Attached files

| file | filename |

|---|---|

| 8-K - 8-K 2017 EEI FINANCIAL - NORTHWESTERN CORP | a201711058keeifinancialcon.htm |

8-K November 3, 2017

EEI Financial Conference

November 5-7, 2017

Hebgen Reservoir – south of Big Sky, MT

2

Forward Looking Statements

Forward Looking Statements

During the course of this presentation, there will be forward-looking statements within

the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements often address our expected future business

and financial performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current expectations as of the

date hereof unless otherwise noted. Our actual future business and financial

performance may differ materially and adversely from our expectations expressed in

any forward-looking statements. We undertake no obligation to revise or publicly

update our forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual results

may differ materially. The factors that may affect our results are listed in certain of our

press releases and disclosed in the Company‟s most recent Form 10-K and 10-Q

along with other public filings with the SEC.

NorthWestern Corporation

dba: NorthWestern Energy

Ticker: NWE

Trading on the NYSE

www.northwesternenergy.com

Corporate Office

3010 West 69th Street

Sioux Falls, SD 57108

(605) 978-2900

Investor Relations Officer

Travis Meyer

605-978-2967

travis.meyer@northwestern.com

Company Information

About NorthWestern

3

Montana Operations

Electric

363,800 customers

24,450 miles – transmission & distribution lines

809 MW nameplate owned power generation

Natural Gas

194,100 customers

7,250 miles of transmission and distribution pipeline

18 Bcf of gas storage capacity

Own 61 Bcf of proven natural gas reserves

Nebraska Operations

Natural Gas

42,300 customers

787 miles of distribution pipeline

South Dakota Operations

Electric

63,200 customers

3,550 miles – transmission & distribution lines

440 MW nameplate owned power generation

Natural Gas

46,200 customers

1,673 miles of transmission and distribution pipeline

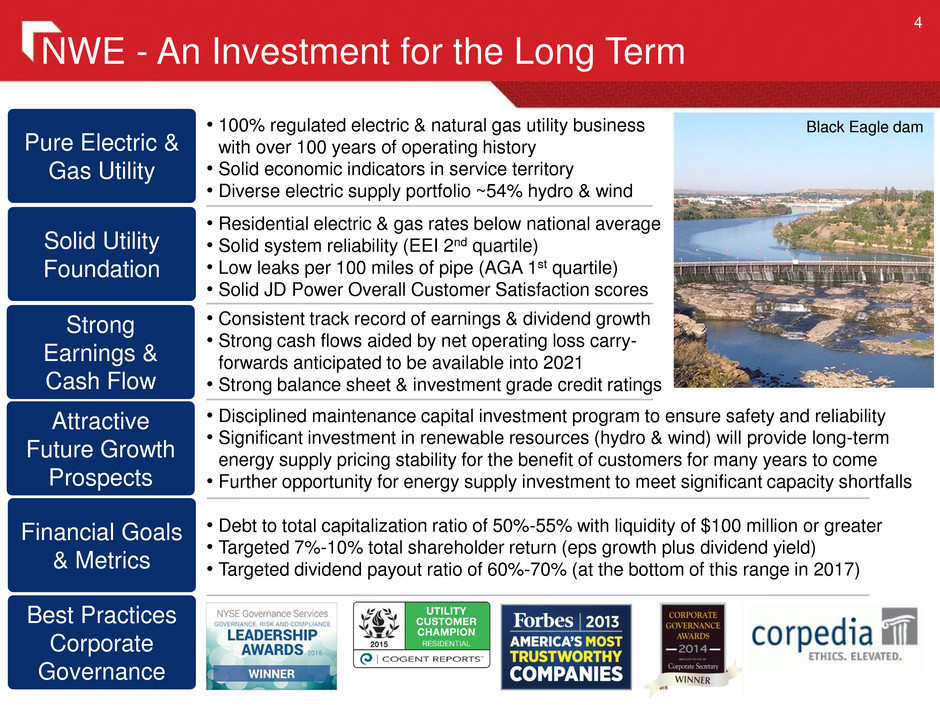

NWE - An Investment for the Long Term

4

• 100% regulated electric & natural gas utility business

with over 100 years of operating history

• Solid economic indicators in service territory

• Diverse electric supply portfolio ~54% hydro & wind

Black Eagle dam

Pure Electric &

Gas Utility

Solid Utility

Foundation

Strong

Earnings &

Cash Flow

Attractive

Future Growth

Prospects

Financial Goals

& Metrics

Best Practices

Corporate

Governance

• Residential electric & gas rates below national average

• Solid system reliability (EEI 2nd quartile)

• Low leaks per 100 miles of pipe (AGA 1st quartile)

• Solid JD Power Overall Customer Satisfaction scores

• Disciplined maintenance capital investment program to ensure safety and reliability

• Significant investment in renewable resources (hydro & wind) will provide long-term

energy supply pricing stability for the benefit of customers for many years to come

• Further opportunity for energy supply investment to meet significant capacity shortfalls

• Consistent track record of earnings & dividend growth

• Strong cash flows aided by net operating loss carry-

forwards anticipated to be available into 2021

• Strong balance sheet & investment grade credit ratings

• Debt to total capitalization ratio of 50%-55% with liquidity of $100 million or greater

• Targeted 7%-10% total shareholder return (eps growth plus dividend yield)

• Targeted dividend payout ratio of 60%-70% (at the bottom of this range in 2017)

A Diversified Electric and Gas Utility

5

NorthWestern‟s „80/20‟ rules:

Approximately 80% Electric, 80% Residential and 80% Montana

Nearly $3.5 billion of rate base investment to serve our customers

Data as of 12/31/2016.

6

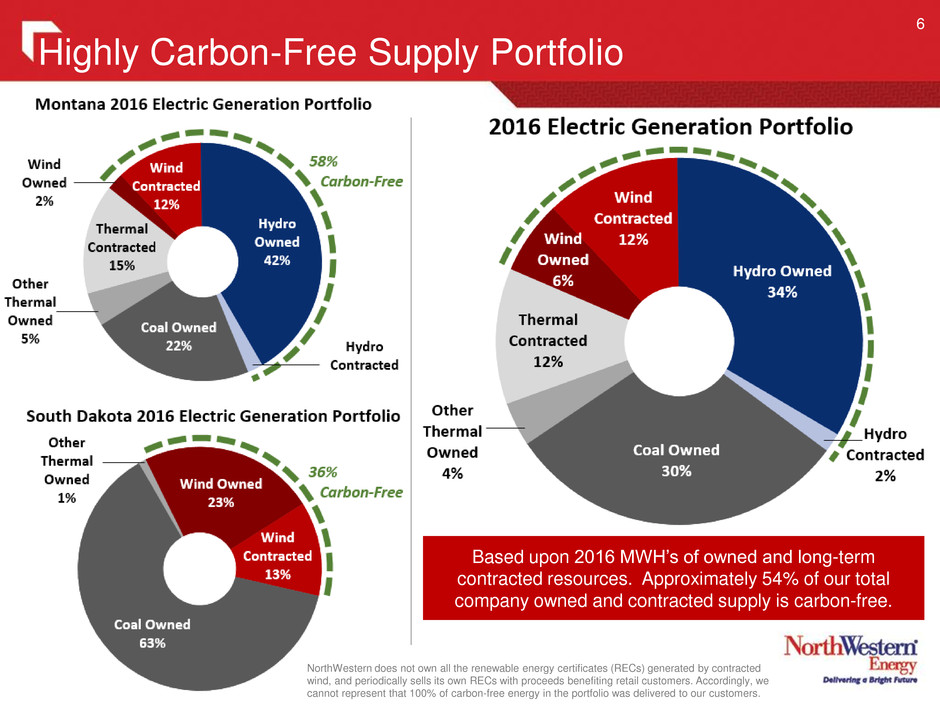

Highly Carbon-Free Supply Portfolio

Based upon 2016 MWH‟s of owned and long-term

contracted resources. Approximately 54% of our total

company owned and contracted supply is carbon-free.

NorthWestern does not own all the renewable energy certificates (RECs) generated by contracted

wind, and periodically sells its own RECs with proceeds benefiting retail customers. Accordingly, we

cannot represent that 100% of carbon-free energy in the portfolio was delivered to our customers.

Strong Utility Foundation

7

Solid and improving JD Power Overall Customer Satisfaction Scores

Residential electric and natural gas rates below national average

Solid electric system reliability and low gas leaks per mile

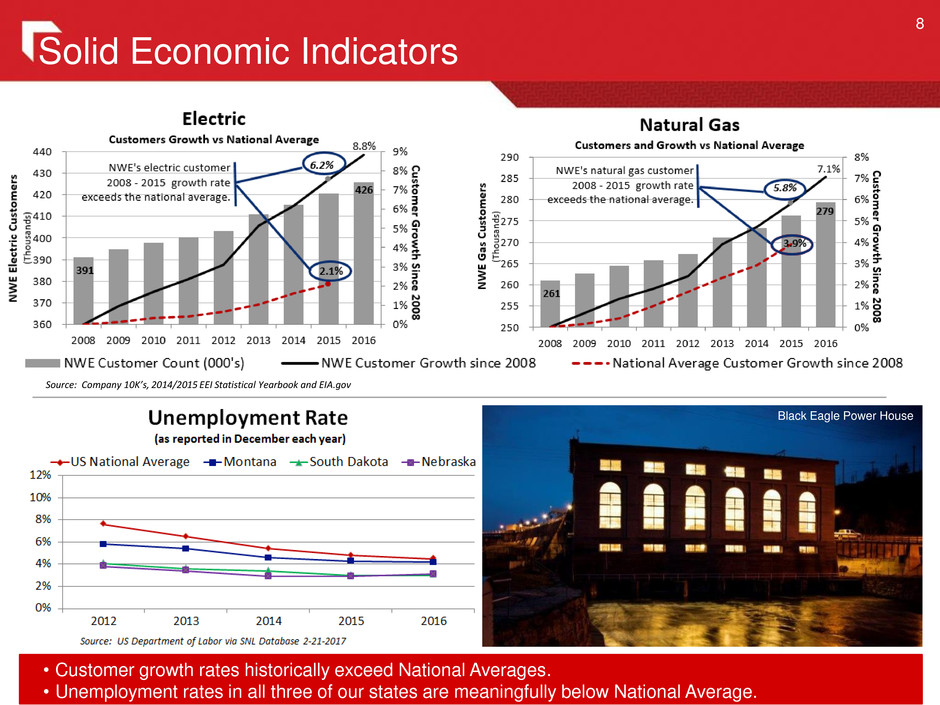

Solid Economic Indicators

8

• Customer growth rates historically exceed National Averages.

• Unemployment rates in all three of our states are meaningfully below National Average.

Source: NorthWestern customer growth - 2008-2016 Forms 10-K

Unemployment Rate: US Department of Labor via SNL Database 2/21/17

Electric: EEI Statistical Yearbook (published December 2015, table 7.2)

Natural Gas: EIA.gov (Data table "Number of Natural Gas Consumers")

Source: Company 10K’s, 2014/2015 EEI Statistical Yearbook and EIA.gov

Black Eagle Power House

A History of Growth

9

2008-2016 CAGR‟s: GAAP EPS: 8.5% - Non-GAAP EPS: 7.6% - Dividend: 5.3%

See appendix for “Non-GAAP Financial Measures”

$2.60 - $2.75

$3.10 - $3.30 $3. 0-$3.40

$3.30-$3.50

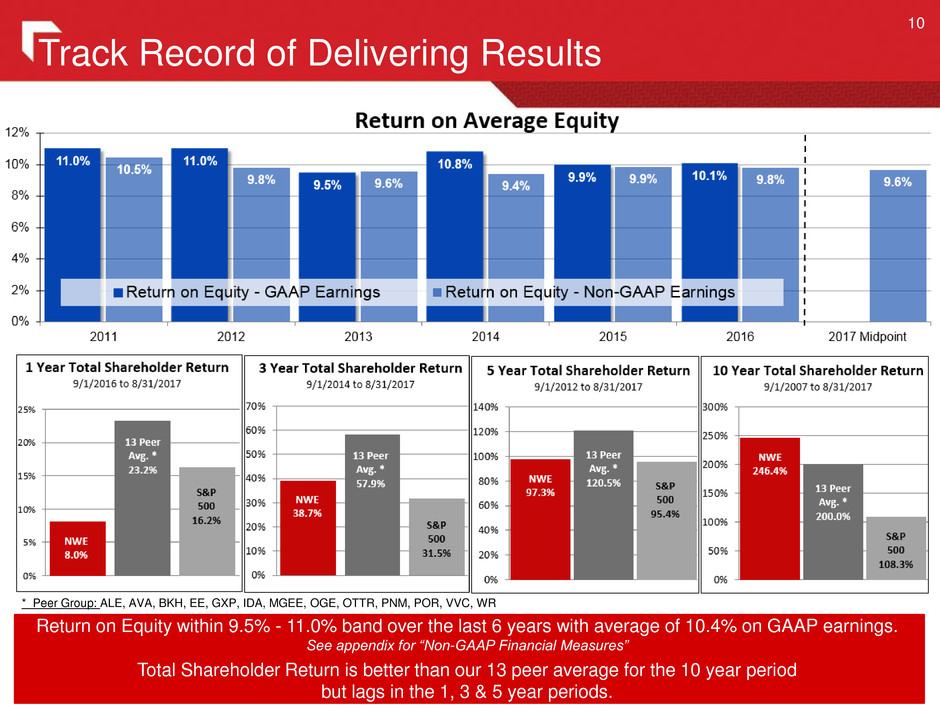

Track Record of Delivering Results

10

Return on Equity within 9.5% - 11.0% band over the last 6 years with average of 10.4% on GAAP earnings.

See appendix for “Non-GAAP Financial Measures”

Total Shareholder Return is better than our 13 peer average for the 10 year period

but lags in the 1, 3 & 5 year periods.

* Peer Group: ALE, AVA, BKH, EE, GXP, IDA, MGEE, OGE, OTTR, PNM, POR, VVC, WR

Investment for Our Customers‟ Benefit

11

Over the past 8 years we have been reintegrating our Montana energy supply portfolio and making additional investments across

our entire service territory to enhance system safety, reliability and capacity.

We have made these enhancements with minimal impact to customers‟ bills while maintaining bills lower than the US average.

As a result we have also been able to deliver solid earnings growth for our investors.

2008-2016 CAGRs Estimated Rate Base: 14.8% GAAP Diluted EPS: 8.4%

NWE typical electric bill: 2.2% NWE typical natural gas bill: (7.5%)

US average electric bill: 1.7%* US average natural gas bill: (4.0%)**

Balance Sheet Strength and Liquidity

12

Solid credit ratings, liquidity in excess of $100 million target, and debt to cap within our targeted 50%-55% range.

Our next debt maturity ($250 million 6.34% Montana First Mortgage Bonds due in 2019) is expected to be

redeemed with a recently signed bond purchase agreement to issue $250M of MT FMB at a fixed rate of 4.03%

maturing in 2047. We expect to close on transaction in early November 2017.

Dotted lines in 2019 & 2047 include refinancing to close in November 2017

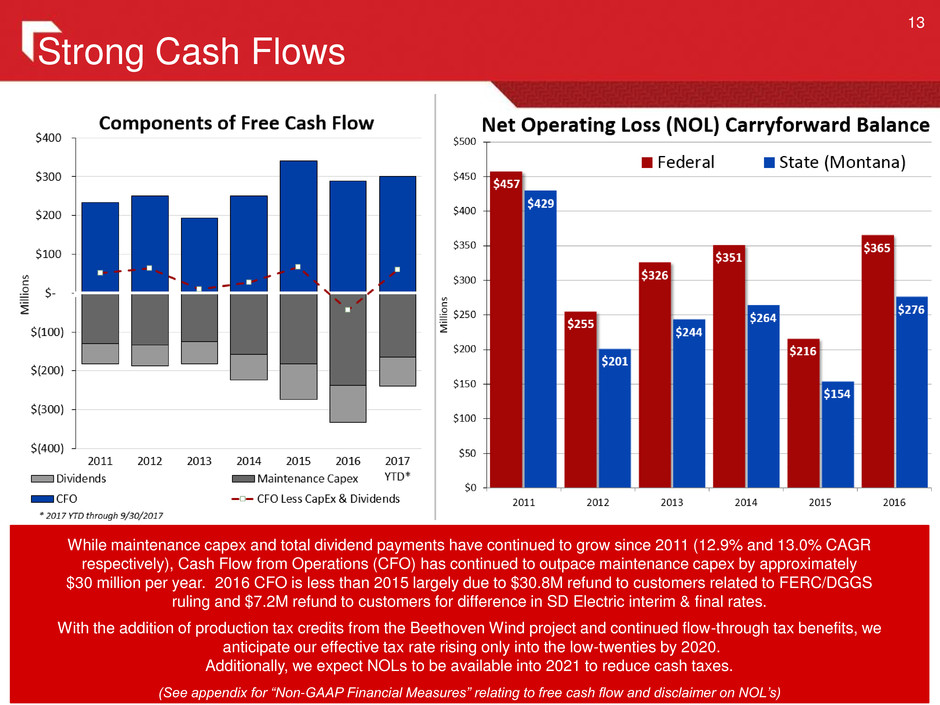

While maintenance capex and total dividend payments have continued to grow since 2011 (12.9% and 13.0% CAGR

respectively), Cash Flow from Operations (CFO) has continued to outpace maintenance capex by approximately

$30 million per year. 2016 CFO is less than 2015 largely due to $30.8M refund to customers related to FERC/DGGS

ruling and $7.2M refund to customers for difference in SD Electric interim & final rates.

With the addition of production tax credits from the Beethoven Wind project and continued flow-through tax benefits, we

anticipate our effective tax rate rising only into the low-twenties by 2020.

Additionally, we expect NOLs to be available into 2021 to reduce cash taxes.

(See appendix for “Non-GAAP Financial Measures” relating to free cash flow and disclaimer on NOL’s)

Strong Cash Flows

13

Experienced Leadership & Solid Corp. Governance

14

Board of Directors (left to right)

Executive Management Team (left to right)

Linda G. Sullivan – Independent Director since April 27, 2017 – Audit Committee

Dana J. Dykhouse – Independent Director since January 30, 2009 – Human

Resources (chair) and Audit Committees

Britt E. Ide – Independent Director since April 27, 2017 – Governance &

Innovation Committee

Jan R. Horsfall – Independent Director since April 23, 2015 – Audit and Governance &

Innovation Committees

Anthony T. Clark – Independent Director since December 6, 2016 – Governance &

Innovation Committee

Robert C. Rowe - CEO & President – Director since August 13, 2008

Dr. E. Linn Draper Jr. -Chairman of the Board – Independent Director since

November 1, 2004

Julia L. Johnson – Independent Director since November 1, 2004 – Governance &

Innovation (chair) and Human Resources Committees

Stephan P. Adik – Independent Director since November 1, 2004 – Audit (chair) and

Human Resources Committees

Patrick R. Corcoran – VP Gov’t & Regulatory Affairs – current position since 2002

Crystal D. Lail – VP & Controller – current position since 2015

Curtis T. Pohl – VP Distribution – current position since 2003

Bobbi L. Schroeppel – VP Customer Care, Communications & Human Resources –

current position since 2002

Brian B. Bird – VP & CFO – current position since 2003

Heather H. Grahame – VP & General Counsel – current position since 2010

Robert C. Rowe - President & CEO – current position since 2008

John D. Hines – VP Supply – current position since 2011

Michael R. Cashell – VP Transmission – current position since 2011

Recent Significant Achievements

15

Strong year for safety in 2016

• Fewest OSHA recordable events of any year.

• Best year for least lost time incidents.

Record best customer satisfaction scores

• Received our best Overall Customer Satisfaction scores in the

JD Power residential utility survey in 2016.

Corporate Governance Finalist

• NorthWestern‟s proxy statement has been recognized as a

finalist by Corporate Secretary magazine for Best Small to

Mid-Cap Proxy Statement for several years, including 2016 &

2017, and won the award in 2014.

Recognized for Strong Dividend

• In March 2016, NorthWestern was added to the NASDAQ US

Broad Dividend AchieversTM Index, which aims to represent the

country‟s leading stocks by dividend yield in addition to Dow

Jones US Dividend Select TM Index in 2015.

Echo Lake Nordic Trail

New Board Members

• Anthony T. Clark, senior advisor at Wilkenson Barker Knauer LLP and former

FERC commissioner and North Dakota Public Service Commissioner, joined in December 2016

• Britt E. Ide, president of Ide Energy & Strategy, joined in April 2017

• Linda G. Sullivan, exec. vice president and chief financial officer of American Water, joined in April 2017

Looking Forward

16

Montana Regulatory

• Working toward successful implementation of new

Power Cost and Credit Adjustment Mechanism (PCCAM)

• Anticipate filing an electric rate case by September 2018

(based on a 2017 test year).

Cost control efforts

• Continue to monitor costs, including labor, benefits and

property tax valuations to mitigate increases

Continue to invest in our T&D infrastructure.

• Transition from DSIP/TSIP to overall infrastructure

capital investment plan

• Natural gas pipeline investment (Integrity Verification Process

and PHMSA1 Requirements)

• Advanced Metering Infrastructure (AMI) investment

Refining our Supply Plan in Montana

• Continue to work with Montana Public Service

Commission and other stakeholders to refine energy

supply plan to resolve significant capacity deficit

Continue to search for natural gas reserve

acquisition opportunities

• Acquisitions at a price that benefits both customers

and shareholders

1. Pipeline & Hazardous Materials Safety Administration

Much of our focus in the next year will

be on the electric rate case in

Montana and controlling our costs to

benefit all stakeholders while

continuing to invest in our core

business to provide safe and reliable

energy for our all of our customers.

Financing Activities

17

Long-Term Debt Refinancing

• In October 2017, we priced $250 million

principal, 4.03% - 30 year Montana First

Mortgage Bonds

• We expect to close the transaction in early

November 2017.

• Proceeds used to redeem existing

$250 million – 6.34% Montana First

Mortgage Bonds due in 2019

At-The-Market

Equity Offering Program

• Initiated in September 2017

• Proceeds to repay or refinance debt (including

short-term debt), fund capital expenditures

and other general corporate purposes

• During the third quarter 2017 we sold 83,769

shares of common stock at an average price

of $59.56 per share, for a total of

approximately $5 million of proceeds.

Big Sky Substation

Expect annual interest expense savings of

over $5 million net of make-whole

amortization

We anticipate issuing the remaining $95 million,

from time to time, by the end of 2018.

Property Tax Tracker Rules Filing – In March 2017, the MPSC proposed new rules to establish minimum filing

requirements for property tax trackers.

• Current MT Property tax tracker rules allows recovery of 60 percent of the change in state and local taxes and fees.

• In June 2017, the MPSC adopted new rules to establish minimum filing requirements with some of the rules appearing

to be based on a narrow interpretation of the enabling statute and suggest that the MPSC will challenge the amount

and allocation of these taxes to customers. We expect to submit our annual filing in December 2017, with resolution

during the first quarter of 2018.

Montana Natural Gas Rate Filing

• In June 2017, we reached a settlement agreement with intervenors. In August 2017,the MPSC’s issued a final order accepting

the settlement with modifications resulting in an annual revenue increase $5.1 million, ROE at 9.55% with ROR of 6.96%

and including an annual reduction in production rates to reflect depletion until our next rate filing. Rates were effective

September 1, 2017.

• While the final order reflects an annual increase of approximately $5.1 million, we expect the increase in 2018 to be

approximately $2.0 million due to the inclusion in 2017 of four months of increased rates and the step down of gas production

rates to reflect depletion.

18

Regulatory & Legal Update

FERC / DGGS – April 2014 order regarding cost allocation

at DGGS between retail & wholesale customers

• FERC denied our request for rehearing in May 2016

• Required us to make refunds in June 2016 of $27.3 million plus interest

• We filed a petition for review with the US Circuit Court of Appeals for the District of

Columbia Circuit in June 2016 and oral argument is scheduled for December 1, 2017.

• We do not expect a decision until the first quarter of 2018, at the earliest.

Colstrip – In May 2016, the MPSC issued a final order disallowing recovery of certain

costs included in the electric supply tracker related to a 2013 Unit 4 outage

• Appeals have been filed in two Montana district courts regarding disallowance.

• We believe we are likely to receive orders from the courts in these matters within

the next 12 months.

Montana - Implementation of HB 193

19

PCCAM - as proposed by NorthWestern

Procedural Timeline:

May 2017 MPSC issued Notice of Commission Action (NCA) initiating process

July 7, 2017 MPSC issued additional NCA addressing arguments in our motion

to reconsider the original NCA. (July 7, 2017 – D2017.5.39).

July 14, 2017 We proposed electric Power Cost and Credit Adjustment

Mechanism (PCCAM) with the MPSC.

Aug. 1, 2017 MPSC concluded work session declining to require NWE to

submit additional filing.

Sept. 20, 2017 MPSC established procedural schedule for PCCAM.

Nov. 13, 2017 Final day for Intervenor testimony

Jan. 12, 2018 Final day for NWE to file rebuttal testimony

Mar. 12, 2018 Hearing on PCCAM.

Background: In April 2017, the Montana legislature passed House Bill

193 (HB 193), repealing the statutory language that provided for mandatory

recovery of our prudently incurred electric supply costs, effective July 1, 2017.

The enacted legislation gives the MPSC discretion whether to approve an

electric supply cost adjustment mechanism.

In support of the passage of HB 193, A

MPSC Commissioner testified before Senate

requesting the bill should be passed “to

subject NorthWestern to the exact same

regulatory treatment as Montana Dakota

Utilities.” The proposed PCCAM, with the

90% / 10% risk sharing mechanism was

designed to be responsive to the

Commission‟s advocacy.

If the MPSC approves the PCCAM, we

expect it will apply the mechanism to

variable costs on a retroactive basis to the

effective date of HB 193 (July 1, 2017)

20

Regulatory Update (continued)

Qualified Facilities (QF) Decision: Under the Public Utility Regulatory Policies

Act (PURPA), electric utilities are required, with exceptions, to purchase energy and

capacity from independent power producers that are Qualified Facilities (QF).

• In July 2017, the MPSC issued a final order in the QF-1 docket that adopted generally lower rates

and shortened the maximum contract length for new QFs to 10 years (with a rate adjustment after

5 years). The MPSC also ordered that any future resources, be subject to the same period, saying

it “will not initially authorize NorthWestern rate revenue for more than ten years” and “at the end of

the ten year period the Commission may provide for subsequent rate revenue based on a

consideration of the value of the asset to customers and not necessarily based on the costs of the

resource.”

• We and other parties filed motions for reconsideration of this decision. The MPSC voted in

October 2017 to revise the initial order extending the contract length to 15 years and to

continue to apply the contract term to both QF contracts and our future electric supply resources,

however, it has not yet issued a final order. Based on the MPSC‟s October 2017 vote, we expect

that the decision will result in substantially lower rates for future QF contracts.

• We have significant generation capacity deficits and negative reserve margins, and our 2016 resource plan identified price and

reliability risks to our customers if we rely solely upon market purchases to address these capacity needs. In addition to our

responsibility to meet peak demand, national reliability standards effective July 2016 require us to have even greater

dispatchable generation capacity available and be capable of increasing or decreasing output to address the irregular nature of

intermittent generation such as wind or solar.

As a result of the MPSC‟s July decision, we suspended a competitive solicitation process to determine

the lowest-cost / least-risk approach for addressing capacity needs in Montana.

A final determination regarding the competitive solicitation will be dependent upon reviewing the

MPSC‟s revised order (based on the October reconsideration). We anticipate the order to be issued

during the fourth quarter of 2017.

Critical Capacity Shortfall

21

The resource initiatives and actions developed in our 2015 Electricity Supply Resource Procurement Plan identify the critical

future needs of our portfolio, including solutions to resolve our current negative planning reserve margin of 28%, which is

projected to grow to 50% by 2035 without any additional owned or contracted resources added to our portfolio.

As a result of a July 2017 decision by the MPSC regarding maximum contract length for all new generation, we suspended a

competitive solicitation process to determine the lowest-cost / least-risk approach for addressing our intermittent capacity and

reserve margin needs in Montana. A final determination regarding the competitive solicitation will be dependent upon reviewing

the MPSC's revised order resulting from an October 2017 decision (expected during the fourth quarter 2017).

Planning Reserve Margin

Capital Spending

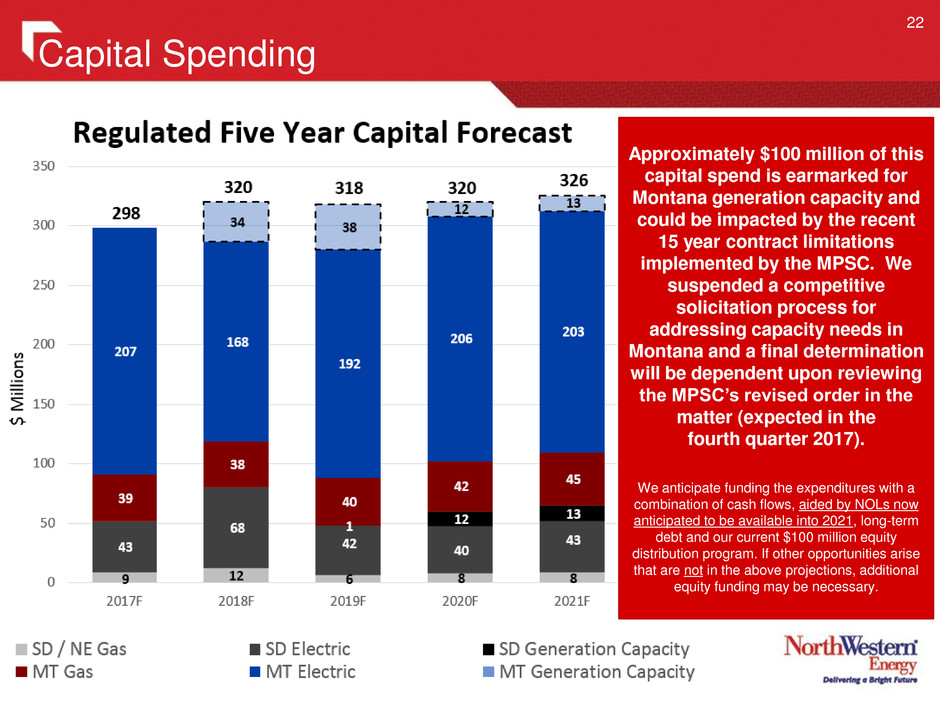

22

Approximately $100 million of this

capital spend is earmarked for

Montana generation capacity and

could be impacted by the recent

15 year contract limitations

implemented by the MPSC. We

suspended a competitive

solicitation process for

addressing capacity needs in

Montana and a final determination

will be dependent upon reviewing

the MPSC’s revised order in the

matter (expected in the

fourth quarter 2017).

We anticipate funding the expenditures with a

combination of cash flows, aided by NOLs now

anticipated to be available into 2021, long-term

debt and our current $100 million equity

distribution program. If other opportunities arise

that are not in the above projections, additional

equity funding may be necessary.

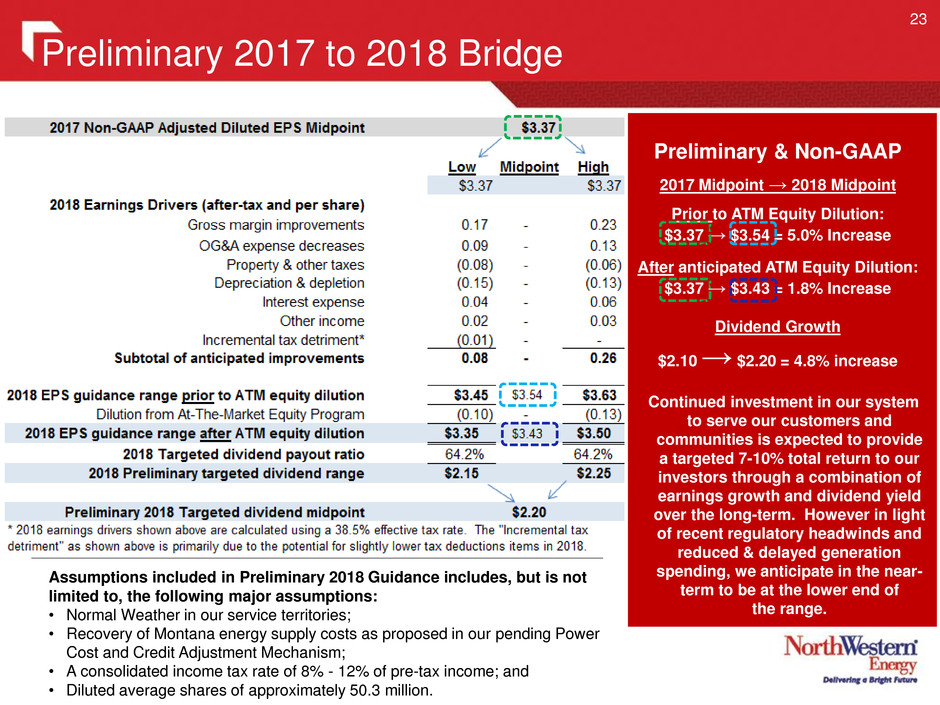

Preliminary 2017 to 2018 Bridge

Preliminary & Non-GAAP

2017 Midpoint → 2018 Midpoint

Prior to ATM Equity Dilution:

$3.37 → $3.54 = 5.0% Increase

After anticipated ATM Equity Dilution:

$3.37 → $3.43 = 1.8% Increase

Dividend Growth

$2.10 → $2.20 = 4.8% increase

Continued investment in our system

to serve our customers and

communities is expected to provide

a targeted 7-10% total return to our

investors through a combination of

earnings growth and dividend yield

over the long-term. However in light

of recent regulatory headwinds and

reduced & delayed generation

spending, we anticipate in the near-

term to be at the lower end of

the range.

Assumptions included in Preliminary 2018 Guidance includes, but is not

limited to, the following major assumptions:

• Normal Weather in our service territories;

• Recovery of Montana energy supply costs as proposed in our pending Power

Cost and Credit Adjustment Mechanism;

• A consolidated income tax rate of 8% - 12% of pre-tax income; and

• Diluted average shares of approximately 50.3 million.

23

Conclusion

24

Best

Practices

Corporate

Governance

Pure Electric

& Gas Utility

Solid Utility

Foundation

Strong

Earnings &

Cash Flows

Attractive

Future

Growth

Prospects

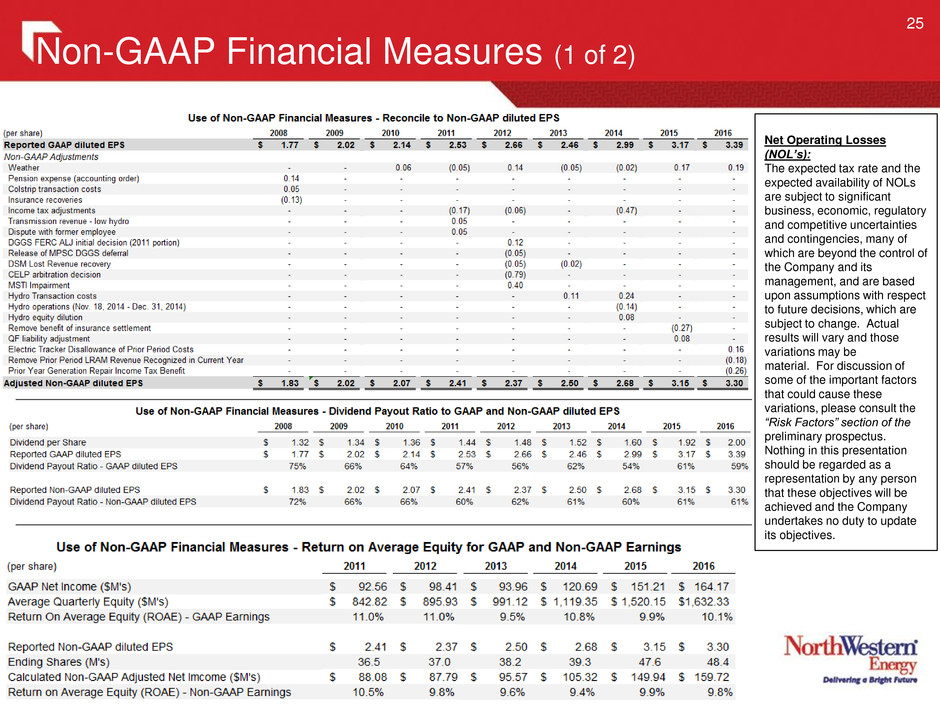

Non-GAAP Financial Measures (1 of 2)

25

Disclaimer on Net Operating

Net Operating Losses

(NOL’s):

The expected tax rate and the

expected availability of NOLs

are subject to significant

business, economic, regulatory

and competitive uncertainties

and contingencies, many of

which are beyond the control of

the Company and its

management, and are based

upon assumptions with respect

to future decisions, which are

subject to change. Actual

results will vary and those

variations may be

material. For discussion of

some of the important factors

that could cause these

variations, please consult the

“Risk Factors” section of the

preliminary prospectus.

Nothing in this presentation

should be regarded as a

representation by any person

that these objectives will be

achieved and the Company

undertakes no duty to update

its objectives.

Non-GAAP Financial Measures (2 of 2)

26

The data presented in this presentation

includes financial information prepared in

accordance with GAAP, as well as other Non-

GAAP financial measures such as Gross

Margin (Revenues less Cost of Sales), Free

Cash Flows (Cash flows from operations less

maintenance capex and dividends) and Net

Debt (Total debt less capital leases), that are

considered “Non-GAAP financial measures.”

Generally, a Non-GAAP financial measure is a

numerical measure of a company’s financial

performance, financial position or cash flows

that exclude (or include) amounts that are

included in (or excluded from) the most

directly comparable measure calculated and

presented in accordance with GAAP. The

presentation of Gross Margin, Free Cash

Flows and Net Debt is intended to supplement

investors’ understanding of our operating

performance. Gross Margin is used by us to

determine whether we are collecting the

appropriate amount of energy costs from

customers to allow recovery of operating

costs. Net Debt is used by our company to

determine whether we are properly levered to

our Total Capitalization (Net Debt plus Equity).

Our Gross Margin, Free Cash Flows and Net

Debt measures may not be comparable to

other companies’ similarly labeled measures.

Furthermore, these measures are not

intended to replace measures as determined

in accordance with GAAP as an indicator of

operating performance.

27