders of CSRA are strongly advised to read the proxy statement and the other relevant materials, as they may be amended from time to time, when they become available, because they will contain important information about the One Step Merger and the parties to the One Step Merger, before making any voting or investment decision with respect to the One Step Merger. The proxy statement will be available at no charge on the SEC’s web site at www.sec.gov. The proxy statement and other documents filed by CSRA with the SEC will be made available to all stockholders of CSRA free of charge at www.csra.com. CSRA and its directors and officers may be deemed to be participants in the solicitation of proxies from CSRA’s stockholders with respect to the One Step Merger. Information about CSRA’s directors and executive officers and their ownership of CSRA’s common stock is set forth in the proxy statement for CSRA’s 2017 Annual Meeting of Stockholders, which was filed with the SEC on June 27, 2017. CSRA stockholders may obtain additional information regarding the interests of CSRA and its directors and executive officers in the Merger, which may be different than those of CSRA stockholders generally, by reading the proxy statement and other relevant documents regarding the One Step Merger, when filed with the SEC. Forward-Looking Statements; Notice to Investors

CSRA + GDIT = Compelling Combination Creates a premier provider of IT services and solutions Complementary portfolios and capabilities Combined CSRA/GDIT to become new GD financial reporting segment Cash tender offer structure; close expected 1st half 2018 Significant long-term value creation for GD shareholders

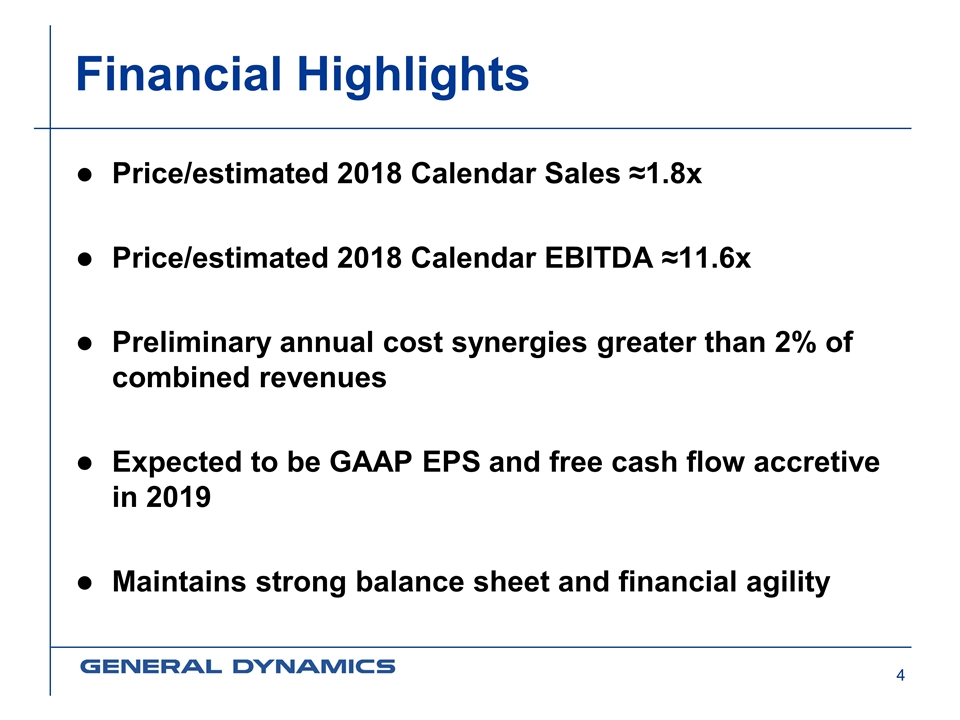

Financial Highlights Price/estimated 2018 Calendar Sales ≈1.8x Price/estimated 2018 Calendar EBITDA ≈11.6x Preliminary annual cost synergies greater than 2% of combined revenues Expected to be GAAP EPS and free cash flow accretive in 2019 Maintains strong balance sheet and financial agility

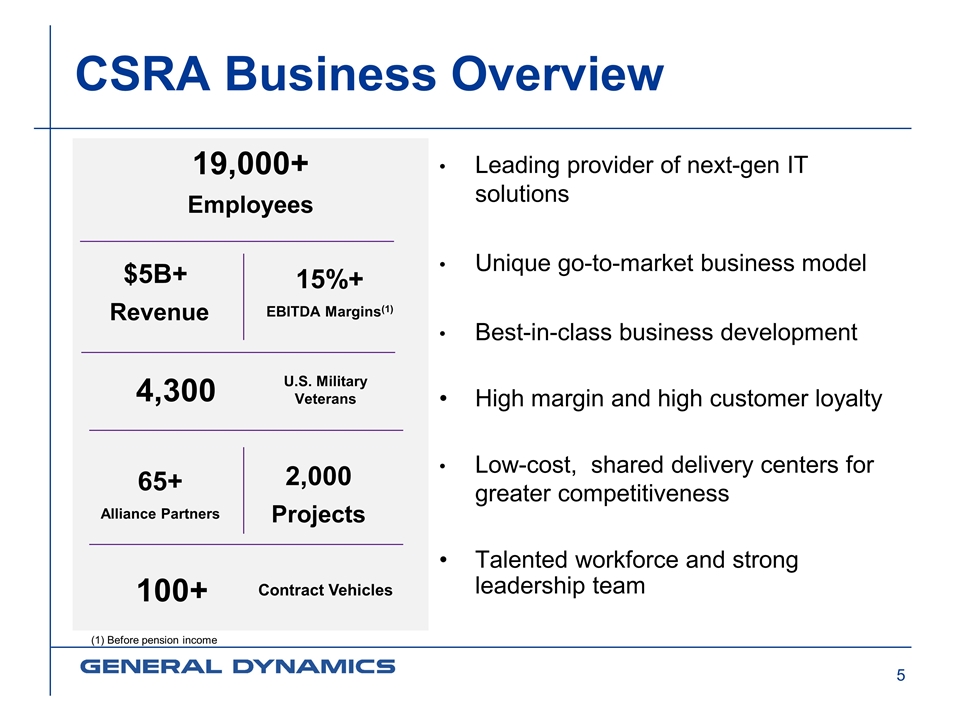

(1) Before pension income Leading provider of next-gen IT solutions Unique go-to-market business model Best-in-class business development High margin and high customer loyalty Low-cost, shared delivery centers for greater competitiveness Talented workforce and strong leadership team CSRA Business Overview 19,000+ Employees $5B+ Revenue 15%+ EBITDA Margins(1) 4,300 U.S. Military Veterans 65+ Alliance Partners 2,000 Projects 100+ Contract Vehicles

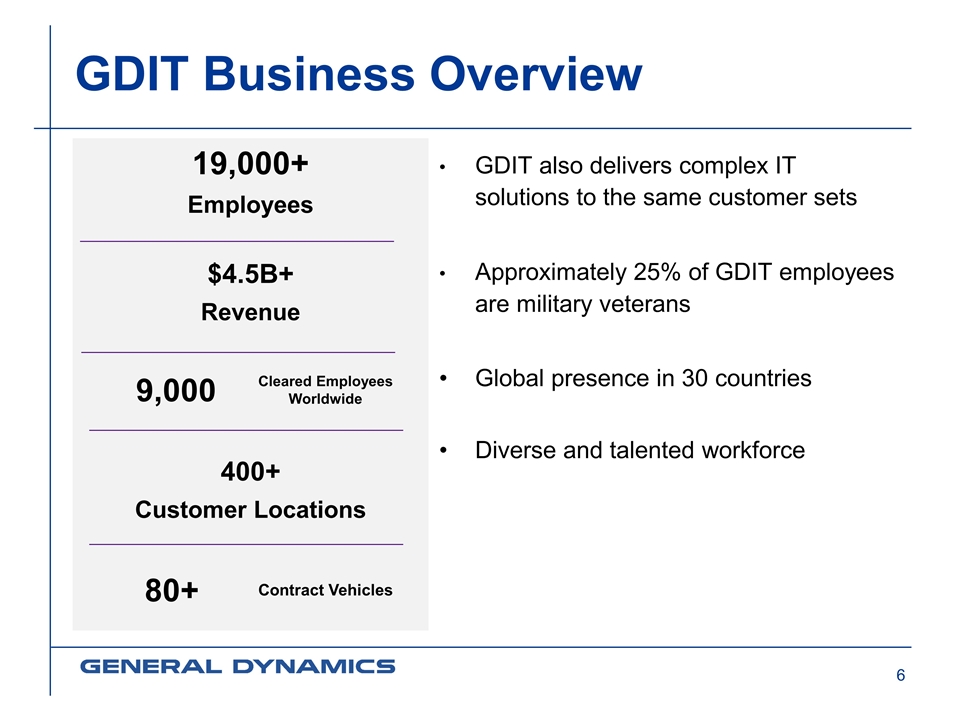

GDIT also delivers complex IT solutions to the same customer sets Approximately 25% of GDIT employees are military veterans Global presence in 30 countries Diverse and talented workforce 19,000+ Employees $4.5B+ Revenue 9,000 Cleared Employees Worldwide 80+ Contract Vehicles GDIT Business Overview 400+ Customer Locations

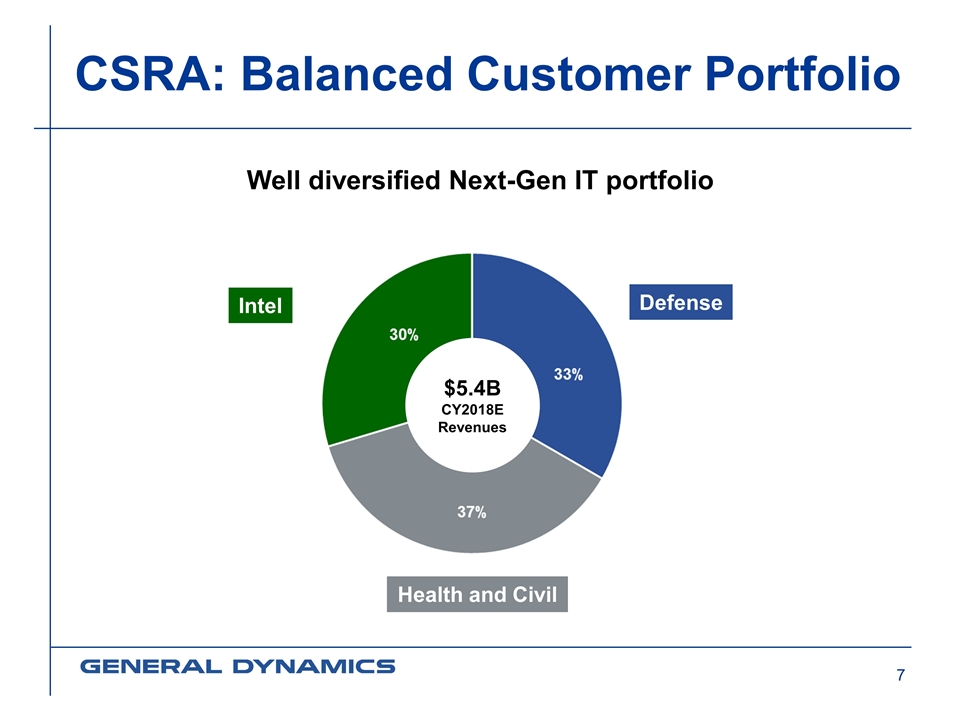

$5.4B CY2018E Revenues Defense Intel Health and Civil Well diversified Next-Gen IT portfolio CSRA: Balanced Customer Portfolio

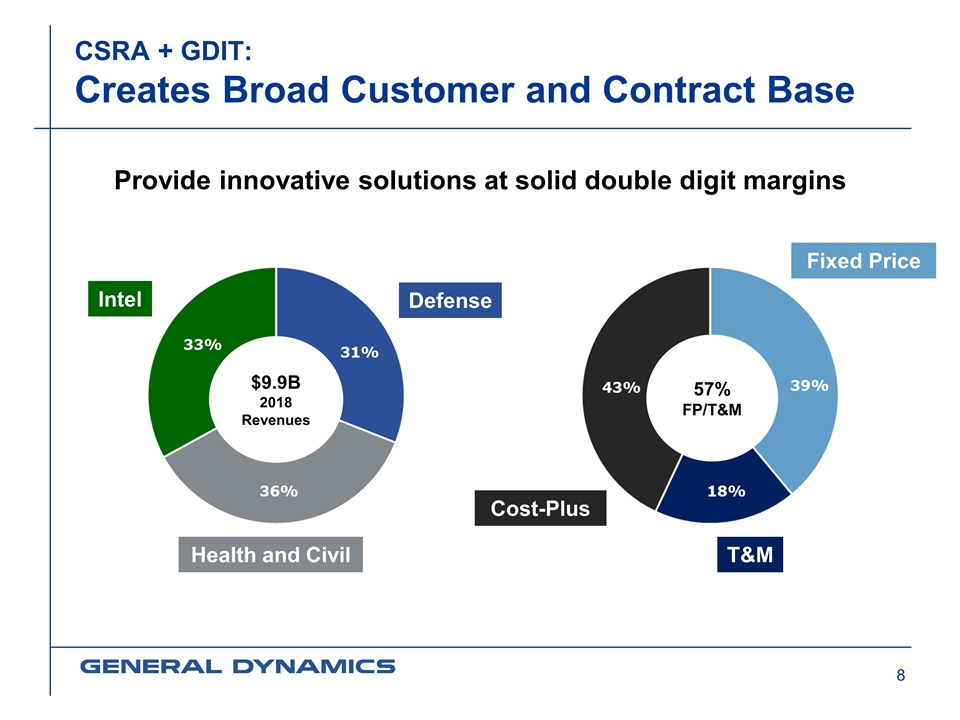

[ ]% [ ]% [ ]% $9.9B 2018 Revenues Defense Health and Civil Intel 57% FP/T&M Fixed Price Cost-Plus T&M CSRA + GDIT: Creates Broad Customer and Contract Base Provide innovative solutions at solid double digit margins

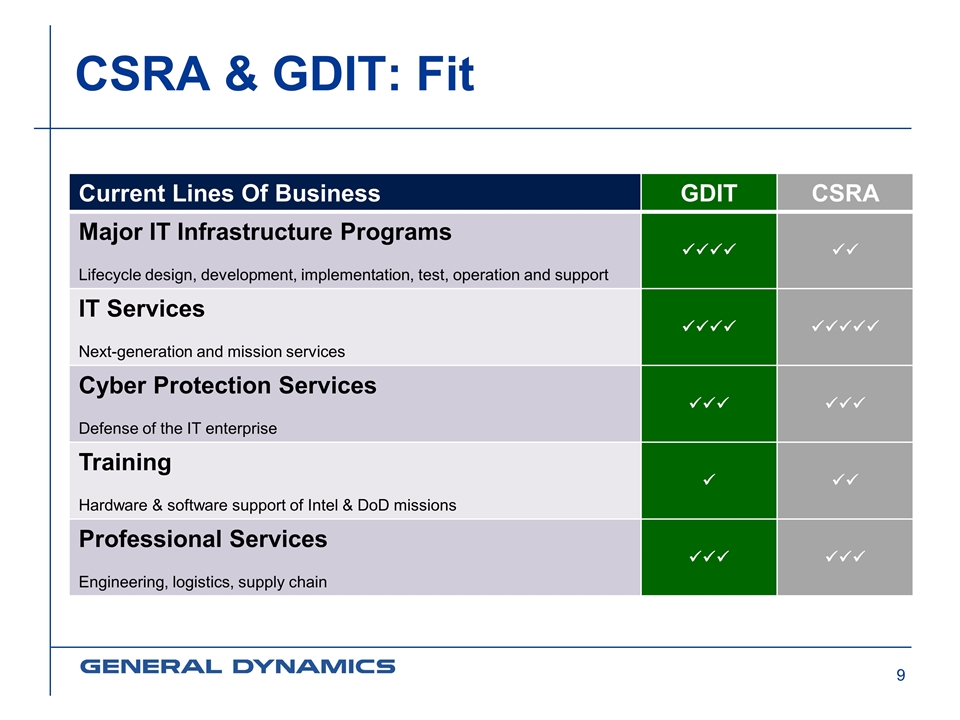

Current Lines Of Business GDIT CSRA Major IT Infrastructure Programs Lifecycle design, development, implementation, test, operation and support üüüü üü IT Services Next-generation and mission services üüüü üüüüü Cyber Protection Services Defense of the IT enterprise üüü üüü Training Hardware & software support of Intel & DoD missions ü üü Professional Services Engineering, logistics, supply chain üüü üüü CSRA & GDIT: Fit

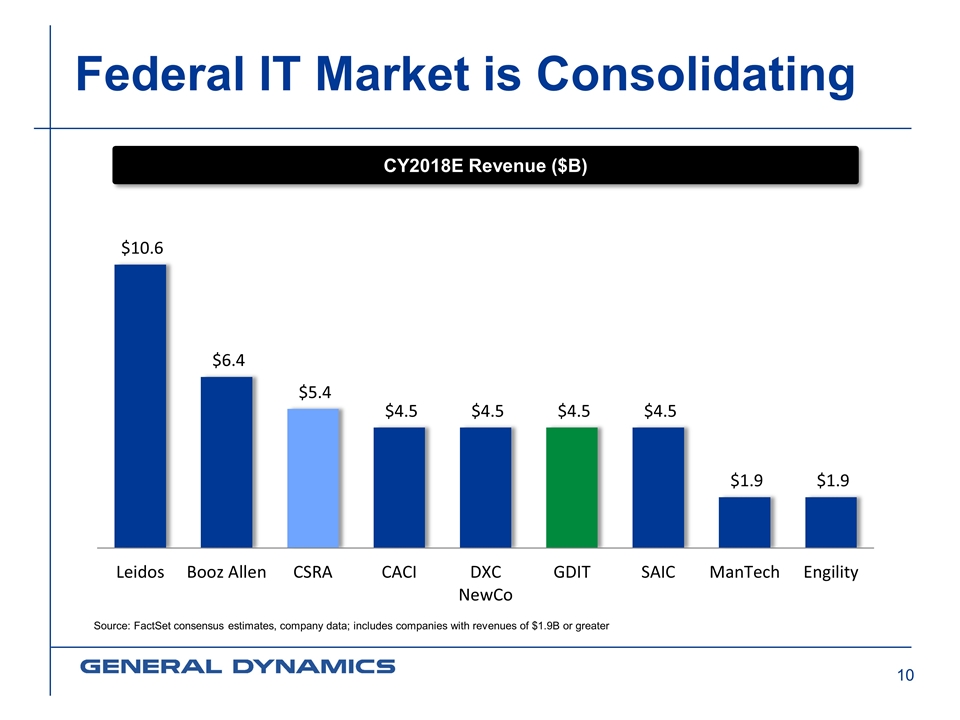

CY2018E Revenue ($B) Source: FactSet consensus estimates, company data; includes companies with revenues of $1.9B or greater Federal IT Market is Consolidating

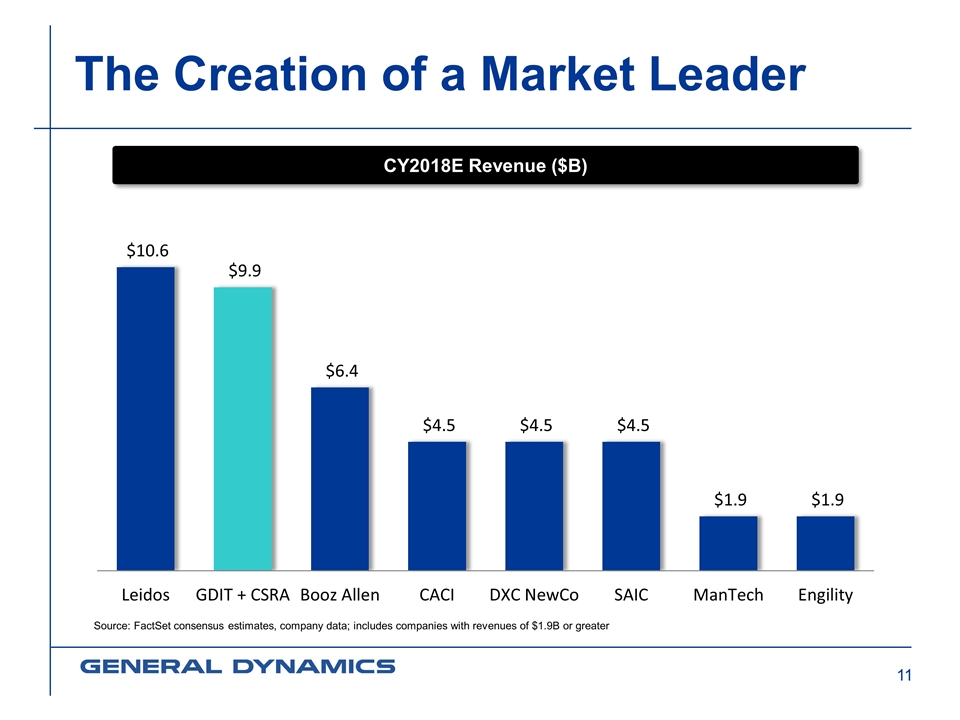

CY2018E Revenue ($B) Source: FactSet consensus estimates, company data; includes companies with revenues of $1.9B or greater The Creation of a Market Leader

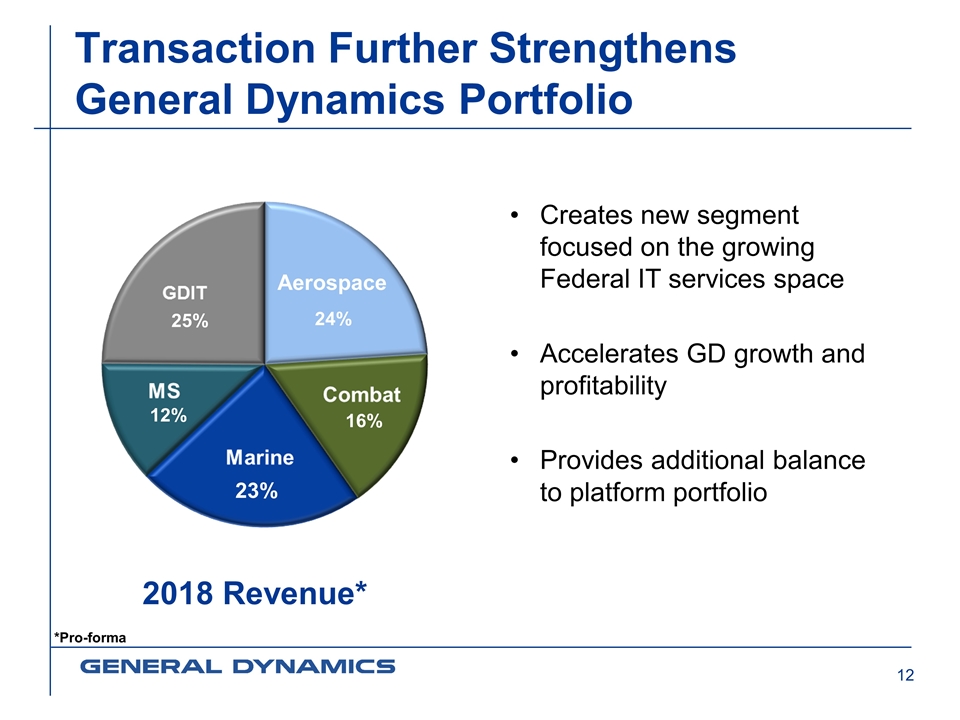

Creates new segment focused on the growing Federal IT services space Accelerates GD growth and profitability Provides additional balance to platform portfolio 24% 16% 23% 12% 25% Aerospace 2018 Revenue* 25% 24% 23% 12% 16% *Pro-forma Transaction Further Strengthens General Dynamics Portfolio

CSRA + GDIT = Compelling Combination