Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Arbutus Biopharma Corp | exhibit322q32017.htm |

| EX-32.1 - EXHIBIT 32.1 - Arbutus Biopharma Corp | exhibit321q32017.htm |

| EX-31.2 - EXHIBIT 31.2 - Arbutus Biopharma Corp | exhibit312q32017.htm |

| EX-31.1 - EXHIBIT 31.1 - Arbutus Biopharma Corp | exhibit311q32017.htm |

| EX-10.1 - EXHIBIT 10.1 SUBSCRIPTION AGREEMENT - Arbutus Biopharma Corp | exhibit101q32017.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number: 001-34949

ARBUTUS BIOPHARMA CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

British Columbia, Canada | 98-0597776 | |

(State or Other Jurisdiction of | (I.R.S. Employer | |

Incorporation or Organization) | Identification No.) | |

100-8900 Glenlyon Parkway, Burnaby, BC, Canada V5J 5J8

(Address of Principal Executive Offices)

604-419-3200

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] | Accelerated filer [X] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

(Do not check if a smaller | |||

reporting company) | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

1

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

As of October 31, 2017, the registrant had 55,051,995 common shares, no par value, outstanding. In addition, the Company had outstanding 500,000 convertible preferred shares, which will be mandatorily convertible into 7,037,839 common shares on October 16, 2021. Assuming the convertible preferred shares were converted as of October 31, 2017, the Company would have had 62,089,834 common shares outstanding at October 31, 2017.

2

ARBUTUS BIOPHARMA CORP.

TABLE OF CONTENTS

Page | ||

3

4

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

ARBUTUS BIOPHARMA CORPORATION

Condensed Consolidated Balance Sheets

(Unaudited)

(Expressed in thousands of U.S. dollars, except share and per share amounts)

(Prepared in accordance with US GAAP)

September 30, | December 31, | ||||||

2017 | 2016 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 15,225 | $ | 23,413 | |||

Short-term investments (note 2) | 72,954 | 107,146 | |||||

Accounts receivable | 846 | 273 | |||||

Accrued revenue | 128 | 128 | |||||

Investment tax credits receivable | 160 | 293 | |||||

Prepaid expenses and other assets | 1,500 | 1,311 | |||||

Total current assets | 90,813 | 132,564 | |||||

Restricted investment (note 2) | 12,601 | 12,601 | |||||

Property and equipment | 24,747 | 17,683 | |||||

Less accumulated depreciation | (12,125 | ) | (10,738 | ) | |||

Property and equipment, net of accumulated depreciation | 12,622 | 6,945 | |||||

Intangible assets (note 3) | 99,445 | 99,445 | |||||

Goodwill (note 3) | 24,364 | 24,364 | |||||

Total assets | $ | 239,845 | $ | 275,919 | |||

Liabilities and stockholders' equity | |||||||

Current liabilities: | |||||||

Accounts payable and accrued liabilities (note 5) | $ | 6,403 | $ | 9,910 | |||

Deferred revenue (note 4) | 15 | 15 | |||||

Liability-classified options (note 2) | 1,817 | 553 | |||||

Warrants | — | 107 | |||||

Total current liabilities | 8,235 | 10,585 | |||||

Deferred lease incentives, net of current portion | 744 | — | |||||

Loan payable | 12,001 | 12,001 | |||||

Contingent consideration (notes 2 and 6) | 10,211 | 9,065 | |||||

Deferred tax liability | 41,263 | 41,263 | |||||

Total liabilities | 72,454 | 72,914 | |||||

Stockholders’ equity: | |||||||

Common shares | |||||||

Authorized - unlimited number with no par value | |||||||

Issued and outstanding: 55,051,983 (December 31, 2016 - 54,841,494) | 876,049 | 867,393 | |||||

Additional paid-in capital | 40,755 | 36,543 | |||||

Deficit | (699,631 | ) | (651,149 | ) | |||

Accumulated other comprehensive loss | (49,782 | ) | (49,782 | ) | |||

Total stockholders' equity | 167,391 | 203,005 | |||||

Total liabilities and stockholders' equity | $ | 239,845 | $ | 275,919 | |||

Nature of business and future operations (note 1)

Contingencies and commitments (note 6)

Subsequent events (note 8)

See accompanying notes to the condensed consolidated financial statements.

F- 1

ARBUTUS BIOPHARMA CORPORATION

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(Expressed in thousands of U.S. dollars, except share and per share amounts)

(Prepared in accordance with US GAAP)

Three months ended | Nine months ended | |||||||||||||

September 30, | September 30, | |||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||

Revenue (note 4) | 6,892 | 774 | 8,166 | 1,686 | ||||||||||

Expenses | ||||||||||||||

Research, development, collaborations and contracts | 15,537 | 15,738 | 44,854 | 44,097 | ||||||||||

General and administrative | 3,659 | 3,720 | 12,586 | 34,705 | ||||||||||

Depreciation of property and equipment | 593 | 291 | 1,407 | 760 | ||||||||||

Impairment of intangible assets (note 3) | — | — | — | 156,324 | ||||||||||

Total expenses | 19,789 | 19,749 | 58,847 | 235,886 | ||||||||||

Loss from operations | (12,897 | ) | (18,975 | ) | (50,681 | ) | (234,200 | ) | ||||||

Other income (losses) | ||||||||||||||

Interest income | 337 | 425 | 1,095 | 1,104 | ||||||||||

Interest expense | (76 | ) | — | (186 | ) | — | ||||||||

Foreign exchange gain (loss) | 1,233 | (795 | ) | 2,458 | 2,180 | |||||||||

Gain on disposition of financial instrument | — | — | — | 1,000 | ||||||||||

Decrease (increase) in fair value of warrant liability (note 2) | — | 10 | (22 | ) | 339 | |||||||||

Increase in fair value of contingent consideration (note 6) | (197 | ) | (260 | ) | (1,146 | ) | (756 | ) | ||||||

Total other income (losses) | 1,297 | (620 | ) | 2,199 | 3,867 | |||||||||

Loss before income taxes | (11,600 | ) | (19,595 | ) | (48,482 | ) | (230,333 | ) | ||||||

Income tax benefit | — | — | — | 64,864 | ||||||||||

Net and comprehensive loss | $ | (11,600 | ) | $ | (19,595 | ) | $ | (48,482 | ) | $ | (165,469 | ) | ||

Loss per common share | ||||||||||||||

Basic and diluted | $ | (0.21 | ) | $ | (0.37 | ) | $ | (0.89 | ) | $ | (3.15 | ) | ||

Weighted average number of common shares | ||||||||||||||

Basic and diluted | 54,877,103 | 53,652,007 | 54,612,081 | 52,588,505 | ||||||||||

See accompanying notes to the condensed consolidated financial statements.

F- 2

ARBUTUS BIOPHARMA CORPORATION

Condensed Consolidated Statement of Stockholders’ Equity

(Unaudited)

(Expressed in thousands of U.S. dollars, except share and per share amounts)

(Prepared in accordance with US GAAP)

Number of shares | Share capital | Additional paid-in capital | Deficit | Accumulated other comprehensive loss | Total stockholders' equity | |||||||||||||||||

December 31, 2016 | 54,841,494 | $ | 867,393 | $ | 36,543 | $ | (651,149 | ) | $ | (49,782 | ) | $ | 203,005 | |||||||||

Stock-based compensation | — | 7,972 | 5,198 | — | — | 13,170 | ||||||||||||||||

Certain fair value adjustments to liability stock option awards | — | — | (962 | ) | — | — | (962 | ) | ||||||||||||||

Issuance of common shares pursuant to exercise of options | 31,489 | 203 | (24 | ) | — | — | 179 | |||||||||||||||

Issuance of common shares pursuant to exercise of warrants | 179,000 | 481 | — | — | — | 481 | ||||||||||||||||

Net loss | — | — | — | (48,482 | ) | — | (48,482 | ) | ||||||||||||||

Balance, September 30, 2017 | 55,051,983 | $ | 876,049 | $ | 40,755 | $ | (699,631 | ) | $ | (49,782 | ) | $ | 167,391 | |||||||||

See accompanying notes to the condensed consolidated financial statements.

F- 3

ARBUTUS BIOPHARMA CORPORATION

Condensed Consolidated Statements of Cash Flow

(Unaudited)

(Expressed in thousands of U.S. dollars)

(Prepared in accordance with US GAAP)

Three months ended | Nine months ended | |||||||||||||

September 30, | September 30, | |||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||

OPERATING ACTIVITIES | ||||||||||||||

Net loss for the period | $ | (11,600 | ) | $ | (19,595 | ) | $ | (48,482 | ) | $ | (165,469 | ) | ||

Items not involving cash: | ||||||||||||||

Deferred income taxes | — | — | — | (64,864 | ) | |||||||||

Depreciation of property and equipment | 593 | 291 | 1,407 | 760 | ||||||||||

Stock-based compensation - research, development, collaborations and contract expenses | 2,468 | 2,759 | 8,145 | 8,225 | ||||||||||

Stock-based compensation - general and administrative expenses | 1,511 | 1,695 | 5,440 | 26,253 | ||||||||||

Unrealized foreign exchange (gains) losses | (1,328 | ) | 826 | (2,578 | ) | (2,130 | ) | |||||||

Change in fair value of warrant liability | — | (10 | ) | 22 | (339 | ) | ||||||||

Change in fair value of contingent consideration | 197 | 260 | 1,146 | 756 | ||||||||||

Impairment of intangible assets (note 3) | — | — | — | 156,324 | ||||||||||

Net change in non-cash operating items: | ||||||||||||||

Accounts receivable | 196 | 61 | (573 | ) | 613 | |||||||||

Investment tax credits receivable | — | — | 133 | 98 | ||||||||||

Prepaid expenses and other assets | 83 | 584 | (189 | ) | (263 | ) | ||||||||

Accounts payable and accrued liabilities | (1,805 | ) | (887 | ) | (3,513 | ) | (1,961 | ) | ||||||

Deferred revenue | (6,739 | ) | (696 | ) | — | (1,066 | ) | |||||||

Deferred lease incentives | 744 | — | 744 | — | ||||||||||

Net cash used in operating activities | (15,680 | ) | (14,712 | ) | (38,298 | ) | (43,063 | ) | ||||||

INVESTING ACTIVITIES | ||||||||||||||

Disposition (acquisition) of short and long-term investments, net | 5,843 | (712 | ) | 34,192 | (98,457 | ) | ||||||||

Acquisition of property and equipment | (538 | ) | (168 | ) | (7,076 | ) | (1,397 | ) | ||||||

Net cash provided by (used) in investing activities | 5,305 | (880 | ) | 27,116 | (99,854 | ) | ||||||||

FINANCING ACTIVITIES | ||||||||||||||

Issuance of common shares pursuant to exercise of options | 61 | 76 | 66 | 192 | ||||||||||

Issuance of common shares pursuant to exercise of warrants | — | — | 353 | 445 | ||||||||||

Net cash provided by financing activities | 61 | 76 | 419 | 637 | ||||||||||

Effect of foreign exchange rate changes on cash and cash equivalents | 1,327 | (824 | ) | 2,575 | 2,131 | |||||||||

(Decrease) Increase in cash and cash equivalents | (8,987 | ) | (16,340 | ) | (8,188 | ) | (140,149 | ) | ||||||

Cash and cash equivalents, beginning of period | 24,212 | 42,970 | 23,413 | 166,779 | ||||||||||

Cash and cash equivalents, end of period | $ | 15,225 | $ | 26,630 | $ | 15,225 | $ | 26,630 | ||||||

Supplemental cash flow information | ||||||||||||||

Non-cash transactions: | ||||||||||||||

Investment tax credit received | 108 | $ | — | 108 | — | |||||||||

Acquired property and equipment in trade payables | — | (266 | ) | 6 | (266 | ) | ||||||||

See accompanying notes to the condensed consolidated financial statements.

F- 4

ARBUTUS BIOPHARMA CORPORATION

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in thousands of US Dollars, except share and per share amounts)

1. Nature of business and future operations

Arbutus Biopharma Corporation (the “Company” or “Arbutus”) is a biopharmaceutical business dedicated to discovering, developing, and commercializing a cure for patients suffering from chronic hepatitis B infection, a disease of the liver caused by the hepatitis B virus (“HBV”). The Company's portfolio of assets includes a broad pipeline of drug candidates to develop a cure for HBV and leverages the Company’s expertise in Lipid Nanoparticle ("LNP") technology.

The success of the Company is dependent on obtaining the necessary regulatory approvals to bring its products to market and achieve profitable operations. The continuation of the research and development activities and the commercialization of its products are dependent on the Company’s ability to successfully complete these activities and to obtain adequate financing through a combination of financing activities and operations. It is not possible to predict either the outcome of future research and development programs or the Company’s ability to continue to fund these programs in the future.

2. Significant accounting policies

Basis of presentation

These unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles of the United States of America (“U.S. GAAP”) for interim financial statements and accordingly, do not include all disclosures required for annual financial statements. These statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended December 31, 2016 and included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016. The unaudited condensed consolidated financial statements reflect, in the opinion of management, all adjustments and reclassifications necessary to present fairly the financial position, results of operations and cash flows at September 30, 2017 and for all periods presented. The results of operations for the three and nine months ended September 30, 2017 and September 30, 2016 are not necessarily indicative of the results for the full year. These unaudited condensed consolidated financial statements follow the same significant accounting policies as those described in the notes to the audited consolidated financial statements of the Company for the year ended December 31, 2016, except as described below.

Principles of Consolidation

These unaudited condensed consolidated financial statements include the accounts of the Company and its two wholly-owned subsidiaries, Arbutus Biopharma Inc. ("Arbutus Inc.") and Protiva Biotherapeutics Inc. ("Protiva"). All intercompany transactions and balances have been eliminated on consolidation.

Income or loss per share

Income or loss per share is calculated based on the weighted average number of common shares outstanding. Diluted loss per share does not differ from basic loss per share since the effect of the Company’s stock options, liability-classified stock option awards, and warrants are anti-dilutive. During the nine months ended September 30, 2017, potential common shares of 5,339,714 (September 30, 2016 – 4,978,101) were excluded from the calculation of loss per common share because their inclusion would be anti-dilutive.

Fair value of financial instruments

The Company measures certain financial instruments and other items at fair value.

F- 5

To determine the fair value, the Company uses the fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use to value an asset or liability and are developed based on market data obtained from independent sources. Unobservable inputs are inputs based on assumptions about the factors market participants would use to value an asset or liability. The three levels of inputs that may be used to measure fair value are as follows:

• | Level 1 inputs are quoted market prices for identical instruments available in active markets. |

• | Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly. If the asset or liability has a contractual term, the input must be observable for substantially the full term. An example includes quoted market prices for similar assets or liabilities in active markets. |

• | Level 3 inputs are unobservable inputs for the asset or liability and will reflect management’s assumptions about market assumptions that would be used to price the asset or liability. |

The following table presents information about the Company’s assets and liabilities that are measured at fair value on a recurring basis, and indicates the fair value hierarchy of the valuation techniques used to determine such fair value:

Level 1 | Level 2 | Level 3 | September 30, 2017 | |||||||||||

Assets | ||||||||||||||

Cash and cash equivalents | $ | 15,225 | — | — | $ | 15,225 | ||||||||

Short-term investments | 72,954 | — | — | 72,954 | ||||||||||

Restricted investment | 12,601 | — | — | 12,601 | ||||||||||

Total | $ | 100,780 | — | — | $ | 100,780 | ||||||||

Liabilities | ||||||||||||||

Liability-classified options | — | — | $ | 1,817 | $ | 1,817 | ||||||||

Contingent consideration | — | — | 10,211 | 10,211 | ||||||||||

Total | — | — | $ | 12,028 | $ | 12,028 | ||||||||

Level 1 | Level 2 | Level 3 | December 31, 2016 | |||||||||||

Assets | ||||||||||||||

Cash and cash equivalents | $ | 23,413 | — | — | $ | 23,413 | ||||||||

Short-term investments | 107,146 | — | — | 107,146 | ||||||||||

Restricted investment | 12,601 | — | — | 12,601 | ||||||||||

Total | $ | 143,160 | — | — | $ | 143,160 | ||||||||

Liabilities | ||||||||||||||

Warrants | — | — | $ | 107 | $ | 107 | ||||||||

Liability-classified options | 553 | 553 | ||||||||||||

Contingent consideration | — | — | 9,065 | 9,065 | ||||||||||

Total | — | — | $ | 9,725 | $ | 9,725 | ||||||||

F- 6

The following table presents the changes in fair value of the Company’s warrants:

Liability at beginning of the period | Fair value of warrants exercised in the period | Increase (decrease) in fair value of warrants | Liability at end of the period | ||||||||||||

Nine months ended September 30, 2016 | $ | 883 | $ | (247 | ) | $ | (339 | ) | $ | 297 | |||||

Nine months ended September 30, 2017 | $ | 107 | $ | (129 | ) | $ | 22 | $ | — | ||||||

On March 1, 2017, the remaining balance of the Company's warrants of 22,000 expired, resulting in a nil liability balance for the period-ended September 30, 2017. The change in fair value of warrant liability for the nine months ended September 30, 2017 is recorded in the statement of operations and comprehensive loss.

The following table presents the changes in fair value of the Company’s liability-classified stock option awards:

Liability at beginning of the period | Fair value of liability-classified options exercised in the period | Increase (decrease) in fair value of liability | Liability at end of the period | ||||||||||||

Nine months ended September 30, 2016 | $ | 1,909 | $ | (54 | ) | $ | (907 | ) | $ | 948 | |||||

Nine months ended September 30, 2017 | $ | 553 | $ | (103 | ) | $ | 1,367 | $ | 1,817 | ||||||

The following table presents the changes in fair value of the Company’s contingent consideration:

Liability at beginning of the period | Increase in fair value of Contingent Consideration | Liability at end of the period | |||||||||

Nine months ended September 30, 2016 | $ | 7,497 | $ | 756 | $ | 8,253 | |||||

Nine months ended September 30, 2017 | $ | 9,065 | $ | 1,146 | $ | 10,211 | |||||

Recent accounting pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (FASB) or other standard setting bodies that are adopted by the Company as of the specified effective date.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (ASC 606). The standard, as subsequently amended, is intended to clarify the principles for recognizing revenue and to develop a common revenue standard for U.S. GAAP and IFRS by creating a new Topic 606, Revenue from Contracts with Customers. This guidance supersedes the revenue recognition requirements in ASC 605, Revenue Recognition, and supersedes some cost guidance included in Subtopic 605-35, Revenue Recognition – Construction-Type and Production-Type Contracts. The core principle of the accounting standard is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those good or services. The amendments should be applied by either (1) retrospectively to each prior reporting period presented; or (2) retrospectively with the cumulative effect of initially applying this ASU recognized at the date of initial application ("modified retrospective method"). The new guidance would be effective for fiscal years beginning after December 15, 2017, which for the Company means January 1, 2018. The Company anticipates applying the modified retrospective method for its implementation, and continues to evaluate the expected impact that the standard could have on its consolidated financial statements and related disclosures, which the Company believes most materially relates to the timing and recognition of its licensing and collaboration contracts that are described in note 4.

F- 7

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842): Recognition and Measurement of Financial Assets and Financial Liabilities. The update supersedes Topic 840, Leases and requires the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous GAAP. Topic 842 retains a distinction between finance leases and operating leases, with cash payments from operating leases classified within operating activities in the statement of cash flows. The amendments in this update are effective for fiscal years beginning after December 15, 2018 for public business entities, which for the Company means January 1, 2019. The Company does not plan to early adopt this update. The extent of the impact of this adoption has not yet been determined. The Company currently has no assets that meet the definition of restricted cash.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. The update addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice. Under this update, the classification of cash receipts and payments that have aspects of more than one class of cash flows should be determined first by applying specific guidance in GAAP. In the absence of specific guidance, an entity should determine each separately identifiable source or use within the cash receipts and cash payments on the basis of the nature of the underlying cash flows. An entity should then classify each separately identifiable source or use within the cash receipts and payments on the basis of their nature in financing, investing, or operating activities. In situations in which cash receipts and payments have aspects of more than one class of cash flows and cannot be separated by source or use, the appropriate classification should depend on the activity that is likely to be the predominant source or use of cash flows for the item. The amendments in this update are effective for public business entities for fiscal years beginning after December 31, 2017, which for the Company means January 1, 2018, and interim periods within those fiscal years. Early adoption is permitted. The amendments in this update should be applied using a retrospective transition method to each period presented. If it is impracticable to apply the amendments retrospectively for some of the issues, the amendments for those issues would be applied prospectively as of the earliest date practicable. The Company is currently evaluating the extent of the impact of this adoption.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Statement of Cash Flows: Restricted Cash. The update requires the statement of cash flows to explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The amendments in this update are effective for public business entities for fiscal years beginning after December 15, 2017, which for the Company means January 1, 2018. Early adoption is permitted, including adoption in an interim period. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that included that interim period. The amendments in this update should be applied using a retrospective transition method to each period presented. The Company is currently evaluating the extent of the impact of this adoption.

In January 2017, the FASB issued ASU 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. The update simplifies the subsequent measurement of goodwill by eliminating Step 2 from the goodwill impairment test. In computing the implied fair value of goodwill under the existing standard, an entity had to perform procedures to determine the fair value at impairment testing date of its assets and liabilities following the procedure that would be required in determining the fair value of assets required and liabilities assumed in a business combination. Instead, under the amendments in this update, an entity should perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. The amendments in this update are effective for public business entities should be adopted for its annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019, which for the Company means January 1, 2020. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The Company is currently evaluating the extent of the impact of this adoption.

F- 8

In May 2017, the FASB issued ASU 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting. The amendments in this Update provide guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting under Topic 718. An entity should account for effects of a modification unless all of the following are met: (1) the fair value of the modified award is the same as the fair value of the original award immediately before the original award is modified; (2) the vesting conditions of the modified award are the same as the vesting conditions of the original award immediately before the original award is modified; (3) the classification of the modified award as an equity instrument or a liability instrument is the same as the classification of the original award immediately before the original award is modified. The amendments in this Update are effective for all entities for annual periods and interim periods within those annual periods, beginning after December 15, 2017, which for the Company means January 1, 2018. Early adoption is permitted, including adoption in any interim period for public business entities for reporting periods for which financial statements have not yet been issued. The amendments in this Update should be applied prospectively to an award modified on or after the adoption date. The Company early adopted the amendments in this Update effective April 1, 2017. This adoption did not have an effect in the Company's statement of operations and comprehensive loss for the period beginning on the adoption date, to the period ended September 30, 2017, as no award modifications occurred.

3. Intangible assets and goodwill

All in-process research and development (IPR&D) acquired is currently classified as indefinite-lived and is not currently being amortized. IPR&D becomes definite-lived upon the completion or abandonment of the associated research and development efforts, and will be amortized from that time over an estimated useful life based on respective patent terms. The Company evaluates the recoverable amount of intangible assets on an annual basis and performs an annual evaluation of goodwill as of December 31 each year, unless there is an event or change in the business that could indicate impairment, in which case earlier testing is performed.

The following table summarizes the carrying values of the intangible assets as at September 30, 2017:

September 30, 2017 | December 31, 2016 | |||||

IPR&D – Immune Modulators | $ | 40,798 | $ | 40,798 | ||

IPR&D – Antigen Inhibitors | 14,811 | 14,811 | ||||

IPR&D – cccDNA Sterilizers | 43,836 | 43,836 | ||||

Total Intangible Assets | $ | 99,445 | $ | 99,445 | ||

Impairment evaluation of goodwill

At September 30, 2017, the Company did not identify any new indicators of impairment. No impairment charge on intangible assets or goodwill was recorded for the period ended September 30, 2017 (three months ended September 30, 2016 - nil; nine months ended September 30, 2016 - $156,324,000).

4. Collaborations, contracts and licensing agreements

The following table set forth revenue recognized under collaborations, contracts and licensing agreements, in thousands:

Three months ended September 30, | Nine months ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Alexion (a) | $ | 6,859 | $ | — | $ | 7,956 | $ | — | |||||||

Dicerna (b) | — | 727 | — | 1,292 | |||||||||||

Other milestone and royalty payments (c) | 33 | 47 | 210 | 394 | |||||||||||

Total revenue | $ | 6,892 | $ | 774 | $ | 8,166 | $ | 1,686 | |||||||

F- 9

(a) License Agreement with Alexion Pharmaceuticals, Inc. ("Alexion")

On March 16, 2017, the Company signed a license agreement with Alexion that entitles Alexion to research, develop, manufacture, and commercialize products with the Company's lipid nanoparticle ("LNP") technology in their single orphan disease target. In consideration for the rights granted under the agreement, the Company received a $7,500,000 non-refundable upfront cash payment, as well as payments for services provided. This upfront payment was amortized over the period of expected benefit.

On July 27, 2017, the Company received notice of termination from Alexion for the Company's LNP license agreement. The termination was driven by a strategic review of Alexion's business and research and development portfolio, which included a decision to discontinue development of mRNA therapeutics. The $7,500,000 upfront payment received in March 2017 is non-refundable, and the Company has recorded the remaining deferred revenue balance of $6,739,000, as well as any revenue and costs related to closeout procedures in the statement of operations and comprehensive loss for the period ended September 30, 2017.

(b) License and Development and Supply Agreement with Dicerna Pharmaceuticals, Inc. (“Dicerna”)

On November 16, 2014, the Company signed a License Agreement and a Development and Supply Agreement (together, the “Agreements”) with Dicerna to develop, manufacture, and commercialize products directed to the treatment of Primary Hyperoxaluria 1 (“PH1”). In consideration for the rights granted under the Agreements, Dicerna paid the Company an upfront cash payment of $2,500,000, as well as payments for manufacturing and services provided.

In September 2016, Dicerna announced the discontinuation of their DCR-PH1 program using the Company's technology. As such, the Company revised the estimated completion date of performance period from March 2017 to September 30, 2016, at which time the Company had no further remaining performance obligations. This resulted in the recognition of $1,066,000 in Dicerna license fee revenue for year ended December 31, 2016 and no revenue thereafter.

(c) Agreements with Spectrum Pharmaceuticals, Inc. (“Spectrum”)

On May 6, 2006, the Company signed a number of agreements with Talon Therapeutics, Inc. (“Talon”, formerly Hana Biosciences, Inc.) including the grant of worldwide licenses (the “Talon License Agreement”) for three of the Company’s chemotherapy products, Marqibo®, Alocrest ™ (Optisomal Vinorelbine) and Brakiva ™ (Optisomal Topotecan).

On August 9, 2012, the Company announced that Talon had received accelerated approval for Marqibo from the FDA for the treatment of adult patients with Philadelphia chromosome negative acute lymphoblastic leukemia in second or greater relapse or whose disease has progressed following two or more anti-leukemia therapies. Marqibo is a liposomal formulation of the chemotherapy drug vincristine. In the year ended December 31, 2012, the Company received a milestone of $1,000,000 based on the FDA's approval of Marqibo and will receive royalty payments based on Marqibo's commercial sales. There are no further milestones related to Marqibo but the Company is eligible to receive total milestone payments of up to $18,000,000 on Alocrest and Brakiva.

Talon was acquired by Spectrum in July 2013. The acquisition does not affect the terms of the license between Talon and the Company. On September 3, 2013, Spectrum announced that they had shipped the first commercial orders of Marqibo. For the three and nine months ended September 30, 2017, the Company recorded $33,000 and $156,000 in Marqibo royalty revenue (three and nine months ended September 30, 2016 - $50,000 and $136,000 respectively). For the nine months ended September 30, 2017, the Company accrued 2.5% in royalties due to TPC in respect of the Marqibo royalty earned by the Company – see note 6, contingencies and commitments.

5. Accounts payable and accrued liabilities

Accounts payable and accrued liabilities are comprised of the following, in thousands:

F- 10

September 30, 2017 | December 31, 2016 | ||||||

Trade accounts payable | $ | 2,291 | $ | 3,215 | |||

Research and development accruals | 2,955 | 3,131 | |||||

Professional fee accruals | 226 | 498 | |||||

Deferred lease inducements | 38 | 350 | |||||

Payroll accruals | 189 | 2,178 | |||||

Other accrued liabilities | 704 | 538 | |||||

$ | 6,403 | $ | 9,910 | ||||

6. Contingencies and commitments

Product development partnership with the Canadian Government

The Company entered into a Technology Partnerships Canada ("TPC") agreement with the Canadian Federal Government on November 12, 1999. Under this agreement, TPC agreed to fund 27% of the costs incurred by the Company, prior to March 31, 2004, in the development of certain oligonucleotide product candidates up to a maximum contribution from TPC of $7,179,000 (C$9,323,000). As at September 30, 2017, a cumulative contribution of $2,966,000 (C$3,702,000) had been received and the Company does not expect any further funding under this agreement. In return for the funding provided by TPC, the Company agreed to pay royalties on the share of future licensing and product revenue, if any, that is received by the Company on certain non-siRNA oligonucleotide product candidates covered by the funding under the agreement. These royalties are payable until a certain cumulative payment amount is achieved or until a pre-specified date. In addition, until a cumulative amount equal to the funding actually received under the agreement has been paid to TPC, the Company agreed to pay 2.5% royalties on any royalties the Company receives for Marqibo. For the three and nine months ended September 30, 2017, the Company earned royalties on Marqibo sales in the amount of $33,000 and $156,000 respectively (three and nine months ended September 30, 2016 – $50,000 and $136,000, respectively) (see note 4(c)), resulting in $4,000 being recorded by the Company as royalty payable to TPC (September 30, 2016 -$3,000). The cumulative amount paid or accrued up to September 30, 2017 was $21,000, therefore the remaining contingent amount due to TPC is $2,945,000 (C$3,675,000).

Arbitration with the University of British Columbia (“UBC”)

Certain early work on lipid nanoparticle delivery systems and related inventions was undertaken at the Company and assigned to the University of British Columbia (UBC). These inventions are licensed to the Company by UBC under a license agreement, initially entered in 1998 as amended in 2001, 2006 and 2007. The Company has granted sublicenses under the UBC license to Alnylam. Alnylam has in turn sublicensed back to the Company under the licensed UBC patents for discovery, development and commercialization of siRNA products. Certain sublicenses to other parties were also granted.

On November 10, 2014, UBC filed a notice of arbitration against the Company and on January 16, 2015, filed a Statement of Claim, which alleges entitlement to $3,500,000 in allegedly unpaid royalties based on publicly available information, and an unspecified amount based on non-public information. UBC also seeks interest and costs, including legal fees. The Company filed its Statement of Defense to UBC's Statement of Claims, as well as filed a Counterclaim involving a patent application that Arbutus alleges UBC wrongly licensed to a third party rather than to Arbutus. The proceedings have been divided into three phases, with a first hearing that took place in June 2017. The arbitrator determined in the first phase which agreements are sublicense agreements within UBC's claim, and which are not. No finding was made as to whether any licensing fees are due to UBC under these agreements; this will be the subject of the second phase of arbitration. A schedule for the remaining phases has not yet been set. Arbitration and related matters are costly and may divert the attention of the Company’s management and other resources that would otherwise be engaged in other activities. The Company continues to dispute UBC's allegations, and seeks license payments for said application, and an exclusive worldwide license to said application. However, the Company notes that arbitration is subject to inherent uncertainty and an arbitrator could rule against the Company. The Company has not recorded an estimate of the possible loss associated with this arbitration, due to the uncertainties related to both the likelihood and amount of any possible loss or range of loss. Costs related to the arbitration are recorded by the Company as incurred.

F- 11

Arbitration with Acuitas Therapeutics (“Acuitas”)

In August 2017, Arbutus provided Acuitas with notice that Arbutus considered Acuitas to be in material breach of the cross-license agreement. The cross-license agreement provides that it may be terminated upon any material breach by the other party 60 days after receipt of written notice of termination describing the material breach in reasonable detail. In October 2016, Acuitas filed a Notice of Civil Claim in the Supreme Court of British Columbia seeking an order that Arbutus perform its obligations under the Cross License Agreement, for damages ancillary to specific performance, injunctive relief, interest and costs. The Company disputes Acuitas’ position, and filed a Counterclaim seeking a declaration that Acuitas is in breach of the Cross License Agreement, and claiming injunctive relief, damages, interest and costs. In January 2017, the Company filed an application seeking an order to enjoin Acuitas from, among other things, entering into any further agreements purporting to sublicense Arbutus’ technology from the date of the order to the date of trial or further order from the Court. In February 2017, the Company announced that the Supreme Court of British Columbia granted its request for a pre-trial injunction against Acuitas, preventing Acuitas from further sublicensing of the Company's lipid nanoparticle (LNP) technology until the end of October, or further order of the Court. Under the terms of the pre-trial injunction, Acuitas is prevented from entering into any new agreements which include sublicensing of the Company's LNP. In March 2017, Acuitas sought leave to appeal from the injunction decision and in April 2017, the appeal was denied. On September 29, 2017, the injunction order was extended by consent to March 2, 2018. The contractual issues concerning the Cross License Agreement (excluding the claims for damages) are set for trial for 10 days commencing on February 19, 2018.

Arbitration and related matters are costly and may divert the attention of the Company’s management and other resources that would otherwise be engaged in other activities. Costs related to the arbitration are recorded by the Company as incurred. No contingency asset was recorded by the Company for the period ended September 30, 2017, as the damages, interest and costs are not determined until following the trial.

Contingent consideration from Arbutus Inc. acquisition of Enantigen and License Agreements between Enantigen and the Baruch S. Blumberg Institute (“Blumberg”) and Drexel University (“Drexel”)

In October 2014, Arbutus Inc. acquired all of the outstanding shares of Enantigen pursuant to a stock purchase agreement. Through this transaction, Arbutus Inc. acquired a HBV surface antigen secretion inhibitor program and a capsid assembly inhibitor program, each of which are now assets of the Company, following the Company’s merger with Arbutus Inc.

Under the stock purchase agreement, Arbutus Inc. agreed to pay up to a total of $21,000,000 to Enantigen’s selling stockholders upon the achievement of certain triggering events related to Enantigen’s two programs in pre-clinical development related to HBV therapies. The first triggering event is the enrollment of the first patient in a Phase 1b clinical trial in HBV patients, which the Company believes is likely to occur in the next twelve-month period.

The regulatory, development and sales milestone payments had an initial estimated fair value of approximately $6,727,000 as at the date of acquisition of Arbutus Inc., and have been treated as contingent consideration payable in the purchase price allocation, based on information available at the date of acquisition, using a probability weighted assessment of the likelihood the milestones would be met and the estimated timing of such payments, and then the potential contingent payments were discounted to their present value using a probability adjusted discount rate that reflects the early stage nature of the development program, time to complete the program development, and market comparative data.

Contingent consideration is recorded as a financial liability, and measured at its fair value at each reporting date, based on an updated consideration of the probability-weighted assessment of expected milestone timing, with any changes in fair value from the previous reporting date recorded in the statement of operations and comprehensive loss (see note 2).

Drexel and Blumberg

In February 2014, Arbutus Inc. entered into a license agreement with Blumberg and Drexel that granted an exclusive, worldwide, sub-licensable license to three different compound series: cccDNA inhibitors, capsid assembly inhibitors and HCC inhibitors.

F- 12

In partial consideration for this license, Arbutus Inc. paid a license initiation fee of $150,000 and issued warrants to Blumberg and Drexel. The warrants were exercised in 2014. Under this license agreement, Arbutus Inc. also agreed to pay up to $3,500,000 in development and regulatory milestones per licensed compound series, up to $92,500,000 in sales performance milestones per licensed product, and royalties in the mid-single digits based upon the proportionate net sales of licensed products in any commercialized combination. The Company is obligated to pay Blumberg and Drexel a double digit percentage of all amounts received from the sub-licensees, subject to customary exclusions.

In November 2014, Arbutus Inc. entered into an additional license agreement with Blumberg and Drexel pursuant to which it received an exclusive, worldwide, sub-licensable license under specified patents and know-how controlled by Blumberg and Drexel covering epigenetic modifiers of cccDNA and STING agonists. In consideration for these exclusive licenses, Arbutus Inc. made an upfront payment of $50,000. Under this agreement, the Company is required to pay up to $1,200,000 for each licensed product upon the achievement of a specified regulatory milestone and a low single digit royalty, based upon the proportionate net sales of compounds covered by this intellectual property in any commercialized combination. The Company is also obligated to pay Blumberg and Drexel a double digit percentage of all amounts received from its sub-licensees, subject to exclusions.

Research Collaboration and Funding Agreement with Blumberg

In October 2014, Arbutus Inc. entered into a research collaboration and funding agreement with Blumberg under which the Company will provide $1,000,000 per year of research funding for three years, renewable at the Company’s option for an additional three years, for Blumberg to conduct research projects in HBV and liver cancer pursuant to a research plan to be agreed upon by the parties. Blumberg has exclusivity obligations to Arbutus with respect to HBV research funded under the agreement. In addition, the Company has the right to match any third party offer to fund HBV research that falls outside the scope of the research being funded under the agreement. Blumberg has granted the Company the right to obtain an exclusive, royalty bearing, worldwide license to any intellectual property generated by any funded research project. If the Company elects to exercise its right to obtain such a license, the Company will have a specified period of time to negotiate and enter into a mutually agreeable license agreement with Blumberg. This license agreement will include the following pre-negotiated upfront, milestone and royalty payments: an upfront payment in the amount of $100,000; up to $8,100,000 upon the achievement of specified development and regulatory milestones; up to $92,500,000 upon the achievement of specified commercialization milestones; and royalties at a low single to mid-single digit rates based upon the proportionate net sales of licensed products from any commercialized combination.

On June 5, 2016, the Company and Blumberg entered into an amended and restated research collaboration and funding agreement, primarily to: (i) increase the annual funding amount to Blumberg from $1,000,000 to $1,100,000; (ii) extend the initial term through to October 29, 2018; (iii) provide an option for the Company to extend the term past October 29, 2018 for two additional one year terms; and (iv) expand our exclusive license under the Agreement to include the sole and exclusive right to obtain and exclusive, royalty-bearing, worldwide and all-fields license under Blumberg's rights in certain other inventions described in the agreement.

7. Concentrations of credit risk

Credit risk is defined by the Company as an unexpected loss in cash and earnings if a collaborative partner is unable to pay its obligations on a timely basis. The Company’s main source of credit risk is related to its accounts receivable balance which principally represents temporary financing provided to collaborative partners in the normal course of operations.

The Company does not currently maintain a provision for bad debts as the majority of accounts receivable are from collaborative partners or government agencies and are considered low risk.

The carrying amount of financial assets represents the maximum credit exposure. The maximum exposure to credit risk at September 30, 2017 was the accounts receivable balance of $846,000 (December 31, 2016 - $273,000).

All accounts receivable balances were current at September 30, 2017 and at December 31, 2016.

F- 13

8. Subsequent events

Investment from Roivant Sciences Ltd ("Roivant")

On October 2, 2017, the Company announced that it entered into a subscription agreement with Roivant for the sale of Series A participating convertible preferred shares ("Preferred Shares:) to Roivant for gross proceeds of $116,400,000. The Preferred Shares are non-voting and are convertible into common shares at a conversion price of $7.13 per share (which represents a 15% premium to the closing price of $6.20 per share). The purchase price for the Preferred Shares plus an amount equal to 8.75% per annum, compounded annually, will be subject to mandatory conversion into common shares on October 16, 2021 (subject to limited exceptions in the event of certain fundamental corporate transactions relating to Arbutus’ capital structure or assets, which would permit earlier conversion at Roivant’s option). After conversion of the Preferred Shares into common shares, based on the number of common shares outstanding on October 2, 2017, Roivant would hold 49.90% of the Company's common shares. Roivant has agreed to a four year lock-up period for this investment and its existing holdings in Arbutus. Roivant has also agreed to a four year standstill whereby Roivant will not acquire greater than 49.99% of the Company's common shares or securities convertible into common shares.

The initial investment of $50,000,000 closed on October 16, 2017, and the remaining amount of $66,400,000 is expected to close by the end of the year upon satisfaction of customary closing conditions including regulatory and shareholder approvals, as applicable, under Canadian securities law.

License agreement with Gritstone Oncology, Inc. ("Gritstone")

On October 16, 2017, the Company entered into a license agreement with Gritstone that entitles Gritstone to research, develop, manufacture and commercialize products with the Company’s LNP technology. The total potential payments under this arrangement include upfront, development and commercial milestone payments and royalty payments on future product sales.

F- 14

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis by our management of our financial position and results of operations in conjunction with our audited consolidated financial statements and related notes thereto included as part of our Annual Report on Form 10-K for the year ended December 31, 2016 and our unaudited condensed consolidated financial statements for the three and nine month periods ended September 30, 2017. Our consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles and are presented in U.S. dollars.

FORWARD-LOOKING STATEMENTS

The information in this report contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and forward looking information within the meaning of Canadian securities laws (collectively, “forward-looking statements”). Forward-looking statements in this report include statements about our strategy, future operations, clinical trials, prospects and the plans of management; the discovery, development and commercialization of a cure for HBV; our beliefs and development path and strategy to achieve a cure for HBV; obtaining necessary regulatory approvals; obtaining adequate financing through a combination of financing activities and operations; the possibility of receiving total milestone payments of up to $18,000,000 on Alocrest and Brakiva; an additional investment of $66,400,000 from Roivant and the expected timing thereof; the filing of a proxy statement by the Company with respect to the additional investment from Roivant; potential payments from the Gritstone license agreement; evaluating different treatment durations to determine the optimal finite duration of therapy; selecting combination therapy regimens and treatment durations to conduct Phase III clinical trials intended to ultimately support regulatory filings for marketing approval; approval for a single product from our pipeline by combining with available agents to improve upon the cure rate with the current standard of care; expanding our HBV drug candidate pipeline through internal development, acquisitions and in-licenses; initiating a 30-week Phase II study of ARB-1467 in combination with tenofovir and pegylated interferon in 4Q17, with interim results from this study expected in the second half of 2018, followed by final results in 2019; initiating an AB-423 Phase II multi ascending dose (MAD) study in HBV patients in 1Q18; an IND (or equivalent) filing for AB-506 in mid-2018; an IND (or equivalent) filing for AB-452 in mid-2018; nominating a clinical development candidate in early 2018; possible low to mid-single-digit royalty payments escalating based on sales performance as Alnylam’s LNP-enabled products are commercialized; payments from the Gritstone licensing agreement; the belief that current legal proceedings will not have a material adverse effect on our consolidated results of operations, cash flows, or financial condition; the expected return from strategic alliances, licensing agreements, and research collaborations; statements with respect to revenue and expense fluctuation and guidance; having sufficient cash resources to fund our operations for at least the next 12 months; and the quantum and timing of potential funding.

With respect to the forward-looking statements contained in this report, we have made numerous assumptions regarding, among other things: meeting the conditions to close the additional investment of $66,400,000 from Roivant (including shareholder approval) LNP’s status as a leading RNAi delivery technology; our research and development capabilities and resources; the effectiveness of our products as a treatment for chronic HBV infection or other diseases; continued positive results from pre-clinical and clinical trials; the timing and quantum of payments to be received under contracts with our partners; assumptions related to our share price volatility, expected lives of warrants, and warrant issuances and/or exercises; and our financial position and its ability to execute our business strategy. While we consider these assumptions to be reasonable, these assumptions are inherently subject to significant business, economic, competitive, market and social uncertainties and contingencies.

Our actual results could differ materially from those discussed in the forward-looking statements as a result of a number of important factors, including the risk factors discussed in this report and the risk factors discussed in our Annual Report on Form 10-K under the heading “Risk Factors,” and the risks discussed in our other filings with the Securities and Exchange Commission and Canadian Securities Regulators. In addition, a further discussion with respect to the risks and uncertainties related to the additional investment of $66,400,000 from Roivant will appear in the Company’s Management Proxy Circular and Proxy Statement on Form 14A, which will be available at www.sedar.com and www.sec.gov once filed. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief or expectation only as of the date hereof. All forward-looking statements herein are qualified in their entirety by this cautionary statement, and we explicitly disclaim any obligation to revise or update any such forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, except as required by law.

F- 15

OVERVIEW

Arbutus Biopharma Corporation ("Arbutus", the "Company", "we", "us", and "our") is a publicly traded industry-leading Hepatitis B Virus (HBV) therapeutic solutions company. HBV represents a significant, global unmet medical need. Our goal is to develop curative treatment regimens of finite dosing duration. We believe that development can be accelerated when multiple components of a combination therapy regimen are controlled by the same company, therefore we have assembled a HBV pipeline consisting of multiple drug candidates with complementary mechanisms of action, each of which have the potential to improve upon the standard of care and contribute to curative combination treatment regimen. In addition to our HBV pipeline, our lipid nanoparticle (LNP) delivery technology is a key asset that has the potential to generate significant value through both new and existing partnerships and licenses.

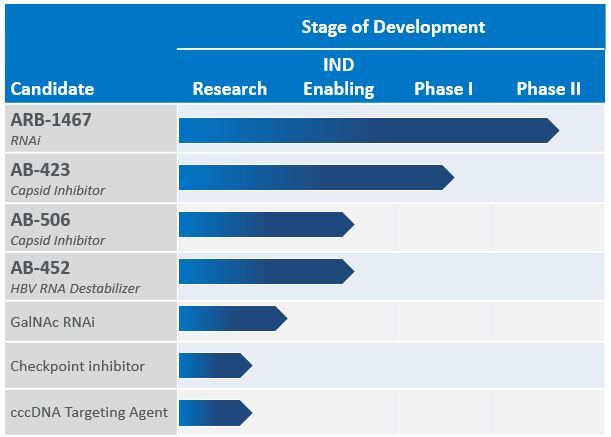

HBV Product Pipeline

Our HBV product pipeline consists of multiple programs, with different mechanisms of action that have the objective of intervening at different points in the viral life cycle and reactivating the host immune system. For each program, we begin clinical development by evaluating the safety and activity of each drug individually in patients with chronic HBV infection. We will then study these new product candidates in combination with other treatments. While we will initially evaluate combinations with approved therapies, we also intend to study combinations of multiple complementary development stage agents that are proprietary to Arbutus. Once we have established a curative regimen with finite dosing duration, we will seek to improve that regimen in terms of efficacy, tolerability, duration, and convenience.

We intend to continue to expand our HBV pipeline through internal development, acquisitions, and in-licenses. We also have a research collaboration agreement with the Baruch S. Blumberg Institute that provides exclusive rights to in-license any intellectual property generated through the collaboration.

RNAi (ARB-1467)

Our lead RNA interference (RNAi) HBV candidate, ARB-1467 (formerly TKM-HBV), is designed to reduce Hepatitis B surface antigen (HBsAg) expression in patients chronically infected with HBV. Reducing HBsAg is thought to be a key prerequisite to enable a patient’s immune system to raise an adequate immune response against the virus. The ability of ARB-1467 to inhibit numerous viral elements in addition to HBsAg increases the likelihood of affecting the viral infection.

F- 16

ARB-1467 is a multi-component RNAi therapeutic that simultaneously targets three sites on the HBV genome, including the HBsAg coding region. Targeting three distinct and highly conserved sites on the HBV genome is intended to facilitate potent knockdown of all viral mRNA transcripts and viral antigens across a broad range of HBV genotypes and reduce the risk of developing antiviral resistance. In preclinical models, ARB-1467 treatment results in reductions in intrahepatic and serum HBsAg, HBV DNA, covalently closed circular DNA (cccDNA), Hepatitis B e antigen (HBeAg) and Hepatitis B c antigen (HBcAg). ARB-1467 was evaluated in a Phase I Single Ascending Dose (SAD) trial designed to assess the safety, tolerability, and pharmacokinetics of intravenous administration of the product in healthy adult subjects. In the Phase I SAD study, healthy volunteer subjects were dosed up to a dose of 0.4 mg/kg but a defined maximum tolerated dose was not reached.

The Phase II trial is a multi-dose study in chronic HBV patients who are also receiving nucleot(s)ide analog (NA) therapy. The trial consists of four cohorts. The first three cohorts each enrolled eight subjects; six receiving three monthly doses of ARB-1467, and two receiving placebo. Cohort 4 enrolled twelve patients, all receiving five bi-weekly doses of ARB-1467, followed by monthly dosing for the reminder of a year for patients who meet a predefined response criteria. Cohorts 1, 2, and 4 enrolled HBeAg- patients and Cohort 3 enrolled HBeAg+ patients. ARB-1467 is administered at 0.2 mg/kg in Cohort 1 and 0.4 mg/kg in Cohorts 2, 3, and 4. Results from this trial based on multiple dose administration of ARB-1467 in Cohorts 1, 2 and 3 demonstrated significant reductions in serum HBsAg levels and showed a step-wise, additive reduction in serum HBsAg with each subsequent dose. The HBsAg reduction achieved after three monthly doses of 0.4mg/kg in Cohort 2 was greater than that seen at 0.2 mg/kg in Cohort 1, demonstrating a dose-response seen with repeat dosing. There were no significant differences in serum HBsAg reductions between HBeAg-negative and HBeAg-positive patients. In Cohort 4, five doses of ARB-1467 were administered on a bi-weekly dosing schedule. Initial results from the first three months demonstrated that all twelve patients had reductions in serum HBsAg levels with an average reduction of 1.4 log10, which was greater than that observed with monthly dosing in Cohorts 1-3. Seven of the twelve patients met the predefined response criteria at or before day 71 and five of the seven patients who met the response criteria had their serum HBsAg reduced to low absolute levels (below 50 IU/mL) during the bi-weekly dosing period. Initial results for the monthly dosing extension suggest that monthly dosing is not sufficient to maintain or improve upon these reductions in HBsAg levels. As a result, we have discontinued the monthly extension and new studies will utilize bi-weekly dosing. Overall treatment was well tolerated in all four cohorts (Cohorts 1, 2, 3, and 4).

We are initiating a triple combination study of our RNAi agent, ARB-1467, with current standard of care NAs and interferon (IFN) therapies, to evaluate the opportunity to improve current cure rates with a finite dosing period. The Phase II triple combination trial is a 30-week multi-dose study in HBV DNA positive chronic HBV patients. The trial will enroll 20 HBeAg- patients who will receive bi-weekly doses of ARB-1467 at 0.4 mg/kg and daily oral tenofovir NA doses for 30 weeks. Predefined treatment responders at 6 weeks will qualify for the addition of weekly pegylated interferon treatment, while continuing to receive bi-weekly doses of ARB-1467 and daily doses of tenofovir for the remaining 24 weeks. Patients will be followed for 24 weeks after the treatment period concludes. Interim on-treatment results from this trial are expected in the second half of 2018 followed by final results in 2019. Combination treatment has the potential to result in sustained HBV DNA and HBsAg loss in patients. Achieving this in a significant proportion of patients would put this Arbutus therapeutic on a potential late stage development and approval pathway.

Capsid Inhibitor (AB-423 & AB-506)

HBV core protein, or capsid, is required for viral replication and core protein may have additional roles in cccDNA function. Current NA therapy significantly reduces HBV DNA levels in the serum but HBV replication continues in the liver, thereby enabling HBV infection to persist. Effective therapy for patients requires new agents which will effectively block viral replication. We are developing core protein inhibitors (also known as capsid assembly inhibitors) as oral therapeutics for the treatment of chronic HBV infection. By inhibiting assembly of the viral capsid, the ability of HBV to replicate is impaired, resulting in reduced cccDNA.

AB-423 was evaluated in a Phase I Single Ascending Dose (SAD) and Multiple Ascending Dose (MAD) trial designed to assess the safety, tolerability, and pharmacokinetics (PK) of oral administration of the product in healthy volunteers. AB-423 has been generally well-tolerated in this trial, with no serious adverse events following single doses up to 800mg and multiple doses up to 400mg twice daily. AB-423’s favorable safety and PK profile following single and multiple doses in healthy volunteers supports further evaluation of multiple-dose administration of AB-423 in patients with chronic HBV, which is expected to begin in HBV patients in the first quarter of 2018. Following initial studies of AB-423 in patients we will consider inclusion in a combination study with our other proprietary HBV assets, NAs, and IFN.

We recently nominated AB-506, a next-generation capsid inhibitor, for Investigational New Drug (IND)-enabling studies. In preclinical studies, this new capsid inhibitor has shown to have improved PK and potency through increased binding

F- 17

interaction with its target when compared to AB-423. Pending successful IND-enabling studies, this product candidate could be the subject of an IND (or equivalent) filing in 2018.

HBV RNA Destabilizer (AB-452)

In addition to our clinical candidates, we have a number of research programs aimed at the discovery and development of proprietary HBV candidates with different and complementary mechanisms of action. One of our most advanced preclinical programs, AB-452, a HBV RNA Destabilizer (formerly known as our oral surface antigen (HBsAg) inhibitor program) has novel activity in destabilizing HBV RNA, broad activity against HBV RNAs, and reduces HBsAg. In preclinical studies, AB-452 has shown synergistic effects when combined with two of Arbutus’ proprietary HBV RNAi agents in vitro. In in vivo, twice-a-day oral administration of AB-452 resulted in up to 1.4 log10 reduction of serum HBsAg in a dose dependent manner and correlated well with liver HBV RNA levels as well. This molecule has the potential for once daily oral dosing. Pending successful IND-enabling studies, this product candidate could be the subject of an IND (or equivalent) filing in 2018.

Additional Research Programs

We have designed a number of highly potent HBV-targeting RNAi payloads for use with our proprietary GalNAc conjugate platform to enable subcutaneous delivery. In preclinical models, our molecules display acute knockdown of viral proteins and a duration of effect that is highly competitive in the field. We observe a significant dose response, and a stepwise reduction in viral proteins when multi-dosing. We expect to nominate a clinical development candidate in early 2018. We also have ongoing discovery efforts focused on cccDNA targeting and checkpoint inhibition.

Our Proprietary Delivery Technology

Development of RNAi therapeutic products is currently limited by the instability of the RNAi trigger molecules in the bloodstream and the inability of these molecules to access target cells or tissues following administration. Delivery technology is necessary to protect these drugs in the bloodstream to allow efficient delivery and cellular uptake by the target cells. Arbutus has developed a proprietary delivery LNP platform. The broad applicability of this platform to RNAi development has established Arbutus as a leader in this new area of innovative medicine.

Our proprietary LNP delivery technology allows for the successful encapsulation of RNAi trigger molecules in LNP administered intravenously, which travel through the bloodstream to target tissues or disease sites. LNPs are designed to protect the triggers, and stay in the circulation long enough to accumulate at disease sites, such as the liver or cancerous tumors. LNPs are then taken up into the target cells by a process called endocytosis. Subsequent activation by the changing environment inside the cell causes the LNP to release the trigger molecules, which can then successfully mediate RNAi.

Ongoing Advancements in LNP Technology

Our LNP technology represents the most widely adopted delivery technology in RNAi, which has enabled several clinical trials and has been administered to hundreds of human subjects. We continue to explore opportunities to generate value from our LNP platform technology, which is well suited to deliver therapies based on RNAi, mRNA, and gene editing constructs. We have also made progress in developing a proprietary GalNAc conjugate technology to enable subcutaneous delivery of an RNAi therapeutic targeting HBsAg and/or other HBV targets.

F- 18

Partner Programs

Patisiran (ALN-TTR02)

Alnylam has a license to use our intellectual property to develop and commercialize products and may only grant access to our LNP technology to its partners if it is part of a product sublicense. Alnylam’s license rights are limited to patents that we have filed, or that claim priority to a patent that was filed, before April 15, 2010. Alnylam's patisiran (ALN-TTR02) program represents the most clinically advanced application of our LNP delivery technology, and results demonstrate that multi-dosing with our LNP has been well-tolerated with treatments out to 25 months. In September 2017, Alnylam announced that its Phase III study of patisiran met its primary efficacy endpoint and all secondary endpoints. Alnylam announced its intention to file a New Drug Application (NDA) in late 2017 and a Marketing Authorisation Application (MAA) in early 2018 for patisiran. We are entitled to single-digit royalty payments escalating based on sales performance as Alnylam’s LNP-enabled products are commercialized.

Gritstone Oncology

In October 2017, we entered into a license agreement with Gritstone Oncology (Gritstone) that granted them worldwide access to our portfolio of proprietary and clinically validated LNP products and associated intellectual property to deliver Gritstone’s RNA-based neoantigen immunotherapy products. Gritstone will pay us an upfront payment, payments for achievement of development, regulatory, and commercial milestones, royalties, and will reimburse us for conducting technology development and providing manufacturing and regulatory support for Gritstone’s product candidates.

Marqibo®

Marqibo, originally developed by Arbutus, is a novel, sphingomyelin/cholesterol liposome-encapsulated formulation of the FDA-approved anticancer drug vincristine. Marqibo’s approved indication is for the treatment of adult patients with Philadelphia chromosome-negative acute lymphoblastic leukemia (Ph-ALL) in second or greater relapse or whose disease has progressed following two or more lines of anti-leukemia therapy. Our licensee, Spectrum Pharmaceuticals, Inc. (Spectrum), launched Marqibo through its existing hematology sales force in the United States. Spectrum has ongoing trials evaluating Marqibo in three additional indications, which are: first line use in patients with Philadelphia Negative Acute Lymphoblastic Leukemia (Ph-ALL), Pediatric ALL and Non-Hodgkin’s lymphoma. We are receiving mid-single digit royalty payments on sales of Marqibo.

Recent Developments

Acuitas Therapeutics Inc.

In December 2013, we entered into a cross-license agreement with Acuitas Therapeutics Inc., or Acuitas. The terms of the cross-license agreement provided Acuitas with access to certain of our earlier intellectual property (IP) generated prior to April 2010 for a specific field. On August 29, 2016, we provided Acuitas with notice that Arbutus considered Acuitas to be in material breach of the cross-license agreement. On October 25, 2016, Acuitas filed a Notice of Civil Claim in the Supreme Court of British Columbia seeking an order that we perform our obligations under the cross-license agreement , for damages ancillary to specific performance, injunctive relief, interest and costs. We disputed Acuitas' position and filed a counterclaim seeking a declaration that Acuitas is in breach of the cross-license agreement, and claiming injunctive relief, damages, interest and costs. On January 10, 2017, we filed an application seeking an order to enjoin Acuitas from entering into any further agreements purporting to sublicense Arbutus' technology from the date of the order to the date of trial or further order from the court. Acuitas filed a response to Arbutus' application and the matter was the subject of a hearing on January 26, 2017, which resulted in the Supreme Court of British Columbia granting a pre-trial injunction against Acuitas. On February 8, 2017, Arbutus announced that the Supreme Court of British Columbia granted Arbutus’ request for a pre-trial injunction against Acuitas, preventing Acuitas from further sublicensing of Arbutus’ LNP technology until the end of October 2017, or further order of the Court. Under the terms of the pre-trial injunction, Acuitas is prevented from entering into any new agreements, which include sublicensing of Arbutus’ LNP. On March 7, 2017, Acuitas sought leave to appealed from the injunction decision and on April 3, 2017, the application for leave to appeal was denied. On September 29, 2017, the injunction order was extended by consent to March 2, 2018. The contractual issues concerning the cross-license agreement (excluding the claims for damages) are set for trial for 10 days commencing on February 19, 2018.

F- 19

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

There are no changes to our critical accounting policies and estimates from those disclosed in our annual MD&A contained in our Annual Report Form 10-K for the year ended December 31, 2016.

RECENT ACCOUNTING PRONOUNCEMENTS

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board or other standard setting bodies that are adopted by us as of the specified effective date. Unless otherwise discussed, we believe that the impact of recently issued standards that are not yet effective will not have a material impact on our financial position or results of operations upon adoption.

Please refer to Note 2 to our consolidated financial statements included in Part I, Item 1, "Financial Statements (Unaudited)" of this Quarterly Report on Form 10-Q for a description of recent accounting pronouncements applicable to our business.

SUMMARY OF QUARTERLY RESULTS

The following table presents our unaudited quarterly results of operations for each of our last eight quarters. These data have been derived from our unaudited condensed consolidated financial statements, which were prepared on the same basis as our annual audited financial statements and, in our opinion, include all adjustments necessary, consisting solely of normal recurring adjustments, for the fair presentation of such information.

(in millions $ except per share data) – unaudited

Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | ||||||||||||||||||||||||

2017 | 2017 | 2017 | 2016 | 2016 | 2016 | 2016 | 2015 | ||||||||||||||||||||||||

Total revenue | 6.8 | 1.0 | 0.2 | (0.2 | ) | 0.7 | 0.3 | 0.6 | 12.7 | ||||||||||||||||||||||

Expenses | (19.8 | ) | (20.5 | ) | (18.5 | ) | (257.2 | ) | (19.7 | ) | (195.6 | ) | (20.6 | ) | (24.4 | ) | |||||||||||||||

Other income (losses) | 1.3 | 1.2 | (0.3 | ) | (1.4 | ) | (0.6 | ) | 0.4 | 4.1 | 5.5 | ||||||||||||||||||||

Loss before income taxes | (11.7 | ) | (18.3 | ) | (18.6 | ) | (258.8 | ) | (19.6 | ) | (194.9 | ) | (15.9 | ) | (6.2 | ) | |||||||||||||||

Income tax benefit | — | — | — | 40.1 | — | 64.9 | — | 1.0 | |||||||||||||||||||||||

Net loss | (11.7 | ) | (18.3 | ) | (18.6 | ) | (218.7 | ) | (19.6 | ) | (130.0 | ) | (15.9 | ) | (5.2 | ) | |||||||||||||||

Basic and diluted net loss per share | $ | (0.21 | ) | $ | (0.33 | ) | $ | (0.34 | ) | $ | (4.05 | ) | $ | (0.37 | ) | $ | (2.47 | ) | $ | (0.31 | ) | $ | (0.10 | ) | |||||||

Quarterly Trends

Revenue / Our revenue is derived from research and development collaborations and contracts, licensing fees, milestone and royalty payments.

In January 2014, we signed an Option Agreement and a Services Agreement with Monsanto for the use of our proprietary delivery technology and related intellectual property in agriculture. In Q4 2015, we recognized the remaining deferred revenue balance of $11.8 million as the estimated option period ended. In March 2016, Monsanto exercised its option to acquire 100% of the outstanding shares of Protiva Agricultural Development Company Inc. (PADCo), for which Monsanto paid us an exercise fee of $1.0 million in Q1 2016. We recorded this receipt in Q1 2016 as Other income (losses).

In November 2014, we signed a License Agreement and a Development and Supply Agreement with Dicerna for the use of our proprietary delivery technology and related technology intended to develop, manufacture, and commercialize products related to the treatment of PH1. In Q3 2016, Dicerna announced the discontinuation of their DCR-PH1 program using our technology, and we recognized the remaining balance of Dicerna license fee revenue of $0.6 million, as well as other Dicerna collaboration revenue for the provision of development services.

F- 20