Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - NUVASIVE INC | nuva-ex993_7.htm |

| EX-99.1 - EX-99.1 - NUVASIVE INC | nuva-ex991_6.htm |

| 8-K - 8-K - NUVASIVE INC | nuva-8k_20171024.htm |

Q3 2017 Results Supplemental Presentation to Earnings Press Release October 24, 2017 Exhibit 99.2

Forward-Looking Statements NuVasive cautions you that statements included in this presentation that are not a description of historical facts are forward-looking statements that involve risks, uncertainties, assumptions and other factors which, if they do not materialize or prove correct, could cause NuVasive’s results to differ materially from historical results or those expressed or implied by such forward-looking statements. In addition, this presentation contains selected financial results from the third quarter 2017, as well as projections for 2017 financial guidance and longer-term financial performance goals. The Company’s projections for 2017 financial guidance and longer-term financial performance goals represent current estimates, including initial estimates of the potential benefits, synergies and cost savings associated with acquisitions, which are subject to the risk of being inaccurate because of the preliminary nature of the forecasts, the risk of further adjustment, or unanticipated difficulty in selling products or generating expected profitability. The potential risks and uncertainties that could cause actual growth and results to differ materially include, but are not limited to: the risk that NuVasive’s revenue or earnings projections may turn out to be inaccurate because of the preliminary nature of the forecasts; the risk of further adjustment to financial results or future financial expectations; unanticipated difficulty in selling products, generating revenue or producing expected profitability; the risk that acquisitions will not be integrated successfully or that the benefits and synergies from the acquisition may not be fully realized or may take longer to realize than expected; and those other risks and uncertainties more fully described in the Company’s news releases and periodic filings with the Securities and Exchange Commission. NuVasive’s public filings with the Securities and Exchange Commission are available at www.sec.gov. The forward-looking statements contained herein are based on the current expectations and assumptions of NuVasive and not on historical facts. NuVasive assumes no obligation to update any forward-looking statement to reflect events or circumstances arising after the date on which it was made.

Non-GAAP Financial Measures Management uses certain non-GAAP financial measures such as non-GAAP earnings per share, non-GAAP net income, non-GAAP operating expenses and non-GAAP operating profit margin, which exclude amortization of intangible assets, non-cash purchase accounting adjustments on acquisitions, business transition costs, CEO transition related costs, certain litigation charges, significant one-time items, non-cash interest expense (excluding debt issuance cost) and/or losses on repurchase of convertible notes, and the impact from taxes related to these items, including those taxes that would have occurred in lieu of these items. Management also uses certain non-GAAP measures which are intended to exclude the impact of foreign exchange currency fluctuations. The measure constant currency is the use of an exchange rate that eliminates fluctuations when calculating financial performance numbers. The Company also uses measures such as free cash flow, which represents cash flow from operations less cash used in the acquisition and disposition of capital. Additionally, the Company uses an adjusted EBITDA measure which represents earnings before interest, taxes, depreciation and amortization and excludes the impact of stock-based compensation, non-cash purchase accounting adjustments on acquisition, business transition costs, CEO transition related costs, certain litigation charges, and other significant one-time items. Management calculates the non-GAAP financial measures provided in this presentation excluding these costs and uses these non-GAAP financial measures to enable it to further and more consistently analyze the period-to-period financial performance of its core business operations. Management believes that providing investors with these non-GAAP measures gives them additional information to enable them to assess, in the same way management assesses, the Company’s current and future continuing operations. These non-GAAP measures are not in accordance with, or an alternative for, GAAP, and may be different from non-GAAP measures used by other companies. This presentation is intended to accompany the Company’s third quarter 2017 earnings announcement, which includes financial results reported on a GAAP and non-GAAP basis. For reconciliations of non-GAAP financial measures to the comparable GAAP financial measure, please refer to the earnings announcement, as well as supplemental financial information posted on the Investor Relations section of the Company’s corporate website at www.nuvasive.com.

Third Quarter 2017 Performance Reported year-over-year revenue growth of 3.2% to $247.4 million, or 3.4% on a constant currency basis. Delivered GAAP operating profit margin of 12.4%; non-GAAP operating profit margin of 17.6%, up 150 basis points from prior year. Drove GAAP diluted earnings per share of $0.64; non-GAAP diluted EPS up 30.0% to $0.52. ü ü *Performance growth reflects comparison to prior year period; for additional details regarding full year 2017 guidance, see slide 13 . Updated full year 2017 guidance: Revenue growth of ~7.1% to $1,030.0 million, including ~$2 million in year-over-year currency headwinds Non-GAAP operating profit margin of ~16.6% Adjusted EBITDA margin of ~25.9% Non-GAAP diluted EPS of ~$1.91

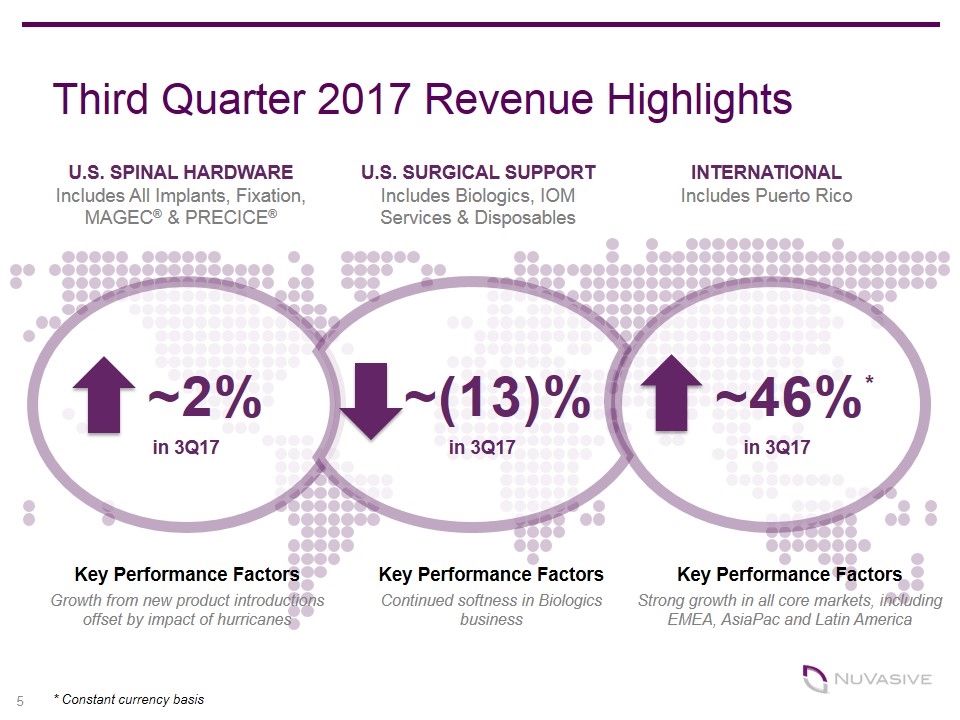

Third Quarter 2017 Revenue Highlights ~2% U.S. SPINAL HARDWARE Includes All Implants, Fixation, MAGEC® & PRECICE® ~(13)% ~46%* * Constant currency basis U.S. SURGICAL SUPPORT Includes Biologics, IOM Services & Disposables INTERNATIONAL Includes Puerto Rico Key Performance Factors Growth from new product introductions offset by impact of hurricanes Key Performance Factors Continued softness in Biologics business Key Performance Factors Strong growth in all core markets, including EMEA, AsiaPac and Latin America in 3Q17 in 3Q17 in 3Q17

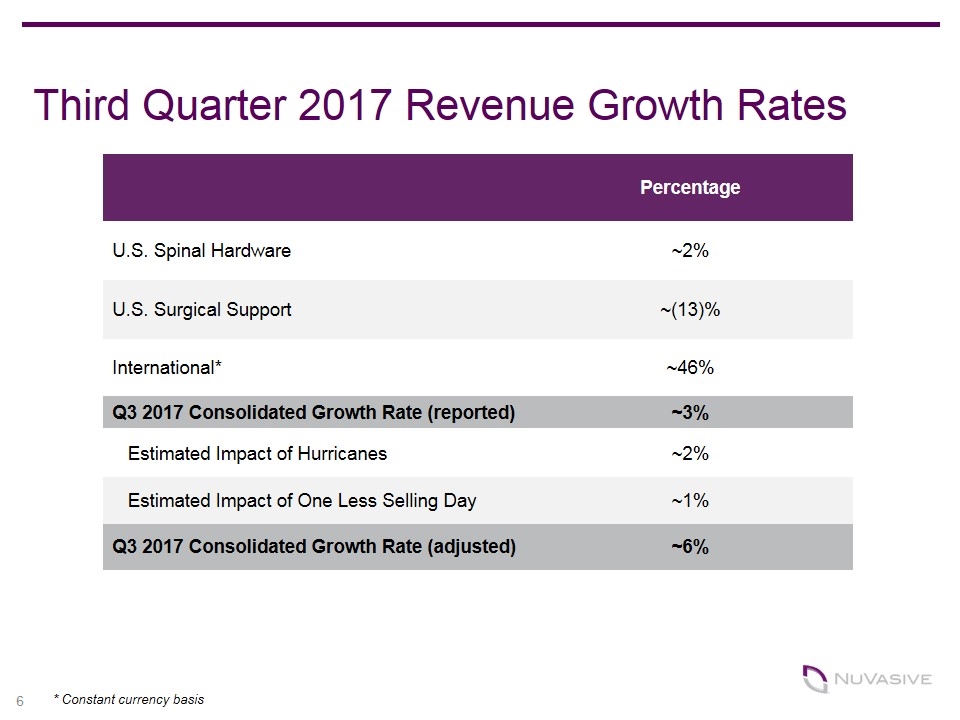

Third Quarter 2017 Revenue Growth Rates Percentage U.S. Spinal Hardware ~2% U.S. Surgical Support ~(13)% International* ~46% Q3 2017 Consolidated Growth Rate (reported) ~3% Estimated Impact of Hurricanes ~2% Estimated Impact of One Less Selling Day ~1% Q3 2017 Consolidated Growth Rate (adjusted) ~6% 6 * Constant currency basis

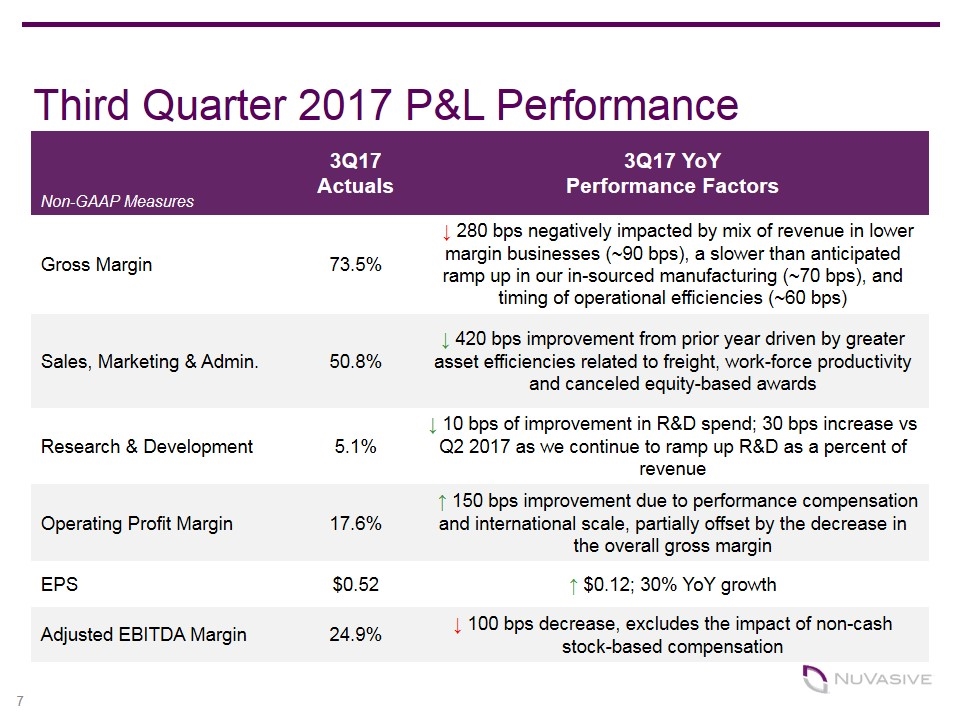

Third Quarter 2017 P&L Performance Non-GAAP Measures 3Q17 Actuals 3Q17 YoY Performance Factors Gross Margin 73.5% ↓ 280 bps negatively impacted by mix of revenue in lower margin businesses (~90 bps), a slower than anticipated ramp up in our in-sourced manufacturing (~70 bps), and timing of operational efficiencies (~60 bps) Sales, Marketing & Admin. 50.8% ↓ 420 bps improvement from prior year driven by greater asset efficiencies related to freight, work-force productivity and canceled equity-based awards Research & Development 5.1% ↓ 10 bps of improvement in R&D spend; 30 bps increase vs Q2 2017 as we continue to ramp up R&D as a percent of revenue Operating Profit Margin 17.6% ↑ 150 bps improvement due to performance compensation and international scale, partially offset by the decrease in the overall gross margin EPS $0.52 ↑ $0.12; 30% YoY growth Adjusted EBITDA Margin 24.9% ↓ 100 bps decrease, excludes the impact of non-cash stock-based compensation 7

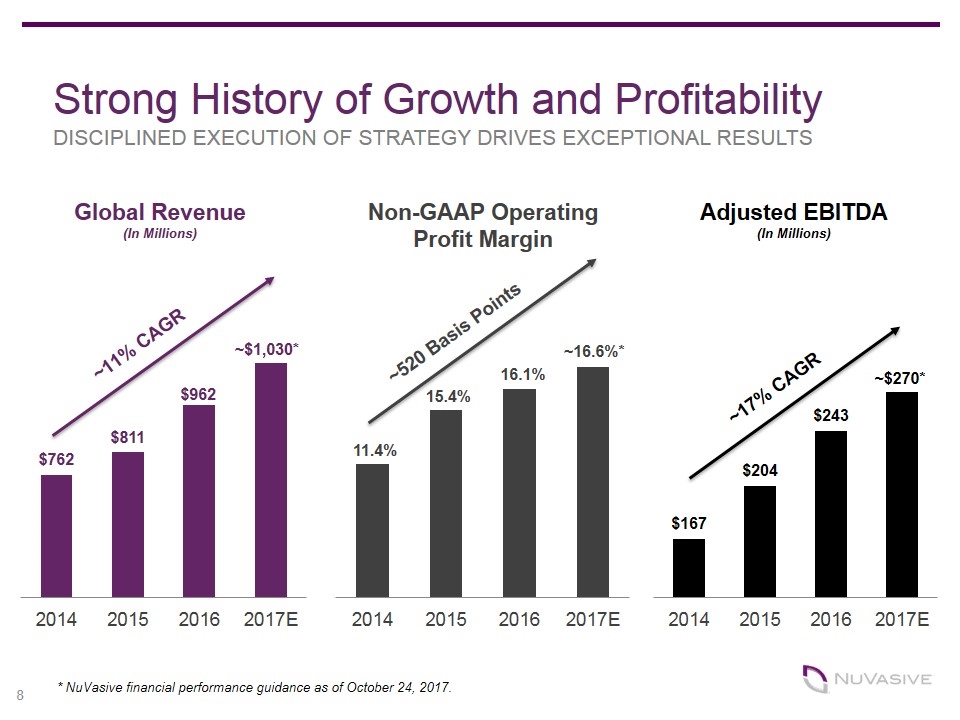

Global Revenue (In Millions) Non-GAAP Operating Profit Margin ~$1,030* 11.4% 15.4% 16.1% ~16.6%* Strong History of Growth and Profitability DISCIPLINED EXECUTION OF STRATEGY DRIVES EXCEPTIONAL RESULTS Adjusted EBITDA (In Millions) ~17% CAGR ~520 Basis Points ~11% CAGR * NuVasive financial performance guidance as of October 24, 2017.

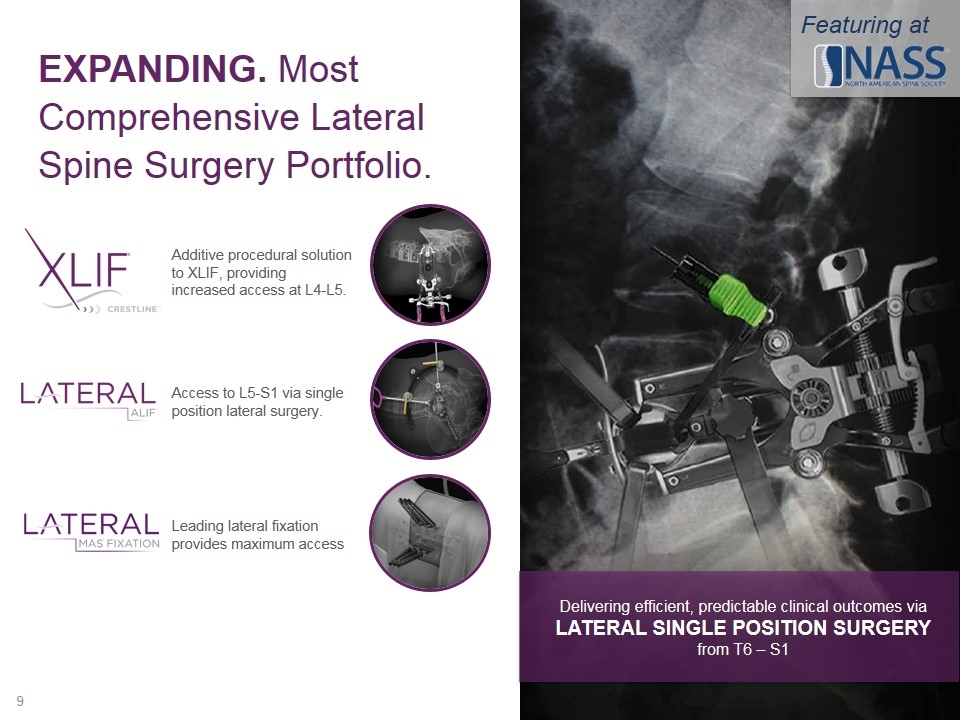

EXPANDING. Most Comprehensive Lateral Spine Surgery Portfolio. Access to L5-S1 via single position lateral surgery. Additive procedural solution to XLIF, providing increased access at L4-L5. Leading lateral fixation provides maximum access Delivering efficient, predictable clinical outcomes via LATERAL SINGLE POSITION SURGERY from T6 – S1 Featuring at 9

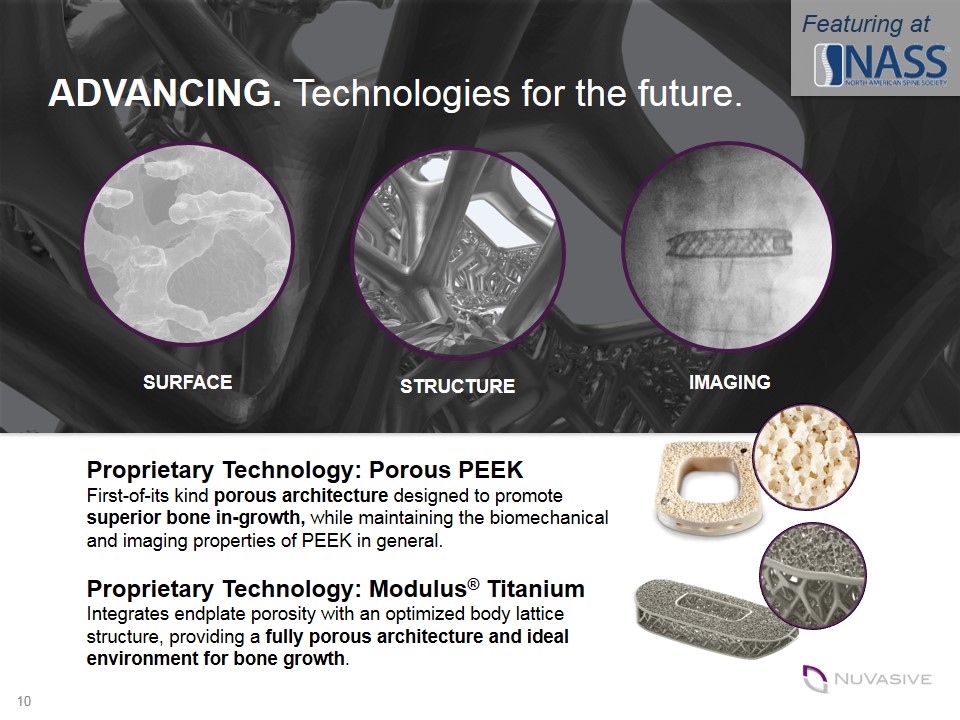

Proprietary Technology: Porous PEEK First-of-its kind porous architecture designed to promote superior bone in-growth, while maintaining the biomechanical and imaging properties of PEEK in general. Proprietary Technology: Modulus® Titanium Integrates endplate porosity with an optimized body lattice structure, providing a fully porous architecture and ideal environment for bone growth. ADVANCING. Technologies for the future. SURFACE IMAGING STRUCTURE Featuring at 10

Investing in Innovation BUILDING WORLD-CLASS CENTERS OF EXCELLENCE SAN DIEGO, CALIFORNIA Expanding surgeon education lab for onsite surgeon training Building a prototype design facility with 3D-printing capabilities Developing state-of-the art biomedical testing center Building a world-class manufacturing center Produced 70% more parts out of facility in Q3 vs. Q2 Transitioning from current Fairborn facility by end of 2017 WEST CARROLLTON, OHIO 11

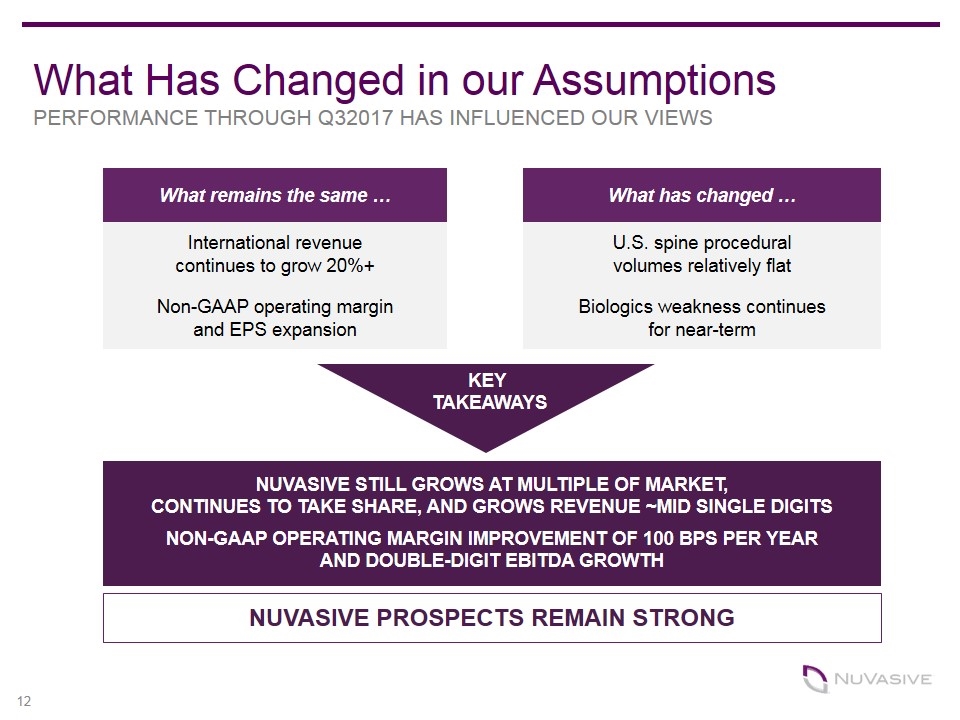

What Has Changed in our Assumptions PERFORMANCE THROUGH Q32017 HAS INFLUENCED OUR VIEWS What remains the same … What has changed … International revenue continues to grow 20%+ U.S. spine procedural volumes relatively flat Non-GAAP operating margin and EPS expansion Biologics weakness continues for near-term NUVASIVE STILL GROWS AT MULTIPLE OF MARKET, CONTINUES TO TAKE SHARE, AND GROWS REVENUE ~MID SINGLE DIGITS NON-GAAP OPERATING MARGIN IMPROVEMENT OF 100 BPS PER YEAR AND DOUBLE-DIGIT EBITDA GROWTH NUVASIVE PROSPECTS REMAIN STRONG KEY TAKEAWAYS 12

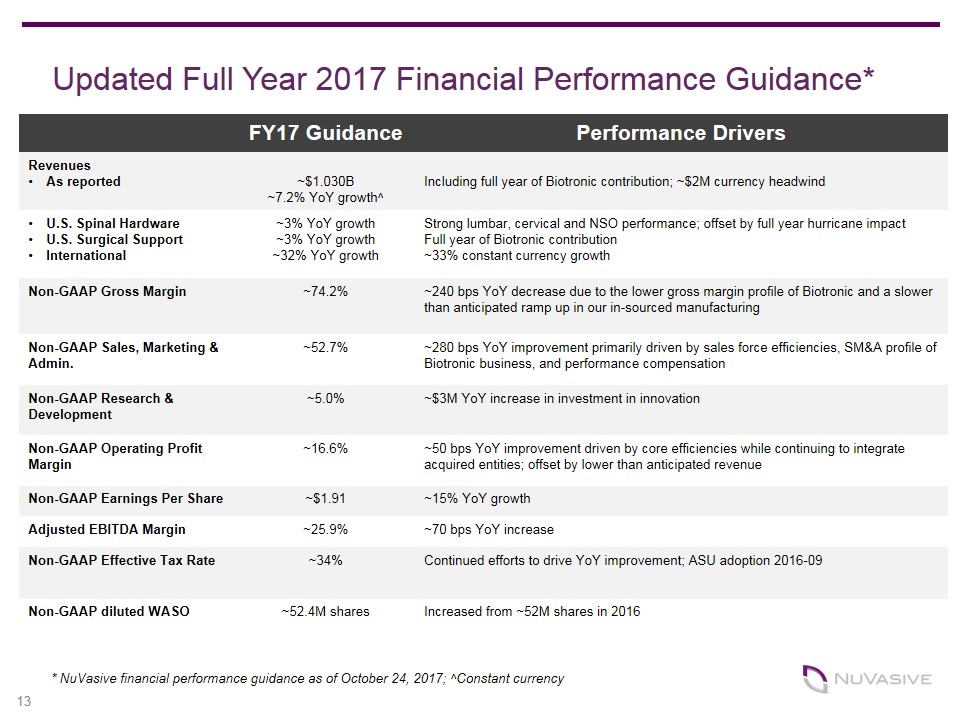

* NuVasive financial performance guidance as of October 24, 2017; ^Constant currency FY17 Guidance Performance Drivers Revenues As reported ~$1.030B ~7.2% YoY growth^ Including full year of Biotronic contribution; ~$2M currency headwind U.S. Spinal Hardware U.S. Surgical Support International ~3% YoY growth ~3% YoY growth ~32% YoY growth Strong lumbar, cervical and NSO performance; offset by full year hurricane impact Full year of Biotronic contribution ~33% constant currency growth Non-GAAP Gross Margin ~74.2% ~240 bps YoY decrease due to the lower gross margin profile of Biotronic and a slower than anticipated ramp up in our in-sourced manufacturing Non-GAAP Sales, Marketing & Admin. ~52.7% ~280 bps YoY improvement primarily driven by sales force efficiencies, SM&A profile of Biotronic business, and performance compensation Non-GAAP Research & Development ~5.0% ~$3M YoY increase in investment in innovation Non-GAAP Operating Profit Margin ~16.6% ~50 bps YoY improvement driven by core efficiencies while continuing to integrate acquired entities; offset by lower than anticipated revenue Non-GAAP Earnings Per Share ~$1.91 ~15% YoY growth Adjusted EBITDA Margin ~25.9% ~70 bps YoY increase Non-GAAP Effective Tax Rate ~34% Continued efforts to drive YoY improvement; ASU adoption 2016-09 Non-GAAP diluted WASO ~52.4M shares Increased from ~52M shares in 2016 Updated Full Year 2017 Financial Performance Guidance*

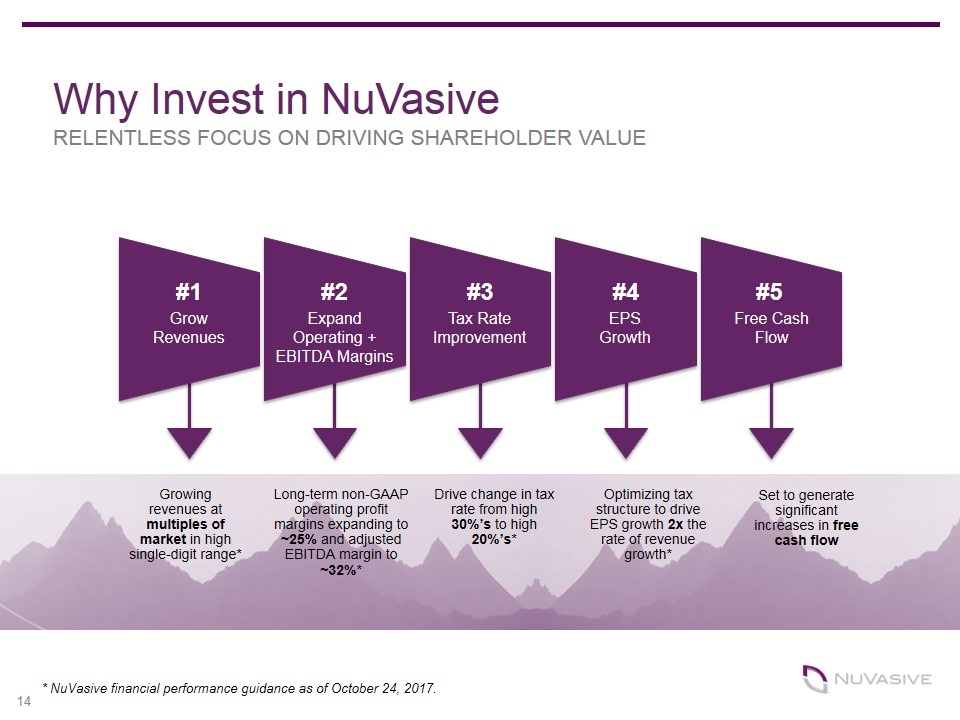

Growing revenues at multiples of market in high single-digit range* Long-term non-GAAP operating profit margins expanding to ~25% and adjusted EBITDA margin to ~32%* Drive change in tax rate from high 30%’s to high 20%’s* Optimizing tax structure to drive EPS growth 2x the rate of revenue growth* Set to generate significant increases in free cash flow #1 #2 #3 #4 #5 Grow Revenues Expand Operating + EBITDA Margins Tax Rate Improvement Free Cash Flow EPS Growth Why Invest in NuVasive RELENTLESS FOCUS ON DRIVING SHAREHOLDER VALUE * NuVasive financial performance guidance as of October 24, 2017.