Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CIMPRESS plc | q1fy18earnings8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - CIMPRESS plc | q1_fy18earningsrelease.htm |

This document is Cimpress’ first quarter fiscal year 2018 earnings commentary. This document contains slides and

accompanying comments in the “notes” section below each slide.

1Cimpress N.V. Q1 FY2018 Earnings Presentation

Please read the above safe harbor statement. Additionally, a detailed reconciliation of GAAP and non-GAAP measures is

posted in the appendix of the Q1 fiscal 2018 earnings presentation that accompanies these remarks.

2Cimpress N.V. Q1 FY2018 Earnings Presentation

This presentation is organized into the categories shown on the left-hand side of this slide.

Robert Keane, CEO, and Sean Quinn, CFO, will host a live question and answer conference call tomorrow, November 2,

2017 at 7:30 a.m. U.S. Eastern daylight time which you can access through a link at ir.cimpress.com.

3Cimpress N.V. Q1 FY2018 Earnings Presentation

We have made three reporting changes at the start of fiscal year 2018 that reflect internal reporting changes we have made to improve our

ability to measure returns on investments and reflect the increased financial clarity that we have gained from our decentralization.

First, our primary externally reported profitability metric will be Adjusted Net Operating Profit ("Adjusted NOP"). The only change relative to

our prior Adjusted NOPAT metric is that it no longer includes the "cash taxes attributable to the current period". We do not use this view of

"cash taxes attributable to the current period" internally and don't believe it was meaningful to readers of our financial results. As a reminder,

the sum of the components of our Segment Profit will not equal our consolidated Adjusted NOP, since our central and corporate costs do not

constitute a reportable segment, and we do not allocate the gains or losses from hedging contracts included in Adjusted NOP to our

reportable segments since we hedge our net currency exposures at a Cimpress level. For clarity, we have changed the name of our segment

profitability measure to "Segment Profit" though we haven't changed the underlying calculation other than for the cost allocation described

below. Please note that unlevered free cash flow ("UFCF"), not Adjusted NOP or Segment Profit, is the in-year financial performance

measure that we use internally. This is because UFCF is a primary input to our estimate of our uppermost financial objective: intrinsic value

per share, and because UFCF incorporates factors such as working capital and cash taxes that impact the returns on invested capital which

each business delivers to Cimpress. The SEC requires that our segment measure of profitability is not a liquidity measure, which is why we

will continue to report Segment Profit. We believe Segment Profit and, on a consolidated basis, Adjusted NOP are good indicators of the

underlying profitability trends in the business.

Second, we now present inter-segment fulfillment activity as revenue for the fulfilling business for purposes of measuring and reporting our

segment financial performance. For example, if National Pen fulfills an order for Vistaprint, National Pen records both revenue and COGS for

that order, and Vistaprint correspondingly records the amount of revenue recorded by National Pen as Vistaprint COGS. Previously, we

would have recorded this inter-segment activity as a pure cost transfer. We made this change because we believe it will encourage our

businesses to leverage each other when doing so will create value for each business. This inter-segment revenue is, of course, eliminated

from our consolidated revenue so we do not double count revenue. Historically, the most meaningful inter-segment activity took place

between Vistaprint and All Other Businesses, but we expect this to expand in the future as more businesses leverage each other via our

mass customization platform. Please note that activity between businesses within a single segment are not presented in our segment

financial results. For example, when our upload and print businesses produce on behalf of each other, this activity is eliminated within the

single segment and, therefore, not seen in our external reporting. Tracking the growth of this inter-segment revenue will only help you

understand when cross-segment transactions take place, but it will not give you a full picture of the amount of business being transacted

between all of our businesses.

Third, we refined our historical segment profitability for the allocation of certain IT costs to further improve the comparability of profit results

between segments and central and corporate groups, resulting in a small change to Segment Profit and central and corporate groups costs.

These costs are for services performed by the Vistaprint business on behalf of our other businesses. The change has the effect of slightly

increasing Vistaprint Segment Profit, and correspondingly reducing profit for our other segments and increasing costs within our central and

corporate groups. This change results from the development and improvement of operating routines and reporting systems in the wake of

our 2017 reorganization. We have recast historical results for all of the above changes in our Financial and Operating Metrics spreadsheet

on ir.cimpress.com.

4Cimpress N.V. Q1 FY2018 Earnings Presentation

As a reminder and as context for the initiatives and examples discussed in the remainder of this presentation, Cimpress'

uppermost priorities are described above. Extending our history of success into the next decade and beyond in line with these

top-level priorities is important to us. Even as we report results on a quarterly basis it is important for investors to understand

that we manage to a much longer-term time horizon and that we explicitly forgo short-term actions and metrics except to the

extent those short-term actions and metrics support our long-term goals.

5Cimpress N.V. Q1 FY2018 Earnings Presentation

Total revenue for the first quarter was $563.3 million, reflecting a 27% increase year over year in USD and a 24% increase in

constant currencies. Excluding the revenue from the addition of our acquisitions in the past four quarters and from

Albumprinter (which we divested in the quarter), constant-currency revenue growth was 12%. Our first quarter constant

currency revenue growth by segment was in line with the commentary we provided at the beginning of the year, and we are

pleased with the progress we are making to improve customer value in our various businesses. We believe our recent

decentralization has contributed to improved operating results across the company, and we expect these benefits to

compound over time.

Our Q1 GAAP operating income increased significantly year over year to $46.6 million compared to an operating loss of $27.8

million in the year ago period, primarily due to a $47.5 million gain on the sale of our Albumprinter business in the current

period, reduced acquisition-related costs, and the year-over-year savings from our January 2017 decentralization.

Adjusted NOP increased to $10.4 million versus the year ago period due primarily to the savings from our January 2017

decentralization.

6Cimpress N.V. Q1 FY2018 Earnings Presentation

The quarterly trends for reported revenue and revenue growth by segment are illustrated above.

A full discussion of segment performance is included in the next several slides, including the trend for constant-currency

growth excluding recent acquisitions and divestitures.

7Cimpress N.V. Q1 FY2018 Earnings Presentation

• First quarter revenue grew 11% in reported terms and 10% in constant-currency terms year over year. We saw continued growth in both

repeat and new customer bookings, and our focus product categories of signage, marketing materials, promotional products and apparel

continued to grow faster than total Vistaprint revenue. Repeat bookings as a percent of total bookings has been slowly but steadily

increasing and we continue to see positive trends in our repeat rate, which for the quarter was the highest it's been since fiscal 2012.

• First quarter Segment Profit for Vistaprint was up by $5.6 million year over year primarily due to savings from our 2017 decentralization.

Segment Profit margin was 10% in the first quarter, up 100 bps compared to the year ago period. Gross margin declined year over year

as our expanded design services and new product introduction continue to create an unfavorable mix shift. Advertising as a percent of

revenue declined 100 basis points year over year with typical fluctuations in both spend and revenue.

• As previously discussed at our investor day in August, one of Vistaprint's objectives is to optimize the large number of new products and

services that were launched in fiscal 2017 and which we continue to launch in fiscal 2018: we believe that there are pricing and operating

levers to improve the profitability of these products over time. That effort is underway but it will take time to scale and transition those

new products and services from being net investments to being incrementally cash generative. Vistaprint has begun to make such

improvements and will continue this effort throughout the year. While these investments in new products and services put pressure on

current period profitability, we expect they will continue to help us attract higher-value customers, improve customer loyalty and grow

gross profit dollars over time.

• Gross profit per customer in constant currencies was flat year over year. Although our gross margins have come down, this was largely

offset by higher-value customers and improved repeat rates. Please note that starting with this quarter, gross profit per customer now

includes products sold on the "Promotional Products" tab of Vistaprint's website, which has moved under Vistaprint management as a

result of our 2017 reorganization.

• We continue to see stable to improving year-over-year customer loyalty (NPS) scores within Vistaprint.

We conclude from the combination of these trends that Vistaprint continues to strengthen as a result of the many changes and investments

we have made over the past five years. We are optimistic about the progress we're making in Vistaprint and remain focused on achieving

strong returns on the capital invested over those years. We also expect growth rates to fluctuate as we continue to make further investments

that we believe will further improve the value proposition to Vistaprint customers, often at the expense of higher near-term revenue, gross

margin and/or profit.

As previously described, we expect the year-over-year impact of our shipping price reduction within the Vistaprint business to be minimal for

fiscal year 2018. The year-over-year profit impact for the first quarter was a slight benefit as returns from past changes more than offset the

impact from new changes.

New and repeat bookings as a percent of total Vistaprint bookings, and advertising spend as a percent of revenue are presented in the

appendix of this presentation.

8Cimpress N.V. Q1 FY2018 Earnings Presentation

Our Upload and Print segment results during the first quarter were as follows.

• Revenue grew 22% in reported terms and 16% in constant currencies. There were no acquisitions within the past 12

months for this segment, so both of these growth rates are organic.

• Segment Profit was up by $1.3 million year over year due to improved profits in several businesses, partially offset by

increased investments in technology and the expansion of support organizations. Segment Profit margin was 9% during

the first quarter, compared to 10% in the year ago period.

We continue to see evidence that the January 2017 decentralization is driving the desired impacts within Upload and Print in

terms of a tighter connection between customer facing teams and the manufacturing groups, allowing the businesses to be

more agile and work faster toward a common goal. We continue to see opportunities to shift production of certain products to

lower-cost and/or higher quality options through the mass customization platform. The current benefits remain small, but we

expect them to begin to grow through the fiscal year.

The performance across the Upload and Print group varies, with a wide range of revenue growth and cash flow contribution

by business. As described at our investor day in August 2017, the aggregate free cash flow of the full portfolio of Upload and

Print businesses has exceeded our aggregate deal model plans to date, and we expect it to continue to do so in the future.

9Cimpress N.V. Q1 FY2018 Earnings Presentation

• National Pen's revenue during the first quarter was $59.7 million. Since we did not own this business in the year-ago

period, reported revenue growth cannot be calculated as a percentage. On a pro forma basis, adjusted for a portion of its

business that was discontinued before our acquisition closed, revenue declined 3% in constant currencies year over year.

This quarter, we passed the anniversary of the discontinued operations, so that should not have a year-over-year impact

going forward. We continue to expect single-digit constant currency revenue growth for National Pen in fiscal year 2018.

As a reminder, National Pen made changes to its marketing team and approach in the second half of fiscal year 2017. We

believe these are value-creating decisions even though they hurt near-term revenue.

• First quarter Segment Profit was $1.2 million, or 2% of revenue. We expect National Pen to continue its pre-acquisition

seasonal pattern that means most profits are made in the December quarter.

We continue to work on targeted integration activities in line with those we discussed at investor day in August. We've made

great progress here and multiple other Cimpress businesses have begun to tap into National Pen's offering via our mass

customization platform. We've also delivered shipping and freight savings by leveraging Cimpress' contracts and scale

advantages, as well as through moving decoration of products for National Pen's Japanese customers to the Cimpress Japan

facility. We believe that these initiatives will drive attractive returns for National Pen and our other businesses over time.

10Cimpress N.V. Q1 FY2018 Earnings Presentation

Our All Other Businesses segment includes Most of World businesses in Japan, India, Brazil and China, and our Corporate

Solutions business. On August 31, 2017 we sold our Albumprinter business, net of transaction costs and based on the

exchange rate as of the date of sale, for $93.1 million plus $11.9 million in pre-closing dividends. As a result of the sale, we

recognized a gain of $47.5 million, net of transaction costs during the first quarter.

• First quarter revenue grew 7% in reported terms and 5% in constant currencies. Revenue growth was negatively impacted

by the divestiture of our Albumprinter business as there were only two months of revenue and profits in the results.

Constant-currency growth was 40% excluding the impact of the Albumprinter divestiture.

• First quarter Segment Profit (Loss) increased by $2.2 million year over year primarily due to incremental gross profit,

driven by revenue growth and volume absorption. Segment Profit (Loss) margin improved from (37)% to (27)% year over

year.

• During the quarter we recognized a restructuring charge of $0.7 million related to a restructuring initiative within this

segment.

Corporate Solutions continues to build foundations for new growth opportunities and remains early in this process. The Most

of World businesses continue strong growth off a relatively small base. Our objective in both of these young businesses

remains the same: to build foundations for the long term in these large and heterogeneous markets. In both of these

businesses we continue to operate at a significant operating loss as previously described and as planned, and expect to

continue to do so in the next several years.

During the September quarter our Corporate Solutions team chose to shift resources away from its very early stage

investments in Cimpress Open in order to concentrate on its Vistaprint Corporate offering. Cimpress Open will continue to

serve some of its existing customers but we do not see this portion of Corporate Solutions growing in the future. Despite this

change, our expectations for Corporate Solutions, in terms of investment and potential value creation, have not materially

changed. Please note that this change does not mean that we are not connecting our businesses to third-party fulfillers. We

currently connect to hundreds of external suppliers, and post decentralization, the responsibility for managing these

relationships lies with the businesses that are selling those third-party products.

11Cimpress N.V. Q1 FY2018 Earnings Presentation

Central and corporate costs consist primarily of global procurement, a central technology team whose responsibility is building

and operating technology that we have chosen to keep central including our mass customization platform, and corporate

services such as the corporate-level finance, CEO, board, investor relations, communications, strategy and legal functions.

First quarter central and corporate costs of $28.3 million were flat year over year, as planned increases in software

development investment was offset by savings in corporate services as a result of our fiscal 2017 decentralization.

Our Cimpress Technology team continues to build and deploy our MCP, which is a growing set of software services and

standards that deliver business and customer functionality to our various businesses. The objective of MCP is to build, over

time, a large collection of services that:

• Increase selection (i.e., the breadth and depth of delivery speed options, substrate choices, product formats, special

finishes, etc. which we offer to our customers)

• Improve conformance (i.e., the degree to which we deliver products to customers as specified, on time)

• Reduce cost (i.e., the total cost of delivering any given selection in conformance with specification)

• Enhance the quality of customer experience

We remain early in the journey toward our vision for MCP, but we are encouraged by the steady progress we are making. As

part of our 2017 decentralization, we redefined the scope of activities that would be managed centrally, and also changed our

engagement model between Cimpress Technology and our businesses so that new capabilities are generated in the

businesses, and therefore closer to our customers. This new approach has increased the internal adoption of our platform

technologies.

12Cimpress N.V. Q1 FY2018 Earnings Presentation

As we have described already, we are seeing the intended benefits of our 2017 decentralization, including tightened coordination between

marketing, technology and manufacturing resources that are now integrated into our various businesses, improved engagement between our

businesses and our central technology resources resulting in increased adoption of our mass customization platform technologies, and an

improved ability to assess which expenses and initiatives are likely to increase our intrinsic value and which ones are not.

That decentralization resulted, among many other changes, in the transfer to Vistaprint of nearly three thousand team members who were

previously in Cimpress-wide central teams.

Furthermore, even prior to the decentralization, Vistaprint's business had been evolving as it adapts to changes in the market and continues

to better understand the needs of its customers. Over recent years, its strategy has led the business to make many changes, including

increasing by orders of magnitude the number of products offered, introducing new services, and designing and implementing new

technologies to enable Vistaprint to evolve faster. The business is starting to see signs that the strategy is working, demonstrated by an

acceleration in its growth rate and NPS scores being the highest in the company's history.

Following more than six months of experience with their newly integrated organization, the Vistaprint leadership team has taken the difficult

but appropriate decision to reduce Vistaprint headcount and other operating costs, simplify operations and even more closely align functions

to increase the speed of execution. We believe these changes will improve the steady-state free cash flow of this business and, importantly,

free up capital to reinvest in other areas of Vistaprint that provide the greatest benefit to our customers and our long-term shareholders.

Cimpress expects the Vistaprint headcount and cost reductions to be largely implemented over the coming two months and believes they will

reduce fiscal year 2018 operating expenses by between $20 million and $22 million. Certain of the actions that are being considered are

subject to mandatory consultations with employees, works councils and/or governmental authorities. Based on a preliminary assessment of

the potential actions, Cimpress expects to take a restructuring charge of approximately $15 million to $17 million during the quarter ending

December 31, 2017, and we expect net savings for the full fiscal year 2018. The slide above has additional detail regarding the nature of the

anticipated charge and savings. As mentioned, we expect a minority portion of the savings will be reinvested in other areas of Vistaprint so

the annualized run-rate savings will be less than what would be implied by simply extrapolating the above partial-year savings range to a full

year. That said, we do expect to realize the majority of these anticipated run-rate savings.

This restructuring announcement is distinct from the Vistaprint efforts to improve, over time, gross profit from newer product lines that are not

yet operating at scale. With that said, the restructuring should help us improve the financial returns on the investments we are making in the

Vistaprint business, partly through a reduction in the cost structure where it makes sense, and partly by freeing up capital from the parts of

the business that yield lower returns to redeploy elsewhere.

We will provide additional information with our second quarter earnings announcement, after the restructuring is implemented.

13Cimpress N.V. Q1 FY2018 Earnings Presentation

No notes here - transition slide

14Cimpress N.V. Q1 FY2018 Earnings Presentation

The quarterly trends for reported revenue, constant-currency revenue growth, and constant-currency growth excluding recent

acquisitions and divestitures are illustrated above. As noted earlier, the consolidated growth is positively impacted by the

National Pen acquisition, for which we do not have a full year-over-year comparison. The Albumprinter divestiture did have a

smaller negative impact on reported revenue growth this quarter, as we had two months of revenue in the current period, and

three months in the year-ago period.

15Cimpress N.V. Q1 FY2018 Earnings Presentation

On a reported basis, the consolidated two-year stacked growth was 45% for the total of Q1 FY17 and Q1 FY18 versus

approximately 31% for Q1 FY16 and Q1 FY17. The stacked growth rate for constant-currency organic revenue was

approximately 18% for the total of Q1 FY17 plus Q1 FY18 compared to approximately 17% for the total of Q1 FY16 and Q1

FY17. The general trend in this number over time is encouraging to us as we believe it is a reflection of improving returns on

past investments in our business. As a reminder, we have now passed the period of time during which our reported and

organic revenue was negatively impacted by the loss of certain partner revenue.

16Cimpress N.V. Q1 FY2018 Earnings Presentation

The quarterly trends for various measures of income and profit are illustrated above.

Operating income increased significantly versus the year ago period. The following year-over-year items positively influenced

GAAP operating income in the first quarter:

• A $47.5 million gain on the sale of our Albumprinter business.

• Net restructuring savings of approximately $10 million related to the decentralization announced on January 25, 2017.

These savings were realized largely in technology and development and general and administrative costs. From a

segment reporting perspective, about half of the savings benefit Vistaprint's Segment Profit, with the bulk of the remaining

benefit in our central and corporate costs.

• A year-over-year decrease in acquisition-related charges as follows: First, earn-out related charges were $15.1 million

lower in the first quarter of 2018 versus the prior-year period. Share-based compensation related to investment

consideration also decreased year-over year by $4.1 million. These reductions were partially offset by an increase in

acquisition-related amortization of intangible assets of $2.5 million.

• Favorable year-over-year currency fluctuations that were offset below the line by year-over-year changes in realized gains

or losses from hedging contracts in other income, net.

Adjusted NOP increased year over year primarily due to the 2017 decentralization savings.

The following below-the-line items also influenced our GAAP net income during the quarter:

• Our "Other expense, net" was $16.3 million. The vast majority of this is currency related. Please see the next slide for a

detailed explanation of underlying currency drivers.

• "Total interest expense, net" was $13.1 million for the quarter.

• Lease-related interest expense of $1.9 million is related to our Waltham, Massachusetts office facility. We

include this lease-related interest expense in our Adjusted NOP calculation.

• The remaining portion of $11.2 million is primarily related to our Senior Unsecured Notes and borrowings

under our credit facility.

17Cimpress N.V. Q1 FY2018 Earnings Presentation

Below is additional color on the impact of currency movements on our P&L this quarter.

First, the currency impacts that affect our GAAP results and Adjusted NOP:

• Our year-over-year revenue growth rate expressed in USD was positively impacted by about 300 basis points for the first

quarter. Our most significant net currency exposures by volume are in the Euro and British Pound.

• There are many natural expense offsets in our business, and therefore the net currency exposure to our bottom line is less

pronounced than it is to revenue.

• For certain currencies where we do have a net exposure because revenue and certain costs are not well matched, we

enter into currency derivative contracts to hedge the risk. Realized gains or losses from these hedges are recorded in

Other expense, net and offset some of the impact of currency elsewhere in our P&L. The realized loss on these currency

derivative contracts was $0.6 million for the first quarter.

Second, the currency impacts that further impact our GAAP results but that are excluded from our Adjusted NOP are other net

currency losses of approximately $16 million for the first quarter, primarily related to unrealized non-cash net losses on

intercompany loans and currency hedges.

18Cimpress N.V. Q1 FY2018 Earnings Presentation

As of September 30, 2017 cash and cash equivalents were approximately $42.8 million.

For the first quarter, we generated $16.4 million in cash from operations, compared with $9.6 million in the first quarter of

fiscal 2017. The year-over-year increase in operating cash flow was primarily due to restructuring savings, cash flow growth in

our Upload & Print businesses, lower cash taxes, and working capital improvements including those associated with the

changes in our compensation programs in fiscal 2017 that we have previously outlined. The impact of the January 2017

decentralization savings is partially offset in operating cash flow by approximately $4 million of remaining severance payments

made in the quarter. These increases were also offset by transaction costs for the Albumprinter sale, higher cash interest

costs, and unfavorable working capital in our National Pen business based on its seasonality. The gain on the sale of

Albumprinter does not influence operating cash flow.

Unlevered free cash flow was $(6.5) million in the first quarter compared to ($14.7) million in the same period a year ago due

to the same reasons as our operating cash flow trends, partially offset by a slight uptick in capital expenditures and capitalized

software and development costs.

Because we have moved away from Adjusted NOPAT, we have revised the calculation for adjusted return on invested capital

(ROIC) which is simplified because it now uses cash taxes from the face of our cash flow statement. We also are now

presenting adjusted ROIC with and without share based compensation for added visibility given the accounting impact of our

recently changed long-term incentive program that requires awards to be expensed on an accelerated basis. On a trailing

twelve-month basis, adjusted ROIC as of September 30, 2017 decreased versus the year-ago TTM period to approximately

6% including share-based compensation not related to investment consideration, and 9% excluding all share-based

compensation expense, though we saw a slight sequential improvement. Adjusted ROIC is materially affected by the fact that

the numerator is not yet benefiting from a full year of National Pen operating results, which are highly seasonal, yet the

increased debt from National Pen is fully included in the denominator. This impact is exacerbated by our significant uplift in

organic investments in 2017, and the adjusted ROIC including SBC is also impacted by the increased accounting cost of our

new performance share units.

The GAAP operating measures which we use as a basis to calculate ROIC are total debt and operating income. The year-

over-year trend in both measures was up.

19Cimpress N.V. Q1 FY2018 Earnings Presentation

We provide commentary on EBITDA for our debt investors. Please note that we do not manage our overall business performance to

EBITDA; however, we actively monitor it for purposes of ensuring compliance with debt covenants.

Based on our debt covenant definitions, our total leverage ratio was 3.39 as of September 30, 2017, and our senior secured leverage ratio

(which is senior secured debt to trailing twelve month EBITDA) was 2.25. Our debt covenants give pro forma effect for acquired and divested

businesses that closed within the trailing twelve month period ending September 30, 2017. As often described, we are willing to temporarily

go above our long-term total leverage ratio target of 3x TTM EBITDA for the right opportunity and with a path to de-lever below that target

within a reasonable period of time. We continue to expect to manage our leverage back to approximately 3x TTM EBITDA by the end of

calendar 2017.

When including all acquired company EBITDA only as of the dates of acquisition, our adjusted EBITDA for Q1 FY2018 was $45.9 million, up

31.0% from Q1 FY2017 and our TTM adjusted EBITDA was $249.3 million, down 7.0% from the year-ago TTM period. This compares to the

trends in operating income discussed on slide 17. In addition to the exclusion of depreciation and amortization (including acquisition-related

amortization of intangible assets) which was up significantly year over year in the TTM period, the TTM EBITDA metrics exclude goodwill and

other impairment charges, restructuring charges, as well as the share-based compensation costs that are included in our TTM GAAP

operating income.

During the quarter, we repurchased 452,820 Cimpress shares for $40.7 million inclusive of transaction costs, at an average price per share

of $89.82. As we have described in the past, we consider share repurchases to be an important category of capital deployment. We make

our share repurchase decisions by comparing the potential returns of share repurchase (by looking at the difference between our current

share price and our estimate of intrinsic value per share) to the potential returns on other uses of that capital. Our choice to repurchase is

also guided by our debt covenants.

We have various covenants that prevent us from borrowing up to the maximum size of the credit facility as of September 30, 2017.

Purchases of our ordinary shares, payments of dividends, and corporate acquisitions and dispositions are subject to more restrictive

consolidated leverage ratio thresholds than our financial covenants when calculated on a pro forma basis in certain scenarios. Also,

regardless of our leverage ratio, the credit agreement limits the amount of purchases of our ordinary shares, payments of dividends,

corporate acquisitions and dispositions, investments in joint ventures or minority interests, and consolidated capital expenditures that we may

make. These limitations can include annual limits that vary from year to year and aggregate limits over the term of the credit facility.

Therefore, our ability to make desired investments may be limited during the term of our credit facility.

We are currently in compliance with all of our debt covenants. Key financial covenants pertaining to our senior secured credit facility are:

• Total leverage ratio not to exceed 4.5x TTM EBITDA (this steps up temporarily to 4.75x for 12 months after a material acquisition)

• Senior leverage ratio not to exceed 3.25x TTM EBITDA (this steps up temporarily to 3.5x for 12 months after a material acquisition)

• Interest coverage ratio of at least 3.0x TTM EBITDA

20Cimpress N.V. Q1 FY2018 Earnings Presentation

No notes here - transition slide

21Cimpress N.V. Q1 FY2018 Earnings Presentation

We have two housekeeping items to discuss:

• First, our expectation for share-based compensation expense for fiscal year 2018 is now approximately $40 million. This is

lower than the $45 million to $50 million that we previously expected, due to a combination of factors. The prior guidance

was an estimate as the grant date fair value for fiscal 2018 annual PSU grants was not yet available and is sensitive to

share price changes. This estimate does not yet incorporate a change related to the anticipated Vistaprint restructuring,

which may cause the SBC expense in FY18 to be slightly lower than this revised estimate and will be updated next

quarter.

• Second, in Q1 FY18, we adopted the new standard ASU 2016-16, which relates to the accounting treatment of tax effects

for intercompany transfers of assets. Under the old rules, the tax effects of intra-entity transfers were deferred until the

transferred asset was sold to a third party or otherwise recovered through use. We were recording a $10 million - $12

million per year benefit through our GAAP tax provision from the previous transfer of intellectual property for Vistaprint and

National Pen with a corresponding increase in our deferred tax assets. With the adoption of the new rules, as of the start

of fiscal year 2018, we have now fully recognized the related tax benefits as a deferred tax asset on our balance sheet

(through equity) and, starting this quarter, they will no longer flow through our GAAP tax provision. Therefore, there are

some large balance sheet movements this quarter, with deferred tax assets increasing significantly, and a decrease in

other current assets. Most importantly, the adoption of this new accounting standard in no way changes the cash tax

benefits that we expect to receive in the future related to prior transfers of intellectual property, which are now simply all

recognized in the balance sheet.

22Cimpress N.V. Q1 FY2018 Earnings Presentation

In summary, Q1 FY18 was a strong quarter for the reasons outlined above.

We believe the capital we are allocating across our business, and the capital we are choosing to free up and/or redeploy,

along with the organizational and strategic changes we implemented in fiscal year 2017, are solidifying our leadership position

in mass customization and continuing to increase our intrinsic value per share.

23Cimpress N.V. Q1 FY2018 Earnings Presentation

Cimpress N.V. Q1 FY2018 Earnings Presentation

Q&A Session

Please go to ir.cimpress.com

for the live Q&A call at

7:30 am EDT on November 2, 2017

Q1 Fiscal Year 2018 Financial and Operating Results Supplement

Cimpress N.V. Q1 FY2018 Earnings Presentation

(1) Please see non-GAAP reconciliation to reported revenue growth rates at the end of this presentation.

Revenue Growth Rates

FY15 FY16 FY17

Constant-currency growth 23% 24% 21%

Constant-currency growth excl. TTM Acquisitions & Divestitures 9% 11% 8%

26

Reported Revenue by Segment

Quarterly, USD in millions

For a description of acquisitions, divestitures and JVs that are excluded from constant currency growth, please see reconciliation to reported revenue growth rates at the end of

this presentation. Percentage of total revenue calculated based off of total segment revenues, inclusive of inter-segment revenues.

Q1 FY2018

Vistaprint

56% of total revenue

11% y/y growth

10% y/y constant currency growth

Upload and Print

28% of total revenue

22% y/y growth

16% y/y constant currency growth

National Pen

11% of total revenue

100% y/y growth

100% y/y constant currency growth

All Other Businesses

5% of total revenue

7% y/y growth

5% y/y constant currency growth

Inter-segment Elimination $(0.8) $(0.9) $(0.8) $(1.1) $(1.1) $(1.4) $(1.6) $(1.6) $(3.9)

Total Consolidated Revenue $375.7 $496.3 $436.8 $479.2 $443.7 $576.9 $550.6 $564.3 $563.3

27

Cimpress N.V. Q1 FY2018 Earnings Presentation

Reported Revenue Growth

(1) National Pen was acquired on December 30, 2016, and therefore reported revenue growth cannot be calculated as a percentage since we did not own this business in the year-ago period.

(2) Q1FY18 All Other Businesses revenue growth impacted by the divestiture of Albumprinter business and includes only two months of revenue. 28

Organic Constant Currency Revenue Growth (excl. TTM acquisitions/divestitures)

N/A N/A

(1) National Pen was acquired on December 30, 2016, and therefore organic constant currency revenue growth cannot be calculated as a percentage since we did not own this business in the

year-ago period.

N/A

29

Cimpress N.V. Q1 FY2018 Earnings Presentation

Vistaprint Bookings Mix & Advertising Spend

% TTM Bookings from Repeat Orders

% TTM Bookings from New Orders

30

Segment Profit

Quarterly, USD in millions

Segment Profit Segment Profit Margin

Note: In Q1FY18, we recast historical segment profitability for the allocation of certain IT costs, which previously burdened our Vistaprint business, but have now been allocated to each of our

businesses in fiscal 2018. 31

Cimpress N.V. Q1 FY2018 Earnings Presentation

Segment Profit Reconciliation to OI

Quarterly, in thousands

Segment Profit Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Vistaprint $36,138 $85,021 $45,631 $48,157 $25,272 $67,016 $37,627 $37,772 $30,895

Upload and Print $10,543 $14,877 $15,448 $17,339 $13,451 $16,798 $12,983 $19,957 $14,768

National Pen N/A N/A N/A N/A N/A N/A ($3,226) $1,001 $1,185

All Other Businesses ($1,213) $6,750 ($3,996) ($10,869) ($9,752) ($2,107) ($10,085) ($9,361) ($7,551)

Total Segment Profit $45,468 $106,648 $57,083 $54,627 $28,971 $81,707 $37,299 $49,369 $39,297

Central and corporate costs ($22,589) ($23,105) ($26,077) ($25,901) ($28,186) ($31,228) ($28,028) ($30,653) ($28,257)

Acquisition-related amortization and depreciation ($9,782) ($9,655) ($10,879) ($10,518) ($10,213) ($10,019) ($13,508) ($12,662) ($12,687)

Earn-out related charges (1) ($289) ($3,413) ($883) ($1,793) ($16,247) ($7,010) ($4,882) ($12,245) ($1,137)

Share-based compensation related to investment consideration ($802) ($1,735) ($1,168) ($1,130) ($4,103) ($601) ($375) ($4,559) ($40)

Certain impairments (2) $— ($3,022) ($37,582) ($1,216) — — ($9,556) — —

Restructuring related charges ($271) ($110) — — — ($1,100) ($24,790) ($810) ($854)

Interest expense for Waltham lease $350 $2,001 $1,975 $1,961 $1,970 $1,956 $1,897 $1,904 $1,911

Gain on the purchase or sale of subsidiaries — — — — — — — — $48,380

Total (loss) income from operations $12,085 $67,609 ($17,531) $16,030 ($27,808) $33,705 ($41,943) ($9,656) $46,613

(1) Includes expense recognized for the change in fair value of contingent consideration & compensation expense related to cash-based earn-out mechanisms dependent upon continued employment.

(2) Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350 - "Intangibles-Goodwill and Other" or ASC 360- "Property, plant, and equipment."

(3) Includes the impact of the gain on the sale of Albumprinter, as well as a bargain purchase gain as defined by ASC 805-30 for an acquisition in which the identifiable assets acquired

and liabilities assumed are greater than the consideration transferred, that was recognized in general and administrative expense in our consolidated statement of operations during the three months

ended September 30, 2017.

32

Quarterly, USD in millions

Share-Based Compensation

*Q1FY18 investment consideration of acquisition-related SBC was immaterial.

Note: Share-based compensation excludes SBC-related tax adjustment. Q4 FY17 includes incremental expense for the accelerated vesting of the Printi shares due to current period amendment

to the arrangement. In Q3FY17 there was a $6.3M acceleration of share-based compensation expense related to our restructuring activities undertaken in that period. Q1 FY17 includes

modification expense related to the RSA granted as part of the Tradeprint acquisition. Starting in Q1 FY17 results include the effect of our new shareholder-approved LTI program which includes

performance share units which have a different accounting treatment than restricted share units.

FY15 $24.1 FY16 $23.8 FY17 $48.6

33

Cimpress N.V. Q1 FY2018 Earnings Presentation

Balance Sheet Highlights

Balance sheet highlights, USD in millions, at period end 9/30/2016 12/31/2016 3/31/2017 6/30/2017 9/30/2017

Total assets $1,456.3 $1,663.9 $1,637.9 $1,679.9 $1,696.1

Cash and cash equivalents $53.6 $49.6 $43.5 $25.7 $42.8

Total current assets $175.2 $242.0 $216.8 $246.0 $233.9

Property, plant and equipment, net $495.2 $505.3 $513.1 $511.9 $511.9

Goodwill and intangible assets $680.2 $821.5 $796.1 $790.9 $794.5

Total liabilities $1,243.9 $1,522.3 $1,510.6 $1,559.2 $1,527.8

Current liabilities $331.7 $436.0 $429.5 $449.5 $453.8

Long-term debt $654.3 $830.0 $860.2 $847.7 $800.9

Shareholders’ Equity attributable to Cimpress NV $147.2 $99.5 $84.4 $75.0 $84.2

Treasury shares (in millions) 12.4 13.0 12.9 12.7 13.1

Note: June 30, 2017 cash and cash equivalents excludes $12.0M of cash classified as part of "held for sale" 34

Appendix

Including a Reconciliation of GAAP to Non-GAAP

Financial Measures

Cimpress N.V. Q1 FY2018 Earnings Presentation

About Non-GAAP Financial Measures

• To supplement Cimpress' consolidated financial statements presented in accordance with U.S. generally accepted accounting

principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and

Exchange Commission, or SEC, rules: adjusted EBITDA, free cash flow, unlevered free cash flow, trailing twelve month return on

invested capital, Adjusted NOP, constant-currency revenue growth and constant-currency revenue growth excluding revenue

from acquisitions, divestitures and joint ventures from the past twelve months. Please see the next two slides for definitions of

these items.

• These non-GAAP financial measures are provided to enhance investors' understanding of our current operating results from the

underlying and ongoing business for the same reasons they are used by management. For example, as we have become more

acquisitive over recent years we believe excluding the costs related to the purchase of a business (such as amortization of

acquired intangible assets, contingent consideration, or impairment of goodwill) provides further insight into the performance of

the underlying acquired business in addition to that provided by our GAAP operating income. As another example, as we do not

apply hedge accounting for our currency forward contracts, we believe inclusion of realized gains and losses on these contracts

that are intended to be matched against operational currency fluctuations provides further insight into our operating performance

in addition to that provided by our GAAP operating income. We do not, nor do we suggest that investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP.

• For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP

Financial Measures” included at the end of this release. The tables have more details on the GAAP financial measures that are

most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures.

36

Non-GAAP Financial Measures Definitions

Non-GAAP Measure Definition

Free Cash Flow FCF = Cash flow from operations – capital expenditures – purchases of intangible assets not related to acquisitions – capitalized software expenses + payment of contingent consideration in excess of acquisition-date fair value + gains on proceeds from insurance

Unlevered Free Cash Flow Unlevered Free Cash Flow = Free Cash Flow as defined above + cash paid during the period for interest - interest expense associated with Waltham lease

Adjusted Net Operating Profit (NOP) Adjusted NOP = GAAP operating income + the impact of M&A related items including acquisition-related amortization and depreciation, the change in fair value of contingent consideration, and expense for deferred payments or equity awards that are treated as compensation expense + the impact of unusual items such as discontinued operations, restructuring related charges, and impairments -interest expense related to our Waltham office lease + realized gains or losses from currency derivatives that are not included in operating income as we do not apply hedge accounting

Trailing Twelve Month Return on Invested Capital ROIC = Adjusted NOP / (debt + redeemable non-controlling interest + total shareholders equity – excess cash)Adjusted NOP is defined above.Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zeroOperating leases have not been converted to debt

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)

Adjusted EBITDA = Operating Income + depreciation and amortization (excluding depreciation and amortization related to our Waltham office lease) + share-based compensation expense + proceeds from insurance + earn-out related charges + certain impairments + restructuring related charges + realized gains or losses on currency derivatives - interest expense related to our Waltham office lease -gain on purchase or sale of subsidiaries

Constant-Currency Revenue Growth Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior year period’s average exchange rate for each currency to the U.S. dollar.

Constant Currency Revenue Growth, excluding TTM Acquisitions Constant-currency revenue growth excluding revenue from trailing twelve month acquisitions excludes the impact of currency as defined above and revenue from acquisitions for which there is not a full-quarter year-over-year comparison.

Two-year stacked constant-currency organic revenue growth Two-year stacked growth is computed by adding the revenue growth from the current period referenced and that of the same fiscal period ended twelve months prior. Constant-currency revenue growth excluding revenue from trailing twelve month acquisitions is defined directly above.

37

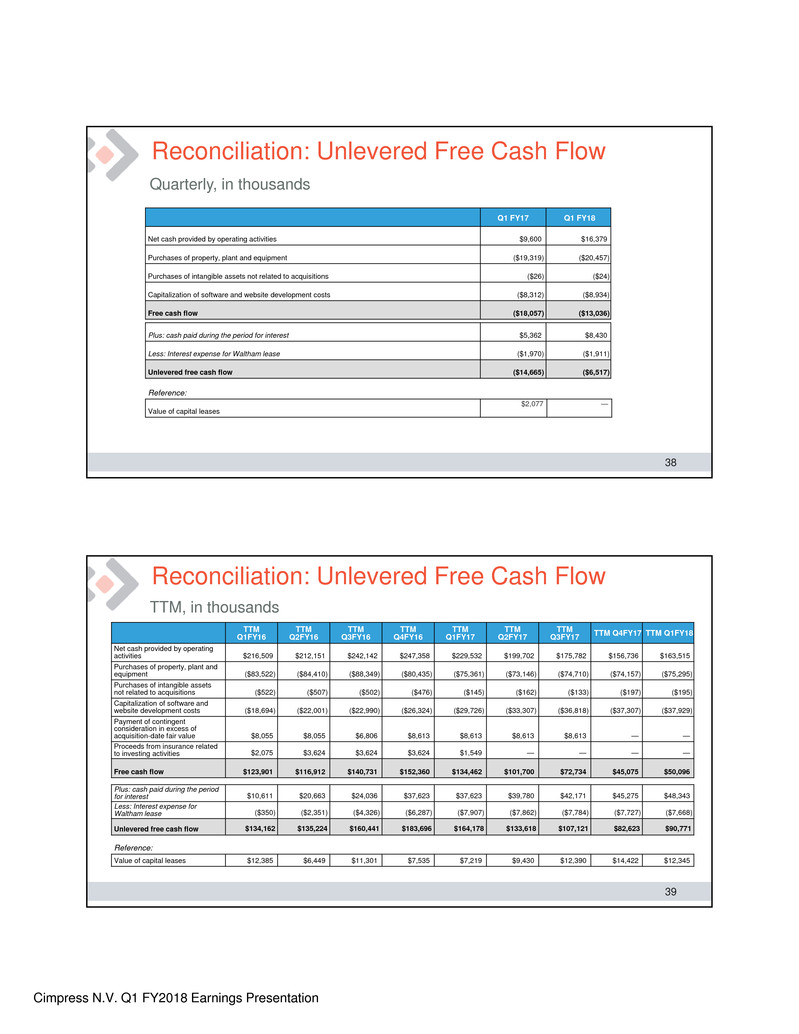

Cimpress N.V. Q1 FY2018 Earnings Presentation

Reconciliation: Unlevered Free Cash Flow

Q1 FY17 Q1 FY18

Net cash provided by operating activities $9,600 $16,379

Purchases of property, plant and equipment ($19,319) ($20,457)

Purchases of intangible assets not related to acquisitions ($26) ($24)

Capitalization of software and website development costs ($8,312) ($8,934)

Free cash flow ($18,057) ($13,036)

Plus: cash paid during the period for interest $5,362 $8,430

Less: Interest expense for Waltham lease ($1,970) ($1,911)

Unlevered free cash flow ($14,665) ($6,517)

Quarterly, in thousands

Reference:

Value of capital leases

$2,077 —

38

Reconciliation: Unlevered Free Cash Flow

TTM, in thousands

TTM Q1FY16 TTM Q2FY16 TTM Q3FY16 TTM Q4FY16 TTM Q1FY17 TTM Q2FY17 TTM Q3FY17 TTM Q4FY17 TTM Q1FY18

Net cash provided by operating activities $216,509 $212,151 $242,142 $247,358 $229,532 $199,702 $175,782 $156,736 $163,515

Purchases of property, plant and equipment ($83,522) ($84,410) ($88,349) ($80,435) ($75,361) ($73,146) ($74,710) ($74,157) ($75,295)

Purchases of intangible assets not related to acquisitions ($522) ($507) ($502) ($476) ($145) ($162) ($133) ($197) ($195)

Capitalization of software and website development costs ($18,694) ($22,001) ($22,990) ($26,324) ($29,726) ($33,307) ($36,818) ($37,307) ($37,929)

Payment of contingent consideration in excess of acquisition-date fair value $8,055 $8,055 $6,806 $8,613 $8,613 $8,613 $8,613 — —

Proceeds from insurance related to investing activities $2,075 $3,624 $3,624 $3,624 $1,549 — — — —

Free cash flow $123,901 $116,912 $140,731 $152,360 $134,462 $101,700 $72,734 $45,075 $50,096

Plus: cash paid during the period for interest $10,611 $20,663 $24,036 $37,623 $37,623 $39,780 $42,171 $45,275 $48,343

Less: Interest expense for Waltham lease ($350) ($2,351) ($4,326) ($6,287) ($7,907) ($7,862) ($7,784) ($7,727) ($7,668)

Unlevered free cash flow $134,162 $135,224 $160,441 $183,696 $164,178 $133,618 $107,121 $82,623 $90,771

Reference:

Value of capital leases $12,385 $6,449 $11,301 $7,535 $7,219 $9,430 $12,390 $14,422 $12,345

39

Cimpress N.V. Q1 FY2018 Earnings Presentation

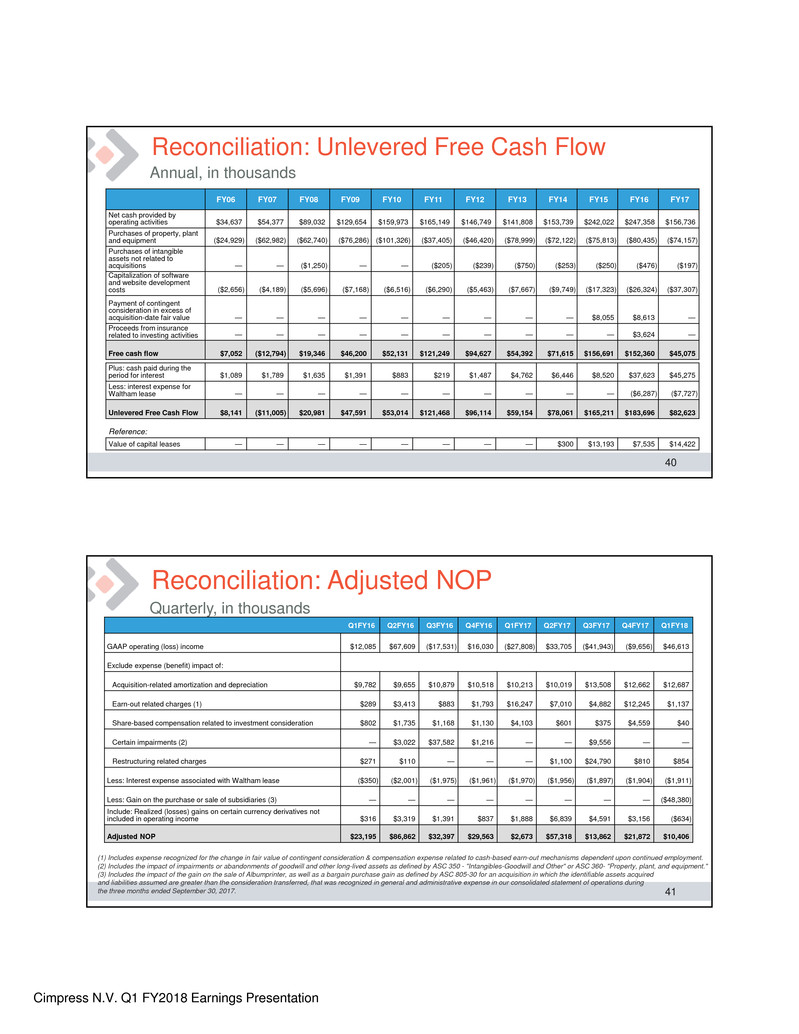

Reconciliation: Unlevered Free Cash Flow

Annual, in thousands

FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17

Net cash provided by

operating activities $34,637 $54,377 $89,032 $129,654 $159,973 $165,149 $146,749 $141,808 $153,739 $242,022 $247,358 $156,736

Purchases of property, plant

and equipment ($24,929) ($62,982) ($62,740) ($76,286) ($101,326) ($37,405) ($46,420) ($78,999) ($72,122) ($75,813) ($80,435) ($74,157)

Purchases of intangible

assets not related to acquisitions — — ($1,250) — — ($205) ($239) ($750) ($253) ($250) ($476) ($197)

Capitalization of software

and website development costs ($2,656) ($4,189) ($5,696) ($7,168) ($6,516) ($6,290) ($5,463) ($7,667) ($9,749) ($17,323) ($26,324) ($37,307)

Payment of contingent

consideration in excess of acquisition-date fair value — — — — — — — — — $8,055 $8,613 —

Proceeds from insurance

related to investing activities — — — — — — — — — — $3,624 —

Free cash flow $7,052 ($12,794) $19,346 $46,200 $52,131 $121,249 $94,627 $54,392 $71,615 $156,691 $152,360 $45,075

Plus: cash paid during the period for interest $1,089 $1,789 $1,635 $1,391 $883 $219 $1,487 $4,762 $6,446 $8,520 $37,623 $45,275

Less: interest expense for Waltham lease — — — — — — — — — — ($6,287) ($7,727)

Unlevered Free Cash Flow $8,141 ($11,005) $20,981 $47,591 $53,014 $121,468 $96,114 $59,154 $78,061 $165,211 $183,696 $82,623

Reference:

Value of capital leases — — — — — — — — $300 $13,193 $7,535 $14,422

40

Reconciliation: Adjusted NOP

Quarterly, in thousands

Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

GAAP operating (loss) income $12,085 $67,609 ($17,531) $16,030 ($27,808) $33,705 ($41,943) ($9,656) $46,613

Exclude expense (benefit) impact of:

Acquisition-related amortization and depreciation $9,782 $9,655 $10,879 $10,518 $10,213 $10,019 $13,508 $12,662 $12,687

Earn-out related charges (1) $289 $3,413 $883 $1,793 $16,247 $7,010 $4,882 $12,245 $1,137

Share-based compensation related to investment consideration $802 $1,735 $1,168 $1,130 $4,103 $601 $375 $4,559 $40

Certain impairments (2) — $3,022 $37,582 $1,216 — — $9,556 — —

Restructuring related charges $271 $110 — — — $1,100 $24,790 $810 $854

Less: Interest expense associated with Waltham lease ($350) ($2,001) ($1,975) ($1,961) ($1,970) ($1,956) ($1,897) ($1,904) ($1,911)

Less: Gain on the purchase or sale of subsidiaries (3) — — — — — — — — ($48,380)

Include: Realized (losses) gains on certain currency derivatives not included in operating income $316 $3,319 $1,391 $837 $1,888 $6,839 $4,591 $3,156 ($634)

Adjusted NOP $23,195 $86,862 $32,397 $29,563 $2,673 $57,318 $13,862 $21,872 $10,406

(1) Includes expense recognized for the change in fair value of contingent consideration & compensation expense related to cash-based earn-out mechanisms dependent upon continued employment.

(2) Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350 - "Intangibles-Goodwill and Other" or ASC 360- "Property, plant, and equipment."

(3) Includes the impact of the gain on the sale of Albumprinter, as well as a bargain purchase gain as defined by ASC 805-30 for an acquisition in which the identifiable assets acquired

and liabilities assumed are greater than the consideration transferred, that was recognized in general and administrative expense in our consolidated statement of operations during

the three months ended September 30, 2017. 41

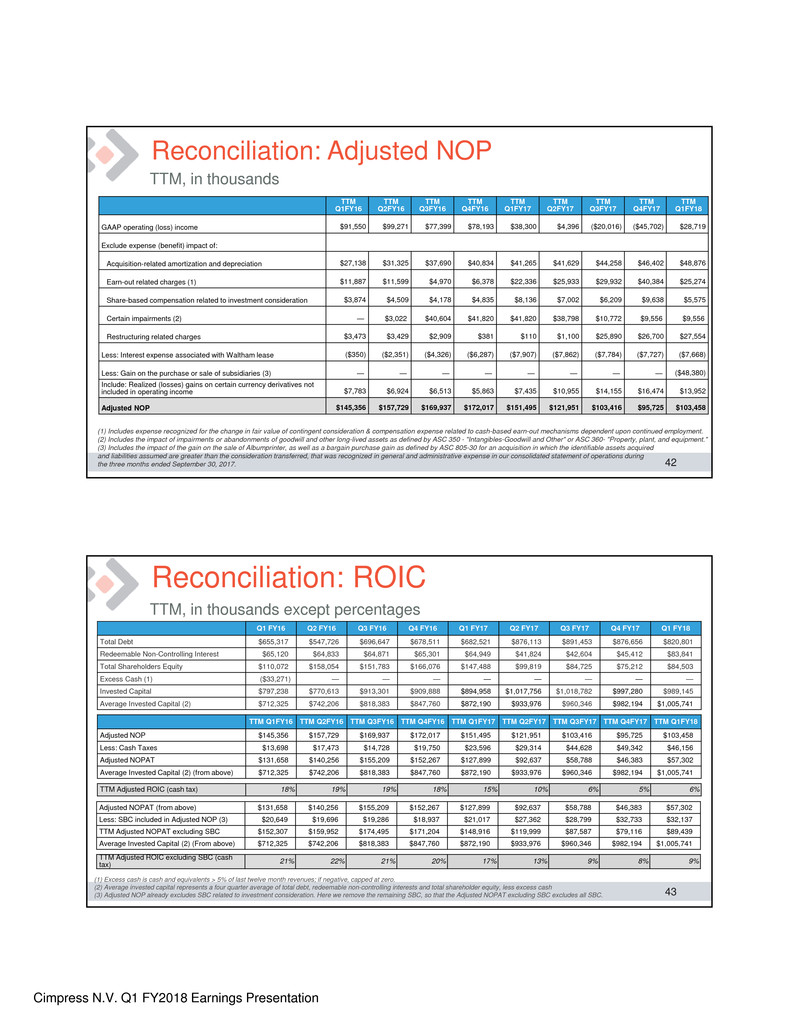

Cimpress N.V. Q1 FY2018 Earnings Presentation

(1) Includes expense recognized for the change in fair value of contingent consideration & compensation expense related to cash-based earn-out mechanisms dependent upon continued employment.

(2) Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350 - "Intangibles-Goodwill and Other" or ASC 360- "Property, plant, and equipment."

(3) Includes the impact of the gain on the sale of Albumprinter, as well as a bargain purchase gain as defined by ASC 805-30 for an acquisition in which the identifiable assets acquired

and liabilities assumed are greater than the consideration transferred, that was recognized in general and administrative expense in our consolidated statement of operations during

the three months ended September 30, 2017.

Reconciliation: Adjusted NOP

TTM, in thousands

TTM

Q1FY16

TTM

Q2FY16

TTM

Q3FY16

TTM

Q4FY16

TTM

Q1FY17

TTM

Q2FY17

TTM

Q3FY17

TTM

Q4FY17

TTM

Q1FY18

GAAP operating (loss) income $91,550 $99,271 $77,399 $78,193 $38,300 $4,396 ($20,016) ($45,702) $28,719

Exclude expense (benefit) impact of:

Acquisition-related amortization and depreciation $27,138 $31,325 $37,690 $40,834 $41,265 $41,629 $44,258 $46,402 $48,876

Earn-out related charges (1) $11,887 $11,599 $4,970 $6,378 $22,336 $25,933 $29,932 $40,384 $25,274

Share-based compensation related to investment consideration $3,874 $4,509 $4,178 $4,835 $8,136 $7,002 $6,209 $9,638 $5,575

Certain impairments (2) — $3,022 $40,604 $41,820 $41,820 $38,798 $10,772 $9,556 $9,556

Restructuring related charges $3,473 $3,429 $2,909 $381 $110 $1,100 $25,890 $26,700 $27,554

Less: Interest expense associated with Waltham lease ($350) ($2,351) ($4,326) ($6,287) ($7,907) ($7,862) ($7,784) ($7,727) ($7,668)

Less: Gain on the purchase or sale of subsidiaries (3) — — — — — — — — ($48,380)

Include: Realized (losses) gains on certain currency derivatives not included in operating income $7,783 $6,924 $6,513 $5,863 $7,435 $10,955 $14,155 $16,474 $13,952

Adjusted NOP $145,356 $157,729 $169,937 $172,017 $151,495 $121,951 $103,416 $95,725 $103,458

42

Reconciliation: ROIC

(1) Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zero.

(2) Average invested capital represents a four quarter average of total debt, redeemable non-controlling interests and total shareholder equity, less excess cash

(3) Adjusted NOP already excludes SBC related to investment consideration. Here we remove the remaining SBC, so that the Adjusted NOPAT excluding SBC excludes all SBC.

TTM, in thousands except percentages

Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 Q1 FY18

Total Debt $655,317 $547,726 $696,647 $678,511 $682,521 $876,113 $891,453 $876,656 $820,801

Redeemable Non-Controlling Interest $65,120 $64,833 $64,871 $65,301 $64,949 $41,824 $42,604 $45,412 $83,841

Total Shareholders Equity $110,072 $158,054 $151,783 $166,076 $147,488 $99,819 $84,725 $75,212 $84,503

Excess Cash (1) ($33,271) — — — — — — — —

Invested Capital $797,238 $770,613 $913,301 $909,888 $894,958 $1,017,756 $1,018,782 $997,280 $989,145

Average Invested Capital (2) $712,325 $742,206 $818,383 $847,760 $872,190 $933,976 $960,346 $982,194 $1,005,741

TTM Q1FY16 TTM Q2FY16 TTM Q3FY16 TTM Q4FY16 TTM Q1FY17 TTM Q2FY17 TTM Q3FY17 TTM Q4FY17 TTM Q1FY18

Adjusted NOP $145,356 $157,729 $169,937 $172,017 $151,495 $121,951 $103,416 $95,725 $103,458

Less: Cash Taxes $13,698 $17,473 $14,728 $19,750 $23,596 $29,314 $44,628 $49,342 $46,156

Adjusted NOPAT $131,658 $140,256 $155,209 $152,267 $127,899 $92,637 $58,788 $46,383 $57,302

Average Invested Capital (2) (from above) $712,325 $742,206 $818,383 $847,760 $872,190 $933,976 $960,346 $982,194 $1,005,741

TTM Adjusted ROIC (cash tax) 18% 19% 19% 18% 15% 10% 6% 5% 6%

Adjusted NOPAT (from above) $131,658 $140,256 $155,209 $152,267 $127,899 $92,637 $58,788 $46,383 $57,302

Less: SBC included in Adjusted NOP (3) $20,649 $19,696 $19,286 $18,937 $21,017 $27,362 $28,799 $32,733 $32,137

TTM Adjusted NOPAT excluding SBC $152,307 $159,952 $174,495 $171,204 $148,916 $119,999 $87,587 $79,116 $89,439

Average Invested Capital (2) (From above) $712,325 $742,206 $818,383 $847,760 $872,190 $933,976 $960,346 $982,194 $1,005,741

TTM Adjusted ROIC excluding SBC (cash tax) 21% 22% 21% 20% 17% 13% 9% 8% 9%

43

Cimpress N.V. Q1 FY2018 Earnings Presentation

Reconciliation: Adjusted EBITDA

Quarterly, in thousands

Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 Q1 FY18

GAAP Operating income (loss) $12,085 $67,609 ($17,531) $16,030 ($27,808) $33,705 ($41,943) ($9,656) $46,613

Depreciation and amortization $30,226 $31,805 $34,561 $35,527 $35,541 $36,977 $44,522 $42,616 $42,384

Waltham lease depreciation adjustment ($328) ($1,045) ($1,030) ($1,030) ($1,030) ($1,030) ($1,030) ($1,030) ($1,030)

Share-based compensation expense $6,190 $6,066 $5,897 $5,619 $11,571 $11,277 $6,541 $12,982 $6,912

Proceeds from Insurance $1,584 $1,553 — $824 $650 — $157 — —

Interest expense associated with Waltham lease ($350) ($2,001) ($1,975) ($1,961) ($1,970) ($1,956) ($1,897) ($1,904) ($1,911)

Earn-out related charges $289 $3,413 $883 $1,793 $16,247 $7,010 $4,882 $12,245 $1,137

Certain Impairments — $3,022 $37,582 $1,216 — — $9,556 — —

Gain on purchase or sale of subsidiaries — — — — — — — — ($48,380)

Restructuring related charges $271 $110 — — — $1,100 $24,790 $810 $854

Realized gains on currency derivatives not included in operating income $316 $3,319 $1,391 $837 $1,888 $6,839 $4,591 $3,156 ($634)

Adjusted EBITDA (1,2) $50,283 $113,851 $59,778 $58,855 $35,089 $93,922 $50,168 $59,219 $45,945

In Q3 FY16 the definition of adjusted EBITDA used in external reporting was modified to include certain impairment charges and adjust for depreciation related to our Waltham lease resulting in a change to

adjusted EBITDA for Q1 and Q2 FY16. Also note that for Q3 FY17, the SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting.

(1) This presentation uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions; however, the senior unsecured notes' covenants allow for the

inclusion of pro-forma impacts to adjusted EBITDA.

(2) Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to non-controlling interests.

This is to most closely align to our debt covenant and cash flow reporting. 44

Reconciliation: Adjusted EBITDA

TTM, in thousands

TTM Q1FY16 TTM Q2FY16 TTM Q3FY16 TTM Q4FY16 TTM Q1FY17 TTM Q2FY17 TTM Q3FY17 TTM Q4FY17 TTM Q1FY18

GAAP Operating income (loss) $91,550 $99,271 $77,399 $78,193 $38,300 $4,396 ($20,016) ($45,702) $28,719

Depreciation and amortization $103,254 $112,164 $124,400 $132,119 $137,434 $142,606 $152,567 $159,656 $166,499

Waltham lease depreciation adjustment ($328) ($1,373) ($2,403) ($3,433) ($4,135) ($4,120) ($4,120) ($4,120) ($4,120)

Share-based compensation expense $24,523 $24,205 $23,464 $23,772 $29,153 $34,364 $35,008 $42,371 $37,712

Proceeds from Insurance $1,584 $3,137 $3,137 $3,961 $3,027 $1,474 $1,631 $807 $157

Interest expense associated with Waltham lease ($350) ($2,351) ($4,326) ($6,287) ($7,907) ($7,862) ($7,784) ($7,727) ($7,668)

Earn-out related charges $11,888 $11,600 $4,971 $6,378 $22,336 $25,933 $29,932 $40,384 $25,274

Certain Impairments — $3,022 $40,604 $41,820 $41,820 $38,798 $10,772 $9,556 $9,556

Gain on purchase or sale of subsidiaries — — — — — — — — ($48,380)

Restructuring related charges $2,799 $2,909 $2,909 $381 $110 $1,100 $25,890 $26,700 $27,554

Realized gains on currency derivatives not included in operating income $7,783 $6,924 $6,513 $5,863 $7,435 $10,955 $14,155 $16,474 $13,952

Adjusted EBITDA (1,2) $242,703 $259,508 $276,668 $282,767 $267,573 $247,644 $238,034 $238,398 $249,254

In Q3 FY16 the definition of adjusted EBITDA used in external reporting was modified to include certain impairment charges and adjust for depreciation related to our Waltham lease resulting in a change to

adjusted EBITDA for Q1 and Q2 FY16. Also note that for Q3 FY17 (and Q4 FY17), the SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting.

(1) This deck uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions; however, the senior unsecured notes' covenants allow for the

inclusion of pro-forma impacts to adjusted EBITDA.

(2) Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to non-controlling interests.

This is to most closely align to our debt covenant and cash flow reporting. 45

Cimpress N.V. Q1 FY2018 Earnings Presentation

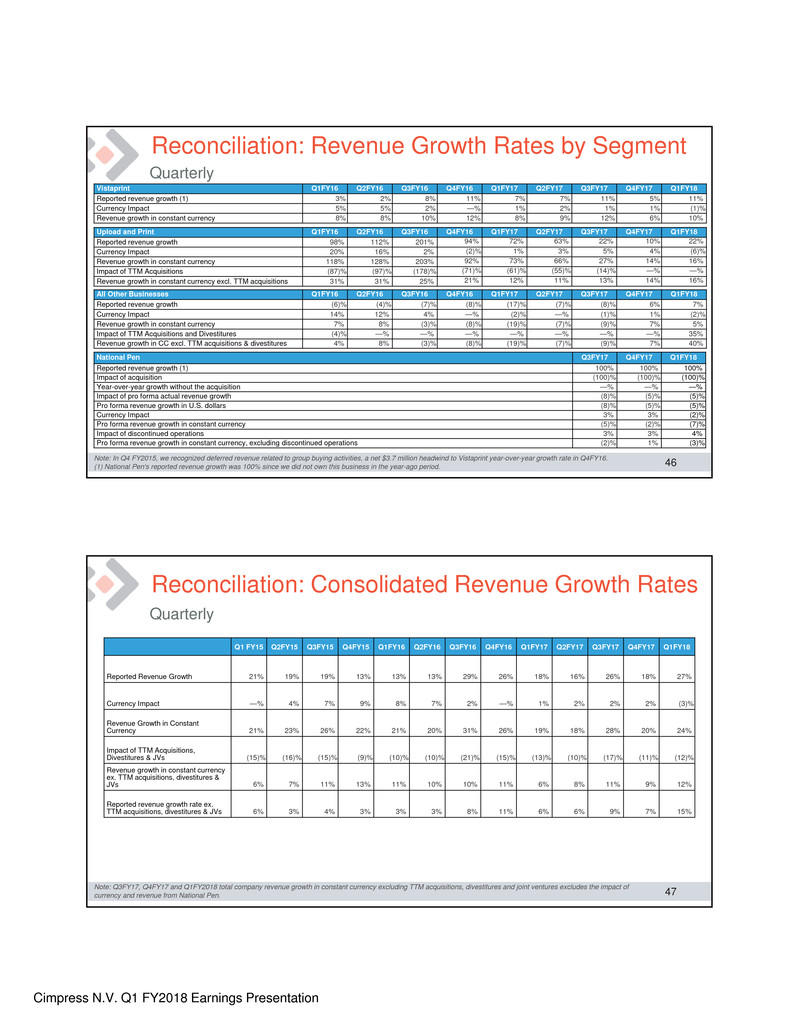

Reconciliation: Revenue Growth Rates by Segment

Quarterly

Vistaprint Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Reported revenue growth (1) 3% 2% 8% 11% 7% 7% 11% 5% 11%

Currency Impact 5% 5% 2% —% 1% 2% 1% 1% (1)%

Revenue growth in constant currency 8% 8% 10% 12% 8% 9% 12% 6% 10%

All Other Businesses Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Reported revenue growth (6)% (4)% (7)% (8)% (17)% (7)% (8)% 6% 7%

Currency Impact 14% 12% 4% —% (2)% —% (1)% 1% (2)%

Revenue growth in constant currency 7% 8% (3)% (8)% (19)% (7)% (9)% 7% 5%

Impact of TTM Acquisitions and Divestitures (4)% —% —% —% —% —% —% —% 35%

Revenue growth in CC excl. TTM acquisitions & divestitures 4% 8% (3)% (8)% (19)% (7)% (9)% 7% 40%

Note: In Q4 FY2015, we recognized deferred revenue related to group buying activities, a net $3.7 million headwind to Vistaprint year-over-year growth rate in Q4FY16.

(1) National Pen's reported revenue growth was 100% since we did not own this business in the year-ago period.

National Pen Q3FY17 Q4FY17 Q1FY18

Reported revenue growth (1) 100% 100% 100%

Impact of acquisition (100)% (100)% (100)%

Year-over-year growth without the acquisition —% —% —%

Impact of pro forma actual revenue growth (8)% (5)% (5)%

Pro forma revenue growth in U.S. dollars (8)% (5)% (5)%

Currency Impact 3% 3% (2)%

Pro forma revenue growth in constant currency (5)% (2)% (7)%

Impact of discontinued operations 3% 3% 4%

Pro forma revenue growth in constant currency, excluding discontinued operations (2)% 1% (3)%

Upload and Print Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Reported revenue growth 98% 112% 201% 94% 72% 63% 22% 10% 22%

Currency Impact 20% 16% 2% (2)% 1% 3% 5% 4% (6)%

Revenue growth in constant currency 118% 128% 203% 92% 73% 66% 27% 14% 16%

Impact of TTM Acquisitions (87)% (97)% (178)% (71)% (61)% (55)% (14)% —% —%

Revenue growth in constant currency excl. TTM acquisitions 31% 31% 25% 21% 12% 11% 13% 14% 16%

46

Quarterly

Reconciliation: Consolidated Revenue Growth Rates

Q1 FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Reported Revenue Growth 21% 19% 19% 13% 13% 13% 29% 26% 18% 16% 26% 18% 27%

Currency Impact —% 4% 7% 9% 8% 7% 2% —% 1% 2% 2% 2% (3)%

Revenue Growth in Constant Currency 21% 23% 26% 22% 21% 20% 31% 26% 19% 18% 28% 20% 24%

Impact of TTM Acquisitions, Divestitures & JVs (15)% (16)% (15)% (9)% (10)% (10)% (21)% (15)% (13)% (10)% (17)% (11)% (12)%

Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 6% 7% 11% 13% 11% 10% 10% 11% 6% 8% 11% 9% 12%

Reported revenue growth rate ex. TTM acquisitions, divestitures & JVs 6% 3% 4% 3% 3% 3% 8% 11% 6% 6% 9% 7% 15%

Note: Q3FY17, Q4FY17 and Q1FY2018 total company revenue growth in constant currency excluding TTM acquisitions, divestitures and joint ventures excludes the impact of

currency and revenue from National Pen. 47

Cimpress N.V. Q1 FY2018 Earnings Presentation

Annual

Reconciliation: Revenue Growth Rates

Total Company FY14 FY15 FY16 FY17

Reported Revenue Growth 9% 18% 20% 19%

Currency Impact (1)% 5% 4% 2%

Revenue Growth in Constant Currency 8% 23% 24% 21%

Impact of TTM Acquisitions & JVs (4)% (14)% (13)% (13)%

Revenue growth in constant currency ex. TTM acquisitions & JVs 4% 9% 11% 8%

FY2017, by Reportable Segments Vistaprint Upload & Print National Pen All Other Businesses

Reported Revenue Growth 7% 36% 100% (7)%

Currency Impact 2% 3% —% —%

Revenue Growth in Constant Currency 9% 39% 100% (7)%

Impact of TTM Acquisitions & JVs —% (26)% (100)% —%

Revenue growth in constant currency ex. TTM acquisitions & JVs 9% 13% —% (7)%

48

Reconciliation: Two-year Stacked Constant-Currency Organic Revenue Growth

Quarterly

Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Reported Revenue Growth 9% 6% (1)% 21% 21% 19% 19% 13% 13% 13% 29% 26% 18% 16% 26% 18% 27%

Currency Impact —% —% —% (2)% —% 4% 7% 9% 8% 7% 2% —% 1% 2% 2% 2% (3)%

Revenue Growth in Constant Currency 9% 6% (1)% 19% 21% 23% 26% 22% 21% 20% 31% 26% 19% 18% 28% 20% 24%

Impact of TTM Acquisitions, Divestitures & JVs —% —% —% (15)% (15)% (16)% (15)% (9)% (10)% (10)% (21)% (15)% (13)% (10)% (17)% (11)% (12)%

Revenue growth in constant currency ex. TTM acquisitions, Divestitures & JVs 9% 6% (1)% 4% 6% 7% 11% 13% 11% 10% 10% 11% 6% 8% 11% 9% 12%

2 Year Stacked

Q1'14+Q1'15 Q2'14+Q2'15 Q3'14+Q3'15 Q4'14+Q4'15 Q1'15+Q1'16 Q2'15+Q2'16 Q3'15+Q3'16 Q4'15+Q4'16 Q1'16+Q1'17 Q2'16+Q2'17 Q3'16+Q3'17 Q4'16+Q4'17 Q1'17+Q1'18

Year 1 9% 6% (1)% 4% 6% 7% 11% 13% 11% 10% 10% 11% 6%

Year 2 6% 7% 11% 13% 11% 10% 10% 11% 6% 8% 11% 9% 12%

Year 1 + Year 2 15% 13% 10% 17% 17% 17% 21% 24% 17% 18% 21% 20% 18%

Note: Q3FY17, Q4FY17 and Q1FY18 total company revenue growth in constant currency excluding TTM acquisitions, divestitures and joint ventures excludes the impact of currency

and revenue from National Pen. 49