Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mahwah Bergen Retail Group, Inc. | a8-kcoverq4fy17.htm |

| EX-99.1 - EXHIBIT 99.1 - Mahwah Bergen Retail Group, Inc. | ex99-1q4fy17.htm |

Q4 FY17 Earnings Release

Supplemental Material

September 25, 2017

Safe Harbor Statement

2

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements are based on current expectations and are indicated by words or phrases

such as “anticipate, “estimate,” “expect,” “project,” “plan,” “we believe,” “will,” “would,” “guidance,” and similar

words or phrases, and involve known and unknown risks, uncertainties and other factors which may cause actual

results, performance or achievements to be materially different from the future results, performance or

achievements expressed in or implied by such forward-looking statements.

Detailed information concerning those risks and uncertainties are readily available in the Company’s filings with the

U.S. Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-

looking statements, whether as a result of new information, future events or otherwise.

Where indicated, certain financial information herein has been presented on a non-GAAP basis. This basis adjusts for

non-recurring items that management believes are not indicative of the Company’s underlying operating

performance. These measures may not be directly comparable to similar measures used by other companies and

should not be considered a substitute for performance measures in accordance with GAAP such as operating income

and net income. Additionally, a reconciliation of the projected non-GAAP EPS, which are forward-looking non-GAAP

financial measures, to the most directly comparable GAAP financial measures, is not provided because the Company

is unable to provide such reconciliation without unreasonable effort. The inability to provide a reconciliation is due to

the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the

non-GAAP adjustments may be recognized. These GAAP measures may include the impact of such items as

restructuring charges, acquisition and integration related expenses, asset impairments and the tax effect of all such

items. As previously stated, the Company has historically excluded these items from non-GAAP financial measures.

The Company currently expects to continue to exclude these items in future disclosures of non-GAAP financial

measures and may also exclude other items that may arise (collectively, “non-GAAP adjustments”). The decisions and

events that typically lead to the recognition of non-GAAP adjustments, such as actions under the Company's Change

for Growth program, or acquisition and integration expenses, are inherently unpredictable as to if or when they may

occur. For the same reasons, the Company is unable to address the probable significance of the unavailable

information, which could be material to future results. Reference should be made to today’s earnings release for the

nature of such adjustments and for a reconciliation of such non-GAAP measures to the Company’s financial results

prepared in accordance with GAAP.

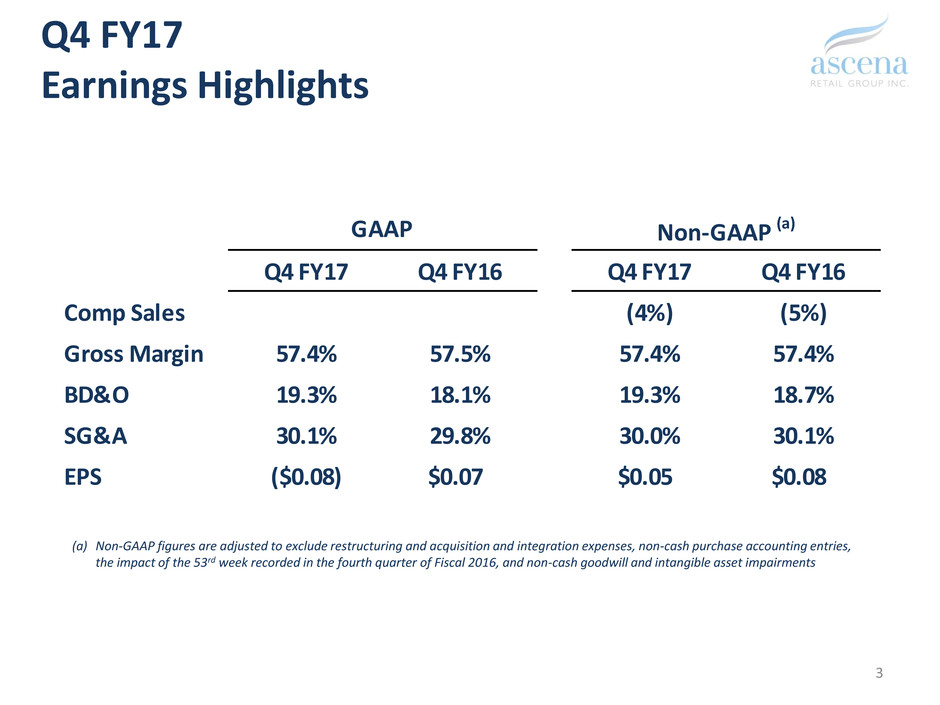

Q4 FY17 Q4 FY16 Q4 FY17 Q4 FY16

Comp Sales (4%) (5%)

Gross Margin 57.4% 57.5% 57.4% 57.4%

BD&O 19.3% 18.1% 19.3% 18.7%

SG&A 30.1% 29.8% 30.0% 30.1%

EPS ($0.08) $0.07 $0.05 $0.08

GAAP Non-GAAP (a)Q4 FY17

Earnings Highlights

3

(a) Non-GAAP figures are adjusted to exclude restructuring and acquisition and integration expenses, non-cash purchase accounting entries,

the impact of the 53rd week recorded in the fourth quarter of Fiscal 2016, and non-cash goodwill and intangible asset impairments

Q4 FY17

Sales Summary

4

Q4 FY17 Q4 FY16

Premium Fashion (3%) (6%)

Ann Taylor (2%) (12%)

LOFT (3%) (2%)

Value Fashion (6%) (8%)

maurices (8%) (9%)

dressbarn (4%) (7%)

Plus Fashion (4%) Flat

Lane Bryant (6%) 1%

Catherines 1% (5%)

Kids Fashion (4%) (4%)

Total Company (4%) (5%)

Comp Sales Performance

Premium

36%

Value

29%

Plus

22%

Kids

13%

Q4 FY17 Sales Mix

(a) Represents results of ANN INC. which was acquired in the first quarter of Fiscal 2016; for comparative purposes, Q4 FY16 comp sales

reflects internally generated ANN INC. data from the pre-acquisition period.

(a)

5,000,000

93,579,518

(13,880,511)

4.8%

(4.3%)

4.9%

(17.6%)

(1.5%)

Premium

Fashion

Value

Fashion

Plus

Fashion

Kids

Fashion

Total

Company

Q4 FY17

End-of-Period Segment Inventory

5

(a) Growth vs. LY at Premium fashion segment primarily caused by floorset timing and shift of seasonal LOFT clearance event into

August ($7M and $2M, respectively)

(b) Growth vs. LY at Plus fashion segment primarily caused by early receipts and major product launches ($9M and $3M, respectively)

(c) Decline vs. LY at Kids Fashion segment primarily driven by $9M reduction of liable Spring carryover goods and $4M in lower

average unit cost (increased penetration of lower cost Specialty product)

(a) (c) (b)

Q4 FY17

Capital Structure / Cash Flow

Capital expenditures: $59 million(a)

Ending cash and equivalents: $326 million(b)

Ending debt: $1,597 million(c)

Ending net debt to TTM EBITDA: ~2.4x(d)

TTM EBITDA cash interest coverage: ~6.1x(d,e)

Current liquidity: $826 million(f)

6

(a) Excludes change in period end accruals ($18.4 million as of Q3 FY17 and $26.6 million as of Q4 FY17)

(b) Of total $326 million, $224 million (~69%) held outside the U.S.

(c) Reflects remaining $1,597 million term loan balance; asset-based revolver undrawn at quarter end

(d) Ending debt net of cash and equivalents to TTM non-GAAP EBITDA of $529 million

(e) Based on TTM average Term Loan balance of $1,602 million and TTM average interest rate of 5.37%

(f) Ending cash and equivalents plus $500 million of availability under the asset based revolver

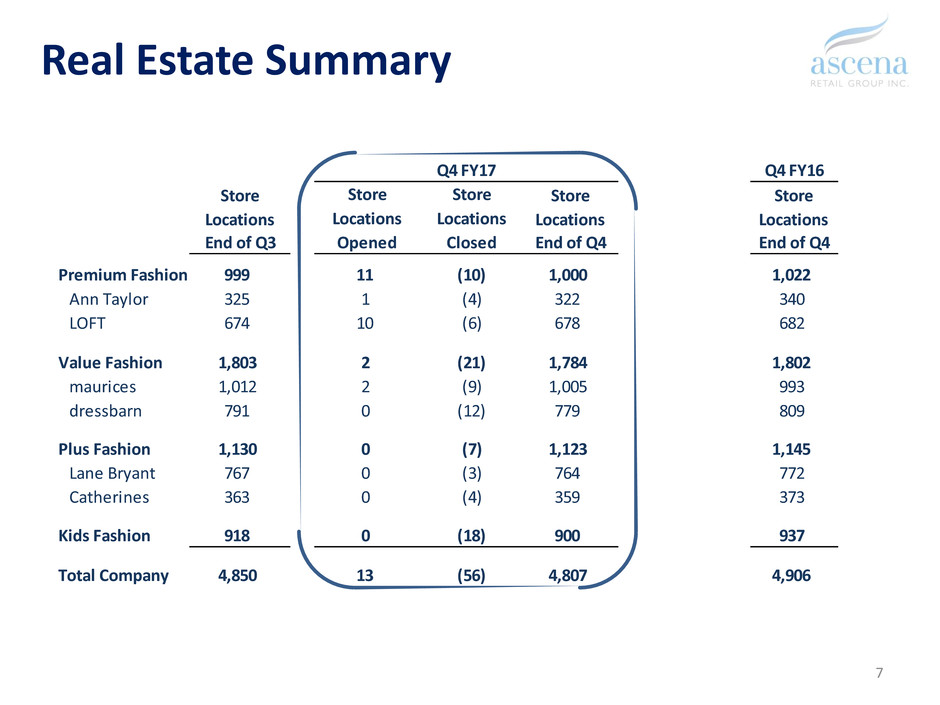

Real Estate Summary

7

Q4 FY16

Store

Locations

Store

Locations

Store

Locations

End of Q3 End of Q4 End of Q4

Premium Fashion 999 11 (10) 1,000 1,022

Ann Taylor 325 1 (4) 322 340

LOFT 674 10 (6) 678 682

Value Fashion 1,803 2 (21) 1,784 1,802

maurices 1,012 2 (9) 1,005 993

dressbarn 791 0 (12) 779 809

Plus Fashion 1,130 0 (7) 1,123 1,145

L ne Bryant 767 0 (3) 764 772

Catherines 363 0 (4) 359 373

Kids Fashion 918 0 (18) 900 937

Total Company 4,850 13 (56) 4,807 4,906

Q4 FY17

Store

Locations

Opened

Store

Locations

Closed

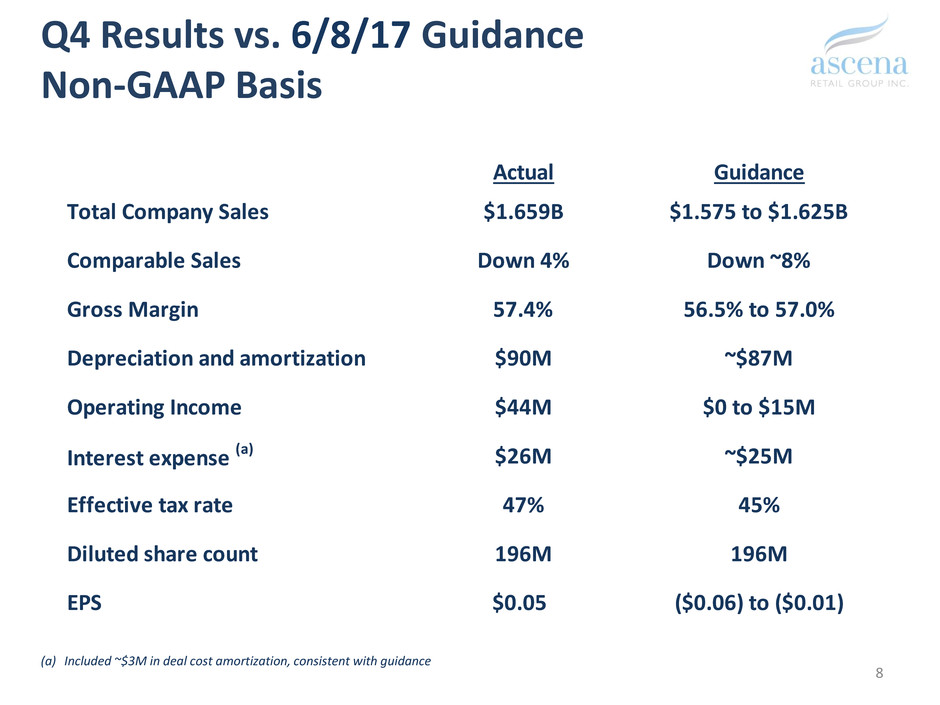

(a) Included ~$3M in deal cost amortization, consistent with guidance

Q4 Results vs. 6/8/17 Guidance

Non-GAAP Basis

8

Actual Guidance

Total Company Sales $1.659B $1.575 to $1.625B

Comparable Sales Down 4% Down ~8%

Gross Margin 57.4% 56.5% to 57.0%

Depreciation and amortization $90M ~$87M

Operating Income $44M $0 to $15M

Interest expense (a) $26M ~$25M

Effective tax rate 47% 45%

Diluted share count 196M 196M

EPS $0.05 ($0.06) to ($0.01)

(a) Inclusive of non-cash interest of approximately $3M and $12M (Q1 and full year, respectively) related to the amortization of the term loan

original issue discount and debt issuance costs

(b) Includes incremental $3M non-cash charge related to change in accounting treatment of stock-based compensation

(c) The Company is issuing selected full year guidance, due to limited visibility to macro trends impacting sales

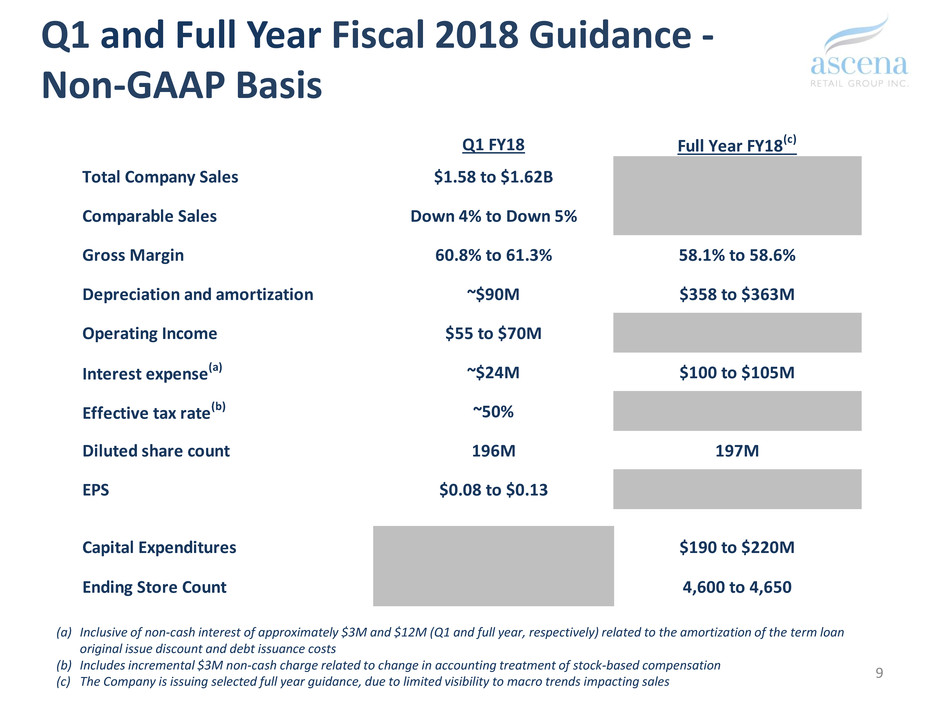

Q1 and Full Year Fiscal 2018 Guidance -

Non-GAAP Basis

9

Q1 FY18 Full Year FY18(c)

Total Company Sales $1.58 to $1.62B

Comparable Sales Down 4% to Down 5%

Gross Margin 60.8% to 61.3% 58.1% to 58.6%

Depreciation and amortization ~$90M $358 to $363M

Operating Income $55 to $70M

Interest expense(a) ~$24M $100 to $105M

Effective tax rate(b) ~50%

Diluted share count 196M 197M

EPS $0.08 to $0.13

Capital Expenditures $190 to $220M

Ending Store Count 4,600 to 4,650

Anticipated Platform Savings

10

$235M

$300M(a)

(a) Represents top of the $250M - $300M range

$M FY15 FY16 FY17 FY18 FY19 FY20 Total

ANN Synergies

SG&A/COGS Non-merch procurement 9.4 24.0 15.3 2.0 50.7

Supply chain

BD&O Distribution / fulfillment 12.1 2.1 2.5 16.6

COGS Transportation / logistics 26.9 12.0 7.2 46.1

Organizational efficiency

SG&A Duplicative management teams 14.0 4.9 18.9

SG&A Employment benefit realignment 3.1 3.9 3.7 3.7 14.3

SG&A Public company costs / Other 2.1 1.1 3.3

ANN Cost Savings

SG&A SG&A optimization 7.4 27.6 35.0

COGS COGS initiative 24.5 20.5 5.0 50.0

Total ANN Savings 7.4 56.2 96.4 54.7 20.3 0.0 235.0

Change for Growth

Operating model

SG&A Front office efficiencies 29.0 31.0 60.0

SG&A Corporate efficiencies 6.9 15.0 18.1 40.0

SG&A Non-merch procurement 16.2 30.8 45.0 8.0 100.0

BD&O Real estate 10.6 15.0 15.0 9.4 50.0

SG&A IT efficiencies 5.0 35.0 10.0 50.0

Total Change For Growth 0.0 0.0 62.7 96.8 113.1 27.4 300.0

Total Platform Savings 7.4 56.2 159.0 151.6 133.4 27.4 535.0

Total Cumulative Achieved Savings 7.4 63.6 222.6 374.2 507.6 535.0 535.0