Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ONE LIBERTY PROPERTIES INC | f8k110717_onelibertyproper.htm |

Exhibit 99.1

INVESTOR PRESENTATION JANUARY 2018 onelibertyproperties.com

2 TABLE OF CONTENTS DESCRIPTION PAGE Table of Contents 2 Safe Harbor Disclosure 3 Company Overview 4 Experienced Management Team 5 Attractive Portfolio Fundamentals 6 Portfolio Detail 7 Diversified Portfolio 8 Diversified Tenant Base 9 Financial Summary 10 Targeting Long Term Total Return 11 Growth in Operations 12 Growth Oriented Balance Sheet 13 Mortgage Debt Maturities 14 Lease Maturity Profile 15 Consistent Operational Performance 16 - 17 Acquisition Track Record 18 Recent Acquisitions 19 Recent Dispositions 20 DESCRIPTION PAGE Recent Mortgages 21 Case Studies: Acquisition – Des Moines, IA 22 Disposition – Greenwood Village, CO 23 Summary 24 APPENDIX Case Studies: Acquisition – Cleveland, OH 26 Acquisition – El Paso, TX 27 Blend and Extend – Office Depot 28 Top Tenant Profiles: Havertys Furniture 30 LA Fitness 31 Northern Tool & Equipment 32 Regal Entertainment Group 33 Office Depot 34 GAAP Reconciliation to FFO & AFFO 35

3 SAFE HARBOR The statements in this presentation , including targets and assumptions, state the Company’s and management’s hopes, intentions, beliefs, expectations or projections of the future and are forward - looking statements. It is important to note that the Company’s actual results could differ materially from those projected in such forward - looking statements. Factors that could cause actual results to differ materially from current expectations include the key assumptions contained within this presentation, general economic conditions, local real estate conditions, increases in interest rates, tenant defaults, non - renewals, and/or bankruptcies, and increases in operating costs and real estate taxes. Additional information concerning factors that could cause actual results to differ materially from those forward - looking statements is contained in the Company’s SEC filings , and in particular the sections of such documents captioned “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Copies of the SEC filings may be obtained from the Company or the SEC. The Company does not undertake to publicly update or revise any forward - looking statements included in this presentation, whether as a result of new information, future events or otherwise.

4 COMPANY OVERVIEW Fundamentals – focused real estate company Disciplined track record through economic cycles Active net lease strategy Experienced management team Alignment of interests through significant insider ownership

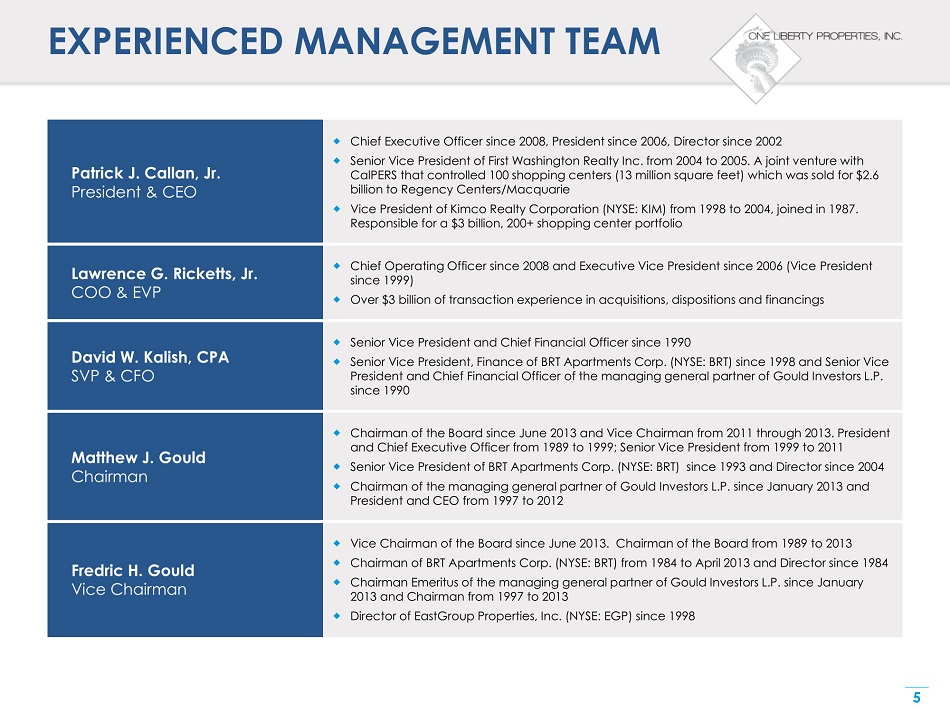

5 EXPERIENCED MANAGEMENT TEAM Patrick J. Callan, Jr. President & CEO Chief Executive Officer since 2008, President since 2006, Director since 2002 Senior Vice President of First Washington Realty Inc. from 2004 to 2005. A joint venture with CalPERS that controlled 100 shopping centers (13 million square feet) which was sold for $2.6 billion to Regency Centers/Macquarie Vice President of Kimco Realty Corporation (NYSE: KIM) from 1998 to 2004, joined in 1987. Responsible for a $3 billion, 200+ shopping center portfolio Lawrence G. Ricketts, Jr. COO & EVP Chief Operating Officer since 2008 and Executive Vice President since 2006 (Vice President since 1999) Over $3 billion of transaction experience in acquisitions, dispositions and financings David W. Kalish, CPA SVP & CFO Senior Vice President and Chief Financial Officer since 1990 Senior Vice President, Finance of BRT Apartments Corp. (NYSE: BRT) since 1998 and Senior Vice President and Chief Financial Officer of the managing general partner of Gould Investors L.P. since 1990 Matthew J. Gould Chairman Chairman of the Board since June 2013 and Vice Chairman from 2011 through 2013. President and Chief Executive Officer from 1989 to 1999; Senior Vice President from 1999 to 2011 Senior Vice President of BRT Apartments Corp. (NYSE: BRT) since 1993 and Director since 2004 Chairman of the managing general partner of Gould Investors L.P. since January 2013 and President and CEO from 1997 to 2012 Fredric H. Gould Vice Chairman Vice Chairman of the Board since June 2013. Chairman of the Board from 1989 to 2013 Chairman of BRT Apartments Corp. (NYSE: BRT) from 1984 to April 2013 and Director since 1984 Chairman Emeritus of the managing general partner of Gould Investors L.P. since January 2013 and Chairman from 1997 to 2013 Director of EastGroup Properties, Inc. (NYSE: EGP) since 1998

6 ATTRACTIVE PORTFOLIO FUNDAMENTALS (1) Total Square Footage 10.4 M Number of Properties 119 Current Occupancy 98.0% Contractual Rental income (2) $70.1 M Lease Term Remaining 8.7 Years (1) Information presented as of September 30, 2017, including five properties owned by unconsolidated joint ventures (2) Our contractual rental income represents, after giving effect to any abatements, concessions or adjustments, the base rent payable to us for the twelve months ending September 30, 2018 under leases in effect at September 30, 2017 and excludes approximately $437,000 of straight - line rent and $1.0 million of amortization of intangibles. In addition, we have included our $2.8 million share of the base rent payable to our unconsolidated joint ventures for the twelve months ending September 30, 2018. Forbo – Charlotte, NC Saddle Creek Logistics – Pittston, PA

7 PORTFOLIO DETAIL Type of Property Number of Properties Contractual Rental Income (1) % of Contractual Rental Income Retail – General 40 $ 18,173,643 25.9% – Furniture 14 6,109,004 8.7 – Supermarket 3 2,613,926 3.7 – Office Supply 7 2,430,408 3.5 Industrial 28 24,533,745 35.0 Restaurants 17 3,528,262 5.0 Health & Fitness 3 3,075,583 4.4 Theater 2 (2) 2,520,619 (3) 3.6 Other 5 7,113,047 10.2 119 $70,098,237 100.0% (1) Our contractual rental income represents, after giving effect to any abatements, concessions or adjustments, the base rent pa yab le to us for the twelve months ending September 30, 2018 under leases in effect at September 30, 2017 and excludes approximately $437,000 of straight - line rent and $1.0 million of amortization of intangibles. In addition, we have included our $2.8 million share of the base rent payable to our unconsolidated joint ve ntu res for the twelve months ending September 30, 2018. (2) Though we have three theaters, one is part of a multi - tenant shopping center property in Manahawkin, NJ and is therefore exclude d from this column (3) The contractual rental income associated with the theater in Manahawkin, NJ is included in this row

8 DIVERSIFIED PORTFOLIO Geographically diverse footprint Own 119 properties in 31 states Strong markets drive value Highest State Concentration by Contractual Rental Income State Number of Properties Contractual Rental Income % Contractual Rental Income Texas 12 $8,741,749 12.5% South Carolina 6 5,622,613 8.0 New York 8 5,208,894 7.4 Pennsylvania 10 4,204,505 6.0 Georgia 12 4,097,689 5.8 48 $27,875,450 39.7%

9 DIVERSIFIED TENANT BASE Top Tenants Number of Locations Contractual Rental Income % of Contractual Rental Income Haverty Furniture Companies, Inc. (NYSE: HVT) 11 $ 4,842,847 6.9% LA Fitness International , LLC 3 3,075,583 4.4 Northern Tool & Equipment 1 2,809,880 4.0 Regal Entertainment Group (NYSE: RGC) 3 2,520,619 3.6 Office Depot, Inc. (NYSE: ODP) 7 2,430,408 3.5 25 $15,679,337 22.4%

10 FINANCIAL SUMMARY Market Cap (1) $487.5 M Shares Outstanding (1) 19.0 M Insider Ownership (2) 23.0% Current Annualized Dividend $1.80 Dividend Yield (3) 7.0% (1) Market cap is calculated using the shares outstanding and the closing OLP stock price of $ 25.62 at January 19, 2018 (2) Calculated as of January 19, 2018 (3) Based on the closing OLP stock price of $ 25.62 at January 19, 2018 Power Distributors / Keystone Automotive – Des Moines, IA Dufresne Spencer Group – Memphis, TN

11 TARGETING LONG TERM TOTAL RETURN (1) Performance period ended September 30, 2017 Consistent driver of long term stockholder value 10.9% 7.3% 5.8% 0% 2% 4% 6% 8% 10% 12% OLP S&P 500 NAREIT Equity Index 10 - Year Annualized Total Return (1)

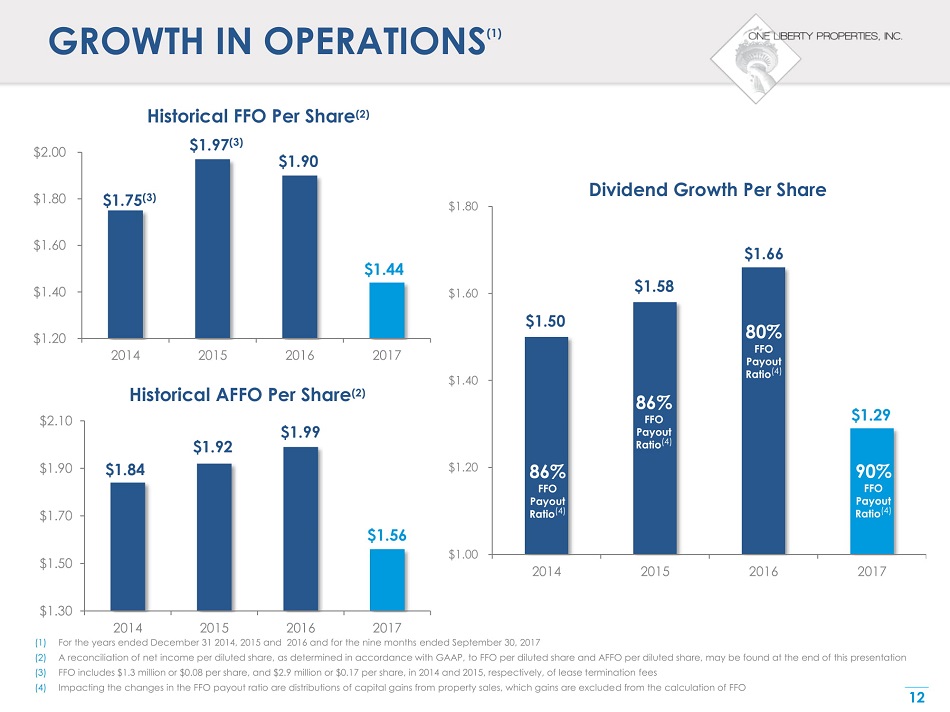

12 GROWTH IN OPERATIONS (1) (1) For the years ended December 31 2014, 2015 and 2016 and for the nine months ended September 30, 2017 (2) A reconciliation of net income per diluted share, as determined in accordance with GAAP, to FFO per diluted share and AFFO pe r d iluted share, may be found at the end of this presentation (3) FFO includes $1.3 million or $0.08 per share, and $2.9 million or $0.17 per share, in 2014 and 2015, respectively, of lease t erm ination fees (4) Impacting the changes in the FFO payout ratio are distributions of capital gains from property sales, which gains are exclude d f rom the calculation of FFO $1.75 (3) $1.97 (3) $1.90 $1.44 $1.20 $1.40 $1.60 $1.80 $2.00 2014 2015 2016 2017 Historical FFO Per Share (2) $1.84 $1.92 $1.99 $1.56 $1.30 $1.50 $1.70 $1.90 $2.10 2014 2015 2016 2017 Historical AFFO Per Share (2) $1.50 $1.58 $1.66 $1.29 $1.00 $1.20 $1.40 $1.60 $1.80 2014 2015 2016 2017 Dividend Growth Per Share 86% FFO Payout Ratio (4) 86% FFO Payout Ratio (4) 90% FFO Payout Ratio (4) 80% FFO Payout Ratio (4)

13 GROWTH ORIENTED BALANCE SHEET AS AT SEPTEMBER 30, 2017 Gross Assets (1) $842.7 M Total Debt/Gross Assets (2) 50.4% Fixed Rate Debt 98.5% Debt Service Coverage Ratio (3) 2.3 to 1.0 Fixed Charge Coverage Ratio (3) 2.3 to 1.0 FFO Payout 90.0% (1) Gross assets represent total assets plus accumulated depreciation of $105.2 million (2) Total debt includes our share ( i.e. $17.7 million) of debt of our unconsolidated joint ventures (3) Calculated in accordance with the terms of our credit facility Liquidity available to acquire in excess of an estimated $150 million of properties as of January 19, 2018 $90.6 million available as of January 19, 2018 on Line of Credit of up to $100 million

14 LADDERED MORTGAGE DEBT MATURITIES AS AT SEPTEMBER 30, 2017 (1) (1) Includes our share of the mortgage debt of our unconsolidated joint ventures Weighted average interest rate of 4.2% on fixed rate debt There is approximately $8.6 million ($0.46 per share) of scheduled amortization of mortgages for the twelve months ending September 30, 2018 $12.8 $6.2 $0.9 $2.1 $26.8 $239.1 $0 $50 $100 $150 $200 $250 $300 2018 2019 2020 2021 2022 2023 & Beyond ($ in millions) Balloon Payments Due For the Twelve Months Ending September 30

15 LEASE MATURITY PROFILE 12 Months Ending September 30, Number of Expiring Leases Contractual Rental Income Under Expiring Leases % of Contractual Rental Income Represented by Expiring Leases Approximate Square Feet Subject to Expiring Leases 2018 23 $ 2,731,908 3.9% 455,005 2019 26 4,064,050 5.8 561,276 2020 15 1,895,714 2.7 144,447 2021 25 3,797,876 5.4 472,471 2022 27 14,491,800 20.7 2,856,360 2023 13 3,440,053 4.9 556,295 2024 9 4,399,246 6.3 505,339 2025 8 4,624,095 6.6 438,032 2026 9 4,504,141 6.4 288,989 2027 11 7,409,097 10.6 885,096 2028 & Beyond 26 18,740,257 26.7 3,057,014 192 $70,098,237 100.0% 10,220,324

16 CONSISTENT OPERATIONAL PERFORMANCE (1) As at December 31 (2) Based on square footage, including our unconsolidated joint ventures 100.0% 98.0% 99.0% 98.9% 98.1% 98.8% 99.6% 98.6% 98.3% 97.3% 80.0% 90.0% 100.0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Stable Occupancy (1)(2) At September 30, 2017: Occupancy 98.0%

17 CONSISTENT OPERATIONAL PERFORMANCE (1) As at December 31 (2) Includes straight - line rent accruals and amortization of intangibles $41.4 $44.4 $42.8 $49.3 $56.6 $59.0 $64.2 $35 $40 $45 $50 $55 $60 $65 2010 2011 2012 2013 2014 2015 2016 ($ in millions) Strong Rental Income Growth (1)(2) For the 9 Months Ended September 30, 2017 (2) : Total Rental Income $50.8 million

18 ACQUISITION TRACK RECORD (1) Includes our 50% share of an unconsolidated joint venture property in (a) Savannah, GA acquired in 2011 and (b) Manahawkin, N J a cquired in 2015 Acquired $43.2 million of properties through December 31, 2017 Current pipeline of diverse opportunities in excess of $225.0 million $29.6 (1) $44.6 $107.5 $56.8 $95.2 (1) $118.6 $43.2 $0 $20 $40 $60 $80 $100 $120 2011 2012 2013 2014 2015 2016 2017 ($ in millions) Acquisitions per Year

19 RECENT ACQUISTIONS Date Acquired Property Type Tenant (or d/b/a) MSA State Current Lease Expiration Purchase Price (in ‘000s) Yield (1) Financing Info (at time of purchase) (in ‘000s) 10/10/17 Industrial Dufresne Spencer Group Holdings Memphis TN 10/09/27 $ 8,000 7.8% All cash 06/20/17 Industrial Power Distributors/Keystone Automotive Des Moines IA 10/31/23 - 02/28/30 $14,700 7.4% All cash 06/09/17 Industrial Saddle Creek Logistics Scranton PA 02/28/22 $11,750 8.0% All cash 05/25/17 Industrial Forbo Charlotte NC 05/31/25 $ 8,700 7.3% $5,190 mortgage 09/01/16 Industrial Famous Footwear / Caleres Nashville TN 06/30/31 $32,734 6.4% $21,288 mortgage 08/16/16 Other The Vue Apartments Cleveland OH 08/15/46 $13,896 9.4% All cash 08/12/16 Retail Burlington / Micro Center Minneapolis MN 07/31/19 - 01/31/20 $14,150 7.9% All cash 08/02/16 Other The Briarbrook Apartments Chicago IL 07/31/46 $10,530 9.4% All cash 06/16/16 Retail (2) Advance Auto – 4 sites Various OH 12/31/25 - 12/31/26 $ 6,523 6.8% $4,300 mortgage 06/03/16 Industrial The Toro Company El Paso TX 06/30/22 $23,695 7.7% All cash 03/30/16 Industrial Multi tenant industrial Greenville SC 12/31/17 - 04/30/21 $17,050 7.7% All cash (1) Yield represents the base rent and straight - line rent accrual payable over the remaining term of the lease, annualized, divided by the purchase price (2) Represents four properties with four individual mortgages which are cross - collateralized

20 RECENT DISPOSITIONS Date Sold Date Acquired Property Type Tenant (or d/b/a) MSA State Gross Sales Price (in ‘000s) Net Gain (Loss) (in ‘000s) 11/14/2017 09/12/2013 Restaurant Former Joe’s Crab Shack Ann Arbor MI $ 2,300 $ (153) 08/31/2017 09/14/2011 Retail Former hhgregg , Inc. Niles IL $ 5,000 $1,089 07/14/2017 06/30/2010 Retail Kohls Kansas City MO $10,250 $2,180 05/08/2017 04/08/1996 Retail Former Sports Authority Denver CO $ 9,500 $6,568 12/22/2016 12/22/2010 Restaurant Ruby Tuesday Long Island NY $ 2,702 $ 213 06/30/2016 02/18/2005 Industrial Sweet Ovations Philadelphia PA $14,800 $5,660 06/15/2016 06/07/2014 Other The River Crossing Apartments Atlanta GA $ 8,858 $2,331 05/19/2016 07/30/2013 Restaurant Texas Land & Cattle Killeen - Temple - Fort Hood TX $ 3,100 $ 980 02/01/2016 11/14/2006 Retail Portfolio of 8 Pantry stores Various LA/MS $13,750 $ 787

21 RECENT MORTGAGES Date Financed Property Type Tenant (or d/b/a) MSA State Amount (in ‘000s) Mortgage Maturity Interest Rate 08/11/17 Industrial Saddle Creek Logistics Scranton PA $ 7,200 08/10/42 3.75% 07/10/17 Industrial Power Distributors/Keystone Automotive Des Moines IA $ 8,820 08/01/27 3.61% 05/25/17 Industrial Forbo Charlotte NC $ 5,190 06/01/27 3.72% 12/12/16 (1) Industrial Ferguson Enterprises, Inc. Baltimore MD $21,000 01/01/27 3.75% 11/14/16 Retail Bed Bath & Beyond Kennesaw GA $ 5,525 11/01/41 3.50% 09/01/16 Industrial Famous Footwear / Caleres Nashville TN $21,288 10/01/31 3.70% 08/24/16 Industrial The Toro Company El Paso TX $15,000 09/01/22 3.50% 07/29/16 Industrial Iron Mountain, Anixter & Softbox Systems Greenville SC $ 5,850 08/01/26 4.00% 07/29/16 Industrial Hartness Int’l, Imperial Pools & Minileit Greenville SC $ 5,265 08/01/26 4.00% 06/30/16 Retail Ross Stores, Hobby Lobby, Tuesday Morning & Mattress Firm El Paso TX $11,500 07/01/26 4.00% 06/28/16 Furniture LaZBoy Naples FL $ 2,150 11/05/24 3.24% 06/28/16 Industrial FedEx Durham NC $ 2,900 11/05/23 3.02% 06/16/16 (2) Retail Advance Auto – 4 sites Various OH $ 4,300 07/01/26 3.24% 05/20/16 Industrial US Lumber Baltimore MD $10,000 06/01/28 3.65% 04/20/16 Retail Carmax Knoxville TN $ 9,500 07/31/28 3.80% 03/11/16 (1) Supermarket Whole Foods West Hartford CT $18,000 04/01/28 3.38% 01/21/16 Industrial FedEx Tampa FL $ 2,500 12/05/25 3.57% 01/14/16 (1) Retail Avalon Carpet & Tile Store Deptford NJ $ 2,850 02/01/41 3.95% (1) These mortgages were refinanced or modified (2) Represents four individual loans on four Advance Auto properties which are cross - collateralized

22 ACQUISITION CASE STUDY - INDUSTRIAL In June 2017, acquired a multi - tenant distribution facility in Des Moines, IA net leased to Power Distributors and Keystone Automotive. Power Distributors is a distributor of outdoor power equipment with annual sales of $180 million. Keystone Automotive is a global distributor of auto parts and a subsidiary of LKQ Corporation (NASDAQ: LKQ). The $13 billion dollar market cap company fully guarantees the lease. The 208,234 SF Class A concrete tilt wall building was built to spec in 2016. It features 32’ clear heights, modern lighting, ESFR sprinklers and 24’ dock high doors. Des Moines is well located for distribution in the Midwestern United States due to the city’s proximity to Interstate 35 and Interstate 80. There are multiple, diverse economic drivers in Des Moines, the capital of Iowa. Facebook invested $1.5 billion with 2.5 million SF of data centers and Principal Life Insurance has its headquarters in this city. Purchase Price $14,700,000 Mortgage (1) (8,820,000) Net Equity Invested $5,880,000 Year 1 Base Rent $1,026,835 Interest Expense – 3.61% (1) (381,402) Net Cash to OLP $645,433 Return on Equity 10.98% (1) Mortgage with an interest rate of 3.61% closed in July 2017 Power Distributors / Keystone Automotive – Des Moines, IA

23 DISPOSITION CASE STUDY Purchase Price $ 4,040,000 Sales Price 9,500,000 Internal Rate of Return to OLP 19.57% In April 1996, acquired a net leased retail property in Greenwood Village (Denver MSA), CO leased to Gart Bros. Sporting Goods Company for $4.0 million » 11 miles southeast of downtown Denver » The building is 45,000 SF on 3.5 acres of land Financed the asset at closing and refinanced the asset in July 2006. Paid off the loan balance in November 2015. Gart Bros merged with Sports Authority in August 2003. Sports Authority filed bankruptcy on March 2, 2016. Property was sold to Recreational Equipment, Inc. (REI) in May 2017 for $9.2 million , net of closing costs, resulting in a gain to OLP of approximately $6.6 million , net of all costs Former Sports Authority – Greenwood Village, CO

24 SUMMARY – WHY OLP ? Fundamentals – focused real estate company Disciplined track record through economic cycles Active net lease strategy Experienced management team Alignment of interests through significant insider ownership

APPENDIX

26 ACQUISITION CASE STUDY – GROUND LEASE In August 2016, acquired 8 acres of land in Beachwood, OH , a wealthy suburb of Cleveland » Simultaneously ground leased to an experience multi - family operator » Land is improved by a class A 348 unit mid - rise multi - family complex » Building and improvements constructed in 2015 feature the market’s best modern amenities including: – Underground parking and storage – Heated saltwater pool – Two story fitness center – Yoga room – Art gallery Purchase Price $13,896,000 Year 1 Base Rent 1,450,633 Return on Equity 10.44% The Vue Apartments – Beachwood, OH (Cleveland MSA)

27 ACQUISITION CASE STUDY – INDUSTRIAL In June 2016, acquired a distribution facility in El Paso, TX , net leased to Toro Co (NYSE: TTC) » Toro is global developer , manufacturer and distributor of lawn and landscape equipment » Toro has a market cap of approximately $7.2 billion (as of 12/1/2017) and a BBB investment grade credit per Standard & Poors » Building is 419,821 SF on 24.09 acres of land with 24’ clear heights and 69 dock doors. Building features a depth of 240’ and provides in - place flexibility to be converted into a multi - tenant facility Purchase Price $23,695,000 Mortgage (1) (15,000,000) Net Equity Invested $ 8,695,000 Year 1 Base Rent $ 1,657,600 Interest Expense – 3.70% (1) (519,000) Net Cash to OLP $ 1,138,600 Return on Equity 13.09% The Toro Company – El Paso, TX

28 BLEND & EXTEND CASE STUDY – OFFICE DEPOT In September 2008, acquired 8 sites from Office Depot in a sale - leaseback transaction » The 10 year original leases were absolute net » Sold three locations at a profit in 2011 and 2012 In June 2015, Office Depot agreed to lease extensions through 2025 at four sites, absolute net, with increases of 10% of base rent every 5 years » In exchange for this long - term commitment , rent was lowered at these four sites by an average of 7% from prior rent » In July 2015 – new financing aggregating $12.85 million with a 10 year term at an interest rate of 4.35% secured by these four sites 7 remaining properties represent 3.5% of contractual rental income » Formerly represented 12.5% of 2011 contractual rental income Green: Extended Red: Sold Black: Re - leased Office Depot – Cary, NC

TOP TENANTS’ PROFILES

30 HAVERTYS FURNITURE – TENANT PROFILE Tenant: Haverty Furniture Companies, Inc. (NYSE: HVT) (Source: Tenant’s website) » Full service home furnishing retailer founded in 1885 » Public company since 1929 » 124 showrooms in 15 states in the Southern and Midwestern regions » Weathered economic cycles, from recessions to depressions to boom times » Total assets of $470 million and stockholders’ equity of $294 million at 9/30/2017 Represents 6.9% of contractual rental income 11 properties aggregating 611,930 SF – Duluth (Atlanta), GA – Fayetteville (Atlanta), GA – Wichita, KS – Lexington, KY – Bluffton (Hilton Head), SC – Amarillo, TX – Cedar Park (Austin), TX – Tyler, TX – Richmond, VA – Newport News, VA – Virginia Beach, VA Properties subject to a unitary lease which expires in 2022 Rent per square foot on the portfolio is $7.86 Havertys – Cedar Park, TX (Austin MSA)

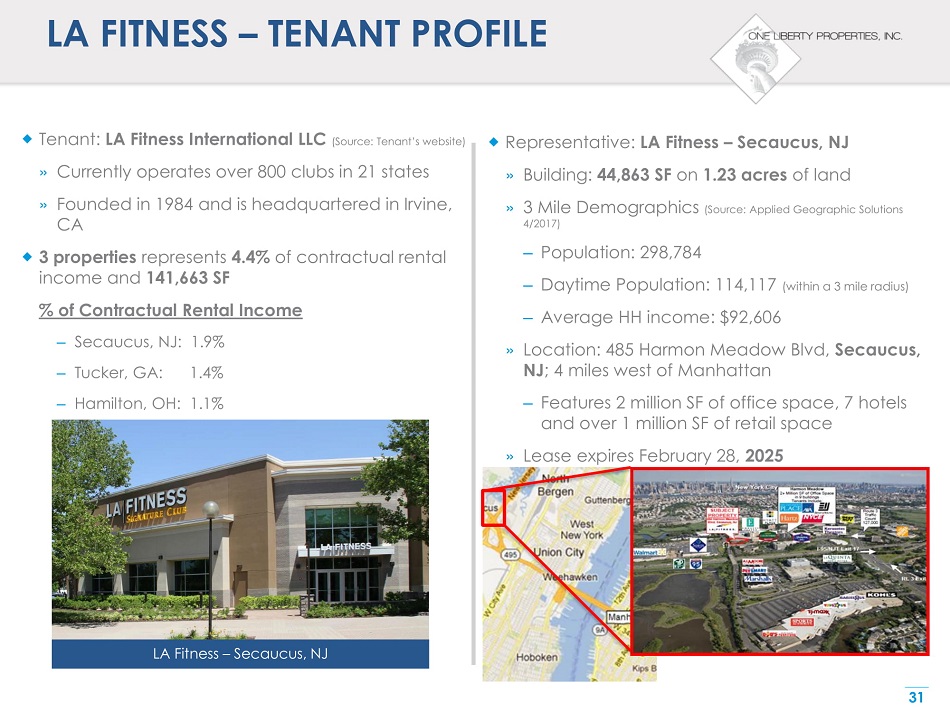

31 LA FITNESS – TENANT PROFILE Tenant: LA Fitness International LLC (Source: Tenant’s website) » Currently operates over 800 clubs in 21 states » Founded in 1984 and is headquartered in Irvine, CA 3 properties represents 4.4% of contractual rental income and 141,663 SF % of Contractual Rental Income – Secaucus, NJ: 1.9% – Tucker, GA: 1.4% – Hamilton, OH: 1.1% Representative: LA Fitness – Secaucus, NJ » Building: 44,863 SF on 1.23 acres of land » 3 Mile Demographics (Source: Applied Geographic Solutions 4/2017) – Population: 298,784 – Daytime Population: 114,117 (within a 3 mile radius) – Average HH income: $92,606 » Location: 485 Harmon Meadow Blvd, Secaucus, NJ ; 4 miles west of Manhattan – Features 2 million SF of office space, 7 hotels and over 1 million SF of retail space » Lease expires February 28, 2025 LA Fitness – Secaucus, NJ

32 NORTHERN TOOL & EQUIPMENT – TENANT PROFILE Tenant: Northern Tool & Equipment (Source: Tenant’s website) » Distributor and retailer of industrial grade and personal use power tools and equipment » 95 retail stores in the U.S. » Acquired The Sportsman’s Guide and The Golf Warehouse to sell outdoor sports and leisure goods through their distribution chain » Class A, 30’ clearance building is situated 18 miles south of downtown Charlotte, NC off Interstate - 77 Represents 4.0% of contractual rental income Location: 1850 Banks Road, Fort Mill, SC » Building: 701,595 SF on 40.0 acres of land » 3 Mile Demographics (Source: Applied Geographic Solutions 4/2017) – Population: 24,098 – Average HH income: $70,476 » Lease expires April 30, 2029 Northern Tool & Equipment – Fort Mill, SC

33 REGAL ENTERTAINMENT GROUP – TENANT PROFILE Tenant: Regal Entertainment Group (NYSE: RGC) (Source: Tenant’s website) » Brands include: Regal Cinemas, Edward Theaters and United Artists Theaters » 7,379 screens and 566 theaters in America » Currently the largest American theater chain. The second largest chain, AMC, bought Carmike (4 th largest chain) which will make AMC the largest American chain » $ 3.6 billion market cap (as of 1/18/2018) 3 locations represents 3.6% of contractual rental income and 150,250 SF % of Contractual Rental Income – Indianapolis, IN: 1.0% – Manahawkin, NJ (1) : 0.3% – Greensboro, NC: 2.3% Regal Cinemas (d/b/a United Artists) – Indianapolis, IN Sample Regal Luxury Seating Conversion (1) Represents one tenant at a multi - tenant shopping center

34 OFFICE DEPOT – TENANT PROFILE Tenant: Office Depot, Inc. (NYSE: ODP) (Source: Tenant’s website) » Leading global provider of office products and services » Operates more than 1,400 retail stores » Revenues of $11.0 billion (as of 12/31/2016) » $ 1.8 billion market cap (as of 1/18/2017 ) 7 properties represents 3.5% of contractual rental income and 174,431 SF % of Contractual Rental Income – Chicago, IL: 0.8% – Cary (Raleigh), NC: 0.6% – El Paso, TX: 0.5% – Eugene, OR: 0.5% – Athens, GA: 0.4% – Lake Charles, LA: 0.4% – Batavia, NY: 0.3% » The first 4 locations listed above are subject to similar leases which expire in 2025 and were all part of the original sale - leaseback transaction in 2008 Office Depot – Batavia, NY

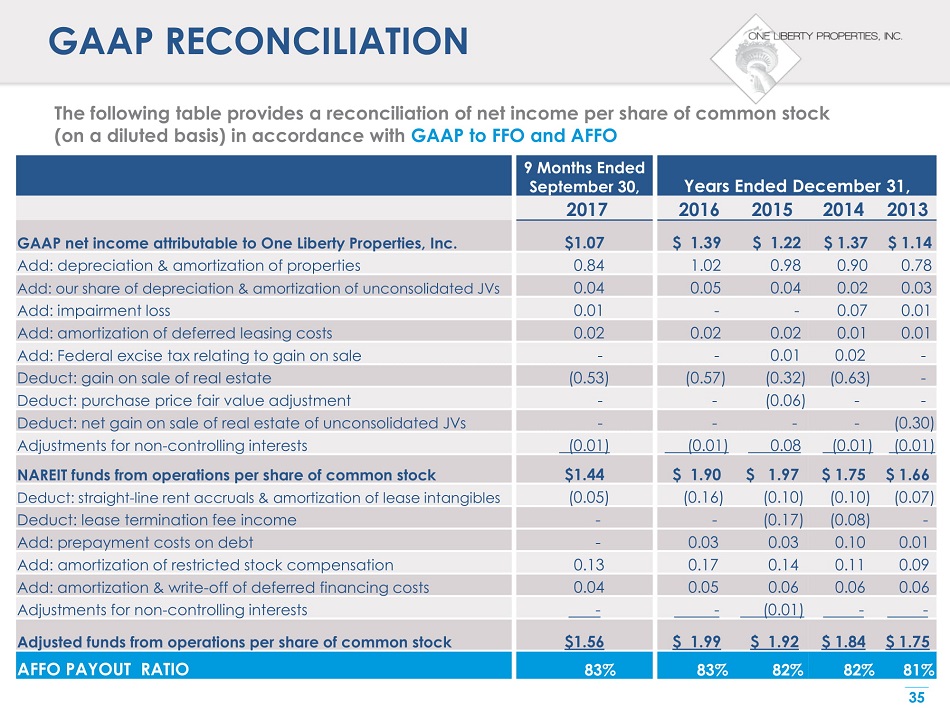

35 GAAP RECONCILIATION The following table provides a reconciliation of net income per share of common stock (on a diluted basis) in accordance with GAAP to FFO and AFFO 9 Months Ended September 30, Years Ended December 31, 2017 2016 2015 2014 2013 GAAP n et income attributable to One Liberty Properties, Inc. $1.07 $ 1.39 $ 1.22 $ 1.37 $ 1.14 Add: depreciation & amortization of properties 0.84 1.02 0.98 0.90 0.78 Add: our share of depreciation & amortization of unconsolidated JVs 0.04 0.05 0.04 0.02 0.03 Add: impairment loss 0.01 - - 0.07 0.01 Add: amortization of deferred leasing costs 0.02 0.02 0.02 0.01 0.01 Add: Federal excise tax relating to gain on sale - - 0.01 0.02 - Deduct: gain on sale of real estate (0.53) (0.57) (0.32) (0.63) - Deduct: purchase price fair value adjustment - - (0.06) - - Deduct: net gain on sale of real estate of unconsolidated JVs - - - - (0.30) Adjustments for non - controlling interests (0.01) (0.01) 0.08 (0.01) (0.01) NAREIT f unds from operations per share of common stock $1.44 $ 1.90 $ 1.97 $ 1.75 $ 1.66 Deduct: straight - line rent accruals & amortization of lease intangibles (0.05) (0.16) (0.10) (0.10) (0.07) Deduct: lease termination fee income - - (0.17) (0.08) - Add: prepayment costs on debt - 0.03 0.03 0.10 0.01 Add: amortization of restricted stock compensation 0.13 0.17 0.14 0.11 0.09 Add: amortization & write - off of deferred financing costs 0.04 0.05 0.06 0.06 0.06 Adjustments for non - controlling interests - - (0.01) - - Adjusted funds from operations per share of common stock $1.56 $ 1.99 $ 1.92 $ 1.84 $ 1.75 AFFO PAYOUT RATIO 83% 83% 82% 82% 81%