Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - PIONEER ENERGY SERVICES CORP | ex992pr-termloanandablanno.htm |

| 8-K - 8-K - PIONEER ENERGY SERVICES CORP | a8kpreliminarycommitments1.htm |

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

$175mm Term Loan Financing

Lenders’ Presentation

October 2017

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Forward-looking Statements

This presentation contains various forward-looking statements and information that are based on management’s current expectations and assumptions about

future events. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “expect,” “anticipate,” “plan,”

“intend,” “seek,” “will,” “should,” “goal” and other words that convey the uncertainty of future events and outcomes. Forward-looking information includes,

among other matters, statements regarding the Company’s anticipated performance, quality of assets, rig utilization rate, capital spending by oil and gas

companies, and the Company's international operations.

Although the Company believes that the expectations and assumptions reflected in such forward-looking statements are reasonable, it can give no assurance

that such expectations and assumptions will prove to have been correct. Such statements are subject to certain risks, uncertainties and assumptions, including

general economic and business conditions and industry trends, levels and volatility of oil and gas prices, the continued demand for drilling services or

production services in the geographic areas where we operate, decisions about exploration and development projects to be made by oil and gas exploration

and production companies, the highly competitive nature of our business, technological advancements and trends in our industry and improvements in our

competitors’ equipment, the loss of one or more of our major clients or a decrease in their demand for our services, future compliance with covenants under

our senior secured revolving credit facility and our senior notes, operating hazards inherent in our operations, the supply of marketable drilling rigs, well

servicing rigs, coiled tubing and wireline units within the industry, the continued availability of drilling rig, well servicing rig, coiled tubing and wireline unit

components, the continued availability of qualified personnel, the success or failure of our acquisition strategy, including our ability to finance acquisitions,

manage growth and effectively integrate acquisitions, the political, economic, regulatory and other uncertainties encountered by our operations, and changes

in, or our failure or inability to comply with, governmental regulations, including those relating to the environment.

Should one or more of these risks, contingencies or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary

materially from those expected. Many of these factors have been discussed in more detail in the Company's annual report on Form 10-K for the fiscal year

ended December 31, 2016 and its subsequent quarterly reports on Form 10-Q. Other unpredictable or unknown factors that the Company has not discussed in

this presentation or in its filings with the Securities and Exchange Commission could also have material adverse effects on actual results of matters that are the

subject of the forward-looking statements. All forward-looking statements speak only as the date on which they are made and the Company undertakes no

duty to update or revise any forward-looking statements. We advise investors to use caution and common sense when considering our forward-looking

statements.

2

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

COMPANY OVERVIEW

AND CREDIT HIGHLIGHTS

3

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

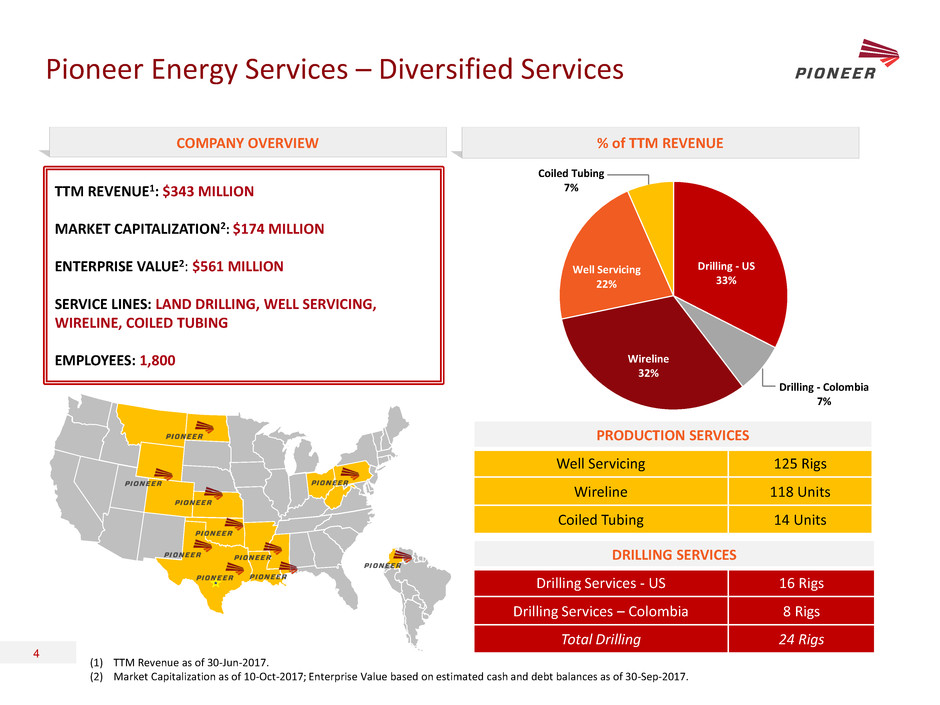

Pioneer Energy Services – Diversified Services

% of TTM REVENUE

(1) TTM Revenue as of 30-Jun-2017.

(2) Market Capitalization as of 10-Oct-2017; Enterprise Value based on estimated cash and debt balances as of 30-Sep-2017.

DRILLING SERVICES

Drilling Services - US 16 Rigs

Drilling Services – Colombia 8 Rigs

Total Drilling 24 Rigs

PRODUCTION SERVICES

Well Servicing 125 Rigs

Wireline 118 Units

Coiled Tubing 14 Units

4

TTM REVENUE1: $343 MILLION

MARKET CAPITALIZATION2: $174 MILLION

ENTERPRISE VALUE2: $561 MILLION

SERVICE LINES: LAND DRILLING, WELL SERVICING,

WIRELINE, COILED TUBING

EMPLOYEES: 1,800

COMPANY OVERVIEW

Drilling - US

33%

Drilling - Colombia

7%

Wireline

32%

Well Servicing

22%

Coiled Tubing

7%

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Key Credit Highlights

5

Premium onshore assets that provide exposure to life-cycle of the well

• Production services earns revenues from completion of a well through abandonment

• Drilling services provides exposure to increased activity levels in commodity recovery

• Demand for Pioneer’s assets demonstrated by utilization through the cycle

• Successful high grading of fleet positions the company well to meet customer demand

Diverse geographical footprint

• Strong exposure to many leading basins in North America

• Provides company with optionality to re-deploy assets over time as E&P companies improve economics in

various basins

Established and diverse customer base

• Only two customers with >5% of revenue contribution

• Strong mix of large cap independents and emerging high growth E&Ps

Industry leading safety track record

Improving outlook for onshore services demand

• Longer laterals / more complex wells driving increased demand for services

• EBITDA margins beginning to show recovery

Disciplined management team, committed to preserving financial flexibility of the

company

• Executed $65 million equity offering in 2016

• Repaid $170 million debt since the first quarter of 2013

• The company’s capital expenditures are primarily maintenance, resulting in additional FCF that can be

used to pay down debt

1

2

3

4

5

6

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Premium Shale-Oriented Assets

6

US DRILLING SERVICES PRODUCTION SERVICES

• Fleet comprised of 100% pad-capable AC rigs

• Versatile and competitive 1,500 horsepower

AC drilling rigs with:

• 2,000hp mud pumps and 7,500psi mud

systems with bi-fuel capability

• Capable of moving in less than three days

from release to acceptance by the operator

on new pad

• Can walk 150’ x 50’ while racking over

24,000’ of 5” drill pipe

• Premium shale-capable equipment

• 100% of well servicing fleet is 550-

600hp with 104’, 112’, 116’ or 121’

masts

• Full suite of coiled tubing offerings

from 1 1/4” to 2 5/8” coil

• Balanced exposure to completion

and production-oriented activity in

major shale plays

1

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

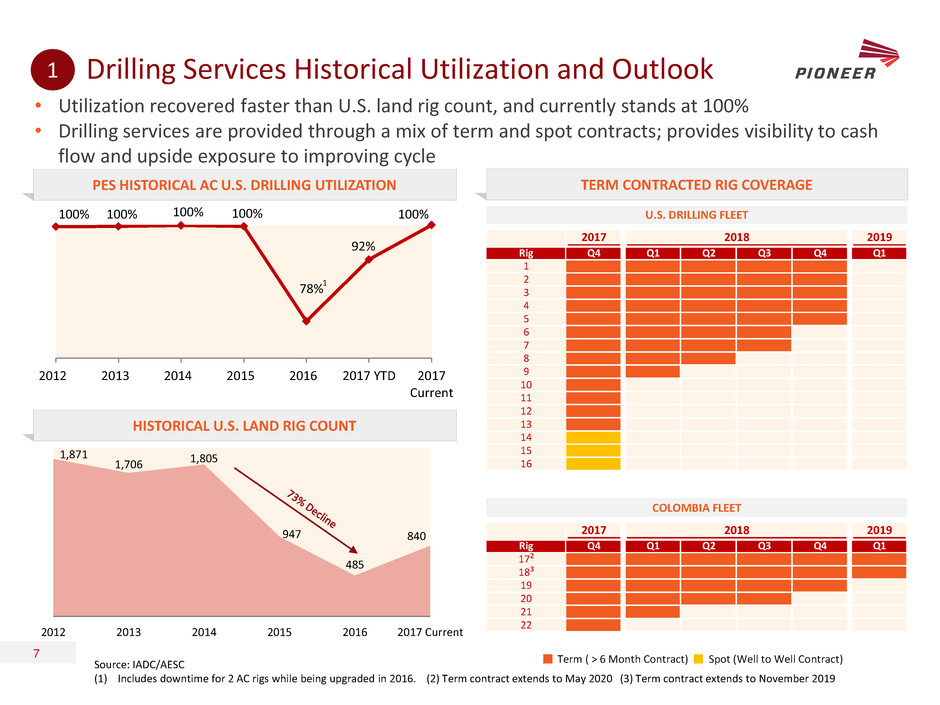

100% 100% 100% 100%

78%

92%

100%

2012 2013 2014 2015 2016 2017 YTD 2017

Current

1,871

1,706 1,805

947

485

840

2012 2013 2014 2015 2016 2017 Current

Drilling Services Historical Utilization and Outlook

• Utilization recovered faster than U.S. land rig count, and currently stands at 100%

• Drilling services are provided through a mix of term and spot contracts; provides visibility to cash

flow and upside exposure to improving cycle

7

Source: IADC/AESC

(1) Includes downtime for 2 AC rigs while being upgraded in 2016. (2) Term contract extends to May 2020 (3) Term contract extends to November 2019

PES HISTORICAL AC U.S. DRILLING UTILIZATION TERM CONTRACTED RIG COVERAGE

Term ( > 6 Month Contract) Spot (Well to Well Contract)

1

HISTORICAL U.S. LAND RIG COUNT

1

U.S. DRILLING FLEET

2017 2018 2019

Rig Q4 Q1 Q2 Q3 Q4 Q1

1 $19,500 $19,500 $19,500 $19,500 $19,500

2 $17,000 $17,000 $17,000 $17,000 $17,000

3 $19,500 $19,500 $19,500 $19,500 $19,500

4 $28,800 $28,800 $28,800 $28,800 $28,800

5 $17,500 $17,500 $17,500 $17,500 $17,500

6 $28,800 $28,800 $28,800 $28,800

7 $28,800 $28,800 $28,800 $28,800

8 $19,900 $19,900 $19,900

9 $27,950 $27,950

10 $19,000

11 $15,750

12 $19,000

13 $18,000

14 $19,500

15 $19,500

16 $18,000

COLOMBIA FLEET

2017 2018 2019

Rig Q4 Q1 Q2 Q3 Q4 Q1

17²

18³

19

20

21

22

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Exposure to the Full Well Life Cycle

PLUG AND PERFORATE TOE PREP DRILLING

MAINTENANCE UNTIL PLUG AND ABANDON DRILL OUT PLUGS COMPLETE AND

INSTALL ARTIFICIAL LIFT

8

1

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Balanced Revenue Mix Between Completion and

Remedial Services

9

1

COILED TUBING WIRELINE WELL SERVICES

PRODUCTION SERVICES TOTAL

Completion

63%

Remedial

38%

Completion

58%

Remedial

42%

Completion

18%

Remedial

82%

Completion

48%

Remedial

52%

Note: Based on revenue for the quarter ended 30-Jun-2017.

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

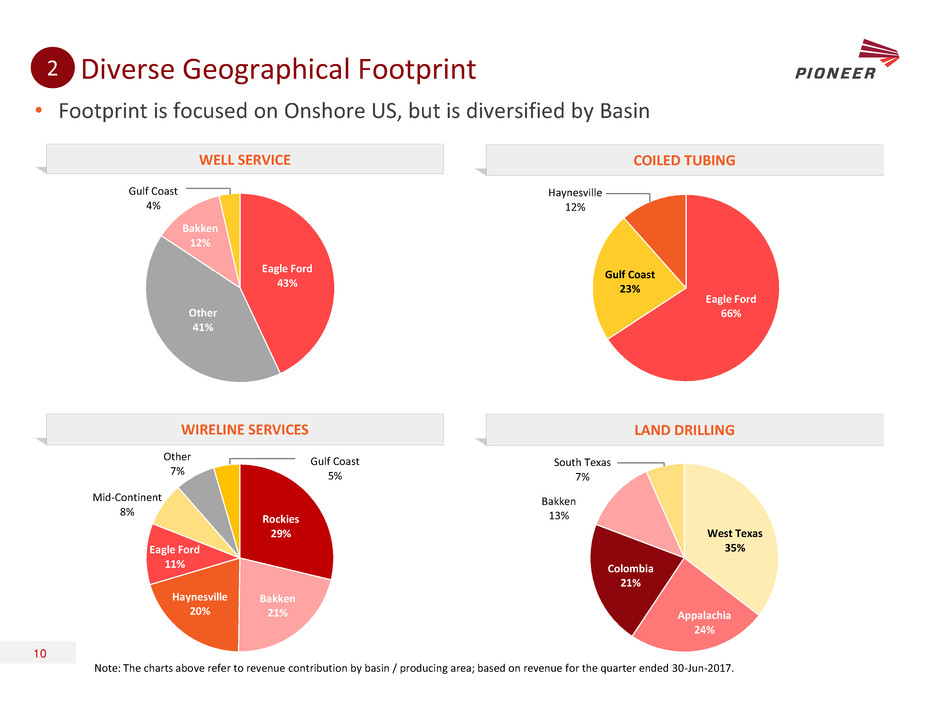

Diverse Geographical Footprint

COILED TUBING

10

WIRELINE SERVICES LAND DRILLING

WELL SERVICE

• Footprint is focused on Onshore US, but is diversified by Basin

2

West Texas

35%

Appalachia

24%

Colombia

21%

Bakken

13%

South Texas

7%

Eagle Ford

66%

Gulf Coast

23%

Haynesville

12%

Note: The charts above refer to revenue contribution by basin / producing area; based on revenue for the quarter ended 30-Jun-2017.

Rockies

29%

Bakken

21%

Haynesville

20%

Eagle Ford

11%

Mid-Continent

8%

Other

7%

Gulf Coast

5%

Eagle Ford

43%

Other

41%

Bakken

12%

Gulf Coast

4%

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

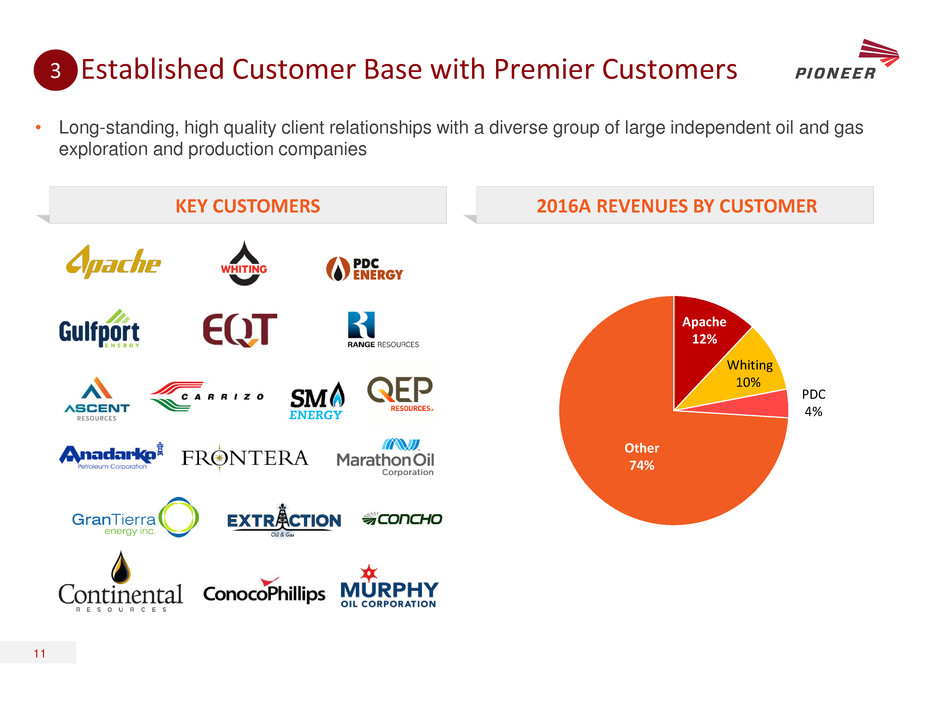

Apache

12%

Whiting

10%

PDC

4%

Other

74%

Established Customer Base with Premier Customers

KEY CUSTOMERS

11

2016A REVENUES BY CUSTOMER

• Long-standing, high quality client relationships with a diverse group of large independent oil and gas

exploration and production companies

3

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

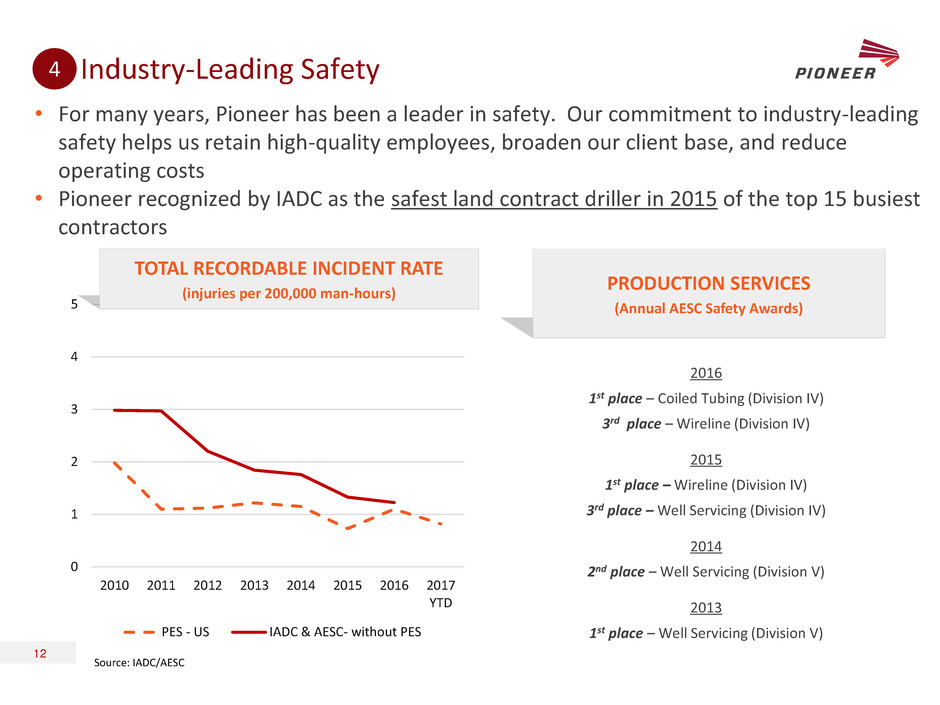

Industry-Leading Safety

• For many years, Pioneer has been a leader in safety. Our commitment to industry-leading

safety helps us retain high-quality employees, broaden our client base, and reduce

operating costs

• Pioneer recognized by IADC as the safest land contract driller in 2015 of the top 15 busiest

contractors

0

1

2

3

4

5

2010 2011 2012 2013 2014 2015 2016 2017

YTD

PES - US IADC & AESC- without PES

TOTAL RECORDABLE INCIDENT RATE

(injuries per 200,000 man-hours)

12

Source: IADC/AESC

PRODUCTION SERVICES

(Annual AESC Safety Awards)

2016

1st place – Coiled Tubing (Division IV)

3rd place – Wireline (Division IV)

2015

1st place – Wireline (Division IV)

3rd place – Well Servicing (Division IV)

2014

2nd place – Well Servicing (Division V)

2013

1st place – Well Servicing (Division V)

4

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Improving Outlook for Onshore Services Demand

13

5

Source: Goldman Sachs Investment Research

% Completions:

• Demand for completion and production services expected to increase despite slower

growth in rig count

• Increased activity levels are driving demand for PES services

NEW WELLS DRILLED FRAC STAGES U.S. LAND RIG COUNT

1,805

947

485

840 822

864 871

2014 2015 2016 2017E 2018E 2019E 2020E

37,833

20,264

10,094

17,013 17,050

18,357

18,970

2014 2015 2016 2017E 2018E 2019E 2020E

580,235

378,060

210,621

418,915

514,025

588,363

634,417

2014 2015 2016 2017E 2018E 2019E 2020E

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

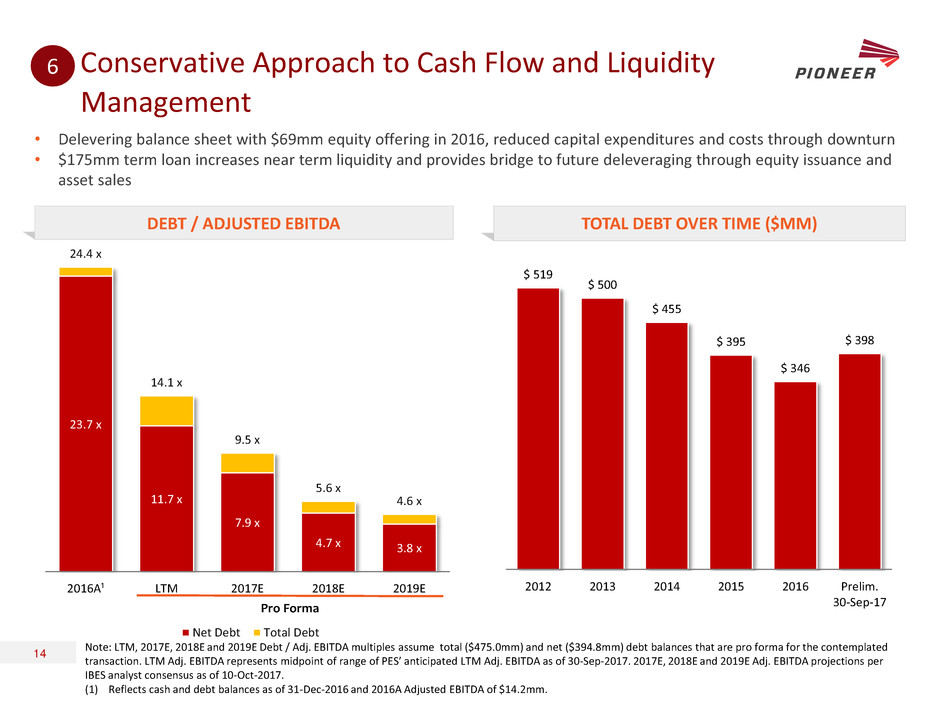

23.7 x

11.7 x

7.9 x

4.7 x 3.8 x

24.4 x

14.1 x

9.5 x

5.6 x

4.6 x

2016A¹ LTM 2017E 2018E 2019E

Net Debt Total Debt

Conservative Approach to Cash Flow and Liquidity

Management

14

6

• Delevering balance sheet with $69mm equity offering in 2016, reduced capital expenditures and costs through downturn

• $175mm term loan increases near term liquidity and provides bridge to future deleveraging through equity issuance and

asset sales

DEBT / ADJUSTED EBITDA TOTAL DEBT OVER TIME ($MM)

$ 519

$ 500

$ 455

$ 395

$ 346

$ 398

2012 2013 2014 2015 2016 Prelim.

30-Sep-17

Note: LTM, 2017E, 2018E and 2019E Debt / Adj. EBITDA multiples assume total ($475.0mm) and net ($394.8mm) debt balances that are pro forma for the contemplated

transaction. LTM Adj. EBITDA represents midpoint of range of PES’ anticipated LTM Adj. EBITDA as of 30-Sep-2017. 2017E, 2018E and 2019E Adj. EBITDA projections per

IBES analyst consensus as of 10-Oct-2017.

(1) Reflects cash and debt balances as of 31-Dec-2016 and 2016A Adjusted EBITDA of $14.2mm.

Pro Forma

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Historical Financial Results

REVENUE / ADJUSTED EBITDA ($ millions) CAPEX SPEND ($ millions)

Note: All data points reflect calendar year and trailing twelve months information derived from 10-K and 10-Q filings.

(1) As of 30-Jun-2017.

15

$960

$1,055

$541

$277

$343

$235

$277

$111

$14 $23

2013 2014 2015 2016 2017 TTM

Revenue Adjusted EBITDA

Q2

$165

$175

$160

$32

$40

2013 2014 2015 2016 2017 YTDQ2 1 1

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

APPENDIX

16

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Company Overview

17

% Hz:

% Completions:

• Pioneer Energy Services (“PES” or the “Company”) provides land-based drilling services and production services

to a diverse group of exploration and production companies in the United States and internationally in Colombia

• PES operates through two main business segments including:

— Drilling Services Segment, which provides contract land drilling services, and

— Production Services Segment, which provides well servicing, wireline and coiled tubing services

• Drilling Services Segment

— PES has a current fleet of 24 drilling rigs, 100% of which are pad-capable

o US Fleet: Comprised of 16 AC walking rigs built within the last five years and specifically designed to optimize pad drilling

o Colombia Fleet: Comprised of 8 SCR rigs (ideally suited for conventional operations, pad capable)

• Production Services Segment

— Well Servicing: Consists of a rig fleet of 125 rigs which provide services in order to establish production in

newly-drilled wells and to maintain production over the useful lives of active wells PES’s rig fleet routinely

performs completion services, maintenance and workover services, and plugging and abandonment

operations

— Wireline Services: Consists of a fleet of 118 wireline units which mainly provide services such as perforating,

logging and pipe recovery. PES has a leading market share position in a number of key geographic markets

include the Bakken, Eagle Ford, Niobrara, Gulf Coast and onshore/offshore Louisiana

— Coiled Tubing Services: Consists of a fleet of 14 coiled tubing units primarily servicing the Gulf Coast,

Niobrara, and Eagle Ford.

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

DRILLING

SERVICES

18

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Drilling Services

FLEET CHARACTERISTICS OPERATING LOCATIONS – 24 RIGS

TOTAL RIG FLEET UTILIZATION¹

19

(1) Red indicates active rigs; two additional rigs in Colombia are

contracted and scheduled to begin work in Q4 2017.

100%

100%

94%

94%

100%

100%

AC

Pad-Ready

Walking

≥1,500HP Drawworks

7,500psi Mud System

Contracted

U.S. FLEET

75 %

100 %

75 %

100 %

100 %

Contracted

1,500+ HP Drawworks

Walking

Pad-Ready

SCR

COLOMBIA FLEET

7

1

2

4

6

7

1

2

8

6

Permian Eagle

Ford/STX

Bakken Colombia Appalachia

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

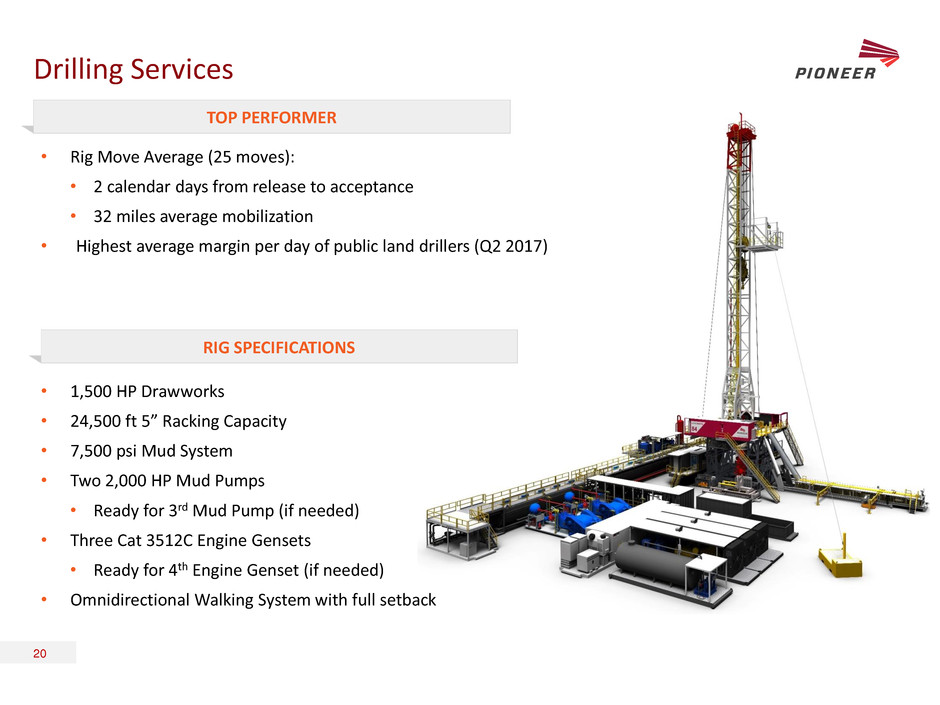

• Rig Move Average (25 moves):

• 2 calendar days from release to acceptance

• 32 miles average mobilization

• Highest average margin per day of public land drillers (Q2 2017)

Drilling Services

20

TOP PERFORMER

• 1,500 HP Drawworks

• 24,500 ft 5” Racking Capacity

• 7,500 psi Mud System

• Two 2,000 HP Mud Pumps

• Ready for 3rd Mud Pump (if needed)

• Three Cat 3512C Engine Gensets

• Ready for 4th Engine Genset (if needed)

• Omnidirectional Walking System with full setback

RIG SPECIFICATIONS

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

Drilling Services

21

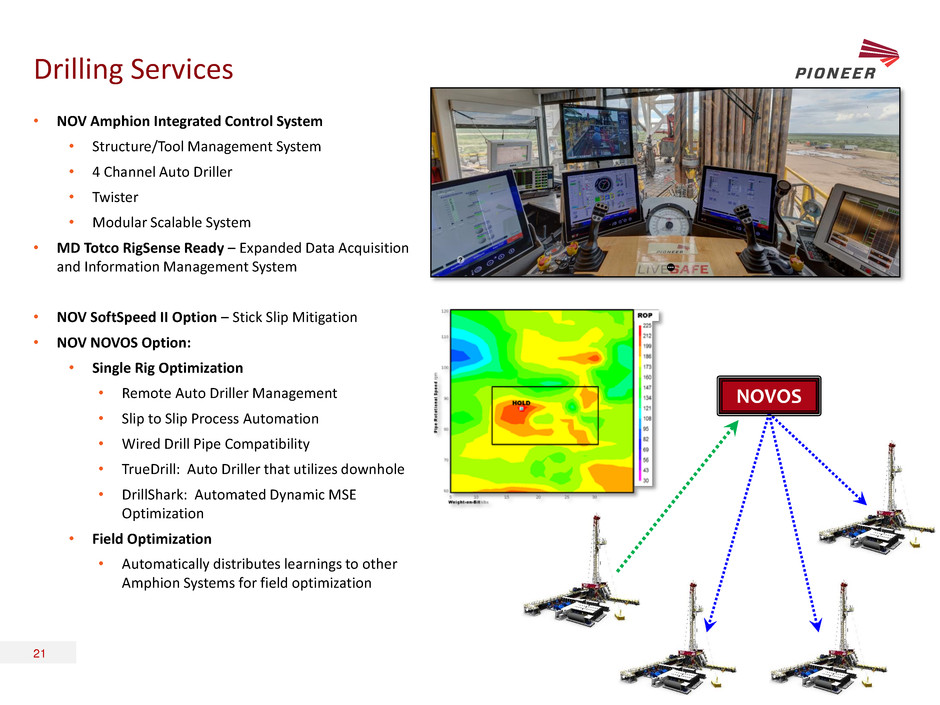

• NOV Amphion Integrated Control System

• Structure/Tool Management System

• 4 Channel Auto Driller

• Twister

• Modular Scalable System

• MD Totco RigSense Ready – Expanded Data Acquisition

and Information Management System

• NOV SoftSpeed II Option – Stick Slip Mitigation

• NOV NOVOS Option:

• Single Rig Optimization

• Remote Auto Driller Management

• Slip to Slip Process Automation

• Wired Drill Pipe Compatibility

• TrueDrill: Auto Driller that utilizes downhole

• DrillShark: Automated Dynamic MSE

Optimization

• Field Optimization

• Automatically distributes learnings to other

Amphion Systems for field optimization

NOVOS

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

PRODUCTION

SERVICES

22

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

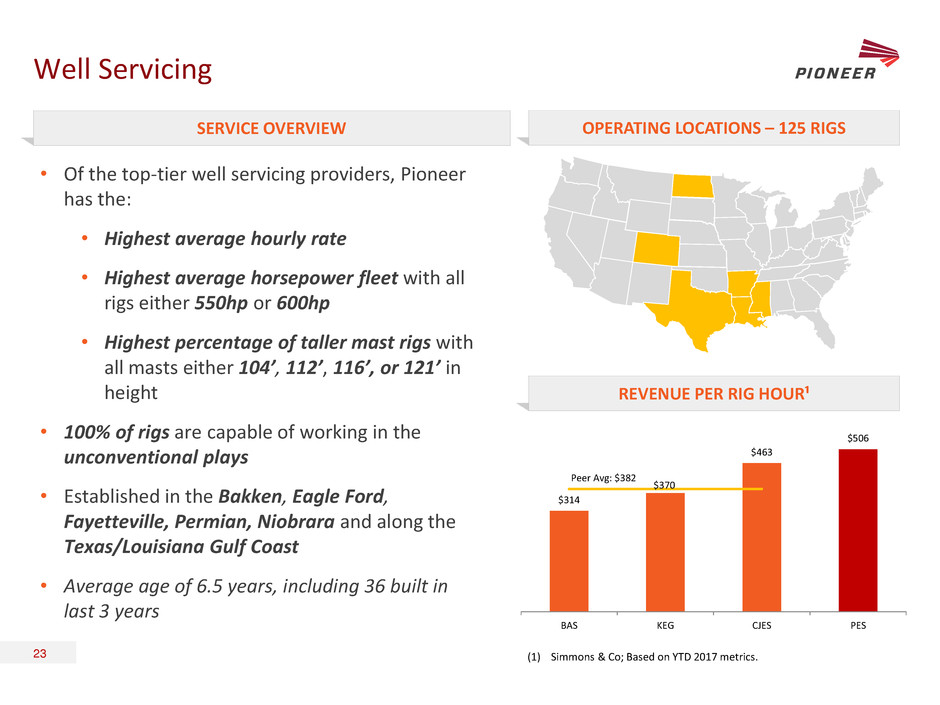

Well Servicing

• Of the top-tier well servicing providers, Pioneer

has the:

• Highest average hourly rate

• Highest average horsepower fleet with all

rigs either 550hp or 600hp

• Highest percentage of taller mast rigs with

all masts either 104’, 112’, 116’, or 121’ in

height

• 100% of rigs are capable of working in the

unconventional plays

• Established in the Bakken, Eagle Ford,

Fayetteville, Permian, Niobrara and along the

Texas/Louisiana Gulf Coast

• Average age of 6.5 years, including 36 built in

last 3 years

SERVICE OVERVIEW OPERATING LOCATIONS – 125 RIGS

REVENUE PER RIG HOUR¹

23 (1) Simmons & Co; Based on YTD 2017 metrics.

$314

$370

$463

$506

BAS KEG CJES PES

Peer Avg: $382

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

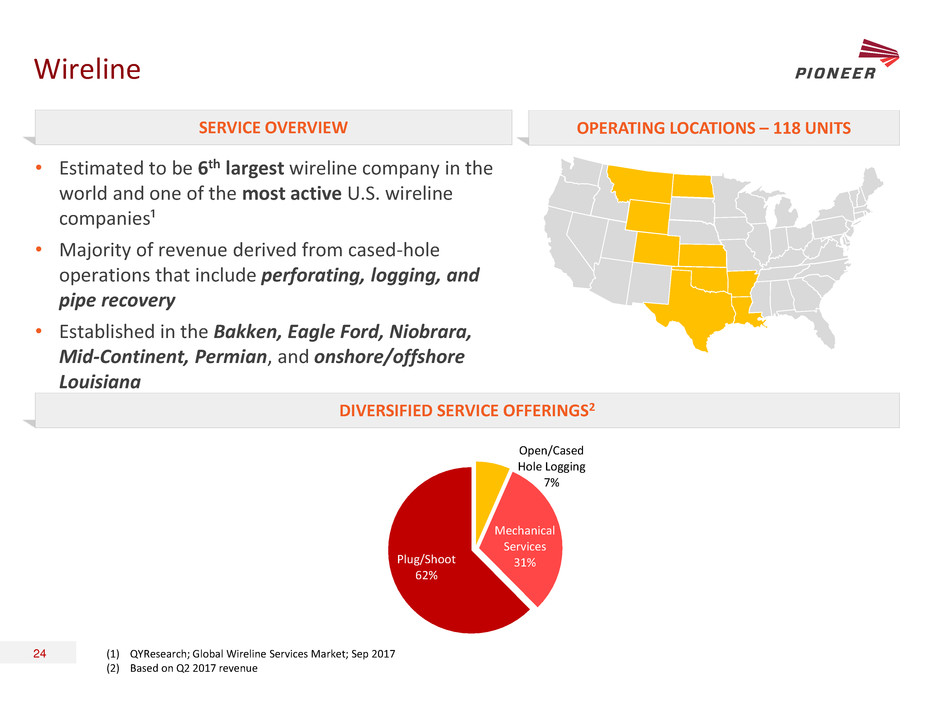

Open/Cased

Hole Logging

7%

Mechanical

Services

31% Plug/Shoot

62%

Wireline

• Estimated to be 6th largest wireline company in the

world and one of the most active U.S. wireline

companies¹

• Majority of revenue derived from cased-hole

operations that include perforating, logging, and

pipe recovery

• Established in the Bakken, Eagle Ford, Niobrara,

Mid-Continent, Permian, and onshore/offshore

Louisiana

(1) QYResearch; Global Wireline Services Market; Sep 2017

(2) Based on Q2 2017 revenue

SERVICE OVERVIEW OPERATING LOCATIONS – 118 UNITS

DIVERSIFIED SERVICE OFFERINGS2

24

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx

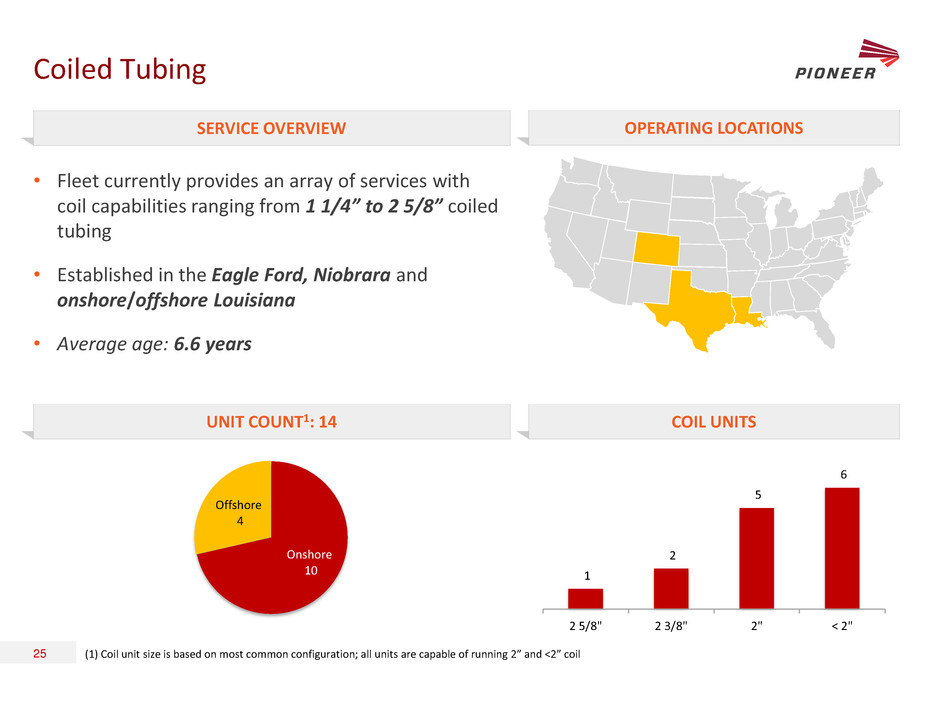

Coiled Tubing

• Fleet currently provides an array of services with

coil capabilities ranging from 1 1/4” to 2 5/8” coiled

tubing

• Established in the Eagle Ford, Niobrara and

onshore/offshore Louisiana

• Average age: 6.6 years

SERVICE OVERVIEW OPERATING LOCATIONS

UNIT COUNT1: 14 COIL UNITS

(1) Coil unit size is based on most common configuration; all units are capable of running 2” and <2” coil 25

1

2

5

6

2 5/8" 2 3/8" 2" < 2"

Onshore

10

Offshore

4

IBDROOT\PROJECTS\IBD-NY\TOPKNOT2017\607628_1\14. Lenders Presentation\PES Lenders Presentation v16.pptx