Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - Ameris Bancorp | tv484146_ex99-4.htm |

| EX-99.3 - EXHIBIT 99.3 - Ameris Bancorp | tv484146_ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - Ameris Bancorp | tv484146_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Ameris Bancorp | tv484146_ex99-1.htm |

| EX-2.2 - EXHIBIT 2.2 - Ameris Bancorp | tv484146_ex2-2.htm |

| EX-2.1 - EXHIBIT 2.1 - Ameris Bancorp | tv484146_ex2-1.htm |

| 8-K - FORM 8-K - Ameris Bancorp | tv484146_8k.htm |

Exhibit 99.5

Acquisition of Remainder of US Premium Finance & Acquisition of Hamilton State Bancshares, Inc . January 26, 2018

Forward - Looking Statements 2 This presentation contains “forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995 about Ameris Bancorp (“Ameris”) and Hamilton State Bancshares, Inc. (“Hamilton”). In general, forward - looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the proposed merger transaction between Ameris and Hamilton, the expected returns and other benefits of the proposed merger transaction to shareholders, expected improvement in operating efficiency resulting from the proposed merger transaction, estimated expense reductions resulting from the proposed merger transaction and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the proposed merger transaction on the capital ratios of Ameris. Forward - looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward - looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to the following: the parties’ ability to consummate the proposed merger or satisfy the conditions to the completion of the proposed merger, including, without limitation, the receipt of shareholder approval and the receipt of required regulatory approvals on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed merger; the businesses of Ameris and Hamilton may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the proposed merger may not be fully realized within the expected timeframes; disruption from the proposed merger may make it more difficult to maintain relationships with customers, employees or others; diversion of management time to merger - related issues; dilution caused by Ameris’s issuance of additional shares of its common stock in connection with the proposed merger; general competitive, economic, political and market conditions and fluctuations, including, without limitation, movements in interest rates; competitive pressures on product pricing and services; and success and timing of other business strategies. For a discussion of some of the other risks and other factors that may cause such forward - looking statements to differ materially from actual results, please refer to Ameris’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10 - K for the year ended December 31, 2016 and subsequently filed Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K. Neither Ameris nor Hamilton undertakes any obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. For any forward - looking statements made in this presentation or any related documents, Ameris and Hamilton claim protection of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995.

Additional Information 3 Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving Ameris and Hamilton. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger transaction, Ameris will file with the SEC a registration statement on Form S - 4 that will include a proxy statement/prospectus for the shareholders of Hamilton. Ameris also plans to file other documents with the SEC regarding the proposed merger transaction with Hamilton. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The proxy statement/prospectus, as well as other filings containing information about Ameris and Hamilton, will be available without charge, at the SEC’s website (http://www.sec.gov). Copies of the proxy statement/prospectus and other documents filed with the SEC in connection with the proposed merger transaction can also be obtained, when available, without charge, from Ameris’s website ( http://www.amerisbank.com ). Participants in the Merger Solicitation Ameris and Hamilton, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Hamilton in respect of the proposed merger transaction. Information regarding the directors and executive officers of Ameris and Hamilton and other persons who may be deemed participants in the solicitation of the shareholders of Hamilton in connection with the proposed merger transaction will be included in the proxy statement/prospectus for Hamilton’s special meeting of shareholders, which will be filed by Ameris with the SEC. Information about Ameris’s directors and executive officers can also be found in Ameris’s definitive proxy statement in connection with its 2017 annual meeting of shareholders, as filed with the SEC on April 3, 2017, and other documents subsequently filed by Ameris with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the proposed merger transaction filed with the SEC when they become available.

Overview of US Premium Finance 4 • Founded in 1993 and based in Atlanta, GA US Premium Finance is the fifth largest insurance premium finance company in the U.S. • Provides short - term, collateralized financing to fund the purchase of primarily property and casualty insurance lines for commercial customers - Average term of approximately 10 months - 93% of portfolio fully secured by unused premium - Exceptional portfolio diversification among customers, carriers, and product type • Operated as a division of ABCB since the beginning of 2017 - 4.99% acquired on January 18 th , 2017 Growth and Profitability History and Background • Average receivables of approximately $501 million in Q4 2017 • LTM originations of $1.03 billion - 22% CAGR since 2013 • Net charge - offs have averaged less than 5 bps of loan volume over the past 20 years • 2017 pre - tax operating ROAA of 3.36% vs 1.78% for the rest of ABCB • Division earnings of $6.0 million in 2017 under joint marketing agreement • Expect earnings of approximately $12.0 million in 2018 as a division of ABCB (limited incremental EPS impact because of shares exchanged in purchase)

US Premium Finance Acquisition Overview 5 • Mid - single digit dilution to TBV per share in Q1 • Earnback of approximately 3.5 years from initial acquisition • EPS estimates lifted 7 – 8% in January 2017 • Internal rate of return well over 20% Strategic Rationale Deal Structure Financial Impact • Initial acquisition of 4.99% of USPF in exchange for 128,572 shares of ABCB stock, closed on January 18, 2017 • Remainder acquired for 944,419 shares of ABCB and $21.5 million in cash • Closing January 2018 • High performing locally - based nationwide lending platform and experienced origination team • High - yielding quality loan portfolio with minimal net charge - offs provides diversification to existing Ameris portfolio • Superb cultural alignment confirmed over the past year with a consistent vision for future growth

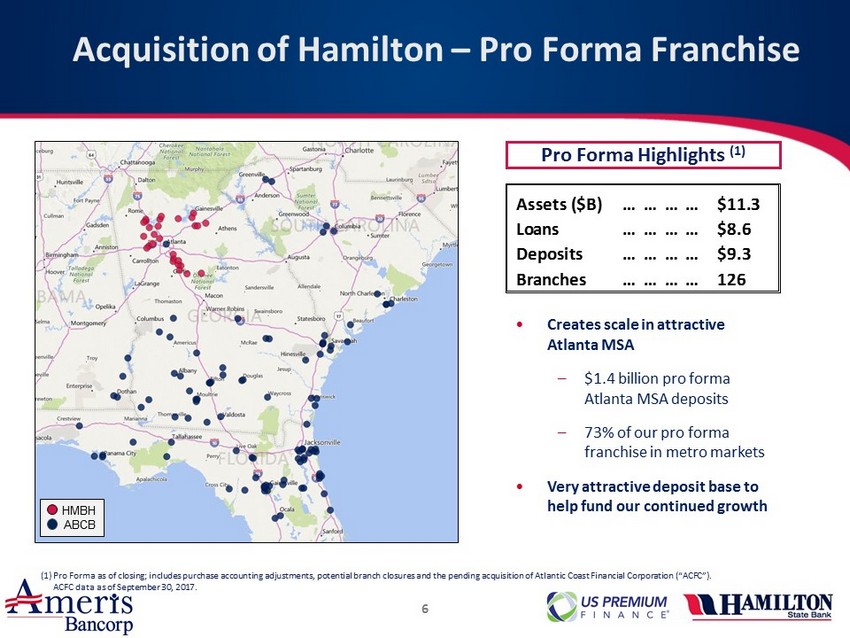

Assets ($B) … … … … $11.3 Loans … … … … $8.6 Deposits … … … … $9.3 Branches … … … … 126 Acquisition of Hamilton – Pro Forma Franchise 6 (1) Pro Forma as of closing; includes purchase accounting adjustments, potential branch closures and the pending acquisition of Atlantic Coast Financial Corporation (“ACFC”). ACFC data as of September 30, 2017. Pro Forma Highlights (1) • Creates scale in attractive Atlanta MSA – $ 1.4 billion pro forma Atlanta MSA deposits – 73% of our pro forma franchise in metro markets • Very attractive deposit base to help fund our continued growth HMBH ABCB

Hamilton Transaction Rationale 7 • Experienced Southeast acquiror • Thorough due diligence process completed with over 70 % of the total loan portfolio reviewed • Growth assumptions, revenue synergies and cost savings are all conservative relative to Ameris’s results in previous deals Strategic Rationale Financially Accretive Low - Risk • Pays for cost of crossing $10 billion in assets • 3 - 4% accretion with fully phased in cost saves including the effects of crossing $10 billion in assets (5 - 7% without $10 billion cost) • Neutral to tangible book value • Pro forma capital ratios remain “well - capitalized” • Internal rate of return over 20% • The initial step in our five - year vision to build a robust community bank in Atlanta • Continues focus of franchise expansion in higher growth metro markets • Valuable low - cost core deposit base • Strengthens multiple lines of business Note: Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates. Includes purchase accounting mar ks and deal related expenses. Includes ACFC and USPF transactions.

Overview of Hamilton 8 Acquisition History Company Snapshot Financial Highlights (1) • Formed in 2004 by team of long - time Atlanta community bankers • Attracted private equity sponsors in 2011 to pursue M&A growth strategy • Highly successful at integrating acquired banks and transitioning to organic growth - Only 14% of loans are acquired at this point • Exceptional deposit base – 36 bps Q3 cost of deposits Assets…………………………………….............. $1.8 B Gross Loans……………………………………….. $1.3 B Deposits…………………………………………….. $1.5 B Loans / Deposits………………………........... 84.0 % TCE / TA……………………………………........... 10.6 % Adjusted ROAA (2) ……………………….......... 1.28 Net Interest Margin……………………………. 4.43 (1) Data as of or for the three months ended December 31, 2017. (2) ROAA excludes DTA adjustment. HMBH ABCB Target Date Deal Value ($M) Total Assets ($M) Highland Financial 9/01/2015 20.1 130.0 Cherokee Banking Co 2/17/2014 8.5 168.0 Douglas County Bank 4/26/2013 FDIC 260.9 First State Bank 1/20/2012 FDIC 515.6 McIntosh State Bank 6/17/2011 FDIC 339.9 Bartow County Bank 4/15/2011 FDIC 330.2

• Over 70 higher education institutions and 5.7 million residents • Primary market drivers include financial technology, cyber security, health IT, logistics and advanced manufacturing • The world’s most traveled airport, three major highways and abundant bus and rail services • Lowest relative cost of doing business among nation’s 10 largest metro areas • Headquarters of 15 Fortune 500 companies Atlanta Market Highlights 9 Atlanta Market Snapshot Source: S&P Global Intelligence; Metro Atlanta Chamber. ABCB demographics deposit weighted by county. Major Area Employers ’18 – ’23 Pop. Growth ABCB Southeast Atlanta 4.2% 4.6% 6.4% 8.1% 6.5% 9.2% Markets of Operation ’18 – ’23 HHI Growth $53,165 $54,648 $71,162 2023 HHI

Atlanta Market Highlights (Cont.) 10 Rank Among Southeast MSAs Source: United States Census. MSA Population Miami – Fort Lauderdale – West Palm Beach 6,066,387 Atlanta – Sandy Springs – Roswell 5,789,700 Tampa – St. Petersburg – Clearwater 3,032,171 Charlotte – Concord – Gastonia 2,474,314 Orlando – Kissimmee – Sanford 2,441,257 Nashville – Davidson – Murfreesboro – Franklin 1,865,298 Virginia Beach – Norfolk – Newport News 1,726,907 Jacksonville 1,478,212 Memphis 1,342,842 Raleigh 1,302,946 Louisville – Jefferson County 1,283,430 Richmond – Petersburg 1,281,708 New Orleans – Metairie - Kenner 1,268,883

Loan & Deposit Composition 11 ABCB (1) (1) Data as of September 30, 2017, Ameris data pro forma for pending ACFC acquisition, excluding cost of deposits. (2) Excludes purchase accounting adjustments. Source: S&P Global Intelligence. HMBH (1) Pro Forma (2) C&D 13% 1 - 4 Family 12% Multifamily 5% Owner - Occupied CRE 19% Non Owner - Occupied CRE 28% C&I 17% Consumer & Other 7% C&D 10% 1 - 4 Family 28% Multifamily 4% Owner - Occupied CRE 12% Non Owner - Occupied CRE 19% C&I 12% Consumer & Other 16% C&D 10% 1 - 4 Family 25% Multifamily 4% Owner - Occupied CRE 13% Non Owner - Occupied CRE 21% C&I 13% Consumer & Other 15% ABCB (1) HMBH (1) Pro Forma Demand Deposits 23% NOW Accounts 17% Money Market & Savings 27% Retail Time Deposits 29% Jumbo Time Deposits 4% Demand Deposits 27% NOW Accounts 19% Money Market & Savings 35% Retail Time Deposits 15% Jumbo Time Deposits 4% Demand Deposits 26% NOW Accounts 19% Money Market & Savings 34% Retail Time Deposits 18% Jumbo Time Deposits 4% Deposits Loans Cost of Total Deposits: 0.36% Cost of Total Deposits: 0.35%

Metro Vs. Non - Metro Footprint 12 ABCB - 2009 Pro Forma Today Metro, 60.8% Non - Metro, 39.2% Metro, 73.4% Non - Metro, 26.6% (1) Rank among banks with less than $30 billion in assets. Note: Based on branch deposit data as of June 30, 2017, pro forma for pending ACFC acquisition. Source: S&P Global Intelligence. ` Population Market Overall Community MSA (000) Share Rank Bank Rank (1) Atlanta-Sandy Springs-Roswell, GA 5,920 0.87% 14 6 Jacksonville, FL 1,520 2.48 6 1 Greenville-Anderson-Mauldin, SC 902 0.39 25 17 Columbia, SC 830 1.06 11 5 Charleston-North Charleston, SC 786 0.90 17 9 Deltona-Daytona Beach-Ormond Beach, FL 652 1.33 15 6 Savannah, GA 393 7.13 5 2 Tallahassee, FL 388 1.49 13 8 Ocala, FL 357 0.98 15 8 Columbus, GA-AL 307 0.47 12 6 Gainesville, FL 285 10.36 3 1 Crestview-Fort Walton Beach-Destin, FL 273 0.63 20 13 Hilton Head Island-Bluffton-Beaufort, SC 218 2.54 11 4 Panama City, FL 203 5.21 8 5 Albany, GA 150 9.92 4 2 Pro Forma MSA Presence (1)

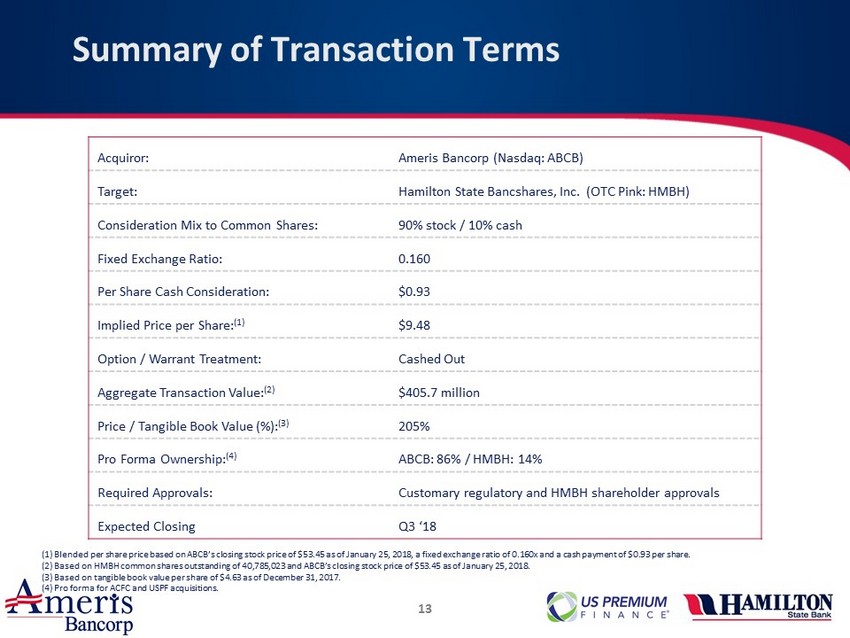

Summary of Transaction Terms 13 (1) Blended per share price based on ABCB’s closing stock price of $53.45 as of January 25, 2018, a fixed exchange ratio of 0.160x and a cash payment of $0.93 per share. (2) Based on HMBH common shares outstanding of 40,785,023 and ABCB’s closing stock price of $53.45 as of January 25, 2018. (3) Based on tangible book value per share of $4.63 as of December 31, 2017. (4) Pro forma for ACFC and USPF acquisitions. Acquiror: Ameris Bancorp (Nasdaq: ABCB) Target: Hamilton State Bancshares, Inc. (OTC Pink: HMBH) Consideration Mix to Common Shares: 90% stock / 10% cash Fixed Exchange Ratio: 0.160 Per Share Cash Consideration: $0.93 Implied Price per Share: (1) $9.48 Option / Warrant Treatment: Cashed Out Aggregate Transaction Value : (2) $405.7 million Price / Tangible Book Value (%) : (3) 205% Pro Forma Ownership: (4) ABCB: 86% / HMBH: 14% Required Approvals: Customary regulatory and HMBH shareholder approvals Expected Closing Q3 ‘18

Credit Due Diligence 14 Credit Diligence Process • Comprehensive review process for HMBH’s loans and OREO portfolios • Experienced credit review team – Completed ten FDIC - assisted acquisitions, one branch transaction, and four whole bank transactions in FL and GA through cycle • Credit team reviewed 72% of the dollar balance of HMBH’s loan portfolio – 100% of all relationships over $1 million – 99% or more of HMBH’s three distinct lines of business • All OREO properties over $100,000 evaluated for impairment

Transaction Assumptions 15 Assumptions • 35% of HMBH’s noninterest expense • 50% realized in 2018 and 100% thereafter • 1.5% of transaction accounts (Approximately $15.7 million) • $11.2 million after - tax • Net pre - tax other adjustments of $11.4 million, including reversal of existing purchase accounting marks and ALLL • Gross credit mark to loans and OREO of $20.0 million Credit Mark Core Deposit Intangible Other Purchase Accounting Merger-Related Expenses Cost Savings

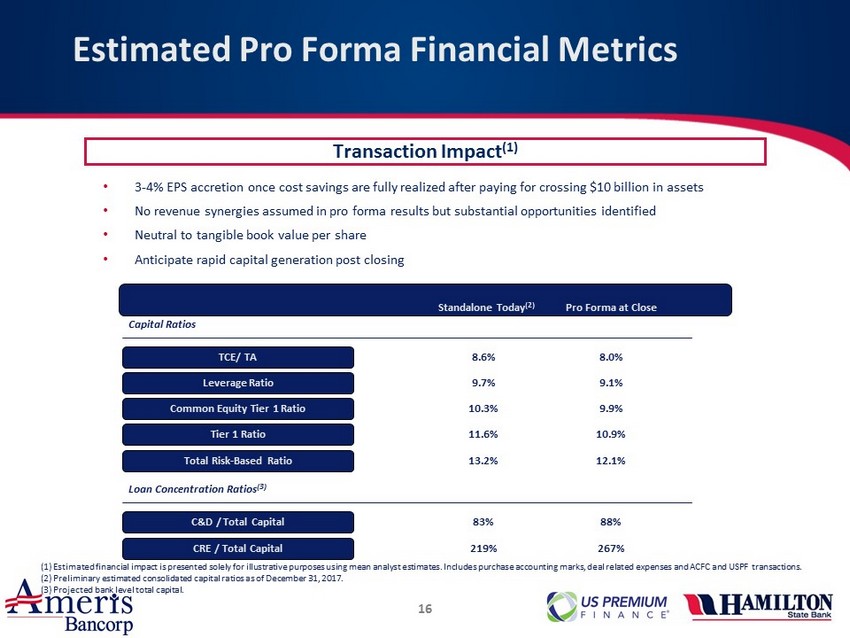

• 3 - 4% EPS accretion once cost savings are fully realized after paying for crossing $10 billion in assets • No revenue synergies assumed in pro forma results but substantial opportunities identified • Neutral to tangible book value per share • Anticipate rapid capital generation post closing Estimated Pro Forma Financial Metrics 16 Capital Ratios TCE/ TA Leverage Ratio Common Equity Tier 1 Ratio Tier 1 Ratio Total Risk - Based Ratio Loan Concentration Ratios (3) C&D / Total Capital CRE / Total Capital 8.6% 9.7% 10.3% 11.6% 13.2% 8.0% 9.1% 9.9% 10.9% 12.1% 83% 219% 88% 267% Standalone Today (2) Pro Forma at Close (1) Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates. Includes purchase accounting marks, deal related expenses and ACFC and USPF transactions. (2) Preliminary estimated consolidated capital ratios as of December 31, 2017. (3) Projected bank level total capital. Transaction Impact (1)

Conclusion 17 • Attractive core franchise in an important market • Provides a platform for further growth in Atlanta • Good financial outcome even with cost of crossing $10 billion in assets • Value of Hamilton’s core deposit base exceptionally high