Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Versum Materials, Inc. | form8-k1162018.htm |

THE SEMICONDUCTOR INDUSTRY FROM A

MATERIALS SUPPLIER PERSPECTIVE

Guillermo Novo

President and CEO

Versum Materials, Inc.

FORWARD‐LOOKING INFORMATION

This presentation contains, and management may make, certain “forward‐looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward‐looking

statements may be identified by references to future periods, and include statements we make about business strategies, operating plans, growth rates and

prospects, sales expectations, estimates of the size of the market for specialty materials products, forecasted industry demand, the ongoing core importance of

specialty materials to semiconductor innovation and productivity, our ability to successfully compete as a leading materials supplier to the semiconductor industry,

and other matters. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “growing,” “continue,” “could,” “intend,” “may,” “plan,” “potential,”

“predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,” “target” and similar expressions, among others, generally identify forward‐looking

statements, which are based on management’s reasonable expectations and assumptions as of the date the statements were made. Actual results and the

outcomes of future events may differ materially from those expressed or implied in the forward‐looking statements because of a number of risks and uncertainties,

including, without limitation, product supply versus demand imbalances in the semiconductor industry or in certain geographic markets may decrease the demand

for our goods and services; our concentrated customer base; our ability to continue technological innovation and successfully introduce new products to meet the

evolving needs of our customers; our ability to protect and enforce our intellectual property rights and to avoid violating any third party intellectual property or

technology rights; unexpected interruption of or shortages in our raw material supply; inability of sole source, limited source or qualified suppliers to deliver to us in

a timely manner or at all; hazards associated with specialty chemical manufacturing, such as fires, explosions and accidents, could disrupt our operations or the

operations of our suppliers or customers; increased competition and new product development by our competitors, changing customer needs and price changes in

materials and components could result in declining demand for our products; operational, political and legal risks of our international operations; the impact of

changes in environmental and health and safety regulations, anticorruption enforcement, sanctions, import/export controls, tax and other legislation and

regulations in jurisdictions in which Versum Materials and its affiliates operate; our available cash and access to additional capital may be limited by substantial

leverage and debt service obligations; uncertainty regarding the availability of financing to us in the future and the terms of such financing; agreements governing

our indebtedness may restrict our current and future operations, and hamper our ability to respond to changes or to take certain actions; government regulation of

raw materials, products and facilities may impact our product manufacturing processes, handling, storage, transportation, uses and applications; possible liability for

contamination, personal injury or third party impacts if hazardous materials are released into the environment; cyber security threats may compromise our data or

disrupt our information technology applications or services; fluctuation of currency exchange rates; costs and outcomes of litigation or regulatory investigations; the

timing, impact, and other uncertainties of future acquisitions or divestitures; restrictions in our governing documents and of Delaware law may prevent or delay an

acquisition of us; our ability to complete, on a timely or cost‐effective basis, the changes necessary to successfully complete our transition to an independent public

company; tax and other potential liabilities to Air Products assumed in connection with the separation and spin‐off; restrictions against engaging in certain

corporate transactions for two years following the separation and spin‐off; potential liabilities arising out of state and federal fraudulent conveyance laws and legal

dividend requirements with respect to the separation and spin‐off and related internal reorganization transactions; and other risk factors described in our filings

with the Securities and Exchange Commission, including in our Annual Report on Form 10‐K for the fiscal year ended September 30, 2017, and in our other periodic

filings. Versum Materials assumes no obligation to update any forward‐looking statements or information in this presentation to reflect any subsequent change in

assumptions, beliefs or expectations, or any change in events, conditions or circumstances occurring after the date of this presentation.

SEMI FROM A SPECIALTY MATERIAL PERSPECTIVE

TODAYS DISCUSSION

• Historic View

• What is Changing?

• Implications for Materials Players

© Versum Materials 2018

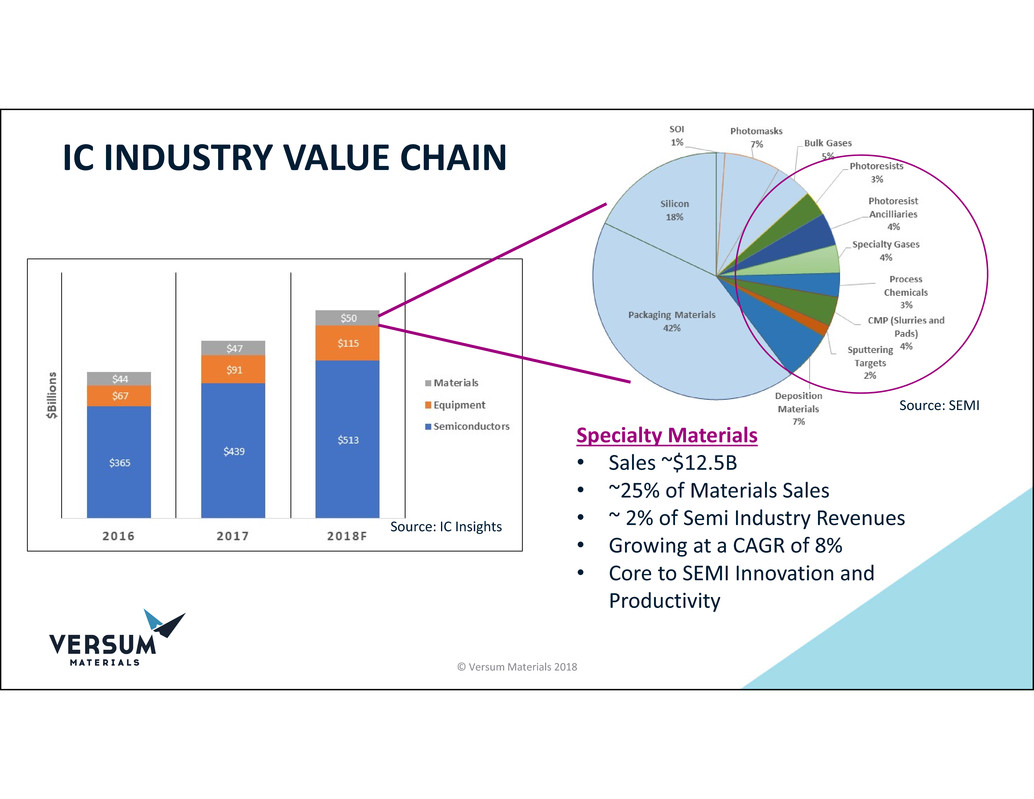

IC INDUSTRY VALUE CHAIN

Specialty Materials

• Sales ~$12.5B

• ~25% of Materials Sales

• ~ 2% of Semi Industry Revenues

• Growing at a CAGR of 8%

• Core to SEMI Innovation and

Productivity

Source: IC Insights

Source: SEMI

© Versum Materials 2018

WHAT DRIVES SPECIALTY MATERIALS?

VOLUME And MIX

• Industry Volume Growth

- Silicon MSI/Wafer Starts

• Technology Changes Due to New Device Architectures

- Next Generation Nodes (New Materials)

- 3 Dimensional Structures (More Materials and More

Processing Steps)

• Competitive Position as a Materials Supplier

- Innovation/Differentiation Capabilities

- Supply Infrastructure/Cost/Quality

- Customer Partnership/Access

Source: IMEC

© Versum Materials 2018

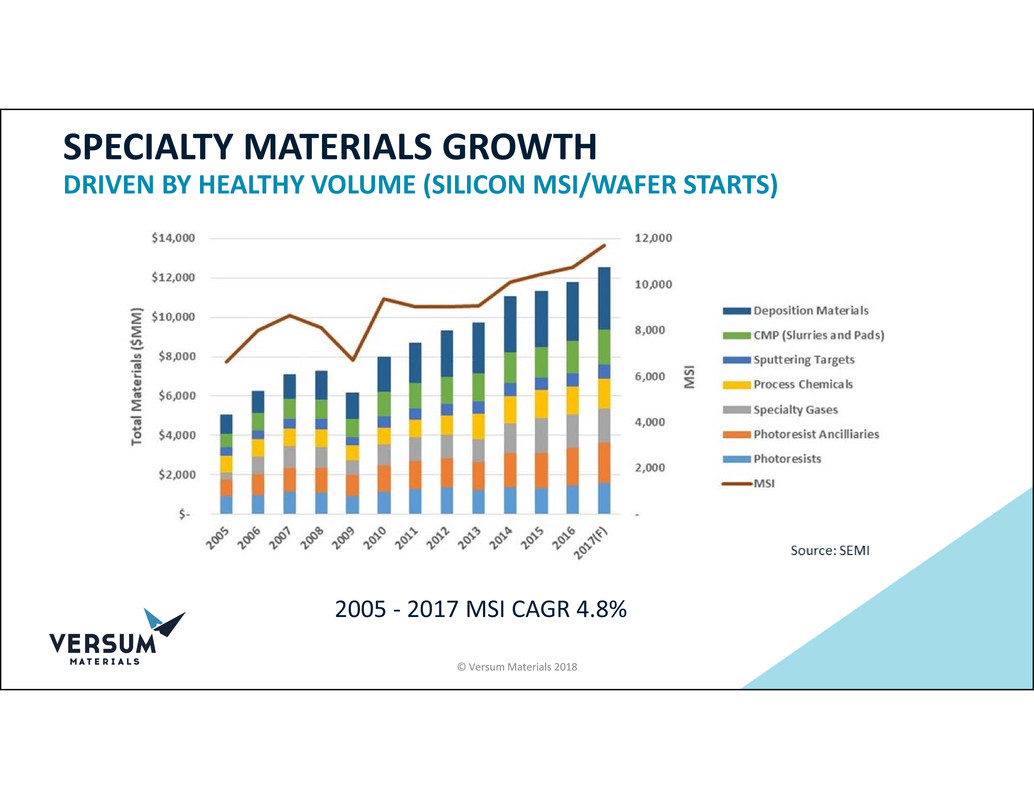

SPECIALTY MATERIALS GROWTH

DRIVEN BY HEALTHY VOLUME (SILICON MSI/WAFER STARTS)

2005 ‐ 2017 MSI CAGR 4.8%

© Versum Materials 2018

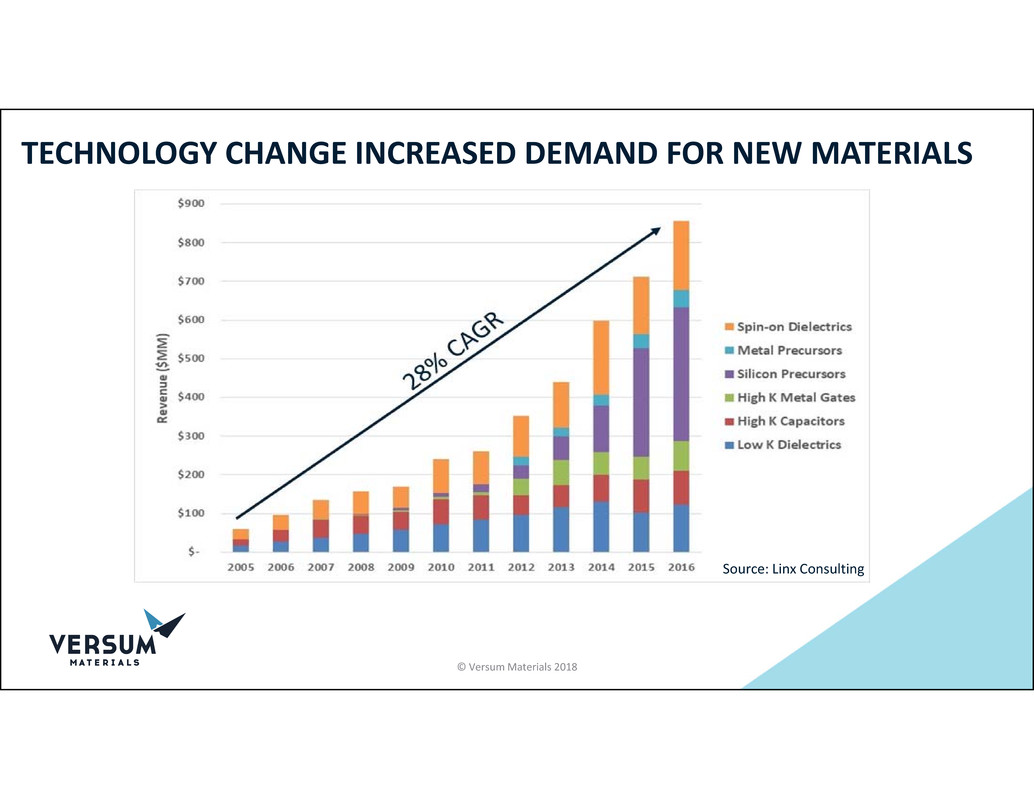

TECHNOLOGY CHANGE INCREASED DEMAND FOR NEW MATERIALS

Source: Linx Consulting

© Versum Materials 2018

SO, WHAT IS CHANGING?

© Versum Materials 2018

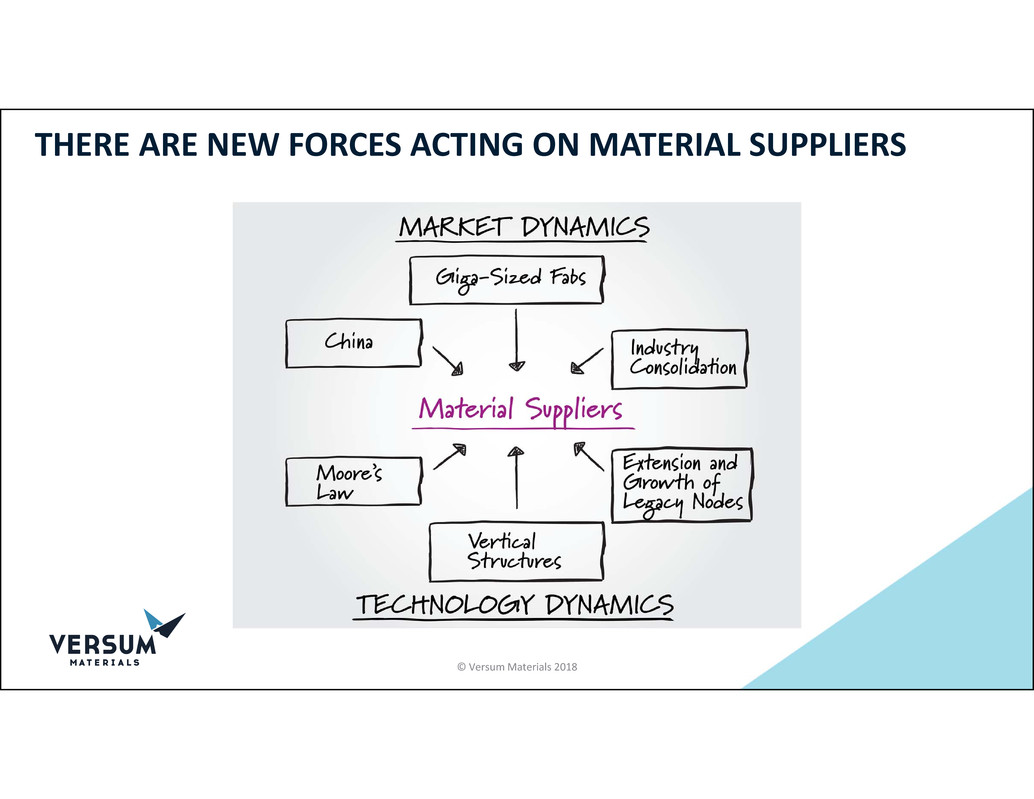

THERE ARE NEW FORCES ACTING ON MATERIAL SUPPLIERS

© Versum Materials 2018

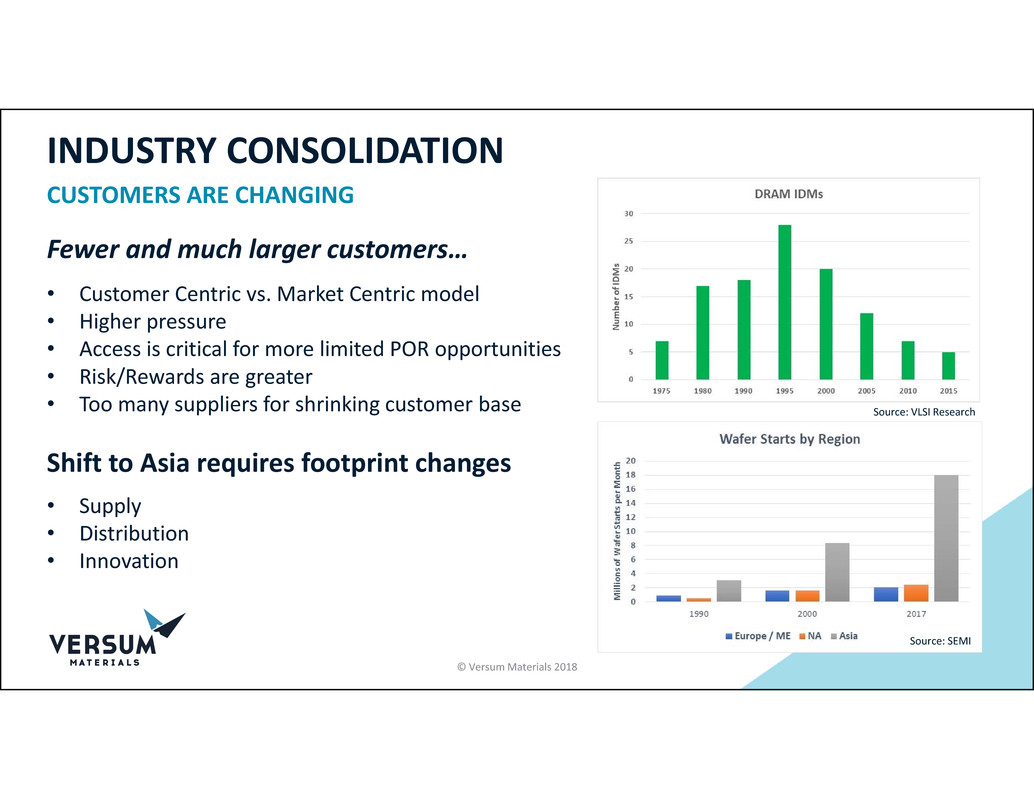

INDUSTRY CONSOLIDATION

CUSTOMERS ARE CHANGING

Source: SEMI

Source: VLSI Research

Fewer and much larger customers…

• Customer Centric vs. Market Centric model

• Higher pressure

• Access is critical for more limited POR opportunities

• Risk/Rewards are greater

• Too many suppliers for shrinking customer base

Shift to Asia requires footprint changes

• Supply

• Distribution

• Innovation

© Versum Materials 2018

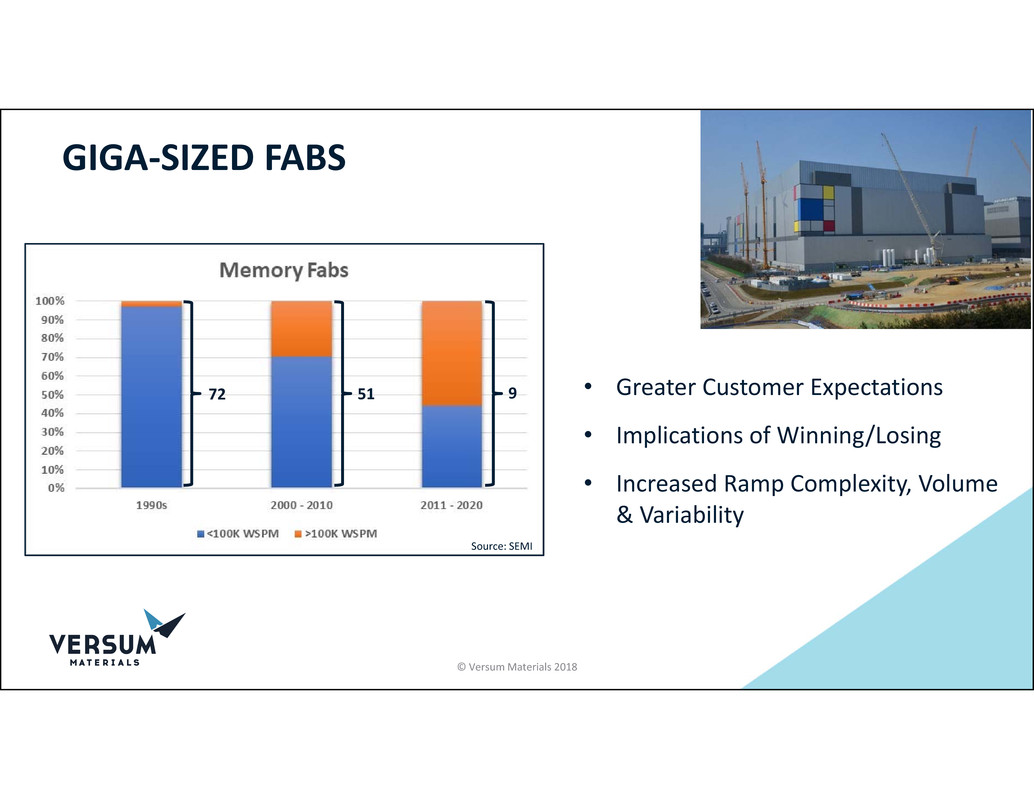

GIGA‐SIZED FABS

72 51 9 • Greater Customer Expectations

• Implications of Winning/Losing

• Increased Ramp Complexity, Volume

& Variability

Source: SEMI

© Versum Materials 2018

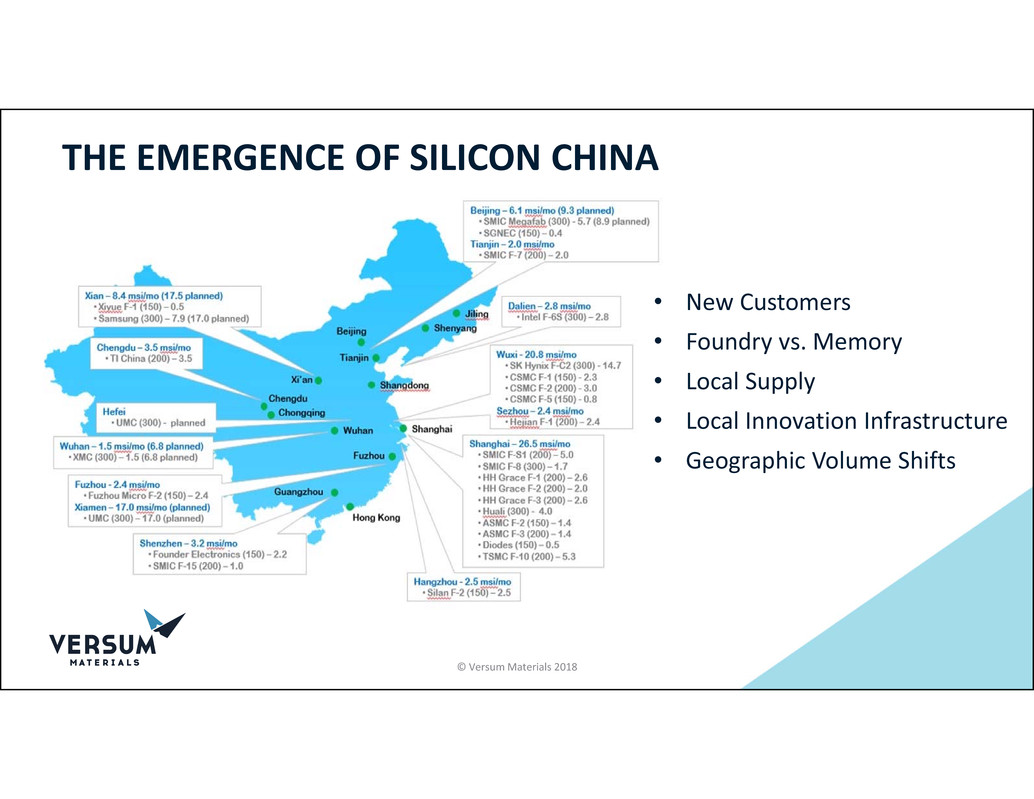

THE EMERGENCE OF SILICON CHINA

• New Customers

• Foundry vs. Memory

• Local Supply

• Local Innovation Infrastructure

• Geographic Volume Shifts

© Versum Materials 2018

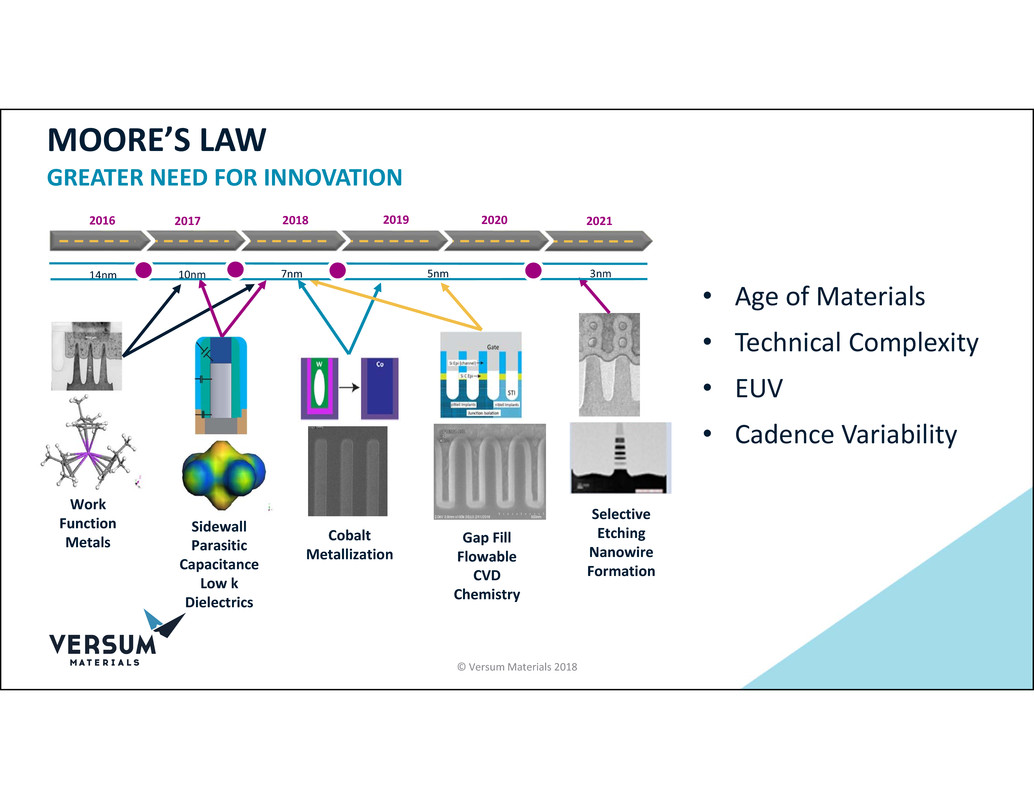

MOORE’S LAW

GREATER NEED FOR INNOVATION

201920182016 2017 2020 2021

14nm 10nm 7nm 5nm 3nm

Work

Function

Metals

Sidewall

Parasitic

Capacitance

Low k

Dielectrics

Gap Fill

Flowable

CVD

Chemistry

Cobalt

Metallization

Selective

Etching

Nanowire

Formation

• Age of Materials

• Technical Complexity

• EUV

• Cadence Variability

© Versum Materials 2018

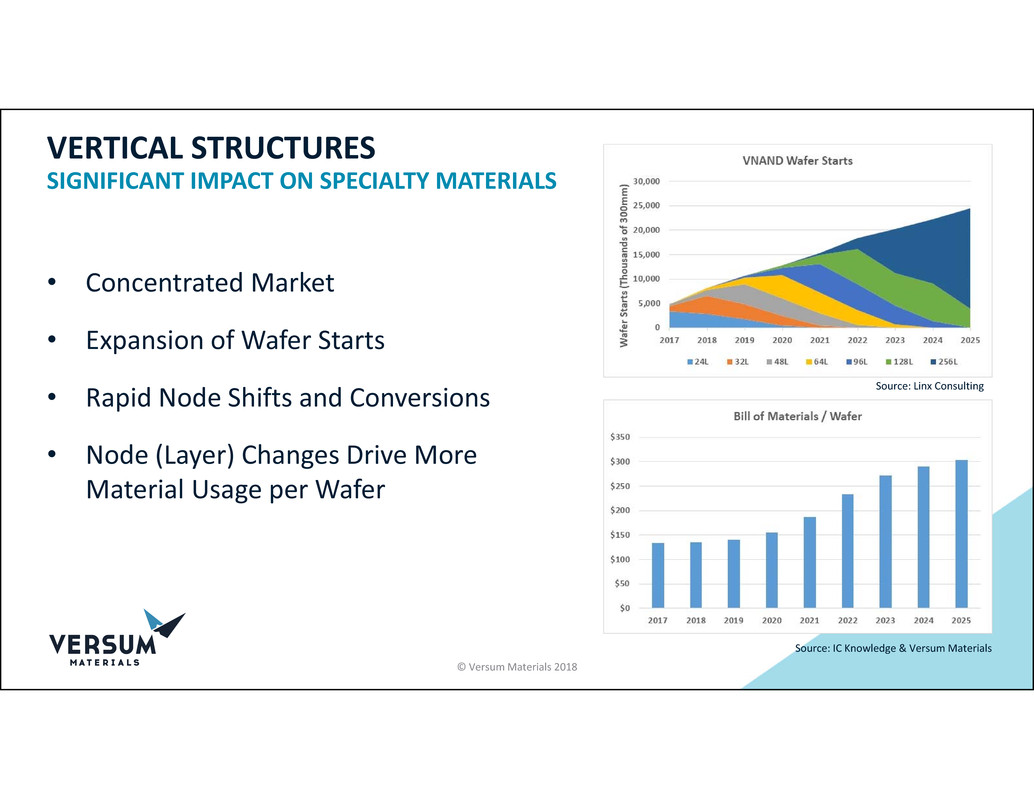

VERTICAL STRUCTURES

SIGNIFICANT IMPACT ON SPECIALTY MATERIALS

• Concentrated Market

• Expansion of Wafer Starts

• Rapid Node Shifts and Conversions

• Node (Layer) Changes Drive More

Material Usage per Wafer

Source: IC Knowledge & Versum Materials

© Versum Materials 2018

Source: Linx Consulting

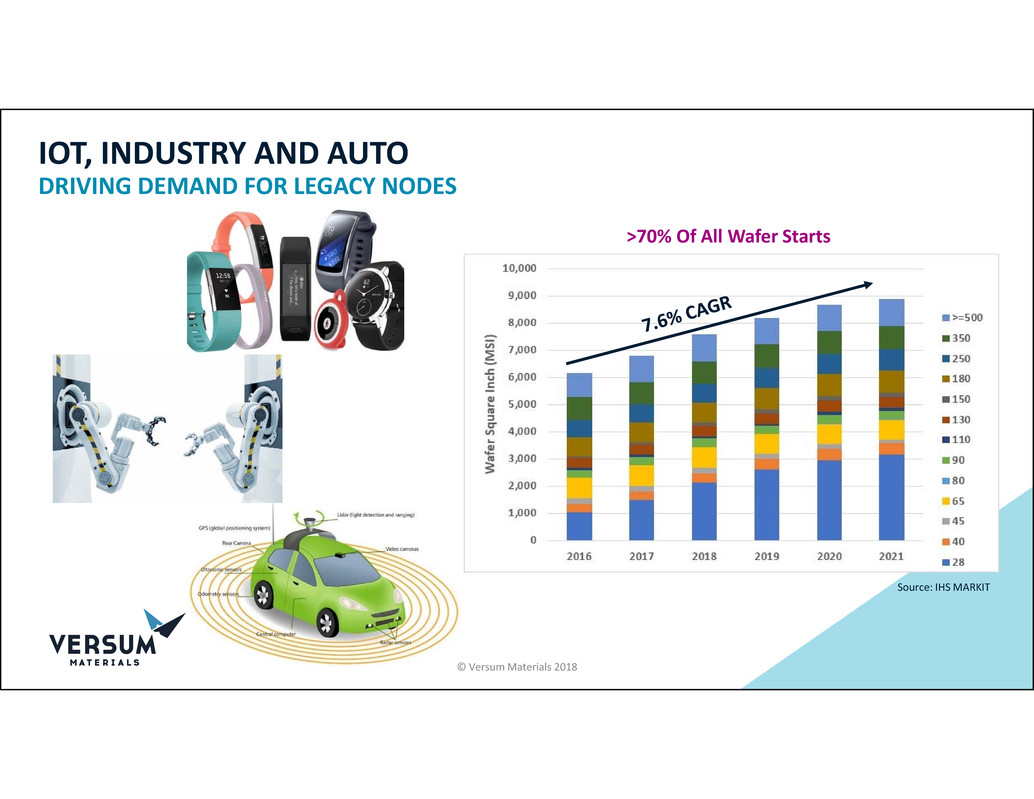

IOT, INDUSTRY AND AUTO

DRIVING DEMAND FOR LEGACY NODES

>70% Of All Wafer Starts

Source: IHS MARKIT

© Versum Materials 2018

IMPLICATIONS FOR MATERIALS SUPPLIERS

© Versum Materials 2018

ISSUES TO REMEMBER

• Embrace Industry Concentration or Leave

• Innovation and Productivity/Yield Drive SEMI Value

• There is a Symbiotic Relationship Across the Value Chain

• Customers Know the Value you Provide

• Know Your Capabilities and Respect Yourself

© Versum Materials 2018

CRITERIA FOR SUCCESS GOING INTO THE 2020s

Customer Relationships

Diversified Portfolio

Innovation Capabilities and Intellectual Property

Global Infrastructure and Reliable Supply

SEMI

Next

Generation

Specialty

Materials

Supplier

© Versum Materials 2018

DEEPER CUSTOMER RELATIONSHIPS

LEARNING TO “DANCE WITH ELEPHANTS”

• Customer Focus & Value Creation

• Trust and Reliability

• Ability to Respond & Scale Quickly

• Critical Mass & Global Infrastructure

• Intellectual Property and Knowhow

• Portfolio Diversification

Grace, Elegance… and Fortitude

© Versum Materials 2018

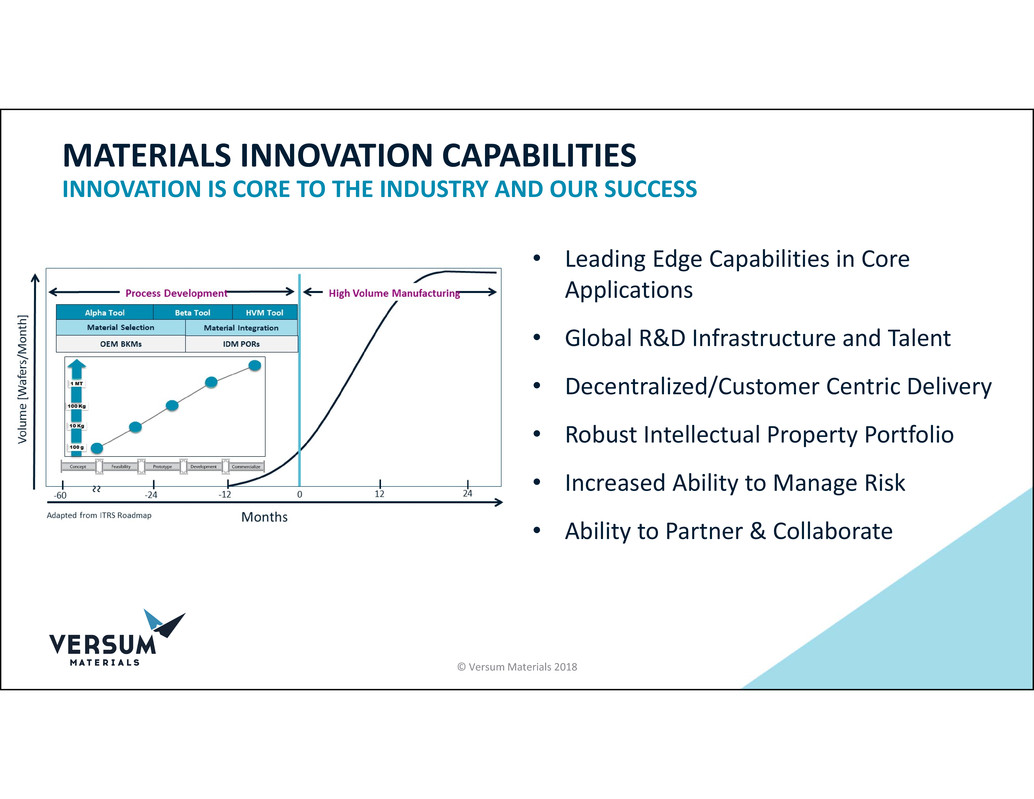

MATERIALS INNOVATION CAPABILITIES

INNOVATION IS CORE TO THE INDUSTRY AND OUR SUCCESS

• Leading Edge Capabilities in Core

Applications

• Global R&D Infrastructure and Talent

• Decentralized/Customer Centric Delivery

• Robust Intellectual Property Portfolio

• Increased Ability to Manage Risk

• Ability to Partner & Collaborate

© Versum Materials 2018

PORTFOLIO DIVERSIFICATION

ABILITY TO MANAGE UNCERTAINTY AND SUSTAIN COMMITMENT

• Stay committed to SEMI

• Leverage SEMI Focus

• Build Critical Mass and Core

Competencies in Key Technologies

• Diversify performance drivers

• Build Resilience

© Versum Materials 2018

Customer

Relationships

Innovation

Capabilities and

Intellectual

Property

Global

Infrastructure and

Reliable Supply

Diversified

Portfolio

CRITERIA FOR SUCCESS GOING INTO THE 2020s

© Versum Materials 2018

Potential

For

Industry

Consolidation

THANK YOU

© Versum Materials 2018