Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - N1 Liquidating Trust | nsre09302017exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - N1 Liquidating Trust | nsre09302017exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - N1 Liquidating Trust | nsre09302017exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - N1 Liquidating Trust | nsre09302017exhibit311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017

Commission File Number: 000-54671

NORTHSTAR REAL ESTATE INCOME TRUST, INC.

(Exact Name of Registrant as Specified in its Charter)

Maryland (State or Other Jurisdiction of Incorporation or Organization) | 26-4141646 (IRS Employer Identification No.) | |

399 Park Avenue, 18th Floor, New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o Emerging growth company o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The Company has one class of common stock, $0.01 par value per share, 119,333,203 shares outstanding as of November 8, 2017.

NORTHSTAR REAL ESTATE INCOME TRUST, INC.

FORM 10-Q

TABLE OF CONTENTS

Index | Page | |

2

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to our ability to make distributions to our stockholders, our reliance on our advisor and our sponsor, the operating performance of our investments, our financing needs, the effects of our current strategies, the impact of the transactions pursuant to the master combination agreement, or the combination agreement, with, among others, Colony Capital Operating Company, LLC, or CLNS OP, the operating company of our sponsor, Colony NorthStar, Inc., and NorthStar Real Estate Income II, Inc., or NorthStar Income II, on our business and operations. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

• | our ability to consummate the transactions pursuant to the combination agreement on the contemplated terms or at all, including whether such transactions will have the full or any strategic and financial benefits and efficiencies we expect and whether such benefits will be delayed or materialize at all; |

• | the occurrence of any event, change or other circumstances that could give rise to the termination of the combination agreement and the risk that the conditions to the closing of the transactions will not be satisfied; |

• | adverse economic conditions and the impact on the commercial real estate industry; |

• | our ability to deploy capital quickly and successfully; |

• | our dependence on the resources and personnel of our advisor, our sponsor and their affiliates, including our advisor’s ability to source and close on attractive investment opportunities on our behalf; |

• | the performance of our advisor, our sponsor and their affiliates; |

• | our liquidity and access to capital; |

• | our use of leverage; |

• | our ability to make distributions to our stockholders; |

• | the lack of a public trading market for our shares; |

• | the effect of economic conditions on the valuation of our investments; |

• | the effect of paying distributions to our stockholders from sources other than cash flow provided by operations; |

• | the impact of our sponsor’s recently completed merger with NorthStar Realty Finance Corp. and Colony Capital, Inc., and whether any of the anticipated benefits to our advisor’s and its affiliates’ platform will be realized in full or at all; |

• | our advisor’s and its affiliates’ ability to attract and retain qualified personnel to support our operations and potential changes to key personnel providing management services to us; |

• | our reliance on our advisor and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial fees to our advisor, the allocation of investments by our advisor and its affiliates among us and the other sponsored or managed companies and strategic vehicles of our sponsor and its affiliates, and various potential conflicts of interest in our relationship with our sponsor; |

• | the impact of market and other conditions influencing the performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments; |

• | changes in our business or investment strategy; |

3

• | the impact of economic conditions on borrowers of the debt we originate and acquire and the mortgage loans underlying the commercial mortgage backed securities in which we invest as well as on the tenants of the real property that we own; |

• | changes in the value of our portfolio; |

• | the impact of fluctuations in interest rates; |

• | our ability to realize current and expected returns over the life of our investments; |

• | any failure in our advisor’s and its affiliates’ due diligence to identify relevant facts during our underwriting process or otherwise; |

• | illiquidity of debt investments, equity investments or properties in our portfolio; |

• | our ability to finance our assets on terms that are acceptable to us, if at all, including our ability to complete securitization financing transactions; |

• | environmental compliance costs and liabilities; |

• | risks associated with our joint ventures and unconsolidated entities, including our lack of sole decision making authority and the financial condition of our joint venture partners; |

• | increased rates of loss or default and decreased recovery on our investments; |

• | the degree and nature of our competition; |

• | the effectiveness of our risk and portfolio management strategies; |

• | the potential failure to maintain effective internal controls, disclosure and procedures; |

• | regulatory requirements with respect to our business generally, as well as the related cost of compliance; |

• | legislative and regulatory changes, including changes to laws governing the taxation of real estate investment trusts, or REITs, and changes to laws affecting non-traded REITs and alternative investments generally; |

• | our ability to maintain our qualification as a REIT for federal income tax purposes and limitations imposed on our business by our status as a REIT; |

• | the loss of our exemption from registration under the Investment Company Act of 1940, as amended; |

• | general volatility in capital markets; |

• | the adequacy of our cash reserves and working capital; and |

• | other risks associated with investing in our targeted investments, including changes in our industry, interest rates, the securities markets, the general economy or the capital markets and real estate markets specifically. |

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Quarterly Report on Form 10-Q are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the U.S. Securities and Exchange Commission, or the SEC, included in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and in Part II, Item 1A of this Quarterly Report on Form 10-Q under the heading “Risk Factors.” The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

4

PART I. Financial Information

Item 1. Financial Statements

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands, Except Per Share Data)

September 30, 2017 (Unaudited) | December 31, 2016 | ||||||

Assets | |||||||

Cash and cash equivalents | $ | 163,087 | $ | 153,039 | |||

Restricted cash | 45,130 | 74,195 | |||||

Real estate debt investments, net | 367,262 | 745,323 | |||||

Real estate debt investments, held for sale | 150,150 | — | |||||

Operating real estate, net | 477,531 | 488,839 | |||||

Investments in unconsolidated ventures (refer to Note 5) | 55,401 | 90,579 | |||||

Real estate securities, available for sale | 148,158 | 93,975 | |||||

Mortgage loans held in a securitization trust, at fair value | 922,034 | — | |||||

Receivables, net | 14,546 | 13,956 | |||||

Deferred costs and other assets, net | 50,570 | 56,370 | |||||

Loan collateral receivable, related party | 50,791 | 52,204 | |||||

Total assets(1) | $ | 2,444,660 | $ | 1,768,480 | |||

Liabilities | |||||||

Securitization bonds payable, net | $ | — | $ | 39,762 | |||

Mortgage notes payable, net | 394,903 | 393,410 | |||||

Credit facilities | 185,728 | 249,156 | |||||

Mortgage obligations issued by a securitization trust, at fair value | 870,075 | — | |||||

Due to related party (refer to Note 8) | 4,304 | 68 | |||||

Accounts payable and accrued expenses | 19,875 | 7,862 | |||||

Escrow deposits payable | 21,061 | 58,453 | |||||

Distribution payable | 6,866 | 8,192 | |||||

Other liabilities | 16,101 | 19,191 | |||||

Loan collateral payable, net, related party (refer to Note 8) | 23,408 | 23,261 | |||||

Total liabilities(1) | 1,542,321 | 799,355 | |||||

Commitments and contingencies | |||||||

Equity | |||||||

NorthStar Real Estate Income Trust, Inc. Stockholders’ Equity | |||||||

Preferred stock, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding as of September 30, 2017 and December 31, 2016 | — | — | |||||

Common stock, $0.01 par value, 400,000,000 shares authorized, 119,333,203 and 120,903,352 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively | 1,193 | 1,209 | |||||

Additional paid-in capital | 1,066,717 | 1,080,434 | |||||

Retained earnings (accumulated deficit) | (203,735 | ) | (151,731 | ) | |||

Accumulated other comprehensive income (loss) | 20,854 | 20,175 | |||||

Total NorthStar Real Estate Income Trust, Inc. stockholders’ equity | 885,029 | 950,087 | |||||

Non-controlling interests | 17,310 | 19,038 | |||||

Total equity | 902,339 | 969,125 | |||||

Total liabilities and equity | $ | 2,444,660 | $ | 1,768,480 | |||

_______________________________________

(1) | Represents the consolidated assets and liabilities of NorthStar Real Estate Income Trust Operating Partnership, LP (the “Operating Partnership”). The Operating Partnership is a consolidated variable interest entity (“VIE”), of which the Company is the sole general partner and owns approximately 99.98%. As of September 30, 2017, the Operating Partnership includes $1.3 billion and $1.3 billion of assets and liabilities, respectively, of certain VIEs that are consolidated by the Operating Partnership. Refer to Note 2, “Summary of Significant Accounting Policies.” |

Refer to accompanying notes to consolidated financial statements.

5

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Net interest income | ||||||||||||||||

Interest income | $ | 14,869 | $ | 18,649 | $ | 47,529 | $ | 59,006 | ||||||||

Interest expense | (2,938 | ) | (4,003 | ) | (9,044 | ) | (13,150 | ) | ||||||||

Interest income on mortgage loans held in a securitization trust | 11,892 | — | 15,774 | — | ||||||||||||

Interest expense on mortgage obligations issued by a securitization trust | (10,582 | ) | — | (14,202 | ) | — | ||||||||||

Net interest income | 13,241 | 14,646 | 40,057 | 45,856 | ||||||||||||

Property and other revenues | ||||||||||||||||

Rental and other income | 22,889 | 21,843 | 66,827 | 58,330 | ||||||||||||

Total property and other revenues | 22,889 | 21,843 | 66,827 | 58,330 | ||||||||||||

Expenses | ||||||||||||||||

Asset management and other fees, related party | 4,355 | 5,410 | 13,592 | 18,747 | ||||||||||||

Mortgage notes interest expense | 4,805 | 4,552 | 14,160 | 12,895 | ||||||||||||

Other expenses related to securitization trust | 42 | — | 55 | — | ||||||||||||

Transaction costs | 3,988 | 182 | 5,544 | 1,909 | ||||||||||||

Property operating expenses | 10,836 | 10,918 | 30,294 | 27,478 | ||||||||||||

General and administrative expenses (refer to Note 8) | 2,600 | 3,381 | 7,862 | 11,553 | ||||||||||||

Depreciation and amortization | 12,318 | 9,481 | 29,770 | 21,386 | ||||||||||||

Total expenses | 38,944 | 33,924 | 101,277 | 93,968 | ||||||||||||

Other income (loss) | ||||||||||||||||

Unrealized gain (loss) on mortgage loans and obligations held in a securitization trust, net | 725 | — | 725 | — | ||||||||||||

Unrealized gain (loss) on investments | (1,487 | ) | (33 | ) | (1,487 | ) | (3,432 | ) | ||||||||

Income (loss) before equity in earnings (losses) of unconsolidated ventures and income tax benefit (expense) | (3,576 | ) | 2,532 | 4,845 | 6,786 | |||||||||||

Equity in earnings (losses) of unconsolidated ventures | 1,040 | 5,575 | 6,553 | 19,647 | ||||||||||||

Income tax benefit (expense) | 9 | (810 | ) | (579 | ) | (2,265 | ) | |||||||||

Net income (loss) | (2,527 | ) | 7,297 | 10,819 | 24,168 | |||||||||||

Net (income) loss attributable to non-controlling interests | 245 | 194 | (80 | ) | (89 | ) | ||||||||||

Net income (loss) attributable to NorthStar Real Estate Income Trust, Inc. common stockholders | $ | (2,282 | ) | $ | 7,491 | $ | 10,739 | $ | 24,079 | |||||||

Net income (loss) per share of common stock, basic/diluted | $ | (0.02 | ) | $ | 0.06 | $ | 0.09 | $ | 0.20 | |||||||

Weighted average number of shares of common stock outstanding, basic/diluted | 119,479,714 | 121,080,070 | 119,900,584 | 120,979,224 | ||||||||||||

Distributions declared per share of common stock | $ | 0.18 | $ | 0.20 | $ | 0.52 | $ | 0.60 | ||||||||

Refer to accompanying notes to consolidated financial statements.

6

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Dollars in Thousands)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Net income (loss) | $ | (2,527 | ) | $ | 7,297 | $ | 10,819 | $ | 24,168 | |||||||

Other comprehensive income (loss) | ||||||||||||||||

Unrealized gain (loss) on real estate securities, available for sale | (539 | ) | (885 | ) | 679 | 1,332 | ||||||||||

Total other comprehensive income (loss) | (539 | ) | (885 | ) | 679 | 1,332 | ||||||||||

Comprehensive income (loss) | (3,066 | ) | 6,412 | 11,498 | 25,500 | |||||||||||

Comprehensive (income) loss attributable to non-controlling interests | 245 | 194 | (80 | ) | (89 | ) | ||||||||||

Comprehensive income (loss) attributable to NorthStar Real Estate Income Trust, Inc. common stockholders | $ | (2,821 | ) | $ | 6,606 | $ | 11,418 | $ | 25,411 | |||||||

Refer to accompanying notes to consolidated financial statements.

7

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Dollars and Shares in Thousands)

Common Stock | Additional Paid-in Capital | Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Income (Loss) | Total Company’s Stockholders’ Equity | Non- controlling Interests | Total Equity | ||||||||||||||||||||||||

Shares | Amount | |||||||||||||||||||||||||||||

Balance as of December 31, 2015 | 120,758 | $ | 1,207 | $ | 1,078,154 | $ | (86,938 | ) | $ | 21,901 | $ | 1,014,324 | $ | 17,687 | $ | 1,032,011 | ||||||||||||||

Non-controlling interests - contributions | — | — | — | — | — | — | 4,473 | 4,473 | ||||||||||||||||||||||

Non-controlling interests - distributions | — | — | — | — | — | — | (3,377 | ) | (3,377 | ) | ||||||||||||||||||||

Proceeds from distribution reinvestment plan | 4,467 | 45 | 43,501 | — | — | 43,546 | — | 43,546 | ||||||||||||||||||||||

Shares redeemed for cash | (4,349 | ) | (43 | ) | (41,412 | ) | — | — | (41,455 | ) | — | (41,455 | ) | |||||||||||||||||

Issuance and amortization of equity-based compensation | 27 | — | 191 | — | — | 191 | — | 191 | ||||||||||||||||||||||

Other comprehensive income (loss) | — | — | — | — | (1,726 | ) | (1,726 | ) | — | (1,726 | ) | |||||||||||||||||||

Distributions declared | — | — | — | (96,745 | ) | — | (96,745 | ) | — | (96,745 | ) | |||||||||||||||||||

Net income (loss) | — | — | — | 31,952 | — | 31,952 | 255 | 32,207 | ||||||||||||||||||||||

Balance as of December 31, 2016 | 120,903 | $ | 1,209 | $ | 1,080,434 | $ | (151,731 | ) | $ | 20,175 | $ | 950,087 | $ | 19,038 | $ | 969,125 | ||||||||||||||

Non-controlling interests - contributions | — | — | — | — | — | — | 105 | 105 | ||||||||||||||||||||||

Non-controlling interests - distributions | — | — | — | — | — | — | (1,913 | ) | (1,913 | ) | ||||||||||||||||||||

Proceeds from distribution reinvestment plan | 2,711 | 27 | 26,805 | — | — | 26,832 | — | 26,832 | ||||||||||||||||||||||

Shares redeemed for cash | (4,301 | ) | (43 | ) | (40,703 | ) | — | — | (40,746 | ) | — | (40,746 | ) | |||||||||||||||||

Issuance and amortization of equity-based compensation | 20 | — | 181 | — | — | 181 | — | 181 | ||||||||||||||||||||||

Other comprehensive income (loss) | — | — | — | — | 679 | 679 | — | 679 | ||||||||||||||||||||||

Distributions declared | — | — | — | (62,743 | ) | — | (62,743 | ) | — | (62,743 | ) | |||||||||||||||||||

Net income (loss) | — | — | — | 10,739 | — | 10,739 | 80 | 10,819 | ||||||||||||||||||||||

Balance as of September 30, 2017 (unaudited) | 119,333 | $ | 1,193 | $ | 1,066,717 | $ | (203,735 | ) | $ | 20,854 | $ | 885,029 | $ | 17,310 | $ | 902,339 | ||||||||||||||

Refer to accompanying notes to consolidated financial statements.

8

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Thousands)

(Unaudited)

Nine Months Ended September 30, | |||||||

2017 | 2016 | ||||||

Cash flows from operating activities: | |||||||

Net income (loss) | $ | 10,819 | $ | 24,168 | |||

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||

Equity in (earnings) losses of unconsolidated ventures | (6,553 | ) | (19,647 | ) | |||

Depreciation and amortization | 29,770 | 21,386 | |||||

Straight-line rental income | (822 | ) | (1,409 | ) | |||

Amortization of capitalized above/below market leases | 1,107 | 70 | |||||

Amortization of premium/accretion of discount and fees on investments and borrowings, net | (3,284 | ) | (774 | ) | |||

Amortization of deferred financing costs | 3,015 | 2,185 | |||||

Interest accretion on investments | (5,798 | ) | (5,352 | ) | |||

Distributions of cumulative earnings from unconsolidated ventures (refer to Note 5) | 6,553 | 19,647 | |||||

Unrealized gain (loss) on mortgage loans and obligations held in a securitization trust, net | (725 | ) | — | ||||

Unrealized (gain) loss on investments | 1,487 | 3,432 | |||||

Amortization of equity-based compensation | 181 | 135 | |||||

Deferred income tax (benefit) expense | (2,597 | ) | (2,225 | ) | |||

Changes in assets and liabilities: | |||||||

Restricted cash | (3,548 | ) | (2,783 | ) | |||

Receivables, net | 4,108 | 1,290 | |||||

Deferred costs and other assets | (9,363 | ) | (1,250 | ) | |||

Due to related party | 4,236 | 334 | |||||

Accounts payable and accrued expenses | 9,527 | 5,677 | |||||

Other liabilities | (1,362 | ) | 2,444 | ||||

Net cash provided by (used in) operating activities | 36,751 | 47,328 | |||||

Cash flows from investing activities: | |||||||

Origination and funding of real estate debt investments, net | (13,403 | ) | (130,224 | ) | |||

Repayment on real estate debt investments | 246,513 | 247,042 | |||||

Repayment on loan collateral receivable, related party | 1,413 | 1,384 | |||||

Acquisition of operating real estate | — | (103,384 | ) | ||||

Improvements of operating real estate | (5,700 | ) | (4,521 | ) | |||

Investments in unconsolidated ventures (refer to Note 5) | (13,248 | ) | (49,743 | ) | |||

Proceeds from sale of unconsolidated ventures | — | 59,760 | |||||

Distributions in excess of cumulative earnings from unconsolidated ventures (refer to Note 5) | 47,145 | 41,596 | |||||

Acquisition of real estate securities, available for sale | (106,255 | ) | (13,822 | ) | |||

Repayment of real estate securities, available for sale | 4,694 | 8,538 | |||||

Change in restricted cash | (4,779 | ) | (415 | ) | |||

Net cash provided by (used in) investing activities | 156,380 | 56,211 | |||||

Cash flows from financing activities: | |||||||

Proceeds from distribution reinvestment plan | 26,832 | 32,950 | |||||

Shares redeemed for cash | (40,746 | ) | (29,034 | ) | |||

Distributions paid on common stock | (64,069 | ) | (72,690 | ) | |||

Borrowings from mortgage notes | 660 | 70,096 | |||||

Repayment of mortgage notes | (161 | ) | (151 | ) | |||

Borrowings from credit facilities | 83,847 | 100,080 | |||||

Repayment of credit facilities | (147,275 | ) | (94,380 | ) | |||

Repayment of securitization bonds | (39,762 | ) | (120,930 | ) | |||

Payment of deferred financing costs | (601 | ) | (2,793 | ) | |||

Contributions from non-controlling interests | 105 | 4,432 | |||||

Distributions to non-controlling interests | (1,913 | ) | (1,191 | ) | |||

Net cash provided by (used in) financing activities | (183,083 | ) | (113,611 | ) | |||

Net increase (decrease) in cash and cash equivalents | 10,048 | (10,072 | ) | ||||

Cash and cash equivalents - beginning of period | 153,039 | 127,890 | |||||

Cash and cash equivalents - end of period | $ | 163,087 | $ | 117,818 | |||

Refer to accompanying notes to consolidated financial statements.

9

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Dollars in Thousands)

(Unaudited)

Nine Months Ended September 30, | |||||||

2017 | 2016 | ||||||

Supplemental disclosure of non-cash investing and financing activities: | |||||||

Consolidation of securitization trust (VIE asset / liability) | $ | 873,951 | $ | — | |||

Reclassification of CRE debt investments to held for sale | 150,150 | — | |||||

Escrow deposits payable related to real estate debt investments | 37,392 | 12,874 | |||||

Accrual of distribution payable | 6,866 | 7,942 | |||||

Non-cash related to PE Investments (refer to Note 5) | 3,908 | 1,016 | |||||

Acquisition of operating real estate / reduction of CRE debt investment(1) | — | 67,493 | |||||

CRE debt investment payoff due from servicer | — | 24,400 | |||||

Reclassification related to measurement-period adjustment | — | 18,674 | |||||

_______________________________________

(1) | Non-cash activity occurred in connection with taking title to collateral. |

Refer to accompanying notes to consolidated financial statements.

10

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. | Business and Organization |

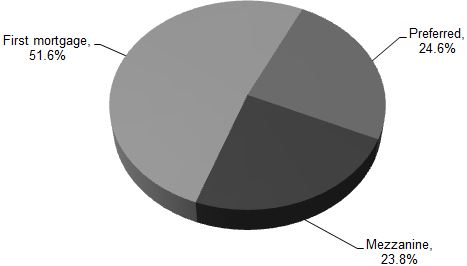

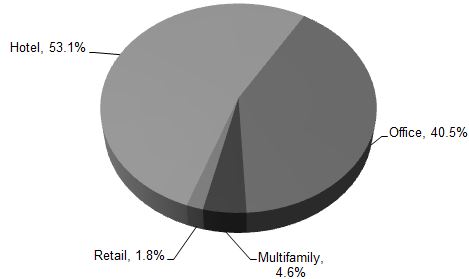

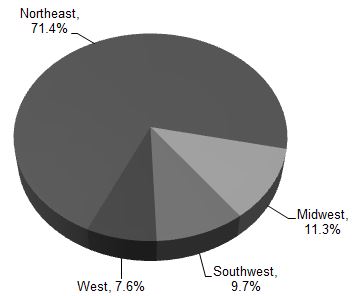

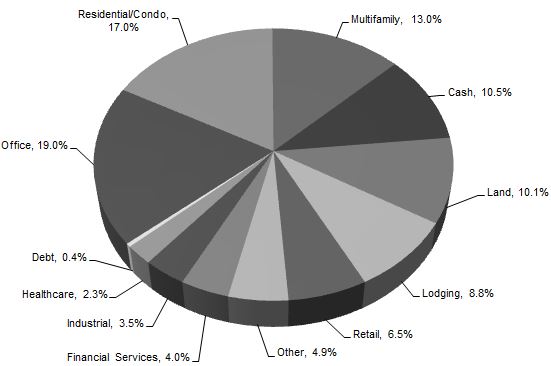

NorthStar Real Estate Income Trust, Inc. (the “Company”) was formed to originate, acquire and asset manage a diversified portfolio of commercial real estate (“CRE”) debt, select equity and securities investments, predominantly in the United States. The Company may also invest in CRE investments internationally. CRE debt investments include first mortgage loans, subordinate mortgage and mezzanine loans and participations in such loans and preferred equity interests. Real estate equity investments include the Company’s direct ownership in properties, which may be structurally senior to a third-party partner’s equity, as well as indirect interests in real estate through real estate private equity funds (“PE Investments”). CRE securities primarily consist of commercial mortgage-backed securities (“CMBS”) and may in the future include unsecured real estate investment trust (“REIT”) debt, collateralized debt obligation (“CDO”) notes and other securities. In addition, the Company may own investments through joint ventures. The Company was formed in January 2009 as a Maryland corporation and commenced operations in October 2010. The Company elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), commencing with the taxable year ended December 31, 2010. The Company conducts its operations so as to continue to qualify as a REIT for U.S. federal income tax purposes.

The Company is externally managed and has no employees. Prior to January 11, 2017, the Company was managed by an affiliate of NorthStar Asset Management Group Inc. (NYSE: NSAM) (“NSAM”). Effective January 10, 2017, NSAM completed its previously announced merger with Colony Capital, Inc. (“Colony”), NorthStar Realty Finance Corp. (“NorthStar Realty”), and Colony NorthStar, Inc. (“Colony NorthStar”), a wholly-owned subsidiary of NSAM, which the Company refers to as the mergers, with Colony NorthStar surviving the mergers and succeeding NSAM as the Company’s sponsor (the “Sponsor”). As a result of the mergers, the Sponsor became an internally-managed equity REIT, with a diversified real estate and investment management platform and publicly-traded on the NYSE under the ticker symbol “CLNS.” In addition, following the mergers, CNI NSI Advisors, LLC (formerly known as NSAM J-NSI Ltd), an affiliate of NSAM (the “Advisor”), became a subsidiary of Colony NorthStar. The Advisor manages the Company’s day-to-day operations pursuant to an advisory agreement. The mergers had no material impact on the Company’s operations.

Colony NorthStar manages capital on behalf of its stockholders, as well as institutional and retail investors in private funds, non-traded and traded REITs and registered investment companies.

Substantially all the Company’s business is conducted through NorthStar Real Estate Income Trust Operating Partnership, LP (the “Operating Partnership”). The Company is the sole general partner and a limited partner of the Operating Partnership. The other limited partners of the Operating Partnership are NS Real Estate Income Trust Advisor, LLC (the “Prior Advisor”) and NorthStar OP Holdings, LLC (the “Special Unit Holder”), each an affiliate of the Sponsor. The Prior Advisor invested $1,000 in the Operating Partnership in exchange for common units and the Special Unit Holder invested $1,000 in the Operating Partnership and was issued a separate class of limited partnership units (the “Special Units”), which are collectively recorded as non-controlling interests on the consolidated balance sheets as of September 30, 2017 and December 31, 2016. As the Company accepted subscriptions for shares in its continuous, public offering which closed in July 2013, it contributed substantially all of the net proceeds to the Operating Partnership as a capital contribution. As of September 30, 2017, the Company’s limited partnership interest in the Operating Partnership was 99.98%.

The Company’s charter authorizes the issuance of up to 400,000,000 shares of common stock with a par value of $0.01 per share and up to 50,000,000 shares of preferred stock with a par value of $0.01 per share. The board of directors of the Company is authorized to amend its charter, without the approval of the stockholders, to increase the aggregate number of authorized shares of capital stock or the number of shares of any class or series that the Company has authority to issue.

On August 25, 2017, the Company entered into a master combination agreement (the “Combination Agreement”) with, among others, Colony Capital Operating Company, LLC, (“CLNS OP”), the operating company of the Sponsor, and NorthStar Real Estate Income II, Inc. (“NorthStar Income II”), a company managed by an affiliate of the Sponsor, pursuant to which a select portfolio of the assets and liabilities of the Sponsor will be combined with substantially all of the assets and liabilities of the Company and all of the assets and liabilities of NorthStar Income II in an all-stock combination transaction to create an externally managed commercial real estate credit REIT (the transactions associated with the Combination Agreement, collectively the “Combination”). The Combination has been unanimously approved by the special committees and the boards of directors of both the Company and NorthStar Income II and approved by the board of directors of the Sponsor. The combined company will be named “Colony NorthStar Credit Real Estate, Inc.” (“CLNC”) and its Class A common stock is expected to be listed on a national securities exchange.

11

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Upon completion of the Combination, the Company’s stockholders, the Sponsor and NorthStar Income II’s stockholders will own approximately 32%, 37% and 31%, respectively, of CLNC on a fully diluted basis, subject to certain adjustments as set forth in the Combination Agreement.

The Combination is expected to close in the first quarter of 2018, subject to customary closing conditions, including approval by the stockholders of each of the Company and NorthStar Income II, and the listing of CLNC’s Class A common stock on a national securities exchange. There can be no assurance that the closing conditions will be satisfied, that the Combination will be consummated, or the timing thereof.

The Company initially registered to offer up to 100,000,000 shares pursuant to its primary offering to the public (the “Primary Offering”) and up to 10,526,315 shares pursuant to its distribution reinvestment plan (the “DRP”), which are herein collectively referred to as the Offering. The Primary Offering (including 7.6 million shares reallocated from the DRP, (the “Total Primary Offering”) was completed on July 1, 2013 and all of the shares initially registered for the Offering were issued. As a result of an additional registration statement to offer up to 10.0 million shares pursuant to the DRP, the Company continued to offer DRP shares beyond the Total Primary Offering. On August 25, 2017, in connection with the entry into the Combination Agreement, the Company’s board of directors, including all of its independent directors, voted to suspend the DRP until further notice. Pursuant to the terms of the DRP, the suspension went into effect prior to the monthly distributions to be paid on or about October 1, 2017 and as a result, all stockholders will receive only cash distributions through the completion of the Combination unless and until the DRP is reinstated.

The Company raised total gross proceeds of $1.1 billion in the Offering. In addition, from the close of the Primary Offering through November 8, 2017, the Company has raised an additional $0.2 billion in gross proceeds pursuant to the DRP.

2. | Summary of Significant Accounting Policies |

Basis of Quarterly Presentation

The accompanying unaudited consolidated financial statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and note disclosures normally included in the consolidated financial statements prepared under U.S. GAAP have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which was filed with the U.S. Securities and Exchange Commission (the “SEC”).

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, the Operating Partnership and their consolidated subsidiaries. The Company consolidates variable interest entities (“VIEs”), if any, where the Company is the primary beneficiary and voting interest entities which are generally majority owned or otherwise controlled by the Company. All significant intercompany balances are eliminated in consolidation.

Variable Interest Entities

A VIE is an entity that lacks one or more of the characteristics of a voting interest entity. A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of whether an entity is a VIE includes both a qualitative and quantitative analysis. The Company bases its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and relevant financial agreements and the quantitative analysis on the forecasted cash flow of the entity. The Company reassesses its initial evaluation of an entity as a VIE upon the occurrence of certain reconsideration events.

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents has both the: (i) power to direct the activities that most significantly impact the VIE’s economic performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. The Company determines whether it is the primary beneficiary of a VIE by considering qualitative and quantitative factors, including,

12

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

but not limited to: which activities most significantly impact the VIE’s economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for the Company or other interests to provide financial support; consideration of the VIE’s purpose and design, including the risks the VIE was designed to create and pass through to its variable interest holders and the similarity with and significance to the business activities of the Company and the other interests. The Company reassesses its determination of whether it is the primary beneficiary of a VIE each reporting period. Significant judgments related to these determinations include estimates about the current and future fair value and performance of investments held by these VIEs and general market conditions.

The Company evaluates its investments and financings, including investments in unconsolidated ventures and securitization financing transactions, if any, to determine whether each investment or financing is a VIE. The Company analyzes new investments and financings, as well as reconsideration events for existing investments and financings, which vary depending on type of investment or financing.

As of September 30, 2017, the Company has identified certain consolidated and unconsolidated VIEs. Assets of each of the VIEs, other than the Operating Partnership, may only be used to settle obligations of the respective VIE. Creditors of each of the VIEs have no recourse to the general credit of the Company.

Consolidated VIEs

The most significant consolidated VIEs are the Operating Partnership, the Investing VIE (as discussed below) and certain properties that have non-controlling interests. These entities are VIEs because the non-controlling interests do not have substantive kick-out or participating rights.

The Operating Partnership consolidates certain properties that have non-controlling interests. Included in operating real estate, net on the Company’s consolidated balance sheet as of September 30, 2017 is $343.9 million related to such consolidated VIEs. Included in mortgage notes payable, net on the Company’s consolidated balance sheet as of September 30, 2017 is $324.4 million collateralized by the real estate assets of the related consolidated VIEs.

Investing VIEs

The Company’s investments in securitization financing entities (“Investing VIEs”), include subordinate first-loss tranches of the securitization trust, which represent interests in such VIE. Investing VIEs are structured as pass through entities that receive principal and interest payments from the underlying debt collateral assets and distribute those payments to the securitization trust’s certificate holders, including the most subordinate tranches of the securitization trust. Generally, a securitization trust designates the most junior subordinate tranche outstanding as the controlling class, which entitles the holder of the controlling class to unilaterally appoint and remove the special servicer for the trust, and as such may qualify as the primary beneficiary of the trust.

If it is determined that the Company is the primary beneficiary of an Investing VIE as a result of acquiring the subordinate first-loss tranches of the securitization trust, the Company would consolidate the assets, liabilities, income and expenses of the entire Investing VIE. The assets held by an Investing VIE are restricted and can only be used to fulfill its own obligations. The obligations of an Investing VIE have neither any recourse to the general credit of the Company as the consolidator of an Investing VIE, nor to any of the Company’s other consolidated entities.

As of September 30, 2017, the Company held subordinate tranches of the securitization trust in an Investing VIE for which the Company has determined it is the primary beneficiary because it has the power to direct the activities that most significantly impact the economic performance of the securitization trust. The Company’s subordinate tranches of the securitization trust, which represent the retained interest and related interest income, are eliminated in consolidation. In accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810, Consolidation, the assets, liabilities (obligations to the certificate holders of the securitization trust, less the Company’s retained interest from the subordinate tranches of the securitization trust), income and expense of the entire Investing VIE are presented in the consolidated financial statement of the Company. As a result, although the Company legally owns the subordinate tranches of the securitization trust only, U.S. GAAP requires the Company to present the assets, liabilities, income and expenses of the entire securitization trust on its consolidated financial statements. Regardless of the presentation, the Company’s consolidated financial statements of operations ultimately reflect the net income attributable to its retained interest in the subordinate tranches of the securitization trust. Refer to Note 6, “Real Estate Securities, Available for Sale” for further discussion.

The Company elected the fair value option for the initial recognition of the assets and liabilities of its consolidated Investing VIEs. Interest income and interest expense associated with this VIE will be recorded separately on the consolidated statements of operations. The Company will separately present the assets and liabilities of its consolidated Investing VIEs as “Mortgage loans

13

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

held in a securitization trust, at fair value” and “Mortgage obligations issued by a securitization trust, at fair value,” respectively, on its consolidated balance sheets. Refer to Note 12, “Fair Value” for further discussion.

The Company has adopted guidance issued by the FASB, allowing the Company to measure both the financial assets and liabilities of a qualifying collateralized financing entity (“CFE”), such as its Investing VIEs, using the fair value of either the CFE’s financial assets or financial liabilities, whichever is more observable. As the liabilities of the Company’s Investing VIE are marketable securities with observable trade data, their fair value is more observable and will be referenced to determine the fair value for assets of its Investing VIE. Refer to section “Fair Value Option” below for further discussion.

Unconsolidated VIEs

As of September 30, 2017, the Company identified unconsolidated VIEs related to its securities investments, PE investments and CRE debt investments. Assets of each of the VIEs may only be used to settle obligations of the respective VIE. Creditors of each of the VIEs have no recourse to the general credit of the Company.

The following table presents the Company’s classification, carrying value and maximum exposure of unconsolidated VIEs as of September 30, 2017 (dollars in thousands):

Carrying Value | Maximum Exposure to Loss | |||||||

Real estate securities, available for sale | $ | 148,158 | $ | 148,158 | ||||

Investments in unconsolidated ventures | 14,482 | 14,482 | ||||||

Real estate debt investments, net(1) | 142,250 | 142,250 | ||||||

Total assets | $ | 304,890 | $ | 304,890 | ||||

_______________________________________

(1) | Includes loan collateral receivable, related party of $50.8 million. |

Based on management’s analysis, the Company determined that it is not the primary beneficiary of the above VIEs. Accordingly, the VIEs are not consolidated in the Company’s financial statements as of September 30, 2017. The Company did not provide financial support to the unconsolidated VIEs during the nine months ended September 30, 2017. As of September 30, 2017, there were no explicit arrangements or implicit variable interests that could require the Company to provide financial support to the unconsolidated VIEs.

Voting Interest Entities

A voting interest entity is an entity in which the total equity investment at risk is sufficient to enable it to finance its activities independently and the equity holders have the power to direct the activities of the entity that most significantly impact its economic performance, the obligation to absorb the losses of the entity and the right to receive the residual returns of the entity. The usual condition for a controlling financial interest in a voting interest entity is ownership of a majority voting interest. If the Company has a majority voting interest in a voting interest entity, the entity will generally be consolidated. The Company does not consolidate a voting interest entity if there are substantive participating rights by other parties and/or kick-out rights by a single party or a simple majority vote.

The Company performs on-going reassessments of whether entities previously evaluated under the voting interest framework have become VIEs, based on certain events, and therefore subject to the VIE consolidation framework.

Investments in Unconsolidated Ventures

A non-controlling, unconsolidated ownership interest in an entity may be accounted for using the equity method or the cost method, and for either method, the Company may elect the fair value option. The Company will account for an investment in an unconsolidated entity that does not qualify for equity method accounting or for which the fair value option was not elected using the cost method if the Company determines that it does not have significant influence. Under the cost method, equity in earnings is recorded as dividends are received to the extent they are not considered a return of capital, which is recorded as a reduction of cost of the investment.

Under the equity method, the investment is adjusted each period for capital contributions and distributions and its share of the entity’s net income (loss). Capital contributions, distributions and net income (loss) of such entities are recorded in accordance with the terms of the governing documents. An allocation of net income (loss) may differ from the stated ownership percentage interest in such entity as a result of preferred returns and allocation formulas, if any, as described in such governing documents.

14

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Equity method investments are recognized using a cost accumulation model in which the investment is recognized based on the cost to the investor, which includes acquisition fees. The Company records as an expense certain acquisition costs and fees associated with consolidated investments deemed to be business combinations and capitalizes these costs for investments deemed to be acquisitions of an asset, including an equity method investment.

The Company may account for an investment in an unconsolidated entity at fair value by electing the fair value option. The Company elected the fair value option for PE Investments. The Company records the change in fair value for its share of the projected future cash flow of such investments from one period to another in equity in earnings (losses) of unconsolidated ventures in the consolidated statements of operations. Any change in fair value attributed to market related assumptions is considered unrealized gain (loss).

Non-controlling Interests

A non-controlling interest in a consolidated subsidiary is defined as the portion of the equity (net assets) in a subsidiary not attributable, directly or indirectly, to the Company. A non-controlling interest is required to be presented as a separate component of equity on the consolidated balance sheets and presented separately as net income (loss) and other comprehensive income (loss) (“OCI”) attributable to non-controlling interests. An allocation to a non-controlling interest may differ from the stated ownership percentage interest in such entity as a result of a preferred return and allocation formula, if any, as described in such governing documents.

Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could materially differ from those estimates and assumptions.

Comprehensive Income (Loss)

The Company reports consolidated comprehensive income (loss) in separate statements following the consolidated statements of operations. Comprehensive income (loss) is defined as the change in equity resulting from net income (loss) and OCI. The only component of OCI is unrealized gain (loss) on CRE securities available for sale for which the fair value option was not elected.

Fair Value Option

The fair value option provides an election that allows a company to irrevocably elect to record certain financial assets and liabilities at fair value on an instrument-by-instrument basis at initial recognition. The Company may elect to apply the fair value option for certain investments due to the nature of the instrument. Any change in fair value for assets and liabilities for which the election is made is recognized in earnings.

The Company has elected the fair value option for PE Investments. The Company has also elected the fair value option to account for the eligible financial assets and liabilities of its consolidated Investing VIEs in order to mitigate potential accounting mismatches between the carrying value of the instruments and the related assets and liabilities to be consolidated. The Company has adopted guidance issued by the FASB allowing the Company to measure both the financial assets and liabilities of a qualifying CFE it consolidates using the fair value of either the CFE’s financial assets or financial liabilities, whichever is more observable.

Cash and Cash Equivalents

The Company considers all highly-liquid investments with an original maturity date of three months or less to be cash equivalents. Cash, including amounts restricted, may at times exceed the Federal Deposit Insurance Corporation deposit insurance limit of $250,000 per institution. The Company mitigates credit risk by placing cash and cash equivalents with major financial institutions. To date, the Company has not experienced any losses on cash and cash equivalents.

Restricted Cash

Restricted cash consists of amounts related to loan origination (escrow deposits) and operating real estate (escrows for taxes, insurance, capital expenditures and payments required under certain lease agreements).

Real Estate Debt Investments

CRE debt investments are generally intended to be held to maturity and, accordingly, are carried at cost, net of unamortized loan fees, premium and discount. CRE debt investments that are deemed to be impaired are carried at amortized cost less a loan loss

15

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

reserve, if deemed appropriate, which approximates fair value. CRE debt investments where the Company does not have the intent to hold the loan for the foreseeable future or until its expected payoff are classified as held for sale and recorded at the lower of cost or estimated fair value.

The Company may syndicate a portion of the CRE debt investments that it originates or sell the CRE debt investments individually. When a transaction meets the criteria for sale accounting, the Company will no longer recognize the CRE debt investment sold as an asset and will recognize gain or loss based on the difference between the sales price and the carrying value of the CRE debt investment sold. Any related unamortized deferred origination fees, original issue discounts, loan origination costs, discounts or premiums at the time of sale are recognized as an adjustment to the gain or loss on sale, which is included in interest income on the consolidated statement of operations. Any fees received at the time of sale or syndication are recognized as part of interest income.

Operating Real Estate

Operating real estate is carried at historical cost less accumulated depreciation. Ordinary repairs and maintenance are expensed as incurred. Major replacements and betterments which improve or extend the life of the asset are capitalized and depreciated over their useful life. The Company accounts for purchases of operating real estate that qualify as business combinations using the acquisition method, where the purchase price is allocated to tangible assets such as land, building, improvements and other identified intangibles. Costs directly related to an acquisition deemed to be a business combination are expensed and included in transaction costs in the consolidated statements of operations.

The Company refers to real estate acquired in connection with a foreclosure, deed in lieu of foreclosure or a consensual modification of a loan as real estate owned (“REO”). The Company evaluates whether REO, herein collectively referred to as taking title to collateral, constitutes a business and whether business combination accounting is appropriate. Any excess upon taking title to collateral between the carrying value of a loan over the estimated fair value of the property is charged to provision for loan losses.

Operating real estate is depreciated using the straight-line method over the estimated useful lives of the assets, summarized as follows:

Category: | Term: | |

Building | 30 to 40 years | |

Building improvements | Lesser of the useful life or remaining life of the building | |

Land improvements | 10 to 30 years | |

Tenant improvements | Lesser of the useful life or remaining term of the lease | |

Furniture, fixtures and equipment | 3 to 10 years | |

Real Estate Securities

The Company classifies its CRE securities investments as available for sale on the acquisition date, which are carried at fair value. Unrealized gains (losses) are recorded as a component of accumulated OCI in the consolidated statements of equity. However, the Company has elected the fair value option for certain of its available for sale securities, and as a result, any unrealized gains (losses) on such securities are recorded in unrealized gain (loss) on mortgage loans and obligations held in a securitization trust, net in the consolidated statements of operations. As of September 30, 2017, the Company held subordinate tranches of a securitization trust, which represent the Company’s retained interest in the securitization trust, which the Company consolidates under U.S. GAAP. Refer to Note 6, “Real Estate Securities, Available for Sale” for further discussion.

Deferred Costs

Deferred costs primarily include deferred financing costs and deferred lease costs. Deferred financing costs represent commitment fees, legal and other third-party costs associated with obtaining financing. Costs related to revolving credit facilities are recorded in deferred costs and other assets, net and are amortized to interest expense using the straight-line basis over the term of the facility. Costs related to other borrowings are recorded net against the carrying value of such borrowings and are amortized to interest expense using the effective interest method. Unamortized deferred financing costs are expensed to realized gain (loss) when the associated facility is repaid before maturity. Costs incurred in seeking financing transactions, which do not close, are expensed in the period in which it is determined that the financing will not occur. Deferred lease costs consist of fees incurred to initiate and renew operating leases, which are amortized on a straight-line basis over the remaining lease term and are recorded to depreciation and amortization in the consolidated statements of operations.

16

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Identified Intangibles

The Company records acquired identified intangibles, which includes intangible assets (such as the value of the above-market leases, in-place leases, and other intangibles) and intangible liabilities (such as the value of below market leases), based on estimated fair value. The value allocated to the identified intangibles are amortized over the remaining lease term. Above/below-market leases are amortized into rental income, below-market ground leases are amortized into real estate properties-operating expense and in-place leases are amortized into depreciation and amortization expense. Identified intangible assets are recorded in deferred costs and other assets, net, and identified intangible liabilities are recorded in other liabilities on the accompanying consolidated balance sheets.

Deferred Costs and Other Assets, Net and Other Liabilities

The following tables present a summary of deferred costs and other assets, net and other liabilities as of September 30, 2017 and December 31, 2016 (dollars in thousands):

September 30, 2017 (Unaudited) | December 31, 2016 | |||||||

Deferred costs and other assets, net: | ||||||||

Intangible assets, net(1) | $ | 29,366 | $ | 41,375 | ||||

Prepaid expenses | 9,236 | 1,386 | ||||||

Deferred commissions and leasing costs | 9,407 | 10,287 | ||||||

Deferred financing costs, net - credit facilities | 1,546 | 2,772 | ||||||

Deposits | 538 | 550 | ||||||

Other | 477 | — | ||||||

Total | $ | 50,570 | $ | 56,370 | ||||

September 30, 2017 (Unaudited) | December 31, 2016 | |||||||

Other liabilities: | ||||||||

Intangible liabilities, net(2) | $ | 6,881 | $ | 8,506 | ||||

Prepaid rent and unearned revenue | 4,147 | 4,601 | ||||||

PE Investments deferred purchase price, net | 3,342 | 4,248 | ||||||

Tenant security deposits | 1,401 | 1,433 | ||||||

Other | 330 | 403 | ||||||

Total | $ | 16,101 | $ | 19,191 | ||||

_______________________________________

(1) | Represents in-place leases and above-market leases, net. |

(2) | Represents below-market leases, net. |

Acquisition Fees and Expenses

The total of all acquisition fees and expenses for an investment, including acquisition fees to the Advisor, cannot exceed, in the aggregate, 6.0% of the contract purchase price of such investment unless such excess is approved by a majority of the Company’s directors, including a majority of its independent directors. For the nine months ended September 30, 2017, total acquisition fees and expenses did not exceed the allowed limit for any investment. An acquisition fee incurred related to an equity investment will generally be expensed as incurred. An acquisition fee paid to the Advisor related to the acquisition of an equity or debt investment in an unconsolidated joint venture is included in investments in unconsolidated ventures on the consolidated balance sheets. An acquisition fee paid to the Advisor related to the origination or acquisition of debt investments is included in debt investments, net on the consolidated balance sheets and is amortized to interest income over the life of the investment using the effective interest method. The Company records as an expense certain acquisition costs and fees associated with transactions deemed to be business combinations in which it consolidates the asset and capitalizes these costs for transactions deemed to be acquisitions of an asset, including an equity investment.

17

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Revenue Recognition

Real Estate Debt Investments

Interest income is recognized on an accrual basis and any related premium, discount, origination costs and fees are amortized over the life of the investment using the effective interest method. The amortization is reflected as an adjustment to interest income in the consolidated statements of operations. The amortization of a premium or accretion of a discount is discontinued if such loan is reclassified to held for sale.

Operating Real Estate

Rental and other income from operating real estate is derived from the leasing of space to various types of tenants. Rental revenue recognition commences when the tenant takes legal possession of the leased space and the leased space is substantially ready for its intended use. The leases are for fixed terms of varying length and generally provide for annual rentals and expense reimbursements to be paid in monthly installments. Rental income from leases is recognized on a straight-line basis over the term of the respective leases. The excess of rent recognized over the amount contractually due pursuant to the underlying leases is included in receivables on the consolidated balance sheets. The Company amortizes any tenant inducements as a reduction of revenue utilizing the straight-line method over the term of the lease. Other income represents revenue from tenant/operator leases which provide for the recovery of all or a portion of the operating expenses and real estate taxes paid by the Company on behalf of the respective property. This revenue is recognized in the same period as the expenses are incurred.

In a situation in which a lease(s) associated with a significant tenant have been, or are expected to be, terminated early, the Company evaluates the remaining useful life of depreciable or amortizable assets in the asset group related to the lease that will be terminated (i.e., tenant improvements, above- and below-market lease intangibles, in-place lease value and deferred leasing costs). Based upon consideration of the facts and circumstances surrounding the termination, the Company may write-off or accelerate the depreciation and amortization associated with the asset group. Such amounts are included within rental and other income for above- and below-market lease intangibles and depreciation and amortization for the remaining lease related asset groups in the consolidated statements of operations.

Real Estate Securities

Interest income is recognized using the effective interest method with any premium or discount amortized or accreted through earnings based on expected cash flow through the expected maturity date of the security. Changes to expected cash flow may result in a change to the yield which is then applied retrospectively for high-credit quality securities that cannot be prepaid or otherwise settled in such a way that the holder would not recover substantially all of the investment or prospectively for all other securities to recognize interest income.

Credit Losses and Impairment on Investments

Real Estate Debt Investments

Loans are considered impaired when, based on current information and events, it is probable that the Company will not be able to collect all principal and interest amounts due according to the contractual terms. The Company assesses the credit quality of the portfolio and adequacy of loan loss reserves on a quarterly basis or more frequently as necessary. Significant judgment of the Company is required in this analysis. The Company considers the estimated net recoverable value of the loan as well as other factors, including but not limited to the fair value of any collateral, the amount and the status of any senior debt, the quality and financial condition of the borrower and the competitive situation of the area where the underlying collateral is located. Because this determination is based on projections of future economic events, which are inherently subjective, the amount ultimately realized may differ materially from the carrying value as of the balance sheet date. If, upon completion of the assessment, the estimated fair value of the underlying collateral is less than the net carrying value of the loan, a loan loss reserve is recorded with a corresponding charge to provision for loan losses. The loan loss reserve for each loan is maintained at a level that is determined to be adequate by management to absorb probable losses.

Income recognition is suspended for a loan at the earlier of the date at which payments become 90-days past due or when, in the opinion of the Company, a full recovery of income and principal becomes doubtful. When the ultimate collectability of the principal of an impaired loan is in doubt, all payments are applied to principal under the cost recovery method. When the ultimate collectability of the principal of an impaired loan is not in doubt, contractual interest is recorded as interest income when received, under the cash basis method until an accrual is resumed when the loan becomes contractually current and performance is demonstrated to

18

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

be resumed. Interest accrued and not collected will be reversed against interest income. A loan is written off when it is no longer realizable and/or legally discharged. As of September 30, 2017, the Company did not have any impaired CRE debt investments.

Operating Real Estate

The Company’s real estate portfolio is reviewed on a quarterly basis, or more frequently as necessary, to assess whether there are any indicators that the value of its operating real estate may be impaired or that its carrying value may not be recoverable. A property’s value is considered impaired if the Company’s estimate of the aggregate expected future undiscounted cash flow generated by the property is less than the carrying value. In conducting this review, the Company considers U.S. macroeconomic factors, real estate sector conditions and asset specific and other factors. To the extent an impairment has occurred, the loss is measured as the excess of the carrying value of the property over the estimated fair value and recorded in impairment on operating real estate in the consolidated statements of operations. As of September 30, 2017, the Company did not have any impaired operating real estate.

An allowance for a doubtful account for a tenant receivable is established based on a periodic review of aged receivables resulting from estimated losses due to the inability of tenants to make required rent and other payments contractually due. Additionally, the Company establishes, on a current basis, an allowance for future tenant credit losses on unbilled rent receivable based on an evaluation of the collectability of such amounts.

Real Estate Securities

CRE securities for which the fair value option is elected are not evaluated for other-than-temporary impairment (“OTTI”) as any change in fair value is recorded in the consolidated statements of operations. Realized losses on such securities are reclassified to realized gain (loss) on investments as losses occur.

CRE securities for which the fair value option is not elected are evaluated for OTTI quarterly. Impairment of a security is considered to be other-than-temporary when: (i) the holder has the intent to sell the impaired security; (ii) it is more likely than not the holder will be required to sell the security; or (iii) the holder does not expect to recover the entire amortized cost of the security. When a CRE security has been deemed to be other-than-temporarily impaired due to (i) or (ii), the security is written down to its fair value and an OTTI is recognized in the consolidated statements of operations. In the case of (iii), the security is written down to its fair value and the amount of OTTI is then bifurcated into: (a) the amount related to expected credit losses; and (b) the amount related to fair value adjustments in excess of expected credit losses. The portion of OTTI related to expected credit losses is recognized in the consolidated statements of operations. The remaining OTTI related to the valuation adjustment is recognized as a component of accumulated OCI in the consolidated statements of equity. CRE securities which are not high-credit quality are considered to have an OTTI if the security has an unrealized loss and there has been an adverse change in expected cash flow. The amount of OTTI is then bifurcated as discussed above. As of September 30, 2017, the Company did not have any OTTI recorded on its CRE securities.

Equity-Based Compensation

The Company accounts for equity-based compensation awards using the fair value method, which requires an estimate of fair value of the award at the time of grant. All fixed equity-based awards to directors, which have no vesting conditions other than time of service, are amortized to compensation expense over the awards’ vesting period on a straight-line basis. Equity-based compensation is classified within general and administrative expense in the consolidated statements of operations.

Income Taxes

The Company elected to be taxed as a REIT and to comply with the related provisions of the Internal Revenue Code beginning in its taxable year ended December 31, 2010. Accordingly, the Company will generally not be subject to U.S. federal income tax to the extent of its distributions to stockholders as long as certain asset, income and share ownership tests are met. To maintain its qualification as a REIT, the Company must annually distribute at least 90% of its REIT taxable income to its stockholders and meet certain other requirements. The Company believes that all of the criteria to maintain the Company’s REIT qualification have been met for the applicable periods, but there can be no assurance that these criteria will continue to be met in subsequent periods. If the Company were to fail to meet these requirements, it would be subject to U.S. federal income tax and potential interest and penalties, which could have a material adverse impact on its results of operations and amounts available for distributions to its stockholders. The Company’s accounting policy with respect to interest and penalties is to classify these amounts as a component of income tax expense, where applicable.

19

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The Company may also be subject to certain state, local and franchise taxes. Under certain circumstances, U.S. federal income and excise taxes may be due on its undistributed taxable income.

The Company made joint elections to treat certain subsidiaries as taxable REIT subsidiaries (“TRS”) which may be subject to U.S. federal, state and local income taxes. In general, a TRS of the Company may perform non-customary services for tenants, hold assets that the REIT cannot hold directly and may engage in most real estate or non-real estate-related business.

Certain subsidiaries of the Company are subject to taxation by federal, state and local authorities for the periods presented. Income taxes are accounted for by the asset/liability approach in accordance with U.S. GAAP. Deferred taxes, if any, represent the expected future tax consequences when the reported amounts of assets and liabilities are recovered or paid. Such amounts arise from differences between the financial reporting and tax bases of assets and liabilities and are adjusted for changes in tax laws and tax rates in the period which such changes are enacted. A provision for income tax represents the total of income taxes paid or payable for the current period, plus the change in deferred taxes. Current and deferred taxes are recorded on the portion of earnings (losses) recognized by the Company with respect to its interest in TRSs. Deferred income tax assets and liabilities are calculated based on temporary differences between the Company’s U.S. GAAP consolidated financial statements and the federal, state and local tax basis of assets and liabilities as of the consolidated balance sheet date. The Company evaluates the realizability of its deferred tax assets (e.g., net operating loss and capital loss carryforwards) and recognizes a valuation allowance if, based on the available evidence, it is more likely than not that some portion or all of its deferred tax assets will not be realized. When evaluating the realizability of its deferred tax assets, the Company considers estimates of expected future taxable income, existing and projected book/tax differences, tax planning strategies available and the general and industry specific economic outlook. This realizability analysis is inherently subjective, as it requires the Company to forecast its business and general economic environment in future periods. Changes in estimate of deferred tax asset realizability, if any, are included in income tax benefit (expense) in the consolidated statements of operations.

For the three and nine months ended September 30, 2017, the Company recorded income tax benefit of less than $0.1 million and income tax expense of $0.6 million, respectively. For the three and nine months ended September 30, 2016, the Company recorded income tax expense of $0.8 million and $2.3 million, respectively.

Transfers of Financial Assets

Sale accounting for transfers of financial assets requires the transfer of an entire financial asset, a group of financial assets in its entirety or if a component of the financial asset is transferred, that component meets the definition of a participating interest by having characteristics that mirror the original financial asset.

Transfers of financial assets are accounted for as sales when control over the assets has been surrendered. If the Company has any continuing involvement, rights or obligations with the transferred financial asset (outside of standard representations and warranties), sale accounting would require that the transfer meets the following sale conditions: (1) the transferred asset has been legally isolated; (2) the transferee has the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred asset; and (3) the Company does not maintain effective control over the transferred asset through an agreement that provides for (a) both an entitlement and an obligation by the Company to repurchase or redeem the asset before its maturity, or (b) the unilateral ability by the Company to reclaim the asset and a more than trivial benefit attributable to that ability, or (c) the transferee requiring the Company to repurchase the asset at a price so favorable to the transferee that it is probable the repurchase will occur.

If sale accounting is met, the transferred financial asset is removed from the balance sheet and a net gain or loss is recognized upon sale, taking into account any retained interests. Transfers of financial assets that do not meet the criteria for sale are accounted for as financing transactions, or secured borrowing. As of September 30, 2017, the carrying value of CRE debt investments that did not meet the requirements of sale accounting was $23.7 million and recorded in real estate debt investments, net with an offsetting secured borrowing recorded in loan collateral payable, net, related party of $23.4 million. Refer to Note 7, “Borrowings” for additional information.

Recent Accounting Pronouncements

Revenue Recognition- In May 2014, the FASB issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers, requiring a company to recognize as revenue the amount of consideration it expects to be entitled to in connection with the transfer of promised goods or services to customers. The accounting standard update will replace most of the existing revenue recognition guidance currently promulgated by U.S. GAAP. In July 2015, the FASB decided to delay the effective date of the new revenue standard by one year. The effective date of the new revenue standard for the Company will be January 1, 2018.

20

NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)