Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Meet Group, Inc. | exhibit991-acquisitionpres.htm |

| EX-21.1 - SHARE PURCHASE AGREEMENT - Meet Group, Inc. | ex21sharepurchaseagreement.htm |

| EX-10.1 - JPM CREDIT AGREEMENT - Meet Group, Inc. | ex101jpmcreditagreement.htm |

| 8-K - 8-K - Meet Group, Inc. | a8-kxacquisition92017.htm |

LOVOO Acquisition

September 20, 2017

2

LOVOO Acquisition

Cautionary Note Regarding Forward Looking Statements

Certain statements in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements

regarding whether we will meet our expected financial projections and guidance, the expected financial and operating performance of The Meet Group following completion

of the acquisition of Lovoo, the expected synergies from the combined company; whether Lovoo will be accretive to the Company's non-GAAP EPS in 2018 and beyond;

whether and when we will close the acquisition of Lovoo and how we will finance the transaction; whether the acquisition of Lovoo represents an opportunity to extend

livestreaming leadership; whether Lovoo’s strength in subscription and in-app purchases will help diversify our revenue model; whether mobile app MAU for the combined

company will be 15.8 million; whether DAU for the combined company will be 4.6 million; whether Lovoo will achieve revenue and/or Adjusted EBITA margins in the future

consistent with past results; whether Lovoo will more than double our current international mobile revenue, subscription mobile revenue and in-app purchasing mobile

revenue, and whether we will achieve the expected percentages that each of those revenue streams will constitute of our overall revenue; whether our investments in video

are easily portable to the European market; whether Lovoo will be our largest app in terms of traffic; whether the acquisition of Lovoo presents operating leverage

opportunities through lower technology costs and other cost savings opportunities; whether Lovoo management’s expertise in subscription an in-app purchases

compliments our advertising best practices and whether we will be able to share that expertise and improve our entire app ecosystem; whether after the closing of the Lovoo

acquisition we will be one of the largest video platforms in Europe; whether and when we will launch video to the Lovoo user base; whether the launch of video in the Lovoo

app will present a substantial monetization opportunity with no increase to planned marketing spend; whether and when we will launch cash-out, guest broadcaster and

other video features; whether we will continue similar advertising spending levels and focus at Lovoo; whether Benjamin Bak will remain as a consultant to assist with our

transition and integration; whether Florian Braunschweig will join The Meet Group Europe as a managing director and GM; whether the remainder of the Lovoo team will

remain in place at Lovoo and whether the acquisition of Lovoo will deliver strong shareholder value. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “could,” “target,” “potential,” “is likely,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have

based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial

condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements

include the risk that our applications will not function easily or otherwise as anticipated, the risk that we will not launch additional features and upgrades as anticipated, the

risk that unanticipated events affect the functionality of our applications with popular mobile operating systems, any changes in such operating systems that degrade our

mobile applications’ functionality and other unexpected issues which could adversely affect usage on mobile devices. Further information on our risk factors is contained in

our filings with the Securities and Exchange Commission (the “SEC”), including the Form 10-K for the year ended December 31, 2016 filed with the SEC on March 9, 2017

and the Form 10-Q for the quarter ended March 31, 2017 filed with the SEC on May 10, 2017. Any forward-looking statement made by us herein speaks only as of the date

on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be

required by law.

Regulation G – Non-GAAP Measures

The Company defines mobile traffic and engagement metrics (including MAU, DAU, chats per day, and new users per day) to include mobile app traffic for all properties and

mobile web traffic for MeetMe and Skout.

This presentation includes a discussion of Adjusted EBITDA from continuing operations which is a non-GAAP financial measure. Reconciliations to the most directly

comparable GAAP financial measures are provided in the Investors section of our corporate website, www.meetmecorp.com.

The Company defines mobile traffic and engagement metrics (including MAU, DAU, chats per day, and new users per day) to include mobile app traffic for all properties and

mobile web traffic for MeetMe and Skout.

The Company defines Adjusted EBITDA as earnings (or loss) from continuing operations before interest expense, change in warrant liability, benefit or provision income

taxes, depreciation and amortization, non-cash stockbased compensation, non-recurring acquisition and restructuring expenses, gain or loss on cumulative foreign

currency translation adjustment, gain on sale of asset, bad debt expense outside the normal range, and the goodwill impairment charges. The Company excludes stock

based compensation because it is noncash in nature.

3

The Meet Group to Acquire LOVOO

Mobile Daily (DAU) and Monthly (MAU) Active Users for proforma Q2 2017 for The Meet Group and LOVOO combined from internal sources.

Meeting the Universal Need for Human Connection

4.6M

Mobile Daily Active Users

15.8M

Mobile Monthly Active Users

Diversified

Revenue Strong ProfitabilityGlobal strength

Livestreaming

Leader

4

• TMG to acquire LOVOO for $70 million cash; $5 million

of which is contingent upon achievement of an earnout

target

• Q2 2017 trailing twelve-month revenue of €27.2 million,

or $32.4 million based on current exchange rate

• Financed from balance sheet and cash flows and a

non-dilutive increase in an existing debt facility

• Expected to be accretive to the Company’s non-GAAP

EPS in 2018 and beyond

• Leading European dating app - #1 by downloads in

German speaking countries: Germany, Switzerland,

and Austria combined2

• Expected to be largest app by traffic in the TMG

portfolio with 1.9 million DAU1

• Opportunity to extend livestreaming leadership

• Strength in subscriptions and in-app purchases

projected to diversify TMG revenue model

• Closing targeted for October 2017

1 - Q2 2017 LOVOO internal sources

2 - Q2 2017 country download statistics for iOS and Android according to AppAnnie

The Meet Group to Acquire LOVOO

5

About LOVOO

1 - Q2 2017 country download statistics for iOS and Android according to AppAnnie

2 - Q2 2017 LOVOO internal sources

Popular European Dating App

• #1 in Germany, Austria, Switzerland (DACH countries combined)1

• Top 3 in France, Spain, Italy (Southern Europe)1

Sizable audience

• 1.92 million DAU; 5.02 million MAU

Diversified revenue streams

• 48%2 subscriptions; 24%2 in-app purchases; 28%2 advertising

47,0002 new registered mobile app users added each day

Dresden and Berlin based team

• 97 full-time employees

61 - Q2 2017 LOVOO internal sources

Familiar Product / Diversified Revenue

Familiar Products Diversified Revenue

72%1 of LOVOO’s

revenue is from

non-ad sources

7

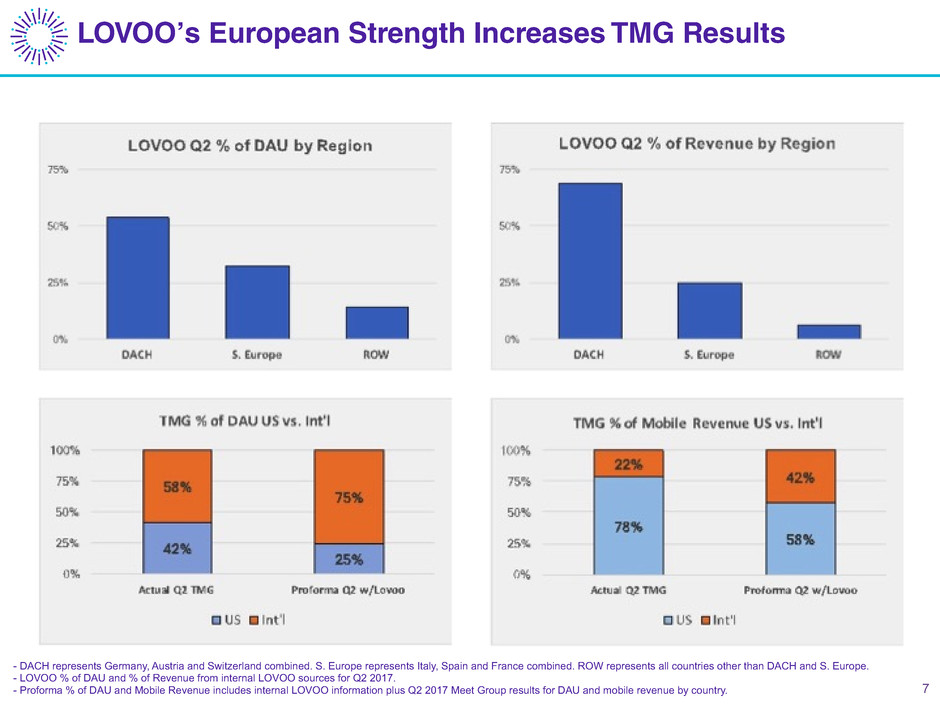

LOVOO’s European Strength Increases TMG Results

- DACH represents Germany, Austria and Switzerland combined. S. Europe represents Italy, Spain and France combined. ROW represents all countries other than DACH and S. Europe.

- LOVOO % of DAU and % of Revenue from internal LOVOO sources for Q2 2017.

- Proforma % of DAU and Mobile Revenue includes internal LOVOO information plus Q2 2017 Meet Group results for DAU and mobile revenue by country.

8

Strategic Positioning

1 – Q2 2017 LOVOO revenue from internal sources.

2 – Proforma % Mobile Revenue includes internal LOVOO information plus Q2 2017 Meet Group results for mobile revenue by type.

3 – Comparison of unique users across all TMG individually and combined for last 30 days.

Familiar Product and Users:

• Well aligned with existing TMG apps

• Strong engagement and retention

• Less than 5% overlap among user bases3

Revenue Diversification:

• LOVOO Q2 revenue: 48% subscriptions; 24% in-app purchases; 28% advertising1

• Proforma Q2 with LOVOO revenue: 19% Subscription; 11% in-app purchases; 70% ads2

Sizable Video Opportunity:

• TMG investments in video easily portable to European market

• No clear European video leader today

Clear Strategy to Drive Operating Leverage:

• Lower technology costs through standardization / shared platform

• Cost saving opportunities – German engineering costs markedly lower that US

9

Transaction Details

Structure:

• $65 million cash at close

• $5 million cash based on LOVOO achieving a 2017 Adjusted EBITDA target

• Target close in October 2017

Sources of Cash Consideration:

• Cash on hand and cash from operations

• Newly signed increase to $80 million of the Company’s credit facility with JPMorgan and

Silicon Valley as co-leads

Projected Financial Impact:

• Expected to be accretive to the Company’s non-GAAP EPS in 2018 and beyond

• Revenue and Adjusted EBITDA multiples comparable to previous acquisitions

Thank you.