Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 CERTIFICATION OF CHIEF FINANCIAL OFFICER - NORTHWESTERN CORP | exhibit312certification10k.htm |

| EX-32.2 - EXHIBIT 32.2 CERTIFICATION OF BRIAN B. BIRD PURSUANT TO SECTION 906 - NORTHWESTERN CORP | exhibit322certification10k.htm |

| EX-32.1 - EXHIBIT 32.1 CERTIFICATION OF ROBERT C. ROWE PURSUANT TO SECTION 906 - NORTHWESTERN CORP | exhibit321certification10k.htm |

| EX-31.1 - EXHIBIT 31.1 CERTIFICATION OF CHIEF EXECUTIVE OFFICER - NORTHWESTERN CORP | exhibit311certification10k.htm |

| EX-23.1 - EXHIBIT 23.1 AUDITOR CONSENT - NORTHWESTERN CORP | exhibit231consent10k2016.htm |

| EX-21 - EXHIBIT 21 SUBSIDIARIES 10-K 2016 - NORTHWESTERN CORP | exhibit21subsidiaries10k20.htm |

| EX-12 - EXHIBIT 12.1 EARNINGS TO FIXED CHARGES 2016 - NORTHWESTERN CORP | exhibit121earningstofixedc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2016

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission File Number: 1-10499

NORTHWESTERN CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 46-0172280 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3010 W. 69th Street, Sioux Falls, South Dakota | 57108 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 605-978-2900

Securities registered pursuant to Section 12(b) of the Act:

(Title of each class) | (Name of each exchange on which registered) | |

Common Stock, $0.01 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

Large Accelerated Filer x Accelerated Filer o Non-accelerated Filer o Smaller Reporting Company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common stock held by nonaffiliates of the registrant was $3,046,980,000 computed using the last sales price of $63.07 per share of the registrant’s common stock on June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter.

As of February 10, 2017, 48,354,198 shares of the registrant’s common stock, par value $0.01 per share, were outstanding.

Documents Incorporated by Reference

Certain sections of our Proxy Statement for the 2017 Annual Meeting of Shareholders

are incorporated by reference into Part III of this Form 10-K

1

INDEX | PAGE | |

Part I | ||

Part II | ||

Part III | ||

Part IV | ||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

On one or more occasions, we may make statements in this Annual Report on Form 10-K regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. All statements other than statements of historical facts, included or incorporated by reference in this Annual Report, relating to management's current expectations of future financial performance, continued growth, changes in economic conditions or capital markets and changes in customer usage patterns and preferences are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Words or phrases such as “anticipates," “may," “will," “should," “believes," “estimates," “expects," “intends," “plans," “predicts," “projects," “targets," “will likely result," “will continue" or similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and believe such statements are based on reasonable assumptions, including without limitation, management's examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that we will achieve our projections. Factors that may cause such differences include, but are not limited to:

• | adverse determinations by regulators, as well as potential adverse federal, state, or local legislation or regulation, including costs of compliance with existing and future environmental requirements, could have a material effect on our liquidity, results of operations and financial condition; |

• | changes in availability of trade credit, creditworthiness of counterparties, usage, commodity prices, fuel supply costs or availability due to higher demand, shortages, weather conditions, transportation problems or other developments, may reduce revenues or may increase operating costs, each of which could adversely affect our liquidity and results of operations; |

• | unscheduled generation outages or forced reductions in output, maintenance or repairs, which may reduce revenues and increase cost of sales or may require additional capital expenditures or other increased operating costs; and |

• | adverse changes in general economic and competitive conditions in the U.S. financial markets and in our service territories. |

We have attempted to identify, in context, certain of the factors that we believe may cause actual future experience and results to differ materially from our current expectation regarding the relevant matter or subject area. In addition to the items specifically discussed above, our business and results of operations are subject to the uncertainties described under the caption “Risk Factors” which is part of the disclosure included in Part II, Item 1A of this Annual Report on Form 10-K.

From time to time, oral or written forward-looking statements are also included in our reports on Forms 10-Q and 8-K, Proxy Statements on Schedule 14A, press releases, analyst and investor conference calls, and other communications released to the public. We believe that at the time made, the expectations reflected in all of these forward-looking statements are and will be reasonable. However, any or all of the forward-looking statements in this Annual Report on Form 10-K, our reports on Forms 10-Q and 8-K, our Proxy Statements on Schedule 14A and any other public statements that are made by us may prove to be incorrect. This may occur as a result of assumptions, which turn out to be inaccurate, or as a consequence of known or unknown risks and uncertainties. Many factors discussed in this Annual Report on Form 10-K, certain of which are beyond our control, will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from forward-looking statements. In light of these and other uncertainties, you should not regard the inclusion of any of our forward-looking statements in this Annual Report on Form 10-K or other public communications as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent reports filed with the Securities and Exchange Commission (SEC) on Forms 10-K, 10-Q and 8-K and Proxy Statements on Schedule 14A.

Unless the context requires otherwise, references to “we,” “us,” “our,” “NorthWestern Corporation,” “NorthWestern Energy,” and “NorthWestern” refer specifically to NorthWestern Corporation and its subsidiaries.

3

GLOSSARY

Accounting Standards Codification (ASC) - The single source of authoritative nongovernmental GAAP, which supersedes all existing accounting standards.

Allowance for Funds Used During Construction (AFUDC) - A regulatory accounting convention that represents the estimated composite interest costs of debt and a return on equity funds used to finance construction. The allowance is capitalized in the property accounts and included in income.

Base-Load - The minimum amount of electric power or natural gas delivered or required over a given period of time at a steady rate. The minimum continuous load or demand in a power system over a given period of time usually is not temperature sensitive.

Base-Load Capacity - The generating equipment normally operated to serve loads on an around-the-clock basis.

COD - commercial operating date.

Commercial Customers - consists primarily of main street businesses, shopping malls, grocery stores, gas stations, bars and restaurants, professional offices, hospitals and medical offices, motels, and hotels.

Cushion Gas - The natural gas required in a gas storage reservoir to maintain a pressure sufficient to permit recovery of stored gas.

DGGS - The Dave Gates Generating Station at Mill Creek, a 150 MW natural gas fired facility, which provides up to 105 MW of regulation service.

Environmental Protection Agency (EPA) - A Federal agency charged with protecting the environment.

Federal Energy Regulatory Commission (FERC) - The Federal agency that has jurisdiction over interstate electricity sales, wholesale electric rates, hydroelectric licensing, natural gas transmission and related services pricing, oil pipeline rates and gas pipeline certification.

Franchise - A special privilege conferred by a unit of state or local government on an individual or corporation to occupy and use the public ways and streets for benefit to the public at large. Local distribution companies typically have franchises for utility service granted by state or local governments.

GAAP - Accounting principles generally accepted in the United States of America.

Hedging - Entering into transactions to manage various types of risk (e.g. commodity risk).

Industrial Customers - consists primarily of manufacturing and processing businesses that turn raw materials into products.

Lignite Coal - The lowest rank of coal, often referred to as brown coal, used almost exclusively as fuel for steam-electric power generation. It has high inherent moisture content, sometimes as high as 45 percent. The heat content of lignite ranges from 9 to 17 million Btu per ton on a moist, mineral-matter-free basis.

Midcontinent Independent System Operator (MISO) - MISO is a nonprofit organization created in compliance with FERC as a regional transmission organization, to improve the flow of electricity in the regional marketplace and to enhance electric reliability. Additionally, MISO is responsible for managing the energy markets, managing transmission constraints, managing the day-ahead, real-time and financial transmission rights markets and managing the ancillary market.

Midwest Reliability Organization (MRO) - MRO is one of eight regional electric reliability councils under NERC.

Montana Public Service Commission (MPSC) - The state agency that regulates public utilities doing business in Montana.

Nameplate Capacity - the intended full-load sustained output of a generating facility. Nameplate capacity is the number registered with authorities for classifying the power output of a power station usually expressed in megawatts (MW).

Nebraska Public Service Commission (NPSC) - The state agency that regulates public utilities doing business in Nebraska.

4

North American Electric Reliability Corporation (NERC) - NERC oversees eight regional reliability entities and encompasses all of the interconnected power systems of the contiguous United States. NERC's major responsibilities include developing standards for power system operation, monitoring and enforcing compliance with those standards, assessing resource adequacy, and providing educational and training resources as part of an accreditation program to ensure power system operators remain qualified and proficient.

Open Access - Non-discriminatory, fully equal access to transportation or transmission services offered by a pipeline or electric utility.

Open Access Transmission Tariff (OATT) -The OATT, which is established by the FERC, defines the terms and conditions of point-to-point and network integration transmission services offered by us, and requires that transmission owners provide open, non-discriminatory access on their transmission system to transmission customers.

Peak Load - A measure of the maximum amount of energy delivered at a point in time.

Qualifying Facility (QF) - As defined under the Public Utility Regulatory Policies Act of 1978 (PURPA), a QF sells power to a regulated utility at a price agreed to by the parties or determined by a public service commission that is intended to be equal to that which the utility would otherwise pay if it were to generate its own power or buy power from another source.

Regulation Services - FERC jurisdictional services that ensure reliability and support the transmission of electricity from generation sites to customer loads. Such services are also referred to as ancillary services and include regulating reserves, load balancing and voltage support.

Securities and Exchange Commission (SEC) - The U.S. agency charged with protecting investors, maintaining fair, orderly and efficient markets and facilitating capital formation.

South Dakota Public Utilities Commission (SDPUC) - The state agency that regulates public utilities doing business in South Dakota.

Southwest Power Pool (SPP) - A nonprofit organization created in compliance with FERC as a regional transmission organization to ensure reliable supplies of power, adequate transmission infrastructure, and a competitive wholesale electricity marketplace. SPP also serves as a regional electric reliability entity under NERC.

Sub-bituminous Coal - A coal whose properties range from those of lignite to those of bituminous coal and used primarily as fuel for steam-electric power generation. Sub-bituminous coal contains 20 to 30 percent inherent moisture by weight. The heat content of sub-bituminous coal ranges from 17 to 24 million Btu per ton on a moist, mineral-matter-free basis.

Tariffs - A collection of the rate schedules and service rules authorized by a federal or state commission. It lists the rates a regulated entity will charge to provide service to its customers as well as the terms and conditions that it will follow in providing service.

Tolling Contract - An arrangement whereby a party moves fuel to a power generator and receives kilowatt hours (kWh) in return for a pre-established fee.

Transmission - The flow of electricity from generating stations over high voltage lines to substations. The electricity then flows from the substations into a distribution network.

Western Area Power Administration (WAPA) - A federal power-marketing administration and electric transmission agency established by Congress.

Western Electricity Coordination Council (WECC) - WECC is one of eight regional electric reliability councils under NERC.

5

Measurements:

Billion Cubic Feet (Bcf) - A unit used to measure large quantities of gas, approximately equal to 1 trillion Btu.

British Thermal Unit (Btu) - a basic unit used to measure natural gas; the amount of natural gas needed to raise the temperature of one pound of water by one degree Fahrenheit.

Degree-Day - A measure of the coldness / warmness of the weather experienced, based on the extent to which the daily mean temperature falls below or above a reference temperature.

Dekatherm - A measurement of natural gas; ten therms or one million Btu.

Kilovolt (kV) - A unit of electrical power equal to one thousand volts.

Megawatt (MW) - A unit of electrical power equal to one million watts or one thousand kilowatts.

Megawatt Hour (MWH) - One million watt-hours of electric energy. A unit of electrical energy which equals one megawatt of power used for one hour.

6

Part I |

ITEM 1. BUSINESS

OVERVIEW | ||||

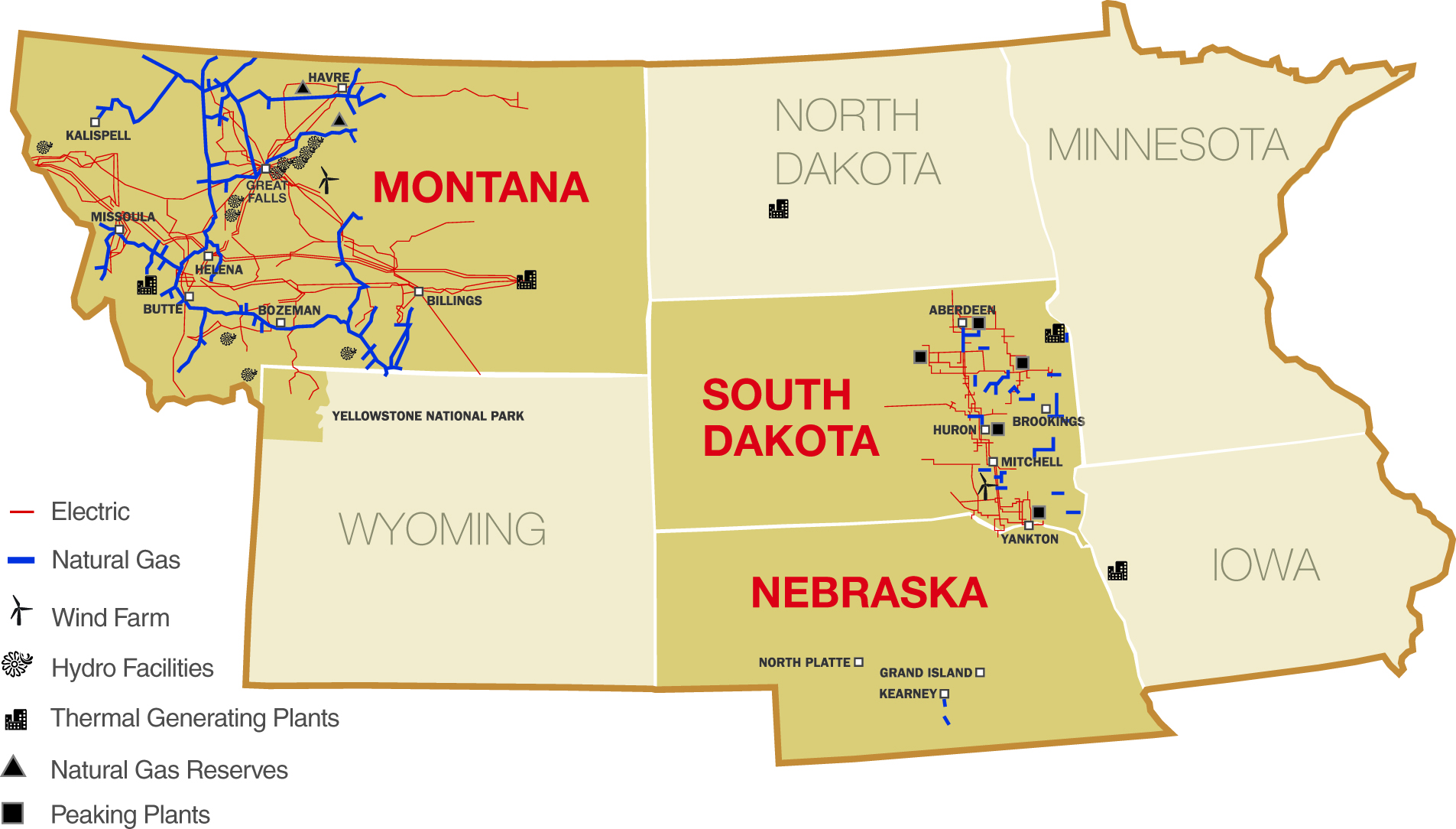

NorthWestern Corporation, doing business as NorthWestern Energy, provides electricity and natural gas to approximately 709,600 customers in Montana, South Dakota and Nebraska. We have generated and distributed electricity in South Dakota and distributed natural gas in South Dakota and Nebraska since 1923 and have generated and distributed electricity and distributed natural gas in Montana since 2002.

We operate our business in the following reporting segments:

• | Electric operations; |

• | Natural gas operations; |

• | All other, which primarily consists of unallocated corporate costs. |

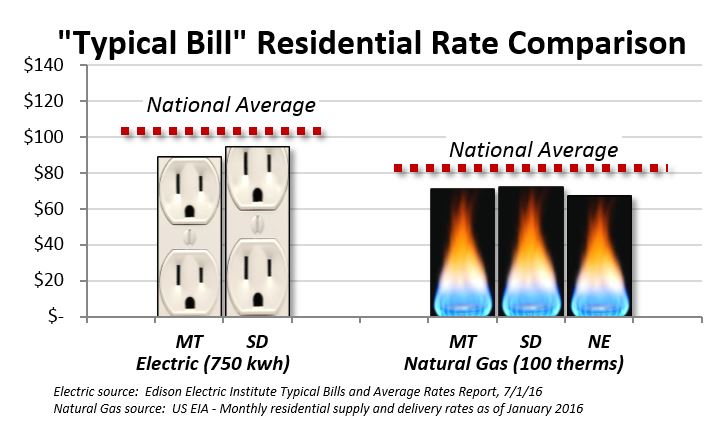

We seek to maintain attractive rates for our customers. As rates are largely cost-based, maintaining low rates requires a strategy focused on developing and maintaining a low-cost position. Our average residential customer bill is below the national average benchmark.

7

Environmental Stewardship

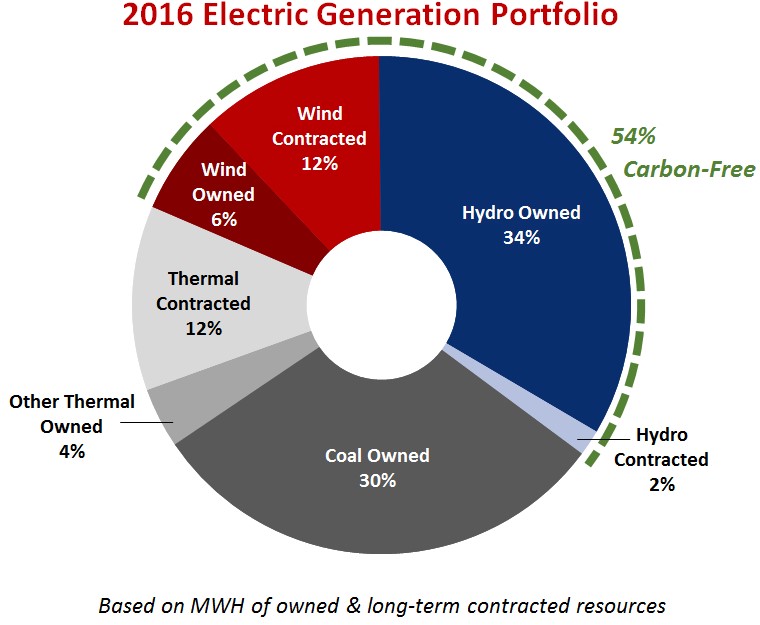

We strive to balance statutory requirements to provide cost-effective, reliable and stably priced energy with being good stewards of natural resources, with a diligent focus on sustainability. We own a mix of clean and carbon-free energy resources balanced with traditional energy sources that help us deliver affordable and reliable electricity to our customers 24/7. Our policies support both the role of cost-effective energy efficiency and the potential value of low or carbon-free resources as part of our diverse supply portfolio. In 2016, approximately 54%, based on megawatt hours generated, of our total company-owned generating assets and contracted electric supply is carbon-free. During 2015 and 2014, we added more than $1 billion of carbon-free electric generation, including the Montana run-of-the-river hydro system and wind generation in South Dakota.

8

ELECTRIC OPERATIONS | ||||

Montana

Our regulated electric utility business in Montana includes generation, transmission and distribution. Our service territory covers approximately 107,600 square miles, representing approximately 73% of Montana's land area, and includes a 2015 census estimated population of approximately 905,600. As of year-end 2016, we delivered electricity to approximately 363,800 customers in 187 communities and their surrounding rural areas, 15 rural electric cooperatives and, in Wyoming, to the Yellowstone National Park. In 2016, by category, residential, commercial, industrial, and other sales accounted for approximately 40%, 50%, 6%, and 4%, respectively, of our Montana retail electric utility revenue. We also transmit electricity for nonregulated entities owning generation, and utilities, cooperatives, and power marketers serving the Montana electricity market. Our total control area peak demand was approximately 1,808 MWs on December 17, 2016, which was a new all-time peak. Our control area average demand for 2016 was approximately 1,239 MWs per hour, with total energy delivered of more than 10.8 million MWHs.

Our Montana electric distribution system consists of approximately 17,750 miles of overhead and underground distribution lines and 393 transmission and distribution substations. Our Montana electric transmission system consists of approximately 6,700 miles of transmission lines, ranging from 50 kV to 500 kV, 288 circuit segments and approximately 104,000 transmission poles on approximately 74,000 structures with associated transformation and terminal facilities, and extends throughout the western two-thirds of Montana from Colstrip in the east to Thompson Falls in the west. We are directly interconnected with Avista Corporation; Idaho Power Company; PacifiCorp; the Bonneville Power Administration; WAPA; and Montana Alberta Tie Ltd. Such interconnections, coupled with transmission line capacity made available under agreements with some of the above entities, permit the interchange, purchase, and sale of power among all major electric systems in the west interconnecting with the winter-peaking northern and summer-peaking southern regions of the western power system. We provide wholesale transmission service and firm and non-firm transmission services for eligible transmission customers. Our 500 kV transmission system, which is jointly owned, along with our 230 kV and 161 kV facilities, form the key assets of our Montana transmission system. Lower voltage systems, which range from 50 kV to 115 kV, provide for local area service needs.

Energy Sources and Resource Planning

Resource planning is an important function necessary to meet our future energy needs. We filed a biennial Electric Supply Resource Procurement Plan with the MPSC during 2016, which guides future resource acquisition activities. Due to our acquisition of the hydroelectric generating facilities in Montana during 2014, adding additional base-load capacity was not identified as a priority. Instead, this plan identified meeting customers' peak requirements as the primary need. A scenario with new gas generation was identified as the most reliable, economical, lowest risk, and affordable means of serving our customers, consistent with state law. The benefits from this scenario hold true even assuming a high cost of carbon. The plan identifies a number of follow-up actions, one of which is to conduct a competitive solicitation in which all types of generation are allowed to participate. From this solicitation, we will identify the lowest cost/lowest risk means of meeting the portfolio's requirements and the most affordable and reliable ways of addressing our customers' peak needs.

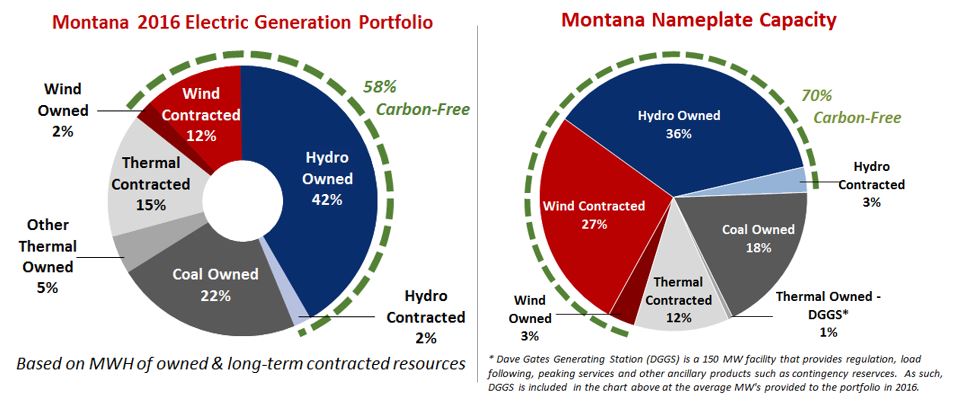

The following charts depict the makeup of our current Montana portfolio. Hydro generation is by far our largest and most important resource, as it is reliable, dramatically lowers the portfolio's carbon intensity, and reduces economic risks associated with future carbon costs.

9

Our annual retail electric supply load requirements averaged approximately 735 MWs, with a peak load of approximately 1,200 MWs, and are supplied by owned and contracted resources and market purchases with multiple counterparties. Owned generation resources supplied approximately 60% of our retail load requirements for 2016. We expect that approximately 60% of our retail obligations will be met by owned generation in 2017 as well. We also purchase power from QFs, which provide a total of 321 MWs of contracted capacity, including 87 MWs of capacity from waste petroleum coke and waste coal, 192 MWs of capacity from wind, 16 MWs of capacity from hydro, and 26 MWs of capacity from solar projects, located in Montana. We have several other long and medium-term power purchase agreements including contracts for 135 MWs of wind generation and 21 MWs of seasonal base-load hydro supply. For 2017, including both owned and contracted resources, we have resources to provide over 90% of the energy requirements necessary to meet our forecasted retail load requirements.

Generation Facilities

In 2014, we completed the purchase of hydroelectric generating facilities and associated assets located in Montana (Hydro Transaction). The Hydro Transaction included temporary ownership of the Kerr Project until it was conveyed to the Confederated Salish and Kootenai Tribes of the Flathead Reservation on September 5, 2015. The remaining hydro facilities are listed in the table below.

10

Plant | COD | River Source | FERC License Expiration | Net Capacity (MW) (1) |

Black Eagle | 1927 | Missouri | 2040 | 21 |

Cochrane | 1958 | Missouri | 2040 | 69 |

Hauser | 1911 | Missouri | 2040 | 19 |

Holter | 1918 | Missouri | 2040 | 48 |

Madison | 1906 | Madison | 2040 | 8 |

Morony | 1930 | Missouri | 2040 | 48 |

Mystic | 1925 | West Rosebud Creek | 2050 | 12 |

Rainbow | 1910/2013 | Missouri | 2040 | 60 |

Ryan | 1915 | Missouri | 2040 | 63 |

Thompson Falls | 1915 | Clark Fork | 2025 | 94 |

Total | 442 | |||

(1) Hebgen facility (0 MW net capacity) excluded from figures. These are run-of-river dams except for Mystic, which is storage generation.

We have a 30% joint ownership interest in Colstrip Unit 4, a coal-fired generating unit that provides base-load supply and is operated by Talen Energy. Talen Energy has a 30% joint ownership interest in Colstrip Unit 3. We have a risk sharing agreement with Talen Energy regarding the operation of Colstrip Units 3 and 4, in which each party receives 15% of the respective combined output and is responsible for 15% of the respective operating and construction costs, regardless of whether a particular cost is specified to Colstrip Unit 3 or 4. However, each party is responsible for its own fuel-related costs. Colstrip Unit 4 is supplied with fuel from adjacent coal reserves under coal supply and transportation agreements in effect through 2019. We also own the 40 MW Spion Kop wind project. The capacity of Spion Kop represents the nameplate MW, which varies from actual energy expected to be received as wind generation resources are highly dependent upon weather conditions.

We also own the Dave Gates Generating Station at Mill Creek (DGGS), a 150 MW natural gas fired facility. In 2016, DGGS typically operated with one unit providing regulation service, one unit providing other intra-hour balancing, and the third unit providing contingency reserves. In addition, DGGS provided approximately 7 MWs of retail base-load requirements in 2016.

Details of these generating facilities are described in the table below.

Name and Location of Plant | Fuel Source | Namplate Capacity (MW) | Ownership Interest | Owned Capacity (MW) | ||||

Colstrip Unit 4, located near Colstrip in southeastern Montana | Sub-bituminous coal | 740 | 30% | 222 | ||||

Dave Gates Generating Station, located near Anaconda, Montana | Natural Gas | 150 | 100% | 150 | ||||

Spion Kop Wind, located in Judith Basin County in Montana | Wind | 40 | 100% | 40 | ||||

Renewable portfolio standards (RPS) enacted in Montana currently require that 15% of our annual electric supply portfolio be derived from eligible sources, including resources such as wind, biomass, solar, and small hydroelectric. Eligible resources used to serve our load generate renewable energy credits (RECs). Any RECs in excess of the annual requirements for a given year are carried forward for up to two years to meet future RPS needs. Our owned hydro generation assets are not eligible resources under the RPS. Given contracts under negotiation and our portfolio resources, we expect to meet the Montana RPS requirements through at least 2026. The penalty for not meeting the RPS is up to $10 per MWH for each REC short of the requirement.

As a subset of the total RPS requirement, we were required to acquire, as of December 31, 2016, approximately 68 MW of community renewable energy projects, if cost effective. Since 2008, we have undertaken competitive solicitations to acquire this particular resource but have only contracted for 25 MW. We have filed waivers for the years 2012 through 2015, as we have not been able to contract with projects that meet the required qualifications. The MPSC granted waivers for 2012 through 2014, and the waiver request for 2015 is still pending. We expect to file a waiver request for 2016. If the requested waivers are

11

not granted, we may be liable for penalties. If penalties are applied, the amount of the penalty would depend on how the MPSC calculates the energy that a community renewable energy project would have produced.

South Dakota

Our South Dakota electric utility business operates as a vertically integrated generation, transmission and distribution utility. We have the exclusive right to serve an area in South Dakota comprised of 25 counties with a combined 2010 census population of approximately 226,200. We provide retail electricity to more than 63,200 customers in 110 communities in South Dakota. In 2016, by category, residential, commercial and other sales accounted for approximately 39%, 59%, and 2%, respectively, of our South Dakota retail electric utility revenue. Peak demand was approximately 330 MWs, the average load was approximately 189 MWs, and 1.66 million MWHs were supplied during the year ended December 31, 2016.

Our transmission and distribution network in South Dakota consists of approximately 3,550 miles of overhead and underground transmission and distribution lines as well as 124 substations. We have interconnection with the transmission facilities of Otter Tail Power Company; Montana-Dakota Utilities Co.; Xcel Energy Inc.; and WAPA. We have emergency interconnections with the transmission facilities of East River Electric Cooperative, Inc. and West Central Electric Cooperative.

Energy Sources and Resource Planning

We have a resource plan that includes estimates of customer usage and programs to provide for the economic, reliable and timely supply of energy. We continue to update our load forecast to identify the future electric energy needs of our customers, and we evaluate additional generating capacity requirements on an ongoing basis. We use market purchases and peaking generation to provide peak supply in excess of our base-load capacity. We have an agreement with Missouri River Energy Services to supply firm capacity of 30 MW in 2017 and 35 MW in 2018. We are a member of the SPP, which is a regional transmission organization that operates an organized energy market in the Central United States. As a market participant in SPP, we buy and sell wholesale energy and reserves in both day-ahead and real-time markets through the operation of a single, consolidated SPP balancing authority. We and other SPP members submit into the SPP market both offers to sell our generation and bids to purchase power to serve our load. SPP optimizes next-day and real-time generation dispatch across the region and provides participants with greater access to economic energy.

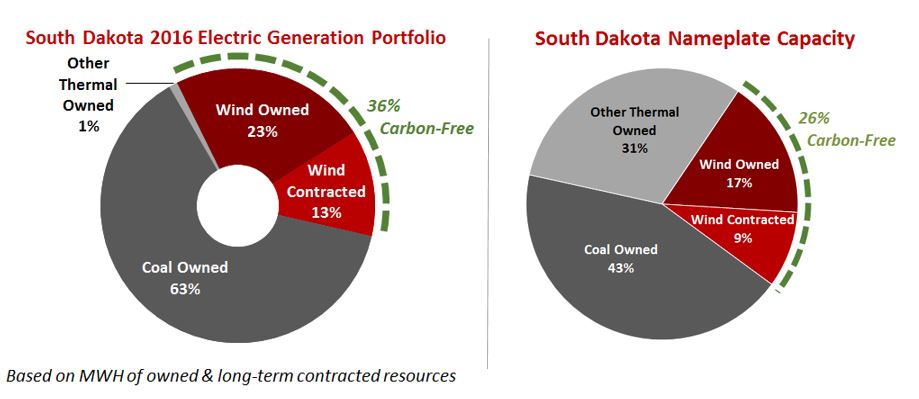

Our sources of energy by type during 2016 were as follows:

12

Generation Facilities

Our electric supply portfolio consists primarily of power plants that we own jointly with unaffiliated parties. Each of the jointly owned plants is subject to a joint management structure, and we are not the operator of any of these plants. Based upon our ownership interest, we are entitled to a proportionate share of the capacity of our jointly owned plants and are responsible for a proportionate share of the operating costs. Additional resources in our supply portfolio include several wholly owned peaking units and three wind projects. The Beethoven wind project is a 80 MW nameplate facility. Actual output varies as wind generation resources are highly dependent upon weather conditions. We also purchase the output of two wind projects, one of which is a QF, under power purchase agreements. We also have several wholly owned peaking/standby generating units at locations throughout our service territory.

Details of our generating facilities are described further in the chart below.

Name and Location of Plant | Fuel Source | Nameplate Capacity (MW) | Ownership Interest | Owned Capacity (MW) | ||||

Big Stone Plant, located near Big Stone City in northeastern South Dakota | Sub-bituminous coal | 475 | 23.4% | 111 | ||||

Coyote I Electric Generating Station, located near Beulah, North Dakota | Lignite coal | 427 | 10.0% | 43 | ||||

Neal Electric Generating Unit No. 4, located near Sioux City, Iowa | Sub-bituminous coal | 644 | 8.7% | 56 | ||||

Aberdeen Generating Unit, located near Aberdeen, South Dakota | Natural gas | 52 | 100.0% | 52 | ||||

Beethoven Wind Project, located near Tripp, South Dakota | Wind | 80 | 100.0% | 80 | ||||

Miscellaneous combustion turbine units and small diesel units (used only during peak periods) | Combination of fuel oil and natural gas | 100.0% | 98 | |||||

Total Capacity | 440 | |||||||

13

The fuel for our jointly owned base-load generating plants is provided through supply contracts of various lengths with several coal companies. Coyote is a mine-mouth generating facility. Neal #4 and Big Stone receive their fuel supply via rail. The average delivered cost by type of fuel burned varies between generation facilities due to differences in transportation costs and owner purchasing power for coal supply. Changes in our fuel costs are passed on to customers through the operation of the fuel adjustment clause in our South Dakota tariffs.

South Dakota has a voluntary renewable and recycled energy objective. The objective states that 10% of all electricity sold at retail within South Dakota be obtained from renewable and recycled energy sources. In 2016, approximately 26% of the South Dakota retail needs were generated from renewable resources. In 2017, we expect to continue to exceed South Dakota's voluntary objective at approximately the same level.

Since October 2015 when we joined the SPP as a transmission owning member we have continued to transfer control of qualifying South Dakota transmission assets into the SPP. To date, we have transferred control of over 330 line miles of 115 kV facilities and over 97 line miles of 69 kV facilities. All of our SPP controlled facilities reside in the Upper Missouri Zone (UMZ), which is also known as Zone 10 in the regional transmission organization. Along with us, other transmission owning members in the UMZ include Basin Electric Power Cooperative, Corn Belt Power Cooperative, Heartland Consumers Power District, Missouri River Energy Services, and WAPA. The Coyote and Big Stone power plants in which we are a joint owner, are connected directly to the MISO system, and we have ownership rights in the transmission lines from these plants to our distribution system. Marketing activities in SPP are handled for us by a third-party provider acting as our agent. Along with operating the transmission system, SPP also coordinates transmission planning for all members of the organization.

NATURAL GAS OPERATIONS | ||||

Montana

Our regulated natural gas utility business in Montana includes production, storage, transmission and distribution. As of year-end 2016, we distributed natural gas to approximately 194,100 customers in 105 Montana communities over a system that consists of approximately 5,150 miles of underground distribution pipelines. We also serve several smaller distribution companies that provide service to approximately 32,000 customers. We transmit natural gas in Montana from production receipt points and storage facilities to distribution points and other nonaffiliated transmission systems. We transported natural gas volumes of approximately 41.6 Bcf during the year ended December 31, 2016.

Our natural gas transmission system consists of more than 2,100 miles of pipeline, which vary in diameter from two inches to 24 inches, and serve more than 130 city gate stations. We have connections in Montana with four major, nonaffiliated transmission systems: Williston Basin Interstate Pipeline, NOVA Gas Transmission Ltd., Colorado Interstate Gas, and Spur Energy. Seven compressor sites provide more than 43,000 horsepower, capable of moving more than 335,000 dekatherms per day. In addition, we own and operate two transmission pipelines through our subsidiaries, Canadian-Montana Pipe Line Corporation and Havre Pipeline Company, LLC.

We have municipal franchises to transport and distribute natural gas in the Montana communities we serve. The terms of the franchises vary by community. They typically have a fixed 10-year term and continue for an additional 10-year term unless and until cancelled, with 5 years notice. If a cancellation notice is received, our policy generally is to work with the community to resolve any issues and execute a new franchise. We currently have four franchises, which account for approximately 7,500 or approximately four percent of our natural gas customers, where the fixed term has expired. We continue to serve those customers while we obtain formal renewals. During the next five years, four additional municipal franchises are scheduled to reach the end of their fixed term, which account for approximately 36,000 or 19 percent of our natural gas customers. We do not anticipate termination of any of these franchises.

Natural gas is used for residential and commercial heating, and for fuel for two electric generating facilities. The demand for natural gas largely depends upon weather conditions. Our Montana retail natural gas supply requirements for the year ended December 31, 2016, were approximately 18.7 Bcf. Our Montana natural gas supply requirements for electric generation fuel for the year ended December 31, 2016, were approximately 4.5 Bcf. We have contracted with several major producers and marketers with varying contract durations to provide the anticipated supply to meet ongoing requirements. Our natural gas supply requirements are fulfilled through third-party fixed-term purchase contracts, short-term market purchases and owned production. Our portfolio approach to natural gas supply is intended to enable us to maintain a diversified supply of natural gas sufficient to meet our supply requirements. We benefit from direct access to suppliers in the major natural gas producing regions in the United States, primarily the Rockies (Colorado), Montana, and Alberta, Canada.

14

Owned Production and Storage

Since 2010, we have acquired gas production and gathering system assets as a part of an overall strategy to provide rate stability and customer value: as we own these assets, which are regulated, our customers are protected from potential price spikes in the market. As of December 31, 2016, these owned reserves totaled approximately 60.6 Bcf and are estimated to provide approximately 4.7 Bcf in 2017, or about 23 percent of our expected annual retail natural gas load in Montana. In addition, we own and operate three working natural gas storage fields in Montana with aggregate working gas capacity of approximately 17.75 Bcf and maximum aggregate daily deliverability of approximately 195,000 dekatherms.

South Dakota and Nebraska

We provide natural gas to approximately 88,500 customers in 60 South Dakota communities and four Nebraska communities. We have approximately 2,405 miles of underground distribution pipelines and 55 miles of transmission pipeline in South Dakota and Nebraska. In South Dakota, we also transport natural gas for nine gas-marketing firms and three large end-user accounts. In Nebraska, we transport natural gas for three gas-marketing firms and one end-user account. We delivered approximately 26.5 Bcf of third-party transportation volume on our South Dakota distribution system and approximately 3.0 Bcf of third-party transportation volume on our Nebraska distribution system during 2016.

Our South Dakota natural gas supply requirements for the year ended December 31, 2016, were approximately 5.2 Bcf. We contract with a third party under an asset management agreement to manage transportation and storage of supply to minimize cost and price volatility to our customers. In Nebraska, our natural gas supply requirements for the year ended December 31, 2016, were approximately 3.9 Bcf. We contract with a third party under an asset management agreement that includes pipeline capacity, supply, and asset optimization activities. To supplement firm gas supplies in South Dakota and Nebraska, we contract for firm natural gas storage services to meet the heating season and peak day requirements of our customers.

We have municipal franchises to purchase, transport and distribute natural gas in the South Dakota and Nebraska communities we serve. The maximum term permitted under Nebraska law for these franchises is 25 years while the maximum term permitted under South Dakota law is 20 years. Our policy generally is to seek renewal or extension of a franchise in the last year of its term. During the next five years, 10 of our South Dakota franchises are scheduled to reach the end of their fixed term. We do not anticipate termination of any of these franchises.

15

REGULATION | ||||

Base rates are the rates we are allowed to charge our customers for the cost of providing delivery service and rate-based supply services, plus a reasonable rate of return on invested capital. We have both electric and natural gas base rates. We may ask the respective regulatory commission to increase base rates from time to time. We have historically been allowed to increase base rates to recover our utility plant investment and operating costs, plus a return on our capital investment. Rate increases are normally granted based on historical data and those increases may not always keep pace with increasing costs. For more information on current regulatory matters, see Note 4 - Regulatory Matters, to the Consolidated Financial Statements.

The following is a summary of our rate base and authorized rates of return in each jurisdiction:

Jurisdiction and Service | Implementation Date | Authorized Rate Base (millions) (1) | Estimated Rate Base (millions) (2) | Authorized Overall Rate of Return | Authorized Return on Equity | Authorized Equity Level | ||||||

Montana electric delivery (3) | July 2011 | $632.5 | $1,069.4 | 7.92% | 10.25% | 48% | ||||||

Montana - DGGS (3) | January 2011 | 172.7 | 121.0 | 8.16% | 10.25% | 50% | ||||||

Montana - Colstrip Unit 4 | January 2009 | 400.4 | 310.0 | 8.25% | 10.00% | 50% | ||||||

Montana Spion Kop | December 2012 | 81.7 | 49.4 | 7.0% | 10.00% | 48% | ||||||

Montana hydro assets | November 2014 | 870.0 | 796.7 | 6.91% | 9.80% | 48% | ||||||

Montana natural gas delivery | June 2013 | 309.2 | 383.2 | 7.48% | 9.80% | 47.65% | ||||||

Montana natural gas production (4) | November 2012 | 12.0 | 58.3 | 7.48% | 9.80% | 47.65% | ||||||

South Dakota electric (5) | December 2015 | 557.3 | 577.8 | 7.24% | n/a | n/a | ||||||

South Dakota natural gas (5) | December 2011 | 65.9 | 62.3 | 7.8% | n/a | n/a | ||||||

Nebraska natural gas (5) | December 2007 | 24.3 | 25.1 | 8.49% | 10.40% | n/a | ||||||

$3,126.0 | $3,453.2 | |||||||||||

(1) Rate base reflects amounts on which we are authorized to earn a return.

(2) Rate base amounts are estimated as of December 31, 2016.

(3) | The FERC regulated portion of Montana electric transmission and DGGS are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. |

(4) | The authorized rate base represents our Battle Creek natural gas production assets. The estimated rate base also includes two natural gas production fields acquired in August 2012 and December 2013 in northern Montana's Bear Paw Basin, which are recovered in customer rates on an interim basis pending the resolution of our Montana natural gas delivery and production rate filing submitted in September 2016. |

(5) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms.

MPSC Regulation

Our Montana operations are subject to the jurisdiction of the MPSC with respect to rates, terms and conditions of service, accounting records, electric service territorial issues and other aspects of our operations, including when we issue, assume, or guarantee securities in Montana, or when we create liens on our regulated Montana properties. We have an obligation to provide service to our customers with an opportunity to earn a regulated rate of return.

Electric and Natural Gas Supply Trackers - Rates for our Montana electric and natural gas supply are set by the MPSC. Certain supply rates are adjusted on a monthly basis for volumes and costs during each July to June 12-month tracking period. Annually, supply rates are adjusted to include any differences in the previous tracking year's actual to estimated information for recovery during the subsequent tracking year. We submit annual electric and natural gas tracker filings for the actual 12-month period ended June 30 and for the projected supply costs for the next 12-month period. The MPSC reviews such filings and makes its cost recovery determination based on whether or not our electric and natural gas energy supply procurement activities were prudent. If the MPSC subsequently determines that a procurement activity was imprudent, then it may disallow such costs.

16

Montana Property Tax Tracker - We file an annual property tax tracker (including other state/local taxes and fees) with the MPSC for an automatic rate adjustment, which reflects 60% of the change in property taxes. Adjusted rates are typically effective January 1st of each year.

SDPUC Regulation

Our South Dakota operations are subject to SDPUC jurisdiction with respect to rates, terms and conditions of service, accounting records, electric service territorial issues and other aspects of our electric and natural gas operations. Our retail electric rates, approved by the SDPUC, provide several options for residential, commercial and industrial customers, including dual-fuel, interruptible, special all-electric heating, and other special rates. Our retail natural gas tariffs include gas transportation rates for transportation through our distribution systems by customers and natural gas marketers from the interstate pipelines at which our systems take delivery to the end-user. Such transporting customers nominate the amount of natural gas to be delivered daily. Usage for these customers is monitored daily by us through electronic metering equipment and balanced against respective supply agreements.

An electric adjustment clause provides for quarterly adjustment based on differences in the delivered cost of energy, delivered cost of fuel, ad valorem taxes paid and commission-approved fuel incentives. The adjustment goes into effect upon filing, and is deemed approved within 10 days after the information filing unless the SDPUC staff requests changes during that period. A purchased gas adjustment provision in our natural gas rate schedules permits the monthly adjustment of charges to customers to reflect increases or decreases in purchased gas, gas transportation and ad valorem taxes.

NPSC Regulation

Our Nebraska natural gas rates and terms and conditions of service for residential and smaller commercial customers are regulated by the NPSC. High volume customers are not subject to such regulation, but can file complaints if they allege discriminatory treatment. Under the Nebraska State Natural Gas Regulation Act, a regulated natural gas utility may propose a change in rates to its regulated customers, if it files an application for a rate increase with the NPSC and with the communities in which it serves customers. The utility may negotiate with those communities for a settlement with regard to the rate change if the affected communities representing more than 50% of the affected ratepayers agree to direct negotiations, or it may proceed to have the NPSC review the filing and make a determination. Our tariffs have been accepted by the NPSC, and the NPSC has adopted certain rules governing the terms and conditions of service of regulated natural gas utilities. Our retail natural gas tariffs provide residential, general service and commercial and industrial options, as well as firm and interruptible transportation service. A purchased gas adjustment clause provides for adjustments based on changes in gas supply and interstate pipeline transportation costs.

FERC Regulation

We are subject to FERC's jurisdiction and regulations with respect to rates for electric transmission service in interstate commerce and electricity sold at wholesale rates, hydro licensing and operations, the issuance of certain securities, incurrence of certain long-term debt, and compliance with mandatory reliability regulations, among other things. Under FERC's open access transmission policy promulgated in Order No. 888, as owners of transmission facilities, we are required to provide open access to our transmission facilities under filed tariffs at cost-based rates. In addition, we are required to comply with FERC's Standards of Conduct, as amended, governing the communication of non-public information between our transmission employees and wholesale merchant employees.

Our Montana wholesale transmission customers, such as cooperatives, are served under our OATT, which is on file with FERC. The OATT also defines the terms, conditions and rates of our Montana transmission service, including ancillary services. As discussed above, our South Dakota transmission operations joined the SPP during 2015, and the majority of transmission service in that territory is provided under the SPP OATT. We maintain an OATT in South Dakota, however, to provide discrete transmission service to a small number of transmission customers.

Our natural gas transportation pipelines are generally not subject to FERC's jurisdiction under the NGA, although we are subject to state regulation. We conduct limited interstate transportation in Montana and South Dakota that is subject to FERC jurisdiction, but FERC has allowed the MPSC and SDPUC to set the rates for this interstate service. We have capacity agreements in South Dakota and Nebraska with interstate pipelines that are also subject to FERC jurisdiction.

The facilities acquired in the Hydro Transaction are licensed by the FERC. In connection with the relicensing of these generating facilities, applicable law permits the FERC to issue a new license to the existing licensee or to a new licensee, and alternatively allows the U.S. government to take over the facility. If the existing licensee is not relicensed, it is compensated for

17

its net investment in the facility, not to exceed the fair value of the property taken, plus reasonable severance damages to other property affected by the lack of relicensing.

Reliability Standards - We must comply with the standards and requirements that apply to the NERC functions for which we have registered in both the MRO for our South Dakota operations and the WECC for our Montana operations. WECC and the MRO have responsibility for monitoring and enforcing compliance with the FERC approved mandatory Reliability Standards within their respective regions. Additional reliability standards continue to be developed and will be adopted in the future. We expect that the existing reliability standards will change often as a result of modifications, guidance and clarification following industry implementation and ongoing audits and enforcement.

SEASONALITY AND CYCLICALITY | ||||

Our electric and gas utility businesses are seasonal businesses, and weather patterns can have a material impact on operating performance. Because natural gas is used primarily for residential and commercial heating, the demand for this product depends heavily upon weather patterns throughout our market areas, and a significant amount of natural gas revenues are recognized in the first and fourth quarters related to the heating season. Demand for electricity is often greater in the summer and winter months for cooling and heating, respectively. Accordingly, our operations have historically generated less revenue and income when weather conditions are milder in the winter and cooler in the summer. When we experience unusually mild winters or summers in the future, these weather patterns could adversely affect our results of operations, financial condition and liquidity.

ENVIRONMENTAL | ||||

The operation of electric generating, transmission and distribution facilities, and gas gathering, transportation and distribution facilities, along with the development (involving site selection, environmental assessments, and permitting) and construction of these assets, are subject to extensive federal, state, and local environmental and land use laws and regulations. Our activities involve compliance with diverse laws and regulations that address emissions and impacts to the environment, including air and water, protection of natural resources and wildlife. We monitor federal, state, and local environmental initiatives to determine potential impacts on our financial results. As new laws or regulations are issued, we assess their applicability and implement the necessary modifications to our facilities or their operation to maintain ongoing compliance.

We strive to comply with all environmental regulations applicable to our operations. However, it is not possible to determine when or to what extent additional facilities or modifications of existing or planned facilities will be required as a result of changes to environmental regulations, interpretations or enforcement policies or, what effect future laws or regulations may have on our operations. The EPA is in the process of proposing and finalizing a number of environmental regulations that will directly affect the electric industry over the coming years. These initiatives cover all sources - air, water and waste. For more information on environmental regulations and contingencies and related capital expenditures, see Note 19 - Commitments and Contingencies, to the Consolidated Financial Statements.

CORPORATE INFORMATION AND WEBSITE | ||||

We were incorporated in Delaware in November 1923. Our Internet address is http://www.northwesternenergy.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments, along with our annual report to shareholders and other information related to us, are available, free of charge, on our Internet website as soon as reasonably practicable after we electronically file those documents with, or otherwise furnish them to, the SEC. This information is available in print to any shareholder who requests it. Requests should be directed to: Investor Relations, NorthWestern Corporation, 3010 W. 69th Street, Sioux Falls, South Dakota 57108 and our telephone number is (605) 978-2900. References to our website in this report are provided as a convenience and do not constitute, and should not be viewed as, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this report.

18

EMPLOYEES | ||||

As of December 31, 2016, we had 1,552 employees. Of these, 1,231 employees were in Montana and 321 were in South Dakota or Nebraska. Of our Montana employees, 459 were covered by seven collective bargaining agreements involving five unions. Six of these agreements were renegotiated in 2016 with terms that will expire in 2020. Through the acquisition of PPL Montana's hydroelectric generating facilities, we assumed the terms of the remaining agreement, which will be renegotiated in 2017. Of our South Dakota and Nebraska employees, 187 were covered by a collective bargaining agreement that was renegotiated in 2016 with a term that expires at the end of 2019. We consider our relations with employees to be good.

Executive Officer | Current Title and Prior Employment | Age on Feb. 10, 2017 | ||

Robert C. Rowe | President, Chief Executive Officer and Director since August 2008. Prior to joining NorthWestern, Mr. Rowe was a co-founder and senior partner at Balhoff, Rowe & Williams, LLC, a specialized national professional services firm providing financial and regulatory advice to clients in the telecommunications and energy industries (January 2005-August, 2008); and served as Chairman and Commissioner of the Montana Public Service Commission (1993–2004). | 61 | ||

Brian B. Bird | Vice President and Chief Financial Officer since December 2003. Prior to joining NorthWestern, Mr. Bird was Chief Financial Officer and Principal of Insight Energy, Inc., a Chicago-based independent power generation development company (2002-2003). Previously, he was Vice President and Treasurer of NRG Energy, Inc., in Minneapolis, MN (1997-2002). Mr. Bird serves on the board of directors of a NorthWestern subsidiary. | 54 | ||

Michael R. Cashell | Vice President - Transmission since May 2011; formerly Chief Transmission Officer since November 2007; formerly Director Transmission Marketing and Business Planning since 2003. Mr. Cashell serves on the board of directors of a NorthWestern subsidiary. | 54 | ||

Patrick R. Corcoran | Vice President-Government and Regulatory Affairs since December 2004; formerly Vice President-Regulatory Affairs since February 2002; formerly Vice President-Regulatory Affairs for the former Montana Power Company (2000-2002). | 64 | ||

Heather H. Grahame | Vice President and General Counsel since August 2010. Prior to joining NorthWestern, Ms. Grahame was a partner in the law firm of Dorsey & Whitney, LLP, where she co-chaired its Telecommunications practice (1999-2010). | 61 | ||

John D. Hines | Vice President - Supply since May 2011; formerly Chief Energy Supply Officer since January 2008; formerly Director - Energy Supply Planning since 2006. Previously, Mr. Hines served as the Montana representative to the NorthWest Power and Conservation Council (2003-2006). | 58 | ||

Crystal D. Lail | Vice President and Controller since October 2015; formerly Assistant Controller since February 2008 and, prior to that an SEC Reporting Manager. Prior to joining NorthWestern, Ms. Lail was an auditor for KPMG LLP. | 38 | ||

Curtis T. Pohl | Vice President - Distribution since May 2011; formerly Vice President-Retail Operations since September 2005; Vice President-Distribution Operations since August 2003; formerly Vice President-South Dakota/Nebraska Operations since June 2002; formerly Vice President-Engineering and Construction since June 1999. Mr. Pohl serves on the board of directors of a NorthWestern subsidiary. | 52 | ||

Bobbi L. Schroeppel | Vice President, Customer Care, Communications and Human Resources since May 2009, formerly Vice President-Customer Care and Communications since September 2005; formerly Vice President-Customer Care since June 2002; formerly Director-Staff Activities and Corporate Strategy since August 2001; formerly Director-Corporate Strategy since June 2000. | 48 | ||

Officers are elected annually by, and hold office at the pleasure of the Board of Directors (Board), and do not serve a “term of office” as such.

19

ITEM 1A. RISK FACTORS

You should carefully consider the risk factors described below, as well as all other information available to you, before making an investment in our common stock or other securities.

We are subject to potential unfavorable state and federal regulatory outcomes. To the extent our incurred costs are deemed imprudent by the applicable regulatory commissions or certain regulatory mechanisms are not available, we may not recover some of our costs, which could adversely impact our results of operations and liquidity.

Our profitability is dependent on our ability to recover the costs of providing energy and utility services to our customers and earn a return on our capital investment in our utility operations. We provide service at rates established by several regulatory commissions. These rates are generally set based on an analysis of our costs incurred in a historical test year. In addition, each regulatory commission sets rates based in part upon their acceptance of an allocated share of total utility costs. When commissions adopt different methods to calculate inter-jurisdictional cost allocations, some costs may not be recovered. Thus, the rates we are allowed to charge may or may not match our costs at any given time. While rate regulation is premised on providing a reasonable opportunity to earn a reasonable rate of return on invested capital, there can be no assurance that the applicable regulatory commission will judge all of our costs to have been prudently incurred or that the regulatory process in which rates are determined will always result in rates that will produce full recovery of such costs.

In addition to rate cases, our cost tracking mechanisms are a significant component of how we recover our costs. Our wholesale costs for electricity and natural gas supply are recovered through various pass-through cost tracking mechanisms in each of the states we serve. The rates are established based upon projected market prices or contractual obligations. As these variables change, we adjust our rates through our monthly trackers, which are subject to approval by the applicable regulatory commissions. When electric generation outages occur, we may procure replacement power in the market. These costs have typically been included in our monthly trackers. To the extent our energy supply costs are deemed imprudent by the applicable state regulatory commissions, we may not recover some of our costs, which could adversely impact our results of operations.

We have received several unfavorable regulatory rulings in Montana, including:

•In 2016, the MPSC disallowed approximately $8.2 million of replacement power costs from a 2013 outage at Colstrip Unit 4, and approximately $1.3 million of costs related to generation portfolio modeling previously recovered through our electric tracker filings.

•In October 2015, the MPSC issued an order eliminating the lost revenue adjustment mechanism. This mechanism was established in 2005 by the MPSC as a component of an approved energy efficiency program, by which we recovered on an after-the-fact basis a portion of our fixed costs that would otherwise have been collected in the kWh sales lost due to energy efficiency programs through our supply tracker. Lost revenues were removed prospectively effective December 1, 2015.

•In October 2013, the MPSC concluded that $1.4 million of incremental costs associated with regulation service acquired from third parties during a 2012 outage at DGGS were imprudently incurred, and disallowed recovery.

We appealed the October 2013 decision regarding DGGS outage costs to the Montana District Court, which, in August 2015, upheld the MPSC’s decision. In October 2015, we appealed the District Court’s decision to the Montana Supreme Court, which, in September 2016, upheld the District Court's decision.

In June 2016, we filed an appeal of the MPSC decision regarding the disallowance of portfolio modeling costs in Montana District Court (Lewis & Clark County). Also, in September 2016, we appealed the MPSC’s decisions regarding the disallowance of Colstrip Unit 4 replacement power costs and the modeling/planning costs, arguing that these decisions were arbitrary and capricious, and violated Montana law. We brought this action in Montana District Court, as well (Yellowstone County). The briefing in this case is currently scheduled to conclude by the end of the second quarter of 2017. While the courts are not obligated to rule on these appeals within a certain period of time, based on our experience, we believe we are likely to receive orders from the courts in these matters within 9-20 months of filing.

In addition, the November 2016, MPSC order in our hydro compliance filing lowered our authorized recovery of certain costs and requires us to indicate by April 30, 2017, whether we intend to file a Montana electric rate case based on a 2016 test year. The order also indicated that if we do not intend to file a rate case in 2017, the MPSC may require us to make an

20

additional filing that would facilitate an assessment of whether additional action would be required to fulfill the MPSC's obligation to authorize just and reasonable rates.

In addition to our supply trackers, we file an annual property tax tracker with the MPSC for an automatic rate adjustment of our Montana property taxes, which allows recovery of 60 percent of the change in property taxes. Adjusted rates are typically effective January 1st of each year. The MPSC has identified concerns with the amount of annual increases proposed by the Montana Department of Revenue, and the MPSC is considering what, if any, alternatives it might pursue. Any change in recovery of property taxes could have a material impact on our results of operations.

In addition, in our regulatory filings related to DGGS, we proposed an allocation of approximately 80% of costs to retail customers subject to the MPSC's jurisdiction and approximately 20% allocated to wholesale customers subject to FERC's jurisdiction. In March 2012, the MPSC's final order approved using our proposed cost allocation methodology, but requires us to complete a study of the relative contribution of retail and wholesale customers to regulation capacity needs. The results of this study may be used in determining future cost allocations between retail and wholesale customers. However, there is no assurance that both the MPSC and FERC will agree on the results of this study, which could result in an inability to fully recover our costs.

In May 2016, we received an order from the FERC denying a May 2014 request for rehearing and requiring us to make refunds. The request for rehearing challenged a September 2012 FERC Administrative Law Judge's (ALJ) initial decision regarding cost allocation at DGGS between retail and wholesale customers. This decision concluded that only a portion of these costs should be allocated to FERC jurisdictional customers. We had deferred cumulative revenue of approximately $27.3 million, consistent with the ALJ's initial decision, which was refunded to wholesale and choice customers in June 2016 in accordance with the FERC order. In June 2016, we filed a petition for review with the U.S. Circuit Court of Appeals for the District of Columbia Circuit. A briefing schedule has been established, with final briefs due by the end of the first quarter of 2017. We do not expect a decision in this matter until the second half of 2017, at the earliest. The FERC order was assessed as a triggering event as to whether an impairment charge should be recorded with respect to DGGS.The cost recovery of any alternative use of DGGS would be subject to regulatory approval and we cannot provide assurance of such approval. If we are not able to obtain cost recovery of DGGS we may be required to record an impairment charge, which could have a material adverse effect on our operating results.

Our ability to invest in additional generation is impacted by regulatory and public policy. Under PURPA, electric utilities are required, with exceptions, to purchase energy and capacity from independent power producers that are qualifying co-generation facilities and qualifying small power production facilities (QFs). Our requirements to procure power from these sources could impact our ability to make generation investments depending upon the number and size of QF contracts we ultimately enter into. In addition, the cost to procure power from these QFs may not be a cost effective resource for customers, or the type of generation resource needed, resulting in increased supply costs.

We must also comply with established reliability standards and requirements, which apply to NERC functions in both the MRO for our South Dakota operations and WECC for our Montana operations. The FERC, NERC, or a regional reliability organization may assess penalties against any responsible entity that violates their rules, regulations or standards. Violations may be discovered through various means, including self-certification, self-reporting, compliance investigations, audits, periodic data submissions, exception reporting, and complaints. Penalties for the most severe violations can reach as high as approximately $1.2 million per violation, per day. If a serious reliability incident or other incidence of noncompliance did occur, it could have a material adverse effect on our operating and financial results.

We are also subject to changing federal and state laws and regulations. Congress and state legislatures may enact legislation that adversely affects our operations and financial results.

We are subject to existing, and potential future, federal and state legislation. In the planning and management of our operations, we must address the effects of legislation within a regulatory framework. Federal and state laws can significantly impact our operations, whether it is new or revised statutes directly affecting the electric and gas industry, or other issues such as taxes.

We are subject to changing tax laws, regulations, and interpretations in multiple jurisdictions. Corporate tax reform continues to be a priority in the U.S. Changes to the U.S. tax system could have significant effects, positive and negative, on our effective tax rate, and on our deferred tax assets and liabilities. In addition, the timing of realization of certain tax benefits may be further delayed in the event of future extensions of bonus depreciation or expensing of capital investments and impact our ability to utilize our federal and state net operating loss carryforwards.

21

In addition, new or revised statutes can also materially affect our operations through impacting existing regulations or requiring new regulations. These changes are ongoing, and we cannot predict the future course of changes or the ultimate effect that this changing environment will have on us. Changes in laws, and the resulting regulations and tariffs and how they are implemented and interpreted, may have a material adverse effect on our businesses, financial condition, results of operations and cash flows.

In April 2016, the U.S. Senate passed the Securing America’s Future Energy: Protecting our Infrastructure of Pipelines and Enhancing Safety Act (SAFE PIPES Act), which would reauthorize appropriations for the Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) safety programs through 2019. The bill prioritizes PHMSA's completion of outstanding regulations. In addition, PHMSA proposed revisions to safety standards for natural gas transmission and gathering pipelines. The long-anticipated proposal could impose significant regulatory requirements for additional miles of natural gas pipeline, including pipelines constructed prior to 1970 which were previously exempt from PHMSA regulations related to pressure testing. It would also create a new "Moderate Consequence Area" category to expand safety protocols to pipelines in moderately populated areas. The rule also would codify the Integrity Verification Process (IVP) which is a process that will require companies to have reliable, traceable, verifiable, and complete records for pipelines in certain areas. The rule would establish a deadline for IVP completion that we will be required to meet. Costs incurred to comply with the proposed regulations may be material.

We are subject to extensive and changing environmental laws and regulations and potential environmental liabilities, which could have a material adverse effect on our liquidity and results of operations.

We are subject to extensive laws and regulations imposed by federal, state, and local government authorities in the ordinary course of operations with regard to the environment, including environmental laws and regulations relating to air and water quality, protection of natural resources, migratory birds and other wildlife, solid waste disposal, coal ash and other environmental considerations. We believe that we are in compliance with environmental regulatory requirements; however, possible future developments, such as more stringent environmental laws and regulations, and the timing of future enforcement proceedings that may be taken by environmental authorities, could affect our costs and the manner in which we conduct our business and could require us to make substantial additional capital expenditures or abandon certain projects.

There is uncertainty associated with the new EPA Administration and the timeframe for actions that may be taken with regard to the existing and pending GHG-related regulations. National and international actions have been initiated to address global climate change and the contribution of greenhouse gas (GHG) emissions including, most significantly, carbon dioxide.

In October 2015, the EPA issued standards for states to implement to control GHG emissions from existing electric generating units. These standards are referred to as the Clean Power Plan or CPP. We, along with a number of states and other parties, filed lawsuits against the EPA standards. In February 2016, the U.S. Supreme Court entered an order staying the implementation of the CPP standards. In a separate proceeding, in January 2017, the EPA denied our administrative Petition for Reconsideration that had requested the EPA reconsider the CPP on the grounds that the carbon dioxide (CO2) reductions in the CPP were substantially greater in Montana than in the proposed rule. In response, we may file a Petition for Review in the U.S. Court of Appeals for the District of Columbia. Additional information regarding the CPP, the proposed reductions in South Dakota and Montana, and the pending litigation is included in Note 19 - Commitments and Contingencies to the Consolidated Financial Statements.

If the CPP standards survive judicial review and are implemented as written, they could result in significant additional compliance costs that would affect our future results of operations and financial position if such costs are not recovered through regulated rates. Due to the pending litigation and the uncertainties in the state approaches, the ultimate timing and impact of these standards on our operations cannot be determined with certainty at this time. Complying with the carbon emission standards, and with other future environmental rules, may make it economically impractical to continue operating all or a portion of our jointly owned facilities or for individual owners to participate in their proportionate ownership of the coal-fired generating units. This could lead to significant impacts to customer rates for recovery of plant improvements and / or closure related costs and costs to procure replacement power. In addition, these changes could impact system reliability due to changes in generation sources.

Many of these environmental laws and regulations provide for substantial civil and criminal fines for noncompliance which, if imposed, could result in material costs or liabilities. In addition, there is a risk of environmental damages claims from private parties or government entities. We may be required to make significant expenditures in connection with the investigation and remediation of alleged or actual spills, personal injury or property damage claims, and the repair, upgrade or expansion of our facilities to meet future requirements and obligations under environmental laws.

22

To the extent that costs exceed our estimated environmental liabilities, or we are not successful in recovering remediation costs or costs to comply with the proposed or any future changes in rules or regulations, our results of operations and financial position could be adversely affected.

Our revenues, results of operations and financial condition are impacted by customer growth and usage in our service territories and may fluctuate with current economic conditions or response to price increases. We are also impacted by market conditions outside of our service territories related to demand for transmission capacity and wholesale electric pricing.

Our revenues, results of operations and financial condition are impacted by customer growth and usage, which can be impacted by a number of factors, including the voluntary reduction of consumption of electricity and natural gas by our customers in response to increases in prices and demand-side management programs, economic conditions impacting decreases in their disposable income, and the use of distributed generation resources or other emerging technologies for electricity. Advances in distributed generation technologies that produce power, including fuel cells, micro-turbines, wind turbines and solar cells, may reduce the cost of alternative methods of producing power to a level competitive with central power station electric production. Customer-owned generation itself reduces the amount of electricity purchased from utilities and has the effect of increasing rates unless retail rates are designed to share the costs of the distribution grid across all customers that benefit from their use. Such developments could affect the price of energy, could affect energy deliveries as customer-owned generation becomes more cost-effective, could require further improvements to our distribution systems to address changing load demands and could make portions of our electric system power supply and transmission and/or distribution facilities obsolete prior to the end of their useful lives. Such technologies could also result in further declines in commodity prices or demand for delivered energy.