Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - OCLARO, INC. | q2-18exhibit991.htm |

| 8-K - 8-K Q218 EPR - OCLARO, INC. | oclrform8-kq2x18epr.htm |

Q2 FY 2018 Investor Call

Greg Dougherty

Chief Executive Officer

February 5, 2018

Pete Mangan

Chief Financial Officer

© 2018 Oclaro, Inc.

Safe Harbor Statement

This presentation, in association with Oclaro’s second quarter of fiscal year 2018 financial results conference call, contains statements about

management’s future expectations regarding the plans or prospects of Oclaro and its business, and together with the assumptions underlying

these statements, constitute forward-looking statements for the purposes of the safe harbor provisions of The Private Securities Litigation

Reform Act of 1995. Investors should not unduly rely on such forward-looking statements. These forward-looking statements include

statements concerning (i) financial guidance for the fiscal quarter ending March 31, 2018 regarding revenues, non-GAAP gross margin, and

non-GAAP operating income, (ii) customer demand for Oclaro’s products, (iii) Oclaro’s future financial performance and operating

prospects and (iv) the statements in our CEO’s quote. Such statements can be identified by the fact that they do not relate strictly to

historical or current facts and may contain words such as “anticipate,” “estimate,” “expect,” “forecast,” “project,” “intend,” “plan,”

“believe,” “will,” “should,” “outlook,” “could,” “target,” “model,” "objective," and other words and terms of similar meaning in connection

with any discussion of future operations or financial performance. There are a number of important factors that could cause our actual

results or events to differ materially from those indicated by such forward-looking statements, including (i) our dependence on a limited

number of customers for a significant percentage of our revenues, (ii) competition and pricing pressure, (iii) the absence of long-term

purchase commitments from many of our long-term customers, (iv) our ability to effectively manage our inventory, (v) our ability to meet

or exceed our gross margin expectations, (vi) our ability to timely develop, commercialize and ramp the production of new products to

customer required volumes, (vii) the effects of fluctuations in foreign currency exchange rates, (viii) our ability to respond to evolving

technologies, customer requirements and demands, and product design challenges, (ix) potential operating or reporting disruptions that

could result from the implementation of our new enterprise resource planning system, (x) our manufacturing yields, (xi) our ability to

conclude agreements with our customers on favorable terms, (xii) the risks associated with delays, disruptions or quality control problems in

manufacturing, (xiii) fluctuations in our revenues, growth rates and operating results, (xiv) changes in our effective tax rates or outcomes of

tax audits or similar proceedings, (xv) our ability to obtain governmental licenses and approvals for international trading activities or

technology transfers, including export licenses, (xvi) our dependence on a limited number of suppliers and key contract manufacturers,

(xvii) the impact of financial market and general economic conditions in the industries in which we operate and any resulting reduction in

demand for our products, (xviii) our ability to protect our intellectual property rights, (xix) the risks associated with our international

operations, and (xx) other factors described under the caption "Risk Factors" and elsewhere in the documents we periodically file with the

SEC.

© 2018 Oclaro, Inc.

Non-GAAP Financial Results

$ in Millions (except per share amounts) Q217 Q118 Q218

Total Revenues 153.9 155.6 139.3

Gross Profit (non-GAAP) (1) 61.2 63.1 53.6

Gross Margin % 39.8% 40.6% 38.4%

R&D (non-GAAP) 13.2 15.6 14.5

SG&A (non-GAAP) 11.8 13.0 14.6

Non-GAAP Operating Income 36.2 34.6 24.5

Non-GAAP Net Income 36.3 34.5 23.1

Non-GAAP EPS (diluted) 0.21 0.20 0.14

(1) See reconciliation to comparable GAAP numbers in financial tables of press release dated February 5, 2018.

© 2018 Oclaro, Inc.

Revenue By Product Group

$ in Millions Q217 Q317 Q417 Q118 Q218

100G+ Transmission 113.8 125.8 120.6 125.6 105.4

40G & Lower Transmission 40.1 36.4 28.8 30.0 34.0

Total Revenues 153.9 162.2 149.4 155.6 139.3

Percent of Total

100G+ Transmission 74% 78% 81% 81% 76%

40G & Lower Transmission 26% 22% 19% 19% 24%

$ in Millions Q217 Q317 Q417 Q118 Q218

Datacom/Client Side 69.8 75.8 72.6 75.1 64.9

Telecom/Line Side 84.1 86.4 76.8 80.5 74.4

Total Revenues 153.9 162.2 149.4 155.6 139.3

Percent of Total

Datacom/Client Side 45% 47% 49% 48% 47%

Telecom/Line Side 55% 53% 51% 52% 53%

Numbers may not foot due to rounding

© 2018 Oclaro, Inc.

Trended Non-GAAP Financial Results - $M

© 2018 Oclaro, Inc.

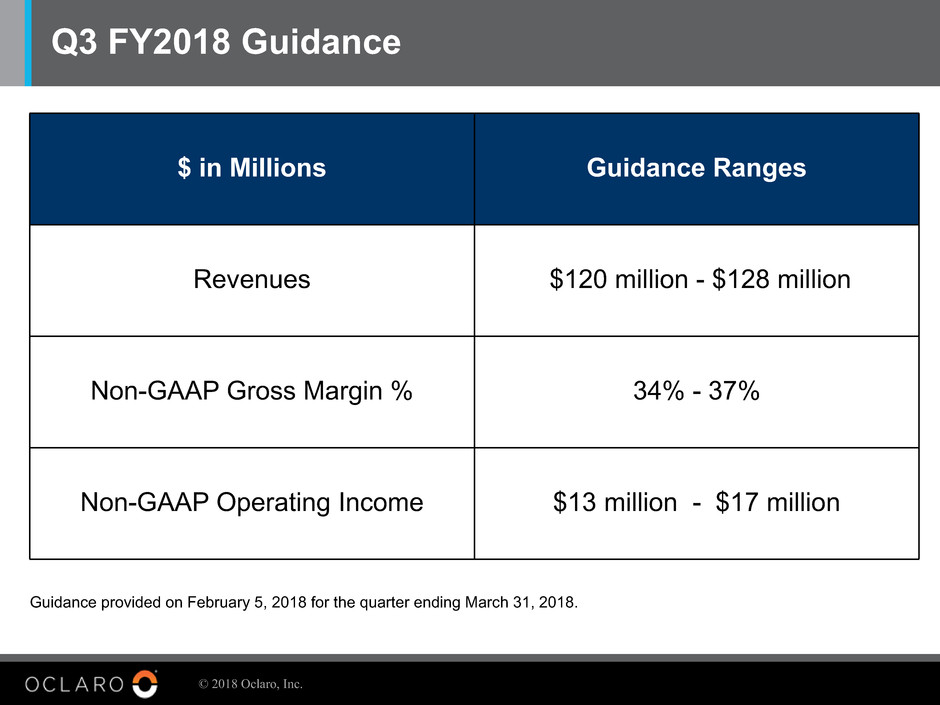

Q3 FY2018 Guidance

$ in Millions Guidance Ranges

Revenues $120 million - $128 million

Non-GAAP Gross Margin % 34% - 37%

Non-GAAP Operating Income $13 million - $17 million

Guidance provided on February 5, 2018 for the quarter ending March 31, 2018.

© 2015 Oclaro, Inc.© 2018 Oclaro, Inc

Thank You

For more information, visit us at www.oclaro.com.

Follow us on @OclaroInc and LinkedIn.